With centralized crypto exchange giants like Binance, Coinbase, and Bybit dominating the cryptocurrency trading space, smaller exchanges often struggle to gain visibility amidst the hundreds of options available. However, given the inherent risks associated with using crypto exchanges—along with the potential losses if your chosen exchange were to collapse—diversifying your portfolio of exchanges is a prudent strategy for managing risk.

One such smaller yet noteworthy and well-regulated platform is CoinCatch. Despite flying relatively under the radar so far, CoinCatch delivers a seamless trading experience tailored to a diverse range of users. With features and security measures that rival those of its more established competitors, it positions itself as a strong alternative for traders looking to explore new options.

In this CoinCatch review, we’ll dive into the platform’s offerings, examining its security protocols, trading tools, and overall user experience to help you decide if it’s a good fit for your trading needs.

CoinCatch Review Summary

CoinCatch is a centralized cryptocurrency exchange launched in 2022, registered in the British Virgin Islands, and operated by Linkbase Technology Limited. Despite being a smaller platform compared to its major competitors, CoinCatch offers a solid set of features designed to cater to both novice and experienced traders.

The Key Features of CoinCatch Are:

- Security and Privacy: Implements industry-standard security measures, including Two-Factor Authentication (2FA), anti-phishing codes, and fund passwords. CoinCatch employs Merkle Tree Proof of Reserves with monthly snapshots to enhance transparency, ensuring user assets are securely custodied. The platform holds over 90% excess reserves for major assets like BTC, ETH, USDT, and USDC.

- Diverse Trading Options: Offers both spot trading and futures trading for popular cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and over 120 other assets. Futures trading provides up to 200x leverage on select trading pairs.

- Copy Trading: Features advanced copy trading options, including Smart Copy and Diverse Copy modes. These allow users to replicate elite traders’ strategies with proportional investments or diversified approaches, catering to different risk profiles.

- Extensive Cryptocurrency Support: Provides access to 129 spot trading pairs and 189 perpetual contract pairs, featuring both popular cryptocurrencies like BTC, ETH, and Solana, as well as smaller altcoins for diversified trading options.

- Flat Fee Structure: Maintains a straightforward fee system with a flat 0.1% fee for spot trades and competitive rates of 0.02% for limit orders and 0.06% for market orders on futures.

- User-Friendly Interface: Features an intuitive and easy-to-navigate platform accessible via a user-friendly mobile application, ensuring a seamless trading experience for both beginners and seasoned traders.

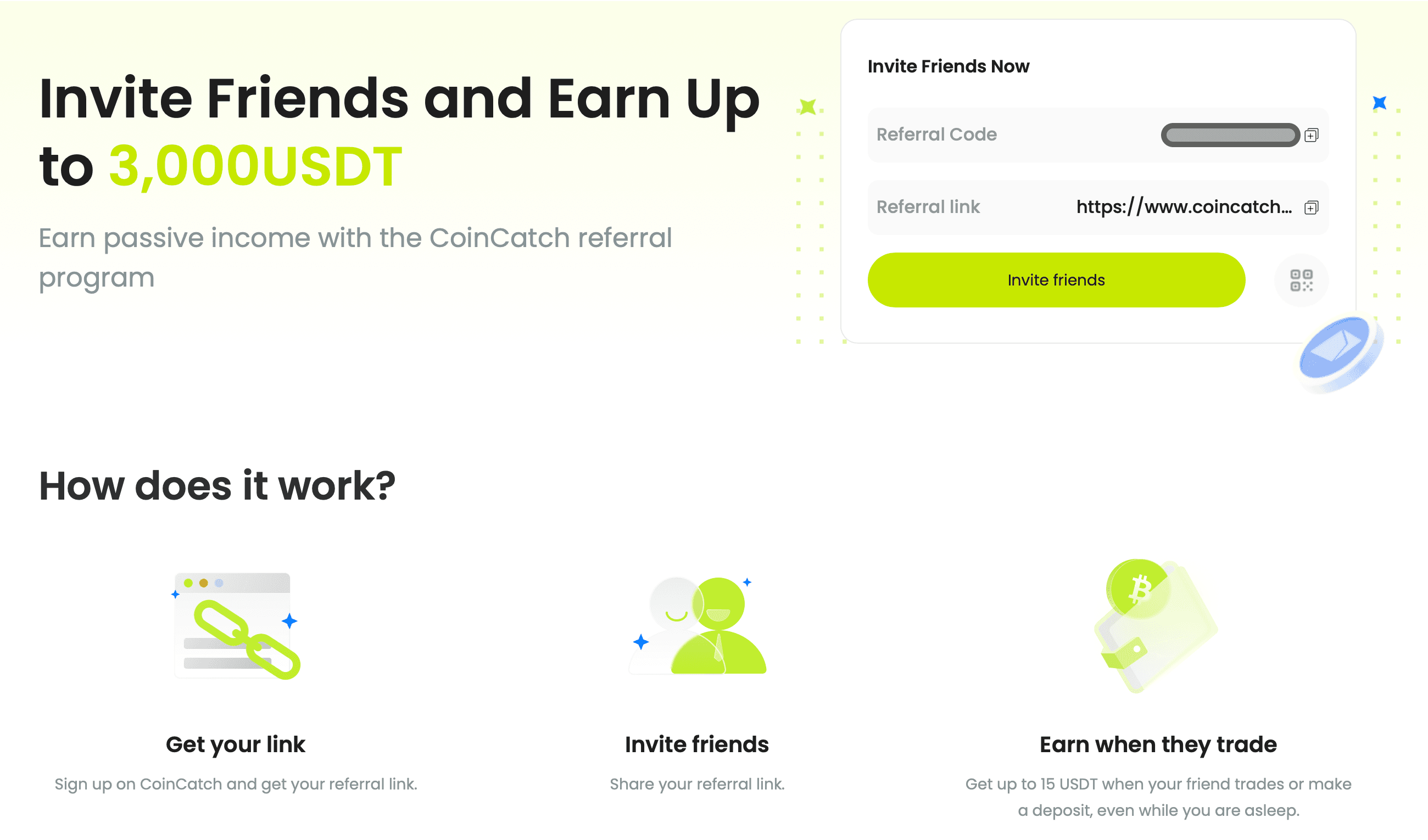

- Affiliate & Referral Programs: Provides both an Affiliate Program for influencers and content creators, offering competitive commission rates, daily settlements, and a multi-tier sub-affiliate system, and a Referral Program for everyday users to earn up to 3,000 USDT in bonuses and 30% commission on trading fees by inviting friends to join the platform.

- High Non-KYC Limits: Supports withdrawals of up to 50,000 USDT daily without KYC, accommodating privacy-conscious users while still enabling robust trading limits.

What is CoinCatch?

CoinCatch is a centralized cryptocurrency exchange launched in 2022 and registered in the British Virgin Islands. It is operated by Linkbase Technology Limited, though there is very little publicly available information about the company or its founding team.

Despite its relatively low profile, CoinCatch operates as a well-regulated platform, holding registrations as a Money Service Business (MSB) with FINTRAC in Canada and FinCEN in the United States. This compliance ensures accessibility for users in both countries—a notable advantage over some larger competitors like OKX, KuCoin, and Bybit, which have limited availability in these regions.

The exchange supports a variety of trading services, including spot and futures trading for popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and over 120 other assets. Additionally, it offers features like copy trading and educational resources, making it a compelling option for beginners and experienced traders alike. All services are easily accessible via CoinCatch’s user-friendly mobile application.

In line with industry standards, CoinCatch employs proof of reserves to verify user asset backing. It also implements robust security measures, including two-factor authentication (2FA), anti-phishing codes, and fund passwords, ensuring the safety of users’ accounts and funds.

Getting Started with CoinCatch

Whether you’re a seasoned trader or just dipping your toes into cryptocurrency, getting started with CoinCatch is simple and intuitive. The platform offers two sign-up options:

- Register via email.

- Register using your mobile number.

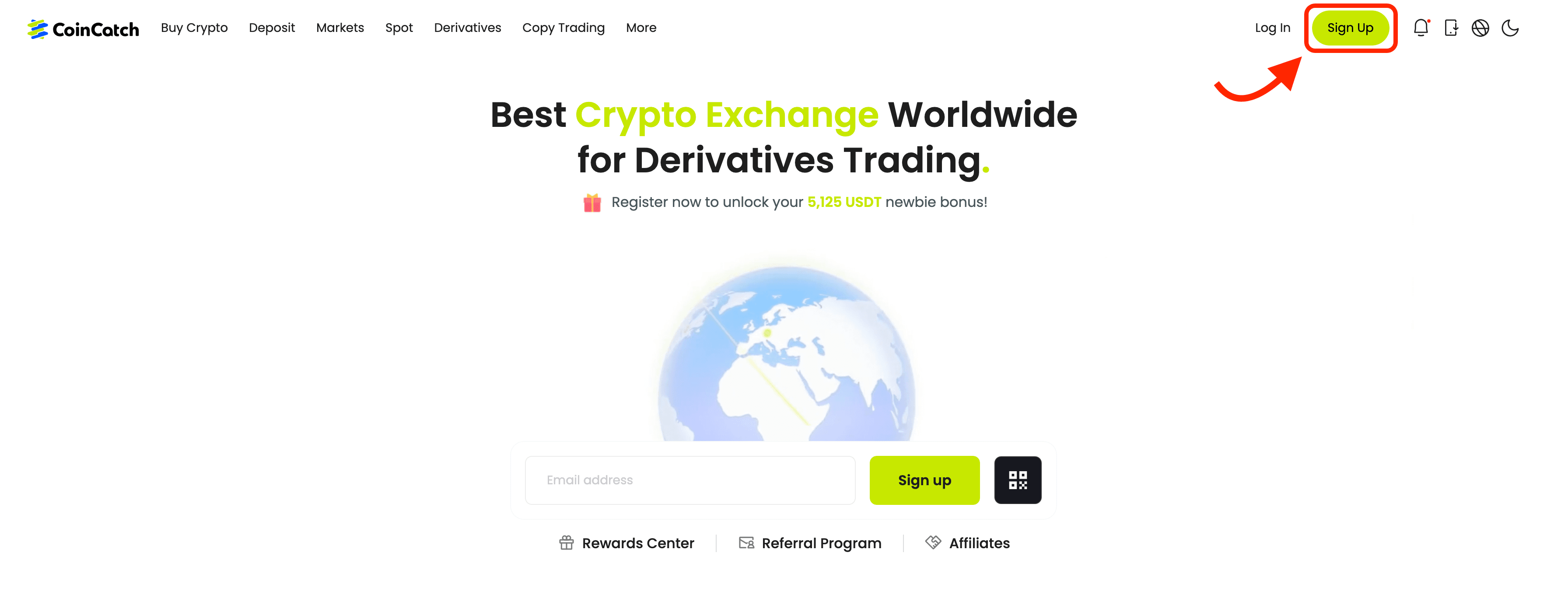

To begin, visit CoinCatch.com and click the “Sign Up” button located in the top-right corner of the homepage. Select your preferred method of registration and, if you have a referral code, enter it during the sign-up process. If not, simply proceed by clicking “Sign Up.”

👉 Sign Up Using Our Exclusive Link To Get a $150 Sign Up Bonus + Deposit & Trade to Earn $50,000 And Get Up to 75% Deposit Cashback!

CoinCatch Sign-Up Button in the Top-Right Corner. Image via CoinCatch

CoinCatch Sign-Up Button in the Top-Right Corner. Image via CoinCatchIf you choose to register via email, you will receive a verification code in your inbox. If you opt for mobile registration, the verification code will arrive as a text message. Once you’ve entered the code, you’re all set to start exploring CoinCatch!

CoinCatch KYC

With the cryptocurrency space moving toward greater compliance with global regulatory standards, most exchanges now require users to complete Know Your Customer (KYC) verification. However, CoinCatch stands out by granting non-KYC users access to several features while imposing relatively high limits on withdrawals and deposits.

Non-KYC users can withdraw up to 50,000 USDT per day and 200,000 USDT per month, though they won’t have access to P2P trading. Completing KYC unlocks far greater limits—3 million USDT per day with no monthly cap—and enables access to additional features like P2P trading.

How to Complete KYC on CoinCatch?

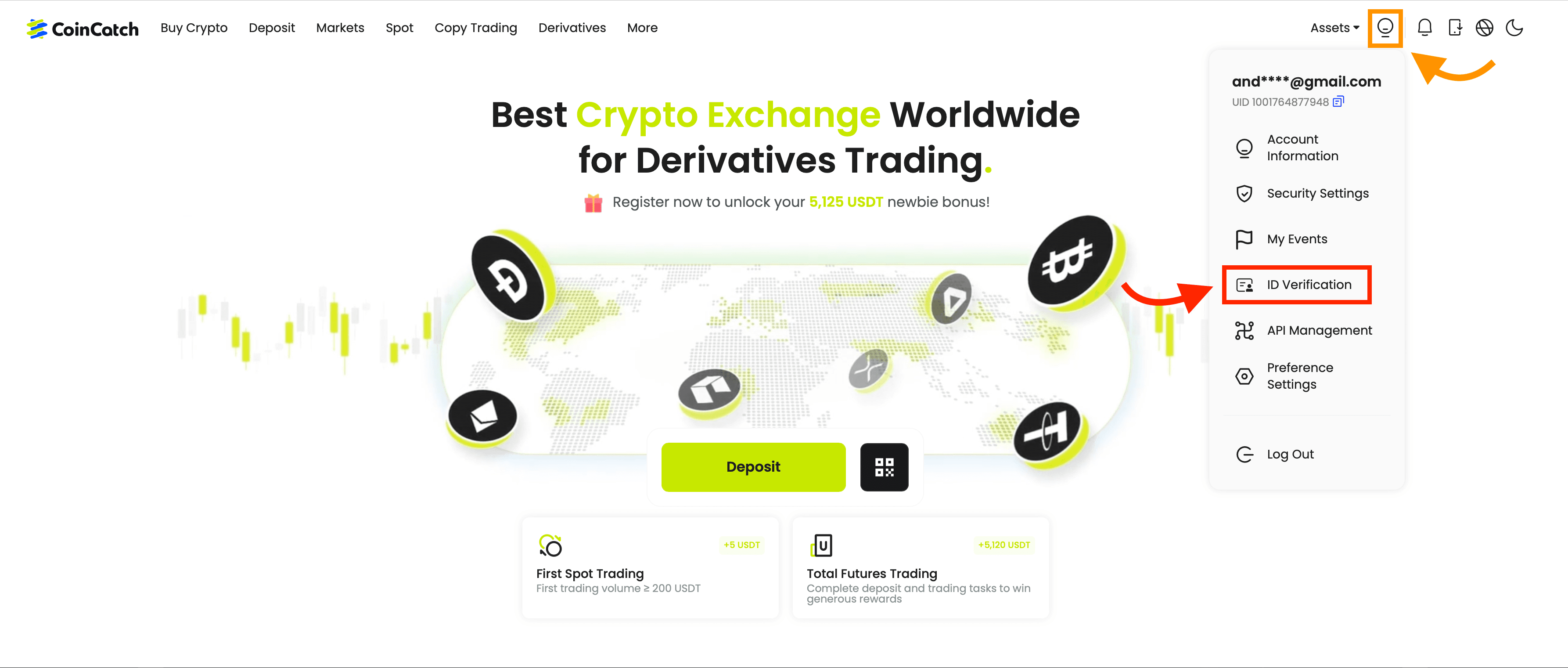

STEP 1: Access the ID Verification Page

- Click on the profile icon in the top-right corner and navigate to the "ID Verification" page.

ID Verification Under Profile Tab. Image via CoinCatch

ID Verification Under Profile Tab. Image via CoinCatchSTEP 2: Choose Individual Verification

- Select the “Individual Verification” option from the available options.

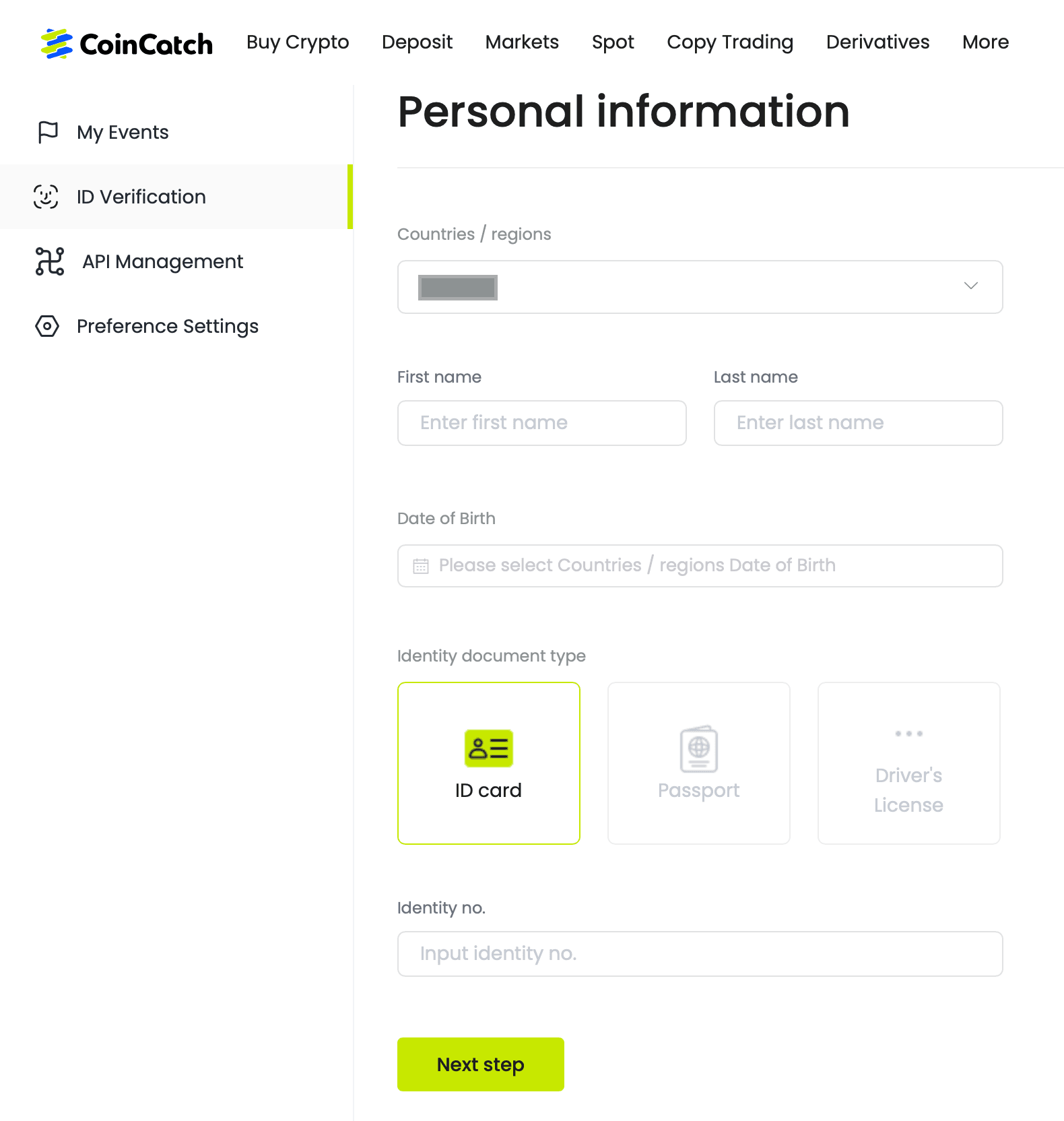

STEP 3: Provide Personal Information

- Choose your country/region and upload a valid identity document such as a passport or driver’s license.

Personal Information Required to Complete ID Verification. Image via CoinCatch

Personal Information Required to Complete ID Verification. Image via CoinCatch

STEP 4: Complete Biometric Verification

- Authorize camera access and take a real-time selfie following the on-screen instructions.

STEP 5: Submit Your Application

- After submitting your selfie, you’ll see a confirmation message indicating that your identity verification is under review.

Funding Your CoinCatch Account

One notable drawback of CoinCatch is its lack of support for fiat transfers, even through third-party service providers. This means that users will need to purchase cryptocurrencies on another platform before depositing them into CoinCatch.

That said, CoinCatch supports a wide variety of cryptocurrency deposits, including major assets like BTC, ETH, and various stablecoins, as well as a broad range of altcoins.

Security and Privacy at CoinCatch

The security and privacy of user data and funds have become top priorities for cryptocurrency traders. While CoinCatch has maintained a strong security record with no known breaches affecting user data or funds, the exchange is missing one very important ranking from cer.live, an independent cybersecurity ranking and certification platform that evaluates the security of cryptocurrency exchanges. That is most likely due to CoinCatch's relatively small size.

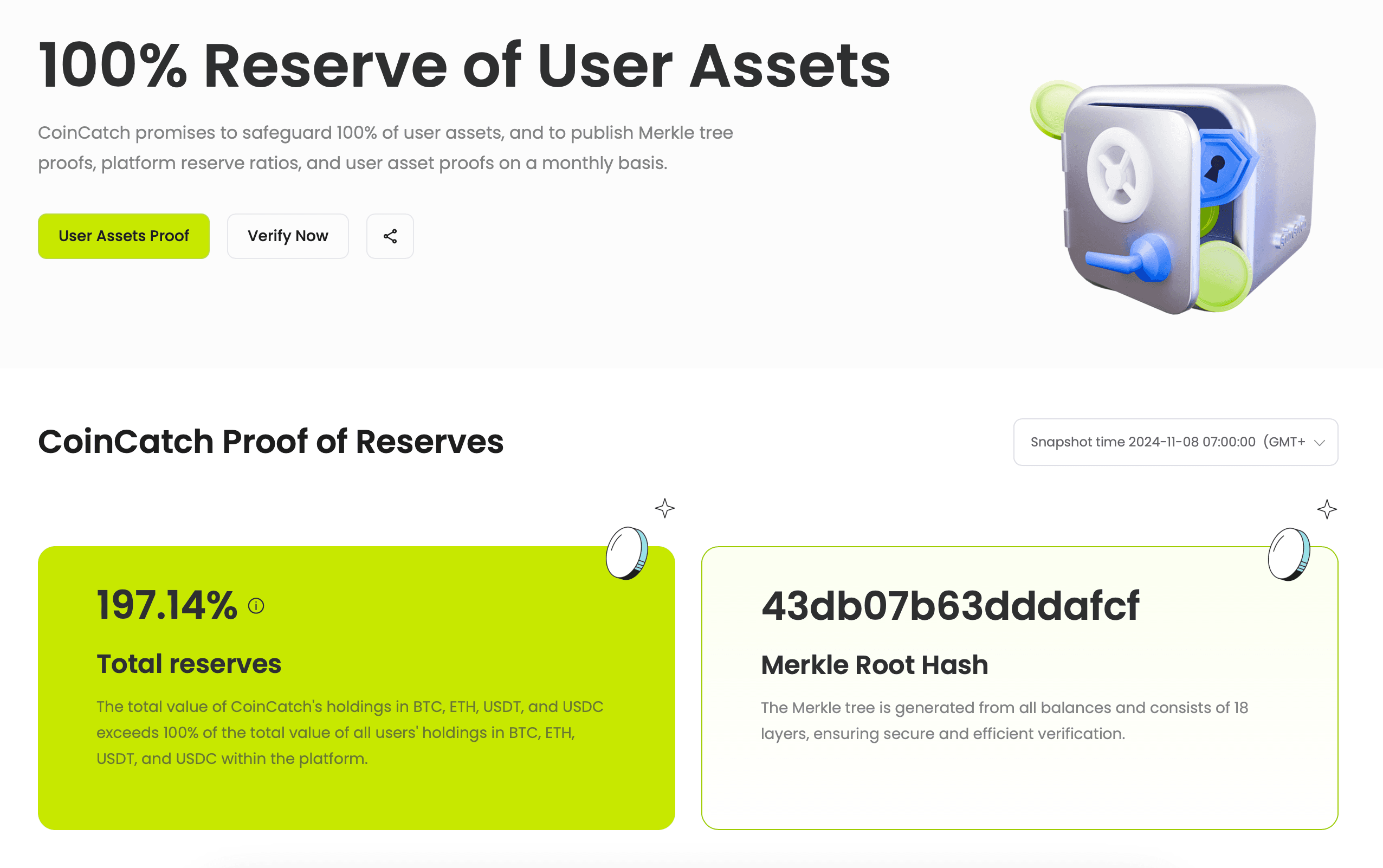

Despite this, CoinCatch employs Proof of Reserves (PoR) with monthly snapshots to ensure transparency and trust. The platform maintains over 90% excess reserves in cryptos like BTC, ETH, USDT, and USDC, which are the most actively traded cryptocurrencies on the exchange.

CoinCatch Holds Over 190% Reserves For BTC, ETH, USDT & USDT. Image via CoinCatch

CoinCatch Holds Over 190% Reserves For BTC, ETH, USDT & USDT. Image via CoinCatchThat said, traders are encouraged to practice safe custody for assets they are not actively trading. Self-custody remains the gold standard for security, particularly using hardware wallets, which are less vulnerable to hacking or exploits compared to software wallets.

For those looking for reliable options, you can find some great deals on The Coin Bureau’s Deals page.

In addition to PoR, CoinCatch states that it conducts regular security audits and employs industry-standard security measures to protect user data and funds. These measures include two-factor authentication (2FA), anti-phishing codes, and advanced encryption protocols, ensuring a secure trading environment for its users.

CoinCatch Supported Cryptocurrencies

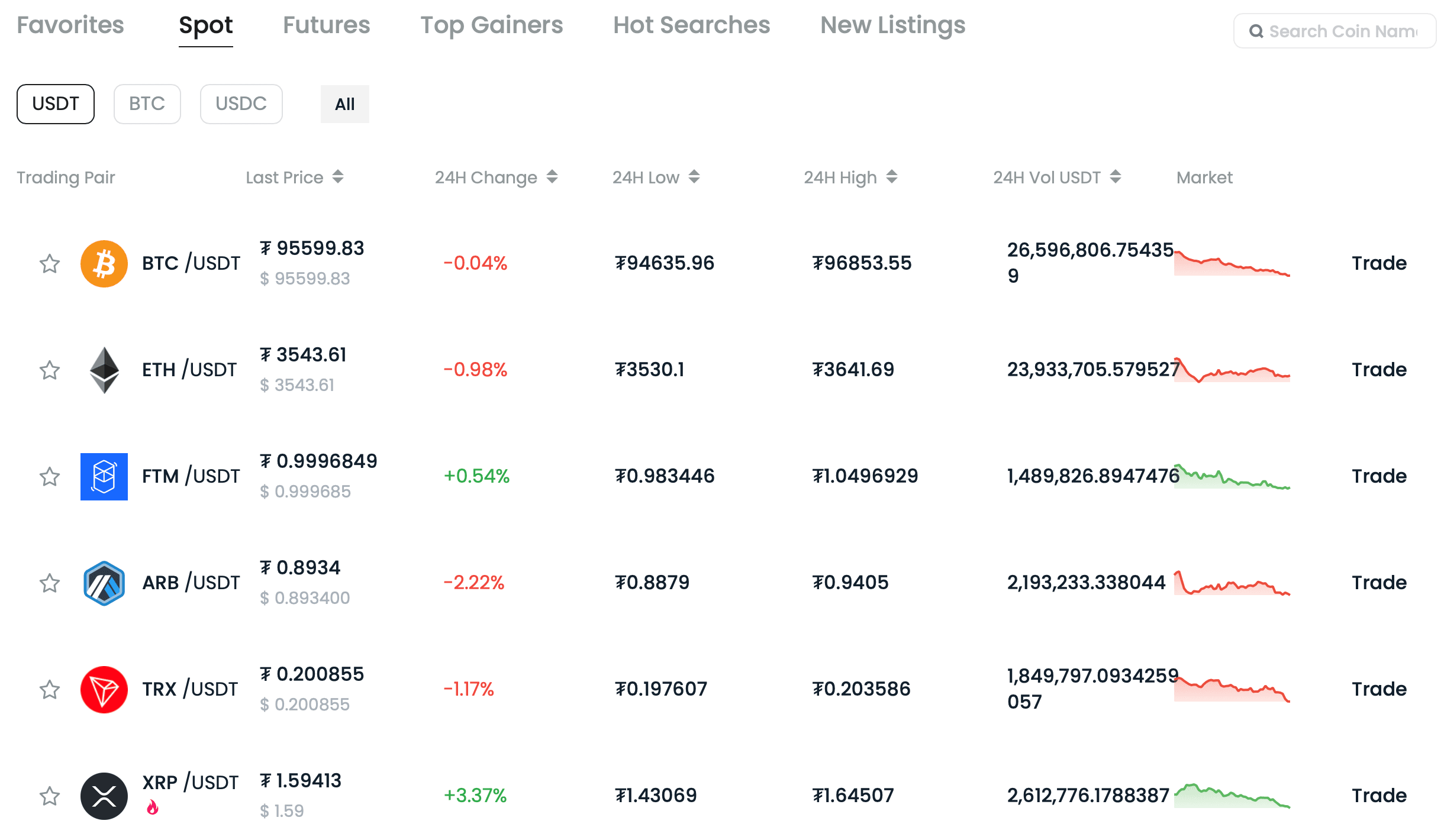

CoinCatch offers a diverse selection of cryptocurrencies, ranging from well-established options like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) to a wide array of smaller altcoin. At the time of writing, the platform supports 129 spot trading pairs and 189 perpetual contract pairs, providing traders with ample choices for trading.

CoinCatch Markets. Image via CoinCatch

CoinCatch Markets. Image via CoinCatchDeposit and Withdrawal Options

As mentioned before, CoinCatch currently supports only cryptocurrency deposits, with no options for bank transfers or purchasing crypto using debit or credit cards. This limitation extends to withdrawals, which are also restricted to crypto-only transactions.

Order Types on CoinCatch

CoinCatch provides a wide array of order types to cater to diverse trading strategies and preferences. Understanding these options is key to executing trades efficiently, whether you’re a beginner or an advanced trader. Here’s a breakdown of the order types available on CoinCatch, complete with practical examples to clarify their use:

Market Orders

Market orders prioritize speed and certainty, executing immediately at the best available market price. This type of order is ideal when immediate execution is more important than the price.

- Example: If Bitcoin (BTC) is trading at $90,000, placing a market buy order will purchase BTC at the best available price, such as $90,005 or $90,010, depending on market liquidity.

Limit Orders

Limit orders allow traders to set a specific price at which they wish to buy or sell an asset. The order is only executed when the market reaches the desired price or better.

- Example: If BTC is currently at $90,000, placing a buy limit order at $89,500 ensures the order is only filled if the price drops to $89,500 or below.

Stop-Limit Orders

A stop-limit order combines a stop price (trigger) and a limit price. Once the stop price is reached, a limit order is automatically placed at the specified limit price.

- Example: If you hold BTC at $90,000, you could set a stop-limit order with a stop price of $88,000 and a limit price of $87,800. If the price drops to $88,000, the system places a sell limit order at $87,800 to manage potential losses.

Take Profit Orders

Take profit orders automatically close a position once a predefined profit target is reached. This helps lock in gains without constant monitoring.

- Example: If you bought BTC at $85,000, setting a take profit order at $95,000 ensures your position closes once the price hits $95,000, securing your profit.

Trailing Stop Orders

Trailing stop orders adjust dynamically with market fluctuations. The stop price follows the market price at a set distance, locking in profits as the price moves favorably.

- Example: If BTC rises from $90,000 to $95,000, a trailing stop order set at $2,000 below the market price will adjust the stop price to $93,000. If the market reverses to $93,000, the order is executed, preserving gains.

Good-Til-Cancelled (GTC) Orders

Good-Til-Cancelled orders remain active until they are either filled or manually canceled, ensuring they stay open as long as necessary.

- Example: Placing a GTC buy order for BTC at $88,000 ensures the order remains active until the price hits $88,000 or you cancel it.

Immediate-Or-Cancel (IOC) Orders

IOC orders execute as much of the order as possible immediately, canceling any unfilled portion. This type is useful for traders seeking partial fills without leaving open orders.

- Example: A buy IOC order for 2 BTC at $90,000 might fill only 1.5 BTC at that price if liquidity is limited, canceling the remaining 0.5 BTC.

Fill-Or-Kill (FOK) Orders

FOK orders must be entirely filled immediately or canceled outright. This ensures no partial fills, making it suitable for traders who require complete order execution.

- Example: A sell FOK order for 3 BTC at $91,000 will only execute if all 3 BTC can be sold at that price. If not, the order is canceled entirely.

Post-Only Orders

Post-only orders are designed to ensure the order is added to the order book as a maker order. If the order matches with an existing one, it is canceled to avoid taker fees.

- Example: Placing a post-only buy order for BTC at $89,900 ensures it remains on the order book rather than executing immediately if the market price is $89,900.

How to Trade Spot on CoinCatch?

Now that you’re familiar with the range of order types available on CoinCatch, the next logical step is to dive into the trading process itself. Here’s a quick walkthrough to help you get started with spot trading on the platform:

STEP 1: Log In to Your Account

- Visit the CoinCatch homepage and log in using your registered email address and password.

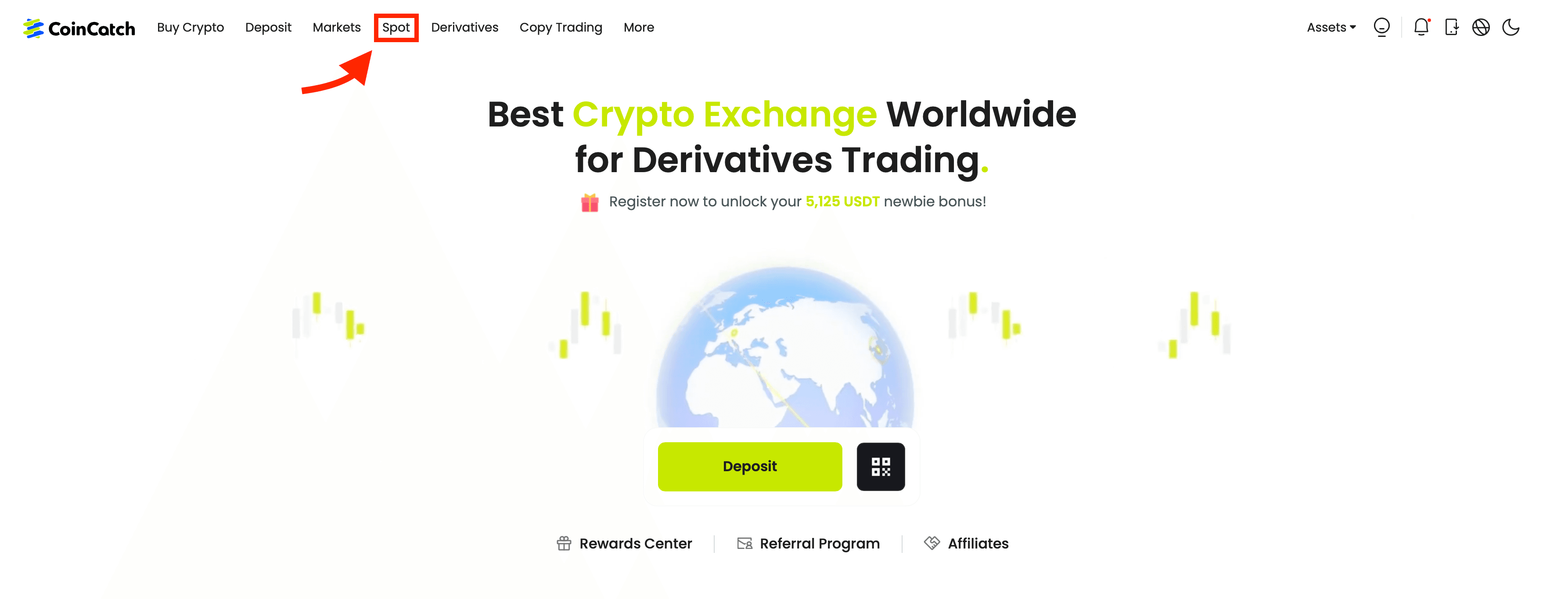

STEP 2: Navigate to the Spot Trading Section

- Once logged in, click on the "Spot" tab located at the top of the homepage.

CoinCatch Spot Tab on the Menu Bar. Image via CoinCatch

CoinCatch Spot Tab on the Menu Bar. Image via CoinCatchSTEP 3: Select Your Desired Trading Pair

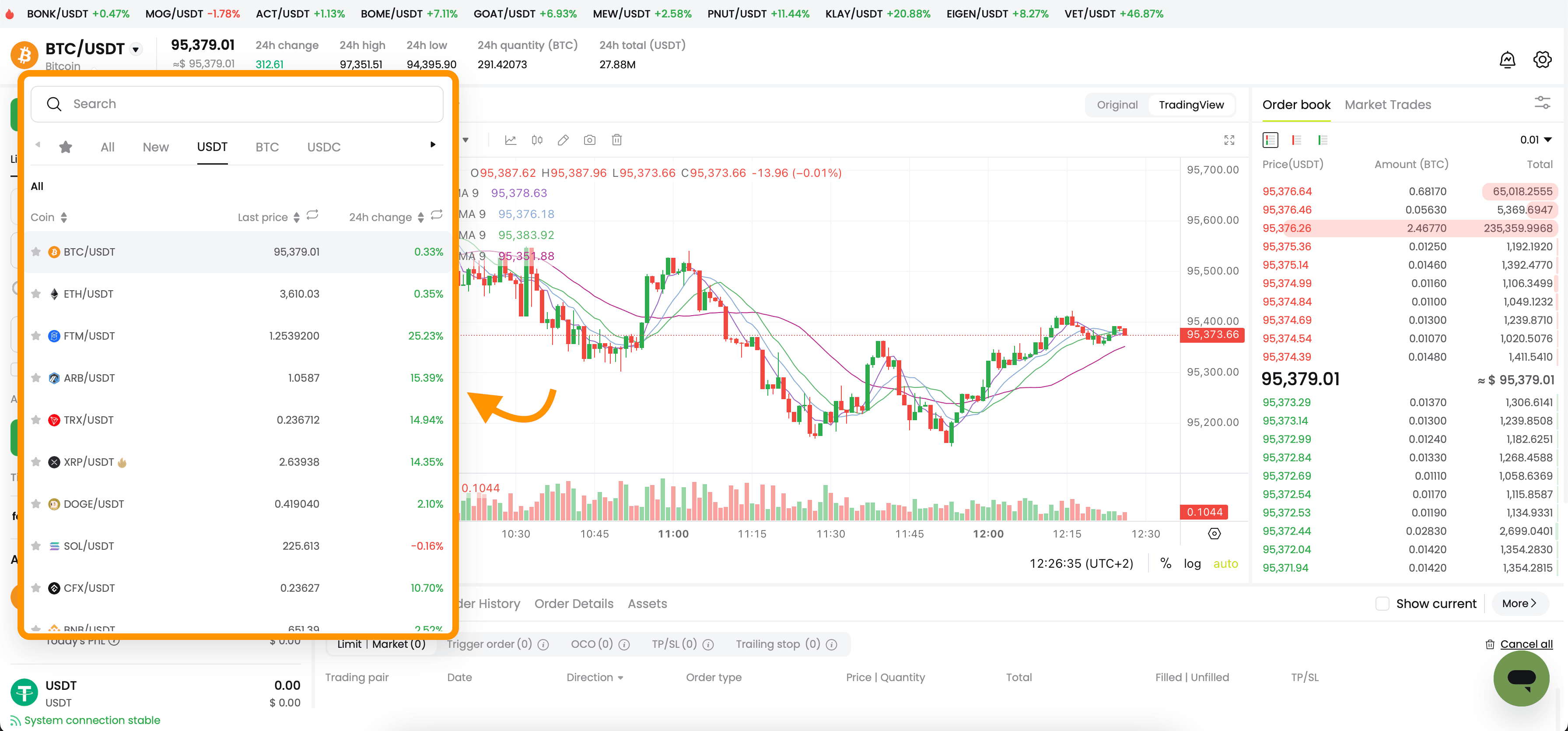

- Browse through the list of available trading pairs or use the search function to find the pair you wish to trade (e.g., BTC/USDT).

- Click on the chosen pair to open its trading interface.

Trading Pairs List on CoinCatch. Image via CoinCatch

Trading Pairs List on CoinCatch. Image via CoinCatchSTEP 4: Choose and Place Your Order

- Select your preferred order type from the available options (e.g., market, limit, or stop-limit).

- Choose whether you wish to "Buy" or “Sell.”

- Review all details, such as price and quantity, and submit your order.

Placing an Order on CoinCatch. Image via CoinCatch

Placing an Order on CoinCatch. Image via CoinCatchSTEP 5: Monitor Your Orders

- Open Orders: View all active orders that have yet to be filled, which can be modified or cancelled if needed.

- Order History: Access a detailed history of all your past trades, including executed and canceled orders.

Leverage on CoinCatch

Leverage is a cornerstone of futures trading, allowing traders to control larger positions with a fraction of the capital. CoinCatch offers a flexible and user-friendly leverage system, catering to both beginners and seasoned traders by providing up to 200x leverage on select trading pairs.

Margin Requirements

To trade futures on CoinCatch, traders must deposit a portion of the trade’s value as collateral, referred to as the margin. This serves two purposes: amplifying trading power through leverage and mitigating risk in volatile markets.

- Initial Margin: The minimum required deposit to open a position.

- Formula: Position Value ÷ Leverage.

- Example: For a $90,000 BTC position at 10x leverage, the initial margin is $9,000.

- Any unused funds from the initial deposit are returned to the account balance once the position is opened.

- Formula: Position Value ÷ Leverage.

- Maintenance Margin: The minimum margin level needed to sustain a position.

- Formula: Leverage Maintenance Margin Rate × Position Value.

- Maintenance margin ensures traders can withstand small market fluctuations. Falling below this level triggers a margin call, requiring additional funds to keep the position open or risk liquidation.

- Formula: Leverage Maintenance Margin Rate × Position Value.

Liquidation and Risk Management

Liquidation occurs when the account’s margin falls below the required maintenance margin, driven by adverse price movements. CoinCatch integrates robust mechanisms to protect traders:

- Dual-Price Mechanism: CoinCatch uses a “Mark Price” (a global average) to trigger liquidations, rather than the “Last Traded Price,” preventing price manipulation from prematurely liquidating positions.

- Auto-Deleveraging (ADL): In cases where liquidation fails to cover losses beyond the bankruptcy price, CoinCatch employs ADL. This system automatically reduces positions from opposing profitable traders to balance the loss. Traders with the highest profits and leverage are prioritized for deleveraging.

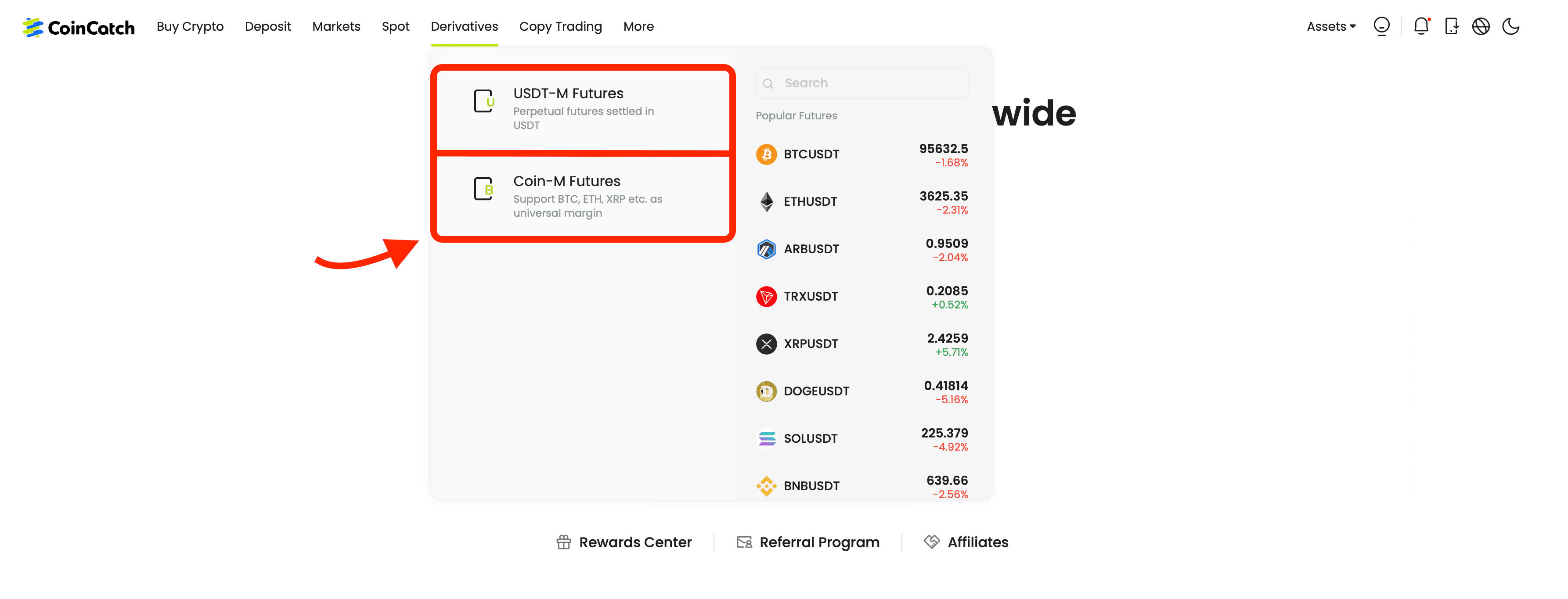

Perpetual Futures: USDT vs. COIN-Margined

CoinCatch provides two perpetual futures types, catering to diverse trading strategies:

- USDT-Margined Futures: These contracts use stablecoin USDT as collateral, offering a stable, predictable trading experience.

- COIN-Margined Futures: Here, the base cryptocurrency (e.g., BTC or ETH) is used for margin and settlement. This type is favored by long-term holders (HODLers), as profits and collateral are in the underlying cryptocurrency, potentially benefiting during bull markets.

Futures Types on CoinCatch. Image via CoinCatch

Futures Types on CoinCatch. Image via CoinCatchPractical Tips for Using Leverage on CoinCatch

- Control Leverage Carefully: While CoinCatch allows traders to adjust leverage up to 200x, beginners should start with lower levels (e.g., 5x) to limit risk.

- Monitor Maintenance Margin: Keep a close eye on margin levels, especially during volatile markets, to avoid liquidation.

- Implement Stop-Loss Orders: Setting stop-loss levels helps minimize potential losses by automatically closing positions if unfavorable price movements occur.

- Diversify Futures Types: Choose between USDT- or COIN-margined contracts based on your strategy. For instance, use COIN-margined futures to increase crypto holdings in bullish markets.

❗IMPORTANT❗Margin trading involves significant risks and should only be undertaken by experienced traders who understand the complexities and potential pitfalls associated with leveraging positions.

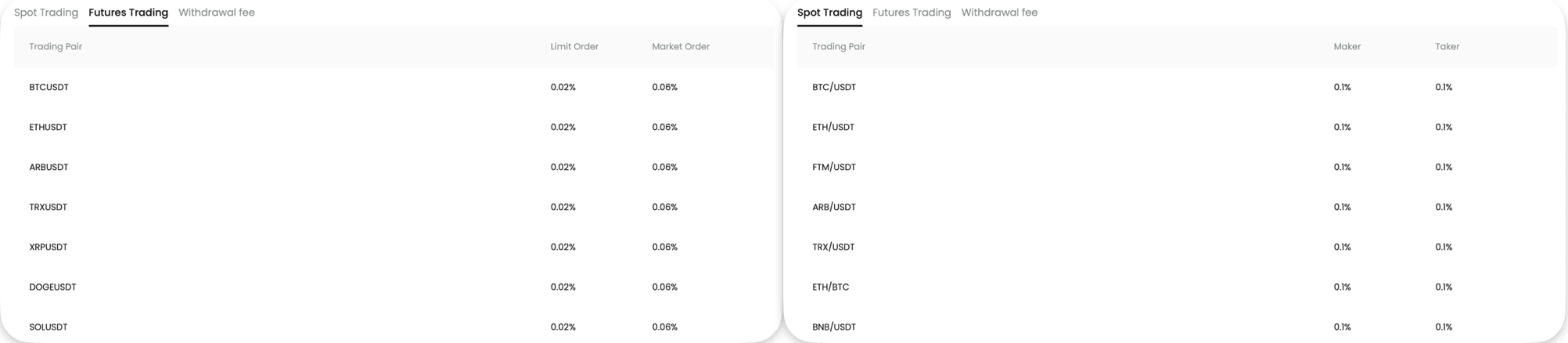

CoinCatch Fees

CoinCatch maintains a straightforward fee structure without tiered discounts. For spot trading, both maker and taker fees are set at a flat 0.1%, while futures trading features a 0.02% fee for limit orders and 0.06% for market orders.

CoinCatch Spot and Futures Trading Fees. Image via CoinCatch

CoinCatch Spot and Futures Trading Fees. Image via CoinCatchThis simplicity makes fees easy to understand, but some traders may find the absence of a tiered structure less competitive. Larger exchanges like Toobit, OKX, and KuCoin reward frequent and high-volume traders with reduced fees, offering an advantage for loyal, active users.

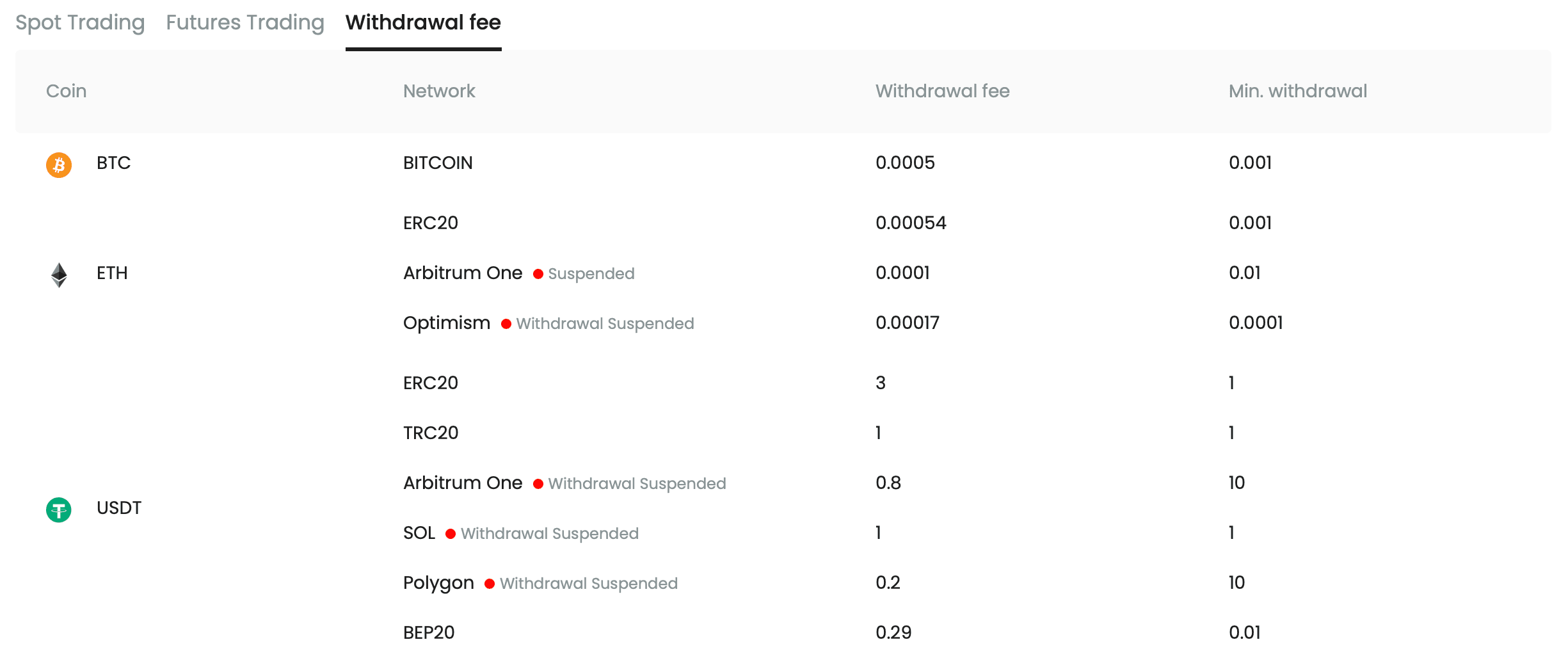

Looking at CoinCatch’s deposit and withdrawal fees, the platform charges no fees for crypto deposits, while its withdrawal fees remain competitive compared to larger exchanges.

CoinCatch Withdrawal Fees. Image via CoinCatch

CoinCatch Withdrawal Fees. Image via CoinCatchCoinCatch Affiliate and Referral Programs

CoinCatch provides two rewarding programs aimed at growing its user base: the Affiliate Program and the Referral Program. Both initiatives are designed to incentivize users while promoting platform growth.

CoinCatch Affiliate Program

The affiliate program is tailored for influencers, content creators, and those with substantial networks, offering attractive commissions and tools to optimize their referral efforts.

Key Highlights:

- Competitive Commission Rates: Affiliates earn commissions that exceed standard industry rates by 10%, maximizing their earning potential.

- Daily Settlements: Earnings are settled daily, ensuring prompt and reliable payouts for affiliates.

- Multi-Tier Sub-Affiliate System: Affiliates can recruit sub-affiliates, expanding their network and boosting their income through layered rewards.

- Real-Time Analytics: The platform offers a comprehensive dashboard for tracking referral performance and earnings in real-time.

- Custom Promotional Support: CoinCatch collaborates with top affiliates to create targeted marketing materials, boosting referral conversion rates.

Some of CoinCatch's Affiliate Program Features. Image via CoinCatch

Some of CoinCatch's Affiliate Program Features. Image via CoinCatchCoinCatch Referral Program

Designed for everyday users, the Referral Program provides an opportunity to earn rewards simply by inviting friends to join the platform.

Key Highlights:

- Earn Up to 3,000 USDT in Bonuses: Referrers can unlock rewards when invitees meet milestones such as depositing 200 USDT and achieving a 10,000 USDT futures trading volume.

- 30% Commission on Trading Fees: Receive a share of trading fees generated by referees, providing a passive income stream.

- User-Friendly Sharing Tools: Unique referral codes and links are accessible through the CoinCatch app, simplifying the process of inviting new users.

- Mutual Rewards: Both referrers and referees benefit from the program.

CoinCatch Referral Program. Image via CoinCatch

CoinCatch Referral Program. Image via CoinCatchCoinCatch Review: Closing Thoughts

CoinCatch undeniably has room for growth before it can compete head-to-head with larger, more established exchanges. However, it still manages to offer a solid array of features, along with some unique aspects, that make it a viable cryptocurrency exchange overall.

While the absence of key features like bank transfers and credit card support for crypto purchases may limit its appeal to beginners entering the crypto space, CoinCatch could prove to be a strong option for more crypto-savvy users. The platform provides a notable mix of benefits, including a comprehensive list of cryptocurrencies, high levels of security and privacy, as well as generous non-KYC withdrawal and trading limits.

For users seeking to diversify their portfolio of exchanges, CoinCatch offers a reliable alternative, even if it lacks some of the convenience features found on larger platforms.

Disclaimer: This is a paid review, yet the opinions and viewpoints expressed by the writer are their own and were not influenced by the project team. The inclusion of this content on the Coin Bureau platform should not be interpreted as an endorsement or recommendation of the project or product being discussed. The Coin Bureau assumes no responsibility for any actions taken by readers based on the information provided within this article.