We reviewed Arkham Intelligence a while ago. This platform brought institutional-grade on-chain analytics to retail users. Its unique approach sets Arkham apart: allowing users to monetize their blockchain insights by selling intelligence to others. This model transforms on-chain data from a passive research tool into an active marketplace for alpha discovery.

Now, the Arkham team is expanding on this vision by launching Arkham Exchange, a trading platform built on the same guiding ethos of transparency. While offering spot and perpetual trading services, Arkham Exchange integrates its intelligence platform directly into the trading experience, providing users with insights that traditional exchanges lack.

This review thoroughly examines Arkham Exchange, how its on-chain intelligence integration changes the trading game, and whether it’s a worthy platform for crypto traders seeking an edge.

What is Arkham?

Arkham Intelligence is a blockchain analytics platform transforming complex blockchain data into actionable insights. It leverages advanced data science and artificial intelligence and offers a user-friendly interface for in-depth analysis of user behavior, transaction patterns, and DApp utilization.

Entity-Based Intelligence

Traditional crypto analytics often focus on individual transactions or addresses, making it challenging to understand the broader context. Arkham addresses this by adopting an entity-based intelligence approach, tracking on-chain activity from the user's perspective rather than just the network's. This methodology enables a deeper understanding of the entities behind transactions and their activities across wallets and blockchains.

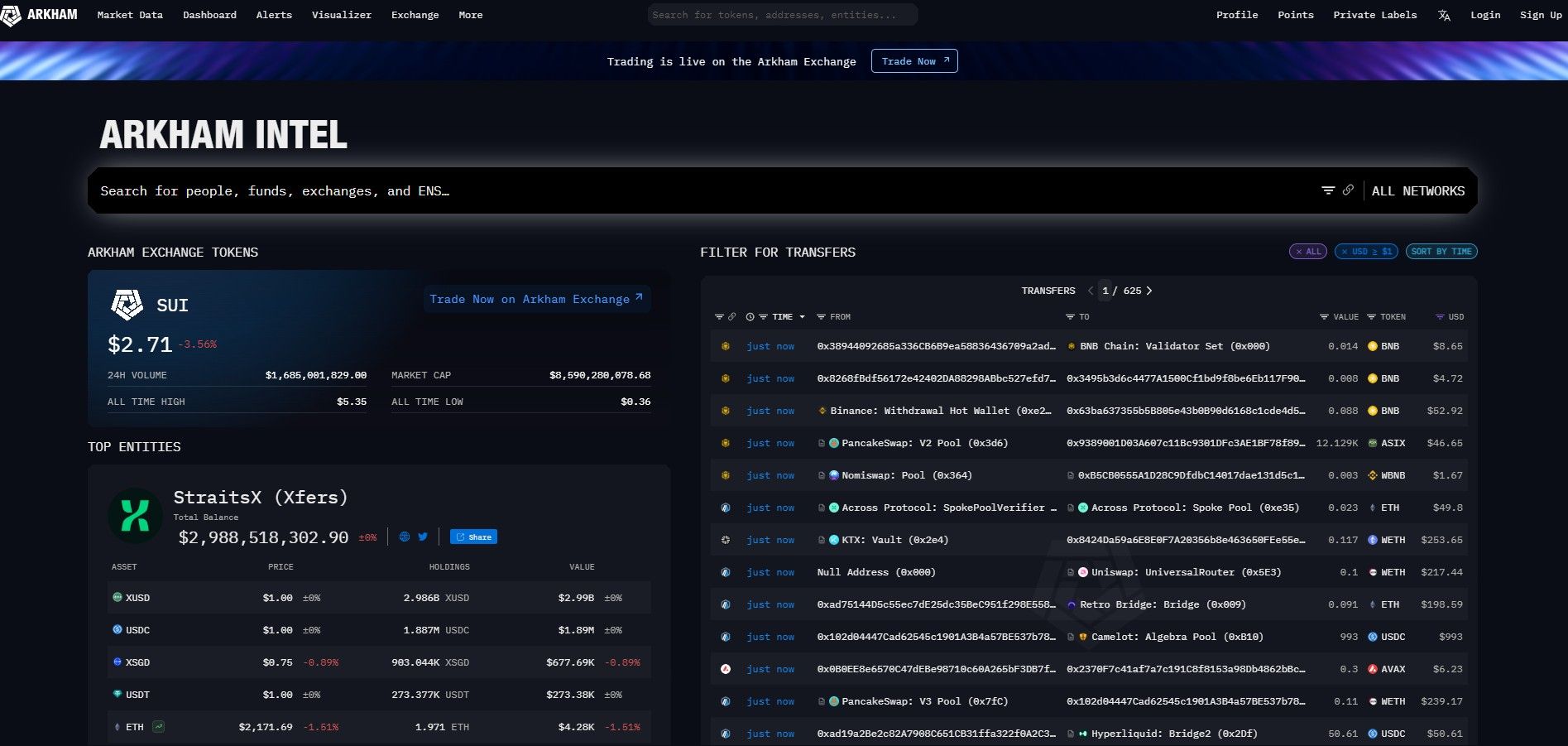

The Arkham Platform

The core of Arkham's offerings is its public web-based application, providing an intuitive interface for accessing and analyzing blockchain data. Key features include:

- Dashboard: Users can create customized intelligence dashboards displaying data and metrics relevant to their interests.

- Alerts: Set up notifications for transactions that meet specific criteria, aiding in real-time monitoring.

- Visualizer: This tool generates network analyses of transaction activity across wallets and entities, offering a clear view of fund flows and relationships.

Intel Exchange Marketplace

Arkham also features the Intel Exchange, a marketplace for buying and selling crypto intelligence using its native token, ARKM. This platform incentivizes the capture and sharing of intelligence, creating an information economy. Intel Seekers can post requests for specific blockchain-related intelligence and stake ARKM as a reward, while providers can earn tokens by fulfilling these requests.

Arkham Intelligence is a Blockchain Analytics Platform. Image via Arkham

Arkham Intelligence is a Blockchain Analytics Platform. Image via Arkham

ARKM Token

The ARKM token serves as the native cryptocurrency of the Arkham ecosystem, with several utilities:

- Settlement Currency: Used for transactions within the Intel Exchange, facilitating the buying and selling of intelligence.

- Incentives: Users earn ARKM rewards for submitting intelligence, referring new users, and growth-taking other actions that benefit the ecosystem's growth.

- Governance: Token holders have governance rights, allowing them to vote on the strategic direction of Arkham.

- Trading Fee Discounts: Arkham Exchange users can earn trading fee discounts based on their ARKM holdings and choosing to pay for their fees in ARKM

By integrating these features, Arkham Intelligence aims to democratize access to blockchain information, empowering users with the tools needed for business analysis, personal portfolio tracking, market research, and more. This commitment to transparency and data accessibility lays the foundation for their latest venture: Arkham Exchange.

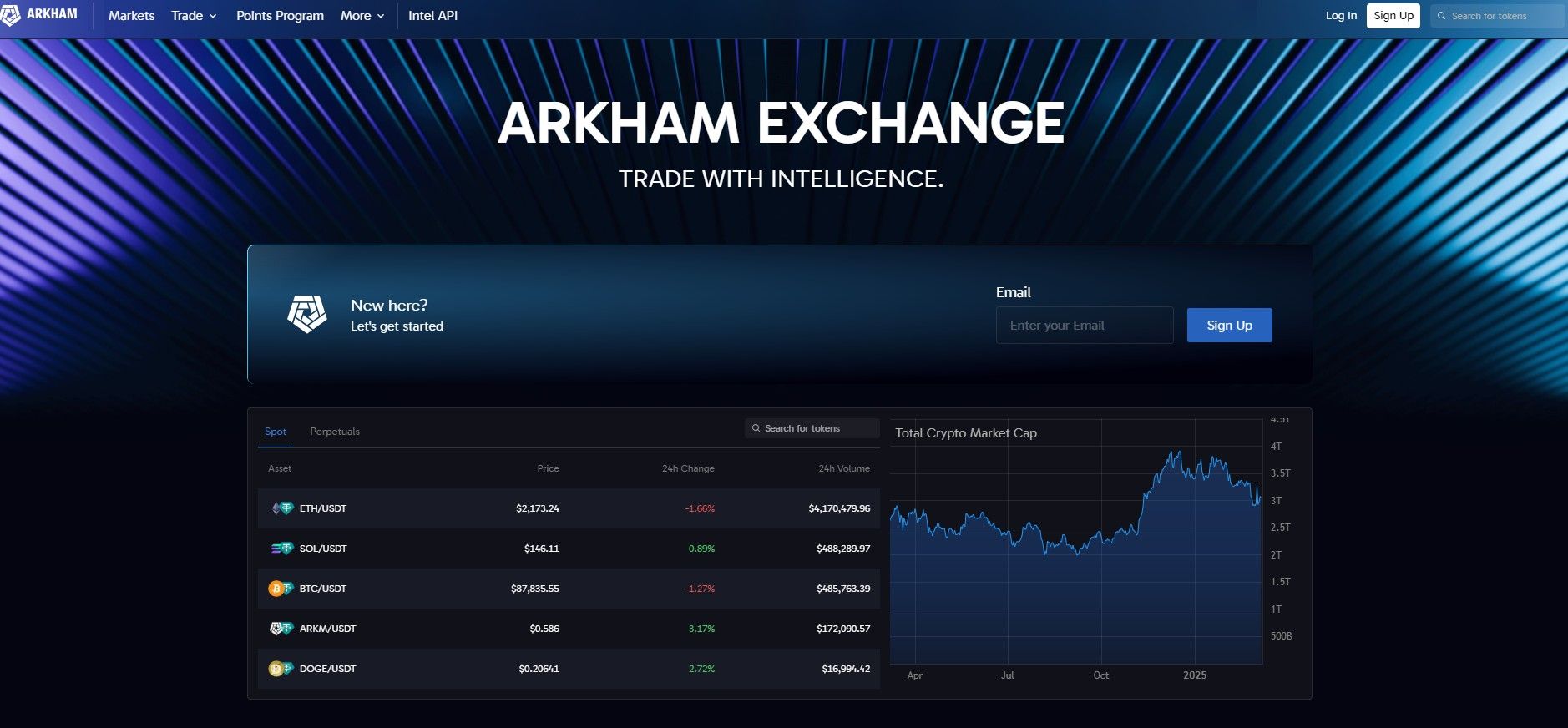

The Arkham Exchange

Building on its transparency ethos, Arkham has launched Arkham Exchange, a centralized platform for cryptocurrency spot and perpetual trading. Access to these markets requires users to complete a Know Your Customer (KYC) verification process, ensuring compliance and security. The seamless integration between its intelligence platform and the exchange allows users to gain comprehensive insights into their trade assets, setting a new standard for transparency in the crypto trading space.

Spot trading on the Arkham Exchange is available in the following US states:

Colorado, Hawaii, Indiana, Iowa, Kansas, Michigan, New Hampshire, New Jersey, South Carolina, Tennessee, Utah, Virginia, Wyoming, Wisconsin, California, Massachusetts & Montana.

Arkham Exchange restricted jurisdictions include:

The Crimea, Luhansk, and Donetsk regions; Cuba; Iran; North Korea; Syria; Albania; Bosnia and Herzegovina; North Macedonia; Montenegro; Kosovo; Serbia; Afghanistan; Central African Republic; Democratic Republic of the Congo; Ethiopia; Iraq; Lebanon; Libya; Mali; Nicaragua; Russia; Venezuela; Yemen; Zimbabwe; Belarus; Libya; Myanmar (Burma); Somalia; South Sudan; United Kingdom; Canada; Turkey; UAE; The Netherlands; Japan; Pakistan; India; Indonesia; Algeria; Morocco; Bangladesh; Nepal; Caribbean Netherlands; Eritrea; Guinea-Bissau; Cameroon; Namibia; and Sudan.

Arkham Exchange Features

Arkham Exchange offers a suite of features designed to cater to both novice and seasoned cryptocurrency traders. Here's a comprehensive overview:

Spot Trading

Arkham's spot trading platform provides a standard trading terminal with essential charting tools reminiscent of TradingView. Traders can execute various order types, including limit and market, and take profit/stop loss orders, offering flexibility in trade execution. All tokens are paired against USDT, simplifying the trading process for users familiar with stablecoin settlements. Deposits are supported for select tokens, with USDT deposits available via the Ethereum network.

Arkham Exchange Landing Page. Image via Arkham

Arkham Exchange Landing Page. Image via ArkhamUSDT Perpetual Trading

Arkham offers USDT-based perpetual contracts for those interested in leveraged trading. The trading experience mirrors that of other perpetual markets, with all contracts paired against USDT, providing a consistent and straightforward trading environment.

Arkham Exchange Trading Interface. Image via Arkham

Arkham Exchange Trading Interface. Image via ArkhamArkham Points Program

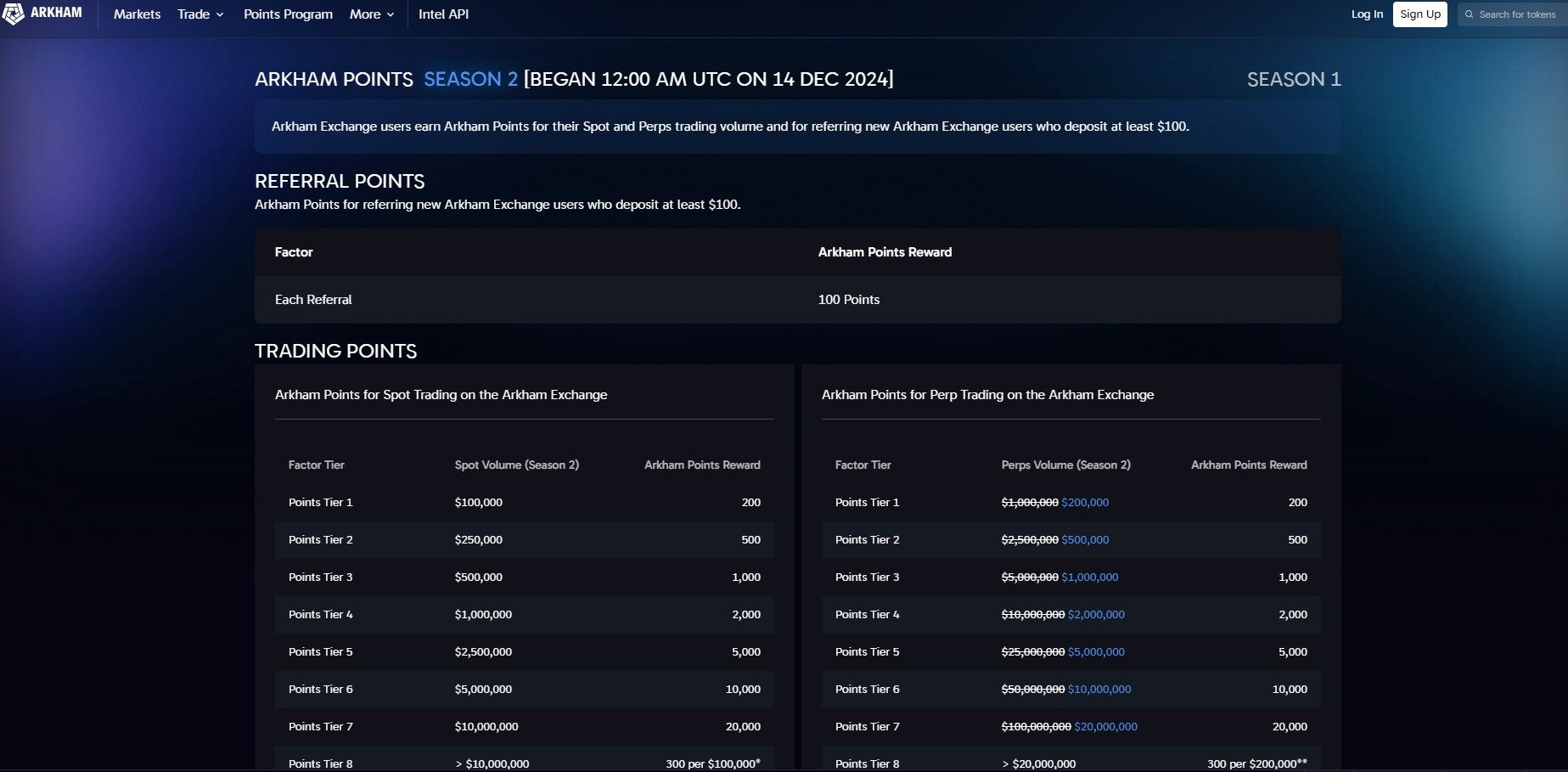

Arkham has introduced a Points Program to reward active traders and community members:

- Earning Points: Users accumulate Arkham Points based on their trading volumes in both spot and perpetual markets. Additionally, referring new users who deposit at least $100 earns 100 points per referral.

- Seasonal Structure: Season 2 of the Points Program commenced on December 14, 2024. Specific Arkham Points rewards are structured across various trading volume tiers, encouraging increased trading activity.

- Volume Caps: To maintain a balanced reward system, there's a $20,000,000 points-earning volume cap per spot trading pair and a $40,000,000 cap for each perpetual trading pair. Beyond these caps, additional volume doesn't yield extra points for that pair.

- Redemption: Redemption: Accumulated Arkham Points during Season 1 were redeemable for ARKM on a one-to-one basis.

- VIP Boost: VIP members receive a 10% boost on their earned points, enhancing the rewards for high-volume traders and influencers.

Arkham Season 2 Points Program. Image via Arkham

Arkham Season 2 Points Program. Image via ArkhamVIP Program

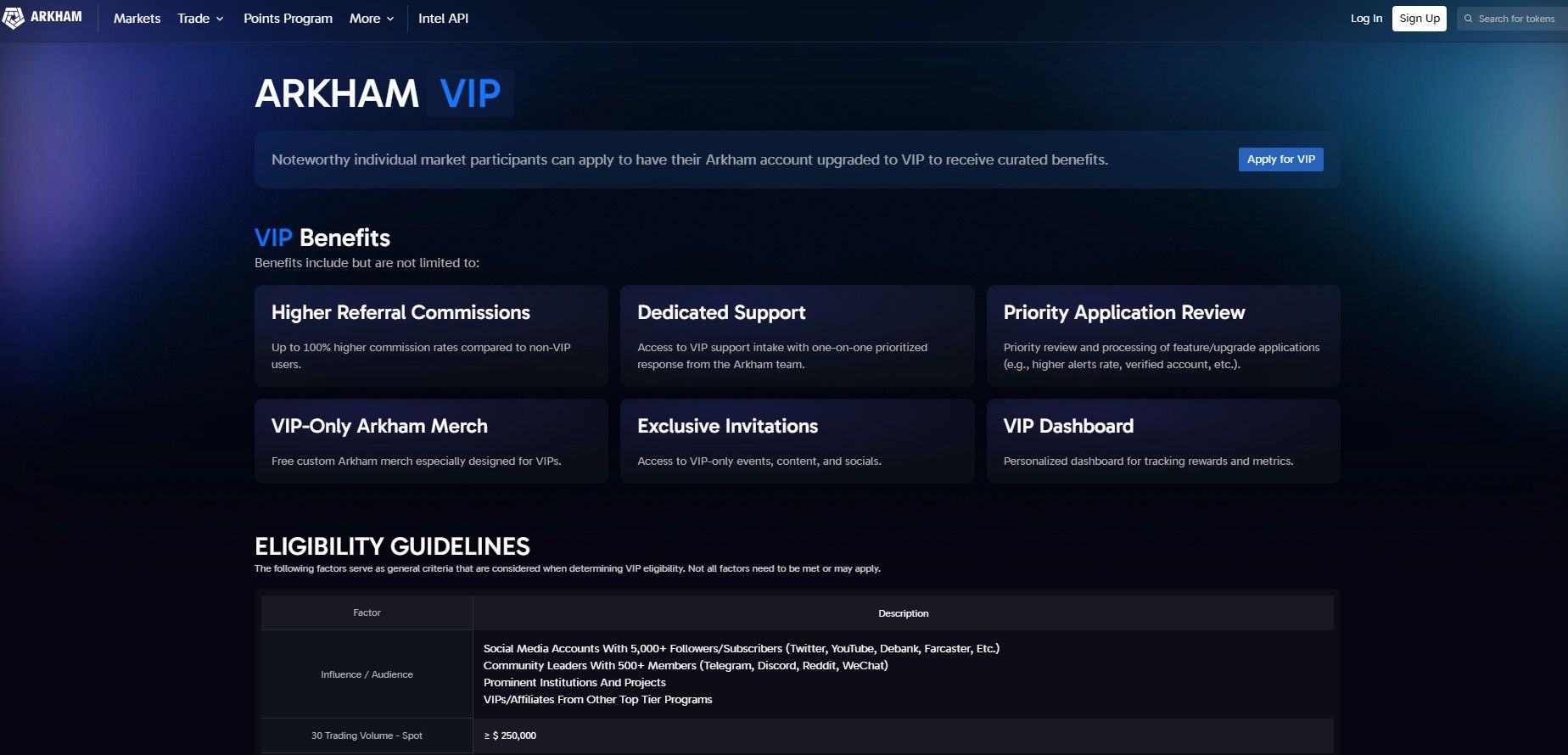

Arkham's VIP Program offers exclusive benefits to notable market participants:

- Eligibility: Individuals with a high monthly trading volume (over $250,000) or influencers with significant reach can apply for VIP status. Arkham's VIP page has detailed eligibility criteria.

- Benefits: VIPs enjoy enhanced Arkham Points earnings, higher referral commissions, dedicated support, priority application reviews, exclusive Arkham merchandise, invitations to VIP-only events, and access to a personalized VIP dashboard for tracking rewards and metrics.

- Continued Rewards: VIPs retain their point-earning capabilities from the Intel Platform referrals and nominations during an initial period. Even if they choose not to trade on the exchange, VIPs can convert their accumulated points to ARKM tokens, ensuring their contributions are rewarded.

Arkham VIP Program. Image via Arkham

Arkham VIP Program. Image via ArkhamBy integrating these features, Arkham Exchange aims to provide a comprehensive and rewarding trading experience and foster a vibrant community of traders and analysts.

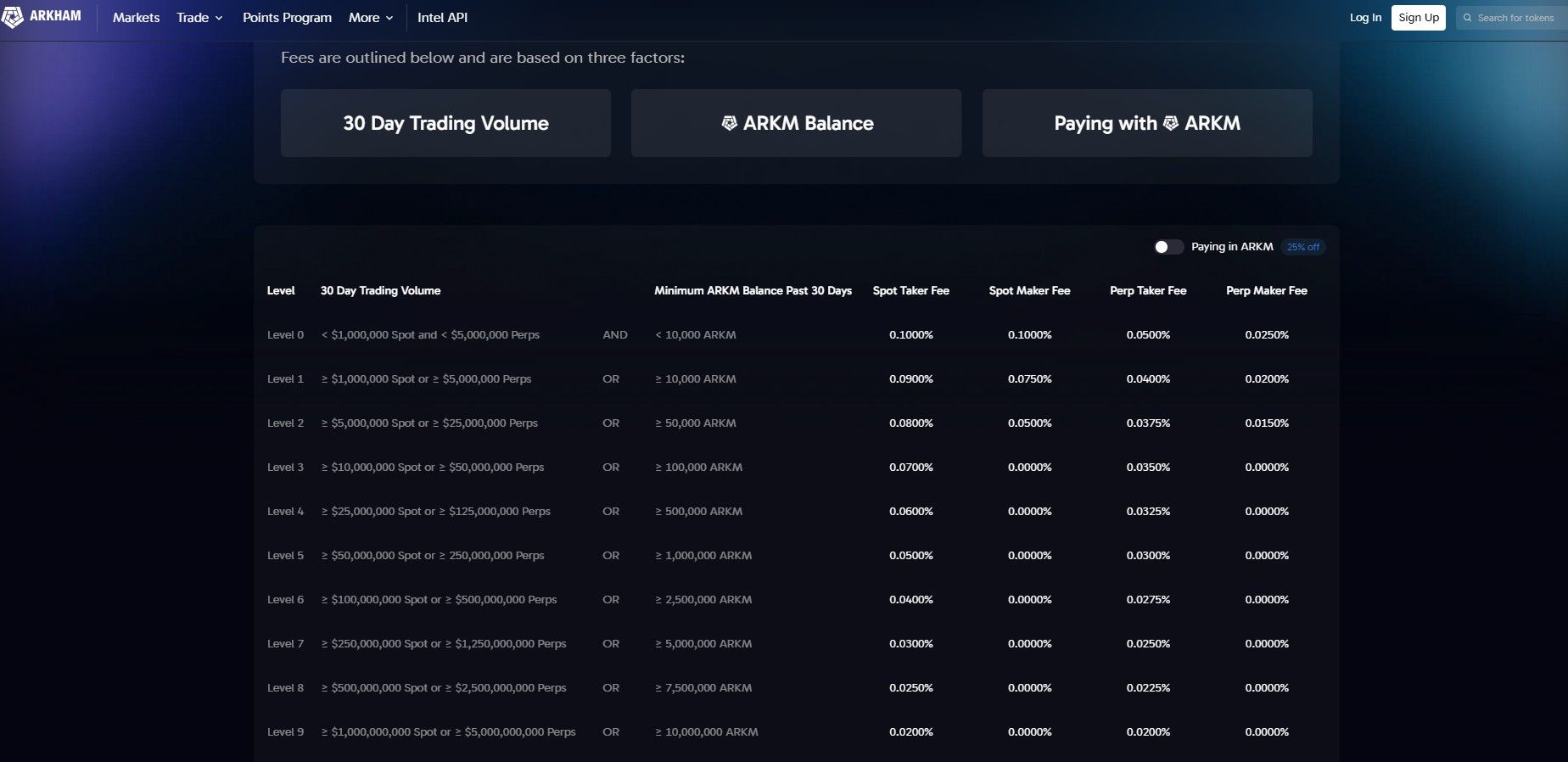

Arkham Exchange Fees

Arkham Exchange offers a competitive fee structure to reward active traders and ARKM token holders. Here's an overview:

Zero Maker Fees

Arkham Exchange has heavily discounted maker fees for spot and perpetual trading to attract liquidity providers. This means that users who place orders that add liquidity to the order book incur minimal fees.

Taker Fees with Tiered Discounts

Taker fees apply when orders are executed immediately against existing orders on the order book. Arkham implements a tiered discount system based on two main factors:

- ARKM Holdings: Users holding ARKM tokens can receive discounts of up to 95% on taker fees, depending on the amount held.

- Trading Volume: Higher 30-day trading volumes can qualify users for additional fee reductions.

Additional ARKM Payment Discount

Users opting to pay their trading fees using ARKM tokens from their spot balance receive an extra 25% discount, further reducing overall trading costs.

Fee Levels and Structure

Arkham's fee structure is divided into multiple levels, each offering specific taker and maker fees based on ARKM holdings and trading volume. Users should refer to Arkham's official fee schedule for detailed information on each level.

Arkham Exchange Fee Tiers. Image via Arkham

Arkham Exchange Fee Tiers. Image via ArkhamBy leveraging ARKM holdings and maintaining active trading, users can significantly minimize their trading costs on Arkham Exchange.

Arkham Exchange Security

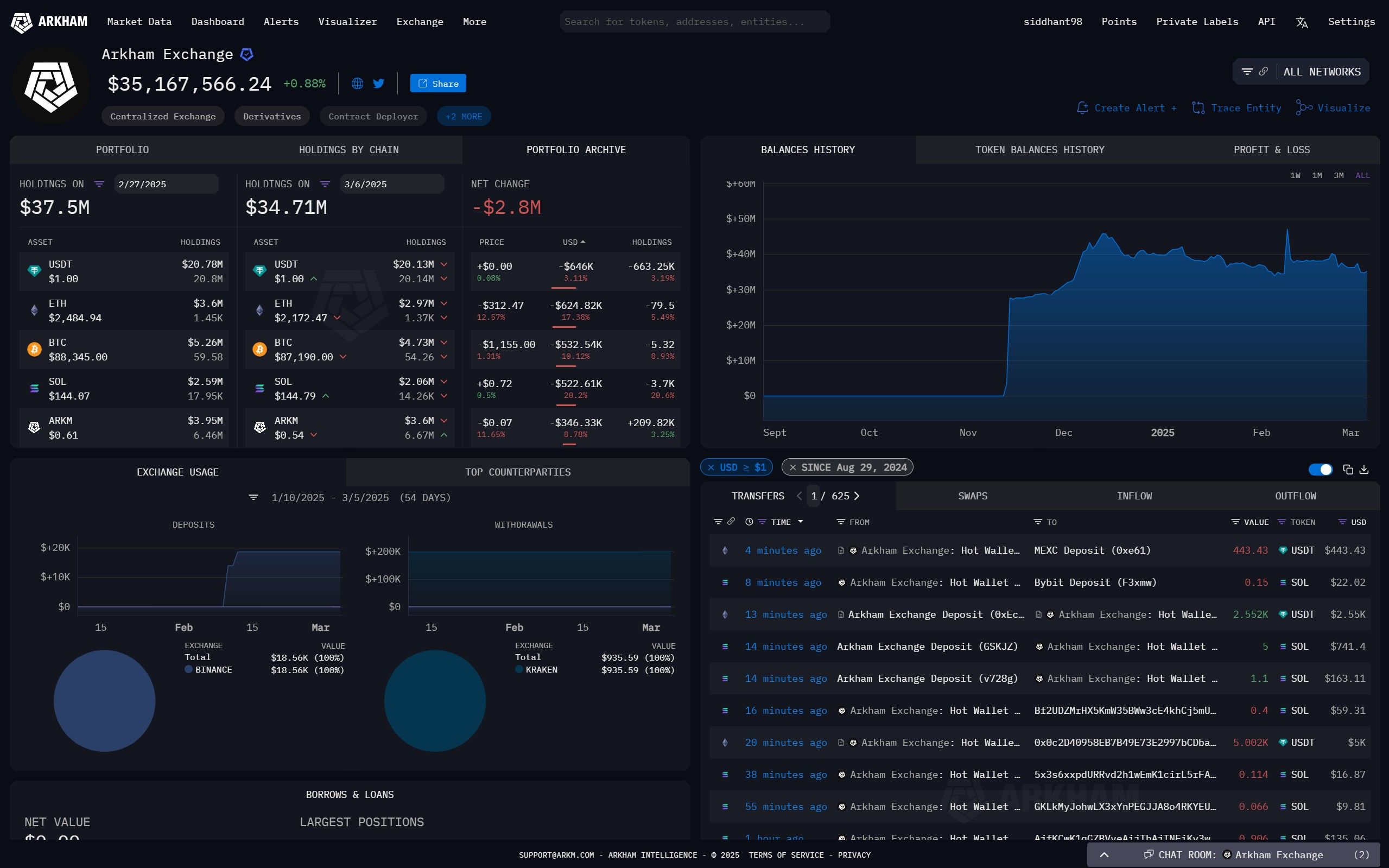

Arkham Exchange prioritizes security and transparency, integrating its blockchain intelligence capabilities to enhance user trust.

Proof of Reserves and Transparency

A standout feature of Arkham Exchange is its commitment to transparency, as evidenced by its publicly accessible dashboard. The Arkham Intelligence platform allows users to verify the exchange's asset holdings and offers real-time insights into reserves and liquidity. This integration allows users to monitor the exchange's financial health, fostering trust and confidence.

The Arkham Dashboard provides key details about the exchange's liquidity | Image via Arkham Intelligence

The Arkham Dashboard provides key details about the exchange's liquidity | Image via Arkham IntelligenceSecurity Measures

While specific security protocols are not extensively detailed on Arkham's official website, the exchange emphasizes the protection of personal data. According to its privacy policy, Arkham employs reasonable technical, organizational, and physical safeguards to protect collected personal data. However, they acknowledge that no security measures are infallible, and inherent risks exist in data transmission over the internet.

Third-Party Security Assessments

External platforms like CER.live provide additional insights into Arkham Exchange's security posture. Users are encouraged to consult these resources for comprehensive evaluations of the exchange's security measures.

Final Thoughts

Arkham Exchange offers a unique blend of trading services and blockchain intelligence. It offers users an integrated platform for trading and data analysis. This integration allows traders to access comprehensive on-chain data, enhancing decision-making and fostering a more informed trading environment.

Current Limitations

As a relatively new entrant in the cryptocurrency exchange landscape, Arkham Exchange currently faces certain limitations:

- Limited Token Listings: The exchange offers a modest selection of tokens.

- Lack of fiat on/off ramp: The exchange currently only supports crypto on/off ramping, without the ability to natively purchase crypto with fiat.

Future Prospects

To address these challenges and bolster liquidity, Arkham Exchange has initiated several strategies:

- Designated Market Maker (DMM) Program: The exchange offers curated benefits to select institutions that contribute liquidity, including rebates on maker trades. This program aims to attract professional market makers to enhance liquidity and reduce slippage.

- User Incentives: By providing substantial discounts for market-making activities, Arkham encourages active participation from its user base, which could lead to improved liquidity over time.

Ideal User Base

Given its current features and ecosystem, Arkham Exchange is particularly well-suited for crypto-native traders, especially those already engaged with the Arkham platform and holders of ARKM tokens. These users can leverage the integrated intelligence tools and benefit from the exchange's native token incentives, creating a cohesive and rewarding trading experience.

In summary, Arkham Exchange offers innovative integration with blockchain intelligence for greater incites and transparency. As the platform continues to grow and implement its liquidity enhancement strategies, it holds the potential to become a more robust and versatile trading venue with more supported listings and fiat on/off ramps.