In a crypto landscape saturated with decentralized exchanges, automated market makers, and yield farming platforms, it takes something truly innovative to stand out. Enter Meteora — a protocol on Solana that’s not just aiming to provide liquidity, but to redefine how liquidity is managed, optimized and sustained.

Now, you might be asking yourself, what exactly is Meteora, and why is it worth your attention? Well, rather than functioning as just another place to swap tokens, Meteora operates as a dynamic liquidity layer — offering liquidity providers smarter, more efficient ways to earn yield, all while helping to build a more robust and sustainable DeFi ecosystem on Solana.

In today’s review, we're going to tell you everything you need to know about Meteora — from its unique approach to automated market-making, to how you can use its pools and vaults to farm yield more effectively. We’ll also walk through practical guides on how to use its features and explore the risks every liquidity provider should be aware of.

So, if you’re looking for a deeper understanding of one of Solana’s most promising DeFi protocols, then stay tuned.

What is Meteora?

Let’s start with what Meteora actually is — and perhaps more importantly, what it isn’t.

Unlike your typical decentralised exchange, Meteora is not a swapping interface where traders go to buy or sell tokens directly. Instead, it functions as a liquidity layer — a backend infrastructure that provides liquidity for trades executed across Solana's DeFi ecosystem. And rather than trying to compete with DEXs, Meteora integrates with them — most notably with Jupiter, Solana’s leading DEX aggregator. This means when users make swaps on Jupiter, there’s a good chance the trade is routed through Meteora’s liquidity pools.

Now, you might be wondering — if I can’t trade directly on Meteora, what exactly does it offer?

Here’s the core of it: Meteora offers a suite of dynamic liquidity products that allow users to earn yield by providing liquidity. These include:

- Dynamic AMM Pools – Traditional constant product pools with added yield via lending.

- DLMM Pools – Highly efficient concentrated liquidity pools with zero-slippage bins and dynamic fees.

- Dynamic Vaults – Yield-optimizing vaults that distribute idle capital across lending protocols.

- Specialized Pools – Such as Memecoin Pools, Launch Pools, and Multi-token Pools, tailored for specific use cases.

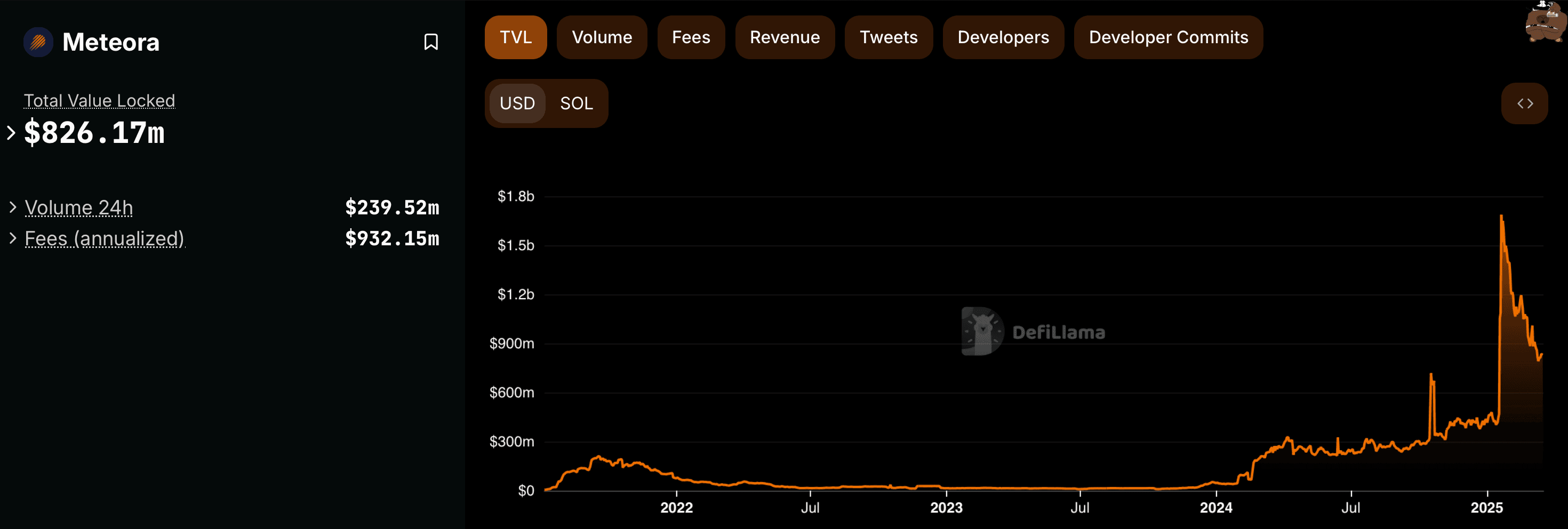

Meteora has also seen impressive growth in both Total Value Locked (TVL) and swap volumes. To give you an idea, TVL currently sits close to $800 million, with daily swap volumes consistently exceeding $200 million.

Meteora TVL. Image via DefiLlama

Meteora TVL. Image via DefiLlamaMeteora Core Features and How to Use Them

Now that you have a sense of what Meteora is and how it fits into the Solana ecosystem, let’s take a closer look at its core features — and, more importantly, how to use them. From yield-boosting liquidity pools to automated vaults, Meteora offers a range of tools for liquidity providers looking to earn efficiently and sustainably.

Let’s break them down.

Dynamic AMM Pools

Let’s begin with Dynamic AMM Pools — the most familiar offering for those already versed in DeFi. These pools operate on the classic constant product formula, commonly represented as x * y = k. In simple terms, this means that the product of the two token amounts in the pool must always remain constant. As traders swap tokens, the balance shifts, and the price automatically adjusts to maintain equilibrium.

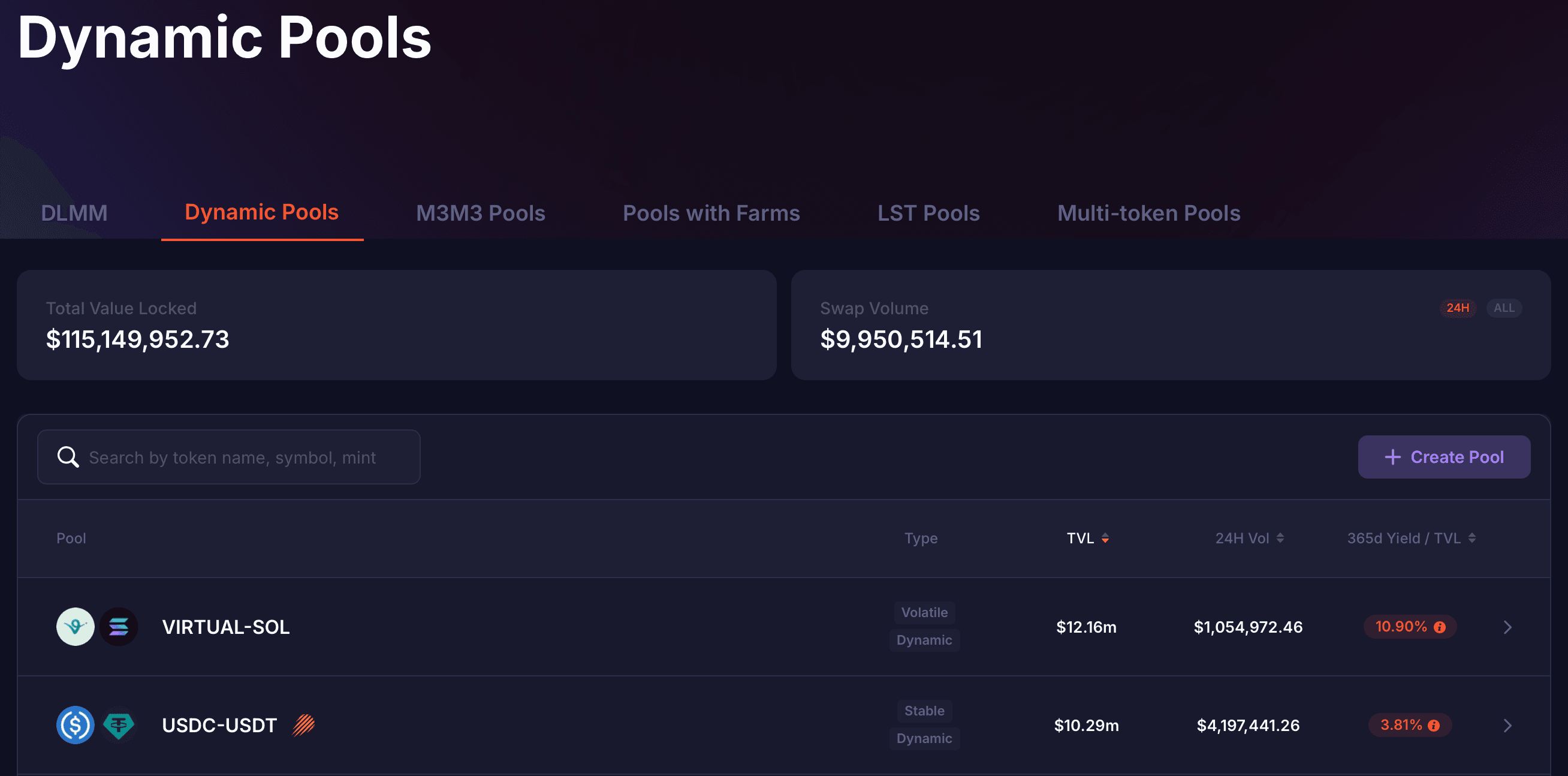

Meteora Dynamic Pools. Image via Meteora

Meteora Dynamic Pools. Image via Meteora This model is well-known for protocols like Uniswap V2 and is widely used for its simplicity and reliability. However, Meteora’s implementation adds a significant twist — one that aims to solve a common limitation of traditional AMMs.

A Dual-Yield Mechanism

In most AMMs, liquidity providers (LPs) earn solely from trading fees — a model that can become unsustainable during periods of low volume or competition. To address this, Meteora introduces a second layer of yield by integrating its Dynamic Vaults directly into the AMM infrastructure.

Here’s how it works:

- When you provide liquidity to a Dynamic AMM Pool, the assets you deposit are used for swaps as usual.

- However, idle assets — the portion of your deposit not immediately needed for trading — are automatically allocated to external lending protocols like Kamino, Marginfi, and Solend.

- These assets generate lending yield while remaining accessible, thanks to real-time monitoring and rebalancing by Hermes, Meteora’s off-chain optimization system.

This means that as an LP, you’re earning from two sources simultaneously:

- Trading fees from swaps in the pool.

- Lending returns from your assets working behind the scenes.

How to Use Dynamic AMM Pools

- Providing Liquidity (50:50 Value Ratio)

- When you add liquidity, you must do so in equal value amounts. For example, if 1 SOL = 100 USDC, then you must deposit 1 SOL and 100 USDC.

- This ratio ensures that the pool price matches the market price. Failing to do so opens you to arbitrage losses, as traders exploit the price discrepancy.

- When you add liquidity, you must do so in equal value amounts. For example, if 1 SOL = 100 USDC, then you must deposit 1 SOL and 100 USDC.

- Tracking Fees and Virtual Price

- You receive LP tokens representing your share in the pool.

- Fees are automatically added to the pool, growing its total value. This is measured by Virtual Price, calculated as:

- Virtual Price = Pool Value / LP Token Supply

- Virtual Price = Pool Value / LP Token Supply

- If Virtual Price > 1, your LP tokens have increased in value. If < 1, the pool has lost value.

- You receive LP tokens representing your share in the pool.

- Withdrawing Liquidity

- You can withdraw at any time. Your LP tokens convert back into the underlying assets.

- To check earnings:

- Go to Withdraw Tab → Click Max → Review token amounts and compare to initial deposit.

- Go to Withdraw Tab → Click Max → Review token amounts and compare to initial deposit.

- Note: LP token quantity never increases — only its value grows over time through compounding fees.

- You can withdraw at any time. Your LP tokens convert back into the underlying assets.

DLMM Pools (Dynamic Liquidity Market Maker)

One of Meteora’s most distinctive features is its DLMM Pools — short for Dynamic Liquidity Market Maker. These pools take the concept of concentrated liquidity and add an extra layer of efficiency, allowing liquidity providers (LPs) to earn more with less capital by placing their assets into discrete price bins.

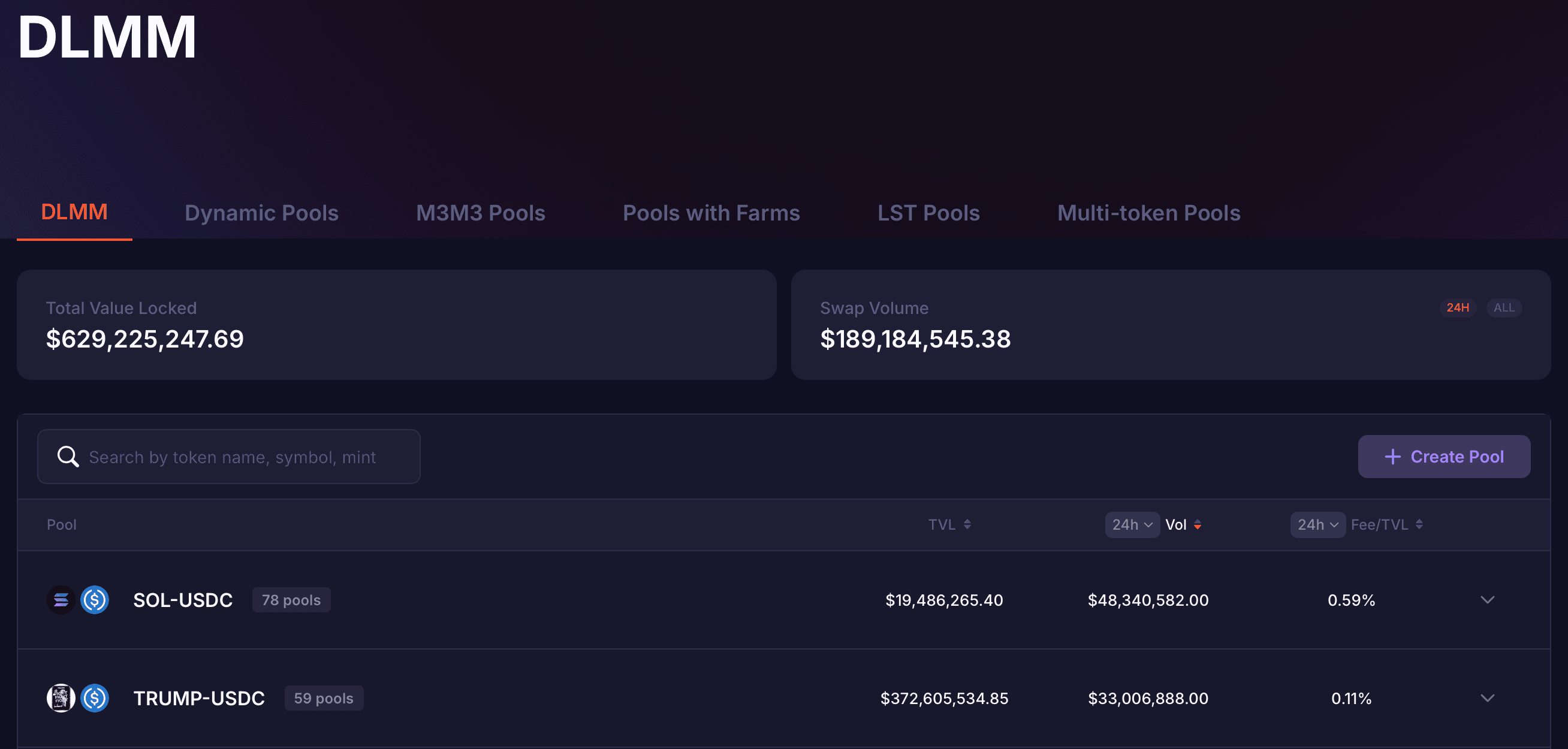

Meteora DLMM. Image via Meteora

Meteora DLMM. Image via MeteoraNow, if you’ve used platforms like Uniswap V3 or Trader Joe’s Liquidity Book, the idea of concentrated liquidity may already be familiar. But Meteora’s DLMM implementation has a few unique twists, so let’s break it down.

How DLMM Works:

Instead of spreading your liquidity across the entire possible price spectrum — from zero to infinity — DLMM allows you to concentrate your liquidity within a specific price range by allocating funds into price bins.

Think of bins as mini price zones. Each bin corresponds to a narrow price point where trades can occur. For example, in a SOL/USDC pool, one bin might cover the price range from $25.00 to $25.10, the next from $25.10 to $25.20, and so on. When you add liquidity, you’re essentially choosing which bins (price zones) your funds will sit in, allowing you to focus your capital where trades are most likely to happen.

What’s unique about this system is that within each bin, trades can happen without slippage — meaning that the price doesn’t move until all the liquidity in that bin is used up. Once that happens, the pool moves to the next bin, adjusting the price accordingly. This system allows for high trading efficiency and low slippage for traders, which translates into more fees for LPs.

Volatility Strategies

When you add liquidity to a DLMM pool, you can also choose how to distribute your funds across your selected price range, depending on your strategy and risk tolerance. Meteora offers three volatility strategies to make this easier:

- Spot: This is a uniform distribution where your liquidity is spread evenly across your selected bins. It’s versatile and balanced, suitable for most market conditions.

- Curve: This strategy concentrates most of your liquidity near the current price, with less allocated to the edges. It’s ideal for stable pairs or tokens that trade within a tight range.

- Bid-Ask: Here, your liquidity is weighted toward the outer edges of your price range, rather than the center. This is useful in volatile markets or when you want to DCA (dollar-cost average) in or out of a position. It’s a more advanced strategy and may require active management.

Dynamic Fees: Capitalizing on Volatility

Another feature of DLMM is Dynamic Fees. Rather than using a fixed fee per swap, DLMM pools can adjust fees in real-time based on market volatility. When volatility increases, so do the fees — meaning LPs can capture more value during periods of heavy trading activity. This helps to offset the potential impermanent loss and aligns LP rewards with market conditions.

How to Use DLMM Pools

1. Adding Liquidity

To get started, you first select your token pair — for example, SOL/USDC. You then choose a bin step, which determines the distance between price bins:

- Small bin step: Finer price intervals, ideal for stable pairs where prices don’t fluctuate much.

- Large bin step: Wider price intervals, better suited for volatile pairs with larger price swings.

Next, you define your price range by selecting where you want your liquidity to sit on the liquidity chart — this is where the bins become visible. You then choose your volatility strategy (Spot, Curve, or Bid-Ask), and confirm your deposit.

2. Managing Active and Inactive Positions

Once your liquidity is added, it’s important to understand that only bins that are “active” earn fees. A bin is active when the current price falls within its range. If the market price moves outside your selected range, your position becomes inactive, and you stop earning fees.

At that point, you have two choices:

- Wait for the price to move back within your range (if you believe it will), or

- Withdraw and redeploy your liquidity into a new range.

DLMM pools therefore require more active management compared to Dynamic AMM Pools, but they also offer higher earning potential if managed effectively.

3. Claiming Fees and Farming Rewards

Unlike Dynamic AMM Pools, fees in DLMM pools do not auto-compound — they must be claimed manually. Additionally, farming rewards (when available) are only earned on liquidity that’s active or that was crossed during swaps.

Rewards are distributed at a fixed rate per second and are proportional to your share of liquidity in the relevant bins. Again, if your position is inactive, you won’t earn rewards — only liquidity in play earns yield.

Dynamic Vaults

In addition to its liquidity pools, Meteora offers a yield optimization layer through its Dynamic Vaults — a system designed to maximize returns on idle capital while ensuring accessibility and risk management. These vaults act as automated yield aggregators, distributing assets like SOL, USDC, and USDT across leading Solana-based lending protocols, including Kamino, Marginfi, and Solend.

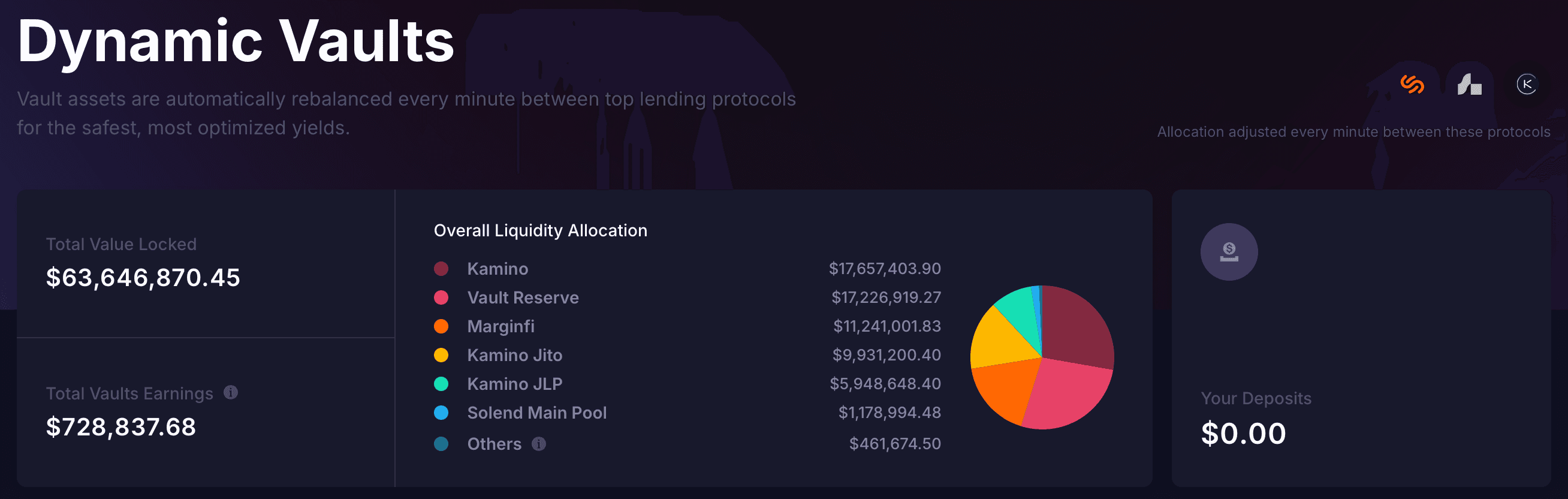

Meteora Dynamic Vaults. Image via Meteora

Meteora Dynamic Vaults. Image via MeteoraWhat makes Meteora’s vaults particularly noteworthy is their dual functionality. You can access them indirectly by providing liquidity to Meteora’s Dynamic AMM Pools, where idle capital is automatically lent out. But importantly, you can also interact with Dynamic Vaults directly — depositing your assets into the vaults themselves to earn lending yield without participating in liquidity provision.

Hermes: The Engine Behind Optimization

Behind the scenes, vaults are managed by Hermes, Meteora’s off-chain keeper program. Hermes is responsible for:

- Continuously monitoring lending protocols to identify the most optimal yield opportunities.

- Reallocating funds dynamically to capture the best APY, while keeping sufficient capital in reserve for withdrawals.

- Managing risk thresholds, including withdrawal of funds if a lending platform exceeds 80% utilization.

Hermes operates in real time, adjusting vault allocations every few minutes. This ensures that assets are not only generating yield efficiently, but are also readily accessible should users decide to withdraw.

How to Use Dynamic Vaults

There are two ways to utilize Dynamic Vaults:

1. Via Dynamic AMM Pools

When you provide liquidity to Dynamic AMM Pools, a portion of your deposit is automatically routed to Dynamic Vaults. This generates additional yield, which is compounded back into the pool, increasing the overall value of your LP tokens.

2. Direct Deposit into Vaults

Alternatively, you can deposit directly into Dynamic Vaults, allowing you to earn pure lending yield without exposure to swap activity or impermanent loss. This approach is ideal for those looking to passively earn interest on assets like USDC, SOL, or USDT, while still benefiting from the vaults’ automated optimization and risk management.

Deposits and withdrawals can be made at any time, with no lock-up periods.

Specialized Pool Types

While Meteora’s Dynamic AMM and DLMM Pools serve the majority of liquidity providers, the protocol also offers a set of specialized pool types, each tailored to meet specific needs within the DeFi ecosystem. These include Memecoin Pools, Launch Pools with Alpha Vault integration, and Multi-Token and LST Pools.

Let’s explore each one in more detail.

Memecoin Pools

In the memecoin space, where trust and transparency are paramount, Meteora’s Memecoin Pools offer a practical solution: the ability to permanently lock liquidity while continuing to earn trading fees and lending yield. This gives project teams a way to demonstrate commitment to their community while keeping capital productive.

Memecoin Pools are a subset of Dynamic AMM Pools but come with a dynamic fee structure, which ranges from 0.15% to 15%, adjusted by the Meteora team based on market conditions. This allows for fee optimization, ensuring pools remain attractive to both traders and LPs.

These pools are also integrated with trading platforms like Jupiter ensuring maximum visibility and volume potential. Additionally, they support fee-sharing via referral links, known as Blink, allowing influencers and community members to earn a portion of swap fees when they direct traffic to the pool.

Launch Pools + Alpha Vault

Launching a new token can be a challenge, particularly when it comes to bootstrapping liquidity and protecting against bot-driven manipulation. Meteora addresses both issues with its Launch Pools and Alpha Vault integration.

Launch Pools are customizable DLMM Pools, optimized for new token launches. They allow projects to design concentrated liquidity using a price distribution curve, ensuring tokens are tradable on day one across platforms like Jupiter, Phantom, and Birdeye.

To safeguard launches from sniper bots, projects can use Alpha Vault, an anti-bot vault that allows supporters to purchase tokens before public trading, all at a uniform average price. This creates a fairer distribution while also enabling the project to set vesting schedules and lock-up periods to promote long-term holding.

Alpha Vault supports two modes:

- Pro Rata – All deposits are pooled and used proportionally; excess funds are refunded.

- First Come First Serve (FCFS) – Deposits accepted up to a cap; once filled, no additional deposits allowed.

Multi-Token and LST Pools

Beyond standard pairwise liquidity, Meteora also supports Multi-Token Pools, allowing liquidity providers to pool multiple assets in a single pool. This enables diversification, capital efficiency, and simplified liquidity management, particularly for those seeking exposure to several stablecoins or correlated assets.

Additionally, LST (Liquid Staking Token) Pools are tailored for staking derivatives like bSOL, JitoSOL, and others. These pools are designed to track the increasing value of LSTs over time — as they accrue staking rewards — while minimizing risk. Rather than relying on price oracles, LST Pools fetch on-chain data from the staking program itself, reducing oracle dependency and potential exploit vectors.

Both pool types use stable curve AMMs to minimize slippage and require minimal active management from LPs.

Risks to Consider

As with any DeFi platform — especially one involving liquidity provision and yield generation — it’s essential to understand the risks that come with the rewards. While Meteora has gone to great lengths to mitigate these risks through careful design and robust infrastructure, no system is entirely immune. So, let’s walk through the main risks you need to be aware of when using Meteora.

Every DeFi Platform Comes With It’s Own Set of Risks. Image via Shutterstock

Every DeFi Platform Comes With It’s Own Set of Risks. Image via ShutterstockImpermanent Loss

First up is impermanent loss, a term many of you will already be familiar with, but one that’s especially relevant for anyone providing liquidity. In simple terms, impermanent loss occurs when the price of one token in a liquidity pair changes relative to the other, and your LP position ends up being worth less than if you had simply held the tokens separately.

Let’s say you deposit $100 worth of BONK and $100 worth of SOL into a pool. If BONK’s price doubles while SOL remains the same, you may end up with more SOL and less BONK, as the pool balances shift. If you were to withdraw at that point, the total value of your position might be, say, $190 instead of the $200 it would have been if you'd held. That $10 difference is your impermanent loss. The more volatile the price movements between the tokens, the larger this loss can become.

However, it’s worth noting that fees earned from swaps and lending yield can offset this loss — and in some cases, result in a net gain. Meteora allows you to track this by comparing the value of your position at withdrawal to your initial deposit, and for DLMM positions, there are tools available to help you estimate your IL based on price changes.

Smart Contract Risk

Next, we have smart contract risk, which is, unfortunately, an ever-present factor in DeFi. This refers to the possibility of bugs or vulnerabilities in the protocol’s code — something that, if exploited, could result in the loss of funds. Meteora has undergone several external audits, including for its more complex DLMM pools, but as always, audits can only reduce risk — not eliminate it entirely.

It’s also worth highlighting that Meteora’s contracts are designed so that users remain in control of their funds. The protocol cannot arbitrarily move user funds, and interaction with the platform is always user-initiated. Even so, caution is always advised — particularly when interacting with smart contracts.

Lending Risk

When you deposit assets into Meteora’s Dynamic AMM Pools, a portion of that capital is lent out to external lending platforms via Meteora’s Dynamic Vaults. This generates extra yield, but it also introduces lending risk — specifically, the risk that your funds may not be immediately available for withdrawal if those platforms experience high usage or liquidity issues.

To manage this, Meteora’s off-chain optimizer — named Hermes — keeps a close watch on lending platforms, monitoring utilization rates in real time. If usage spikes and utilization crosses 80%, Hermes withdraws funds back to the vault, ensuring there’s enough liquidity available for users to access their capital. Additionally, capital is diversified across multiple platforms and there are caps on how much can be lent to any single protocol, which adds another layer of protection.

Stablecoin Depeg Risk

Another risk — often overlooked — is stablecoin depeg risk. Meteora supports pools with assets like USDC and USDT, which are designed to hold a 1:1 peg with the US dollar. However, in rare but real black swan events, stablecoins can deviate from this peg. For example, if you’ve deposited 100 USDC and 100 USDT into a stable pool, and USDC drops to $0.90, your total position now holds less value — around $190 instead of $200.

In such cases, there’s little that can be done, although it’s worth mentioning that Meteora’s stable pools use an AMP factor to manage slippage and encourage balance. That said, the risk of depegging cannot be engineered away, so it’s one to keep in mind, especially when providing liquidity in stablecoin pairs.

Operational Risk

Finally, there’s operational risk, which refers to the potential issues arising from changes in partner protocols or infrastructure. Meteora integrates with external platforms for lending and yield generation, and if those platforms make updates or encounter issues — say a bug in their smart contract — this could disrupt services on Meteora as well.

To mitigate this, Meteora employs a maximum allocation matrix. Lending platforms are evaluated on criteria such as audits, open-source code, insurance coverage, and usage history. If a protocol falls short on any of these fronts, the amount Meteora allocates to it is reduced accordingly. And importantly, Hermes cannot withdraw funds to external wallets — meaning even in the event of an exploit, your principal remains either in the vault or with the lending protocol.

Conclusion

Meteora presents a focused and adaptable approach to liquidity provision on Solana, offering a suite of tools that cater to both passive and active liquidity providers. Rather than positioning itself as a one-stop-shop DeFi platform, Meteora concentrates on doing one thing well — providing capital-efficient, sustainable liquidity infrastructure that benefits both traders and LPs.

Its Dynamic AMM Pools offer a familiar entry point, enhanced by lending yield integration via Dynamic Vaults, while the DLMM Pools introduce more control and efficiency through concentrated liquidity and real-time fee adjustment. For LPs seeking greater yield or more precise strategies, these tools offer flexibility without unnecessary complexity.

Beyond standard pools, Meteora’s specialized offerings — including Memecoin Pools, Launch Pools with Alpha Vault, and LST integrations — extend its reach to support emerging projects and evolving DeFi use cases.

Of course, no protocol is without risk. Impermanent loss, smart contract vulnerabilities, lending exposure, and operational risks are all present, though Meteora does provide systems — such as Hermes monitoring and allocation caps — to manage them proactively. Users should still evaluate their own risk tolerance and stay informed when engaging with these systems.

In summary, for those looking to deploy capital efficiently, whether through yield farming, liquidity provisioning, or direct lending, Meteora offers a structured, well-integrated platform with an emphasis on sustainability over speculation. Its trajectory suggests a protocol built for long-term participation — one that could quietly underpin much of Solana’s trading activity moving forward.