Quick Verdict

If you want money now, use instant debit or PayPal. Expect a 1.5% to 2% fee and lower daily limits. If you want low cost, use ACH in the U.S. or SEPA in the EU. ACH is free and lands in 1 to 3 business days. SEPA costs about €0.15 and lands in 1 to 2 business days. For large same day amounts, use a domestic wire and watch your bank cut off time. Check your current withdrawal limit on the Fees and Limits page before you start.

Pick a Method

- Need speed, choose instant debit or PayPal

- Need low cost, choose ACH or SEPA

- Need large same day, choose a wire

- Weekend or holiday, use instant methods

Key Facts

- Limits depend on verification and method

- Bank rails queue outside business hours

- Instant methods have higher fees

- Confirm fees and arrival time before you submit

Step By Step Withdrawal Process

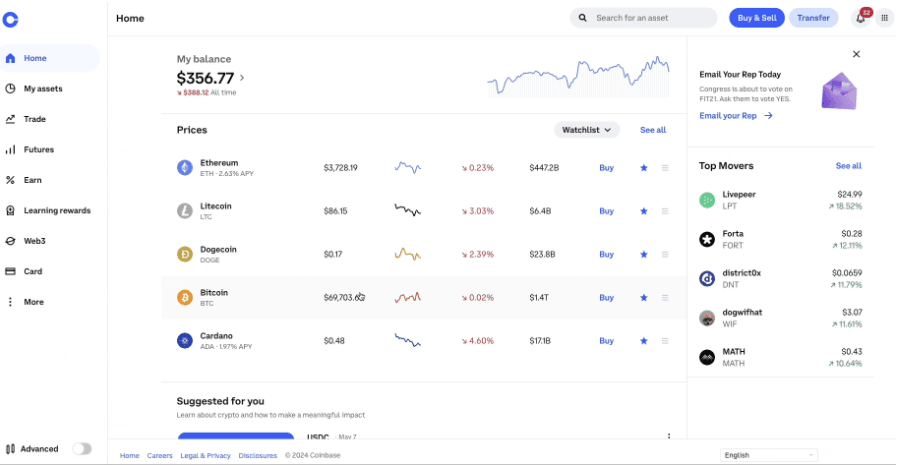

Desktop

- Step 1: Log in and go to My Assets.

- Step 2: Select your fiat balance.

- Step 3: Click Cash Out / Withdraw cash.

- Step 4: Pick your payment method and enter the amount.

- Step 5: Review the details and confirm with 2FA.

Mobile

- Step 1: Open the Coinbase app and tap Assets.

- Step 2: Select your fiat balance.

- Step 3: Tap Transfer, then choose Withdraw cash.

- Step 4: Pick your payment method and enter the amount.

- Step 5: Review the details and confirm with device authentication or 2FA.

Common Methods and Timings

| Method | Typical Time | Typical Cost | Notes |

|---|---|---|---|

| Instant debit | Minutes | About 1.5% to 2% | Lower limits, works 24/7 |

| PayPal | Minutes | Varies by region | PayPal country must match your account |

| ACH, U.S. | 1–3 business days | Free | Most common for U.S. users |

| SEPA, EU | 1–2 business days | About €0.15 | Requires a small verification deposit |

| Wire, U.S. | Same day | $10–$25 | Cut off time applies, higher limits |

| Faster Payments, U.K. | Same business day | Low or free | Requires a small linked deposit with reference |

Understanding Coinbase Cash Out Options

Cashing out on Coinbase means converting your cryptocurrency into local currency, or fiat currency (like USD, EUR, or GBP), and then moving those funds to a linked payment method. You must do this through your Coinbase exchange account, not the separate Coinbase Wallet app.

Before withdrawing, make sure your account is verified and that you’ve added a valid bank account, debit card, or PayPal. Once these steps are complete, you can choose from several withdrawal options depending on your region.

Selling Cryptocurrency for Cash

On both the website and mobile app, here's how you can sell your crypto for fiat:

- Navigate to Trade or Assets.

- Select the cryptocurrency you want to sell.

- Click or tap "Sell," enter the amount, and select your fiat currency balance (USD, EUR, GBP).

- Review the order details, including price and fees.

- Confirm the transaction.

These steps transfer your crypto into a fiat wallet within Coinbase, which is necessary before you can withdraw to a bank or PayPal.

Withdrawal Methods Available

To withdraw funds (assets) from Coinbase Exchange, you have a couple of options: you can either convert your cryptocurrency to fiat currency or sell your cryptocurrency instantly for cash to load onto your debit card. Additionally, Coinbase offers the convenience of withdrawing funds through PayPal as well.

- ACH (U.S.): Free, common for U.S. accounts, typically 1–3 business days.

- SEPA (EU): Low fixed fee (around €0.15), 1–2 business days, requires bank verification via a small deposit.

- Faster Payments (U.K.): Quick GBP withdrawals, usually same business day. Requires a small linked deposit with reference.

- Wire transfers (U.S. and select regions): Faster (often same day if before cut-off) but higher cost, typically $10–$25 per transaction.

What The Process Looks Like: After selling crypto for fiat, go to your fiat balance, select Cash Out, choose your linked bank, enter the amount, and confirm.

Limits: Daily and weekly limits depend on your verification level and payment method.

- Process: Link your PayPal account under settings, authorize with your matching email, sell your crypto to fiat, and select PayPal as the withdrawal method.

- Timing: Usually instant.

- Fees & Limits: Regular Coinbase trading fees apply when converting crypto to cash. Withdrawal fees vary by country. Daily limits apply.

- Restrictions: PayPal can only be used for withdrawals/sales, not for buying. Your PayPal account’s country must match your Coinbase account.

- Process: Withdraw directly to an eligible Visa or Mastercard debit card using Visa Direct or Mastercard Send.

- Eligibility: Available in supported regions like the U.S., U.K., and select EU countries. The card must support instant transfer networks.

- Timing: Usually within minutes, but may vary by bank.

- Fees & Limits: Typically 1.5% in the U.S., up to 2% in the U.K./EU. Daily limits often apply (commonly up to $2,500/day).

Take a look at which works the best for you to withdraw your funds from Coinbase.

Regional Withdrawal Methods

| Region | Bank Transfer Options | Instant Options | PayPal Availability | Notes |

|---|---|---|---|---|

| United States | ACH (free, 1–3 business days) Wire transfer ($10–$25, same day if before cut-off) | Debit card instant cash out (Visa Direct/Mastercard Send) Real-Time Payments (RTP) for supported banks | Yes | ACH is most common. Wire useful for large amounts. |

| European Union (SEPA Zone) | SEPA transfer (€0.15 fee, 1–2 business days) | Debit card instant cash out (Visa/Mastercard, ~2% fee) | Yes (select countries) | Requires initial SEPA deposit to link bank. |

| United Kingdom | Faster Payments (free or very low cost, often same business day) | Debit card instant cash out (Visa/Mastercard, ~2% fee) | Yes | Requires small GBP deposit with reference to link bank. |

| Rest of World | Bank transfers where supported (varies by country and currency) | Limited instant debit card support | Limited | Availability depends on local banking partnerships. |

Step-by-Step Guide to Withdrawing Funds

Getting cash off Coinbase involves three stages: preparing your account, selling your crypto, and finally withdrawing your fiat balance. Let’s break it down.

Before we begin, however, you should keep one thing in mind: Before you withdraw, confirm the network matches your destination’s supported network. If you send to an unsupported or wrong network, your funds may be lost permanently. Coinbase cannot recover them.

Preparing Your Account

Before you can withdraw, you need to set up your Coinbase account correctly:

- Complete Level 1 and Level 2 verification: Provide ID and, in some regions, proof of address to unlock higher withdrawal limits.

- Link and verify a payment method: Add a bank account, PayPal, or debit card. The account name must match your Coinbase profile.

- Check withdrawal limits: Found in Settings, limits vary by verification level, region, and payment method.

- Enable 2FA: Use an authenticator app for stronger security.

- Add a withdrawal allowlist (if supported): Restricts withdrawals to pre-approved accounts for added protection.

Sell on Coinbase (Desktop)

Once your account is set up, the next step is to sell your crypto for fiat.

- Step 1: Sign in and Transfer

Buy. Sell or Transfer Crypto via Coinbase Desktop. Image via Ledger

Buy. Sell or Transfer Crypto via Coinbase Desktop. Image via Ledger- Step 2: Choose Sell and the crypto asset you want to sell,

- Step 3: Enter the amount. Review the rate, spread, and fees.

- Step 4: Confirm the sale to your fiat wallet (USD, EUR, GBP, or stablecoin like USDC).

Fiat balance will update under Assets.

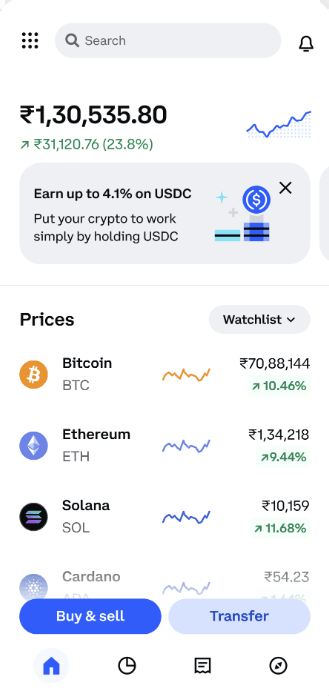

Sell on Coinbase (Mobile App)

Buy And Sell Crypto Easily Via Coinbase Mobile App. Image via Coinbase

Buy And Sell Crypto Easily Via Coinbase Mobile App. Image via Coinbase - Open the Coinbase app, tap Buy & Sell, then select Sell.

- Pick the cryptocurrency and amount.

- Review all fee and rate details.

- Confirm the sale. Proceeds will move to your fiat balance.

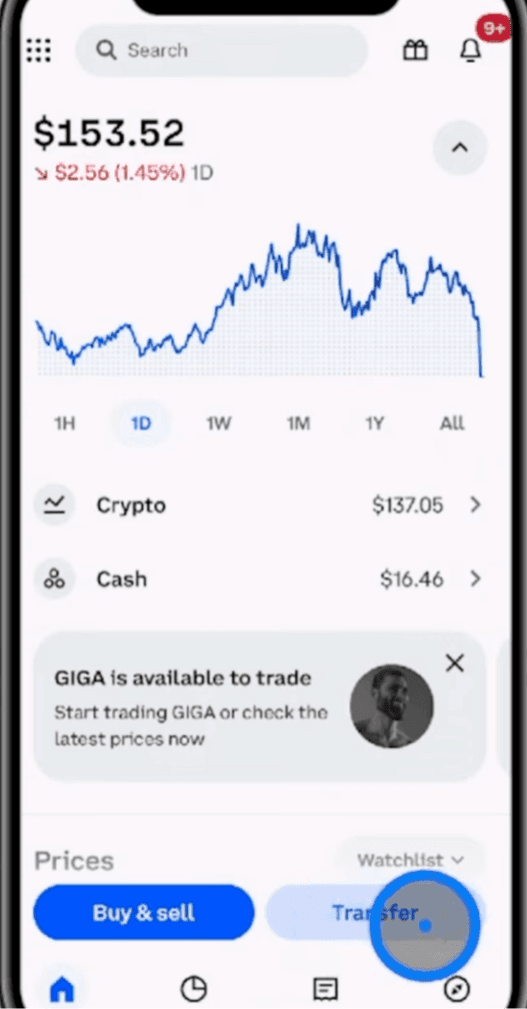

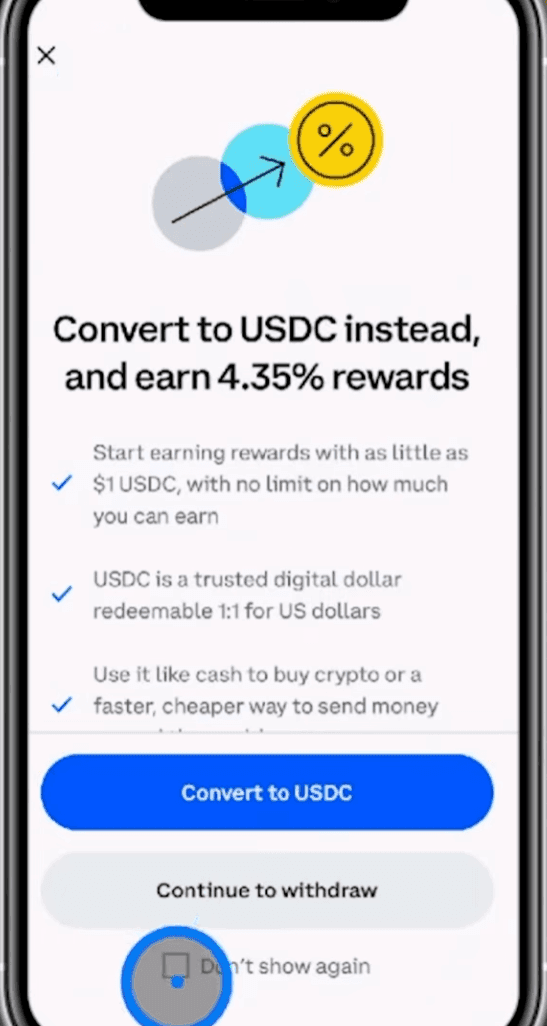

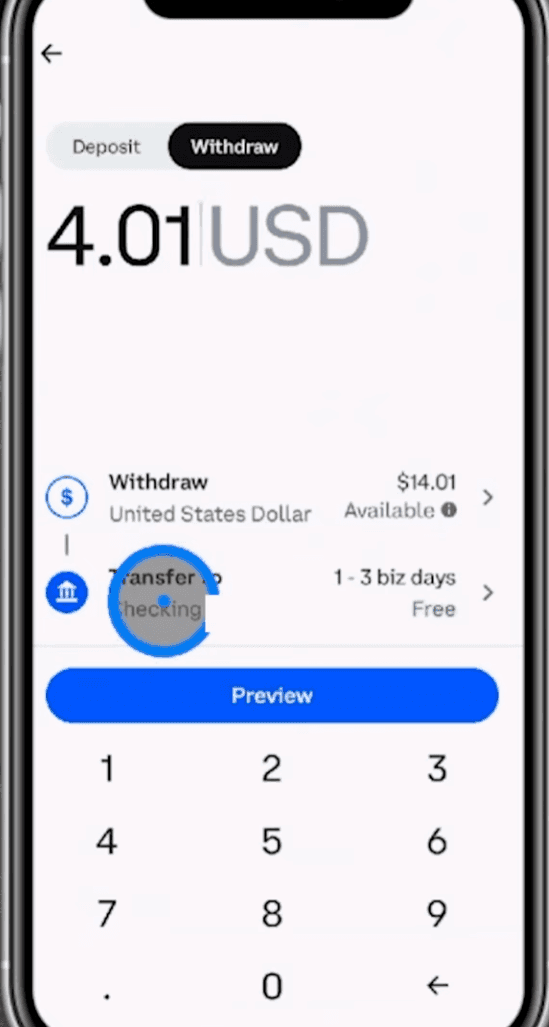

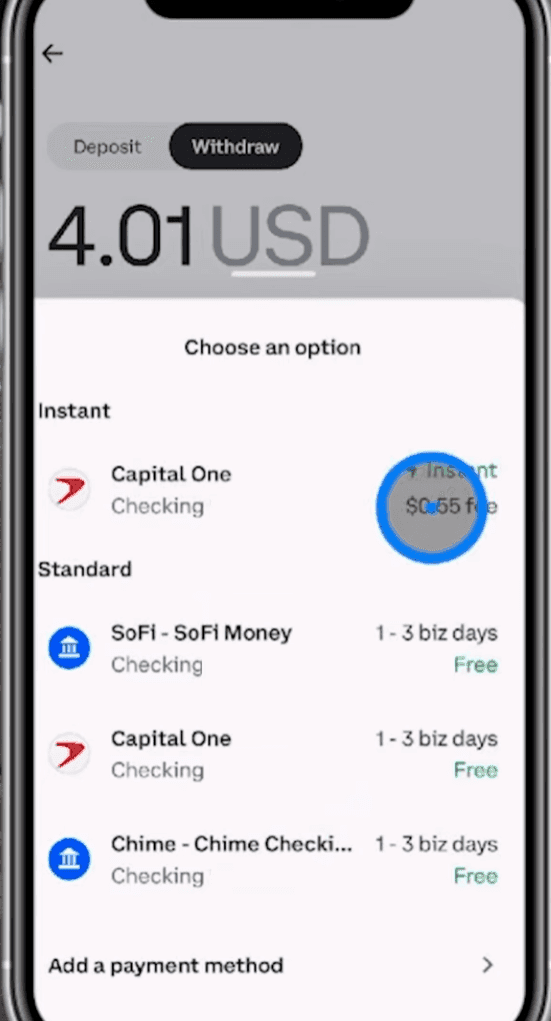

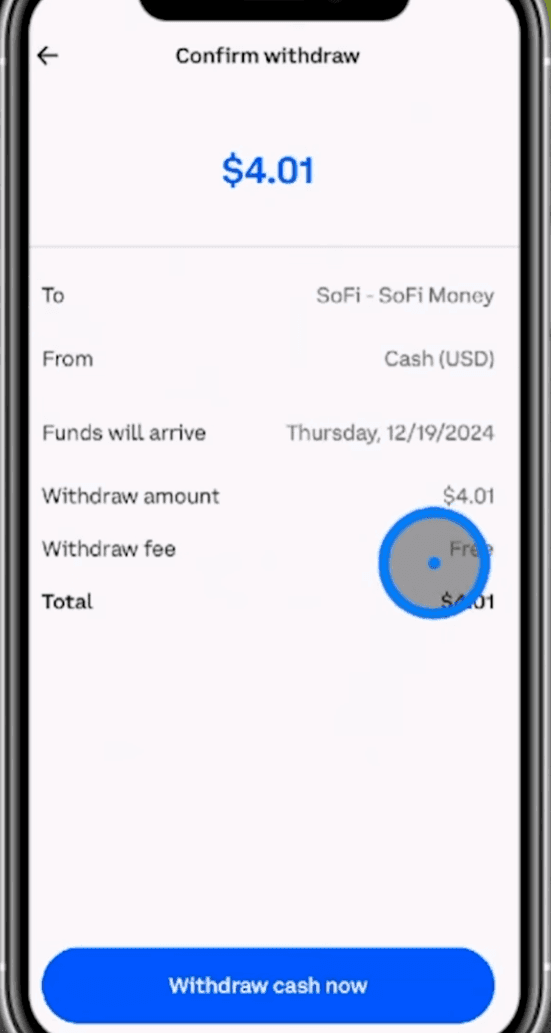

Withdraw to Your Bank or PayPal (Mobile App)

The process of withdrawal is almost identical to selling on the mobile app. We will walk you through every step below:

Step 1: Open your Wallet App and select Transfer

Select Transfer in Coinbase App. Image via Trufinancials

Select Transfer in Coinbase App. Image via Trufinancials Step 2: Coinbase will give you an option to convert it to USDC instead. Choose “Continue to Withdraw” if you still want to withdraw.

Select Continue To Withdraw. Image via TruFinancials

Select Continue To Withdraw. Image via TruFinancialsStep 3: Enter the amount of withdrawal and select the account you want to transfer to.

Select Transfer To Account and Check The Time. Image via Trufinancials

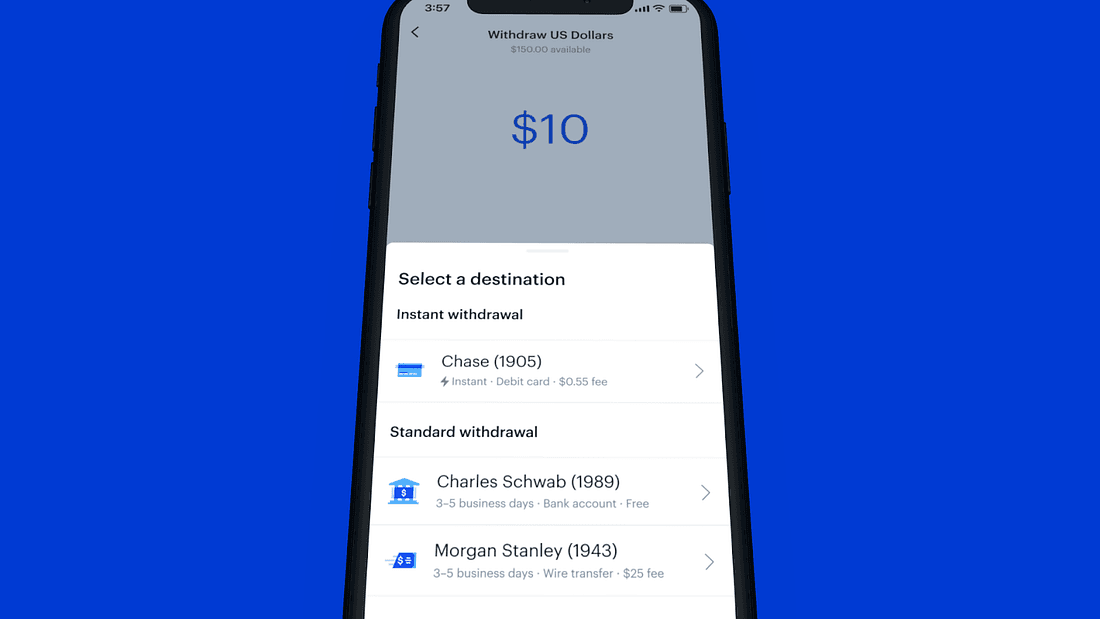

Select Transfer To Account and Check The Time. Image via TrufinancialsStep 4: Now select the type of withdrawal you want to make. Coinbase offers “Instant” and “Standard” withdrawals. Instant withdrawals come with fees.

Select The Type of Transfer. Image via Trufinancials

Select The Type of Transfer. Image via Trufinancials Step 5: Once the account and method are selected, you can preview the transaction amount and confirm.

Finally Review Your Transaction Details And Confirm. Image via Trufinancials

Finally Review Your Transaction Details And Confirm. Image via TrufinancialsWithdraw to Your Bank or PayPal (Desktop)

With cash in your fiat wallet, you can move it out to a linked payment method.

- Navigate to My Assets.

- Select your fiat balance and click Cash Out / Withdraw cash.

- Review order details to make sure that everything is correct and tap on Place Order to begin the transaction.

- Choose your linked bank, PayPal, or debit card.

- Enter withdrawal amount.

- Review arrival time and fees (ACH free in the U.S.; wires, debit, or PayPal may charge).

- Confirm using 2FA.

- Save the receipt.

On mobile, the withdrawal flow looks slightly different but achieves the same result:

- Tap Assets, then select your fiat balance.

- Tap Transfer, then Withdraw cash.

- Pick a payment method (bank, PayPal, debit card).

- Enter withdrawal amount.

- Review the fee and estimated arrival.

- Confirm with device authentication or 2FA.

- Save the receipt.

Examples and Scenarios

Different Cash Out Situations Show Speed And Cost. Image via Shutterstock

Different Cash Out Situations Show Speed And Cost. Image via ShutterstockThe right withdrawal method depends on how much you’re moving and how fast you need it. These examples show how different options work in practice:

- Small instant payout: A $200 withdrawal to a debit card settles within minutes. The fee appears on the preview screen before you confirm.

- Large low-cost withdrawal: A $15,000 transfer via ACH or SEPA arrives in one to three business days. These standard transfers are cheaper, often free.

- Cross-border need: If you’re moving funds internationally, PayPal may be faster, but a wire transfer could be more cost-effective depending on the amount.

Instant vs Standard Withdrawals

Compare Instant Payout Options Against Slower Bank Transfers. Image via Coinbase

Compare Instant Payout Options Against Slower Bank Transfers. Image via CoinbaseWhen you withdraw from Coinbase, you’ll have two main choices: instant payouts or standard transfers. Each serves a different need, and the right option depends on how fast you want the funds, what you’re willing to pay in fees, and how much you’re moving.

Instant Payouts

Instant payouts are designed for speed. If you’ve linked an eligible Visa or Mastercard debit card, or PayPal in supported regions, you can move funds out within minutes. In rare cases, your bank may take up to 24 hours, but generally, this is the quickest route. The trade-off is cost; instant options carry higher fees, which you’ll see on the confirmation screen before finalizing. They also come with lower daily limits, so they’re best suited for smaller withdrawals or urgent payments.

Standard Transfers

Standard transfers use traditional banking rails like ACH in the U.S., SEPA in Europe, Faster Payments in the U.K., and wires in some regions. These methods take anywhere from one to five business days, but they’re far more cost-effective. In fact, ACH and SEPA transfers are often free. They also allow higher limits than instant cash outs, which makes them better for larger withdrawals.

When to Use Which

If speed matters most, go with instant payouts. They work 24/7, even on weekends and holidays, which can be critical if you need access outside banking hours. If you’d rather save on fees or you’re moving a larger sum, standard transfers are the smarter option. Just plan around business days, since weekend requests won’t process until banks reopen.

Fees, Limits, and Timeframes

Understand Coinbase Withdrawal Fees, Daily Caps And Restrictions. Image via Shutterstock

Understand Coinbase Withdrawal Fees, Daily Caps And Restrictions. Image via ShutterstockWithdrawal costs and processing times depend on the method you select, your account verification level, and in some cases, blockchain activity. Always review the fees and estimates shown in-app before confirming a transaction.

Withdrawal Fees on Coinbase

Coinbase fees for fiat withdrawals:

- ACH (U.S.): Free.

- Wire transfer (USD): Typically $25 per withdrawal.

- SEPA (EUR): Free.

- SWIFT (GBP): About £1 per withdrawal.

- PayPal: Often instant and fee-free in supported regions.

For cryptocurrency withdrawals:

- Network fees: Variable, passed directly to miners or validators.

- Lightning Network (Bitcoin): 0.2% processing fee.

- Asset recovery fee: If unsupported assets are sent, Coinbase may recover them but charges the network fee plus 5% of the recovered amount over $100.

Withdrawal Limits

Withdrawal limits vary with your verification level, account type, region, and mode of withdrawal:

For Fiat withdrawals

- EUR SEPA: €100,000 per day.

- USD Fedwire: $100,000 per day.

- USD SWIFT International Wires: $10,000,000 per day.

- USD ACH: $100,000 per day.

- GBP Faster Payments: £1,000,000 per deposit.

Crypto networks charge different fees, and they vary based on different factors like congestion, maintenance, infrastructure, etc. Experts at Coinbureau have crafted a complete guide to crypto network fees to help you understand.

How Long Do Coinbase Withdrawals Take

All crypto withdrawals are completed within 5 business days; however, the exact timeframe for withdrawals on the Coinbase exchange differs region by region and method by method. Let's break it down.

| Method | Typical Time | Cutoffs / Weekend Impact |

|---|---|---|

| ACH (U.S.) | 3–5 business days | Transfers pause on weekends and U.S. bank holidays |

| Wire (U.S.) | 1–3 business days | Same-day possible if before bank cut-off; none on weekends |

| SEPA (EU) | 1–3 business days | Delays on weekends and EU banking holidays |

| GBP Faster Payments WIthdrawal | 1-3 business days | Contact Coinbase support if not received in 3 days. |

| PayPal | Often instant | 24/7, though minor delays can occur |

| Crypto (on-chain) | Minutes to hours, longer with congestion | Not tied to bank hours; speed varies by blockchain |

| Crypto (off-chain, Coinbase to Coinbase) | Instant | None |

Maximizing Security When Withdrawing

Essential Security Measures For Safe Coinbase Withdrawals. Image via Shutterstock

Essential Security Measures For Safe Coinbase Withdrawals. Image via ShutterstockSecurity should be your top priority whenever you move funds out of Coinbase. Following a few simple practices reduces the risk of errors or fraud.

Checklist

- Turn on two-factor authentication (2FA) with an authenticator app rather than SMS.

- Add withdrawal addresses to a whitelist if you transfer crypto before cashing out.

- Use only known devices and secure networks when accessing your account.

- Always check the URL and SSL certificate to avoid phishing sites.

- Ensure the bank account name matches your Coinbase profile details.

- Review and confirm all details carefully before completing a withdrawal.

Here is a guide to protect your cryptocurrency assets and keep your funds safe. And if you are a newbie looking to invest and withdraw, then withdrawal processes alone are not enough to decide the security of any exchange. Conduct thorough research on key factors to determine if Coinbase is a safe exchange before making a decision.

Troubleshooting Coinbase Withdrawal Issues

Even with everything set up correctly, withdrawals can sometimes get stuck or fail. Here are the most common problems you might face, what causes them, and how to resolve them.

| Issue | What happens | Common causes | How to resolve |

|---|---|---|---|

| Delayed withdrawals | Funds arrive later than expected | Bank processing windows, weekends, internal compliance reviews, blockchain congestion, temporary Coinbase glitches | Wait for the stated timeframe, then contact support with the transaction ID; use instant payout if available; complete “Accelerate Withdrawal” ID check if requested |

| Failed withdrawals | Transfer reverses back to your account | Wrong or unsupported bank details, name mismatch, withdrawal limits exceeded, policy violations, wallet or network maintenance | Verify bank details and re-link if needed; use a supported domestic bank; lower the amount to fit limits or try PayPal or wire; complete KYC |

| “Cash out unavailable” or “Payout disabled” | You cannot withdraw at all | Pending verification, fraud-detection hold, region restrictions, negative balance from chargebacks or disputes | Finish Level 2 verification and submit documents; clear negative balances; check Coinbase Status for outages; contact support if needed |

Delayed Withdrawals

Withdrawals don’t always land when you expect them to.

Causes: Delays often come from routine bank processing windows, weekends, or internal compliance reviews. For crypto transfers, congestion on blockchains like Bitcoin or Ethereum can slow things down. Occasionally, Coinbase’s own systems may experience temporary glitches.

Fix: Most delays clear on their own within the stated timeframe. If funds still haven’t arrived, contact Coinbase support with your transaction ID. If you need money faster, try an instant payout where available. In some cases, you may be asked to provide extra ID through the “Accelerate Withdrawal” option.

Failed Withdrawals

Sometimes a withdrawal fails and is returned to your account.

Causes: The most common reasons are incorrect or unsupported bank details, a name mismatch, or exceeding your withdrawal limits. Policy violations or temporary wallet/network maintenance can also stop a payout from going through.

Fix: Double-check your bank information and re-link the payment method if needed. Use a domestic bank account supported by Coinbase. Reduce your withdrawal amount to stay within daily or weekly limits, or try another option such as PayPal or a wire transfer. Make sure your account is fully verified under Coinbase’s KYC requirements.

“Cash out unavailable” or “Payout disabled”

In some cases, you may see a message that prevents you from withdrawing altogether.

Causes: This usually signals an account-level issue such as pending verification, a temporary hold triggered by fraud detection, or region-based restrictions.

Fix: Complete Level 2 verification if you haven’t already, and submit any requested documents. Clear any outstanding negative balances that may be tied to chargebacks or disputes. If the issue isn’t on your end, check the Coinbase Status page for platform-wide outages before contacting support.

Alternatives to Withdrawing Cash Directly

Withdrawing funds to a bank isn’t the only way to access the value of your crypto. Coinbase offers alternatives that may be faster, more convenient, or better suited to long-term strategies.

Coinbase Card

Spend Crypto Instantly With Coinbase Card Worldwide Access. Image via Coinbase Card

Spend Crypto Instantly With Coinbase Card Worldwide Access. Image via Coinbase CardThe Coinbase Card is a Visa debit card linked directly to your Coinbase account. It lets you spend crypto like Bitcoin, Ethereum, or USDC anywhere Visa is accepted. Each purchase converts the required amount of crypto into local currency instantly, and you can also use the card for ATM withdrawals. For many users, this avoids waiting for bank transfers. A bonus: purchases can earn crypto rewards. (Coinbase Card US, EU, UK)

Move USDC or Fiat to Other Platforms

Transfer USDC Or Fiat To Exchanges Offering Better Rates. Image via Shutterstock

Transfer USDC Or Fiat To Exchanges Offering Better Rates. Image via ShutterstockInstead of withdrawing directly to a bank or PayPal, you can transfer USDC or other assets from Coinbase to another platform that may offer better conversion rates. If your funds are in Coinbase Wallet, move them first into your Coinbase Exchange account before sending them elsewhere. Always select the correct blockchain network for transfers, as using the wrong one can permanently result in lost funds.

Use a Hardware Wallet for Long-Term Storage

Protect Long Term Holdings With Secure Hardware Wallets. Image via Shutterstock

Protect Long Term Holdings With Secure Hardware Wallets. Image via ShutterstockFor long-term holders, keeping most assets in a hardware wallet is a safer choice. By moving your crypto from Coinbase to devices like Ledger or Trezor, you maintain direct control of your private keys and reduce exposure to online threats. Many users keep only a small “spending balance” in their Coinbase account, while storing the rest offline. Coinbase Wallet also supports connecting to hardware wallets for secure management and dApp use.

Coinbase Vaults

Coinbase Vaults are a secure storage option offered by Coinbase, designed for holding larger amounts of cryptocurrency that you don't need immediate access to. Think of it like a savings account for your crypto, contrasted with a regular Coinbase wallet, which functions more like a checking account for frequent transactions.

Withdrawal Process of a Vault looks like:

- To withdraw funds from a Vault, you first need to initiate a withdrawal request within your Coinbase account, specifying the amount and the destination (your regular Coinbase balance or an external wallet).

- Approval Process: If you've set up multi-signature, all designated approvers will need to authorize the withdrawal.

- Time Delay: After approval, the mandatory 48-hour time delay begins, providing a crucial window to review and potentially cancel the withdrawal if it's fraudulent.

- Transfer to Wallet: Once the time delay passes and all approvals are confirmed, the funds are released to your chosen destination.

Compliance and Taxes

Withdrawing from Coinbase isn’t just a technical process; it also comes with regulatory and tax responsibilities.

Selling Crypto to Fiat is a Taxable Event

In many regions, converting cryptocurrency into fiat currency (like USD, EUR, or INR) counts as a taxable event. If you sell Bitcoin or Ethereum on Coinbase before withdrawing to your bank, any profit realized is subject to capital gains tax. The exact rules differ by country, so check how your local laws treat crypto-to-fiat sales.

Keep Records

Accurate record-keeping is essential. To calculate gains or losses, you’ll need the original purchase price (cost basis) and the selling price. Coinbase provides downloadable reports in its tax center, but ultimately, you are responsible for tracking and reporting your transactions.

AML and KYC Laws

Coinbase requires identity verification under Anti-Money Laundering (AML) and Know Your Customer (KYC) laws. These checks are mandatory for all regulated exchanges and ensure withdrawals are tied to verified users, helping prevent fraud, money laundering, and tax evasion.

Link to Official Tax Help

Tax treatment of crypto varies widely. Always consult official tax authority resources or a qualified professional before filing. Coinbase’s crypto tax guide is a good starting point, but your local regulations should take priority.