ZKsync is one of the many layer 2 scaling solutions on Ethereum. The Ethereum layer 2 ecosystem has blown up with innovation in recent times. These networks are improving rapidly because of Ethereum's recent narrative shift to promote higher use of layer-2 networks for everyday on-chain activities. It promotes this shift by introducing upgrades that make layer-2s faster, cheaper, and more secure.

This ZKsync review will explain to readers what it is all about and how ZKsync differs from other scaling solutions in Ethereum. We will also talk about a few emerging trends in Web3, such as account abstraction and how ZKsync incorporates these to enhance user experience and network performance.

ZKsync Era Overview

ZKsync Era is a layer 2 rollup on Ethereum. It is a trustless blockchain protocol that uses zero-knowledge validity proofs to offer low-cost transactions on Ethereum. A rollup is a scalability solution where transactions are executed and stored off the Ethereum chain. The transaction data is bundled into a compressed package and sent to Ethereum with validity proofs to prove their legitimacy. Layer 2 chains inherit most of the security guarantees from Ethereum, albeit at a lower cost than layer 1 transactions.

Key Features:

- It offers Ethereum-like security. It inherits Ethereum's security with zk-proofs without using third-party validators.

- It supports permissionless EVM-compatible smart contracts.

- ZKsync offers fast proof proof generation while also maintaining Ethereum compatibility.

- It includes native account abstraction and paymaster features.

- It offers enhanced multi-layered scalability with a network of interconnected ZK Chains.

ZKsync Homepage

ZKsync HomepageTypes of ZK-EVMs

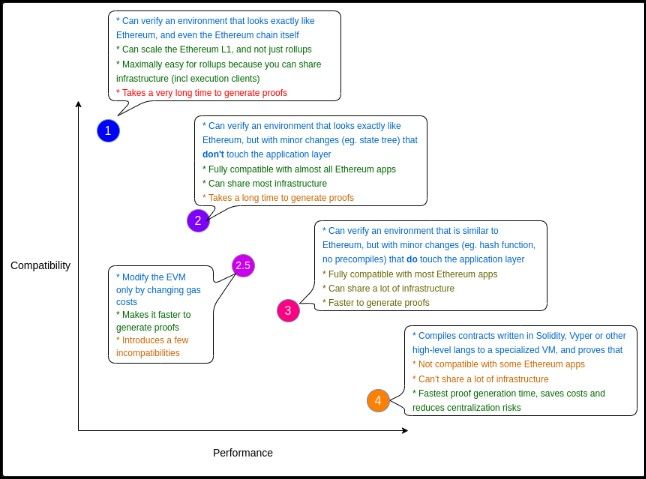

Have you ever wondered why there are so many zero-knowledge layer 2 chains in Web3, and aren't they all the same? Vitalik Buterin classifies zk-based chains by EVM compatibility, describing four ZK-EVM types:

- Type -1: Completely Ethereum equivalent. These ZK-EVMs can verify Ethereum blocks as they are today. Deploying Ethereum applications on type-1 ZK-EVMs demands no additional overheads. Scroll and Taiko are some type-1 ZK-EVMs.

- Type -2: Completely EVM-equivalent. If not Ethereum, EVM equivalence ensures compatibility with Ethereum at the execution level. Most Ethereum DDpps will work perfectly on EVM-equivalent ZK-EVMs without any additional overheads. While still slow, proof generation time is better than that in type-1. Polygon zkEVM and ConsenSys are some type-2 ZK-EVMs.

- Type-3: Almost EVM-equivalent. Such ZK-EVMs designs value throughput over Ethereum compatibility. Faster proof generation is achieved at the cost of more incompatibility. Ethereum DApps may still work after minimal rewriting efforts from developers.

- Type-4: Only language level equivalent. Only high-level code, such as Solidity and Vyper, is made ZK-friendly. Porting DApps from Ethereum may face challenges like different contract addresses and extensive debugging requirements, but with very fast proving times. ZKsync and StarkNet are building type-4 zk-EVMs.

Types of ZK-EVMs | Source: Vitalik’s Blog

Types of ZK-EVMs | Source: Vitalik’s BlogZKsync is a Type 4 ZK-EVM, meaning that the proof generation times are extremely fast, transaction speed is high, and centralization risks are reduced. The ZKsync team has improved EVM compatibility by introducing custom compilers, zksolc and zkvyper, that let developers write smart contracts in Solidity or Vyper. Developers can also use existing tools and libraries from Ethereum, addressing several compatibility drawbacks of type-4 ZK-EVMs.

How Does ZKsync Work?

To understand how ZKsync works, we must learn how rollup operations work as a layer 2 scaling solution for Ethereum. The primary job of a rollup is to reduce the load on layer 1, like Ethereum, without giving up its security guarantees and decentralization.

The ethos of rollups is off-chain transaction execution. The primary throughput bottleneck for Ethereum is its inability to process many transactions in a short time. However, its slow speed is a trade-off for security since its transactions are verified by a vast network of trustless nodes interacting and participating in Ethereum's PoS consensus protocol. Therefore, a rollup scales Ethereum by executing many transactions off-chain and then submitting a single, compressed summary of the transactions to Ethereum for verification and storage, which treats the batch as a single transaction. The costs associated with Ethereum are split between all the transactions included in the batch, making them incredibly cheap.

Zero-Knowledge Rollups

Zero-Knowledge Rollups use zk-proofs for blockchain scalability. In this design, the layer 2 operator, called a sequencer, bundles or “rolls up” several L2 transactions and creates a zk-proof, a cryptographic validity proof of the batch. The generated proof is sent to Ethereum for verification and to finalize the rollup batch. ZKsync uses a form of zk-proofs called SNARKs (Succinct Non-interactive Arguments of Knowledge).

ZKsync Protocol Components

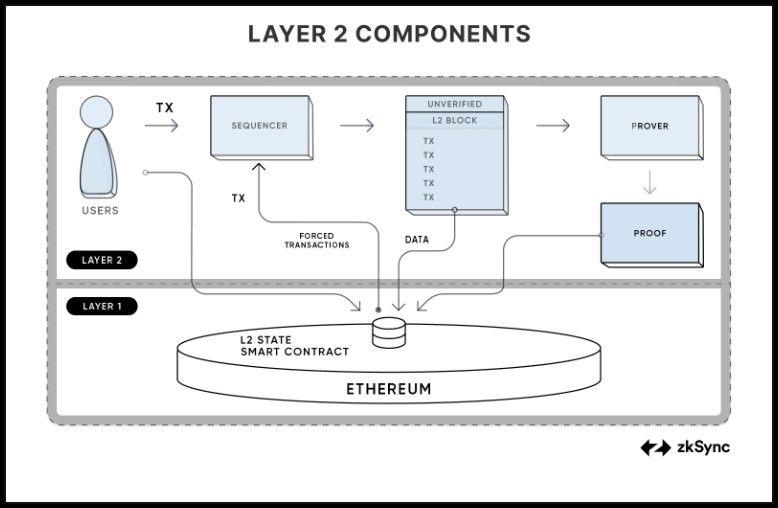

The lifecycle of a ZKsync transaction begins when the user initiates a transaction and ends when it achieves finality on Ethereum. There are several roles involved in helping the transactions finalize on Ethereum, and they are discussed here:

Sequencers

The Sequencer gathers, executes, and organizes user transactions into blocks on ZKsync's Layer 2. It plays a critical role in ensuring the efficiency and speed of transaction processing on the zkRollup layer. It has the following functions:

- Transaction Collection: The Sequencer collects transactions submitted by users. It can receive transactions directly on L2 or through L1 (forced transactions).

- Execution: Using the zkEVM (Zero-Knowledge Ethereum Virtual Machine), the Sequencer executes these transactions, ensuring they adhere to the network rules.

- Block Formation: After execution, the Sequencer groups transactions into blocks for further processing. It gives users a quick, soft confirmation once their transactions are included in a block.

- Forced Inclusion: The Sequencer must include forced transactions submitted through L1, ensuring they are processed in the next block.

Provers

The prover is tasked with validating the correctness of the transactions executed by the Sequencer. It generates cryptographic proofs to confirm that the transactions within a block have been processed accurately. It is tasked with the following functions:

- Proof Generation: After receiving an unverified block from the Sequencer, the prover generates a zk-SNARK cryptographic proof. This proof attests to the validity of all the transactions in the block.

- Submission to L1: The Prover submits the generated proof and the state diff data to the Ethereum L1 contract for final verification and state update.

Unverified Blocks

An unverified block is a collection of transactions that the Sequencer has executed, but the prover has not yet validated them with cryptographic proof. These blocks are temporarily held until the prover confirms their validity.

- Holding Stage: Unverified blocks are essentially in a holding stage between initial execution and final proofing. They ensure that transactions are grouped and prepared for the prover.

- Batching for Proofs: Multiple unverified blocks may be combined into batches, which are then processed together by the prover. This batching approach enhances the efficiency of proof generation.

Proofs

Proofs in ZKsync refer to the cryptographic evidence that confirms the correct execution of transactions within a block. They are a core part of zkRollup technology, providing security and integrity.

ZKsync uses zk-SNARKs, a type of zero-knowledge proof that allows one party to prove to another that a statement is true without revealing any specific information about the statement. Here's the proving process:

- Proof Creation: After the Prover receives an unverified block, it generates a zero-knowledge proof that certifies the block's correctness.

- Data Submission: Alongside the proof, only the changes in the blockchain state (state diff) are sent to L1, optimizing the amount of data transmitted.

- Verification and State Update: The Ethereum L1 smart contract then verifies this proof. If valid, it updates the rollup's state on the Ethereum blockchain, ensuring the integrity and security of the transaction data.

To summarize:

- Sequencers act as the initial gatekeepers, collecting, executing, and organizing transactions into blocks and providing quick user confirmations.

- Provers validate the transactions by generating cryptographic proofs, ensuring that all transactions are executed correctly and securely.

- Unverified Blocks serve as temporary collections of executed transactions awaiting validation.

- Proofs are cryptographic attestations that confirm the correctness of these transactions and facilitate secure and efficient updates to the blockchain's state.

Together, these components ensure that ZKsync can provide scalable, secure, and efficient transaction processing on Ethereum.

ZKsync Transaction Life Cycle

ZKsync Transaction Life Cycle | Image via ZKsync Docs

ZKsync Transaction Life Cycle | Image via ZKsync DocsZKsync transactions or any on-chain operation on layer 2 must follow an automated process of verifications and consensus that ultimately leads to its finality. Finality in the context refers to the transaction getting recorded in a finalized Ethereum block after its consensus process. Every transaction achieves great execution speed on ZKsync and top-notch security from Ethereum.

One noteworthy feature of ZKsync is forced transactions. A ZKsync sequencer may censor (ignore) a layer 2 transaction mistakenly or with malicious intent. The user can then emit a forced transaction, a layer 2 transaction submitted directly to Ethereum by the user. Such transactions may cost significantly more than usual ZKsync transactions, but direct submission will guarantee its inclusion in the ZKsync block. Here is a step-wise breakdown of the ZKsync transaction lifecycle:

- User Transaction Submission:

- Users submit their transactions to the ZKsync system. These transactions are sent to the Sequencer.

- Transactions can be sent directly to layer 2 (ZKsync) for fast processing or forced through layer 1 (Ethereum) to ensure their inclusion, providing censorship resistance.

- Transaction Collection and Execution:

- The Sequencer gathers the submitted transactions and organizes them into blocks.

- It executes these transactions using the zkEVM (Zero-Knowledge Ethereum Virtual Machine), which functions similarly to Ethereum's EVM but is optimized for zkRollups.

- Soft Confirmation: After executing the transactions, the Sequencer gives users a soft confirmation. This ensures that users get quick feedback about their transaction status before the final verification.

- Handling Forced Transactions: If users submit transactions through L1, these are labeled as forced transactions. The Sequencer must include these in the next block it processes, ensuring that no transaction is unjustly ignored.

- Block Formation: Once transactions are executed, they are grouped into an Unverified L2 Block by the Sequencer. These blocks are collections of transactions awaiting cryptographic proof and final submission to L1.

- Proof Generation: The Prover takes the unverified L2 block and generates a cryptographic zk-proof of the block's execution. This proof verifies that all transactions within the block have been executed correctly.

- Data Submission to L1:

- The generated proof and the necessary data about the transactions are submitted to a ZKsync smart contract on Ethereum.

- ZKsync optimizes this step by sending only the 'state diff' or changes in the blockchain state, which reduces the amount of data sent to L1, making transactions more cost-effective, especially those that modify the same storage slots.

- Verification and State Update on L1:

- The L1 smart contract verifies the cryptographic proof and the completeness of the data submission.

- Upon successful verification, the contract updates the rollup's state on Ethereum, reflecting the changes from the executed transactions.

- Distinction Between Blocks and Batches: In ZKsync, a distinction is made between blocks and batches. While blocks are collections of transactions, batches are larger collections of these blocks. Batches are processed together by the prover, enhancing the efficiency of proof generation and submission to L1.

- L1<>L2 Communication: Transactions initiated via L1 facilitate communication between L1 and L2. This mechanism supports trustless bridges to L1 and ensures that transactions can flow seamlessly between the two layers.

ZKsync ensures efficient and secure transaction processing by following these steps and leveraging zkRollups to maintain Ethereum's scalability and security.

ZKsync Fee Mechanism

A ZKsync transaction is subject to fees from layer 3 and Ethereum. The transactions face intrinsic inclusion in layer 2 blocks, the proofs and necessary transaction data for which are sent to Ethereum, which then charges for computation and storage. We will now discuss some factors that influence ZKsync transaction costs and analyze the fee the protocol has charged historically.

Factors influencing ZKsync fee structure:

- Transaction Publication Fees: ZKsync needs to publish necessary rollup data on Ethereum, such as transaction data, validity proofs, and state transitions. These data require memory and cost gas on Ethereum.

- ZK-Proof Complexity: Zero-knowledge proof operations like generation and verification are mathematically complex and differ from standard CPU operations. ZK-proofs incur high costs due to this complexity and CPU demands.

- Intrinsic Costs in ZKsync: The costs in the ZKsync layer primarily compensate for the sequencers and provers. Unlike Ethereum, these costs are related to the transaction's mathematical complexity rather than its storage in bytes.

ZKsync Fee History on L2Beat

ZKsync Fee History on L2BeatThe graph above charts out the transaction fee history of ZKsync. An acute drop in fees is evident on March 13, when the Ethereum network passed a monumental upgrade called proto-danksharding. The upgrade enabled an upwards of 90% drop in fees for nearly all layer 2 networks. You can refer to our piece on Ethereum Innovations to learn more about proto-danksharding.

Account Abstraction and Paymasters

Account Abstraction (AA) and Paymasters on zkSync represent significant advancements in blockchain account management, offering enhanced functionality, flexibility, and user experience.

Account Abstraction

Traditionally, Ethereum accounts are categorized into two types:

- Externally Owned Accounts (EOAs): These accounts are controlled by private keys and can initiate transactions. However, they cannot execute complex logic directly.

- Contract Accounts (CAs): These accounts are smart contracts that can execute arbitrary code but cannot initiate transactions independently; they require an EOA to trigger actions.

This bifurcation can complicate use cases that require both transaction initiation and complex logic execution, such as smart contract wallets or privacy protocols. On standard Ethereum, such use cases often necessitate the involvement of L1 relayers, adding friction to the user experience.

zkSync Era's Approach to Account Abstraction:

- Unified Account Model: zkSync Era introduces a unified account model where accounts can initiate transactions (like EOAs) and execute arbitrary logic (like CAs). This model, known as Smart Accounts, simplifies the interaction between account types and enhances functionality.

- Smart Accounts: These accounts are programmable, supporting customizations like unique signature schemes, native multi-signature (multi-sig) capabilities, spending limits, and application-specific restrictions. This flexibility allows developers to implement advanced features directly into accounts without the need for intermediaries or relayers.

Paymasters

Paymasters are a key component of zkSync's AA implementation, providing an innovative way to manage transaction fees and facilitate user transactions.

- Transaction Sponsorship: Paymasters can sponsor transaction fees on behalf of users. This means that users can transact without holding ETH, the native token typically required to pay gas fees.

- ERC-20 Fee Payments: Users can pay transaction fees in ERC-20 tokens, not just in ETH. This flexibility makes transactions more accessible and user-friendly, especially for those who hold assets in different tokens.

- Enhanced User Experience: By enabling fee payments in various tokens and sponsoring transactions, Paymasters reduce friction for users and support more seamless interactions with Dapps.

Implementation and Impact:

- Smart Accounts and Custom Logic: Smart Accounts in zkSync Era can implement any logic, similar to smart contracts, while still having the ability to initiate transactions. This combination allows for complex applications such as smart contract wallets, where accounts can enforce spending limits or multi-signature approvals directly.

- Paymasters and User-Friendly Transactions: Paymasters introduce flexibility in fee management, allowing transactions to be funded in tokens other than ETH. This capability is particularly beneficial for applications that deal with diverse token economies or aim to onboard users with minimal crypto experience.

- Security and Flexibility: With AA and Paymasters, zkSync enhances security and adaptability. For instance, businesses can deploy Smart Accounts with customized security measures, like multi-sig setups or transaction whitelists, directly within the account.

- Broader Adoption: These features lower barriers to entry for new users and developers, facilitating the broader adoption of blockchain technology by simplifying interactions and reducing the need for extensive token management.

Account Abstraction and Paymasters on zkSync are transformative in making blockchain interactions more accessible, flexible, and secure. By allowing accounts to initiate transactions and execute arbitrary logic, and enabling transaction fees to be paid in various tokens, zkSync is pioneering a user-centric approach to blockchain technology. This evolution holds significant potential for the future of decentralized applications and blockchain ecosystems.

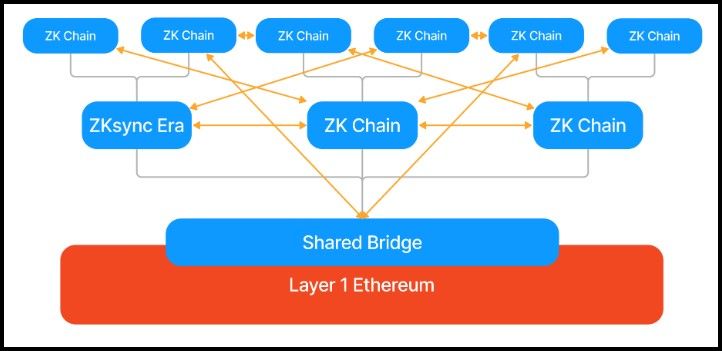

ZK Chains

ZK Chains is not a single blockchain but a framework to intrinsically connect multiple blockchains with shared infrastructure. Similar to Polygon 2.0, the ZKsync team realized that Web3 in Ethereum is fragmented across many chains in multiple layers. The fragmentation is set to worsen with the rise of the appchain narrative – a concept that proposes a unique chain for every decentralized application. The team introduced ZK Chains under the recent v24 upgrade and particularly highlighted the following inefficiencies in Ethereum's multi-chain landscape:

- Inefficient Interoperability and Message Passing: Current blockchain ecosystems struggle with seamless communication between different chains. Protocols like Cosmos and Polkadot focus on interoperability but often rely on trust-based mechanisms. This introduces security and efficiency issues, especially when considering the ultimate goal of trustless and decentralized systems. This trust-based approach exposes vulnerabilities and can lead to significant security risks and inefficiencies.

- Inefficiencies in Current Bridging Solutions:

- Liquidity Bridges: These are costly as they require significant capital to be locked up to facilitate transactions between chains.

- Lock-Mint Bridges: They are less secure because the locking mechanism often becomes a target for hacks, as seen in several high-profile blockchain breaches.

- Chain Hard Forks: When chains hard fork, existing bridges often require reprogramming, adding to the operational burden and risk.

- Economic Incentives for Hacks: Due to the value locked in bridges, they become lucrative targets for hackers, presenting a persistent security threat.

Solution: ZK Chains and Hyperbridges

ZK Chains Are a Network of Many Chains | Image via ZKsync Docs

ZK Chains Are a Network of Many Chains | Image via ZKsync DocsZK Chains are custom Layer 2 or Layer 3 blockchains built using zkSync's ZK Stack. They are designed to operate independently yet seamlessly interact with each other and the Ethereum layer 1 through Hyperbridges. Here's how they solve the challenges:

- Trust-Minimized Interoperability

- ZK Chains leverage zk-based bridges for efficient message passing among each other. All the token liquidity is locked in a shared bridge contract on Ethereum so that token transfers happen seamlessly through burning and minting. Instead of these bridges individually finalizing on Ethereum, all the zk-proofs are combined in the shared bridge contract before verification on Ethereum, which serves as the ultimate source of truth. This design will only demand Ethereum to manage one bridge contract, reducing gas and transactional overheads significantly.

- Through Hyperbridges, ZK Chains can communicate efficiently, abstracting away the complexity of cross-chain interactions from the user, thanks to account abstraction. This means users experience seamless interactions without worrying about the underlying technical steps.

- Enhanced Scalability and Efficiency

- A shared prover mechanism aggregates proofs from multiple ZK Chains. Instead of each chain submitting individual proofs to Ethereum L1, the shared prover consolidates them into a single proof, drastically reducing the load on L1. This aggregation not only saves resources but also increases the scalability of the entire system.

- This method allows ZK Chains to achieve near-instantaneous transaction finality across different chains while maintaining high security and cost-effectiveness.

Benefits of ZK Chains and Hyperbridges

- Sovereignty and Flexibility: ZK Chains can operate as independent entities within the ecosystem. They can join or leave the system in a permissionless manner, adding or removing their assets from the shared pool. This sovereignty ensures chains can tailor their features and operations to their specific needs while benefiting from the collective ecosystem.

- Seamless User Experience: With account abstraction, complex interactions involving multiple chains are simplified for users. They no longer need to manually initiate calls on destination chains; the process is automated and managed by external relayers and lower fees on rollups, providing a smoother and more intuitive user experience.

ZK Chains and Hyperbridges thus represent a significant advancement in blockchain interoperability, providing a secure, scalable, and efficient framework for cross-chain communication and liquidity sharing within the Ethereum ecosystem and beyond.

The ZK Token

The ZK token is the official token of the ZKsync ecosystem. It was unveiled in June 2024 with the announcement of a ZK token airdrop and fits into the ecosystem's narrative of providing seamless interoperability and cross-chain communication with the help of novel technologies like zkbridges and account abstraction.

ZK Token Utility:

- Participate in the ZKsync protocol governance processes by introducing and voting on protocol upgrades.

- Pay for fees. The protocol leverages its native account abstraction technique to let users pay gas fees on any ZK chain with the ZK token. While the ZKsync Era is the first ZK chain, many protocols like the Lens Network, Cronos zkEVM and GRVT are set to join the ecosystem in the months following the token launch.

- Use the ZK token for staking and other DeFi-related functions.

Tokenomics and Allocation

zkSync's ZK token is designed to align the ecosystem's growth with its core values and community vision.

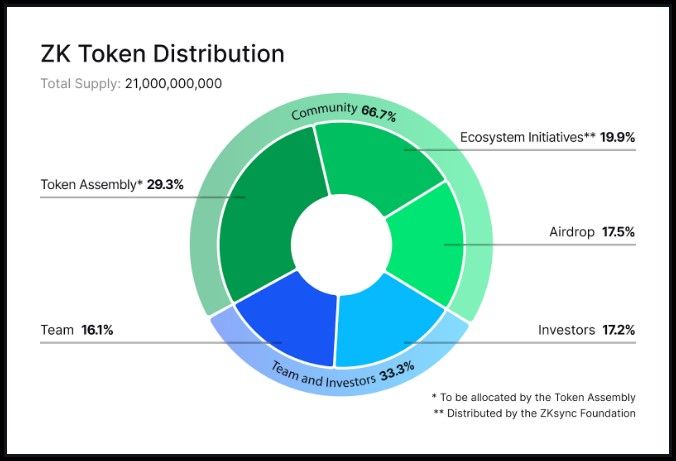

ZK Tokenomics | Image via ZKsync Blog

ZK Tokenomics | Image via ZKsync BlogHere's a detailed breakdown of the tokenomics:

Community Allocation (~67%):

- Airdrop (17.5%): To honor early adopters and supporters, 17.5% of the total ZK token supply will be distributed through a one-time airdrop. This allocation rewards those who believed in zkSync's potential from the beginning.

- Ongoing Ecosystem Initiatives (49.5%):

- Managed by the zkSync Foundation, this portion will be used to support the ongoing development and expansion of the zkSync ecosystem. The distribution is guided by the ZK Nation governance process, ensuring that the community has a significant say in how these tokens are utilized.

- This allocation aims to incentivize new users to join and engage with the ecosystem, fund development projects, and support dApps that enhance the zkSync protocol.

The substantial community allocation underscores zkSync's commitment to decentralization and community engagement. By placing a significant portion of the tokens in the hands of those who share and advance zkSync's vision, the protocol ensures sustained growth and alignment with its core values.

Investors and Team Allocation (33.3%)

- Investor Allocation (17.2%):

- This segment is reserved for the investors who have supported zkSync's development. It reflects their belief in the long-term success of the project.

- These tokens are locked for the first year post-issuance and will gradually unlock over a three-year period from June 2025 to June 2028. This lock-up period aligns investor interests with the protocol's long-term goals, reducing the likelihood of sudden large-scale sales that could destabilize the token price.

- Team Allocation (16.1%):

- Allocated to the Matter Labs team, these tokens reward the contributors who have built and continue to drive the zkSync project.

- Similar to the investor tokens, these are locked for the first year and then unlock over three years, ensuring that the team remains committed to the protocol's long-term success and growth.

Summary

- The ZK tokenomics are designed to foster a community-driven and sustainable ecosystem. The major points include:

- Community-Focused Distribution: Two-thirds of the ZK supply is allocated to the community through direct airdrops and ecosystem initiatives, reinforcing zkSync's commitment to decentralization and user empowerment.

- Incentivizing Early Adoption and Growth: By rewarding early users and continuously supporting new entrants and developers, zkSync ensures ongoing engagement and development within its ecosystem.

- Long-Term Alignment with Investors and Team: The lock-up and gradual release of tokens for investors and the team align their interests with the protocol's long-term vision, promoting stability and sustained growth.

This thoughtful allocation strategy highlights zkSync's dedication to building a decentralized, user-centered protocol that encourages active participation and long-term commitment from all stakeholders.

Where to Buy ZKsync Token?

The token can be bought via Binance, OKX, Bybit and KuCoin, among others. Also, check out our top picks for the best crypto exchanges.

You can also buy the token through decentralized exchanges such as OpenOcean and Jupiter. We also have an article on the best decentralized exchanges.

ZKsync Review: Closing Thoughts

Reviewing ZKsync, I have noticed a clear trend evolving in Web3, which also permeates through other scalability projects as well. This trend is of enhancing user experience by reducing their technological overheads. Polygon, ZKsync, and many other layer 2 projects are adopting ZK Chains-like architectures to improve seamless cross-chain communication.

Account abstraction is also not a concept anymore, allowing greater account programmability and customizability. These developments are building towards a future where the user might not need to know what set of chains they're using when on a particular application or what tokens they are paying gas in. These developments are crucial for mainstream Web3 adoption.