Desktop wallets hit a nice balance between convenience and control. You’re working on a bigger screen, which makes it easier to review addresses and transaction details, and you often get power-user features you won’t find in many mobile wallets, like PSBT signing, coin control, and the option to connect to a full node.

This guide breaks down the best desktop wallets based on security, coin support, privacy, and how easy they are to use day to day.

Disclosure: This article may include affiliate links, but they never influence what we publish or how wallets are ranked.

Editor's note: We fully updated this guide in February 2026 to reflect how desktop wallets are actually used in 2026, not how they looked a few years ago. The update expands the list from 8 to 13 wallets, refreshes every recommendation, and adds new desktop-relevant criteria like PSBT/offline signing, coin control, Tor/privacy routing, CoinJoin workflows, and full-node vs SPV trade-offs. We also introduced a clear scoring rubric + testing methodology, rebuilt the comparison tables and feature snapshot, and added practical sections like a desktop safety checklist and when to use hardware wallets instead.

Quick Answer: The Best Desktop Wallets in 2026

Use this list if you want a fast recommendation with the least scrolling.

Best for long-term storage where you want private keys kept off your computer.

Best for users who want a polished desktop app experience with broad asset support.

Best for beginners who want a clean desktop interface and wide multi-network coverage.

Best for advanced Bitcoin controls like fee control, multisig options, and hardware workflows.

Best for users who want staking options inside a desktop-friendly multi-asset wallet.

Best for coin control, PSBT workflows, and privacy-focused Bitcoin setup options.

Best for users who want multichain Web3 access with a large ecosystem behind it.

What the rating reflects: a blended score across security model, track record and transparency, recovery safety, usability, asset support, and desktop-relevant features.

Quick Comparison Table

If you just want to compare the top picks side by side without reading every review, this section is your shortcut.

Desktop Wallet Comparison (2026)

| Wallet | Type | Rating | Best for | Platforms | Coins supported (high level) | Key security features | Price |

| Trezor | Hardware wallet + desktop interface | 4.8/5 | Maximum security | Win/Mac/Linux | Major coins + tokens (device dependent) | Hardware signing, on-device approval | $53 to $249 |

| Ledger | Hardware wallet + desktop interface | 4.6/5 | Portfolio management | Win/Mac/Linux | Broad (apps + tokens) | Hardware signing, on-device approval | €40.83 to €332.50 |

| Exodus | Software | 4.5/5 | Beginner UX | Win/Mac/Linux | Large catalog | Local encryption, optional hardware pairing | Free |

| Guarda | Software | 4.4/5 | Staking on desktop | Win/Mac/Linux | Very broad catalog | Local keys, backup phrase | Free |

| Coinomi | Software | 4.2/5 | Multilingual + long-running | Win/Mac/Linux | Broad catalog | Local encryption | Free |

| Atomic Wallet | Software | 3.9/5 | Swaps + staking | Win/Mac/Linux | Broad catalog | Local keys, backup phrase | Free |

| OKX Wallet | Software (desktop app/extension varies) | 4.3/5 | Exchange ecosystem Web3 | Win/Mac + extension | Many chains | Self-custody, multichain | Free |

| Binance Web3 Wallet | Ecosystem wallet (desktop access varies) | 4.1/5 | Binance ecosystem users | Varies | Many chains | Ecosystem tooling | Free |

| Electrum | Software (Bitcoin) | 4.7/5 | Bitcoin power users | Win/Mac/Linux | Bitcoin | Advanced controls, hardware support | Free |

| Sparrow | Software (Bitcoin) | 4.6/5 | BTC privacy + PSBT | Win/Mac/Linux | Bitcoin | Coin control, PSBT, flexible connections | Free |

| Wasabi | Software (Bitcoin) | 4.2/5 | CoinJoin workflows | Win/Mac/Linux | Bitcoin | CoinJoin tooling, Tor-first posture | Free |

| Armory | Software (Bitcoin) | 3.8/5 | Offline workflows (technical) | Win/Linux (varies) | Bitcoin | Cold storage, multisig options | Free |

| Bitcoin Core | Full node wallet | 4.4/5 | Full validation | Win/Mac/Linux | Bitcoin | Full node verification | Free |

Important: “Coins supported” depends on network, token standard, and integration. Always verify your exact asset and network before moving meaningful funds.

Feature Snapshot

✅ = built-in or typical support, ❌ = not typical, ⚠️ = possible but depends on setup.

| Wallet | 2FA | Hardware integration | Staking | NFTs | Tor | CoinJoin | PSBT / offline signing | Open-source |

| Trezor | ❌ | ✅ | ⚠️ | ⚠️ | ⚠️ | ❌ | ✅ | ✅ |

| Ledger | ❌ | ✅ | ⚠️ | ⚠️ | ⚠️ | ❌ | ✅ | ⚠️ |

| Exodus | ❌ | ✅ | ⚠️ | ✅ | ❌ | ❌ | ⚠️ | ❌ |

| Guarda | ❌ | ⚠️ | ✅ | ⚠️ | ❌ | ❌ | ⚠️ | ❌ |

| Coinomi | ❌ | ❌ | ⚠️ | ⚠️ | ⚠️ | ❌ | ⚠️ | ❌ |

| Atomic Wallet | ❌ | ❌ | ✅ | ✅ | ❌ | ❌ | ⚠️ | ❌ |

| OKX Wallet | ❌ | ❌ | ✅ | ✅ | ❌ | ❌ | ⚠️ | ⚠️ |

| Binance Web3 Wallet | ❌ | ❌ | ✅ | ✅ | ❌ | ❌ | ⚠️ | ⚠️ |

| Electrum | ✅ | ✅ | ❌ | ❌ | ⚠️ | ❌ | ✅ | ✅ |

| Sparrow | ❌ | ✅ | ❌ | ❌ | ✅ | ⚠️ | ✅ | ✅ |

| Wasabi | ❌ | ⚠️ | ❌ | ❌ | ✅ | ✅ | ⚠️ | ✅ |

| Armory | ❌ | ⚠️ | ❌ | ❌ | ❌ | ❌ | ✅ | ✅ |

| Bitcoin Core | ❌ | ⚠️ | ❌ | ❌ | ⚠️ | ❌ | ⚠️ | ✅ |

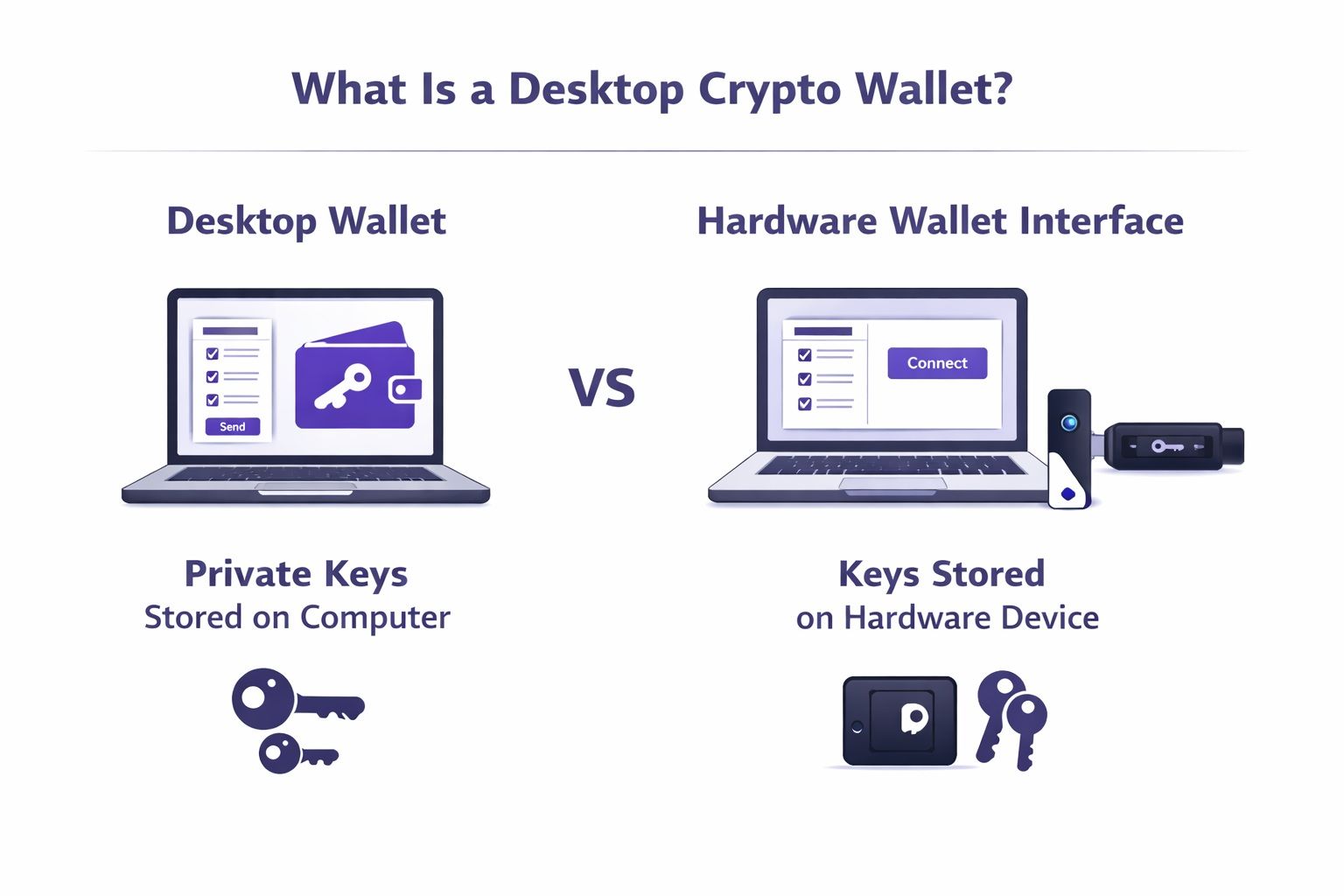

What Is a Desktop Crypto Wallet?

Desktop wallets are crypto wallet apps for your computer (Windows, macOS, or Linux). They let you create addresses and sign transactions.

What matters is where the keys are. Some wallets store them on your computer. If you pair it with a hardware wallet, your keys never leave the device. The desktop app is simply where you view accounts and build transactions.

Desktop Wallets Are Crypto Wallet Apps For Your Computer That Let You Create Addresses And Sign Transactions

Desktop Wallets Are Crypto Wallet Apps For Your Computer That Let You Create Addresses And Sign TransactionsDesktop vs Mobile vs Browser Extension

Desktop wallets tend to win when you want:

A larger screen to review addresses and transaction details.

Better tooling for privacy, coin control, and advanced signing workflows.

Easier integration with full nodes or custom servers.

Mobile wallets, on the other hand, are best for daily convenience and spending.

Meanwhile, browser extension wallets are commonly used for DeFi and NFTs, but your risk of phishing is higher because most scams live in the browser.

Check out our top picks for the best mobile wallets.

Desktop Wallet vs Hardware Wallet

If you are planning to hold a meaningful amount for a while, a hardware wallet is usually the safer way to do it. That’s because your private keys stay on the device, not on your computer.

You will still often use a desktop app, but think of it as the place where you manage things and set up the send. When it is time to actually sign, you confirm it on the hardware wallet. After that, the network checks it like any other transaction.

Take a look at our analysis of best crypto hardware wallets.

Full Node vs SPV (Simple Payment Verification)

With Bitcoin wallets, you often choose between two trust models:

Full node wallets validate the blockchain themselves. This reduces reliance on third-party servers but requires storage and time.

SPV or lightweight wallets use servers to fetch and verify what they need. This is faster and easier, but your privacy and trust assumptions depend on your connection setup.

If you are security- and privacy-focused, full nodes are the gold standard. But if you want speed plus strong controls, lightweight desktop Bitcoin wallets can still be excellent.

How We Rated and Tested These Desktop Wallets

To keep this guide fair and practical, we used the same criteria for every wallet and verified the key details that tend to matter most once you are actually using it.

Our Rating Criteria

We score wallets using a weighted model:

Security model (30%)

Where keys live, how signing works, encryption, and high-impact protections.Track record + transparency (20%)

We checked how clearly the wallet is explained, how updates are handled, and how the team communicates security issues or incidents.UX + recovery (20%)

Backup clarity, restore flow, and “safe defaults” that prevent mistakes.Asset/network support (15%)

Breadth and correctness of supported assets, plus how clearly it is documented.Features (10%)

Hardware integration, advanced controls, staking, and privacy tools that matter on desktop.Support + documentation (5%)

Quality of official documentation and support channels.

Testing Methodology (What We Verified)

For each wallet, we verified:

Desktop platform availability and official download paths.

Official documentation for backup, recovery, and signing workflows.

Supported asset lists where published by the wallet team.

Common risk factors like seed phrase handling and fake download exposure.

Whether the wallet is “device security dependent” (most software wallets are).

Disclosure + Update Policy

This article may include affiliate links. Editorial decisions are independent, and wallet rankings are based on the scoring rubric described in this guide.

Refresh cadence

We review and re-verify this guide every 3 months to confirm platform availability, recovery flows, supported assets, and any meaningful security or policy changes.

What triggers an out-of-cycle update

We update sooner than the quarterly review if any of the following happens:

A wallet changes platform support, recovery flows, or core security behavior (key storage, signing model, encryption).

A wallet publishes a security incident or there is credible reporting of a material exploit affecting users.

There is a significant shift in features or supported networks/assets that changes who the wallet is best for.

A wallet changes distribution or installer behavior, or there is a spike in fake download activity targeting that wallet.

- After a major Windows, macOS, or Linux update, a wallet can get glitchy. Installs fail, syncing acts up, or signing stops working like it should.

What to Look For in a Desktop Wallet (Buying Criteria)

Desktop wallets can seem pretty similar at first, so here we focus on the few features that actually affect your safety and how smooth the wallet feels day to day.

Desktop Wallets Can Seem Pretty Similar At First, But There Are a Few Features That Can Affect Your Safety

Desktop Wallets Can Seem Pretty Similar At First, But There Are a Few Features That Can Affect Your Safety Supported Coins and Networks

Multi-asset support is not the same as supporting your exact token on your exact network. The most common mistake is sending the right coin on the wrong chain.

A safe pattern:

Verify the asset and network before sending.

Send a small test transaction first.

Only then send larger amounts.

Security Basics

Seed phrase protection: Store your seed phrase offline, keep it out of sight, and make sure it will not “disappear” when you actually need it.

Device hygiene: Treat your computer like part of your security setup. Malware can swap copied addresses, trick you with fake installers, or pull sensitive data off your system.

Hardware pairing: If you plan to hold meaningful value, hardware signing is one of the highest impact upgrades.

Read our guide on how to store your seed phrase securely.

Privacy Features

Privacy is one of those areas where desktop wallets really aren’t all the same. Some barely give you any options, others give you a lot of control.

If privacy is high on your list, here’s what I’d actually check for:

Tor support, so you’re not broadcasting everything as openly.

Coin control and UTXO tools (Bitcoin), because sometimes you want to choose exactly what you’re spending.

Watch-only mode, so you can keep an eye on a wallet without putting the keys on that computer.

One heads-up: The more privacy tools a wallet offers, the more “hands-on” it usually feels. Expect a bit more setup and a bit more fiddling.

Advanced Controls

If you are looking for a deeper control, prioritize wallets that support:

PSBT workflows for offline signing and hardware wallets.

Fee controls for cost and timing.

Multisig for shared control and stronger recovery options.

UX and Recovery

Good UX is not just a pretty interface. It is a wallet that makes it hard to do the wrong thing.

A safe wallet experience should:

Force you to back up correctly.

Make restoration predictable.

Encourage address verification every time.

Support and Reputation

Look for:

Clear, official installation guidance.

Explicit anti-scam warnings.

A track record of regular updates.

Modern Security and Privacy Tech You’ll See in Desktop Wallets

Wallet tech has moved fast, and it helps to know which “new” features are genuinely useful and which ones mostly add complexity.

MPC and “Key Shares”

MPC wallets split signing power across multiple shares. This can reduce the risk of a single device compromise, but it can also introduce new trust assumptions, especially if any part of recovery depends on infrastructure you do not control.

MPC can make sense in setups that prioritize convenience. You do not see it as often in traditional desktop Bitcoin wallets, where people usually want clear, local control and fewer moving parts.

Account Abstraction

On Ethereum, account abstraction helps smart contract wallets behave more like programmable accounts, which can enable features like custom recovery rules, batching transactions, and different fee payment patterns. The official Ethereum roadmap explains how account abstraction fits into the broader plan for improving wallet UX.

If your desktop wallet is mostly used for Ethereum DeFi, you will increasingly hear account abstraction mentioned as part of the “smart wallet” story.

PSBT and Offline Signing

PSBT is a standardized way to pass around unsigned or partially signed Bitcoin transactions, which is why it is central to offline signing workflows and many hardware wallet integrations. PSBT matters most if you are trying to build transactions on an online computer and sign them on a separate device.

CoinJoin and WabiSabi (Privacy)

CoinJoin is a privacy technique where your transaction is mixed in with other people’s transactions. The goal is to make it harder to link inputs and outputs. Before you judge a wallet’s CoinJoin feature, it helps to read Wasabi’s documentation on this. It is a good reality check on what you are getting, and what you are not.

And yes, there are real costs here: it can be slower, it can be more expensive, liquidity matters, and some exchanges may not love CoinJoin history.

Client-side Block Filtering and Lightweight Privacy Helpers

Compact block filters help lightweight wallets scan for relevant transactions without downloading the full chain, which can improve practicality while still reducing reliance on some older, leakier approaches.

The 13 Best Desktop Wallets (Ranked and Reviewed)

Every wallet below follows the same format so you can scan and compare.

Trezor

⭐ 4.8/5

Tap to expand

🏆 Best For: Maximum security and transparency on desktop

Quick Overview: Trezor is a hardware wallet, so your private keys stay on the device. On desktop, your experience is mostly “transaction building on the computer, signing on the device.” This is one of the cleanest security upgrades you can make without changing how you manage funds day to day.

Key Features

- Hardware-based signing, keys never touch your computer.

- On-device confirmation for critical actions.

- Optional passphrase feature for advanced users.

- Strong fit for long-term holdings.

Supported Assets

- Total: Thousands of coins and tokens listed on Trezor’s supported assets page.

- Major coins: BTC, ETH, XRP, ADA, SOL, LTC, DOGE.

- Networks/standards: ERC-20, ERC-721 (NFTs), SPL tokens, and Token-2022.

- Not supported (notable): Anything not shown as supported for your exact Trezor model and wallet app/integration.

Security Analysis: How Safe Is Trezor?

- Key storage model: Keys generated and stored on the hardware device.

- 2FA / multisig / hardware integration: Hardware signing is the core model; multisig depends on your workflow.

- Privacy tools: Privacy depends on network connections and your settings.

- Recovery method: Seed phrase backup, with optional passphrase.

- Device dependency note: Even if a computer is compromised, the goal is that keys stay isolated on the hardware device.

- Keys kept off your computer.

- Clear signing confirmations.

- Strong long-term storage posture.

- Mature ecosystem.

- Costs money.

- Requires disciplined seed storage.

- Advanced features require learning.

Who It’s For / Who Should Avoid

- ✅ For long-term holders who want maximum safety.

- ✅ For users willing to verify addresses on-device.

- ❌ Avoid if you refuse to store a seed phrase securely.

How to Get Started

- Install Trezor Suite from the official Trezor site and run it on your desktop.

- Plug in your Trezor and follow the in-app security check to verify the device and packaging.

- Install firmware (Trezor ships without firmware), then create a wallet and write down your wallet backup offline.

- Set a PIN (and optionally enable a passphrase if you understand the trade-offs).

- Enable the coins you plan to use in Trezor Suite, then do a small test receive/send before moving larger funds.

Ledger

⭐ 4.6/5

Tap to expand

🏆 Best For: Portfolio management and broad asset support

Quick Overview: Ledger is another hardware wallet approach, with a desktop app experience built around managing many accounts and assets. For multi-asset users, it can feel like a dashboard that keeps day-to-day actions organized while still using hardware signing.

Key Features

- Hardware signing with on-device approval.

- Portfolio and account management across many assets.

- Device apps for different networks.

- Strong mainstream support and documentation.

Supported Assets

- Total: Thousands of coins/tokens listed in Ledger’s supported assets catalog.

- Major coins: BTC, ETH, XRP, SOL, ADA, LTC, DOGE, XMR.

- Networks/standards: ERC-20 (Ethereum/BASE), TRC-10/20 (Tron), BEP-20 (BNB Chain), SPL (Solana), and Stellar tokens.

- Not supported (notable): Any asset/network not listed in Ledger’s catalog (or not supported for your chosen wallet path).

Security Analysis: How Safe Is Ledger?

- Key storage model: Keys stay on the hardware device.

- 2FA / multisig / hardware integration: Hardware signing is the main protection; multisig depends on your setup.

- Privacy tools: Privacy depends on how you connect and what services you use.

- Recovery method: Seed phrase backup.

- Device dependency note: A compromised computer can still trick you into approving the wrong transaction, so verify addresses on-device.

- Keys kept off your computer.

- Broad asset support.

- Strong portfolio management feel.

- Mature product ecosystem.

- Costs money.

- You are a common phishing target.

- Some features vary by asset.

Who It’s For / Who Should Avoid

- ✅ For users managing multiple assets and accounts.

- ✅ For users who want a structured desktop interface.

- ❌ Avoid if you will not verify addresses on the device screen.

How to Get Started

- Download and install Ledger’s desktop app from Ledger’s official download page.

- Connect your Ledger device, then follow the app’s “Get started” flow to either set up a new device or restore an existing one.

- Create a PIN on the device and write down the recovery phrase offline (never store it digitally).

- In the desktop app, install the network apps you need (e.g., Bitcoin/Ethereum) and add the corresponding accounts.

- Receive a small test amount first, then verify addresses on-device for every send.

Exodus

⭐ 4.5/5

Tap to expand

🏆 Best For: Beginners who want a clean desktop UI

Quick Overview: Exodus is a popular multi-asset desktop wallet with a smooth interface. It is often the easiest starting point for people moving from exchanges into self-custody, as long as you understand that your computer becomes part of your security model.

Key Features

- Very beginner-friendly design.

- Strong portfolio visibility on desktop.

- Built-in swapping and basic app features (depending on region).

- Optional pairing with some hardware wallet workflows.

Supported Assets

- Total: Large multi-asset catalog listed in Exodus’s supported assets directory.

- Major coins: BTC, ETH, SOL, XRP, ADA, LTC, DOGE.

- Networks/standards: 50+ blockchains. ERC-20, SPL & Token-2022,BSC/BEP-20.

- Not supported (notable): Any asset or specific network version not shown as supported in Exodus’s directory.

Security Analysis: How Safe Is Exodus?

- Key storage model: Private keys are stored on your device.

- 2FA / multisig / hardware integration: Traditional 2FA does not protect private keys; hardware pairing can reduce risk.

- Privacy tools: Not a privacy-first wallet.

- Recovery method: Seed phrase backup.

- Device dependency note: If your computer is compromised, a software wallet can be compromised.

- Easy onboarding.

- Clean interface that reduces confusion.

- Broad multi-asset support.

- Good for learning self-custody basics.

- Not open-source.

- Desktop malware risk matters more.

- Not designed for advanced Bitcoin privacy.

Who It’s For / Who Should Avoid

- ✅ For beginners who want a friendly desktop wallet.

- ✅ For users holding smaller day-to-day balances.

- ❌ Avoid if you demand fully open-source verification.

How to Get Started

- Download Exodus Desktop only from the official Exodus site and install it.

- Create a new wallet, then go to *Settings* → *Backup* and complete the backup flow to record your 12-word secret phrase offline.

- Set a strong password in Exodus (this encrypts the wallet data on your device when Exodus is closed).

- Add the asset you want to use and generate a receive address inside Exodus.

- Send a small test deposit first, then verify networks and addresses before moving larger amounts.

Guarda

⭐ 4.4/5

Tap to expand

🏆 Best For: Staking on desktop with broad asset coverage

Quick Overview: Guarda aims to be an all-in-one wallet with a strong set of supported assets and staking options. It is a common pick for users who want staking access without juggling multiple apps.

Key Features

- Multi-asset wallet with broad network support.

- Staking support for selected assets.

- Desktop app with a familiar wallet workflow.

- Common utility features for send, receive, and swaps.

Supported Assets

- Total: 50+ blockchains and a very large token list listed on Guarda’s supported assets page.

- Major coins: BTC, ETH, XRP, XMR, LTC, DOGE.

- Networks/standards: ERC-20, ERC-721, BEP-2, BEP-20, TRC10 and TRC-20 and SPL.

- Not supported (notable): Any coin/token/network not shown on Guarda’s official supported assets list.

Security Analysis: How Safe Is Guarda?

- Key storage model: Keys controlled by the user on the device.

- 2FA / multisig / hardware integration: Software wallet model; hardware integration varies by workflow.

- Privacy tools: Not Tor-first.

- Recovery method: Seed phrase backup.

- Device dependency note: Security depends heavily on the health of your desktop environment.

- Broad support and practical staking.

- Works well as a multi-asset desktop wallet.

- Simple enough for regular users.

- Useful for users holding many coins.

- Not built for Bitcoin privacy power-users.

- Desktop security is part of the wallet’s security.

- Features vary by chain.

Who It’s For / Who Should Avoid

- ✅ For users who want staking options in a desktop wallet.

- ✅ For multi-asset holders who want one interface.

- ❌ Avoid if you want deep Bitcoin privacy tooling.

How to Get Started

- Download Guarda Desktop from the official Guarda site and install it on your computer.

- Create a new wallet and set a strong password (this protects access on your device).

- Go to *Settings* → *Download Backup* and save your backup file securely (Guarda recommends downloading the backup file for recovery).

- Add the coin/network you plan to use, then generate a receive address in the wallet.

- Do a small test transaction first; only then use staking features (if applicable) after reviewing lockups and unbonding rules per asset.

Coinomi

⭐ 4.2/5

Tap to expand

🏆 Best For: Multilingual support and a long-running multi-asset wallet

Quick Overview: Coinomi is a long-running multi-asset wallet with a desktop app and a broad global user base. It is usually chosen for its straightforward approach and accessibility across languages.

Key Features

- Desktop wallet option with a familiar interface.

- Broad multi-asset support.

- Focus on accessibility and language support.

- Simple restore workflow across devices.

Supported Assets

- Total: 50+ blockchains and 10,000+ tokens listed on Coinomi’s supported assets page.

- Major coins: BTC, ETH, SOL, XRP, LTC, DOGE.

- Networks/standards: 125+ blockchain. ERC-20, ERC-223 and ERC-721, BEP-2 and BEP-20 ,TRC-10 and TRC-20, and SPL.

- Not supported (notable): Anything not listed on Coinomi’s supported assets page (or tokens you can’t add manually).

Security Analysis: How Safe Is Coinomi?

- Key storage model: Software wallet with keys stored on the device.

- 2FA / multisig / hardware integration: Not a hardware-first desktop workflow.

- Privacy tools: Privacy varies by configuration and features.

- Recovery method: Seed phrase backup.

- Device dependency note: Treat as a hot wallet and keep balances realistic.

- Accessible for a wide range of users.

- Desktop app available.

- Straightforward wallet flow.

- Good for basic multi-asset holding.

- Not open-source.

- Not ideal for Bitcoin power-user tooling.

- Device compromise risk applies.

Who It’s For / Who Should Avoid

- ✅ For users who want a simple multi-asset desktop wallet.

- ✅ For users who value multilingual support.

- ❌ Avoid if you want fully auditable open-source code.

How to Get Started

- Download Coinomi Desktop from Coinomi’s official site and install it.

- Create a new wallet and write down the recovery phrase offline (this is the backup for coins you add under that wallet).

- Set a strong password (separate from the recovery phrase) for day-to-day access/spending actions.

- Add the coins/tokens you plan to use, then generate a receive address for the correct network.

- Send a small test transaction first, then only transfer larger amounts once you’ve confirmed the network and address are correct.

Atomic Wallet

⭐ 3.9/5

Tap to expand

🏆 Best For: Swaps and staking features inside a desktop wallet

Quick Overview: Atomic Wallet combines a large asset list with features like swaps and staking. It is feature-packed, but it demands higher due diligence because its risk profile is different from simpler wallets.

Key Features

- Multi-asset wallet experience.

- Built-in swap features (availability varies).

- Staking options for some assets.

- Desktop app across major OS platforms.

Supported Assets

- Total: 300+ coins and tokens, with live availability shown on Atomic’s Assets Status page.

- Major coins: BTC, ETH, XRP, LTC, XLM.

- Networks/standards: ERC-20, BEP-2, TRC-20, SPL.

- Not supported (notable): Any asset/network not listed (or not active for send/receive) on Atomic’s Assets Status page.

Security Analysis: How Safe Is Atomic Wallet?

- Key storage model: Software wallet where device security is central.

- 2FA / multisig / hardware integration: Not a hardware-first workflow.

- Privacy tools: Not privacy-first.

- Recovery method: Seed phrase backup.

- Track record note: The team published an incident update describing reports of unauthorized transactions in June 2023, which is important context for risk assessment in Atomic’s incident statement.

- Device dependency note: Desktop malware risk matters for all hot wallets, and even more so for wallets used for frequent swaps.

- Many assets and features in one place.

- Easy onboarding.

- Useful for users who like built-in utilities.

- Desktop client available.

- Requires extra caution due to incident history.

- Not open-source.

- Not designed for Bitcoin privacy workflows.

Who It’s For / Who Should Avoid

- ✅ For users who want a feature bundle and accept higher operational risk.

- ✅ For users who maintain strong device hygiene and modest balances.

- ❌ Avoid if you are storing long-term savings on a hot device.

How to Get Started

- Download Atomic Wallet Desktop from the official Atomic site and install it.

- Open the app, click *Create Wallet*, and set a strong password.

- Write down the 12-word backup phrase shown during setup and store it offline (never share it).

- Add the assets you plan to use and confirm “send/receive” is available for that network on Atomic’s *Assets Status* page.

- Start with a small test deposit and avoid using a hot desktop wallet for long-term savings.

OKX Wallet

⭐ 4.3/5

Tap to expand

🏆 Best For: Multichain Web3 usage in an exchange ecosystem

Quick Overview: OKX Wallet is positioned for users who want multichain access, DeFi, and NFT workflows. It tends to appeal to users who already use a large exchange ecosystem and want a bridge into onchain apps.

Key Features

- Multichain wallet experience.

- DeFi and NFT workflows (chain dependent).

- Extension-based access common for desktop.

- Ecosystem integration that can simplify discovery.

Supported Assets

- Total: 60+ networks listed in OKX’s supported networks documentation.

- Major coins: BTC, ETH, SOL, AVAX, MATIC/POL.

- Networks/standards: ERC-20, BEP-20, SPL, TRC-20 and ARC-20 (Atomicals).

- Not supported (notable): Any chain/token not supported in your OKX Wallet version/region.

Security Analysis: How Safe Is OKX Wallet?

- Key storage model: Self-custody design where the user controls keys.

- 2FA / multisig / hardware integration: Traditional 2FA does not protect private keys; hardware pairing can reduce risk.

- Privacy tools: Not Tor-first.

- Recovery method: Seed phrase backup.

- Device dependency note: Web3 wallets increase phishing exposure because approvals and permissions are constant.

- Broad multichain access.

- Useful for DeFi and NFT activity.

- Ecosystem integration can reduce friction.

- Familiar UX for Web3 users.

- Permission mistakes are common in Web3.

- Not built for Bitcoin power-user privacy tooling.

- Desktop experience depends on extension security habits.

Who It’s For / Who Should Avoid

- ✅ For multichain users interacting with dApps regularly.

- ✅ For users who understand and manage permissions.

- ❌ Avoid if you want minimal complexity and minimal attack surface.

How to Get Started

- Install OKX Wallet (desktop is commonly via the official browser extension, or the official desktop app where available).

- Choose *Create wallet* and select a seed phrase-backed wallet (or connect a hardware wallet if you prefer hardware signing).

- Set a password/security method, then back up the seed phrase offline during the official backup flow.

- Add the networks/assets you plan to use, and generate a receive address on the correct chain.

- Start with a small amount, and review/revoke dApp approvals regularly as you use DeFi/NFT apps.

Binance Web3 Wallet

⭐ 4.1/5

Tap to expand

🏆 Best For: Binance ecosystem users who want Web3 access

Quick Overview: Binance’s Web3 wallet is designed for users already inside Binance’s ecosystem who want access to decentralized apps. Desktop usage often depends on how you connect to dApps and which Binance-supported interfaces you use.

Key Features

- Designed to connect to dApps within a large ecosystem.

- Multichain support (varies by configuration).

- Helpful for users already using Binance services.

- Developer tooling for integration.

Supported Assets

- Total: Multi-chain wallet with scope described in Binance’s wallet extension announcement.

- Major coins: Depends on the network selected (EVM/Solana/TRON ecosystems).

- Networks/standards: ERC-20, ERC-721, ERC-1155 (multi-token standard), BEP-20 and BEP-721, BRC-20, ARC-20 and ERC-404(fractionalized NFTs).

- Not supported (notable): Chains outside the wallet’s stated multi-chain scope and anything not available in your wallet UI.

Security Analysis: How Safe Is Binance Web3 Wallet?

- Key storage model: Self-custody model, but features and structure vary across implementations.

- 2FA / multisig / hardware integration: Not typically hardware-first.

- Privacy tools: Not Tor-first.

- Recovery method: Depends on setup.

- Device dependency note: Web3 use increases phishing risk, so transaction review and permission discipline matter more than ever.

- Convenient for Binance ecosystem users.

- Multichain Web3 access.

- Good integration pathways.

- Useful developer tooling.

- Desktop experience depends on how you connect.

- Web3 permissions are a constant risk vector.

- Not a Bitcoin-focused privacy wallet.

Who It’s For / Who Should Avoid

- ✅ For Binance users who actively use dApps.

- ✅ For users comfortable managing permissions and security hygiene.

- ❌ Avoid if you want a simple, minimal, “do one thing well” wallet.

How to Get Started

- In the Binance app, go to *Wallet* and tap *Create Wallet* to create a Binance Keyless (MPC) wallet (or import an existing seed phrase/private key wallet if you prefer).

- Complete the backup process: Binance Wallet uses MPC key-shares (no seed phrase) and a recovery password; follow the in-app backup flow and store the recovery password safely.

- Confirm your backup status in *Wallet Management* (you can also back up again later via *Backup Management*).

- Select the correct network in the wallet UI (e.g., Ethereum/EVM networks) before receiving or sending tokens.

- Start with a small test transfer and be strict about dApp permissions and approvals when using DeFi/NFT apps.

Electrum

⭐ 4.7/5

Tap to expand

🏆 Best For: Bitcoin power users

Quick Overview: Electrum is one of the most established Bitcoin desktop wallets and is built for speed and control. It is lightweight, configurable, and widely used by Bitcoin-focused users who want more than a basic send-and-receive experience.

Key Features

- Advanced fee controls.

- Optional multisig and 2FA-style workflows depending on setup.

- Hardware wallet support in common workflows.

- Lightweight design using servers rather than full chain sync.

Supported Assets

- Bitcoin only.

Security Analysis: How Safe Is Electrum?

- Key storage model: Keys stored on the device unless using watch-only or hardware signing workflows.

- 2FA / multisig / hardware integration: Strong for advanced setups when configured correctly.

- Privacy tools: Privacy depends on server connections and optional Tor routing.

- Recovery method: Seed phrase backup.

- Device dependency note: A compromised machine can compromise a hot wallet, so hardware signing is a major upgrade.

- Best-in-class controls for Bitcoin users.

- Lightweight and fast.

- Works well with hardware wallets.

- Flexible advanced setups.

- Learning curve.

- Bitcoin only.

- Privacy depends on how you connect.

Who It’s For / Who Should Avoid

- ✅ For Bitcoin users who want granular control.

- ✅ For users comfortable verifying downloads and settings.

- ❌ Avoid if you want a simple multi-asset wallet.

How to Get Started

- Download Electrum only from the official Electrum site.

- (Recommended) Verify the download using Electrum’s official GPG signature verification instructions.

- Install and launch Electrum, then choose *Create new wallet* (or restore with your seed if you already have one).

- Write down your seed phrase offline and set an encryption password for the wallet file.

- Do a small test receive/send, and consider pairing a hardware wallet for meaningful balances.

Sparrow

⭐ 4.6/5

Tap to expand

🏆 Best For: Bitcoin privacy, coin control, and PSBT workflows

Quick Overview: Sparrow is built for users who want detailed visibility into UTXOs, transaction structure, and fees. It is one of the best desktop wallets for people who care about privacy and operational control, especially when used with your own node or a private server.

Key Features

- Coin control and UTXO management.

- PSBT workflows for offline signing.

- Flexible connections (public servers, private Electrum server, or your own Bitcoin Core).

- Strong hardware wallet support.

Supported Assets

- Bitcoin only.

Security Analysis: How Safe Is Sparrow?

- Key storage model: Can be hot, watch-only, or hardware-backed depending on setup.

- 2FA / multisig / hardware integration: Excellent for multisig and hardware workflows.

- Privacy tools: Strong privacy posture when using coin control and private connections, with Tor-capable setups.

- Recovery method: Depends on wallet type; seed phrase and descriptors are commonly part of serious setups.

- Device dependency note: The safest default for many users is watch-only plus hardware signing.

- Excellent coin control.

- Strong PSBT workflows.

- Great hardware wallet support.

- Privacy-focused approach.

- Bitcoin only.

- Learning curve.

- Best results require good connection choices.

Who It’s For / Who Should Avoid

- ✅ For Bitcoin users who want privacy and detailed control.

- ✅ For users who plan to use hardware signing or their own node.

- ❌ Avoid if you want a beginner-only “simple mode” wallet.

How to Get Started

- Download Sparrow from the official Sparrow site and install it.

- On first launch, follow the Welcome wizard to choose how you will connect (public server, your own Bitcoin Core node, or a private Electrum server).

- Create a wallet (or import an existing one), and prefer watch-only + hardware signing if you’re protecting meaningful funds.

- If using Bitcoin Core, follow Sparrow’s official “Connect to Bitcoin Core” guide to configure RPC and ensure it can talk to your node.

- Do a small test receive/send, then use coin control and PSBT workflows as you get comfortable.

Wasabi

⭐ 4.2/5

Tap to expand

🏆 Best For: CoinJoin-focused Bitcoin privacy workflows

Quick Overview: Wasabi is a desktop Bitcoin wallet known for privacy tooling, especially CoinJoin workflows. It is designed for users who have a specific privacy goal and are ready to learn the operational details.

Key Features

- CoinJoin workflows for privacy.

- Tor-first networking posture.

- Privacy-centered coin management approach.

- Wallet tooling geared toward anonymity goals.

Supported Assets

- Bitcoin only.

Security Analysis: How Safe Is Wasabi?

- Key storage model: Self-custody design, keys controlled by the user.

- 2FA / multisig / hardware integration: Hardware workflows may be possible depending on setup.

- Privacy tools: CoinJoin is the headline feature, but it is not magic and should be used with understanding.

- Recovery method: Seed phrase backup and wallet backups depending on workflow.

- Device dependency note: Hot wallet risks apply, so keep balances appropriate.

- Strong privacy tooling focus.

- Tor-forward posture.

- Built for privacy use cases.

- Bitcoin-only simplicity.

- Learning curve.

- Bitcoin only.

- Complexity can cause user mistakes.

Who It’s For / Who Should Avoid

- ✅ For users with a clear privacy requirement and patience to learn.

- ❌ Avoid if you just want an everyday wallet with minimal complexity.

How to Get Started

- Download Wasabi from the official site and (recommended) verify the download as described in Wasabi’s official documentation.

- Install and open Wasabi, then choose *Add Wallet* to create a new wallet or import an existing one.

- Let Wasabi finish downloading block filters before relying on balance/transaction history.

- Receive a small test amount first; confirm you can see it and spend it normally.

- If you plan to CoinJoin, select a strategy and only proceed once you understand the costs and trade-offs.

Armory

⭐ 3.8/5

Tap to expand

🏆 Best For: Deep-cold and offline workflows (technical users)

Quick Overview: Armory is a more technical Bitcoin wallet option historically known for cold storage workflows. It can be powerful for certain offline signing setups, but it is not the “easy” path.

Key Features

- Designed with offline workflows in mind.

- Advanced wallet management tools.

- Cold storage patterns that can reduce online exposure.

- Technical flexibility for expert users.

Supported Assets

- Total: Bitcoin only.

Security Analysis: How Safe Is Armory?

- Key storage model: Can be kept offline if you follow a true cold storage approach.

- 2FA / multisig / hardware integration: Multisig is possible, but setup is technical.

- Privacy tools: Not Tor-first by default.

- Recovery method: Advanced backups, but operational safety depends on the operator.

- Device dependency note: Offline signing reduces online risk but increases operational complexity.

- Strong cold storage concepts.

- Good for offline signing patterns.

- Flexible for advanced users.

- Bitcoin-only focus.

- High complexity.

- Not beginner-friendly.

- Smaller mainstream ecosystem.

Who It’s For / Who Should Avoid

- ✅ For technical users who can operate offline workflows safely.

- ❌ Avoid if you want speed, simplicity, and modern UX.

How to Get Started

- Install Armory on an offline computer for cold storage workflows (and Armory on an online computer for a watching-only wallet).

- Create a new wallet on the offline computer, then make the permanent paper backup as instructed in Armory’s offline wallet tutorial.

- Create a watching-only copy on the offline machine and move it (e.g., via USB) to the online computer to monitor balances and build unsigned transactions.

- Create unsigned transactions on the online machine, then transfer them to the offline machine for signing, following Armory’s offline transaction flow.

- Practice the full loop with small amounts before relying on Armory for meaningful funds.

Bitcoin Core

⭐ 4.4/5

Tap to expand

🏆 Best For: Running a full node and verifying everything yourself

Quick Overview: If you want maximum verification, Bitcoin Core is the reference full node implementation and includes wallet functionality. It requires significant resources, but you get the strongest “verify, do not trust” posture and you can support other wallets by providing your own node.

Key Features

- Full validation of blocks and transactions.

- Strongest trust model without third-party servers.

- Can serve as the backend for other wallets.

- Helps decentralization by running a node.

Supported Assets

- Bitcoin only.

Security Analysis: How Safe Is Bitcoin Core?

- Key storage model: Wallet keys live on the device unless you use external signing.

- 2FA / multisig / hardware integration: Advanced setups possible, but not “click simple.”

- Privacy tools: Running your own node improves privacy by reducing server reliance.

- Recovery method: Wallet backup practices matter and should be tested.

- Device dependency note: A full node improves verification, but desktop security still matters for wallet keys.

- Strongest verification posture.

- Helps the network.

- Can support other wallets.

- Widely reviewed open-source code.

- Heavy disk and bandwidth requirements.

- Long initial sync.

- Not a beginner UI.

Who It’s For / Who Should Avoid

- ✅ For users who want full-node validation.

- ✅ For users who want their own backend for privacy.

- ❌ Avoid if your computer cannot handle the resource requirements described on the Bitcoin Core download page.

How to Get Started

- Download Bitcoin Core from the official Bitcoin Core distribution page and install it.

- Choose whether to run a full node or enable pruning (pruning reduces disk usage but limits some use cases).

- Let the node fully sync before relying on it for verification or wallet activity.

- Create a wallet in the GUI (or via RPC if you’re using an advanced setup), and encrypt it if you’re storing keys on the machine.

- Back up your wallet file (e.g., using the GUI backup option or the official

backupwalletRPC), then test restoring with a small amount.

Pros and Cons of Desktop Wallets

Desktop wallets have real strengths, but they also come with trade-offs that aren’t always obvious until you’ve used one for a while.

Desktop Wallet Pros

Better visibility: A large screen makes it easier to spot mistakes.

Better advanced tooling: Desktop apps often offer features you rarely see on mobile.

Hardware wallet pairing: Desktop interfaces + hardware signing is one of the safest everyday patterns.

Node support: Desktop can be the easiest place to run or connect to a full node.

Desktop Wallet Cons

Less portable: You cannot quickly move a desktop wallet like a phone wallet.

Malware risk: A compromised desktop can steal from hot wallets and trick hardware wallet users into signing wrong outputs.

Learning curve: The best desktop wallets assume you want to learn how transactions work.

Update hygiene: Old versions and unofficial downloads are common attack paths.

Desktop Wallet Risks and Safety Checklist

Most wallet disasters aren’t caused by “hacks,” they’re caused by avoidable mistakes, so this checklist focuses on the few habits that prevent the most common losses.

Most Wallet Disasters Aren’t Caused By Hacks, But By Avoidable Mistakes

Most Wallet Disasters Aren’t Caused By Hacks, But By Avoidable MistakesThe “Don’t Lose Your Coins” Checklist

Backups: Seed phrase on paper. Offline. Safe place.

Anti-malware basics: Update your OS. Skip pirated apps. Scan your machine.

Passwords: Password manager, and a strong device password.

Phishing: Never trust “support” that reaches out to you first.

Fake downloads: Fake wallet apps are a real threat, and one security report described fake Ledger apps targeting macOS users that try to trick victims into entering a seed phrase, which is always a scam.

Test restores: Practice restoring with a small amount so you know your backup actually works.

When You Should Use Hardware Instead

Use a hardware wallet setup instead of a software desktop wallet when:

Your holdings are long-term savings.

Losing funds would meaningfully harm you.

You are unsure about your desktop’s security.

You want the biggest security improvement with the least ongoing effort.

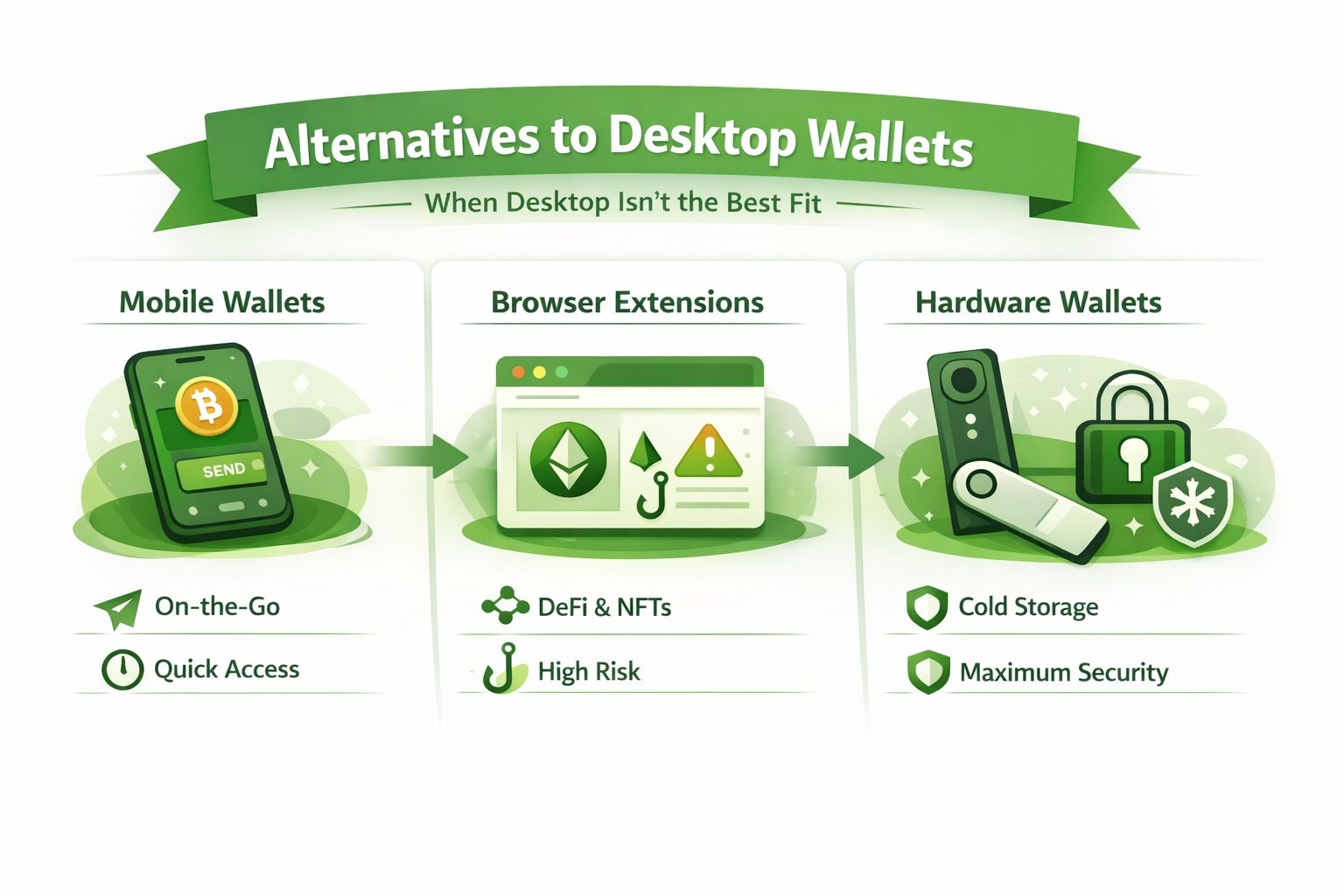

Alternatives to Desktop Wallets

Sometimes a desktop wallet is the wrong tool for the job, and this section helps you pick a better fit without overcomplicating it.

Sometimes A Desktop Wallet Is The Wrong Tool For The Job, So There Are Alternatives You Could Turn To

Sometimes A Desktop Wallet Is The Wrong Tool For The Job, So There Are Alternatives You Could Turn ToMobile Wallets

Mobile wallets are best for convenience and spending balances. They are not usually ideal for long-term savings unless you combine them with strong device security and good habits.

Check out our top picks for the best mobile wallets.

Browser Extensions

Browser extensions are the default for DeFi and NFT interactions, but phishing risk is higher because most malicious prompts originate in the browser. If you use them, keep balances small and review permissions often.

Hardware Wallets

Hardware wallets are usually the safest way to store crypto long term, especially if you are treating it like savings. A setup that works well for a lot of people is simple: keep a hardware wallet for what you are not touching, and use a separate hot wallet for day-to-day spending.

Conclusion

If you just want the bottom line, this section pulls the top picks together and helps you choose based on what you care about most.

Our Top Picks Recap

Max security: Trezor

Portfolio management: Ledger

Best beginner desktop UX: Exodus

Bitcoin power-user controls: Electrum

Best desktop staking focus: Guarda

Best Bitcoin privacy workflows: Sparrow

Best exchange ecosystem Web3: OKX Wallet

How to Choose in 60 Seconds

If you want max security → hardware wallet interface like Trezor or Ledger.

If you are Bitcoin-only and privacy-focused → Sparrow (CoinJoin-specific users may consider Wasabi).

If you want the easiest desktop UI → Exodus.

If you want staking in a desktop wallet → Guarda.

If you want multichain Web3 in a large ecosystem → OKX Wallet or Binance Web3 Wallet.