The cryptocurrency industry is evolving rapidly, attracting a wave of new investors and enthusiasts eager to dive into digital assets.

Exchanges play a pivotal role in the crypto ecosystem, offering platforms where users can buy, sell, and trade digital currencies. For newcomers, choosing a reliable and secure exchange is crucial to ensure their investments are protected. A key feature of many exchanges is their "Earn" programs, which allow users to generate passive income by staking their assets. This can be an excellent way for investors to grow their holdings without actively trading.

BloFin is one such exchange, which offers an “Earn” program that allows users to generate yield through flexible and locked staking options.

In this BloFin Earn review, we'll explore how BloFin provides a secure and reliable platform for earning interest on your crypto assets, delving into its features, benefits, and potential risks to help you make informed decisions.

BloFin Earn Review Summary:

BloFin Earn is a suite of products that allows users to earn rewards through flexible and locked staking options for cryptocurrencies like USDT, BTC, and ETH. Flexible products provide liquidity, while locked products offer higher returns for a fixed commitment period, catering to different investment preferences.

BloFin Overview

Founded in September 2019 in the Cayman Islands, BloFin is a cryptocurrency exchange offering a array of services, including perpetual and futures trading with up to 150x leverage, spot trading, copy trading, crypto buying, wealth management, educational resources, and API access.

BloFin is a Cryptocurrency Exchange. Image via BloFin

BloFin is a Cryptocurrency Exchange. Image via BloFinBloFin prioritizes fund security with advanced measures like Merkle Tree proof of reserves, wallet-as-a-service custody, and Fireblocks insurance. It maintains a 1:1 proof of reserves policy, ensuring all customer assets are fully backed and transparent. Partnerships with Chainalysis and AnChain.AI enhance its risk management and regulatory compliance.

The platform supports over 320 USDT-M trading pairs, including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). Its user-friendly interface and high liquidity make it appealing to advanced traders. BloFin also offers easy deposits and withdrawals in over 80 fiat currencies, competitive trading fees, and 24/7 customer support. The BloFin Academy provides educational resources to keep users informed about cryptocurrency.

Key features of BloFin include:

- Futures Trading: Advanced features for USDT-M perpetual contracts.

- Copy Trading: Follow and replicate top traders' strategies at no cost.

- Spot Trading: Access numerous cryptocurrencies with deep liquidity.

- Crypto Purchasing: Supports over 80 fiat currencies.

- Earn: Staking and savings options to maximize asset value.

- Affiliate Program: Up to 50% commission on futures trading fees.

- Security: Advanced measures like Merkle Tree proof of reserves, wallet-as-a-service custody, and partnerships with Chainalysis and AnChain.AI.

- Ease of Use: User-friendly interface, high liquidity, easy deposits and withdrawals, and 24/7 customer support.

- Educational Resources: BloFin Academy for cryptocurrency education.

For more details, you can read our full BloFin review. We've also covered BloFin copy trading in great detail.

BloFin Earn Products

BloFin Earn provides users with opportunities to earn yield through staking . The platform supports both flexible and fixed-term products. Let's explore these in more detail!

Flexible Products

Flexible products allow users to earn interest on their assets while maintaining the ability to redeem them at any time. This is similar to a bank account where you can deposit and withdraw money freely, but with the added benefit of earning interest.

While we are at it, let's be clear that while flexible products allow for interest accrual, they may not offer the same rates as traditional savings accounts, which underscores the unique benefits of staking. So, Flexible products are ideal for those who need liquidity, offering quick access to funds without penalties.

Locked Products

Locked products require you to deposit your assets for a fixed period, offering higher returns compared to flexible products. This can be compared to a fixed deposit account where you commit your funds for a set time to earn higher interest.

By locking up your assets, you can benefit from increased interest rates though users may lose some or all of the interest earned if they withdraw early. This option is suitable for users who can set aside their funds without needing immediate access, thereby maximizing potential rewards.

Apart from BloFin Earn, some other leading Earn products being offered include OKX Earn, KuCoin Earn, ByBit Earn and Binance Earn. Be sure to check their reviews out as well.

BloFin Earn Supported Cryptocurrencies

Currently, BloFin Earn supports staking for 3 currencies:

- USDT

- BTC

- ETH

As BloFin continues to expand its services, more tokens are expected to become available for interest-earning deposits.

Analysis of BloFin Earn Products

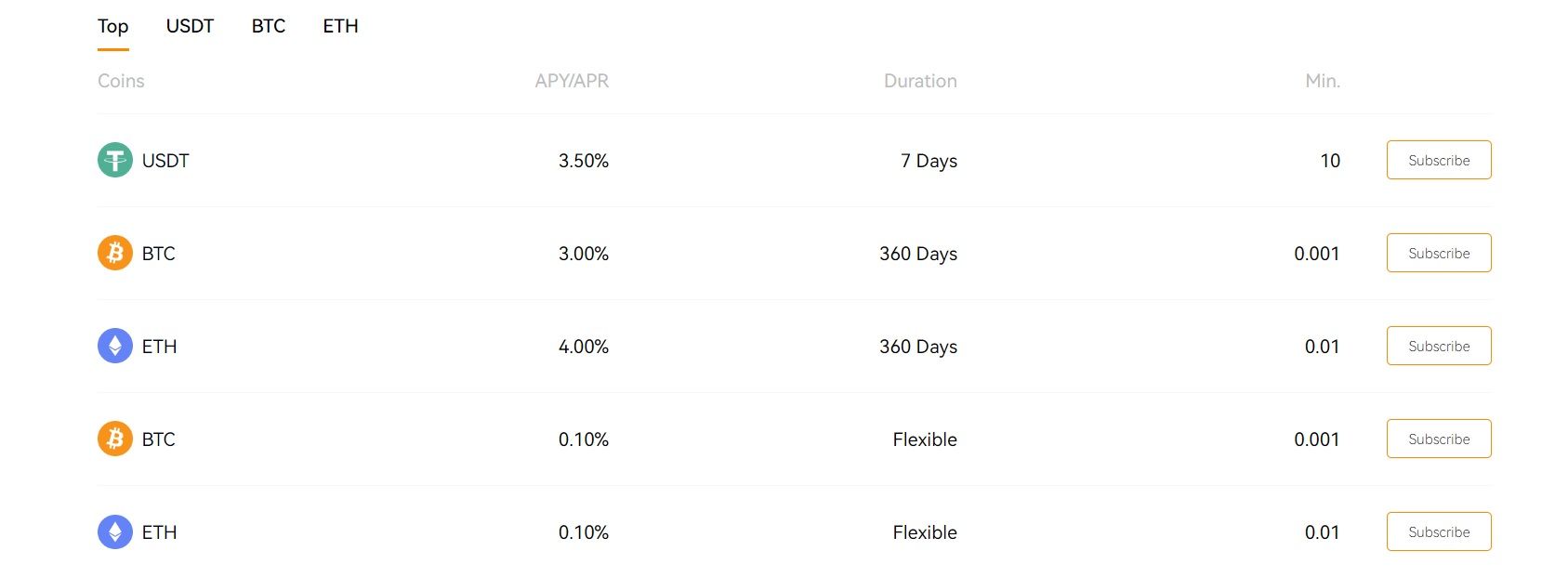

The BloFin Earn table highlights various staking options for cryptocurrencies with differing durations and interest rates. Here is an overview:

The Platform Supports Both Flexible and Fixed-Term Products. Image via BloFin

The Platform Supports Both Flexible and Fixed-Term Products. Image via BloFin- USDT: Offers a 3.50% APY for a 7-day period with a minimum stake of 10 USDT. This short-term option provides a decent return with minimal commitment.

- BTC: Provides a 3.00% APY for a 360-day lock-up, requiring a minimum of 0.001 BTC. This long-term option offers substantial returns but requires a full-year commitment.

- ETH: Offers a 4.00% APY for a 360-day period with a minimum stake of 0.01 ETH. This option provides the highest return among the listed assets, ideal for long-term ETH holders.

Flexible Options:

BTC and ETH: Both offer a modest 0.10% APY with flexible withdrawal options, requiring minimum stakes of 0.001 BTC and 0.01 ETH, respectively. These are suitable for users seeking liquidity over higher returns.

Key Takeaways:

- Short-term and Long-term Options: Users can choose between short-term (7 days for USDT) and long-term (360 days for BTC and ETH) staking based on their investment goals.

- Interest Rates: Longer commitments (360 days) offer higher returns (up to 4.00% for ETH) compared to flexible options (0.10% for BTC and ETH).

- Minimum Stakes: The minimum required stakes are accessible, encouraging participation from a wide range of investors.

How to Use BloFin Earn

Signing up for BloFin Earn is a fairly straightforward affair.

BloFin Earn Caters to Different Investor Preferences. Image via BloFin

BloFin Earn Caters to Different Investor Preferences. Image via BloFin1. Select a Product

Log in to your BloFin account and navigate to the Earn page. Here, you can view all available Earn products and choose between flexible and locked products.

2. Subscribe

Select the duration and amount for your chosen product. If necessary, transfer assets to your Earn account. Agree to the service terms and click "Subscribe" to complete the process.

You can also enable Auto-Subscribe to automatically reinvest in the same product or a similar flexible product if the original one becomes unavailable.

3. Review Assets

Monitor your earnings and asset details through the Earn section in your account. You can view interest records and manage your subscriptions easily. Redemption processes for flexible and locked products differ; flexible products can be redeemed at any time, while locked products are automatically redeemed upon maturity unless Auto-Subscribe is enabled.

Redeeming BloFin Earn

Flexible Products

To redeem, go to the Earn section, select your active order, and click "Redeem." Fill in the amount you wish to redeem and confirm the action. The assets will be returned to your Earn account.

Locked Products

These are automatically redeemed upon maturity. If Auto-Subscribe is not enabled, the principal and interest will be returned to your Earn account. If Auto-Subscribe is enabled, the reinvestment occurs automatically, but users should be aware of the terms and conditions associated with it.

BloFin Security

Security is a cornerstone for any cryptocurrency exchange, crucial for building trust and protecting user assets.

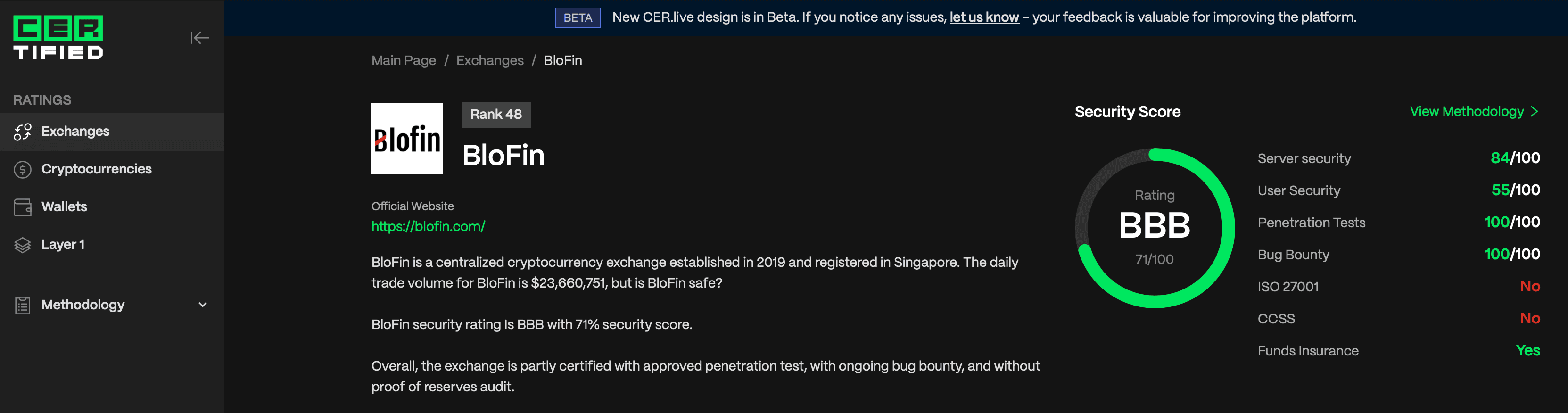

BloFin has implemented several comprehensive security protocols to safeguard user funds and ensure compliance with regulatory standards. According to CER.live, which evaluates crypto exchange security, BloFin scores 71/100, earning a BBB rating and ranking 48th in security among exchanges.

BloFin Earned a BBB Rating. Image via CER.live

BloFin Earned a BBB Rating. Image via CER.liveAsset Reserves and Custody

BloFin maintains a 1:1 reserve policy for all customer assets, ensuring that user funds are fully backed. This transparency can be verified through their proof of reserves. Partnering with Fireblocks, a leading custodial institution, BloFin uses advanced custody solutions with comprehensive insurance coverage, protecting against cyber threats and operational errors.

Transaction Monitoring

BloFin enhances its transaction security through a Know-Your-Transaction (KYT) solution from AnChain.AI. This AI-powered blockchain intelligence allows real-time monitoring and analysis of transactions, improving compliance by detecting and preventing suspicious activities. Additionally, integrating Chainalysis' blockchain data platform bolsters BloFin’s compliance capabilities, enabling the detection and prevention of illicit activities such as money laundering.

Security Track Record

Prospective users will be reassured to know that BloFin has never experienced a significant security breach, which shows its robust security infrastructure. This track record is a strong indicator of the exchange's commitment to maintaining a secure trading environment.

BloFin Earn: Benefits and Risks

Investing in cryptocurrency products like BloFin Earn offers potential benefits but also comes with inherent risks. It's crucial for investors to understand these aspects to make informed decisions. While earning rewards through digital asset staking can be lucrative, one must also consider the associated risks to avoid potential pitfalls.

Benefits

- Passive Income: BloFin Earn allows users to generate passive income by staking their digital assets. This can be an attractive option for those looking to earn interest on their holdings without actively trading.

- Flexible Options: BloFin Earn provides both flexible and locked products. Flexible products offer liquidity, allowing users to withdraw their funds at any time without penalties. Locked products, on the other hand, offer higher returns for committing assets for a fixed period.

- Security and Transparency: BloFin's robust security measures and transparent operations add an extra layer of confidence for investors. With a 1:1 reserve policy and partnerships with Fireblocks and Chainalysis, users can trust that their assets are well-protected and that transactions are thoroughly monitored for compliance.

- Diverse Crypto Support: The platform supports staking for popular cryptocurrencies like USDT, BTC, and ETH, giving users a range of options for earning interest on their assets.

Risks

- Market Volatility: Cryptocurrency markets are highly volatile. The value of staked assets can fluctuate significantly, impacting the overall returns.

- Liquidity Risk: Although flexible products offer liquidity, locked products do not. Investors must be prepared to commit their funds for the specified period, which could be problematic if they need access to their assets unexpectedly.

- Regulatory Risks: The regulatory environment for cryptocurrencies is constantly evolving. Changes in regulations can affect the operations of platforms like BloFin and the security of digital assets.

- Security Breaches: Despite strong security measures, no platform is completely immune to cyber threats. Investors should be aware of the potential risks of hacking and other security breaches.

- Operational Risks: Technical issues or operational failures can impact the accessibility and performance of the platform, potentially affecting users' investments.

BloFin Earn Review: Closing Thoughts

BloFin Earn offers opportunities for passive income through flexible and locked staking products. Flexible products allow users to withdraw funds anytime without penalties, providing liquidity, while locked products offer higher returns for those willing to commit their assets for a fixed period.

Investing in BloFin Earn comes with several advantages, including a range of flexible options, robust security measures, and support for popular cryptocurrencies like USDT, BTC, and ETH. However, potential investors should consider risks such as market volatility, liquidity constraints with locked products, regulatory risks, and the possibility of security breaches.

As always, before you dabble in the world of crypto, balance potential gains with an understanding of risks, conduct thorough research, consider your financial goals and risk tolerance and stay informed about the latest crypto developments.