I first heard of Alchemix through an acquaintance when I was bemoaning about how I am rubbish at making money from crypto. What caught my attention about Alchemix was: self-paying loans. That was the magic phrase. My ears shot up like rabbits upon hearing the sound of a predator coming. So many questions followed. Of course, I had to find out if something like this was too good to be true. Most importantly, what are the risks and are they worth taking? If this piques your interest, let's find out together!

A different and safer way of doing DeFi Image via Alchemix

A different and safer way of doing DeFi Image via Alchemix What is Alchemix?

In a nutshell, it's a DeFi project built on the Ethereum network that allows people to borrow and lend, just like one of the hundreds floating in the crypto space. What sets Alchemix apart is that the borrowed loans aren't necessarily reliant on the borrower's paying back the loan. Instead, the borrower can choose to borrow against time. Oooh... sounds fishy? Actually, not really. It's like getting an advance in your salary from the company you work for (assuming they allow you to do that). Your loan repayments are deducted from your future paychecks. Of course, there's also the payday lenders with their eye-watering 20% and above interest rates, but that's a whole lot more sinister, so let's not go there.

Unique features of the project include:

- The ability for borrowers to customise their loan structure and yield strategy

- Borrow against stablecoins (DAI for now) with minimal risk of auto-liquidation.

- Deposit collateral and get synthetic assets which can, in turn, be staked or used to provide liquidity in other DeFi protocols.

This project has a TVL of $488.8 million, according to DeFiPulse at the time of writing, including 51.6 ETH locked in its protocol.

How Alchemix works in a nutshell. Image via Alchemix

How Alchemix works in a nutshell. Image via Alchemix How Alchemix Loans Work

Imagine that you deposited 100 dollars to the bank, which it then uses to lend to someone else at 1% interest. At the same time, you borrow 50 dollars at 1% interest from the bank using the 100 as collateral. Instead of the bank keeping the 1% interest all to itself, they share half of the 1% interest with you, which goes towards paying the interest from the 50 dollars borrowed. Eventually, the money deposited would earn enough to pay back the interest, so you don't need to do it yourself. Now, that might take a while. Until that happens, you have no access to the deposited funds.

That's pretty much how loans work with the Alchemix protocol. To get started, deposit DAI via Metamask or one of the Web3 wallets into Alchemix. You get a synthetic token called alUSD, which can be swapped for DAI at a 1:1 ratio. The maximum amount of alUSD you can get is 50% of the amount of DAI deposited. This means $100 worth of DAI gets you $50 of alUSD.

Put another way, the collateralization ratio between DAI and alUSD is 200%. This ratio remains fairly constant. If by some unlucky chance, the collateralization is less, part of the collateral, i.e. the deposited DAI, will be liquidated to maintain the ratio. On the other hand, if the opposite were to happen, users can withdraw more DAI or mint more alUSD.

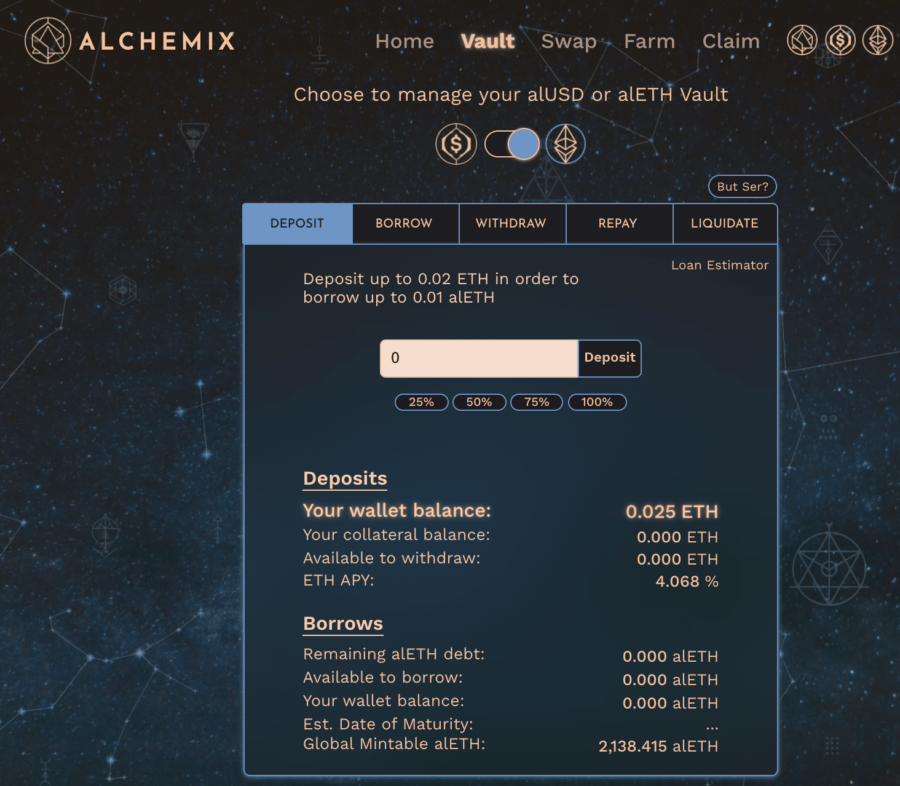

Alchemix also allows for deposits of ETH (not too much) to mint alETH, which can also be used for further staking and farming potential. There is a global ceiling for minting the synthetic versions for both assets to keep the supply and demand constant.

Here's where the magic starts with your DAI/ETH deposit

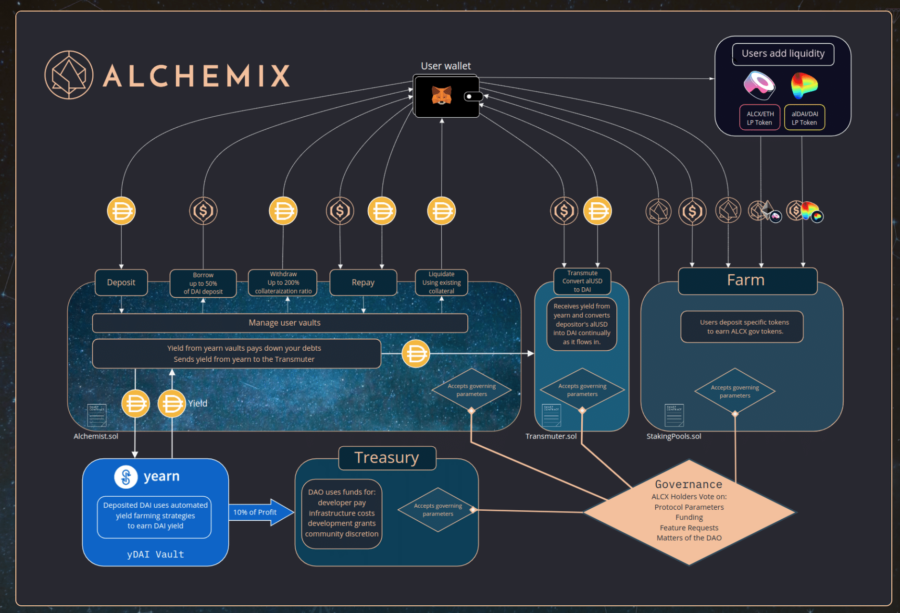

Here's where the magic starts with your DAI/ETH deposit Alchemix DAI and yDAI Yields

The DAI deposited is sent to the yDAI vault in yearn.finance to earn its keep, i.e. generate yield in the form of alUSD. The profits are sent to the Transmuter, a unique tool in Alchemix that converts alUSD and DAI at a 1:1 ratio. The alUSD is auto-converted to DAI, which is then used to pay off the loan against it, given enough time. A quick peek at the yDAI vault shows a few yield-earning strategies involving Compound Finance, Curve Finance, Balancer, Kashi and AAVE.

Earning Yields for alUSD

The alUSD you get in exchange for the DAI deposit can also be put to work in various ways:

- Swap alUSD for DAI with the Transmuter, which you can then use in any other DeFi protocol or even swap the DAI for USD and get cash! The DAI withdrawal also triggers an equal amount of alUSD to be burnt to maintain the stability of both.

- Stake alUSD and get ALCX in the alUSD pool.

- Deposit alUSD together with other crypto tokens such as USDT, USDC, FEI and FRAX, to name a few, to participate in liquidity pools at Curve, Saddle and Frax Finance.

- Deposit alUSD only in the mStable pool to earn MTA.

One of the key elements of DeFi is composability, which means DeFi products interact with each other to get maximum functionality. Unfortunately, most of the earlier DeFi products rely on users to make the most out of their interactions with DeFi products. Alchemix has made it easier to get started with composability by automating some elements.

Repaying Alchemix Debt

While it's all well and good to know that the loan taken out need not be paid back in a hurry, sometimes users might want to have access to the collateral before the loan is paid back. In those instances, the users can pay back the loan using DAI, alUSD or a mixture of both.

What if you desperately need access to the collateral but don't have enough to pay back the loan? Well, you could liquidate part of the loan. Unfortunately, this means if you're short 10 dollars to repay the loan, you only get back 90 dollars of your deposit. Not ideal, but it is an option.

Alchemix DAO and ALCX

Like any blockchain project worth its salt these days, the Alchemix team also has a DAO made up of holders of ALCX, the governance token for Alchemix. The holders are participants of the protocol and members of the community. Incentives for them to hold ALCX include:

- Staking ALCX to earn more ALCX.

- Using ALCX to participate in other liquidity pools in Curve, Sushiswap and Tokemark.

- Have voting rights to the following areas, but not limited to:

- Operational matters concerning the DAO.

- Allocation of Treasury funds.

- Grants to help bring progress to the ecosystem.

- Submit proposals for consideration to the community.

Alchemix DAO Treasury

The Treasury's income source is 10% of the yields generated from the yDAI vault from Yearn. A chunk of that is used to pay developers infrastructure costs and have the core team keep the lights on. The rest of the funds will be voted on by the ALCX holders from the DAO.

Currently, the Alchemix team controls the Treasury with a multisig wallet set-up. Proposals are voted on at Snapshot, a DAO voting platform, allowing the community to vote without paying gas fees. Later, there is a transition plan to a fully-working DAO on-chain that will enable the community to have complete say-so over the operations of the protocol and the DAO itself.

Alchemix Tokenomics

Unlike some of the DeFi projects that got bootstrapped from venture capital funding, Alchemix was entirely self-funded until the launch in March 2021, followed by a fair launch. The token itself was designed to work best when most holders are also participants on the platform.

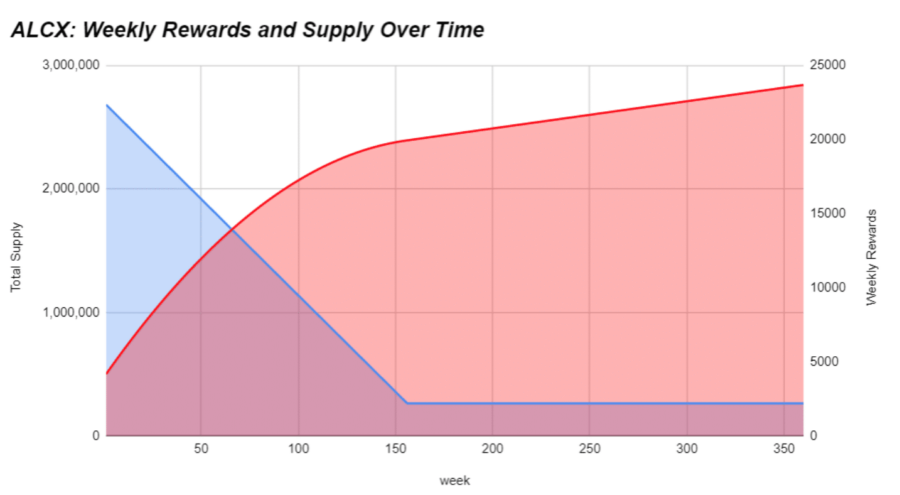

Although there is no hard cap on the supply side, the current stats from Coingecko.com shows a max supply of 2,393,060 with a circulating supply of 1,171,200 tokens. The first number is calculated to be reached based on an initial pre-mine of 478,612 tokens after 3 years. Of the initial amount:

- 15% goes to the DAO Treasury

- 5% reserved for bug bounties, controlled by the team

- 80% as rewards for staking participants

How the tokens will be distributed within a 3-year period

How the tokens will be distributed within a 3-year period The plan is to have 2,200 ALCX tokens issued weekly, representing a 4.5% annual inflation to the supply, gradually decreasing over time.

ALCX Price Movement and Yields

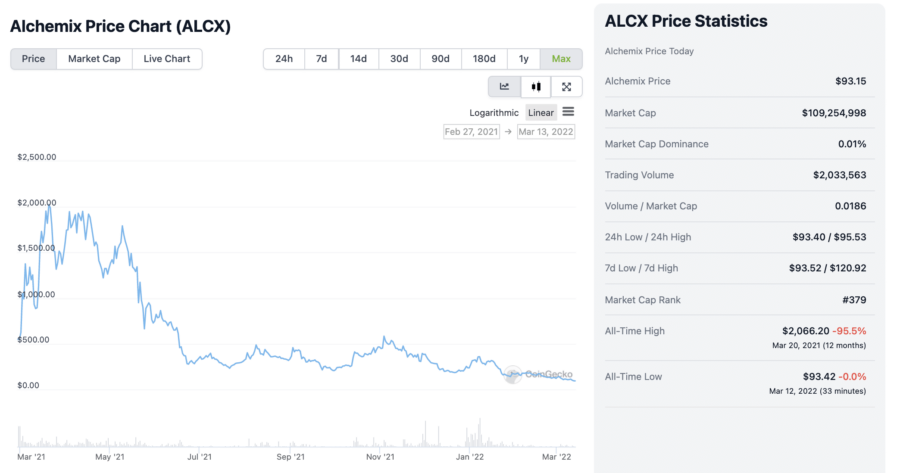

Price movement for ALCX to-date Image via Coingecko.com

Price movement for ALCX to-date Image via Coingecko.comStarting out at around $500 per token, ALCX has seen some pretty intense highs and lows. It 4x'ed its price to $2066.20 not long after its launch. Like many other tokens, it was in the vicinity for a while before sustaining a steep decline during the May 2021 crash. Since then, the price has ranged between $230 and $530, even going as low as $94 thereabouts. That's quite a far cry from the initial listed price.

From a trader's point of view, this would be a terrible buy as the floor price hasn't been established yet. However, this would be less of a trading asset than a farming asset as you could probably make more with staking and yield-farming. If you are interested in getting some to give it a try, it can easily be bought on major exchanges such as Binance and Coinbase. If DeXes are your trading place of choice, then Sushiswap would be a good one to check out. The token is available in the following pairs: ALCX/USD, ALCX/EUR, and ALCX/USDT. Note that it requires 35 network confirmations when transferring from one wallet to another.

ALCX Pools

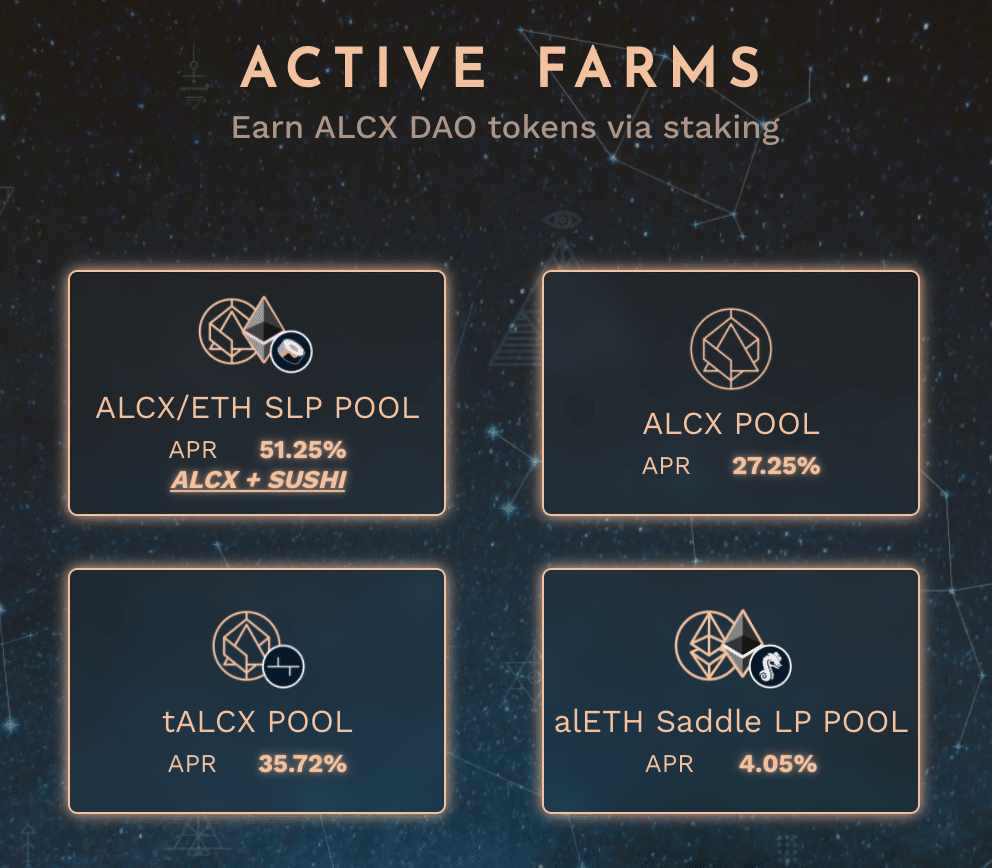

There are currently 3 pools to choose from:

ALCX/ETH SLP pool (approx. 50.69% APY) - deposit LP tokens from this pool to claim ALCX and SUSHI rewards.

ALCX pool (approx. 27.07% APY) - straight-up staking ALCX to get more of the same.

tALCX pool (approx. 36.50% APY) - staking tALCX tokens from Tokemak to get ALCX rewards.

Ways to put your ALCX to work

Ways to put your ALCX to work Alchemix Team

Scoopy Trooples is known as the co-founder of Alchemix. He's been on a podcast/YouTube interview with the Bankless team, Gabriel Haines, and a few other interviews. I'd almost say he is the spokesperson for the project, as he seems to be the only one I can find who is officially related to the Alchemix team.

Nevertheless, the Alchemix founders, onboarded developers, and community developers who build on Alchemix will have access to an exclusive staking pool, which will receive 20% of the ALCX block reward. This equates to 16% of all emissions.

The visible co-founder of Alchemix Image via Twitter

The visible co-founder of Alchemix Image via Twitter Alchemix Roadmap/Future Plans

There are many exciting plans lined up for the future, even if the roadmap seems to yield few details.

These few sparse lines contain lots of gems

These few sparse lines contain lots of gems Each section in the roadmap belies a wealth of info that's sure to dazzle some eyes. Let's dig further!

Alchemix V2 Contracts

The V1 smart contracts do not interact with the Alchemix vaults to prevent attacks made to them. However, this also limits what the contracts can do. For the V2 version, the smart contracts get to interact a little, but they come with heavy restrictions. These V2 smart contracts have been audited by Runtime Verification, the company that specialises in auditing smart contracts. This was recently completed in February 2022. Details of what the audit entails can be found here.

The project itself is audited by Certik, one of the leading blockchain protocol auditors in the crypto space. You can also view the audit results here. Talk about transparent security, huh?

Below are some of the ideas that will be made into reality with the V2 contracts:

- Enable a wider variety of stablecoins to be used as collateral for alUSD. Similar to how DAI is a multi-asset-backed stablecoin, alUSD looks to tread a similar path. The idea is that alUSD can be backed, not only with stablecoins but with some NFTs too. Price stability for the assets is of paramount importance, so they are also looking into a partnership with Chainlink to take care of this aspect. According to their white paper, users may want to take advantage of some arbitrage opportunities "by minting alUSD with the less expensive stablecoin to pay off debt minted from a more expensive stablecoin". When enough people do this, it will help stabilise the price of the supported coins.

- Other ways of using collateral. Instead of just paying down the principal, the yields earned can also be used through other means like credit delegation, where the yield amount can be used to make other kinds of payments in the real world via a potential partnership with an entity like StreamPay.

- A new architecture allows new collateral types like yWBTC to be added easily.

Alchemix Risks

So far, the project looks to be quite a solid home-runner. However, there is always risks everywhere, and Alchemix is no exception to this rule. With composability comes reliance with other blockchain projects, so the key risk areas for Alchemix lies in the other blockchains and its own smart contracts.

Smart Contract Risk

In Oct 2021, Alchemix suffered a "reverse rug", whereby the yETH vault had an exploit resulting in the debt being paid down too quickly. This was reported by Coindesk.com at the time. No doubt, the $4 million loss lit a fire under the team, which resulted in the V2 contract verification to prevent such incidents from happening in the future. This shows that the smart contract risk is very real, even with the best of intentions.

Other Blockchain Projects Risk

MakerDAO and DAI

Since Alchemix relies on the DAI token to kickstart the cycle, the risks associated with DAI and its issuing organisation, MakerDAO, will also be carried forward to Alchemix. However, as one of the OGs of crypto projects in the space, MakerDAO is as solid as it gets. Not to say there are no risks. In the grand scheme of things, though, smart contract risks that may result in the DAI going off-peg is small but present.

Yearn and yDAI vault

Recently, there was an announcement by Andre Cronje of his retirement from the DeFi space. He was one of the founders of yearn.finance, even though, at the time of the announcement, he had long removed himself from the day-to-day operations of the protocol. Nevertheless, Yearn still took a dip in its price. This reflects on the association people have with Cronje and the protocol.

As with MakerDAO and DAI, the yDAI vault in Yearn is the keystone to Alchemix's current success and their primary source of income, so to speak. Therefore, if anything were to happen to that vault, Alchemix might not escape unscathed. This happened in February 2021, before Alchemix launched, where an exploit resulted in an $11 million loss to the DAI vault at Yearn.

Ironically, it's a good thing this happened before the Alchemix launch, as it will surely be much more secure than before. It's like flying with an airline company that had just suffered an accident. You know the rest of the fleets will have doubled or tripled their safety checks to make sure it doesn't happen again, so it's the current safest airline to fly.

Conclusion

The thing about Alchemix that I like is it's not wholly reliant on getting liquidity from participants to keep the project afloat. Through Yearn's yDAI vault, the project's income source is less susceptible to manipulation by whale participants or the project founders themselves. Of course, there is always the risk of the founders doing some kind of a rug pull, but I also believe there are honest people out there who genuinely want to build something lasting that would, at the same time, benefit others.

As more and more DeFi projects start to interact and rely on each other, the possibility of a domino-style cascading risk grows too. However, with enough projects supporting each other, it is also possible that what happens to one might have minimal effect on the rest. The way forward for everyone in the crypto space is for this robustness to grow so that the projects together will be too big to fail.