Metamask, the popular Web 3.0 browser extension wallet used to interact with DeFi protocols, recently surpassed 1 million monthly users. This makes sense given the explosive interest in DeFi, which now has nearly 11 billion US dollars locked up in its various protocols.

This begs the question: how long can this growth be sustained on the Ethereum blockchain which has seen network fees rise to record highs?

Project Serum is not waiting around to find out. While the appetites of hungry yield farmers keep them fixed on sketchy, food themed DeFi protocols, Project Serum is silently building a new, futureproof DeFi space. Their recently launched Serum DEX is the first pillar of this ecosystem. Fully interoperable with Ethereum, Serum may just become the one DEX to rule them all.

A brief history of Serum

Serum’s history begins with Sam Bankman-Fried, an MIT graduate with over 3 years of experience trading ETFs with Jane Street Capital, a famous Wall Street trading firm. Shortly after leaving Jane Street in late 2017, Sam founded Alameda Research, a cryptocurrency trading firm.

Image via Twitter

Image via Twitter In 2019, Sam founded the FTX cryptocurrency derivatives exchange. He has also been active in the DeFi community for some time and is considered by some to be the de facto community leader of the infamous SushiSwap DEX.

The Serum story goes something like this: Sam and other members of the FTX exchange team were brainstorming a DeFi protocol to build. They decided to build a DEX but knew that it could not be built on Ethereum given the network intensive features they wanted it to have. After looking at multiple different blockchains, the team eventually chose Solana (SOL), a blockchain designed with efficiency in mind.

Image via Twitter

Image via Twitter Sam and the team wanted their DEX to be a standalone platform – something new and separate from the FTX exchange. They decided to name their DEX Serum after putting together a huge spreadsheet of name ideas and crossing off those which had been taken by an existing crypto project and/or website domain. The Serum DEX took about three months to develop, with the whitepaper being released in July of this year. The DEX itself was launched at the end of August.

Since the historic collapse of FTX, the Serum community stated that Serum, as it was known, became defunct as the upgrade authority was held by FTX. The community have gone ahead to create a fork of Serum to keep the project alive.

What is Serum?

Serum is a decentralized cryptocurrency exchange built on the Solana blockchain. Serum is one of the first major projects to build on Solana and is interoperable with other cryptocurrencies including Bitcoin and Ethereum.Unlike other DEXes, Serum features order book based trading like centralized cryptocurrency exchanges. It can handle between 50-65 000 transactions per second, which is the current TPS of the underlying Solana Blockchain.

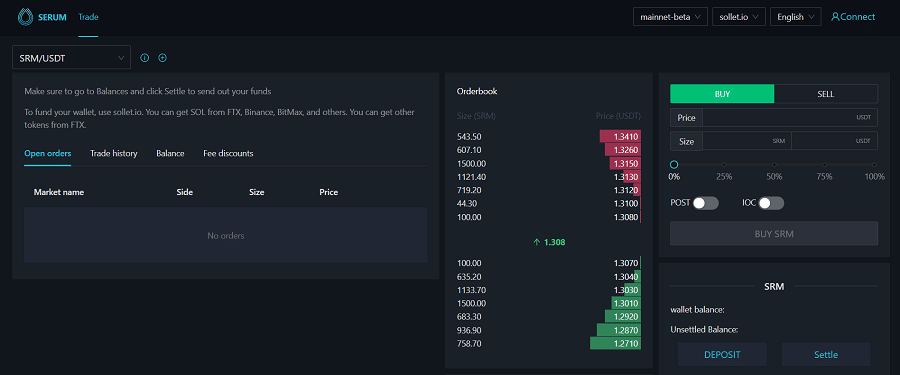

The Serum DEX currently features around 30 different cryptocurrency markets, all which trade against either USDT or USDC. Anyone can create their own DEX on top of the Serum DEX and support additional trading pairs using the instructions outlined on Serum Academy. There are over 18 Serum DEXes so far and the Serum DEX is also available on Android and iOS devices via the Coin98 mobile app.

How does Serum work?

It is important to note that the Serum DEX is still in development and how it works will likely be impacted by its changing role in Project Serum’s future ecosystem. There are three fundamental mechanisms which underly the Serum DEX.

Image via Medium

Image via Medium The first is Solana’s SPL token standard, the second is Serum’s interoperability protocol, and the third is Serum’s SRM cryptocurrency token. The SRM token along with SRM staking and voting will be covered in detail in the next section.

SPL Tokens

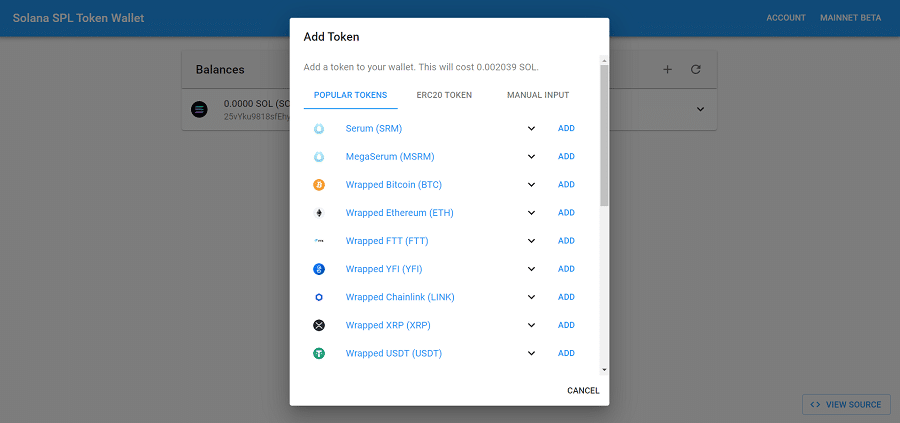

Cryptocurrencies that you see on the Serum DEX like YFI, USDC and USDT are not ERC-20 tokens, but SPL tokens. SPL tokens on Solana are like ERC-20 tokens on Ethereum. Any non-SPL token being used on the Serum DEX is wrapped for use on Solana-based protocols in the same way that Bitcoin is wrapped for use on Ethereum-based protocols.

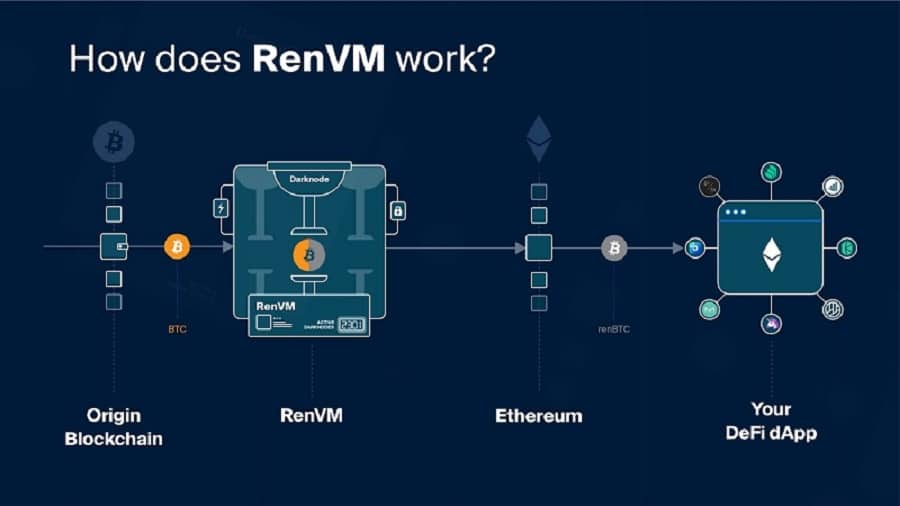

An example of Bitcoin wrapping with Ren’s RenVM.

Wrapping in cryptocurrency can be simply understood as giving your cryptocurrency (e.g. 1 Bitcoin) to a custodian (e.g. Ren protocol) which then mints (creates) an equal amount of tokens on another blockchain (e.g. 1 renBTC, which can be used on Ethereum). In this example, your 1 Bitcoin is ‘backing’ an equivalent amount of renBTC so that you can use it on the Ethereum blockchain as an ERC-20 token.

Cryptocurrencies from other blockchains can be turned into SPL tokens and traded on the Serum DEX by using the Metamask browser extension/wallet. To do so, you will need the Sollet.io wallet which is also used to interact with the Serum DEX. The Sollet.io wallet is not a browser extension, nor does it require you to download any software. It is entirely web-based.

The FTX exchange offered wrapped SPL versions of popular cryptocurrencies such as Bitcoin, Ethereum, and Chainlink. FTX acted as the custodian which held the actual Bitcoin, Ethereum etc. that traders provided to mint wrapped SPL versions which could be used on the Serum DEX. These were deposited to a user's Sollet.io wallet.

Any ERC-20 token can be converted to a wrapped SPL token equivalent using the Metamask wallet. When you do this, your ERC-20 tokens are locked in a trustless smart contract on Ethereum and the Sollet.io wallet will mint wrapped SPL token equivalents for you to use in the Serum DEX.

Serum Interoperability Explained

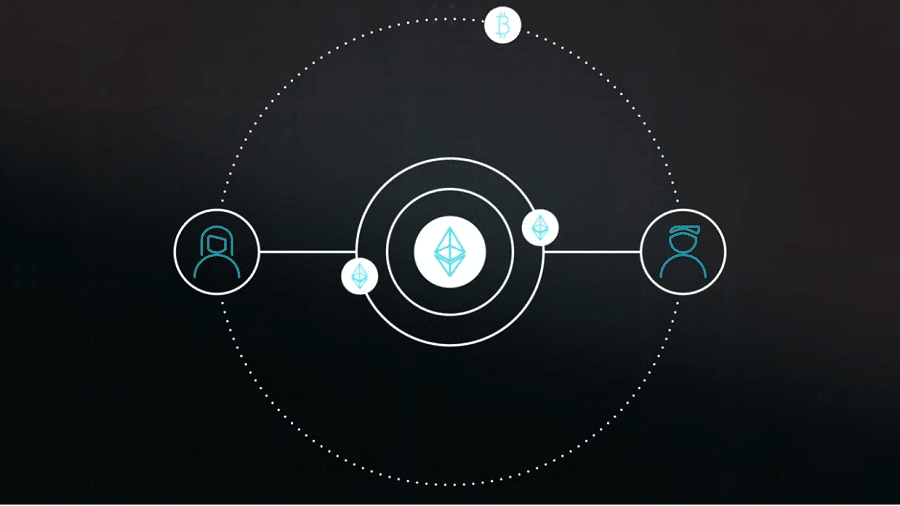

The Serum DEX uses smart contracts with built-in economic incentives to allow users to swap assets across different blockchains in a trustless manner (e.g. Ethereum for Bitcoin). This is done by requiring both parties involved in the swap to put down some amount of collateral to execute a swap.

If the other party involved in the swap does not receive their funds in a timely manner, they are able to dispute the swap with the smart contract by submitting a snapshot of the transaction request which was stored on the Solana blockchain. If the dispute is valid, they earn the stake from the sender. If it is invalid, the sender receives part of the stake from the receiver.

Serum cryptocurrency

SRM is an SPL token on the Solana blockchain and an ERC-20 token on the Ethereum blockchain. It is used in Project Serum’s DeFi ecosystem, most notably for staking on the Serum DEX. Staking SRM is required to run a validator node for the Serum DEX and can be staked to reduce trading fees on the DEX. 1 million SRM tokens can also be converted into one MegaSerum (MSRM) and vice versa.

Image via Asiacryptotoday

Image via Asiacryptotoday MSRM gives additional benefits to holders and is also required to run a validator node. MSRM also exists as an ERC-20 token. Only 1000 MSRM can exist at any given point. Both SRM and MSRM and can be swapped between Ethereum and Solana at a 1-1 ratio. SRM is used to govern the Serum DEX and future DeFi protocols within Project Serum’s ecosystem. 68% of fees on Serum go towards a buy and burn of the SRM token.

Serum cryptocurrency ICO

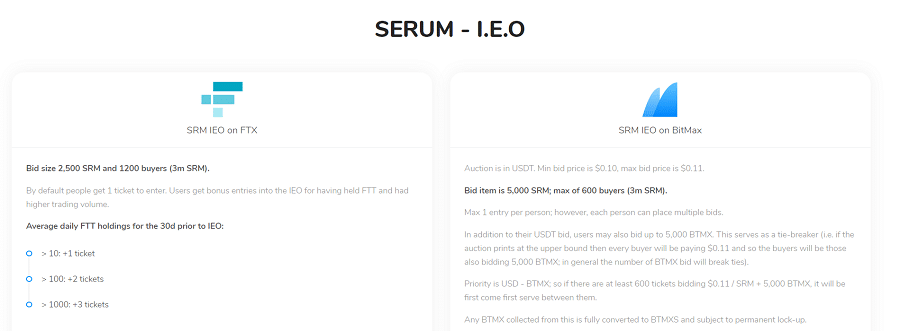

Project Serum hosted two simultaneous initial exchange offerings (IEOs) for the SRM token on August 11th, 2020. These took place on the FTX and BitMax cryptocurrency exchanges. Each exchange sold 3 million SRM at a price of roughly 0.11$USD per token. With 6 million SRM sold in total, 660 000$USD was raised. KYC was required for both IEOs and a cap of 1800 participants was set between both exchanges.

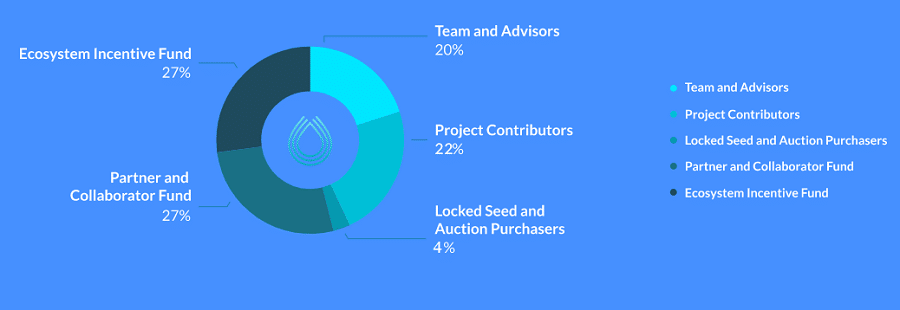

There was also a presale for Serum. This saw 400 MegaSerum (400 million SRM) sold at a price of 80 00$USD per MSRM. While this works out to 32 million USD, Project Serum notes that only 20 million USD was raised from this presale. This accounts for about 4% of Serum’s total supply of 10 billion SRM. SRM is deflationary due to the buy and burn fee mechanism noted earlier.

Of the remaining 96%, 20% has been set aside for the Team and Advisors, 22% has been reserved for Project Contributors, 27% has been reserved for Ecosystem Incentive Funds, and the last 27% has been allocated to a Partner and Collaborator Fund.

Only about 10% of Serum’s total supply is currently in circulation. This includes the 6 million SRM sold during the IEOs, plus 169 million SRM being used to provide liquidity to exchanges (only 44 million of these are currently in circulation at the time of writing). Another 825 million SRM has been allocated to provide incentives to users to build the Serum ecosystem (e.g. the Coins98 mobile app integration).

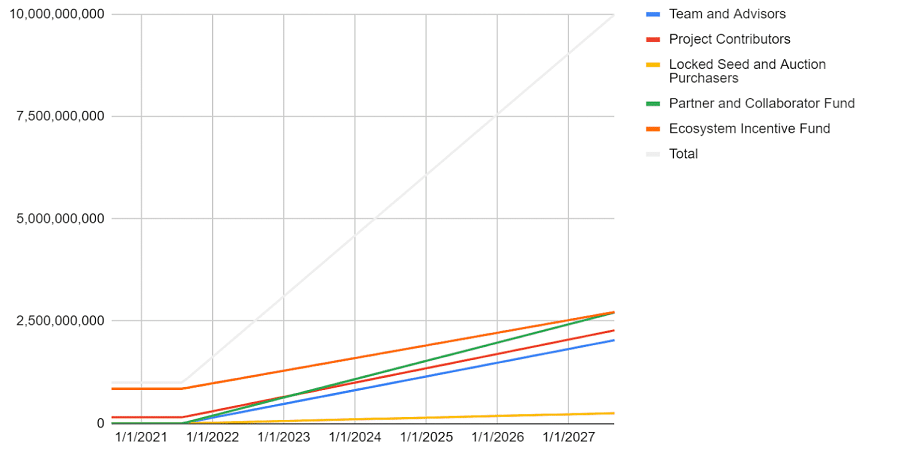

SRM cryptocurrency emission schedule

SRM cryptocurrency emission schedule The remaining 90% of SRM which is not circulation will be fully locked until August 2021. After this point, the remaining SRM will be unlocked linearly over a six-year period. This was done to ensure the long-term viability of Project Serum.

Serum SRM staking

The Serum DEX has quite an elaborate staking system. First, to become a validator node you must stake 10 million SRM, 1 million of which must be in the form of 1 MSRM. Anyone can create their own node becoming a Leader and have others delegate the necessary SRM to their node for them to become a validator. Each node is subject to a 100 million SRM maximum stake.

Image via Wall Street Journal

Image via Wall Street Journal Validator nodes have two duties on the Serum network: to support cross-chain cryptocurrency swaps and “turn the crank”. The second function refers to the fact that orders on the Serum DEX are not fulfilled automatically due to the nature of the Solana blockchain – they must be manually activated by a third party, in this case a validator node.

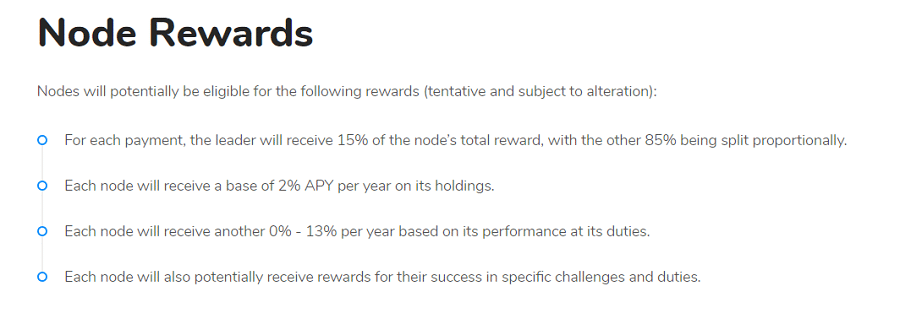

SRM staking rewards

SRM staking rewards While node rewards are not set in stone, the annual percentage yield is set at 2% per year, with up to an additional 13% based on node performance. These yields come from a part of Serum’s ecosystem fees, currently set at 10%. These fees could be changed in the future by community vote.

Serum SRM voting

In the context of voting, validator nodes on Serum can either be set to ‘voting-stake’ or ‘delegated stake’. In voting stake nodes, the SRM being delegated to the node can vote independently of the node Leader. All SRM delegated to delegated stake nodes will automatically vote the same way that the node Leader is voting for any given proposal. Voting takes place via Ecoserum.

It costs 50 000 SRM to table a proposal which is taken from the total amount being staked on a node (whether delegated or not). More than 60% of the total SRM currently being staked must vote in favor of the proposal for it to pass. If passed, the 50 000 SRM is returned to the node. If rejected, the 50 000 SRM is burned. Nodes are able to propose rule changes to the protocol, such as fees.

Serum cryptocurrency price analysis

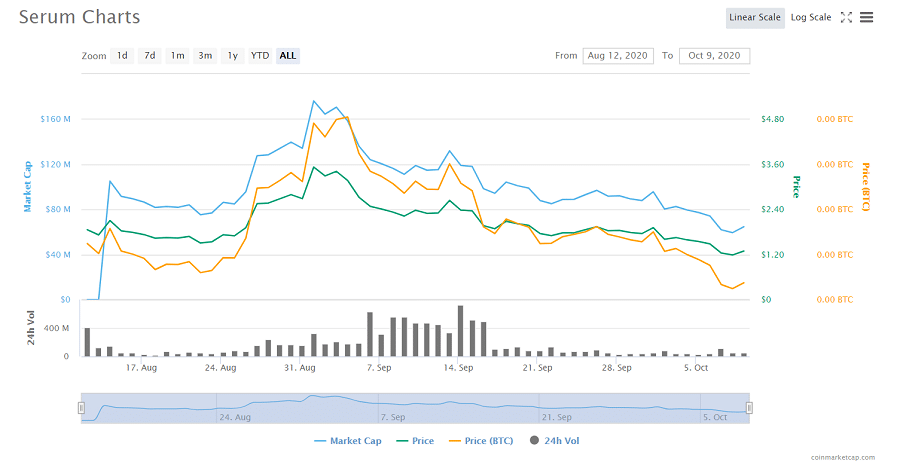

Within 12 hours of the Serum IEO on August 11th, the SRM token was trading at over 15x its IEO price of 11 cents USD. Price continued to rise in anticipation of the release of the Serum DEX which took place at the end of the August.

SRM price history. Image via CoinMarketCap

SRM price history. Image via CoinMarketCap In the days after launch, the SRM token reached its high of nearly 4$USD. While SRM has retraced over the last month, it appears to have found a level of support around 1.20$USD.

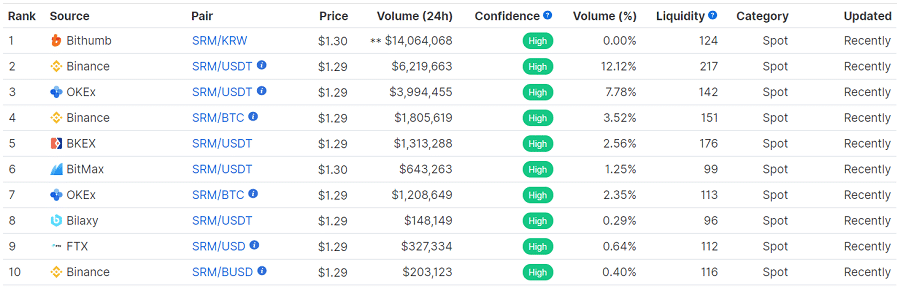

Where to get Serum cryptocurrency

If you are looking to grab some SRM cryptocurrency, your best options appear to be Binance and OKEx. While SRM is offered on over two dozen cryptocurrency exchanges, the volume is by far the highest on these exchanges.

SRM market pairs. Image via CoinMarketCap

SRM market pairs. Image via CoinMarketCap Note that the 24-hour volume of SRM has declined significantly in recent weeks. This could lead to some increased volatility, so trade wisely!

Serum cryptocurrency wallets

If you are looking to store your SRM cryptocurrency, you do not have too many options. SRM is a Solana-based token and Solana is a new project. SRM is also one of the first cryptocurrencies to be built on the Solana blockchain.

If you are a fan of mobile wallets, your best option will be that Coin98 app that was mentioned earlier. Otherwise your best bet will be the Sollet.io web wallet. Both the Coin98 mobile wallet and Sollet.io web wallet give you access to the Serum DEX.

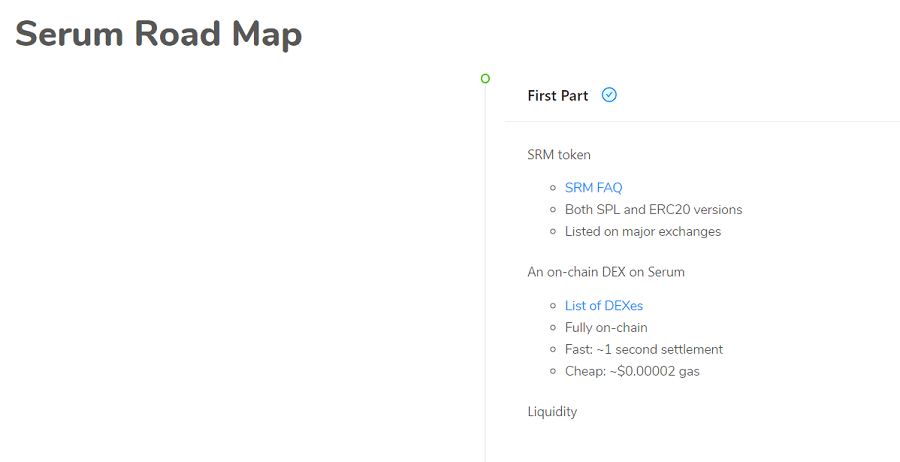

Serum Roadmap

The roadmap for Project Serum appears to be divided into five parts. Parts one and two have already been completed. Part one involved launching the Serum token and the Serum DEX. Part two involved building a cross-chain bridge, opening the door to third party DEX development on Solana, and introducing ecosystem grants for promising projects related to Serum.

The first part of the Serum roadmap

The first part of the Serum roadmap Of the remaining three parts, only the third part is currently visible. It is geared towards implementing familiar DeFi goodies such as decentralized lending and borrowing, yield farming, and even the integration of automated market maker smart contracts (this is the technology which underlies current DEX leaders such as Uniswap). It is unclear when the third part will be completed as there are no specific timelines provided by Project Serum.

Serum's FUSD stablecoin (AKA SerumUSD)

Serum's FUSD stablecoin (AKA SerumUSD) One specific element missing from the current roadmap was noted in Serum’s whitepaper and promotional video involves two unique tokens, SerumBTC (FBTC) and SerumUSD (FUSD). Both will be “truly decentralized” tokens representing Bitcoin and USD, respectively.

While details for the former a tad more speculative and involve a series of perpetual futures contracts, the latter will simply base its price off a basket of stablecoins. This is to ensure there is no central point of failure for the stablecoin.

Image via Solana Collective Blog

Image via Solana Collective Blog More broadly, Serum is hoping to shift enough attention onto Solana to convince other projects to start building on it. Sam Bankman-Fried is also looking at the possibility of releasing Sushiswap on Solana with the help of the community. It is unclear how the centralized Serum roadmap will mesh with the decentralized governance of the protocol which is also in its early stages of development.

Our take on Serum

Serum is a very, very ambitious project. While its long list of promises would make it a write off for many, the proof is in the pudding; the team and the tokenomics. Sam Bankman-Fried is nothing short of a mad DeFi scientist. Those who have seen his interviews are likely familiar with his anxious knee jumping when discussing all the different ways the cryptocurrency space could be improved.

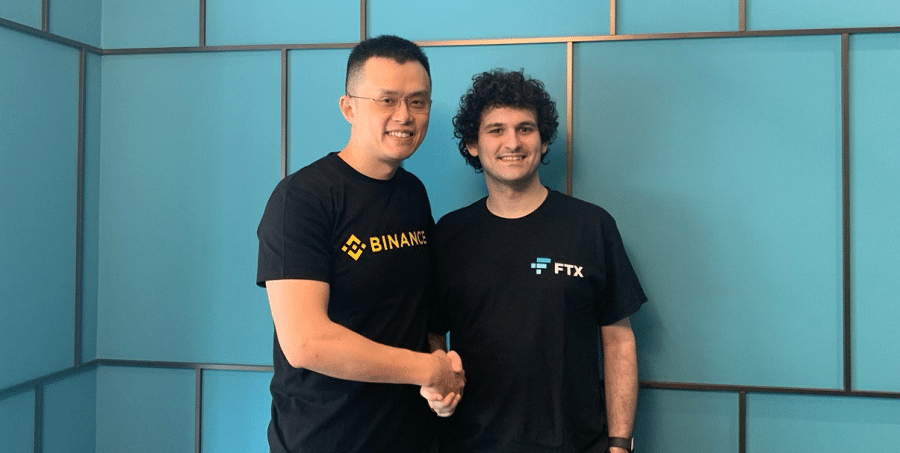

Sam Bankman-Fried with Binance CEO Changpeng Zhao. Image via TheBlockCrypto

Sam Bankman-Fried with Binance CEO Changpeng Zhao. Image via TheBlockCrypto Regarding Serum’s tokenomics, Sam claimed in a Serum blog post that the decision to vest funds over a 7-year period scared away many large venture capitalists who were interested in the project. As many of you may know, venture capitalists have been the bane of the crypto space in recent months, perhaps even years. Their presence has often resulted in inequitable token distributions, and even shameless pump and dump schemes.

While the dual IEO for the SRM token appears to have been quite equitable, it is a bit surprising that only 6 million SRM were sold. For context, that is less than 0.06% of the total supply of 10 billion SRM. Although this may be a part of ensuring the longevity of the Serum ecosystem, it is nonetheless a red flag whose reason for being raised can only be speculated on.

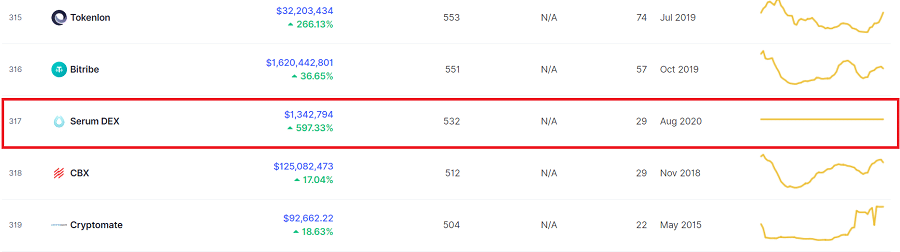

The current ranking of the Serum DEX ranking on CoinMarketCap

The current ranking of the Serum DEX ranking on CoinMarketCap There is still a long way to go for Project Serum. The Serum DEX is still very much in its infancy but progress is happening. The number of DEXes built on top of Serum went from a handful to nearly 20 within a month. Those of you with a fine eye may have also noticed the Serum DEX on CoinMarketCap.

The 24-hour volume of the DEX is over 1 million USD and appears to be rising slowly but steadily. That is within 6 weeks of launch! Could it overtake heavyweights like Uniswap? We will be watching, and you should too!