Lido, a leading liquid staking platform, currently holds the largest share of staked Ether (ETH), with approximately 9.73 million ETH staked, accounting for about 27.86% of the market (via Dune Analytics).

In decentralized finance (DeFi), liquid staking has emerged as a prominent yield strategy. Staked ETH, a yield-bearing token, has found diverse applications within the Web3 ecosystem:

- Stablecoin Protocols: Platforms like Ethena utilize staked ETH as collateral to mint stablecoins, integrating it into their financial models.

- Yield Speculation: Derivative platforms such as Pendle employ staked ETH to facilitate yield speculation, allowing users to trade future yield streams.

- Yield Farming: Staked ETH is an asset in yield farming strategies, enabling users to earn additional returns by providing liquidity or participating in various DeFi protocols.

- Restaking: The most innovative application, restaking, involves using staked ETH to secure additional protocols beyond Ethereum, enhancing the security and decentralization of the broader blockchain ecosystem.

Restaking represents a significant advancement in the staking paradigm. By enabling ETH holders to earn additional rewards through securing multiple protocols, restaking increases the profitability of staking and contributes to the robustness of the Ethereum network. Restaking is a DeFi-native innovation operating independently of traditional financial systems and markets.

This article focuses on EigenLayer, a pioneering restaking protocol that allows staked ETH holders from platforms like Lido to restake their assets. EigenLayer provides a mechanism for other chains and protocols to leverage this staked ETH for their cryptoeconomic security, extending Ethereum's security model to a broader range of applications.

This EigenLayer review provides a comprehensive breakdown of the protocol and serves as a guide to restaking Ether, exploring its mechanisms, benefits, and implications for the future of DeFi.

EigenLayer Review Summary

EigenLayer is a restaking protocol that enables:

- Restaking of Staked ETH: Holders of staked ETH from various platforms can restake their assets with EigenLayer to earn additional rewards.

- Enhanced Security for Other Protocols: As a Data Availability service, EigenLayer uses restaked assets to secure and support the cryptoeconomic security of other chains and protocols.

What is Data Availability?

Data availability is one of the core security guarantees of blockchain networks and is central to the utility of restaking protocols. It ensures that transaction data is accessible to all network participants for verification and consensus. Let's understand data availability at different levels of blockchain design complexity.

Monolithic Blockchain

In monolithic blockchains like Ethereum, a validator node's core responsibility is sharing the data for the transactions it includes in a block with other nodes. The sharing allows other nodes to perform validity checks and participate in consensus by signing the block. Sharing transaction data with the network is known as data availability.

Data Availability in Ethereum Image via Medium

Data Availability in Ethereum Image via MediumIf transaction data were not made available, other nodes wouldn't be able to verify or attest to the blocks. This hurdle would cause the consensus round to fail to produce a block, leading to a chain halt—a scenario known as a liveness failure.

Data availability ensures that enough nodes (typically more than two-thirds in proof-of-stake systems) in the network have sufficient transaction data to independently verify the proposed block without relying on another entity. This threshold is crucial for maintaining censorship resistance and decentralization in the network. Ethereum protects data availability through the ETH staked by validators in its protocol, incentivizing them to perform their duties correctly under the threat of financial penalties (slashing).

Check out our breakdown of monolithic vs modular blockchains.

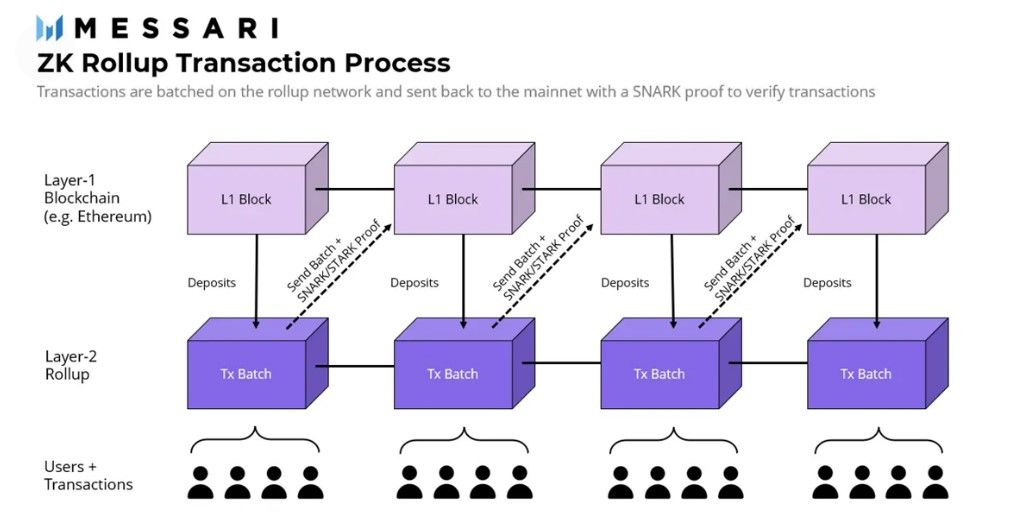

Data Availability in Rollups (Layer 2s)

Layer 2 solutions, or rollups, scale Ethereum by batch-executing many transactions in a separate execution layer off-chain. When layer 2s rely on Ethereum for security, we mean they borrow Ethereum's data availability, consensus, and settlement guarantees.

To achieve these guarantees, a rollup sequencer shares the following information about its chain's state for every block:

- Transaction Data: The actual transactions submitted by users.

- Rollup Block State Data: The state changes resulting from executing the transactions.

- Transaction Validity Proofs: Cryptographic proofs (especially in zk-rollups) attest to state transitions' correctness.

These data packets are made available to Ethereum nodes, reconstructing the rollup's state and verifying the rollup block's validity. An important insight is that transaction data often accounts for a significant portion of the layer 2 block data shared with Ethereum. In many cases, transaction data can account for over 90% of the data that rollups post to Ethereum.

High-Level Rollup Architecture Illustrates DA Batch Commitments to Ethereum | image via ResearchGate

High-Level Rollup Architecture Illustrates DA Batch Commitments to Ethereum | image via ResearchGateStoring and processing large amounts of transaction data costs a lot of gas when included as calldata on Ethereum. Therefore, while layer 2s like zk-rollups scale Ethereum by increasing transaction throughput and reducing execution costs, they still pay significant gas fees for storing (data availability) and processing (settlement) their transaction data on Ethereum.

What is a Data Availability Service

A data availability (DA) service is a network of nodes that specialize in providing data availability. DA services are built on the idea that Ethereum's cost of data availability is very high but that alternative solutions can provide this service more efficiently. Instead of relying solely on Ethereum for data availability, rollups can use specialized DA layers to store transaction data, reducing costs and improving scalability.

DA services propose a three-layer blockchain architecture where:

- Ethereum Layer: Handles consensus (ordering) and settlement (verification) of transactions. Ethereum remains the secure base layer that finalizes transactions and enforces security guarantees.

- Data Availability Layer: This layer stores transaction data and makes it available to Ethereum and other network participants on demand. It is optimized for data storage and retrieval, offering cost and efficiency advantages.

- Execution Layer (Rollup): This layer handles transaction execution off-chain. Rollups process transactions, compute state transitions and then submit the necessary data and proofs to the Ethereum layer for verification and settlement.

DA services offer liveness guarantees and censorship resistance similar to Ethereum, though not as strong due to differences in security models and the amount of economic security (e.g., staked assets) backing them. However, the data availability guarantees provided by projects like EigenLayer and Celestia are sufficient for many appchains and rollups, enabling them to scale efficiently while maintaining acceptable levels of security and decentralization.

By offloading data availability to specialized layers, rollups can significantly reduce costs and increase throughput, paving the way for more complex and resource-intensive decentralized applications. This modular approach allows each layer to focus on its core competencies—Ethereum on security and consensus, the DA layer on efficient data storage, and the rollup on fast execution—resulting in a more scalable and efficient blockchain ecosystem.

What is EigenLayer?

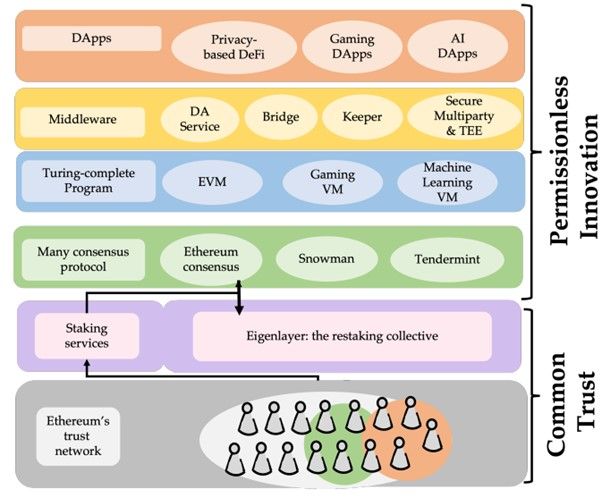

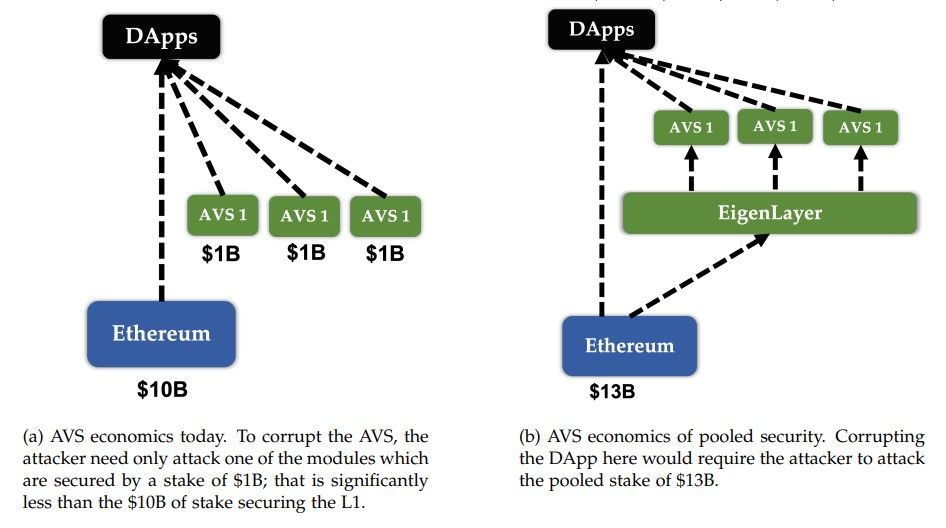

EigenLayer is an innovative protocol introducing the restaking primitive to the Ethereum ecosystem. By leveraging restaking, EigenLayer enables pooled security sourced directly from Ethereum validators and creates an open marketplace where Ethereum layer 2 solutions (rollups) and other networks can rent this pooled security. This model allows for enhanced scalability, security, and efficiency within the Ethereum ecosystem.

EigenLayer is a Restaking Protocol | Image via EigenLayer

EigenLayer is a Restaking Protocol | Image via EigenLayerBuilding on the concepts we've previously discussed, EigenLayer serves two broad functions:

1. Pooled Security

EigenLayer sources pooled security from Ethereum's own validator network. Here's how it works:

- Opt-In Slashing Conditions: Ethereum validators are accustomed to accepting slashing conditions from Ethereum if they misbehave during consensus. EigenLayer allows these validators to opt-in to accept additional slashing conditions. By doing so, they can offer similar security services to multiple networks beyond Ethereum.

- Restaking via Delegated Staking Model:

- Users Stake ETH: Users begin by staking their ETH through a liquid staking protocol like Lido, receiving Liquid Staking Tokens (LSTs) in return. These LSTs represent their staked ETH and accrue staking rewards.

- Delegation to EigenLayer Validators: Users can then delegate their LSTs to validators who have opted into EigenLayer. This delegation allows validators to use the staked ETH (represented by LSTs) to secure additional networks while users continue to earn rewards.

- Leveraging Ethereum's Validator Network: By tapping into the existing pool of Ethereum validators, EigenLayer bootstraps pooled security efficiently and at scale. Validators benefit from additional revenue streams, and new networks gain access to Ethereum-grade security without establishing their own validator sets.

EigenLayer Enables Pooled Security and Composability in Ethereum | Image via EigenLayer whitepaper

EigenLayer Enables Pooled Security and Composability in Ethereum | Image via EigenLayer whitepaperThis model enhances the overall security of participating networks by:

- Increased Economic Security: The more stake that backs a network, the more secure it becomes against attacks. EigenLayer amplifies this by aggregating stake from Ethereum validators.

- Rapid Scalability: New networks can quickly attain high levels of security without the time-consuming process of building and incentivizing their own validator communities.

2. Open Marketplace

EigenLayer establishes an open marketplace where networks in need of pooled security can rent it through modular components:

- Marketplace Dynamics:

- Price Discovery: Given the risk of slashing (loss of staked ETH) that validators accept when securing additional networks, there is a natural market mechanism for price discovery. Networks must offer sufficient incentives to attract validators willing to take on additional slashing risks.

- Incentivizing Validators: Networks looking to rent security need to appropriately incentivize validators by balancing rewards with the associated risks. This ensures that validators are compensated fairly for their services.

- Validator Choice and Risk Assessment:

- Optimal Network Selection: Validators have the autonomy to select which networks they want to secure based on the slashing conditions and rewards offered. They will typically choose networks where the potential rewards justify the risks involved.

- Risk Management: Validators assess the slashing risks associated with each network. Networks with stringent slashing conditions may need higher rewards to attract validators.

- Enabling a Market for Data Availability:

- Dedicated Data Availability Layer: EigenLayer facilitates a market specifically for Data Availability (DA) services. As we've discussed, data availability is crucial for running rollups and other layer 2 solutions.

- High Throughput and Low Costs: By offering DA services through this marketplace, EigenLayer provides networks with access to high-throughput data availability solutions at lower costs compared to relying solely on Ethereum's mainnet.

- Security Through Integration: The close integration with Ethereum's validator network ensures that the DA services provided are highly secure, benefiting from the economic security and decentralization of Ethereum.

Benefits of EigenLayer's Model

- For Validators:

- Additional Revenue Streams: Validators can earn extra rewards by securing multiple networks without additional capital investment.

- Portfolio Diversification: Validators can diversify their sources of income and mitigate the risks associated with any single network by participating in multiple networks.

- For Networks and Rollups:

- Access to Ethereum-Grade Security: New and existing networks can leverage the robust security of Ethereum's validator set without the overhead of building their own.

- Cost Efficiency: Renting security through EigenLayer can be more cost-effective than incentivizing a separate validator network.

- Scalability: Networks can scale more rapidly by focusing on their core functionalities while outsourcing security to EigenLayer.

- For the Ethereum Ecosystem:

- Enhanced Security and Decentralization: The restaking model promotes greater security across interconnected networks, reinforcing the overall integrity of the ecosystem.

- Innovation and Growth: An open marketplace encourages innovation by lowering barriers to entry for new networks and services.

EigenLayer represents a significant advancement in blockchain security and scalability. Introducing restaking and creating an open marketplace for pooled security it allows Ethereum validators to extend their services beyond the Ethereum mainnet, benefiting validators, networks, and the broader ecosystem alike. This model enhances security and efficiency and fosters innovation by enabling new networks to emerge and scale securely and rapidly.

The EigenLayer ecosystem comprises several key components that enhance Ethereum's security and scalability.

The EigenLayer Protocol

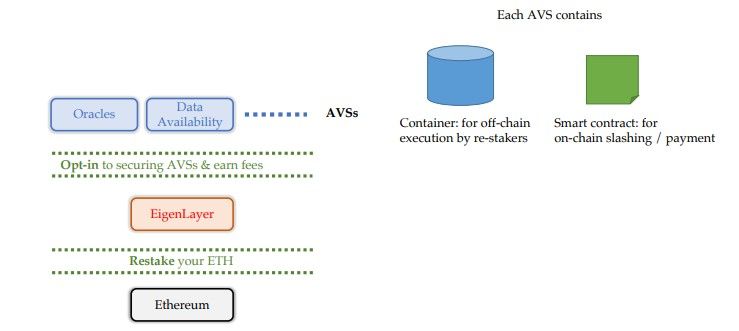

EigenLayer utilizes Ethereum smart contracts to facilitate:

- Restaking: Allows ETH holders to restake their assets, thereby extending Ethereum's security to additional protocols.

- Stake Management: Maintains an active record of delegated stakes, tracking validator participation and associated slashing conditions.

- Enforcement Mechanisms: Implements conditions accepted by validators, ensuring compliance and integrity within the network.

EigenLayer Uses Staking to Implement AVS Services | Image via EigenLayer Whitepaper

EigenLayer Uses Staking to Implement AVS Services | Image via EigenLayer WhitepaperThis framework supports Actively Validated Services (AVS), enabling protocols to leverage Ethereum's security through restaking. EigenLayer itself functions as an AVS, operating as a restaking layer on Ethereum.

EigenDA

EigenDA is a data availability layer within the EigenLayer ecosystem, comprising:

- Network of Operators: Restaked Ethereum validators who participate in data availability tasks.

- Dispersers and Rollup Sequencers: Entities responsible for distributing data and sequencing transactions, facilitating efficient data availability services.

While Ethereum smart contracts handle protocol management and governance, EigenDA operates as a network of restaked validators, enhancing data availability for rollups and other applications.

EIGEN Token

The EIGEN token serves a unique role within the EigenLayer ecosystem:

- Dual Security Model: Combines ETH restaking for cryptoeconomic security with EIGEN staking to protect against extreme attacks that may necessitate hard forks.

- Hard-Forking Mechanism: EIGEN staking provides a mechanism to execute hard forks without compromising interoperability and composability with the Ethereum ecosystem.

This dual approach ensures robust security and resilience against potential threats.

In subsequent sections, we will explore each of these components more fully to provide a comprehensive understanding of their functions and significance within the EigenLayer ecosystem.

Deep Dive into EigenDA

EigenDA is the Data Availability (DA) layer of the EigenLayer protocol. Its primary function is to provide DA services to layer 2 chains by storing their transaction data, securing it through EigenLayer's consensus and restaking mechanisms, and making it available to Ethereum network validators (or any other Layer 1 validator) during the settlement process. This enables validators to verify rollup transactions efficiently without bearing the burden of storing large amounts of data on Ethereum.

EigenLayer Offers a Model for Pooled Security | Image via EigenLayer

EigenLayer Offers a Model for Pooled Security | Image via EigenLayerBuilding on our earlier discussion about Data Availability services, EigenDA operates as follows:

- Data Blob Storage: EigenDA is a DA service That stores rollup transaction data as data blobs. These are chunks of data that nodes store without necessarily verifying their validity. This approach allows for efficient storage and retrieval of transaction data.

- Decentralized Data Sharing: EigenDA nodes share data across the network for decentralized storage. Each node holds a fragment of the data, contributing to its overall availability and redundancy.

- Reduced Costs for Rollups: The data chunks are available to Ethereum nodes when needed, eliminating the requirement for these nodes to store the data themselves. This reduces rollup storage and processing costs, making transactions more affordable and scalable.

EigenDA Security Model

Liveness Guarantees

Liveness guarantees in EigenDA ensure that the network remains operational and data is continuously accessible. EigenLayer can prove on Ethereum that enough EigenDA nodes have attested to the rollup's DA data. An attacker might attempt to interfere with liveness by neglecting their duties, such as not attesting to the data. If a significant threshold of staked validators in EigenDA stops responding, Ethereum may no longer reach a consensus about the EigenLayer state, leading to a liveness attack. However, as more validators join EigenDA and more ETH is restaked in the protocol, the liveness guarantees strengthen, making such attacks increasingly difficult.

Security Guarantees

Security guarantees ensure that EigenDA nodes actually store and provide the correct DA data without manipulation. This means that the data underwritten by EigenDA is trustworthy and has not been tampered with. The protocol includes cryptographic and cryptoeconomic mechanisms to detect and penalize any malicious behavior by nodes, thereby maintaining the integrity of the data. As more validators participate and more ETH is staked, the security guarantees improve, enhancing the overall robustness of the network.

Liveness and security guarantees both increase as more validators join EigenDA and more ETH is restaked, reinforcing the network's resilience against attacks.

EigenDA Architecture

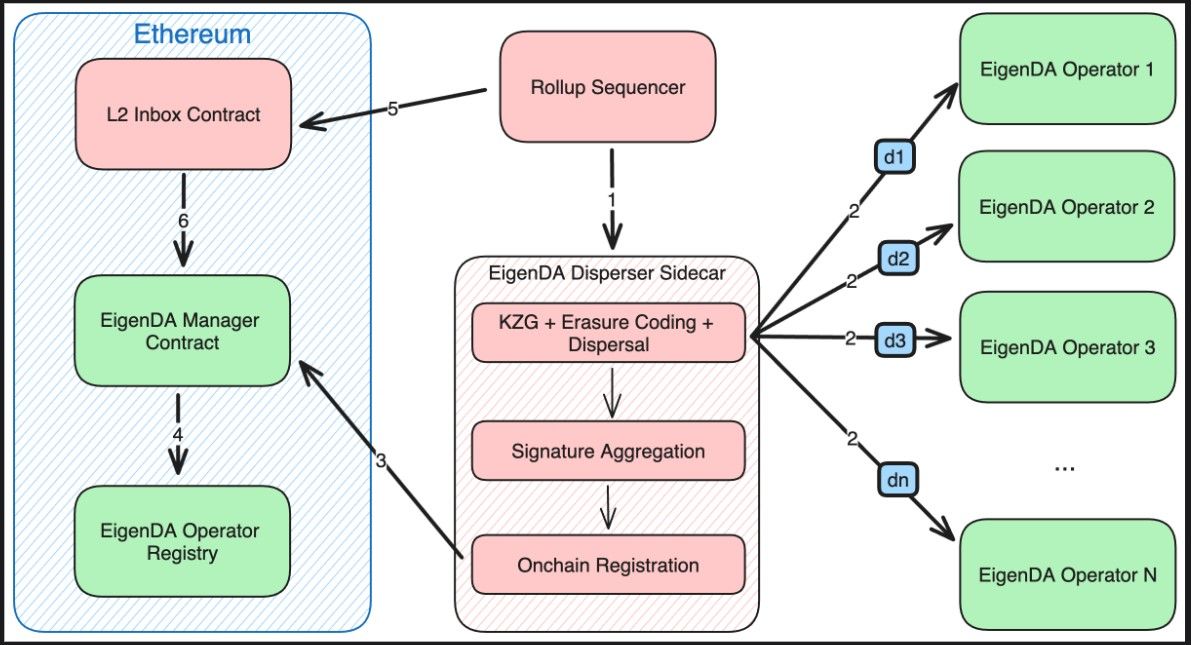

EigenDA consists of several key components that work together to provide efficient and secure data availability services:

Operators

Operators are the EigenDA nodes responsible for storing and maintaining the data chunks. They participate in the network by holding a portion of the data and ensuring its availability. Operators are incentivized to act honestly through the EigenLayer's staking and slashing mechanisms. Misbehavior can result in losing their staked ETH, aligning their interests with the network's integrity.

Dispersers

Dispersers prepare rollup blobs for EigenDA attestation. Their responsibilities include:

- Blob Preparation: Creating data blobs from rollup transactions and preparing them for distribution.

- Erasure Encoding: Performing erasure coding on the data blobs, splitting them into chunks suitable for storage across the network.

- Generating Validity Proofs: Creating KZG commitments and KZG multi-reveal proofs, which are cryptographic proofs ensuring the integrity and correctness of the data chunks.

- Data Distribution: Sending the commitments, chunks, and proofs to the operator nodes in the EigenDA network.

- Signature Aggregation: This involves collecting signatures from operators who have verified and stored the data and aggregating them for submission to Ethereum. This aggregated signature is essential for enforcing slashing conditions against misbehaving validators.

Retrievers

Retrievers assist in data acquisition when someone wants to challenge a DA attestation. They query EigenDA to download the relevant data blobs and verify their validity. Retrievers play a crucial role in maintaining transparency and accountability within the network by enabling third parties to audit and validate the data stored in EigenDA.

EigenDA and Rollup Integration Process

The Bbove Process Defines How Rollups Integrate EigenDA | Image via EigenLayer

The Bbove Process Defines How Rollups Integrate EigenDA | Image via EigenLayerThe integration between EigenDA and rollups involves a coordinated process:

- Rollup Sequencer Creates a Block: The rollup sequencer compiles a block containing transactions and sends a request to disperse the associated data blob.

- Disperser Processes the Data: The disperser erasure-encodes the data blob into chunks, generates a KZG commitment and KZG multi-reveal proofs, and sends the commitment, chunks, and proofs to the operator nodes of the EigenDA network.

- Dispersal Service Options: Rollups can run their own disperser or use a third-party dispersal service (e.g., operated by EigenLabs) for convenience and to reduce signature verification costs. Rollups may adopt an optimistic approach, using the third-party service by default but switching to their own disperser if the service becomes non-responsive or attempts censorship. This ensures censorship resistance without sacrificing efficiency.

- Operators Verify and Attest: EigenDA nodes verify the chunks they receive against the KZG commitment using the multi-reveal proofs, store the data, and generate a signature attesting to its validity. These signatures are returned to the disperser for aggregation.

- Aggregation and Submission: The disperser aggregates the operators' signatures and uploads the aggregated signature to Ethereum. This submission serves as proof that the data has been properly stored and attested by the required number of operators and is essential for slashing misbehaving validators if necessary.

EigenDA is a highly efficient solution for Data Availability, offering scalability, security, and cost-effectiveness for rollups and other layer 2 solutions. By utilizing erasure coding and leveraging the existing infrastructure of EigenLayer and Ethereum validators, EigenDA reduces storage costs and increases processing speeds.

It allows rollups to rent their desired throughput in advance, ensuring consistent transaction speeds and a better user experience. With its robust architecture and seamless integration process, EigenDA significantly enhances the capabilities of decentralized applications and contributes to the overall growth and efficiency of the Ethereum ecosystem.

EIGEN Token

The Eigen Token | Image via EigenLayer

The Eigen Token | Image via EigenLayerThe EIGEN token is a crucial component to understand when reviewing the EigenLayer protocol. This token is pivotal in extending EigenLayer's capabilities beyond objective cryptoeconomic security, enabling it to handle a broader class of tasks that require intersubjective consensus. Below, we'll explore the fundamental concepts behind the EIGEN token and delve into its technical aspects.

Fundamental Concept of the EIGEN Token

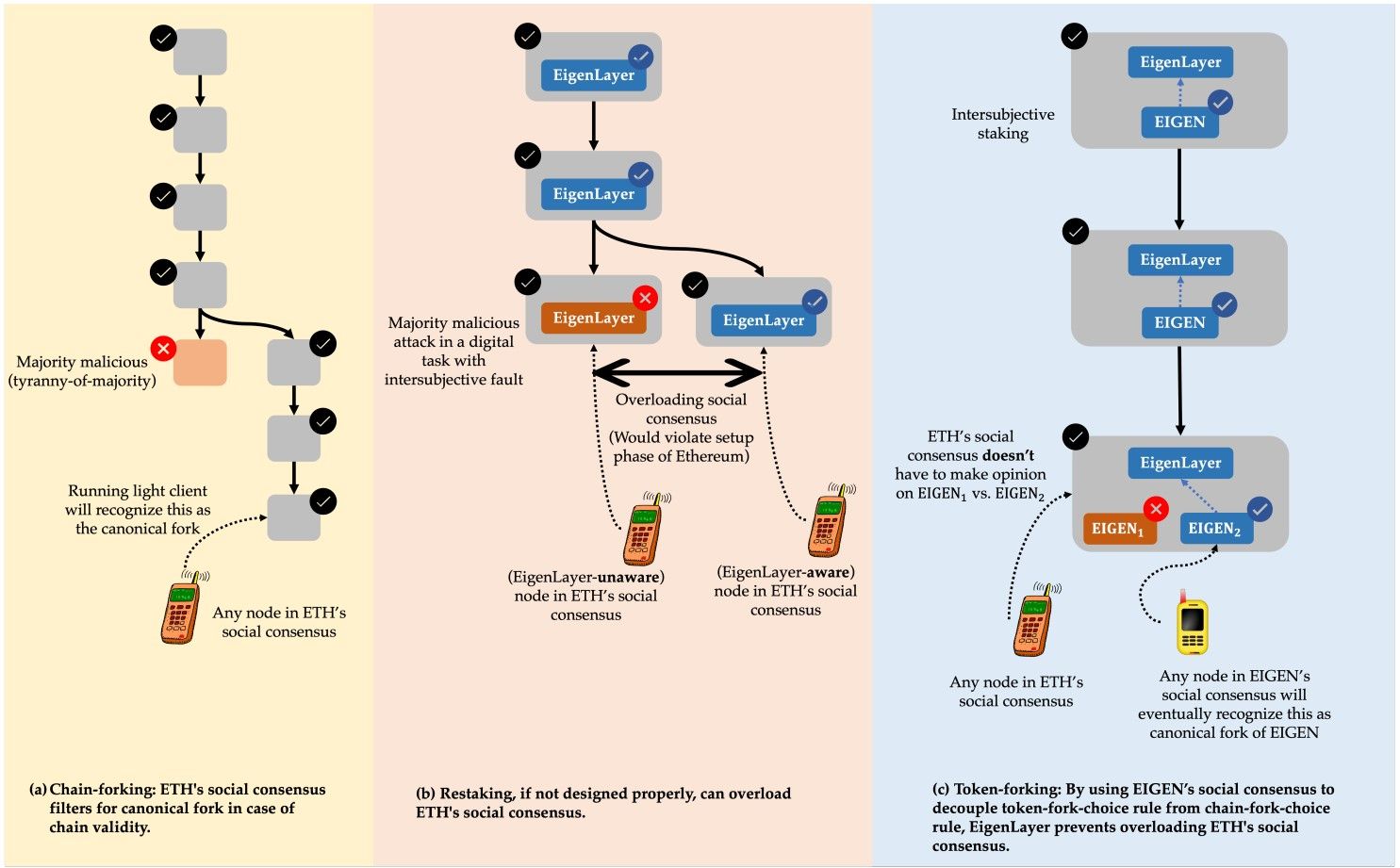

Ethereum's Security Model and the Role of Social Consensus

To appreciate the significance of the EIGEN token, starting with Ethereum's security model is helpful. Ethereum operates as a deterministic machine where all nodes execute the same operations in the same order, arriving at a consistent state. Validators stake ETH to participate in consensus, risking slashing if they act dishonestly. This mechanism ensures that the network maintains integrity through cryptoeconomic incentives.

- Beyond these technical mechanisms, Ethereum's social consensus acts as a critical layer of security. The Ethereum community collectively decides which chain is canonical in scenarios like major attacks or network splits. A historical example is the split leading to Ethereum Classic (ETC), where social consensus determined the path forward for the main Ethereum chain.

- Layer 2 networks and scaling solutions, such as rollups, operate without overloading Ethereum's consensus. They resolve their operations within the Ethereum Virtual Machine (EVM) and pay appropriate gas fees, ensuring they don't impose additional burdens on Ethereum's core consensus mechanism.

The Thought Experiment: Overloading Ethereum's Consensus

- Imagine a scenario where most EigenLayer validators go offline simultaneously—a majority liveness attack. Normally, if an individual EigenLayer node fails, the protocol's smart contracts on Ethereum penalize the node deterministically without overloading Ethereum's consensus.

- However, when a majority fails, the situation becomes complex. The EigenLayer smart contracts might recognize the failure and halt the network, but honest validators continue operating, leading to conflicting views of EigenLayer's state. This creates ambiguity for Ethereum nodes that are unaware of EigenLayer's internal state, potentially overloading Ethereum's consensus mechanism with external subjectivity.

Overloading Ethereum's consensus poses significant risks:

- Ambiguity in Consensus: Conflicting blocks make it difficult for the network to decide on the correct state deterministically.

- Reliance on Social Consensus: Ethereum's consensus isn't designed to resolve disputes from external protocols, potentially requiring social consensus intervention.

- Security Threats: Attackers might exploit this edge case to disrupt Ethereum indirectly by targeting EigenLayer.

The Purpose of the EIGEN Token

The EIGEN token is introduced as a universal intersubjective work token to address these challenges. Its purpose is to handle tasks and resolve disputes that cannot be objectively verified within the EVM but can achieve wide agreement among observers—referred to as intersubjectively attributable faults.

By shifting the resolution of such disputes to the EIGEN staking layer, EigenLayer avoids overloading Ethereum's consensus. The EIGEN token allows for:

- Forking and Penalization: In cases of majority failure or malicious behavior, the EIGEN token can fork, penalizing non-performing validators without affecting Ethereum's consensus.

- Handling Subjective Disputes: It can manage frequent disputes like censorship attacks or broken oracle feeds that are not easily resolvable through objective on-chain mechanisms.

The Process Above Demonstrates How EIGEN Forks Without Losing Interoperability With the Network | Image via EIGEN Whitepaper

The Process Above Demonstrates How EIGEN Forks Without Losing Interoperability With the Network | Image via EIGEN WhitepaperTechnical Details of the EIGEN Token

Understanding Intersubjectively Attributable Faults

- Intersubjectively attributable faults are faults where there is wide agreement among observers about their occurrence, even if they can't be mathematically proven on-chain. Examples include:

- AI Inference Accuracy: Whether an AI model's output is accurate within a margin of error.

These differ from objective faults (provable on-chain) and subjective faults (where no wide agreement is possible).

Mechanisms Enabling EIGEN Staking

The EIGEN token leverages three core ideas to resolve intersubjectively attributable faults:

- Setup and Execution Phases:

- Setup Phase: Participants agree on execution rules and monitoring mechanisms for tasks.

- Execution Phase: These pre-agreed rules are followed, enabling faults to be self-evident to any observer without requiring external coordination.

- Slashing Mechanisms:

- Punishment for Misbehavior: Validators who deviate from agreed-upon rules risk having their staked EIGEN tokens slashed.

- Cryptoeconomic Incentives: This deters malicious behavior by aligning validators' interests with network integrity.

- Token Forking:

- Forking to Penalize Malicious Actors: If a majority becomes malicious, the EIGEN token can fork to create a new canonical version, excluding the malicious stakers.

- Avoiding Tyranny of the Majority: This mechanism prevents a corrupt majority from dictating the network's state.

Key Features of EIGEN Staking

- Universality:

- The EIGEN token is designed to secure any intersubjectively attributable fault, not just a specific task.

- Actively Validated Services (AVSs) can encode their own rules and slashing conditions within the EIGEN staking framework.

- Isolation:

- To prevent disruptions in DeFi markets due to token forking, EIGEN employs a two-token model:

- bEIGEN: Used for staking and can be subjected to forking.

- EIGEN: The main token used in DeFi and other applications remains unaffected by forks in bEIGEN.

- To prevent disruptions in DeFi markets due to token forking, EIGEN employs a two-token model:

- Metering:

- Bond Requirements: Initiating a fork requires depositing a bond in bEIGEN to deter frivolous challenges.

- Cost Considerations: Challenges such as contract upgrades should only occur when the benefits outweigh the ecosystem costs.

- Compensation:

- Redistribution of Slashed Tokens: In the event of an attack, slashed tokens can be redistributed to affected AVS users.

- Strong cryptoeconomic security: Ensures that honest users do not suffer losses and maintains trust in the network.

Complementarity with ETH Restaking

EIGEN staking complements ETH restaking by addressing different types of faults:

- ETH Restaking: Secures services with objectively attributable faults that can be proven on-chain.

- EIGEN Staking: Secures services with intersubjectively attributable faults, handling tasks where faults are evident but not objectively provable.

This dual approach allows AVSs to leverage the strengths of both staking models, enhancing overall security and enabling a broader range of services.

Accelerating Innovation with EIGEN Staking

For AVSs that could be secured via objective fraud proofs but face technical complexities, EIGEN staking offers a pathway to bootstrap security:

- Early Stage Security: AVSs can initially use EIGEN staking to secure their protocols.

- Transition Over Time: As the AVS matures, it can transition to ETH restaking or native protocol adoption when more faults become objectively verifiable.

The EIGEN token extends EigenLayer's capabilities by introducing a staking mechanism designed for intersubjective consensus. It addresses the limitations of relying solely on Ethereum's consensus for resolving disputes that are not objectively verifiable on-chain. By doing so, it enhances the security and scalability of the EigenLayer protocol and enables a wide array of services that require this nuanced approach to consensus and fault resolution.

Through EIGEN staking, EigenLayer can handle both objectively and intersubjectively attributable faults, fostering innovation and allowing for developing robust, decentralized services without overburdening Ethereum's core consensus mechanism.

Where to Buy EIGEN?

The EIGEN token is available on several centralized exchanges (CEXs) and decentralized exchanges (DEXs). Prominent CEXs include Coinbase, where the EIGEN/USDT trading pair is actively traded, and other platforms like OKX, Binance and Bybit.

For decentralized options, platforms such as Uniswap may offer EIGEN trading pairs, allowing users to trade directly from their wallets. Before trading, ensure you verify the token contract address and assess the liquidity and fees associated with each platform.

EigenLayer Review: Closing Thoughts

EigenLayer represents a significant advancement in blockchain technology, particularly in how it leverages Ethereum's existing infrastructure to enhance scalability, security, and efficiency. Its unique design is intricately tied to Ethereum's consensus and validator network, enabling it to tap into the robust security and decentralization that Ethereum offers. By allowing validators to opt-in to additional slashing conditions and restake their ETH, EigenLayer creates a powerful synergy between Ethereum's proven consensus mechanism and new, innovative services like data availability layers.

The introduction of a dual-token security structure is a noteworthy innovation. By utilizing ETH for cryptoeconomic security and the EIGEN token for social consensus, EigenLayer addresses both objectively and intersubjectively attributable faults. This approach ensures that while the economic incentives align validators to act honestly, the social layer can effectively manage disputes and subjective issues without overloading Ethereum's consensus. It's a balanced model that combines the strengths of deterministic protocol enforcement with the flexibility of social governance.

EigenLayer's emergence is well-timed with the growing trend of appchains and the increasing importance of data availability services. As more specialized chains and layer 2 solutions seek scalability without compromising security, the demand for efficient data availability layers is rising. EigenLayer meets this demand by providing a scalable, secure, and cost-effective solution that is deeply integrated with Ethereum's ecosystem. Its ability to offer high throughput at low costs without sacrificing security makes it an attractive option for developers and networks aiming to build the next generation of decentralized applications.

Perhaps EigenLayer's most unique quality is its provision of Ethereum-like cryptoeconomic security combined with high throughput and low cost. By harnessing Ethereum's existing security and enhancing it with innovative features like erasure coding and an open marketplace for pooled security, EigenLayer enables networks to achieve a level of security previously accessible only to the most established blockchains. This democratizing security resource paves the way for more diverse and robust decentralized platforms, fostering innovation and growth across the blockchain space.

In conclusion, EigenLayer stands out as a transformative protocol that enhances Ethereum's capabilities and propels the broader blockchain industry forward. Its thoughtful design addresses critical challenges in scalability and security, positioning it as a foundational layer for future developments in decentralized technology.