If you’ve been anywhere near crypto X (formerly Twitter) lately, you’ve probably heard the name Hyperliquid. It's one of the fastest-growing decentralized perpetuals exchanges that’s got both degens and serious traders raising their eyebrows (and their leverage).

So, what exactly is Hyperliquid? At its core, it’s a decentralized exchange (DEX) built on its own custom Layer 1 blockchain, specifically optimized for blazing-fast, high-frequency trading. Think centralized exchange (CEX) speed, but with full on-chain transparency — no middlemen, no KYC, and definitely no custodians holding your crypto hostage.

But it’s not just about speed. Hyperliquid is gaining traction because it’s solving a long-standing problem in the DeFi world: how do you get the performance and precision of a Binance or Bybit without giving up decentralization?

Whether you’re a veteran trader looking to explore new tools or a DeFi newcomer trying to make sense of what the hype’s about, this guide is for you. We’re going to walk you through everything — from setting up your wallet and bridging your funds, to placing your first trade and managing risk like a pro. And don’t worry, we’ll also unpack the HYPE token

By the end of this, you’ll not only understand how to use Hyperliquid, you’ll know how to use it well.

Key Takeaways

- Hyperliquid is a decentralized perpetuals exchange that features a fully on-chain order book, 50x leverage, no gas fees, and a user-friendly interface designed for both pros and beginners.

- Traders can connect via popular EVM-compatible wallets or even use an email-based wallet for quick onboarding.

- Funding is done through a native bridge that brings USDC from major chains like Ethereum, Arbitrum, and Solana into the Hyperliquid ecosystem.

- Advanced tools like stop-loss, take-profit, isolated margin, and TWAP orders offer strong risk management for high-leverage positions.

- The HYPE token powers platform governance, fee discounts, staking rewards, and vault participation, making it central to the Hyperliquid ecosystem.

A Closer Look at Hyperliquid

So what makes Hyperliquid tick under the hood? To really understand why this platform has caught the attention of the DeFi crowd, let’s zoom in on its core infrastructure and the standout features that give it an edge in all the DEX noise.

Built for Speed and Transparency

Imagine trading on a platform that combines the lightning-fast execution of centralized exchanges with the trustless nature of decentralized finance. That's Hyperliquid for you.

At its core, Hyperliquid operates on its own Layer 1 blockchain, meticulously crafted to handle the demands of high-frequency trading. This isn't just any blockchain, it's engineered for performance, boasting the capability to process over 200,000 transactions per second with an average block time of just 0.2 seconds.

But speed isn't the only highlight. Hyperliquid employs a fully on-chain order book system. Unlike traditional decentralized exchanges that rely on automated market makers, Hyperliquid's order book ensures that every trade, order placement, and cancellation is transparent and verifiable on the blockchain. This design not only enhances trust but also provides traders with a level of precision and control akin to that of centralized platforms.

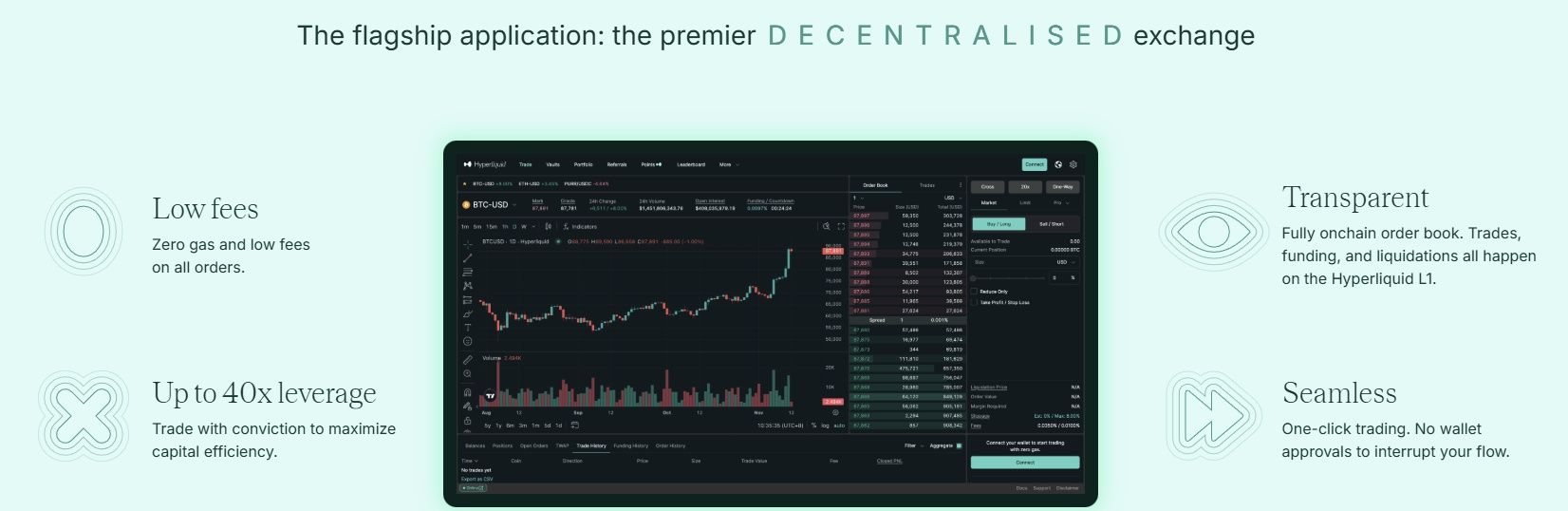

Hyperliquid brings a Blend of Speed, Transparency, and User-Friendly Features. Image via Hyperliquid

Hyperliquid brings a Blend of Speed, Transparency, and User-Friendly Features. Image via HyperliquidKey Features that Set it Apart

No KYC, Decentralized Yet High Performance

In a world where privacy is paramount, Hyperliquid stands out by eliminating the need for Know Your Customer (KYC) procedures. Traders can connect their wallets and start trading without divulging personal information. This approach preserves user anonymity while maintaining the platform's integrity and security.

Up to 50x Leverage with Minimal Fees

For those looking to amplify their trading positions, Hyperliquid offers leverage up to 50x on perpetual futures contracts. This feature allows traders to maximize potential returns, though it's essential to approach leveraged trading with caution. Complementing this is the platform's competitive fee structure, which includes zero gas fees and low trading fees.

Seamless Wallet Integrations and User-Centric Design

Hyperliquid prioritizes user experience. The platform supports a range of wallets, including MetaMask, Trust Wallet, and others compatible with WalletConnect. This broad compatibility ensures that users can effortlessly connect and manage their assets. Moreover, the intuitive interface is designed to cater to both novices and seasoned traders, providing tools and features that enhance the overall trading experience.

For a comprehensive analysis of Hyperliquid, including its high-speed perpetual futures, spot trading capabilities, and meme coin launchpad, explore our full review here.

Getting Started with Hyperliquid

Before you can unleash your inner degen or tactician on Hyperliquid, the first move is getting your setup in place. Fortunately, the process is rather simple, whether you’re on a desktop or mobile device, or even if you don’t yet have a wallet. Let’s break it down.

Key Points

- Hyperliquid supports popular EVM-compatible wallets like MetaMask, Trust Wallet, and Coinbase Wallet—just connect and start trading in seconds.

- Mobile users can sync their wallet via QR code, enabling fast and extension-free access on the go.

- Newcomers can use an email wallet to start trading instantly, with the option to export it to MetaMask later for full control.

- To trade, bridge USDC to Hyperliquid using deBridge; ETH, BTC, and SOL can also be transferred but must be converted to USDC for margin use.

Connecting Your Wallet

Hyperliquid supports a wide range of EVM-compatible wallets, so chances are you won’t need to jump through hoops. MetaMask, Trust Wallet, Coinbase Wallet, Ledger Live, and any wallet using WalletConnect are all good to go. All it takes is a few clicks: hit “Connect Wallet” on the top-right of the trading interface, pick your wallet, approve the connection, and voilà, you’re ready to trade.

Mobile Access via QR Code

If you're the kind of person who trades on the go, Hyperliquid has your back. Using your mobile wallet app, simply scan a QR code generated on the desktop interface to sync your wallet. It's fast, secure, and doesn’t require any extensions or browser add-ons.

Email Wallet Option

For absolute beginners or users who don't want to fiddle with browser extensions, there's the email wallet feature. By signing in with an email, Hyperliquid auto-generates a private on-chain wallet. While it's a great entry point, it’s worth noting this setup trades some custody and flexibility for ease of use. Exporting the wallet later to MetaMask or another service is possible, so think of it as training wheels for DeFi.

Hyperliquid supports a Wide Range of EVM-Compatible Wallets. Image via Freepik

Hyperliquid supports a Wide Range of EVM-Compatible Wallets. Image via FreepikBridging and Funding Your Account

With your wallet locked and loaded, it’s time to bring in some funds. Hyperliquid operates primarily with USDC as trading collateral, so you'll need to get that on-chain.

Enter the Hyperliquid Bridge, powered by deBridge. This tool allows users to port USDC from major chains like Ethereum, Arbitrum, Solana, Optimism, and Base over to Hyperliquid’s custom Layer 1. Here’s the play-by-play:

- Go to the deBridge portal and connect your wallet.

- Choose your source chain and the token (typically USDC).

- Select Hyperliquid as your destination.

- Confirm the bridging transaction and wait a few minutes for the transfer to settle.

Supported Assets

Beyond USDC, you can bridge tokens like ETH, BTC, and SOL, but keep in mind that only USDC is used as margin for trading. Other assets will need to be swapped into USDC on-chain, or via external platforms before you deposit.

Once your funds arrive, you're ready to start exploring charts, toggling leverage, and placing trades. But don’t worry, we’ll walk you through that next.

Navigating the Trading Interface

Once your funds are in and your wallet's connected, it’s time to get acquainted with the battlefield. Don’t worry, it’s not as intimidating as it sounds. Let’s walk through what you’ll see and how to make sense of it all.

Key Points

- Hyperliquid's trading dashboard offers a clean, real-time interface featuring trading pairs, an on-chain order book, and a portfolio overview.

- You can trade with market, limit, stop, TWAP, and scale orders—mirroring the flexibility of top centralized exchanges.

- Choose between cross margin or isolated margin for better risk control, with leverage available up to 50x depending on the asset.

- Once your trade is placed, monitor and manage your positions from the portfolio section with tools for take-profit and stop-loss.

Dashboard Overview

Once you're connected and funded, Hyperliquid's trading interface greets you with a sleek, dark-themed dashboard designed for both clarity and functionality.

- Trading Pairs: Hyperliquid offers a diverse range of trading pairs, including major cryptocurrencies like BTC, ETH, and SOL, as well as various altcoins.

- Order Book Layout: The platform utilizes a fully on-chain order book system, mirroring the functionality of centralized exchanges. Orders are matched based on price-time priority, ensuring transparency and fairness in trade executions.

- Portfolio Display: Your portfolio section provides a comprehensive overview of your open positions, account balances, and trading history. Real-time updates ensure you have the latest information at your fingertips, aiding in informed decision-making.

Hyperliquid supports a Wide Range of EVM-Compatible Wallets. Image via Hyperliquid

Hyperliquid supports a Wide Range of EVM-Compatible Wallets. Image via HyperliquidPlacing Your First Trade

Embarking on your first trade with Hyperliquid is a straightforward process, designed to cater to both novices and seasoned traders.

1. Select a Trading Pair: Navigate to the trading pair of your choice from the available list.

2. Choose Order Type: Hyperliquid supports various order types:

- Market Order: Executes immediately at the current market price.

- Limit Order: Executes at a specified price or better.

- Stop Market Order: Triggers a market order when a specified price is reached.

- Stop Limit Order: Triggers a limit order when a specified price is reached.

- Scale Order: Places multiple limit orders within a defined price range.

- TWAP Order: Executes large orders over time to minimize market impact.

3. Set Leverage and Margin: Hyperliquid allows leverage up to 50x, depending on the asset. You can choose between:

- Cross Margin: Shares collateral across all positions, maximizing capital efficiency.

- Isolated Margin: Limits collateral to a single position, containing potential losses.

4. Review and Place Order: After configuring your order, review the details, including potential liquidation price and fees. Once satisfied, click "Place Order" to execute.

5. Monitor Positions: Post-execution, your positions will appear in the portfolio section, where you can track performance, set take-profit or stop-loss orders, and make adjustments as needed.

By following these steps, you can confidently navigate Hyperliquid's trading interface and execute trades effectively.

Risk Management Tools and Order Controls

Hyperliquid doesn’t just hand you a trading engine and wish you luck—it equips you with some serious risk management tools. Whether you're guarding against liquidation or locking in profits, here’s how to stay sharp and protected.

Key Points

- Hyperliquid supports stop loss and take profit orders in both market and limit formats, giving traders flexibility in managing execution and slippage.

- Margin requirements are clearly defined with automatic liquidation if account value drops below the maintenance threshold—protecting against runaway losses.

- Using isolated margin, avoiding excessive leverage, and monitoring open positions are critical best practices for managing trading risk effectively.

- Traders can monitor real-time PnL via Hyperliquid’s dashboard or third-party tools like SuperX for advanced analytics and alerts.

Stop Losses, Take Profits, and Liquidations

The reality is, crypto trading requires robust risk management tools, and Hyperliquid delivers with its comprehensive suite of features.

Stop Loss and Take Profit Orders

Hyperliquid allows traders to set both Stop Loss (SL) and Take Profit (TP) orders to manage potential losses and secure gains. These orders can be configured as either market or limit orders:

- Market TP/SL Orders: Execute immediately at the best available price once the trigger price is reached, with a default slippage tolerance of 10%.

- Limit TP/SL Orders: Allow traders to specify the exact price at which the order should be executed, providing greater control over slippage and execution price.

For instance, setting a SL order to close a long position with a trigger price of $10 and a limit price of $10 will attempt to execute at $10 when the mark price drops below $10. However, if the price drops rapidly to $9, the order may remain unfilled unless a more aggressive limit price is set.

Hyperliquid Equips you with some Serious Risk Management Tools. Image via Freepik

Hyperliquid Equips you with some Serious Risk Management Tools. Image via FreepikMargin Checks and Liquidation Mechanisms

Hyperliquid employs a margining system to ensure traders maintain sufficient collateral:

- Initial Margin: The required collateral to open a position, calculated as position_size * mark_price / leverage.

- Maintenance Margin: Set at half of the initial margin at maximum leverage, it's the minimum collateral required to keep a position open.

If the account value, including unrealized PnL, falls below the maintenance margin requirement, the position becomes eligible for liquidation. In such cases, Hyperliquid initiates a process to close the position, either partially or fully, to prevent further losses.

Best Practices for Protecting Trades

- Regular Monitoring: Keep an eye on your positions and adjust SL/TP orders as market conditions change.

- Use Isolated Margin: For high-risk trades, isolated margin confines potential losses to a single position, safeguarding the rest of your portfolio.

- Avoid Over-Leveraging: While Hyperliquid offers up to 50x leverage, using high leverage increases liquidation risk.

Monitoring Positions and PnL

Hyperliquid provides real-time tracking of your positions and Profit and Loss (PnL):

- Portfolio Page: Displays account value and PnL graphs over 24-hour, 7-day, and 30-day periods. Account value includes unrealized PnL from both cross and isolated margin positions.

- Third-Party Tools: Platforms like SuperX offer real-time PnL tracking, alerts, and analytics, helping traders make informed decisions and adjust strategies promptly.

By leveraging these tools and adhering to best practices, traders can effectively manage risk and navigate the dynamic crypto markets on Hyperliquid. Luckily, we recently published a detailed guide on crypto risk management to help you stay clear of trouble.

Exploring the HYPE Token Ecosystem

Beyond just being a powerful DEX, Hyperliquid has built an ecosystem centered around its native token, HYPE.

Key Points

- HYPE is the native token of Hyperliquid, used for paying fees, voting on governance proposals, and earning rewards through staking and ecosystem activity.

- Staking HYPE offers auto-compounding rewards based on future emissions, with APYs that decrease as total staked supply increases.

- Unstaking involves a 1-day bonding and a 7-day unbonding period before tokens can be withdrawn to a spot account.

- Vaults let users passively participate in algorithmic or trader-managed strategies, with shared profits and community liquidity backing key platform functions like market-making.

What is HYPE?

HYPE is the native utility and governance token of the Hyperliquid ecosystem. It serves multiple purposes:

- Utility: HYPE is used to pay for transaction fees on the Hyperliquid platform, offering users fee discounts and incentives for holding and using the token.

- Governance: HYPE holders can participate in the decision-making process of the platform by voting on protocol upgrades, fee structures, and other key proposals, ensuring a decentralized and community-driven development.

- Rewards: Users are incentivized with HYPE tokens for providing liquidity, staking, and participating in various ecosystem activities, fostering active engagement and growth.

This multifaceted role of HYPE ensures that it remains integral to the functionality and evolution of the Hyperliquid platform.

HYPE makes a Central Component of the Platform's Decentralized Finance Offerings. Image via Hyperliquid

HYPE makes a Central Component of the Platform's Decentralized Finance Offerings. Image via HyperliquidStaking and Vaults

Staking Mechanics

Staking HYPE tokens allows users to support the network's security and earn passive income. The staking process is straightforward:

- Delegation: Users delegate their HYPE tokens to trusted validators who are responsible for maintaining the network's integrity.

- Rewards: Stakers earn rewards sourced from future token emissions. The annual percentage yield (APY) varies based on the total amount staked, with rates inversely proportional to the square root of the total staked HYPE. For instance, at 400 million HYPE staked, the APY is approximately 2.37%.

- Compounding: Rewards are accrued every minute and distributed daily, with an automatic compounding feature that reinvests earnings, enhancing the yield over time.

- Unstaking: To unstake, users initiate a process that includes a 1-day bonding period during which tokens do not earn rewards, followed by a 7-day unbonding period before tokens can be transferred back to the spot account.

Vault Participation

Hyperliquid offers vaults as a means for users to participate in collaborative trading strategies:

- Functionality: Vaults allow users to deposit funds that are managed by experienced traders or algorithms, aiming to generate profits through various strategies.

- HLP Vaults: The Hyperliquidity Provider (HLP) vault is a protocol-owned vault that engages in market-making and liquidation processes. It democratizes strategies typically reserved for institutional traders, allowing the community to contribute liquidity and share in the profits.

- Profit Sharing: Vault owners receive a percentage of the profits generated, incentivizing skilled traders to manage vaults effectively.

By participating in staking and vaults, users can actively contribute to the Hyperliquid ecosystem's growth while earning rewards, making HYPE a central component of the platform's decentralized finance offerings.

Pro Tips and Best Practices

Before you dive into live trades, it’s worth learning from those who’ve already slipped on the DeFi banana peel. From smart setups to simulation tools, here’s how to dodge common mistakes and train up without burning your bankroll.

Key Points

- Avoid common trading mistakes like over-leveraging, ignoring stop-losses, and trading blindly without market context.

- Always factor in fees when calculating profit margins—frequent trades can eat into gains even with low-cost platforms.

- Use Hyperliquid’s testnet to explore trading strategies, risk tools, and order types without risking real funds.

- To access the testnet faucet, you must first deposit on the mainnet using the same wallet address, ensuring you're familiar with live environment requirements.

How to Avoid Common Pitfalls

Even with its user-friendly interface, Hyperliquid can present challenges for newcomers. Here are some common pitfalls and how to avoid them:

- Over-Leveraging: While the allure of high leverage (up to 50x) is tempting, it's crucial to understand that higher leverage increases the risk of liquidation. Start with lower leverage to get a feel for the platform's dynamics.

- Neglecting Fees: Although Hyperliquid boasts competitive fees, frequent trading can accumulate costs. Always factor in fees when planning your trades to ensure profitability.

- Ignoring Risk Management Tools: Failing to set stop-loss or take-profit orders can lead to significant losses. Utilize these tools to automate your exit strategies and protect your capital.

- Disregarding Market Conditions: Trading without considering market volatility or news events can be detrimental. Stay informed and adjust your strategies accordingly.

Using Testnet and Practice Accounts

Before committing real funds, it's wise to familiarize yourself with Hyperliquid's features using the testnet:

- Accessing the Testnet Faucet: Visit the Hyperliquid Testnet Faucet to claim 1,000 mock USDC. Note that you need to have deposited on the mainnet with the same address to use the faucet.

- Connecting Your Wallet: Ensure your EVM-compatible wallet is connected to the testnet. This setup allows you to interact with the platform without risking real assets.

- Exploring Features: Use the testnet to practice placing orders, adjusting leverage, and utilizing risk management tools. This hands-on experience can build confidence and proficiency.

Engaging with the testnet provides a risk-free environment to learn and experiment, ensuring you're well-prepared for live trading on Hyperliquid.

Conclusion: Is Hyperliquid Right for You?

So, there you have it: Hyperliquid in all its on-chain, no-KYC, high-performance glory.

From its custom Layer 1 blockchain to the fully transparent order book and institutional-grade speed, Hyperliquid is doing something few decentralized exchanges have pulled off: it's giving traders the feel of a centralized platform without sacrificing the ethos of DeFi.

The process of getting started is refreshingly straightforward — connect your wallet (or even your email), bridge some USDC, and you're ready to roll. Add in powerful risk controls, leverage options, a testnet playground, and the HYPE token's staking and governance roles, and you've got a pretty full toolbox to work with.

Of course, with great power (like 50x leverage) comes great responsibility. Hyperliquid doesn’t hold your hand, so if you skip your homework, like risk management or understanding margining, you could learn some tough lessons. But for those willing to put in a bit of time, the rewards can be very real.