Ever wish you could trade crypto like a big shot without that gut-wrenching fear of losing your life savings? You’re not alone.

In a world where one bad Bitcoin dip can wipe out months of hard work, prop trading has become the secret weapon for smart, ambitious traders. Instead of risking their own cash, traders partner up with firms that provide the capital. Your job? Trade smart, make profits, and split the winnings. No second mortgages required.

That’s where PropW comes into play – they’re a fresh face in the crypto scene, offering a new twist: trade with simulated accounts tied to real profit payouts. No need to cough up huge deposits or nervously check your balance every 10 minutes.

Whether you’re a seasoned chart stalker or just starting to find your rhythm in the markets, PropW promises a low-risk, high-reward playground for crypto traders who are ready to prove themselves.

What is Prop Trading?

Prop trading, short for proprietary trading, is when a firm (usually a big financial company) uses its own funds to trade stocks, bonds, crypto, or other assets, aiming to make direct profits rather than earning commissions from clients. Now, fast-forward to today’s market: prop trading has evolved to include ordinary traders to become the pilots for their crypto jets.

In the crypto space, prop firms act like talent scouts. They’re on the hunt for skilled traders who can grow an account without blowing it up. They give you a simulated account (or sometimes a real one) and set you on a challenge: hit certain profit targets, don’t break risk rules, and if you succeed, you’ll get access to much larger "funded" accounts. Even better, you get to keep a juicy portion of the profits.

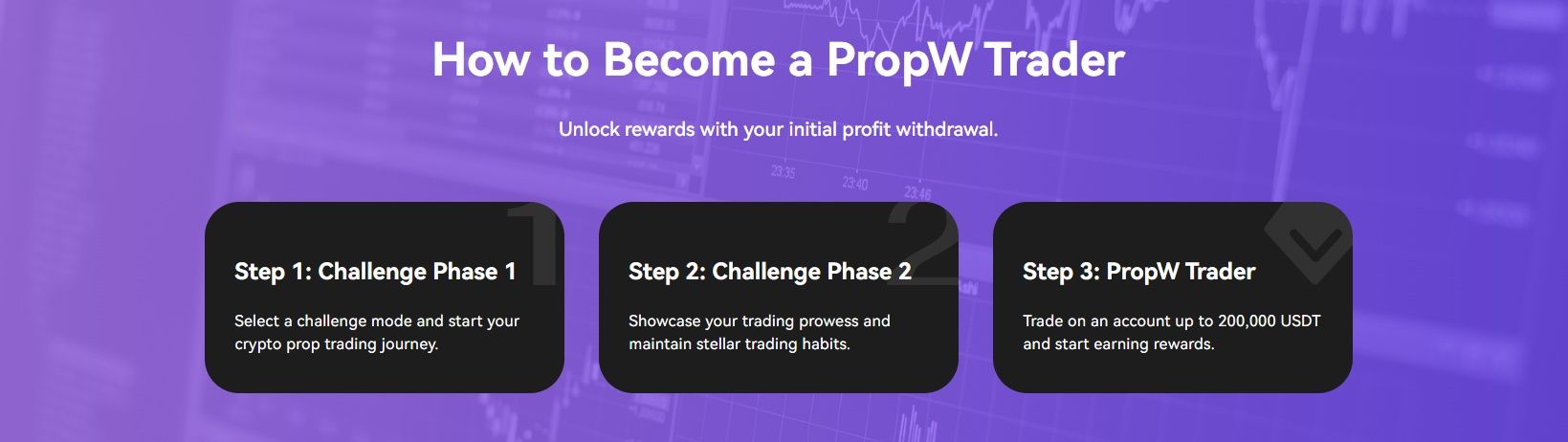

Most prop firms follow a general model:

- Challenge Phase: Prove your trading skills by hitting a profit target without violating risk limits.

- Verification Phase: Confirm that your success wasn’t a fluke by doing it again under similar rules.

- Funded Trader Phase: If you pass, you get a larger account and start earning a real share of the profits.

What is PropW?

Now that we know the basics of prop trading, let’s zoom in on the star of the show — PropW.

PropW is a crypto-focused prop trading platform. Unlike many traditional prop firms that dabble in forex, stocks, or commodities, PropW is laser-focused on cryptocurrencies. Think of them as a specialized talent agency, but instead of hunting for actors or musicians, they're scouting for crypto traders who can handle market swings like pros.

PropW is a Proving Ground for the Next generation of Crypto Traders. Image via PropW

PropW is a Proving Ground for the Next generation of Crypto Traders. Image via PropWThe company runs completely on a simulated trading model, meaning you're not handling real money at the audition stage. You’ll trade using virtual accounts, which replicate real market conditions closely. This removes the financial risk while still allowing PropW to assess whether you know how to ride the crypto waves or if you're more of a shipwreck-in-waiting (no judgment — we’ve all been there).

PropW’s mission is pretty straightforward:

They want to find talented traders who can trade smartly and sustainably. If you pass their trading challenge, they’ll back you with a virtual account tied to real profit payouts. So, you get the upside without the downside of risking your own funds.

One thing that sets PropW apart is that they’re not tied to traditional finance — they live and breathe crypto. If Bitcoin pumps at midnight or Ethereum nosedives during breakfast, your PropW account is ready because they run 24/7, just like the crypto markets themselves. No waiting for the NYSE to open!

Key Highlights About PropW

- Virtual Trading Accounts: When you join PropW, you're given access to a simulated trading account, with balances ranging up to $200,000 depending on the challenge you sign up for.

- Profit Sharing: Smash their targets and play within the rules, and you could be eligible for up to an 80% share of the profits you generate.

- Refundable Fees: PropW does charge an audition fee to enter the challenge, but the good news is it’s fully refundable once you make your first successful withdrawal. It’s a nice little incentive to actually stick to the rules and hit those profit targets.

How Does PropW Work?

Okay, so you're probably wondering: how exactly do you go from "random crypto trader" to "PropW certified money maker"? Good question — and honestly, PropW keeps it pretty simple, but not necessarily easy.

PropW Separates the Disciplined Traders from the Gamblers. Image via PropW

PropW Separates the Disciplined Traders from the Gamblers. Image via PropWHere’s the step-by-step breakdown:

First up, you pick a challenge — this is your audition to prove you're not just lucky but actually skilled. You pay a one-time audition fee based on the size of the account you want to trade (more on fees later), and you get handed a simulated trading account. Your job? Hit the profit target without breaking any major rules like blowing up your account or losing too much in one day.

The challenge happens in two phases:

- Phase 1: You have to reach a specific profit target while staying within the daily loss limit and overall drawdown rules.

- Phase 2: If you pass Phase 1, you go through a second phase. Here, the profit target is a bit lower, but risk management rules still apply. PropW wants to see that your win wasn’t a fluke.

Complete both phases successfully, and voilà — you’re a PropW Certified Trader! This means you now trade a larger virtual account and earn a real share of the profits you generate.

And here’s the kicker: there’s no time limit to finish these phases.

You can take a week, a month, or longer. PropW focuses on consistency, not speed, which is honestly pretty refreshing in a crypto world that’s obsessed with instant gratification.

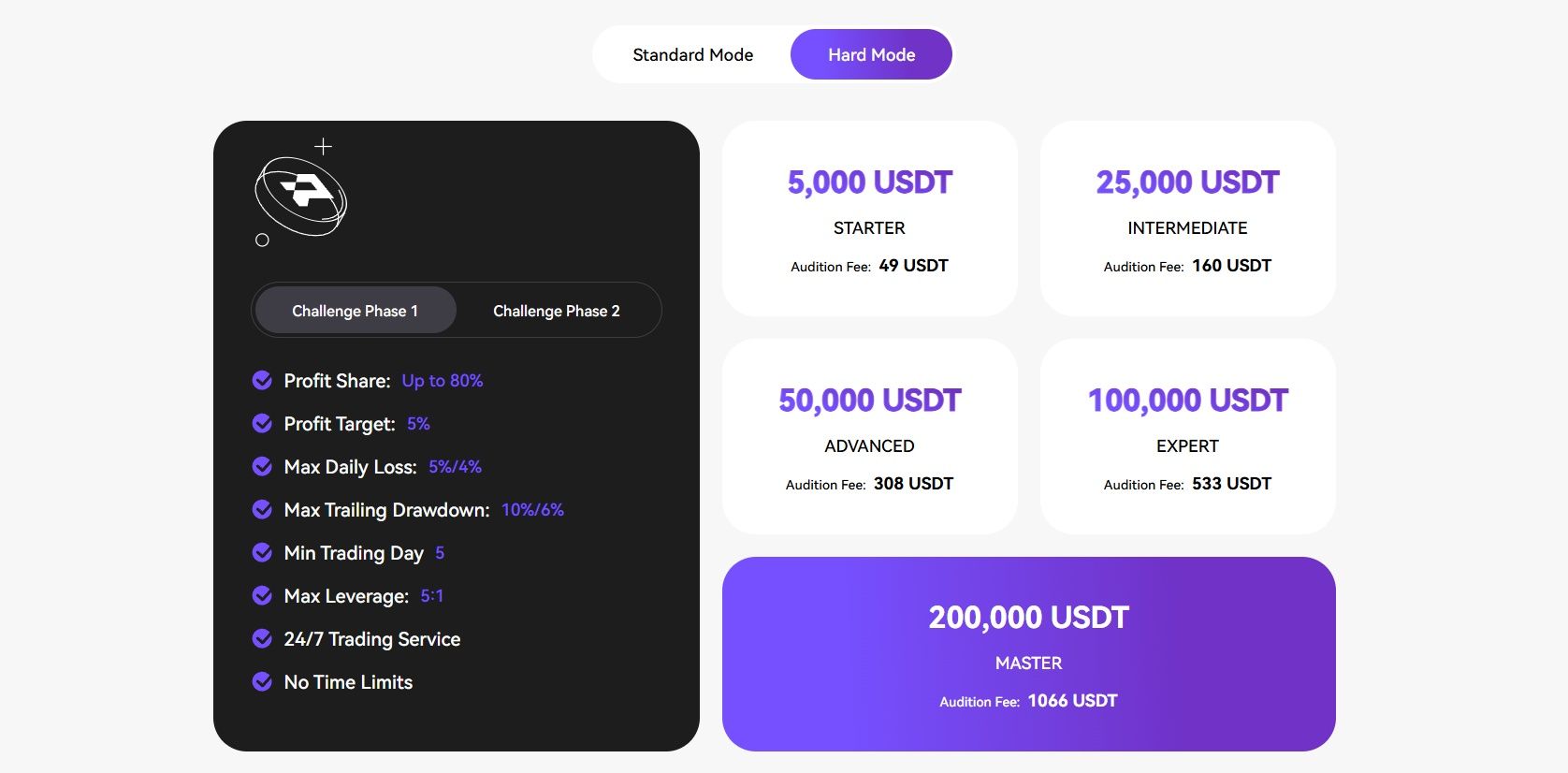

Challenge Modes: Standard vs Hard

When you sign up, you’ll also choose between two flavors of the challenge: Standard Mode and Hard Mode.

- Standard Mode: This is the "regular difficulty" path. You get more relaxed rules around daily losses and overall drawdowns. Profit targets are reasonable, making it the go-to choice for most traders who want a fair shot without insane pressure.

- Hard Mode: As you might guess, Hard Mode is for the thrill-seekers. You’ll have stricter risk limits and probably higher profit targets. But the upside? Better rewards, like even bigger payouts or improved conditions, once you make it through. It’s a bit like playing a video game on “Expert” mode: higher risk, higher bragging rights.

PropW Trading Features and Tools

Once you're inside the PropW ecosystem, you’ll notice pretty quickly — it’s not just about setting you loose and wishing you good luck. They actually give you some solid features and tools to help you trade smarter (or at least avoid rookie mistakes).

Let’s unpack what’s on offer:

Leverage Up to 5x

In the PropW trading environment, you can trade with up to 5x leverage. That means if you have $10,000 in your virtual account, you can control up to $50,000 worth of crypto trades. It's enough to amplify your gains (or your losses) without pushing you into insane, 100x degen territory. Smart move by PropW — 5x keeps things exciting, but still manageable for most traders.

24/7 Crypto Trading

Because PropW focuses entirely on crypto, you’re not limited by traditional market hours. Bitcoin at 2AM? Ethereum over brunch? Dogecoin while pretending to work? Totally fine. The platform runs 24/7, just like the underlying crypto markets. This flexibility is a massive plus for anyone who can't (or doesn’t want to) trade during "normal" business hours.

Assets Available

PropW offers access to a broad set of major crypto assets — think Bitcoin (BTC), Ethereum (ETH), and other top coins.

While it’s not an endless shopping cart of every altcoin under the sun, it covers the big players where liquidity is strong, slippage is low, and trades actually matter. (Again, smart — nobody wants to blow a challenge account on some microcap meme coin.)

Dashboard and Analytics Tools

Now, about the backend — PropW isn’t just tossing you into the deep end. You get access to a trader dashboard where you can monitor:

- Your account details

- Objectives

- Your open positions

- Daily profit/loss stats

- Analytics

- Drawdown tracking…and more.

The dashboard is clean, simple, and actually useful — no clutter or overwhelming bells and whistles. Plus, you can keep an eye on your challenge progress directly, which takes out the guesswork and helps you stay focused.

On top of that, there are performance analytics available, so you can see your strengths and weaknesses over time. This is super helpful, especially if you’re serious about improving your trading game and not just winging it.

Fees and Costs

Let's talk money — specifically, how much it costs to get started with PropW.

PropW’s Model is Refreshingly Straightforward. Image via PropW

PropW’s Model is Refreshingly Straightforward. Image via PropWFirst off, yes, there is an audition fee.

This is pretty standard in the prop trading world, and it basically covers the cost of setting up your simulated account, monitoring your performance, and giving you access to all their tools. The fee you’ll pay depends on the account size you’re aiming for — bigger accounts come with higher fees, naturally.

As per the PropW website, there are two modes:

- Standard Mode: Audition fees start from as low as 28 USDT competing for 2,000 USDT account, and go up to expert level at 399 USDT, competing for 50,000 USDT account. The Master level audition fee is 799 USDT for 100,000 USDT account.

- Hard Mode: Audition fees start from as low as 49 USDT competing for 5,000 USDT account, and go up to expert level at 533 USDT, competing for 100,000 USDT account. The Master level in hard mode has an audition fee of 1066 USDT for a 200,000 USDT account.

The good news? It’s a one-time payment. No monthly subscriptions, no sneaky renewal charges — just a flat upfront cost.

The part traders love:

When you pass the challenge, start trading as a Certified Trader, and make your first withdrawal, PropW refunds your audition fee.

So, technically, if you’re a good trader, you’re getting a free pass to the funding table. It’s like paying for your gym membership upfront but getting it all back if you actually show up and get fit.

Payout System and Profit Sharing

Alright, now for the fun part — getting paid. Once you’ve crossed the finish line, passed the challenges, and become a PropW Certified Trader, you officially start earning money based on your trading performance. And honestly? The payout structure is one of PropW’s strongest selling points.

You Officially Start Earning Real Money based on your Trading Performance. Image via Freepik

You Officially Start Earning Real Money based on your Trading Performance. Image via FreepikHere’s the deal:

As a certified trader, you get to keep up to 80% of the profits you generate. PropW keeps the remaining 20%.

How do payouts work?

It’s pretty straightforward:

- Once you make profits in your funded (simulated) account, you can request a payout.

- Payouts can be processed once in 14 days, and PropW requires 24 – 72 hours to process a withdrawal after a request is initiated.

- Your first payout also triggers something extra sweet: your audition fee refund.

That means if you stick to the rules and trade smartly, you’re not only banking real profits but also getting your original investment back.

As for payout methods, most prop firms — and likely PropW as well — prefer using stablecoins like USDT for fast, smooth payments. (Specific payout options like wire transfers or crypto wallets might vary, and it’s always smart to double-check at the time you're ready to cash out.)

Important reminder: You do need to remain in compliance with all risk management rules even after becoming funded. Breaking them can void your funded account privileges, and that would mean missing out on future payouts.

Advantages of Using PropW

Whether you’re a fresh-faced amateur or a grizzled trading veteran, PropW’s setup has some serious perks that make it worth considering.

PropW is Offering a Well-Designed On-Ramp for Serious Traders. Image via PropW

PropW is Offering a Well-Designed On-Ramp for Serious Traders. Image via PropWNo Real Capital Risk for Users

One of the biggest psychological hurdles in trading is the fear of losing your own hard-earned money. With PropW, that stress is gone. Since you’re trading on a simulated account tied to real profit payouts, your actual bank account stays safe. Even if you completely bomb your challenge (hey, it happens), you’re only out the initial audition fee, not thousands of dollars in real losses.

High Profit Split

Not all prop firms are this generous, but PropW offers an up to 80% profit share for its certified traders. That’s a solid cut and puts a nice chunk of the earnings right into your pocket. It’s a clear incentive structure: the better you trade, the more you make — and there’s no sneaky clawback that reduces your profits over time.

Strong Training Focus

Even though PropW isn’t a traditional “trading academy,” their challenge structure is basically a hands-on masterclass in risk management, discipline, and consistency. You can’t pass without sticking to strict trading rules, which train you to think and act like a professional trader.

Simulated Environment = Safe for Beginners

For newer traders, diving into the crypto markets with real money can feel like swimming with sharks wearing a meat suit. PropW’s simulated environment offers a safety net. You’re still facing real market conditions, but without the added horror of watching your personal savings disappear. It’s a low-pressure way to build experience, learn from mistakes, and develop strategies that can actually survive out in the wild.

Drawbacks and Considerations

To keep things real: no platform is perfect, and PropW isn’t some magical trading utopia. While it offers some great opportunities, there are also a few important things you should definitely keep in mind before diving in.

You have to Treat PropW like a Serious Business rather than a Lottery Ticket. Image via Shutterstock

You have to Treat PropW like a Serious Business rather than a Lottery Ticket. Image via ShutterstockNo Real Money Market Experience

Trading in a simulated environment is awesome for lowering risk, but it does come with a catch: You’re not dealing with real capital, and that can change the way you behave. When there’s no actual money on the line, it’s easy to stay calm during a brutal drawdown or go a little more "YOLO" with risk. Real money trading brings in fear, greed, hesitation — all those spicy emotions that simulation can’t fully replicate.

So, even if you dominate a PropW challenge, transitioning to live markets elsewhere may still feel a little different.

Can Still Be Psychologically Challenging

Don’t let the word "simulation" fool you — the challenges are tough. Risk rules are tight, targets are non-trivial, and one sloppy day can send you back to square one. Managing your emotions, sticking to discipline, and bouncing back from losses are still very real challenges, even if you're not risking your own cash.

Crypto-Only Limitation for Multi-Asset Traders

If you love having a buffet of asset classes — forex, stocks, commodities — PropW might feel a little restrictive. They are purely focused on crypto. No oil futures, no Tesla stock plays, no USD/JPY swing trades.

For die-hard crypto fans, it’s heaven. But if you like spreading your wings across different markets, you’ll find the offering pretty narrow.

Potentially Steep Learning Curve for Complete Novices

PropW isn’t necessarily beginner-exclusive. Sure, the low-risk setup is attractive for newbies, but the challenges aren’t exactly built for hand-holding. If you're brand new to crypto trading and don’t yet understand basic concepts like leverage, drawdown, or position sizing, you might find yourself struggling hard early on. It’s doable, but expect a serious learning curve if you’re starting from zero.

Final Verdict: Is PropW Worth It?

So, is PropW the golden ticket to crypto trading glory? Well, it depends. If you're an ambitious trader who’s itching to level up but not so keen on torching your personal savings along the way, PropW ticks a lot of the right boxes.

Low-risk entry? Check. Solid profit splits? Check. A chance to sharpen your trading skills under real market conditions? Double-check.

Of course, it’s not without its bumps. The simulated environment can’t fully prep you for the raw emotions of real-money trading, and the crypto-only setup might feel a little narrow if you’re used to juggling forex or stocks. But if you’ve got the talent — or at least the hunger to develop it — PropW offers a smart, structured way to prove you belong in the big leagues.

Bottom line: If you’re ready to bet on yourself without betting the house, PropW might just be something to explore.