In the high-stakes game of crypto trading, Solana has carved out a niche as the go-to platform for traders seeking rapid transactions, high yields, and the thrill of memecoin speculation. Its high-throughput architecture and single-chain design facilitate swift, high-frequency trading while consolidating liquidity across the ecosystem. This infrastructure has propelled Solana to the forefront of memecoin trading.

Platforms like Pump.fun exemplify this trend, enabling users to create and trade memecoins with ease. Since its launch in January 2024, Pump.fun's decentralized exchange, PumpSwap, has achieved a total value locked (TVL) exceeding $100 million within 50 days, with cumulative trading volumes surpassing $18 billion. Notable tokens such as Popcat and Dogwifhat have contributed to a combined market capitalization of nearly $8 billion for Solana-based memecoins.

Amid this landscape, Axiom Trade has emerged as a specialized platform catering to serious memecoin traders. Backed by Y Combinator, Axiom offers advanced trading tools, including real-time analytics, wallet tracking, and integration with perpetual trading via Hyperliquid. On April 14, 2025, Axiom's daily trading volume exceeded $100 million, capturing approximately 50% of the Solana memecoin trading market and serving over 26,800 active traders.

For traders aiming to engage with the memecoin economy using professional-grade tools and strategies, Axiom Trade presents a comprehensive solution tailored to the fast-paced Solana ecosystem.

Key Takeaways

- Axiom Trade is the leading memecoin trading platform on Solana, combining high-speed execution with pro-level tools tailored for serious speculators.

- It aggregates memecoin listings from Pump.fun, Raydium, and more, offering advanced analytics, wallet tracking, and sniper/bundler detection tools.

- Perpetual trading is enabled through full integration with Hyperliquid, giving users access to up to 50x leverage, an on-chain order book, and zero gas fees.

- Discovery features like Axiom Pulse and Tracker help traders catch early launches, track wallet activity, and monitor memecoin lifecycle data in real time.

- Accounts are non-custodial but come with optional email registration and built-in wallet creation, making onboarding both flexible and secure.

- Axiom rewards active traders via a tiered fee + cashback system and offers optional MEV protection, gas priority settings, and slippage controls for optimized execution.

Axiom Background and History

Axiom Trade was launched in early 2024 by co-founders Henry Zhang and Preston Ellis, both computer science graduates from UC San Diego. Zhang, who previously worked on generative AI at TikTok, and Ellis, a former DoorDash intern, combined their expertise to create a platform tailored for high-frequency memecoin trading on the Solana blockchain.

In early 2025, Axiom was accepted into Y Combinator's Winter 2025 batch, providing the startup with mentorship, resources, and validation within the crypto community. This backing facilitated rapid growth, enabling Axiom to scale its operations and enhance its platform features.

Axiom Trade is a Memecoin Trading Platform on Solana | Image via X

Axiom Trade is a Memecoin Trading Platform on Solana | Image via XSince its inception, Axiom has achieved significant milestones:

- Trading Volume: By May 14, 2025, Axiom's daily trading volume peaked at over $438.9 million, contributing to a cumulative trading volume exceeding $10.5 billion within its first 129 days.

- Revenue: The platform reached $100 million in revenue in just 129 days, outpacing competitors like Photon and Pump.fun.

- User Base: Axiom has facilitated over 110 million transactions from more than 382,500 unique wallets, with active wallets increasing from 17,000 to over 41,000 between April and May 2025.

Axiom's rapid ascent underscores its position as a leading platform for memecoin trading on Solana, offering advanced tools and integrations that cater to both novice and professional traders.

Axiom Spot Trading

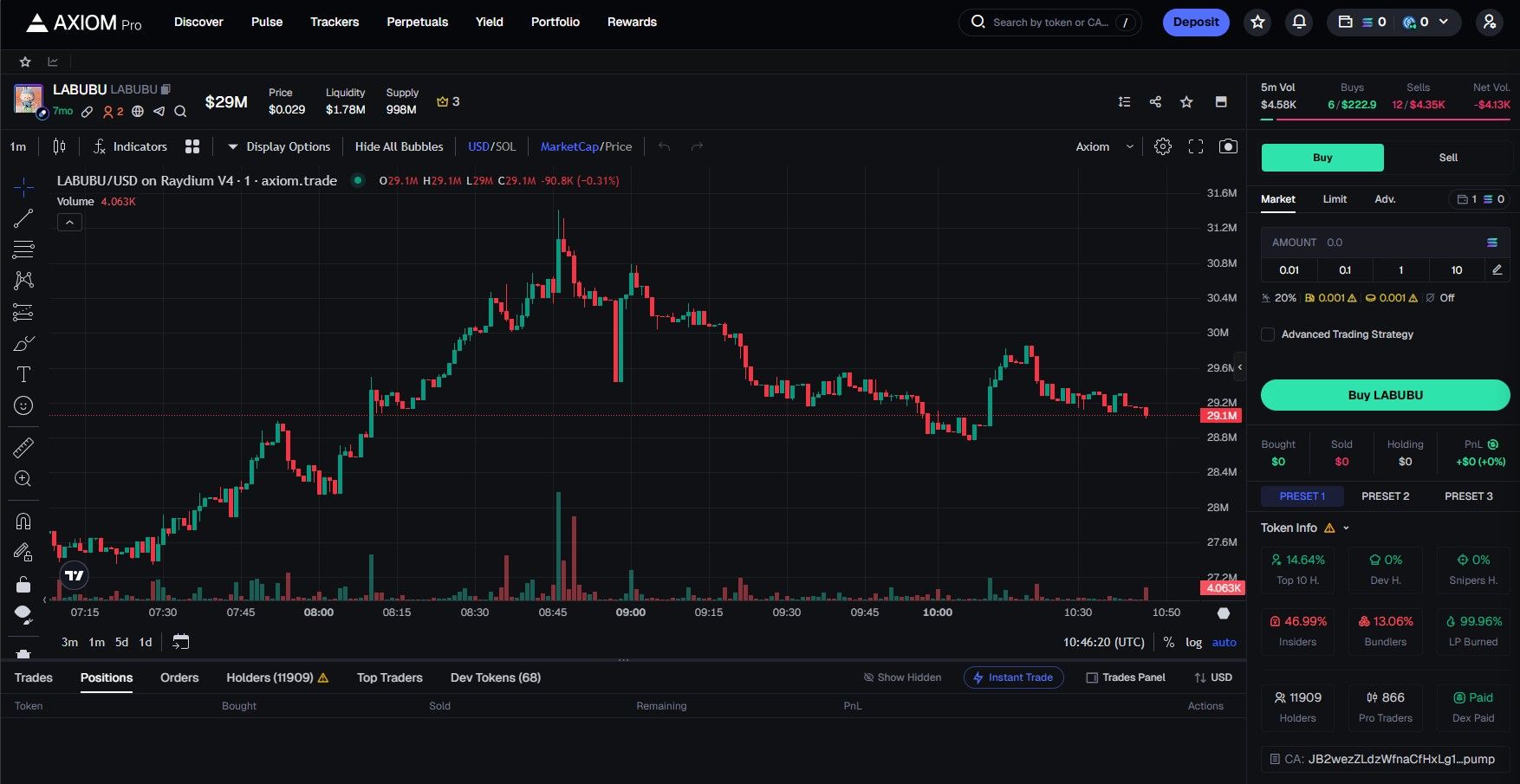

Axiom Trade's spot trading interface is meticulously crafted for Solana-based memecoins. By aggregating listings from prominent platforms like Raydium, Pump.fun, and Moonshot, Axiom offers traders a hub to access diverse memecoin listings.

Trading Infrastructure and Execution

Drawing inspiration from platforms like Hyperliquid, Axiom employs a trading model where users fund separate accounts for trading activities, distinct from their personal wallets. This design facilitates high-frequency trading while ensuring each transaction is settled on-chain, leveraging Solana's inherent speed and efficiency.

Axiom Features a Clean Spot Trading Interface Inspired By Hyperliquid | Image via Axiom

Axiom Features a Clean Spot Trading Interface Inspired By Hyperliquid | Image via AxiomLiquidity Landscape

Liquidity is just as important in memecoins as it is in other assets. According to industry insights, a liquidity range of 501 to 2,000 SOL is considered median, suitable for projects with active communities and regular trading volumes. Axiom's top-listed memecoins often fall within or exceed this range, indicating a healthy trading environment for participants.

Advanced Trading Features

Axiom's platform is enriched with features tailored for the memecoin market:

- Order Types: Supports both market and limit orders, providing traders with flexibility in execution.

- Token Insights: Offers detailed information on token holders, including:

- Top Holders: Addresses holding significant portions of a token, potentially influencing price movements.

- Bundlers: Entities that group multiple transactions, possibly indicating coordinated trading strategies.

- Snipers: Traders who swiftly act on new listings to capitalize on early price movements.

- Charting Tools: Provides comprehensive charting capabilities with various indicators to assist in technical analysis.

User Interface and Token Discovery

The platform's intuitive interface displays key metrics for each listed token, such as liquidity, trading volume, market capitalization, and transaction count. Users can sort and filter tokens based on these parameters, streamlining the discovery process. Additionally, Axiom's "Pulse" feature highlights trending tokens, aiding traders in identifying potential opportunities.

In summary, Axiom Trade's spot trading platform amalgamates the essential tools and features required for effective memecoin trading on Solana, catering to both novice and seasoned traders.

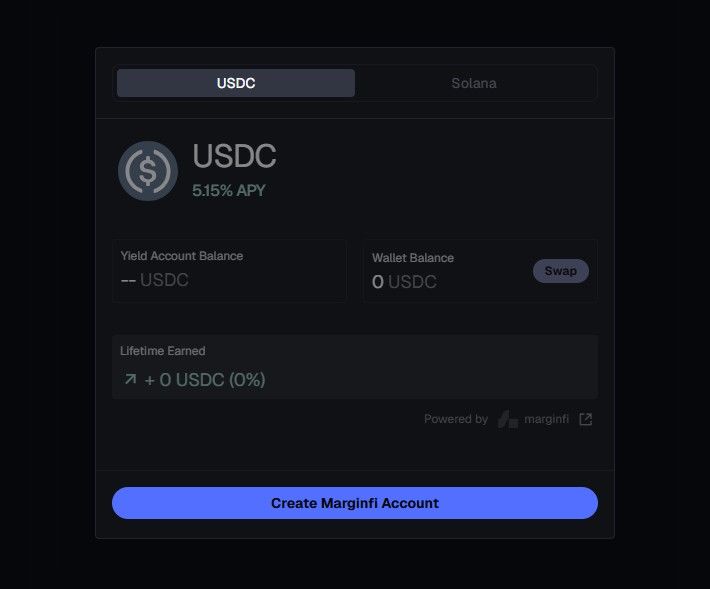

Staking on Axiom

Axiom Trade offers staking options to enhance user engagement and provide passive income opportunities.

USDC Staking via Marginfi

Axiom integrates with Marginfi, a Solana-based DeFi protocol, to offer USDC staking. Users can deposit USDC into Marginfi through Axiom's platform to earn yields. Marginfi operates as a liquidity layer, providing lending and borrowing services, and has a total value locked (TVL) of approximately $156.55 million (per DefiLlama). The staking process is designed to be user-friendly, allowing for instant withdrawals and competitive annual percentage yields (APYs).

You Can Farm USDC Yield On Axiom | Image via Axiom

You Can Farm USDC Yield On Axiom | Image via AxiomUpcoming SOL Staking via Jito

Axiom plans to introduce SOL staking through integration with Jito, a liquid staking protocol on Solana. Jito allows users to stake SOL and receive JitoSOL tokens, which accrue staking and MEV (Maximal Extractable Value) rewards. This approach enables users to maintain liquidity while earning staking rewards . However, specific timelines and release details for this integration have not been disclosed

These staking options reflect Axiom's commitment to providing users with diversified opportunities to earn passive income within the Solana ecosystem.

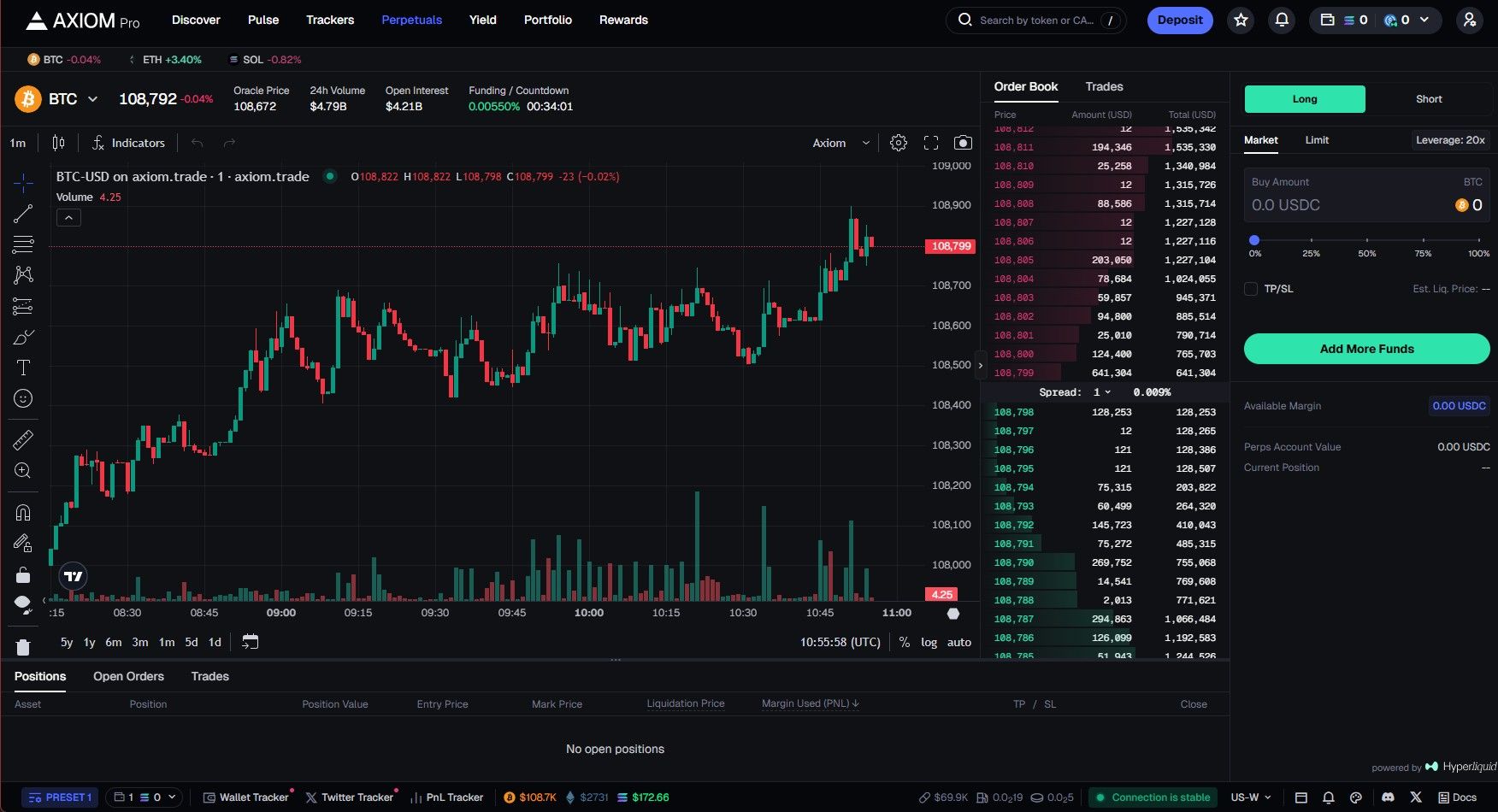

Perp Trading on Axiom

Axiom Trade expands its offerings beyond Solana-based memecoin spot trading by integrating with Hyperliquid, a decentralized perpetual futures exchange. This partnership enables Axiom users to access a wide range of perpetual contracts, including major cryptocurrencies like BTC, ETH, SOL, DOGE, and various EVM and non-EVM tokens .

Trading Infrastructure and Experience

While Axiom's spot trading is tailored for memecoins, the perpetual trading interface mirrors Hyperliquid's platform, providing a seamless experience for users familiar with professional trading environments. The integration offers features such as an on-chain order book, advanced charting tools, and various order types, including market, limit, stop-loss, and take-profit orders.

Hyperliquid's Exact Trading Interface is Available on Axiom | Image via Axiom

Hyperliquid's Exact Trading Interface is Available on Axiom | Image via AxiomLiquidity and Performance

Hyperliquid operates on its own Layer 1 blockchain, designed for high-speed, low-latency trading. It boasts a fully on-chain order book and processes over 200,000 transactions per second with an average block time of 0.2 seconds . This infrastructure ensures deep liquidity and minimal slippage, providing Axiom users with efficient trade executions.

Leverage and Risk Management

Axiom users can leverage up to 50x on perpetual contracts through Hyperliquid. The platform supports both cross and isolated margin modes, allowing traders to manage risk according to their strategies. Additionally, Hyperliquid's fee structure includes zero gas fees and low trading fees, enhancing cost efficiency for high-frequency traders.

Funding and Account Separation

It's important to note that Axiom's spot and perpetual trading accounts are separate. Users must fund their perpetual trading wallets independently, typically using USDC as collateral. This separation allows for distinct management of spot and derivative trading activities, catering to different trading strategies and risk profiles.

In summary, Axiom's integration with Hyperliquid significantly broadens its trading capabilities, offering users access to a diverse range of perpetual contracts with professional-grade tools and infrastructure. This expansion positions Axiom as a comprehensive platform for both memecoin enthusiasts and traders seeking exposure to major cryptocurrencies through leveraged derivatives.

How to Use Axiom

Navigating Axiom Trade is designed to be intuitive, especially for users familiar with centralized exchanges (CEXs). The platform offers a seamless experience, integrating advanced tools for both spot and perpetual trading. Here's a comprehensive guide on how to get started and make the most of Axiom's features.

1. Account Registration

Axiom provides two methods for account creation:

- Email Registration: Sign up using your email address. Upon registration, Axiom generates a non-custodial wallet for you and provides a seed phrase. It's crucial to store this seed phrase securely, as it grants access to your funds.

- Phantom Wallet Connection: Alternatively, you can connect your existing Phantom wallet to Axiom, allowing for a quick and secure login process.

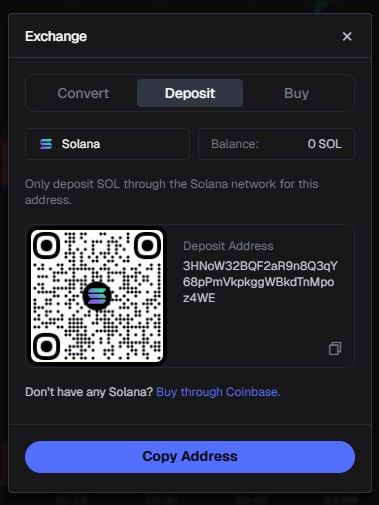

2. Funding Your Account

To begin trading, you'll need to fund your Axiom account:

- Spot Trading: Deposit SOL by clicking the 'Deposit' button on the platform. A QR code and a Solana address will be displayed, to which you can send SOL.

- Perpetual Trading: Perpetual trades are executed using USDC on the Hyperliquid platform. Axiom offers a feature to convert your deposited SOL to USDC seamlessly, facilitating perpetual trading.

Fund Your Axiom Account By Depositing SOL In the UNIQUE SOL Address Provided To You | Image via Axiom

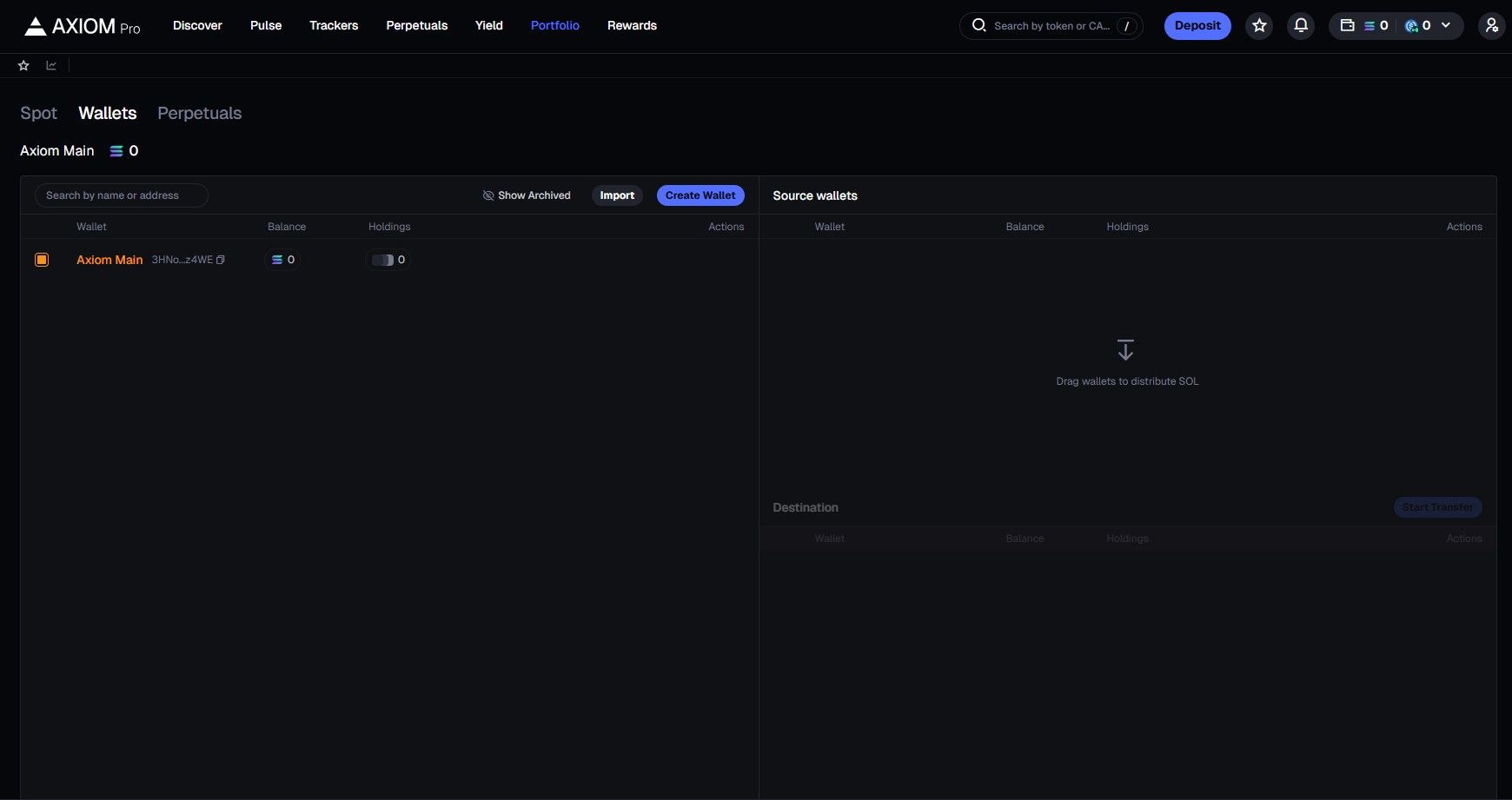

Fund Your Axiom Account By Depositing SOL In the UNIQUE SOL Address Provided To You | Image via Axiom3. Managing Multiple Wallets

Axiom allows users to create and manage multiple wallets under a single account. This feature is particularly useful for traders who wish to separate their spot and perpetual trading activities:

- Navigate to the 'Portfolio' tab on the Axiom homepage.

- Here, you can view all your positions and holdings.

- To create a new wallet, use the provided option within the portfolio section. Each wallet can be funded separately, enabling distinct profit and loss tracking.

Your Holdings and Wallet Balances Will Appear On This Page | Image via Axiom

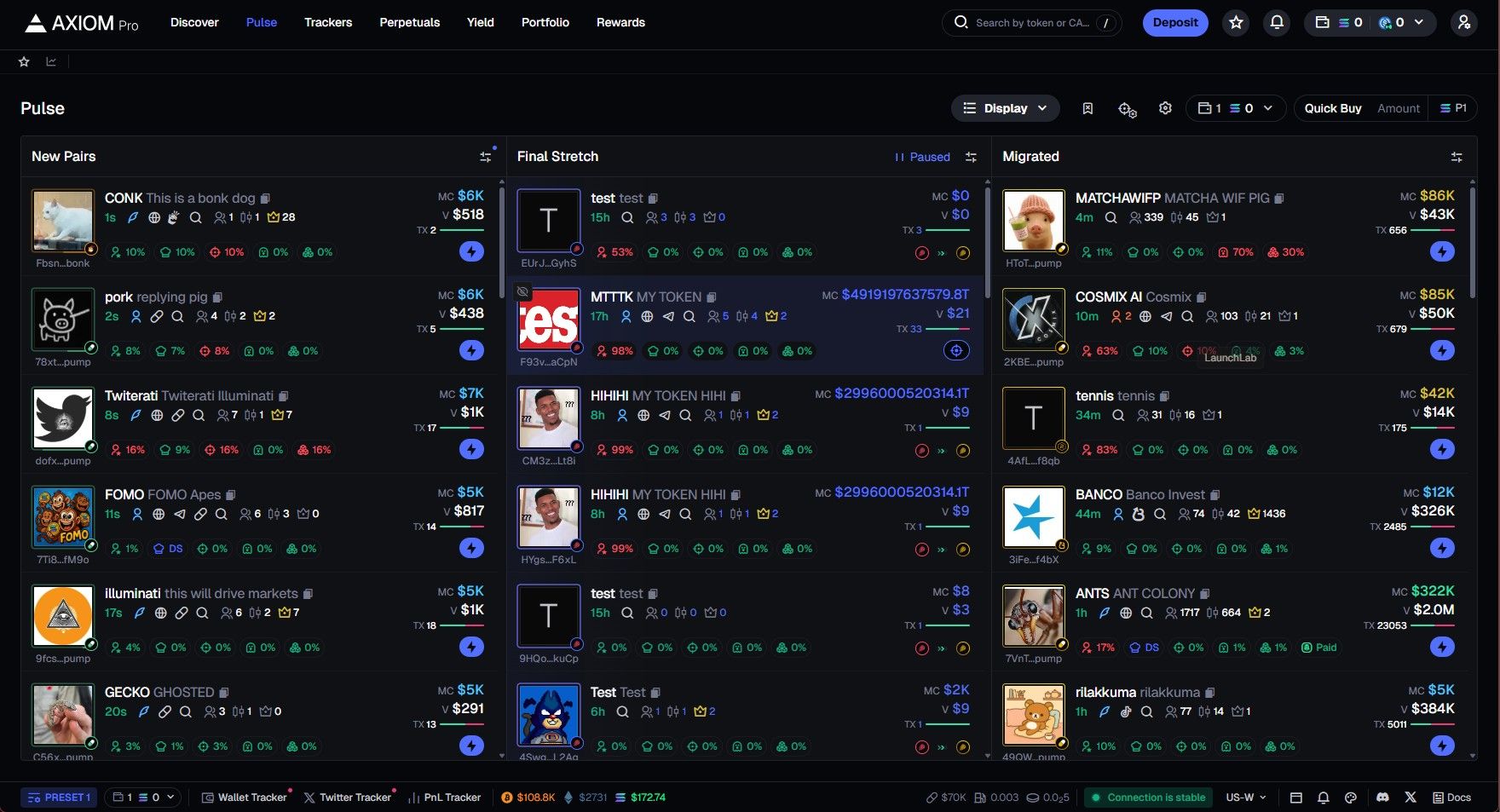

Your Holdings and Wallet Balances Will Appear On This Page | Image via Axiom4. Discovering Tokens with Axiom Pulse

Pulse is Axiom’s built-in token discovery tool designed to help users track the memecoin lifecycle without needing to access external, lag-prone sites like pump.fun. Pulse is divided into three sections:

- New Pairs – Recently created tokens you can catch at launch.

- Final Stretch – Tokens close to completing their bonding curve and ready to migrate to Raydium.

- Migrated to Raydium – Tokens that have just migrated and may experience heightened liquidity and visibility.

You can also Quick Buy directly from any of these tables by clicking the lightning bolt icon next to the token.

Axiom Pulse Is Like a Memecoin Market Snapshot | Image via Axiom

Axiom Pulse Is Like a Memecoin Market Snapshot | Image via AxiomFiltering Tools Available in Pulse:

- Age (mins) – Find newly created tokens.

- Top 10 Holders % – Identify decentralization levels.

- Dev Holding % – Spot risky dev-heavy distributions.

- Snipers % – Detect bot-dominated launches.

- Insiders % – Measure insider/token team control.

- Bundle % – Gauge distribution across bundlers.

- Holders – Track adoption by unique wallets.

- Pro Traders % – Flag tokens held by experienced traders.

- Liquidity ($) – Target high or low liquidity tokens.

- Volume, Market Cap, Transactions – Standard trading metrics.

- Num Buys/Sells – Analyze buy vs sell pressure.

These filters help traders efficiently locate promising memecoins at different stages of their lifecycle.

5. Tracking Wallets and Twitter Feeds with Axiom Tracker

Axiom Tracker is a powerful tool that allows users to monitor the trading activities of specific wallets and Twitter accounts:

- Wallet Tracking: By adding wallet addresses, you can observe trading patterns, token holdings, and transaction histories of other traders. This feature is invaluable for identifying strategies employed by successful traders.

- Twitter Feed Monitoring: Integrate Twitter handles or import your Twitter lists to monitor real-time tweets directly within the Axiom platform. This integration ensures you stay updated with market sentiments and announcements without leaving the trading interface.

Axiom Trade combines the familiarity of centralized exchanges with the advantages of decentralized platforms. Its user-friendly interface, coupled with advanced tools like Pulse and Tracker, empowers traders to navigate the volatile memecoin market effectively. Whether you're a novice or an experienced trader, Axiom offers a comprehensive suite of features to enhance your trading journey.

Axiom Fees and Rewards

Axiom charges a base trading fee that decreases as your cumulative trading volume increases. The more you trade, the higher your multiplier tier, and the more cashback you receive in SOL. This creates an incentive loop that rewards active traders on the platform.

Tiered Fee and Cashback System:

Tier | Fees | Cashback |

|---|---|---|

Wood (1x) | 0.95% | 0.05% |

Bronze (2x) | 0.90% | 0.10% |

Silver (2.5x) | 0.875% | 0.125% |

Gold (3x) | 0.85% | 0.15% |

Platinum (3.5x) | 0.825% | 0.175% |

Diamond (4x) | 0.80% | 0.20% |

Champion (5x) | 0.75% | 0.25% |

Each trade you execute earns you SOL cashback based on your tier. As you move up the ranks, the effective cost of trading decreases, resulting in significant savings for frequent traders.

Solana Network Fees and Custom Gas Controls

Since Axiom operates on Solana, you also pay network gas fees, which are minimal compared to EVM chains but can still fluctuate based on congestion. To give users more control over execution speed and cost, Axiom allows you to customize your gas fee settings:

- Priority Fee: Increases the confirmation speed of your transaction during periods of high congestion. The default is 0.001 SOL.

- Bribe: An optional extra tip for validators to expedite inclusion. Also defaults to 0.001 SOL.

- MEV Protection: Can be enabled to route transactions through Jito, minimizing front-running or sandwich attacks. Disabling may result in faster but less secure execution.

- Slippage Settings: Adjustable percentage (e.g., 0.5% or up to 1000%) to define acceptable execution price range. Important for volatile or illiquid memecoins.

Axiom also provides recommended presets based on current network conditions to help optimize for speed and reliability without requiring manual fine-tuning.

Closing Thoughts

Platforms like Axiom Trade remind me of how Blur transformed NFT trading by professionalizing a chaotic, speculative space through sleek design and trader-focused tools. Axiom is now doing the same for memecoins.

Its decision to mirror Hyperliquid’s user experience is a smart one. It strikes a balance between the transparency of on-chain execution and the familiar, fluid interface that CEX traders expect. Add to that the ability to fund separate wallets, view real-time order books, and quickly toggle between assets, and you have a platform purpose-built for high-speed, high-stakes trading.

But where Axiom really shines is in its memecoin-native tooling. Features like sniper and bundler detection, token lifecycle tracking through Pulse, wallet analytics, and integrated Twitter monitoring are not afterthoughts—they’re core to how serious memecoin traders operate.

That said, the nature of memecoin trading is volatile by design. These are not passive investments; they’re fast, risky plays that demand focus and a sharp edge. Traders looking to survive—and thrive—should treat Axiom not just as a platform, but as a toolbox. Understanding and using these features well can mean the difference between catching a breakout or holding the bag.