Decentralized exchanges (DEXs) are a vital part of the crypto ecosystem. They are one of the cornerstones of Decentralized Finance (DeFi), and for the first time in history, provide traders with of way of swapping assets without having to go through a centralized authority. This LFJ review and tutorial will cover why it is so much more than just a DEX and go over everything you need to know about the #1 crypto hub in the Avalanche ecosystem.

| Headquarters: | N/A- Decentralized platform |

| Year Established: | 2021 |

| Regulation: | None- Decentralized |

| Spot Cryptocurrencies Listed: | 100+ |

| Native Token: | JOE |

| Fees: | 0.3% fee on swaps which goes to liquidity providers and sJOE staking rewards |

| Security: | Secured by the Avalanche protocol, Self-Custodial security measures required. Third-party audited |

| Beginner Friendly: | No- DEXs have a steep learning curve. Those familiar with DeFi will find trading, staking, and lending easy. LP, Farming, and Launch are more suitable for experienced DeFi users. |

| KYC/AML verification: | None |

| Fiat Currency Support: | None |

| Deposit/Withdraw Methods: | Crypto |

Trader Joe DEX Rebrand?

In September 2024, Trader Joe underwent a major rebrand to "Let's F***ing Joe (LFJ)." As part of this transformation, the platform introduced a redesigned mascot and updated its domain from "www.traderjoexyz.com" to "www.LFJ.gg."

What is LFJ DEX?

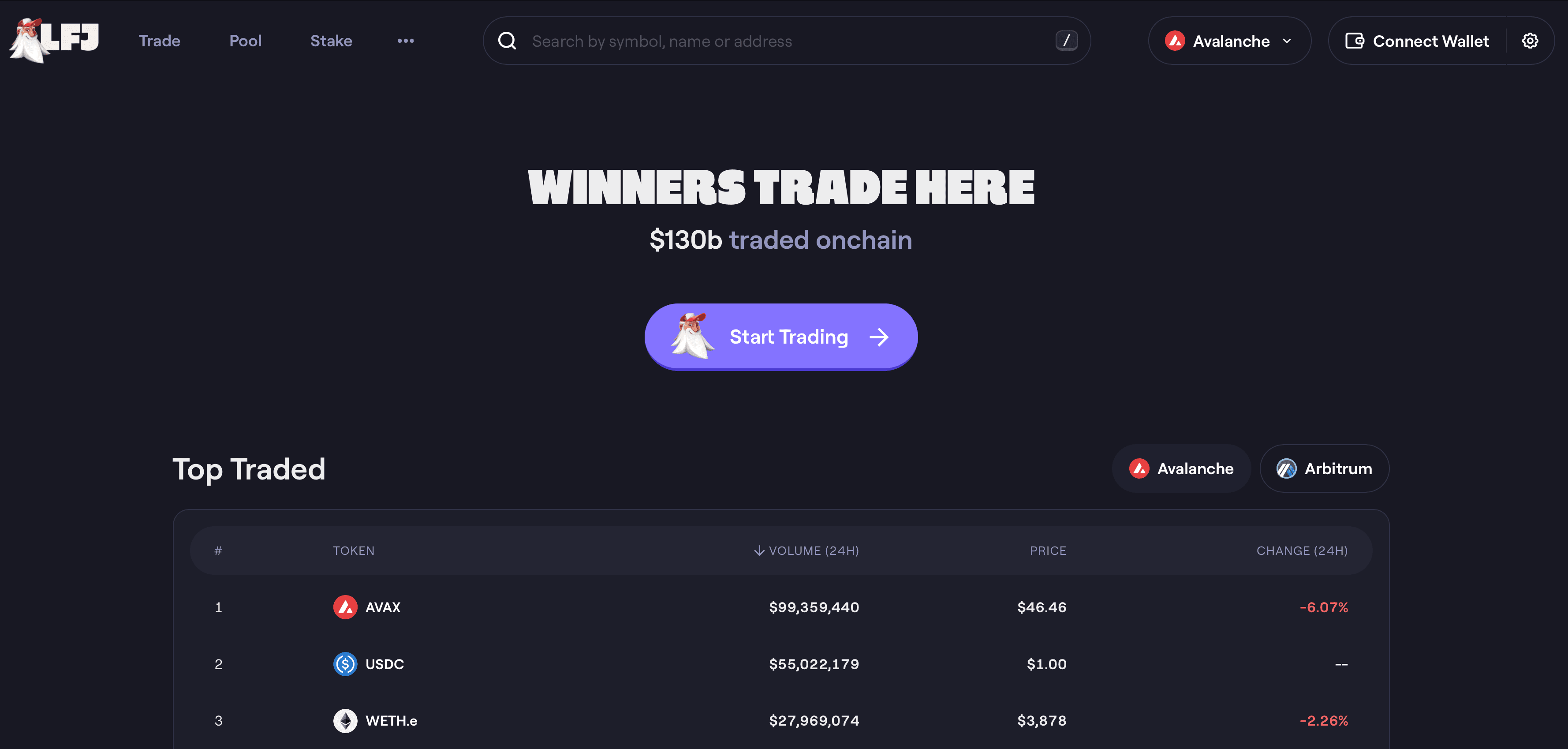

LFJ introduces itself as a one-stop shop for decentralized finance, and they certainly fit that description. LFJ is primarily a DEX for trading on Avalanche and Arbitrum, offering features such as staking, lending, borrowing, liquidity pools, NFTs, farming, and a launch pad.

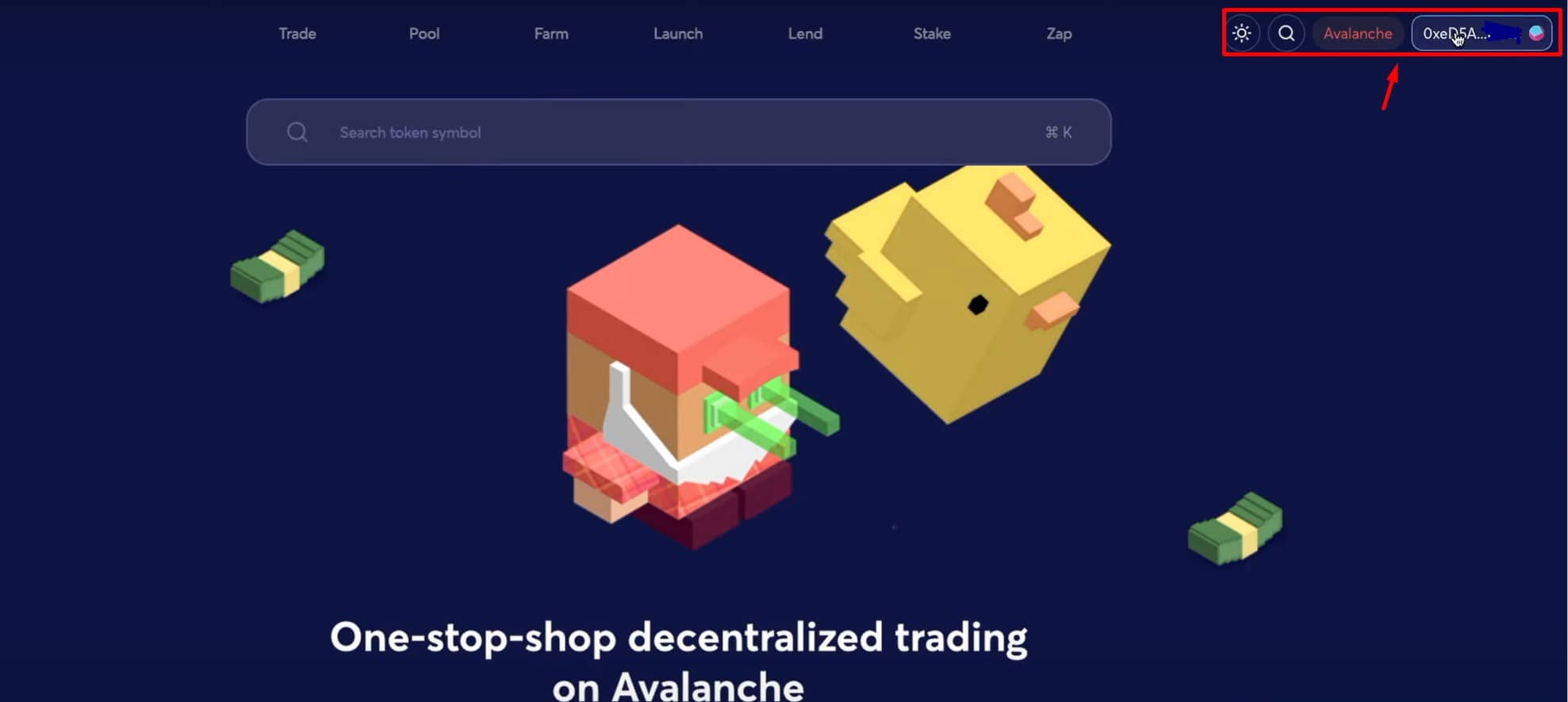

A Look at the LFJ Homepage

A Look at the LFJ HomepageLFJ was founded in 2021 by pseudonymous founders 0xMurloc and Cryptofish who set out to create a unique and innovative trading platform for the Avalanche blockchain and advance the new frontier of decentralized finance.

Cryptofish claims to be a full-stack and smart contract engineer who was an early contributor to several Avalanche projects such as Snowball and Sherpa Cash and has worked at Google while holding a master’s in Computer Science. 0xMurloc is a full-stack developer with experience in several startups and also a Senior Product Lead at Grab. I say “claims” due to the founders being quasi-anonymous, so we can only take them at their word.

Since launching, the platform has attracted over $4 billion in total value locked (TVL) and has quickly become the largest DEX on Avalanche. LFJ is also backed by some big money and players in the space, here is a shot showing the backers who have confidence in the platform:

Image via Trader Joe Whitepaper

Image via Trader Joe Whitepaper⚠️Important Note⚠️: This goes for ANY DEX or platform; always be sure that you are using the proper URL to access the website. Multiple fake websites are carbon copies of the original with similar URLs, set up to trick users into depositing funds onto a scam site. Always bookmark the proper site and be sure to find the URL directly from the platform’s whitepaper, or a site like CoinMarketCap. LFJ URL is traderjoexyz.com NOT traderjoe.xyz.com

The first thing you will need to do to get started with LFJ is add the Avalanche network to your MetaMask wallet and add some funds. If you already know how to do this, then feel free to skip the LFJ Tutorial and go straight to the “Key Features” section.

How to Connect MetaMask to LFJ

In case you didn’t know, MetaMask has grown far beyond just the Ethereum network, and now supports Polygon, Avalanche, BSC, Fantom, and more, you just need to make sure you’ve selected the proper network. If you are new to MetaMask, here is a MetaMask tutorial to catch you up to speed.

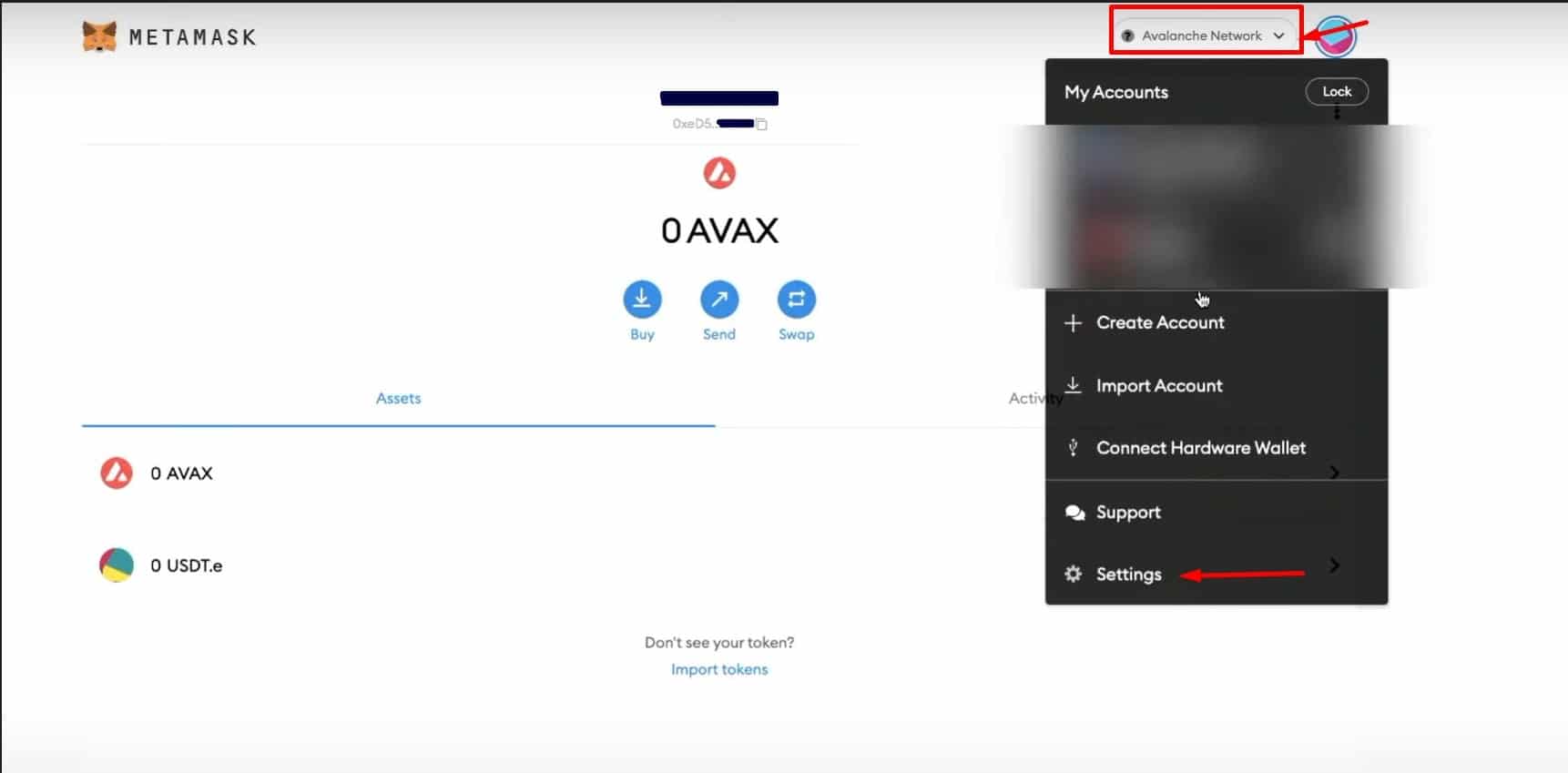

To change the network on MetaMask from Ethereum to Avalanche, simply go to settings:

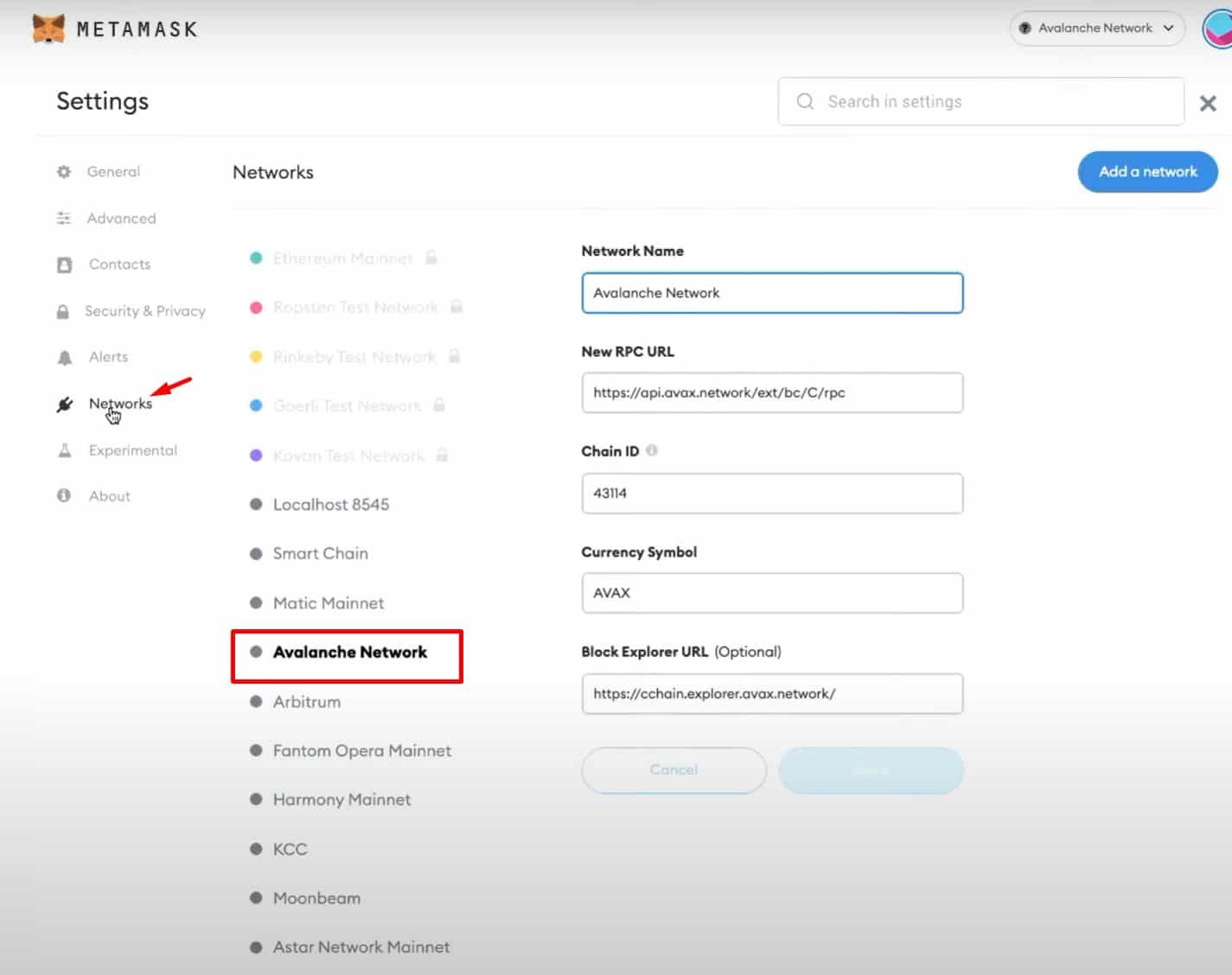

Then go to networks and you should already see Avalanche available:

If Avalanche is not available, you will need to go back to settings and select "add custom RPC" then add it manually. Don't worry, it's easy and only takes a minute. Here are the steps to add the Avalanche network to MetaMask.

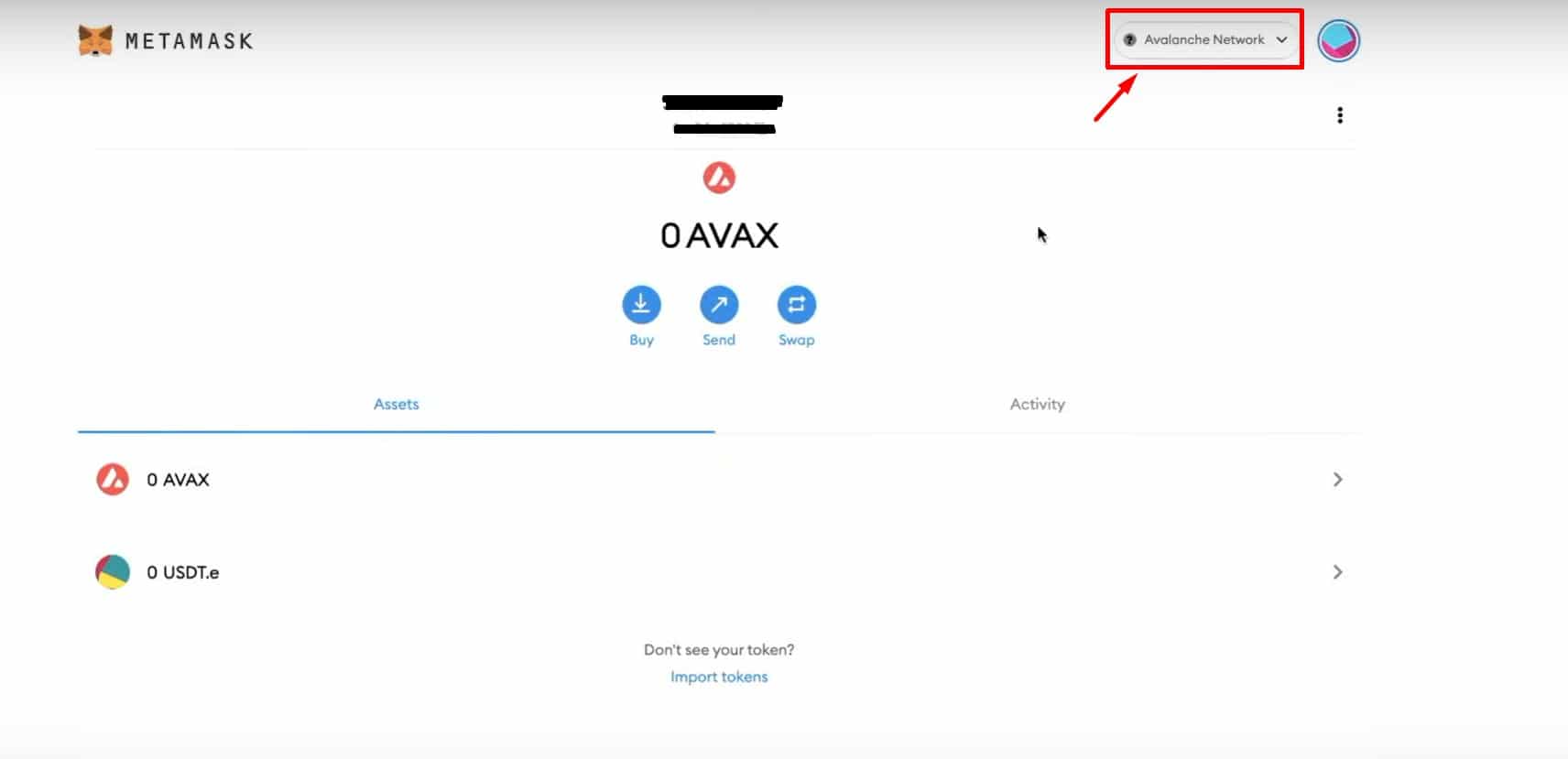

Now to access LFJ your MetaMask should look like this with the Avalanche network selected:

When you navigate to the LFJ site, you should see this in the top right-hand corner, confirming that you have MetaMask set to the correct network:

Now you have license to kill and can go ahead and access the magic of the LFJ DEX. But hold up, you’re gonna need some ammo before going in guns blazin’. Be sure your MetaMask is funded with some Avalanche (AVAX) tokens as it is needed to cover transaction fees on the Avalanche network.

Avalanche can be picked up on major exchanges, I recommend Binance. Needing AVAX to cover fees on the Avalanche network is the same concept as needing to hold some ETH to cover transaction fees on the Ethereum network.

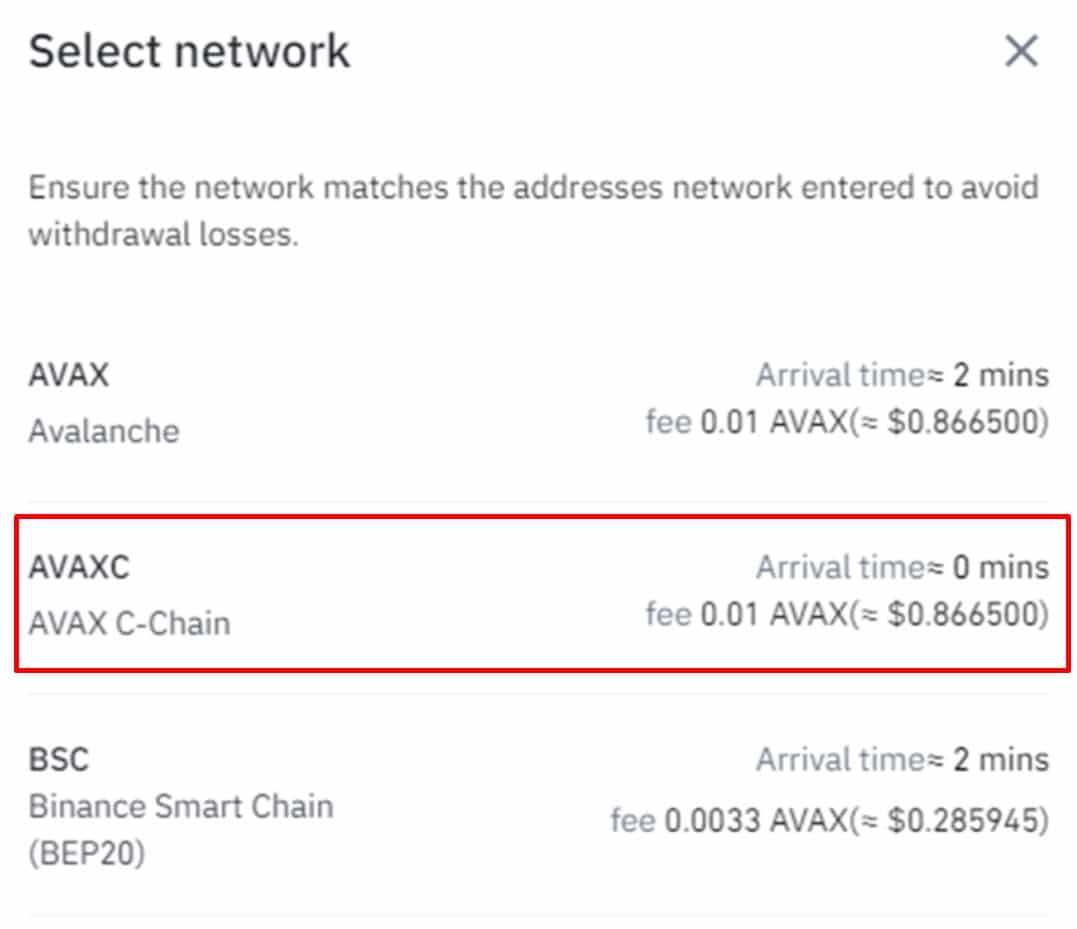

Important Note: When funding your MetaMask wallet with AVAX, be sure you select the network Avalanche C-Chain aka AVAXC (AVAX C-Chain) when withdrawing your Avalanche from an exchange.

Avalanche Withdraw Options on Binance

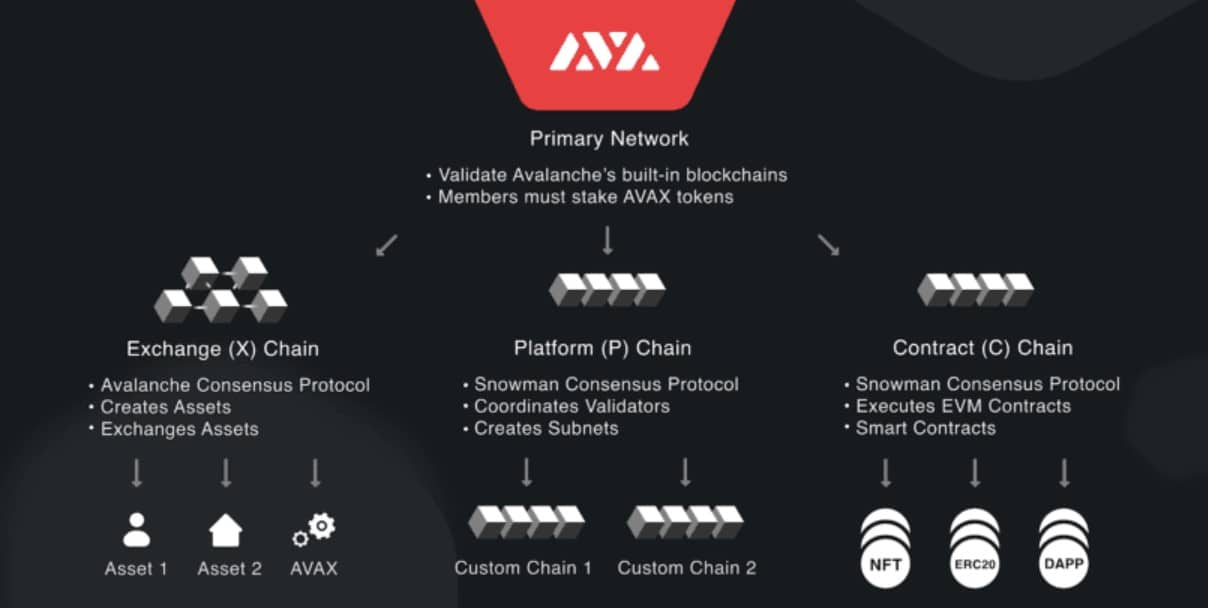

Avalanche Withdraw Options on BinanceSelecting the wrong network to withdraw on can result in lost funds so it is important to understand the difference between Avalanches C-Chain, X-Chain, and P-Chain.

C-Chain is the Contract Chain. This is the chain that is primarily used to access the Avalanche network for DeFi. The C stands for “contracts”, as in, the type of smart contracts that are used in DeFi. The key difference is that the C-Chain uses Ethereum-style addresses that begin with 0x, which makes it compatible with MetaMask.

X-Chain is the Exchange Chain. The key difference between the C-Chain and the X-Chain is that the X-Chain cannot be used with MetaMask or similar wallets and cannot be used in DeFi. The X-Chain address is used to access native Avalanche wallets and follows a different format.

The X-Chain is primarily used to send and receive funds on the AVAX network and focuses on fund transfers, avoiding the expensive fees that can be present on the C-Chain during high network usage. The X-Chain can send transactions for 0.001 AVAX, cheaper than the C-Chain, and much quicker as well.

P-Chain is the Platform Chain. The primary function of this chain is for staking AVAX and serving as a validator. When validating, your AVAX rewards will be received on this chain, and it is also possible to receive transfers from the other two chains. If you don’t plan on staking AVAX then you don’t need to worry about this chain.

While having three different chains may seem silly and unnecessary, I actually think this is quite clever. We have seen the issues with ETH in the form of insanely high gas fees and slow transaction times, and networks like Solana completely crashing under network stress.

Instead of trying to do everything on one chain, Avalanche spreads the burden, making it one of the most useable, cheap, and advanced layer one networks, with a high TPS of 4,500, approximately 2-second transaction times, and thorough decentralization over 1,040 validators.

Image via blocmates

Image via blocmatesAlright, back to LFJ. You will also likely want to fund your MetaMask wallet with JOE tokens to interact with the platform.

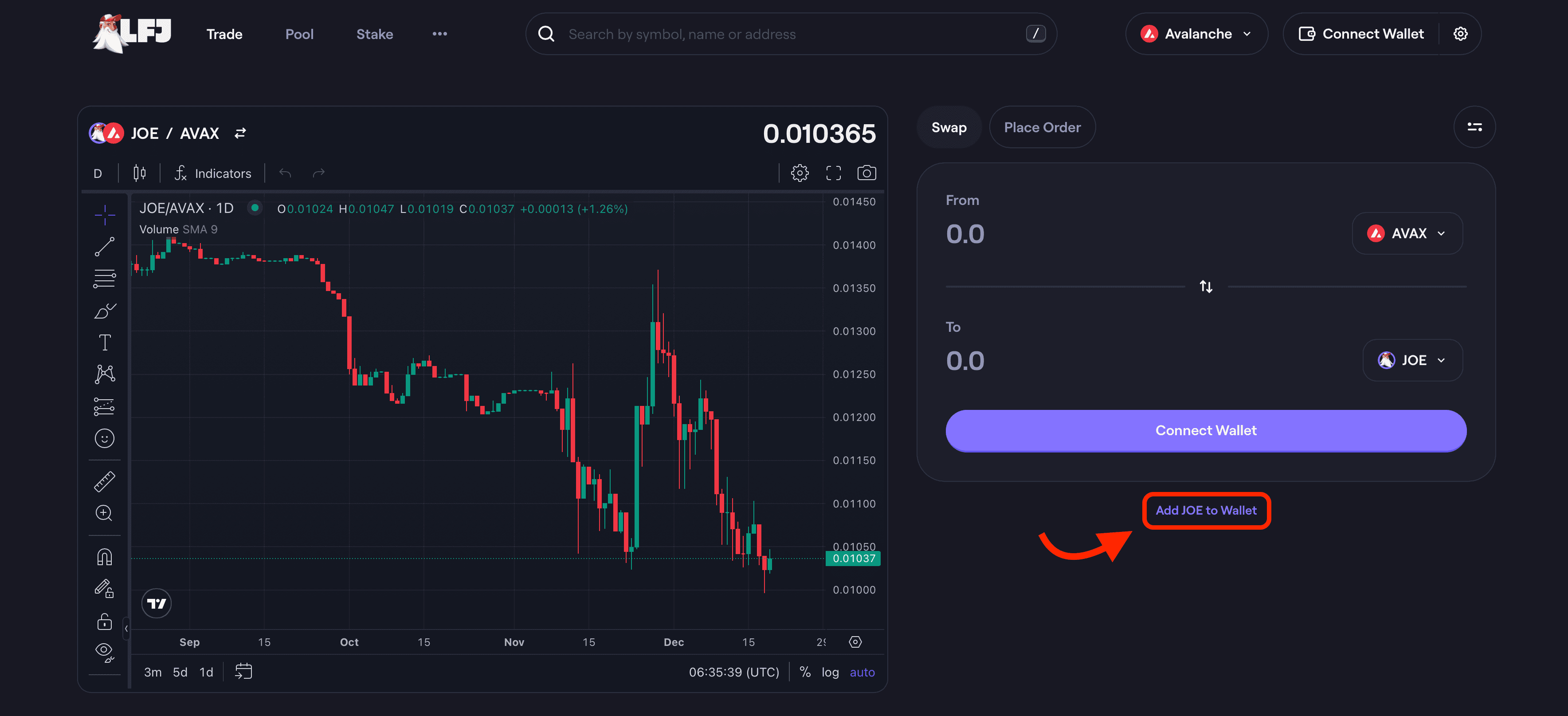

Here's an easy way to add token addresses on LFJ: You can select the token you want to swap for, and again, will see the option to “add token to wallet,” here is an example of how this would look for JOE:

Now that you can see JOE under "assets" in MetaMask, you can swap some AVAX for JOE on the LFJ Trade screen, or purchase some JOE from Binance or Crypto.com and send to your wallet.

Safety Tip: When adding a token contract address to MetaMask, or any wallet, if the platform doesn’t give you the option to “add token,” you need to manually enter the token contract address, make sure you are always locating the original and legitimate token address. These can be found on the project’s websites, whitepapers, Coin Market Cap, or Blockchain explorers such as Etherscan. Don’t copy and paste a contract address from a random stranger pretending to help you out on Telegram.

LFJ Key Features

There is a lot to unpack on LFJ, they weren’t kidding when they said a “One-Stop-Shop” for DeFi. I will just quickly note in case you get overwhelmed, that trading/swaps are super straightforward and simple, so is staking and lending. You do not need to get involved with the more complex features of liquidity provision or farming if you choose not to.

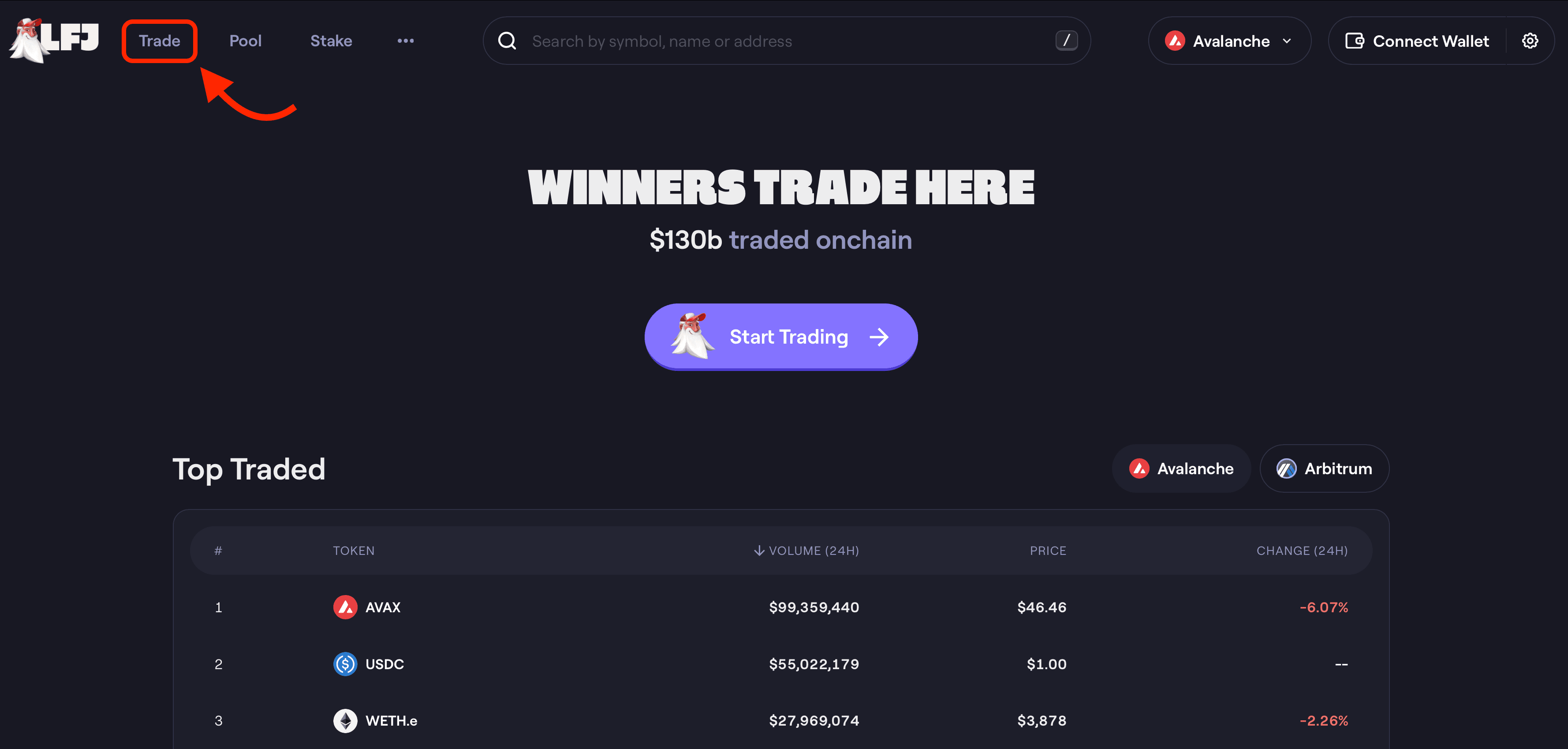

How to Trade on LFJ

For anyone who has used a standard AMM DEX like Uniswap or SushiSwap, this will look familiar to you as LFJ works on the same principles. Simply head to the top of the screen where it says “trade” or select the Trade tile like so:

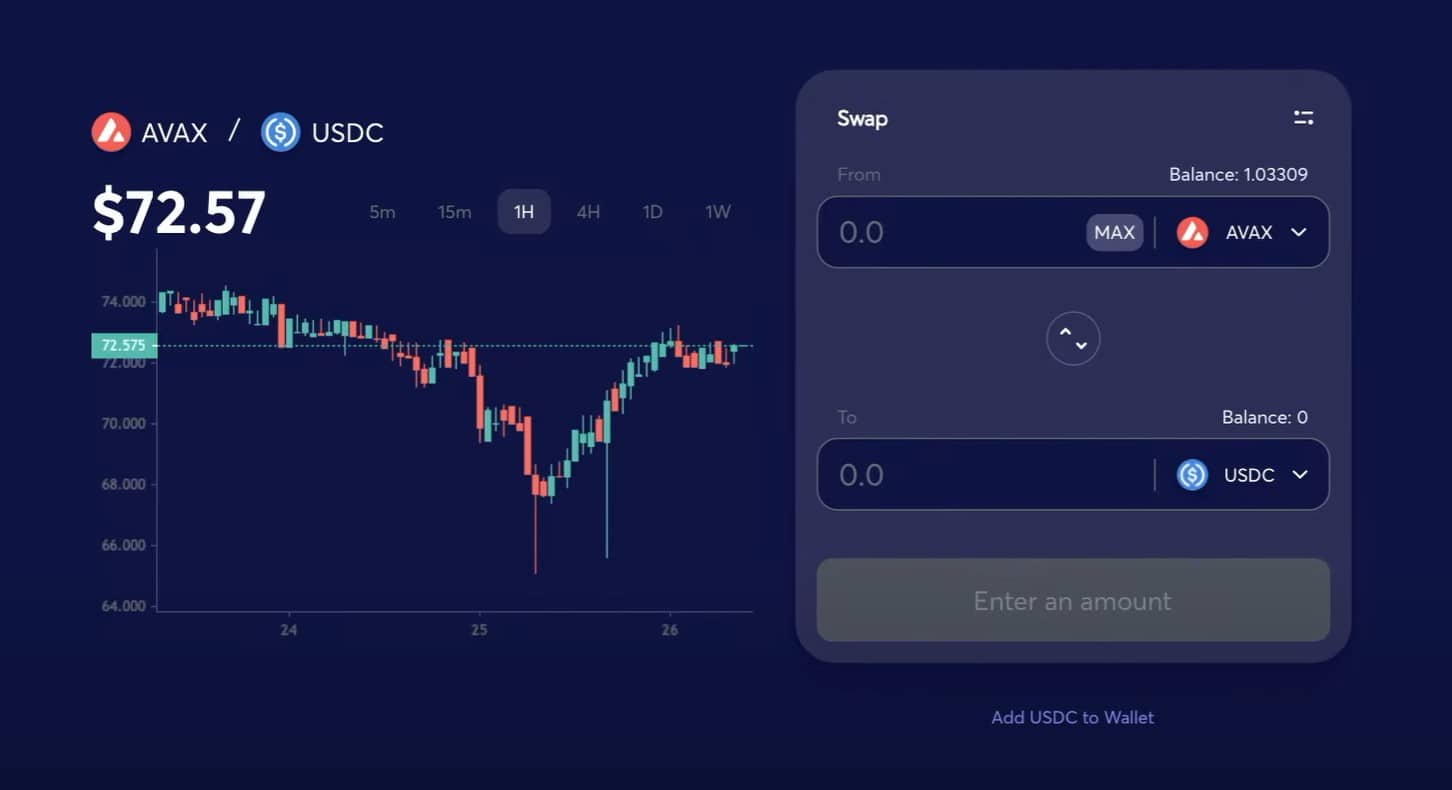

And that will take you to the simple trading screen where you can swap tokens which looks like this:

This will allow you to swap whatever tokens are available in your MetaMask for new tokens. Before you hit the Swap button, you will see a confirmation screen that will provide you with some important details about your swap:

Minimum received - This shows the minimum amount you will receive and takes into account things like possible slippage. The transaction will automatically revert if there is a sudden large unfavourable price movement before the transaction is confirmed.

Price Impact - This shows the impact that your swap will have on the liquidity pools. This only needs to be taken into consideration if you are trading massive amounts, as whales don’t want to have a large negative impact on the pool.

Liquidity Provider Fee - This is the fee that rewards the liquidity providers for providing liquidity to the DEX. A DEX could not run if it wasn’t for these guys, many of who are average folks just like you and I who choose to simply provide liquidity.

Once you hit the Swap button, you will see a popup that asks if you want to confirm the transaction. Hitting “confirm swap” will prompt your MetaMask wallet to open up and ask you to sign or confirm the transaction. This is normal for MetaMask, it just approves the transaction from the wallet side.

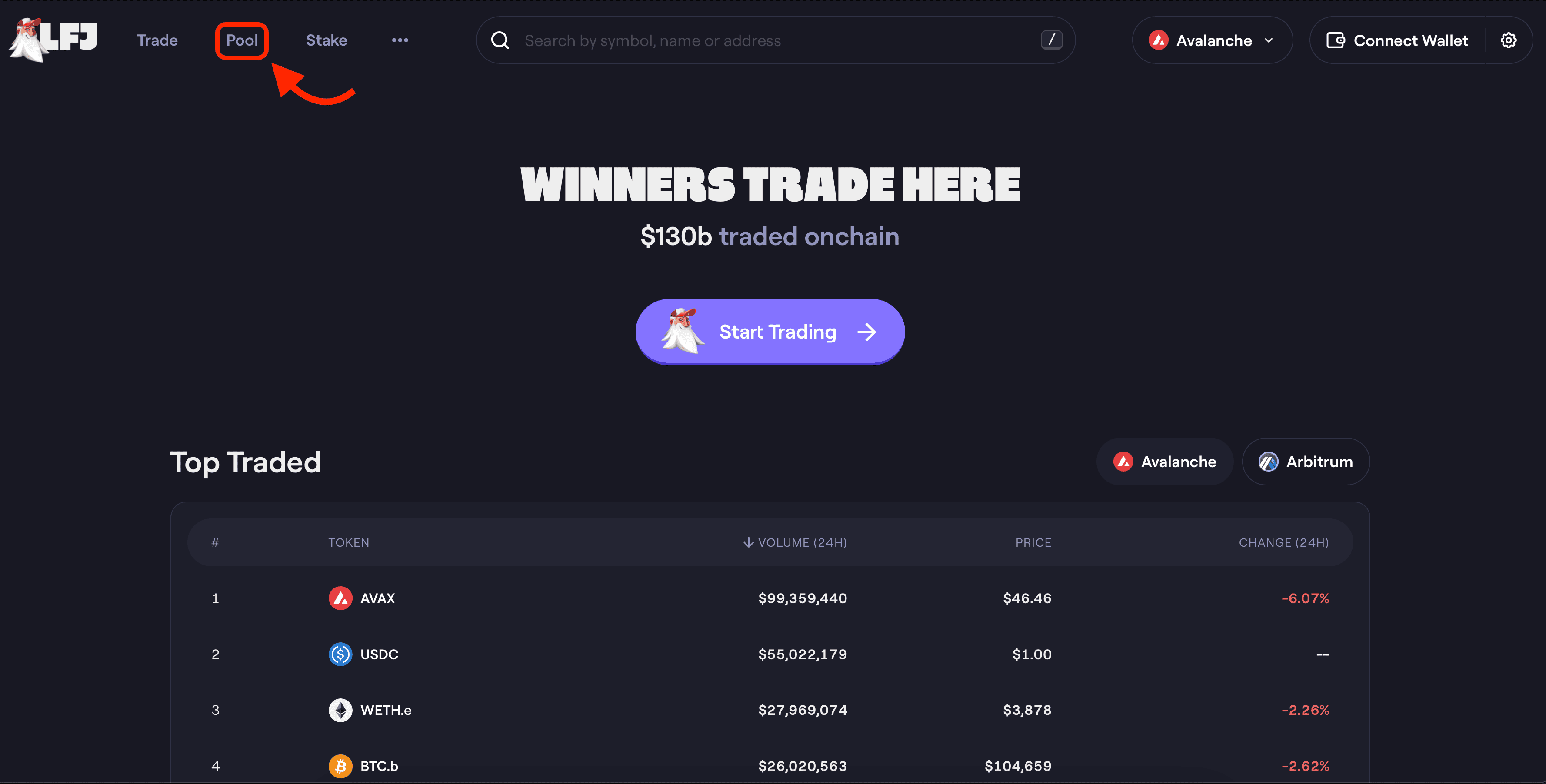

Liquidity Pools at LFJ

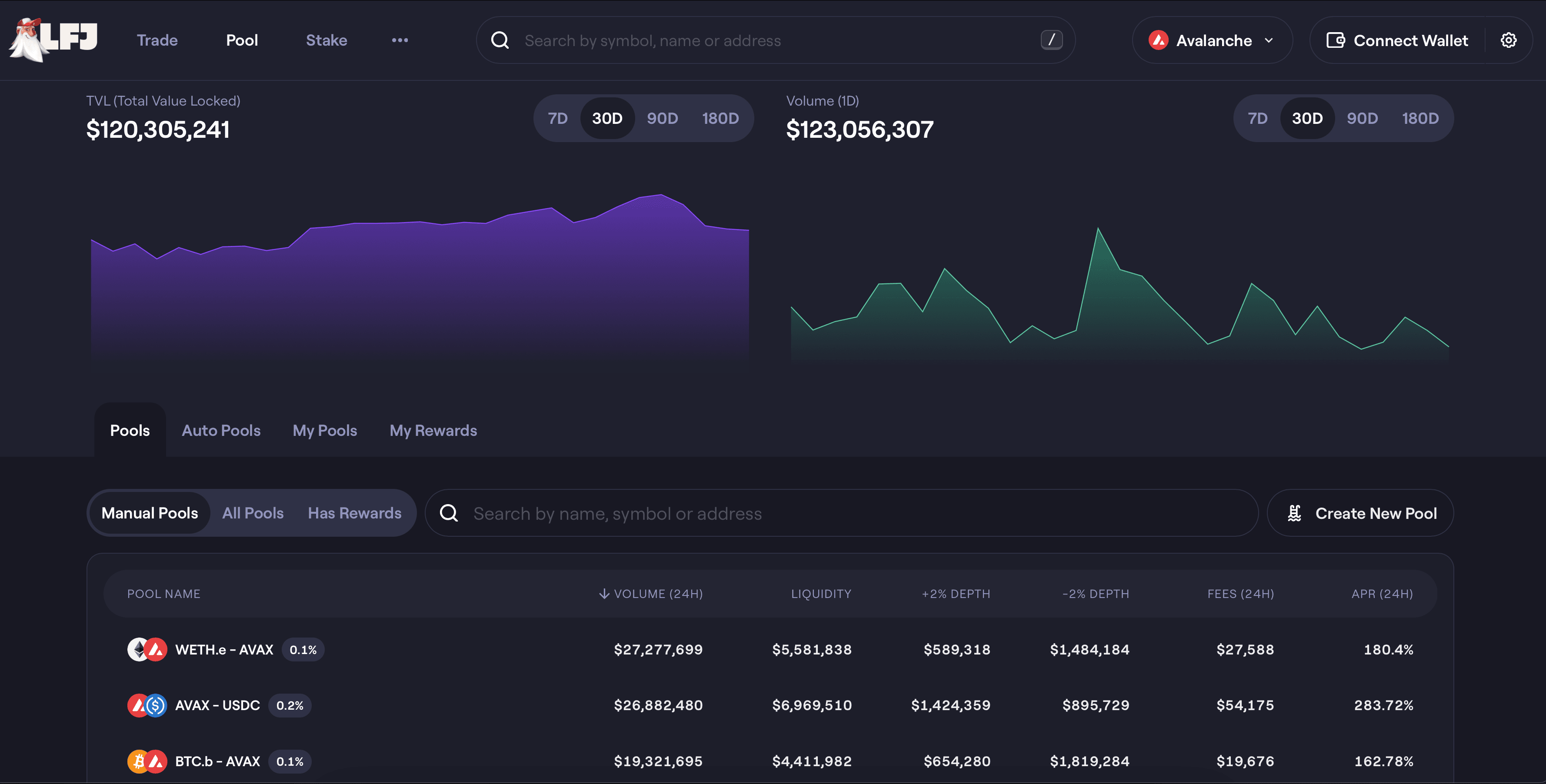

As with other DEXs, users can add their tokens to the LFJ liquidity pools and earn some passive income from fees generated on the platform.

When you click into the pool section, you will be brought to a screen that shows you all the token pair pools available that you can join and provide liquidity for, as well as all the token pools you are already a part of, and the option to create a pool.

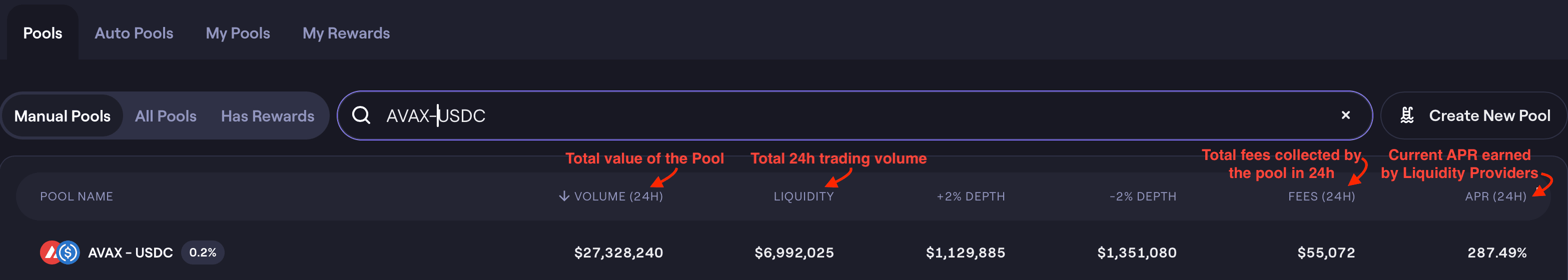

A Look at LFJ Liquidity Pools

A Look at LFJ Liquidity PoolsIf we take the USDC.e-AVAX pool as an example, we can see the following metrics available that give users important information about that pool:

The APR is a variable fee and will change from day to day depending on trading activity and volume on the platform.

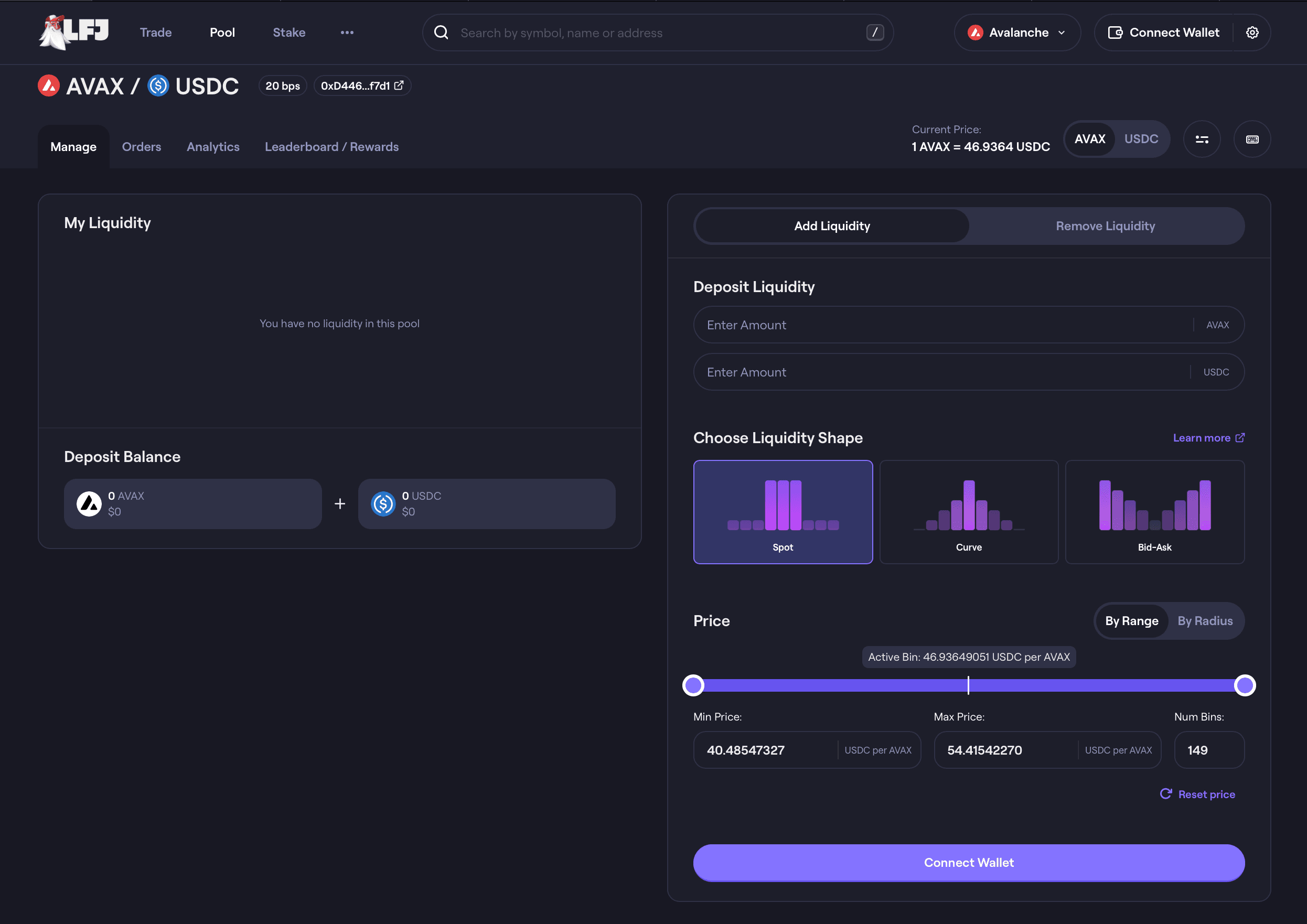

To add tokens to the pool, users will need to hold both tokens, so for AVAX-USDC.e, users need both AVAX and USDC.e in their MetaMask wallet. This is what the screen looks like to add or manage your funds in a pool:

Now, it is important to discuss the biggest risk involved when providing liquidity on any DEX, and that is the risk of Impermanent Loss (IL).

Image via Shutterstock

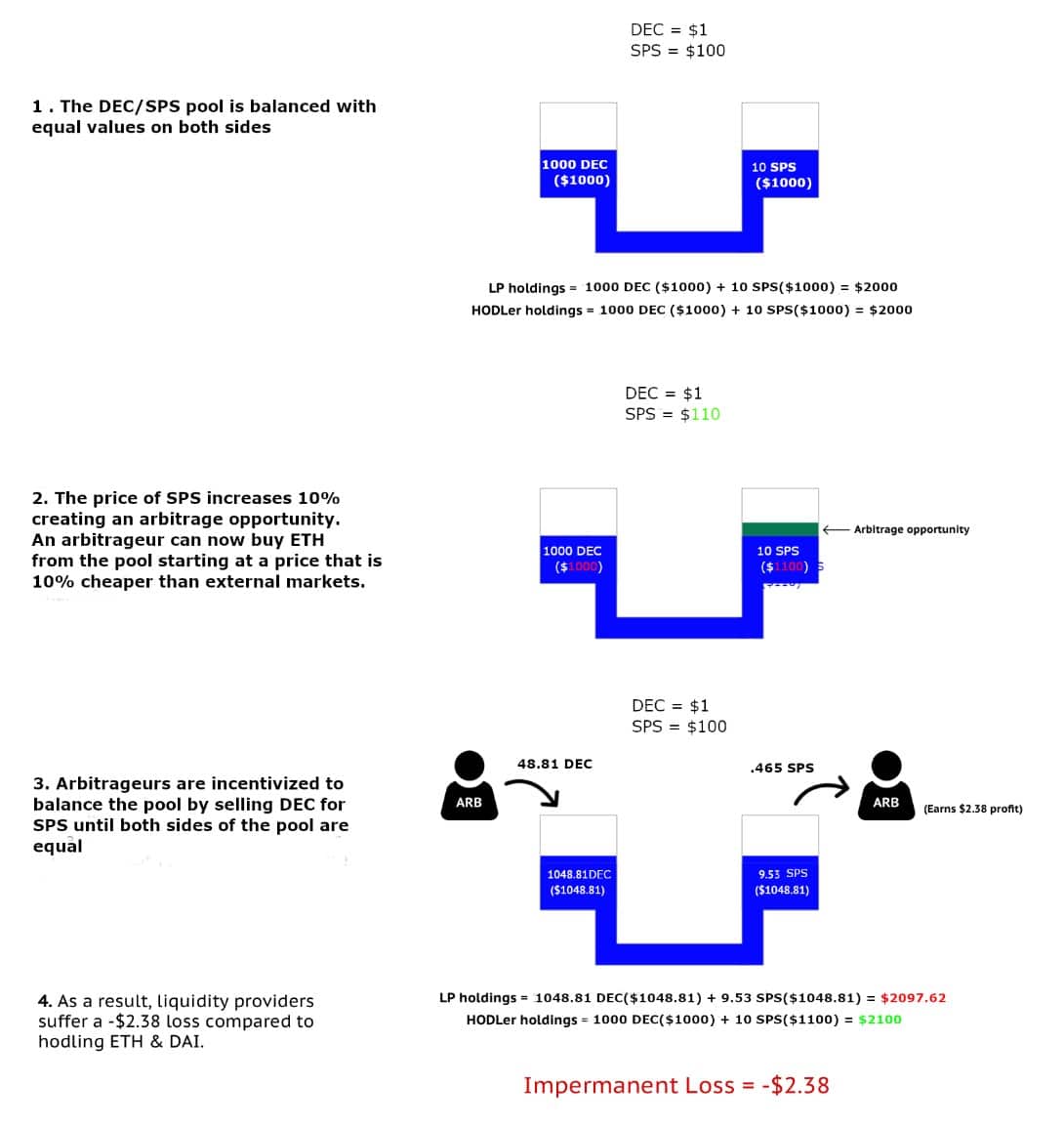

Image via ShutterstockImpermanent loss occurs when the price ratio of the supplied token pair changes. The more volatile the assets are in the pool, the more likely it is that users may be exposed to impermanent loss. The Automated Market Maker (AMM) system dictates that the total liquidity must remain balanced across both tokens to maintain equilibrium within the pool.

The impermanent part means that the value of the token that was readjusted to maintain equilibrium may return to its initial price if left in the pool. If the user withdrawals their tokens while the balance is off, they could be withdrawing tokens that now have a lower value than when they were entered into the pool, which turns the “impermanent” loss part to “permanent” loss as withdrawing the tokens made the loss “realized” and no longer “unrealized” to use financial terms.

Here is a great diagram from Splintertalk.io showing an example of this:

Image via Splintertalk

Image via SplintertalkBe sure to fully understand the risks of impermanent loss before deciding if liquidity providing is right for you.

LFJ Yield Farming

If you are going to be providing liquidity on LFJ then you may as well take advantage of Yield Farming too, a nice one-two combo for earning passive income.

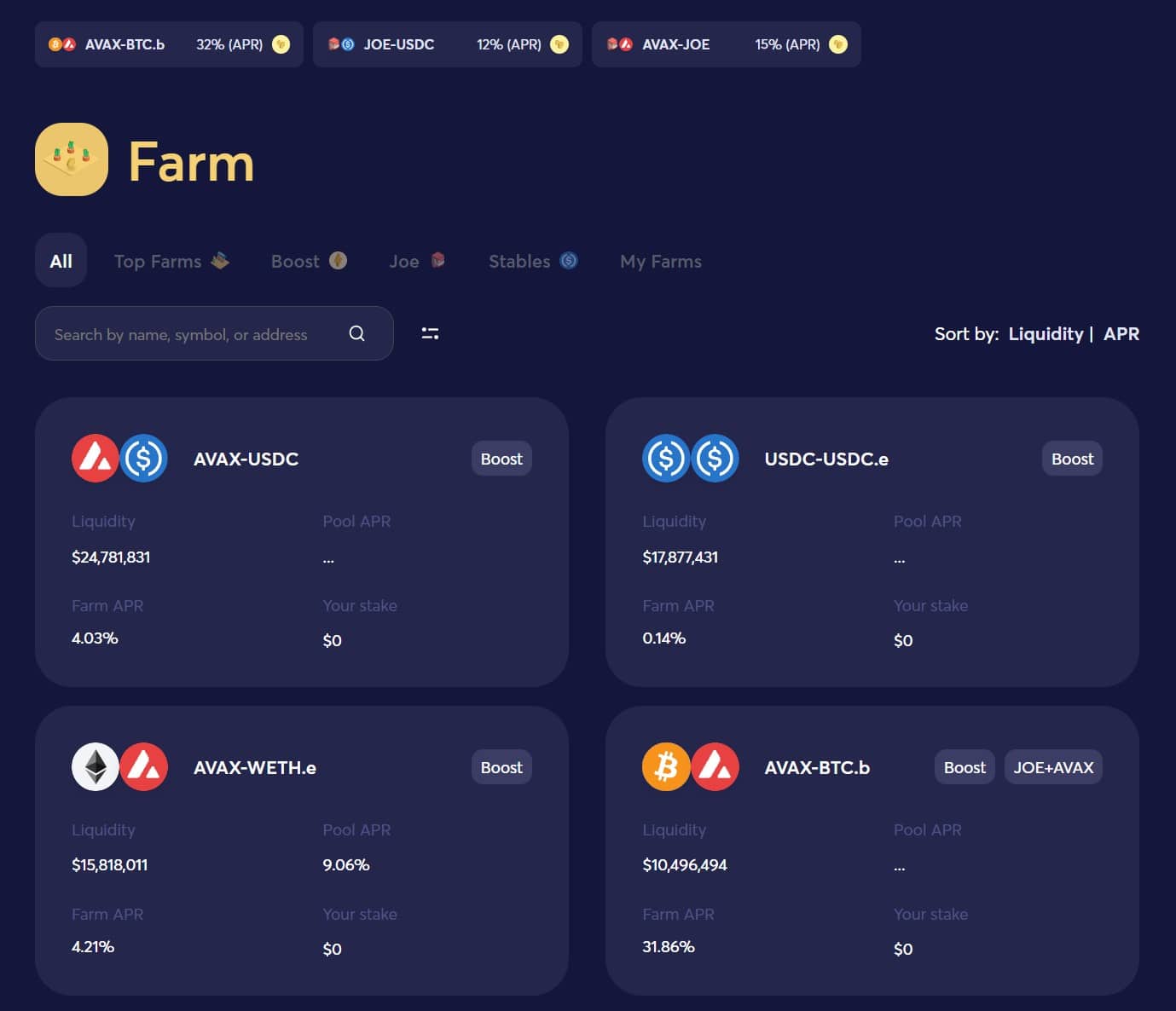

Farms are a way to incentivize users to add liquidity. The Farm section will show all the token pairs you can add tokens into, as well as show the top farms, stablecoin farms, and any farms you are already participating in:

This is where you can put those LP tokens to work that I mentioned in the Pool section, the tokens that users receive and earn by participating in liquidity pools. LP tokens can be staked in the farms for an additional APY.

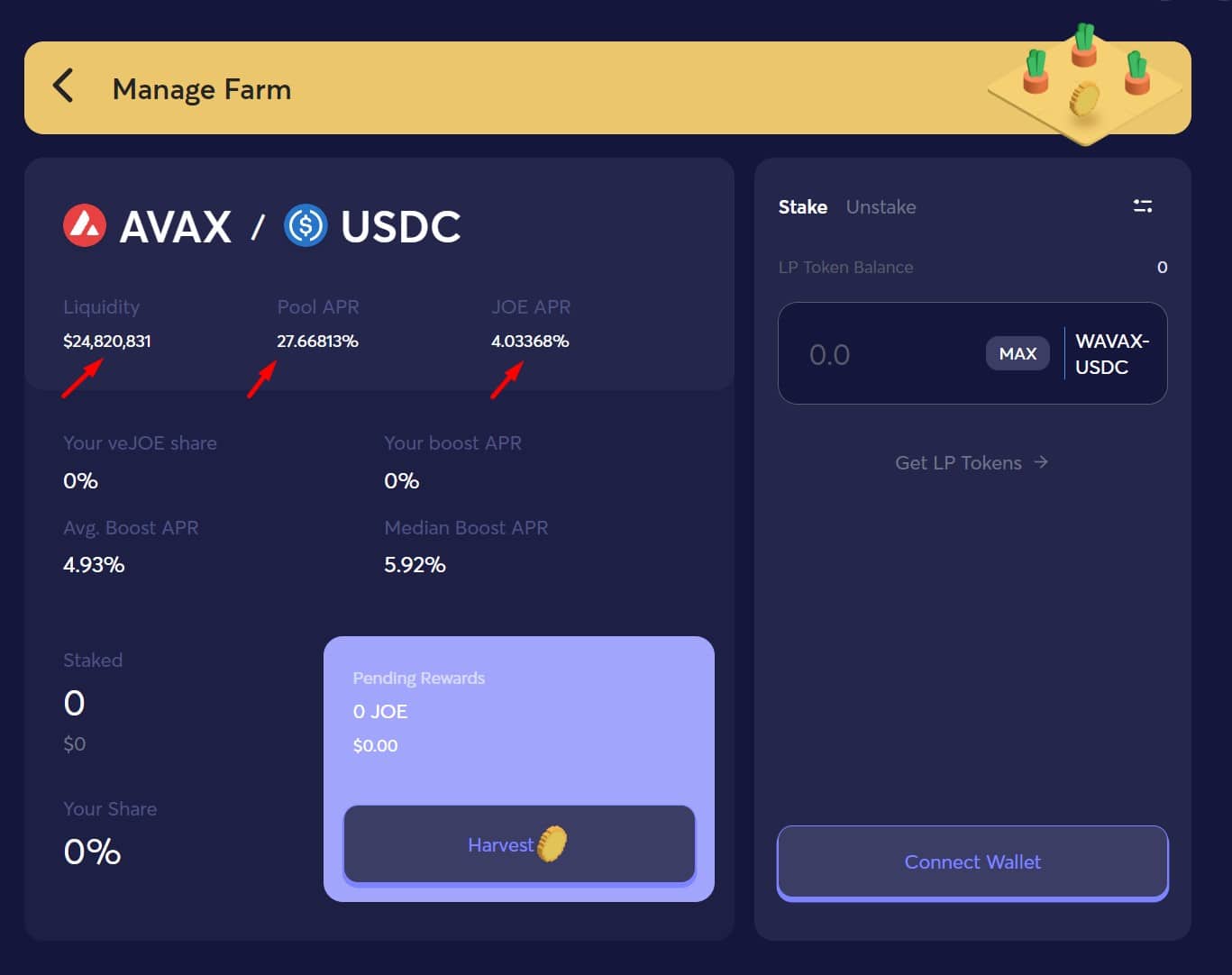

Once you find the farm that you hold the corresponding LP tokens for, we’ll use AVAX/USDC as an example, you will click on the pair in the Farm section which will take you to a screen that looks like this:

You will find important information such as the liquidity, Pool APR, JOE APR, and this is where you will select the amount of LP tokens you want to stake on the right-hand side.

Once again, as soon as you click stake, or make any transaction, your MetaMask wallet will automatically pop up again for you to verify the transaction.

The JOE APR is a nice little bonus, not only will traders earn the Pool APR for the tokens they deposited into the pool, but also JOE tokens, shown by the “JOE APR”, to incentivize users to use LFJ over the competitors.

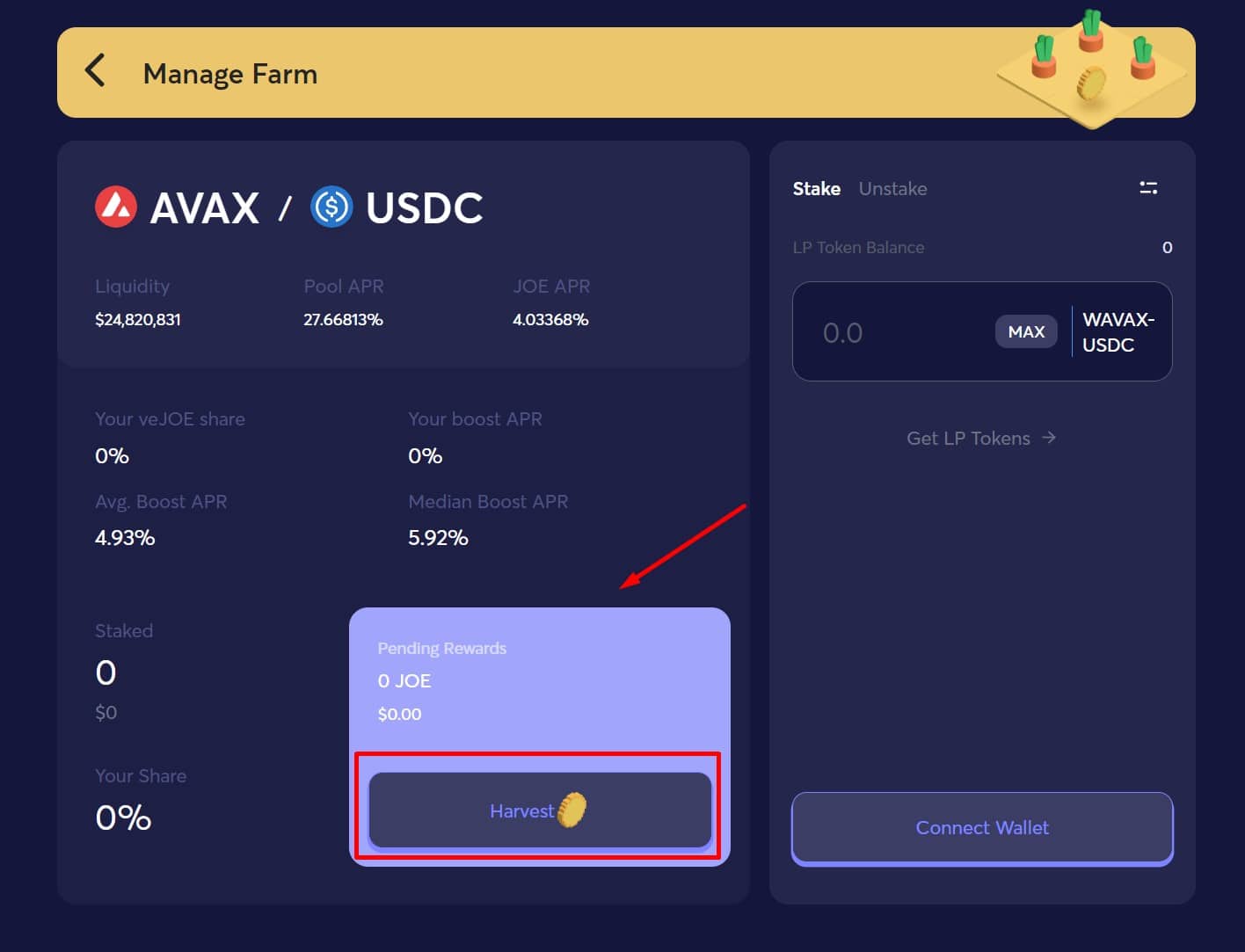

Once you’ve accrued some JOE tokens, you will be able to see the JOE rewards and hitting “harvest” will add the tokens to your wallet:

Pro Tip for the DeFi Degenerates 💰: What to do with your JOE tokens? Well, you can simply hodl em’ and sell them when they appreciate in value, or why not head back to the Trade section, swap out your JOE for additional pool tokens, and reinvest those tokens back into the pool, therefore earning more token rewards AND more JOE tokens, rinse and repeat and cha-ching! 🤓 💸

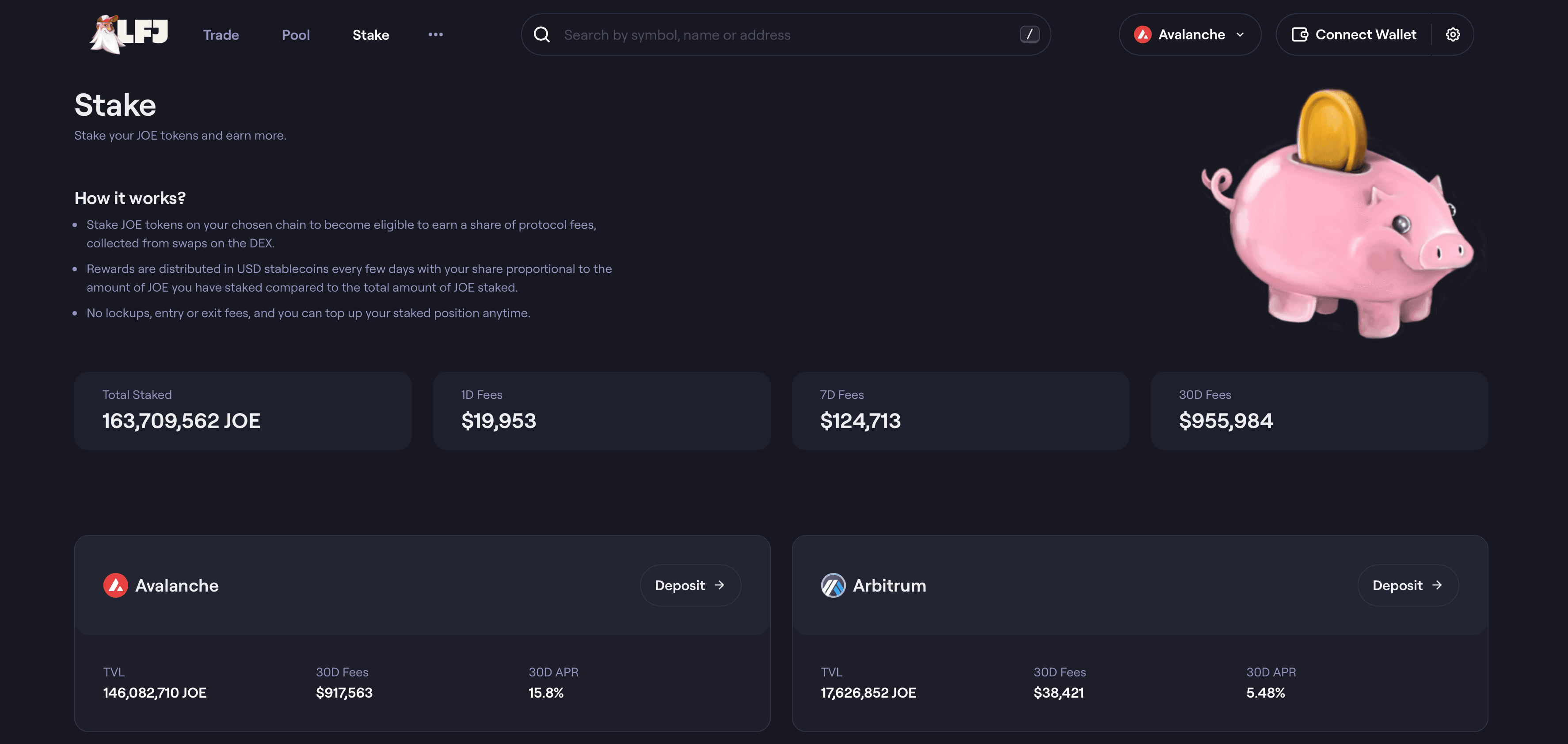

Staking on LFJ

LFJ also supports staking, which is a pretty nice perk, increasing the usability of the platform. Users can stake their JOE tokens on their chosen chain to earn a portion of the protocol fees, with rewards distributed in USDC.

A Look at JOE Staking

A Look at JOE StakingLFJ DeFi Lending

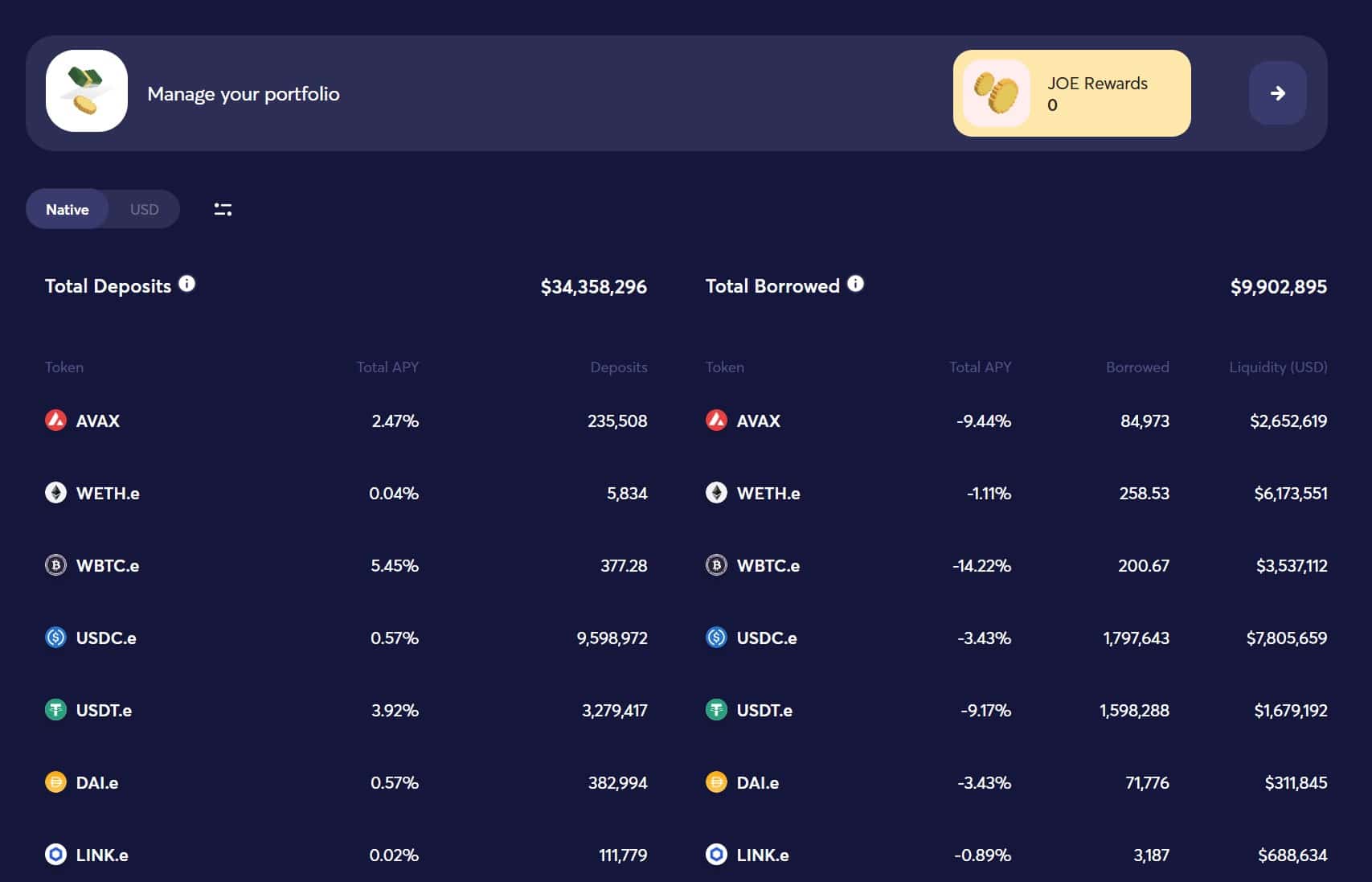

While liquidity pools and farming can seem overwhelming, LFJ Lend provides a far more user-friendly and simple way to earn passive income on your holdings.

If you have tokens sitting idle in your MetaMask wallet, you can lend them out to other users and earn interest. Once inside the Lend area, you will see the tokens that you can deposit and the APY:

APYs range from 0.04% up to 9.85% at the time of writing and are subject to change. There are currently 11 assets available to lend. The entire lending and borrowing process is automated, one of the beautiful functions of smart contracts, so the user doesn’t need to seek borrowers, vet them, or worry about if they will be able to pay back the loan as lending is over collateralized and repayments are automatically coded into the contract, making lending low-risk.

Lending on LFJ is great as you earn in-kind APY rewards for the token you lend out. Users who lend out AVAX, for example, will receive AVAX interest payments, and some lent tokens can also qualify to receive additional JOE token APY as a cheeky little added bonus. 😎

LFJ Fees

As with any good DeFi DEX (excluding those on Ethereum), the fees are minuscule compared to centralized exchanges. Also, like any top-tier DEX, most, if not all fees should go back to the community and LPs who make the DEX possible. LFJ is legit and on the up and up here, no shady business going on.

Because the DEX is built on AVAX, users will experience significantly lower fees than on its Ethereum counterparts, with average fees being 1-5 cents per transaction, all of which go to the Avalanche network validators, not the LFJ platform.

Token swaps on the platform will have a 0.3% trading fee.

- 0.25% - Paid to liquidity pools in the form of a trading fee for liquidity providers

- 0.05% - Sent to sJOE Staking

LFJ KYC and Account Verification

Not here! As LFJ is a decentralized application, there is no KYC or account verification necessary. If you are just coming across Decentralized Finance for the first time, check out Guy’s video on DeFi 101:

LFJ Security

As this is a decentralized platform, the onus of security is mostly on the user, not the platform. The platform protocols themselves are secured by the Avalanche blockchain, and the platform was fully audited by HashEX and Paladin. Here are the audit results for LFJ if you want to verify this for yourself.

Ultimately, when it comes to DeFi, all the security responsibilities that come along with self-custody are at play here. Make sure you understand the importance of self-custody security and non-custodial services before jumping in.

Be sure to check out Guy's video: Crypto Custody 101 to learn more about crypto custody.

Cryptocurrencies Available on LFJ

According to Coin Gecko, there are 171 coins and 266 pairs available on LFJ. Traders will not find major coins such as Bitcoin and Ethereum here as the tokens supported need to be on the Avalanche network, though wrapped versions of BTC and ETH can be picked up.

Stablecoins supported are USDC, Tether, and DAI.

LFJ Exchange Platform Design and Usability

As I’ve already alluded to, anyone who has only used centralized exchanges like Coinbase and CeFi platforms like Nexo are in for a trip here if they are accessing DeFi for the first time.

The world of DeFi is a wonderful place and I strongly encourage anyone who is interested in crypto to take the DeFi plunge. It has so many advantages over centralized finance, with the two biggest benefits being:

- More secure- there is no authority or intermediary that can halt withdrawals, restrict asset movement, lock you out of an account, or take back funds. It is the equivalent to if you have cash in your home vs trusting it to your bank, and we’ve all seen how well that plays out when governments ban their people from accessing their bank accounts.

- Considerably cheaper- As there are no greedy banker middlemen or companies taking a cut and charging additional fees, DeFi is much cheaper (except for Ethereum…for now). The only fees go to validators and miners on the associated network, and transactions on networks like Avalanche, Solana, Near and Cardano can be completed for fractions of a dollar.

Anyone who has used a DEX like Uniswap or PancakeSwap will have no issues as LFJ is built and designed brilliantly. The platform is incredibly easy to navigate, it is so simple to use that I feel like I could find my way around darn-near blindfolded.

For early DeFi users, it is clear that LFJ is a next-generation DeFi platform. They have improved upon many of the early complexities and made every task as straightforward as possible. They even added some fun graphics, designs and menus, not every DeFi platform needs to look as boring as QuickSwap.

LFJ Token (JOE)

One thing that I think the LFJ platform does better than most DEXs is that they have created multiple demand drivers and use cases for the JOE token.

Here are some of the use cases for the JOE token:

Staking- Stake JOE to earn sJOE, xrJOE and veJOE and APY.

Liquidity Pool and Farming- JOE token can be used in many of the pools and farms.

Access Launch- rJOE tokens are needed to access the Launch platform.

Lend- JOE tokens can be lent out

Governance- JOE tokens can be used for governance proposals.

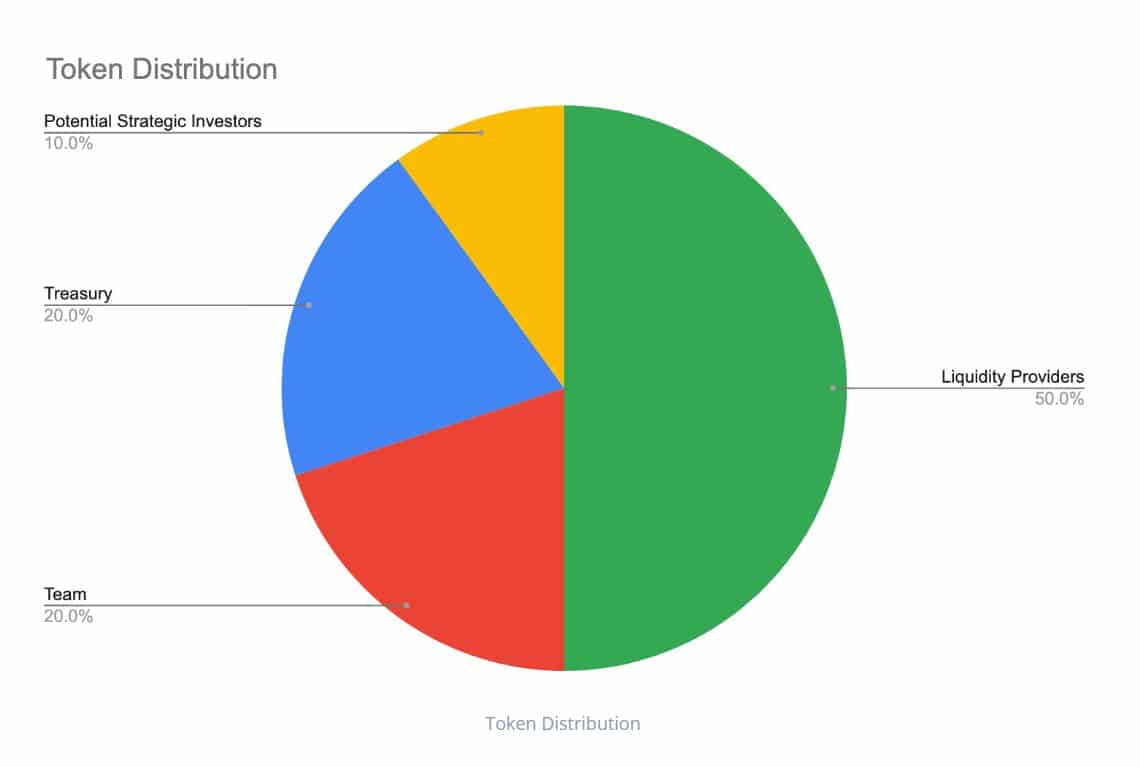

The distribution of JOE is also fair, with the vast majority going to the Liquidity Providers:

Image via LFJ Whitepaper

Image via LFJ WhitepaperWhere Can You Buy JOE?

JOE can be purchased on multiple major exchanges, including Binance, OKX, and HTX, and, of course, directly on LFJ.

LFJ Customer Support

Support can be found on the LFJ official Discord help desk. As a rule of thumb when it comes to DeFi, I generally never expect decent, or any support, as we need to keep in mind that most of these platforms are not run by paid staff. They are platforms created by the people, for the people.

There is generally a strong community behind these platforms and support can often be attained by the generosity of the community who all chip in to help each other out on sites like Reddit and Discord. The LFJ Discord is one of the better support chats I have experienced with over 15k members, so support is pretty quick and easy to come by here.

LFJ also has a very well-put-together whitepaper which explains everything users need to know, including tutorials to help answer many questions.

LFJ Top Benefits Reviewed

The strongest benefits for LFJ are the multitude of options they offer, being so much more powerful than a simple DEX. I like all the options built into the platform; it provides a service that is much needed for the Avalanche ecosystem.

There is also a strong community and a help desk in Discord, along with a handy analytics dashboard and good asset support.

What can be Improved

LFJ truly is a fantastic platform, and I cannot find any glaring faults with it. If I was going to be very picky, I guess it would be nice to see AVAX staking added to the Staking options.

Some users may be put off by the pseudononymous creators behind LFJ as anonymous creators can often be a warning sign of a project that is a scam or a likely rug pull. Though both creators do have active online presences that can be traced back and are known for their work on previous projects.

Normally, anonymous teams and founders put me off projects as well, but I am not concerned here as these guys didn't pop up overnight and we can trace their history. Being pseudononymous is also a clever move here because when crypto regulatory crackdowns happen like we saw with Uniswap, the founder's anonymitity will likely be a strength, not weakness.

LFJ Review Conclusion

I was pleasantly surprised with LFJ. After using and reviewing many DEXs over the years, it is quite clear that the team behind the LFJ platform is well versed, knowledgeable, and knows exactly what it takes to make a great DeFi hub.

While the Avalanche ecosystem is quite new and smaller than many other blockchain networks, it is seeing rapid growth and is a serious contender to become a top layer-1 blockchain and a very strong Ethereum competitor. With LFJ solidly holding onto the title of top DEX on AVAX, I would not be surprised to see the platform continue its growth, adoption, and success.