At the heart of blockchain security lies staking, where participants lock up their crypto assets to help validate transactions and maintain network integrity. This process not only ensures that the network remains robust and decentralized but also rewards those who commit their assets to the cause. However, the traditional approach to staking comes with a catch — your assets are typically locked up and inaccessible for a fixed period.

But what if you could stake your assets and still keep them liquid, ready to seize new opportunities as they arise? Enter liquid staking — a flexible alternative that’s redefining how we think about staking. This approach allows you to earn rewards while retaining access to your assets, making it a game-changer for those who want to stay agile in the fast-paced world of crypto.

In this complete guide to liquid staking, we will answer what is liquid staking, how it works, why it matters, how you can get started, and highlight the top liquid staking platforms.

Understanding the Basics of Staking

Staking has become a big deal in the world of cryptocurrency. Imagine it as a way to earn extra income just by holding onto your crypto—kind of like earning interest on a savings account, but with a bit more excitement. At its core, staking is all about supporting a blockchain network by locking up some of your crypto assets. And, in return, you get rewarded. Simple, right? But there’s a bit more to it, especially when you dive into how it all works under the hood.

What is Staking in Cryptocurrency?

So, what exactly is staking in cryptocurrency? Think of it as a way to help keep a blockchain network running smoothly. By staking your coins, you're basically saying, "Hey, I'm here to support the network, and in exchange, I’d like some rewards." The more crypto you stake, the more power you have in the network.

Now, if you’ve heard of mining, you might be wondering how staking is different.

Mining is all about solving complex puzzles to validate transactions, which takes a lot of energy and expensive hardware. Staking, on the other hand, is more like a community effort where your investment is your ticket to participate. The network chooses validators (the people who check and add transactions to the blockchain) based on how much they’ve staked. And, of course, these validators get rewarded with more crypto for their efforts.

So, in a way, staking is like putting your money where your mouth is, showing you’re committed to the network. And you get rewarded for it. Not a bad deal, right?

How Does Traditional Staking Work?

When it comes to traditional staking, it’s pretty straightforward. You lock up your crypto in a wallet and let it sit there, supporting the network. The amount you stake acts like a deposit that guarantees you won’t misbehave — because if you do, you could lose some or all of it. The more you stake, the better your chances of being selected as a validator, and the more you can earn in crypto staking rewards.

But there’s a catch — once your crypto is staked, it’s locked away. You can’t touch it until the staking period is over. It’s kind of like putting your money in a fixed deposit at the bank; you can’t withdraw it until it matures.

Some of the popular cryptocurrencies you can stake include Ethereum (after its upgrade to Ethereum 2.0), Cardano, Solana, and Polkadot. Each of these networks has its own rules and rewards, but the basic idea is the same — by staking, you help secure the network and earn a little something on the side.

Overall, staking can be a great way to generate yield, especially if you believe in the long-term success of the network. But, like everything in crypto, it’s not without risks. For instance, if the network has issues or you get penalized as a validator, you could lose some of your staked assets. So, it’s always a good idea to do your homework before diving in.

What is Liquid Staking?

Liquid staking is an innovative approach that allows you to stake your crypto assets without locking them up entirely. In traditional staking, once you commit your tokens to the network, they’re essentially frozen — you can’t use or trade them until the staking period ends. But with liquid staking, you receive what are called liquidity tokens in exchange for the assets you stake. These tokens represent your staked assets and can be traded, transferred or used in various decentralized finance (DeFi) applications while your original assets continue to earn staking rewards.

This concept of liquidity tokens is what sets liquid staking apart from traditional staking. It’s like having your cake and eating it too — you get to earn staking rewards while still having the flexibility to use your assets elsewhere. This is particularly useful in volatile markets where quick access to funds can make a big difference. For investors looking to maximize their earnings without sacrificing liquidity, liquid staking is an attractive option.

Staking Helps to Keep a Blockchain Network Running Smoothly. Image via Shutterstock

Staking Helps to Keep a Blockchain Network Running Smoothly. Image via ShutterstockHow Liquid Staking Works

So, how does liquid staking actually work? The process starts just like traditional staking — you choose a liquid staking platform, stake your assets, and then, instead of locking them up, you receive liquidity tokens. These tokens are usually issued at a 1:1 ratio, meaning if you stake one ETH, you’ll receive one liquidity token representing that staked Ethereum.

The beauty of these liquidity tokens is that they can be used across the DeFi ecosystem. Want to lend them out, trade them on an exchange, or use them as collateral for a loan? Go ahead! All the while, your original staked assets remain in the network, continuing to validate transactions and earn rewards. This dual utility — earning staking rewards while participating in other DeFi activities — is what makes liquid staking so powerful.

Moreover, when you’re ready to "unstake," you simply return the liquidity tokens to the platform to redeem your original assets.

The Benefits of Liquid Staking

Understanding the benefits of liquid staking could help you maximize your crypto strategy. Let’s dive into what makes liquid staking so appealing.

Enhanced Liquidity

Liquid staking allows you to earn rewards while keeping your assets flexible. Unlike traditional staking, where assets are locked, liquid staking provides liquidity tokens that can be traded or used in DeFi applications. This means you can respond to market changes without waiting for an unstaking period.

Maximizing Staking Rewards

Liquid staking opens multiple earning avenues. While your staked assets generate rewards, liquidity tokens can be further used in lending, yield farming, or as collateral, effectively compounding your returns. This dual-earning potential maximizes the value of your assets.

Risk Mitigation

Liquid staking offers flexibility in risk management by allowing you to move liquidity tokens even if your original assets are locked. This reduces the impact of market downturns. Additionally, diversifying your liquidity tokens across various DeFi platforms can spread risk and protect against volatility. Some liquid staking platforms also integrate protective measures like insurance against smart contract failures, adding an extra layer of security that traditional staking might not provide.

Liquid Staking vs. Traditional Staking

Let’s break down the differences between traditional and liquid staking and see which one might be a better fit for you.

| Feature | Liquid Staking | Traditional Staking |

|---|---|---|

| Liquidity | High - Assets remain accessible via liquidity tokens | Low - Assets are locked up for a set period |

| Access to Funds | Immediate - Can trade, sell, or use in DeFi | Locked - Funds are inaccessible during staking period |

| Staking Rewards | Earn rewards while retaining flexibility | Earn rewards, but funds are inaccessible |

| Risk Profile | More complex, involves additional smart contract risks | Simpler, potentially more secure as assets are not exposed to extra platforms |

| Market Exposure | Liquidity tokens may fluctuate in value, introducing market volatility | Assets are not directly exposed to market conditions during staking |

| Flexibility | High - Can use liquidity tokens across different DeFi platforms | Low - Cannot react to market changes or take new opportunities until unlocking |

| Complexity | Higher - Requires understanding of liquidity tokens and associated platforms | Lower - Simple process with direct staking and rewards |

| Diversification Opportunities | Yes - Can diversify by using liquidity tokens in various platforms | No - Assets are locked in one staking position |

| Risk Mitigation | Diversification possible, reducing impact of a single platform's failure | No diversification - All staked assets are exposed to the performance of the chosen network |

| Best Fit For | Investors looking for flexibility and opportunities in DeFi | Investors preferring simplicity and willing to lock funds for a set period |

Liquidity Differences

One of the biggest differences between liquid staking and traditional staking is all about liquidity or how easily you can access your funds. In traditional staking, once you commit your assets to the network, they’re locked up for a specific period. This means you can’t touch them, trade them, or move them around until the staking period ends.

On the other hand, liquid staking offers much more flexibility. When you stake your assets, you receive liquidity tokens in return. These tokens represent your staked assets and can be traded, used in DeFi protocols, or even sold on an exchange. Essentially, liquid staking lets you keep earning staking rewards while still having access to your funds. It’s like getting the benefits of a fixed-term deposit, but with the freedom to withdraw or use your money whenever you want.

This flexibility may be appealing to investors who want to stay nimble in a fast-moving market. Whether you need to react to sudden price changes or want to take advantage of new investment opportunities, liquid staking gives you the ability to move your assets around without losing out on staking rewards.

Risk Profiles

When comparing risk profiles, both traditional and liquid staking have their pros and cons. With traditional staking, the main risk is that your assets are locked up and inaccessible for a set period. This means if the market turns, you’re stuck riding out the storm without the option to quickly liquidate your assets. However, the upside is that traditional staking is often viewed as simpler and potentially more secure since your assets are less exposed to additional smart contract risks.

Liquid staking, while offering greater flexibility, comes with its own set of risks. Because your staked assets are represented by liquidity tokens, there’s an added layer of complexity and potential security risks, especially if the platform or protocol issuing those tokens is compromised. Additionally, the value of your liquidity tokens might fluctuate based on market conditions, introducing some level of market volatility to the equation.

That said, liquid staking can also offer some risk mitigation advantages. By allowing you to spread your investments across different platforms or use your liquidity tokens in various DeFi activities, you’re not putting all your eggs in one basket. This diversification can help cushion against specific market downturns or platform failures.

Conclusion

The choice between liquid staking and traditional staking often comes down to your personal risk tolerance and investment goals. If you’re looking for simplicity and are okay with locking up your funds, traditional staking might be the way to go. But if you value flexibility and the ability to adapt quickly, liquid staking could be your best bet.

Top Liquid Staking Platforms

As liquid staking continues to gain traction in the crypto world, several platforms have emerged in this space. Here’s a look at some of the best liquid staking platforms, what sets them apart, and what you should consider before choosing one.

| Platform | Supported Blockchains | APY / APR | Commission on Rewards | Liquidity Tokens Issued | Unique Features |

|---|---|---|---|---|---|

| Lido | Ethereum, Polygon | 2.9% (APR) | 10% | stETH | Largest platform, strong community, DeFi integration |

| Rocket Pool | Ethereum | 2.42% (7-day avg) | 0% protocol, 14% node | rETH | Decentralized, lower entry requirements, high security |

| Marinade Finance | Solana | 7.84% (APY) | 6% | mSOL | Solana-based, user-friendly, immediate withdrawal option |

| Ankr | Ethereum, Multiple | 2.93% (APY) | 10% | ANKRETH | Supports multiple chains, versatile staking options |

Lido

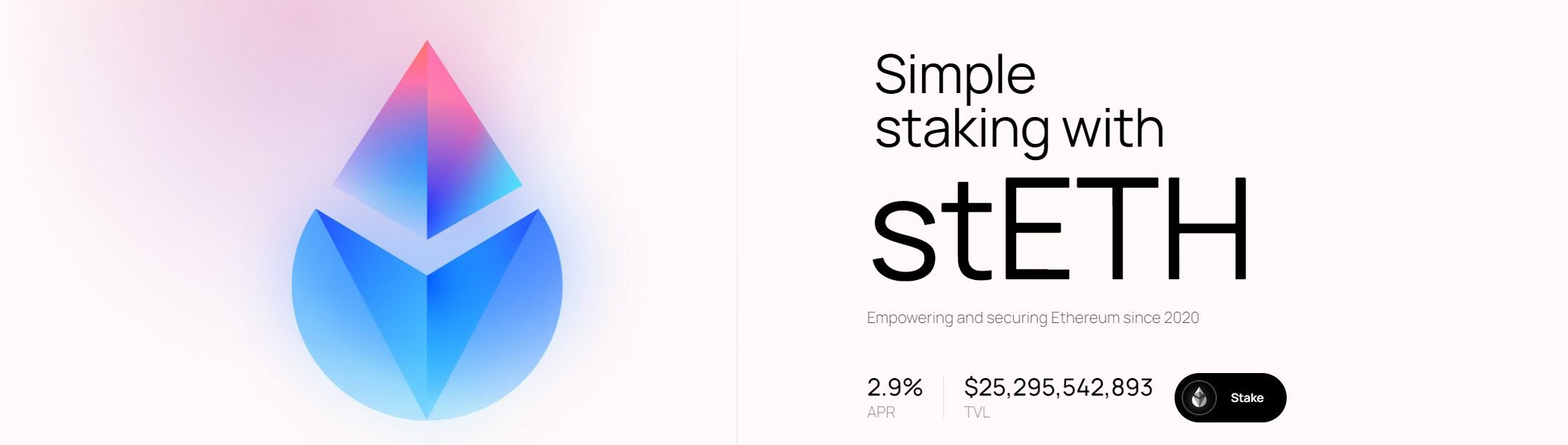

Lido is the Largest Liquid Staking Platform. Image via Lido

Lido is the Largest Liquid Staking Platform. Image via LidoLido is the largest liquid staking platform, and it supports Ethereum and Polygon blockchains. At an APR of 2.9% and a Total Value Locked (TVL) of just over $25 billion, Lido is a super contender.

Lido issues stETH (staked ETH) tokens when you stake Ethereum, which can be used across various DeFi applications. This flexibility, combined with Lido’s strong security and community support, makes it a great option for many investors. Lido applies a 10% fee on staking rewards that are split between node operators and the DAO Treasury. It also used to support Solana, but that's history now due to the termination of development and technical support of Lido on Solana.

Rocket Pool

Rocket Pool's TVL is $3.16 Billion. Image via Rocket Pool

Rocket Pool's TVL is $3.16 Billion. Image via Rocket PoolRocket Pool is a decentralized Ethereum staking protocol that stands out for its focus on decentralization and security. Along with an APR of 2.42% based on a 7-day average, DefiLama confirms its TVL at $3.16 billion. This may seem really small compared to Lido, but Rocket Pool claims to have a perfect score on Ethereum.org.

It allows users to stake ETH in exchange for rETH tokens while maintaining a decentralized network of node operators. Rocket Pool’s unique selling point is its user-centric approach, offering lower entry requirements for staking and a higher level of security through decentralization. It offers consensus rewards, execution rewards, with 0% protocol fee and 14% node operator fee.

Marinade Finance

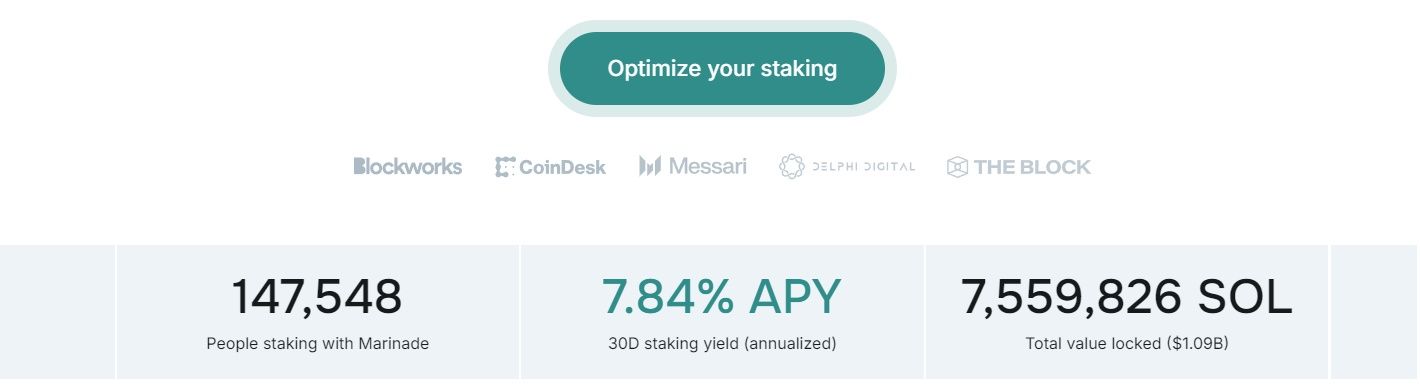

Marinade Finance Charges a 6% Commission on Rewards. Image via Marinade Finance

Marinade Finance Charges a 6% Commission on Rewards. Image via Marinade FinanceOperating on the Solana blockchain, Marinade Finance offers liquid staking for SOL tokens. It issues mSOL tokens in exchange for staked SOL, which can be utilized within the Solana ecosystem. With an APY of 7.84% as per 30D staking yield (annualized), its TVL is just over $1 billion.

The staking platform has over 147,000 people staking. Marinade Finance charges a 6% commission on rewards, and also gives users the option to immediately withdraw their SOL for a small fee. It is known for its user-friendly interface and deep integration with Solana-based DeFi protocols, making it an attractive option for Solana enthusiasts.

Ankr

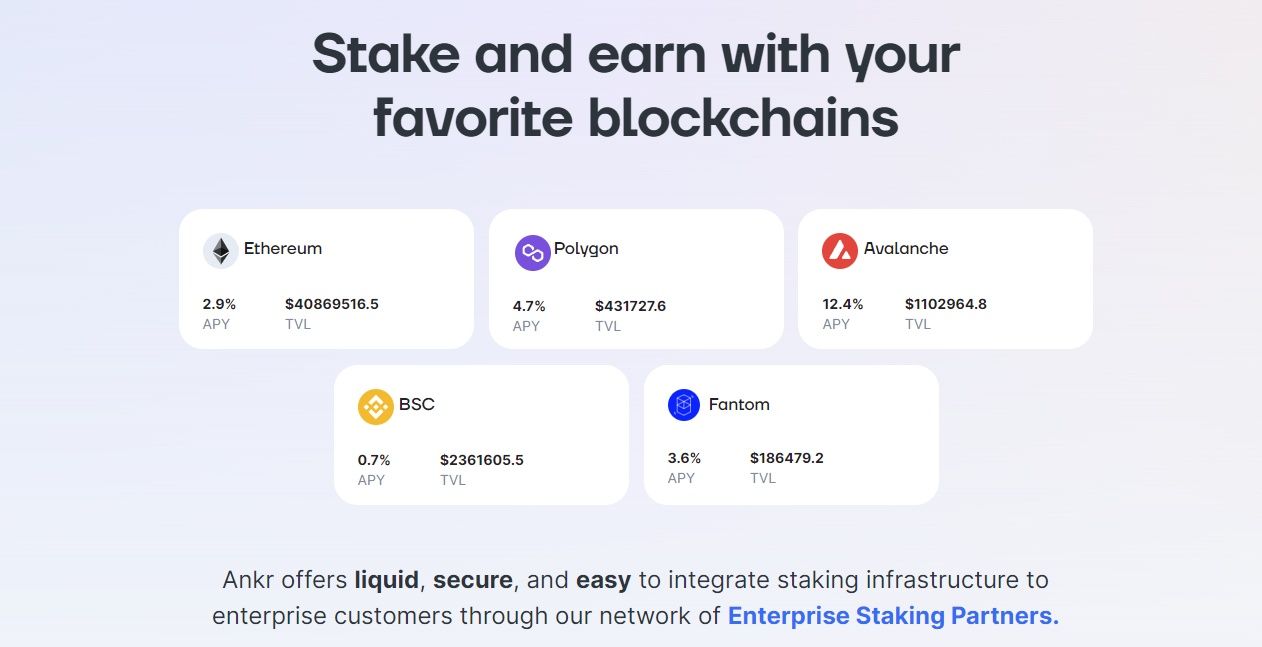

The Platform Charges a 10% Commission on Staking Rewards. Image via Ankr

The Platform Charges a 10% Commission on Staking Rewards. Image via AnkrAnkr is a versatile liquid staking platform supporting multiple blockchains, including Ethereum with an APY of 2.93% and a TVL of over $40 million on Ethereum. Users can stake their assets and receive liquid staking tokens, such as ANKRETH for Ethereum. The platform charges a 10% commission on staking rewards, making it a competitive option for those looking to maximize returns.

You can find a lot more detail in our full Ankr staking review.

How to Choose the Right Liquid Staking Platform

Choosing the right liquid staking platform can feel like navigating a maze — there are plenty of options, each with its own set of features, benefits and risks. To make the best decision, it’s essential to weigh several factors that align with your investment goals and risk tolerance. Here’s a guide to help you find the platform that’s right for you.

Security and Trustworthiness

Prioritize platforms with strong security and transparency. Look for those that undergo regular audits and have a proven track record. Platforms like Lido, known for comprehensive security, and Rocket Pool, which uses decentralization to reduce risks, are solid options.

Supported Blockchains and Assets

Choose a platform based on the blockchains it supports. Ankr is ideal for diverse portfolios with multiple blockchain support, while Marinade Finance is better for Solana-focused investors, for example. So check out blockchain support as per your need.

Staking Rewards and Fees

Compare rewards and fees across platforms. Lido and Rocket Pool offer competitive returns but have varying fee structures that can affect net gains. So, it comes down to your investment profile and strategy as to how aggressive or defensive you plan to be with your investments.

Platform Reputation and Community

Opt for platforms with strong, engaged communities, like Lido and Marinade Finance, as they often provide better support and ongoing development. Support is a critical element over crypto platforms as it secures you from unwanted trouble better than others.

Flexibility and Liquidity

Ensure the platform allows easy trading or DeFi integration for your liquidity tokens. Ankr and Lido excel in offering extensive DeFi integration, maximizing asset utility.

Essentially, the right liquid staking platform for you will depend on your specific needs and investment strategy. By carefully evaluating these factors, you can choose a platform that not only offers solid returns but also aligns with your security preferences and long-term goals.

Step-by-Step Guide to Getting Started with Liquid Staking

Getting started with liquid staking might seem daunting at first, but it’s a straightforward process once you understand the steps. This guide will walk you through everything you need to know to begin earning rewards while keeping your assets liquid.

Getting Started with Liquid Staking is a Straightforward Process. Image via Shutterstock

Getting Started with Liquid Staking is a Straightforward Process. Image via ShutterstockSetting Up a Wallet

The first step in liquid staking is to set up a compatible cryptocurrency wallet. This wallet will store your assets and connect with the liquid staking platform of your choice. It’s crucial to select a wallet that supports the specific blockchain and tokens you intend to stake. For instance, if you’re planning to stake Ethereum, you’ll need a wallet that supports Ethereum-based tokens, like MetaMask or Trust Wallet.

Once you’ve chosen a wallet, follow these steps:

- Download and Install: Download the wallet from a trusted source, install it on your device, and create a new account.

Secure Your Wallet: Security is paramount in crypto. Write down your seed phrase and store it in a safe place. Never share it with anyone.

Connect to the Staking Platform: Most liquid staking platforms require you to connect your wallet. Navigate to the staking platform’s website and follow the prompts to link your wallet.

With your wallet set up and secured, you’re ready to move on to the next step.

While we are at it, don't forget to check out a host of our wallet reviews on The Coin Bureau. Here are a few to get you started:

Selecting the Cryptocurrency for Liquid Staking

Next, you’ll need to decide which cryptocurrency you want to stake. Different platforms support different assets, so your choice will depend on what’s available and your personal investment strategy. Popular options for liquid staking include Ethereum (ETH), Solana (SOL) and Binance Coin (BNB).

Here’s how to make your selection:

- Research Supported Tokens: Visit the liquid staking platform’s website to see which cryptocurrencies are supported. For example, Lido supports ETH, while Marinade Finance focuses on SOL.

- Evaluate Potential Returns: Consider the staking rewards offered for each token. Higher returns might be tempting, but remember to also consider the associated risks and the platform’s reliability.

- Consider Liquidity Needs: Think about how easily you might need to access your staked assets. Some tokens might have more active markets for their liquidity tokens, providing more flexibility.

Once you’ve chosen the cryptocurrency you want to stake, you’re ready to start staking.

Initiating the Liquid Staking Process

With your wallet connected and cryptocurrency selected, it’s time to initiate the liquid staking process. Here’s how:

- Stake Your Assets: Go to the liquid staking platform’s dashboard, select the amount of cryptocurrency you want to stake, and confirm the transaction. Your assets will be staked, and you’ll receive liquidity tokens in return. These tokens represent your staked assets and can be used in other DeFi applications.

- Understand Transaction Fees: Be aware that staking involves transaction fees, which vary depending on the blockchain. Ensure you have enough tokens to cover these fees before initiating the stake.

- Monitor Your Staking Rewards: After staking, keep an eye on your rewards through the platform’s dashboard. You can track both your staking rewards and the value of your liquidity tokens in real-time.

With these steps completed, you’re officially participating in liquid staking and can enjoy the benefits of earning rewards while maintaining liquidity.

Risks and Considerations in Liquid Staking

While liquid staking offers attractive benefits like enhanced liquidity and the ability to earn rewards while keeping assets accessible, it’s not without its risks. Before diving into liquid staking, it’s crucial to understand the potential pitfalls and how to mitigate them.

Market Risks

One of the primary risks associated with liquid staking is market volatility. When you stake your assets, you receive liquidity tokens in return. The value of these tokens can fluctuate based on the market price of the underlying asset and the supply and demand dynamics within the DeFi ecosystem. If the market experiences a downturn, the value of your liquidity tokens could decrease, leading to potential losses even if your original staked assets are still generating rewards.

Additionally, the redemption process for liquidity tokens can be affected by market conditions. If many users try to redeem their tokens simultaneously, it could lead to slippage or delays, impacting the value you receive when you unstake your assets.

To mitigate these risks, it’s essential to monitor market trends and consider the timing of your staking and unstaking activities. Diversifying your staked assets across multiple platforms or tokens can also help reduce the impact of volatility on your portfolio.

Security Risks

Security is a significant concern in crypto. When you participate in liquid staking, your assets are locked into smart contracts on the staking platform. While these smart contracts are designed to be secure, they are not immune to vulnerabilities. A flaw in the contract code or a hack could lead to the loss of your staked assets or liquidity tokens.

Furthermore, the additional layer of complexity introduced by liquidity tokens can increase exposure to security risks. For example, if the platform that issues these tokens is compromised, the tokens could lose their value, leading to losses for investors.

To minimize security risks, it’s crucial to choose platforms that undergo regular security audits and have a strong reputation in the crypto community. Platforms like Lido and Rocket Pool are known for their rigorous security measures, but it’s still important to stay informed about potential vulnerabilities and platform updates.

Legal and Regulatory Considerations

Legal and regulatory considerations are another important factor to keep in mind when engaging in liquid staking. The regulatory landscape for cryptocurrency is still evolving, and liquid staking is a relatively new innovation. This means that the legal status of liquid staking platforms and the assets they manage can change, potentially leading to compliance issues or restrictions.

In some jurisdictions, staking rewards may be considered taxable income, which adds another layer of complexity to managing your investments. Additionally, if a platform is found to be non-compliant with local regulations, you could face penalties or lose access to your staked assets.

To navigate these risks, it’s essential to stay informed about the regulatory environment in your region and consult with a legal or tax advisor if necessary. Choosing platforms that prioritize compliance and operate transparently can also help mitigate legal risks.

What is Liquid Staking: Closing Thoughts

Liquid staking isn’t just another buzzword — it’s a game-changer that offers a fresh way to earn rewards while keeping your assets within reach. It’s having the best of both worlds: you get to participate in staking without having to lock up your funds, allowing you to stay flexible and ready to jump on new opportunities as they arise.

Throughout this guide, we’ve explored what makes liquid staking so appealing, how it stacks up against traditional staking, and which platforms are leading the charge. We’ve also walked through the practical steps to get started, making sure you have everything you need to begin your liquid staking journey with confidence. But, as with anything in crypto, it’s important to tread carefully.

The potential rewards are enticing, but so are the risks, whether it’s dealing with market swings, security issues, or navigating the murky waters of regulations.