Coinsmart is a relatively new Canadian cryptocurrency exchange that opened their doors in July of 2018.

They are trying to break into the market by providing an exchange solution that will address many of the challenges that traders face in Canada. These include things like antiquated account funding solutions and complicated trading platforms.

However, can you really trust such a new exchange?

In this Coinsmart review, we will attempt to answer that question. We will give you everything that you need to know about the exchange including their security protocols, funding, fees, trading technology and customer support.

Coinsmart Overview

Coinsmart is another Toronto based exchange and they have offices in the city. It was founded by Justin Hartzman and Jeremy Koven. They both worked at Needls and WeSellYourSite.

WeSellYourSite was a website brokering service and Needls is a digital marketing agency. The Coinsmart team has also tapped the brains of Edmund Lau as a technical advisor. He was the CTO of DealTap and WorldGaming.

Coinsmart was actually conceived due to difficulties that these founders faced when they were trading cryptocurrencies on other exchanges. These included such things as Fiat funding complications and slow verification times.

They also found that the other exchange options were quite complicated and not well suited to those new to cryptocurrency trading. Hence, they embarked on developing a user-friendly exchange that had a "personal touch".

Is Coinsmart Safe?

This is perhaps one of the most important questions that Canadian crypto investors are asking themselves. It was only just recently that QuadrigaCX (previously Canada's largest) went under due to lack of liquidity and a number of other questionable factors.

Moreover, recent history is littered with examples of exchanges that have been hacked and had customer's coins / data stolen. When you are choosing an exchange to use you have to make sure that they have the right security protocols in place.

So, how does Coinsmart stack up?

MSB Licence

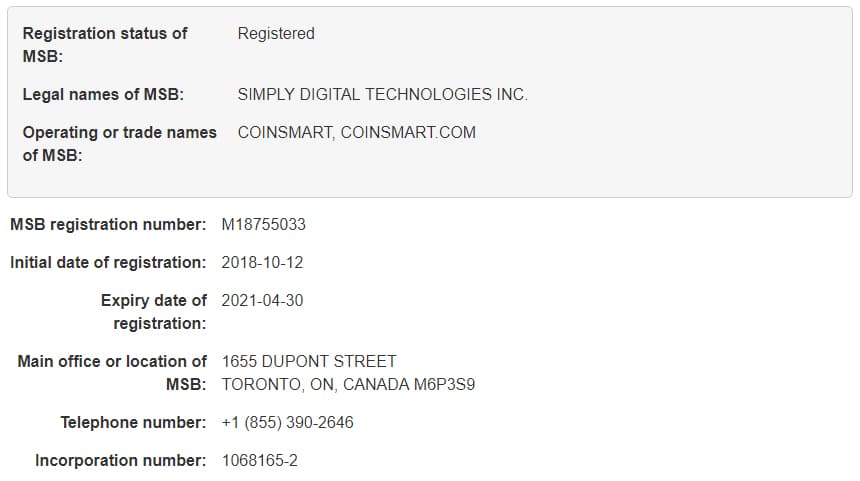

Coinsmart has a Money Service Business (MSB) licence that was issued by FINTRAC. FINTRAC is the Canadian government agency that gathers, analyzes, assesses, and discloses financial intelligence. The Coinsmart licence number is M18755033.

The Coinsmart MSB Licence. Image source: FINTRAC

The Coinsmart MSB Licence. Image source: FINTRACThis is beneficial for a number of reasons.

Firstly, in order to get this licence Coinsmart will have had to have completed a number of compliance steps that are required by FINTRAC. This means that they will have had to disclose to the regulator numerous aspects of their business which would then have to be signed off.

Secondly, it means that there is a standard of ongoing reporting that Coinsmart will have to adhere to if they want to keep their licence. These include things like consistent KYC checks and financial reporting.

Lastly, it means that Coinsmart is able to secure important relationships with the likes of banks and payment processors. With an MSB licence, these partners are way more likely to work with a cryptocurrency exchange.

Coin Storage

As is standard with most exchanges these days, Coinsmart operates a coin cold storage protocol. This means that the majority of their coins are kept in offline storage which makes it is impossible for hackers to access the coins.

In order to facilitate daily business on the exchange, they will keep a minimum amount of coins in their "hot wallets". They will probably also use multi-signature technology to move coins from their cold storage to their hot wallets and back.

Irrespective of the coin management protocol at Coinsmart, it is not advisable to keep large holdings of coins on any exchange. The optimal solution is to be in control of your own private keys.

Communication Encryption

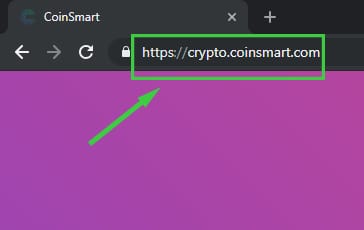

As is standard with most financial websites these days, Coinsmart has full SSL encryption on their site. This means that all of the communication that you submit on their site as well as your password information cannot be intercepted by online snoops.

SSL Padlock for Coinsmart Platform

SSL Padlock for Coinsmart PlatformMoreover, this can be quite a helpful tool for the user when they are logging into sites that are susceptible to hacking and phishing attacks. Full SSL encryption means that you will be presented with a padlock in the browser.

If you happen to log onto a site that has the same domain as Coinsmart but there is no SSL padlock it means that a hacker is trying to dupe you into providing information to a phishing site. So be aware of this indicator.

User Side Security

Of course, most of the security that one can hope for starts with your own account management. You will want to get yourself a strong password for which Coinsmart has a handy generator. If you are going to use this, it is wise to generate the password in an offline state.

However, even if your password is somehow leaked or phished from you, two factor authentications will stop unauthorized access. This makes use of the Google authenticator app which you can download from the iOS store as well as Google Play.

2FA is an additional security feature that is offered and it is not enabled by default. We advise you to enable this the moment that you have created an account and trade with piece of mind.

Coinsmart Assets

There appears to be a reasonable range of cryptocurrency assets available on Coinsmart which is mostly in line with other Canada based exchanges.

Assets available on Coinsmart

Assets available on CoinsmartBelow is a full list of the coins that are available at the time of the review:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

- Bitcoin Cash ABC (BCH)

- Monero (XMR)

- Dash (DASH)

What is interesting is that they are the first Canadian based exchange to offer XMR/CAD pairs. While Kraken does offer Monero on their exchanges, users will first have to buy Bitcoin with their Fiat CAD in order to get their hands on it.

Coinsmart has stated that they will soon be adding other coins including EOS, Stellar, NEO, IOTA and OMG. It is interesting that they are not considering Ethereum Classic (ETC) given the technical similarities to Ethereum. Perhaps this is something they may include at a later date.

Coinsmart Fees

Fees are greatly important to the crypto trader. Not only is it those headline fees that can impact their long-term profitability but it is those hidden types that you are not immediately aware of. Fee transparency is a really important requirement for us.

Let's take a deeper dive into the fee schedule at Coinsmart.

Trading Fees

They have a simple trading fee structure that is set to a flat rate of 0.3% for all single trades. These are trades that are executed between Canadian Dollars and any cryptocurrency or between Bitcoin (BTC) and any cryptocurrency.

So, in other words, all BTC and CAD trades will be charged at 0.3%.

For all other types of cross crypto trades, Coinsmart will charge 0.6%. So, for example, if you are trading ETH / LTC or any other crypto combination that does not involve Bitcoin, you will be charged 0.6%. This makes logical sense as it will be the same fee that you will be charged if you converted your ETH to BTC and then your BTC to LTC for example.

These fees appear pretty reasonable compared to the other Canadian crypto exchanges. While it is slightly higher than Coinsquare's advanced trade fees, it is less than the flat rated fees on exchanges such as BitBuy.

Funding Fees

The deposit fees that you are charge is contingent on the type of funding that you use. If you are funding your account in cryptocurrencies then you will not be charged any fees for the inward transaction.

If you are going to be funding with CAD, you will be charged 2.5% for a Bank Draft as well as Interac. However, if you do a bank wire the fee is only 1%. They will also be introducing credit card and Flexepin funding with 10% and 3% fees respectively.

While the 10% fee for credit cards may seem exorbitant, it is most likely down to the fees charged by the payment processor. While it is a much higher fee than international exchanges such as Bitstamp, it is the same as other Canadian exchanges that offer card funding.

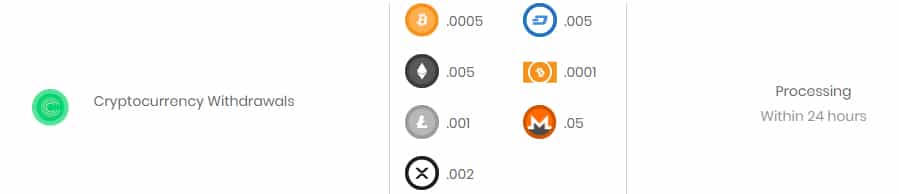

Withdrawal Fees

When it comes to withdrawing your crypto, Coinsmart will charge you a small fee. This is not a fee that is taken by the exchange but is used in order to pay miners through a transaction fee. While other exchanges adjust these fees based on network conditions, Coinsmart has fixed them.

Cryptocurrency Withdrawal network fees at Coinsmart

Cryptocurrency Withdrawal network fees at CoinsmartIf you are going to be withdrawing CAD, then you will pay 2% processing fee. This is irrespective of which withdrawal option you choose (EFT or Bank Wire).

Smart Guarantee

Something that we found quite interesting on offer from Coinsmart was their "Smart Guarantee". This is essentially a promise by the exchange to process your deposit and verification within a certain period of time. These are below:

- Credit Account same day as funds received

- If sending Fiat to their bank, to process your deposit in 5 business days

- Verify Account the same day

The guarantee is compelling because if they are unable to meet it, they will refund you the transaction fees. Of course, there are certain caveats to this. You have to make sure that you meet a number of other requirements such as providing the correct information and documents. You can read all the terms here.

If you feel that you are due a fee refund as they have not met this guarantee, then you will need to email them within 3 business days of the claim arising. You can do this through their support email at [email protected].

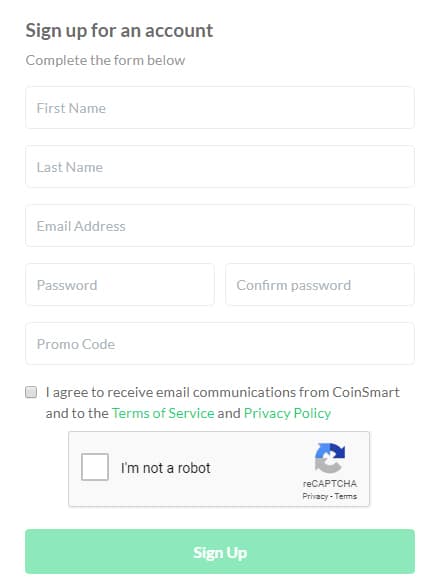

Signup & Verification

If you have decided that you would like to give Coinsmart a try then you will need to signup and create an account. They will need your full name, email, password as well as any promo code (more on this in the referral section).

Coinsmart initial registration Form

Coinsmart initial registration FormOnce you have signed up then they will ask you to confirm your account with a link that they sent to your email. Once that is confirmed you are free to log back into your account and complete the verification steps.

Account Verification

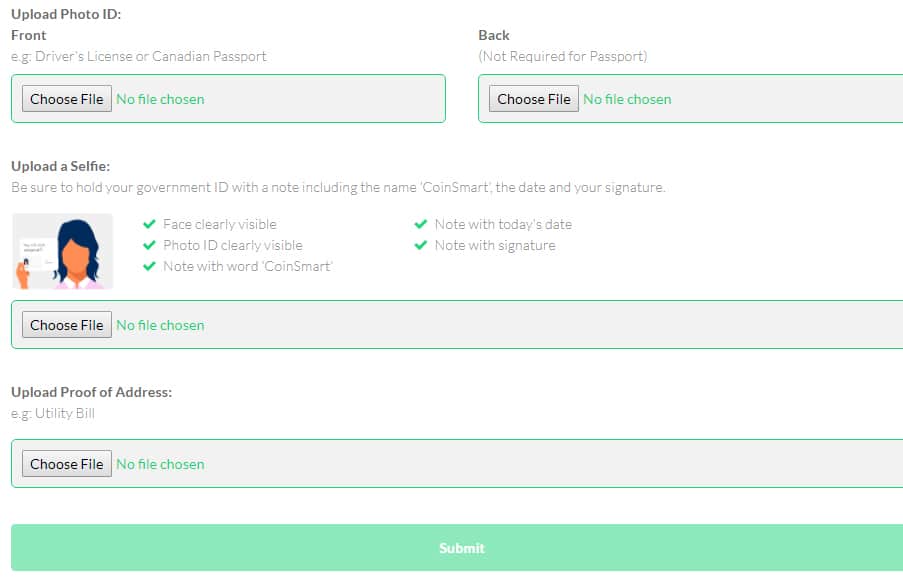

Given that Coinsmart is a MSB that is regulated by FINTRAC, they are required to complete compulsory KYC on their users. This means that they need to confirm your identity and address in order to let you start trading.

While this may be annoying for those traders who like to trade anonymously, there are no other Canadian exchanges that offer unverified accounts for trading. If this is something you are adamant about then you will have to consider an offshore exchange such as Binance.

The first step for verification is to confirm your phone number. They will send you a text message with a verification code. Once this is done you can move onto the identity verification.

In order to speed up the verification, Coinsmart uses the third party services provided by Equifax. Equifax is a credit reporting company that may have financial information about you that they can use in order to verify your identity.

If they are unable to pull your identity from the Equifax database then they will require you to submit your identity documents manually. They will need some form of government issued ID as well as a proof of address (utility bill).

Documents required for Coinsmart Verification

Documents required for Coinsmart VerificationIn order to confirm that it is indeed you that is trying to submit these documents, they will also need you to take a selfie with you holding it up next to your face with a piece of paper saying "Coinsmart". It must also be signed with your signature and have today's date.

Coinsmart Funding & Withdrawal

Once you have an account ready to go, you will probably want to fund it. Funding can be initiated in the wallet section of your account. You will select the wallet depending on how you would like to fund the account.

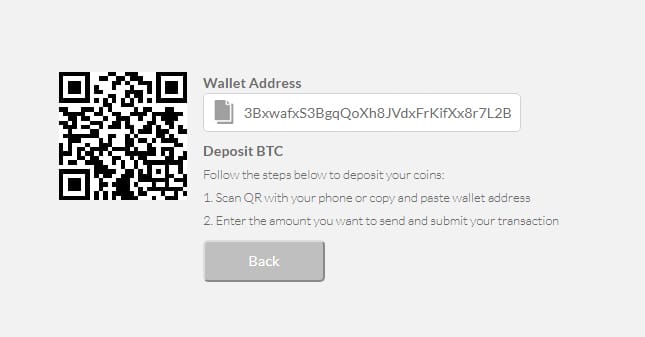

Crypto Payments

The quickest and easiest way to do this is through crypto funding. This is probably also the cheapest if you happen to have crypto on hand. Assuming that you are funding in Bitcoin, you will hit the Bitcoin wallet and then select the Deposit button.

Bitcoin Address on Coinsmart

Bitcoin Address on CoinsmartIt will generate the applicable address as well as the QR code that you can use to fund the account. Once you have sent the transaction to the wallet then you can monitor it on the blockchain. Coinsmart will credit your account the moment that they have 6 confirmations.

Withdrawals are just as easy except this time it will request the applicable address to send your coins to. Once you have placed that in the withdrawal form then they will request confirmation through both the 2FA (if enabled) and email.

Fiat Payments

If you wanted to deposit in fiat then it is just as simple. You will hit "deposit" in your CAD balance and it will pop up with the current funding options. They are presented below along with minimum / maximum amounts and average processing times.

| Method | Min | Max | Received | Withholding |

| Interac | $100 | $3,000 | Same Day | 3 days |

| Bank Wire | $10,000 | $300,000 | Same Day | 3 days |

| Bank Draft | $500 | $5,000 | Same Day | 3 days |

| Credit Cards | $100 | $5,000 | Instant | 7 days |

| Flexepin | $100 | $3,000 | Instant | 1 day |

Once you have chosen one of the above, they will ask for the amount that you would like to deposit and then either give you their bank details or take you through to a payment processing page.

CAD withdrawals will follow the same process. You currently only have an EFT and a Wire option which take about 1-5 business days to arrive. The minimum / maximum limits for the EFT and Wire options are $100 / $10,000 and $10,000 / $250,000 respectively.

Once you have confirmed the amount that you would like to withdraw then they will ask for your banking details. It is important to point out that they will not make third party transfers so you have to make sure that the bank account is in your name and not anyone else’s.

Coinsmart Trading Platform

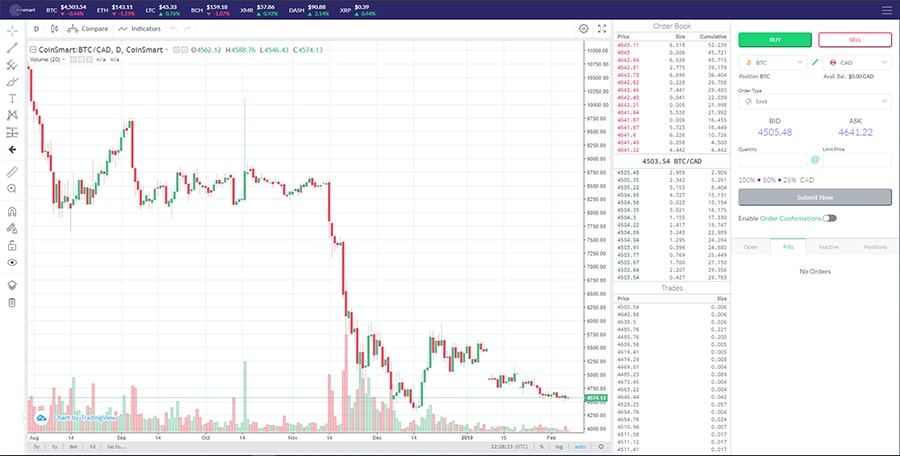

Let's jump right into the most important piece of technology at Coinsmart - their trading platform.

There are two interfaces with which you can trade on. These include the simple Buy/Sell/Trade which is where you can do your quick transactions at the current market rate. This is perhaps the best option for those that are just starting out and want to get their hands on some crypto quickly.

Then, for those traders who would like a great deal more functionality with their trading, you have the advanced trading platform.

Advanced Trading Platform

This is perhaps what most seasoned cryptocurrency traders are used to. It is a standard trading platform with market books, charting, live positions and more bespoke order form functionality.

Below we have the user interface of the platform with your main chart in the centre. In the middle you have the market order books and below that you have the most recent trades. To the right your positions as well as the order form. Unfortunately, the interface is not "widgetised" which means that you cannot move the layout around.

Coinsmart's advanced trading platform

Coinsmart's advanced trading platformIn terms of the charting, Coinsmart uses tradingview technology. This is a well-known charting package that has been used by a number of other exchanges as well. It is also a favourite for those traders who employ a great deal of technical analysis in their trading.

In the order form section, you can toggle between the different markets in the top left. Below that you can select the type of order that you would like to place. These are pretty standard erring on the basic side. You have the following:

- Market Order: This order will execute your trade at the most recent prevailing market rate. This is the order that you place if you would like to get your trade executed the most quickly.

- Limit Order: This is an order that you will place at a chosen level above / below the market rate. It will remain in the order books until you manually cancel it. If the market moves to this level then it should execute your trade

- Stop Order: Stop orders are generally protection orders that are used as a risk management technique. They are placed somewhere below your entry level and supplement any current orders. Once the market hits the stop level it will "stop" you out and limit any more losses from that

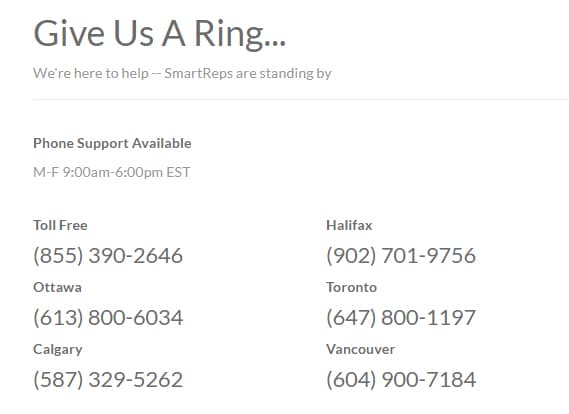

Customer Support

Something that we quite liked about Coinsmart was how open they were and easy to reach. There are a range of contact options through which you can get a hold of them and most of these are available 24/7.

For example, you can reach out to them through the chat function that they have on the platform. This is similar to a number of other exchanges and it is powered by ZenDesk technology.

They also have a range of customer support numbers that you can call for the different regions in Canada. This includes a handy toll-free number. Take note though that they are only available at 9:00am to 6pm EST during the week.

Telephone Support numbers

Telephone Support numbersLastly, if your question is more routine in nature and you would prefer to find the answer yourself then you have have a look at their FAQ section. This has a collection of questions that are most likely to be asked by users so it is quite likely you find your answer there.

Additional Resources

It's always a nice touch when an exchange includes additional resources that can better help you understand the cryptocurrency markets. Coinsmart has included a "Get Smart" section which is their educational portal.

These resources will cover a number of different topics and are well positioned for different levels of cryptocurrency user. They break down these pieces into the "smart", "Savvy" and "Genius" level based on how in-depth you want to go in a topic.

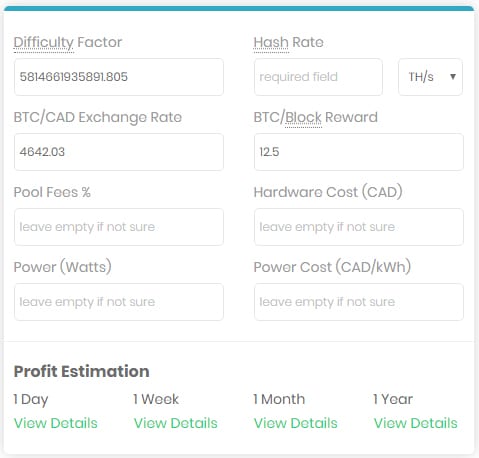

Something else that we found quite unique for a cryptocurrency exchange was their mining calculator. This is an online calculator that will help you determine the profitability of mining Bitcoin.

Mining returns calculator on Coinsmart

Mining returns calculator on CoinsmartThis calculator is similar to some of the other online mining calculators and will require a number of inputs to determine your expected Return on Invesment. They have also provided a host of handy information on what you need to consider when mining Bitcoin.

While most traders are unlikely to take advantage of this feature, it is a helpful tool nonetheless. If you are a miner it sometimes helps to cross check your numbers with other resources to make sure you have the correct assessment.

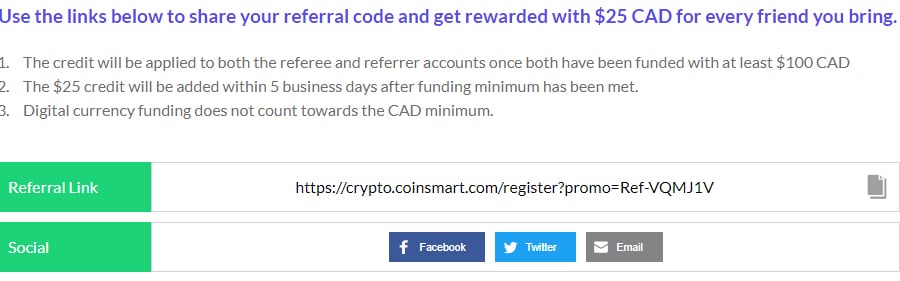

Coinsmart Referral Program

If you have found your Coinsmart trading experience to be a pleasant one then you could refer them to friends, family or anyone really. This can be done through their relatively attractive referral program.

Essentially, for every new trader who signs up with your referral code and funds $100, both of you will get $25 credited to your accounts. It will take 5 business days from the date of funding for the commission to show up in your account. This also only counts for fiat deposits and not those that are made with crypto.

If you would like to take advantage of this program then you will need to get yourself your referral code. You can access this in the referral section of your account.

Getting your referral link on Coinsmart

Getting your referral link on CoinsmartThere you will be given a referral link which you can then share online or send to your potential referees. You can also navigate to the commission tab if you wanted to monitor the number of referrals that have successfully created accounts.

Areas for Improvement

While there were a lot of things that we liked about Coinsmart, there are a few things that we think warrant improvement.

Firstly, they do not have a mobile application or any API functionality. This means that you will have to do all of your trading through the web-based platform. Some traders may like to develop their own bots and algorithms which interact with an Exchange's API. Other's may be away from their desk and would like to trade on a mobile app.

Coinsmart says that they will be introducing a mobile app so we will have to wait and see how it looks before passing judgement.

Secondly, the advanced trading platform still requires some improvement especially as it pertains to the order form functionality. There are only three types of orders that you can place and none of these have options around order life.

Lastly, this is currently a Canadian only exchange. While they are doing this to serve the local market better, it may be cutting off a number of global traders who are looking for attractive alternatives to their status quo.

Conclusion

Coinsmart is indeed quite an impressive exchange. Having launched in less than a year they have managed to build up a pretty compelling service with advanced technology and a reasonable number of features.

Their "smart guarantee" together with their completely transparent operation will no doubt smooth over a great deal of Canadian crypto users. They may be able to instill a certain level of trust back into a sometimes opaque market.

We also liked their advanced trading platform and, unlike many other new exchanges, they seem to have strong levels of liquidity in all of their markets. This means that you can safely execute larger trades without worrying about order slippage.

While there were a few things that we thought warranted improvement, these are relatively easy to implement and could come as Coinsmart grows. They are, after all, only a few months old.

So, is Coinsmart the exchange for you?

Well, if you are looking for a transparent Canadian exchange that simplifies crypto while still having advanced functionality, then you should consider it.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.