Cardano is one of the most innovative and exciting blockchain projects in the space, being referred to by many as a “Third-Generation” blockchain network and often praised for its advanced cryptography and functionality over older, slower, and less efficient blockchains like Ethereum.

As the world of Web3 and the blockchain industry continues to grow and thrive, alternative networks like Solana, Avalanche, NEAR, and Cardano are gaining a lot of popularity and attention as leading-edge projects and DApps are being built out across these ecosystems. Today, we are looking at the top 6 Cardano DApps and projects.

These 6 Cardano projects are by no means a comprehensive list. There are now thousands of projects budding and thriving on the Cardano network, these 6 are simply some of the ones that I feel are worth keeping an eye on and putting on your radar.

Disclaimer: I hold Cardano as part of my personal crypto investment strategy.

What is Cardano

Cardano is an open-source Proof-of-Stake public blockchain platform. It is the first blockchain network to be founded on peer-reviewed research and developed through evidence-based methods.

A Look at the Cardano Homepage. Image via Cardano.org

A Look at the Cardano Homepage. Image via Cardano.orgCardano combines pioneering technologies that provide the highest level of security attainable in blockchain, while being sustainably decentralized, eco-friendly, and aims to benefit applications, systems, and societies. Cardano claims that it overcomes problems faced by other blockchain networks and meets scalability, interoperability, and regulatory needs in the industry.

Founded in 2015 by Ethereum co-founder Charles Hoskinson, the project is overseen and supervised by the Cardano Foundation based in Zug, Switzerland, along with research and development from IOG (previously IOHK), a blockchain engineering company also founded by Hoskinson.

Cardano's Purpose According to Cardano.org

Cardano's Purpose According to Cardano.orgMany blockchain projects such as Solana and Ethereum take a “move fast and break things” approach, releasing technology that is not fit for scale or ready for global adoption, as we have seen with Ethereum’s insanely high gas fees and Solana’s multiple outages.

Other blockchain projects like Cardano and Algorand take a slower, scientific, and methodical approach. Instead of “breaking things,” they opt to move slow and get things right the first time. You can learn more about the impressive Algorand blockchain in our Algorand review.

“We have changed science. We have changed what it means to build global systems and sustainable models of exchange and governance”

-Quote from the Cardano Foundation

The quote goes on to explain: “We, alongside our community and partners, are defining a new future: a decentralized future without intermediaries, in which power is returned to the individual.”

Very bold mission and statement. I can definitely get on board with that!

Cardano’s native token ADA is used in the blockchain’s PoS consensus mechanism and is used to pay transaction fees on the network, as well as reward users who participate in Cardano staking.

This barely scratches the surface of what Cardano is. If you want to learn more about this next-generation blockchain network, you can learn more in our Cardano Deep Dive article. The key takeaways to know about Cardano are:

- It is a decentralized blockchain platform that supports DApp and smart contract development, while being a multi-asset ledger and overcomes issues with scalability, interoperability, security, and sustainability.

- Runs on the Proof-of-Stake Ouroboros consensus protocol.

- Has a thriving DApp and developer ecosystem.

- Oversight of the network is shared by The Cardano Foundation, IOG, and EMURGO.

Alonzo: Ushering in Cardano Smart Contracts

September 13, 2021, was a big day for Cardano as the Alonzo hard fork deployed successfully on the Cardano network and went live. The hard fork introduced the support for Plutus-powered smart contract functionality. Smart contracts are essential for any blockchain network that wants to support a DeFi, DApp, and general web3 functional ecosystem.

Image via Shutterstock

Image via ShutterstockThe Alonzo upgrade was highly anticipated as the Cardano network had been previously referred to as “the smart contract platform with no smart contracts,” and many critics were calling Cardano a “ghost chain.” Alonzo laid the foundation to change all that, and developer activity has since skyrocketed as Alonzo enabled anyone with the ability to create and deploy their own smart contracts and DApps on the Cardano blockchain.

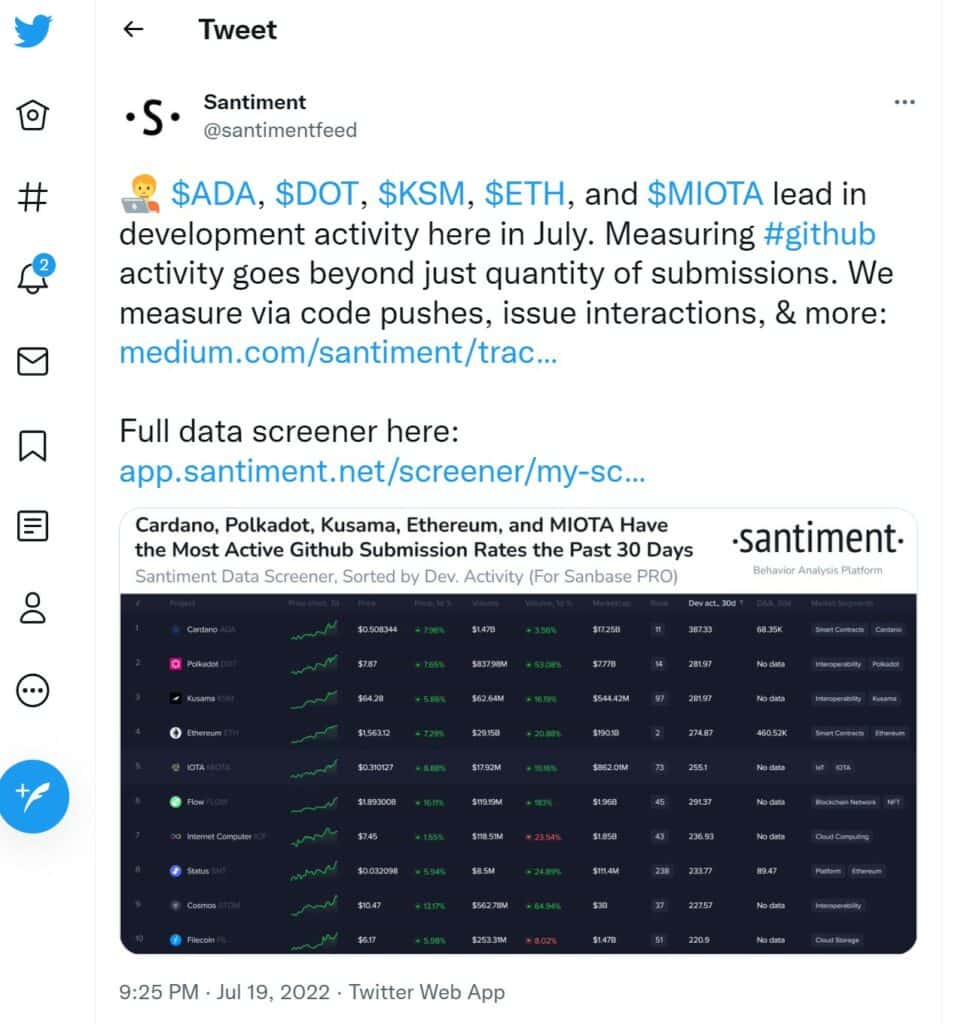

Since the launch of Alonzo, Cardano has been playing leapfrog with other major layer 1 networks like Ethereum, Solana, and Polkadot, often holding the crown of having the most developer activity on the network. According to behaviour analytics company Santiment, in mid-2022, Cardano was the most active for blockchain developers across the entire crypto space.

In July 2022, Cardano Led in Developer Activity. Image via Twitter/Santiment

In July 2022, Cardano Led in Developer Activity. Image via Twitter/SantimentAs many people in tech and crypto say: “follow the developers,” because where development is happening, things are being built that are likely to attract users and investors.

Alonzo was rolled out in three stages:

- Alonzo Blue

- Alonzo White

- Alonzo Purple

With two smaller post-launch phases dubbed “Alonzo Red” and “Alonzo Black.” Each phase added more users to the testnet and identified bugs that needed to be fixed.

The Alonzo Rollout Plan. Image via copper.co

The Alonzo Rollout Plan. Image via copper.coAlonzo Blue introduced smart contracts with around 50 participants, who of which were made up primarily of stake pool operators. Invalidation errors and other small issues were found and tweaked during this phase.

Alonzo White added more features and invited a wider range of participants. Hundreds of new users ran through the testnet, measuring the capabilities of the network. This experimental testing phase was conducted by IOHK and lasted just under a month.

Alonzo Purple was the fully public testnet, which saw the onboarding of thousands of participants onto the network. This stage was split into “light purple” and “dark purple,” the first of which supported simple smart contracts, and the second allowed for complex smart contract transactions.

Then came the final Alonzo Red/Alonzo Black phase, which were reserved for the final bug fixes to prepare for the final release of the hard fork.

After Alonzo, the Real Work Could Begin. Image via Shutterstock

After Alonzo, the Real Work Could Begin. Image via ShutterstockThe Alonzo hard fork was, to the surprise of many, a huge success that went off nearly without a hitch in what was probably the smoothest upgrade in crypto history. In the crypto community, we have gotten used to hard fork failures and upgrades being delayed, such as the Ethereum merge which was delayed by years.

The community has gotten so used to projects missing their deadline targets that Polymarket, a popular crypto news and analytics platform, had publicly and humorously bet against Hoskinson, betting that smart contracts and dApps wouldn’t be deployed on Cardano by the end of the year. The lost bet resulted in Polymarkets donating funds to a Charity of Hoskinson’s choice.

Image via Twitter/IOHK

Image via Twitter/IOHKFor many, this event solidified Cardano as a serious contender as a leading blockchain network and showcased what a research-based and academically founded blockchain network could achieve.

Image via Twitter/IOHK

Image via Twitter/IOHKCardano is often criticised for being slow to develop and roll out integrations, though many Cardano enthusiasts see this as a strength, not a weakness. Hoskinson often borrows from the old tradesmen cliché and states that it is “better to measure twice, cut once,” instead of just winging it as many crypto projects seem to do.

Growth in the Cardano dApp Ecosystem

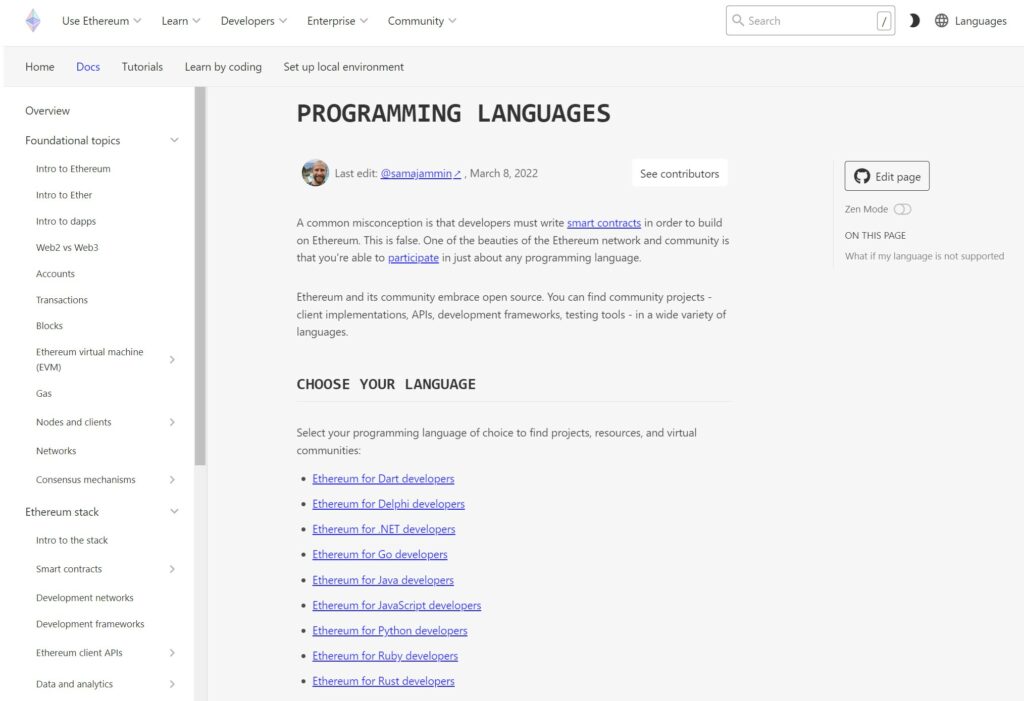

Cardano projects have been on the rise over the past year, surpassing Ethereum in terms of developer activity during some periods. One of the hurdles that Cardano faces and criticisms against the project is that Cardano uses Plutus as the native smart contract language, which is a Turing-complete language written in Haskell.

This is in stark contrast to platforms like Ethereum, which supports multiple languages as you can see from the Ethereum.org programming languages guide:

Image via Ethereum.org

Image via Ethereum.orgThe primary programming language at the core of Ethereum is Solidity. Solidity is an object-oriented coding language that is fairly simple to learn and is used by other networks that are compatible with the Ethereum virtual machine (EVM). Coders who choose to learn Solidity can work in the Ethereum, Binance Chain, Avalanche, Tron, and Hedera ecosystems among others, vs Cardano’s Plutus, which is only used in the Cardano ecosystem.

This led many to worry that Cardano would struggle to attract developers as it requires a more niche and specified skill set, and Haskel is a more complex language than Solidity, making it harder to learn. Though thanks in part to IOG’s Plutus Pioneers course, thousands of developers have been attracted to the ecosystem and Cardano projects quickly started budding, laying to rest many of these concerns.

Cardano Projects are Rapidly Growing. Image via ZyCrypto.com

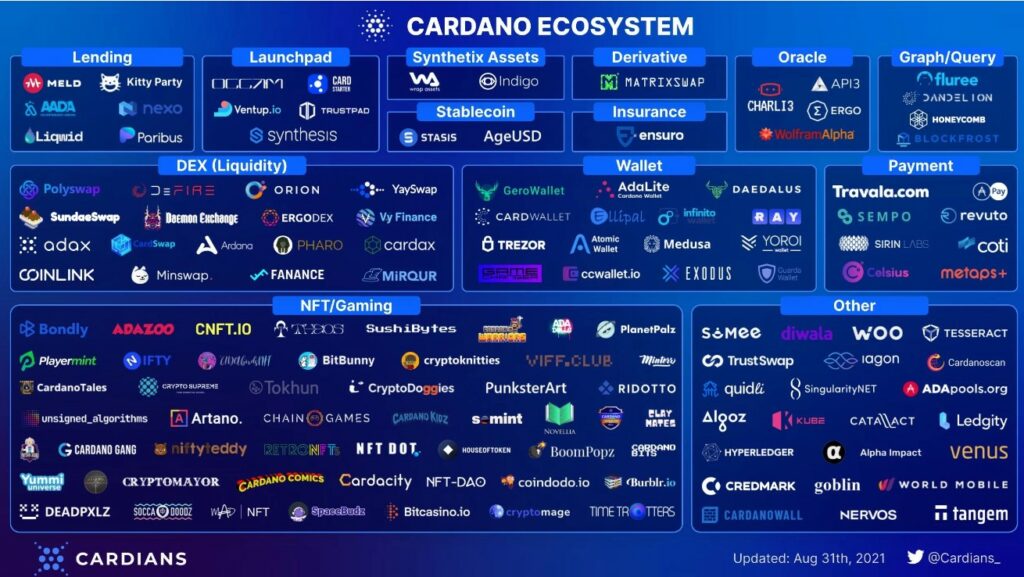

Cardano Projects are Rapidly Growing. Image via ZyCrypto.comHere is a look at Cardano’s ecosystem back in 2021:

Image via IOG

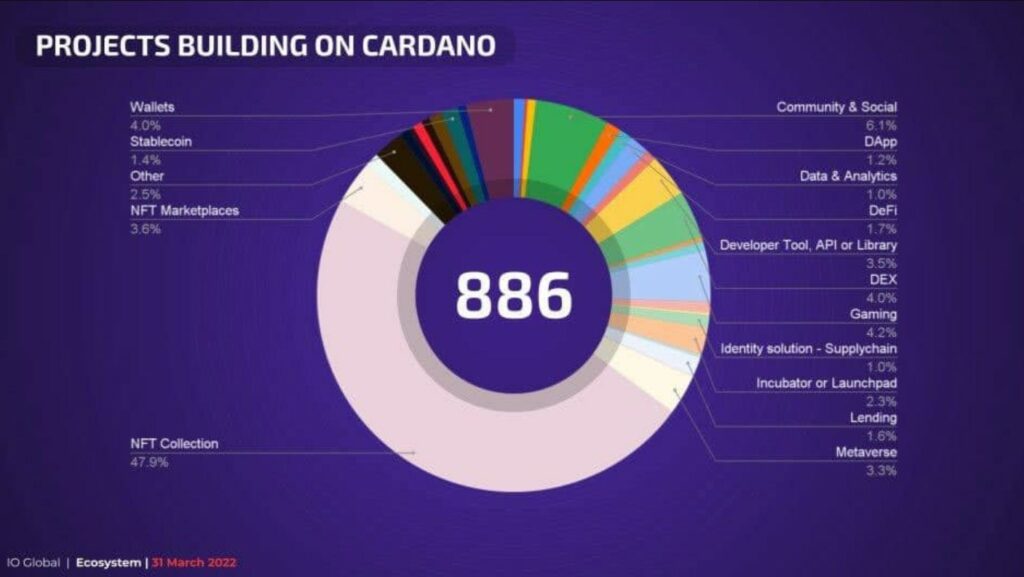

Image via IOGAnd here is how rapidly the DApp ecosystem has grown as we head into 2024:

Image via Cardanocube.io

Image via Cardanocube.ioDespite the crypto bear market and suppressed price action, development in the crypto industry is still thriving among many of the top layer 1 projects. The largest sector fuelling Cardano’s rapid growth are NFTs at 47.9%, which I found surprising.

Image via IOG

Image via IOGThe reason I found this surprising is that Cardano places a large emphasis on building the future of systems and infrastructure. It is an incredibly powerful and advanced blockchain, capable of supporting the future of finance and institutional processes and framework, as we have seen with their foray into helping support infrastructure projects in Africa, along with their work within academia and universities.

To see a network as powerful as Cardano being used primarily for NFTs, which, in these early days, are little more than arbitrary over-priced JPEGs of monkeys used to show off one’s wealth and status, sort of feels akin to using a bazooka to kill a housefly. There are better use cases for blockchain technology in my opinion, many of which are still being explored.

I’m not anti-NFT by any means, I am just in the camp that believes that NFTs are an incredibly powerful innovation, and their true potential has not even come close to being achieved.

It wasn’t just me that was surprised by this NFT surge on Cardano either, IOG’s CEO Charles Hoskinson himself had this to say in an interview with Yahoo Finance in June 2022:

“One surprising area of growth on Cardano is in the NFT space. About 40% of all the applications that are being deployed are NFT-related… About $270 million a month in NFT volume. So, $3 billion a year, and there’s tons of incredible work in the metaverse space, like Cornucopias and others, and it’s really impressive to see how fast it’s grown in just the last year.”

And this growth is happening in the depths of a crypto winter to make it even more impressive. When looking at the upcoming projects launching on ADA, there are some really interesting upcoming NFT projects for sure.

Another factor fuelling growth was the launch of the K EVM program. In March 2022, Milkomeda, an interoperability protocol that focuses on delivering EVM capabilities to non-EVM blockchains went live on the Cardano mainnet, allowing users to deploy Ethereum dApps on the Cardano network for the first time. This supported the introduction of Ethereum-based dApps and introduced liquidity into the Cardano sphere.

Cardano’s EVM Sidechain Contributed to Further Growth of the dApp Ecosystem. Image via U.Today

Cardano’s EVM Sidechain Contributed to Further Growth of the dApp Ecosystem. Image via U.TodaySo, we know that Cardano dApps are blooming faster than April tulips in the Netherlands, let’s cover some of the most exciting ones that are on my radar. If you are interested in Guy’s take on the top Cardano projects, feel free to check out his video below:

Top 6 Cardano Projects in 2024

Cardano DeFi projects take up the lion's share, but there are a few others in there as well. Let's explore!

MinSwap (MIN)

Of course, the first mention on this list has to be a DEX. Every good ecosystem needs a popular DEX, look no further than Uniswap on Ethereum, PancakeSwap on the Binance chain, QuickSwap on Polygon, Trader Joe on Avalanche, or Serum on Solana. A solid DEX is a cornerstone of any reputable layer 1 protocol.

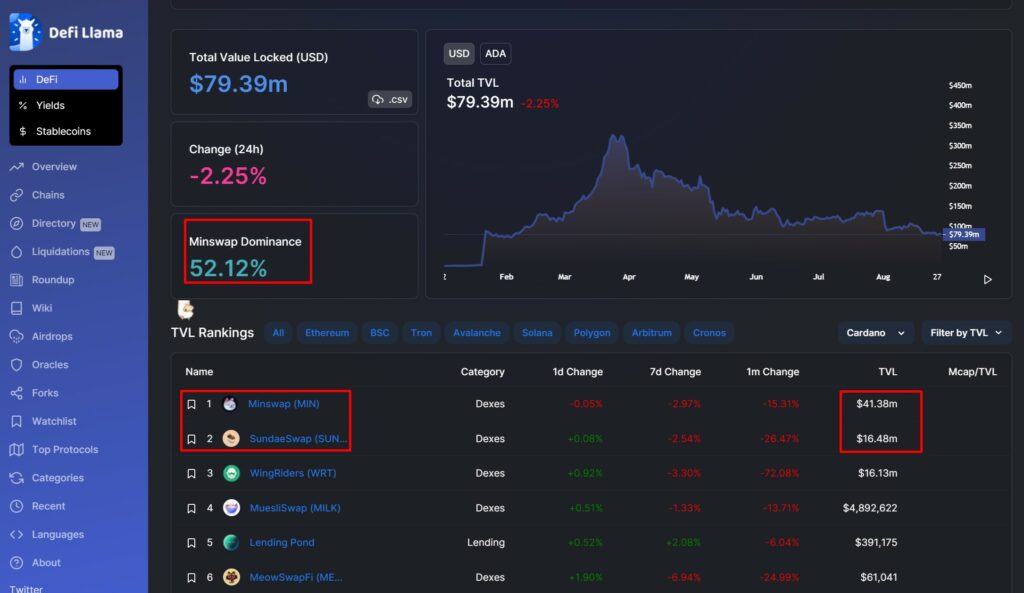

The DEX competition on Cardano is fierce. We witnessed a rare occurrence happen in the space where Cardano’s first DEX SundaeSwap failed to capitalize on their first-mover advantage as it has recently been not only surpassed, but absolutely dominated in terms of TVL by MinSwap

MinSwap is holding over 52% Dominance on the Cardano Network according to Defi Llama

MinSwap is holding over 52% Dominance on the Cardano Network according to Defi LlamaMinSwap has over double the TVL as the second largest DEX, and its dominance only appears to be growing. MinSwap aims to be the #1 liquidity provider in the market by integrating the best asset pool models from across the entire DEX ecosystem into one protocol.

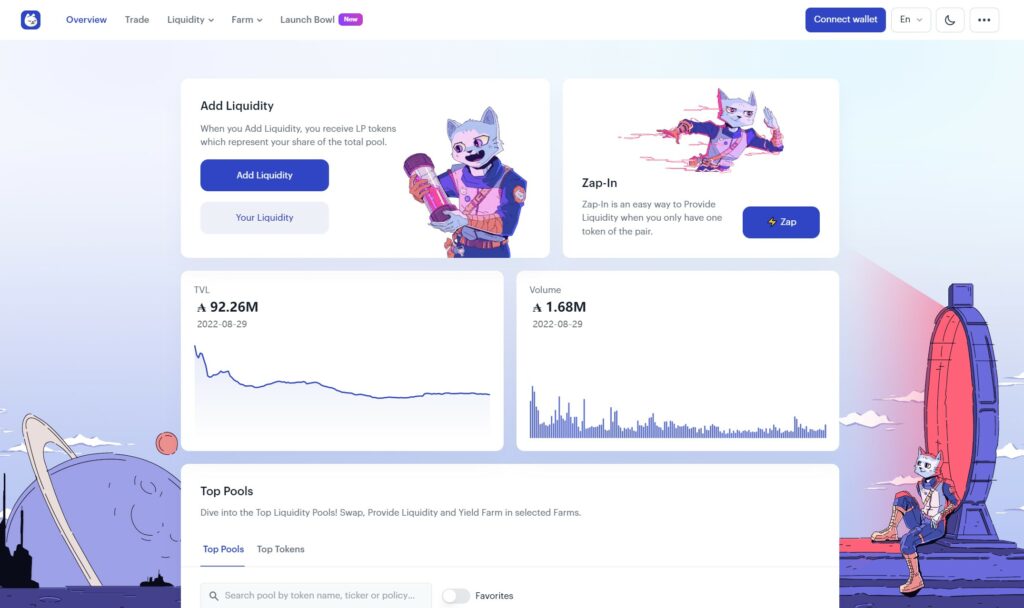

A Look at the MinSwap DEX

A Look at the MinSwap DEXMinSwap is an Automated Market Maker (AMM) decentralized exchange (DEX) built on Cardano that allows users to trade and swap assets with low fees in a user-friendly way. One of the reasons for MinSwap’s rising popularity is a new and innovative strategy for token distribution and liquidity pools.

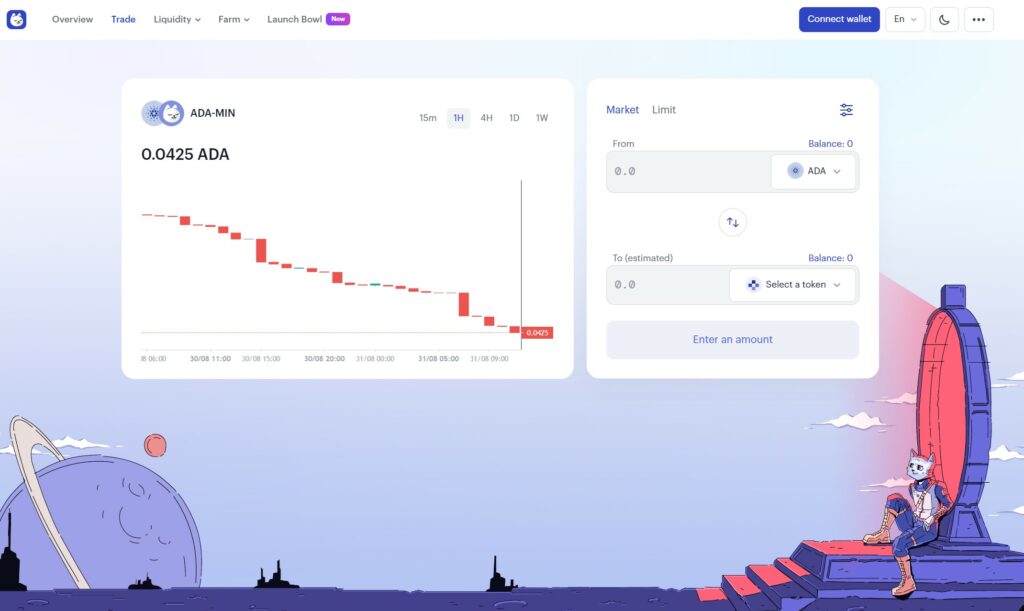

The Clean Trading Interface on MinSwap

The Clean Trading Interface on MinSwapMinSwap uses a multi-function liquidity pool that brings together the best features of other DeFi protocols. Instead of trying to reinvent the wheel, MinSwap Liquidity pools are composed of the following principles:

- Constant-product pool by Uniswap

- Stable pool by Curve

- Multi-asset pool by Balancer

- Dynamic pool by Kyber

The Babel fee mechanism used on MinSwap allows users to pay for transaction fees in other tokens without the need to hold ADA, which is another innovative feature of the platform. This is a game changer as traditionally on Ethereum platforms, users need to hold ETH to swap any two ERC20 tokens, which can be a huge pain, especially for new users who do not understand that ETH needs to be held to cover network fees for any of the 10,000+ tokens in the Ethereum ecosystem.

And if you are reading this thinking that this feature is pedantic and needing to hold ETH is obvious and not a big deal, I will counter by pulling from previous experience. My first job in crypto was working as a support engineer for a crypto wallet with a built-in exchange, and no exaggeration, we would get hundreds, if not thousands of email tickets per day from customers who were upset, annoyed, and did not understand why they needed to hold Ethereum to swap Uni for Chainlink for example.

So yeah, it’s a thing, and a huge breath of fresh air being able to pay fees in any token. Whoop whoop! 🙌

Here is a look at some of the features of MinSwap

Image via Cardians

Image via CardiansAside from the primary function of being a DEX, MinSwap also offers the following DeFi products:

- Fair Distribution- The FISO program allows users to stake ADA in MinSwap partners’ stake pools and they will receive MIN token rewards.

- Yield Farming- MIN tokens are rewarded to liquidity providers who stake liquidity pool tokens.

- Launchpad- The Launchpad supports new projects on Cardano by offering the community access to Initial DEX Offerings (IDOs) and Initial Farm Offerings (IFOs).

- Governance- Liquidity providers (LPs) are rewarded with tokens from the trading fees collected on the DEX. MIN token holders can vote on future proposals and updates about the platform.

MinSwap is also Ethereum compatible featuring an ERC20 converter which is incredibly convenient for bridging assets across networks.

We have seen what a Goliath Uniswap has become for the Ethereum ecosystem and early investors in the UNI token have enjoyed face-meltingly high ROIs. DEXs are a great way to not only swap tokens, but get involved in supporting the industry while earning some nice passive returns by hodling the token or providing liquidity.

Another positive notable mention is around the platform’s MIN token. The DeFi platform underwent a fair launch, which is rare these days. There were no private or VC investment rounds, ensuring that the community benefits, not early speculators, investors, and insiders who have no intention of using the platform.

A Look at MIN distribution. Image via minswap.org

A Look at MIN distribution. Image via minswap.orgThat is why MinSwap makes this list as it is a solid DEX that satisfies both the supply and demand side of an exchange ecosystem. Everyone can benefit, from those looking to trade, or those looking to be liquidity providers, all on a functional and user-friendly interface featuring a cool space cats theme.

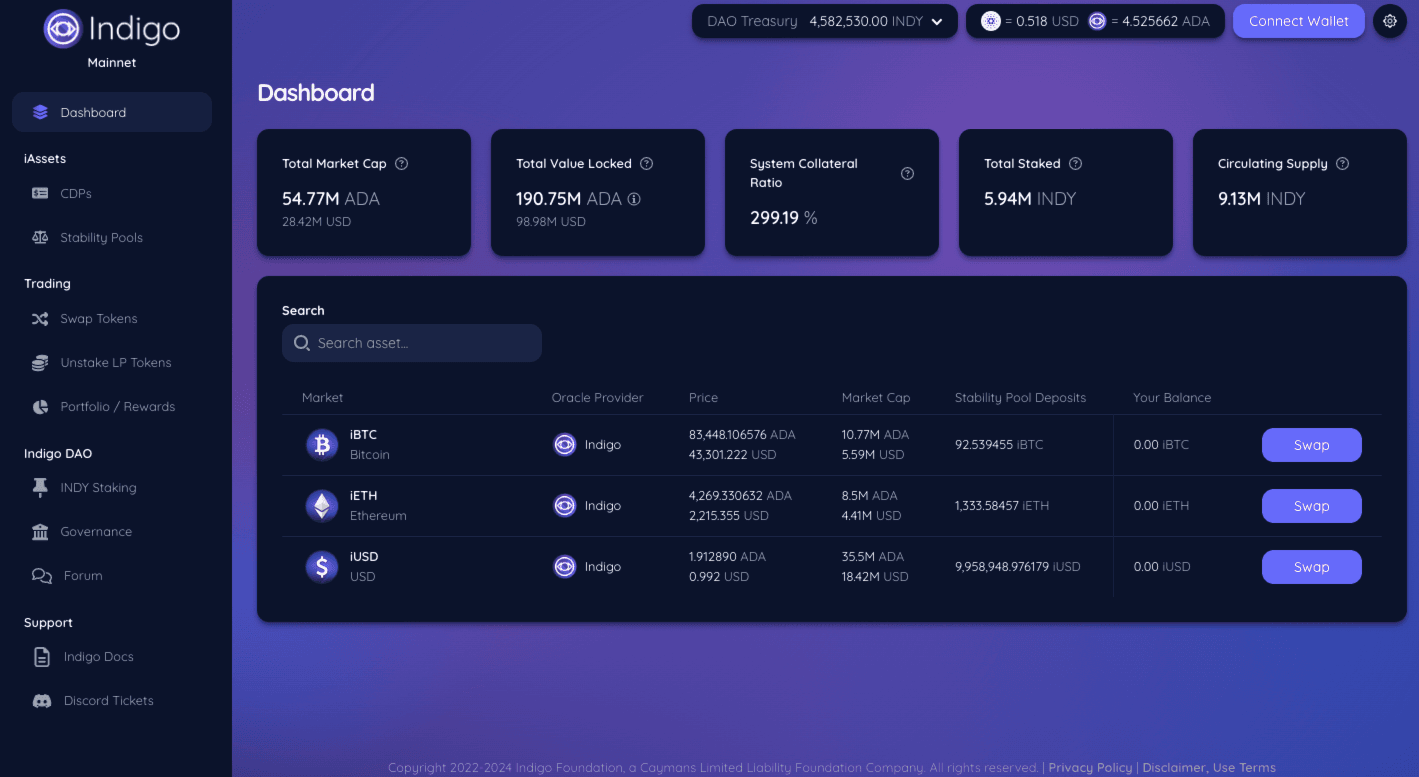

Indigo (INDY)

Indigo is a decentralized non-custodial synthetic assets protocol. Using smart contracts, Indigo allows users to create fully collateralized synthetic assets known within the protocol as iAssets.

A Look at the Indigo Dashboard

A Look at the Indigo DashboardiAssets are digital assets in the cryptocurrency realm whose values are determined by monitored assets. Unlike wrapped assets linked via a bridge to deposits on another chain, iAssets rely on a price Oracle to monitor the value of the underlying asset. A prime illustration of an iAsset is iBTC, which emulates a synthetic version of Bitcoin (BTC). Its purpose is to replicate the price movements of BTC, an asset existing in an ecosystem external to Cardano.

There is little question that Real World Assets (RWAs) are going to be a fundamental and pivotal use case for blockchain technology, Indigo Protocol is well positioned to capitalize on this transformative trend on the highly efficient Cardano blockchain.

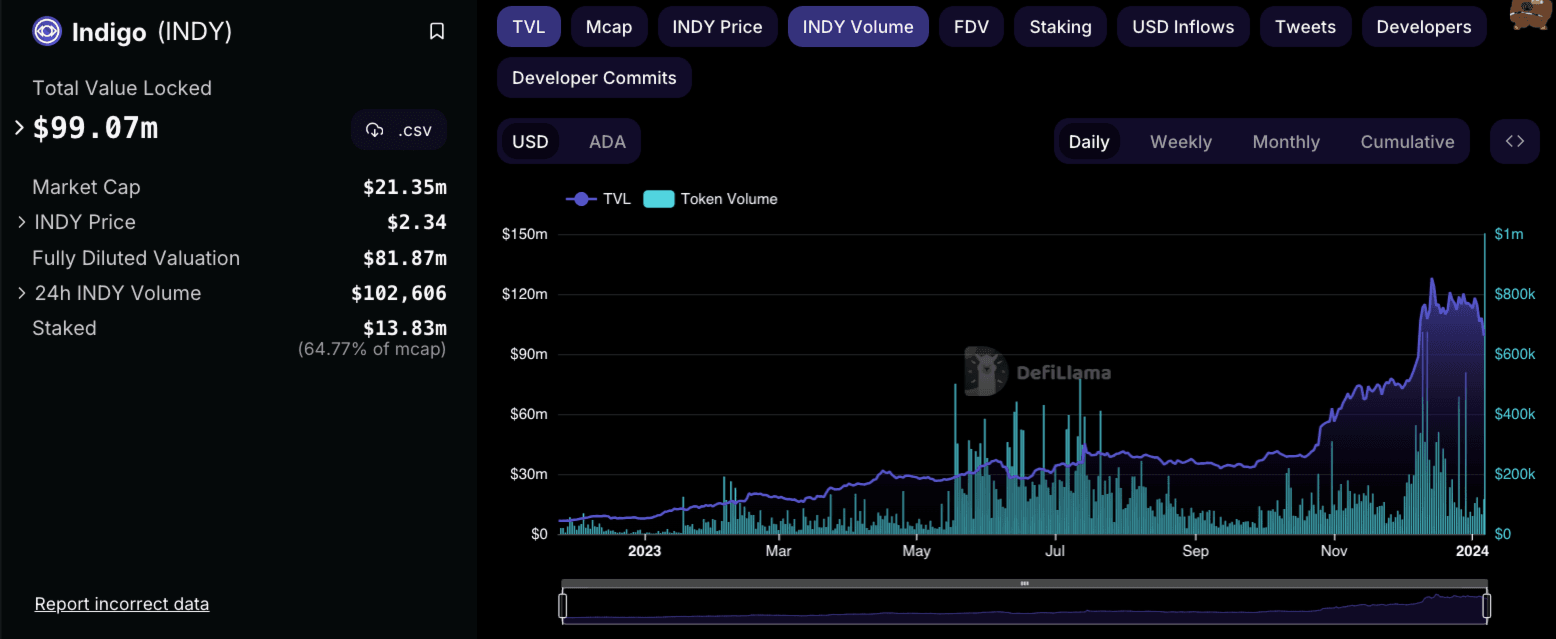

Indigo Protocol has seen impressive growth both in terms of TVL and volume, with currently over $99 million in TVL.

Indigo Has Seen an Impressive Rise in TVL and Volume. Image via DeFiLlama

Indigo Has Seen an Impressive Rise in TVL and Volume. Image via DeFiLlamaCornucopias (COPI)

This brings us to the first gaming mention on the list, Cornucopias. Narrowing down a single gaming project for this list was tough as there are quite a few impressive games and metaverse projects launching on Cardano. It was a tossup between Drunken Dragon Games, which is a fantastic-looking NFT retro-style game, and Cardano’s first metaverse Pavia, which you can learn more about in our Pavia review. Cornucopias took the spot for some solid reasons, which I will cover below.

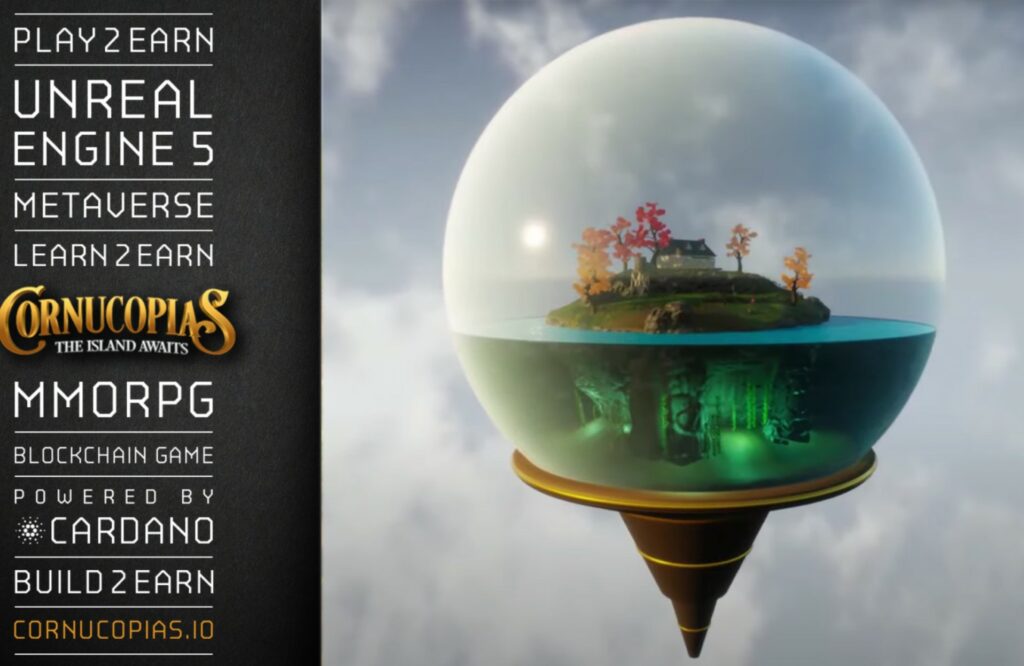

Image via The News Crypto

Image via The News CryptoCornucopias “The Island” is a blockchain-based Play-to-Earn, Build-to-Earn, and Learn-to-Earn platform where players can be rewarded with and/or own land, properties, and other NFT-based assets. Let’s look into each of the ways to earn in a bit more detail:

- Play-to-Earn- By playing games, the player will be able to earn crypto which can be converted into real-life fiat currency.

- Build-to-Earn- Players can craft their own NFTs like furnishings or tools and mint them for other players to buy.

- Learn-to-Earn- Cornucopias is teaming up with educational centres around the world to build learning into the metaverse. Players/students can earn rewards for learning.

- Stake-to-Earn- There will be opportunities for users to stake and earn passive income and NFTs.

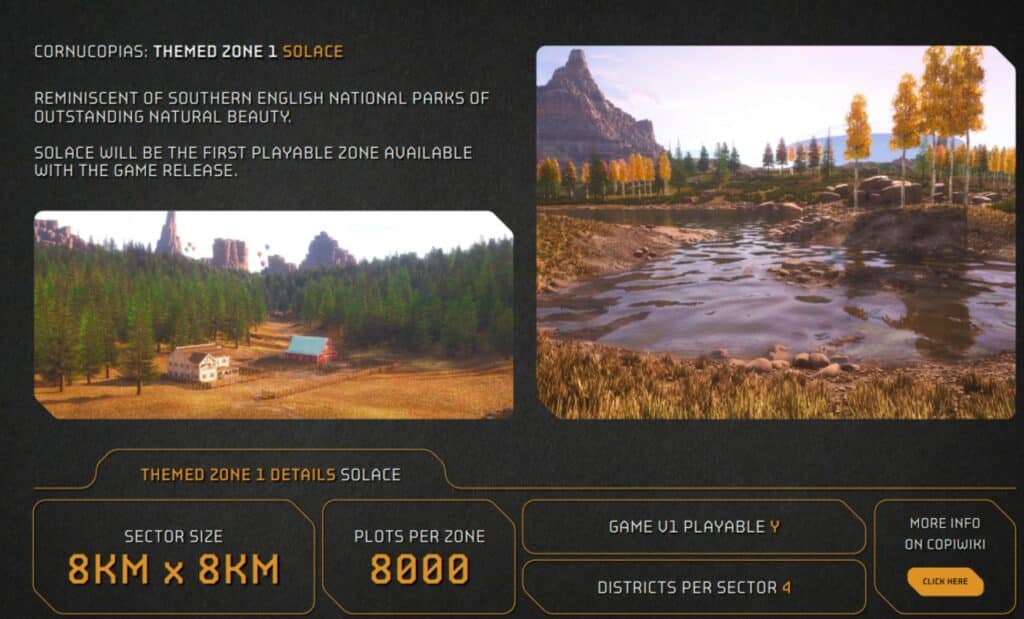

“The Island” is split into a number of themed zones such as the “Wild West” zone, the “Farm Life” zone, the “Age of Samurai” zone, and more. Players can engage in a series of mini-games, taking advantage of the Play-to-Earn mechanics, or design their own items like furniture and décor. Created items can be minted into “Island Blueprints” that other players can buy and craft in the game, allowing those with a creative spark to earn from the Build-to-Earn mechanics.

Cornucopias Themed Zone Land. Image via Cornucopias.io

Cornucopias Themed Zone Land. Image via Cornucopias.ioCornucopias combines gaming with real-world commerce and provides potentially limitless opportunities for entrepreneurs, builders, designers, and gamers. This metaverse can be entered by anyone in the world, including brands and companies who may wish to set up shop in this Cardano-powered metaverse. The sheer earning potential of this game and endless possibilities are one of the key reasons Cornucopias is one of the most promising and exciting metaverse projects that caught my attention.

One of the major drawbacks of blockchain gaming so far is the sad, lacklustre graphics and poor gaming mechanics, which has resulted in blockchain games becoming the laughing stock of the serious gaming community, and I must admit that I feel the same way. There have been no blockchain games launched yet that make me want to nerd-out and pull an all-nighter, staying up and getting lost in the gameplay.

Feeling Anti-Social? Hang Out in Your Home Bubble. Image via Cornucopias

Feeling Anti-Social? Hang Out in Your Home Bubble. Image via CornucopiasCornucopias is changing that and is aiming to become the first Triple-A game on Cardano. And before you roll your eyes about another gaming project claiming to be “Triple-A” quality, only to be disappointed as the game falls far short of delivering on its promises, Cornucopias stands a real shot here. Why?

Well, “The Island” is being built out on the futuristic Unreal 5 gaming engine, which is compatible with PC, mobile, and consoles. Anyone who has kicked around the gaming space for more than a week will likely know that a game launching on the Unreal 5 engine is a big deal as it is known for its cinematic quality graphics and seamlessly fluid motion mechanics. Some of the most groundbreaking, highest-quality and top-selling games of all time have been built on Unreal engines.

This metaverse gaming project will open up players to an entirely new world of currency, economics, and gameplay, where they can create and trade their own NFTs. This project has the potential to be massive and I can only barely scratch the surface in this article. I recommend checking out the Cornucopias Whitepaper and the COPI Wiki to learn more.

If you are interested in why the Metaverse is being referred to as “the next trillion dollar asset class” by some Wall-Street firms, and why the concept of a metaverse has unfathomably massive potential, be sure to check out our article: Metaverse 101: A Guide to the Metaverse.

Empowa (EMP)

Empowa is a fantastic project that brings us back down to Earth and reminds us that crypto is about more than just Lambos and moonbags. Remember that cryptocurrency predominantly rose from the ashes of the 2008 financial crisis as a much-needed alternative to our corrupt and broken financial system.

Blockchain technology does have the potential to make society exponentially better in so many ways, something that is often forgotten as we cross our fingers and hope for our favourite tokens to 10x.

A Look at the Empowa homepage

A Look at the Empowa homepageEmpowa is the first RealFi property platform on Cardano that combines emerging technology, sustainable building, and decentralized financial inclusion for all. Empowa is on a mission to provide affordable housing and banking services for those without access to such services in Africa.

Building a better future by leveraging Cardano’s blockchain technology and DeFi, Empowa is able to overcome systematic issues that have stifled economic and property growth in Africa, providing opportunities that were not attainable before.

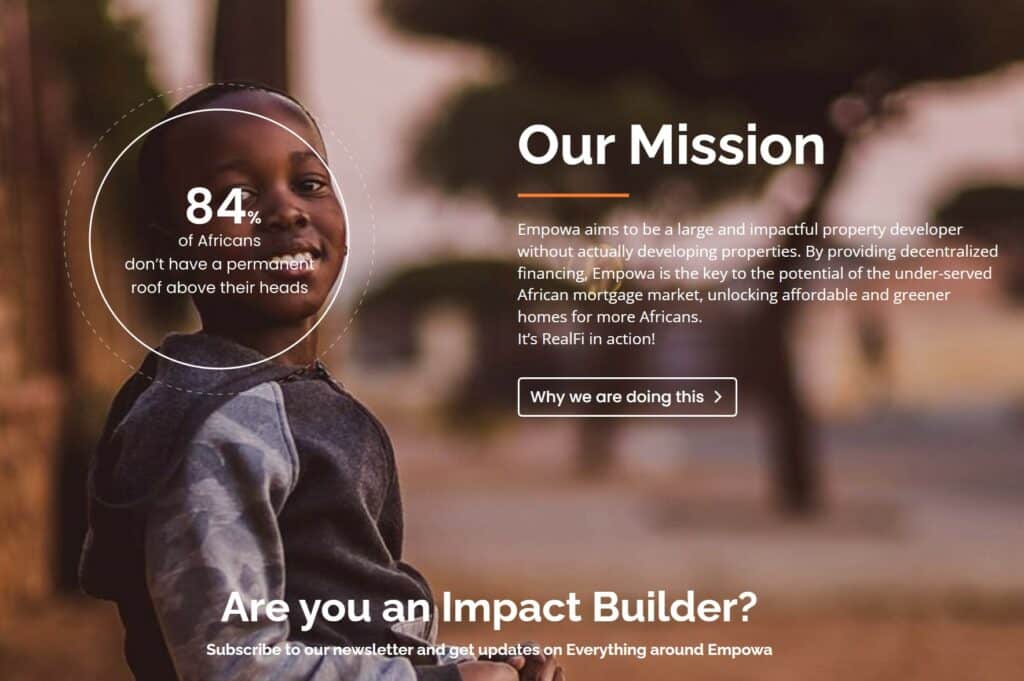

Empowa’s Mission. Image via Empowa.io

Empowa’s Mission. Image via Empowa.ioRemember when I said Cardano can be utilized for so much more than NFT pictures of silly monkeys used by celebrities to show off wealth and status? This is the sort of use case I was driving at.

The Empowa utility token (EMP) allows individuals and parties to participate in the Empowa ecosystem, getting involved in initiatives that focus on sustainable community development projects in Africa, all while using a common unit of value. Participants can also purchase NFTs from the Empowa NFT range to showcase their contribution to the platform.

The term “RealFi” stands for “Real Finance,” which refers to blockchain-based applications that have a real-world impact.

One of the target areas, Mozambique, finds that only 1 in 50,000 of its residents have a mortgage, and rates can be as high as 32%. Zimbabwe tells a similar story with interest rates of 45%. Rates like these result in an astonishing 84% of Africans living without a permanent roof over their heads.

Here is a look at the brutal housing cycle in many parts of Africa:

Image via Empowa

Image via EmpowaEmpowa aims to change that and is on a truly noble mission, addressing issues that have been ignored for far too long. You can learn more about Empowa’s mission and find the Whitepaper on the Empowa Mission page.

Coinbase also released a video report on how Empowa is updating the financial system for affordable homes.

Djed (DJED)

Djed is an algorithmic stablecoin backed by SHEN and ADA. Now, before the PTSD kicks in from Luna’s historic collapse and you flinch at the very mention of an algorithmic stablecoin, Cardano’s Djed is nothing like Luna, so you can take a breath and relax.

Image via adapulse.io

Image via adapulse.ioBefore understanding Djed, we need to know about the project COTI (Currency of The Internet). COTI is a payment solution that provides high transaction throughput with low transaction fees, utilizing a directed acyclic graph (DAG) similar to the IOTA network.

COTI can support around 10,000 transactions per second, more than the Visa network which can process around 4,000 transactions per second. Utilizing a combination of distributed ledger technology and traditional payment systems, COTI is aiming to become the next-generation decentralized payment system for the global digital assets industry.

Image via Twitter/Coti

Image via Twitter/CotiCOTI uses a Proof-of-Trust algorithm which combines Proof-of-Work and Trust Chain algorithms to provide a practical and energy-efficient alternative to the traditional PoW consensus mechanism. COTI uses DAG to solve scalability issues by assigning Trust scores to each network user, which encourages good network behaviour by reducing fees and increasing service standards.

New transactions must link to previous ones, forming a chain referred to as Trustchain. Using Trust scores, the Trustchain algorithm determines the amount of Proof-of-Trust necessary to confirm a transaction.

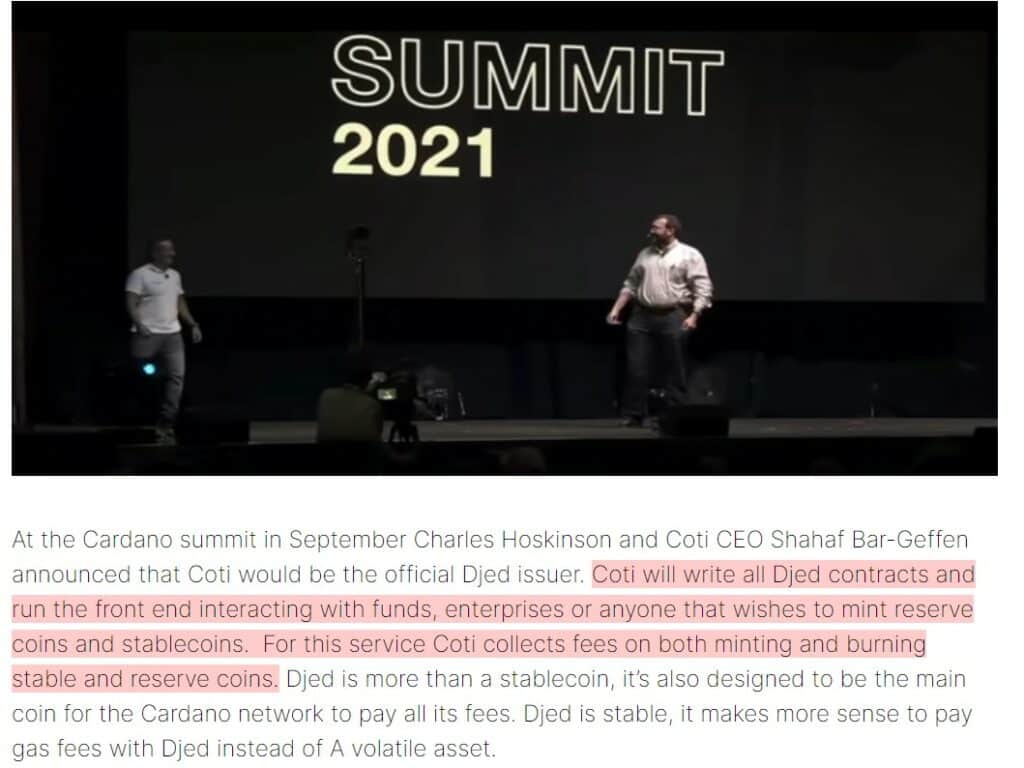

COTI CEO Bar-Geffen and Hoskinson Announce Djed at 2021 Cardano Summit. Image via adapulse.io

COTI CEO Bar-Geffen and Hoskinson Announce Djed at 2021 Cardano Summit. Image via adapulse.ioThe COTI MultiDAG built on top of the Trustchain produces fiat-collateralized, crypto-collateralized, non-collateralized, and other stable currencies that can be created by organizations, which is where Cardano’s Djed comes in.

The DJED stablecoin is the first to ensure price stabilization through formal verification and has been touted by some as the most advanced crypto stablecoin project in existence. For anyone who follows the painstaking attention-to-detail-oriented perfectionism of Cardano builders, this should come as no surprise that even their stablecoin is advanced and complex.

Djed’s Whitepaper states that the protocol “behaves like an autonomous bank that buys and sells stablecoins for a price in a range that is pegged to a target price,” and mentions that Djed is “the first stablecoin protocol where stability claims are precisely and mathematically stated and proven.”

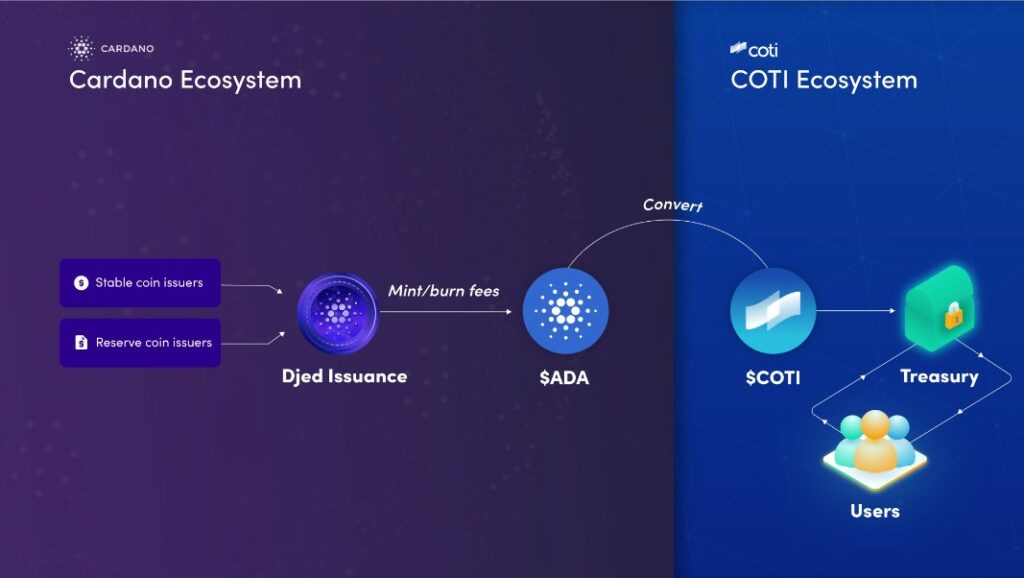

A Look at how the Cardano and COTI Ecosystem Interact. Image via Cardanofeed

A Look at how the Cardano and COTI Ecosystem Interact. Image via CardanofeedAs I am no math whiz and the technical specs of this project are far above my head, I guess I will just have to take IOG’s word for the claim that the Djed protocol is mathematically certifiable. As it is an algorithmic stablecoin, it does not require a bank license to issue, unlike centralized stablecoins. Smart contracts ensure price stabilization and automatically issue more coins as the price increases, or buys more when the price falls, helping to stabilize the price. A reserve of base coins is kept to help ensure a stable price in the event the peg falters.

SHEN is a reserve token that uses a unique mechanism that will maintain the algorithmic peg of DJED while pricing an incentive to SHEN token holders. By buying and selling SHEN, users can maintain the peg of DJED to USD while earning a share of transaction fees in the reserve pool. Since SHEN is an easily tradable asset, holders will also buy and sell to try and profit from short-term price fluctuations.

During the insane market turbulence around the time of the Terra collapse, COTI CEO posted to Twitter to showcase the fact that Djed had managed to keep its 1:1 peg while all hell was breaking loose across most of the other stablecoins, including USDT, which had also slipped off its peg for some time as a result of high volatility. His post went on to explain how Djed is different from other algorithmic stablecoins:

- “Djed’s algorithm is based on a collateral ratio in the range of 400%-800% for $Djed and $Shen. $ADA prices fluctuations are offset by $Shen, covering shortfalls and guaranteeing the collateralization rate.

- The $ADA reserve pool is not managed by market makers, but by users who mint the $Shen reserve coin and add $ADA to the pool. This provides a decentralized aspect to the $Djed mechanism. $Shen holders are incentivized to provide liquidity through fees.

- As $Djed can be over collateralized (up to 8x), the risk of $Djed being unpegged decreases. This means that for every 1 $Djed minted, there are 4-8 $Shen in the reserve pool.

- If the ratio falls below 400%, users will not be able to mint $Djed, and $Shen holders won’t be able to burn their $Shen. So in the event of a market dip there is a security blanket for $Djed holders that ensures its sustainability.

- The minting of new $Shen is also supervised in order to maintain the balances stabilized, and ensure there will always be enough $ADA in the pool to provide a dollar equivalent value to the $Djed when burning it.“

For me, as much as I trust Cardano, and believe that if anyone can create a successful algorithmic stablecoin, it would be Cardano and IOG, it is still going to be a while before I put any significant amount of wealth into any algorithmic stablecoin until I am confident they can truly withstand the test of time. Though the fact that Djed survived the blood-bath extinction event that affected many stablecoins following Terra's collapse is a massive sign of its potential.

It is important to highlight that the DJED stablecoin reportedly faced critical liquidity problems in 2023, along with reports of unminting and depegging challenges. DJED failed to maintain its essential reserve ratio between 400% and 800%. Hoskinson was quick to defend the stablecoin, stating that it was working as intended, though many remained skeptical. Amidst swirling rumours of Djed shutting down, Hoskinson reaffirmed that they are “supercharging the team” and that Djed is just getting started.

You can learn more about Djed in our dedicated Djed Review.

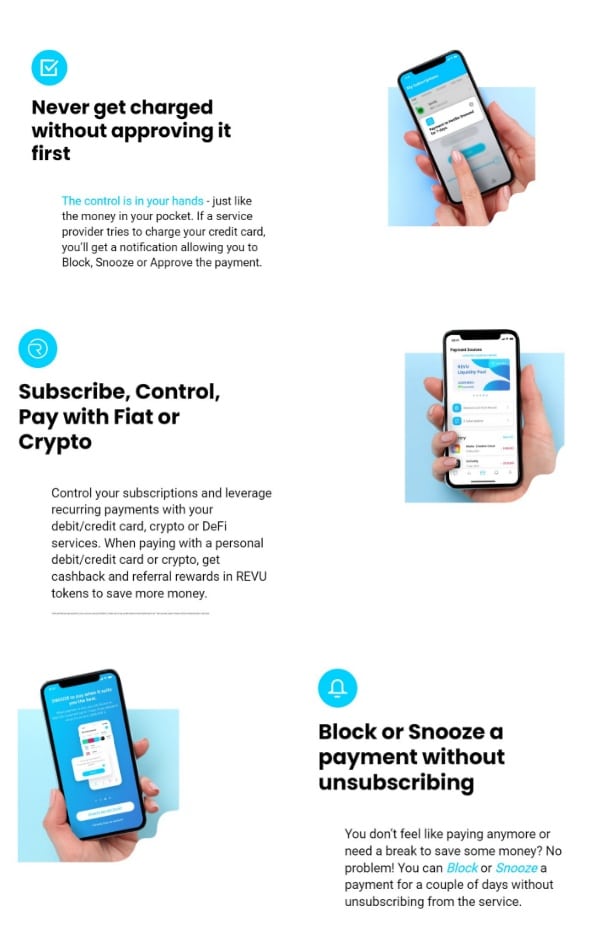

Revuto (REVU)

Revuto might just have one of the simplest, yet best real-world use cases I have come across, and I cannot believe that I’ve never heard of a similar service inside or outside of the crypto space. This Cardano DApp seems so obvious that I can even imagine one of those old cheesy late-night infomercials advertising the service.

“Hey, do you struggle to keep track of all your subscription services?”

“Are all your monthly Spotify, Netflix, Disney +, Hulu, and Amazon Prime invoice emails circling around enough to make your head spin?” “Why not make things easier on yourself and never risk missing another payment? Why not automate your annoying bill payments and live a happy, stress-free life with Revuto?”

A Look at the Revuto Homepage

A Look at the Revuto HomepageYeah, that is basically it! Thankfully I'm not in charge of writing infomercials, I better stick to crypto articles.

In this modern age, there are often a plethora of subscription services linked to our bank accounts. Some people are happy to give these companies access to their funds via direct debit for automatic payments, while other people, myself included, say no way am I letting a company I don’t know, nor trust, have access to the funds in my account!

When I was a financial advisor, I used to encounter endless cases where our clients had signed up for direct debit for a product or service, only to find the company did not cancel their subscription payment when requested, and nearly everyone you meet has a nightmare story about a company that automatically debited their bank account against their wishes.

Amen to That! Image via Revuto

Amen to That! Image via RevutoI’ve seen enough to never want to give any company or organization free reign over my bank account.

The Cardano project Revuto aims to be the solution to mass-subscription headaches. Revuto acts as a single central account that can pay all of a user’s subscriptions, but with the user retaining complete control over the payments. By paying in Revuto’s native token, users can even enjoy a discount on their subscriptions and get cashback rewards. The benefits here are two-fold as those Revuto tokens can also be used for staking to earn passive APY, so not only will users save on their subscriptions, but also earn APY over time.

Some of the Platform’s Features. Image via Revuto

Some of the Platform’s Features. Image via RevutoUsers can easily block, suspend, or snooze payments, putting the power back into the hands of the consumer. This effectively halts those boundary over-stepping companies who conveniently wait until the day after your payment comes out before fulfilling the cancel request you put in like three weeks ago. Sign me up!

Bonus Mentions

With so many fantastic projects, it was difficult to only pick 6, so here are some quick hits also worth spotlighting.

IAGON- IAGON is a cloud storage solution for Web3 built on Cardano. We all know that decentralized cloud storage is going to be big business, with the DePIN narrative standing poised to be a major catalyst in blockchain growth and adoption.

Image via iagon.com

Image via iagon.comIAGON is well-positioned to embrace the future of the Metaverse and virtual worlds by being able to store data in a trustless and permissionless manner. In the decentralized world of Web3, we should not need to rely on centralized storage providers like Amazon and Google. We've already seen the success of decentralized storage projects like Arweave, Filecoin, Storj and others on other networks, IAGON is in a leading position to provide similar solutions for Cardano.

AXO- AXO is self-proclaiming to be creating a “New Standard for Trading” by launching a fair and programmable trading protocol for Cardano that supports trading for Indexes, Futures and Options.

The Axo Protocol attempts to remedy the inefficiencies and central counterparty risks present in both traditional centralized and decentralized protocols. Axo introduces a set of innovative solutions that address these challenges in a trustless manner.

With innovative solutions for trading, ranging from a formal language of exchange and programmable swaps, to a distinctive protocol design, AXO is a project worth keeping an eye on and maybe even testing out as they claim to have created “the world's most frictionless exchange.”

Image via axo.trade

Image via axo.tradeLenfi- Lenfi is an up-and-coming lending protocol on Cardano. The Lenfi protocol is beautifully designed and user-friendly, providing users with the ability to short, long, yield farm, borrow, earn interest, take out flash loans and get involved with protocol governance.

Lenfi is a next-generation lending protocol that enables users to create their own liquidity pools and become pool managers. This could become a major player as DeFi on Cardano heats up.

Conclusion

There is plenty of innovation happening on Cardano since the successful launch of Alonzo, which introduced smart contract functionality on the network. The amount of growth in the Cardano ecosystem is happening at such a pace that Cardano can no longer be ignored as a top contender for Ethereum alternatives.

Though the network was slower to get started than many Cardano fans would have liked, now that the ball is rolling, it is only picking up speed. Even throughout the bear market, the pace of growth happening on the network remains admirable, and Cardano is not even in its final form yet. There are still scaling solutions and upgrades to roll out, meaning that this powerful network is only going to continue to get better.

The future of Cardano looks bright, and it is in an interesting position with a strong foundation to be able to blast off during the next bull market as both retail and institutional interest in the network increases. Cardano is also idolized for the fact that it is not only environmentally friendly, but many projects building on Cardano have a strong focus on sustainable community development projects.