Since its launch in 2018, BitMart has grown to provide a diverse selection of cryptocurrencies across both the spot and futures markets. Beyond standard trading, the platform includes features such as an earn section, access to an NFT marketplace, a launchpad, copy trading, and an extensive academy section available for users looking to deepen their knowledge of the crypto space.

In this BitMart review, we’ll take a closer look at the platform’s offerings, from its bolstered security measures to its trading features and overall user experience, to help you decide whether it’s the right exchange for your needs.

Review Summary

BitMart is a Cayman Islands-based centralized cryptocurrency exchange launched in 2018. Operating in over 180 countries, it offers an extensive suite of trading services—including spot, margin, and futures markets—alongside an NFT marketplace and a launchpad.

The Key Features of BitMart Are:

- Extensive Cryptocurrency Support: BitMart boasts an impressive lineup of over 1,400 cryptocurrencies, featuring more than 1,050 spot trading pairs and over 350 perpetual contract pairs.

- Competitive Fee Structure: BitMart applies a tiered fee schedule for spot trading, with fees ranging between 0.1% and 0.6%, depending on asset type, with further discounts based on trading volume and asset holdings. Futures fees are set at 0.02% for makers and 0.06% for takers. There are no crypto deposit fees, and withdrawal fees adjust automatically based on network conditions.

- Diverse Trading Options: BitMart provides a range of trading options, including spot trading, futures trading with up to 100x leverage, staking, and lending products. The platform also supports copy trading, allowing users to mirror strategies from professional traders.

- Educational Resources: The BitMart Academy offers a wealth of articles, guides, and tutorials to help users navigate the crypto space. From beginner-friendly content to advanced trading insights, there’s something for everyone.

- 24/7 Customer Support: BitMart ensures round-the-clock assistance, offering live support to address user queries and issues promptly.

What is BitMart?

BitMart is a centralized cryptocurrency exchange launched in 2018 and headquartered in the Cayman Islands. Operating globally with users in over 180 countries, BitMart caters to traders of all experience levels by providing a wide array of services, including spot trading, futures trading with leverage up to 100x, staking, and lending products.

For those who have been in the cryptocurrency space for a while, the name BitMart may bring to mind the 2021 security breach the exchange experienced, which resulted in an estimated $200 million loss. However, BitMart has since made significant strides in enhancing its security measures and offers features comparable to top-tier platforms like Binance, OKX, and Bybit.

BitMart supports over 1,400 cryptocurrencies and offers high liquidity across a broad range of trading pairs. Its fee structure includes a base fee for spot trading ranging from 0.1% to 0.6% depending on the asset type, with further discounts available through the tiered fee system based on trading volume and asset holdings. Users paying fees with BMX, BitMart’s native exchange token, can also enjoy an additional discount of 25%. Futures trading fees are set at 0.02% for makers and 0.06% for takers, while deposits are free, and withdrawal fees dynamically adjust based on network conditions.

The platform also provides a user-friendly mobile app for trading on the go, along with advanced trading tools on its web interface. For newcomers, BitMart Academy offers a wealth of educational content, including articles and guides on crypto trading and blockchain technology.

With 24/7 customer support and a focus on user experience, BitMart has positioned itself as a reliable choice for traders at all levels.

Getting Started with BitMart

To access BitMart's features and offerings, the first step is creating an account, a process that is both quick and straightforward.

Creating Your BitMart Account

To begin, navigate to the BitMart homepage and locate the "Get Started" button in the top-right corner of the page.

BitMart “Get Started” Button. Image via BitMart

BitMart “Get Started” Button. Image via BitMart BitMart provides several sign-up methods to suit user preferences. These include:

- Signing up via email

- Using a phone number

- Registering through a Google or Apple ID account

If you choose the email option, a verification code will be sent to your inbox. For those opting for phone registration, the code will arrive via text message. Once you enter the verification code, your account will be created, granting access to the BitMart platform.

Completing KYC on BitMart

After signing up, users must complete the Know Your Customer (KYC) verification process to unlock all platform features, including withdrawals. Without KYC, users cannot withdraw funds, which may be a concern for privacy-conscious individuals. For those seeking less restrictive exchanges, platforms like Toobit offer some of the highest non-KYC withdrawal limits in the industry. You can explore our review of Toobit here.

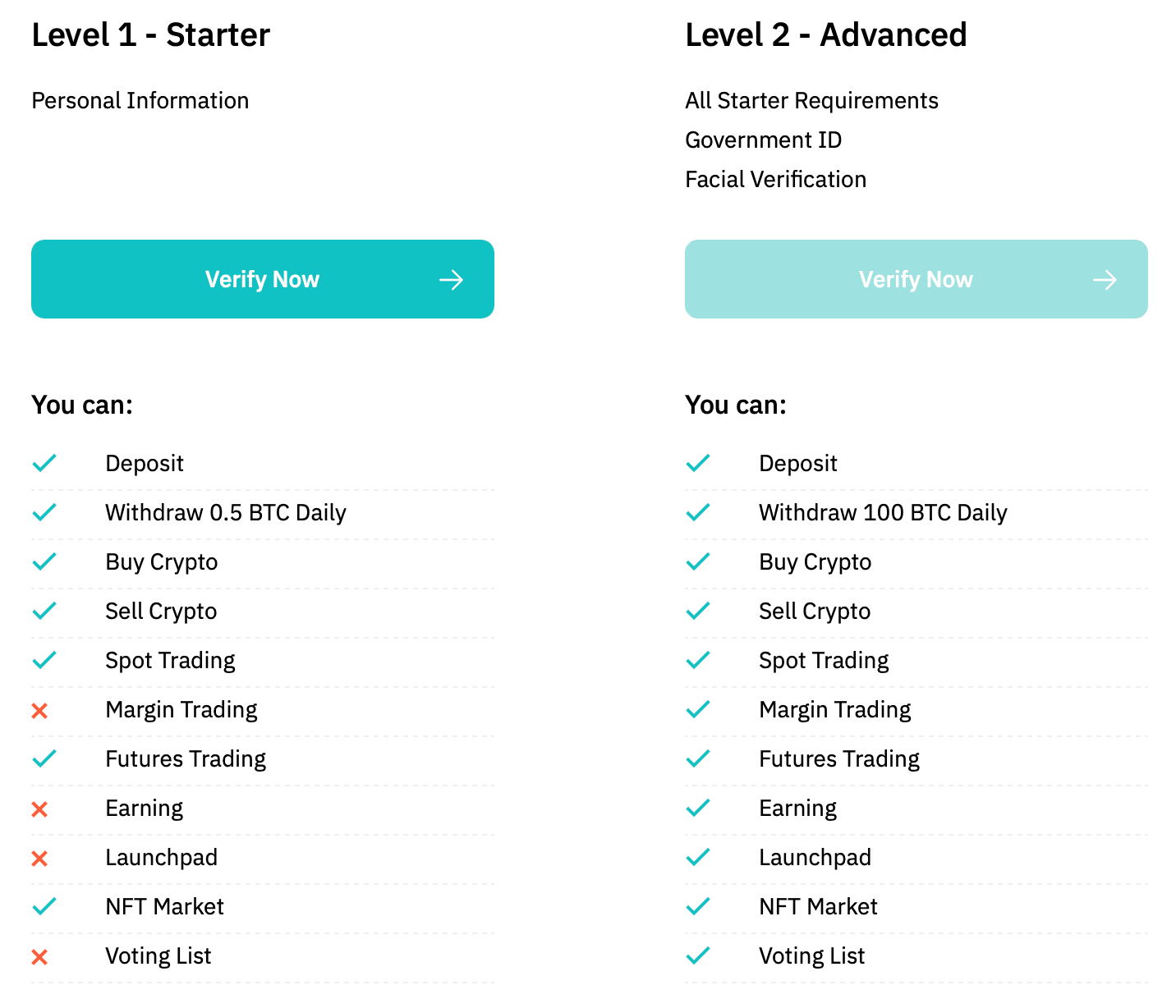

BitMart’s KYC verification is structured into two levels:

- Level 1 KYC: This level unlocks most of BitMart's features and allows for a daily withdrawal limit of 0.5 BTC. It requires only basic personal details, such as your name, country, and date of birth.

- Level 2 KYC: This level significantly increases the withdrawal limit to 100 BTC per day and grants access to features such as margin trading, BitMart Earn, and the BitMart Launchpad. Completing Level 2 involves submitting proof of identity, providing additional documentation, and completing facial recognition.

Below is an overview of the features associated with each KYC level:

BitMart KYC Features. Image via BitMart

BitMart KYC Features. Image via BitMartTo complete the KYC process:

- Access the "Verification" page via the profile icon in the top-right corner of the interface.

- Select "Verify Now" under the desired KYC level.

- Provide the required personal information for Level 1, including your name, date of birth, and country of residence.

- Upgrade to Level 2 by uploading proof of identity documents and completing the facial recognition process.

Funding Your BitMart Account

Once your account is verified, the next step is to fund it. BitMart offers three methods to do so:

- Cryptocurrency Deposits

- Users can deposit a range of supported cryptocurrencies such as BTC, ETH and SOL by generating a deposit address for the desired asset. Funds can then be transferred from external wallets or exchanges.

- Users can deposit a range of supported cryptocurrencies such as BTC, ETH and SOL by generating a deposit address for the desired asset. Funds can then be transferred from external wallets or exchanges.

- Fiat Purchases

- BitMart allows users to buy cryptocurrencies directly using fiat currencies, such as USD or EUR, through credit or debit card payments. These transactions are facilitated by third-party providers, such as MoonPay.

- BitMart allows users to buy cryptocurrencies directly using fiat currencies, such as USD or EUR, through credit or debit card payments. These transactions are facilitated by third-party providers, such as MoonPay.

- Peer-to-Peer (P2P) Trading

- BitMart’s P2P marketplace allows users to buy cryptocurrencies directly from other users.

BitMart Security

As mentioned earlier, BitMart experienced a significant security breach in December 2021, resulting in the loss of nearly $200 million due to a hot wallet exploit on Ethereum and Binance Smart Chain networks. BitMart fully compensated all affected users. This incident highlighted vulnerabilities in the platform's wallet management system, prompting BitMart to implement substantial security upgrades to prevent similar occurrences.

Today, the platform stores the majority of user funds in cold wallets, significantly reducing exposure to online threats. BitMart also conducts regular security audits and operates active bug bounty programs to identify and address potential vulnerabilities.

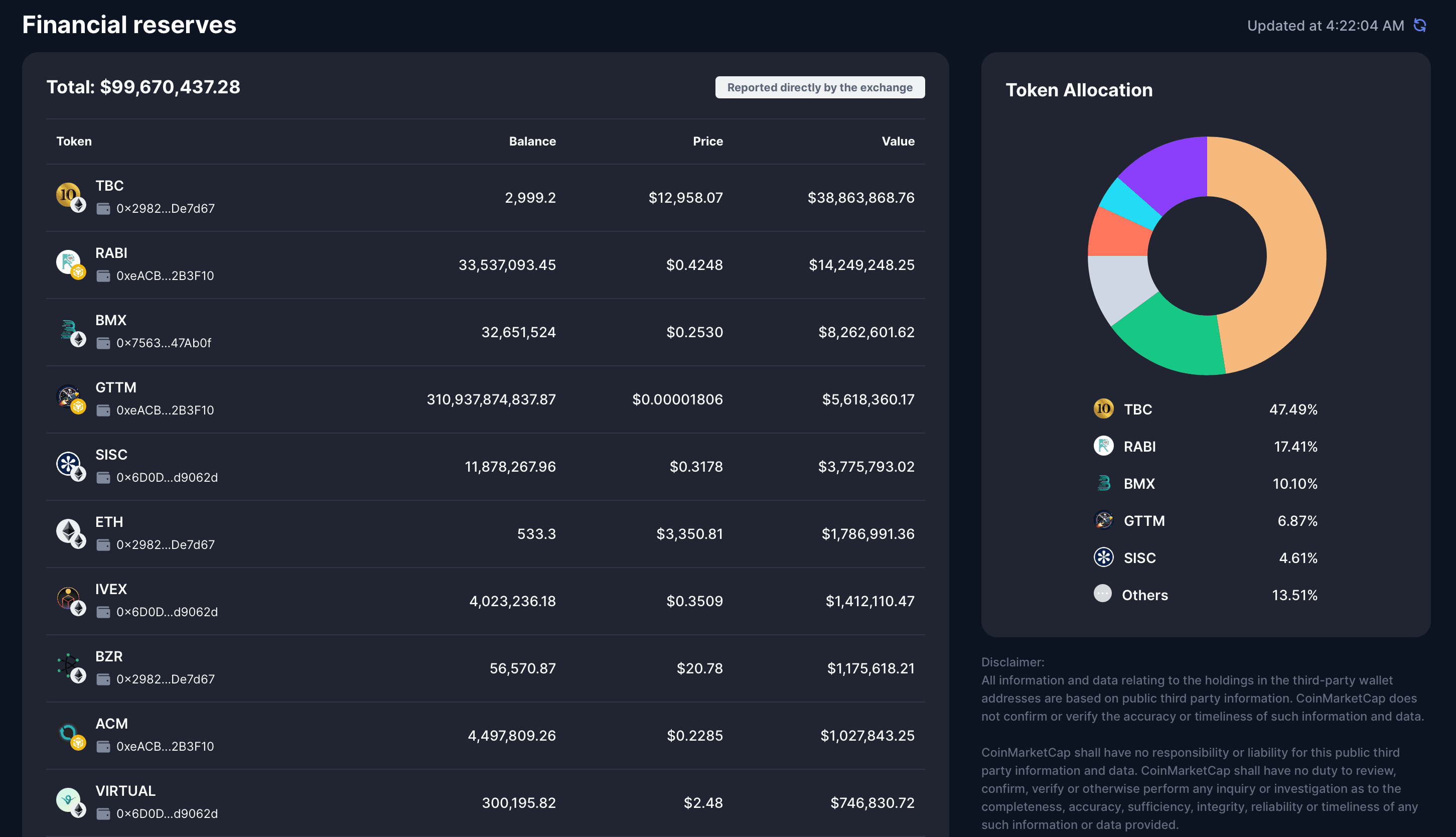

That said, BitMart falls short in offering transparent proof of reserves, allowing users to verify their holdings and access detailed audits, as provided by exchanges like Bybit and OKX. BitMart instead relies on self-reported proof of reserves through CoinMarketCap and discloses some of its hot wallet addresses. While the assurance that most assets are held in cold wallets is a positive step, the lack of fully verifiable proof of reserves is an area for improvement.

BitMart Financial Reserves on CoinMarketCap. Image via CoinMarketCap

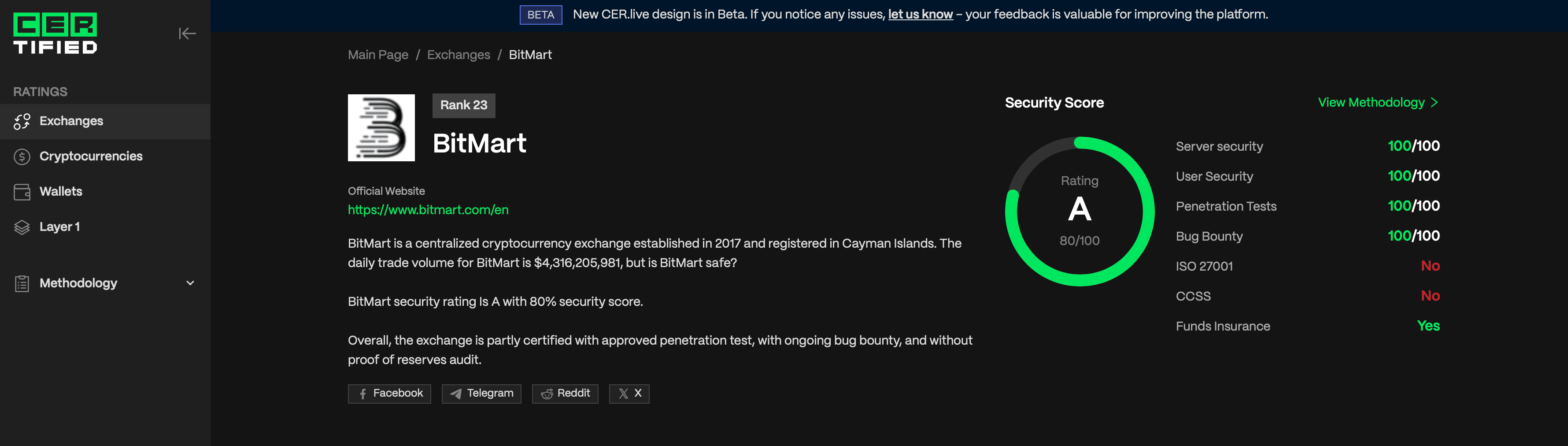

BitMart Financial Reserves on CoinMarketCap. Image via CoinMarketCapOn Certified, BitMart holds an impressive A security score, ranking 23rd among safest cryptocurrency exchanges. However, there is still room for improvement in user-side security measures. For instance, BitMart does not enable two-factor authentication (2FA) by default. Additionally, the lack of withdrawal passwords is a notable feature that could further secure user accounts.

BitMart Security Ranking on Certified. Image via Certified

BitMart Security Ranking on Certified. Image via CertifiedWhile BitMart has undoubtedly strengthened its security protocols since 2021, self-custody remains the most secure way to protect your assets. If you’re seeking reliable options for storing your holdings offline, check out some great deals on hardware wallets available on the Coin Bureau Deals page.

Supported Cryptocurrencies on BitMart

BitMart boasts one of the most extensive selection of cryptocurrencies in the industry. As of the time of writing, the platform supports over 1,400 cryptocurrencies, offering more than 1,050 spot trading pairs and over 350 perpetual trading pairs.

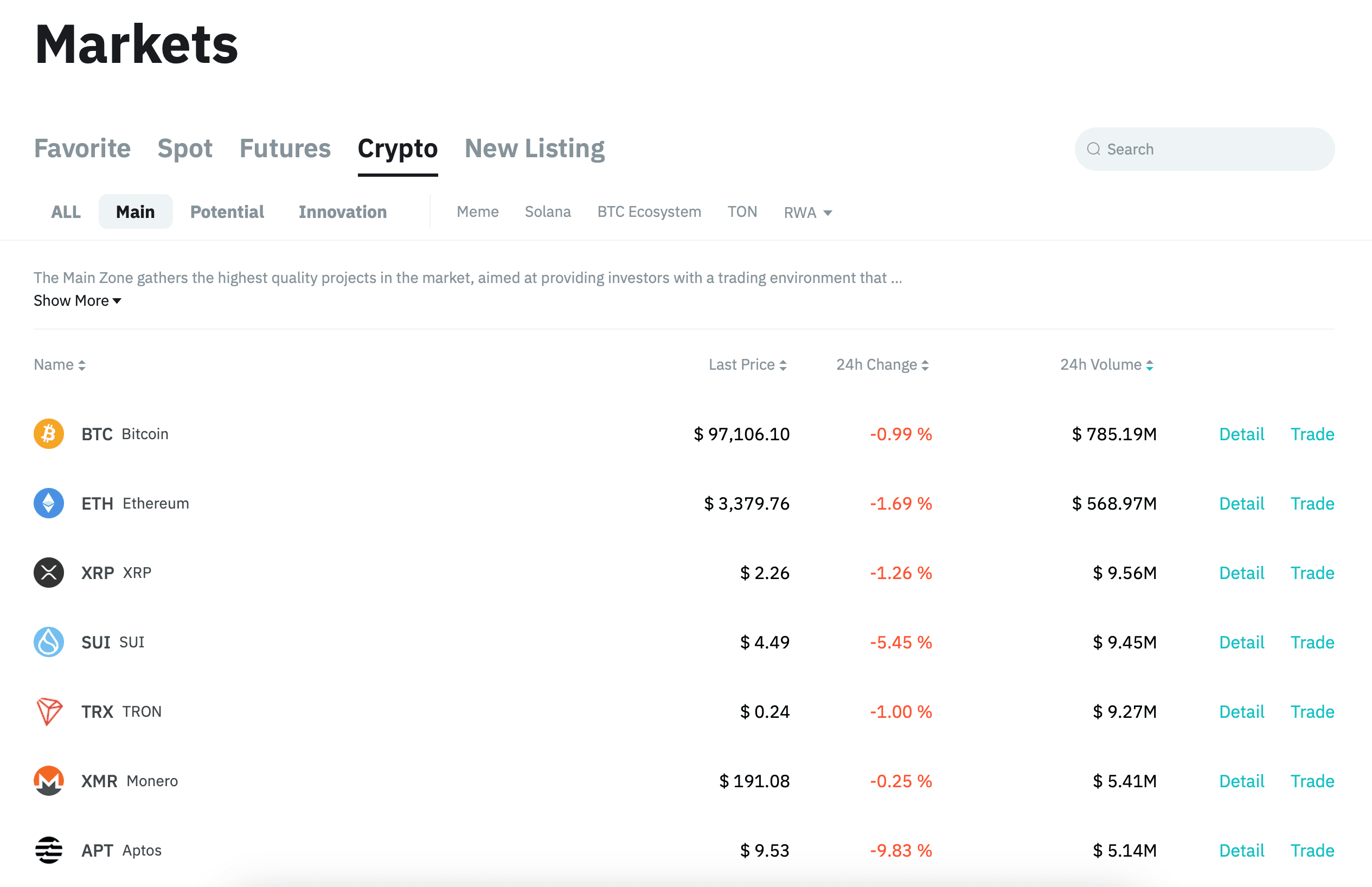

BitMart Markets. Image via BitMart

BitMart Markets. Image via BitMartThis impressive lineup includes household names such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), alongside a diverse range of smaller-cap altcoins. Additionally, BitMart is known for its expansive selection of meme coins, so if you're interested in this niche segment of the crypto market, BitMart has you covered.

Order Types on BitMart

Understanding the various order types available on BitMart is key to effectively managing your trades and executing strategies tailored to your goals. BitMart offers a comprehensive selection of order types to cater to both beginner and advanced traders.

Limit Orders

Limit orders allow traders to set a specific price at which they wish to buy or sell an asset. This ensures that trades are executed only at the desired price or better, providing precision and control over executions.

Example:

- If BTC is trading at $100,000, you can set a buy limit order at $98,000. The trade will only execute if the price drops to $98,000 or below.

Market Orders

Market orders are designed for speed, executing immediately at the best available market price. They are ideal for traders looking to enter or exit positions quickly without waiting for a specific price.

Example:

- If BTC is trading at $100,000, placing a market buy order will execute instantly at the best available price, such as $100,005 or $100,010, depending on liquidity.

Take-Profit/Stop-Loss (TP/SL) Orders

TP/SL orders allow traders to pre-define a price level to secure profits or minimize losses. When the market price reaches the specified trigger price, the system places a limit order automatically.

- Take-Profit: Closes a position when a set profit level is reached.

- Stop-Loss: Closes a position to limit losses if the market moves unfavorably.

Example:

For a BTC position opened at $100,000:

- Set a take-profit trigger at $110,000 and a stop-loss trigger at $95,000. If the price rises to $110,000, the take-profit order will execute, locking in profits. Conversely, if the price falls to $95,000, the stop-loss order will activate to minimize losses.

Trigger Orders

Trigger orders enable traders to automate their entry into the market by setting specific conditions. Once the market price meets the trigger price, the system places the pre-set limit or market order.

Functionality:

Unlike TP/SL orders, trigger orders do not freeze margin or assets until the condition is met, offering more flexibility for traders.

Example:

- Trigger Price: $105,000

- Order Price: $104,500

- Amount: 0.2 BTC When the market price reaches $105,000, the system places a buy limit order at $104,500 for 0.2 BTC.

Advanced Limit Orders

Advanced limit orders cater to more experienced traders by providing additional options for executing trades efficiently and strategically:

- Post Only: Ensures that the order is placed on the order book as a maker order, adding liquidity. If it matches an existing order, it is canceled to avoid taker fees.

- Example: A Post Only order to sell BTC at $101,000 ensures that your order doesn’t match existing buy orders but instead adds liquidity to the market.

- Example: A Post Only order to sell BTC at $101,000 ensures that your order doesn’t match existing buy orders but instead adds liquidity to the market.

- Immediate or Cancel (IOC): Executes as much of the order as possible immediately, canceling any unfilled portion.

- Example: Placing an IOC order for 0.5 BTC at $100,500 will fill 0.3 BTC immediately if liquidity exists and cancel the remaining 0.2 BTC if not filled.

Trailing Stop Order

Trailing stop orders help traders lock in profits or limit losses as the market moves favorably. Instead of setting a fixed price, a trailing stop dynamically adjusts according to market movements.

Example:

For a BTC position opened at $100,000:

- Set a trailing stop with a 5% distance. If the price rises to $105,000, the stop-loss automatically adjusts to $99,750 (5% below $105,000). As the price continues to climb, the stop-loss follows. However, if the price falls below the trailing stop, the position is closed.

How to Start Spot Trading on BitMart?

If you're ready to begin spot trading on BitMart, this step-by-step guide will walk you through the process:

STEP 1: Log In to Your Account

- Head to the BitMart homepage and log in using your registered email address or phone number along with your password.

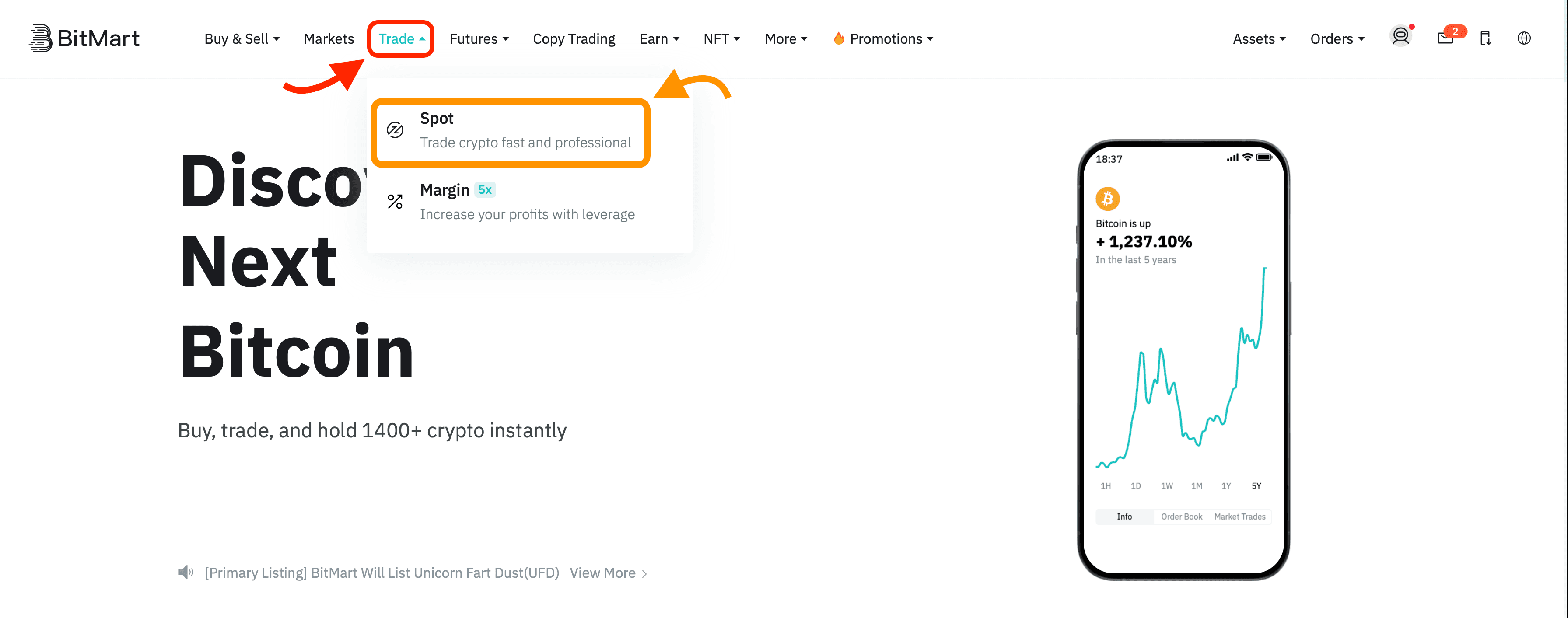

STEP 2: Navigate to the Trade Tab

- Once logged in, find the “Trade” tab located at the top left of the homepage. From the drop-down menu, select “Spot.”

Navigating to the Trade Section on BitMart. Image via BitMart

Navigating to the Trade Section on BitMart. Image via BitMartSTEP 3: Select Your Desired Trading Pair

- Browse the list of available trading pairs and pick the one you'd like to trade. For this example, let's use BTC/USDT.

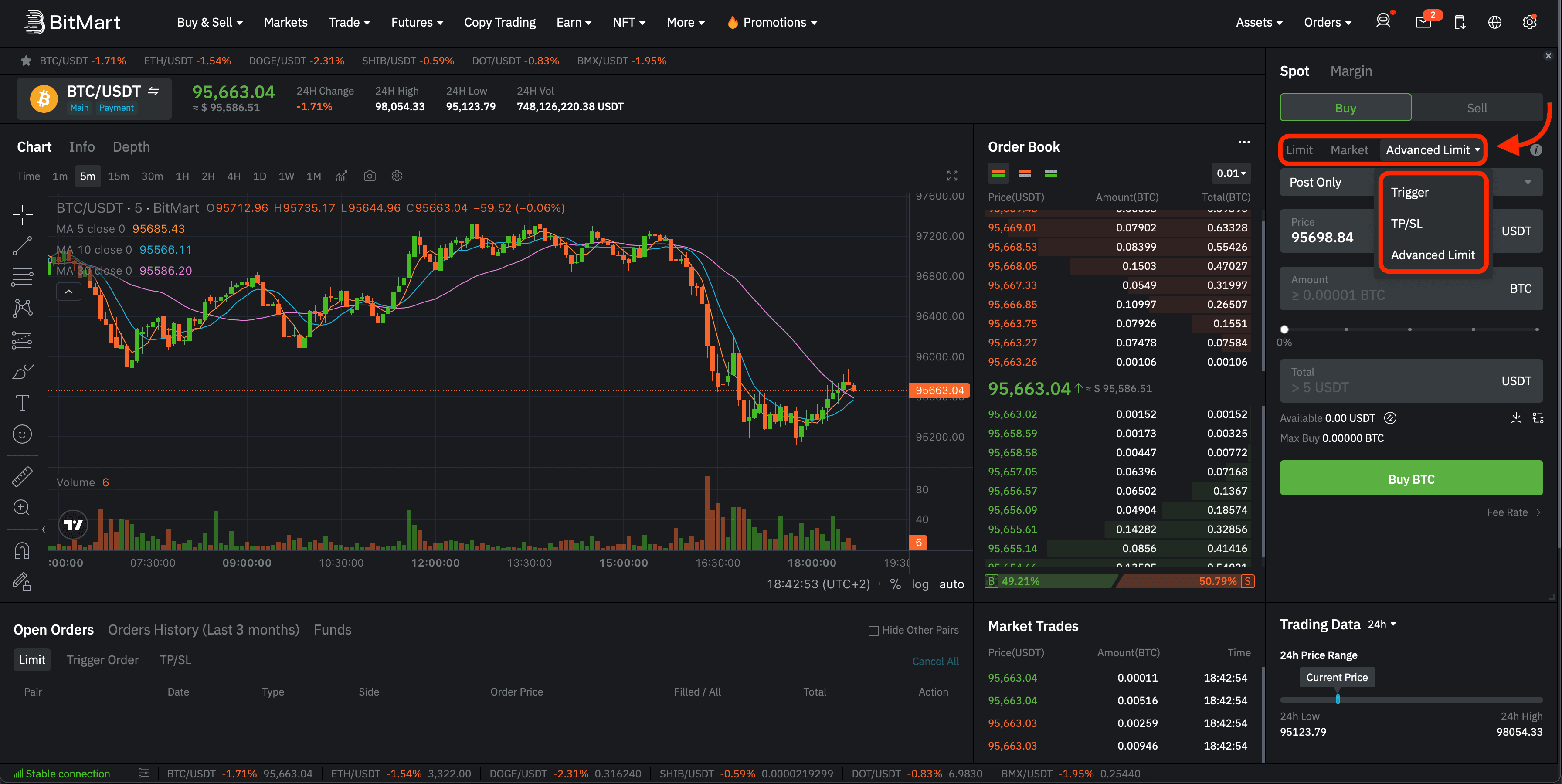

STEP 4: Choose an Order Type

Select from the following order types available on BitMart:

- Limit Order

- Market Order

- Trigger Order

- TP/SL (Take Profit/Stop Loss)

- Advanced Limit

Order Types on BitMart. Image via BitMart

Order Types on BitMart. Image via BitMartSTEP 5: Place Your Order

- Decide whether to buy or sell, input your order details (such as quantity and price), and submit the order.

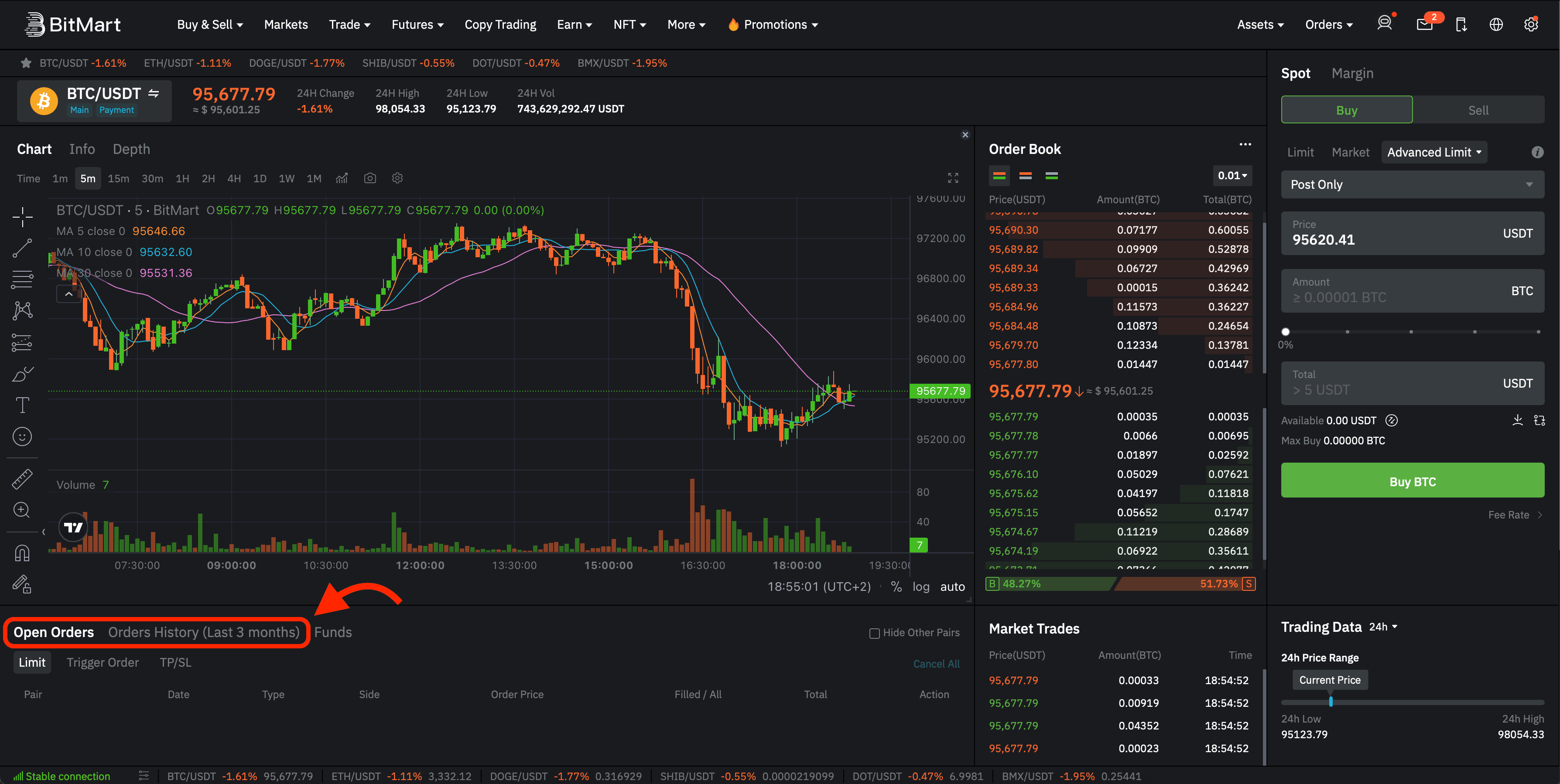

STEP 6: Monitor Your Orders

Once your order has been placed, you can keep track of its status under the following sections:

- Open Orders: View all active orders that have yet to be filled. Here, you can modify or cancel any pending orders if necessary.

- Order History: Access a detailed record of all your previous trades, including executed and canceled orders.

Viewing Open Orders and Order History on BitMart. Image via BitMart

Viewing Open Orders and Order History on BitMart. Image via BitMartLeverage and Margin Trading on BitMart

If you’re looking to trade with leverage on BitMart, you have two options to choose from: margin trading and futures trading.

Margin Trading

Margin trading on BitMart allows users to borrow funds to trade larger positions than their account balance would typically permit. Here's a breakdown:

- Leverage: BitMart offers up to 5x leverage for margin trading, meaning traders can control a position size up to five times their collateral.

- Interest Rates: Interest on borrowed funds is calculated hourly. For instance, if the daily interest rate is 0.02%, the hourly rate would be 0.02% divided by 24.

Margin Modes:

- Isolated Margin: Each position has its own margin balance, limiting potential losses to that specific position.

- Cross Margin: All positions share a margin balance, allowing profits from one position to offset losses in another, but increasing the risk of larger losses.

You can find a detailed guide on getting started with margin trading on BitMart here.

Futures Trading

BitMart's futures platform enables traders to speculate on the future price movements of cryptocurrencies with higher leverage.

- Leverage: Users can access leverage up to 100x, depending on the specific contract and market conditions.

Types of Futures Contracts:

- USDT-Margined Futures: Also known as linear contracts, these are settled in USDT and track the USDT index of the underlying cryptocurrency. This structure simplifies margin allocation and profit/loss calculations, as all settlements are in USDT.

- Coin-Margined Futures: These contracts are settled in the underlying cryptocurrency itself (e.g., BTC), which can introduce complexities due to the asset's price volatility affecting margin requirements and profit/loss calculations.

Margin Requirements:

- Initial Margin: The minimum amount required to open a position, calculated as Contract Value divided by Leverage.

- Maintenance Margin: The minimum equity needed to keep a position open; falling below this level may trigger liquidation.

Margin Modes:

- Isolated Margin: Limits risk to the margin allocated for that specific position.

- Cross Margin: Utilizes the full account balance to maintain positions, sharing margin across all open positions.

BitMart’s Futures Features. Image via BitMart

BitMart’s Futures Features. Image via BitMartBitMart offers an excellent selection of guides to help you get started with futures trading, which you can explore here.

Risk Management and Liquidation

Trading with leverage amplifies both potential gains and losses. BitMart employs a liquidation mechanism to protect traders and the platform:

- Liquidation: Occurs when a trader's margin balance falls below the maintenance margin, leading to the automatic closure of positions to prevent further losses.

- Forced Liquidation Process: If liquidation is triggered, the system will cancel all untraded orders of the perpetual swap to release margin and maintain the position. BitMart applies a partially forced liquidation mechanism, which automatically tries to reduce the maintenance margin requirements to avoid complete liquidation of all positions.

❗IMPORTANT❗ Leverage trading involves significant risks and should only be undertaken by experienced traders who understand the complexities and potential pitfalls associated with leveraging positions.=

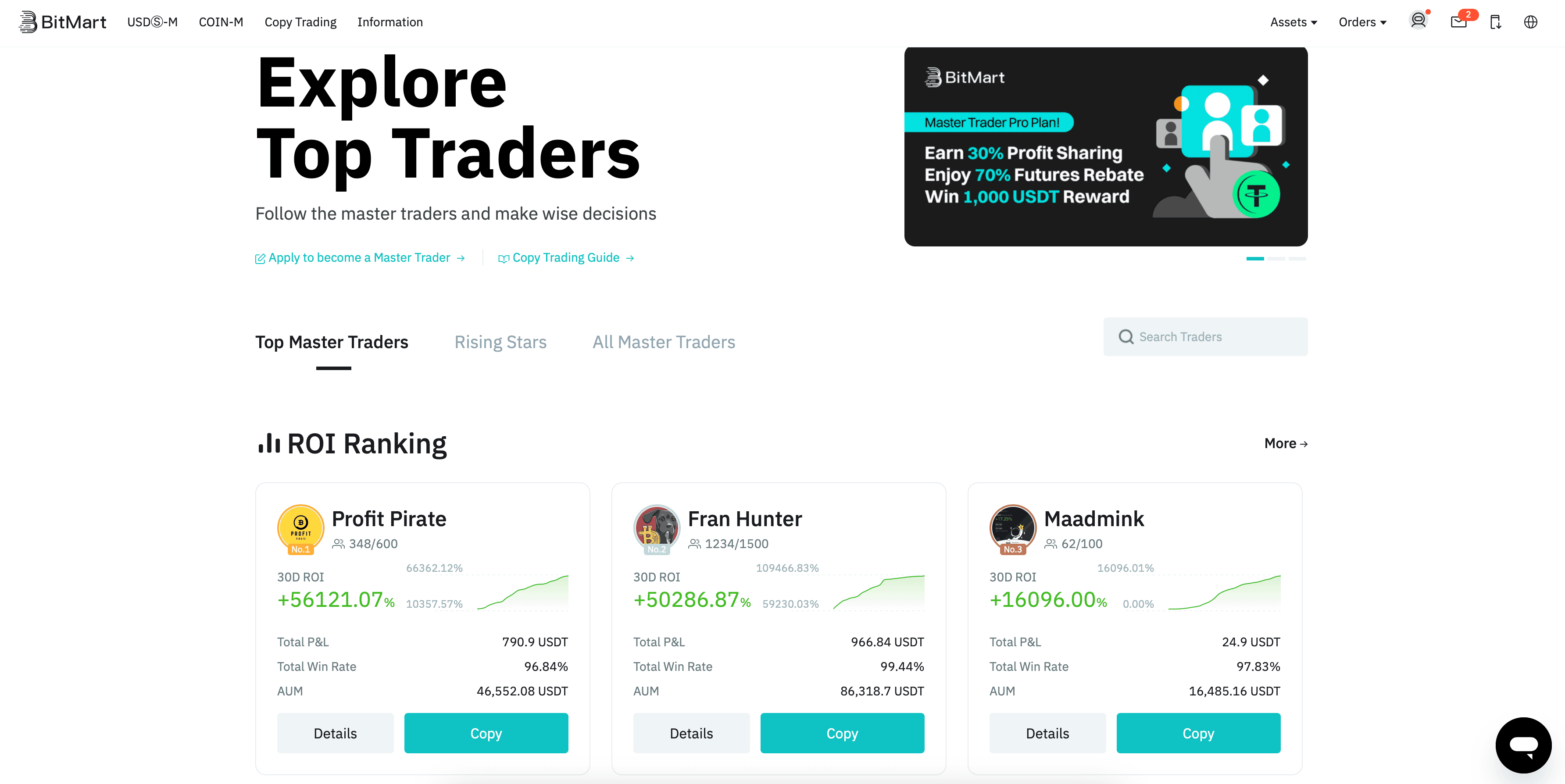

BitMart Copy Trading

BitMart's Copy Trading feature enables users to replicate the trading strategies of experienced traders, known as Master Traders, in real-time. This is particularly beneficial for novice traders seeking to learn from seasoned professionals and potentially profit without the need for in-depth market analysis.

BitMart Copy Trading. Image via BitMart

BitMart Copy Trading. Image via BitMartMaster Traders

Master Traders are professionals who craft and execute trading strategies based on their market expertise. By sharing their trades on the platform, they enable followers to automatically replicate their positions. To become a Master Trader on BitMart, individuals must submit an application and go through a review process. Upon approval, they can configure parameters for copy trading and start placing orders that followers can mirror.

Followers

Followers, or Copiers, are users who choose to mirror the trades of Master Traders. They can select Master Traders based on performance metrics and align their investment strategies accordingly. For those interested in following a Master Trader, BitMart provides a range of margin modes, catering to different risk appetites and trading preferences:

- Fixed Margin: Followers set a specific amount for each copied trade, independent of the Master Trader's margin.

- Fixed Multiplier: Followers apply a multiplier to the Master Trader's margin, allowing proportional scaling of trade sizes.

- Asset Ratio: Followers set a multiplier based on the ratio of their assets to the Master Trader's equity, facilitating proportional investment relative to account sizes.

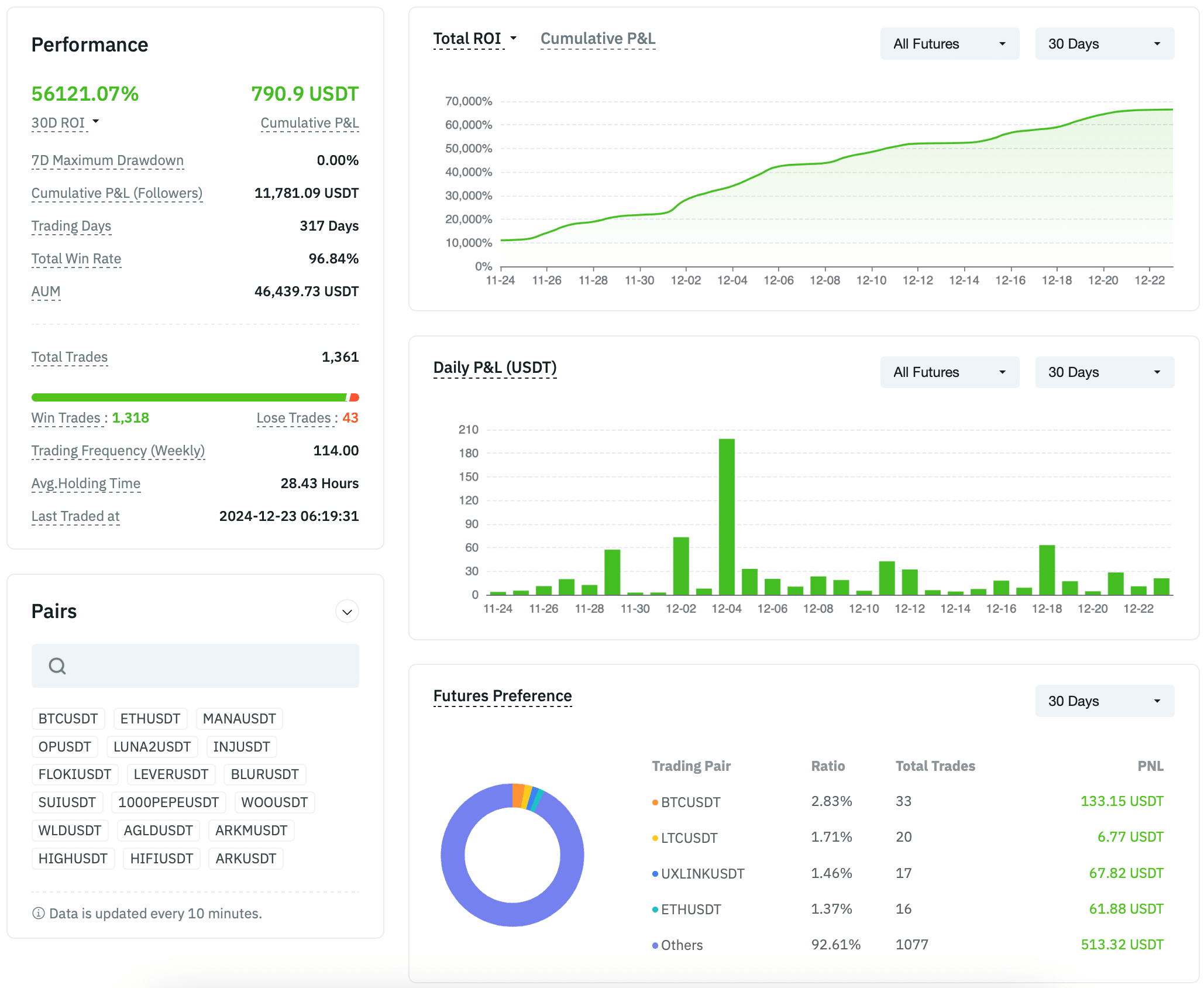

Metrics Displaying Master Trader Performance. Image via BitMart

Metrics Displaying Master Trader Performance. Image via BitMartIt’s important to note that even professional traders can incur losses, and these losses are directly reflected in the accounts of their Copiers. While Copy Trading simplifies the trading process, Copiers should carefully assess the risks involved and select Pro Traders whose strategies align with their own risk tolerance and investment goals.

BitMart Earn

BitMart Earn offers users the opportunity to grow their cryptocurrency holdings through a variety of savings products, including Flexible Savings, Fixed Savings, Staking, and Dual-Investment. These products are designed to accommodate different investment preferences, providing both flexibility and higher-yield options for users.

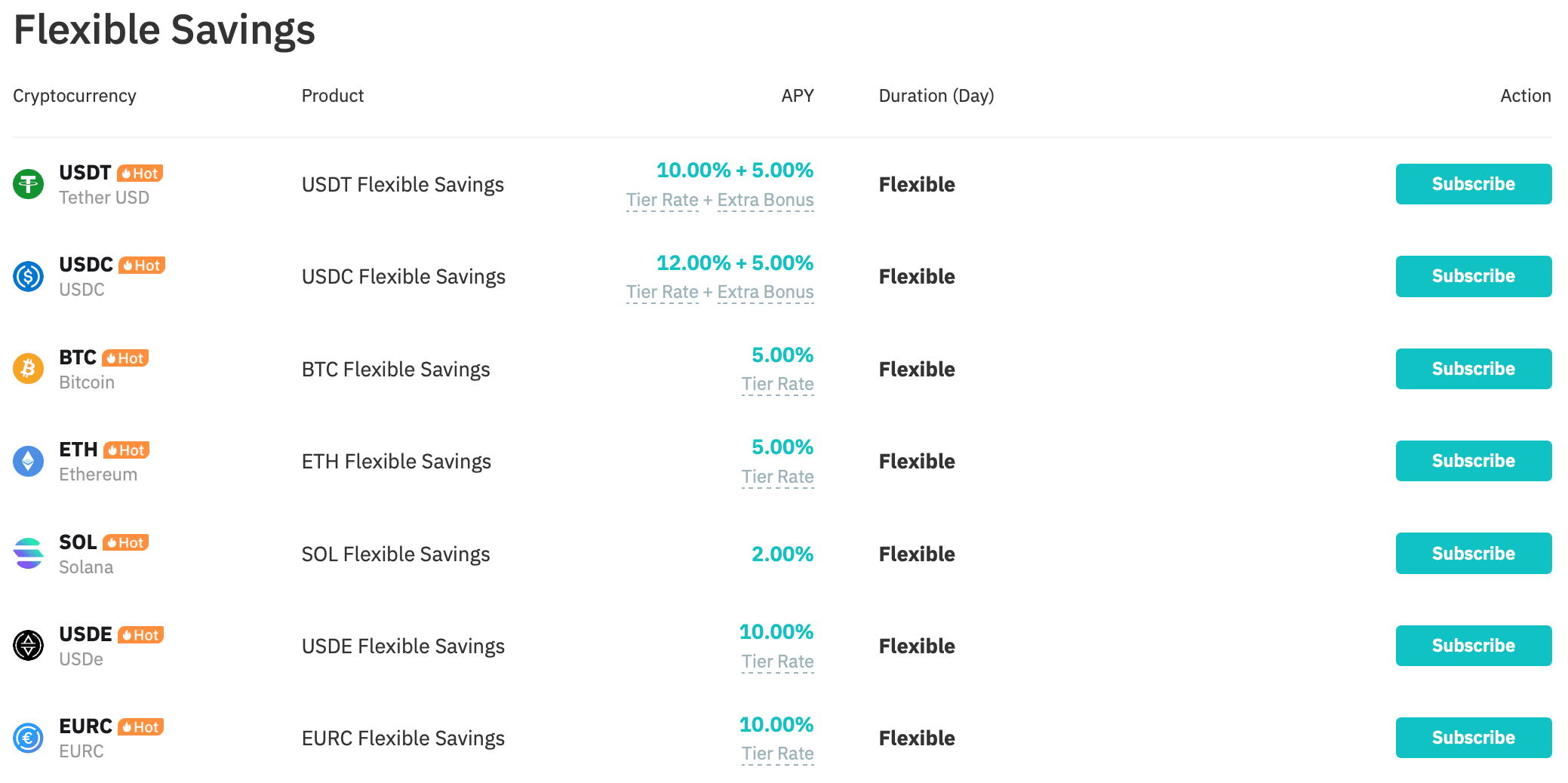

Flexible Savings

Flexible Savings allows users to earn daily interest while maintaining access to their funds at any time. This product is ideal for those who prioritize liquidity and simplicity.

Key Features of Flexible Savings:

- High Liquidity: Funds can be withdrawn at any time without penalties.

- Daily Interest: Yields are calculated daily, ensuring consistent earnings.

- Multiple Cryptocurrencies: Supports a wide range of assets.

Flexible Savings is particularly suitable for new investors seeking a straightforward way to earn passive income while keeping their funds accessible.

Yields Available in Flexible Savings. Image via BitMart

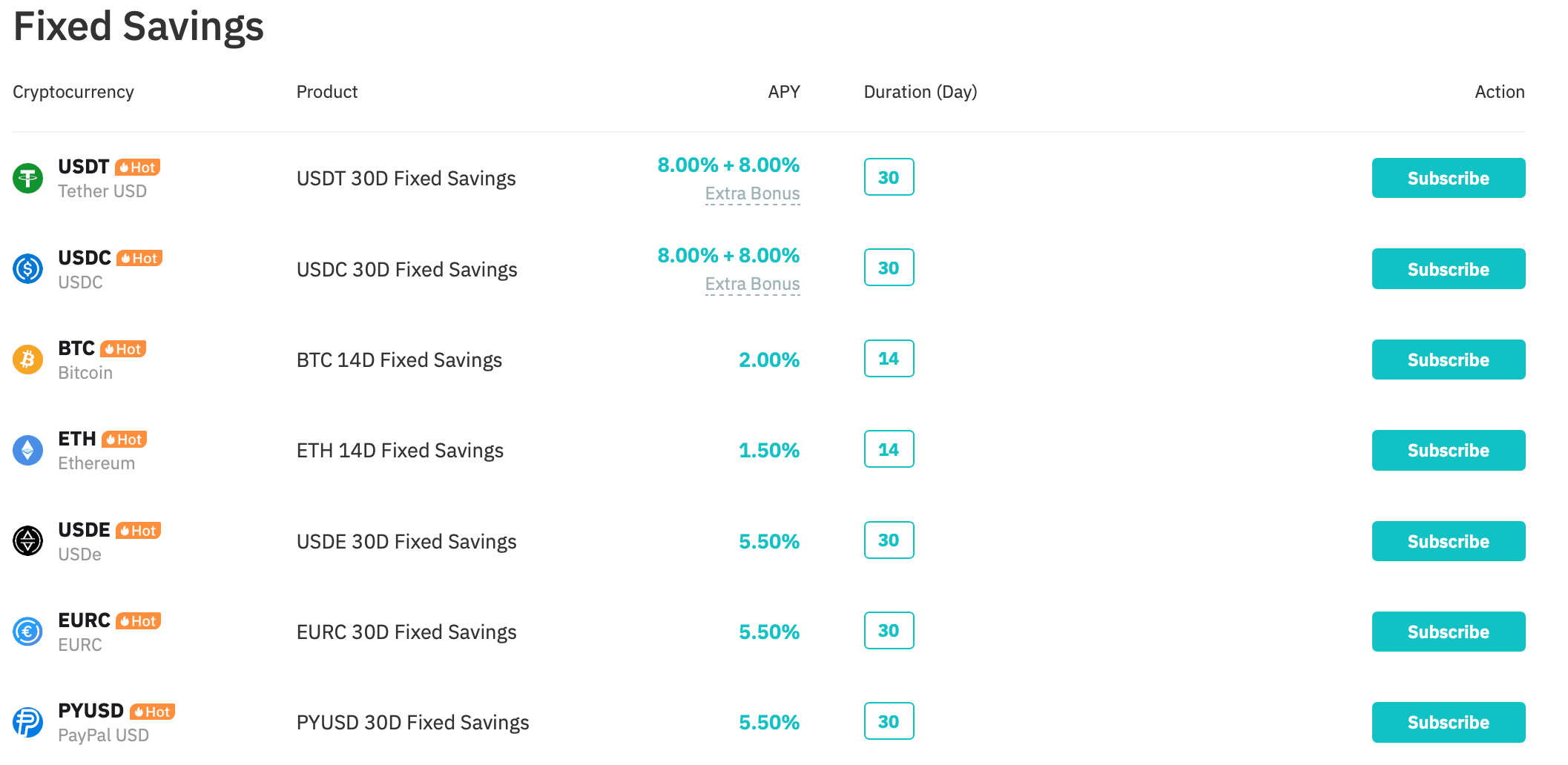

Yields Available in Flexible Savings. Image via BitMartFixed Savings

For those willing to lock their funds for a set period, Fixed Savings offers higher returns compared to Flexible Savings. This product is designed for users with a longer-term investment perspective.

Key Features of Fixed Savings:

- Higher Interest Rates: Rewards are typically higher than Flexible Savings.

- Flexible Terms: Users can choose lock-up periods, such as 3 days, 14 days, or 30 days.

Upon completion of the lock-up period, users can withdraw both the principal and earned interest.

Yields Available in Fixed Savings. Image via BitMart

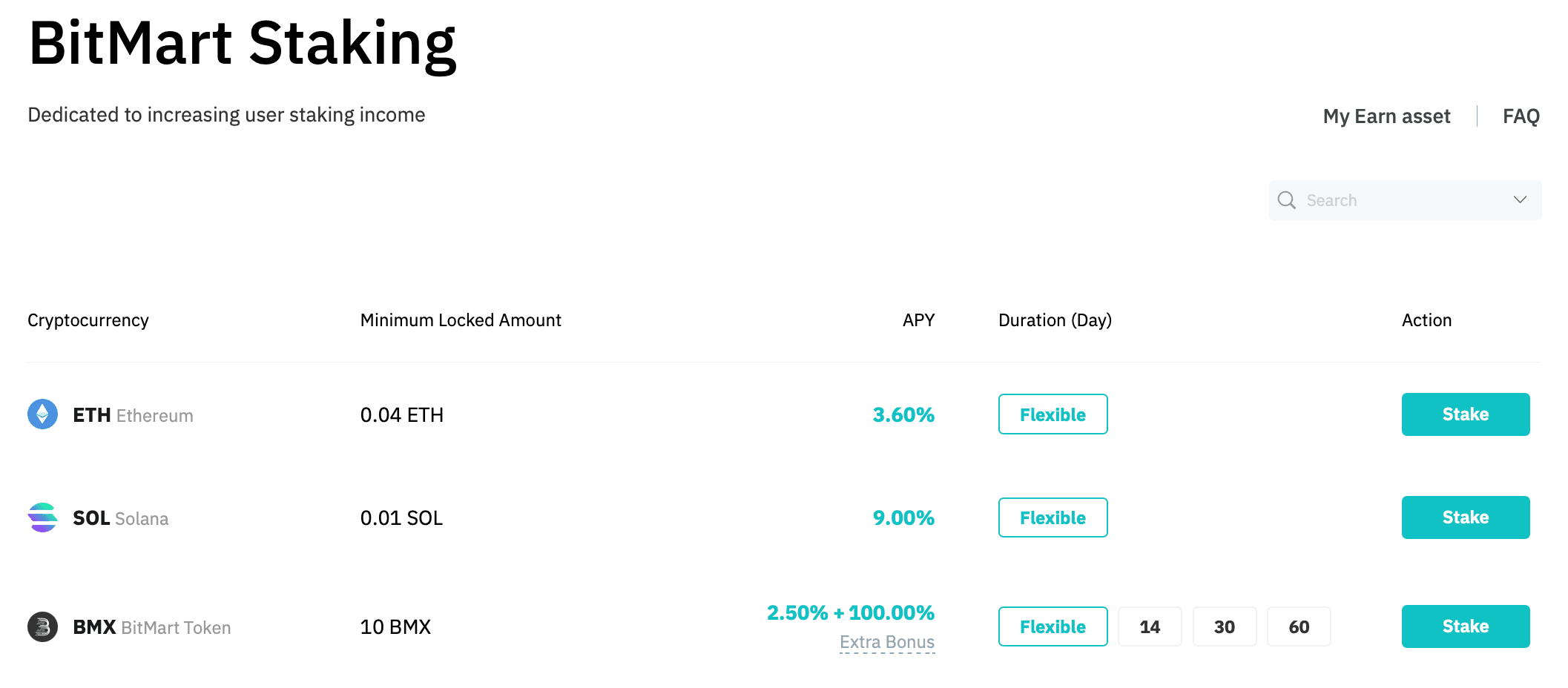

Yields Available in Fixed Savings. Image via BitMartStaking

Staking on BitMart provides users with a simple and efficient way to earn rewards while contributing to the security and operation of blockchain networks. Unlike traditional staking, BitMart eliminates many of the common barriers, making it an accessible option for all users.

Key Features of Staking on BitMart:

- Zero Barriers: Users can participate in staking without worrying about setting up nodes, meeting minimum staking requirements, or locking funds for fixed time periods.

- Competitive Yields: Offers competitive yields, particularly for newer blockchain projects.

BitMart Staking Yields. Image via BitMart

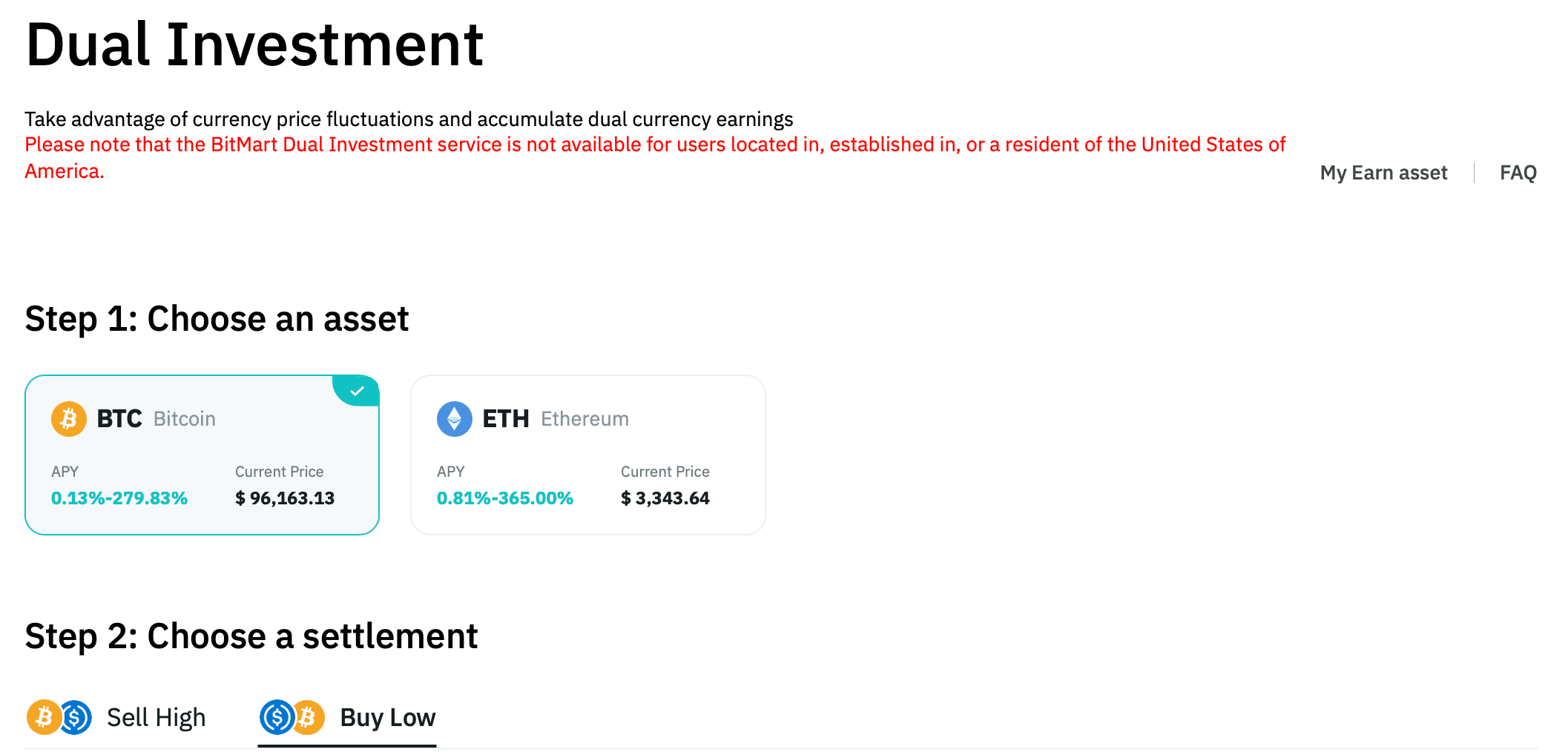

BitMart Staking Yields. Image via BitMartDual-Investment

Dual-Investment allows users to earn returns in one of two selected cryptocurrencies based on predefined market conditions. This product is suited for experienced investors comfortable with higher risk.

Key Features of Dual-Investment:

- Customizable Options: Users can select cryptocurrencies that align with their market expectations.

- Potential for High Yields: Significant returns are possible when market conditions match predefined thresholds.

Dual-Investment Yields on BitMart. Image via BitMart

Dual-Investment Yields on BitMart. Image via BitMartNFTs on BitMart

BitMart offers a NFT Marketplace and a Initial NFT Offering (INO) platform, catering to creators, collectors, and investors in the NFT space.

BitMart NFT Marketplace

Launched in June 2022, the BitMart NFT Marketplace acts as a centralized hub for users to buy and trade NFTs. The platform currently supports ERC-721 tokens, the widely-used standard for non-fungible tokens on the Ethereum blockchain.

BitMart NFT Marketplace. Image via BitMart

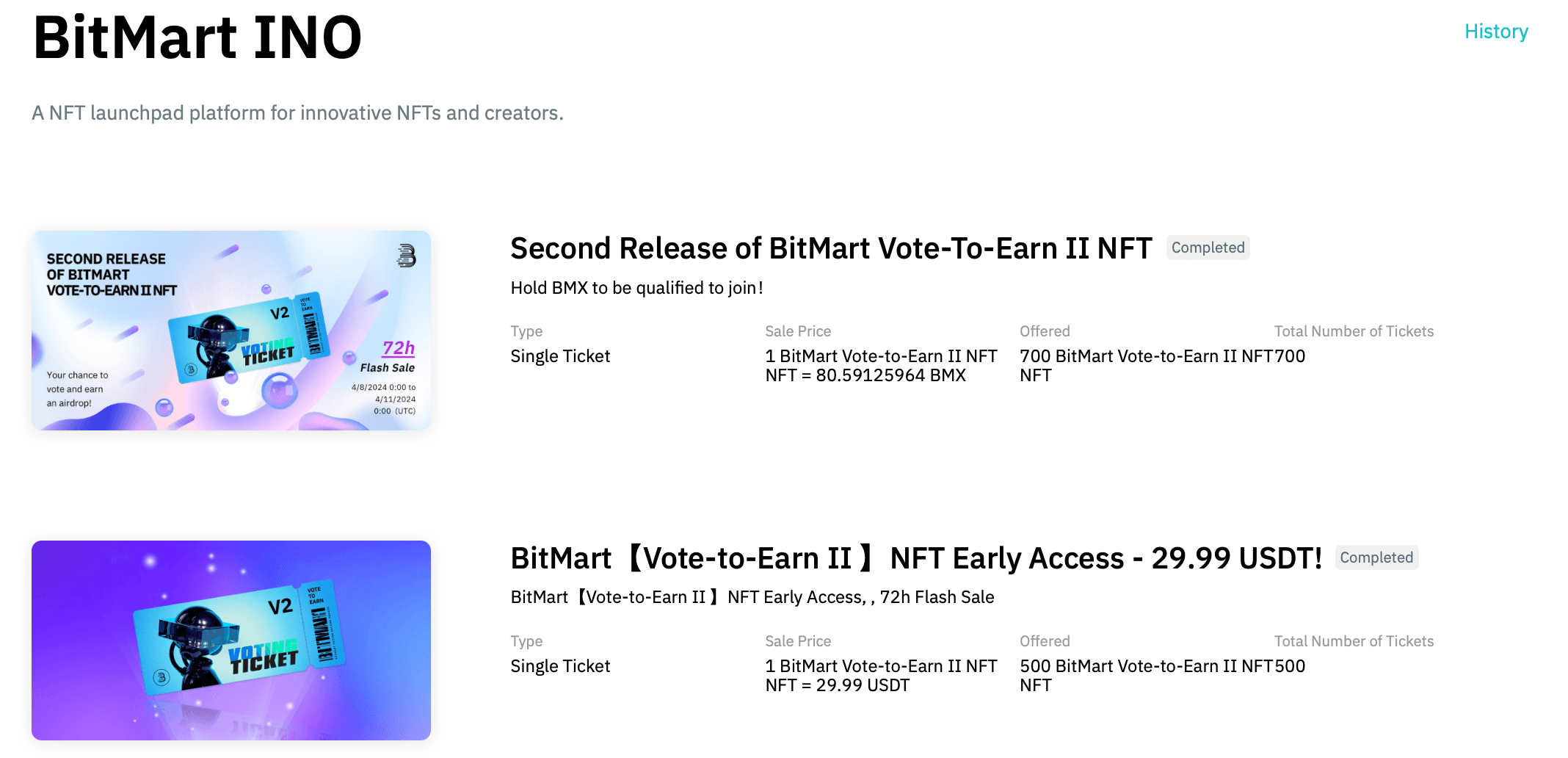

BitMart NFT Marketplace. Image via BitMartInitial NFT Offering (INO) Platform

BitMart’s INO platform allows artists and projects to launch new NFT collections through launch events. These offerings frequently include limited-time flash sales, making them an potentially rewarding opportunity for early access to NFT projects.

BitMart INO Platform. Image via BitMart

BitMart INO Platform. Image via BitMartBitMart Fees

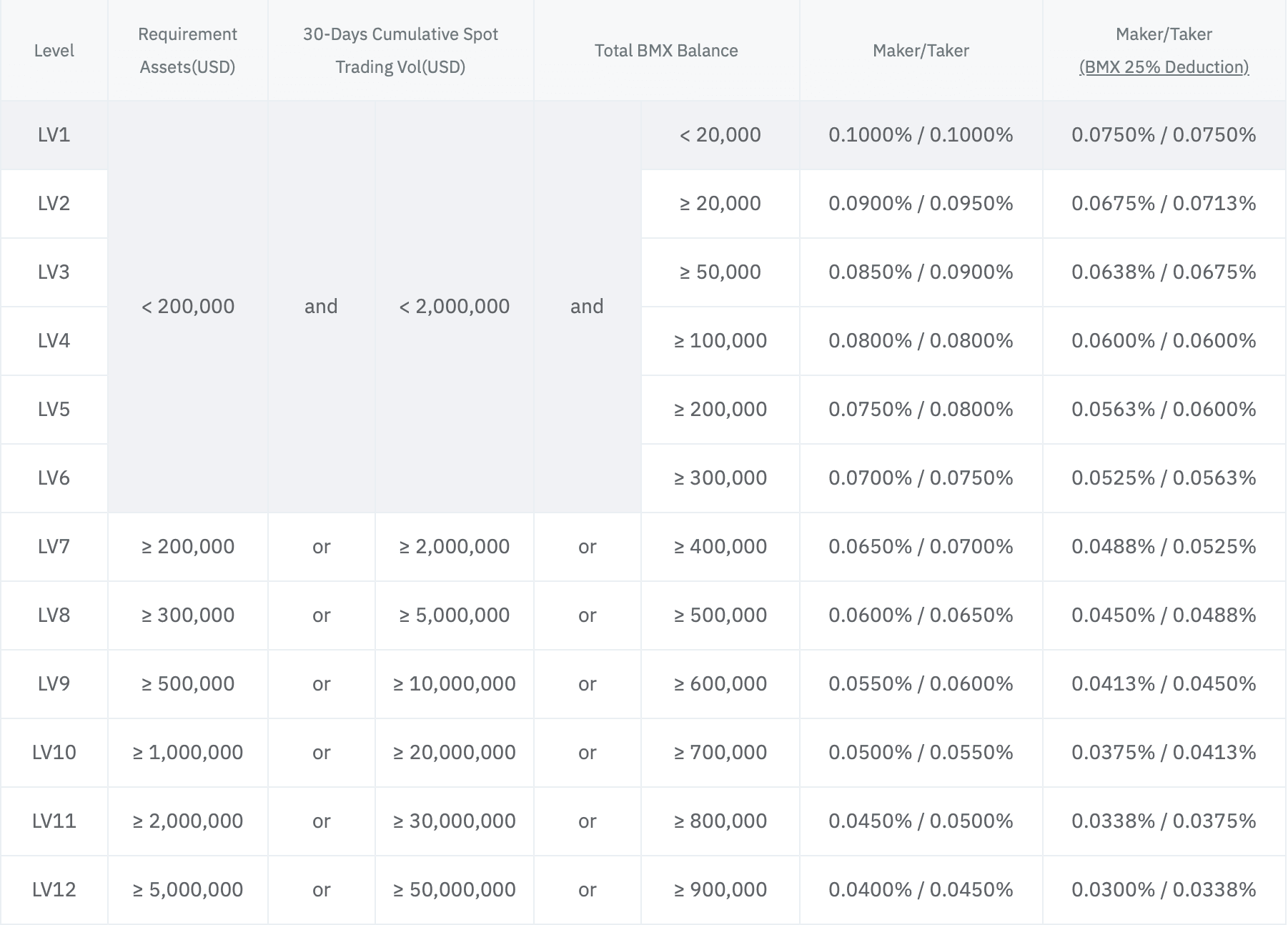

BitMart has both tiered fee structures and flat fee structures tailored for different asset types and trading options. The tiered structure provides lower trading fees based on a user’s asset balance or 30-day trading volume, rewarding loyal and high-volume traders. Meanwhile, the flat fee structure offers a straightforward and consistent rate for certain asset classes and trading activities.

Spot Trading Fees

BitMart divides assets into four classes—A, B, C, and D—based on their popularity and trading volume. Established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) fall into A class, while smaller altcoins are categorized into the lower classes. This classification determines the base trading fees.

In addition to this categorization, BitMart also implements a tiered fee structure, where fees depend not only on the asset’s class but also on the user’s 30-day trading volume or asset balance. It’s important to note that this fee system applies only to spot trading fees.

BitMart’s maker and taker fees for spot trading range from 0.1% to 0.6%, depending on the asset class. Below is a breakdown of fees across the different asset classes:

Fees Across Asset Classes. Image via BitMart

Fees Across Asset Classes. Image via BitMartHere’s a closer look at the tiered fee structure for A-class assets:

Fee Structure for A-Class Assets. Image via BitMart

Fee Structure for A-Class Assets. Image via BitMartFor detailed fee tiers for the other classes (B, C, and D), visit BitMart’s official fees page.

Futures Trading Fees

Futures trading fees on BitMart are significantly more straightforward than spot trading fees. The maker fee is set at 0.02%, while the taker fee is slightly higher at 0.06%.

Note that users can get a 25% discount on fees by paying with BitMart’s BMX exchange token.

Deposit and Withdrawal Fees

- Deposits: BitMart does not charge any fees for cryptocurrency deposits.

- Withdrawals: Fees for withdrawals are dynamically adjusted based on network conditions, including factors such as congestion and transaction size.

NFT Fees

- 1% Trading Fee: A flat 1% fee is applied to all transactions.

- Royalty Fees: Original creators receive a percentage of the sale price each time their NFT is resold, ensuring ongoing compensation for their work.

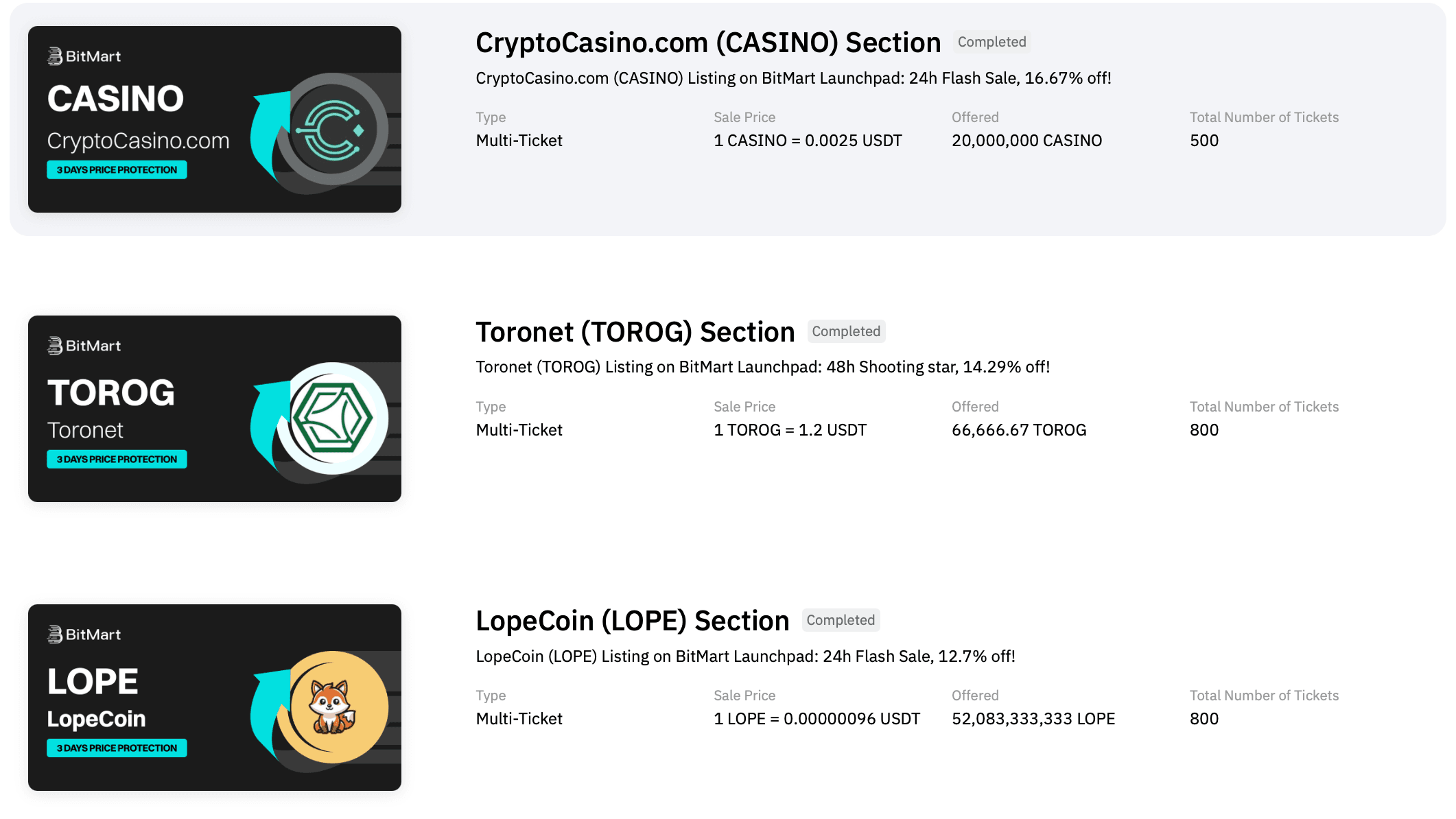

BitMart Launchpad

The BitMart Launchpad offers two distinct features—Shooting Star and Flash Sale—providing users with exclusive opportunities to acquire tokens at discounted prices.

Shooting Star

Launched in June 2020, the Shooting Star platform enables users to participate in limited-time token sales for newly listed projects on the BitMart platform. These events, typically lasting 24 hours, often feature discounted prices and may include price protection to mitigate market volatility after listing.

Key Features:

- Limited-Time Sales: Tokens are available for purchase during a specified time window, usually 24 hours.

- Discounted Prices: Tokens are offered at prices below the anticipated market rate.

- Price Protection: Certain events include a price protection period (e.g., 72 hours post-listing), allowing buyers to claim refunds if the token’s market price drops below the purchase price.

A Look at Some of the Token Sales on Shooting Star. Image via BitMart

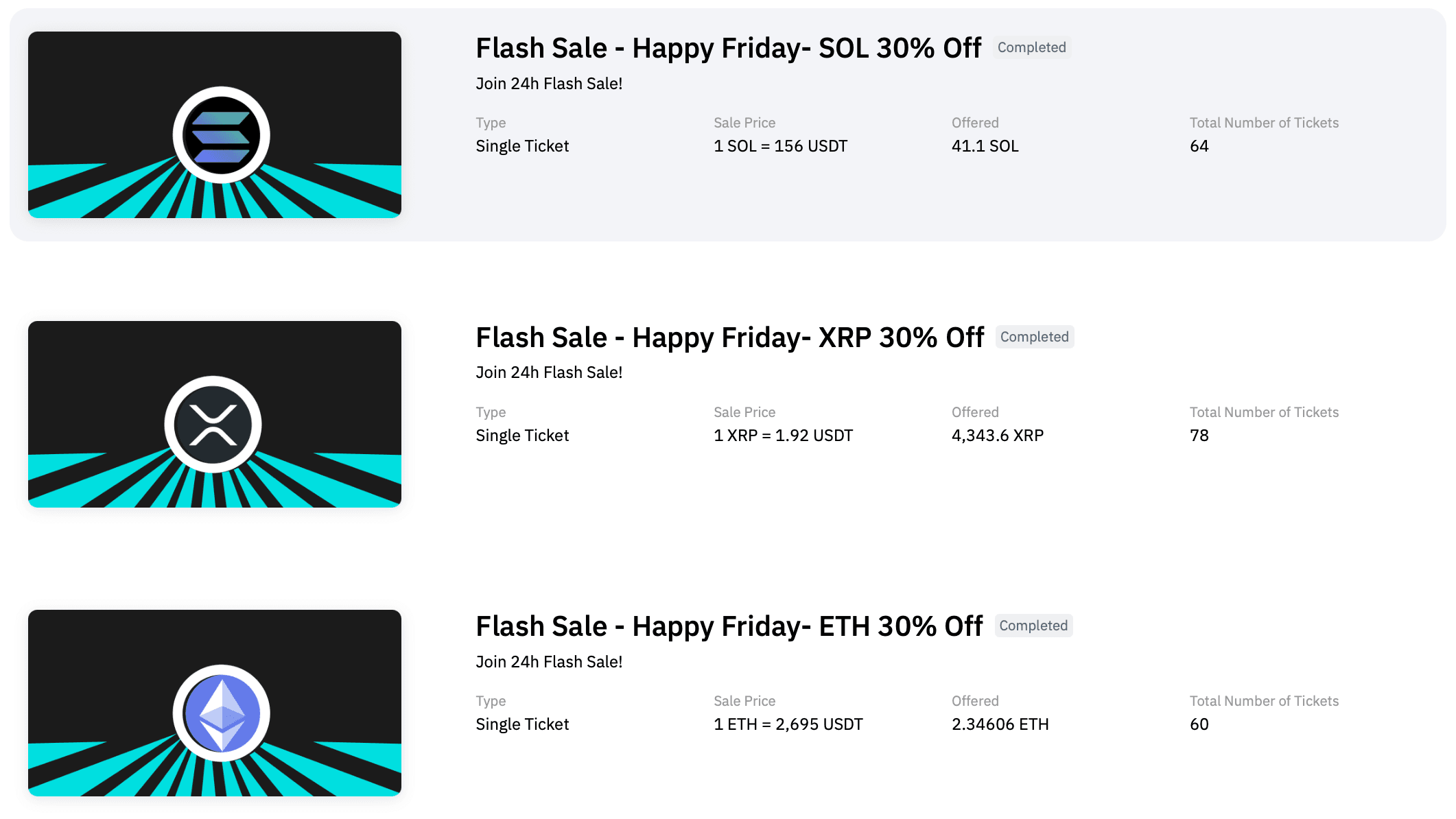

A Look at Some of the Token Sales on Shooting Star. Image via BitMartFlash Sale

The Flash Sale platform provides users with the chance to purchase popular cryptocurrencies at prices below the current market rate during short promotional events. Unlike Shooting Star, Flash Sales focus on immediate value without extended price protection periods.

Key Features:

- Discounted Tokens: Participants can acquire cryptocurrencies at reduced prices compared to the prevailing market rate.

- No Price Protection: Flash Sales typically do not include price protection, focusing instead on providing upfront discounts.

Flash Sales Typically Feature Large-Cap Cryptos. Image via BitMart

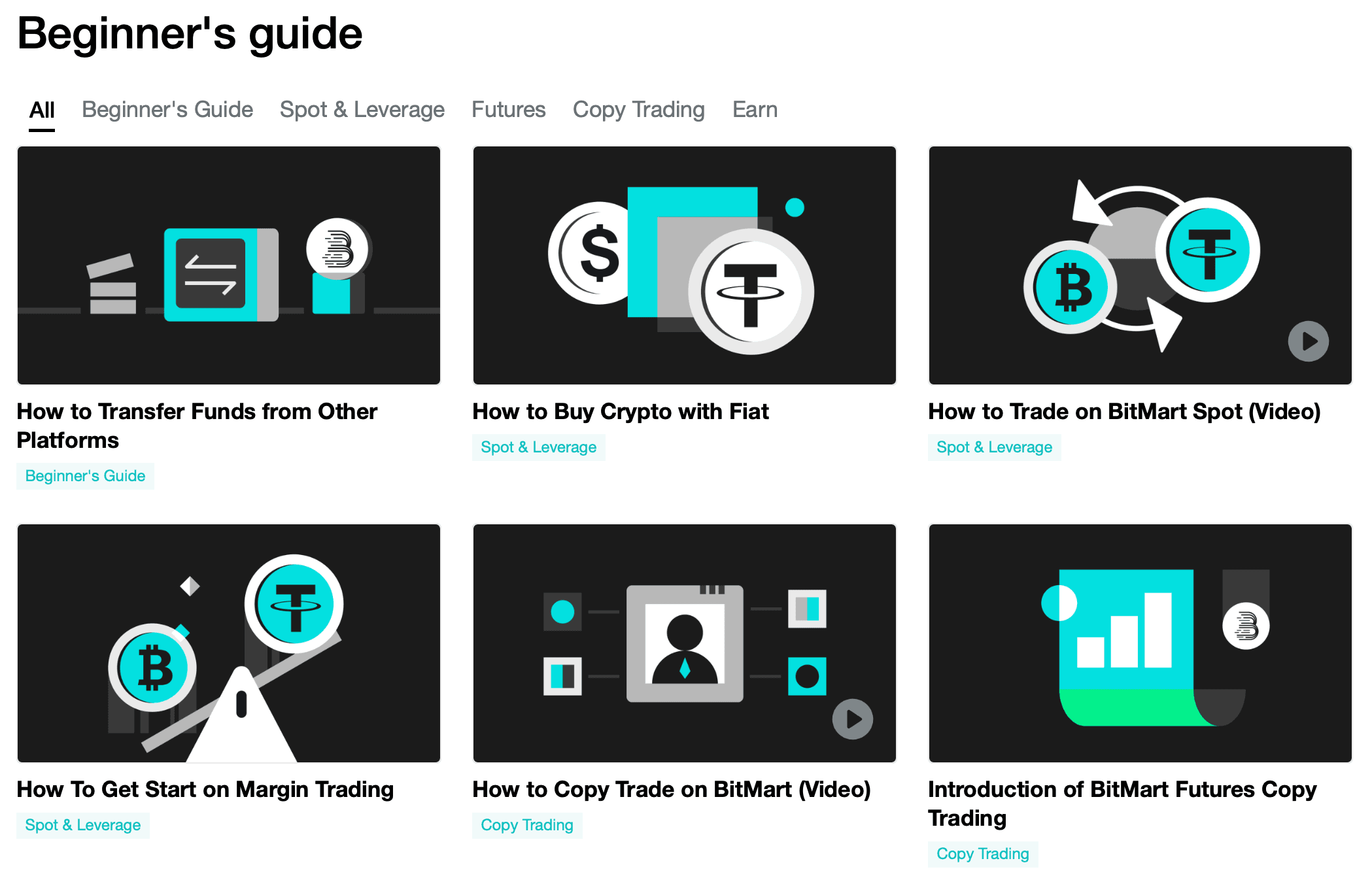

Flash Sales Typically Feature Large-Cap Cryptos. Image via BitMartBitMart Academy

BitMart stands out by offering a very comprehensive academy section, with a selection of educational resources on cryptocurrency and blockchain technology. From beginner-friendly guides to help users navigate the platform to in-depth explanations of advanced blockchain concepts, the Academy is designed to cater to users of all experience levels. So if you're looking to enhance your crypto knowledge or need assistance with platform features, BitMart Academy has you covered.

A Look at BitMart Academy. Image via BitMart

A Look at BitMart Academy. Image via BitMartIn addition, BitMart provides monthly market overviews for its VIP users, offering insights that span from macro trends to developments in the crypto space. To learn more about BitMart’s VIP program, you can check the details here.

BitMart Affiliate & Referral Program

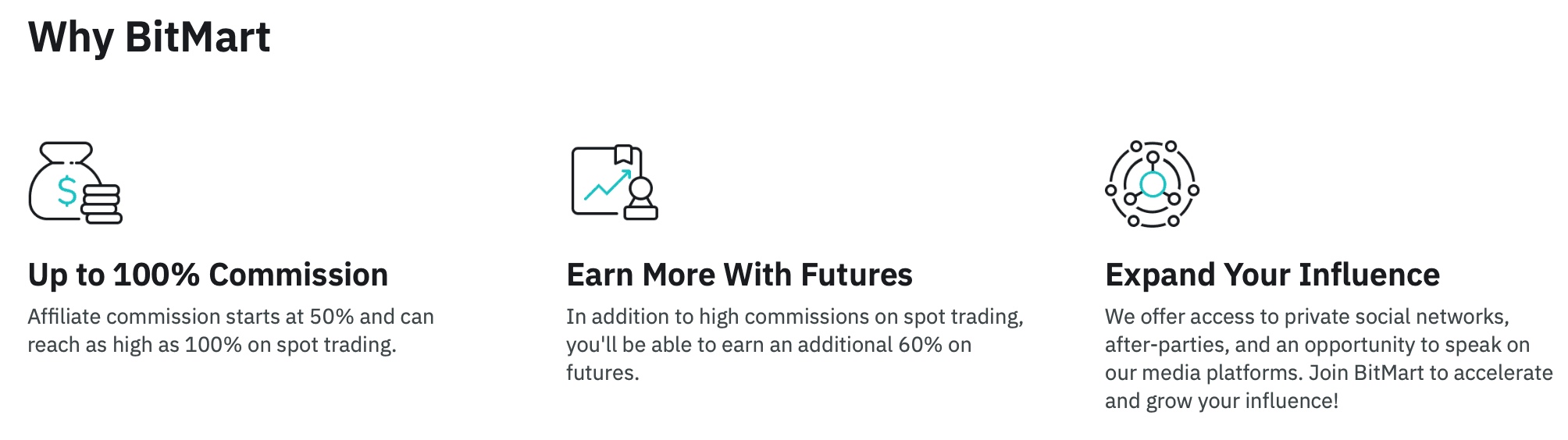

BitMart Affiliate Program

The Affiliate Program is aimed at influencers, businesses, and content creators with an extensive following. This program offers earning opportunities through high commission rates and additional perks that go beyond financial rewards.

Key Features:

- High Commission Rates: Affiliates can earn up to 100% of spot trading fees and 60% on futures trading fees, making it one of the most competitive programs in the market.

- Real-Time Insights: Affiliates gain access to a dedicated analytics dashboard, allowing them to track their performance and optimize their campaigns.

- Exclusive Perks: Affiliates benefit from private networking opportunities and event invitations.

BitMart Affiliate Program Features. Image via BitMart

BitMart Affiliate Program Features. Image via BitMartCommission Tiers:

BitMart offers three exclusive affiliate tiers based on performance:

- Inspiration Club:

- Earn 40% direct commission and 10% sub-commission on spot trading.

- Up to 60% commission on futures trading.

- Suitable for smaller influencers with a modest reach.

- Earn 40% direct commission and 10% sub-commission on spot trading.

- Impact Club:

- Earn 70% direct commission for the first 6 months, with 10% sub-commission, reducing to 60% direct commission thereafter.

- Up to 60% commission on futures trading.

- Requires larger followings or significant referral activity.

- Earn 70% direct commission for the first 6 months, with 10% sub-commission, reducing to 60% direct commission thereafter.

- Influence Club:

- Earn 100% direct commission for the first 6 months and 15% sub-commission, followed by 60% direct commission after the introductory period.

- Exclusively for hand-selected top-tier affiliates.

- Earn 100% direct commission for the first 6 months and 15% sub-commission, followed by 60% direct commission after the introductory period.

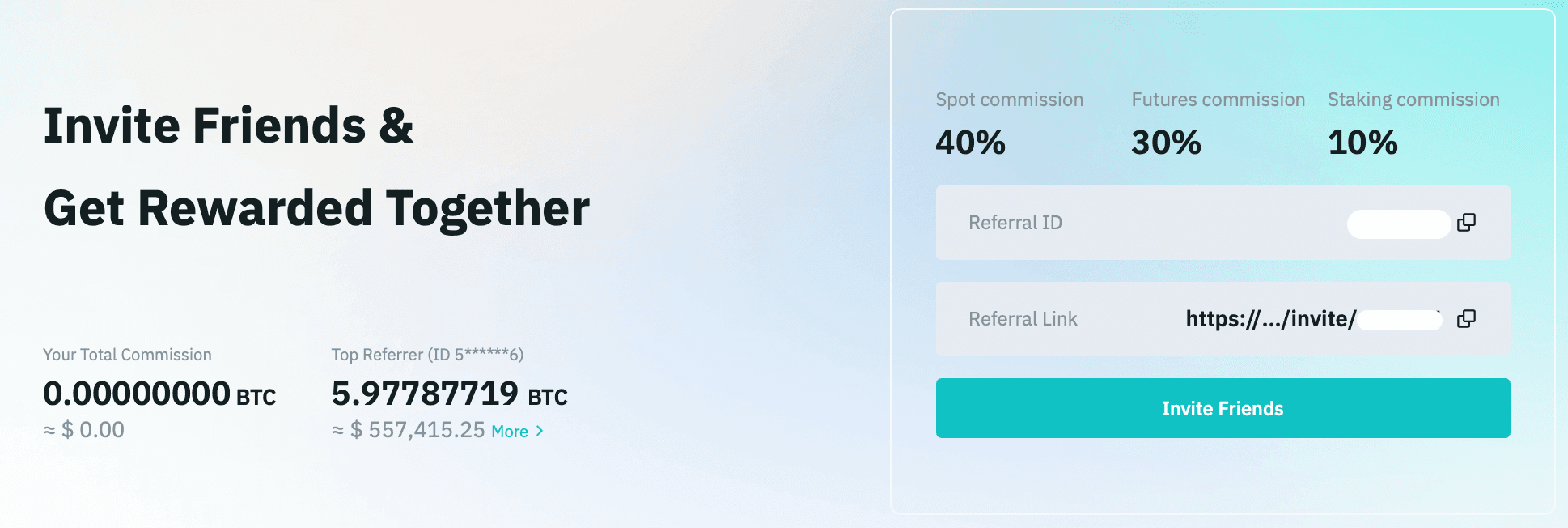

BitMart Referral Program

For individual users, the Referral Program offers a simple and accessible way to earn commissions by inviting friends to trade on BitMart. It’s a great option for anyone looking to monetize their network without the need for a large audience.

Key Features:

- Two-Tier Commissions: Earn 30% of trading fees from direct referrals and 10% from secondary referrals.

- Long-Term Earnings: Spot trading referrals provide commission for up to one year, while futures trading referrals earn commissions indefinitely.

BitMart Referral Program. Image via BitMart

BitMart Referral Program. Image via BitMartClosing Thoughts

BitMart has been a prominent player in the cryptocurrency exchange space for quite some time, and it continues to stand out by offering a comprehensive range of features designed to cater to both novice and experienced traders. From its competitive fee structure to its diverse trading options and exclusive features such as a dedicated NFT marketplace, Launchpad, and Earn programs, BitMart provides a well-rounded trading platform.

That said, there is always room for improvement, and in BitMart’s case, it’s security. For instance, introducing a dedicated proof-of-reserves page allowing users to independently verify their holdings, a feature that has become increasingly important in the crypto industry. Additionally, implementing extra security measures on the user side like a withdrawal password could further bolster trust, especially in light of BitMart’s 2021 exploit.

Despite these areas for improvement, BitMart remains a solid exchange with most of the essential features users expect. Its combination of user-friendly design, diverse trading tools, and competitive offerings makes it a viable choice for a wide range of cryptocurrency traders and investors.

Disclaimer: This is a paid review, yet the opinions and viewpoints expressed by the writer are their own and were not influenced by the project team. The inclusion of this content on the Coin Bureau platform should not be interpreted as an endorsement or recommendation of the project or product being discussed. The Coin Bureau assumes no responsibility for any actions taken by readers based on the information provided within this article.