Cardano is one of the most exciting and advanced blockchain networks ever built, with a thriving DApp ecosystem and bustling community.

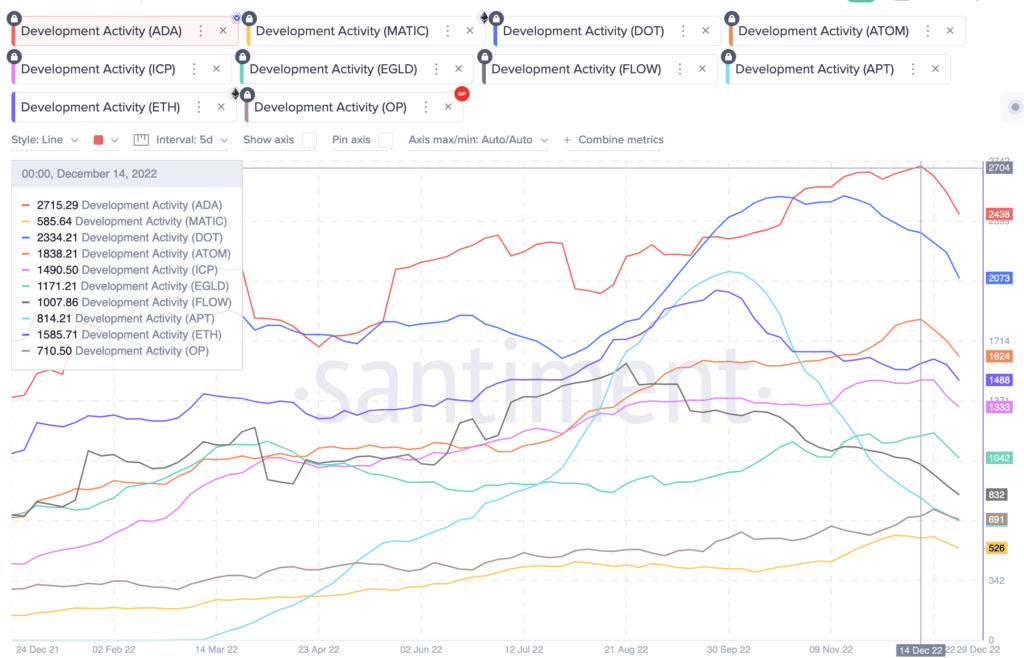

Interestingly, Cardano led the entire crypto industry in terms of development activity in 2022, taking the #1 spot, out-gunning Ethereum, Solana, BSC, and every other network for activity among developers.

Cardano Saw the Most Developer Activity in 2022. Image via Santiment

Cardano Saw the Most Developer Activity in 2022. Image via Santiment

The Cardano network has grown exponentially over the past few years, firmly solidifying itself as a top ten cryptocurrency. Tens of thousands of people are holding, and naturally, looking to stake Cardano and delegate into a staking pool to passively earn ADA. Learning how to do that and what to look for is exactly what this article is going to cover.

Staking Cardano

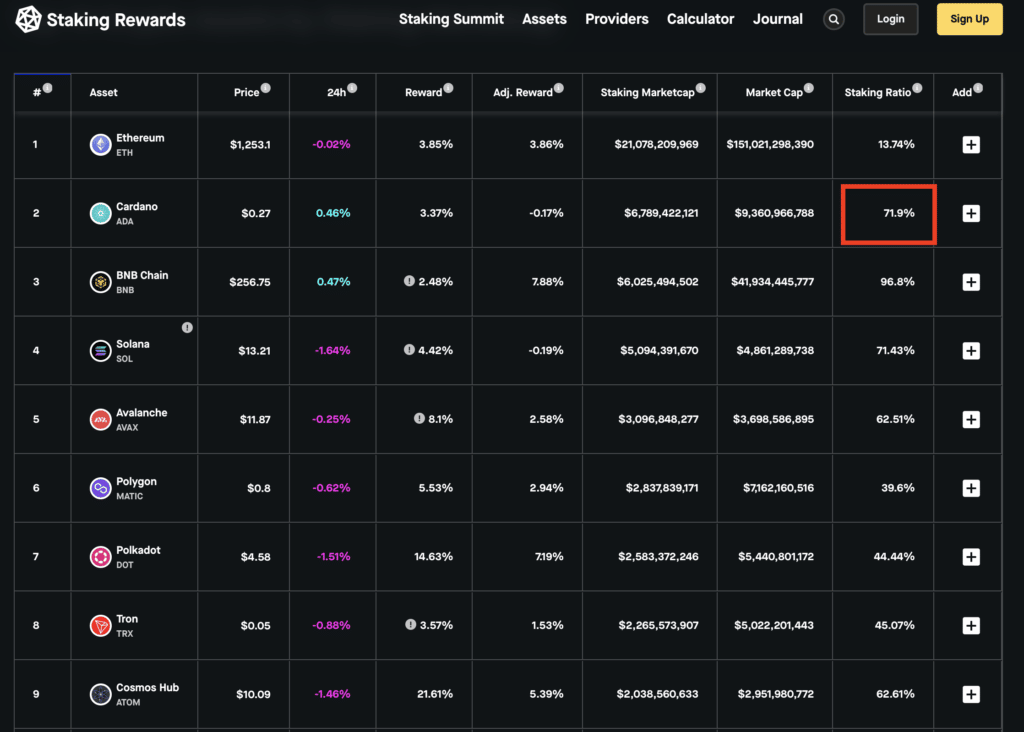

Cardano is one of the best assets to stake thanks to its flexibility, which is why over 70% of Cardano in circulation is actively staked.

Image via stakingrewards.com

Image via stakingrewards.comUnlike most Proof-of-Stake cryptocurrencies, staking ADA does not subject it to any lockup periods, and what is even more convenient is that Cardano staked can still be transacted with, fully available for sending and receiving.

How is that possible?

Cardano staking is unique, and unlike most other PoS coins, Cardano users are not staking their coins, but rather their Cardano address. This leads to the full balance of your ADA wallet being staked at all times, no need to re-stake every time you receive new coins, and you can freely send out any ADA you have held at any time.

To my knowledge, Cardano is the only network that stakes in this way and the reason Cardano is one of the most popular staking assets. You can learn about all the other ways that Cardano is truly a next-generation blockchain in our Cardano review.

Alternatively, if you prefer video format, Guy covers the project in detail below:

Staking Cardano also couldn’t be easier and can conveniently be done within multiple wallets. My personal favourite way to stake Cardano is with the Trezor Model T hardware wallet. This offers top-of-the-line security and the peace of mind that comes with using a hardware wallet, while still being able to benefit from staking. Ledger is another popular hardware wallet that supports Cardano staking.

Other popular wallets for staking Cardano are Exodus, Trust Wallet, and Yoroi software wallets. The Daedalus wallet is also popular and unique as it is a full-node wallet that can be installed onto your computer and synced to run a full Cardano node.

So, to get started, you will need a Cardano Wallet.

Choose a Wallet

Using a non-custodial wallet is the best way to delegate ADA to a staking pool. I won’t go into detail in this article on how to set up a wallet, as I covered this in other articles that I will link to below.

If you are looking for an easy and light wallet that can run in your browser similar to Metamask, I recommend Yoroi. Yoroi is the most convenient wallet for Cardano users who want to interact with DApps and DeFi on the Cardano network. Learn all about it in our How to set up Yoroi Wallet article.

If you have a computer with plenty of hard drive space and want the most self-sovereign solution, which includes running your own Cardano node, then you can check out our Daedalus Wallet Review.

Cardano staking can be done on both Trezor and Ledger. To understand why Trezor and Ledger offer the most secure way to store and stake Cardano and other cryptocurrencies, you may want to read our Trezor Model T review and Ledger Nano X review. We even have the following article specific for How to take Cardano on Ledger.

For mobile wallets, I recommend staking with the Exodus wallet or Trust Wallet.

The Exodus Wallet is a Popular Software Wallet for both Mobile and Computer. Image via Exodus.

The Exodus Wallet is a Popular Software Wallet for both Mobile and Computer. Image via Exodus.Important note: When you stake for the first time, staking rewards will not start accumulating until after the end of the fourth epoch, which can take ~25 days, so don’t worry when you don’t receive any rewards for the first few weeks. After the initial period, rewards will be paid out at the end of each epoch, each epoch takes 5 days to complete.

The delay between delegating your funds and receiving rewards is due to the following sequence of events:

- Epoch 0: the Epoch in progress when you first delegate funds to a pool.

- Epoch 1: delegated ADA becomes part of the stake pool’s live stake amount.

- Epoch 2: delegated ADA counts towards the probability to create blocks

- Epoch 3: rewards from all blocks created during Epoch 2 are calculated.

- Epoch 4: rewards are distributed based on the stake active in Epoch 2.

Cardano staking can be done in literally a couple of clicks or taps of a screen, all you need to know is how to select a pool to delegate to.

Cardano Staking Pool Delegation

There are several factors to consider when choosing a Cardano stake pool to ensure you get your ADA rewards.

Keeping these following factors in mind is a good start to help make sure that you get the most out of your staking. Follow these rules to choose a staking pool and you’ll be set:

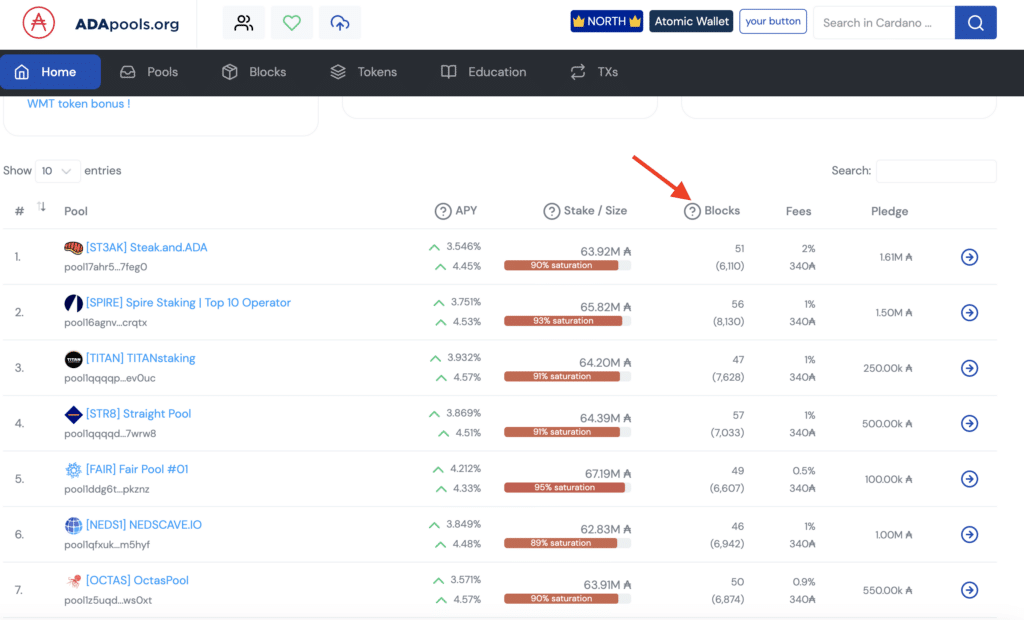

- Select a pool that has produced blocks. This information can be found in the blocks column.

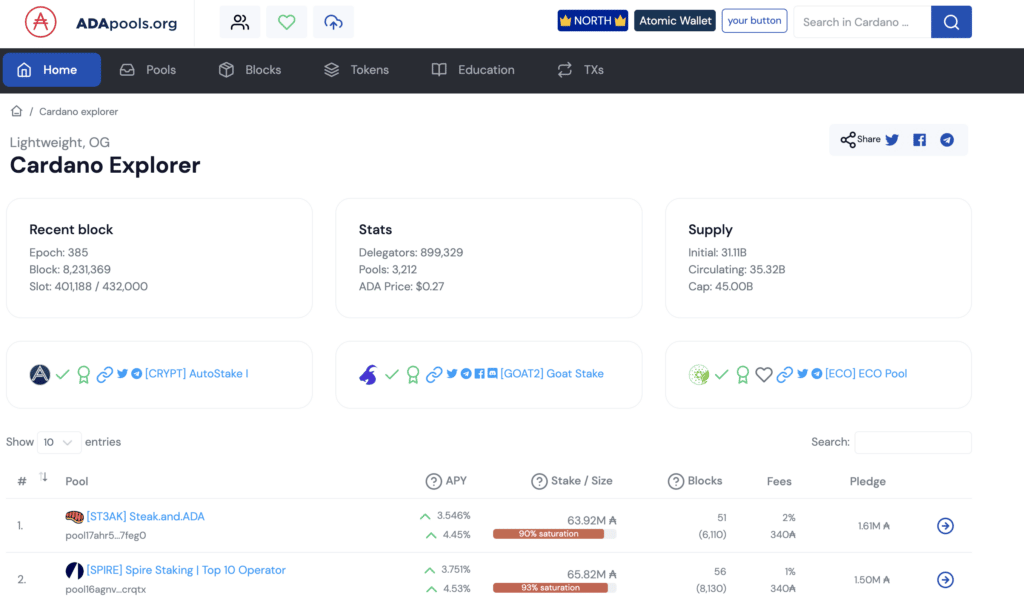

Image via Adapools

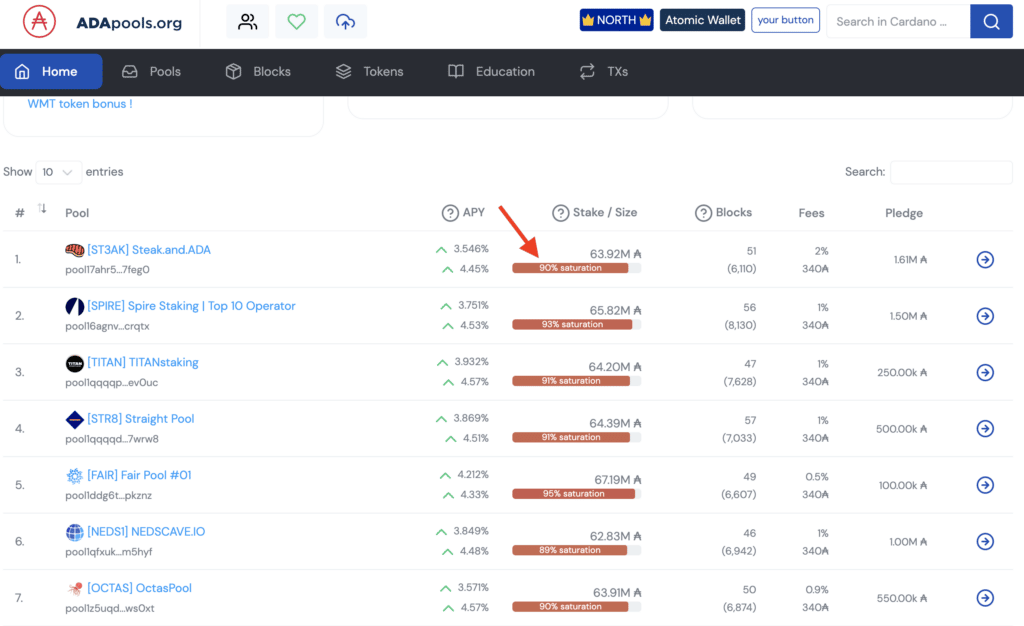

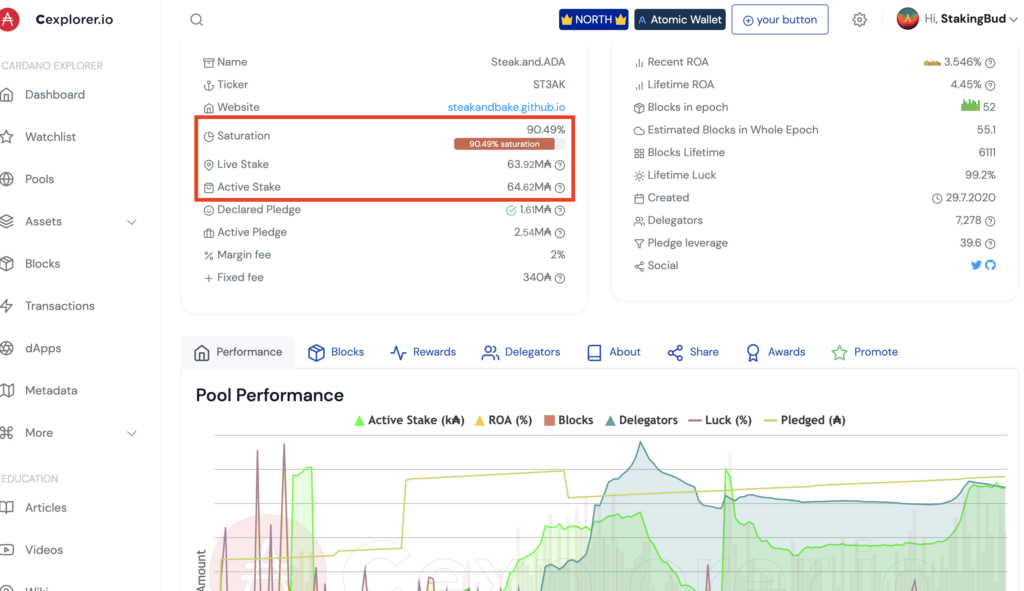

Image via Adapools- Find a pool with less than 60% saturation. To promote decentralization, staking pools that are over 60% full stop paying out staking rewards. It is a good idea to periodically check on your staking pool to ensure saturation has not been exceeded. At the moment, staking pool rewards are only available for pools with lower than 64 million ADA. A good rule of thumb is to find a pool with 30 million or fewer ADA staked. Note that there are currently discussions taking place about lowering the ceiling to 32 million in the near future.

Check for a Pool With Under 60% Saturation. Image via adapools.

Check for a Pool With Under 60% Saturation. Image via adapools.- Some users like to ensure that they can contact the stake pool operator. Clicking on the operator's name will take you to their profile, some operators provide contact information and socials groups. Finding out more about the operator can help build trust, judge competency, and ensure the pool’s purpose is in line with your own. I will cover this further on.

How to Choose a Cardano Pool

With all the above in mind, now we can get into the step-by-step. There are multiple places to search and delegate to pools, and over 3000 pools to choose from.

If you choose to stake with a Trezor, you won’t have a choice over different pool operators unless you choose to connect your Trezor to a third-party wallet. For staking natively within Trezor suite, there is simply one pool available that is managed by Trezor.

The easiest way to stake will be from directly within software wallet interfaces themselves. Wallets like Yoroi, Exodus, Trust Wallet and Daedalus will feature a staking option, with Yoroi, Trust Wallet, and Daedalus showing a list of pool operators you can choose from.

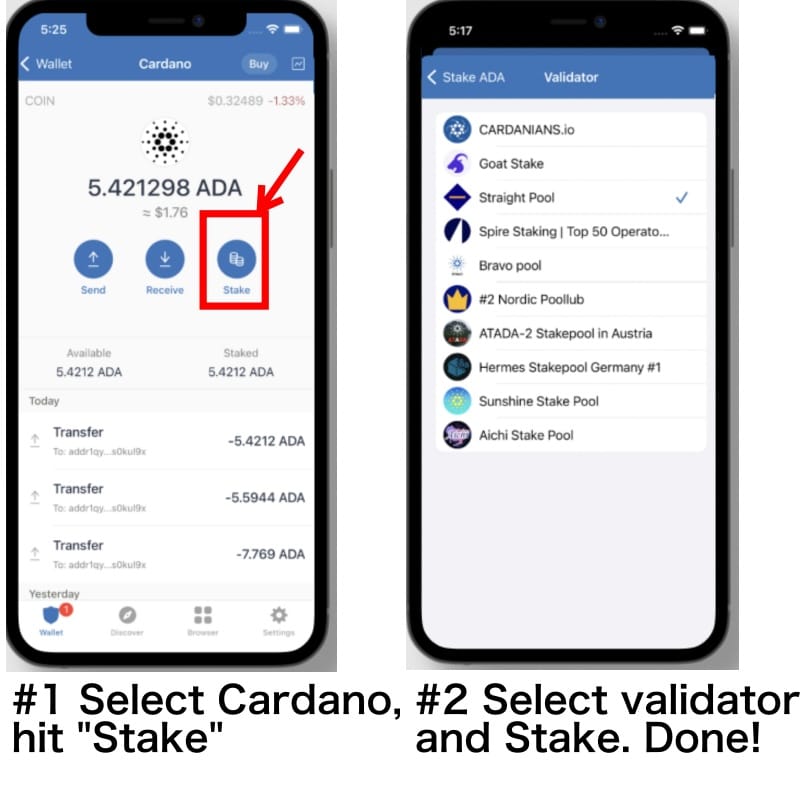

Here is how that looks in Trust Wallet:

Simply Hit the Staking Button, Choose The Stake Pool, and Stake! Image via Trust Wallet.

Simply Hit the Staking Button, Choose The Stake Pool, and Stake! Image via Trust Wallet.The most common source for pool operators and data comes from ADAPools.org. Most wallets will pull data directly from that site to display in the wallet, allowing you to see pertinent information about pool operators available for selection. You can, of course, navigate to the site yourself if you want more in-depth data such as scoring systems and additional filters to help you sort pools by various metrics, which will be covered below.

The Metrics

In this article, I will be using ADAPools to show various metrics, sort, rank, and provide images to help with basic navigation and explain the various metrics.

Current top Cardano stake pools. Image via adapools.

Current top Cardano stake pools. Image via adapools.The above image shows the current top staking pools. Aside from Daedalus, Exodus, and Trezor, most Cardano wallets will show similar information when you go into the Cardano staking option interface.

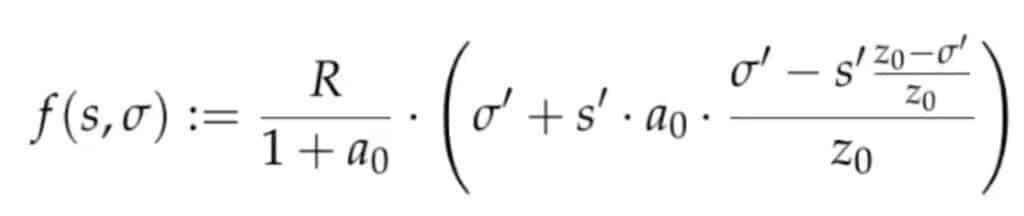

For you math fans out there, here is the formula for how Cardano rewards are calculated:

Cardano's Formula to Calculate Rewards

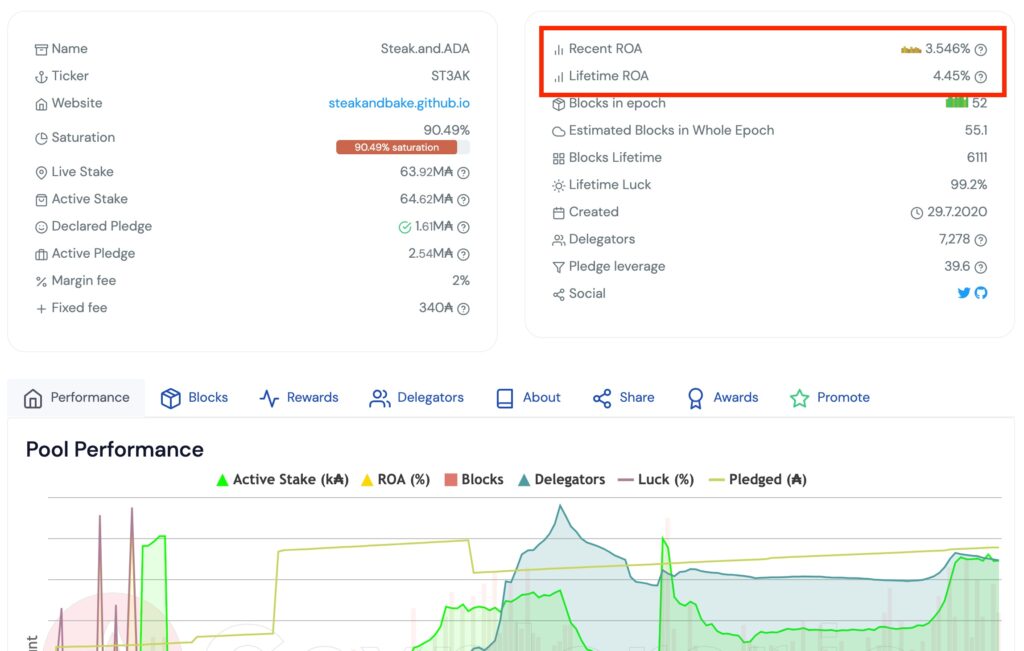

Cardano's Formula to Calculate RewardsROA 1M / Lifetime

This figure shows the current return on ADA that the pool produces over one month and the lifetime return of the pool. ROA stands for Return of ADA. The average return on ADA is currently 4.5%-5.5%.

Image via adapools

Image via adapoolsThis figure fluctuates for smaller pools that are producing fewer blocks.

Stake & Saturation

The staking figure shows how much ADA has been delegated to the pool. Pools that have a higher stake total than the network’s saturation limit results in negative effects on the rewards pool, such as lower or no ADA rewards being paid out. This is where the above-mentioned 64 million ADA limit is shown.

Image via adapools

Image via adapoolsThis is a way to encourage ADA stakers to delegate to smaller pools and for more pool operators to start new pools as the Cardano network grows, as this encourages further decentralization.

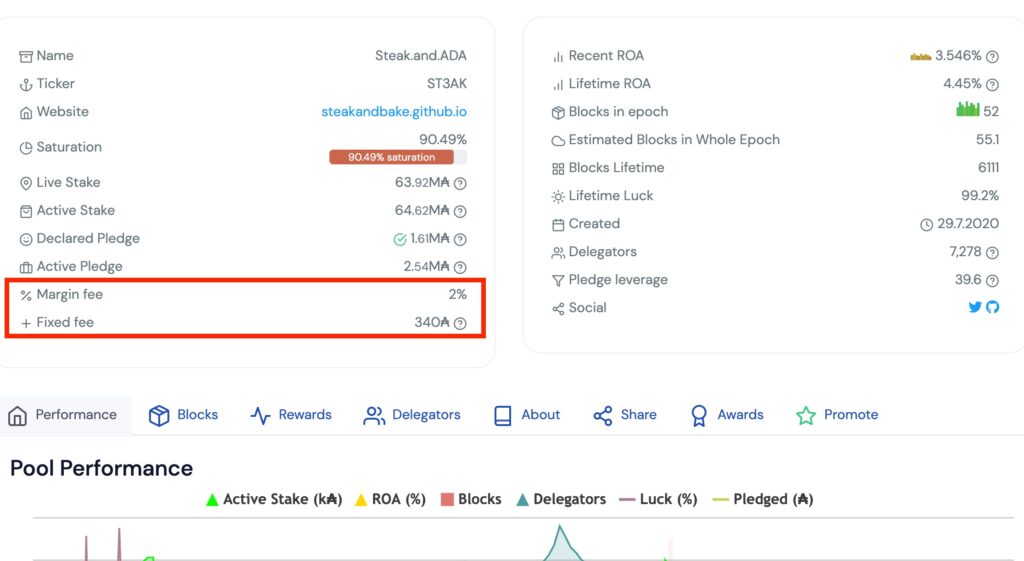

Variable Fees & Fixed Costs

Stake pool operators collect fees for the work that they do managing, maintaining, and marketing the pool. The current minimum fixed cost is 340 ADA, but some pool operators may charge more, so it is a good idea to keep an eye on this figure.

Image via adapools

Image via adapoolsThis fee isn’t paid upfront or charged to the delegate directly and Cardano stakers likely won't even notice the fees. The fees are taken from the rewards that would have been distributed to the pool, so users don’t see the fees enter or exit their wallets.

Pools can also charge an additional variable percentage fee which is taken out of the total rewards the pool delegates. From my experience, this isn’t too common as stake pool operators compete with one another to attract delegates, so as soon as one operator chooses to charge an additional fee, stakers are more likely to choose a different pool operator that doesn’t charge the extra fee.

Pools can charge a variable fee ranging between 0-100% with the most common being 0%-5%. Pools that have 100% variable fees should be avoided, these are usually private pools and delegating here will not issue stakers with rewards.

There are a few good reasons that operators may choose to charge a higher fee, and many Cardano enthusiasts may be more than happy to pay the fee as it can help with projects or support causes they believe in. I will go over this a little more later on.

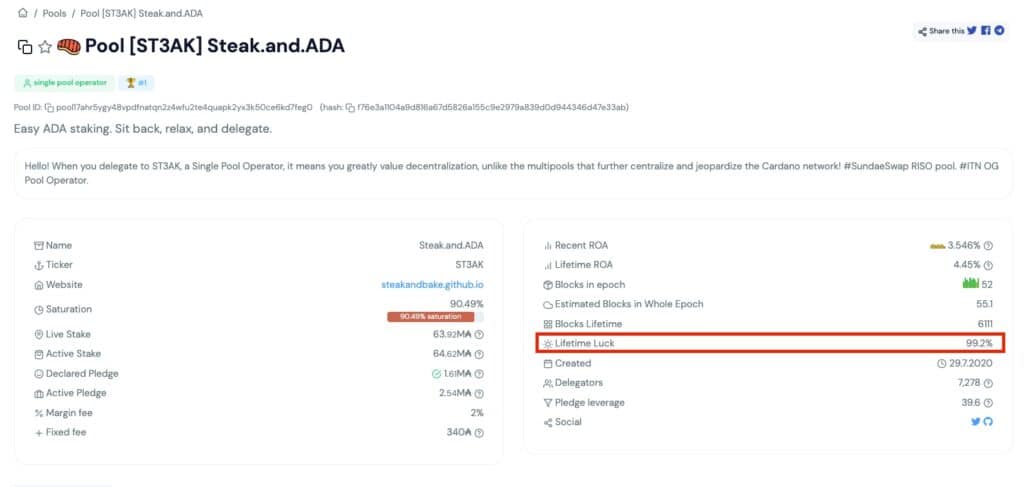

Luck

Yup, like most areas of life, there is always an element of luck involved. For ADA delegation, luck is a measure of how many blocks have been produced compared to the amount that pool is expected to produce.

Sometimes a pool may produce more blocks than what is expected, which is lucky, while other times, a pool may be expected to produce 6 blocks, but during the epoch, it only produces 3. This would be unlucky.

Image via adapools

Image via adapoolsThis figure averages out over time and doesn’t have a large impact on your ADA returns. Some active ADA pool delegators will treat staking like a slot machine and often swap pools, looking to get into some that show unlucky, hoping to get in at the moment the luck has a higher chance of changing. Most stakers don’t worry about it as one of the best things about crypto staking is that it can be passive.

This strategy is known as Pool Hopping. By hopping from pool to pool, some delegators will try to benefit from the fluctuating returns from different staking pools.

As returns from stake pools fluctuate every epoch, a pool currently returning low returns will eventually get a higher rate later on, and pool hoppers will try to play the odds via the pool’s luck.

Pool hopping can be fun, and if lucky, provide slightly higher than average returns, but also understand that each time you hop a pool you are incurring transaction fees, so you could be hurting yourself in the long run.

BPE

Block per Epoch (BPE) is a metric that shows how many blocks have been produced by the pool in the current epoch. With Cardano, one Epoch is 5 days.

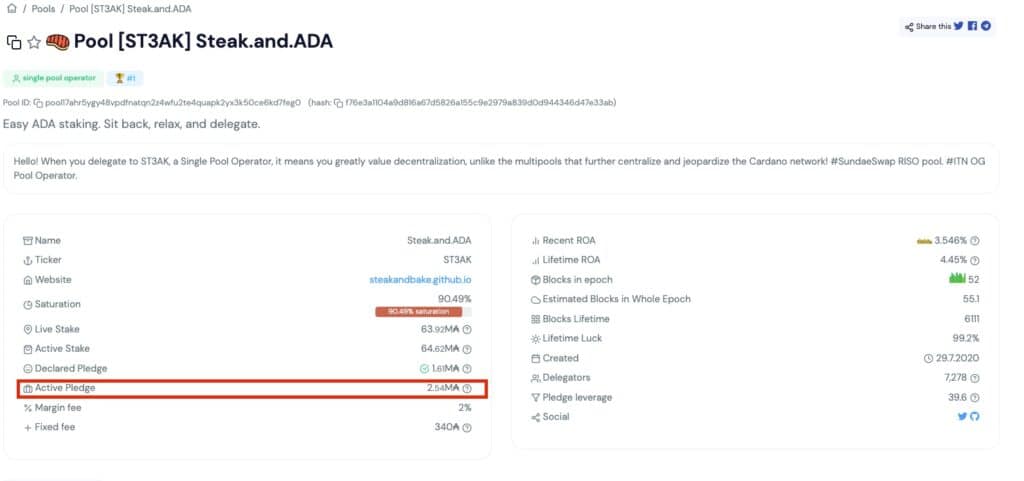

Pledge

Pledge shows the value that the stake pool operators themselves have staked in the pool as their own personal allocation.

Image via adapools

Image via adapoolsNormally, the higher, the better, as it affects rewards calculation and shows that the pool operator has a vested interest in the maintenance and operation of the pool.

Delegation Costs

There will be a deposit fee of 2 ADA the first time you delegate to a pool, but not for switching pools. This deposit will be returned to you when you stop staking.

There will also be a small transaction fee when you delegate, similar to standard network fees when sending a transaction. Keep this fee in mind and remember that you do not need to re-delegate every time you receive new ADA, as your full balance will always be staked.

Now that we have covered the basics and what all the important metrics are showing, here are some extra, optional considerations.

Choosing Between Pools

Many of the different pools will have unique selling points. When you select the pool name, you will be taken to the pool’s profile page, which contains information about the pool’s performance and links to social channels or websites, if applicable. Here are some points to consider:

Purpose:

Some pool operators will have an additional purpose or mission aside from only block production. Some pool operators pledge to give proceeds to charitable causes, fund development projects such as Cardano DApps, or create content. You can select a pool that is in line with your incentives and beliefs if you want to help support certain causes or projects.

Operator:

This is where you can determine the capabilities and competencies of the operator and help build trust. Getting involved in the operator’s communities or social media sites can help you gauge how you feel about the operator.

Track record:

Seeing that the pool has produced multiple blocks over its lifetime indicates that the pool is operating well. This area will also show the pool’s registration date so you can see how long it has been active.

Relays

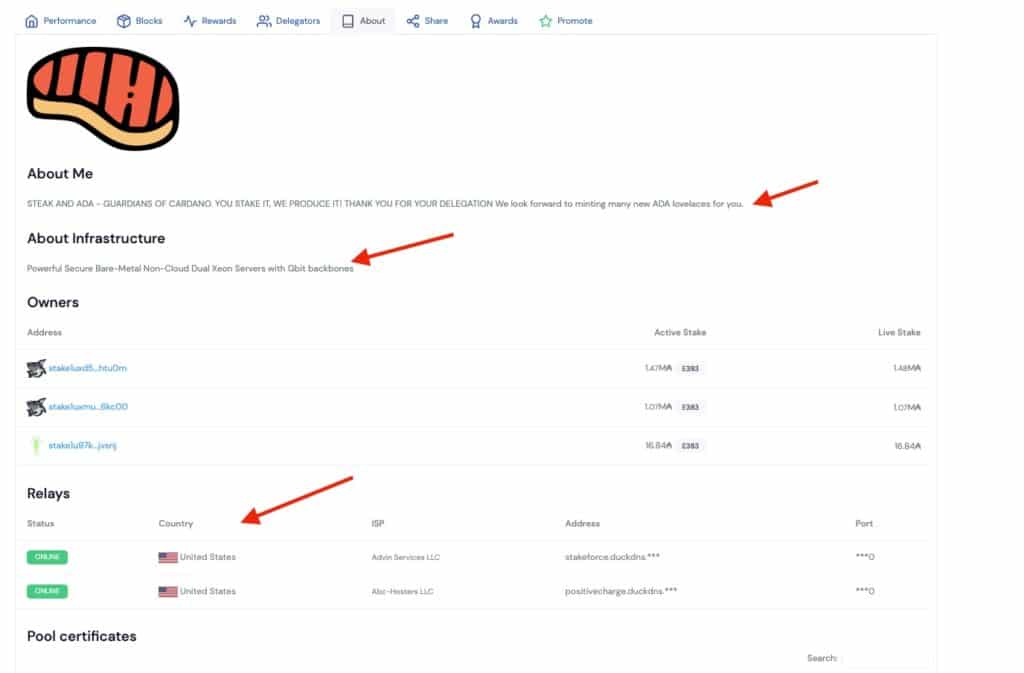

If you go into the “About” tab, you will see how many relays a pool operator has. Try to find a pool that has more than one.

Simply put, the more Relay nodes a pool operator has, the more secure the pool is in terms of keeping bad actors out. Relay nodes grant access to the right people and help keep those with bad intentions out.

About:

The “About” area will show the technical aspects of the pool operator for those who want a deeper look.

Image via adapools

Image via adapoolsThis will often contain information about things like how many nodes a pool has, what power the nodes are running on, and what hardware is being used.

What are the Benefits of Staking ADA Off-Exchange?

Most people buy their Cardano from an exchange like Binance, Kraken, or OKX. These exchanges offer Cardano staking, which is a convenient way for ADA holders to both buy and “stake” their ADA, but this isn’t the most secure way to earn ADA rewards for most users.

You will notice I placed the word stake in quotations above. This is because “staking” on a centralized exchange differs from staking from a self-custodial wallet. When a user stakes on an exchange, they are not actually staking anything, the exchange is staking on their behalf.

In case 2022 didn’t teach you lessons against keeping funds on an exchange, I have three words for you: FTX, Celsius, BlockFi.

When these crypto platforms collapsed, all users on these platforms lost access to their funds. So although staking ADA on an exchange is convenient, you open yourself up to third-party risk. Remember, “not your keys, not your crypto.”

When keeping funds on an exchange, users are essentially relinquishing control over their assets. The exchange, same as a bank, has the power to block access to your funds, lock your funds, and reject transactions. The most revolutionary aspect of crypto is that for the first time in human history, we have the option to escape custodial authoritative financial companies and control our own finances, so let's take advantage of it and hold and stake our own assets.

By staking on an exchange, you are also not contributing to the support and benefit of the Cardano network. Every user who self-stakes, runs a pool, or a node, only adds to the strength, decentralization, security, and robustness of the Cardano blockchain.

Staking Cardano: Closing Thoughts

Staking Cardano is a great way to not only earn passive ADA rewards but also contribute to the future of Cardano, financial freedom, and decentralization.

It is a win-win and a fantastic, safe way to increase your Cardano holdings. It costs absolutely nothing to get started if you choose one of the free wallets and is definitely one of the easiest and most flexible assets to stake.

Here are some resourceful community-built tools that are helpful for Cardano users: