For cryptocurrency exchanges, the emphasis doesn't always have to be on being the largest. The true measure of success lies in becoming the most trusted and responsive platform in the market, prioritizing reliability and user experience over sheer size. A platform's primary goal need not be an extensive range of features or the complexity of trading options. Instead, it can focus on excelling in its core functions.

Whether it's providing a hassle-free onboarding process, ensuring transparent transactions, or offering responsive customer support, a platform can carve out its niche by doing the fundamentals exceptionally well. This approach emphasizes that success in the cryptocurrency space is not solely about scale but about meeting user needs efficiently and reliably.

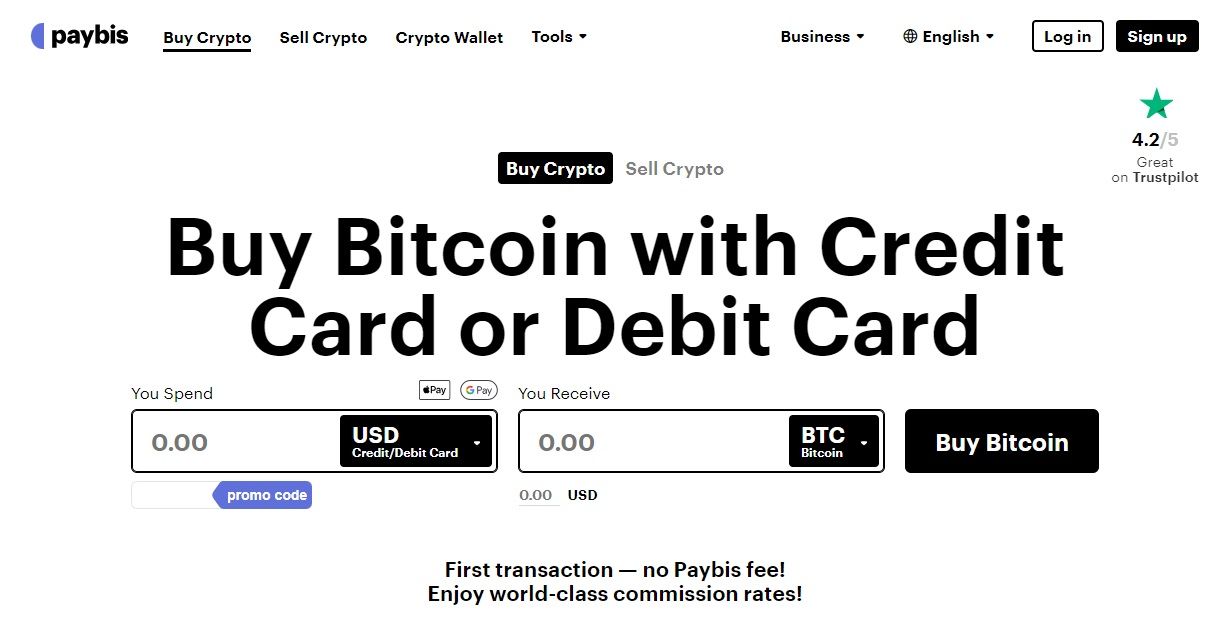

While most crypto exchanges aim to be the largest, offering a myriad of complex products, and showcasing elaborate charts, Paybis takes a refreshing approach. Even as others are engrossed in the quest for grandeur, Paybis focuses on delivering a streamlined and accessible experience for everyone.

This Paybis review will cover its features, customer support and compliance with regulation and KYC standards.

Paybis Review Summary:

Paybis lacks the bells and whistles generally associated with crypto trading platforms — it's not aiming to be the largest, or offer a myriad of complex products or showcase elaborate charts. It offers a simple and intuitive platform to buy and sell crypto.

The Key Features of Paybis Are:

- A wide range of cryptocurrencies

- Convenient cash out

- Diverse payment methods

- Custodial wallet

- Referral program

An Overview of Paybis

| Headquarters | Warsaw, Poland |

|---|---|

| Year Founded | 2014 |

| Supported Crypto | 80 |

| Supported Fiat | 48 |

| Trading Pairs | N/A |

| Native Token | None |

| Total Volume Processed | Over $2 Billion |

| Wallet | Yes |

| KYC | Yes |

What is Paybis?

Paybis, headquartered in Poland, operates as a cryptocurrency buying and selling platform, offering users the advantage of instant payouts through debit or credit cards. The platform provides round-the-clock customer support, and its worldwide reach spans over 180 countries.

You Can Buy and Sell, But Not Trade, Crypto via Paybis. Image via Paybis

You Can Buy and Sell, But Not Trade, Crypto via Paybis. Image via PaybisFacilitating quick and secure transactions, Paybis emphasizes low commissions. Remaining compliant with relevant regulations is also a focus at Paybis and it holds registration with the Financial Crimes Enforcement Network (FinCEN) in the United States.

To maintain security standards, Paybis implements a Know Your Customer (KYC) process, accepting a wide array of identity documents from over 220 countries and territories. The verification process typically takes around 15 minutes. Paybis has been in operation since 2016, with a track record of serving thousands of satisfied users and processing over $2 billion in volume.

With support for over 150 fiat and cryptocurrencies, Paybis caters to diverse user preferences. It's important to note that Paybis does not support cryptocurrency trading. Instead, it focuses on facilitating the buying and selling of cryptocurrencies through various payment methods. If you're looking for the best crypto exchanges, check out our top picks. If you're a DeFi enthusiast, we also have an article on the best decentralized exchanges.

Due to regulatory considerations, the platform does not provide services to residents of New York, Hawaii, and Louisiana. In addition, the platform does not accept fiat-to-crypto orders for certain cryptocurrencies for customers from Alaska, Nevada, New Mexico, North Dakota, Puerto Rico, Vermont, and Washington. For Texas, Paybis does not accept orders that involve stablecoins.

Who Founded Paybis?

Innokenty Isers and Konstantin Vasilenko co-founded Paybis.

Isers, a lifetime entrepreneur with 20 years of experience, is Paybis' CEO. While studying at the University of Latvia, he founded Atoris Designs. Then, in January 2008, Isers founded Protraffic, an online advertising company that introduced “several game-changing techniques” in the industry. In 2014, he founded Paybis.

Vasilenko is Paybis' chief information officer. His resume includes working for professional services company Accenture for over 10 years. He has also co-founded the Latvian Blockchain Association, which aims to inform the masses about blockchain tech.

Getting Started with Paybis

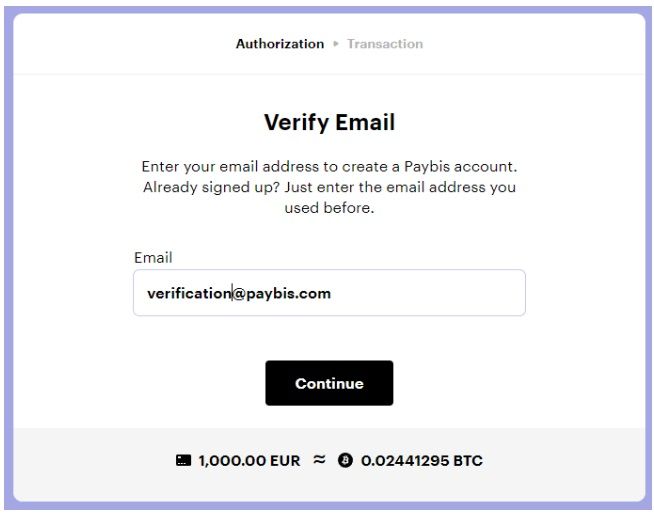

To use Paybis, you should have a working email address and an active mobile phone number. The email address is designated as the username for identification purposes and to assist users with any enquiries they may have.

STEP 1: Click on “Signup” on the top-right of the main page. Then, enter your email address.

STEP 2: You will now have to verify your email. This entails entering a six-digit code sent to your email address.

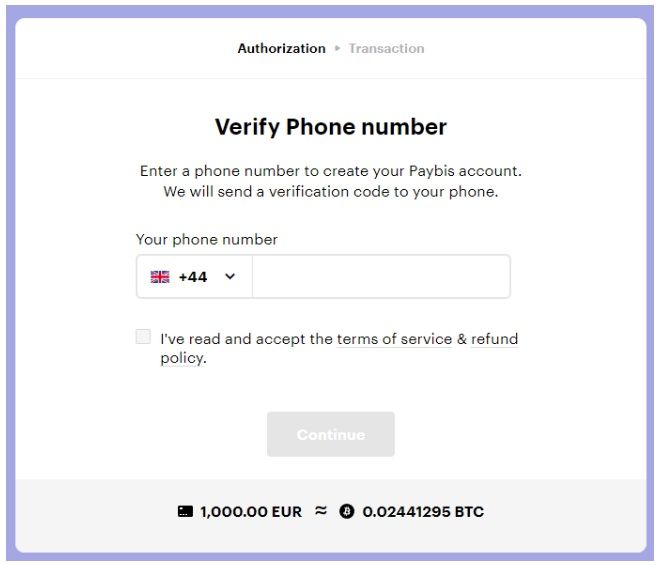

STEP 3: Now comes phone number verification. It works just like email verification, except that the code is sent to your phone number as a text.

Paybis Verification

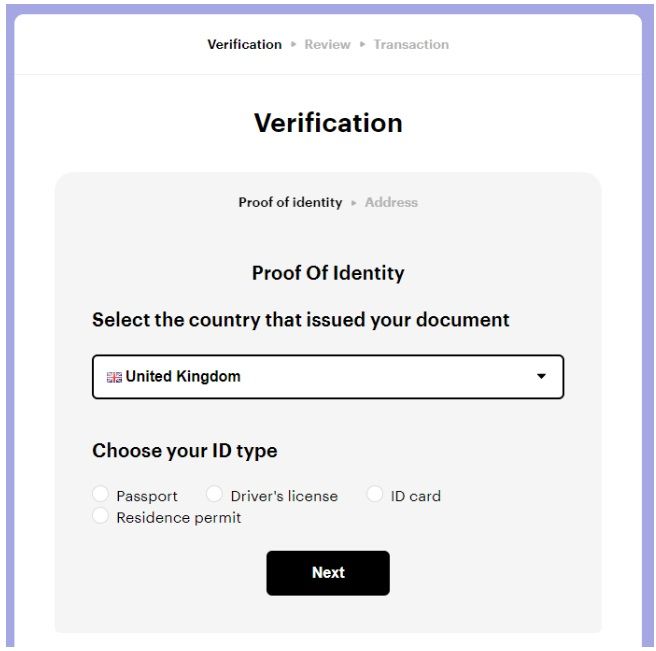

Once you place an order on Paybis, you'll have to undergo identity verification.

To initiate the verification process, it's recommended that you take a high-quality photo of the selected document and upload it. The picture shouldn't be a screenshot and it shouldn't be edited in any way. Paybis says you should make sure that all four corners of the document are visible, and the text is legible. Higher photo quality increases the chances of receiving automatic approval within 5 minutes.

Then, proceed to complete the liveness check by facing your camera, ensuring your face remains within the frame, and slowly moving your head in different directions for a 3D scan. Finally, you'll have to provide your address details, including country, city, state (if applicable), address line, and postcode.

Once you've provided all the required information and uploaded documents, you can only wait for the verification to be approved automatically. Paybis says the system check typically takes five minutes but can take longer in some cases.

If you're put off by KYC, check out the best non-custodial exchanges that do not ask for verification.

Paybis Review: Features

Paybis is packed with features, so let's dive in!

Wide Range of Cryptocurrencies

Paybis says it supports over 150 fiat and cryptocurrencies. Unfortunately, it doesn't give a breakdown between the two (or I just couldn't find it). As a result, I had to indulge in some manual counting. The result? 48 fiat currencies and 80 coins and tokens.

In addition to major coins like Bitcoin, Ethereum, Solana and Cardano, Paybis also lets you buy:

- Chainlink

- Uniswap

- Aave

- SingularityNET

- dydx

- Nexo, and many more

As for fiat, there are the usual big guns like the US Dollar, British Pound and the Euro, the platform also supports currencies like the Danish Krone and Bangladeshi Taka, among many others.

Diverse Payment Methods

You can choose from various payment methods to purchase crypto via Paybis. In addition to the usual credit/debit cards and bank transfers, the platform also supports Skrill, Neteller, Giropay, Astropay, PIX, Khipu, WebPay, PSE and SPEI, depending on which country you live in. Here's what limits look like for some of these:

| Payment method | Min Amount/Transaction | Max Amount/Transaction | Other Maximum Limits |

|---|---|---|---|

| Credit/Debit card | $4 | $20,000 | Unlimited |

| Skrill/Neteller | $20 | $200,000 | $200,000 Daily |

| Bank transfer | $200,000 | $1 Million | $1 Million Monthly |

It's important to note that some banks or card issuers may charge a cash advance fee of up to 5% for purchasing cryptocurrencies using your credit card.

There are a few banks that do not accept payments to Paybis.

United States

- First Abu Dhabi Bank

- Bay First Bank

- Chase Bank USA, N.A

- Green Dot

- Capital One Bank

- Goldman Sachs

- First Bank Trust

Canada

- Citizens Bank of Canada

- Royal Bank of Canada

- Capital One Bank

- Tangerine Bank

- Bank of Montreal

UK

- TSB Bank

- Revolut

- Capital One (Europe) PLC

- Prepay Technologies Ltd

Convenient Cash-Out

While you can buy 80 cryptocurrencies through Paybis, you can only sell the following coins:

- Bitcoin (BTC)

- Ethereum (ETH)

- USD Coin (USDC)

- Tether (USDT-ERC20 and TRC20)

- Cardano (ADA)

- Dogecoin (DOGE)

- Solana (SOL)

- Polygon (MATIC-POLYGON)

- Litecoin (LTC)

Cashing out via Paybis is a simple affair. Users have to select the appropriate cryptocurrency, followed by choosing the preferred withdrawal method. Then, you'll be prompted to input the desired amount and click "Sell." Subsequently, users need to enter their Neteller/Skrill/bank account details and proceed by clicking "Continue."

It is important to note that payouts can only be directed to your personal Neteller, Skrill or bank accounts. For bank transfer payouts, transactions are typically processed on bank business days, and only SEPA (EUR) is allowed for outgoing bank transfers. It's important to highlight that payouts to Revolut accounts are not facilitated, as they often return transfers from crypto merchants.

Paybis Wallet

Paybis also offers a custodial wallet. It offers convenience by eliminating the need for users to manage private keys. However, this convenience is accompanied by potential risks. If you'd like to know more, we touch on the topic in our crypto safety guide.

Here are a few features of the Paybis wallet.

- Accessible Crypto Management: The wallet ensures access to your crypto assets, enabling on-the-go management. Unlike traditional digital wallets, you can access your wallet and its assets easily through your email, eliminating the need for constant retrieval of a lengthy private key or seed phrase. Security is maintained by simply logging out of your Paybis account when not in use, preventing unauthorized access from the device.

- Unified Asset Management: You can manage multiple cryptocurrencies within a single Paybis wallet. This eliminates the need for separate wallets or accounts for each cryptocurrency.

- Quick Buy: The wallet has a quick buy option, allowing users to swiftly top up their crypto assets with a click of the "Buy" button. This streamlines the process of purchasing additional cryptocurrencies directly within the wallet, guiding users through the necessary steps.

- Real-Time Price Tracking: The wallet provides a comprehensive view of cryptocurrency prices in US dollars.

- On-Chain Transparency: The Paybis wallet enhances transparency by storing funds on a dedicated address, ensuring separation from other users' funds. Users can independently verify and track their holdings on any blockchain explorer.

- Web and Mobile Accessibility: The wallet caters to user preferences by being available on both web platforms and mobile apps (Android and iOS).

Speaking of wallets, check out our picks for the best hardware wallets, desktop wallets and mobile wallets.

Crypto Affiliate Program

With the Paybis affiliate program, you can earn 20% of the platform's commission on all purchases made by your referrals.

For those new to crypto affiliate offers, real-time support from the company's affiliate program's account managers is available to address any setup-related questions.

There are a few things to keep in mind, however:

- Each user can register only one affiliate account on Paybis.com

- Payouts are made based on specified conditions explained in the following sections

Paybis' referral program is unique in that the person you introduce to the platform becomes your permanent referral. This means that for every future transaction your referral makes, you receive a 20% payout permanently.

The program also rewards tiered referrals. If you invite a webmaster to join, you receive 5% from their referrals.

Here's some of the fine print:

- Payouts are made monthly once a minimum threshold of $50 is met

- All partners receive payments via SEPA bank transfer or Bitcoin

Paybis Security Measures

Paybis doesn't talk much on its website about the safeguards in place to protect user funds. It does, however, have a bug bounty program in place.

With regard to wallet security, the platform employs the MPC (Multi-Party Computation) model. This cryptographic technique fragments and distributes the private key among multiple computation parties, adding an extra layer of security. This means that even if one party is compromised, the fragmented key prevents unauthorized access to funds.

It's also important to note that Paybis hasn't experienced a known successful security exploit.

Customer Support

Paybis provides round-the-clock customer support, ensuring prompt responses to any issues users may encounter. The support team is accessible through live chat and email but not over the phone. Users can reach out to support via the live chat feature or explore the FAQ section in the Support Portal on the official Paybis page, addressing commonly asked questions.

Moreover, Paybis demonstrates a commitment to user accessibility by offering customer support in over nine languages, including English, French, Arabic, Italian, Korean, Spanish, German, and Russian. This multilingual support enhances the platform's global reach, catering to a diverse user base and facilitating effective communication for users around the world.

Paybis Fees

Paybis is very transparent about its fees. It makes money from fees linked to successful transactions, categorized into two main types: the service fee and the network fee.

Service Fee

This is Paybis' commission for facilitating transactions, covering various operational costs associated with providing services. This encompasses payment processing fees, infrastructure expenses, and technological investments essential for maintaining service quality.

The service fee is subject to variation based on a number of factors:

- Payment Method: Different payment methods incur varying costs. For instance, processing bank transfer payments is generally more cost-effective than alternative methods.

- Transaction Amount: Paybis typically imposes a minimum service fee of $2 to offset overheads. Consequently, for smaller transactions, the $2 minimum may represent a higher percentage compared to larger orders.

- Currency: The service fee may fluctuate depending on the currency used in the transaction, primarily due to foreign exchange fees. Common currencies such as USD, EUR and GBP usually incur lower fees than others.

Network Fee

This fee is essential for confirming transactions on the blockchain. The network fee is contingent on the market demand for the chosen cryptocurrency and is applicable per transaction, irrespective of the transaction amount.

It is important to note that the network fee applies universally to all payment methods. This fee structure reflects the dynamic nature of blockchain transactions and ensures that the costs associated with network confirmation are transparently conveyed to users, regardless of the specific payment method used.

If you'd like to know more, check out our crypto network fees guide.

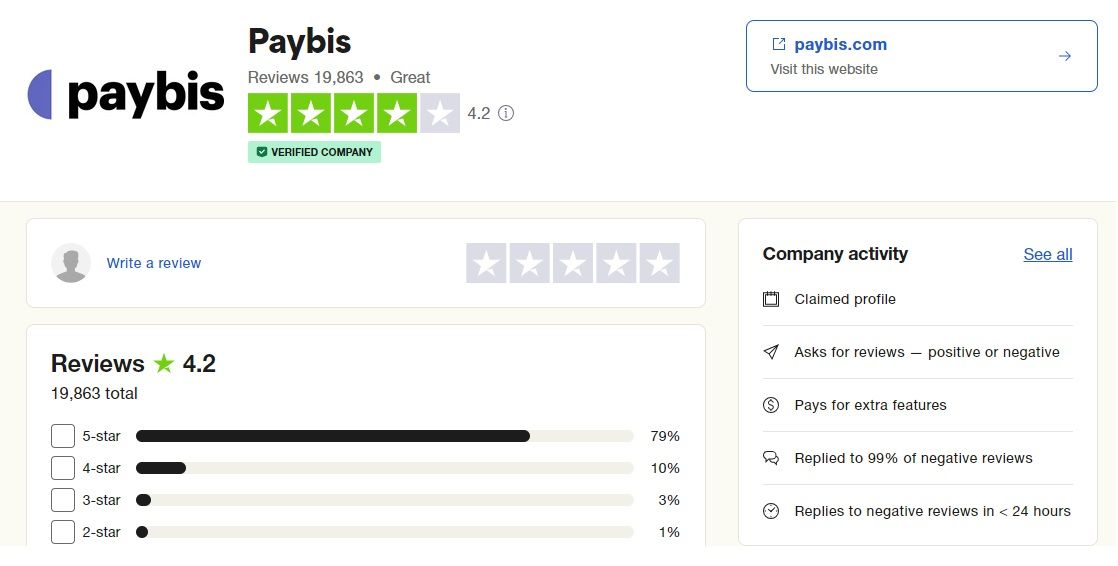

User Reviews and Ratings

On Trustpilot, Paybis is rated “good” with about 20,000 reviews.

The overwhelming majority (79%) rated the platform 5 stars with users calling it a great platform to buy and sell crypto. Users particularly lauded the easy set-up process and customer service. Those in the opposing camp were mostly people whose accounts were suspended soon after signing up. In response, Paybis said the decision is made by its security and is irreversible. In any case, it goes to show how Paybis takes compliance seriously and that it would even turn away customers.

Over at Android's Google Play store, Paybis has a 4-star rating with user sentiment around the same themes as Trustpilot.

Regulatory Compliance

Paybis is fully compliant with relevant regulations.

Paybis is Registered With US FinCEN and Canada's FINTRAC. Image via Paybis

Paybis is Registered With US FinCEN and Canada's FINTRAC. Image via Paybis It is registered with the Financial Crimes Enforcement Network of the US (registration No. 31000224635628) and has permission to operate in 48 states, including those that require a license.

In addition, the platform is also registered with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) (registration No. M22061209).

On top of this, Paybis also has KYC procedures in place. It accepts over 6,500 documents from over 220 countries and territories.

For all countries:

- Identity card

- Driving License

- Passport

- Residence permit

Specific regions:

- PAN card

- Voter card

- Health ID card

- Military ID card

Is Paybis Legit?

Yes, Paybis is a legitimate and reputable cryptocurrency buying and selling platform. Here are factors that contribute to its legitimacy:

- Regulatory Compliance: Paybis is registered with regulatory authorities, including the Financial Crimes Enforcement Network (FinCEN) in the United States and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). This ensures that the platform adheres to legal and regulatory standards.

- Operational History: With several years of operation in the cryptocurrency space, Paybis has established a track record of providing services to users worldwide. The platform has processed over $2 billion in transaction volume.

- User Reviews: While no platform is without occasional user concerns, Paybis generally has positive reviews from users. Online reviews and ratings on platforms like Trustpilot indicate that many users have had satisfactory experiences with Paybis, praising its ease of use and customer support.

- Customer Support: Paybis provides 24/7 customer support to address any issues or concerns users may have. The availability of live chat support from Monday to Sunday ensures quick responses, contributing to a positive user experience.

- Transparent Fee Structure: Paybis maintains transparency in its fee structure, clearly outlining the service fees and network fees associated with transactions. Users can review these fees before engaging in any transactions, contributing to a transparent and trustworthy trading environment.

Is Paybis Safe?

Yes, Paybis is a safe platform, and the platform has implemented various security measures to safeguard user funds.

- Security Measures: Paybis employs security measures to protect user funds and personal information. The platform utilizes the Multi-Party Computation (MPC) model for wallet security, which involves fragmenting and distributing the private key among multiple computation parties, enhancing the overall security of the wallet.

- Know Your Customer (KYC) Procedures: Paybis follows KYC procedures, requiring users to verify their identity. This involves submitting necessary documents for verification, and is designed to combat money laundering.

Paybis Review: Closing Thoughts

Paybis is a legitimate and reputable crypto buying-and-selling platform that prioritizes regulatory compliance, operational transparency and user satisfaction.

Its commitment to adhering to regulatory standards is evident through its registrations with FinCEN in the US and Canada's FINTRAC. This ensures that Paybis operates within the legal framework and upholds industry standards. User reviews on platforms like Trustpilot generally paint a positive picture of Paybis. While no platform is without occasional user concerns, Paybis has garnered a significant number of positive reviews.

In terms of safety, Paybis implements robust security measures, including the Multi-Party Computation (MPC) model for wallet security. The platform's adherence to Know Your Customer (KYC) procedures contributes to user safety by requiring identity verification.

In summary, Paybis positions itself as a safe and reliable option for users seeking a straightforward and user-friendly platform for buying and selling cryptocurrencies. Its emphasis on simplicity, regulatory compliance, and user satisfaction sets it apart in a landscape often characterized by complexity and competition for size.

However, where the platform falls short is in terms of actual crypto trading, so we don't recommend Paybis to anyone looking for a solid crypto exchange. Platforms such as Bybit and OKX are better suited for traders and Kraken is a great choice for anyone who needs to buy and sell crypto for fiat.