Launchpads are one of my favourite services in all of crypto, and the reason is quite simple. Launchpads provide the average investor with the ability to gain early exposure to a project, a privilege that was traditionally reserved only for the wealthy, VCs, financial firms, and those with friends in high places with insider knowledge.

Crypto launchpads have the ability to level the playing field and do away with the exclusive “boys clubs” that exist on Wall Street, where the elite enjoy opportunities unattainable by average folks like you and I. TrustSwap is one of those launchpads that offers just that, and so much more.

Established in 2020, it has risen above and outlasted much of the competition, and has been absolutely crushing it ever since, buying out competitors, forming strong partnerships, and expanding its services to become a DeFi powerhouse.

In my opinion, TrustSwap is one of the most solid decentralized launchpads on the market. This TrustSwap review will cover everything you need to know about this blue-chip launchpad project.

Disclaimer: I use TrustSwap and hold SWAP tokens as part of my personal investment strategy.

Key Takeaways

- Average Investor ROI of 24x

- Provides full incubator services for projects looking to launch

- Can be used to mint tokens and select token properties without needing to code

- Offers attractive staking products

- Offers token and liquidity lock services for crypto projects

| Pros | Cons |

| Attractive launchpad returns for investors | Multiple features and concepts that can be confusing to new users |

| Carefully vetted projects and token/liquidity locks protect investors and inspire confidence | Apps and platforms acquired by TrustSwap have different names and websites, which can cause confusion |

| One of the top incubator and acceleration platforms for new projects | |

| Attractive staking returns on SWAP token | |

| Well-designed portfolio tracking app and innovative NFT platform |

What is TrustSwap?

TrustSwap is a decentralized financial ecosystem designed to help people, projects, and organizations exchange cryptocurrency, accelerate projects, and foster innovation, in a secure and decentralized environment. TrustSwap offers a new evolution in DeFi through the use of next-generation multi-chain and cross-chain token swaps, split payment, subscription services, and more.

A Look at the TrustSwap homepage

A Look at the TrustSwap homepageThe idea for the project came to life as investors were looking for a way to swap their Ethereum for tokens being launched by brand-new projects. TrustSwap was born out of the need to bring venture capitalist money and new projects needing funding together in a trustless and decentralized manner, without the need for third-party intermediaries.

Since the early use case of combining investors with projects, TrustSwap has expanded its list of utilities and offerings to include things like SmartSwaps, time-locked payment systems, SmartLock, Escrow services, as well SmartSubscription, which is a crypto-payment processor, each of which will be covered in more detail throughout this article.

My favourite feature of TrustSwap is the token launchpad offering that can be customized by the projects that are being supported. They can select features such as setting to release amounts of tokens at specific times or implementing lock-up periods for tokens that are allocated to the project’s team so investors don’t need to worry about the founders dumping.

A Look at some of the Features on TrustSwap

A Look at some of the Features on TrustSwapTrustSwap celebrated its 1-year anniversary in style and announced the grand opening of the TrustSwap HQ in the Decentraland metaverse, where the team gave those who visited the new virtual headquarters prizes such NFTs and USD giveaways.

A Look at TrustSwap HQ in Decentraland. Image via swappable.io

A Look at TrustSwap HQ in Decentraland. Image via swappable.ioTrustSwap has provided the platform necessary for many now-successful projects to take off, including Chaingames, Yield.app, Coin, MobiePay, AuBit, GLITCH, Modefi, SOTA, and others.

This DeFi Unicorn has grown to become a very well-known and successful DeFi ecosystem, hitting these impressive milestones within its first year of launching:

- Hired over Forty employees

- Major acquisitions- Purchased competitor Team Finance and The Crypto App

- Raised over 25M from launchpad projects

- $1B+ liquidity locked with Team Finance

- Over 4,500 projects using smart contracts

- Team and Liquidity Token Lock Multichain integration (Ethereum, Avalanche, Binance Smart Chain)

- Launched a token generator for ERC-20 and BSC tokens

- Launched an NFT marketplace

- Average performance across all projects hit an all-time high of 24x

TrustSwap has built itself quite a reputation in the industry and leveraged that to form some high-profile partnerships with the likes of Polkadot, Connect Financial, then their biggest partnership announcement was their team up with Shopping.io, where TrustSwap facilitates crypto payments to a massive catalogue of online stores.

Image via newsbtc.com

Image via newsbtc.comTrustSwap has its platform token, SWAP, which was so popular that its presale sold out in less than one minute. Demand for the token was astronomical as the token provides multiple benefits on the platform, which will be covered in a later section.

Taken directly from the TrustSwap Whitepaper, here is a look at the project’s vision and mission:

Image via TrustSwap whitepaper

Image via TrustSwap whitepaperSounds like a pretty solid mission to me.

Alright, now that we have some background, let's crack into the features.

TrustSwap Consumer Services

TrustSwap offers both consumer/retail and business services, first we will dive into the products offered for the average user.

TrustSwap Launchpad

One of the reasons that the SWAP token sold out within a minute, is that staking SWAP gets you access to tokens from some of the high-quality projects launching on TrustSwap. Thanks to insanely successful launchpads like the one on Binance, where retail investors have the chance to get involved in projects early and sometimes enjoy returns of thousands of percent, investors didn’t want to miss the chance to get involved with TrustSwap, so they picked up the SWAP tokens ASAP.

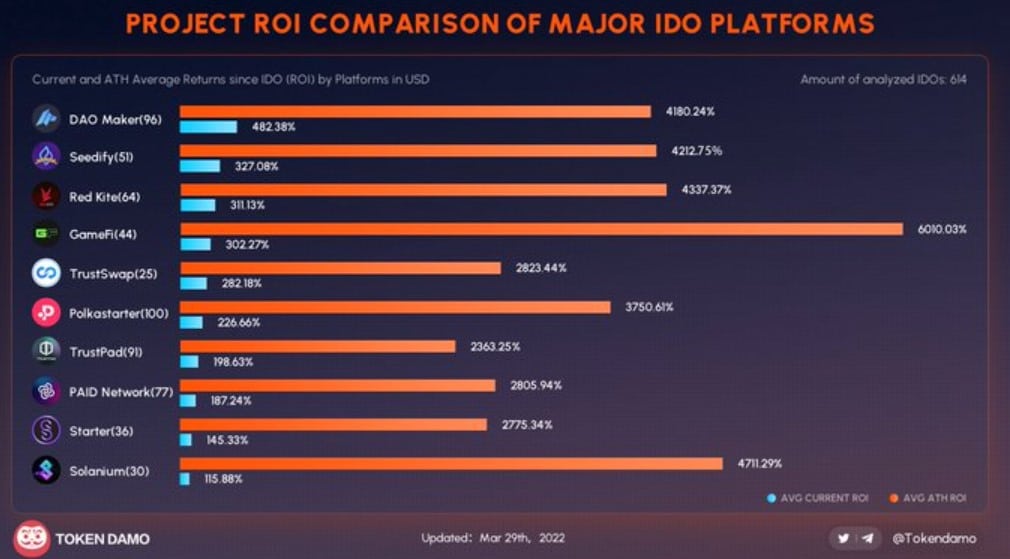

For reference, here is a great visual from Crypto3 View on Twitter showing some of the amazing returns from some of the major launchpads in the space:

Image via Twitter/crypto3view

Image via Twitter/crypto3viewIn the crypto industry, it is most common for speculators to purchase tokens that are already well established, with their most impressive gains having already been achieved. We have all heard those stories of the folks who turned $1,000 into a cool million, and the way that is done is by getting into a small-cap crypto project early before it is on the radar of other investors.

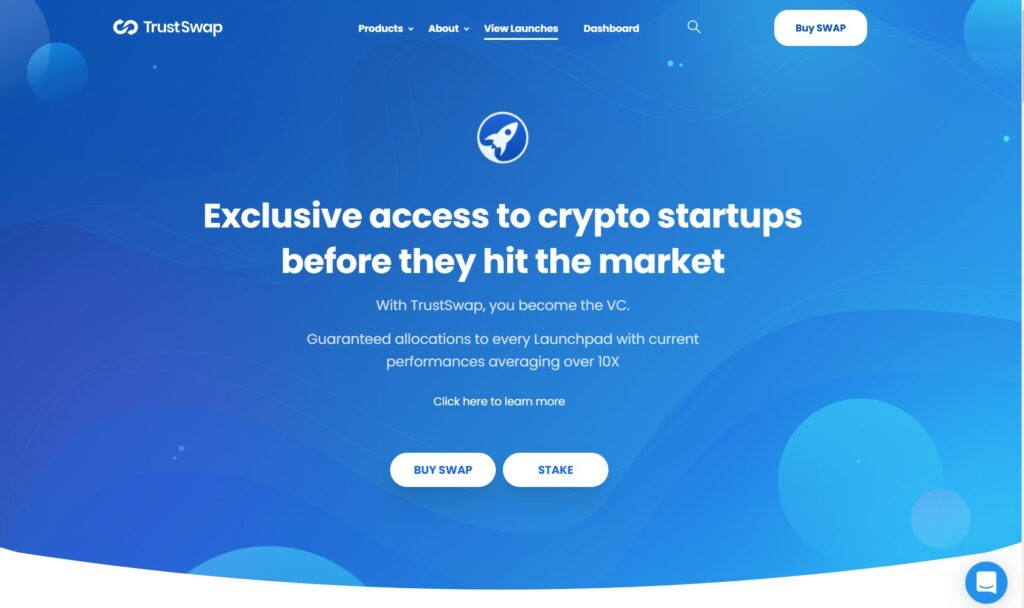

That is the opportunity that the TrustSwap launchpad provides. TrustSwap is a full-service launchpad that allows users to gain exposure to some of the most promising blockchain projects that are carefully vetted by the TrustSwap team.

TrustSwap provides its users with guaranteed token allocation from projects that use TrustSwap as an incubator, or launch on the platform, while they are in the presale stage. Users can confidently trust the TrustSwap team to carefully sift through and select projects with the highest potential.

Become a VC with the TrustSwap Launchpad. Image via TrustSwap

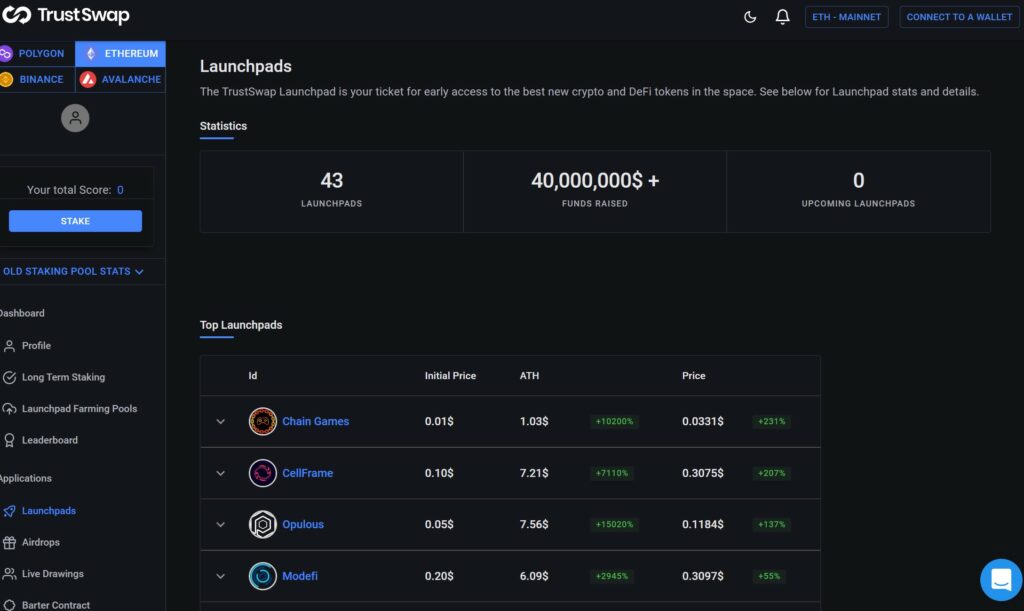

Become a VC with the TrustSwap Launchpad. Image via TrustSwapAt the time of writing, there are over 47 million staked SWAP, 38 launchpad projects, and over $40 million raised on the platform. The launchpad leverages the security of its proprietary SmartLock technology to ensure a white glove launchpad platform experience.

SmartLock technology ensures the integrity and trustworthiness of the launchpad projects, helping them towards their goals by enabling the locking of liquidity, which makes it convenient for investors to know that they are avoiding rug pulls and token dumps. The tech also provides customizable and fully-audited services that can securely lock tokens for teams, developers, and early stakers. This allows for the release of tokens after the completion of specific development milestones and vesting periods.

A Look at the TrustSwap Launchpad

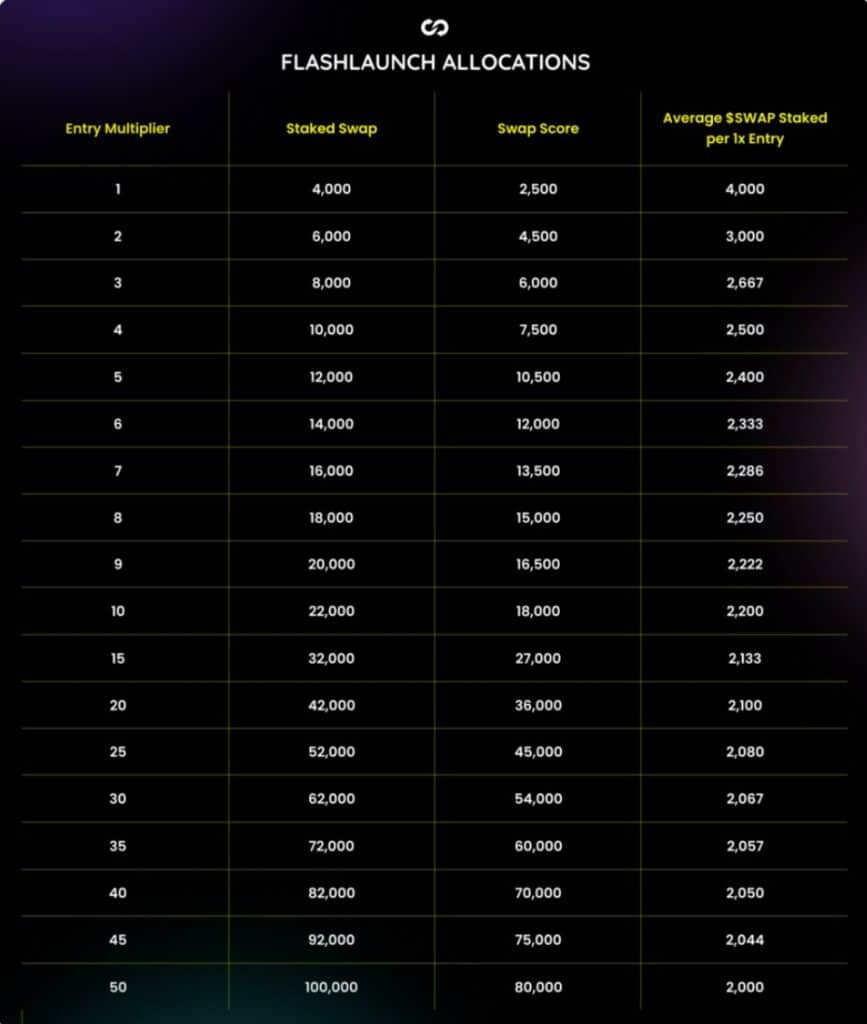

A Look at the TrustSwap LaunchpadStakers buy and stake SWAP tokens on the platform, and in return, they receive a guaranteed allocation for some of these early DeFi project tokens. Here are the unique features for TrustSwap stakers:

- Guaranteed allocation ensures that stakers participate in DeFi projects as early stakers. The bigger the staked amount, the higher the allocation multiplier a staker will receive.

- TrustSwap’s vetting team consists of a panel of blockchain experts, which evaluate each launchpad project before approving the launch.

- Projects disclose the vesting schedule of their token allocation, providing transparency around trust and integrity. These features are powered by TrustSwap’s proprietary SmartLock technology.

To gain access to the launchpad, users must stake at least 4,000 SWAP tokens or earn a 2,500 SwapScore (a 60-day rolling average of SWAP staked on the TrustSwap dashboard). The more SWAP tokens a user stakes, the higher the allocation they will receive for a project.

TrustSwap Launchpad Entry Requirements. Image via TrustSwap

TrustSwap Launchpad Entry Requirements. Image via TrustSwapNote that US residents cannot participate in the Launchpad and KYC needs to be collected to use this feature.

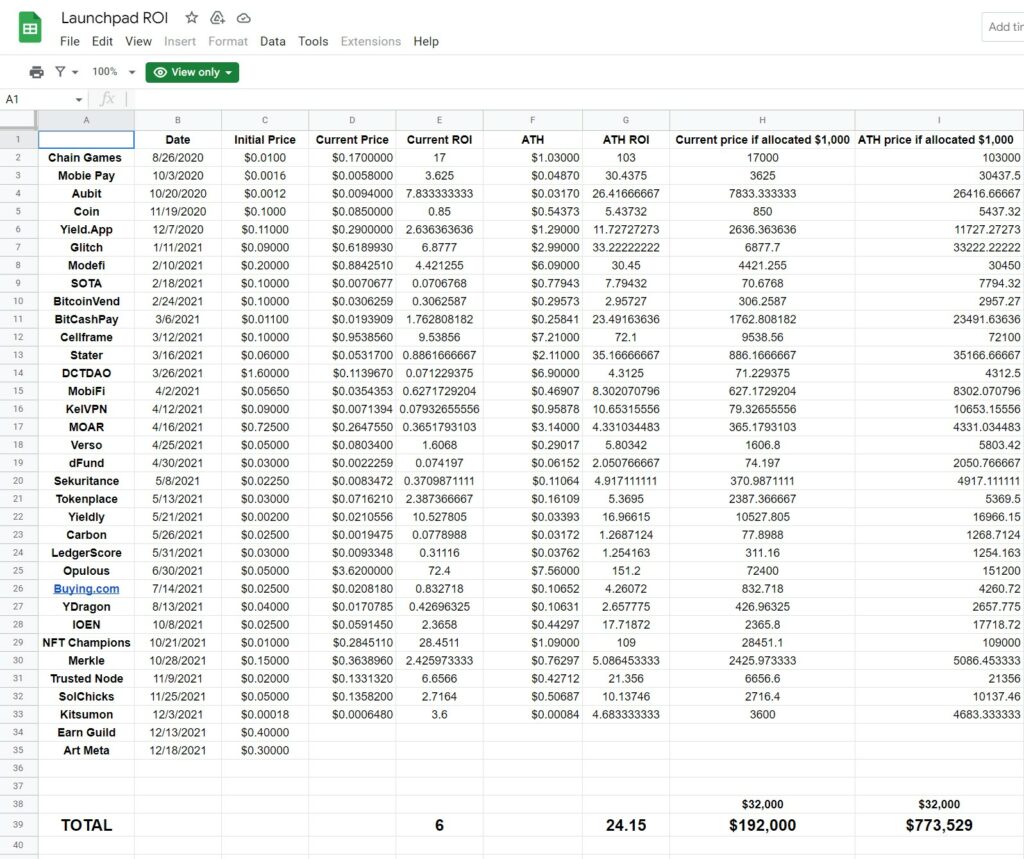

Investors who have invested in the TrustSwap launchpad have enjoyed a nice 24x return on their investment on average, with some projects hitting as high as 72x! Here is a spreadsheet that tracks how the projects have performed.

Results Published by TrustSwap

Results Published by TrustSwapThe Crypto App

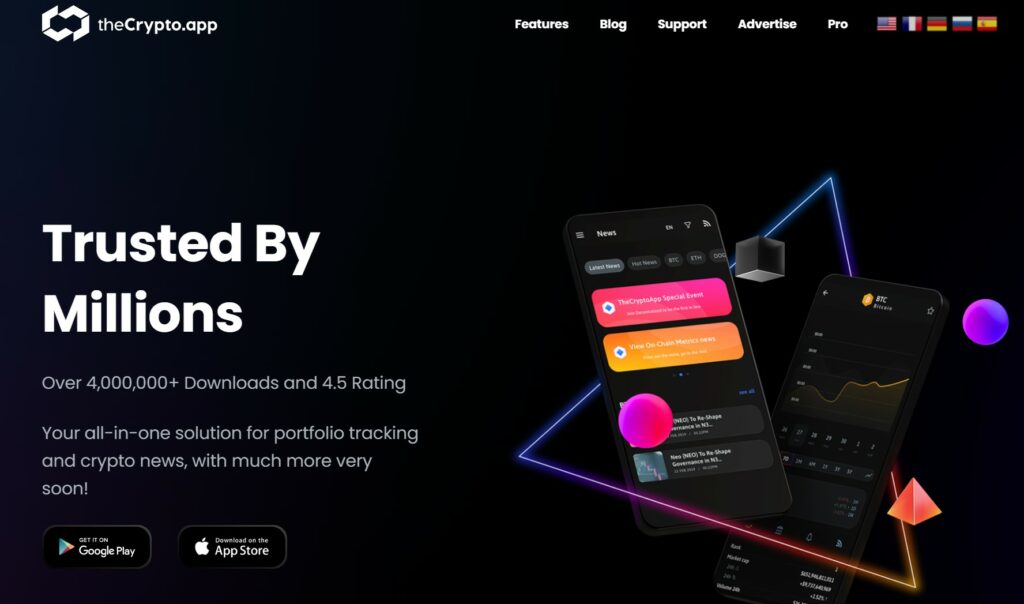

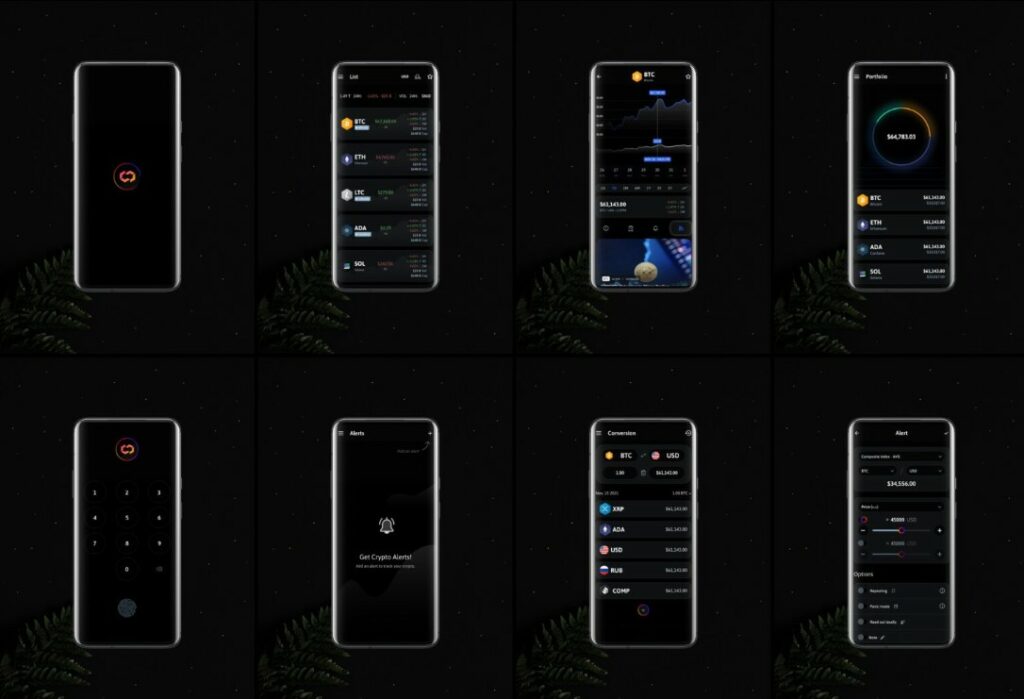

TrustSwap purchased theCrypto.app in 2021, a clever move as the app has over 4 million downloads.

A Look at the crypto.app home page

A Look at the crypto.app home pageThe Crypto App is an all-in-one solution that offers portfolio tracking, a crypto news feed, and charting platform in one powerful mobile application. Users can set up alerts to follow price movements and enable push notifications for when crypto movements happen.

TrustSwap is significantly overhauling the Crypto App, making the UI look stunning, while also upgrading the app to become a place where users can buy, sell, trade, and stake cryptocurrencies. The SWAP token will be the main utility token of the exchange, which is already generating significant revenue for TrustSwap, 20% of which is distributed to stakers, and 80% goes into the company treasury for future growth.

Pulling data from 2 price aggregators, over 100 crypto exchanges, 60+ news publishers and supporting over 35 blockchains, The Crypto App is a powerful crypto tracking tool that has fantastic reviews with a 4.6-star rating on over 81k reviews on Google Play, and a 4.7-star rating on the App Store.

Image via TrustSwap

Image via TrustSwap“The Crypto App felt like a natural extension for TrustSwap and we’re looking forward to further integrating the platform into our ecosystem,” says Jeff Kirdeikis, CEO of TrustSwap. He goes on: “The reputation The Crypto App has built for itself in recent years and the progress the app has made in regard to its integrations and offerings is incredible.”

NFT Platform Swappable

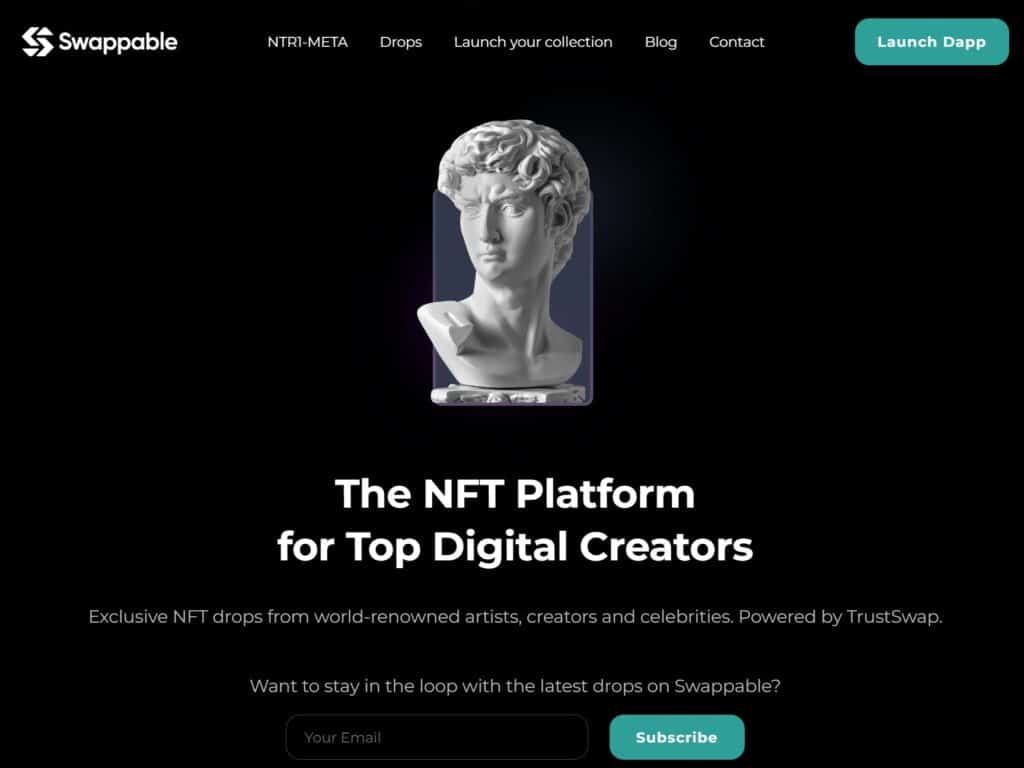

Swappable.io is an innovative NFT platform that empowers digital creators and web3 builders to launch NFT drops, powered by TrustSwap.

A Look at the swappable.io homepage

A Look at the swappable.io homepageSwappable is more than just an NFT marketplace, it curates the best projects and ideas, providing technical and marketing support to launch NFT drops from some of the most impactful and exciting NFT projects in the space.

In Swappable’s own words, they are not the first, not the biggest, but provide different access to a marketplace for NFT creators.

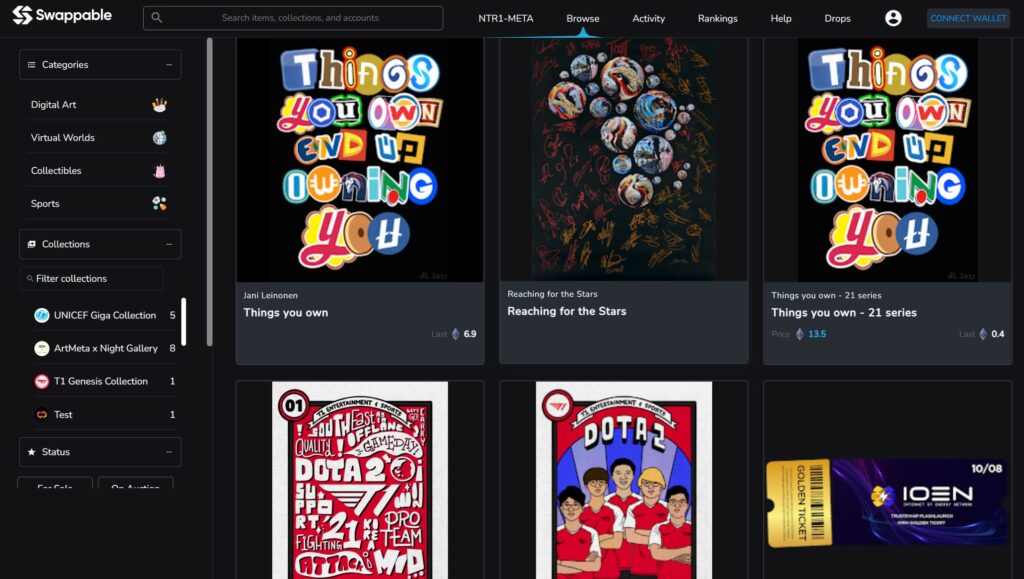

A Look at the Swappable Marketplace

A Look at the Swappable MarketplaceThe Swappable NFT marketplace provides the following features and benefits:

- Swappable provides access to a marketplace that pays 80% of the accrued fees back to the community (SWAP stakers)

- 50% lower selling fees if paid in TrustSwap’s SWAP token

- Buyer pays no additional purchase fees

- Create and sell NFTs quickly and easily

- Supports all major digital content formats (JPG, PNG, GIF, SVG, MP4, WEBM, MP3, WAV, OGG, GLB, GLTF (interactive 3D modelling)

- Easy and intuitive onboarding process. Sign up with your wallet, no account creation needed

- Set a fixed price or auction NFTs to the highest bidder

- Earn royalties each time a created NFT gets resold

Escrow Swaps

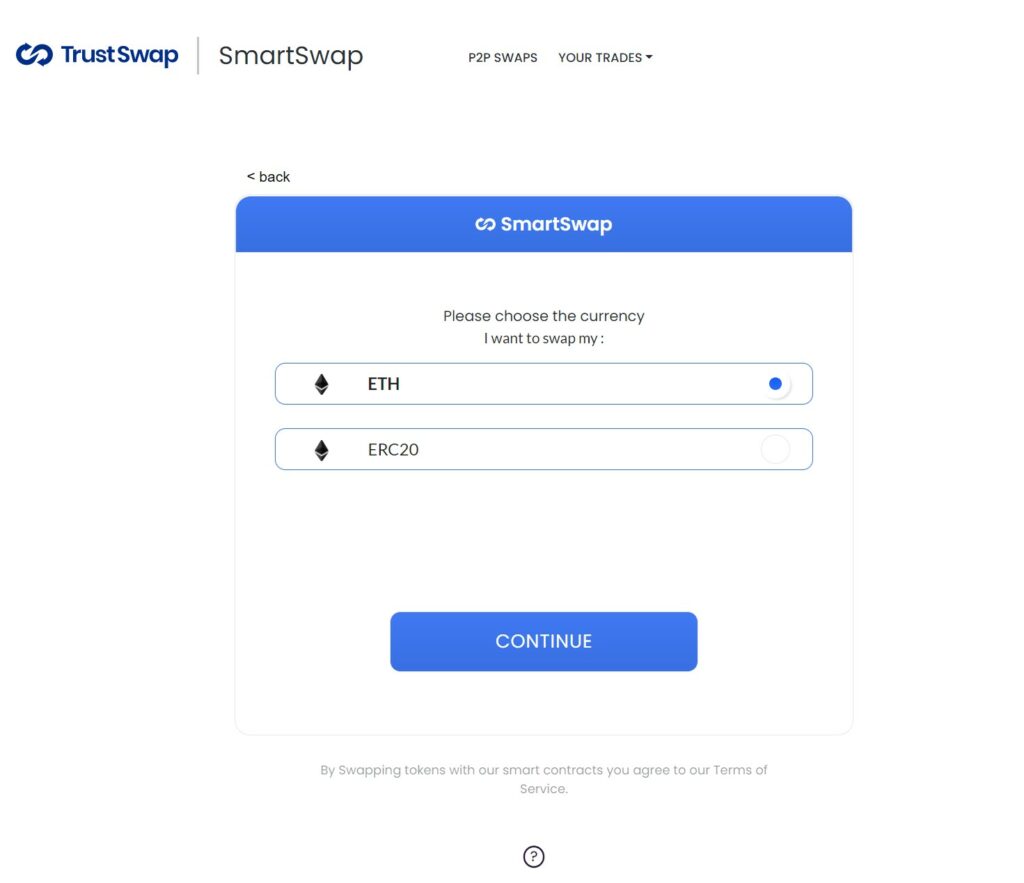

One of the founding goals of TrustSwap was to build a P2P escrow smart contract service that allows anyone in the world to swap tokens on a trustless and secure platform without the need for a third-party intermediary.

Image via TrustSwap

Image via TrustSwapThe Swaps and Escrow service is a fantastic decentralized P2P crypto swapping platform, enabling users to trade ETH or any ERC20 token with anyone in the world, and can be done by setting up customizable swap parameters.

A Look at the P2P Swap Interface

A Look at the P2P Swap InterfaceAll coins are locked using TrustSwaps audited smart contracts and can only be withdrawn once both parties fulfil their end of the agreement. By matching buyers and sellers through the use of automated smart contracts, there is no need for an intermediary or for buyers or sellers to simply trust that the other party won’t run off with funds. That is the power and beauty of smart contract capabilities.

If you are new to the world of smart contracts, you can learn more about them and how they work in our Ethereum Smart Contracts article.

Though simple in principle, this is a significant innovation as for the first time, users can swap crypto without the high escrow fees charged by middlemen like CEXs, law firms, escrow companies, etc. Users simply and instantly create custom token trade parameters and are matched with other buyers and sellers.

Here are some examples of use cases that can be accomplished through TrustSwaps Escrow Swaps:

- Individual P2P trades- Anyone can trade with one another for any amount of ERC20 or ETH tokens.

- OTC/Escrow- Over-the-Counter (OTC) services- Crypto exchanges, brokers, companies, and more can use the Swaps & Escrow service to save significant costs in value transfer procedures.

- Avoiding the cost of exchanges- Trading of tokens can occur on TrustSwap, avoiding the expense of projects needing to get their token listed on an exchange and adding liquidity. Because trading happens in a secure P2P manner, exchanges don’t need to get involved and smart contracts don’t mind working for free, making exchange fees a thing of the past.

- Swap Benefits- SWAP tokens can be traded for ETH with zero fees! This creates a micro-economy of P2P OTC SWAP trading that incentivizes wider adoption of SWAP tokens and promotes organic growth for the SWAP ecosystem.

TrustSwap SmartSubscription

SmartSubscription allows TrustSwap users to create recurring crypto payments at predetermined specific time intervals and other payment parameters on the Ethereum network.

This feature is useful to conduct things like payroll, or dollar cost averaging payments into DeFi protocols, and will likely one day be able to cover things like bill/subscription payments, etc.

TrustSwap Business Services

As mentioned, TrustSwap isn’t just for retail, they look after their business pals too and offer a suite of business services, truly becoming a robust, full-service crypto platform for everyone.

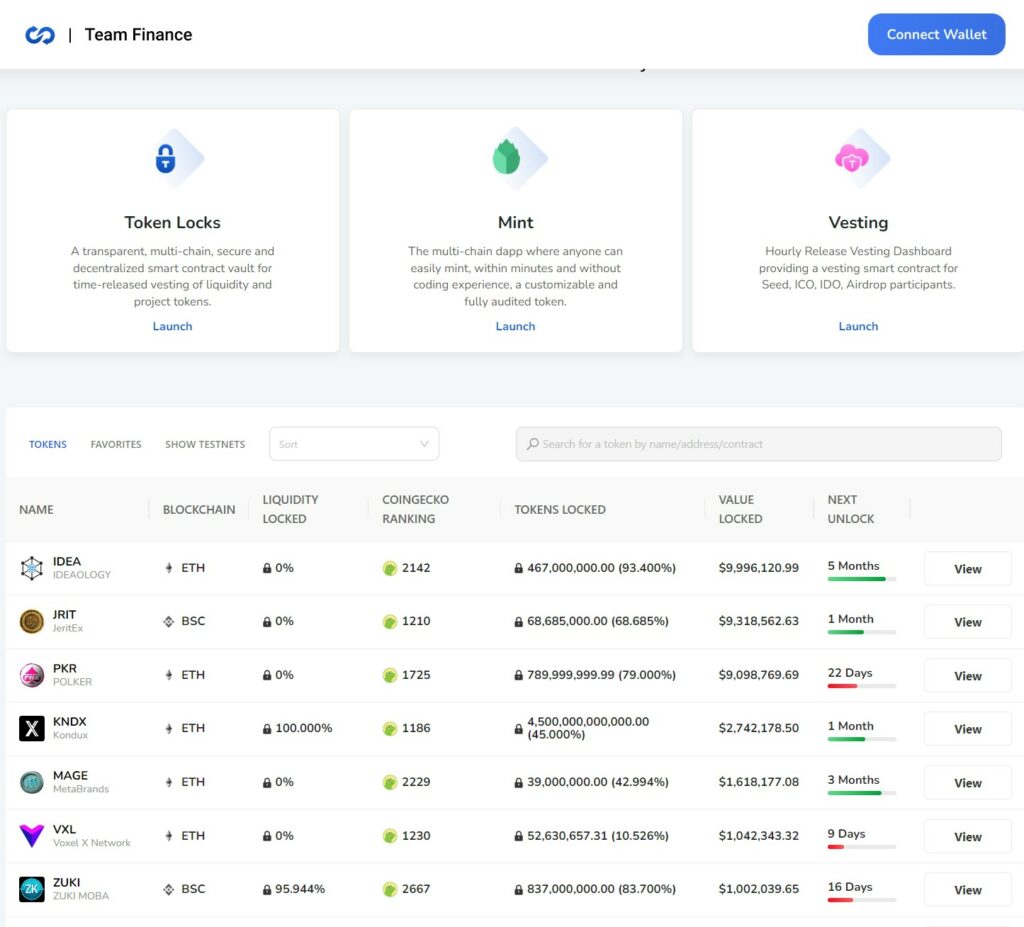

Team Finance

Team.Finance is a DeFi tool from TrustSwap that provides liquidity locking and team vesting services for token founders and the crypto community. This is the feature that provides investors with assurance that DeFi projects won't dump their tokens on the market and prevents rug pulls by keeping tokens locked for a set period.

Image via team.finance

Image via team.financeWith Team Finance, project teams can reassure investors that their project is legitimate. Projects that choose not to use a token locking system risk losing investor trust, as they may be wary of rug pulls and scams that plague the crypto industry.

Team Finance gives DeFi projects a security score, giving them a quantifiable and verified way to advertise their reputability to potential investors. Over 29,000 DeFi projects have locked a whopping $4.5 billion in crypto using the services of Team Finance.

Team Finance ranks #1 on Google search for token-locking-related searches and generates ~$400,000 in income per month. 20% of this revenue is allocated to TrustSwap stakers, the other 80% goes to business development.

Some of the Projects Currently Using Team Finance

Some of the Projects Currently Using Team FinanceTrustSwap’s goal is to create a secure DeFi ecosystem that is safe and sustainable for all stakeholders involved, providing a respite from all the scams and rug pulls that cause justifiable paranoia in the industry. Team Finance is a security-focused ecosystem that includes liquidity locking, token locking, and token generation services.

Team Finance offers this service on the Ethereum, Binance Chain, and Polygon network, making Team Finance the industry leader in this offering, with millions more in value locked than any competitors.

The following actions can be taken through TrustSwap’s Team Finance:

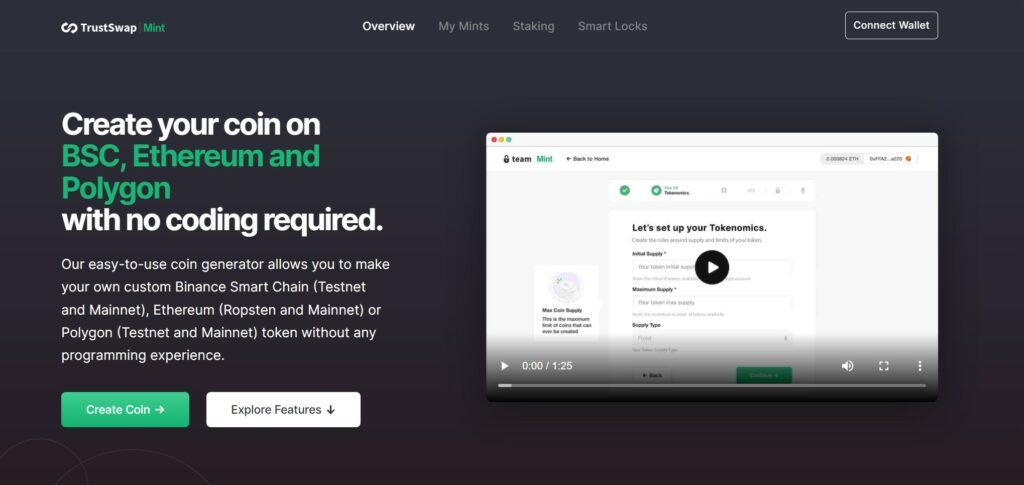

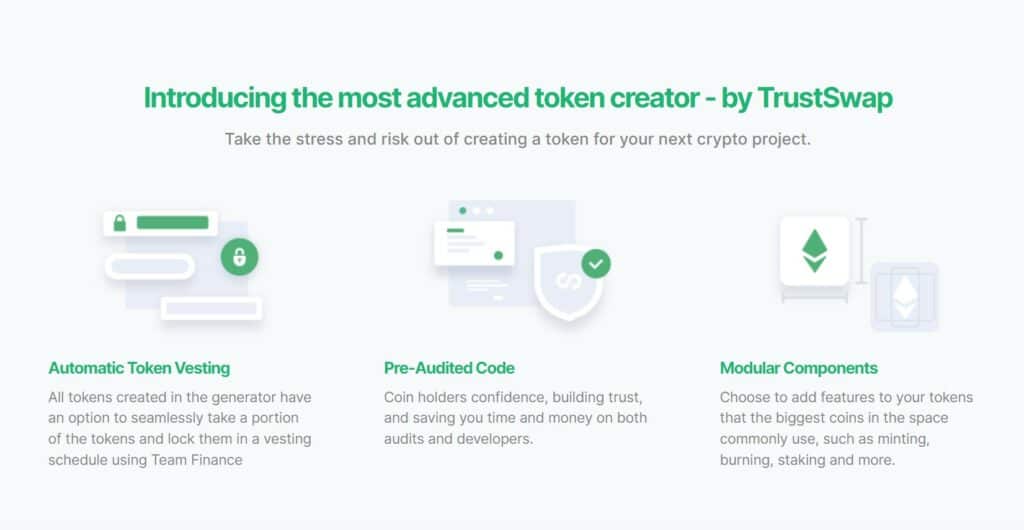

Token Creation/MINT

So, you’ve got a great idea for a crypto project, you’ve put together a team, but you have no idea where to start and you need to launch a token. TrustSwap’s MINT feature has you covered.

Image via mint.trustswap

Image via mint.trustswapThere is a common issue in the DeFi space, where new tokens get launched on the daily with poor, or no audits being conducted, and projects spin their wheels with time-consuming procedures and face legitimacy suspicions regarding their projects.

There are too many scams and coding errors resulting in losses that fill the crypto headlines too often, and many investors are left shell-shocked, and now just assume everything is a scam. Good luck getting a project off the ground with so much distrust in the space. In crypto there is a saying, “don’t trust, verify,” and this is where publicly published audits and project transparency play a key role in gaining investor trust and confidence.

TrustSwap removes the security, time, and cost hurdles involved in token creation for new DeFi projects. The Mint service enables a smooth journey for teams who want to create DApps and launch their projects to the crypto community.

TrustSwap’s Mint feature is one of the easiest platforms for token creation, and allows for the creation of custom Ethereum, Polygon, and Binance chain tokens, with no developer or coding skills needed. It is a user-friendly procedure, fully audited and can be done is 4 simple steps, saving projects significant time and money.

Image via mint.trustswap

Image via mint.trustswapCEO Jeff Kirdeikis had this to say about the Mint feature:

“We’re excited to introduce Mint to the TrustSwap community. Whether it’s setting up tokenomics, inflationary or deflationary properties, or determining token presale opening and closing. We’ve taken the stress, risk and costs out of creating tokens for upcoming crypto projects.”

Here is a look at the simple 4-step process to mint tokens:

- Provide basic info such as blockchain network, token name, token symbol, logo, decimals, and description of the project.

- Set up tokenomics- initial supply, max supply, fee, supply type, inflationary/deflationary properties etc.

- Select token features- transaction fees, mint/burn mechanics

- Configure feature settings- If transaction fee is selected instead of mint/burn function, the fee percentage for each transfer transaction is set here.

The Mint feature can also be combined with complementary SmartLaunch services such as Token Locks, Liquidity Locks, and Vesting-as-a-Service.

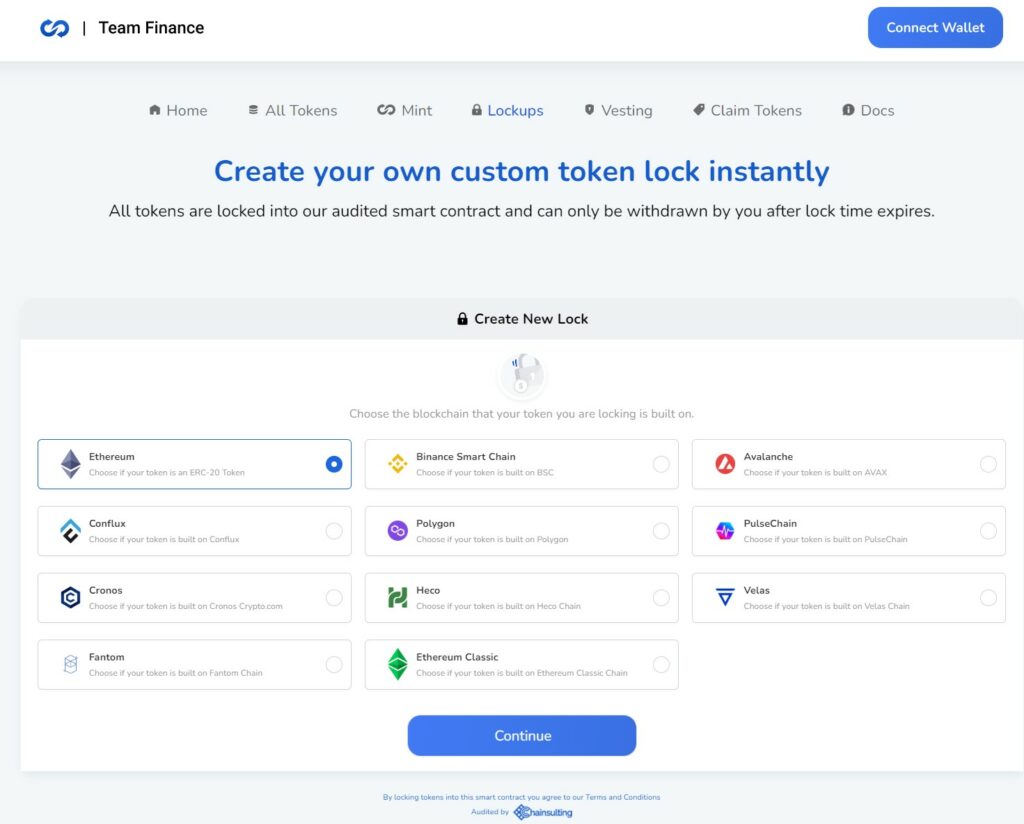

Token Lock

Token locks allow project team members, founders, and developers to set up token lock parameters. Projects can lock a percentage of their pre-mined token supply or team-owned tokens into TrustSwap’s time-locked decentralized smart contract-powered vault.

Tokens that are locked cannot be accessed by the project members until after the locked period ends. This ensures that the community and investors will not get dumped on by the team during the contract period.

A Look at the Beginning of the Token Lock Process. Image via team.finance

A Look at the Beginning of the Token Lock Process. Image via team.financeThis is quite the confidence-inspiring innovation as we have seen many token offerings where the projects have failed to fulfil promises and claims, then maliciously sell off all their tokens, leaving holders, stakers, and investors holding the bag of devalued tokens.

Liquidity Lock

Liquidity locks work to enhance security attributes for token holders. Projects raise capital and use a percentage to supply the DEX pool with liquidity, and in return, the DEX provides each token pair a liquidity pool (LP) token that represents a share in that pool.

Image via team.finance

Image via team.financeThanks to the Liquidity Lock wizard, projects can lock these liquidity tokens by sending them into a time-released vault controlled by smart contracts that will only return the liquidity pool tokens at the configured date. During this lock period, project members cannot pull liquidity from the exchange, and ensures the tokens are secured, further protecting against token dumps.

A liquidity locker allows the developer to store LP tokens in a smart contract, revoking their permission to move these LP tokens from a start date to an end date.

This process has become industry standard by reputable projects and is a common practice that happens right after the creation of any new liquidity pool on a decentralized exchange.

The release dates of these liquidity locks are public and provide a transparent view to users and investors, enhancing trust between all participants.

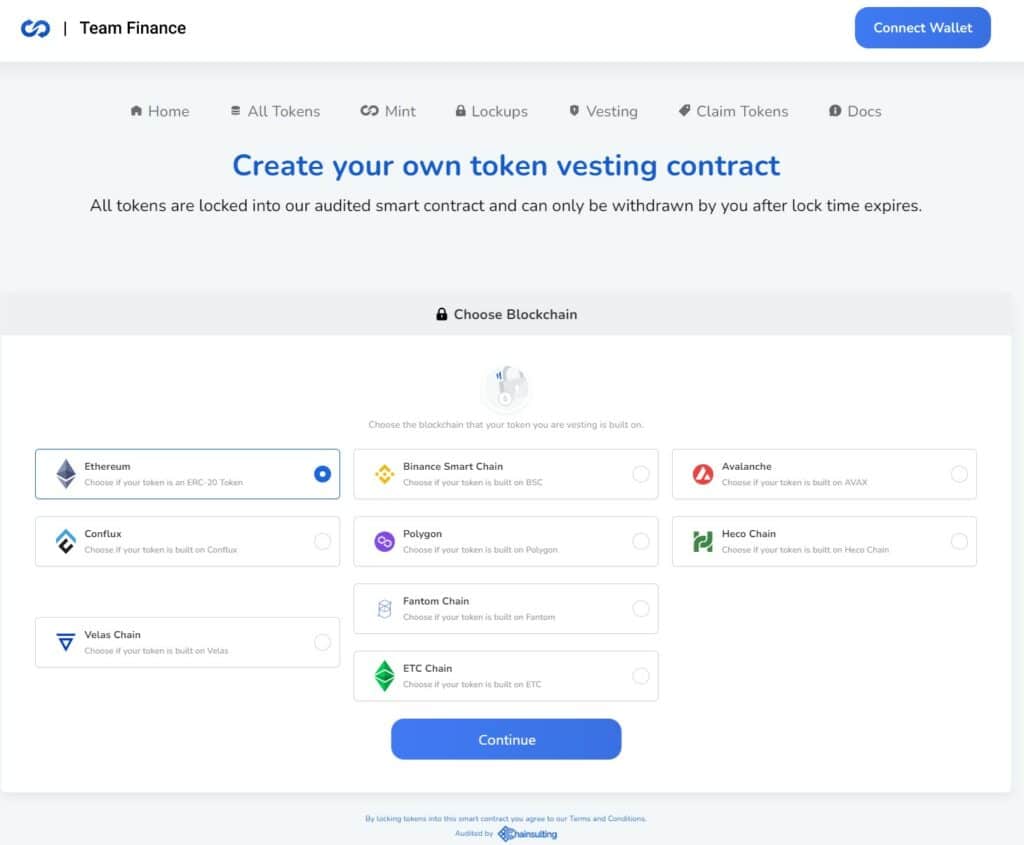

Vesting

Projects can access a token vesting dashboard where they can enter a vesting smart contract for seed rounds, ICOs, IDOs, IEOs, and Airdrops.

Image via team finance

Image via team financeThis function ensures that a pre-set amount of tokens can be unlocked and sent to certain crypto addresses at specified time intervals to support contractual obligations and enhance trust as investors and interested parties can verify the parameters of the vesting smart contract before agreeing to terms and conditions.

Putting It All Together

Okay, so we have covered a lot so far, and you can see what a powerful platform TrustSwap is, truly providing a comprehensive full product suite to meet the needs of both projects and investors. Let’s summarize how this all works together to help us all get our heads around it.

Image via TrustSwap

Image via TrustSwapProjects that launch through the TrustSwap Launchpad can create and mint tokens, embed token and liquidity locks, enter into vesting smart contracts, as well as benefit from the advisory and marketing services of the experienced TrustSwap team.

This combination of services not only helps new projects get off to a strong start but helps secure investment income as the TrustSwap platform attracts investors as they have a strong reputation for offering high-quality projects that can be trusted and verified as legitimate.

The power behind the platform truly lies in the brilliance of smart contract functionality. TrustSwap is very convenient for projects as they do not need to understand how to code their own smart contracts as they can use the plug-and-play services offered by TrustSwap, smart contracts which have been audited and proven successful so investors can rest easy knowing that the code is secure.

For users, not only can they invest in high-quality projects and stake to earn a nice APY, but can swap tokens, and take advantage of the Crypto App and the NFT platform Swappable for both NFT creators and buyers. TrustSwap does have something on offer for nearly any style of crypto enthusiast.

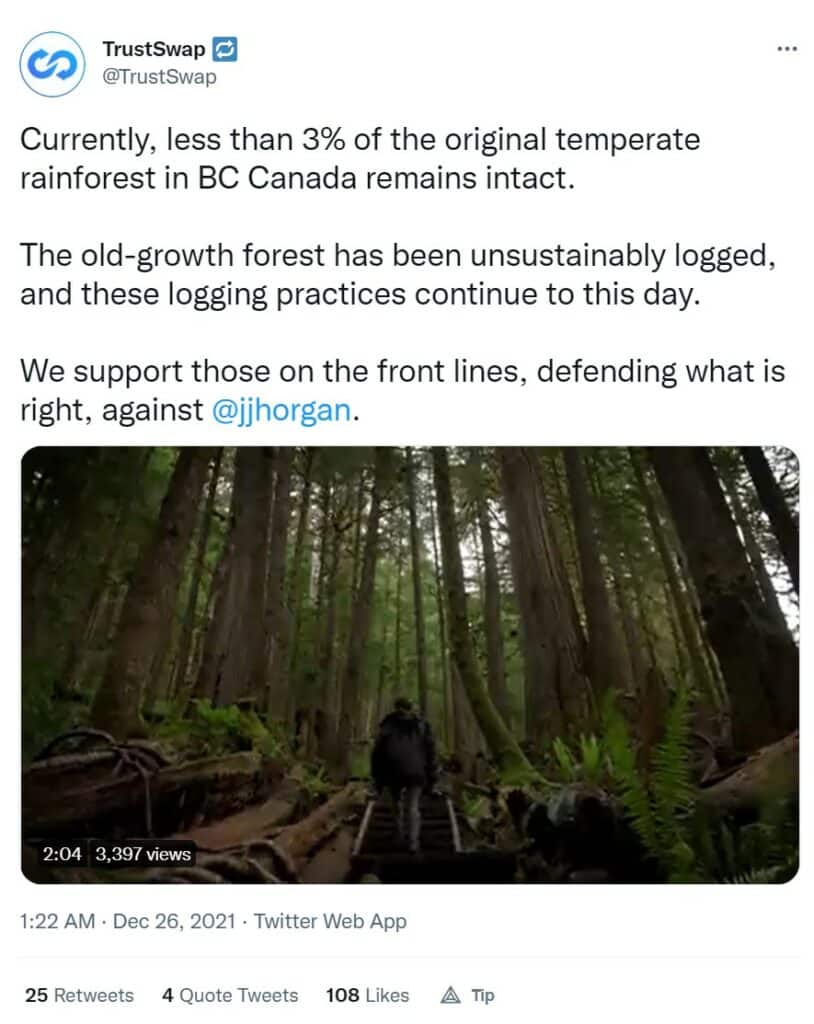

TrustSwap Donantions + Charity

A project that is revolutionizing crypto and places a strong focus on philanthropic ventures to make the world a better place? Nice one! Kudos to the TrustSwap team 🙇

In 2021, TrustSwap planted a million trees in partnership with Eden Reforestation. These guys planted a million trees, and I can’t even keep my two house plants alive. Each tree planted will be tended to until they reach full maturity, bringing jobs into developing nations where the trees are planted.

If a whopping million trees planted wasn’t enough, the team also invested in KlimaDAO, which worked to remove 250 tons of Carbon Credits. In the same year, TrustSwap donated funds to the protesters at Fairy Creek who are protecting the last 3% of old growth forest in British Columbia, Canada.

TrustSwap Donated to the Restoration of Canada’s Old Growth Forest. Image via Twitter/TrustSwap

TrustSwap Donated to the Restoration of Canada’s Old Growth Forest. Image via Twitter/TrustSwapTrustSwap and Swappable also collaborated with UNICEF to launch an NFT auction with all proceeds going directly to UNICEF. These guys are like the Mother Theresa of crypto and did all that in less than a year, with plans of planting another million trees and continuing their charitable endeavours.

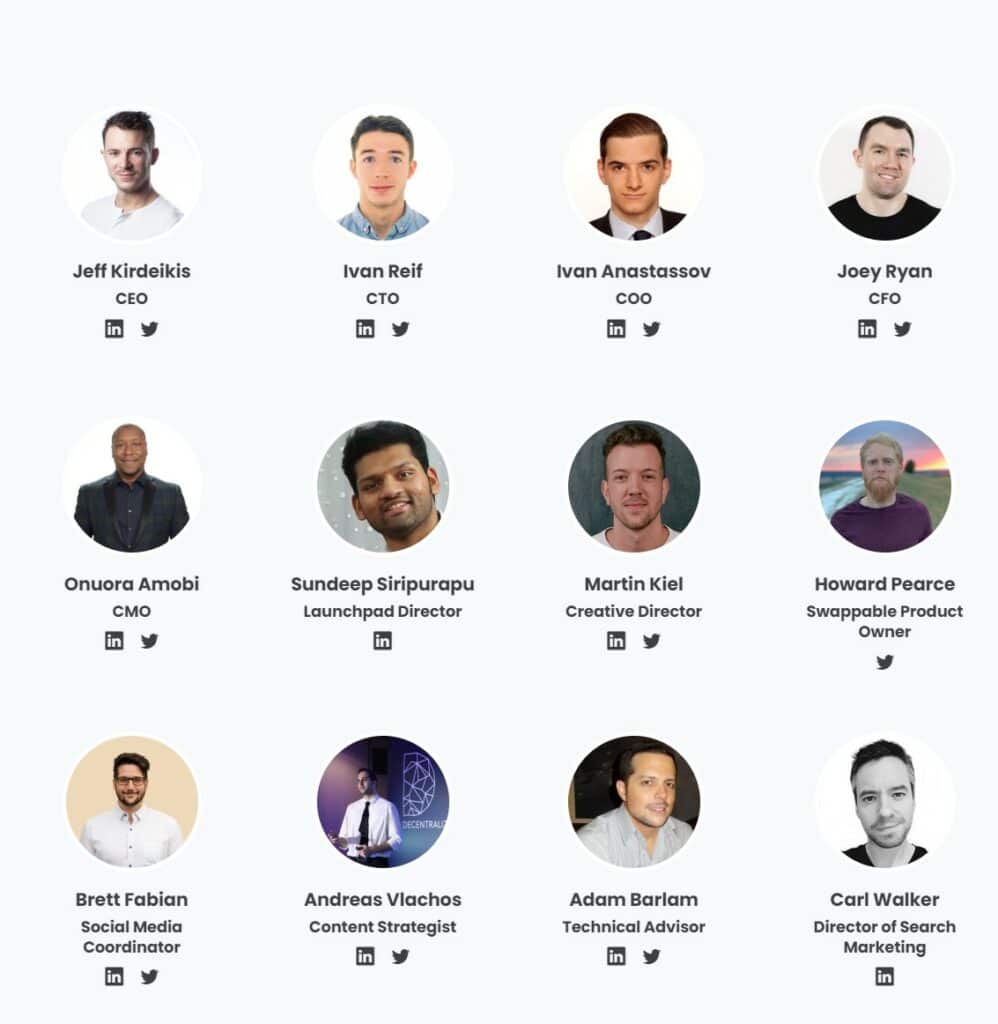

The TrustSwap Team

TrustSwap was incorporated in Canada in July 2020, founded by Jeff Kirdeikis, who is the current CEO, and Adam Barlam, who was the former CTO and a current technical advisor for the project. Both Jeff and Adam have impressive backgrounds prior to founding TrustSwap.

A Look at the TrustSwap Team. Image via TrustSwap

A Look at the TrustSwap Team. Image via TrustSwapKirdeikis is also the founder of Uptrennd, a blockchain-based social media platform. He’s the host of The Bitcoin and Crypto Podcast and runs a successful crypto group on Facebook with over 150,000 members. Kirdeikis embodies the crypto spirit and is truly a positive voice and advocate in the space. I recommend checking out his podcast or watching some of his interviews on YouTube if you get the chance.

Barlam has significant experience both within and outside the crypto space. He was the head developer behind the Bravocoin review platform, and previously held senior developer positions with Intel and GoDaddy.

TrustSwap currently employs over 70 team members from around the globe, with experience spanning various industries. Members held positions for the likes of Goldman Sachs, KPMG, Coinmarketcap, Siemens, Unisys, HP, and more.

The SWAP Token and SWAP Tokenomics

The SWAP token is a utility token for the TrustSwap platform, used in the protocol’s products and services. SWAP holders outside the United States can use SWAP to gain early access to new blockchain projects through the TrustSwap Launchpad. The token also provides governance benefits, powers The Crypto App, and unlocks powerful staking benefits.

Let’s break down some of the SWAP token’s benefits and features:

- Governance- SWAP stakers can participate in governance and voting on the platform.

- Staking Rewards- Stakers are rewarded with transactions fees collected from the platform and can be locked in for longer periods for some attractive APYs.

- Improve Swap Score- Holding SWAP tokens will increase users’ Swap Score, which increases their chances for drops and provides favourable allocation to new launchpad projects.

- Deflationary- 10% of SWAP collected from transaction fees is burned, decreasing the total supply of SWAP over time.

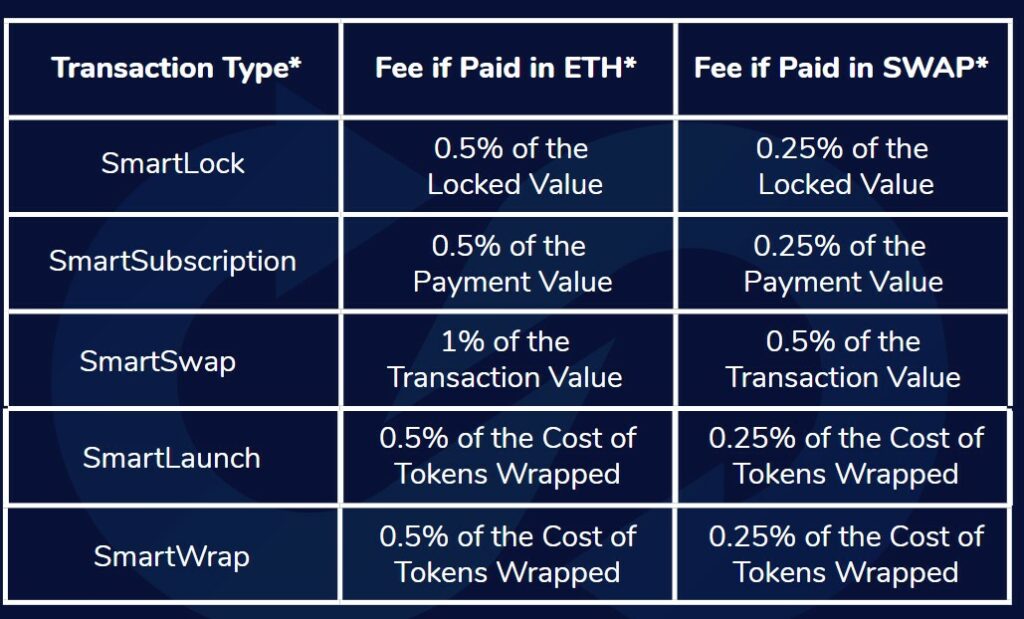

- Reduce fees- Using SWAP tokens can reduce fees on the platform.

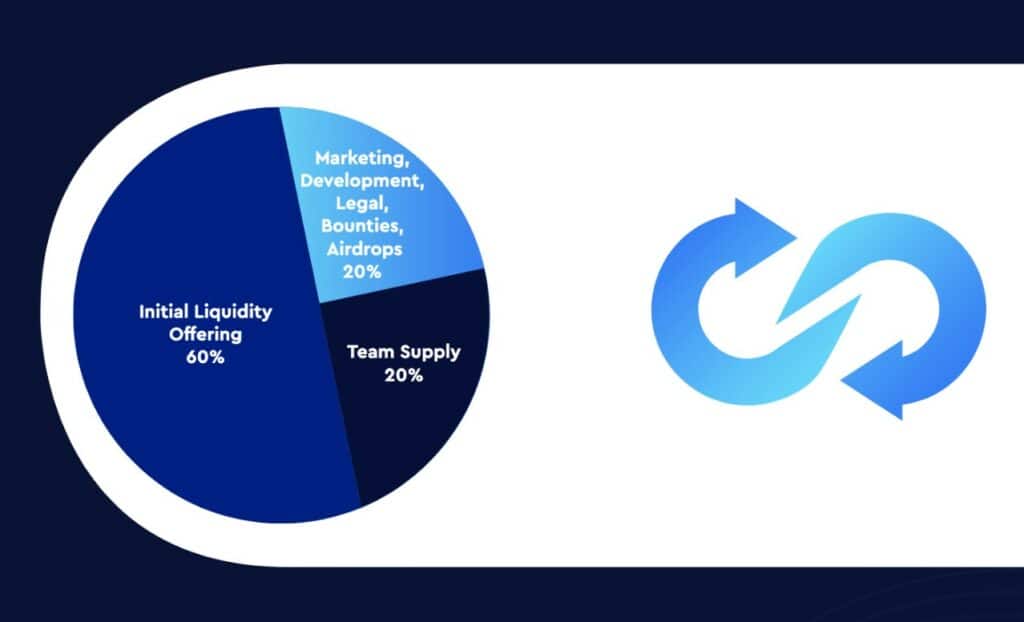

The total supply of SWAP is 100,000,000, and is distributed like so:

Image viaTrustSwp Whitepaper

Image viaTrustSwp WhitepaperHere is a look at the discounts on the platform for users who are happy to pay fees in the SWAP token:

Image via TrustSwap Whitepaper

Image via TrustSwap WhitepaperTrustSwap Staking

I know I already mentioned staking briefly as one of the benefits of the SWAP token, but staking is such an integral part of the TrustSwap platform that it merits its own section. TrustSwap started offering SWAP staking only on the Ethereum network but has now expanded to include SWAP tokens on BSC, AVAX, and MATIC. Over 70% of SWAP is currently being staked on the platform.

SWAP holders and stakers benefit immensely from the following income streams:

- Revenue generated from trading fees on Swappable are distributed with 80% going to stakers, and 20% being used to buy back SWAP tokens which are burned.

- Team Finance revenue is 100% used for buybacks. 80% of this revenue is used for business development, and 20% goes towards long-term staking pools.

- Crypto App revenue is 100% used for buybacks. 80% of this revenue is used for business development, and 20% goes towards long-term staking pools.

So, you can see the multiple ways that staking rewards are collected and benefit stakers on the platform. This multi-tiered staking approach is one of the most robust staking plans I’ve seen in DeFi. By spreading risk and generating income from three separate platforms, all owned and run by the TrustSwap team, the diversification of staking rewards inspires confidence in long-term SWAP holders.

TrustSwap also recently launched long-term staking pools to further incentivize long-term network participants and supporters. The longer users stake, the higher their staking APY. There is a time multiplier benefit for stakers with a longer-term mindset, which you can see below:

Image via TrustSwap

Image via TrustSwapThe long-term staking pools benefit everyone equally whether they choose to stake 10, or 100,000 SWAP tokens. The TrustSwap staking portal is so easy to use and allows holders to instantly earn attractive APYs.

How to Buy SWAP

SWAP can be purchased on popular exchanges: Gate.io, Huobi Global, and Ethereum DEX Uniswap, AVAX DEX Trader Joe, BNB Chain DEX PancakeSwap, and Polygon’s QuickSwap, depending on what network you want to hold the token on.

Best SWAP Wallets

If you are going to be engaging with the TrustSwap platform, it will be easiest to simply keep your SWAP tokens in your MetaMask wallet for Ethereum, or the Binance Smart Chain browser extension wallet if you opt for SWAP on the Binance Smart Chain.

If you are simply planning on HODLing the ERC20 version, Atomic and Trust Wallet are solid choices. Hardware wallets Trezor and Ledger can also hold ERC20 tokens, just be sure to understand how these wallets handle unsupported ERC20 tokens before sending ETH tokens to them so you don’t panic if you can’t see the token on the native wallet interface.

Conclusion

Well, we have covered a lot here in this article as TrustSwap has a lot of features on offer. The TrustSwap platform really has solidified its position as a Titan, not only in the launchpad niche, but as a general-purpose powerhouse DeFi platform with a full product suite to suit retail investors, institutional investors, traders, and projects looking to launch.

The TrustSwap platform is growing so rapidly that it is difficult to keep up with all the changes. I feel like every week there is a new exciting announcement or development from the team, the platform is moving at a remarkable pace. In fact, I found myself muting the TrustSwap Telegram Channel that I follow as it was pinging my phone more frequently than an angry ex after a bad breakup.

Speaking of Telegram, if you want to know which Telegram channels we recommend following to get your crypto fix, feel free to check out our Top Telegram Channels article.

Though crypto prices are down, TrustSwap is not letting that bring them down as they continue to grow and build. Expect to be seeing more of them, especially since UFC champion Amanda Nunes just signed a 1-year sponsorship deal with TrustSwap’s The Crypto App, and TrustSwap, along with Swappable, teamed up with T1, one of the most recognized Esports teams and is sponsoring their Dota 2 tournament. Exciting things coming from this Canadian DeFi Gem.