The cryptocurrency space is home to hundreds of exchanges, making the task of selecting the right platform for your needs a challenging one.

Even when choosing some of the industry’s leading platforms, like Binance, Coinbase, or Bybit, it’s essential to understand that no exchange is entirely risk-free. Security breaches can and do occur, which could result in significant losses. This highlights the importance of diversifying across multiple exchanges—a strategy that can help mitigate risks and safeguard your assets.

One exchange that could fit well into such a portfolio is WEEX. With its wide selection of cryptocurrencies and an array of trading features, WEEX has earned the trust of millions of users as a reliable and feature-rich platform.

In this WEEX review, we’ll explore the exchange's key offerings, security measures, trading tools, and overall user experience to help you determine if it aligns with your trading needs.

Review Summary

WEEX is a centralized cryptocurrency exchange launched in 2018, offering a broad range of trading features tailored to both novice and experienced traders. Operating globally in regions such as the United States, Canada, the United Kingdom and Japan, WEEX provides diverse trading options, high-security standards, and a user-friendly interface, making it a notable contender among crypto exchanges.

Key Features of WEEX:

- Security and Privacy: WEEX prioritizes user protection with industry-standard security measures such as two-factor authentication (2FA), advanced encryption protocols, and regular security audits. It has transparent Proof of Reserves (PoR) and a 1,000 BTC user protection fund.

- Diverse Trading Options: The platform supports spot trading, futures with leverage up to 200x, over-the-counter (OTC) trading, and copy trading.

- Extensive Cryptocurrency Support: WEEX offers an impressive range of over 580 cryptocurrencies with 642 spot trading pairs and 473 perpetual contract pairs, providing traders with ample opportunities to diversify their portfolios.

- Competitive Fee Structure: The exchange employs a straightforward fee system, with 0.10% fees for both maker and taker spot trades, and futures fees set at 0.02% for makers and 0.08% for takers. Deposits are free, while withdrawal fees remain competitive with other leading exchanges.

- Referral & Affiliate Programs: The referral program allows individual users to earn up to 50% commission on trading fees by inviting friends to trade on WEEX, while the affiliate program provides influencers and content creators with additional opportunities to generate income through referrals.

- User-Friendly Interface and Mobile App: An intuitive web platform and mobile app ensure a smooth trading experience, suitable to both beginners and seasoned traders.

- High Non-KYC Limits: WEEX sets itself apart with high non-KYC withdrawal limits, allowing up to 50,000 USDT per transaction and 500,000 USDT daily, catering to privacy-conscious users. Also, check out our top picks for the best no-KYC crypto exchanges.

What is WEEX?

WEEX is a centralized cryptocurrency exchange (CEX) launched in 2018, offering a robust suite of trading features tailored to both novice and seasoned traders. The platform supports a diverse range of trading services, including spot trading, futures trading with leverage up to 200x, over-the-counter (OTC) trading, and copy trading.

WEEX operates across multiple regions, including the United States, Canada, the United Kingdom, and Japan. It is also well-regulated, holding Money Service Business (MSB) registrations with FINTRAC in Canada and FinCEN in the United States.

Security plays a critical role in WEEX’s operations. The exchange has a 1,000 BTC user protection fund, with its address transparently disclosed alongside its Proof of Reserves (PoR). Additionally, it employs advanced security protocols to safeguard user funds and data, creating a reliable and secure trading environment.

With support for over 580 cryptocurrencies, WEEX provides access to a broad selection of digital assets. In addition to its trading features, WEEX offers an attractive affiliate and referral programs with commission up to 50%.

Creating Your WEEX Account

If you want to start trading on WEEX, you first need to sign up for the exchange, so here’s a short guide to get you started:

First, head to weex.com and click the “Sign Up” button in the top-right corner. You’ll see prompts for two sign-up methods—choose the one that suits you best:

- Through your email address

- Via your phone number

If you choose to sign up via email, a verification code will be sent to your inbox, and if you opt to use your phone number, the code will arrive as a text message. Once you enter the code, you’ll be ready to start exploring WEEX.

WEEX KYC

WEEX stands out for offering some of the highest non-KYC withdrawal limits among major cryptocurrency platforms. At the time of writing, these are the limits:

- Non-KYC users: 50,000 USDT single transaction withdrawal limit and 500,000 USDT daily limit, which is quite high.

- KYC users: Single transaction withdrawal limit of 100,000 USDT and a daily limit of 2 million USDT.

Steps to Complete KYC on WEEX

To start the KYC process, you first need to download the WEEX mobile application, as this is currently the only platform where the KYC process can be completed.

Once you have downloaded the application, you can proceed with the following steps:

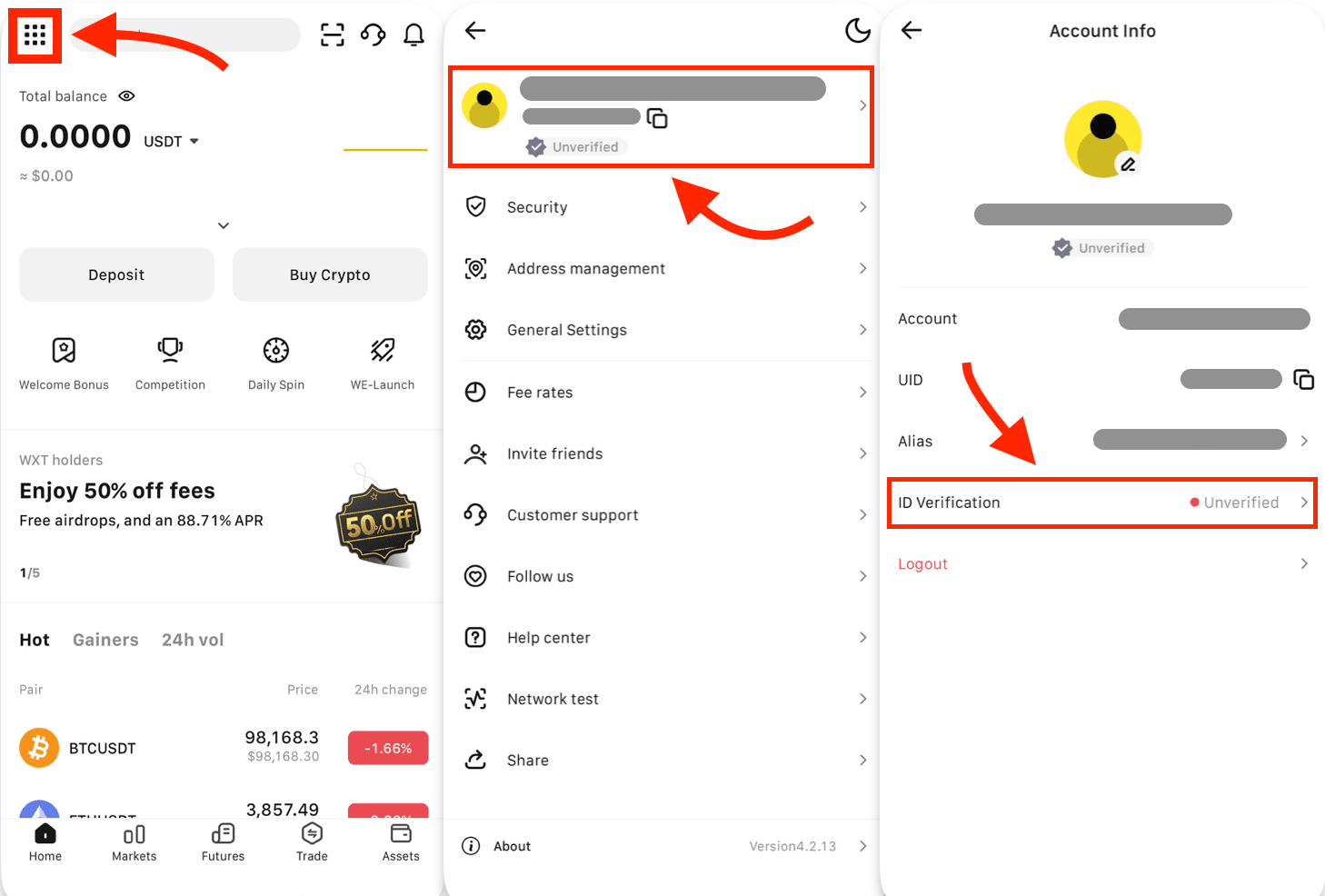

STEP 1: Click on the Menu Icon in the top-left corner of the screen.

STEP 2: Tap your Profile Tab at the top of the screen.

STEP 3: Select “ID Verification.”

Finding ID Verification on WEEX. Image via WEEX

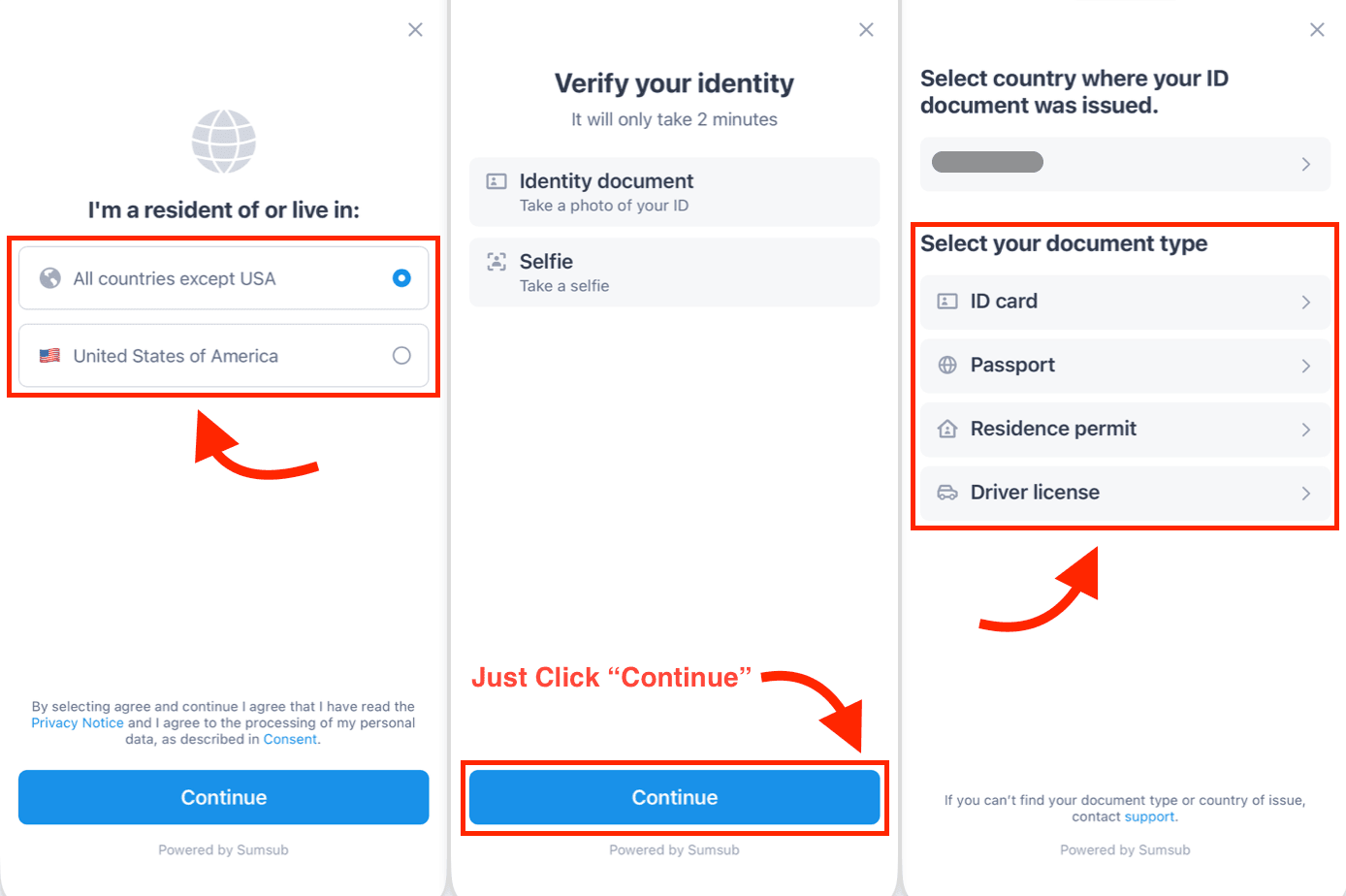

Finding ID Verification on WEEX. Image via WEEXSTEP 4: Choose your Country of Residence, either “All Countries Except USA” or “United States of America.” For the sake of this example, we’ll choose the former.

STEP 5: Submit images of one of the accepted document types and complete a selfie. Your KYC application will then be processed.

Selecting Your ID Verification Parameters. Image via WEEX

Selecting Your ID Verification Parameters. Image via WEEX

Once your KYC application processing is complete, you’ll unlock higher withdrawal limits and gain access to additional features, such as WE-Launch.

Security and Privacy at WEEX

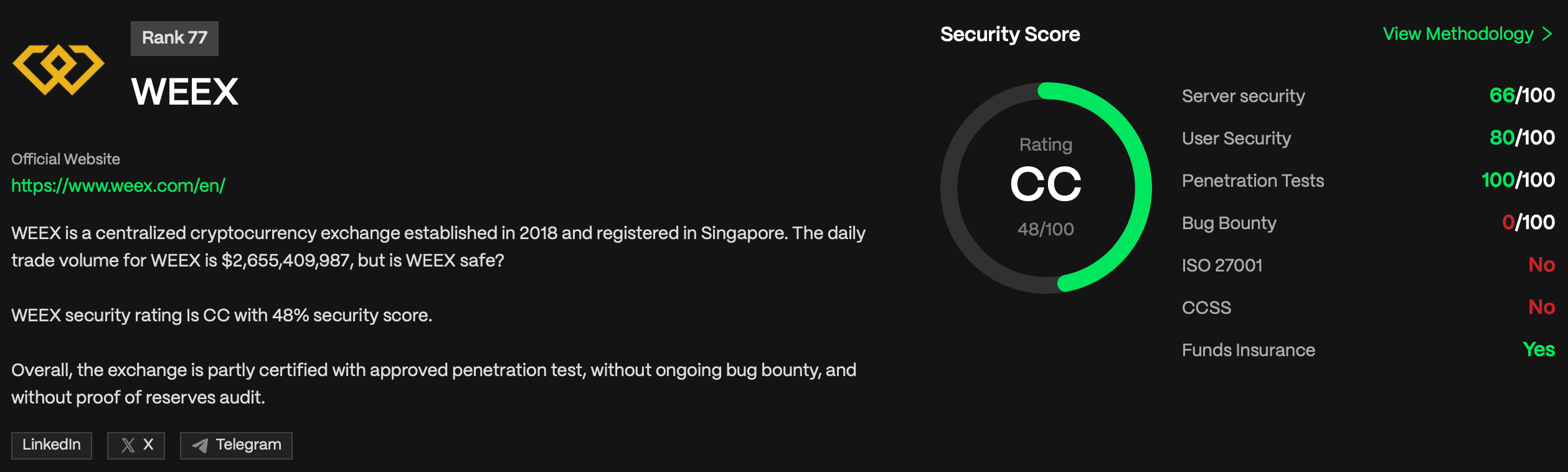

One of the most critical aspects of any cryptocurrency exchange is its security measures, which protect both user funds and personal information. A trusted resource for assessing exchange security is Certified, where WEEX currently holds a modest CC security rating, ranking 77th among its peers.

WEEX Ranking on Certified. Image via Certified

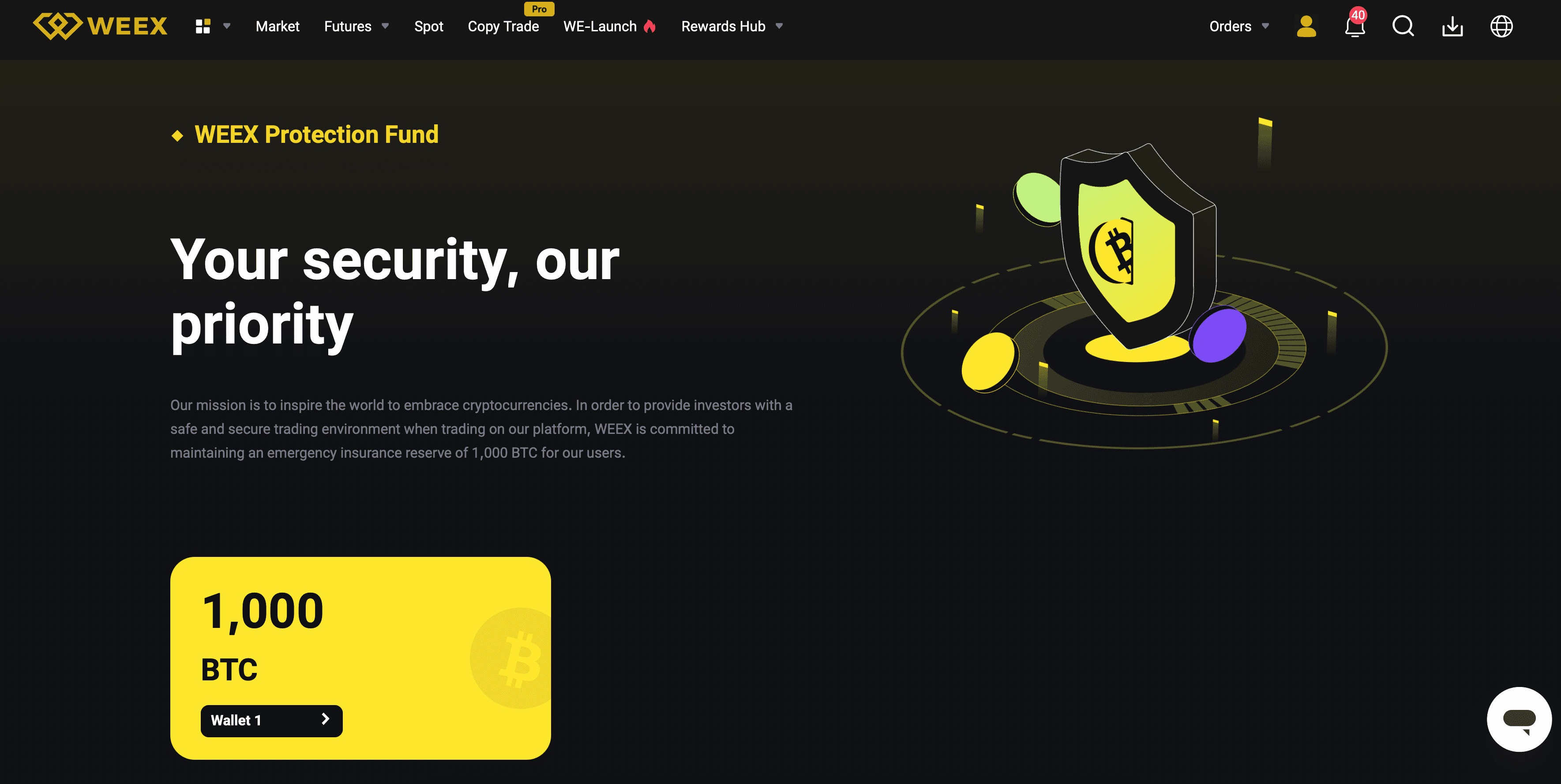

WEEX Ranking on Certified. Image via CertifiedThat said, WEEX implements several robust security features. The exchange provides Proof of Reserves (PoR), with the majority of user assets stored securely in cold storage. Additionally, WEEX has established a 1,000 BTC protection fund, which acts as a safeguard in the event of any incidents that may lead to user fund losses.

WEEX Protection Fund. Image via WEEX

WEEX Protection Fund. Image via WEEXTo further enhance security, WEEX follows industry-standard practices such as regular security audits, two-factor authentication (2FA), and advanced encryption protocols to protect user accounts and data.

However, it’s important to note that self-custody remains the gold standard for safeguarding crypto assets that you don’t plan to trade actively. Using a hardware wallet, which is far more secure than a software wallet, is the best way to keep your holdings safe.

You can find excellent deals on some of the best hardware wallets in the space on the Coin Bureau Deals page.

Supported Cryptocurrencies on WEEX

WEEX offers a truly wide selection of cryptocurrencies, including classics like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Polygon (POL), and Dogecoin (DOGE), along with many others. The platform supports 580 coins, with 642 spot trading pairs and 473 perpetual contract pairs.

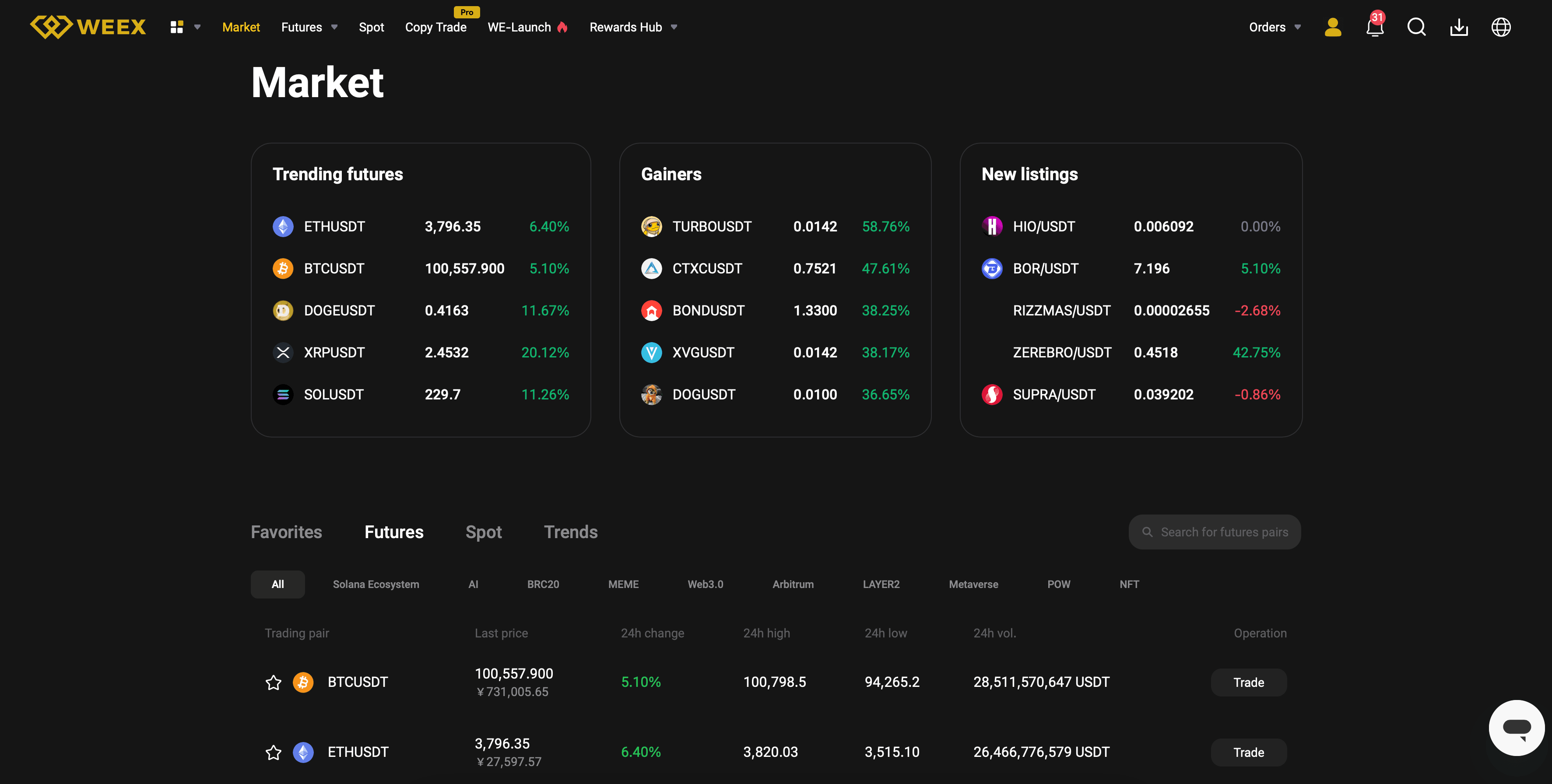

WEEX Markets. Image via WEEX

WEEX Markets. Image via WEEXDeposit and Withdrawal Options

When it comes to funding your account, WEEX supports only crypto deposits or purchases made through the platform’s Over-The-Counter (OTC) service. While OTC services can be useful for certain users, they are not widely adopted and are available only in certain regions, meaning most users will need to acquire crypto from another exchange before depositing it into WEEX.

The withdrawal process is likewise limited to crypto-only transactions.

Order Types on WEEX

WEEX provides a comprehensive range of order types designed to cater to various trading strategies and levels of expertise. Understanding these options allows traders to execute more efficient and tailored trades. Here’s a breakdown of the order types available on the platform:

Market Orders

Market orders are ideal for traders who prioritize speed and certainty as these orders execute instantly at the current market price.

- Example: If Bitcoin (BTC) is trading at $90,000, placing a market buy order ensures the trade is executed immediately at the best available price, such as $90,005 or $90,010, depending on market liquidity.

Limit Orders

Limit orders allow traders to specify a desired price at which they want to buy or sell an asset. The order will only execute when the market reaches the set price, providing greater control over trade execution.

- Example: If BTC is at $90,000, you can set a buy limit order at $89,500. The trade will only execute if the price drops to $89,500 or lower.

Advanced Orders

For more experienced traders, WEEX offers advanced order types that provide greater flexibility and strategic options:

Good-Till-Cancelled (GTC): Orders remain active until they are fully executed or manually canceled by the

trader.

- Example: A GTC order for BTC at $89,500 will stay on the order book until the price meets the condition or you cancel it.

Immediate-Or-Cancel (IOC): Executes as much of the order as possible immediately, canceling any unfilled portions.

- Example: An IOC order for 2 BTC at $90,000 might fill 1.5 BTC if sufficient liquidity exists, canceling the remaining 0.5 BTC.

Fill-Or-Kill (FOK): Requires the entire order to be executed immediately. If it cannot be filled in full, the entire order is canceled.

- Example: A FOK order for 3 BTC at $90,000 will execute only if all 3 BTC can be purchased at that price. Otherwise, it is canceled outright.

Post Only: Ensures that the order adds liquidity to the order book as a maker order. If it would match with an existing order, it is canceled instead.

- Example: A Post Only order at $89,900 guarantees your order contributes to market liquidity and avoids taker fees.

Take Profit Orders Take profit orders automatically close a position once a predefined profit target is reached. This helps lock in gains without constant monitoring.

- Example: If you bought BTC at $85,000, setting a take profit order at $95,000 ensures your position closes once the price hits $95,000, securing your profit.

Spot Trading on WEEX

Now that you're familiar with the different order types WEEX offers, you're ready to begin spot trading. Here’s a quick walkthrough to get started:

STEP 1: Log In to Your Account

- Visit the WEEX homepage and log in using your registered email address or phone number along with your password.

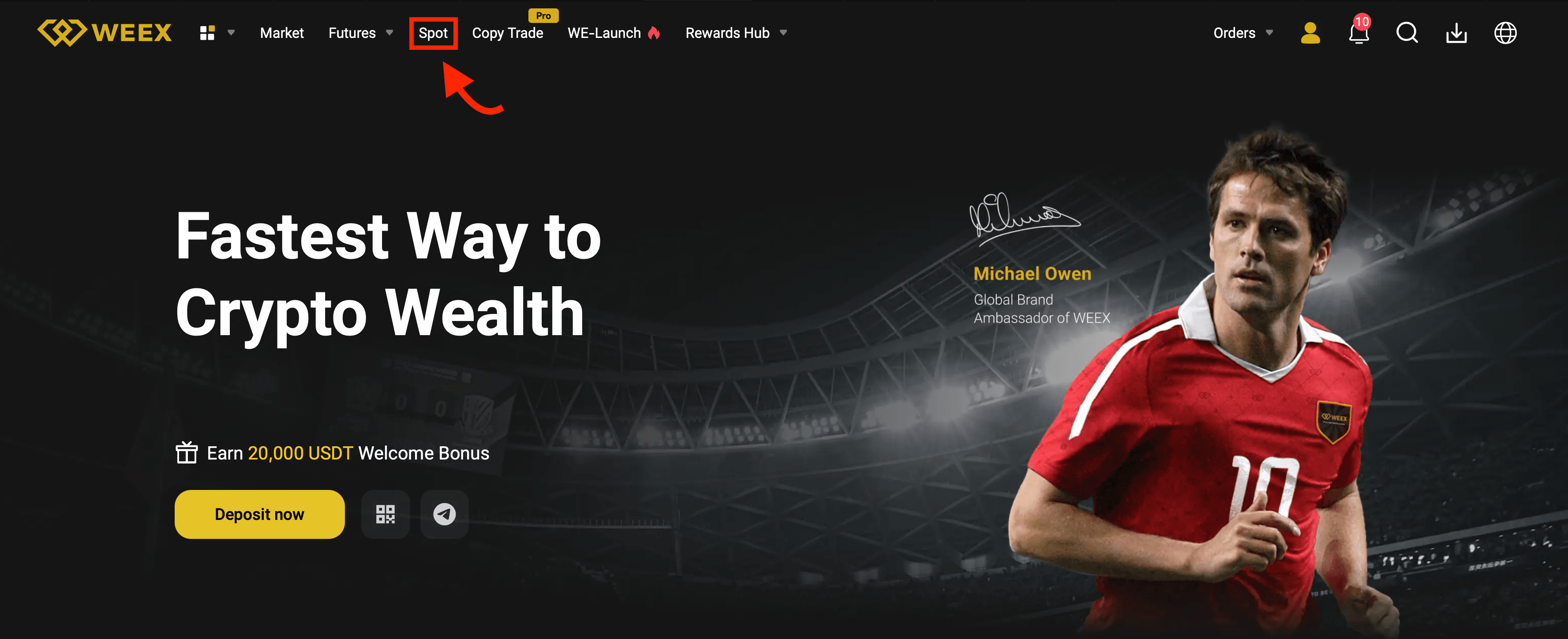

STEP 2: Navigate to the Spot Trading Section

- Once logged in, click on the "Spot" tab located at the top of the homepage.

Navigating to the Spot Trading Section on WEEX. Image via WEEX

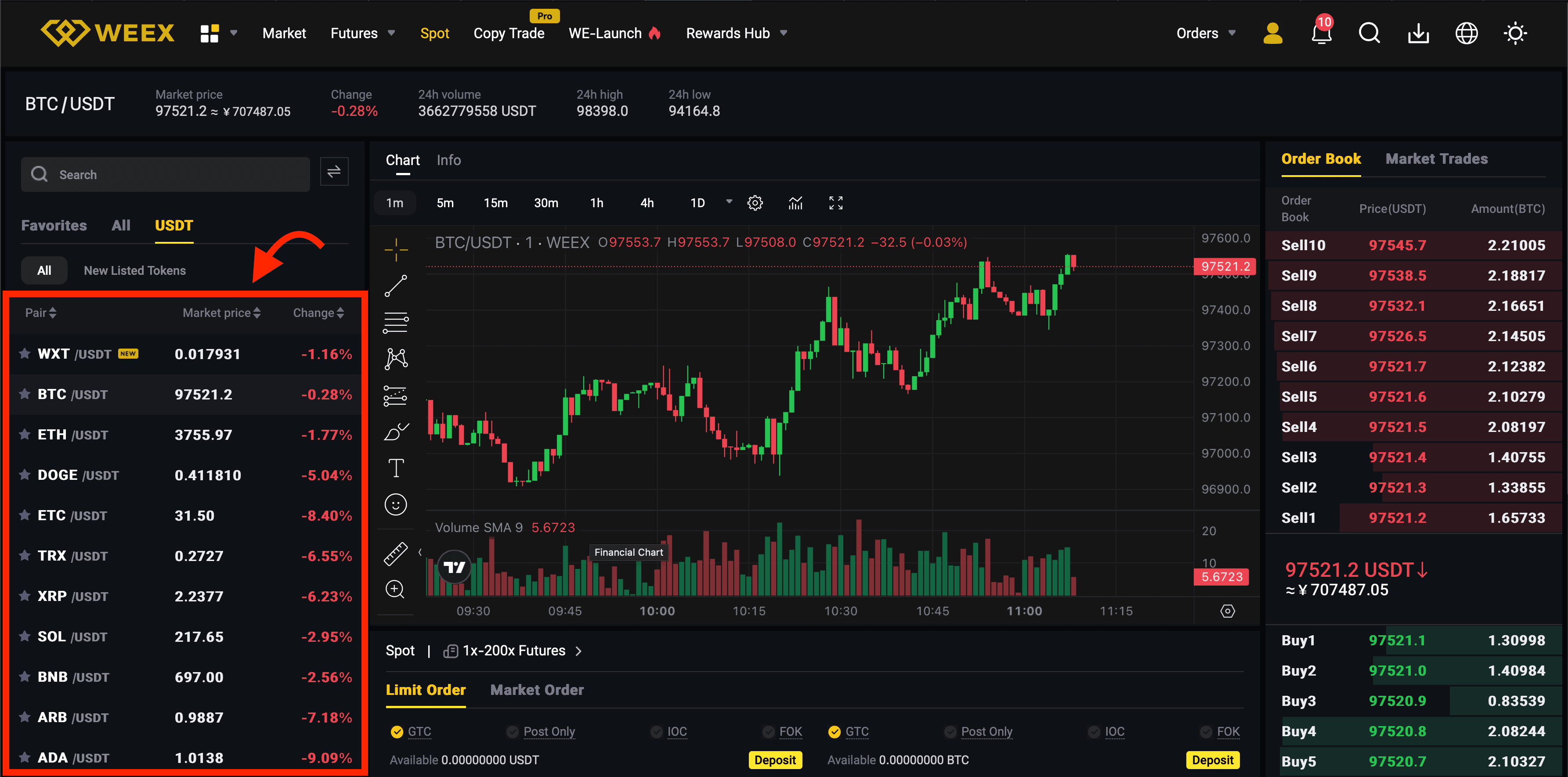

Navigating to the Spot Trading Section on WEEX. Image via WEEXSTEP 3: Select a Trading Pair

- Browse through the available trading pairs and choose the one you wish to trade. For this example, we’ll select BTC/USDT.

Selecting a Trading Pair on WEEX. Image via WEEX

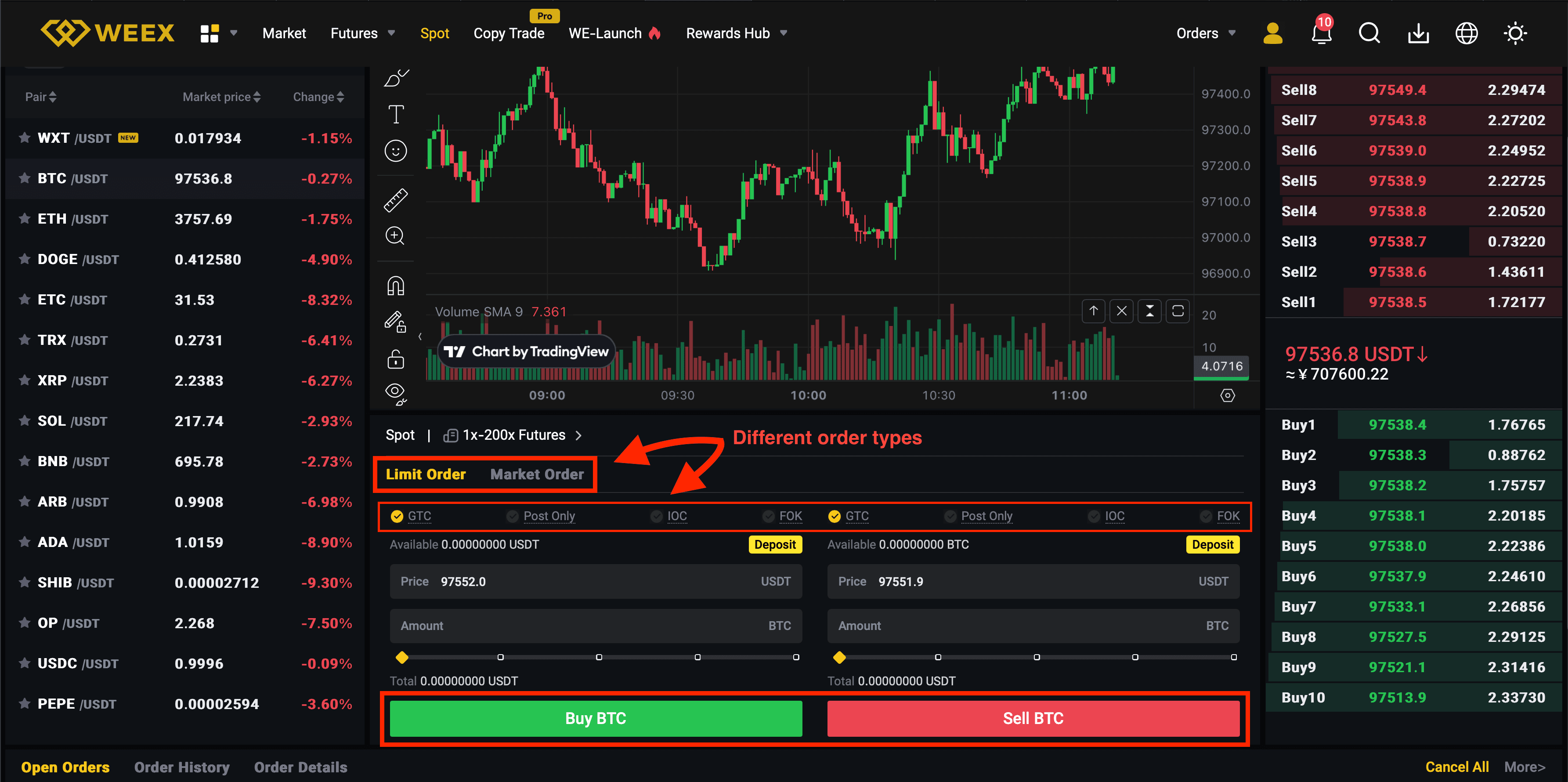

Selecting a Trading Pair on WEEX. Image via WEEXSTEP 4: Choose and Place Your Order

- Select your preferred order type from the available options (e.g., market or limit).

- Choose whether you wish to "Buy" or “Sell.”

- Review the details, such as price and quantity, then submit your order.

Order Types on WEEX. Image via WEEX

Order Types on WEEX. Image via WEEXSTEP 5: Monitor Your Orders

- Open Orders: Review all active orders that are yet to be filled. These can be modified or canceled if necessary.

- Order History: Access a detailed log of all your past trades, including completed and canceled orders.

Leverage on WEEX

Leverage enables traders to magnify their positions by using borrowed funds, offering the potential for higher returns while also increasing the associated risks. Let’s dive into how leverage trading works on WEEX, including margin requirements, position management, and risk mitigation measures.

What is Margin?

Margin is the collateral traders must deposit to open a leveraged position. This enables users to control larger positions with only a fraction of the required capital.

- Initial Margin: The minimum amount required to open a position.

- Formula: Position Value ÷ Leverage.

- Example: If a trader opens a BTC/USDT position with 2x leverage, requiring a position value of 100 USDT, the margin needed is 50 USDT.

- Formula: Position Value ÷ Leverage.

- Maintenance Margin: The minimum equity required to keep a position open.

- Maintenance margins on WEEX are tiered, meaning larger positions need higher maintenance margins, thereby reducing the maximum allowable leverage.

Margin Modes on WEEX

WEEX offers two primary margin modes to suit different trading strategies and risk appetites:

- Isolated Margin:

- Margin is allocated to a single position, ensuring losses are limited to the margin for that specific trade.

- Suitable for traders seeking to minimize risk on individual positions.

- Margin is allocated to a single position, ensuring losses are limited to the margin for that specific trade.

- Cross Margin:

- Margin is shared across all open positions within an account, utilizing the total available balance.

- This mode maximizes capital efficiency but carries the risk of losing the entire account balance in the event of adverse market movements.

- Margin is shared across all open positions within an account, utilizing the total available balance.

Automatic Margin Call on WEEX

To reduce the risk of liquidation, WEEX provides an Automatic Margin Call feature. When the mark price nears the liquidation threshold, the system automatically transfers available funds from the futures account to the position’s margin. This adjustment helps maintain the margin ratio at the user’s initially set level.

- If sufficient funds are unavailable, the position may still face liquidation.

- This feature is only applicable in Isolated Margin Mode and must be reactivated for each new position after closure.

Key Features of Leverage on WEEX

- High Leverage Options: Leverage of up to 200x is available for select trading pairs.

- Flexible Margin Modes: Traders can switch between Isolated and Cross Margin to optimize capital efficiency.

- Tiered Maintenance Margins: Larger positions require higher maintenance margins, reducing systemic risks.

- Free Fund Transfers: Crypto can be transferred between spot and futures accounts without additional fees.

❗IMPORTANT❗Margin trading involves significant risks and should only be undertaken by experienced traders who understand the complexities and potential pitfalls associated with leveraging positions.

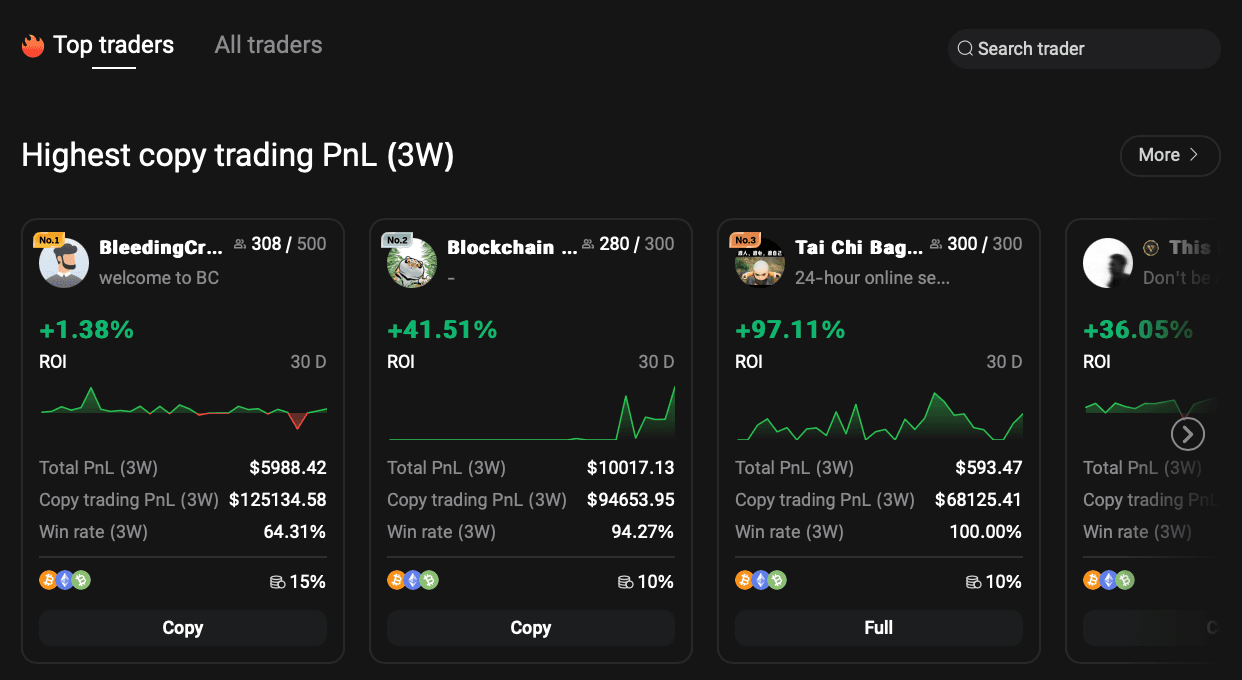

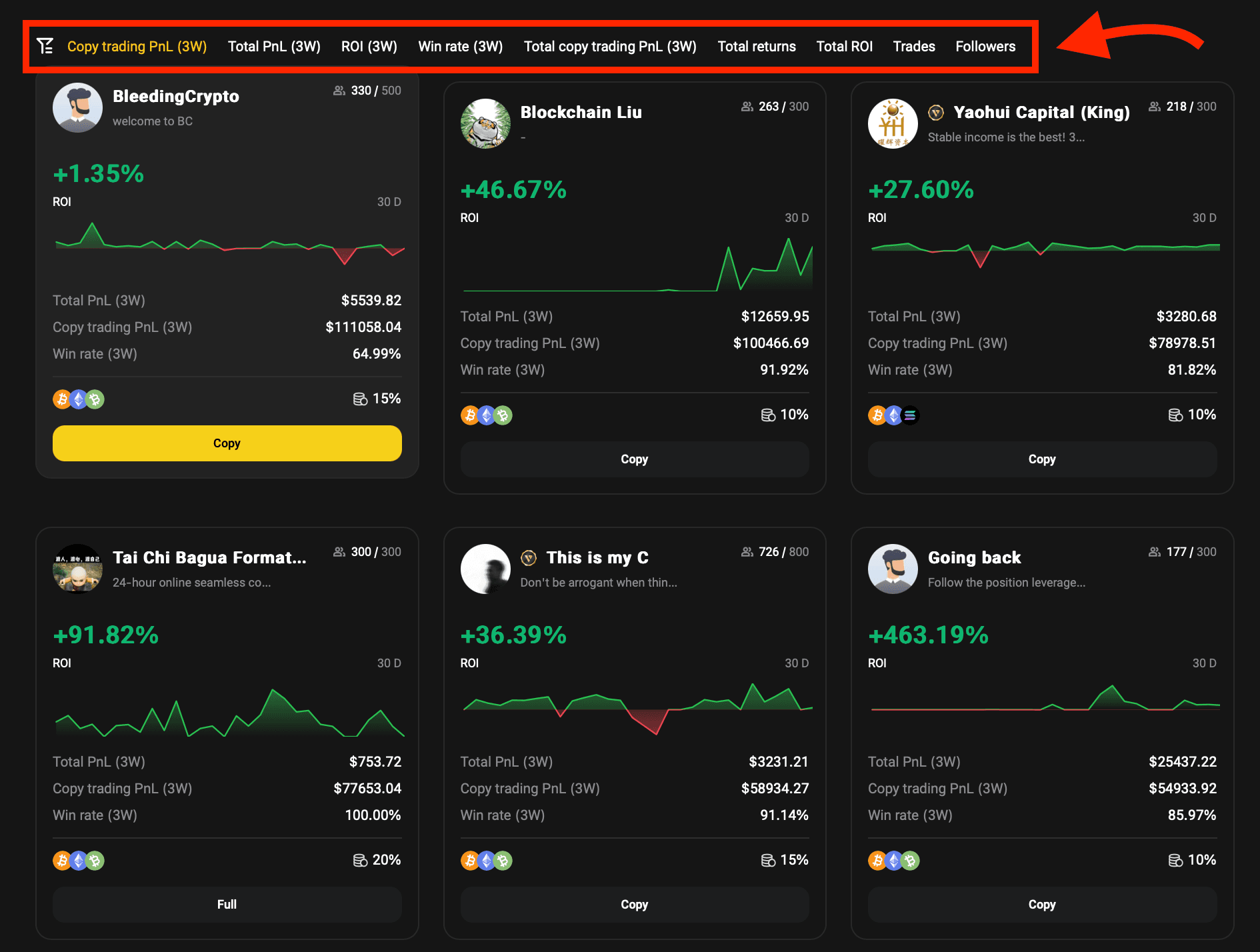

Copy Trading on WEEX

Copy Trading on WEEX allows traders of all levels to participate in the crypto market by following the strategies of experienced professionals. This feature simplifies trading by enabling users to select elite traders and automatically replicate their strategies.

What is WEEX Copy Trading Pro?

WEEX Copy Trading Pro offers users the ability to replicate professional traders strategies with minimal effort. This hands-off approach provides an opportunity to earn profits without requiring in-depth market analysis or active trade management. However, it’s essential to note that all trades, whether successful or not, are mirrored by copiers, making it crucial to select traders whose strategies align with your risk tolerance.

Elite Traders on WEEX. Image via WEEX

Elite Traders on WEEX. Image via WEEXHow It Works?

WEEX’s Copy Trading Pro allows elite traders to showcase their strategies and performance metrics, which can be reviewed by potential copiers. Once a copier selects a trader, all of the trader’s future trades are mirrored in the copier’s account in real-time.

For Copiers:

- Users can choose from hundreds of global traders vetted by WEEX.

- Real-time trading data ensures transparency and reliability.

- Copiers can manage their risk by setting take-profit, stop-loss, and slippage ratios.

- Adjustments can be made anytime, including changing margins or stopping trades.

For Elite Traders:

- Access to a wide audience and the potential to earn commission income.

- The platform offers high profit-sharing rates, with traders earning a 10% share of profits generated by their copiers.

- This system creates opportunities to boost trading influence and earnings through WEEX’s traffic pool.

You can also check out our top picks for the best copy trading platforms.

How to Select a Copy Trader on WEEX?

Selecting a copy trader and configuring your parameters on WEEX is straightforward. Here’s a quick guide to get you going:

STEP 1: Choose a Copy Trader

- Browse the list of elite traders on the WEEX Copy Trading Pro homepage.

- Review their trading history, performance metrics, and profit-sharing ratio (e.g., 10%).

- Select a trader whose strategies align with your investment goals.

Elite Traders Can Be Sorted by Different Parameters. Image via WEEX.

Elite Traders Can Be Sorted by Different Parameters. Image via WEEX.STEP 2: View Available Trading Pairs

- After selecting a trader, check the trading pairs they support.

- Ensure the trader’s pairs match your portfolio interests.

STEP 3: Set Copy Trading Mode

- Choose between the two copy trading modes:

- Uniform Mode: Applies the same margin settings across all trading pairs.

- Separated Mode: Allows individual settings for each trading pair.

- Uniform Mode: Applies the same margin settings across all trading pairs.

STEP 4: Select Margin Mode

- Choose your preferred margin mode:

- Position Mode: Mirrors your leverage settings.

- Trader Mode: Uses the elite trader’s leverage.

- Custom Mode: Lets you set custom leverage for each trade.

- Position Mode: Mirrors your leverage settings.

STEP 5: Define Copy Trade Amount

- Set how much you want to allocate per trade:

- USDT (Fixed): Enter a fixed amount (e.g., $10–$10,000).

- Ratio (Fixed): Allocate a percentage of your portfolio (e.g., 0.01x–100x).

- USDT (Fixed): Enter a fixed amount (e.g., $10–$10,000).

STEP 6: Configure Advanced Settings

- Optimize your risk management by setting the following:

- Stop-Loss Ratio: Limit losses by setting a percentage.

- Take-Profit Ratio: Automatically close trades at a specified profit level.

- Slippage Ratio: Define acceptable price deviation for trades.

- Maximum Copy Trade Amount: Cap the total amount allocated to a trade (e.g., up to 100,000 USDT).

- Stop-Loss Ratio: Limit losses by setting a percentage.

STEP 7: Confirm and Start Copy Trading

- Once all parameters are set click “Next” to confirm your settings.

- Ensure sufficient funds are transferred to your futures account to support trades.

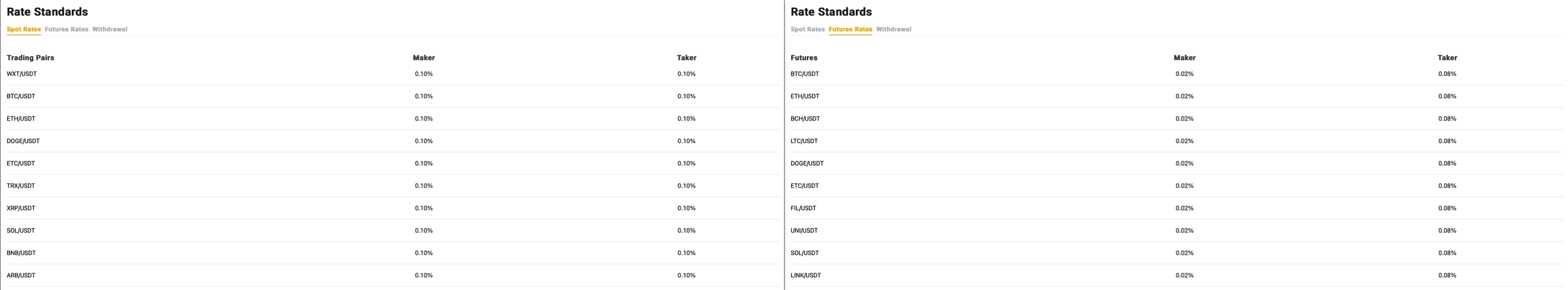

WEEX Fees

WEEX employs a straightforward fee structure without tiered discounts. For spot trading, both maker and taker fees are set at 0.10%. In futures trading, maker fees are 0.02%, while taker fees are slightly higher at 0.08%.

WEEX Spot and Futures Trading Fees. Image via WEEX

WEEX Spot and Futures Trading Fees. Image via WEEXWhile this flat fee structure is simple and easy to understand, the lack of a tiered system may be a drawback for some traders. Tiered fee structures typically reward frequent or high-volume users with reduced fees, providing added value for loyal exchange users.

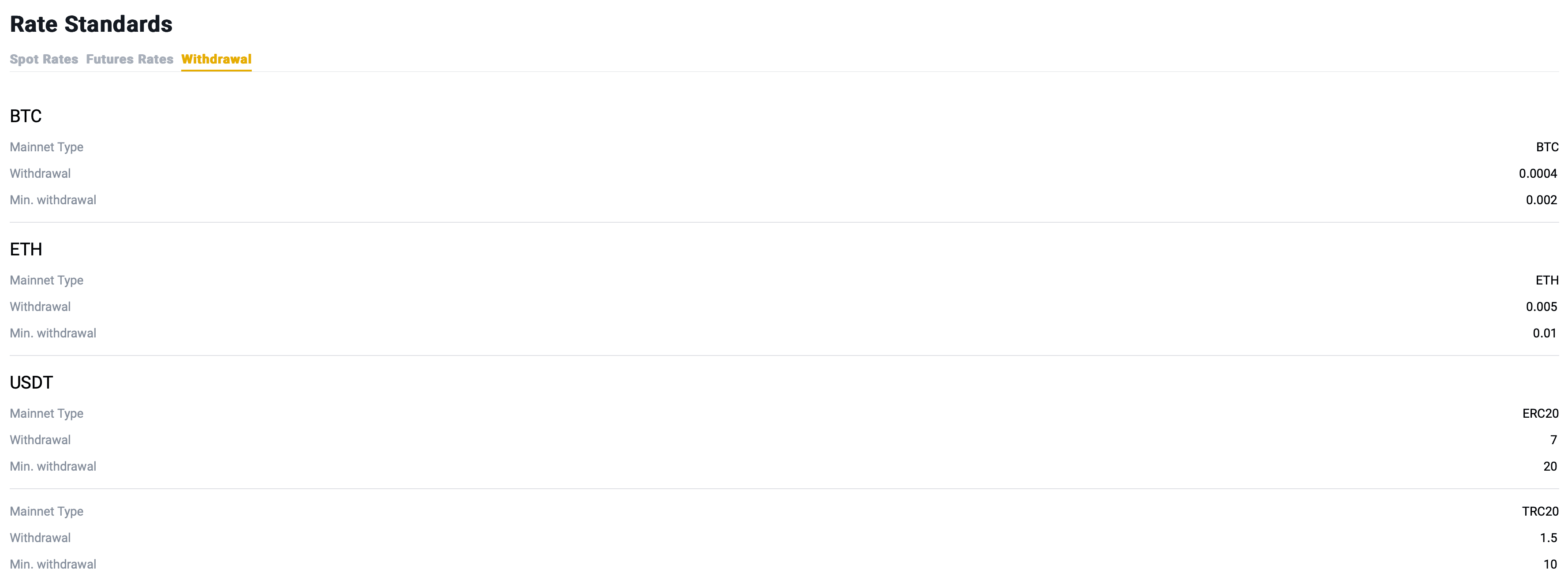

As for deposits and withdrawals, WEEX does not charge any fees for deposits, and its withdrawal fees remain competitive with those seen on other leading exchanges.

Withdrawal Fees on WEEX. Image via WEEX

Withdrawal Fees on WEEX. Image via WEEXWE-Launch

WE-Launch is a unique platform feature on WEEX that allows users to participate in token airdrop events by committing their WXT holdings, the native token of the WEEX exchange, providing users an opportunity to receive tokens from new projects listed on the platform.

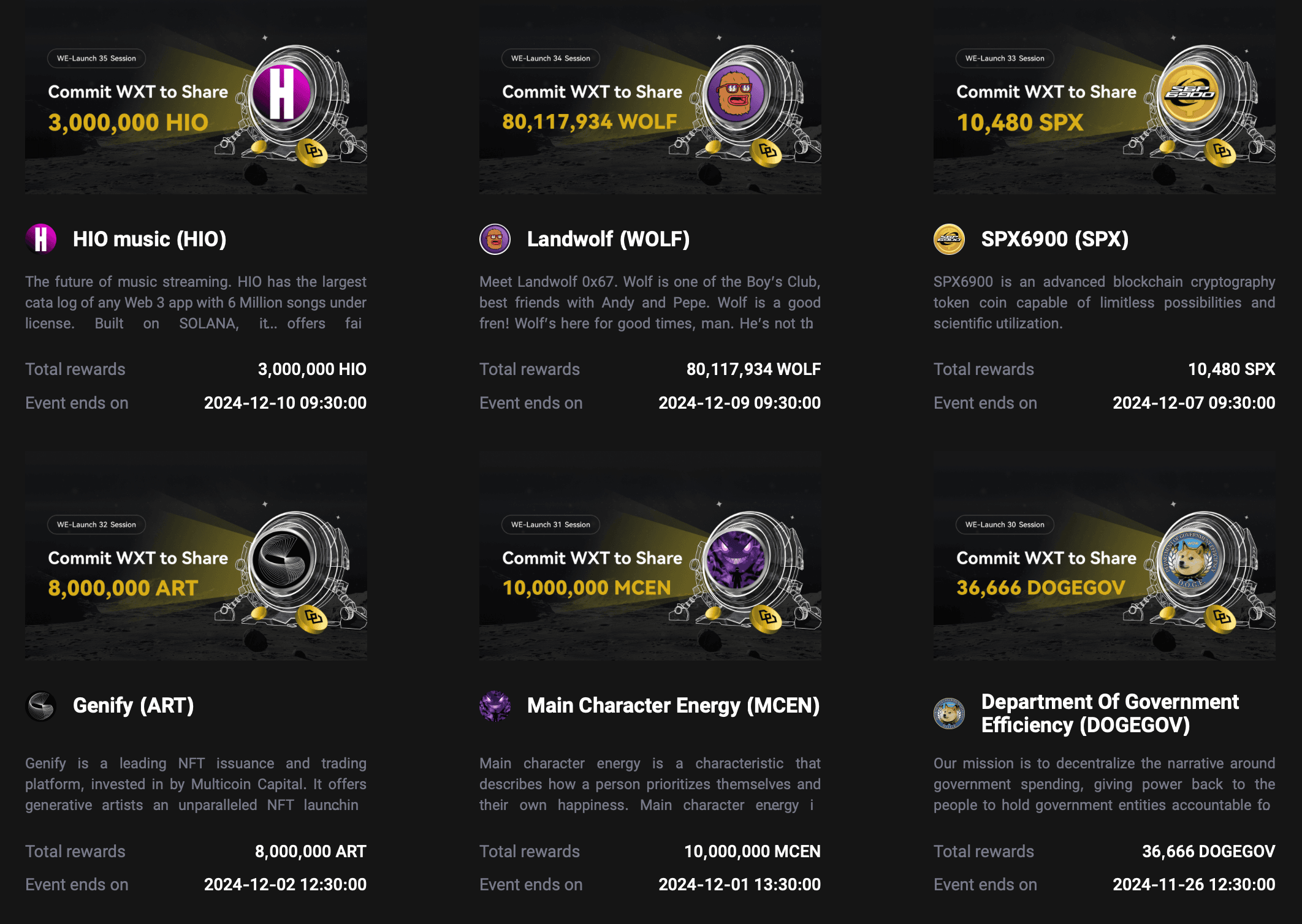

Here’s a look at some of the previous WE-Launch events, of which there are currently 40:

Previous WE-Launch Events. Image via WEEX

Previous WE-Launch Events. Image via WEEXHow to Participate in WE-Launch?

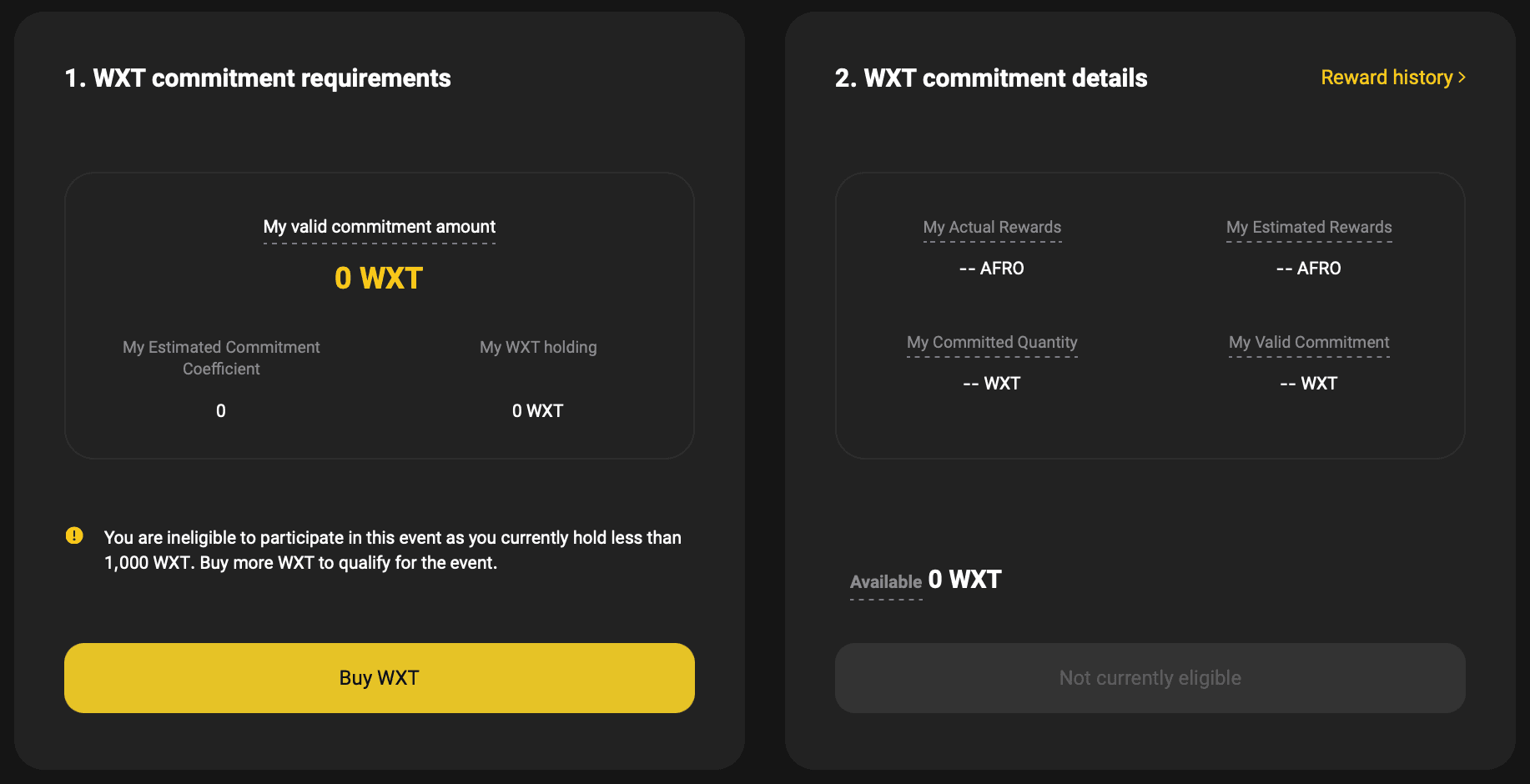

1. Eligibility Criteria:

- Maintain a minimum of 1,000 WXT in your spot account for 30 consecutive days prior to the event.

- Ensure that your WXT holdings do not fall below this threshold during the snapshot period.

- Note that locked coins are excluded from the eligible amount.

2. Committing WXT

- During the commitment period, allocate your WXT to the WE-Launch event.

- The committed WXT is used solely for reward calculation and remains unfrozen.

Committing WXT. Image via WEEX

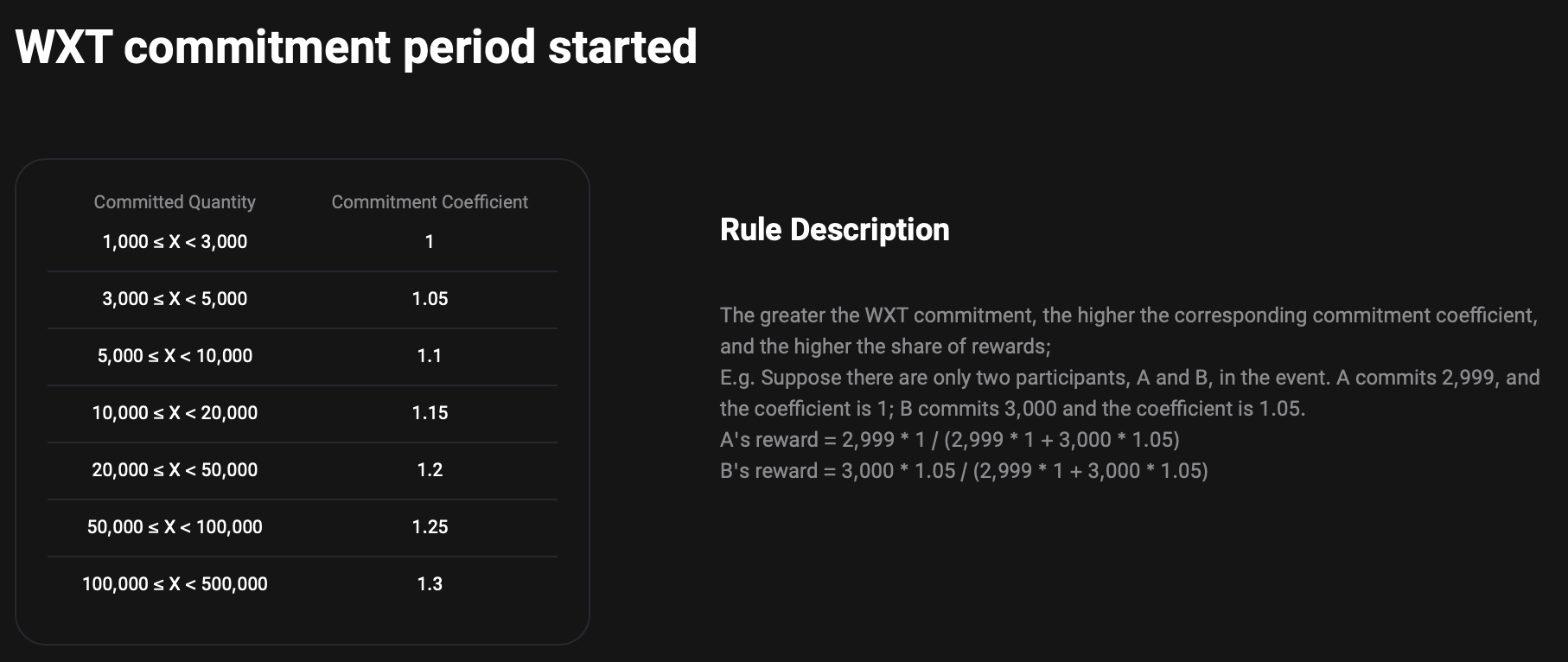

Committing WXT. Image via WEEX3. Reward Calculation

- Rewards are distributed based on a tiered system: higher commitments yield greater rewards.

- The formula for estimating rewards is as follows:

- Estimated Reward = (User's Valid Committed Amount ÷ Total Valid Committed Amount of All Users) × Total Prize Pool

Committing WMT. Image via WEEX

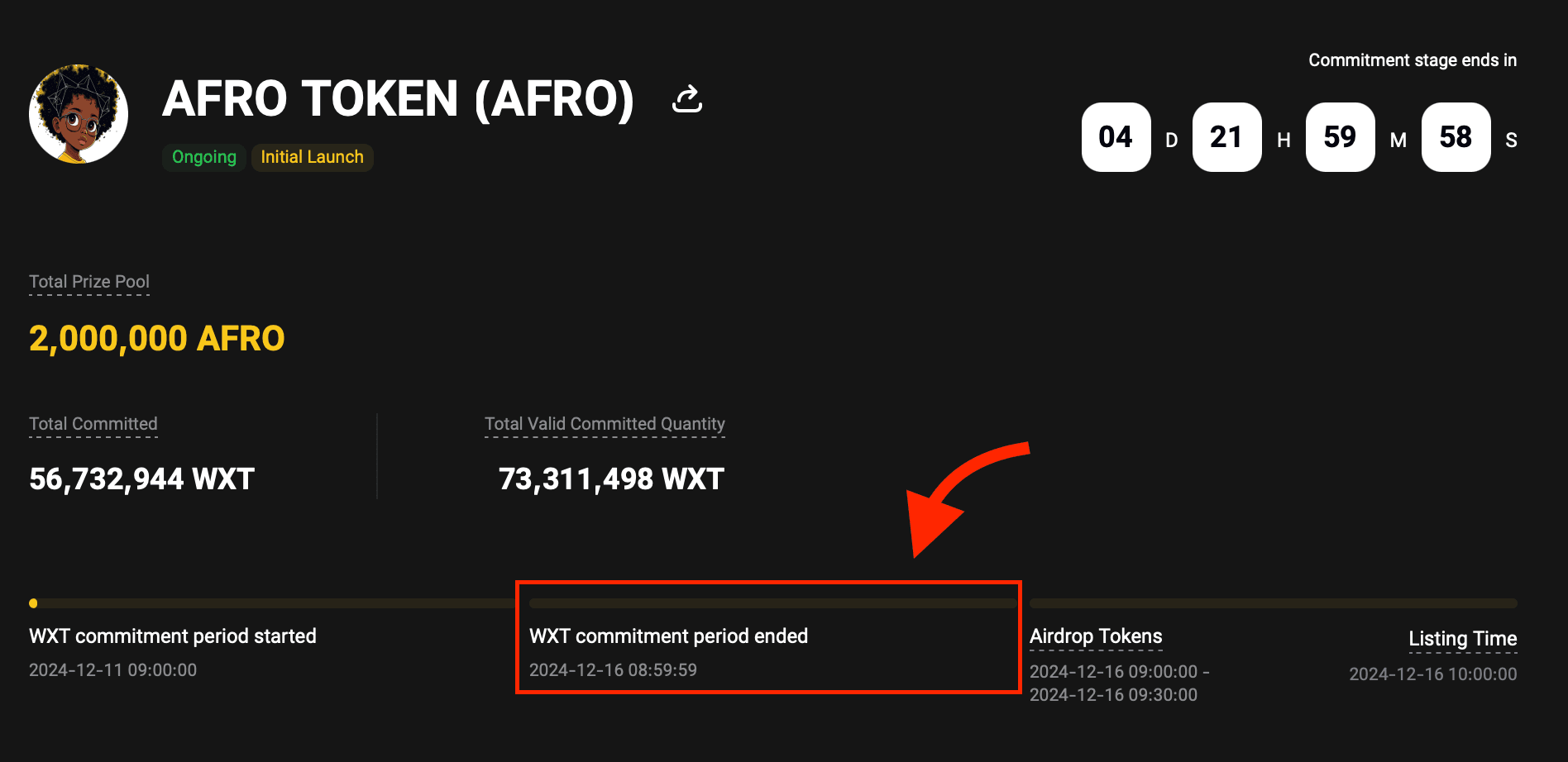

Committing WMT. Image via WEEX4. Reward Distribution

- Once the commitment period ends, tokens are distributed directly to participants' accounts.

Example of the Commitment Period. Image via WEEX

Example of the Commitment Period. Image via WEEXWEEX Affiliate & Referral Programs

WEEX Affiliate Program

The WEEX Affiliate Program is designed for influencers, content creators, and individuals with substantial following. It offers a opportunity to earn commissions by promoting WEEX and referring new users to the platform.

Key Features:

- High Commission Rates: Affiliates can earn a portion of the trading fees generated by their referrals.

- Exclusive Engagements: Affiliates gain access to exclusive AMAs, publications, interviews, and events aimed at enhancing community engagement.

- 24/7 Dedicated Support: A dedicated account manager is available around the clock to assist with any questions.

WEEX Affiliate Program. Image via WEEX

WEEX Affiliate Program. Image via WEEXWEEX Referral Program

The WEEX Referral Program is tailored for individual users who wish to earn commissions by inviting friends to trade on the platform. It offers a straightforward way to generate passive income.

Key Features:

- Commission Earnings: Referrers earn up to 50% of the trading fees from their invitees' transactions.

- Easy Sharing Tools: Users receive a unique referral link or code, which can be easily shared to invite friends and community members.

- No Earning Limits: There is no cap on the number of referrals or the amount of commission one can earn—the more active traders referred, the higher the potential income.

WEEX Referral Program. Image via WEEX

WEEX Referral Program. Image via WEEXWEEX Review: Closing Thoughts

WEEX has positioned itself as a reliable cryptocurrency exchange, catering to a diverse range of traders with its extensive features and comprehensive trading tools. While it may not yet rival the largest platforms in the space, it offers enough features to stand out as an overall solid option.

The lack of fiat support for deposits and withdrawals might be off putting for beginners or those seeking seamless fiat on and off-ramps. However, for experienced traders comfortable navigating the crypto ecosystem, WEEX provides substantial value through its wide selection of cryptocurrencies, competitive fee structure, and high non-KYC withdrawal limits.

With advanced security measures, an intuitive mobile app, and innovative features like WE-Launch and high-leverage futures trading, WEEX presents itself as a compelling alternative for those looking to diversify their exchange options. While there’s room for growth, particularly in areas like fiat integration, WEEX remains a solid choice for crypto traders of all levels.

Disclaimer: This is a paid review, yet the opinions and viewpoints expressed by the writer are their own and were not influenced by the project team. The inclusion of this content on the Coin Bureau platform should not be interpreted as an endorsement or recommendation of the project or product being discussed. The Coin Bureau assumes no responsibility for any actions taken by readers based on the information provided within this article.