SushiSwap is a flexible, multi-chain decentralized exchange that lets you swap tokens, add liquidity, and earn yield across 38+ networks, all while keeping full control of your wallet. Born from a 2020 Uniswap fork, it now focuses on efficient trading, cross-chain swaps, and rewards for users comfortable with DeFi basics like gas fees and smart contracts.

This detailed guide breaks down SushiSwap's features, risks, and step-by-step usage, earning it a 4.5/5 rating for experienced traders. It compares SushiSwap to rivals like Uniswap and PancakeSwap, highlights who it's best for, and shares practical security tips.

SushiSwap in 60 Seconds (Quick Verdict)

SushiSwap is a solid, multi-chain AMM and routing hub for on-chain users who want swaps, liquidity, and yield tools across many networks. Avoid it if you want “customer support,” reversals, or a beginner-proof experience: it’s self-custody, smart contracts, and final transactions.

Best For

- Multi-chain traders using routing and cross-chain execution

- DeFi users comfortable with slippage, approvals, and gas

- LPs and yield farmers who understand impermanent loss (V2/V3)

- SUSHI holders who want governance + fee-linked staking

Not Ideal For

- Absolute beginners (wallet setup, approvals, and phishing risk)

- Anyone expecting refunds, trade reversals, or guaranteed support

- Fiat-first users looking for built-in on-ramps or KYC rails

- Risk-averse capital that can’t tolerate smart-contract exposure

Chains

Multi-chain (30+)

Typical Fees

V2 ~0.3% (V3: 0.01–1%)

Token

SUSHI

KYC

No (core app)

Custody

Non-custodial (wallet-first)

Rating Breakdown

Scores reflect SushiSwap’s strength as a flexible multi-chain swap and routing toolkit, with the usual DeFi tradeoffs: strong capability, limited safety net.

DEX Trading Risk Notice

Read before swappingHow We Tested and Reviewed SushiSwap

This section explains how this SushiSwap review was conducted and where its limits are, so you can judge how closely it reflects real-world usage.

What We Tested

We tested SushiSwap using real on-chain activity (not simulations) across multiple networks where Sushi is actively used. Testing focused on:

- Standard spot swaps through Sushi’s swap interface using V2-style pools and V3 concentrated liquidity pools where available.

- Routing behavior (best-path selection, split routes, price impact visibility) using Sushi’s routing stack, including cross-chain execution flows when supported.

- Everyday swap sizing, aimed at evaluating execution quality, fee behavior, slippage handling, and how clearly Sushi communicates route details and risks.

- Core usability checks, including wallet connection flows, token approvals, chain switching, and the general “swap to receipt” experience through the web app.

- Feature review at a functional level, including liquidity position creation (V2 LP tokens / V3 positions), staking mechanics (xSUSHI-style fee sharing), and incentive/farm discovery, focusing on usability and clarity rather than chasing best yields.

What We Didn’t Test

We did not attempt to test or model everything SushiSwap can be used for. Specifically:

- We did not run long-duration LP experiments or attempt to quantify impermanent loss across changing market conditions.

- We did not benchmark “professional” workflows like MEV-protected routing setups, arbitrage loops, automated trading bots, or high-frequency strategies.

- We did not include highly illiquid tokens, edge-case routing paths, or experimental pools, since those introduce additional variables (liquidity fragility, token contract risk, and execution unpredictability) that don’t reflect typical usage.

- We did not treat farming APRs as stable or comparable across time, since incentives rotate and can change quickly via governance or market conditions.

What Is SushiSwap?

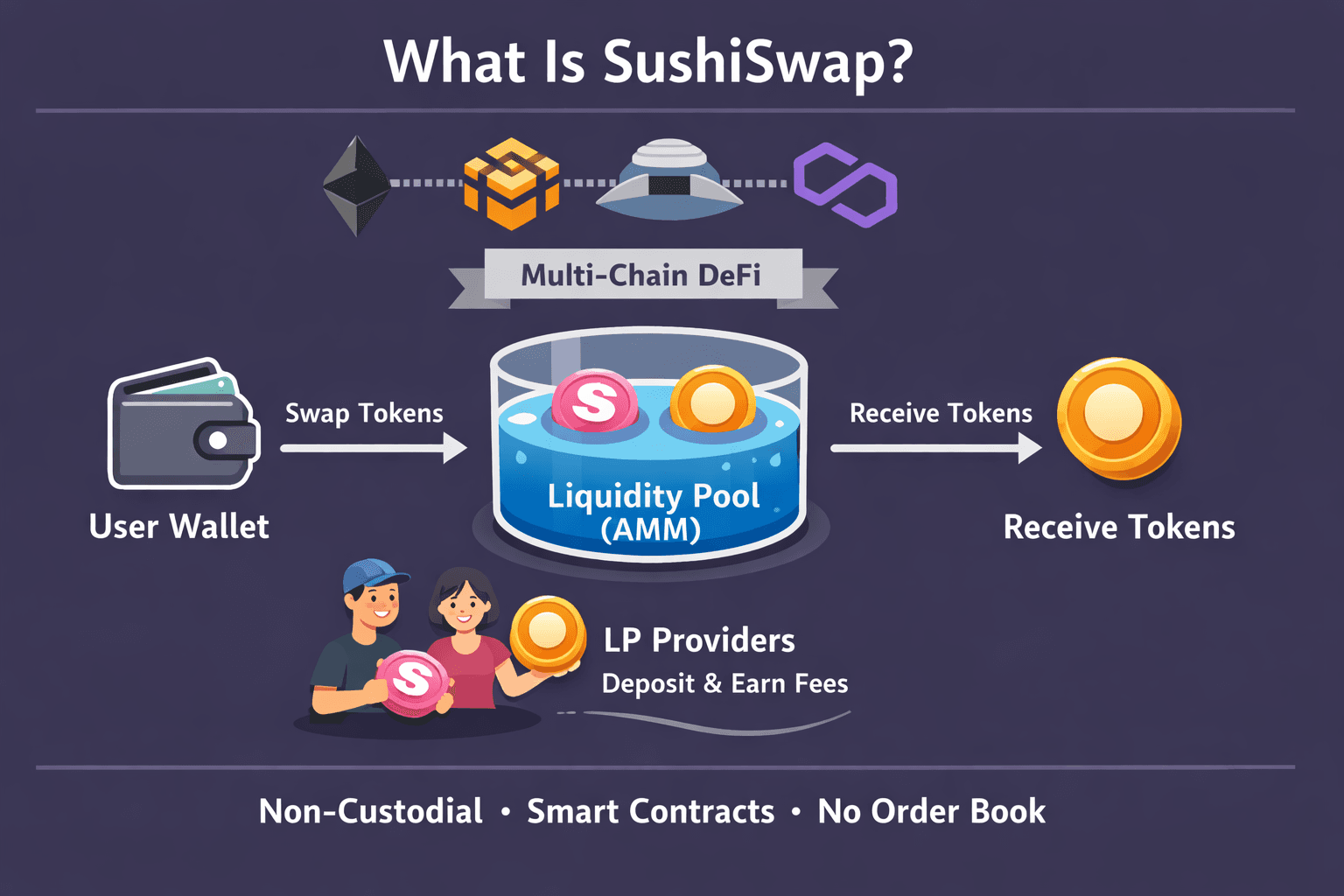

SushiSwap is a decentralized, multi-chain exchange and liquidity protocol that lets users swap tokens, provide liquidity, and earn yield through AMM pools and related products, without relying on a centralized intermediary.

It launched in 2020 as a fork of Uniswap and has since grown into a broader DeFi stack spanning multiple blockchains.

A Community Driven Platform For Permission less On chain Trading

A Community Driven Platform For Permission less On chain TradingOne-Paragraph Definition

SushiSwap is a non-custodial, AMM-based decentralized exchange that originated on Ethereum and now operates across many chains. It supports token swaps, liquidity pools, yield farming, staking, and cross-chain routing through SushiXSwap, all governed by the SUSHI token and a DAO-style community. Trades happen directly from user wallets against liquidity pools rather than order books, and users can earn trading fees or incentives by providing liquidity or staking in supported products.

Take a look at our top picks for top cross-chain swap platforms.

SushiSwap's Product Suite

Sushi's product lineup has narrowed over time. Several early experiments have been phased out, while the core focus today is clearly on swaps, cross-chain routing, liquidity, and staking economics. The sections below reflect what a new user will realistically encounter in the live app today.

- Swap (including routing and aggregation): The main swap interface lets users trade tokens across supported chains using AMM pools. Routing is handled through Sushi’s own liquidity as well as integrated engines like Route Processor and SushiXSwap, which optimize paths and enable cross-chain execution.

- Liquidity pools/LP: Users can deposit token pairs into liquidity pools and receive LP tokens that represent their share. In return, they earn a portion of swap fees generated by the pool. Pool mechanics vary by chain and pool type, ranging from classic V2-style AMMs to newer concentrated liquidity designs.

- Farms and incentives (when active): Liquidity mining programs, historically branded under Onsen, have been used to direct extra SUSHI or partner-token rewards to specific pools. These incentives shift over time based on governance decisions, market conditions, and where the protocol wants to attract liquidity.

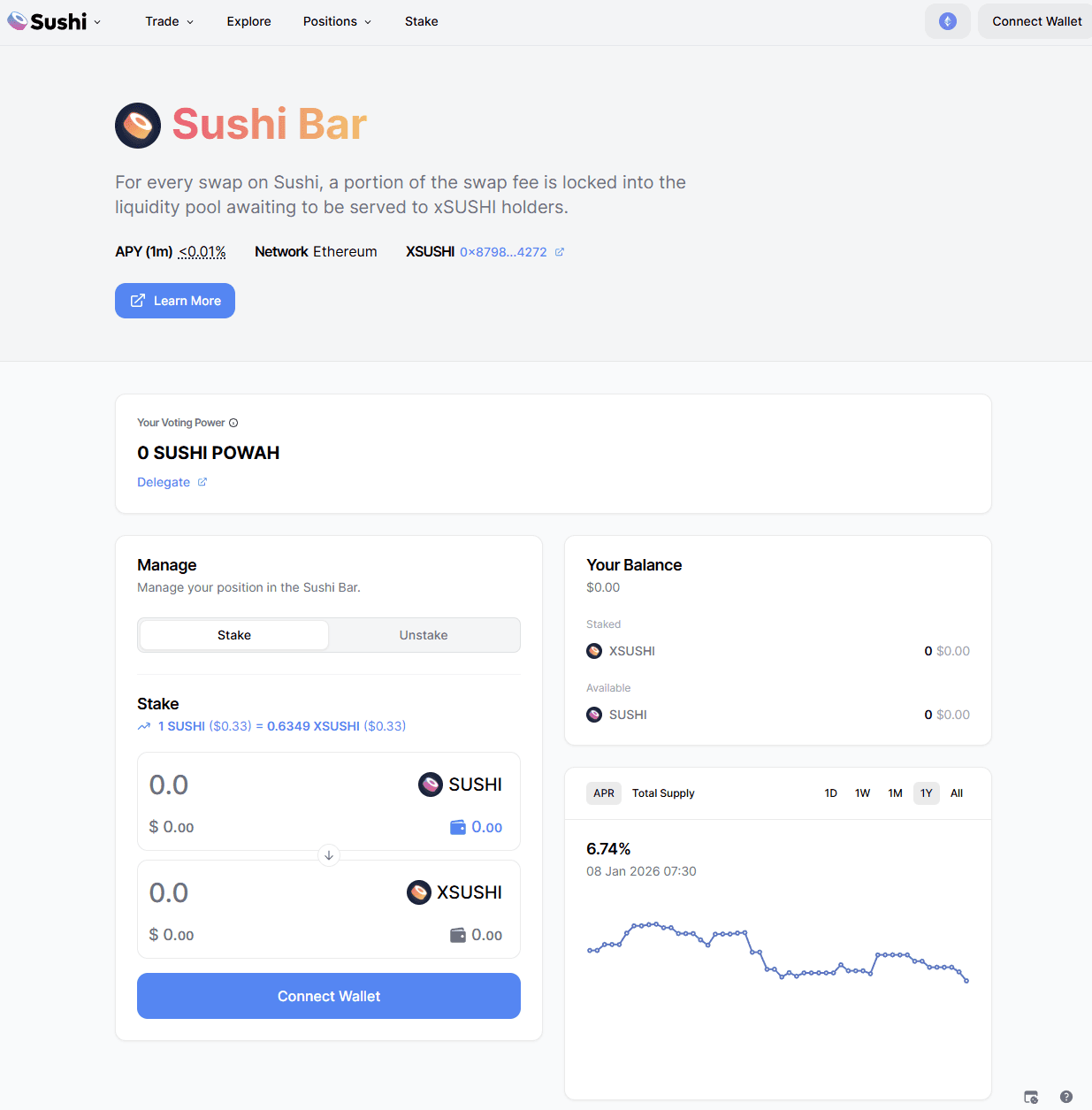

- Staking and fee sharing (xSUSHI logic): SushiBar-style staking allows SUSHI holders to lock or stake tokens and receive a derivative that accrues value from protocol fee share and other revenue streams. This mechanism links governance participation and long-term holding to platform performance.

- BentoBo /Kashi/Trident (status): BentoBox continues to exist as a generalized vault framework used behind the scenes for certain integrations. Earlier user-facing products like Kashi lending struggled to gain traction, and the Trident AMM framework was formally deprecated in favor of Sushi V3 in early 2024. In practice, most users today interact only with swaps, liquidity pools, staking, and cross-chain routing. BentoBox and Trident are better viewed as infrastructure or legacy concepts rather than core user products.

What SushiSwap is Not

Being clear about what SushiSwap does not offer helps set expectations.

- Not a centralized exchange (CEX): SushiSwap does not custody user funds or operate order books. All activity happens through smart contracts, executed directly from user-controlled wallets on public blockchains.

- No guaranteed support or reversals: There is no central authority that can reverse trades, recover funds sent to the wrong address, or guarantee refunds after hacks or user errors. Once a transaction is confirmed on-chain, it is final.

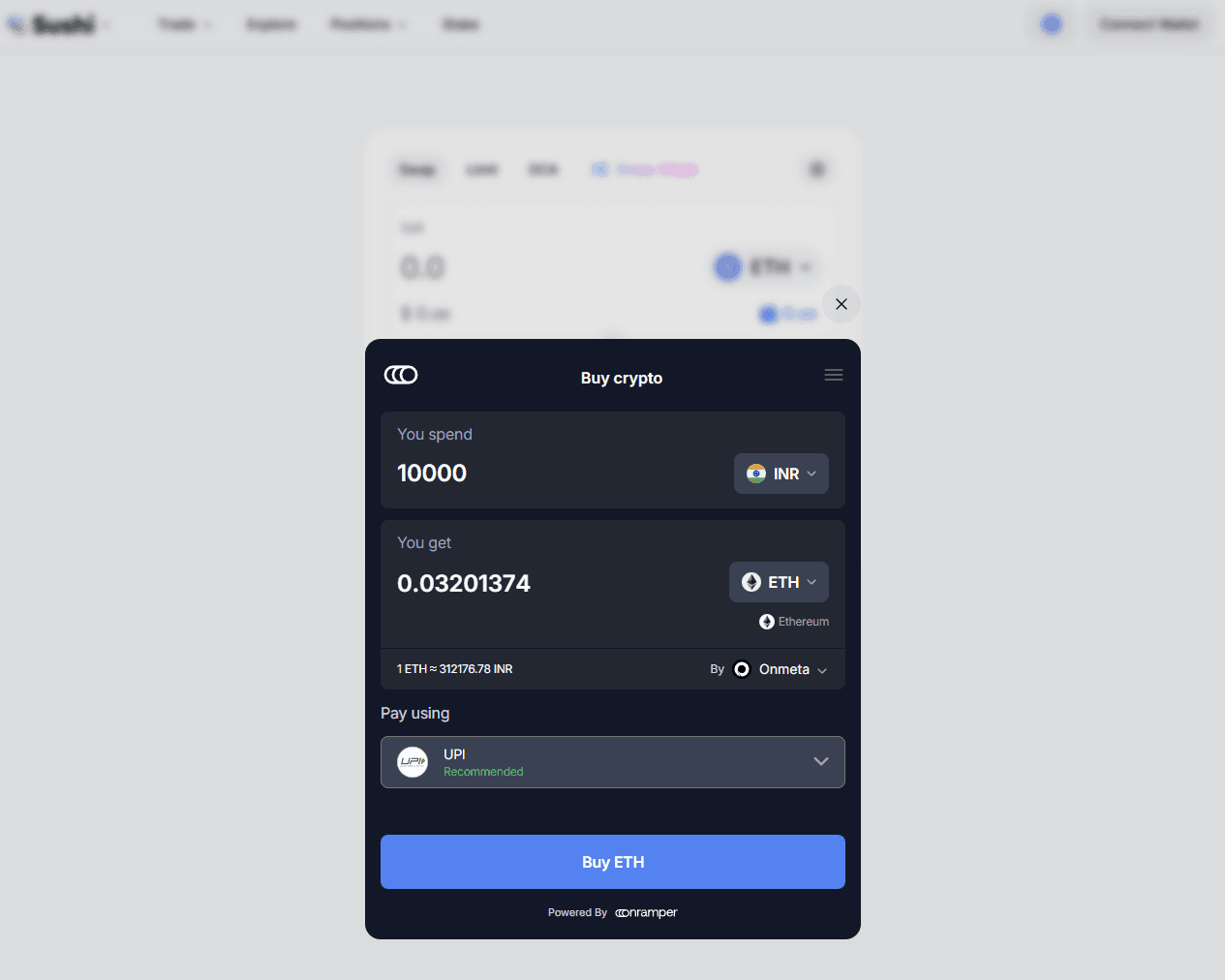

- No built-in KYC or fiat on-ramps: Sushi’s core app does not require KYC and does not offer direct fiat or bank integrations. Most users acquire crypto elsewhere, such as through a centralized exchange or fiat on-ramp, before bringing assets on-chain to use SushiSwap.

With these boundaries in mind, the next section can step back and look at SushiSwap’s origin story and early controversies.

SushiSwap’s Origin Story

Born From DeFi Summer With Community First Incentives

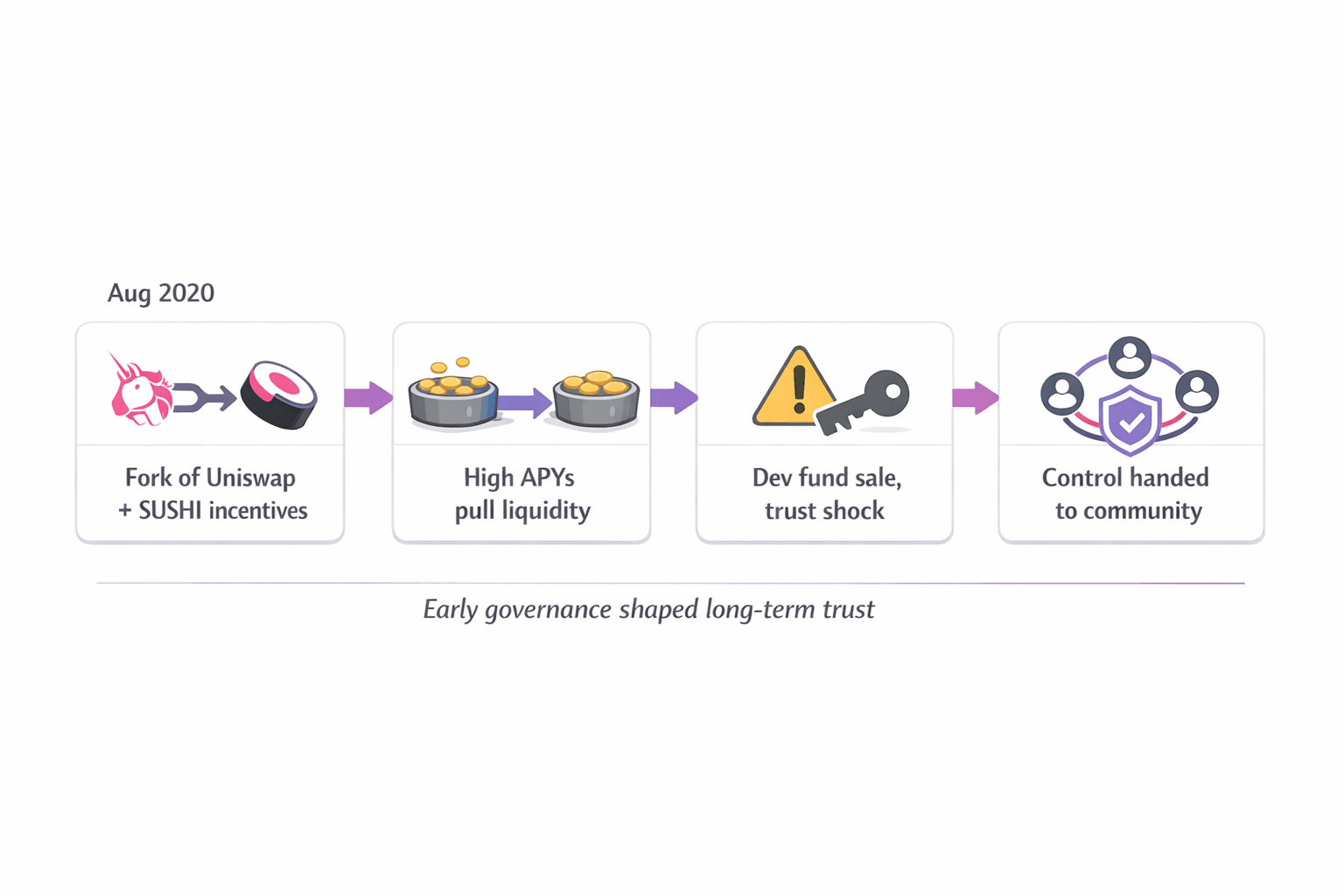

Born From DeFi Summer With Community First IncentivesSushiSwap was launched in August–September 2020 as a fork of Uniswap, launched by pseudonymous developers who pitched it as a more community-driven DEX. The model centered on a native governance token, aggressive liquidity incentives, and fee sharing with liquidity providers and token holders.

Its explosive launch, rapid TVL growth, and early controversies became inseparable from SushiSwap’s identity.

Who Founded SushiSwap?

SushiSwap was launched by anonymous or pseudonymous founders known as “Chef Nomi” and “0xMaki.” They forked Uniswap’s open-source AMM code and introduced the SUSHI token to power governance and incentives.

Chef Nomi initially retained control over the protocol and its developer funds. 0xMaki, meanwhile, quickly emerged as a visible operational and community leader, helping position SushiSwap as a decentralized alternative to venture-backed DEXs during the height of DeFi Summer.

The “Fishy History” Timeline (2020)

SushiSwap’s early months combined explosive growth with governance turbulence. Laying this out chronologically makes it easier to see how trust, control and decentralization evolved.

- Late August 2020 – Launch and extreme APYs: SushiSwap launched around Aug. 28, 2020, offering unusually high SUSHI rewards to Uniswap liquidity providers who deposited their LP tokens into Sushi contracts. This kicked off the now-famous “vampire attack,” rapidly pulling in billions in liquidity and generating headline-grabbing yields.

- Early September 2020 – Dev fund sale (“rug” controversy): In early September, Chef Nomi sold roughly 2.5 million SUSHI and around 20,000 ETH from the developer fund, worth approximately $13 million to $14 million at the time. The move triggered accusations of an exit scam and caused a sharp collapse in community trust.

- September 2020 – Leadership handoff: Facing backlash, Chef Nomi transferred admin control, including key protocol permissions, to Sam Bankman-Fried and other community-aligned contributors. This marked a decisive shift away from founder control and helped stabilize SushiSwap’s governance during a critical moment.

- September 2020 – Vampire attack completes: As incentives continued, a significant share of Uniswap’s liquidity migrated to Sushi. Some estimates suggested more than half of Uniswap’s TVL was briefly drawn over through liquidity mining, cementing SushiSwap’s place as a major DeFi player during DeFi Summer.

- September 11, 2020 – Funds returned and apology: On September 11, Chef Nomi publicly apologized and returned roughly $14 million worth of ETH to the Sushi developer fund. He stepped back from governance, stating that future decisions should rest with the community.

Why This History Still Matters in 2026

What happened in 2020 still shapes how SushiSwap is perceived today.

- Trust and brand impact: The initial “rug pull” scare, followed by the return of funds, left a lasting mark. SushiSwap earned a reputation for bold, fast-moving tactics like the vampire attack, alongside visible governance turbulence. Some institutions still factor this history into decisions around liquidity allocation or protocol integration.

- Governance lessons: The crisis forced a rapid shift away from founder-led control toward a more DAO-driven structure with multiple contributors. Later “Head Chef” roles, leadership rotations, and governance changes reflect an ongoing effort to formalize decision-making rather than depend on a single anonymous developer.

- How controls evolved (multi-sig, process, audits): After the fallout, Sushi strengthened safeguards around key contracts and treasuries using multi-signature controls, clearer governance processes, and greater emphasis on audits and bug bounties. These changes reduced unilateral control and improved resilience against both internal mistakes and external threats.

Understanding this background sets up the next section, which explains how SushiSwap actually works at the protocol level, connecting governance and risk history to everyday usage.

How SushiSwap Works (DEX + AMM, Explained)

SushiSwap operates as an on-chain DEX built around automated market maker (AMM) pools rather than traditional order books. Users trade directly against shared liquidity held in smart contracts.

Understanding this distinction, along with how pricing formulas, slippage, and impermanent loss work, is essential before swapping tokens or providing liquidity.

Onchain Trading Powered By Liquidity Pools Not Orderbooks

Onchain Trading Powered By Liquidity Pools Not OrderbooksDEX vs AMM (Quick Definitions)

A decentralized exchange (DEX) is a blockchain-based trading platform where users keep custody of their funds and interact through smart contracts, without centralized intermediaries or accounts.

An automated market maker (AMM) is a DEX design where prices are set algorithmically based on token balances in liquidity pools, rather than by matching individual buy and sell orders.

Take a look at our picks for the best decentralized exchanges.

Order Book vs Pool-Based

Order-book exchanges, including most centralized platforms, match bids and asks submitted by traders and maintain a live book of limit and market orders.

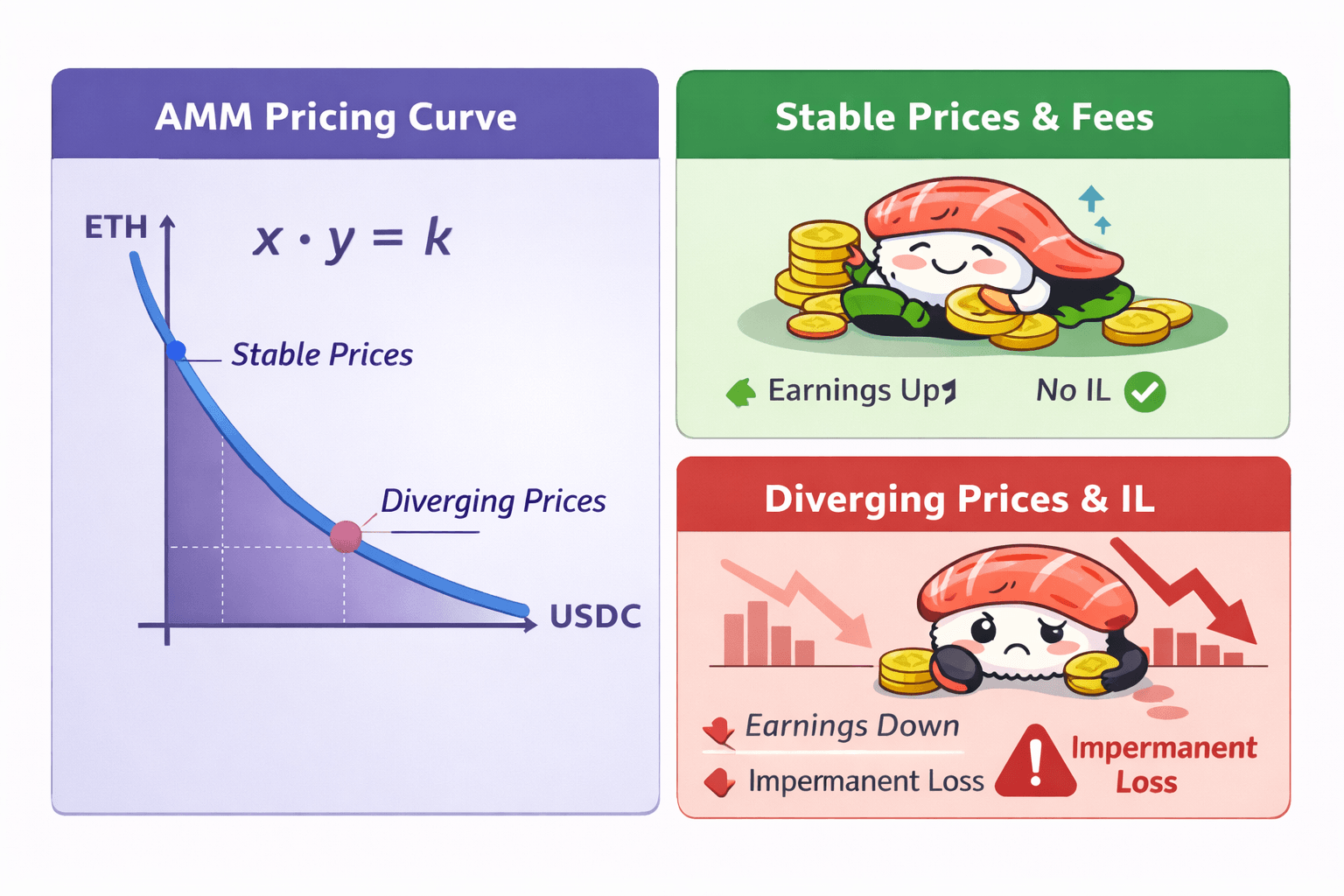

AMM-based DEXs like SushiSwap use pools of two or more tokens. Traders swap against the pool, and prices adjust automatically using formulas such as the constant product rule (x·y = k) as balances change.

Where AMMs Shine And Fail

AMMs excel at permissionless listings, always-on liquidity as long as funds are available, and supporting long-tail or illiquid markets without dedicated market makers.

They are less capital-efficient for large trades due to price impact, expose liquidity providers to impermanent loss, and tend to be more vulnerable to MEV and sandwich attacks than deep, centralized order books.

AMM Pricing & Slippage (x*y=k)

In SushiSwap’s classic constant-product AMM, a two-token pool follows the rule x·y = k, where x and y represent the token balances in the pool and k remains constant during trades, ignoring fees. As trades shift the balance between the two assets, prices automatically adjust.

The key idea is simple: every trade changes the pool ratio, and that change is what moves the price.

Short Example

Assume a pool holds 10 ETH and 10,000 USDC.

Here, x = 10 ETH, y = 10,000 USDC, so k = 100,000.

If a trader buys ETH using 1,000 USDC, the pool’s USDC balance increases while the ETH balance decreases. The pool must still satisfy x·y = 100,000, so each remaining ETH becomes more expensive in USDC terms. That rising marginal price is what creates slippage.

Larger trades relative to pool size cause larger price shifts.

Slippage Tolerance Explained

Slippage is the gap between the price you expect when submitting a trade and the price you actually receive once it executes. On AMMs, this happens because trades change pool ratios in real time.

Users set a slippage tolerance such as 0.5% or 1% to define the maximum price movement they are willing to accept.

If the price moves beyond that limit before the transaction confirms due to other trades, low liquidity, or MEV activity, the transaction fails instead of executing at a much worse rate.

MEV and Why it Happens

MEV, or maximal (miner or validator) extractable value, arises when block producers or specialized searchers reorder, insert, or bundle transactions to capture arbitrage or sandwich profits.

AMMs make this easier because pending transactions are visible and pricing is predictable. On SushiSwap and similar DEXs, MEV bots can front-run or back-run large swaps, often pushing users into worse effective prices than the quoted rate.

This is why slippage settings, pool depth, and trade size matter far more on AMMs than on deep, centralized order books.

Liquidity Providers & Impermanent Loss

Liquidity providers (LPs) deposit pairs of tokens into SushiSwap pools and receive LP tokens that represent their share of the pool. In return, they earn a portion of trading fees and, at times, additional incentives. The trade-off is exposure to impermanent loss when token prices move.

Understanding how impermanent loss works, and when fees can realistically offset it, is essential before choosing LPing over simply holding tokens.

Impermanent Loss With One Numeric Example

Assume an LP deposits 1 ETH and 1,000 USDC into a 50/50 ETH–USDC pool. At deposit, ETH is priced at $1,000, so the total position is worth $2,000.

If ETH later rises to $2,000 while USDC stays at $1, the AMM rebalances the pool. The LP ends up holding less ETH and more USDC than they started with. When withdrawing, the position may be worth roughly $1,886 instead of the $2,000 they would have had by holding ETH and USDC separately.

That difference, about 5–6% before fees, is impermanent loss.

How to reduce Impermanent Loss

- Favor correlated pairs or stablecoin–stablecoin pools such as USDC–USDT, where price divergence is limited.

- Weigh expected trading fees and incentives carefully. High volume or strong fee APR can offset, or even exceed, impermanent loss over time.

- Avoid concentrating liquidity in highly volatile or speculative pairs, especially where liquidity is thin or token economics are uncertain.

- Think in time horizons. Impermanent loss is only realized when you withdraw. If prices revert, losses shrink. Exiting at peak divergence locks them in.

SushiSwap Core Features

SushiSwap's interface centers on a few tightly integrated features that let users trade, earn, and manage positions across chains, with improvements like V3 pools and route optimization making it more competitive. This section breaks down the main actions available today, focusing on what’s live and relevant.

Trade Earn And Manage Assets Across Chains Onchain

Trade Earn And Manage Assets Across Chains OnchainSwap (V2/V3) + Smart Routing

SushiSwap focuses on a small set of tightly integrated features that let users trade, earn, and manage positions across chains.

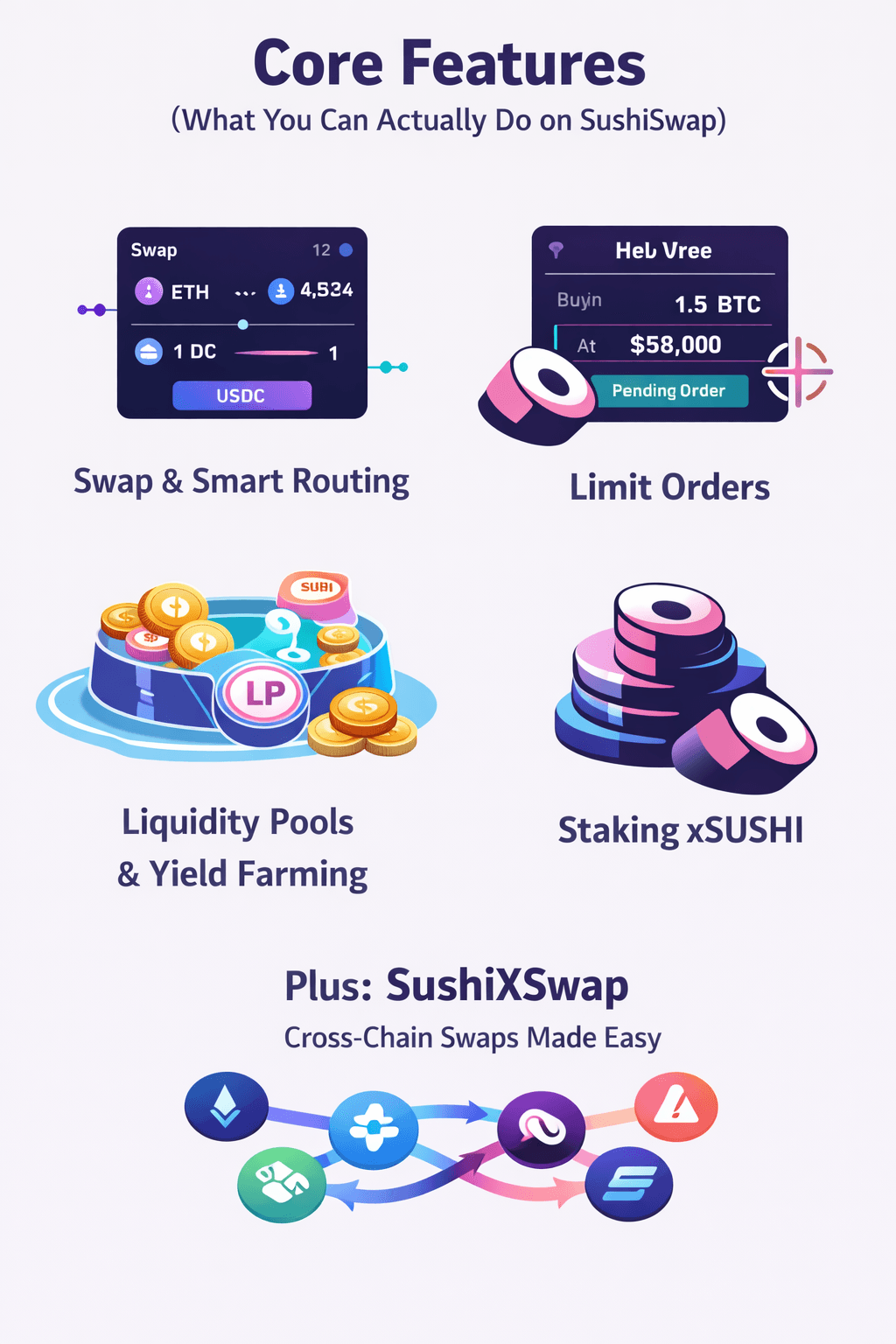

- Swap (V2 / V3) + Smart Routing: Swaps are the entry point for most SushiSwap users, enabling token exchanges across supported chains with automatic route optimization.

- V3 Concentrated Liquidity Basics: Sushi V3 allows LPs to define price ranges where their liquidity is active. Capital is concentrated within those ranges, improving fee efficiency when prices remain inside them. Traders benefit from tighter spreads and lower slippage in active zones, similar to Uniswap V3.

- Route Processor Improvements: The Route Processor, now in its newer iterations, aggregates liquidity across Sushi pools, other DEXs, and bridges. For cross-chain trades via SushiXSwap, it selects routes based on price and speed, often splitting trades or routing through aggregators like Li.Fi to reduce effective costs.

Limit Orders

Limit orders let users set a specific buy or sell price instead of taking the live AMM quote. The trade only executes if the market reaches that price.

What They Are: Users define a token pair, order size, target price, and expiration. The order sits off-chain or with keeper networks, often powered by partners like Orbs, and triggers an on-chain swap once the price condition is met.

When They Make Sense vs AMM Swaps: Limit orders work well for precise entries and exits, dollar-cost averaging, or avoiding slippage during volatile moves. They are most useful when you expect mean reversion or want to build positions near support or resistance. The trade-off is keeper fees and the risk that the order never fills if the price moves too quickly past your level.

Liquidity Pools + Farming

Providing liquidity means depositing token pairs into pools to earn fees, with LP tokens tracking your share of the pool.

- How LP Tokens Work: You deposit an equal value of two tokens, or in some advanced setups a single asset, and receive ERC-20 LP tokens. Fees accumulate in proportion to your share, and LP tokens can often be staked in farms for additional rewards.

- Typical Reward Sources: Liquidity providers earn trading fees, commonly around a 0.3% tier depending on the pool. On top of that, time-limited incentives may apply, such as SUSHI emissions or partner tokens distributed through farms or Onsen programs.

- What “Onsen” Is: Onsen refers to Sushi’s curated liquidity mining programs, where selected pools receive boosted SUSHI rewards to attract liquidity. Today, Onsen incentives remain active across both V2 and V3 pools, with rewards claimable through pool pages or the rewards interface.

Staking (xSUSHI)

Staking SUSHI allows token holders to earn a share of protocol revenue and participate more directly in governance.

- Reward model: Users stake SUSHI to receive xSUSHI, or an equivalent derivative. This position grows in value as protocol fees and treasury yields accumulate, effectively compounding over time without the need for active management.

- Fee share explanation: A portion of platform revenue, primarily from swaps, flows to stakers. This aligns long-term token holders with protocol usage and creates a feedback loop where higher activity can translate into greater value for staked SUSHI.

Other Products

Most experimental features have been streamlined over time. In 2026, the real focus is on swaps, liquidity provision, and staking. Legacy products are listed for context so users know what’s active and what to ignore.

| Category | Product | Status (2026) | Why users should care |

|---|---|---|---|

| Trading | Swap + Limit + Routing | Live and core | Primary way to trade; routing finds best prices across pools and paths. |

| Earn | Pools/LP + Farms/Onsen + xSUSHI staking | Live and core | Fees plus incentives; V3 concentration improves yield efficiency. |

| Advanced | Route Processor/SushiXSwap | Live | Better cross-chain execution and lower effective costs. |

| Legacy | Trident pools | Deprecated | Replaced by V3; no new positions supported. |

| Legacy | Kashi lending | Low activity | Better handled by specialized lending protocols. |

| Legacy | BentoBox vaults | Infrastructure only | Powers some integrations; not user-facing. |

| Legacy | MISO launches | Inactive | Early IDO tooling; now superseded. |

This snapshot makes it clear what’s worth using today versus what’s mostly historical, helping users avoid dead ends.

Fees & Costs

SushiSwap uses a familiar AMM fee model, with competitive pricing across chains. Most costs come from swap fees and gas, which vary by chain and routing path. This section explains how fees are structured in practice so traders can estimate total cost before swapping or LPing.

Understanding Trading Fees Gas Costs And Incentives Structure

Understanding Trading Fees Gas Costs And Incentives StructureSwap Fee Breakdown

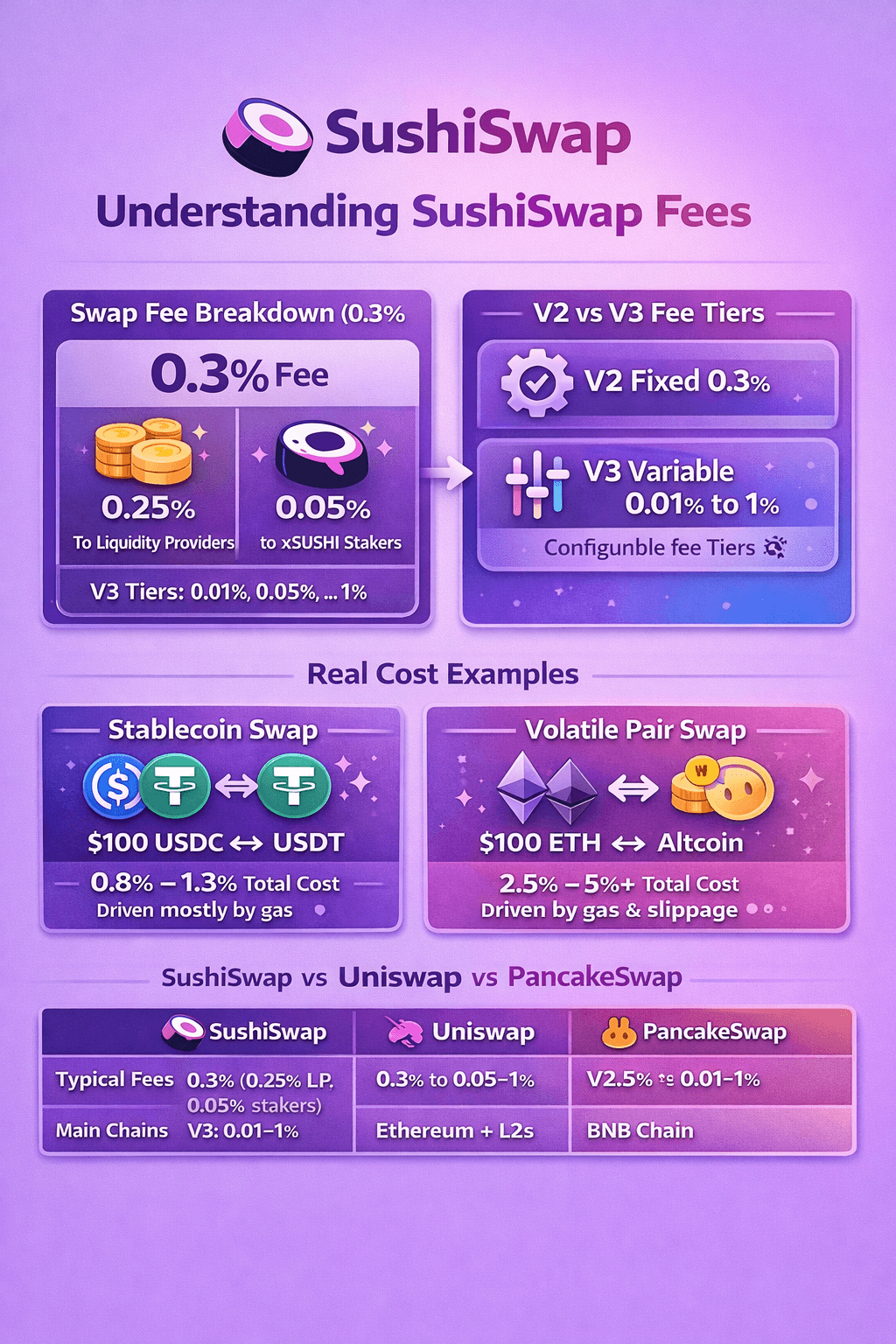

Most V2 swaps on SushiSwap charge a 0.3% fee. V3 pools use configurable fee tiers, typically 0.01%, 0.05%, 0.3%, or 1%, set by pool creators based on asset volatility.

Where the fee goes

- 0.25% to liquidity providers: Earned in the pool’s token pair and realized when liquidity is withdrawn.

- 0.05% to SUSHI stakers: Distributed via xSUSHI or its current equivalent, supporting long-term tokenholders and protocol funding.

V2 vs V3 Fee Tiers

- V2: Fixed 0.3% fee split between LPs and stakers.

- V3: Flexible fee tiers. Lower tiers suit stable or correlated pairs, while higher tiers compensate LPs for volatile assets. Protocol fee share can be adjusted through governance.

The takeaway is simple: headline fees matter less than liquidity depth, routing quality, and gas. On active chains with strong routing, SushiSwap often remains competitive even when nominal fees look similar to other DEXs.

Real Cost Examples

Total trading cost on SushiSwap comes from three parts: the protocol fee, slippage from price impact, and gas. The examples below assume Ethereum mainnet for clarity. On L2s like Arbitrum, gas costs are usually much lower.

- Example: $100 stablecoin swap (stable–stable): Swapping $100 USDC for USDT in a deep pool typically incurs a 0.3% fee ($0.30), negligible slippage (under 0.1%), and around $5–20 in gas on Ethereum. The total effective cost usually lands around 0.8%–20.3%, driven mostly by gas rather than protocol fees.

- Example: volatile pair swap (higher slippage): Swapping $100 worth of ETH into a low-liquidity altcoin can still incur the 0.3% fee ($0.30), but slippage may range from 2% to 5% ($2–5) depending on pool depth. Add gas, and total cost can climb to 2.3%–25% or more, especially on congested networks

The takeaway is simple: swap fees are predictable, but slippage and gas dominate costs on small or volatile pools.

SushiSwap vs Uniswap vs PancakeSwap

This comparison highlights where each major DEX tends to perform best based on chain focus, liquidity depth, and cost structure.

| Metric | SushiSwap | Uniswap | PancakeSwap |

|---|---|---|---|

| Typical swap fees | 0.3% (0.25% LP, 0.05% stakers); V3: 0.01–1% | 0.3% to LPs; V3: 0.05–1% | V2: 0.25%; V3: 0.01–1% |

| Best chains | Multi-chain (ETH, Arbitrum, Polygon, more) | Ethereum + L2s (strongest on ETH) | BNB Chain (lowest gas) |

| Liquidity depth | Solid on majors; spread across chains | Deepest liquidity on ETH majors | Strong within BNB ecosystem |

| Best for | Cross-chain routing and incentives | Deep ETH liquidity and stables | Low-fee trading and farming on BNB |

SushiSwap stands out for its flexibility and cross-chain execution, Uniswap dominates deep Ethereum liquidity, and PancakeSwap wins on low-cost trading within the BNB Chain.

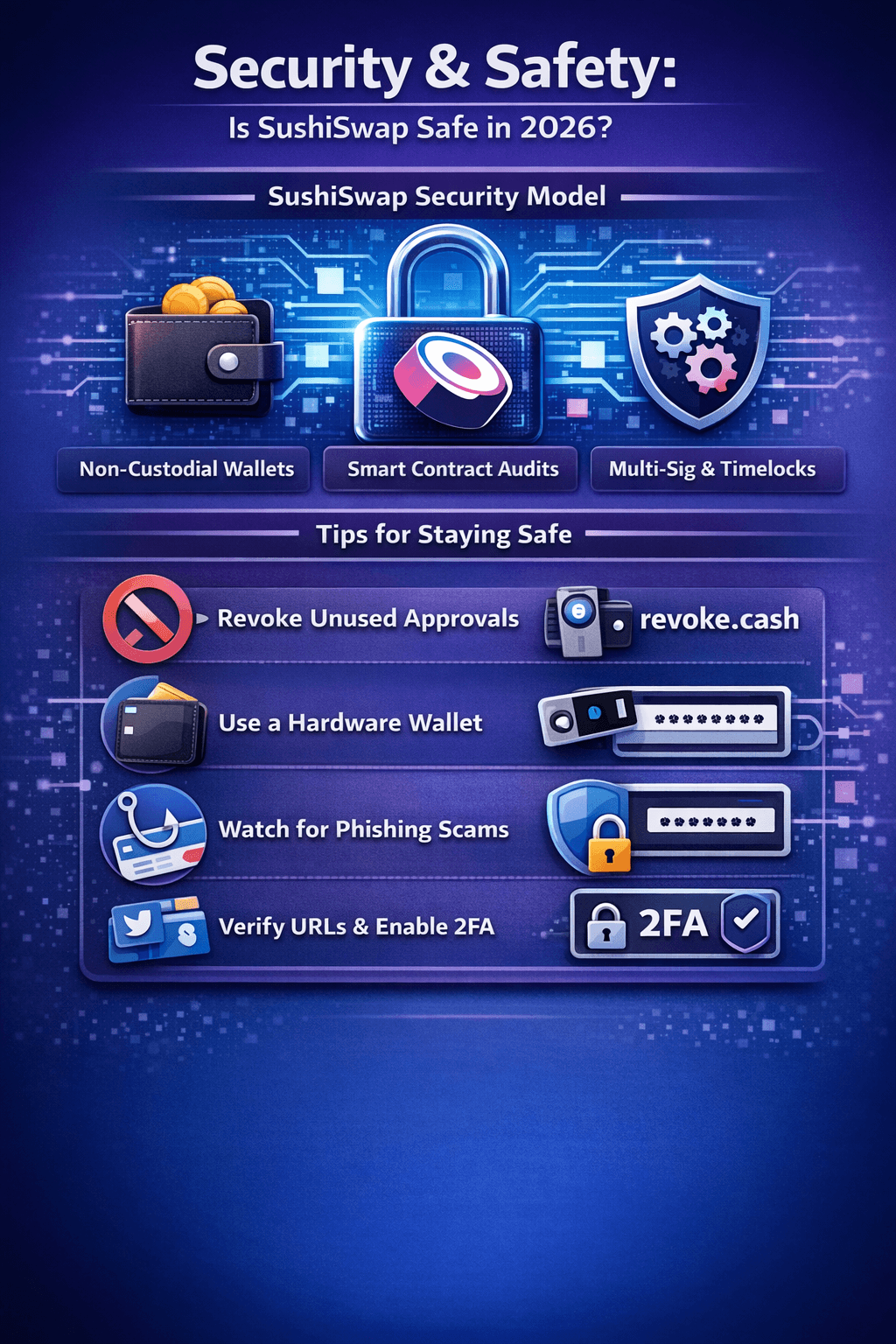

Security & Safety (Is SushiSwap Safe in 2026?)

SushiSwap follows the standard DeFi non-custodial model. Security depends on smart contract design, audits, governance controls, and user behavior rather than centralized safeguards.

The protocol has been battle-tested across chains and market cycles, but like all on-chain systems, it carries structural risks tied to smart contracts, MEV, and user-side mistakes. Understanding those trade-offs is essential before committing meaningful capital.

Evaluating Smart Contract Risk, Governance And User Responsibility On SushiSwap

Evaluating Smart Contract Risk, Governance And User Responsibility On SushiSwapSecurity Model Overview

SushiSwap follows a fully non-custodial design. Users keep control of their assets in their own wallets and interact directly with smart contracts that handle swaps, liquidity, and routing, without intermediaries.

- Non-custodial basics: No platform custody exists. SushiSwap never holds private keys or user funds. All trades execute peer-to-pool through deployed smart contracts on public blockchains.

- Smart contract trust model: The core AMM logic is open-source and has been in production for years. Security depends on code quality, audits, and governance oversight for upgrades, rather than any centralized guarantee. Users implicitly trust that upgrades follow established processes and community review.

- Multi-sig, timelocks, and admin controls: Critical contracts, treasuries, and upgrade paths are managed through multi-signature wallets, typically using Gnosis Safe. These setups require multiple independent signers and are paired with timelocks, commonly around 48 hours, to reduce the risk of unilateral or rushed changes.

Audits, Bug Bounties & Controls

SushiSwap has undergone multiple audits since launch, with an emphasis on core AMM logic, routing contracts, and supporting infrastructure. In addition, it maintains an active bug bounty program to surface critical issues early.

Audit and security coverage overview

| Item | Who | When | What it covers |

|---|---|---|---|

| Core AMM audit | PeckShield | Sept 2020 | SushiSwap v1 contracts; minor issues identified and fixed |

| Partial audit | Quantstamp | Early stages | Selected protocol components |

| Formal verification | Certora | Ongoing | Core math properties and invariants (partial coverage) |

| Bug bounty | Immunefi | Active since 2021 | Mainnet assets including AMM V2/V3 and Router; rewards up to $200,000 for critical issues |

| MISO audit | Halborn | Legacy | Initial DEX offering contracts |

Audits and bounties significantly reduce risk, but they do not eliminate it. As with any DeFi protocol, users remain exposed to unknown vulnerabilities, governance errors, and ecosystem-wide attack vectors.

If you want, the next section can break down past security incidents and explain what actually changed afterward, separating real fixes from surface-level assurances.

Known Incidents

SushiSwap has experienced security incidents tied to newer features rather than its core AMM contracts. The most notable case in 2023 highlighted approval risk and routing complexity.

What Happened: In April 2023, shortly after RouteProcessor2 was deployed, attackers exploited weak input validation. By passing a malicious route parameter that pointed to an attacker-controlled pool, they were able to drain tokens from users who had previously approved the processor. Roughly $3.3 million was taken across multiple chains.

Scope and Impact: Only users who had granted approvals to RouteProcessor2 were affected. Losses were limited by the feature’s recent launch, relatively few approvals, and whitehat interventions that front-ran some drains. MEV bots still amplified the damage in certain cases.

What Changed Afterward: Sushi published a detailed post-mortem, deprecated the vulnerable processor version, urged users to revoke approvals, and strengthened input validation in subsequent RouteProcessor upgrades. Importantly, no core AMM liquidity pools were compromised.

“What users should do” checklist

- Revoke unused token approvals regularly using tools like revoke.cash.

- Pay attention to warnings around new routing contracts and approve only what you trust.

- Use hardware wallets and review transaction details carefully before signing.

- Check Sushi’s official channels for post-mortems or advisories before trying newly released features.

User Safety Checklist

Protocol-level security matters, but most DeFi losses still come down to user behavior. These habits materially reduce risk.

- Wallet hygiene: Use hardware wallets such as Ledger or Trezor for larger balances. Enable transaction simulation or previews through tools like Wallet Guard when possible.

- Token approvals: Grant exact amounts instead of unlimited approvals. Review and revoke old permissions monthly using revoke.cash or Etherscan.

- Phishing awareness: Bookmark sushi.com directly. Verify URLs every time. Never share seed phrases. Use 2FA wherever it applies outside your wallet environment.

- Hardware wallet guidance: For meaningful positions, a hardware wallet is strongly recommended. Software wallets like MetaMask are fine for testing or small balances, but pairing them with hardware adds a critical layer of protection.

- Approval management tools: Revoke.cash provides a free way to scan and remove approvals. Pair it with portfolio trackers like Zapper or DeBank for ongoing visibility.

With these basics in place, the tutorial that follows walks through real SushiSwap usage step by step, helping users build confidence without putting meaningful funds at risk.

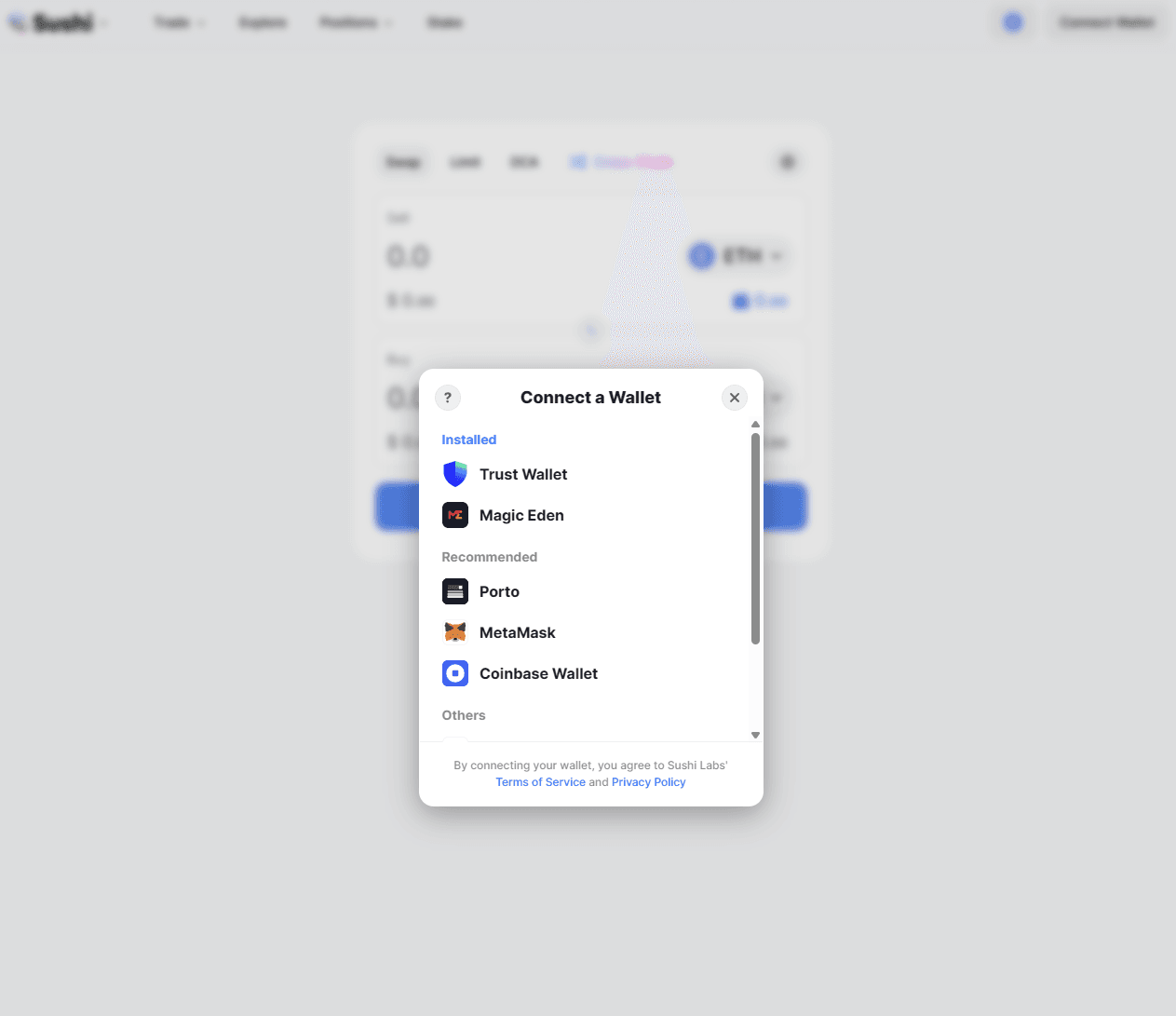

How to Use SushiSwap (Step-by-Step Tutorial)

This walkthrough uses SushiSwap’s official interface. It covers swapping, liquidity provision, and earning, from wallet connection to rewards management.

Step 1: Connect a Wallet

Open sushi.com and connect a self-custody wallet. You will never be asked for seed phrases. Approve connection requests only.

Supported wallets

MetaMask (primary), WalletConnect wallets like Trust Wallet, Phantom, OKX, Coinbase Wallet, and Ledger or Trezor via MetaMask. Mobile users connect via WalletConnect QR.

Network selection

Use the top-right chain selector. Sushi supports 38+ networks, including Ethereum, Arbitrum, Base, Polygon, and BNB Chain. Switch your wallet network to match. Add missing RPCs via chainlist.org if needed.

Safety checks

Confirm the URL is app.sushi.com. Disconnect idle sessions from wallet settings.

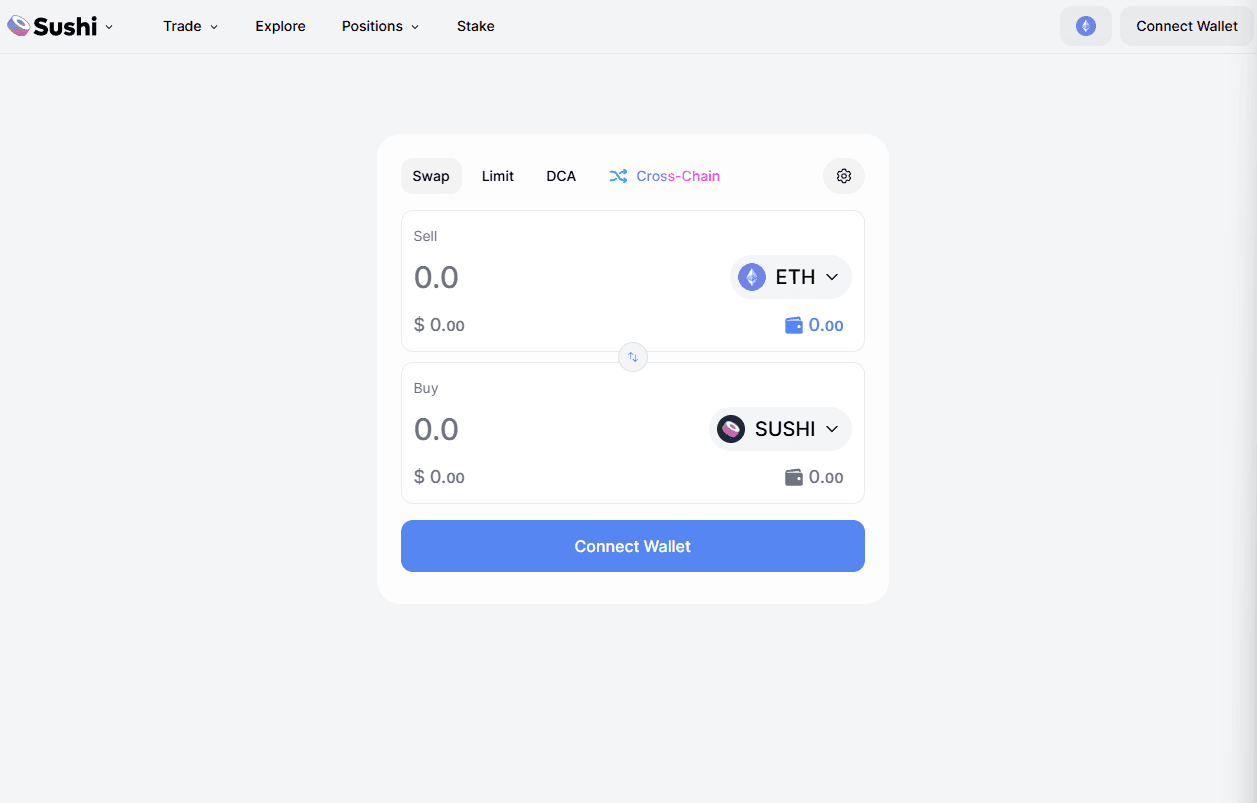

Step 2: Swap Tokens

Swaps are the default landing action.

Select a pair

Click the token selector, search or paste the contract address, and confirm against Etherscan or the chain explorer. Output tokens auto-populate.

Set slippage

- Open the settings icon.

- 0.5% works for stable pairs.

- 1–3% fits volatile majors.

- Higher values may be required for low-liquidity assets.

Review the route

Scroll to see execution details: pool path, fees, price impact, and gas estimate. Sushi shows whether routing uses its own pools, aggregators, or cross-chain paths.

Approve and swap

Approve the token once with an exact allowance. Confirm the swap and sign the transaction. Monitor confirmation in your wallet.

Verify execution

Check the transaction hash on the relevant explorer. Confirm balances and the Swap event.

Step 3: Add Liquidity

Navigate to Pool and choose Add or New Position.

Choose pool type

V2 is simpler.

V3 allows concentrated liquidity and requires price range selection.

Deposit tokens

Enter equal values for both tokens. In V3, set a price range and review projected fees, APR, and impermanent loss exposure.

Supply and receive LP position

- Approve both tokens and confirm the transaction.

- V2 issues ERC-20 LP tokens.

- V3 issues an NFT position.

Monitor performance

Your dashboard shows fees earned, IL versus hold, and APR. In V3, fees accrue only while the price stays in range.

Step 4: Stake or Earn

Open the Earn or Stake section.

Staking flow

Select a farm or SushiBar equivalent. Approve LP tokens or SUSHI, then stake. Track rewards through the position panel.

Claim rewards

Use the Harvest button to claim SUSHI or partner tokens. Batch claims reduce gas costs where available.

Exit cleanly

Unstake first if required. Remove liquidity next. Swap rewards if needed. Time exists around emission changes or when price exits V3 ranges.

This flow reflects how SushiSwap actually works in practice: wallet-first, permissionless, and unforgiving of mistakes. Move slowly, verify every contract, and size positions based on what you are prepared to manage on-chain.

SUSHI Token (Utility, Tokenomics, and Reality Check)

Sushi is the Governance Token Powering Incentives Voting And Protocol Alignment.

Sushi is the Governance Token Powering Incentives Voting And Protocol Alignment.SUSHI is the governance and fee-linked token of SushiSwap. It connects users to protocol decisions, incentives, and a share of platform activity across chains. The token has moved away from hyperinflation-heavy farming toward sustainability, but price volatility remains high. Treat SUSHI as a utility token with upside tied to usage, not as a low-risk yield instrument.

This section covers what SUSHI actually does today, how supply dynamics changed, and how to buy and store it safely.

What SUSHI Is Used For

SUSHI exists to align users, liquidity providers, and governance around protocol growth.

Governance

Holders vote or delegate on Snapshot and on-chain via governance contracts. Decisions include Onsen incentives, treasury usage (roughly $500M+ across assets), upgrades, and ecosystem expansion. One SUSHI equals one vote, with quadratic voting available for select proposals.

Incentives

Emissions fund liquidity programs such as Onsen. These rewards are rotated by governance to bootstrap liquidity on new chains or pairs, often adding 1–10% APR on top of base fees.

Fee share (via staking)

A portion of swap fees, about 0.05% on most routes, flows to SUSHI stakers. Staking converts SUSHI into a derivative position that accrues fees over time, compounding with usage. Returns vary with volume and typically fluctuate year to year.

Tokenomics (How Supply Evolved)

SUSHI launched in 2020 with aggressive emissions. That phase is over.

Supply profile

Total cap near 250M. The circulating supply stands at approximately 243 million as of early 2026. Emissions have dropped roughly 90% from peak levels and now average about 0.5–2 SUSHI per block, primarily routed to farms.

Structural changes

Between 2023 and 2025, governance approved multiple emission reductions, redirected fees toward stakers, standardized cross-chain wrappers to avoid dilution, and introduced a revenue-funded burn program. A portion of protocol revenue now buys back and retires SUSHI, shifting the model from inflation-driven incentives to value retention.

The result is a slower, usage-linked supply curve rather than a growth-at-any-cost token.

Where to Buy and Where to Store SUSHI

Buying on a centralized exchange favors convenience. Buying on-chain favors control.

| Method | Trade-off | How it Works |

|---|---|---|

| CEX | Easier fiat access, custody risk | Buy via INR or USD pairs, then withdraw to your own wallet |

| DEX | Permissionless, gas and slippage | Swap ETH or stablecoins for SUSHI via SushiSwap or Uniswap |

Always withdraw to self-custody after purchase.

Wallet and Storage Guidance

Active DeFi use

MetaMask or Rabby for multi-chain activity. Enable transaction simulation and approval warnings.

Long-term holding

Hardware wallets like Ledger or Trezor. Use a software wallet only as a signing interface if interacting with SushiSwap.

Basic safety

Revoke unused approvals after buying. Use multisig for positions above five figures. Bridge SUSHI across chains only through official Sushi-supported routes.

SUSHI works best when treated as a participation asset. Its value tracks protocol relevance, governance quality, and trading volume, not passive yield guarantees. If you plan to use SushiSwap regularly, holding SUSHI makes sense. If not, exposure adds complexity without a clear benefit.

SushiSwap vs Competitors (When to Choose What)

SushiSwap fills a specific niche in DeFi. Its strength is broad multi-chain coverage (26 networks) paired with advanced routing through SushiXSwap and LiFi. Where it sometimes gives ground is raw liquidity depth or gas efficiency on a single chain, especially Ethereum.

The comparisons below, grounded in 2026 conditions, highlight how these trade-offs play out across liquidity, fees, UX, and risk.

SushiSwap vs Uniswap

Two Leading AMMs With Different Community And Design Philosophies

Two Leading AMMs With Different Community And Design PhilosophiesUniswap remains the Ethereum AMM benchmark, with unmatched liquidity on ETH mainnet and major L2s. SushiSwap competes by offering wider chain coverage, routing flexibility, and tokenholder incentives.

| Aspect | SushiSwap | Uniswap |

|---|---|---|

| Best use cases | Cross-chain swaps and bridging, incentive-driven farming via Onsen, limit orders plus routing for optimized execution | High-volume ETH stablecoin trades, blue-chip LP positions, institutional-grade Ethereum liquidity |

| Liquidity differences | Strong depth on major pairs (e.g., ETH/USDC $100M+ pools); excels on Polygon, Arbitrum, Base; total multi-chain TVL spread $500M+ | Deepest liquidity on Ethereum (often $50B+ TVL historically); benchmark for low slippage on top ETH pairs |

| Fee and routing model | 0.3% default (0.25% LPs, 0.05% SUSHI stakers); Route Processor v2+ aggregates DEXs and bridges for ~10–20% better pricing on complex paths | 0.3% to LPs on V2; V3 tiers 0.01–1%; no native routing or staker cut, often paired with external aggregators like 1inch |

| UX and features | Unified dashboard for swaps, LPs, farms, and staking; V3 concentrated liquidity, limit orders, xSUSHI | Cleaner ETH-focused UX; advanced V3/V4 features (hooks, singleton); no native staking |

| Risk and governance | DAO-led governance with SUSHI voting; history of incidents but active audits and bug bounties | UNI governance with strong Uniswap Labs influence; long audit track record |

Verdict: Choose SushiSwap if you operate across multiple chains, value routing efficiency, or chase yield through incentives. Default to Uniswap if your activity is Ethereum-centric and you prioritize maximum depth, simplicity, and predictable execution.

SushiSwap vs PancakeSwap

Different Ecosystems Different Incentives And User Priorities

Different Ecosystems Different Incentives And User PrioritiesPancakeSwap dominates the BNB Chain with ultra-low fees and gamified yields. SushiSwap takes a different path, offering a chain-agnostic DEX with similar AMM mechanics and broader routing flexibility.

| Aspect | SushiSwap | PancakeSwap |

|---|---|---|

| Chain ecosystems | 26 networks including ETH, BNB, Polygon, and L2s; SushiXSwap unifies cross-chain execution | BNB Chain–first; limited depth elsewhere despite gradual expansion |

| Token availability | Aggregated routing pulls liquidity from many ecosystems; long-tail assets via farms and routing | Deep BNB-native tokens, memecoins, and NFTs; CAKE incentives anchor liquidity |

| UX focus | DeFi-native interface with multi-chain selectors, route previews, and advanced controls | Beginner-friendly UI with games, lotteries, and fast BNB confirmations |

| Fees and yields | ~0.3% plus gas (cheap on L2s); Onsen incentives vary by pool | ~0.25% with minimal gas; consistently high CAKE APRs |

| Liquidity depth | Competitive on majors across chains, but focus is spread | Market leader on BNB Chain with tight spreads on local pairs |

Verdict: Choose SushiSwap for chain-agnostic flexibility and advanced routing. Choose PancakeSwap if you are BNB-native and prioritize cheap execution and gamified yield.

Best Alternatives If SushiSwap Isn’t a Fit

These options serve distinct personas and use cases, without overlapping SushiSwap’s strengths.

- Beginner aggregator (simple swaps): 1inch Fusion auto-routes across hundreds of DEXs with MEV protection and gasless options through partners, removing most wallet and gas friction.

- Ethereum purist (maximum depth): Curve Finance specializes in stablecoins with ultra-low slippage and fees, pairing well with Uniswap for volatile assets.

- Solana speed-first traders: Jupiter offers sub-second execution and very low effective fees, ideal for high-frequency trading without Ethereum gas overhead.

- Yield optimizers (hands-off): Convex Finance or Pendle abstract away manual farming by auto-compounding rewards or tokenizing future yield.

- Perps and advanced trading: Hyperliquid or dYdX v4 provide order-book perpetuals with high leverage, suited for directional strategies beyond spot AMMs.

The bottom line is straightforward: SushiSwap shines as a versatile, multi-chain workhorse. Specialists win when you want depth, speed, or leverage in a single lane.

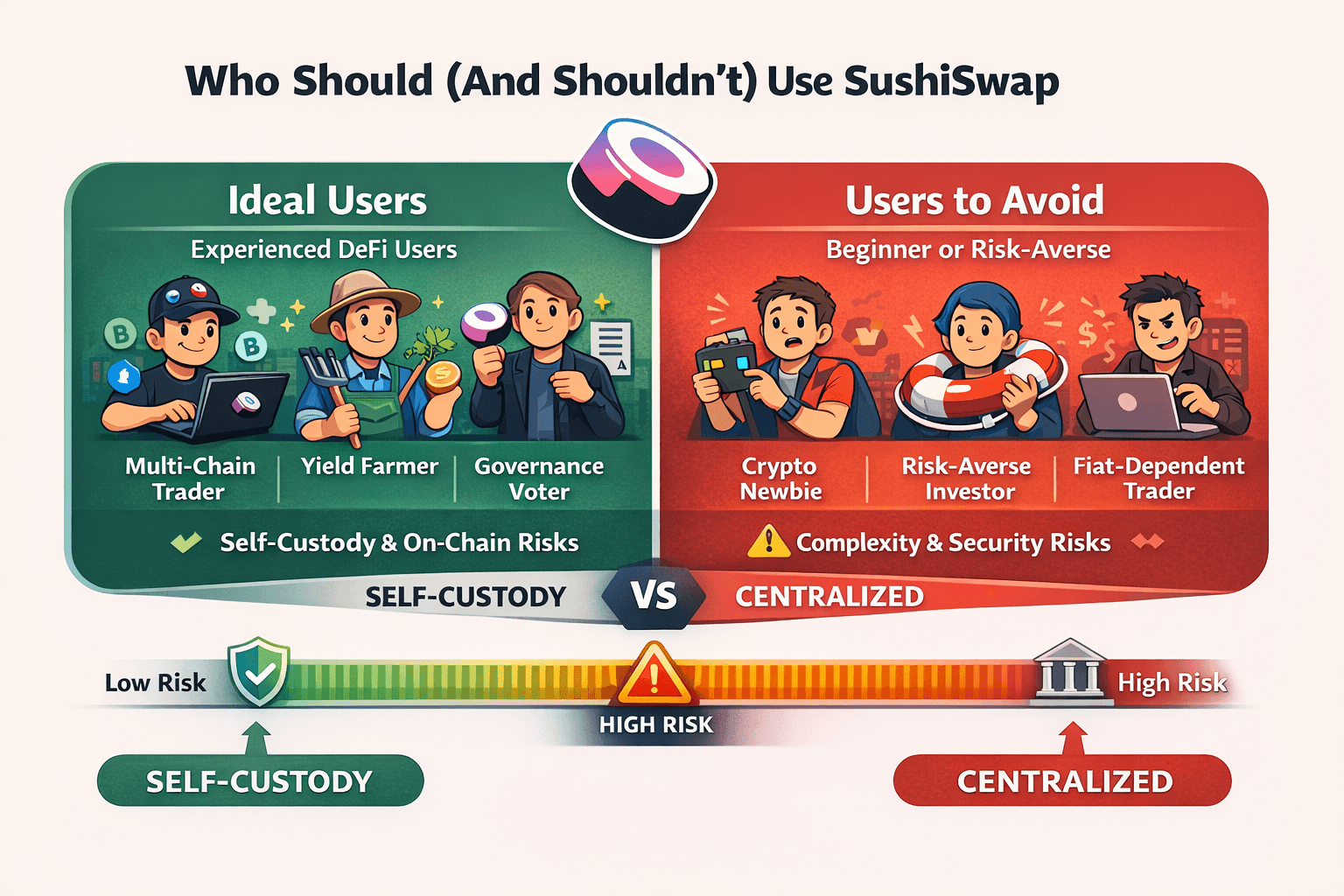

Who Should (And Shouldn’t) Use SushiSwap

SushiSwap is Best Suited For Experienced On-chain Users Managing Self Custody

SushiSwap is Best Suited For Experienced On-chain Users Managing Self CustodySushiSwap offers powerful tools for experienced DeFi users, but it assumes comfort with wallets, on-chain risk, and self-custody. The personas below reflect real usage patterns and help you decide quickly whether SushiSwap fits your skills and goals.

Ideal Users

These profiles align well with SushiSwap’s strengths in multi-chain routing, yield strategies, and governance.

- Multi-Chain Power Trader: Moves capital across Ethereum, Arbitrum, Polygon, and other ecosystems. Uses SushiXSwap and the Route Processor to optimize cross-chain paths, often landing 10–20% better execution on complex routes. Comfortable managing gas, slippage, and explorer-level verification.

- Active Yield Farmer/LP Strategist: Deploys into V3 concentrated liquidity ranges, Onsen farms, and xSUSHI for compounding returns from fees and incentives. Understands impermanent loss, rebalances positions regularly, and tracks performance through tools like Zapper or DeBank.

- SUSHI Governance Participant: Accumulates SUSHI to vote on Snapshot or on-chain proposals covering incentives, expansions, or treasury usage. Follows forum discussions and aligns capital with long-term protocol direction rather than short-term yield alone.

- DEX Aggregator User: Uses SushiSwap as a unified interface for swaps, limit orders, and exotic routes instead of juggling multiple apps. Values permissionless access, avoids centralized KYC, and prefers privacy-focused trading.

Users to Avoid

If you identify with these profiles, SushiSwap’s self-custody model and complexity can amplify mistakes.

- Wallet or Blockchain Novice: New to MetaMask, gas fees, approvals, or slippage. More vulnerable to phishing or signing malicious transactions. Better starting points are centralized platforms like WazirX or Coinbase.

- Ultra Risk-Averse Investor: Expects FDIC-style protection, reversibility, or guaranteed recovery. Smart contract risk, impermanent loss, and MEV exposure mean SushiSwap offers no safety net for conservative capital.

- Fiat-Dependent Casual Trader: Relies on instant bank deposits and withdrawals. SushiSwap has no native fiat rails, making centralized spot exchanges such as Binance a better fit for day-to-day INR or fiat-based trading.

- High-Frequency Scalper or Day Trader: Needs sub-second execution and consistently tight spreads. On-chain latency and MEV make AMMs inefficient for this style. Platforms like Bybit or regulated brokers are better suited.

Conclusion

SushiSwap has matured into a flexible, multi-chain DeFi toolkit rather than a one-chain liquidity giant. Its real strength lies in routing complexity, ecosystem reach, and optionality. For users who understand self-custody, approvals, and on-chain tradeoffs, SushiSwap offers meaningful advantages: better execution across chains, diverse yield paths, and a governance layer that still matters. It does not try to be the simplest or safest option. It tries to be useful where fragmentation and complexity already exist.

At the same time, SushiSwap is honest about its limits. It trades depth on a single chain for breadth across many. It trades simplicity for control. That makes it a strong fit for DeFi-native users who want flexibility and are willing to manage risk themselves, while remaining a poor fit for beginners or capital that demands guarantees. If you know why you’re here and what you’re giving up, SushiSwap can be a powerful ally. If not, there are calmer waters elsewhere.