Crypto traders today are not just looking for platforms to execute trades — they demand reliability, trustworthiness, and robust risk management protocols. These elements not only safeguard their investments but also ensure a trading experience free from operational uncertainties.

Beyond the fundamental appeal of seamless trading and a wide spectrum of digital assets, the defining characteristic of a top-tier exchange is its unwavering dedication to security, transparency, and adherence to regulatory standards. As the crypto market evolves, an exchange that offers Fort Knox-level security, clear and competitive fee structures, and a comprehensive suite of trading tools has become a bare minimum.

BloFin is one exchange that combines technological innovation with a commitment to user protection.

This BloFin review will explore the crypto exchange in-depth, highlighting its features, security measures, user interface, and the overall trading experience it offers.

Review Summary

BloFin is a crypto exchange that prioritizes security and transparency. With robust security measures, transparent fee structures, and a diverse range of trading options including futures, spot trading, and innovative financial products, BloFin caters to both novice and experienced traders.

The Key Features of BloFin Are:

- Futures Trading: Engage in USDT-M perpetual contracts with strategic features like hedge mode.

- Copy Trading: Follow and replicate the trades of elite traders at no cost.

- Spot Trading: Access a deep liquidity market with a variety of trading pairs.

- Crypto Purchasing: Buy and sell crypto with over 80 fiat currencies quickly.

- Earn: Maximize asset value through staking and savings.

- Affiliate Program: Earn up to 50% commission on futures trading fees.

- Comprehensive Security: Employ advanced security measures including third-party custody, insurance, Merkle Tree, KYT protocols, Fireblocks, and Chainalysis.

- Easy Transactions: Convenient deposits and withdrawals with a wide range of fiat and cryptocurrencies.

- Low Fees: Benefit from lower trading fees and special trading events.

- Educational Resources: Stay informed through BloFin Academy and news updates.

What is BloFin?

BloFin is a Cayman Islands-based cryptocurrency exchange. Founded in September 2019 by Matt H., an influencer recognized in Cointelegraph's "Top 100 Influencers in Blockchain" in 2020, BloFin has rapidly grown to become a prominent player in the crypto trading arena. The platform caters to both novice and experienced traders, offering a wide range of services that include perpetual and futures trading with up to 150x leverage, spot trading, copy trading, crypto buying, wealth management, educational resources, and API access.

The name "Blo" represents blockchain, while "Fin" symbolizes finance, reflecting the exchange's commitment to integrating these two critical components of the modern financial ecosystem.

BloFin is a Cayman Islands-Based Cryptocurrency Exchange. Image via BloFin

BloFin is a Cayman Islands-Based Cryptocurrency Exchange. Image via BloFinBloFin’s founder, Matt, brings a wealth of experience from his previous roles in investment and portfolio management at a renowned US venture capital firm, where he was involved in investments in top-tier companies like Twitch and Unity.

BloFin stands out in the competitive crypto market due to its strong commitment to security and regulatory compliance. The exchange ensures fund security through advanced measures such as Merkle Tree proof of reserves, wallet-as-a-service custody, and Fireblocks insurance. Additionally, BloFin maintains a 1:1 proof of reserves policy, guaranteeing that all customer assets are fully backed and transparent. Partnerships with industry-leading firms like Chainalysis and AnChain.AI further bolster BloFin’s risk management and regulatory compliance capabilities.

The platform offers an extensive range of trading pairs and services. With over 320 USDT-M trading pairs, users can trade popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH) and Solana (SOL). BloFin also features a user-friendly interface and high liquidity, which make it an attractive choice for advanced traders. The copy trading feature allows users to follow and replicate the strategies of top traders, while the spot trading market provides access to numerous cryptocurrencies with deep liquidity.

BloFin's ecosystem is designed to support traders at every level. The platform offers easy deposits and withdrawals in over 80 fiat currencies, competitive trading fees, and comprehensive customer support available 24/7. Additionally, the BloFin Academy provides educational resources to help users stay informed about the latest developments in the cryptocurrency world.

BloFin KYC

Know Your Customer (KYC) standards exist to ensure the identity verification of customers. These standards serve several purposes:

- Preventing Fraud: By verifying the identities of users, crypto exchanges can mitigate risks associated with fraudulent activities.

- Anti-Money Laundering (AML): KYC processes help prevent money laundering and other financial crimes by ensuring that the funds used in transactions are not derived from illegal activities.

- Regulatory Compliance: Centralized crypto exchanges are required by law to adhere to KYC regulations.

- Enhancing Security: Identity verification protects the exchange and its clients by ensuring that legitimate users operate accounts.

Right, back to BloFin.

New users start at the “Basic Level” verification. However, you can complete additional verification steps to increase your deposit and withdrawal limits.

| KYC Level | 24h Withdrawal Limit | Futures Trading | Max Leverage |

|---|---|---|---|

| Basic (Level 0) | 20,000 USDT | No limit | No limit |

| Personal Information Verification (Level 1) | 1 million USDT | No limit | No limit |

| Address Proof Verification (Level 2) | 2 million USDT | No limit | No limit |

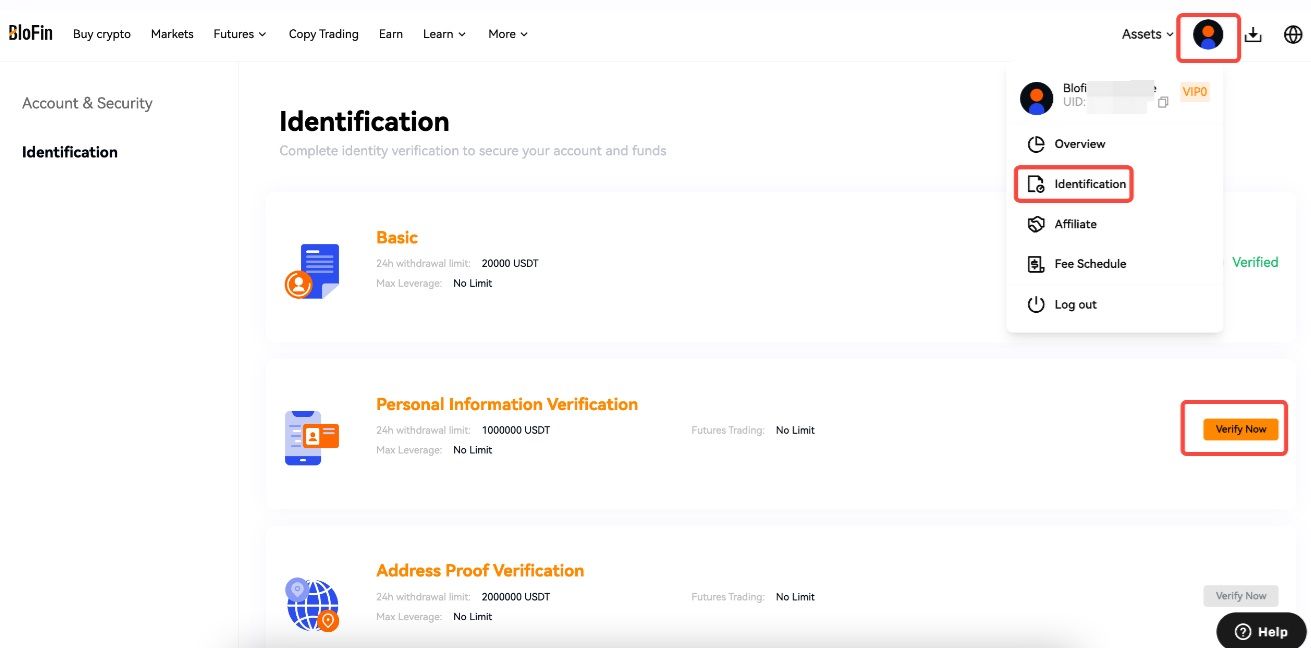

Here's how you can complete BloFin identity verification:

STEP 1: Log in to your BloFin account and navigate to [User Avatar] - [Identification].

KYC Standards Exist to Ensure the Identity Verification of Customers. Image via BloFin

KYC Standards Exist to Ensure the Identity Verification of Customers. Image via BloFinSTEP 2: Click [Verify Now] under [Personal info verification]. As a reminder, the default verification level in 0.

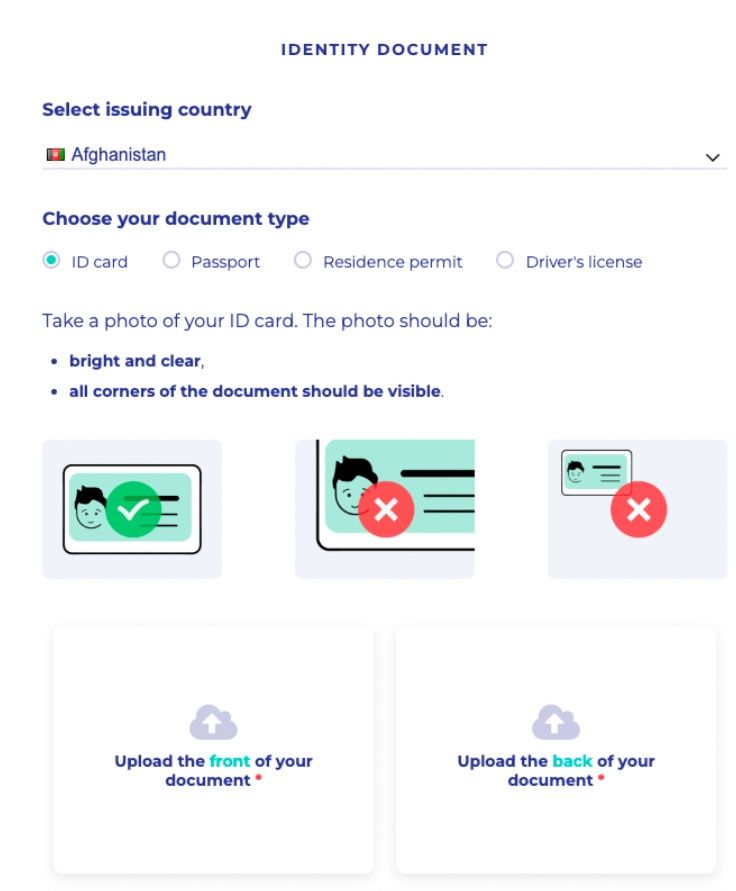

STEP 3: Select your issuing country and choose your document type. BloFin supports ID cards, passports, residence permits and driver's licenses. It's recommended to upload clear photos of your documents.

Identity Verification on BloFin is Straightforward. Image via BloFin

Identity Verification on BloFin is Straightforward. Image via BloFinSTEP 4: Take a selfie.

STEP 5: Your application will be processed, and the status will indicate that it's in progress. At this stage, you must wait for the system approval to receive the second-level account limit.

Order Types on BloFin

Trading crypto requires familiarity with different order types to execute trades strategically. BloFin offers a range of order types designed to cater to various trading needs and preferences.

Here's an overview of the order types available on BloFin:

- Market Price Order: Ideal for traders who prioritize speed and execution certainty, market price orders execute immediately at the best available market price. This type is straightforward and does not require setting a specific price, making it perfect for quickly entering or exiting positions.

- Limit Order: This order type is essential for traders who have a specific price in mind for buying or selling an asset. Limit orders ensure that trades are executed only at the desired price or better. On BloFin’s web platform, users can place limit orders directly from the K-line chart, enhancing precision and control.

- Trigger Order: Trigger orders are useful for setting strategic entry and exit points based on market conditions. By specifying a trigger price, users can ensure that their order is only executed when the market reaches a certain level, providing a way to automate trades and capture opportunities as they arise.

- Trailing Stop Order: A trailing stop order is a type of stop order that adjusts with the market price, allowing you to set a constant or percentage threshold. When the market price reaches this predefined point, a market order is automatically executed.

- Take Profit/Stop Loss Order: A TP/SL order is a type of stop order used in algorithmic trading to limit losses and manage risks. It involves setting a trigger price and an order price. When the market price reaches the trigger price, the order is automatically placed at the predefined order price to either take profit or stop loss.

- Advance Limit Order: BloFin’s advance limit orders offer enhanced functionalities with three mechanisms:

- Post Only: Ensures the order is always placed as a Maker order, providing liquidity and avoiding immediate execution as a Taker.

- FOK (Fill Or Kill): The order must be completely filled immediately or it will be canceled entirely, ensuring no partial fills.

- IOC (Immediate Or Cancel): Executes as much of the order as possible immediately and cancels any remaining unfilled portion.

BloFin Supported Cryptocurrencies

BloFin offers 129 spot trading pairs and 312 perpetual contract trading pairs.

This includes household crypto names like Bitcoin, Ethereum, Solana, Polkadot, Optimism and Litecoin, among many others. Good news for memecoin aficionados as BloFin supports a few of those as well:

- Dogecoin

- Pepe

- Dogwifhat

- Book of Meme

- Bonk

Speaking of memecoins, check out our article charting the evolution of memecoins or find out why Solana became a fertile ground for so many memecoins.

How to Trade Spot on BloFin?

Looking to trade spot on BloFin? We've got you covered.

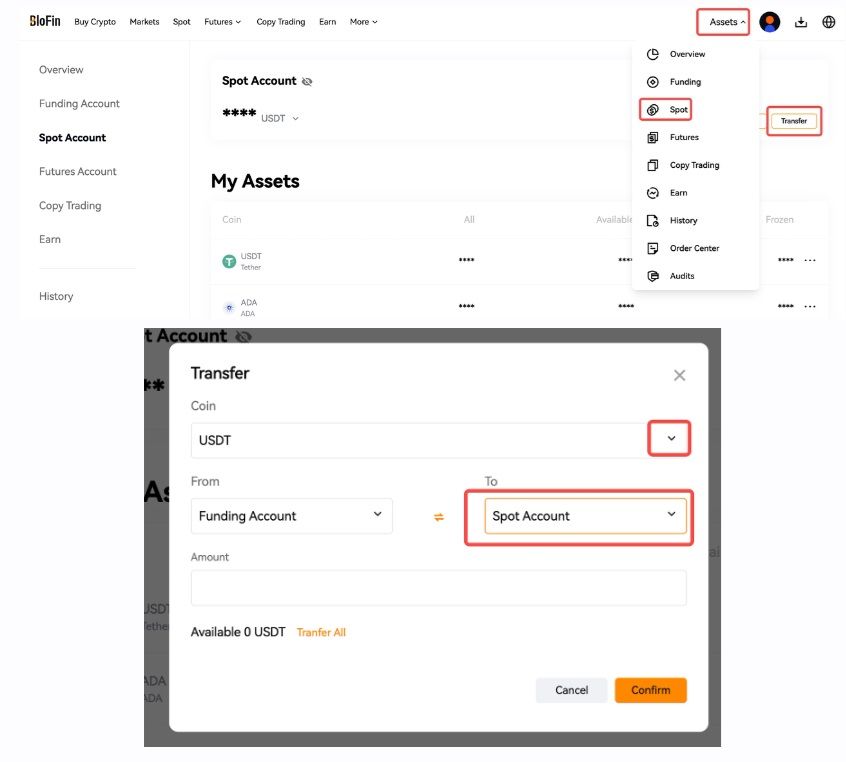

STEP 1: Ensure your assets are transferred to the Spot Account. To do this, log into your BloFin account, go to [Assets] - [Spot], and click [Transfer] to move funds to the Spot Account. Alternatively, you can use the [Transfer] icon on the Spot trading page.

Trading Spot on BloFin Works Like it Does on Other Exchanges. Image via BloFin

Trading Spot on BloFin Works Like it Does on Other Exchanges. Image via BloFinSTEP 2: Once that's done, Click [Spot] in the navigation bar to enter the Spot trading page.

STEP 3: Now, it's time to select your trading pair. If it's BTC, enter "BTC" in the search bar on the trading page and select the BTC/USDT trading pair to conduct your trade.

How to Buy BTC

Now that you have funded your account, it's time to buy the crypto of your choice. As the granddaddy of all cryptocurrencies, we're using the example of Bitcoin here.

STEP 1: Ensure you have USDT in your Spot Account.

STEP 2: Under [Create Order], select "Buy".

You can Buy BTC is Just a Few Clicks. Image via BloFin

You can Buy BTC is Just a Few Clicks. Image via BloFinSTEP 3: Choose an order type: [Limit], [Market], or [Trigger].

STEP 4: Enter the price and USDT amount, or use the slider to set the percentage of your balance.

STEP 5: Place the order and, once filled, you will have BTC in your account.

How to Sell Bitcoin

Once you get BTC and decide in the future that you'd like to sell it for USDT, here's how you can do that:

STEP 1: Ensure you have BTC in your Spot Account.

STEP 2: Under [Create Order], select “Sell.”

Selling BTC is Equally Easy. Image via BloFin

Selling BTC is Equally Easy. Image via BloFinSTEP 3: Choose an order type: [Limit], [Market], or [Trigger].

STEP 4: Enter the price and BTC amount to sell.

STEP 5: Place the order and, once filled, you will have USDT in your account.

Leverage on BloFin

Margin has become a hallmark in cryptocurrency trading, defining the collateral required before entering positions like perpetual contracts. Here's a breakdown:

- Initial Margin: Paid upfront based on chosen leverage. Higher leverage demands less initial margin but increases liquidation risk if positions move unfavorably.

- Maintenance Margin: Minimum equity needed to keep positions open. Falling below prompts a margin call for additional collateral to meet requirements and avoid liquidation.

Here are the margin modes you should be aware of:

- Isolated Margin: Each position has its own margin balance, limiting losses to that specific position.

- Cross Margin: All positions share one margin balance, maximizing exposure but heightening the risk of total loss.

- Portfolio Margin: Calculates margin based on overall portfolio risk, optimizing fund use and reducing margin costs.

Right, back to BloFin.

The exchange allows users to place orders with a leverage of up to 150x. Granted, this isn't extended to all trading pairs; some have a limit of up to 25x leverage, while others have it even lower.

❗❗IMPORTANT ❗❗Margin trading involves significant risks and should only be undertaken by experienced traders who understand the complexities and potential pitfalls associated with leveraging positions.

Forced Liquidation

Forced Liquidation refers to the process where a BloFin takes over a trader's position to prevent the trader's net equity from falling to a negative value. This occurs when price fluctuations lead to unrealized losses, causing the trader to have insufficient margin (maintenance margin plus liquidation fee).

The prerequisites for forced liquidation in BloFin perpetual futures are based on the margin ratio of the contract position. If the margin ratio of a contract position falls to or below 100%, it may lead to a partial reduction or forced liquidation of that position. The margin ratio is an indicator evaluating the sufficiency of the collateral asset in a contract. A higher margin ratio indicates sufficient collateral and a more secure position, while a lower margin ratio indicates a potential shortage of collateral and a less secure position. Users are advised to monitor the margin ratio of their positions to avoid forced liquidation.

The forced liquidation process involves specific steps when the margin ratio of a contract position is ≤100%. At this point, the current collateral assets plus any profits in the account are less than or equal to the required maintenance margins and position closing fees, triggering a position reduction or liquidation. When the mark price reaches the liquidation price, the liquidation engine takes over the position at the bankruptcy price, managing the risk of liquidating the position to the market. The estimated liquidation price is the price at which the margin ratio is 100%, and the actual forced liquidation price occurs when the margin ratio is ≤100%.

Margin Modes and Insurance Fund

In the Isolated Margin Mode, each position has its own margin balance, and positions do not affect each other. In the Cross Margin Mode, positions share the margin balance. The cross-margin mode allows for improved capital efficiency but increases potential risks and losses.

The Insurance Fund is used by BloFin to resist the risk of massive liquidation. It is composed of funds provided by BloFin and liquidation surpluses from liquidation orders. When the system liquidates a user's position, it takes over the position at the actual liquidated price. If the execution price is less favorable or the position cannot be processed, the resulting deficit is covered by the insurance fund. If the insurance fund is insufficient, auto-deleveraging (ADL) will be triggered.

BloFin Copy Trading

Copy trading has become a hallmark crypto-exchange offering as it provides an accessible gateway for newcomers who may lack the expertise or confidence to trade independently. As the name suggests, copy trading lets beginners mirror the trades of experienced and successful traders.

Trading Noobs — Say Hello to Copy Trading. Image via BloFin

Trading Noobs — Say Hello to Copy Trading. Image via BloFinBloFin categorizes copy traders into two buckets:

- Master Traders are seasoned investors who have demonstrated proficiency in trading and have fetched followers interested in replicating their strategies.

- Copiers, who replicate the trading strategies of experienced investors. Copiers entrust their trading decisions to the expertise and track record of experienced traders.

Here's a more detailed breakdown of the two:

Master Traders

These experienced traders develop and implement trading strategies based on their market analysis, experience and expertise. In addition, They execute trades in real time, which are then automatically copied by their followers. Master Traders often provide detailed information about their trading strategies, risk management techniques and past performance to attract more Copiers.

All trade pairs on BloFin are available for copy trading, with no limit on the number of trading pairs. BloFin Copy Trading supports cross-margin and isolate margin modes, and allows traders to set TP/SL at the order level.

At BloFin:

- Master Traders have no leverage limitation

- Copy trading supports market and limit orders

- Masters Traders can modify their open orders

- As Master Trader, you can get 10% of the copiers’ profits

Copiers

A Copier is an individual who follows and replicates the trades of a Master Trader. This role is designed for those who may not have the time, experience, or confidence to trade independently.

Currently, BloFin supports two copy modes:

- Fixed Amount: The amount you'll invest as a margin in each order you copy from a trader.

- Fixed Ratio: Orders will be opened in proportion to the lead trader's position size.

Before starting, copiers must transfer their assets to the copy trading account.

In futures trading, leverage is represented by a margin. This means you do not need to pay the full asset value; instead, you invest a smaller amount based on the leverage rate. This investment is called the margin.

Here are BloFin Copier's margin settings:

- Fixed Amount: The margin cost per copy trade, ranging from 10 to 1,000 USDT.

- Total Amount for Copy Trading: The maximum trade volume for copy trading, ranging from 10 to 50,000 USDT.

- Margin Token: USDT is used as the margin token.

In addition, Copiers have three options for margin modes:

- Copy Trader's Margin Mode: Replicates the margin mode used by the Master Trader.

- Cross Margin: Uses all available funds in the account to prevent liquidation.

- Isolated Margin: Limits the margin to a specific trade, isolating it from the rest of the account's funds.

BloFin Earn

BloFin Earn allows you to generate yield through flexible and fixed staking services.

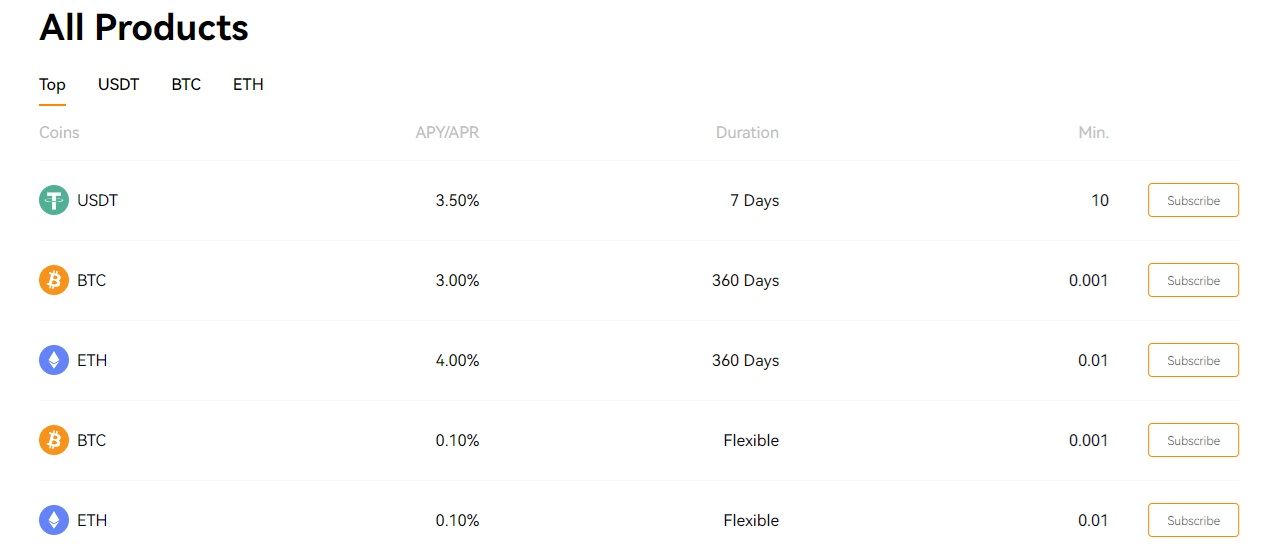

Currently, BloFin Earn supports three major cryptocurrencies: USDT (Tether), BTC (Bitcoin), and ETH (Ethereum). As BloFin continues to expand its services, more tokens will become available for deposit into interest-earning accounts.

The Earn Product Only Supports Three Cryptos. Image via BloFin

The Earn Product Only Supports Three Cryptos. Image via BloFinAfter participating in BloFin Earn, yields are calculated starting from the next day. Daily snapshots ensure accurate accumulation of earnings. The specifics of yield accumulation can vary depending on the product, so users are encouraged to review the detailed information available on each product page.

BloFin Earn offers flexibility in terms of redemption options:

- Flexible products can be redeemed at any time, with yields settled up to the day before redemption. This provides users with quick access to their funds without penalties, ideal for those who require liquidity and want to manage their funds according to immediate needs.

- Fixed products have a required savings period, offering higher returns compared to flexible products. Users can choose to redeem or continue saving upon completion of the lock-up period, with yields calculated based on the actual days staked and the principal unlocked on the redemption day.

BloFin Fees

BloFin offers different trading fee rates based on VIP levels, which provide users with various fee discounts. These levels are determined by either the user's asset balance or trading volume over the past 30 days. The highest qualifying VIP level, based on spot trading volume, total trading volume of perpetual futures, and total assets, will apply to the user. The VIP levels are updated daily at 8:00 AM UTC.

Spot Trading Fees

The maker fee ranges between 0.0100% and 0.1000%, while you can expect to pay a taker fee of 0.0325% to 0.1000%.

| VIP Tier | 30d Volume (USDT) | And/Or | Assets (USDT) | Maker Fee | Taker Fee |

|---|---|---|---|---|---|

| VIP0 | - | Or | - | 0.1000% | 0.1000% |

| VIP1 | ≥ 1,000,000 | Or | ≥ 50,000 | 0.0350% | 0.0600% |

| VIP2 | ≥ 2,000,000 | Or | ≥ 500,000 | 0.0200% | 0.0500% |

| VIP3 | ≥ 4,000,000 | Or | ≥ 1,000,000 | 0.0150% | 0.0450% |

| VIP4 | ≥ 6,000,000 (API Trading Volume ≤ 20%) | Or | ≥ 2,000,000 | 0.0125% | 0.0375% |

| VIP5 | ≥ 8,000,000 (API Trading Volume ≤ 20%) | Or | ≥ 3,000,000 | 0.0100% | 0.0325% |

Futures Trading Fees

The maker fee ranges between 0.0000% and 0.0200%, while you can expect to pay a taker fee of 0.0325% to 0.0600%.

| VIP Tier | 30d Volume (USDT) | And/Or | Assets (USDT) | Maker Fee | Taker Fee |

|---|---|---|---|---|---|

| VIP0 | - | Or | - | 0.0200% | 0.0600% |

| VIP1 | ≥ 10,000,000 | Or | ≥ 50,000 | 0.0060% | 0.0500% |

| VIP2 | ≥ 25,000,000 | Or | ≥ 500,000 | 0.0040% | 0.0450% |

| VIP3 | ≥ 50,000,000 | Or | ≥ 1,000,000 | 0.0020% | 0.0425% |

| VIP4 | ≥ 200,000,000 (API Trading Volume ≤ 20%) | Or | ≥ 2,000,000 | 0.0010% | 0.0400% |

| VIP5 | ≥ 500,000,000 (API Trading Volume ≤ 20%) | Or | ≥ 3,000,000 | 0.0000% | 0.0350% |

Withdrawal Fees

In addition to the aforementioned fees, you'll also be on the hook for withdrawal fees, which cover the cost of processing and confirming the transaction on the blockchain network. This fee can vary based on a few factors:

- Network Congestion: Higher congestion can lead to higher fees as users compete for faster transaction processing.

- Transaction Size: Larger transactions tend to incur higher fees.

It's important to note that this fee is paid to the blockchain miners or validators, not BloFin.

BloFin Earn Fees

BloFin also charges an unspecified fee for its staking service, only saying it charges a “service fee.”

BloFin Trading Bots

BloFin introduced a signal bot feature in the Trading Bots session, enhancing perpetual futures trading through automation. Here's what the signal bot offers:

- Streamlined Futures Trading: Automatically executes trades based on strategies sourced from TradingView signals, allowing users to focus on strategy development.

- Free Access: Available to all users, enabling the refinement of strategies and access to profitable trades without any restrictions.

- Time-Saving Automation: Reduces the need for extensive research and analysis by automating trading based on predefined conditions.

- Informed Decisions: Provides market insights, helping users refine strategies and improve risk management for better long-term trading results.

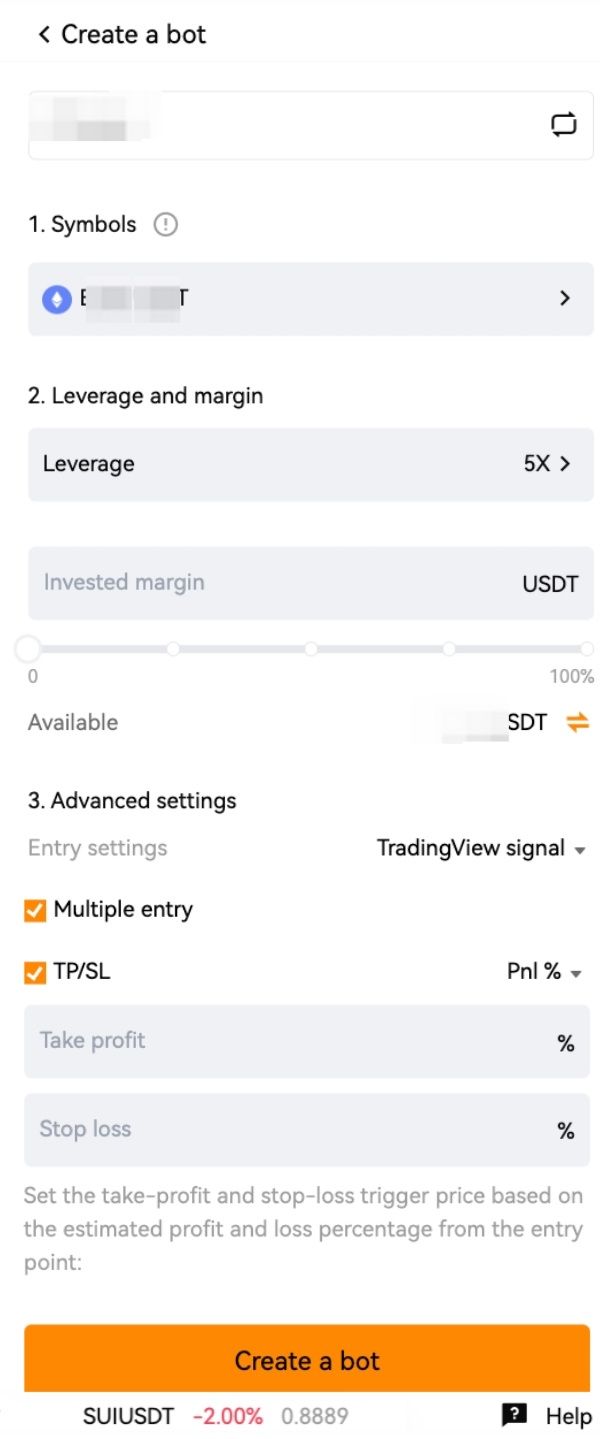

How to Set up a BloFin Trading Signal Bot

Here’s a step-by-step guide to set up a Signal Bot:

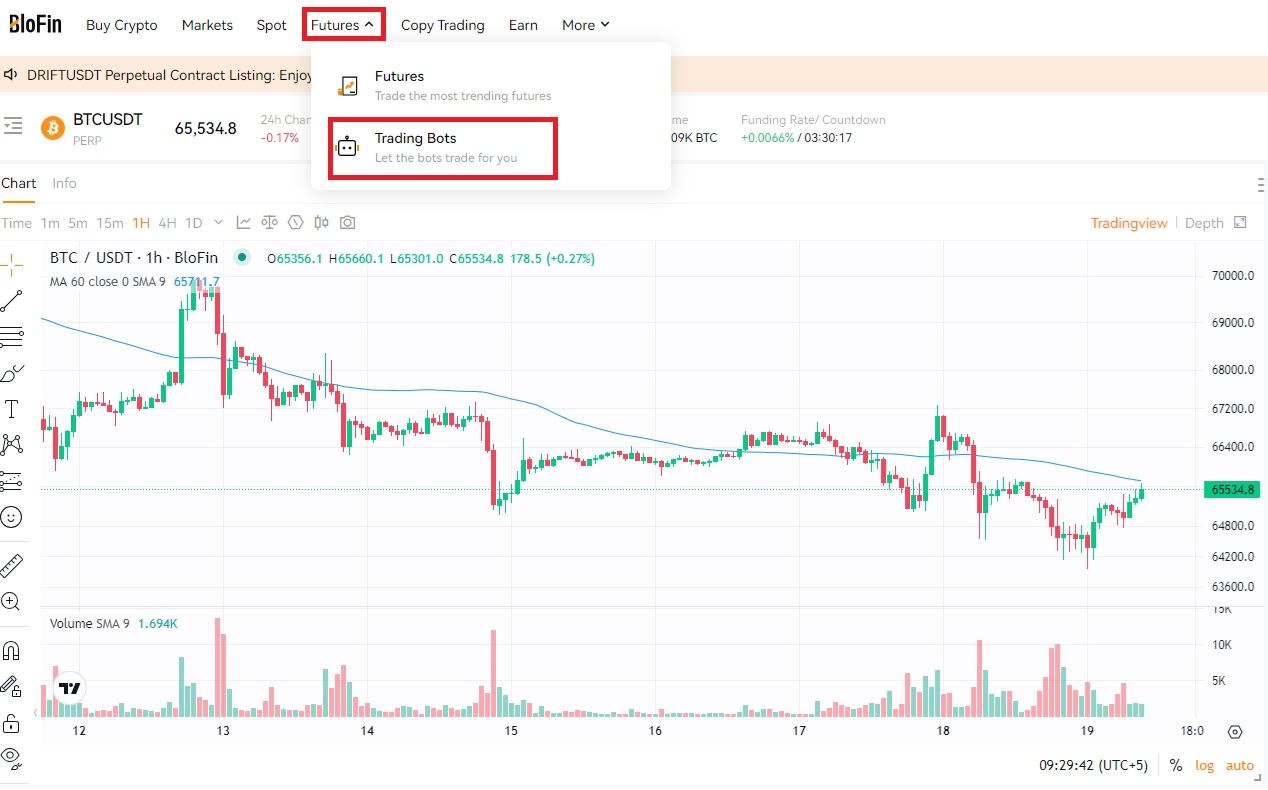

STEP 1: Access the Signal Bot

- Log in to your BloFin account.

- Navigate to Futures -> Trading Bots.

- Select Signal Bot -> Add a Signal.

Bots Enhance Perpetual Futures Trading Through Automation. Image via BloFin

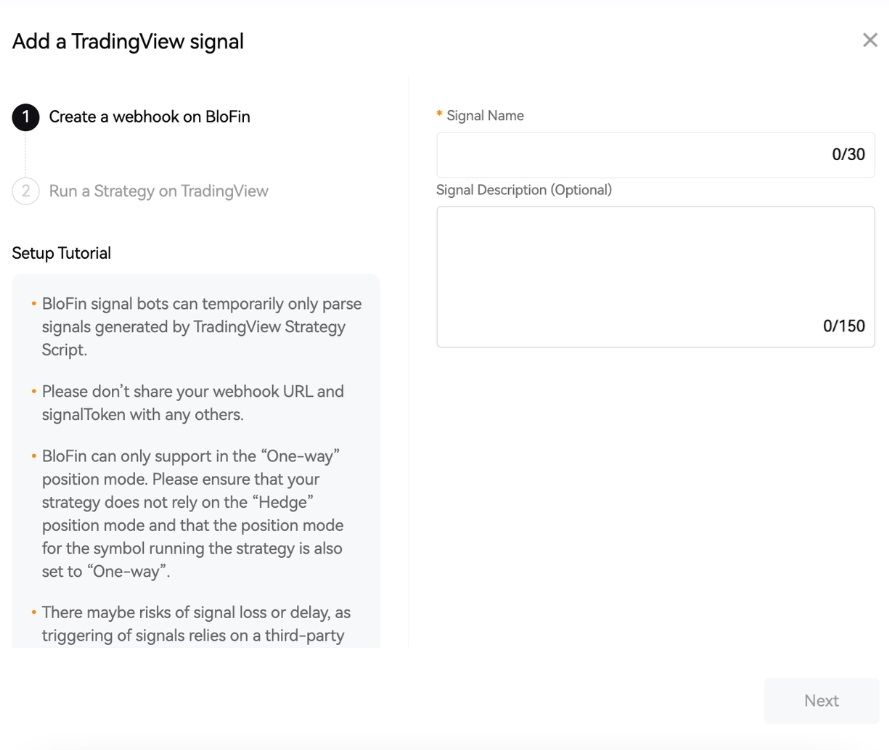

Bots Enhance Perpetual Futures Trading Through Automation. Image via BloFinSTEP 2: Create Your Signal

- Name your signal and provide an optional description.

- Click 'Next' to generate a Webhook URL and AlertMsg Specification.

- Go to TradingView to configure your signal using the provided URL and specifications.

Here's How You Can Set Up Your Own Bot. Image via BloFin

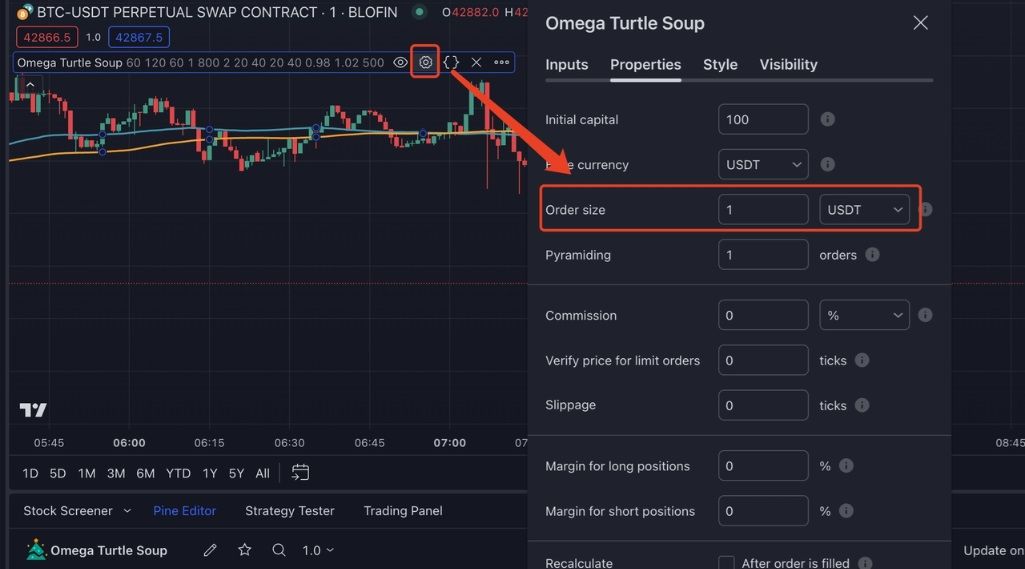

Here's How You Can Set Up Your Own Bot. Image via BloFinSTEP 3: Configure TradingView Alerts

- Select the trading pair on TradingView.

- Configure your strategy script in the Pine Editor and save it.

- Set the strategy properties and save them.

- Create an alert with the condition set to “Order fills only.”

- Use the alert message template provided by BloFin.

- Paste the webhook URL from BloFin into TradingView’s alert settings and create the alert.

Creating a Bot Isn't Exactly Rocket Science. Image via BloFin

Creating a Bot Isn't Exactly Rocket Science. Image via BloFinSTEP 4: Set Up Your Trading Bot

- Click 'Create a Bot' on BloFin.

- Provide trading pairs, leverage ratio, and the margin amount.

- Customize advanced settings, such as order types, entry settings, multiple entries, and TP/SL settings.

- Confirm to finish creating your Bot.

You Have to Provide Trading Pairs, Ieverage Ratio and the Margin Amount. Image via BloFin

You Have to Provide Trading Pairs, Ieverage Ratio and the Margin Amount. Image via BloFinSTEP 5: Monitor and Manage Your Signal Bot

- View ongoing Trading Bots on the [Futures] - [Trading Bots] page.

- Check detailed information, performance history, and signal logs.

- Adjust investments, place manual orders, and close positions as needed.

- Stop the bot via the Trading Bots tab or Bot Details page.

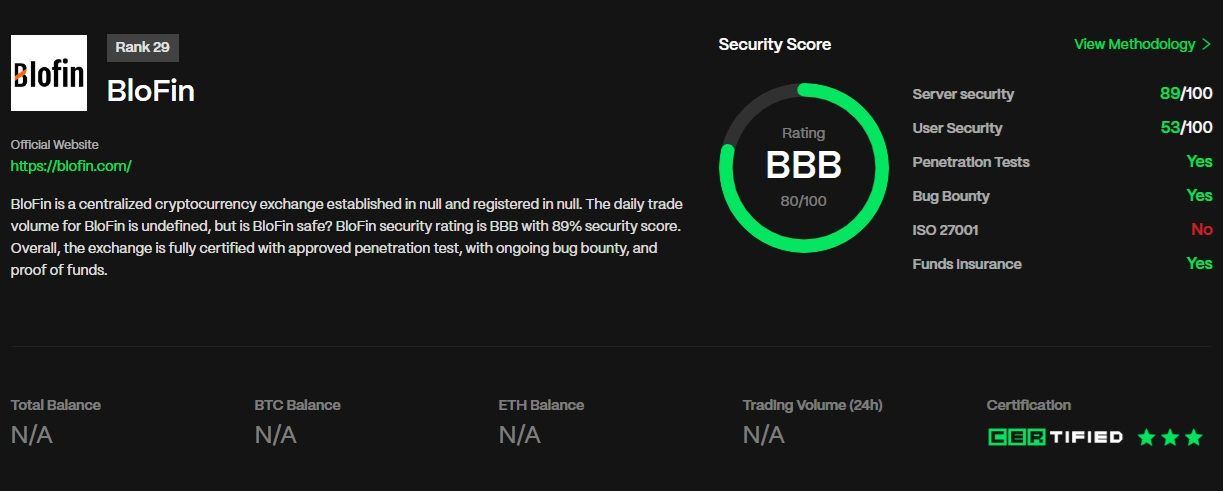

BloFin Security

BloFin has implemented a number of robust security measures to safeguard user funds and ensure compliance with regulatory standards.

CER.live, which assesses crypto exchange security, rates the company BBB giving it an 88/100 score.

CER Ranks BloFin 29th In Terms of Security. Image via CER

CER Ranks BloFin 29th In Terms of Security. Image via CERFirstly, BloFin maintains a policy of holding a 1:1 reserve of all customer assets on its platform. This practice ensures that users' funds are fully backed by assets held by the exchange. You can check out the exchange's proof of reserves here.

In collaboration with Fireblocks, a leading asset custodial institution, BloFin enhances the security of user assets through state-of-the-art custody solutions. This partnership includes comprehensive insurance coverage, further protecting customer funds against potential risks such as cyber threats and operational errors.

To bolster its transaction monitoring capabilities, BloFin has integrated a Know-Your-Transaction (KYT) solution from AnChain.AI. Leveraging AI-powered blockchain intelligence, this solution enhances BloFin's ability to monitor and analyze transactions in real time. It strengthens compliance efforts by detecting and preventing suspicious activities.

Additionally, BloFin has integrated Chainalysis' blockchain data platform to bolster its compliance capabilities. This integration enables real-time monitoring of cryptocurrency transactions, empowering BloFin to detect and prevent illicit activities such as money laundering.

Prospective users would be happy to know that BloFin has never been, a claim not many exchanges can make.

BloFin Affiliate Program

The BloFin Affiliate Program is designed to offer a mutually beneficial partnership, allowing affiliates to generate unique referral links. When someone clicks on these links and completes the registration, they become the affiliate's invitee, enabling the affiliate to receive a rebate based on the invitee's trading fees.

With BloFin Affiliate, You Can Earn Up to 50% Commission on Trading Fee. Image via BloFin

With BloFin Affiliate, You Can Earn Up to 50% Commission on Trading Fee. Image via BloFinHere are a few benefits of being an affiliate:

- Lifetime Commission: Earn from all your invitees' trading fees proportionally.

- Industry-Leading Rebate: Up to 50% rebate on futures trading fees.

- Daily Compensation: Commissions are calculated and processed daily.

- Extra Earnings: Additional commission when inviting sub-affiliates.

To start earning commissions, affiliates need to follow a few steps. First, they get their affiliate links, which can be customized, from the Affiliates Management page. Then, they share these links or codes with friends, communities, or on social media. When invitees use these links or codes to sign up and trade on BloFin, the affiliates earn a commission from every trading fee paid by their invitees for a lifetime. Commissions are settled every 6 hours in USDT.

How to Join:

- Web: Submit an application via BloFin Affiliates.

- App: Tap on the [Affiliate] on the homepage and submit your application.

Here's an overview of affiliate level and commission details:

| Level | Commission Ratio | Sub-affiliate Commission Ratio |

|---|---|---|

| 1 | 40% | 40% |

| 2 | 45% | 45% |

| 3 | 50% | 50% |

As an affiliate, you can expand your network to up to three levels of sub-affiliates, with no limit on the number of sub-affiliates. Both you and your sub-affiliates will earn a share of the invitees' trading fees. To get started:

- Ensure your sub-affiliate has a BloFin account.

- Add sub-affiliates on the Affiliates Management page.

- Set commission rates for your sub-affiliates. Note that you can only modify these rates for existing sub-affiliates.

BloFin Licenses

Cryptocurrency exchanges often highlight their licenses and regulatory compliances prominently on their websites.

This practice reassures users about the legitimacy and security of the platform. By displaying licenses from various geographies, exchanges demonstrate their adherence to international regulatory standards. This transparency is crucial in an industry where security and compliance are paramount.

However, BloFin takes a slightly different approach.

It opts for a more subtle mention of "localized compliance" on its website. This might seem counterintuitive, especially given the industry's emphasis on regulatory transparency. There could be a few possible reasons for this choice:

- Strategic Communication: By mentioning "localized compliance" in a more understated manner, BloFin could be aiming to convey that compliance is a fundamental and integrated aspect of its operations, not just a marketing point.

- Regulatory Sensitivity: Given the varying regulatory environments across different geographies, BloFin might choose to handle compliance information with discretion. This can prevent drawing undue attention to specific regulatory challenges or nuances that the exchange might face in different regions.

While this strategy might make it harder for users to immediately find detailed compliance information, it does not necessarily imply a lack of transparency. Users who prioritize regulatory details can usually find this information through support channels.

In the Cayman Islands, where BloFin is reportedly based, the exchange is registered as a mutual fund, allowing it to accept subscriptions and redemptions in fiat currencies from qualified institutions and individual investors.

Closing Thoughts

BloFin is a robust cryptocurrency exchange that caters to both novice traders and seasoned investors. The exchange's dedication to security is evident through its use of state-of-the-art measures, such as third-party custody solutions, insurance coverage through Fireblocks, and advanced transaction monitoring powered by AI tools from Chainalysis and AnChain.AI.

BloFin offers a comprehensive range of trading options, including spot trading, perpetual futures with leverage up to 150x, copy trading, and financial products like staking. This diversity allows users to engage in various trading strategies, from short-term speculation to long-term investment and yield generation through staking. The platform features over 320 trading pairs, including major cryptocurrencies and niche tokens. Additionally, BloFin provides 24/7 customer support to assist users with any queries or issues, further enhancing the overall trading experience.

Overall, BloFin is a reliable and secure cryptocurrency exchange that combines technological innovation with a user-centric approach, making it an ideal platform for both beginners exploring the world of digital assets and experienced traders seeking advanced trading tools.