Trading in the volatile cryptocurrency market can be daunting, especially for beginners. For those looking to capitalize on market opportunities without diving knee deep into technical analysis or strategy development, copy trading offers a convenient entry point.

Copy trading allows users to mimic the strategies of top-performing traders on a platform. Not only does it serve as an entry point for newcomers to trading, but it also enables seasoned investors to streamline their strategies by leveraging insights from the best in the business.

In this review, we’ll explore how Binance’s copy trading feature works, its benefits, and whether it lives up to the promise of simplifying crypto trading.

What is Binance Copy Trading

Before we give you the lowdown on Binance copy trading, it would be prudent to explain copy trading in a bit more detail.

Copy trading is a portfolio management strategy where investors automatically mimic the trades of more experienced traders. It originated in traditional finance but has since become a popular feature in cryptocurrency trading, offering an easier way for beginners to get involved in the markets. Think of it like shadowing a skilled artist as they paint a masterpiece. You may not have their level of expertise, but by mimicking their brushstrokes and techniques, you can create a similar piece of art—though your final result might not be an exact replica.

Here’s how it works: let’s say you’re copying a trader on a platform like Binance or Bybit. If that trader decides to sell Bitcoin with specific risk and exit parameters, the copy trading software will automatically replicate this trade in your account, tailored to the risk settings you’ve chosen. This automation means you don’t have to monitor the markets constantly or figure out complex strategies on your own.

Right, back to Binance!

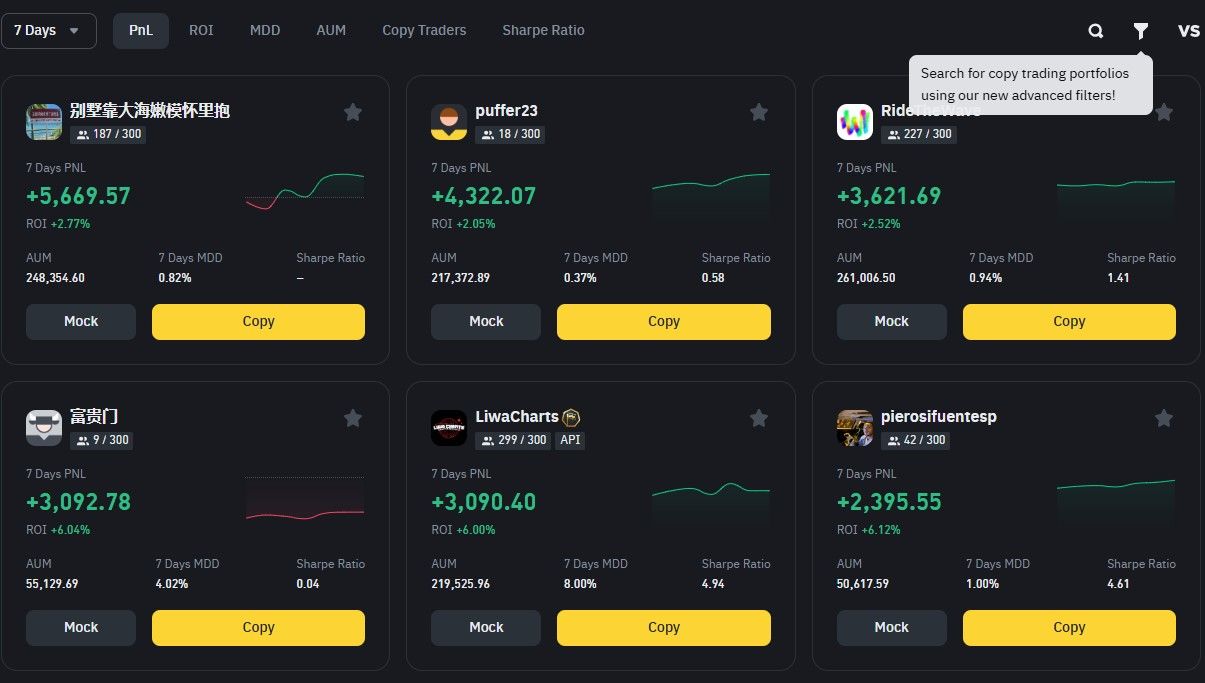

Copy Trading Lets You Automatically Mimic The Trades of More Experienced Traders. Image via Binance

Copy Trading Lets You Automatically Mimic The Trades of More Experienced Traders. Image via BinanceBinance categorizes spot copy traders into two buckets:

- Copy traders, as the name suggests, are the ones copying the trades.

- Leader traders are experienced individuals whose trades are copied.

So, what's in it for lead traders? A slice of the pie. Lead traders earn a percentage of the profits generated by each follower who copies their trades. In Binance spot copy trading, lead traders can receive:

- A 10% profit share from their copy traders.

- A 10% commission from their copy traders' trading fees.

To become a lead trader, you'll have to deposit over 500 USDT to your trading account and complete the KYC verification process.

Top Features

Here are a few features of Binance copy trading.

Trading Strategies and Signal Replication

Binance copy trading allows users to replicate the trading strategies of experienced lead traders. This feature makes it easier for beginners or less experienced traders to profit by mimicking the strategies of seasoned professionals. Lead traders often use a combination of technical analysis, market indicators, and fundamental analysis to develop trading strategies, which are then automatically executed on the followers’ accounts.

For copy traders, this means they can access the strategies of top traders without needing to analyze markets or execute trades themselves. Whether a lead trader specializes in day trading, swing trading, or trend-following strategies, their signals are automatically replicated across the portfolios of their followers.

Integration with Spot and Futures Trading

Binance copy trading seamlessly integrates with both spot and futures trading.

- Spot trading: In the spot market, users trade the actual assets by buying and selling them at current market prices.

- Futures trading: Futures trading allows traders to speculate on the price movements of assets without owning the underlying assets. Futures contracts allow for leverage, meaning traders can take larger positions with less capital. Lead traders can execute short or long positions, and copy traders can follow these actions in real-time.

Automated Trading Tools

One of the standout features of Binance copy trading is the integration of automated trading tools, which simplify the process of executing trades for both lead traders and followers. These tools can automate various aspects of the trading process, from opening and closing positions to setting stop-loss orders, take-profit levels, and more.

For followers, this means that once they copy a lead trader, the system will automatically execute the same trades in their account based on the parameters set by the lead trader. Automated trading helps to reduce the need for constant monitoring and manual execution, which is particularly useful in fast-moving markets like crypto. Followers can also adjust their risk settings (such as stop-loss levels) to automate risk management.

Lead traders benefit from automated trading tools by being able to set predefined parameters for their strategies, such as when to take profits, exit a position, or set stop-loss limits.

Risk Management Tools

Binance's copy trading platform offers a variety of risk management tools to help both lead traders and followers protect their investments.

For followers, Binance allows the customization of risk settings, such as:

- Stop-Loss Orders: Set a specific loss limit at which all positions are automatically closed to prevent further losses.

- Take-Profit Orders: Set a target price at which the system automatically sells assets to lock in profits.

- Portfolio Diversification: Followers can choose to diversify across different lead traders and trading strategies, reducing the risk of relying on a single trader’s performance.

For lead traders, risk management tools help ensure that their strategies stay within their risk tolerance levels and that the capital of their followers is protected. Lead traders can:

- Adjust Position Sizes: Control the amount of capital allocated to each trade based on their strategy.

- Use Stop-Loss Levels: Apply stop-loss orders across all trades to prevent excessive losses from highly volatile market conditions.

- Set Risk-to-Reward Ratios: Maintain a balance between potential gains and losses, which is crucial for long-term profitability.

How to Start Spot Copy Trading on Binance

Copy trading on Binance requires only a few clicks after you've set up your profile and completed KYC.

To start spot copy trading on Binance:

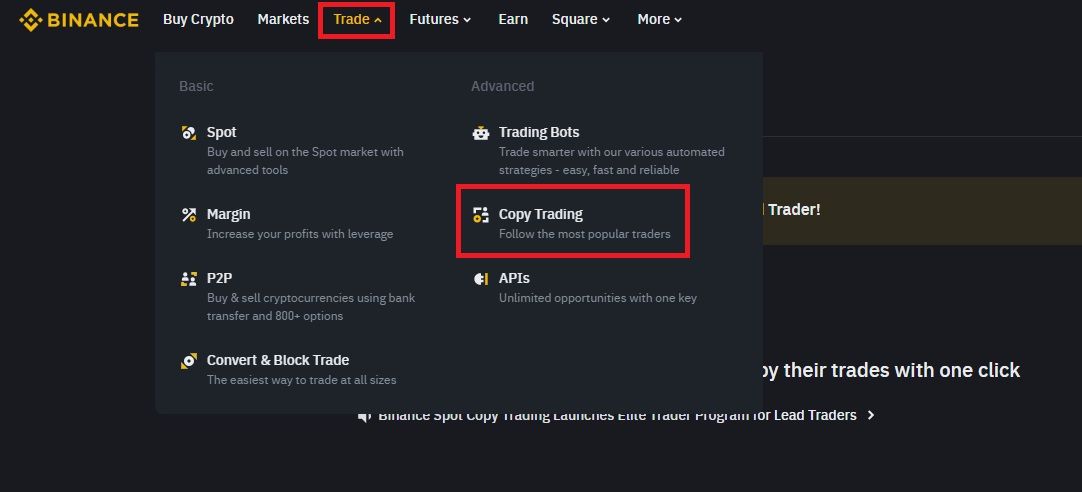

STEP 1: Log in to your Binance account, go to [Trade] and select [Copy Trading], then choose the [Spot] tab.

Copy Trading on Binance Requires Only a Few Clicks. Image via Binance

Copy Trading on Binance Requires Only a Few Clicks. Image via BinanceSTEP 2: Under ‘Spot’ - ‘Portfolio List,’ pick your preferred portfolio and click [Copy] to begin.

To set up your preferences, go to [Spot Copy Setting]:

- Select the [Fixed Ratio] tab to copy trades proportionally based on the lead trader’s orders.

- Choose the [Fixed Amount] tab to copy trades by a set amount per order.

Here’s a table summarizing the key copy trading parameters:

| Parameter | Description |

|---|---|

| Cost Per Order | Each order will be opened/capped at this fixed amount |

| Copy Amount | Total amount to invest per lead trader, which can be spread across multiple orders |

| Total Stop Loss | A stop-loss market order will trigger to sell all cryptocurrencies when this amount is reached. IMPORTANT: Transferring funds while the portfolio is running will affect the total stop loss amount. |

| Personal Pairs Preference | The system will only execute orders for the currencies you have selected. |

Binance Spot Copy Trading Fees

Binance doesn't charge the spot copy trader any fees. That doesn't mean you're off the hook completely, however!

As noted earlier, lead traders earn a percentage of the profits they generate for copy traders. This commission to a lead trader comes from the copy trader's profit.

Here’s how the 10% profit share and 10% commission on trading fees work, with examples to clarify:

10% Profit Share from Copy Traders' Profits

This means that lead traders receive 10% of the profits made by their copy traders. If a follower profits from the trades they copy, the lead trader gets a cut of that profit.

Example:

Follower's Profit: Suppose a follower invests $1,000 in copy trading, and their portfolio gains 20% after a period of trading.

Follower's Profit: 20% of $1,000 = $200.

Lead Trader's Share (10%): The lead trader gets 10% of the $200 profit, which is $20.

So, the lead trader earns $20 as a reward for their strategy, based on the follower’s profits.

10% Commission on Copy Traders' Trading Fees

In addition to the profit share, lead traders also earn 10% of the trading fees that copy traders pay when executing trades. This is a percentage of the fees Binance charges on trades.

Example:

Copy Trader’s Trade: Suppose a copy trader makes a trade of $1,000 worth of cryptocurrency. Binance charges a trading fee of 0.10% on each trade.

Binance Spot Trading Fee: 0.10% of $1,000 = $1 fee.

Lead Trader’s Commission (10%): The lead trader receives 10% of that $1 fee, which is $0.10.

This means the lead trader earns $0.10 for each $1,000 trade their follower makes, purely from the trading fees.

It's important to note that the lead trader, who's making the trades on your behalf, will pay fees according to the Binance fee schedule.

Is Copy Trading on Binance Profitable?

Copy trading on Binance can be profitable, but like any form of trading, the level of profitability depends on several factors, including market conditions, the skill of the lead traders, and the amount of capital invested. While the concept of copying successful traders may seem like an easy way to make profits, it is important to set realistic expectations and understand the risks involved.

Realistic Expectations Regarding Profits

One of the key factors to keep in mind when engaging in copy trading is that profits are not guaranteed. While following experienced lead traders can provide a higher likelihood of making profitable trades, there are still risks involved, and results can vary. Here are some things to consider:

- Consistent Returns Are Rare: Even skilled traders face losses, especially in volatile markets like cryptocurrency. A trader who is profitable over time may still experience losing streaks due to sudden market changes, news events, or shifts in sentiment. Therefore, it is important to expect fluctuations in your portfolio’s value rather than steady, consistent profits.

- High Risk, High Reward: Crypto markets are known for their high volatility, which can lead to both significant gains and significant losses. Lead traders who take higher risks in exchange for potentially larger profits can bring in substantial returns, but they also expose their followers to larger drawdowns.

- Not a Get-Rich-Quick Strategy: Copy trading should not be viewed as a way to instantly make large profits. Success in copy trading requires time, patience, and careful management of risk. It’s important to approach it as a long-term strategy, and set your expectations accordingly.

Market Conditions and Trader Skills

The profitability of copy trading is significantly influenced by market conditions and the skills of the lead traders you choose to follow.

Market Conditions

Crypto markets can be highly unpredictable and influenced by a range of external factors, such as government regulations, technological advancements, or global economic events. In a bullish market, experienced traders may be able to generate significant profits, while in a bearish or sideways market, even skilled traders might struggle to maintain profits. The overall market sentiment—whether the market is trending up or down—greatly impacts the results of both spot and futures trading.

Trader Skills

The performance of the trader you are copying plays a central role in the profitability of your investments. Lead traders with extensive experience, solid risk management strategies, and proven track records are more likely to generate consistent returns. However, even experienced traders can make mistakes, especially when markets are volatile. When choosing who to copy, look for traders with:

- A consistent track record over a period of time (not just a few months).

- A well-defined strategy, whether it’s long-term investing or day trading.

- Risk management techniques, such as the use of stop-loss orders or position sizing to protect against large losses.

Not all lead traders are created equal, and some may perform better in certain market conditions than others. Therefore, it's important to do your research and monitor the performance of the traders you follow regularly.

Tips to Maximize Success on Binance Copy Trading

There are a few key strategies you can follow to make the most out of Binance copy trading:

Diversification and Risk Management

- Spread your investments across multiple traders with different strategies to minimize risk.

- Set a fixed percentage of capital for each trader and use risk settings to control potential losses.

- Consider diversifying across different assets, like crypto pairs or stablecoins, to reduce exposure to market fluctuations.

Regularly Review Trader Performance

- Monitor traders’ long-term profitability and assess their risk-reward ratios.

- Stay informed about any changes in the traders’ strategies and ensure they align with your goals.

- Compare traders' performance against your investment goals and adjust if necessary.

Avoid Emotional Trading Decisions

- Follow a clear strategy and avoid reacting emotionally to market fluctuations.

- Don’t make hasty decisions based on short-term losses. Assess the overall performance.

- Set automatic orders to protect yourself from emotional reactions.

Closing Thoughts

Binance’s copy trading feature offers a simplified and accessible way for newcomers to the cryptocurrency market to benefit from the expertise of seasoned traders. By allowing users to replicate the strategies of experienced lead traders, it bridges the gap for those without the time, skills, or confidence to trade independently.

However, copy trading is not without its challenges and risks. Success largely depends on choosing the right lead traders, managing risk effectively, and understanding the volatile nature of cryptocurrency markets. While it can be profitable, there are no guarantees, and participants should approach it as a long-term strategy rather than a quick path to wealth.

With realistic expectations and proper management, copy trading can be a valuable tool for navigating the complexities of the cryptocurrency market and potentially achieving consistent returns over time.