The rise of decentralized exchanges (DEXs) represents more than just a shift in trading platforms; it points to a broader movement towards decentralized finance (DeFi).

One of the distinguishing features that set DEXs apart is their departure from the stringent Know Your Customer (KYC) standards. While centralized exchanges often require users to undergo a thorough verification process, DEXs afford participants the ability to trade assets in a trustless and anonymous environment. In addition, DEXs operate outside the traditional financial system. Anyone with an internet connection and a compatible wallet can participate, eliminating the need for credit checks or approval by banks.

From security to tradeable assets, this GMX review will cover everything you need to know about the platform.

GMX Review Summary

GMX is a decentralized exchange that operates on both Arbitrum and Avalanche. While most crypto projects have one native coin, GMX has not one, not two but three with each serving a different function.

The Key Features of GMX Are:

- Leverage up to 50x

- Enhanced protection against liquidations through the use of price oracles, guarding against 'scam wicks' often observed on centralized exchanges.

- Cost-effectiveness with minimal spread and zero price impact on orders.

- User-friendly interface, eliminating the confusion associated with terms like margin, debt and collateral.

- Multi-chain presence on low-fee networks Arbitrum and Avalanche.

What is GMX?

GMX operates as a decentralized trading protocol, specializing in margin trading on cost-effective networks like Arbitrum and Avalanche. The platform boasts a user-friendly interface and several tradable assets, but its offerings are not as diverse as many of its centralized exchange counterparts.

GMX is a Decentralized Perpetual Exchange. Image via GMX

GMX is a Decentralized Perpetual Exchange. Image via GMXTrading is supported by a multi-asset pool that earns liquidity providers fees from market making, swap fees, leverage trading (spreads, funding fees and liquidations) and asset rebalancing. Like other DEXs, GMX allows users to engage in trading without the need for KYC or professional investor prerequisites commonly found on centralized exchanges (CEX). Feel free to check out our picks for the best decentralized exchanges, or our article where we highlight the best centralized exchanges.

GMX serves as a decentralized perpetual and spot exchange, enabling users to borrow capital for trading. This is accomplished by utilizing collateral to secure the transaction. The borrowed capital can then be deployed to take long (whether the asset's price will increase) or short positions (betting that a coin's price will decrease), with the leverage determined by the ratio of the position size to the collateral (margin) size.

IMPORTANT: Margin trading is extremely risky and should only be conducted by advanced traders.

GMX Arbitrum vs. GMX Avalanche

As noted, GMX operates on both Arbitrum and Avalanche but it appears most of the action happens on the exchange's Arbitrum version. Please note all of the data is for GMX V1.

GMX Arbitrum

| Total Volume | $128.34 Billion |

| Total Fees | $206.0 Million |

| GLP Pool | $177.3 Million |

| Total Users | 310,560 |

| Open Interest | $39.9 Million |

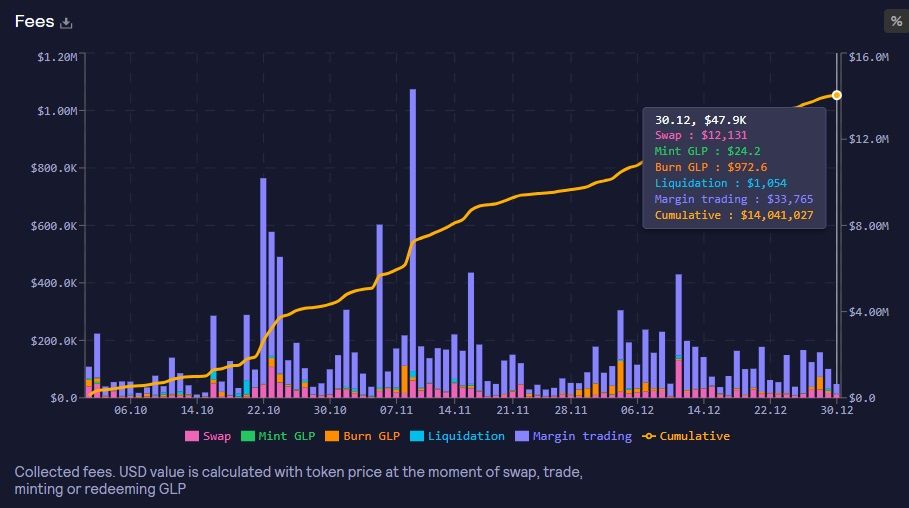

GMX has maintained a consistent fee structure, experiencing occasional lulls in certain periods. Arbitrum generates weekly fees ranging from $300,000 to over $1 million. As of the past quarter, fees on Arbitrum have accumulated to $14 million. Overall, margin trading generates the most fees for GMX.

Fees on GMX Arbitrum Have Totaled $14 million In Q4. Image via GMX

Fees on GMX Arbitrum Have Totaled $14 million In Q4. Image via GMXTurning to pool composition, GMX Arbitrum supports USDCe, USDT, UNI, LINK, DAI, USDC, ETH, BTC, FRAX and MIM.

GMX Avalanche

| Total Volume | $25.22 Billion |

| Total Fees | $47.2 Million |

| GLP Pool | $40.0 Million |

| Total Users | 47,516 |

| Open Interest | $22.0 Million |

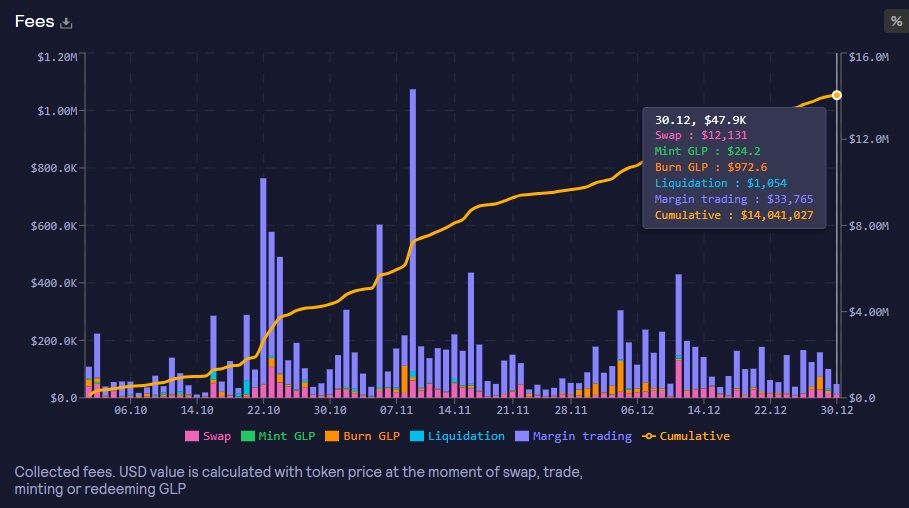

Like Arbitrum, GMX Avalanche generates the bulk of its fees from margin trading as well. Weekly fees generally range from $48,000 to roughly $300,000. As of the past quarter, fees on Arbitrum have accumulated to $6.1 million.

Fees on GMX Avalanche Totaled $6.1 million In Q4. Image via GMX

Fees on GMX Avalanche Totaled $6.1 million In Q4. Image via GMXStats on both V1 and V2 for Avalanche can be found on the GMX Dashboard.

GMX Trading Features

GMX offers a decentralized exchange experience, allowing users to trade without the need for traditional credentials like usernames or passwords. The platform utilizes a price feed derived from an aggregate of exchanges, minimizing the risk of liquidations caused by temporary market fluctuations.

The platform has two versions — V1 and V2 — with V2 being more feature-packed than the platform's first iteration. The fact that GMX is built on incredibly efficient blockchains Arbitrum and Avalanche results in a trading experience that is comparable to the high-performance trading engines found on centralized exchanges in terms of trade execution.

Let's now explore trading features for both versions.

GMX V1 Trading Features

To select GMX V1, simply navigate to the Trade page and click on "V1" in the trading bar. If you don't have a wallet already, GMX recommends Rabby, which supports Ethereum and all ERC-20 tokens. You can also check out our top Ethereum wallets.

After obtaining a wallet, connect it by clicking the "Connect Wallet" button on the Trade page. If prompted with the message "Your wallet is not connected to Arbitrum/Avalanche," select "Add Arbitrum" or "Add Avalanche" to integrate your desired network. Alternatively, you can manually add the network using the provided tutorials for Arbitrum and Avalanche or the RPC URLs available on Chainlist.

To start trading, ensure your Arbitrum account has ETH or your Avalanche account has AVAX. You can either buy ETH or AVAX directly on the platform or transfer them from other networks.

- Swaps: GMX supports both swaps and leverage trading. For swaps, navigate to the "Swap" tab on the Trade page.

- Opening a Position: Choose between "Long" or "Short" on the Trade page, indicating your directional preference. Specify the amount and leverage, with the "Exit Price" displayed below the swap box.

- Managing Positions: Access your Positions list to view and edit open trades. Depositing or withdrawing collateral allows leverage and liquidation price management.

- Closing a Position: Close a position partially or entirely by clicking the "Close" button in the position row. Profits are paid in the asset you traded, but you can customize the token to be received. This works by performing a swap from your profit token to the token you select. The swap fees will be shown in the "Close Position" menu.

- Stop-Loss/Take-Profit Orders: You can set stop-loss and take-profit orders via the "Trigger" tab when closing a position.

- Liquidations: Monitor the liquidation price to prevent the automatic closure of positions. You can deposit collateral using the "Edit" button to improve the liquidation price.

- Pricing: GMX V1 features no price impact for trades. During high volatility, however, there may be a spread from the Chainlink price to the median price of reference exchanges.

Overall, GMX V1 provides a comprehensive and user-friendly interface for decentralized trading with various features catering to novice and experienced traders.

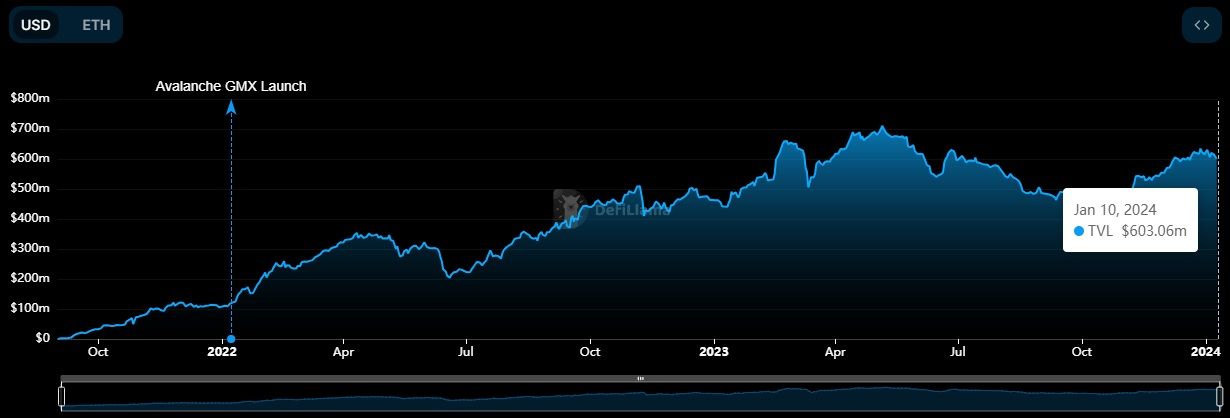

GMX's TVL stood at $603.1 million as of Jan. 10.

GMX's TVL Topped $600 Million as of Jan. 10. Image via DefiLlama

GMX's TVL Topped $600 Million as of Jan. 10. Image via DefiLlamaGMX V2 Trading Features

Selecting GMX V2 and connecting your wallet works like it does in V1. However, V2 improves on many of the features offered in V1, and introduces some new ones.

Choosing a Market

Selecting a market involves selecting the token you wish to either long or short. Within your chosen market, various pools may exist, such as ETH-USDC and ETH-USDT. You have the flexibility to pick the pool that aligns with your preferred collateral for backing your positions.

Speaking of collateral, there are diverse options to choose to choose from. For instance, in the ETH-USDC market, you can decide whether your position's collateral is stored as ETH or USDC.

The maximum allowed leverage for a pool adjusts based on the total open interest. This safeguard is in place to prevent manipulation of price impact using high-leverage positions. While this primarily impacts markets with lower liquidity, it can extend to high-liquidity markets if open interest is exceptionally large. The interface provides a warning if the maximum allowed leverage is at risk of being exceeded. Importantly, this only affects the opening or increasing of positions and existing positions remain unaffected.

When closing or decreasing positions, exceeding the maximum allowed leverage may not prevent execution but will not reduce the collateral within the position.

Limit Orders

Available only in GMX V2, limit orders are a type of order to buy or digital asset at a specific price or better.

For example, Bitcoin is currently trading at $46,000, but you'd like to buy it at $41,000. You can simply open a limit order for $41,000 or lower and the trade will execute automatically once Bitcoin reaches your desired price.

Market Types

There are two types of market types in GMX V2

- Fully backed markets: An example of a fully backed market is an ETH perpetual market supported by ETH-USDC, where the open interest is constrained to be less than the total quantity of ETH and USDC tokens in the pool.

- Synthetic markets: A synthetic market, on the other hand, is represented by a DOGE perpetual market backed by ETH-USDC. In this scenario, while the maximum long open interest may be restricted to a fraction of the ETH tokens, it becomes possible for the profits from long positions to surpass the combined value of tokens in the pool.

To prevent such situations, auto-deleveraging mechanisms come into play. When pending profits surpass a configured threshold for the market, profitable positions may be partially or fully closed. This proactive measure ensures the continual solvency of the markets and guarantees that all profits, at the time of closure, can be completely satisfied.

GMX Tokens

GMX has three tokens:

- GMX is the utility and governance token. Accrues 30% and 27% of V1 and V2 markets generated fees, respectively.

- GM is the liquidity provider token for GMX V2 markets. Accrues 63% of the V2 markets generated fees.

- GLP is the liquidity provider token for GMX V1 markets. Accrues 70% of the V1 markets generated fees.

GMX

GMX is the platform's utility and governance token, and holding it unlocks a variety of benefits in the form of GMX Rewards.

GMX Rewards are designed to benefit long-term users of the protocol, offering two forms of rewards:

Escrowed GMX (esGMX)

- esGMX can be staked for rewards similar to regular GMX tokens.

- Vested over one year to become actual GMX tokens.

- Each staked esGMX token earns rewards in both Escrowed GMX and ETH/AVAX, similar to regular GMX tokens.

- Not transferrable except during a full account transfer.

- Vesting is initiated on the Earn page, converting esGMX into GMX over 365 days.

- Reserved amount of GMX or GLP required for vesting is unique per account.

Multiplier Points

- Reward long-term holders without introducing inflation.

- GMX staking earns Multiplier Points at a fixed rate of 100% APR.

- Multiplier Points can be staked for fee rewards, earning ETH/AVAX at the same rate as regular GMX tokens.

- Burning of proportional Multiplier Points occurs when GMX or esGMX tokens are unstaked.

- The burn applies to both staked and unstaked Multiplier Points.

- The "Boost Percentage" on the Earn page reflects individual boost from Multiplier Points.

- Boost Percentage is calculated based on the ratio of Staked Multiplier Points to the total amount of staked GMX and esGMX.

GMX Tokenomics

The projected maximum supply of GMX tokens is set at 13.3 million. Minting beyond this limit is contingent on a documented necessity, subject to approval through a voting process governed by GMX.

This is what the token's supply allocation looks like:

- 6 million GMX: Allocated for XVIX and Gambit migration, consolidating communities into GMX.

- 2 million GMX: Paired with ETH for liquidity on Uniswap, enhancing market liquidity.

- 2 million GMX: Reserved for the vesting of Escrowed GMX tokens, supporting the vesting process.

- 2 million GMX: Designated for the floor price fund, contributing to price stability.

- 1 million GMX: Reserved for integration incentives and community developers, fostering ecosystem growth.

- 250,000 GMX: Distributed to contributors linearly over a two-year period, rewarding ongoing contributions.

GM

The valuation of the GM token is linked to the prices of long and short tokens, along with the collective net pending profit and loss of traders' active positions.

Key factors influencing the token's price are:

- Fees from Leverage Trading and Swaps: Automatic increments in GM token price are driven by fees generated from leverage trading and swaps.

- Spread Considerations: For GM, spreads are pivotal. Whether dealing with long and short tokens or stablecoins, spreads impact the buying and selling of GM tokens. For stablecoins, the spread extends from the Chainlink price to $1, introducing nuances in GM token pricing. Recognizing and managing these spreads enhances transparency and efficiency in GM token trading.

- Balancing Mechanism in GM Pools: These pools employ a dynamic balancing mechanism to maintain equilibrium between long and short tokens. When the price of a long token rises, a positive impact incentivizes traders to rebalance by selling long tokens for short ones. In the absence of rebalancing, the pool's pricing mechanism mirrors that of a 50% long and 50% short token composition, adjusting to market fluctuations.

GM tokens can be sold using the GM Pools page.

GLP

GLP is comprised of an asset index employed for both swaps and leverage trading. Its creation, or minting, is facilitated by utilizing any asset from the index, and it can be redeemed, or burnt, for any index asset.

The minting and redemption prices are determined by evaluating the total worth of assets in the index, accounting for profits and losses from open positions, divided by the existing GLP supply. This calculation ensures a dynamic pricing mechanism reflective of the overall value of the assets within the index relative to the circulating GLP supply.

Because GLP holders participate in liquidity provision for leverage trading, they experience profitability when leverage traders incur losses and conversely, may incur losses when leverage traders generate profits.

GLP tokens can be bought and sold using the Buy GLP or Sell GLP pages.

GMX Supported Assets

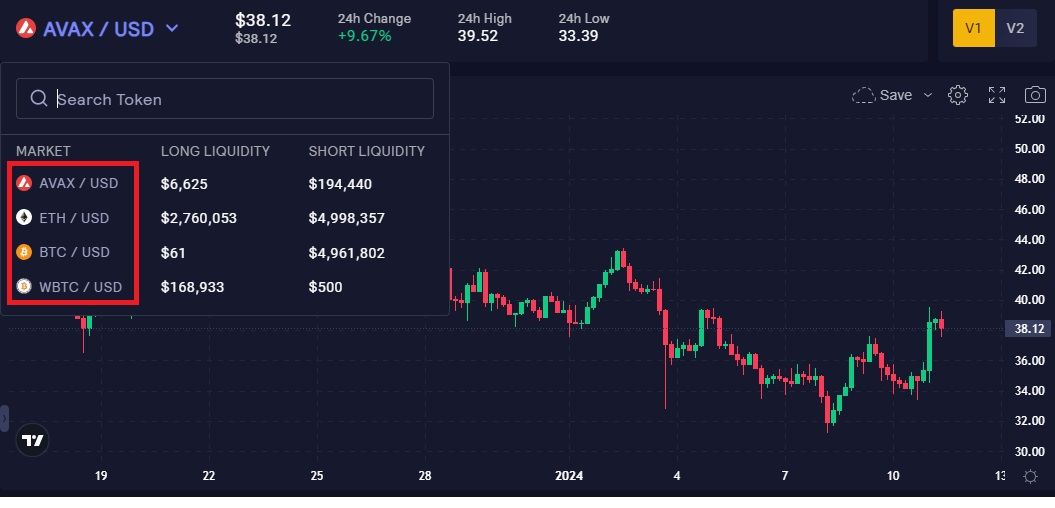

Digital assets supported by GMX depend on what version you're using. For example, V1 on Avalanche only supports four trading pairs:

- AVAX-USD

- ETH-USD

- BTC-USD

- WBTC-USD

GMX V1 Only Supports Four Trading Pairs. Image via GMX

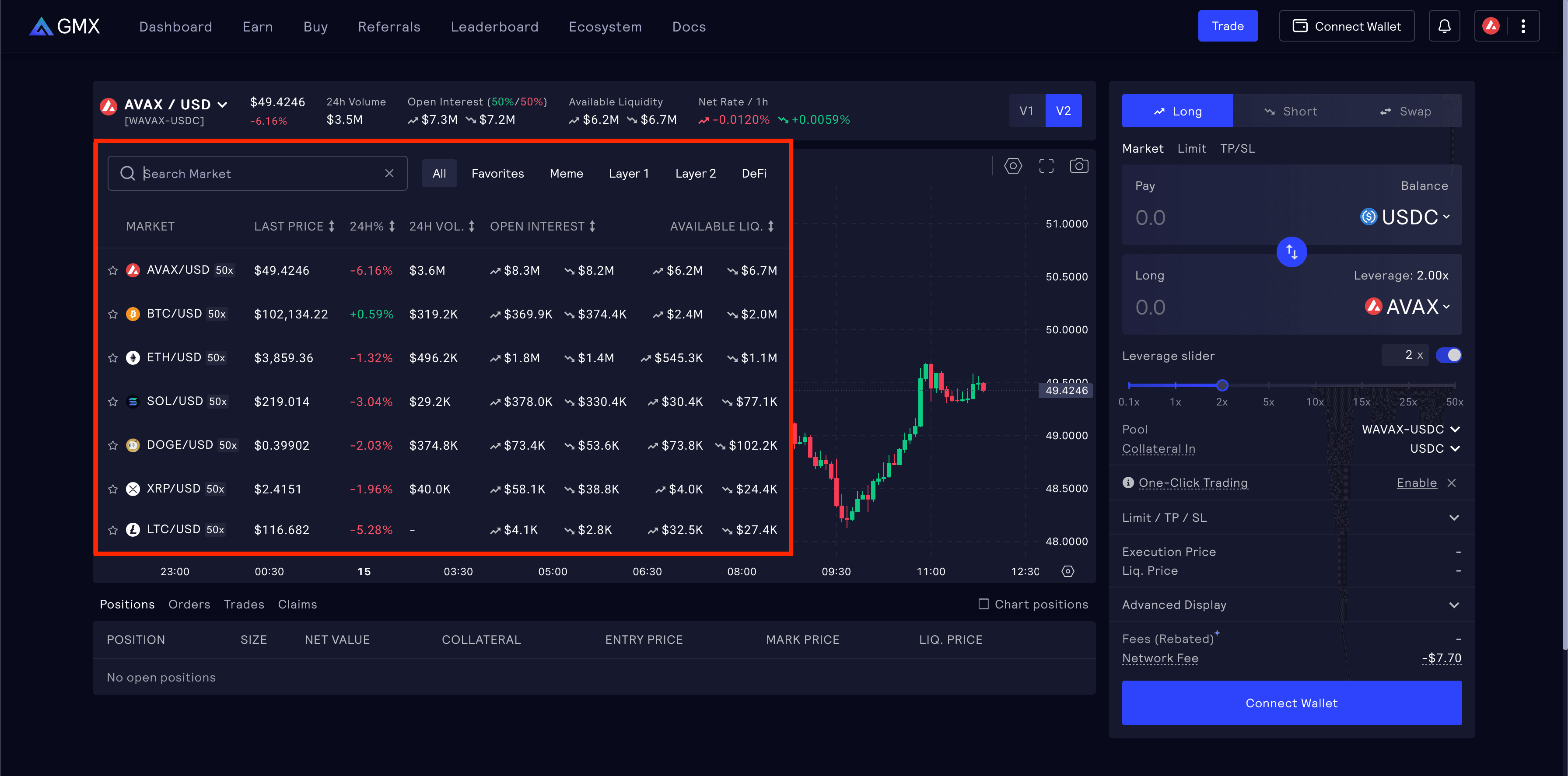

GMX V1 Only Supports Four Trading Pairs. Image via GMXIn GMX V2 on Avalanche, there are a few more tradeable assets. Here's a full list:

- AVAX

- BTC

- ETH

- SOL

- XRP

- LTC

- DOGE

GMX V2 Offers More Tradeable Assets Than V1. Image via GMX

GMX V2 Offers More Tradeable Assets Than V1. Image via GMXGMX on Arbitrum offers a significantly wider selection of cryptocurrencies, with over 40 available on the V2 platform. However, the V1 version remains limited to just 4 offerings.

While GMX offers a decentralized trading experience, it currently provides a limited selection of digital assets for trading compared to many centralized exchanges that boast thousands of tradable cryptocurrencies. The availability of a broader range of tokens on GMX could enhance the platform's attractiveness to a wider audience.

GMX Security

Security measures in place to safeguard user funds are of utmost importance for both centralized and decentralized exchanges, especially because DEXs are more susceptible to hacks.

In 2023, DeFi continued to be the main target of successful exploits at 77.3%, versus CeFi at 22.7% of the total losses, according to Immunefi.

- DeFi suffered $1.39 billion in total losses in 2023 across 306 incidents, down 56.1% compared to 2022.

- CeFi suffered $408.9 million in total losses in 2023 across 13 incidents, declining 46.8% over 2022.

DeFi Was the Main Target of Exploits in 2023. Image via Immunefi

DeFi Was the Main Target of Exploits in 2023. Image via ImmunefiProspective users would be happy to know that GMX has a $5 million bug bounty program in place that is focused on preventing:

- Direct theft of any user funds, whether at rest or in motion, other than unclaimed yield

- Permanent freezing of funds

- Insolvency

- Loss of user funds by freezing, theft, or manipulation of the price of GLP

- Unable to call smart contract

- Thefts and freezing of principal of any amount

- Thefts and freezing of unclaimed yield of any amount

- Theft of governance funds

Audits for GMX contracts are also undertaken, and these reports are available publicly.

GMX Fees

As you're aware, GMX has two versions: V1 and V2.

V1 Fees

GMX V1 fees are fairly straightforward. The cost to open or close a position is 0.1% of the position size. In the process of initiating or terminating a position that involves a swap, standard swap fees are applicable, ranging from 0.2% to 0.8% of the collateral size. The precise fee is contingent on whether the swap contributes to a balance improvement or reduction.

In addition, there's also an “execution fee”, which is paid to the blockchain network.

V2 Fees

GMX V2 fees are higher than V1.

Open/Close Fees

The trading fee to open or close a position is 0.05% or 0.07% of the position size. If the trade increases the balance of longs and shorts, then the fee would be 0.05%; otherwise, the fee would be 0.07%.

Swap Fees

The fees for a normal swap are 0.05% or 0.07% of the swap amount. The fees for stablecoin swaps are 0.005% and 0.02% of the swap amount.

Execution Fee

Just like V1, GMX V2 also charges an execution fee that is paid to the blockchain network.

GMX Review: Closing Thoughts

GMX stands out as a popular and high-performance DEX that operates on both Arbitrum and Avalanche, contributing to the broader movement towards decentralized finance (DeFi). The platform distinguishes itself by offering a decentralized trading experience with features such as leverage up to 50x, protection against liquidations, minimal spread, and zero price impact on orders.

The decentralized nature of GMX enables anyone with an internet connection and a compatible wallet to participate, eliminating the need for KYC, credit checks or approval by traditional financial institutions. The multi-chain presence on low-fee networks Arbitrum and Avalanche enhances accessibility for users.

GMX's unique approach includes the three tokens in its ecosystem, each serving specific utility and governance purposes within the platform.

The platform's security measures, including a substantial $5 million bug bounty program, aim to protect user funds from various potential risks. GMX also undergoes audits for its contracts.

While GMX provides a decentralized trading protocol with a diverse range of supported assets, it currently offers a more limited selection compared to some centralized exchanges.