The pseudonymous nature of public blockchains and the ease of wallet spamming, spoofing, and asset mixing has made credit assessment one of DeFi’s biggest challenges. This has prevented the DeFi ecosystem from developing mature uncollateralised lending protocols with predictable yields and comparatively lower risk, leaving massive untapped potential for a trillion-dollar market to emerge in the form of on-chain credit systems and uncollateralised loans.

While popular DeFi lending protocols such as Maker, COMP, and AAVE have been making waves in the news since last year, one lending protocol that had slid under the radar recently emerged as one of the biggest winners amidst the crypto bloodbath following China’s FUD in May. Its token appreciated from a short-term low of $0.1134 on July 20th to a peak of $1.06 on August 12th on Binance, while its total-value-locked (TVL) skyrocketed from $217 million on August 5th to $1.16 billion on August 14th.

This lending protocol is TrueFi, an uncollateralised DeFi lending protocol powered by on-chain credit scores. In this article, we will take an in-depth look at the TrueFi protocol and explore the future possibilities of centralized decentralized finance (CeDeFi) credit and uncollateralised lending.

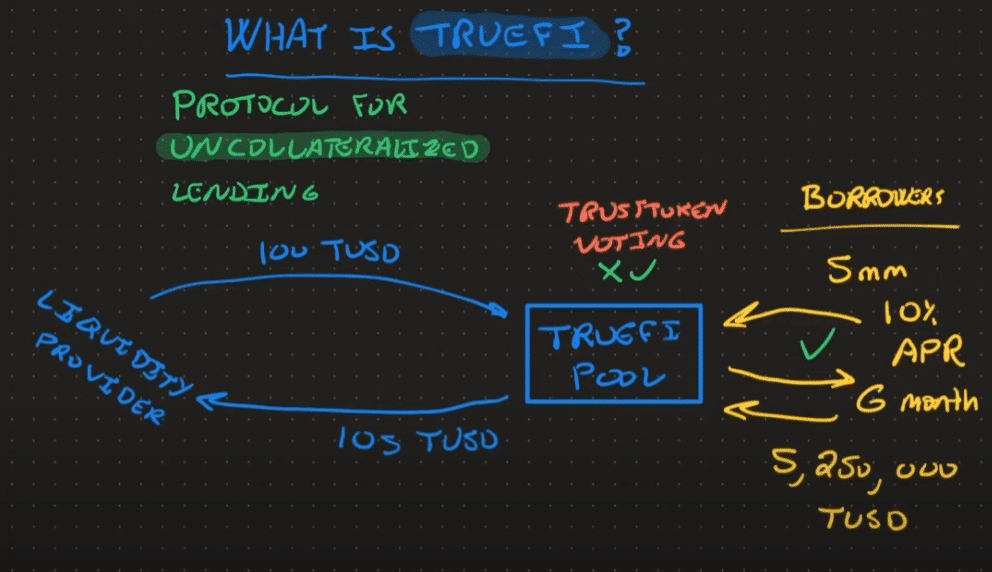

What Is TrueFi?

TrueFi: Uncollateralised Lending and On-Chain Credit Rating. Image via TrueFi.io

TrueFi: Uncollateralised Lending and On-Chain Credit Rating. Image via TrueFi.io Launched on the 21st of November 2020, TrueFi is an uncollateralised DeFi lending platform built on the Ethereum platform. Unlike Compound and AAVE, both of which are “overcollateralised” lending protocols that require a greater amount of collateral for any borrower to take out a loan, TrueFi achieves uncollateralised lending by implementing an on-chain credit-rating system that combines both CeFi and DeFi elements.

Inspired to act as a bridge between traditional and decentralised finance, TrueFi’s objective is to set the industry standard for market-driven, automated DeFi credit-rating and lending services with its on-chain credit system. The team's vision is to bring more high-quality financial investment opportunities to the public through the blockchain, similar to how high-quality information is provided publicly by the internet.

While TrueFi is not the only protocol to offer uncollateralised lending products, it is one of the earliest adopters of on-chain credit-rating to solve creditworthiness problems in DeFi lending. This credit-assessment model is governed by holders of the TRU token, which is used to vote for borrower onboarding and loan approval through staking.

Credit rating and uncollateralised lending could open DeFi to more opportunities in the traditional finance industry.

Credit rating and uncollateralised lending could open DeFi to more opportunities in the traditional finance industry.

TrueFi was originally funded in 2018 by the same company behind the TUSD stablecoin, TrustToken, through SAFT token sales to VC institutions and accredited CoinList investors at prices between $0.08 and $0.12, raising upwards of $31m. The recent surge in the price of TRU was followed by a $12.5m funding round led by prominent investment firms such as a16z, BlockTower, and Alameda Research on August 5th, 2021. The funding round was completed through token purchases by the institutions, with a one-year locked period and daily vesting.

At launch, TrueFi V1 initially supported only the TUSD stablecoin in its lending pool, with institutional investors as its sole customer group. TrueFi V1 managed to attract high-profile institutional borrowers such as Alameda Research, Wintermute Trading, Grapefruit Trading, and Invictus Capital, lending $57.5 million in uncollateralised loans and generating over $500,000 in interest to TUSD lending pool providers.

TrueFi currently supports USDT, USDC, and TUSD.

TrueFi currently supports USDT, USDC, and TUSD.

By June 2021, TrueFi has expanded its platform to support three different ERC-20 stablecoin assets: TUSD, USDC, and USDT. The team has plans to add further support for non-stablecoin ERC-20 cryptocurrencies by the end of 2021. At the time of writing, TrueFi currently maintains ~$1 billion TVL, with zero defaults since launch.

TrueFi follows a “progressive decentralisation” philosophy by gradually distributing TRU to incentivise active and responsible community contribution in a sufficiently decentralised way. As the protocol matures and products fully develop, TrueFi is planned to move towards greater decentralisation in the long run, with the TrustToken team gradually distributing greater authority and responsibility to the community.

How Does TrueFi Work?

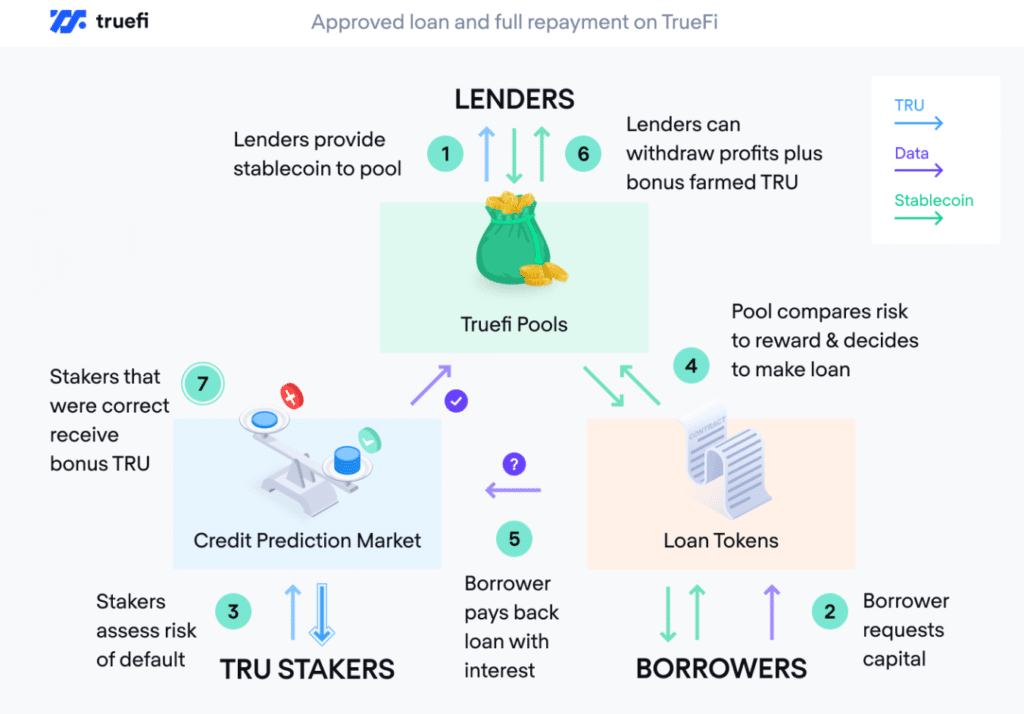

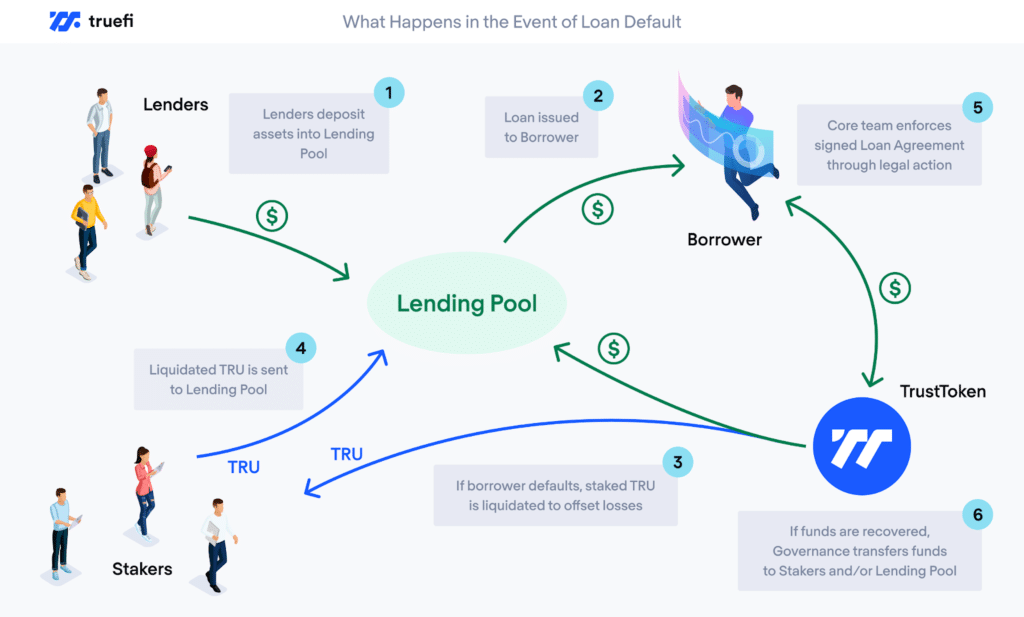

The TrueFi protocol consists of lending pools, a liquidity mining farm, and the TRU staking pool. Liquidity providers deposit assets into the lending pools to earn interest, while TRU stakers are responsible for borrower onboarding, loan approval, and governance in return for a high staking APY and extra voting rewards. When a whitelisted borrower requests a loan, TRU stakers take responsibility for assessing the loan. They also bear the primary risk for the protocol, as in the event of a default, their staked TRU will be slashed by the protocol to reimburse losses in lending pool. This way, TrueFi delegates both the responsibilities and risks from uncollateralised lending to its governance community, who are incentivised to create the best credit model for the protocol to maximise their staking returns while providing sufficient insurance for the lending pools to continue attracting new participants.

TrueFi lending process. Image via TrueFi.io

TrueFi lending process. Image via TrueFi.io

The TrustToken team currently acts as a semi centralised executive authority responsible for KYC approval, protocol development, business and marketing operations, and organising community governance. In case of a default, the TrustToken team is also currently responsible for legal recovery procedures. This currently makes TrueFi more centralised than many other DeFi lending platforms on the market, as the protocol is still in the “incubation phase” of progressive decentralisation. TrueFi's community governance is conducted on the TrueFi forums and Discord server with both Snapshot and direct on-chain voting.

Unlike collateralised DeFi lending protocols that can more readily preserve borrower pseudonymity, TrueFi borrowers are required to undergo strict KYC/AML procedures and sign legally enforceable contracts with the TrustToken team before they can post a borrower onboarding request. This means borrowers must decide a tradeoff between pseudonymity and uncollateralised loans. Borrowers are currently restricted to verified institutions, with plans to expand the customer base through TrueFi’s automated credit-rating system.

As of now, TrueFi only offers fixed-term loans and interest rates. With the release of the TrueFi Credit Model in V3, interest rates for each loan will be automatically calculated based on pool utilisation and a TrueFi creditworthiness score from 0 to 255 for each borrower. This will be used to implement flexible loans with variable interest in the future V4 release to support lines of credit, allowing individually-tailored open-term loans and variable interest rates by integrating off-chain data to automated on-chain credit-rating processes.

In comparison with mainstream lending protocols like AAVE, what TrueFi currently lacks in liquidity, decentralisation, and privacy is mitigated through security, accountability, and transparency. This provides TrueFi with an edge in integrating with legacy financial institutions and regulatory authorities but comes at the cost of less decentralisation and limited borrower privacy in the short to medium term.

Liquidity Providers

Liquidity providers (LPs) contribute stablecoins such as TUSD into the TrueFi lending pools, earning interest from borrowers in the original asset. Idle assets in the lending pool are deposited into Curve for increased returns. Unless TrueFi receives a loan request at a higher interest rate than existing DeFi stablecoin yields such as Curve, idle assets will not be moved into the lending pool from the DeFi protocols. This ensures a minimum APY based on the highest yields from partnering DeFi yield protocols.

LPs will receive tradeable ERC-20 tokens as IOUs called LP tokens for depositing assets to lending pools (with the “tf” prefix). LP tokens represent an LP’s percentage share of a lending pool, and will initially have a 1:1 peg to the underlying asset before any loans were processed by the lending pool. Each lending pool will have its own LP token, and LPs can enter multiple lending pools at the same time.

Liquidity providers deposit funds into the lending pools.

Liquidity providers deposit funds into the lending pools.

As loans are successfully repaid with interest to a lending pool, the net present value of the lending pool expands, which increases the value of its LP token. Any LP who enters the pool afterwards will receive LP tokens at their current value, and as long as the pool continues to earn interest without default, the value of its LP tokens will continue to increase.

LPs may deposit their LP tokens in the Liquidity Gauge farm to earn TRU, which distributes TRU to each lending pool based on community governance. The farm acts as an incentive booster to encourage LPs to leave their deposits while distributing TRU to the community. LPs can then choose to stake their TRU rewards from the farm into the TRU staking pool for more TRU returns.

LPs can stake their LP tokens to earn TRU rewards in the farm on top of loan interests and CRV rewards. Image via TrueFi.io

LPs can stake their LP tokens to earn TRU rewards in the farm on top of loan interests and CRV rewards. Image via TrueFi.io

In total, LPs can receive three different types of yields by providing liquidity to the lending pool: lending pools yields (interest + CRV rewards), TRU rewards from the Liquidity Gauge farm, and potentially more TRU from staking these rewards into the TRU staking pool. Rewards are distributed on an hourly basis, and can be tracked in the TrueFi treasury.

In the current version of TrueFi, participants will have to manually claim and re-stake their rewards for compound interest in each pool/farm, which requires two separate transactions on the Ethereum blockchain. Thus, unless one possesses an unusually large stake, it may be wise to adjust the frequency of reward-claiming and re-staking according to the APY for optimal compound interest in the current TrueFi version, as gas fees may outweigh short-term returns from smaller stakes before the process is automated.

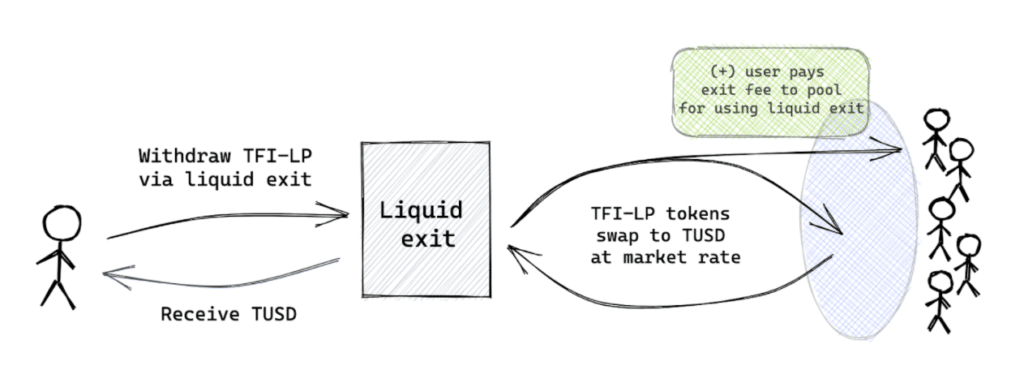

LPs can exit the lending pools anytime and can choose between redeeming their LP tokens for their share of all assets in the lending pool, which include loan tokens, original underlying assets, and altcoins (such as CRV from the Curve pool), or using the liquid exit function, which allows LP tokens to be directly redeemed for the underlying asset. Liquid exit is processed at a fee by utilising the lending pool directly as a liquidity provider. This fee is then distributed to all remaining LPs in the lending pool.

Liquid exit is processed at a fee, which is proportionately distributed to remaining LPs in the pool. Image via TrueFi.io

Liquid exit is processed at a fee, which is proportionately distributed to remaining LPs in the pool. Image via TrueFi.io

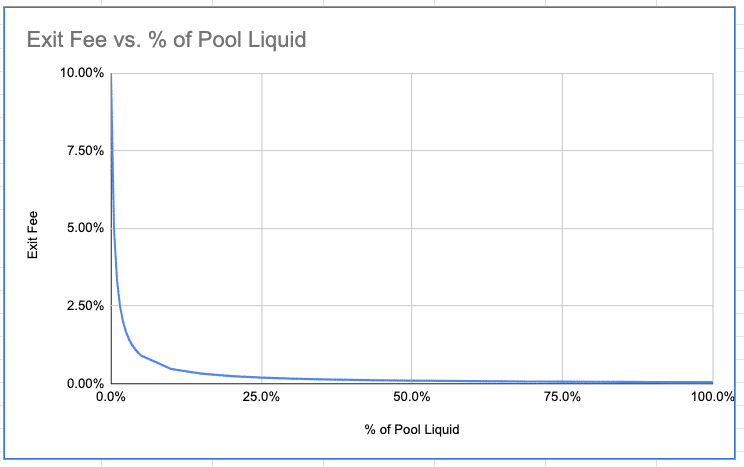

The liquid exit fee will be inversely proportional to the percentage of unutilised assets remaining in the lending pool, with a theoretical maximum exit fee of 10% at 0% of pool liquidity, and a minimum of 0.05% at 100% of pool liquidity, as shown below. However, liquid exit will not be available if there are no liquid assets in the pool and no liquid exit is deployed in Curve, or if the pool will have to liquidate positions in Curve with a loss of over 10 basis points.

Liquid exit fee curve. Image via TrueFi.io

Liquid exit fee curve. Image via TrueFi.io

Borrowing

At present, TrueFi borrowers are restricted to institutional entities onboarded through a strict KYC/AML process and a legally enforceable contract with TrustToken. All disputes related to loans will be settled via binding arbitration laws of California, and all borrowers located in jurisdictions where enforcement of the contract terms is impossible are rejected for onboarding.

Once the legal contracts are signed, detailed information of the borrowers will be posted publicly in the TrueFi governance forums as new borrower onboarding requests. The borrower onboarding request must clearly state the organisation’s background, history, legal and financial status, and borrowing objectives. If a new borrower request is approved through on-chain community voting by TRU stakers, the borrower can then proceed to request loans after providing a whitelisted wallet address.

TrueFi requires strict KYC/AML transparency and legal contracts from its borrowers.

TrueFi requires strict KYC/AML transparency and legal contracts from its borrowers.

TrueFi’s on-chain credit-rating system currently allows partial privacy for borrowers. Borrowers may choose to withhold any public identity information to the governance community for onboarding and loan requests at a small interest premium, but they are required to undergo the same KYC/AML processes by the TrustToken team. KYC/AML information of each private borrower will be kept solely by the TrustToken team and will only be revealed publicly if the borrower defaults.

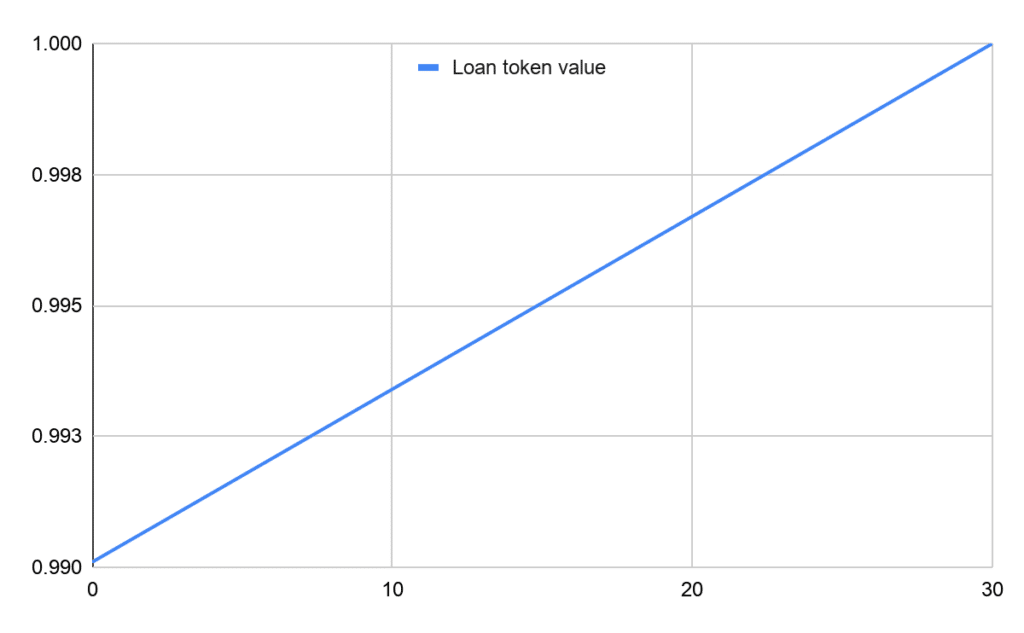

Borrowers on the TrueFi platform are issued loan tokens representing the sum of their principal plus interest for the loan term. When a loan is approved, loan tokens are issued in the TrueFi lending pool with the borrower’s wallet address, and the principal is sent to the borrower’s address.

Loan tokens are unique, non-tradable ERC-20 tokens that track the present value of each loan, they also represent the utilisation rate of each lending pool. Because loan tokens always represent the sum of principal plus interest, their mint value per token in the lending pool is always discounted. Using TrueFi’s example, when a loan (principal = 1,000,000 TUSD, term = 30 days, APR = 12%) is approved, (1,000,000 + 1,000,000 x 12% x 30/365) 1,009,863.013 loan tokens would be minted.

As the loan matures, the value of the loan tokens gradually increases and reaches 1:1 by the end of the term in accordance with the interest rate. The loan tokens will then be burned and replaced with the underlying asset once the borrower successfully repays the loan.

Calculation of loan token value for a $1 million principal 30-day fixed-term loan at 12% APY. Image via TrueFi.io

Calculation of loan token value for a $1 million principal 30-day fixed-term loan at 12% APY. Image via TrueFi.io

Loan tokens are currently untradeable, but they are planned to be made tradeable following progressive decentralisation to expand TrueFi into a cross-platform lending protocol. This will open up new possibilities such as secondary loan markets and loan token collaterals across other platforms, but it will come with regulatory hurdles.

Loan Approval

When a loan is requested by a borrower, an on-chain vote is created where TRU stakers must vote with their staked TRU tokens (stkTRU). Each stkTRU corresponds to one vote. The voters must vote either YES or NO based on their own assessment of the likelihood of default for each loan. Voters can change their votes any number of times before the loan is approved or cancelled by the borrower, and no penalty will be applied if a staker refuses to vote.

TRU stakers must approve loans by voting with stkTRU. Image via Youtube

TRU stakers must approve loans by voting with stkTRU. Image via Youtube

For a vote to be approved, it must receive at least 15 million votes, and at least 80% of the votes must be YES. The voting window will be open for a minimum of two days, which can be extended if the two minimum criteria are not satisfied after this period. Otherwise, the borrower may renegotiate or retract their request.

stkTRU tokens in each wallet are not locked during the voting process. Thus, the same tokens can be used to vote for multiple loan applications by each TRU staker. However, only tokens that have been staked before a loan application is created can be used to vote on the application. This is to prevent opportunistic staking and manipulative voting once a loan application is already registered.

Borrowers with high credit scores may upscale their loans faster after the successful repayment of all previous loans. This will depend on borrower financial history, repayment record, and KYC/AML information detail, with scaling parameters governed purely through community votes. Unlike the direction taken by other DeFi lending protocols, TrueFi hopes to achieve maximal stability and minimal risk by retaining large institutional borrowers with minimal credit risk over the long term.

TRU Staking And Uncollateralised Lending

TrueFi’s uncollateralised lending is secured by the TRU staking pool. Governance participants must stake their TRU in return for tradeable stkTRU tokens to vote on borrower onboarding applications and loan requests. TRU tokens locked in the staking pool are used to cover the lending pool as collateral, effectively acting as the “insurance” of the protocol. In the event of a default, stakers can be slashed up to 10% of their staked TRU to reimburse losses in the lending pool. To decrease this risk, TRU stakers are incentivised to make the best lending decisions in the interests of both themselves and the liquidity providers.

TrueFi delegates both credit assessment responsibility and collateral risk to TRU stakers.

TrueFi delegates both credit assessment responsibility and collateral risk to TRU stakers.

TRU stakers earn a dynamically adjusted APY based on the percent of TRU tokens in circulation that are staked in the protocol. The incentive pool distributes 125,000 TRU proportionately to all stakers each day (subject to community governance amendments). This means staking APY decreases as more TRU is staked in the pool regardless of the price action of TRU itself (and vice versa). Unstaking TRU comes with a 14-day cooldown, and re-staking any TRU during the cooldown will reset the timer. Once the cooldown is over, stakers will have a 48-hour time window to unstake their TRU, otherwise, their tokens will be re-staked into the protocol once the window is over.

How SAFU Is Uncollateralised Lending?

TrueFi uses a SAFU (Secure Asset Fund for Users) smart contract to cover the lending pool and perform slashing and reimbursement functions. The SAFU has its own pool that acts as a buffer and liquidator for the staking pool and the lending pools, it is initially funded by the TrueFi team with 10% of the company’s initial token unlock (~5 million TRU).

In the event of a default, the lending pool will transfer all defaulted loan tokens to the SAFU contract in exchange for the full value of those assets in TRU (principal + interest). The SAFU fund will then slash up to 10% of TRU from the staking pool to cover the losses in the lending pool. If the SAFU fund and slashed TRU are insufficient to cover losses from a default, “deficiency claim tokens” representing the uncovered funds will be issued by the SAFU to the lending pool. The default event will be announced publicly, and all privacy options of the delinquent borrower will be revoked. Afterwards, the TrustToken legal team will initiate the legal recovery process with the defaulting institution.

TrueFi default and recovery process. Image via TrueFi.io

TrueFi default and recovery process. Image via TrueFi.io

If the funds are recovered through the legal process, they will be used to purchase the underlying assets represented by the defaulted loan tokens and returned to the lending pool, with any excess funds remaining after the reimbursement purchase being kept by the SAFU contract. If the legal process is unable to fully recover the lost funds, the remaining “deficiency claim tokens” issued to the lending pool will be burned. This will realise the losses and reduce the total value of the lending pool, decreasing the value of its LP token.

Voting Incentives

To incentivise voting participation, a small amount of TRU is rewarded to voters and will be immediately claimable once each loan is approved. The total amount of TRU voting rewards will be calculated based on the total interest generated by each loan. This reward will be drawn from the incentive pool, proportionally distributed to voters based on the percentage of their votes among the total votes received for each loan.

On top of voting rewards, TRU stakers are also rewarded the protocol fees from each approved loan, amounting to 10% of the total interest from each loan. This protocol fee will be paid in the form of LP tokens once each loan is successfully repaid. This disincentivises “flash voting” in situations where huge stakers, to avoid default risks, immediately request withdrawal of their TRU after receiving voting rewards when large amounts of loans are approved in a very short timeframe.

Since loan voting also requires a small Ethereum gas fee, smaller stakers may potentially be disincentivised to vote on loans with small principal and short terms if gas fees outweigh the voting rewards. This could discourage governance decentralisation in the short term due to larger stakers benefitting more from frequent voting, reward-claiming, and re-staking due to gas fee barriers.

To overcome this gas fee barrier, the protocol will eventually remove the legacy voting system altogether by introducing a new governance mechanism, but this will likely come after the automated credit-rating system as the existing voting structure is still needed to preserve community autonomy and distribution of stakeholder responsibility.

The TRU Token

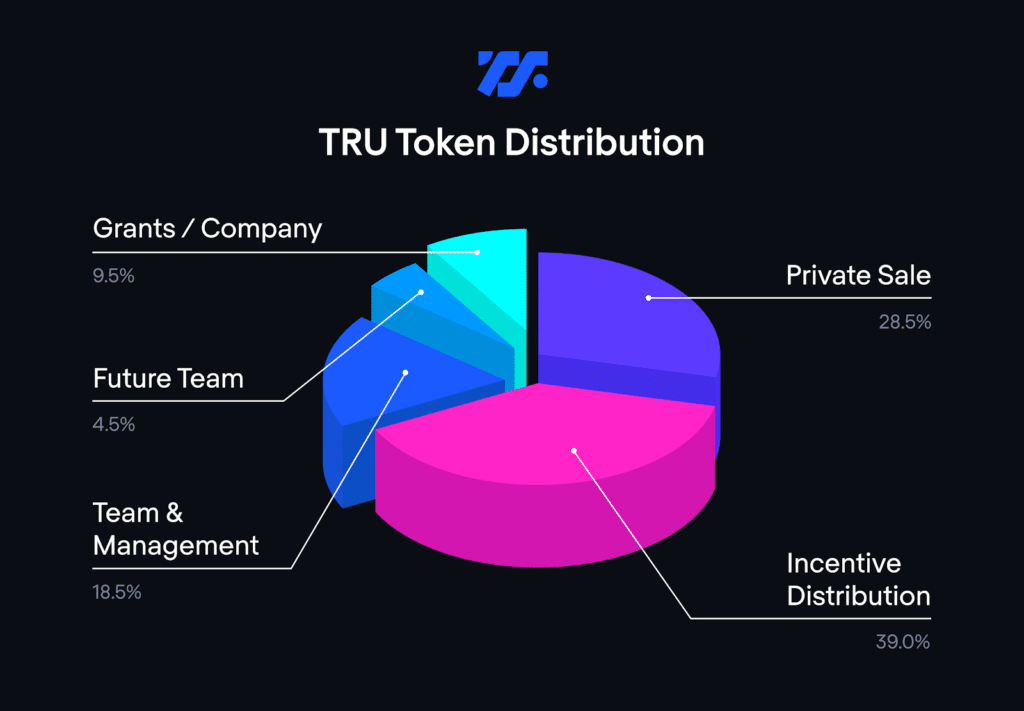

TRU has a maximum supply of 1.45 billion tokens distributed as below:

- Community incentives: 39% (565,500,000 TRU)

- Token sale: 26.75% (387,917,402 TRU)

- Team: 18.5% (268,250,000 TRU),

- Company: 11.25% (163,082,598 TRU)

- Future team: 4.5% (65,250,000 TRU)

TRU distribution, note remaining 2% of private sale tokens were allocated to the company. Image via TrueFi.io

TRU distribution, note remaining 2% of private sale tokens were allocated to the company. Image via TrueFi.io

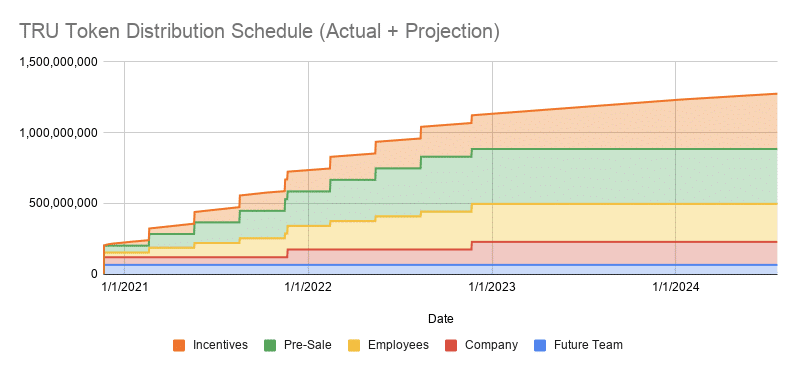

Both the tokens from token sales and the TrueFi team are locked for two years, with quarterly unlocks on November, February, May, and August beginning from November 21st, 2020 to August 13th, 2022, each injecting an additional 82,052,175 TRU into the market (33,562,500 from team + 48,489,675 from token sales).

A third of TrustToken company’s tokens will be unlocked initially, with the remaining two-thirds of company tokens unlocked on November 2021 and 2022 respectively. This will further inject an additional 54,360,866 tokens per unlock.

Projected token emissions schedule. Image via TrueFi.io

Projected token emissions schedule. Image via TrueFi.io

The TrueFi team has been actively burning TRU tokens from the first company unlock, with approximately 8 million TRU tokens burnt at the time of writing, while another 20% of company tokens were allocated to a community treasury and SAFU fund. Finally, 35% of tokens from the first company unlock were provided to AMMs as liquidity.

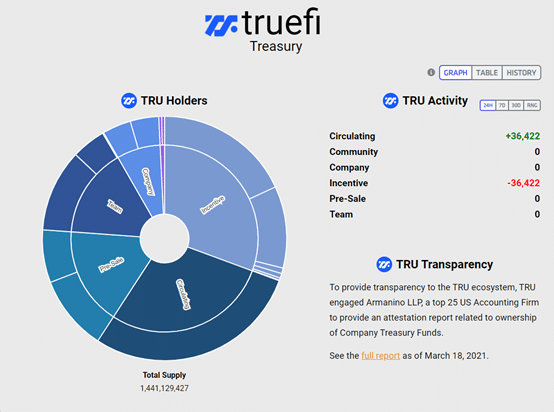

All TRU token distributions are regularly updated, with a treasury procedures report audited by Armanino detailing the company token addresses and asset distribution.

A total of ~410 million TRU tokens are in circulation as retrieved from the TrueFi treasury on 25th of August, 2021.

A total of ~410 million TRU tokens are in circulation as retrieved from the TrueFi treasury on 25th of August, 2021.

The TrueFi Team

The TrueFi team is a part of TrustToken, which first launched the TUSD stablecoin in 2017. The San Francisco-based company is currently led by CEO and co-founder Rafael Cosman. TrustToken was established around the principles of transparency and legal compliance, the team’s initial objective was to build a stablecoin that they would use and trust themselves. This culminated in the True USD stablecoin, which involved the use of multiple escrow accounts, regular attestations, and strict KYC/AML procedures for all customers minting or redeeming the stablecoin. TrueFi operates as an independent product from the True Currencies, which is now offered in TUSD, TGBP, TAUD, TCAD, and THKD.

Rafael Cosman, CEO and Co-Founder of TrustToken. Image via Twitter

Rafael Cosman, CEO and Co-Founder of TrustToken. Image via Twitter

TrueFi's CEO Rafael Cosman is a Stanford computer science graduate with a background in machine learning. Before entering the cryptosphere, Cosman worked as a machine learning engineer for companies such as Google and was a co-founder of the nonprofit education organisation StreetCode Academy, which is dedicated to providing tech education to marginalised youth.

Interestingly, Cosman was also a co-author of a published academic paper on strategy-resistance in voting rules (accessible here), and even holds a patent for a computer-based crime risk forecasting system! Considering the objective of TrueFi is to create a community-governed, fully-automated on-chain credit-rating model for uncollateralised DeFi lending, Cosman’s background provides a convincing case for the platform’s likelihoods of success.

Below is an incomplete list of the leadership team and the most active team members in the TrueFi community:

- Rafael Cosman – CEO and Co-Founder

- Alex de Lorraine – COO & Sr. Director, Finance

- Tom Shields – Chairman of the Board

- Michael Gasiorek – Head of Growth

- Ryan Rodenbaugh – Strategy Lead

- Roshan Dharia – Head of Credit & Corporate Development

- Matt Kielczewski – Marketing Lead

- Tyler Wallace - Analytics

- Ada Wu – Marketing (Chinese)

TrustToken currently lists a total of 41 members on its website, with engineers, legal experts, compliance officers, and marketing professionals etc. employed across North America, Europe, and Asia.

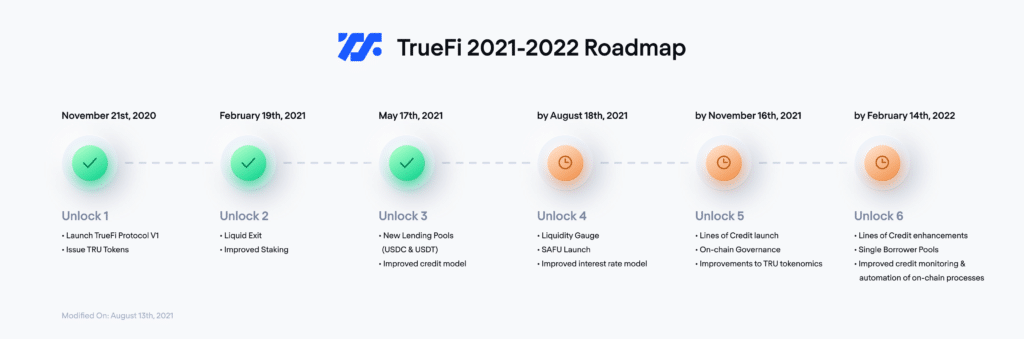

Roadmap

TrueFi’s roadmap follows a similar pattern with its token unlock schedule, as it is logical to meet increased token circulation with improved utility for each stage of the protocol to support a balanced and sustainable development progress.

TrueFi roadmap for V4. Image via TrueFi.io

TrueFi roadmap for V4. Image via TrueFi.io

With the launch of the SAFU and Liquidity Gauge farm in V4, TrueFi’s next objectives are to launch more on-chain governance features and improving the tokenomics and interest rate model to better support lines of credit planned for the end of 2021. Single borrower pools, credit monitoring and on-chain automation will be introduced in 2022, with further plans to be announced. The team will seek to reduce or remove gas fees for voting, reward-claiming, and staking either through Layer-2 integration or introducing new governance mechanisms, and token emissions will gradually decrease as the protocol transitions to a stable fee-based structure.

The major functions of TrueFi are set to be materialised by the end of 2022, following the last token unlock, with progressive decentralisation entering its final phases after the complete automated credit model is released. TrueFi team members will continue to participate as members of the community once executive authority is delegated to the community. While the protocol has experienced delays in the past due to various issues such as code auditing and compliance obstacles, TrueFi has managed to successfully deliver its promises for all previous roadmap targets.

Challenges

While TrueFi’s credit model sounds very promising and potentially game-changing for DeFi, its greatest challenges will come from building a strong community for off-chain credit assessment, on-chain data integration, and legal procedures. To avoid overreliance on centralised legacy infrastructure, TrueFi will need a strong community of responsible and competent credit assessors, developers and legal experts organised in a sufficiently decentralised manner. It will also have to establish a stable fee structure to support an active community to minimise free-riding once the protocol’s products become mature enough for decentralised operation.

A strong, responsible, and competent community is always the backbone of DeFi. TrueFi’s default protection through TRU staking is currently highly volatile due to price fluctuations from the token’s small market cap. This means currently, the protocol’s strongest underlying security actually comes from the TrueFi team’s KYC/AML procedures and legal enforcement power. Therefore, on top of decreased TRU price volatility, TrueFi will likely have to continue relying on a legal executive entity for loan contract enforcement before its credit model could accurately incorporate uncertainty risks.

Otherwise, if the protocol is incapable of coordinating effective legal action once the team transfers legal authority to the community, individual risk-aversion could easily override collective interests in the event of a serious default, causing less committed community members to rapidly abandon the protocol. This is especially the case if no entity possesses a large enough stake to warrant the initiation of costly legal procedures on behalf of the DAO, as retail stakers and LPs will naturally prefer to free-ride passively as long as the APY remains attractive and exit costs remain low.

The backbone of DeFi is always a strong, responsible, and competent community.

The backbone of DeFi is always a strong, responsible, and competent community.

Ideally, TrueFi’s final credit model should be able to minimise the need for legal enforcement by providing accurate credit predictions to calculate stable risk-reward ratios for each borrower, lending pool, and its participants. This will require sufficient statistical power to provide enough error tolerance to generate a new incentive equilibrium based on the transparency provided by the credit model alone. Due to the faster speed at which information travels on the blockchain network, TrueFi’s credit model will have to provide accurate real-time credit updates by integrating both on-chain and off-chain data, which can be extremely difficult to automate without heavy reliance on centralised credit databases as of today.

Conclusion

TrueFi aims to solve the problem of creditworthiness for uncollateralised lending in DeFi by creating an automated credit-rating model that integrates both on-chain and off-chain data. Since its launch at the end of 2020, TrueFi managed to gain steady growth while attracting high-profile investors such as a16z and Alameda Research, raising a total of ~$44m in both public and VC funding from token sales from 2018 and 2021 while lending out over $500m in stablecoins to verified customers.

While TrueFi’s automated credit model is still in its early stages, the protocol has already established an active community on its forums and discord server while rapidly expanding its lending pool and customer base with zero defaults since inception. The financial concept of “credit”, originally introduced by corporations and central banks, will always be challenging to reconcile with the principles of decentralisation and trustless consensus, while traditional finance will continue to exist as long as the demand for trusted intermediaries exist

The gap between CeFi and DeFi is only beginning to close. It could take a long time before we find out whether or not TrueFi’s credit model could truly succeed in the emerging DeFi economy by capturing sufficient market share while earning enough trust from the DeFi community. But TrueFi’s endeavour could potentially give rise to new incentive structures that could better adapt to the “hard” problems between CeFi and DeFi.

In the end, TrueFi’s governance and credit model could very well become a part of an emerging “CeDefi” paradigm through its semi-decentralised philosophy amidst increasing worldwide regulatory pressure. After all, it is difficult to successfully build a bridge without cooperation from both sides of the river.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.