If you've even briefly followed the NFT ecosystem in recent years, you're likely familiar with the Blur NFT Marketplace. Known for catering to professional NFT traders, Blur has gained significant attention through its aggressive airdrops and incentive programs, which have become a staple in the NFT trading community.

The mastermind behind Blur is the enigmatic and anonymous figure known as Pacman. In November 2023, Pacman took a bold step forward by unveiling a new project, Blast, a Layer 2 chain on Ethereum which aims to tackle the high transaction costs and scalability issues that have plagued the NFT space. This endeavor attracted $20 million in funding from prominent venture capital firms like Paradigm, underscoring the market's confidence in Pacman's vision.

The Blast chain is not just another scaling solution; it introduces a unique incentive mechanism designed to attract liquidity and offers native yield on Ethereum (ETH) and stablecoins within the network. As the NFT ecosystem evolves, Blast positions itself by providing enhanced value propositions to NFT traders and broader blockchain users alike.

This Blast Network review will cover the features, benefits, and potential impact of the Blast network, exploring how it aims to reshape the landscape of Layer 2 solutions.

What is Blast Network?

Blast is an Ethereum-compatible Layer 2 network that utilizes optimistic rollup technology to enhance scalability, reduce transaction costs, and increase throughput. Optimistic rollups work by processing transactions off-chain while assuming that all transactions are valid unless challenged during a dispute period, which is why they are termed "optimistic." It allows faster and more cost-effective transactions than processing directly on the Ethereum mainnet.

Blast is an Ethereum-Compatible Layer 2 Network. Image via Blast Docs

Blast is an Ethereum-Compatible Layer 2 Network. Image via Blast DocsBlast distinguishes itself from other Layer 2 networks by offering native yield on assets bridged to its network, including Ethereum (ETH) and real-world assets (RWA) like yield-bearing stablecoins. Unlike other networks where users typically need to deposit their assets into specific yield-generating protocols, Blast automatically accrues yield for users who simply hold these assets on the network. This yield is sourced from ETH staking protocols and RWA lending protocols, enabling users to earn returns without additional steps.

One of the key features of the Blast network is its auto-rebasing yield mechanism. In simple terms, rebasing refers to the automatic adjustment of the token supply to maintain its value relative to a target, such as a certain price or yield rate. In the context of Blast, the yield on assets like ETH and stablecoins is auto-rebasing, meaning that the value of these assets is periodically adjusted to reflect the accrued yield. It allows users to see their holdings increase without needing to take any manual actions, making the process of earning and compounding yield seamless and efficient.

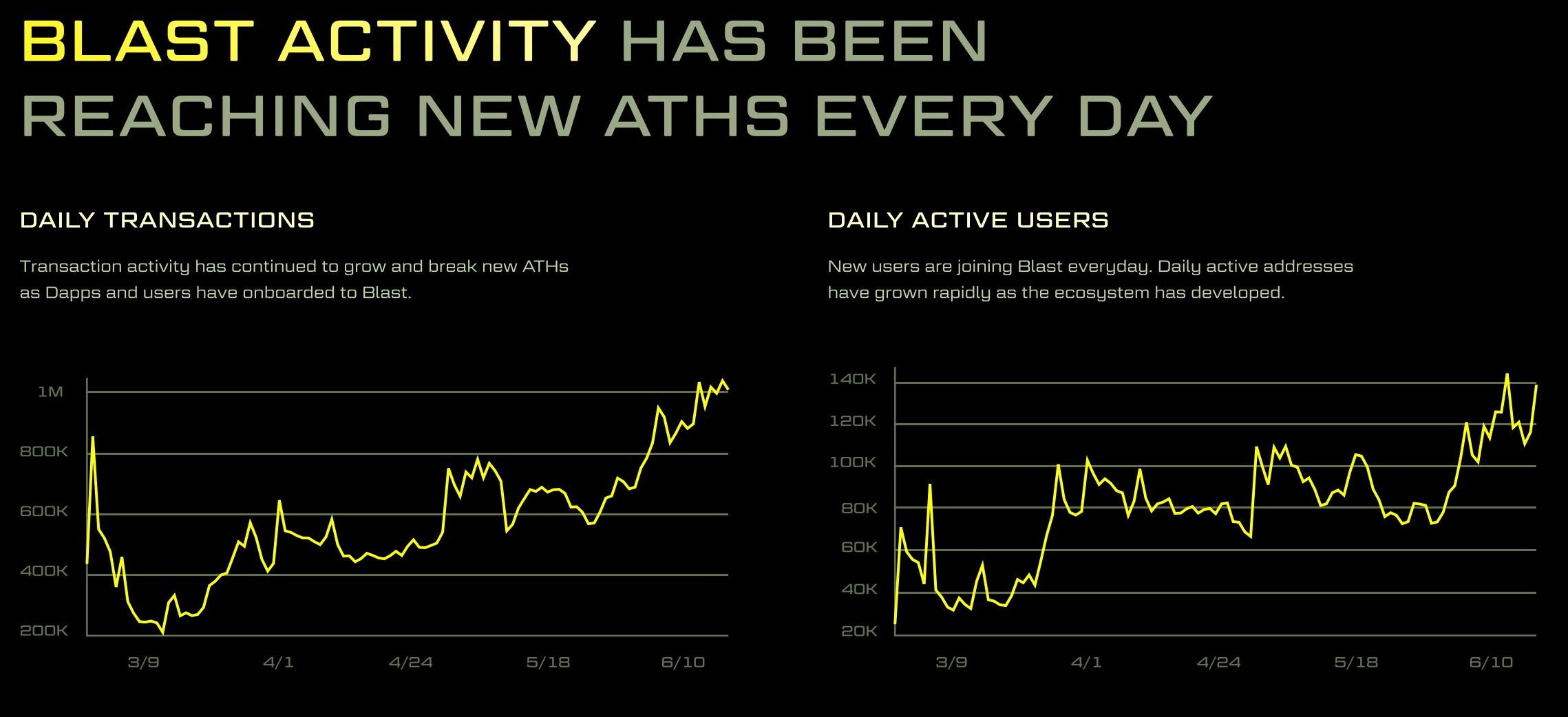

Blast On-Chain Activity Trends Upward | Image via Blast

Blast On-Chain Activity Trends Upward | Image via BlastTo participate, users bridge assets such as ETH, WETH, stETH, or stablecoins like DAI, USDT and USDC to the Blast network through the Blast bridge contract. Once bridged, these assets start accruing yield, which is credited directly to the users' accounts. This feature is particularly noteworthy because it simplifies earning yield on Layer 2 networks, making it more accessible to a broader range of users.

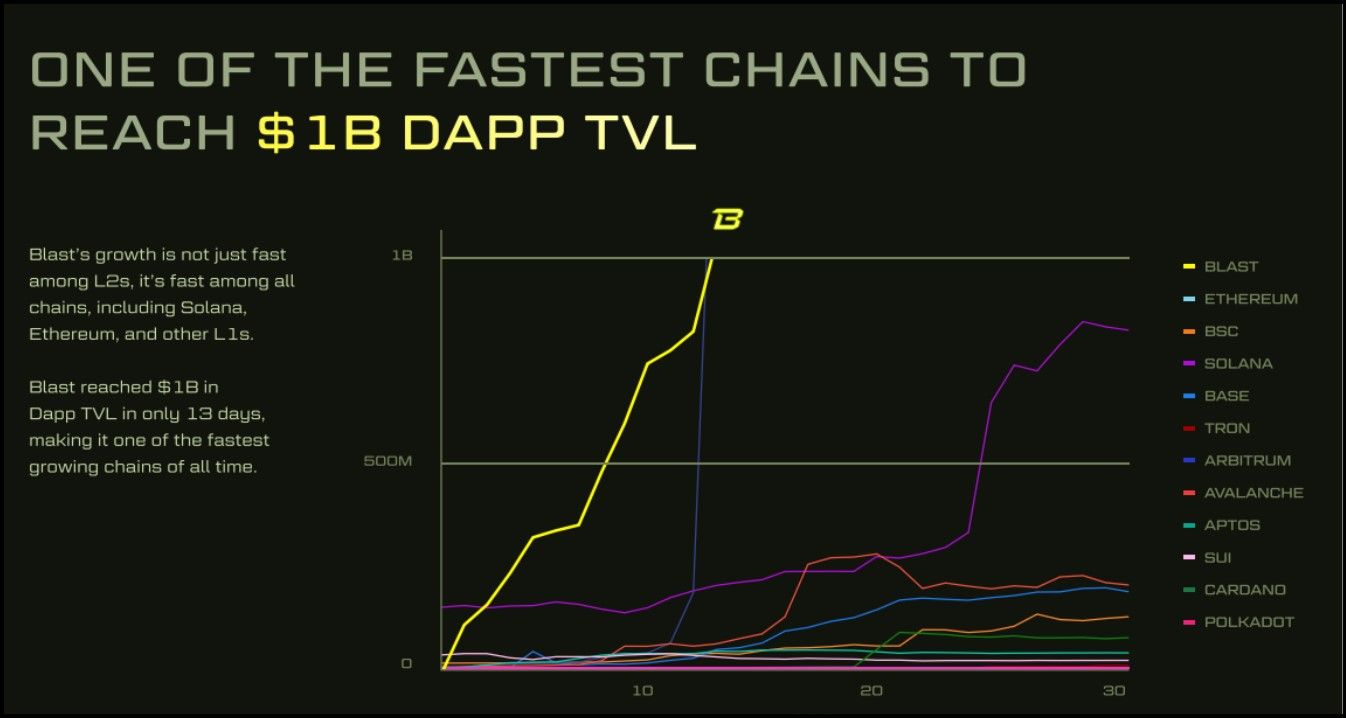

Blast is One the Fastest Growing Chains | Image via Messari

Blast is One the Fastest Growing Chains | Image via MessariBlast has rapidly gained traction in the Ethereum Layer 2 ecosystem, securing its place as one of the fastest-growing total value-locked networks (TVL). It ranks 12th among the largest Layer 2 networks, according to CoinGecko, reflecting its significant impact and adoption within the DeFi and NFT communities.

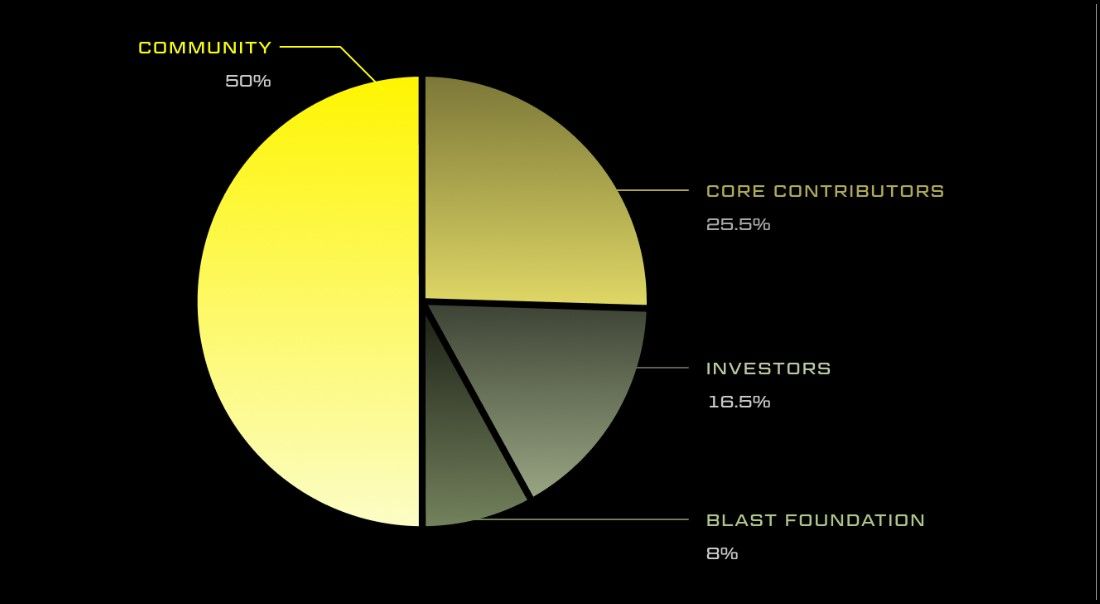

BLAST Tokenomics

The BLAST token is an ERC-20 token that plays a central role in the Blast Layer 2 ecosystem. With a total supply of 100 billion tokens, BLAST is designed to foster a robust and engaged community while supporting the network's ongoing development. The tokenomics of BLAST reflect a strong emphasis on community involvement, with 50% of the total supply allocated to community initiatives. This allocation will be distributed through various incentive campaigns over three years, ensuring that the community continues to play a pivotal role in the ecosystem's growth.

BLAST Tokenomics | Image via Blast

BLAST Tokenomics | Image via BlastThe ethos behind the BLAST token is rooted in creating a user-driven network where contributions from users and developers are recognized and rewarded. By reserving a significant portion of the token supply for community distribution, Blast aims to build a network where users are not just participants but active stakeholders. The remaining token allocations include:

- 25.5% for core contributors

- 16.5% for investors

- 8% reserved for the Blast Foundation.

These allocations are subject to lock-up periods and vesting schedules designed to ensure long-term commitment and stability within the network.

Where to Buy BLAST?

You can buy BLAST via, among others:

Also, check out our top picks for the best crypto exchanges.

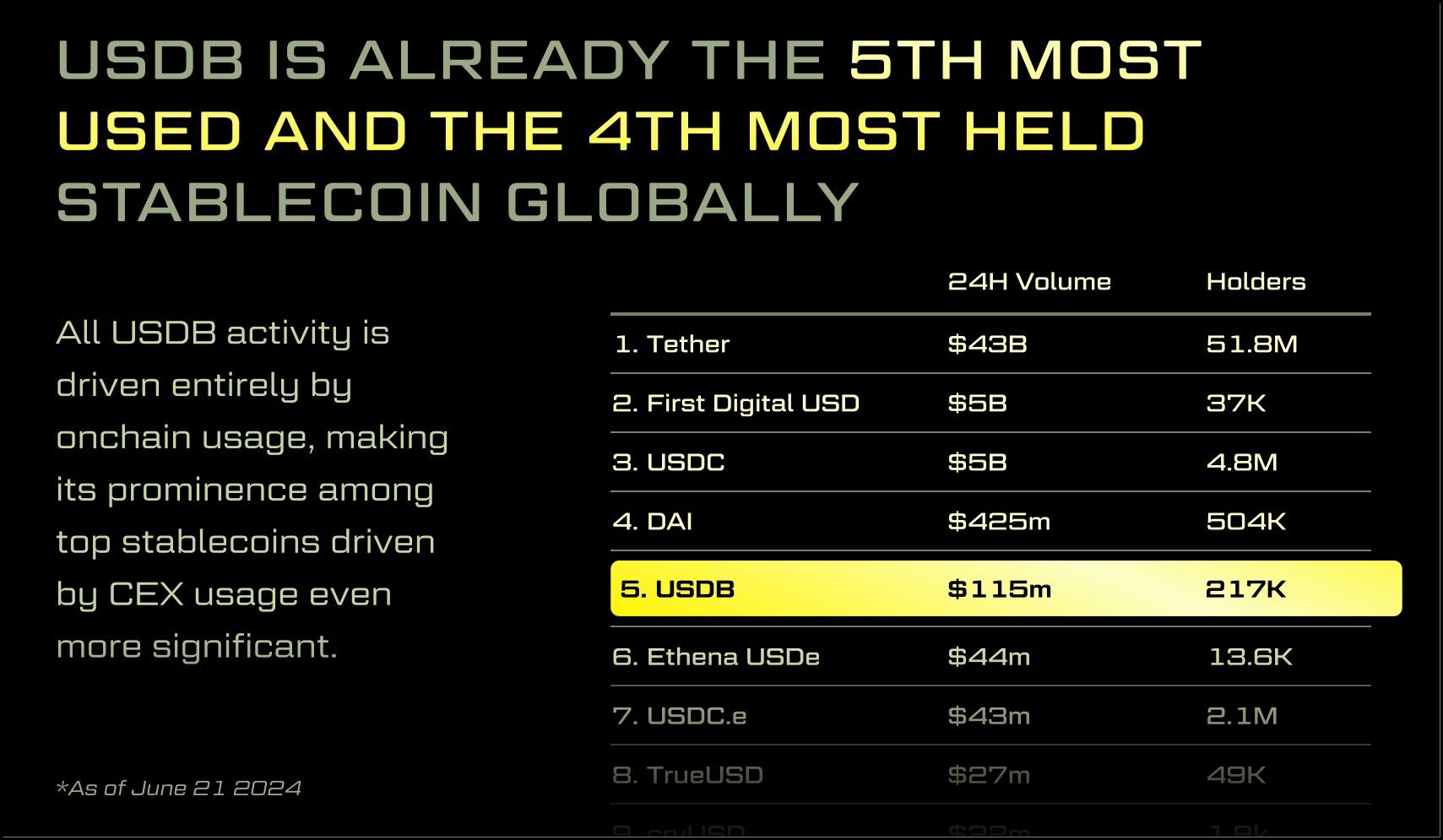

USDB: Blast's Auto-Rebasing Stablecoin

USDB is the native stablecoin of the Blast Layer 2 network, designed to provide users with a yield-bearing asset that maintains stability while earning returns. One of the standout features of USDB is its auto-rebasing mechanism, which automatically adjusts the token’s value to reflect the yield earned over time.

USDB is Accruing Significant Value | Image via Blast

USDB is Accruing Significant Value | Image via BlastYield Generation: USDB earns yield by integrating MakerDAO's on-chain T-Bill protocol. This integration allows holders of USDB to passively accumulate returns, making it an attractive option for those looking to earn a yield on their stablecoin holdings without needing active management.

Bridging and Availability: USDB can be obtained by bridging stablecoins like DAI, USDC, or USDT from the Ethereum mainnet to the Blast network. On the Blast testnet, users can bridge mock USD from Sepolia to acquire USDB, allowing them to test and interact with the stablecoin in a risk-free environment.

Rebasing Mechanism: USDB is an automatically rebasing token, meaning its supply adjusts regularly to reflect the yield earned. This rebasing applies to both externally owned accounts (EOAs) and smart contracts, although smart contracts can opt-out if a stable value is required. For use cases that demand a fixed value, Blast offers nrUSDB, a non-rebasing version that wraps USDB at its current value, which can be unwrapped later to redeem the accumulated rebased value.

Yield Modes: USDB offers three different yield modes to cater to various user needs:

- AUTOMATIC (default): The standard mode where yield is automatically rebased into the token’s value.

- VOID: A mode where the yield is voided, preventing rebasing.

- CLAIMABLE: A mode where the yield is accumulated and can be claimed manually by the user.

Contract Interaction and Redemption: Developers can interact with USDB using the IERC20Rebasing interface, which provides functions for configuring yield modes and claiming yield. USDB can be redeemed for DAI when bridging back to Ethereum, offering users flexibility in managing their stablecoin assets within and outside the Blast network.

Blast's Incentive Driven Ecosystem

The Blast network has designed an elaborate incentive-driven ecosystem to accelerate its growth and establish itself as a leading Layer 2 solution in the Web3 space. This strategy has been highly effective, as evidenced by the network's rapid expansion since its launch in November 2023.

With $3 billion in bridged total value locked (TVL), 1.5 million users, and over 200 live decentralized applications (DApps), Blast is currently ranked as the 9th largest chain by TVL, according to DefiLlama. This is impressive considering the network launched in November 2023. Blast's native stablecoin, USDB has a market cap of about $411M and about 217k holders within its ecosystem.

Blast is the 9th Largest Chain by TVL | Image via Blast

Blast is the 9th Largest Chain by TVL | Image via BlastBlast Incentive Strategy

The Blast team has created an extensive and multi-dimensional incentive program to attract new users into the Blast ecosystem and encourage existing users to add more liquidity to its Layer 2 network.

Incentive Programs

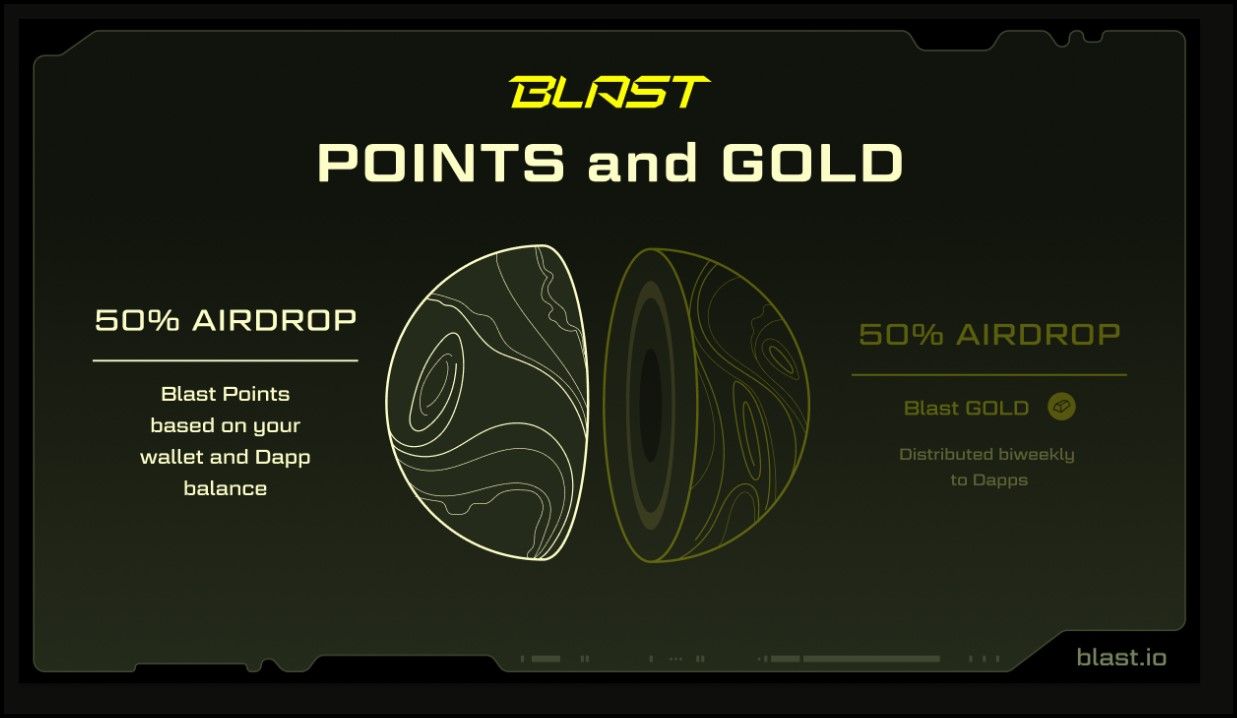

Blast Points: Blast Points are a core component of the incentive strategy, encouraging users to inject liquidity into the network. Users earn Blast Points automatically for holding ETH, WETH, or USDB in their wallets, with point accrual occurring at each block. This system incentivizes users to maintain and increase their liquidity on the Blast network, driving up the TVL and overall activity within the ecosystem.

Blast Gold: Blast Gold serves as an additional layer of incentives, specifically targeting participation in DApps built on the Blast network. By rewarding users who engage with these DApps, Blast fosters a vibrant and active ecosystem where applications can thrive. This dual-incentive system ensures that both liquidity provision and Dapp engagement are adequately rewarded, promoting a balanced growth across the network.

The Blast Incentive System | Image via Blast Docs

The Blast Incentive System | Image via Blast DocsApplication-Specific Incentives: In addition to the foundational incentives provided by Blast Points and Blast Gold, individual applications within the Blast ecosystem, such as Thruster Finance and Crypto Valley, offer their own unique incentive mechanisms. This allows DApps to tailor their rewards to attract and retain users, further enhancing the overall attractiveness of the Blast ecosystem.

Blast Invite Incentive Scheme | Image via Blast

Blast Invite Incentive Scheme | Image via BlastReferral Program: Blast also employs a referral-based incentive program, where users earn bonus points for inviting others to the network. Direct invites provide an additional 16% bonus points, while further invites yield an additional 8% bonus. This referral system creates a viral growth effect, encouraging users to actively expand the network's user base.

Phase 1 Airdrop Distribution

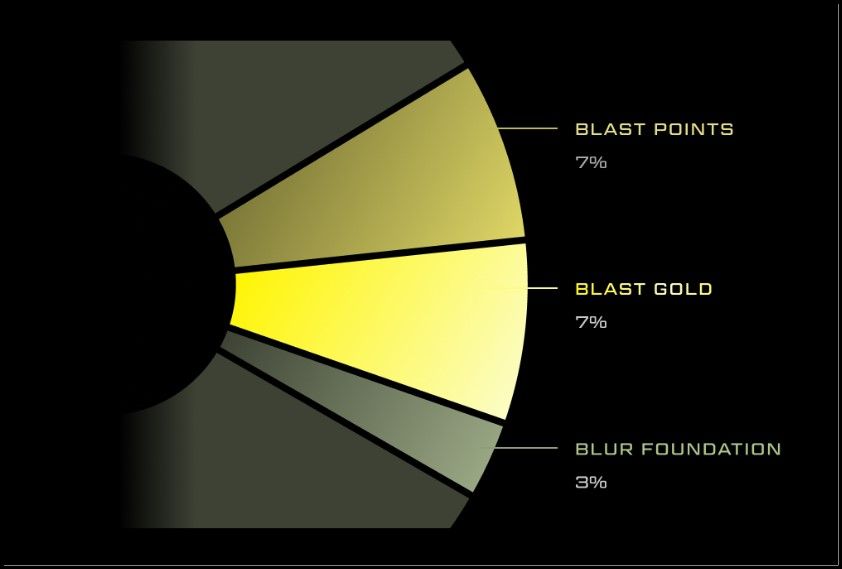

Phase 1 Blast Airdrop | | Image via Blast

Phase 1 Blast Airdrop | | Image via BlastThe first phase of the BLAST token airdrop saw the distribution of 17% of the total supply, amounting to 17 billion tokens. This distribution strategically divided rewards between early adopters and contributors to the ecosystem:

- Users who earned Blast Points by bridging assets like ETH and uSDB to the Blast network got 7% of the total supply.

- Users who contributed to the success of DApps on the network earned Blast Gold and got another 7% of the supply.

- 3% of the total supply was allocated to the Blur Foundation, which supports the NFT marketplace and will be used for retroactive and future airdrops.

These distribution mechanisms incentivize early participation and align the community's interests with the Blast ecosystem's long-term success, ensuring that those who contribute to the network's growth are duly rewarded.

Phase 2 Incentive Program

The incentive strategy continues with the Phase 2 rewards program, which allocates 10 billion BLAST tokens over 12 months to continue building the ecosystem. This phase is split evenly between Blast Points and Blast Gold, with Points incentivizing liquidity provision and Gold empowering Dapps with the resources to grow. Users can enhance their Points earnings by increasing their wallet balances, which are automatically adjusted to reflect the native yield rates—around 4% for ETH/WETH and 5% for USDB. Furthermore, BLAST tokens earn points at twice the rate of ETH/WETH/USDB, providing an additional incentive for holding the network's native token.

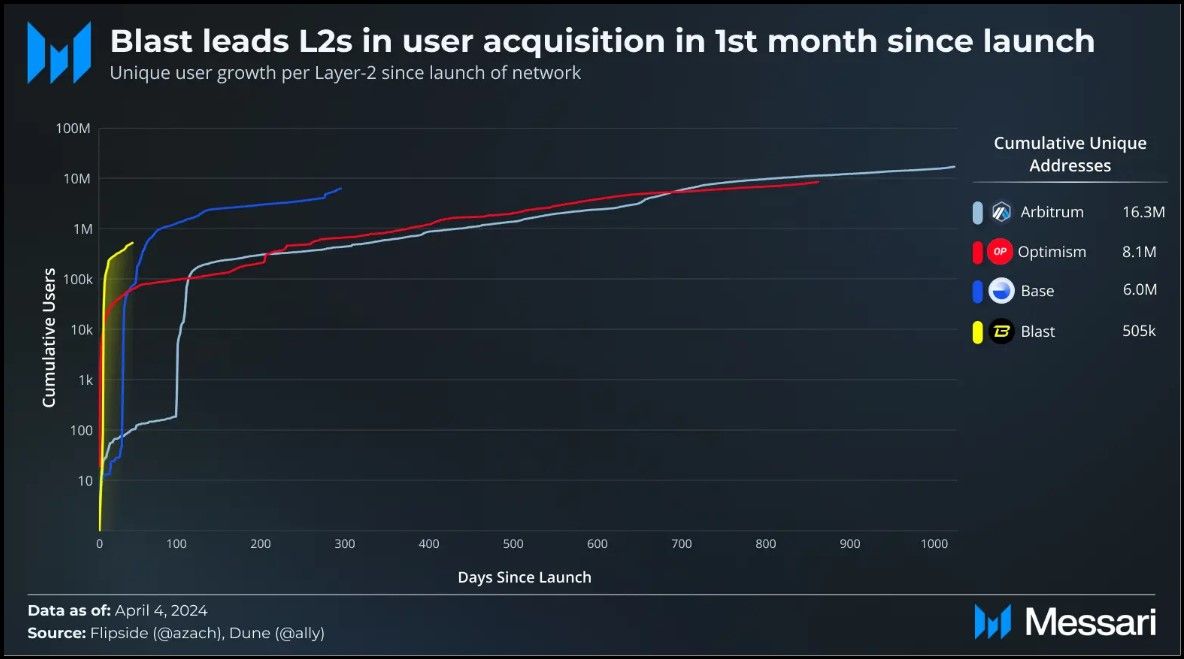

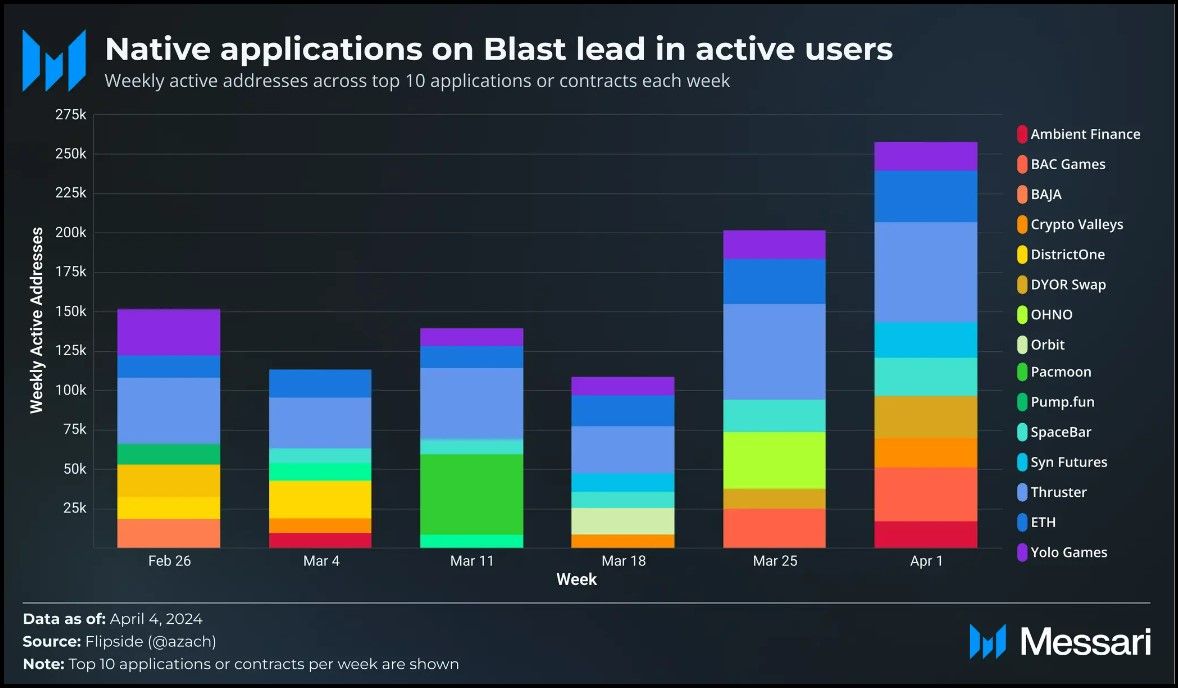

Blast Incentive Scheme Attracts Significant Users | Image via Messari

Blast Incentive Scheme Attracts Significant Users | Image via MessariThis comprehensive and multi-dimensional incentive strategy has successfully rapidly scaled the Blast ecosystem, attracting significant liquidity and users.

Blast DApp Ecosystem

The DApp landscape on the Blast network is rapidly evolving, driven by its incentive-heavy ecosystem. This environment has successfully attracted a large user base, but it has also led to a conservative approach where users focus primarily on maximizing rewards rather than exploring new applications. As a result, while over 200 live DApps on Blast, only a few have made significant impacts. It presents a unique opportunity for innovative consumer applications to capture users' attention, especially as Blast transitions toward a more permissionless network structure.

Despite the conservative tendencies of its user base, the Blast network hosts several unique applications with solid growth potential.

Fantasy Top

Blast Fantasy Top | Image vis Messari

Blast Fantasy Top | Image vis MessariFantasy Top brings a fresh twist to the SocialFi space by blending elements of fantasy sports with the speculative dynamics of crypto influencers on Twitter. Users can collect and trade cards representing influencers, with their real-world performance directly impacting game outcomes. Integrating rare cards, a trading marketplace, and weekly competitions adds layers of engagement, making Fantasy Top a promising candidate for long-term success within the Blast ecosystem.

Baseline Protocol

Baseline Protocol | Image via Baseline DApp

Baseline Protocol | Image via Baseline DAppBaseline Protocol revolutionizes liquidity management on the Blast network through its algorithmic market-making mechanisms. By utilizing smart contracts to automate liquidity placement and rebalancing, Baseline ensures price stability and value growth for tokens on the network. This approach draws inspiration from the Protocol Owned Liquidity (POL) concept and positions Baseline as a critical tool for maintaining the health of the Blast ecosystem's financial products, making it a standout application for developers and users alike.

Crypto Valleys

Crypto Valleys | Image via X

Crypto Valleys | Image via XCrypto Valleys offers a nostalgic gaming experience reminiscent of the DeFi Kingdoms era, complete with pixel art aesthetics and strategic gameplay. The game's utility token, YIELD, powers the in-game economy, allowing players to purchase seeds, items, and upgrades. The gameplay centers around farming and adventuring, where players cultivate crops and manage NFTs to progress through the game. With its engaging mechanics and early traction, Crypto Valleys has the potential to become a staple in the Blast gaming ecosystem.

Criticism of the Blast Ecosystem

The Blast network's incentive-driven ecosystem has garnered significant attention, but it also faces scrutiny regarding the long-term sustainability of its incentive model. While Blast has achieved rapid growth, with $3 billion in bridged TVL and over 1.5 million users, critics have raised concerns that the aggressive incentive programs might lead to short-term inflated activity rather than sustainable, organic growth. There's a worry that as the rewards diminish in value over time, user retention could suffer, especially if the incentives that initially attracted users are reduced or phased out.

Moreover, using a 3/5 multi-signature wallet to control funds has sparked security concerns. Critics argue that this setup could make the network vulnerable to security breaches or collusion among signers. The centralization of this system, where several of the signers reportedly have ties to the same entity, further exacerbates these concerns.

Additionally, some have compared Blast's incentive structure to a pyramid scheme, particularly due to the heavy reliance on referral and reward mechanisms to drive user recruitment. This remark has led to skepticism, especially given the lack of transparency around the network's future roadmap. Following its June airdrop, Blast is struggling to keep its ecosystem afloat after 62% value from its ATH has withered by August 2024.

Despite these concerns, the Blast team has implemented a sustainability plan that gradually reduces rewards over time to maintain economic stability. However, critics remain cautious, suggesting that unless Blast can transition from a rewards-driven model to one that fosters genuine user engagement and innovation, the network's long-term viability may be at risk. This challenge will be pivotal as Blast seeks to balance growth with sustainability in the highly competitive Layer 2 ecosystem.

Blast Network Review: Closing Thoughts

The Blast Layer 2 network has quickly established itself as a formidable player in the Web3 space, driven by a well-crafted incentive system that has attracted significant liquidity and user participation. Its innovative approaches, such as native yield generation and dynamic incentive programs, set it apart from other networks.

However, the long-term sustainability of these incentives remains a key concern, with critics questioning whether the network can maintain its rapid growth without relying heavily on rewards. As Blast continues to evolve, the focus will need to shift toward fostering organic growth and innovation within its ecosystem to ensure lasting success. The network's future will depend on its ability to balance immediate user acquisition with long-term viability, making it a fascinating project to watch in the coming years.