SwissBorg is a blockchain-based wealth management platform that provides its users with the infrastructure and tools to manage their cryptocurrency investments more efficiently. It is a platform that we have been fans of for a while and are looking forward to providing our readers with this SwissBorg review to show you what a powerful crypto investment platform this is.

The project’s aim in creating this easy-to-use platform is to assist users in navigating the new financial field of cryptocurrencies. The founders of SwissBorg saw a need for such a platform in order to overcome the sometimes complex nature of cryptocurrencies and the scattered infrastructure and tools that haven’t found any standardization yet.

In the following review, we will take a deep dive into the SwissBorg app, the SwissBorg token (BORG), and investigate what problems it attempts to solve, how it is going about doing that, and the pros and cons of the platform, among other things.

Editor's note: We refreshed this SwissBorg review in February 2026 to reflect how the platform works today. This update adds a clearer breakdown of SwissBorg’s core product stack (Earn, Bundles, Launchpad), updates the fees section with more practical detail (including the 0.99% headline exchange fee and how cashback can reduce real costs by loyalty rank), and updates the BORG token coverage.

SwissBorg App Summary:

The SwissBorg app is engineered in Switzerland. SwissBorg has offices in Estonia, France and Portugal

| Year Established: | 2017 |

| Regulation + Licenses: | Virtual Currency Service License-Estonia Registered as a PSAN by the AMF- France Regulated by VQF- Switzerland 2 licenses for GDPR requirements on data protection |

| Spot Cryptocurrencies Listed: | 400+ |

| Native Token | SwissBorg Token. Previously CHSB, now BORG |

| Fees: | Deposit Fees: None Withdrawal Fees from your account are subject to an execution fee of 0.1%, with a minimum fee per currency, here are a few examples: BTC- 0.00006 ETH- 0.0005 BORG- 17 Exchange fees: 0.99% with up to 99% returned as a cashback Fiat and crypto withdrawal fees are highly variable, See the SwissBorg Fees page for a detailed breakdown. |

| Security: | High: Cold storage best practices, MPC cryptography, stress tests, Fireblocks partnership. |

| Beginner-Friendly: | Yes |

| KYC/AML Verification: | Required |

| Fiat Currency Support | EUR, CHF, GBP, CAD, CZK, DKK, HKD, ILS, NOK, PLN, RON, SGD, ZAR, SEK, AED, USD |

| Deposit/Withdrawal Methods: | Fiat Deposits/Withdrawals: Bank card, Bank Transfers (SEPA/ SWIFT) Crypto deposits/Withdrawals |

Review: What is SwissBorg?

The SwissBorg project is the brainchild of founders Anthony Lesoismer and Cyrus Fazel. The two initially raised $53 million and another $21.3 million from their community to back the project and then launched at the height of the 2017 cryptocurrency rally in December. SwissBorg became one of the top European crypto exchanges with impressive growth in 2021, with their native BORG token reaching “Unicorn Status,” hitting the coveted 1 Billion dollar market cap milestone.

SwissBorg is so much more than a crypto exchange. It is a multi-utility powerhouse of a crypto investing platform that provides users with everything they need to invest in digital assets and manage their crypto portfolios with ease, which is why it was also featured in our Top 5 CeFi Platforms for Earning Yield article.

SwissBorg is engineered in Switzerland, making it a popular European crypto exchange. It has team members spread all across the globe, counting members from over 20 countries as part of its multi-cultural and multi-disciplinary team which is currently made up of thousands of employees from all walks of life.

A Look at the SwissBorg Homepage

A Look at the SwissBorg HomepageSwissBorg is a blockchain-based secure wealth management platform for cryptocurrency investments. It is the very first of its kind, and its aim is to simplify the process of investing in cryptocurrencies. It does this in a number of ways, including integrating with the major cryptocurrency exchanges, DeFi protocols, and featuring a community-based ownership model.

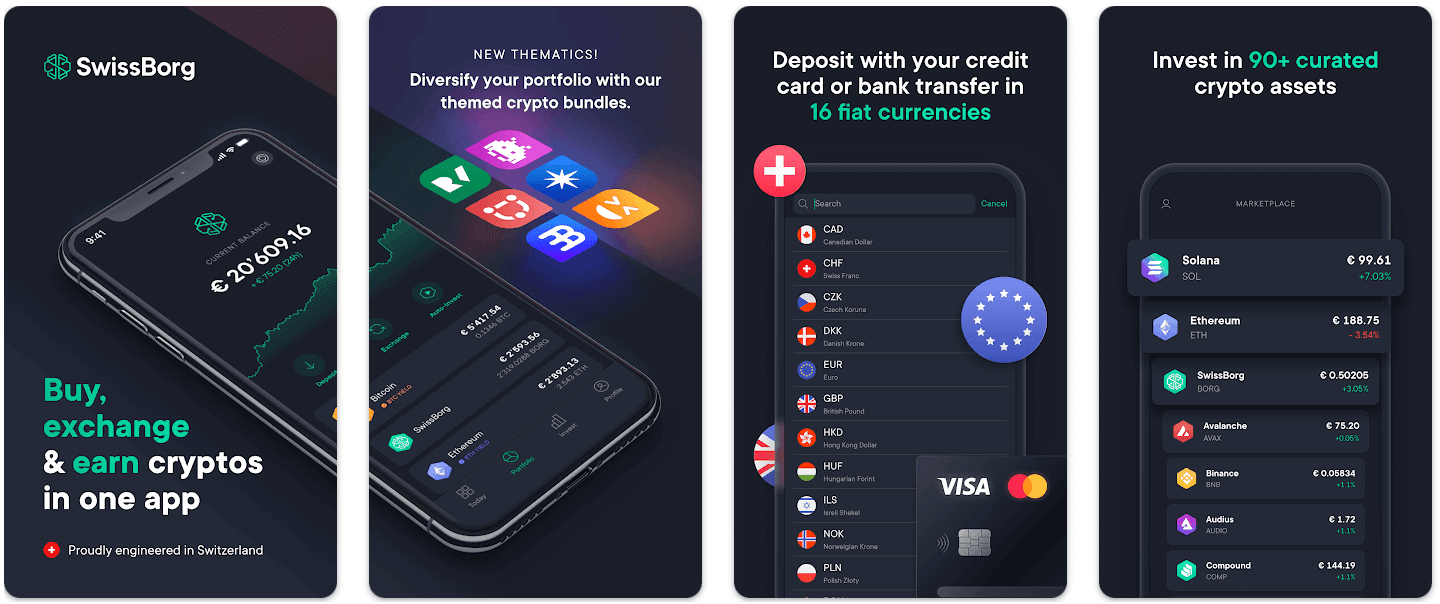

In addition to the desktop platform, there is also the award-winning SwissBorg app, which is available for iOS and Android devices, making the process of accessing the platform far easier. The accolades achieved by the SwissBorg team are quite impressive, not just in terms of growth and adoption, but take a look at the 4.5-star ratings for the app, along with receiving the Mass Adoption Project of the Year award, and the Top Swiss Fintech Startups award.

SwissBorg Puts my Participation and "Thanks for Trying," Trophies to Shame

SwissBorg Puts my Participation and "Thanks for Trying," Trophies to ShameThe top achievements of the project include its successful $53 million fund-raising effort, the creation of a large community, hitting a $1B valuation, the launch of two successful apps, the creation of the massively popular Earn wallets, the rollout of the first-of-their-kind Crypto Bundles and equity raising Launchpad, the Series A round, the community-led initiatives, and the high adoption of both the platform and the native SwissBorg token (BORG).

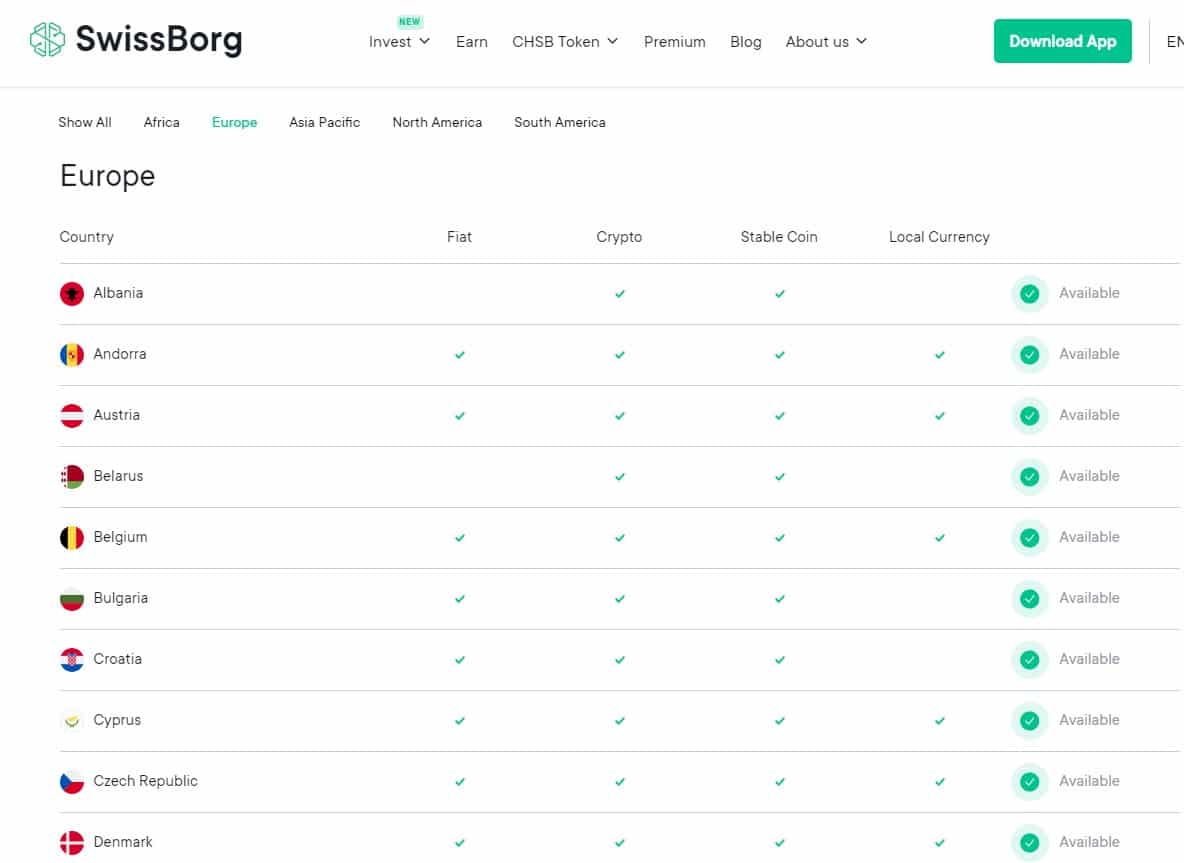

Currently, SwissBorg can be used in 68 countries around the world, and they have plans for the inclusion of many more in the future. One thing to consider is that residents of some countries cannot access the full range of SwissBorg features. You can see if your country is included and what is supported by visiting the Swissborg Supported Countries page.

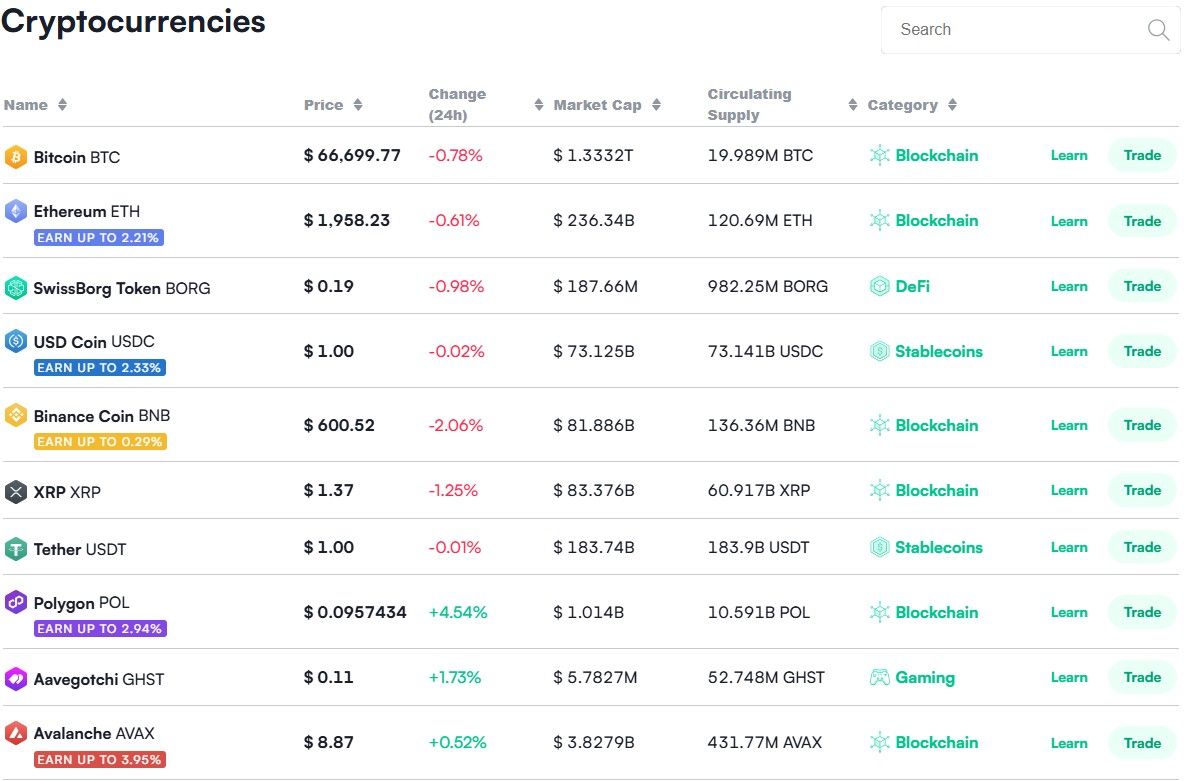

A Good List of Diverse Asset Support. Image via SwissBorg

A Good List of Diverse Asset Support. Image via SwissBorg One notable exclusion from the list is the United States. Investors in the U.S. are unable to open an account with SwissBorg or use their Wealth App due to the stringent financial regulations in the U.S.

SwissBorg Team

SwissBorg calls itself “a team of finance and technology experts dedicated to improving the crypto industry by making it fun, fair and meaningful for all.”

While the SwissBorg website only shows the nine top members of the team, including its two founders Anthony Lesoismer and Cyrus Fazel, it goes on to say that the full team spans 20 different countries. Many of the SwissBorg team members bring years of experience in portfolio management and financial advisory services to the table. Many of them have also graduated from some of the top business schools in Europe.

The Swissborg Motto

The Swissborg MottoCyrus Fazel is one of the founders of SwissBorg and acts as its CEO. Cyrus is a multicultural fintech professional with more than a decade of experience in asset management and algorithmic trading. Prior to founding SwissBorg, he was Head of Investment Management platform & Senior Hedge Fund Advisor at SEQUOIA Asset Management SA.

In addition to his role at SwissBorg, Cyrus is also the co-head of Disruption Disciples, a decentralized global collective of innovators and technology enthusiasts united by shared values and the desire to build a better world together with the help of exponential technologies. Via local meetups and international gatherings, continued thought exchange and collaborations, they explore and develop creative solutions to pressing issues.

Anthony Lesoismer is the other co-founder of SwissBorg and its CSO. Prior to founding SwissBorg Anthony was Head of Financial Market Digital-Advisory at JFD Brokers.

On the technical side of things, the CTO is Nicolas Remond, an experienced software engineer. After obtaining his Masters of Science in Computer Science from Ecole Nationale supérieure des Mines de Paris he went on to several roles in creating and designing software.

Looking at the overall team it’s clear they have extensive experience in finance and investing, and considering their growth and success, not to mention impressive roadmap rollouts and features to come, it would appear that they have the right talent in the right places. You can learn more about the team on SwissBorg’s About us page.

SwissBorg App Key Features

The SwissBorg app is the center of the platform, allowing users to create and manage their crypto portfolios, buy and sell crypto, earn yield, and more. It is an easy and intuitive way to manage your crypto-wealth.

Crypto Bundles

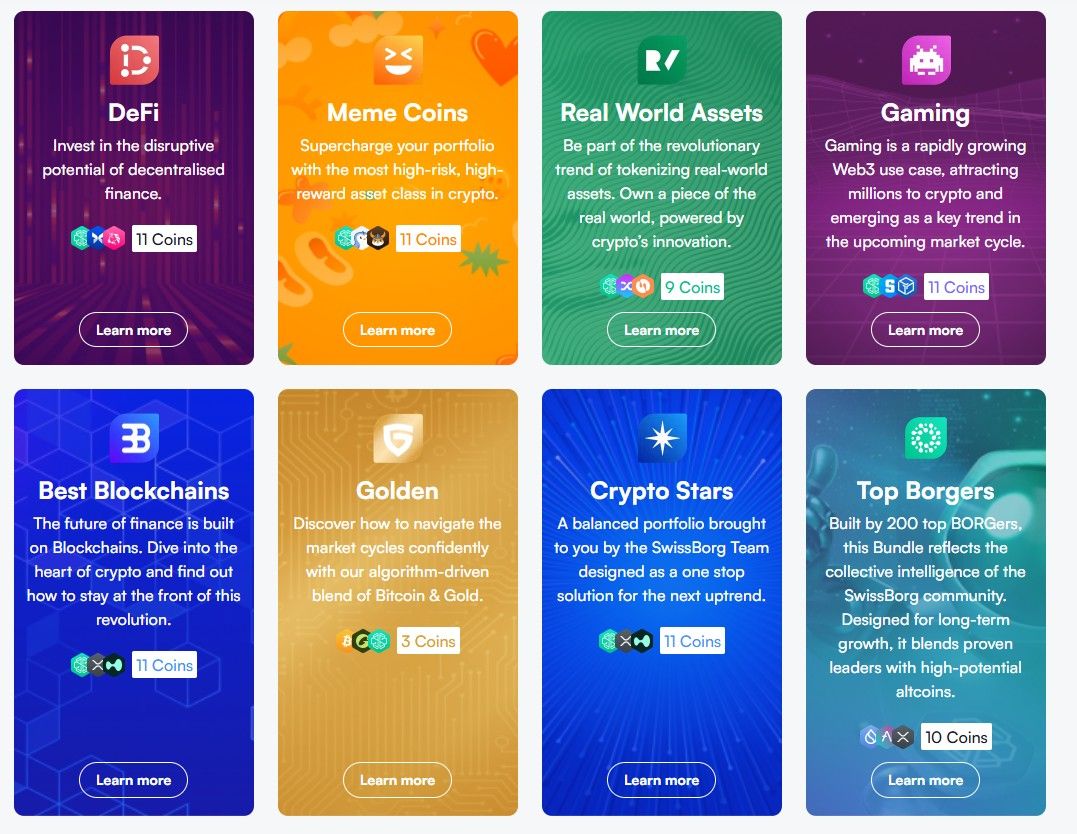

The Crypto Bundles section has established itself as a flagship offering on SwissBorg, a truly original investment product that remains rare in the broader crypto ecosystem.

SwissBorg Crypto Bundles

SwissBorg Crypto BundlesCrypto investing can sometimes feel like being blindfolded while trying to throw darts at a moving dartboard. Let SwissBorg do the guesswork for you and let their expert-designed bundles provide the type of crypto exposure and diversification that is important for every crypto investor.

The bundles that investors can choose from will follow themes, providing investors with "one-click" diversified exposure to trends in Web3. Investors can simply select a theme that they have long-term belief in, and the SwissBorg app will automatically provide exposure to the top projects in that niche. And that isn't even the best part, the Thematics portfolio will also automatically rebalance allocation and adjust depending on market conditions to ensure continual proper diversification and exposure.

Choose From Pre Selected Crypto Bundles

Choose From Pre Selected Crypto BundlesThe first Thematic available is the Web3 bundle, providing investment allocation to projects like Eth, Matic, Polkadot, Mina, Secret, and others. In July 2023, SwissBorg launched their second, the Golden Thematic, which provides investors with the upside potential of Bitcoin, and the protection provided by gold during times of volatility to the downside.

I am not sure what future bundles will be available yet, but I imagine you could select things like metaverse themes which would give you exposure to projects like Decentraland and the Sandbox, or perhaps bundles that are focused on digital identities, blockchain storage space, or web3 hosting. I guess we will wait and see.

Personally, I'd like to see a bundle of layer one protocols that would contain a basket of layer one networks like Ethereum, Cardano, Solana, Avalanche etc. that would automatically rebalance and reallocate. That would make my life as a crypto investor so much easier.

One of the reasons that this product is so revolutionary, is that in traditional finance, active portfolio management is common practice and is done through Portfolio Managers and Financial Planners that can generally only be afforded by the wealthy. This is an incredible feature and just highlights further why I love the crypto industry. Services like these are not available to the average retail investor in the traditional financial industry.

If you're interested to know more about SwissBorg's Thematics products, as well as future plans, head over to our full Thematics review.

SwissBorg Earn

SwissBorg Earn is still one of the main reasons people stick around. Let’s be honest: earning yield on crypto you already plan to hold is one of the few “set it and forget it” wins in this industry.

With SwissBorg Earn, you can deposit supported cryptocurrencies and stablecoins and start generating yield with daily payouts that are automatically compounded. What makes it feel genuinely beginner-friendly is how SwissBorg wraps the complexity into a clean interface: each yield strategy comes with a clear risk label (low, medium, high), and the app shows estimated annual yields at a glance, so you’re not forced to decipher DeFi jargon just to understand what you’re opting into.

Behind the scenes, these yields are produced using different on-chain strategies and partners, but the user experience stays simple: you can typically withdraw within 24 hours, and rates are optimized daily (with yield figures often based on recent performance, such as a 30-day average). In short, it’s an easy way to access yield opportunities without manually hopping between protocols, bridges, and dashboards, while still being able to choose how much risk you’re comfortable taking.

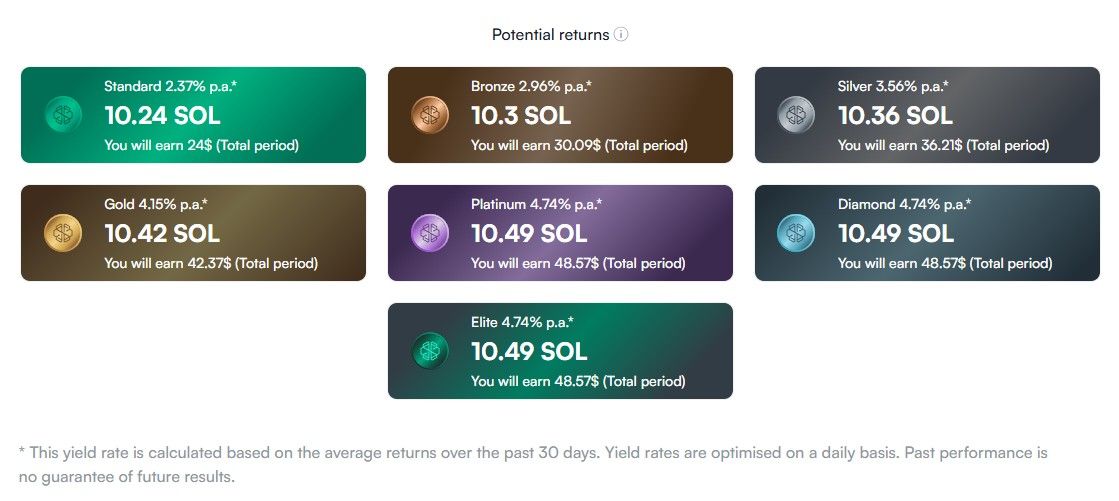

A Look At Potential Returns of SwissBorg Earn

A Look At Potential Returns of SwissBorg EarnSwissBorg Earn covers 30 assets and yield strategies, with rates that vary by both the asset/strategy and your loyalty tier (Standard through Elite).

Yields span everything from low single-digits on more conservative options, like SOL Kyros (about 2.17% to 4.33% p.a.) and ETH Lido (about 1.34% to 2.68% p.a.), to double-digit strategies such as GRT Smart Yield (about 8.34% to 16.67% p.a.).

And if you’re willing to take on higher risk, some strategies go much further, with examples like BORGY Farming (about 19.53% to 39.05% p.a.) and JTO Kyros (about 17.48% to 34.97% p.a.) showing how wide the range can get.

You can find the current rates on the SwissBorg Earn page.

SwissBorg Earn executes a multi-pronged approach to passive crypto earnings by providing users with access to a variety of products with varying degrees of interest rates and risks, with something suitable for all risk appetites. Users can access DeFi protocols like Aave, Curve, and perform liquid staking on Lido, or can simply stake or lend.

If you aren't sure which Earn product is right for you, SwissBorg can help you determine a suitable balance between risk and reward for you. The Earn products are broken down into three risk levels: Low, Medium, High.

SwissBorg Launchpad

SwissBorg has been busy on the product front, not only launching the first-of-its-kind Crypto Bundles, but also a first-of-its-kind multi-asset launchpad.

Image via Swissborg launchpad

Image via Swissborg launchpad The SwissBorg Launchpad is democratizing wealth management and providing the average retail investor with opportunities that were traditionally only reserved for the wealthy elite and those with deep pockets or friends in high places. It is too early to tell the impact that this could have on the future of investing, but I would not be surprised if the SwissBorg's Launchpad goes down in the history books as potentially the first real "stake in the ground" moment that created a fair and equal platform for early round investing.

Image via SwissBorg

Image via SwissBorgNot only is SwissBorg "talking the talk" by offering this launchpad, but they also "walked the walk," with the first launchpad product going live being their very own Series A Equity round, inviting SwissBorg users to invest and share in the future success of SwissBorg.

I think SwissBorg themselves capture the idea of the Launchpad the best with the following statement:

We are proudly breaking up the entry barriers of venture capital firms, investment banks and accredited investors. We are reimagining the investment landscape of the future and placing the power of ownership back in the hands of individuals. This is the next step in our Web3 revolution.

Definitely could not have said that better myself. Isn't that one of the main drivers that brought us all into the world of crypto in the first place?

The Launchpad will give SwissBorg users access to exclusive investment opportunities such as private equity raises to IDOs, ICOs, etc. I don't know if you have ever tried participating in an IDO, but it isn't easy. Having a simple platform to access multiple opportunities is fantastic.

SwissBorg Benefits Plans

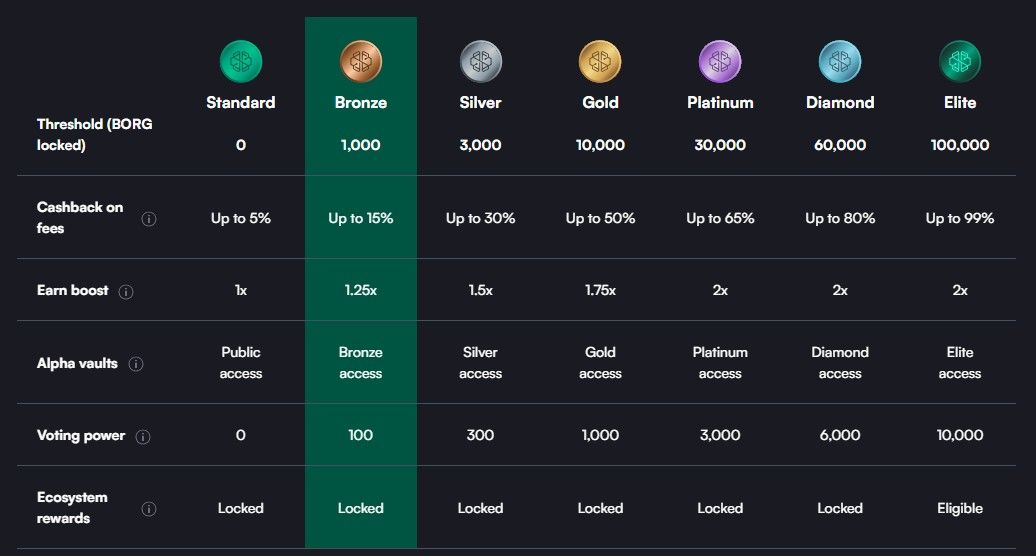

Similar to exchanges like Binance and KuCoin, or CeFi platforms like Nexo, SwissBorg has a tiered membership structure which unlocks certain perks and benefits on the platform.

A Look at SwissBorg Ranks

A Look at SwissBorg RanksSwissBorg’s rewards system is built around Loyalty Ranks. The idea is simple: lock BORG to level up your rank, and higher ranks unlock bigger perks across the app, including boosted Earn yields, priority Alpha access, and a much clearer fee advantage via cashback on trading fees.

The big quality-of-life change is the locking mechanics. Instead of a long, rigid lock-up, BORG locking now uses a 14-day cooldown when you choose to unlock. That makes it far easier to join, test the system, and climb without committing to a year-long freeze. It also means your rank is more flexible: if you unlock BORG and your rank drops, you lose the associated benefits.

Ranks are tied directly to how much BORG you lock, with clear thresholds that make progression feel far more realistic than the old “massive leap” structure. The ladder looks like this:

- Standard: 0 BORG

- Bronze: 1,000 BORG

- Silver: 3,000 BORG

- Gold: 10,000 BORG

- Platinum: 30,000 BORG

- Diamond: 60,000 BORG

- Elite: 100,000 BORG

The perks scale in a way you can actually feel. For example, trading fees are softened through the “Paid to Trade” system, where you receive cashback in BORG based on your rank, distributed weekly and automatically credited to your locked BORG balance. Cashback ranges from up to 5% at Standard, rising through the tiers, and up to 99% at the very top end of Elite. Alongside that, Earn strategies can get an Earn boost multiplier (e.g., 1x at Standard, scaling up to 2x at the higher ranks), plus increasing governance influence: every 10 BORG locked = 1 vote.

Loyalty Ranks is a cleaner, more transparent system built around locked BORG, with perks that are much easier to understand at a glance. The headline upgrades are hard to argue with too: the standard exchange fee drops to 0.99%, the old 12-month lock becomes a 14-day cooldown, and the new “Paid to Trade” idea turns activity on the app into something that actually pays you back. Smart move

SwissBorg explains the reason for the additional tiers being put in place and all the additional benefits which serve to help the community.

Yes, higher ranks unlock bigger perks: more cashback on fees (paid weekly in BORG), boosted Earn multipliers (up to 2x), priority Alpha access, and governance rewards, with voting power tied directly to how much BORG you lock (10 BORG = 1 vote). But the higher you climb, the more you’re concentrating exposure into a single utility token. Platinum, Diamond, and Elite require locking 30,000 / 60,000 / 100,000 BORG, which is not exactly pocket change, and it’s a level of conviction not everyone should assume on day one.

The other practical trade-off: locked BORG is locked. You can unlock it, but there’s a 14-day cooldown, and if unlocking drops your rank, you also lose the associated perks. Meanwhile, the cashback you earn is automatically credited into your locked BORG account, which is great for compounding your rank over time, but it also reinforces that “more BORG, more exposure” loop.

So where do the higher ranks make the most sense? Typically for people who are already active on the platform. If you’re trading regularly, using Earn strategies, and care about Alpha allocations, the system can become a flywheel: cashback refunds part of your fees in BORG, that BORG is auto-locked, and your rank (and perks) can improve over time. If you’re not that active, locking a huge chunk of BORG just to chase perks can be overkill.

The nice part is you don’t need to be a whale to get meaningful value. Even Standard now comes with lower baseline fees and up to 5% cashback, and the early ranks (Bronze/Silver/Gold) create a much more realistic on-ramp than the old “giant leap” structure. In other words: the ladder is better built now, but you still want to pick your rung based on how you actually use SwissBorg, not how shiny the top badge looks.

SwissBorg Exchange Smart Engine

SwissBorg’s Smart Engine is the brains behind the app’s “best execution” promise. Instead of making you hop between venues comparing prices, it routes your swap for you, pulling liquidity from over 10 centralised and decentralised exchanges (including Binance, Kraken, and Orca) and even executing directly on-chain via networks like Solana and Avalanche to secure the best available price at the moment you trade.

The Smart Engine doesn’t just match you to existing markets, it can create the route for pairs that don’t normally exist on a single exchange. That’s how SwissBorg offers thousands of unique crypto-to-fiat combinations, handling the conversions behind the scenes so you can swap pairs like EUR to BORG (or pretty much any fiat-to-crypto combo) in a few taps, without needing multiple accounts across multiple platforms.

And crucially, it’s not a black box. SwissBorg backs this up with a Smart Exchange Report, giving you a transparent breakdown of how your exchange was executed, step by step, so you can review the route, pricing, and details of each swap instead of just trusting “best rate” on vibes.

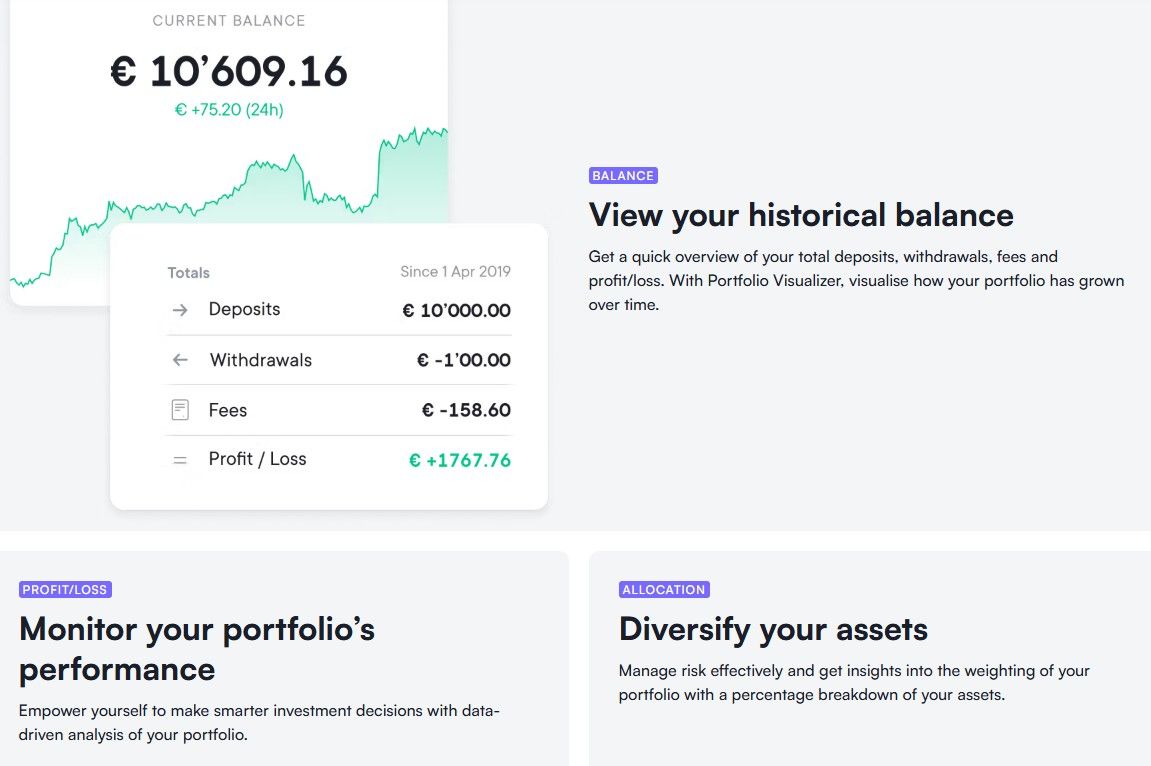

SwissBorg Exchange AI Portfolio Analytics

The SwissBorg app continuously analyzes the assets supported, and through its deep learning algorithms, users are able to gain a better insight into their own portfolios and the tokens they are interested in. This includes analyzing a user’s overall performance, and highlighting personal ROI for unrealized and realized gains.

Powerful Analysis Capabilities Built Right Into the App

Powerful Analysis Capabilities Built Right Into the AppThe app also provides users with hourly asset analysis which is great for traders as it shows sentiment and technical analysis metrics and indicators via SwissBorg’s Cyborg Predictor, the SwissBorg indicator, community sentiment, and support and resistance.

The Cyborg Predictor uses machine learning that can help forecast an asset’s movement, combining a mix of historical data and technical indicators. This is complemented by the SwissBorg indicator which combines the most popular technical indicators, helping traders understand the strength of a market at a glance.

The Community Sentiment indicator is based on volume of transactions in the SwissBorg app over a 24-hour period, and the support and resistance indicator automatically highlights key levels to watch out for.

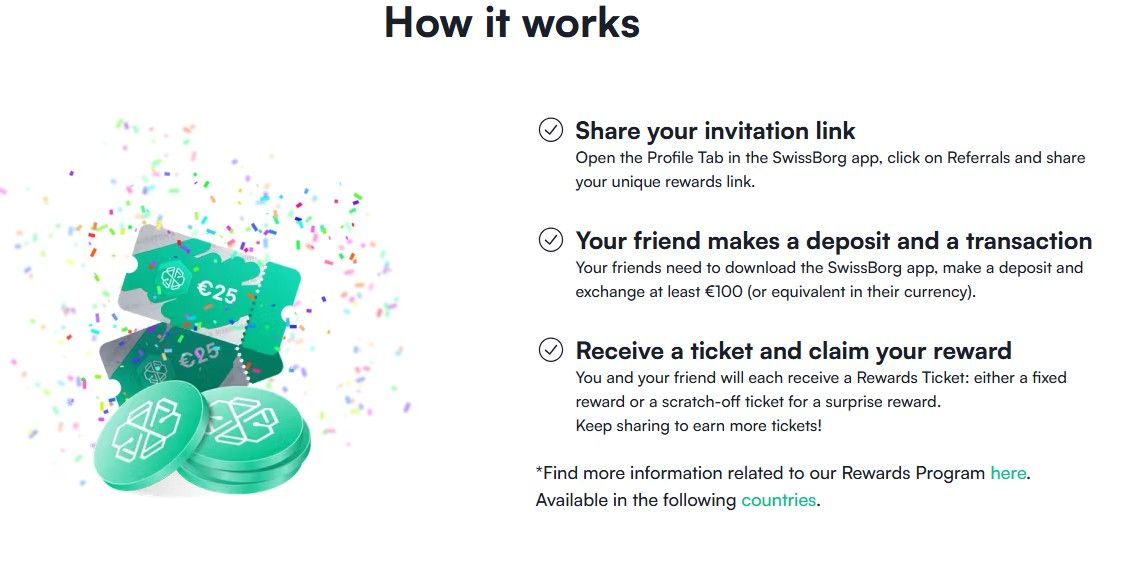

SwissBorg Rewards Program

The SwissBorg Rewards Program is a referral program that allows users to invite their friends and earn crypto in the process. Every successful invite earns the user and their friend a Rewards Ticket valued from €1 to €50 in BTC. The process is quite simple:

SwissBorg Rewards Program

SwissBorg Rewards Program- STEP 1: Share your invitation link by opening the profile tab in the SwissBorg app and sharing the unique rewards link.

- STEP 2: Your friend downloads the SwissBorg app and makes an exchange of €10 or more (or equivalent in their currency).

- STEP 3: Both the user and the friends receive a rewards ticket and can claim their BTC reward. Then keep sharing to earn more tickets and rewards.

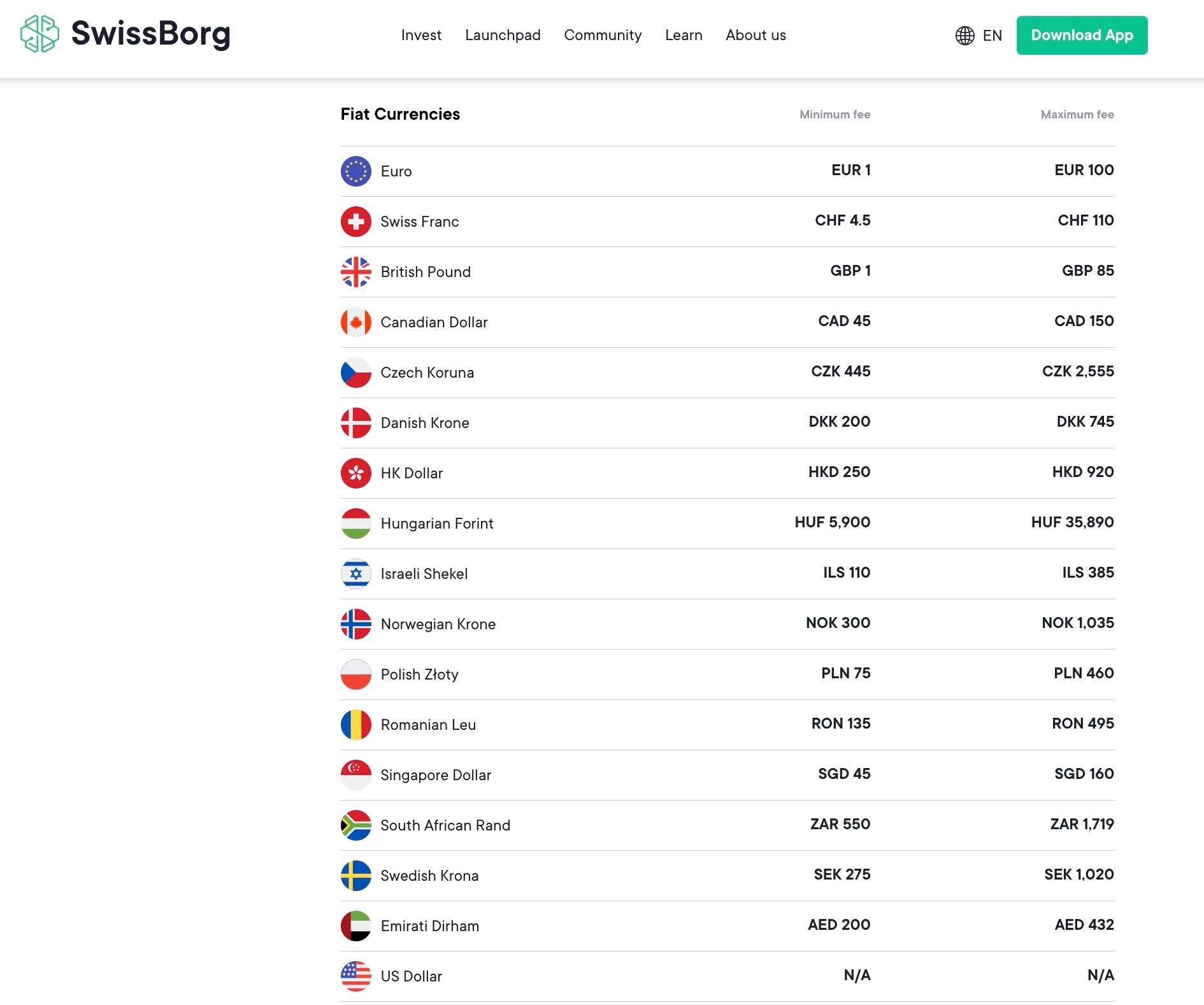

SwissBorg Fees

It seems that almost every platform in the crypto industry promises no fees or low fees, but they rarely provide any transparency to back up their claims. SwissBorg fees are among the most transparent in the crypto industry. The team provides a comprehensive breakdown of SwissBorg’s fees which can be found easily on their site, and all fees are well highlighted at the moment of exchange.

This allows users to always be certain of their costs and allows them to compare to be sure they are getting the best exchange rates available at all times. As mentioned in the Smart Engine section, SwissBorg does not charge a spread which is awesome, and there are no inflated exchange rates which is also fantastic.

Anyone in the crypto game can tell you how frustrating it can be when some platforms use inflated exchange rates and floating spreads that seem to conveniently and suspiciously spike at the very second you make a purchase… The number of times I’ve purchased X amount of crypto on other platforms, pay the expected fees and receive significantly less is one of the reasons I started using SwissBorg.

SwissBorg fees are non-existent for deposits, but crypto withdrawals will see fees in the form of network fees, and SwissBorg charges the following withdrawal fees on top of the network fees for some of the major cryptocurrencies:

Here is a look at SwissBorg fees for fiat withdrawals:

SwissBorg's Fiat Withdrawal Fees. Image via Swissborg

SwissBorg's Fiat Withdrawal Fees. Image via SwissborgThe fee structure provided by Swissborg in 2023 is an improvement over the last time we covered their platform as there are now more fiat currencies supported and crypto withdrawals could only be made in Bitcoin, Ethereum, or SwissBorg Token. 👌

Exchange fees are charged on pairs where the higher fee of the 2 currencies in a pair is used to calculate the fee. SwissBorg automatically adjusts the gas amount to ensure transactions are executed without delays or failure. The fees on SwissBorg are relatively low, but vary greatly depending on things like loyalty tier, and which fiat or crypto asset is being used. You can find a full detailed breakdown on the SwissBorg Fees page.

SwissBorg KYC and Account Verification

SwissBorg follows rules and regulations with regards to KYC and AML. SwissBorg has several account levels with different transaction limits, these levels require different levels of KYC/AML approval. The following levels are:

- Level 1- Proof of Identity: Cumulated deposit limited to EUR 5,000, cumulated withdrawals limited to EUR 5,000

- Level 2- Proof of Residence: Cumulated deposits limited to EUR 50,000, cumulated withdrawals limited to EUR 1,000,000

- Level 3- Proof of Funds: Deposits unlimited, withdrawals unlimited. Only available when cumulated deposit reach EUR 30,000(or when prompted by a SB agent)

Level 1 approval takes place when a user submits proof of identity, while levels 2 and 3 will be prompted when the user hits the deposit or withdrawal limits.

Here are the steps users will need to follow to complete KYC:

- Tap the profile icon in the top-left corner of the SwissBorg app

- Tap Account Level

- Tap the Verify button

- Submit the required documents to complete your verification.

For level 1, identity documents can be a passport, government-issued ID card, residence card, or driver’s license. Account verification is normally automatic and can be done in about two minutes. Stats show that over 60% of accounts have the KYC automatically approved within a few minutes, with other cases taking between 24-48 hours for manual verification.

As these limits and levels can change periodically, be sure to check the SwissBorg KYC page for the most up-to-date information.

SwissBorg Security

Because SwissBorg understands the dangers presented by hackers, they place the security of the platform and the safety of users’ funds as a top priority. Because of this, they have invested heavily in security practices, including MPC cryptography and platform stress tests.

Multi-Party Computation (MPC) keyless technology is considered highly secure as it does not require a private key to be created, therefore, it cannot be compromised. This eliminates a single point of failure, enhancing the security of the platform. MPC works by multiple parties jointly performing mathematical computations, without one party revealing its information to another party. This is where Fireblocks comes in.

SwissBorg has chosen Fireblocks as a partner in security as they are widely respected and known for being the most secure and flexible platform that uses multiparty computation technology to secure digital assets. As a result, the SwissBorg app is stable and strong, and remains safe from both hackers and bugs, ensuring user funds are secure.

Cryptocurrencies Available on SwissBorg

SwissBorg supports over 400 different cryptocurrencies and 16 different fiat currencies.

A Good Mix of Supported Assets

A Good Mix of Supported AssetsThey are adding new assets all the time and have ongoing votes on which other assets should be included in their app. Take a look at the SwissBorg supported assets page for a full breakdown.

SwissBorg Exchange Platform Design and Usability

Users will find the dashboard to be quite intuitive, but also extremely powerful. It is incredibly beginner-friendly, well laid out, and simple to navigate, really taking the guesswork out of the process of cryptocurrency investing.

The team also did a great job in the token descriptions, each token listed on the app has a well-built-out explanation of the token itself, the project, and its eco-friendliness so crypto investors can find out a lot about a token before investing in it.

A Look at the SwissBorg App. Image via Google Play

A Look at the SwissBorg App. Image via Google Play One of the top attraction points to SwissBorg is just the ease of use and beginner-friendliness. The app is so intuitive and easy to use, I’ve often felt that the key to onboarding the masses lies in a well-functioning UI/UX and the SwissBorg app does that brilliantly.

New assets and features are added regularly, the SwissBorg team is quite innovative.

Deposits and Withdrawals at SwissBorg

The platform is quite flexible, allowing users to fund their SwissBorg accounts using 16 different fiat currencies, including USD, EUR, and GBP. Withdrawals are easy and since the SwissBorg banking partners belong to the SEPA and the Faster Payments network, bank transfers can be completed in as little as 5 minutes. Bank transfers (SEPA/ACH), bank card, and crypto deposits/withdrawals are currently supported.

SwissBorg Token BORG: Uses and Performance

BORG is SwissBorg’s ecosystem token, and it’s woven into pretty much every meaningful perk on the app: Loyalty Ranks & cashback, Earn yield boosts, governance voting, and access to exclusive deals.

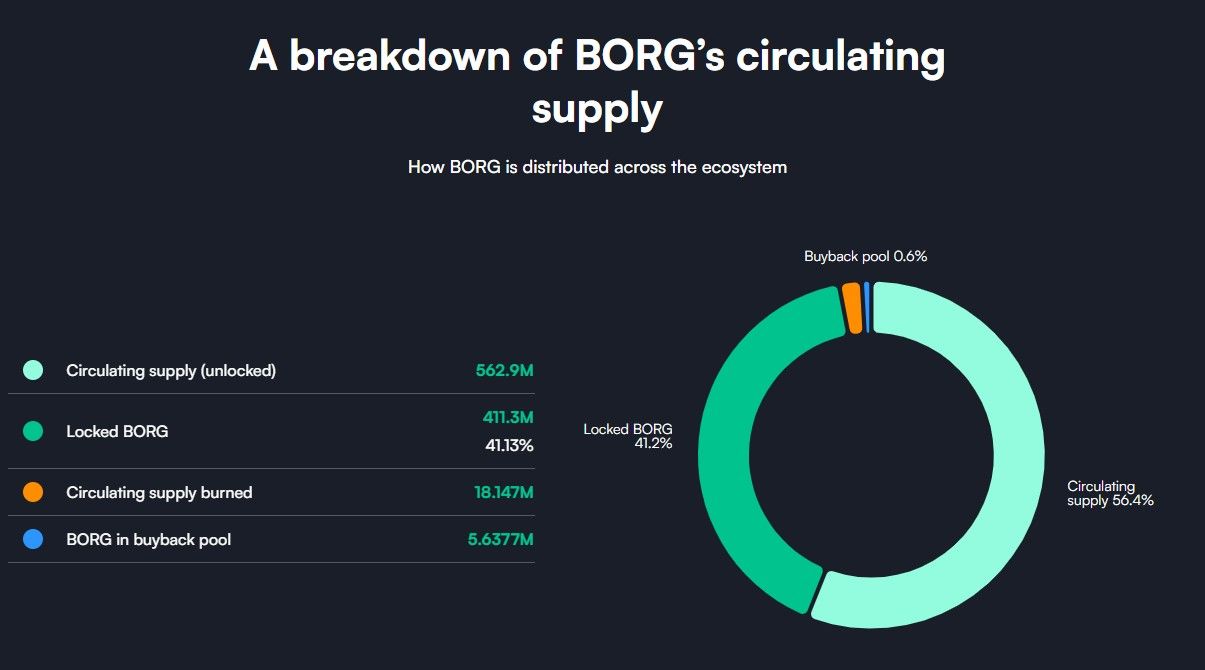

On the numbers side, SwissBorg’s own dashboard puts circulating supply at ~982.25M BORG, with the circulating supply broken out as roughly 562.9M unlocked, 411.3M locked (41.13%), ~18.147M burned, and ~5.6377M sitting in the buyback pool. That’s a meaningful chunk of the supply effectively taken off the table via locking, which can influence liquidity and sell pressure.

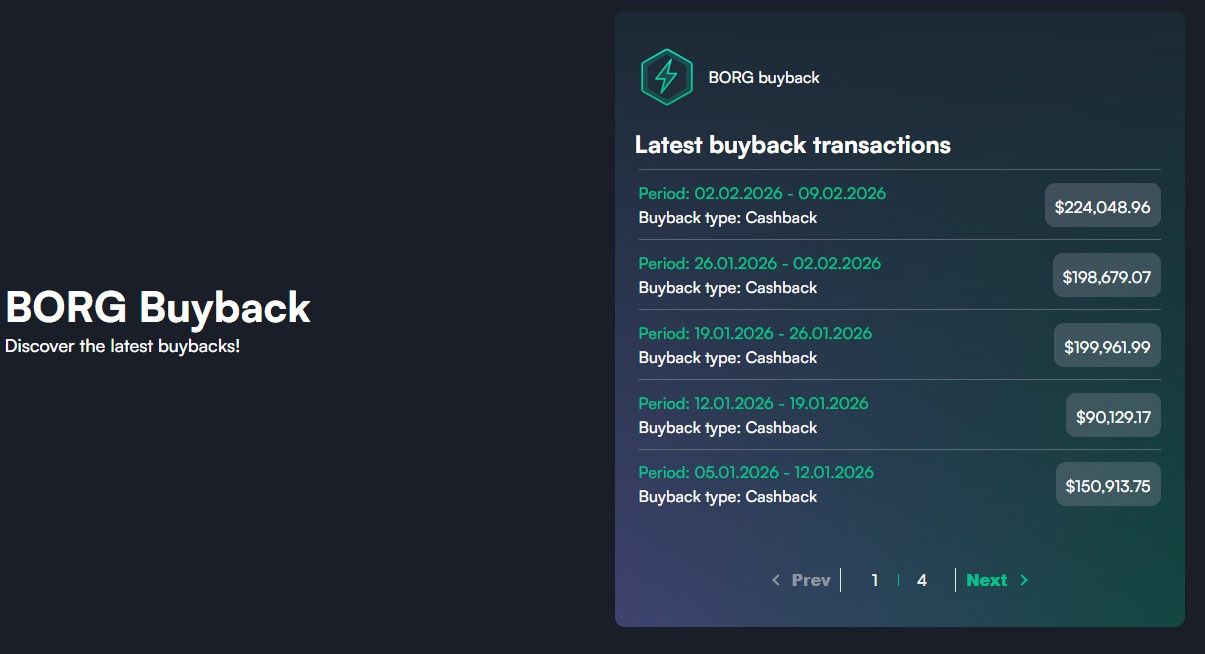

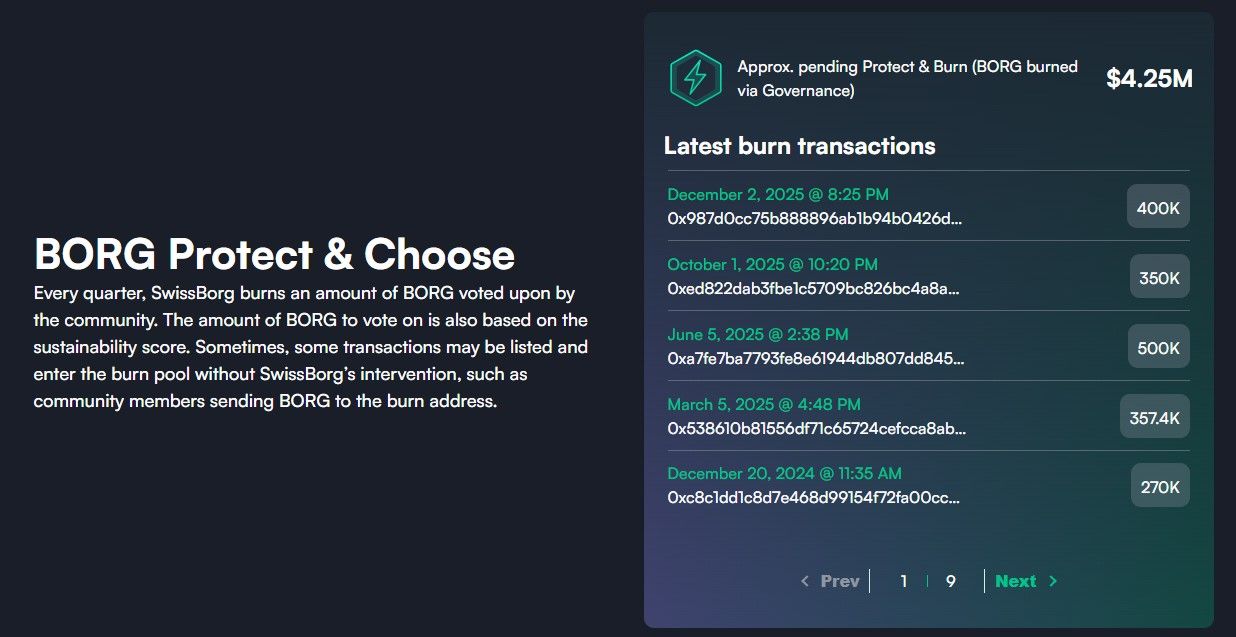

With Paid to Trade, SwissBorg routes a portion of exchange fees into market buybacks of BORG, then credits users with cashback in BORG (distributed weekly and automatically accumulated in the locked BORG account). Alongside that, SwissBorg also runs a separate quarterly buyback tied to company performance and user activity (via its sustainability score framework), plus governance-driven “protect & burn” mechanics where the community influences how much gets burned.

A Look at BORG's Circulating Supply

A Look at BORG's Circulating SupplySwissBorg has done a fantastic job, better than most, at creating multi-faceted demand drivers for the BORG token, which of course, aids in encouraging price appreciation of the asset. There are, of course, incentives to hold the BORG token to earn yield to name a couple. SwissBorg also buys back BORG every week.

There is also the opportunity for BORG holders to participate in referendums, where users can give their opinions on where the future of the SwissBorg app should go. Eventually, SwissBorg would like to see the app be run by a fully decentralized governance model, speaking to the true spirit of crypto and decentralization.

Benefits of the BORG SwissBorg Token

As mentioned above, multiple demand drivers and benefits are gained by holding the SwissBorg crypto token. These benefits include:

- Access to future exclusive wealth management products and services in the app.

- Loyalty Rank system

- Voting rights on the referendums and future of the SwissBorg Platform.

- Earn amazing rewards for investing in the SwissBorg Ecosystem.

The SwissBorg team also conducts periodic BORG token buybacks, removing them from circulating supply. This feature is meant to protect the token from flash crashes and devaluation and is expected to help provide upward pressure and stability for the price of the token.

Because the SwissBorg token powers the entire SwissBorg ecosystem, it has great utility. Not only can users lock BORG to receive cashback on their trading, but the token also grants voting rights to participate in the governance of the platform. It is also used in the reward distributions set out by the Proof of Meritocracy concept.

Since the migration to BORG, we can also expect to see further demand drivers play out in the broader DeFi ecosystem and not just on the SwissBorg platform.

Protect and Choose

SwissBorg used to have a Protect and Burn policy that helped support the price of BORG tokens by buying back and burning circulating tokens any time the price of BORG was trending lower. In the interest of being a true community-centric platform, this has evolved into the Protect and Choose feature that it is now.

Instead of SwissBorg buying back and burning the BORG tokens, in March of 2022, the team switched to buying back the tokens and then putting them into a pool where loyal token holders can vote on how the tokens should be used at the end of each quarter. One of the reasons for the switch was that the SwissBorg team made the observation that the Protect and Burn mechanisms was not enough to break the token from trends where the entire market is crashing or ranging.

The Protect and Choose model will work as follows:

- SwissBorg will continue to perform the buyback with 20% of fees during optimal market conditions to help support the price.

- Every quarter, there will be a community vote on what should be done with the pool of tokens.

Token holders are notified via the app and email when the time comes to participate in the vote should they choose. The decision is made on whether or not the tokens should be burnt at all, and what percentage should be burnt. If the community chooses not to burn, they can vote on what should be done with the tokens, choosing between things like boosting yield, offering a yield for premium tokens, expanding the ecosystem in the DeFi space, boosting the SwissBorg app rewards program and more.

SwissBorg Customer Support

The SwissBorg Support team appears to have generally good reviews across the web for quick response times and helpful support. Questions and issues can be addressed via a request form on the SwissBorg website, though the more common way is to use the in-app chat function.

Submit a Request via the SwissBorg Website

Submit a Request via the SwissBorg Website For this review and since being a SwissBorg user myself, I have reached out to the support team three or four times via the in-app chat and was impressed to have a response within minutes to a half an hour at the most, which is fantastic. Kudos to their support team! In the crypto space, I am generally happy any time I receive support within 24 hours. Anyone who has been kicking around the crypto game long enough knows how common it can be to be stuck waiting days, if not weeks, for support response.

SwissBorg also has a thorough help centre, complete with guides and tutorials to help answer many of the questions that users may have.

SwissBorg Top Benefits Reviewed

SwissBorg is a fantastic European crypto exchange that does so much more with its intuitive, easy-to-use, all-in-one wealth management features.

The platform is providing a service that is much needed in the crypto space, acting as a secure way to buy, sell, and swap crypto, providing valuable analytics, while also acting like a financial planner and portfolio manager for crypto, offering a fantastic investment platform for digital assets.

If you are familiar with traditional investing, what SwissBorg does for your crypto portfolio is the equivalent to what normally happens sitting in a private bank office with people in stuffy suits, signing papers, and let’s be honest, charging more for their services than the average person is able to afford.

SwissBorg feels like having the expertise of a Financial Planner and the attentiveness of a Portfolio Manager for free, right in your pocket. A powerful little app indeed. You can use our SwissBorg sign-up link can earn you up €50 in free crypto.

You can see how SwissBorg stacks up against the competition in our following comparison articles:

Final Thoughts on SwissBorg

The $53 million fundraiser in 2017 was one of the most successful in the blockchain industry at the time. SwissBorg didn’t squander the funds either but has delivered an impressive product that solves many of the problems associated with wealth management for cryptocurrency. It also makes investing in cryptocurrency simple and accessible for everyone.

The Wealth App that’s been developed by SwissBorg is a powerful yet simple solution to cryptocurrency investing. Users are able to buy and sell, deposit and withdraw, earn, trade, and manage all their crypto assets within the same interface.

Even more impressive is that SwissBorg has become fully compliant with all the regulatory frameworks for the more than 115 countries that can take advantage of the Wealth App. This means users can take part in cryptocurrency investing without worrying about the legality of their actions.

The community that SwissBorg is building is also among the strongest in the crypto industry. I like seeing all the incentives that encourage members to not only be users, but actively engage and be part of the SwissBorg community and contribute to the ecosystem. Thanks to things like the Launchpad and Protect and Choose, the SwissBorg community is one of the most vibrant in the industry, which is important as the strength of any platform relies on the strength of its user base.

Taken all together, it seems apparent that the SwissBorg Wealth App is realizing the mission of the project to make cryptocurrency wealth management simple and more accessible. Users and investors seem to agree given the huge price increase seen in the BORG token, and the fact that SwissBorg has been continuing to grow, thrive, build, and roll out some of the most innovative crypto products even as we are in the depths of this 2022/2023 crypto bear market.

If SwissBorg can continue on the path it has set for itself, this could be one of the foundational blockchain projects that will continue to set the pace for wealth management and Web3 innovation for decades to come.