The cryptocurrency markets have become one of the most exciting places for traders, and more are entering crypto trading every single day. If you’ve landed here I presume you’re looking to join their ranks too. It’s good because this is the right place for you to learn everything you need to begin trading popular cryptocurrencies like Bitcoin, Ethereum, and Cardano today.

While this is going to be a fairly long piece, it will still only be going into the basics of crypto trading. It will give you everything you need as a beginning in crypto trading, and if you’re interested in a quick start you could be making your first trade later today.

If you don’t have time to read the entire piece just now though here’s the tldr;

- Find an exchange to trade on and register for an account;

- Complete any verification requirements for the exchange;

- Fund the account;

- Begin trading.

Get started crypto trading today.

Get started crypto trading today. You’ll also want to have an external wallet to transfer your cryptocurrencies to when done trading. For the highest level of safety we always recommend choosing a hardware wallet like the Ledger, Trezor, or BC Vault. Other options for wallets include desktop wallets like Exodus or online wallets such as MetaMask.

Choosing a Crypto Exchange for Trading

Once you’re ready to start trading cryptocurrencies your first job will be to find a suitable exchange. That might not be as easy as it sounds because there are different types of exchanges to consider and different regulations based on where you live.

The first consideration to be made is whether you want to use a centralized exchange (CEX) or a decentralized exchange (DEX). For beginners, we do recommend using a centralized exchange. It will be easier to get started, and they will provide you with more tools and support. Decentralized exchanges are great and we love them, but they aren’t really suitable for beginning traders in our opinion. Plus the decentralized exchange will limit you to trading only the coins on the chain that’s supported by the DEX (Ethereum, Binance Smart Chain, etc).

There are a huge number of cryptocurrency exchanges to choose from, and you’ll want to read through their terms and conditions to get a feel for which one will support your own trading best. Some have a wider selection of cryptocurrencies, some have better fees, and some have better support.

You have so many exchange choices.

You have so many exchange choices. I would recommend checking out our Top Exchanges article, where we break down our top picks for traders with different needs if you are in the market and need a first, or additional crypto exchange. It is also worth checking out the Coin Bureau Deals page as we have some great sign-up offers for many of the leading exchanges.

Cryptocurrency Exchange vs. Cryptocurrency Broker

While many people use the terms “broker” and “exchange” interchangeably, the truth is that there’s some difference between the two that’s important to understand.

A broker is not the same as an exchange. Image via YouTube.

A broker is not the same as an exchange. Image via YouTube. A broker is a person or company that acts as an intermediary in financial transactions. For their assistance in brokering sales and purchases they receive a commission. The well known Coinbase is a broker, although their Coinbase Pro platform is an exchange. Broker’s fees are typically quite high when compared with an exchange.

The upside is that cryptocurrency brokers provide a more suitable environment for those just getting started in the purchase and trading of cryptocurrencies. They offer a means to purchase crypto with fiat currency, and to convert back from crypto to fiat as well. Prices are set by the broker so there’s no slippage involved and buyers know exactly what price they will receive when buying and selling. Brokers can also provide additional services such as cold storage for large amounts of cryptocurrency.

In contrast an exchange connects buyers and sellers with one another using an order book that contains the orders of all the users of the exchange, and often from outside sources as well. Because the exchange is simply connecting buyers and sellers they receive a much smaller fee for their services when compared with brokers. The exchange is simply the platform where buyers and sellers get together.

The downside to this is that slippage can occur in fast moving markets, which means buyers and sellers might not get the price they expected.

Cryptocurrency exchanges are suitable platforms for more advanced holders and traders of cryptocurrencies who want to take advantage of price fluctuations through speculation, hoping to make gains and to avoid losses.

Indirect Solutions for Crypto Trading

While things are getting better in terms of access and removing restrictions on cryptocurrency exchanges, there will likely still be some of you out there who will either have difficulty dealing with a traditional centralized exchange, or simply don’t want to deal with one of these exchanges. Fortunately there are still some options that you could explore.

There are plenty of cryptocurrency exchange alternatives to choose from.

There are plenty of cryptocurrency exchange alternatives to choose from. If you still want to buy actual cryptocurrency you could try Square’s Cash App, which is a particularly good way to avoid using Coinbase if you are just interested in buying and selling Bitcoin. This is also a good option if you need to buy some Bitcoin to deposit to another exchange for trading.

Some other options for very basic crypto trading include Robinhood and Paypal. The downside to these options is that neither allow you to withdraw crypto from their platform, and you’ll only find a handful of the largest cryptocurrencies to trade.

The upside to using Robinhood is they also offer access to equity markets, meaning you can take an even more indirect approach to crypto trading through the various Greyscale Trust products, or through trading stocks that are related to crypto, such as Coinbase, Bakkt, or Riot Blockchain.

There are also swap services out there like Changelly and SimpleSwap which are great for a quick exchange, but not really suitable for crypto trading due to the high fees charged on each transaction. They’re convenient for sure, but you do pay for that convenience.

The Logical Trading Progression

Many new traders go through a typical logical progression with cryptocurrencies. They start with something simple like Cash App or Coinbase to buy and trade a small number of cryptocurrencies (Coinbase has gotten much better for this). Once they are comfortable with these easy entry points to crypto trading they begin to look into the full featured exchanges such as Binance and Coinbase Pro. This gives them a far greater selection of crypto assets, as well as introducing them to technical analysis tools and charting tools.

As you advance you'll get access to a broader group of cryptocurrencies and analysis tools.

As you advance you'll get access to a broader group of cryptocurrencies and analysis tools. While that’s as far as some traders go, others continue exploring and move on to the centralized exchanges such as Uniswap or PancakeSwap. In addition to using these decentralized exchanges this is also the level at which traders begin looking into yield farming or the use of leverage and derivatives in their trading.

This logical progression lets you gradually build on learned skills, and taking these steps out of order could lead to problems, so try not to run before you can walk.

Another good idea along the way is to educate yourself about other areas of the crypto investing universe such as mining and staking. And of course you’ll want to educate yourself on the basics of how blockchains work and how smart contracts work, as well as other technical aspects of blockchain operations. Of course you can do all of that here at the Coin Bureau blog and over at our YouTube channel.

Learn about Market Order Types

If you’re starting out with a broker like Coinbase rather than an exchange you won’t need to know about order types, but once you move to Coinbase Pro, Binance, or some other exchange knowing the different order types will become important for risk management and order management.

The most basic order type is the market order. With this type of order you are simply buying or selling at the current market price. But there are other order types that allow you to fine tune your entries and exits. The most common is the limit order, which allows you to specify the price you buy or sell. So Bitcoin might be currently selling for $40,000, however with a limit order you can specify that your order is only executed if the price is $39,000. This way you don’t have to constantly monitor the market, but can still get a better price.

Another commonly used order type is the stop-loss order. This is a conditional order that protects you from suffering a loss. The stop order is a type of limit order that is placed below the current price or your entry price to protect from sharp drops in price that could lead to large losses. The opposite order type is a take profit limit order. This type of limit order is placed above your entry price at a target level that matches the amount of profit you’d like from the trade.

A great way to protect your account from huge losses.

A great way to protect your account from huge losses. These various order types can help protect you from the inherent volatility of the crypto markets.

Learn about Fundamental Analysis

Fundamental analysis is one method for determining the actual value of an asset. In fundamental analysis the financial and economic factors of the asset are studied to reach what’s considered a fair value for the asset. This analysis can be very broad and takes in such things as the broad economy, conditions within the industry, and the state of the company or project, which can even include the strength of the brand and the management.

The ultimate goal of fundamental analysis is to determine the fair value of the asset to see if it is currently overvalued or undervalued. Then the trader or investor can use that information in their investing decisions.

If you want to find the true value of an asset fundamental analysis in invaluable.

If you want to find the true value of an asset fundamental analysis in invaluable. When it comes to performing fundamental analysis on cryptocurrencies the analysis will include the emerging field of on-chain metrics. This includes the number of holders, the top holders, how many addresses are on-chain, the growth of the blockchain, hash rate, and many other metrics. Using all of the available data about the project the analyst can determine the strength of the network and the potential value of the project.

Fundamental analysis is widely used in equity and currency markets, but isn’t as useful for cryptocurrencies since the asset class is so new. There’s currently no standardized measures that can be used to determine the market value of projects, plus the speculative nature of cryptocurrencies often makes fundamental analysis unhelpful in determining the market movements of a coin or token.

In time the market will mature and then fundamental analysis will be far more useful.

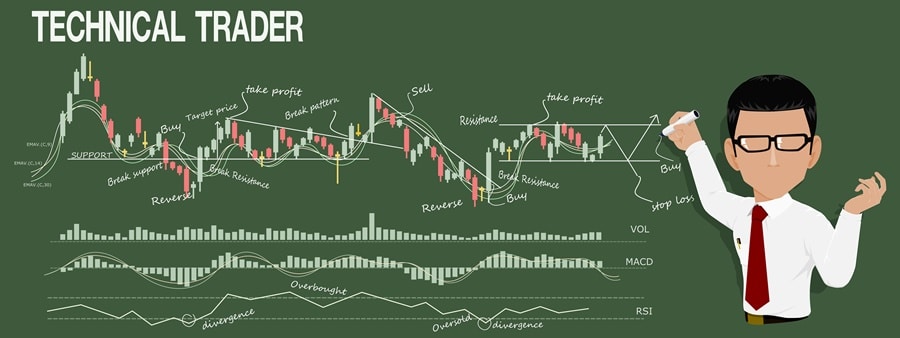

Learn about Technical Analysis

One of the top methods used to determine potentially profitable entry and exits points for cryptocurrencies is crypto technical analysis. This is the analysis of the past price action of an asset to identify possible patterns, such as support and resistance areas, current trends, and potential trend reversals, among other things.

Technical analysis has a long history in fiat currency “forex” markets, and in commodity and equity trading as well. It is well tested, and many of the indicators and methods used can increase the success rate and profitability of trades. Technical analysis is based on the principle that certain patterns in price repeat themselves. While it uses price and volume it is ultimately based on trader psychology, as certain levels tend to create specific reactions from traders.

Price action informs the technical trader.

Price action informs the technical trader. The study of technical analysis can be a life-long endeavor, and there are entire websites and massive books dedicated solely to technical analysis. As a starting point you might want to look into the basics such as support and resistance levels, trend lines, and moving averages.

More advanced technical analysis indicators include the relative strength index (RSI), moving average convergence divergence (MACD), Bollinger Bands, Fibonacci Retracements, and others. Some of the most popular trading methodologies include a number of these indicators. These methodologies include Dow Theory, Elliott Wave Theory, and the Wyckoff Method.

Technical analysis is most often thought of as a way to predict price movements, but it is also a useful framework for risk management. Because technical analysis provides a model for analyzing markets it allows the trader to make their trading more measurable and defined. This allows a trader to more accurately analyze their own performance, and to include risk management strategies as a part of their overall trading strategy.

Types of Crypto Traders

It’s always best to have a trading strategy when approaching the markets. Your trading strategy is the plan you follow when executing your trades. It can be simple or it can be complex, but there’s no correct method. The best method is always one that aligns with the trader’s own goals, risk tolerance, and preferences.

You won't really know what type of trader you are until you start actually trading.

You won't really know what type of trader you are until you start actually trading. No matter what method you decide to follow it is crucial that you do establish a trading plan. And don’t worry when starting out. Your trading plan will likely be simple, but it will also evolve over time. And if you come to find that it doesn’t suit your trading style you can always change it later. The important thing is that it will establish some clear guidelines and goals, and it will keep you from making emotional trades or trades based on your “gut feeling”.

In general the trading plan includes what you’re going to trade, how you’re going to trade it, and what your entry and exits points will be. In a larger context most trading plans also fall under one of the following trading styles: Day Trading, Swing Trading, Position Trading, and Scalping.

Day Trading

Day trading is a popular trading strategy that involves entering and exiting trades on the same day. The term comes from traditional equity markets which are only open for set hours each day. A day trader closes all their positions by the end of the trading day and keeps no positions open overnight.

Cryptocurrency markets are a bit different from traditional markets in that they don’t close – ever. You can trade cryptocurrencies 24 hours a day, 7 days a week, and 365 days out of the year. Yet trading within the context of day trading is still useful for cryptocurrency traders. With this style a trader would keep to a set trading schedule and close out all their trades by the end of their trading day, whether that’s 5pm or midnight.

If you didn't know about day trading before, you do now.

If you didn't know about day trading before, you do now. Day trading relies on technical analysis to determine entry and exit points. Profits may be smaller since trades are closed each day, but this also allows for more diversity in the set of assets you trade. However some day traders do choose to focus on a limited number of assets and stick to those exclusively. There’s a benefit to this as the trader can become intimately familiar with the price action of a limited set of assets.

This style is popular because it provides a good amount of action, but also limits stress for traders since they don’t have to worry about waking up to surprise moves in positions held overnight. That can be particularly helpful in the volatile cryptocurrency markets.

Swing Trading

Swing trading focuses more on longer term trends in the markets, and positions can be held for days or even up to several weeks. The goal is to identify undervalued assets that are just beginning to see an increase in buying momentum and upward price movement. The swing trader looks to get into the asset as it trends higher, and then sell at a later date for a profit.

As with day trading technical analysis is widely used, but because the strategy is focused on a longer time frame fundamental analysis might also be used. For example, a project that has an upcoming large code base change, or the launch of a mainnet might be expected to see a longer term trend in their upward price momentum and could be good picks for swing traders.

Swing traders look to take advantage of larger moves over a longer time frame.

Swing traders look to take advantage of larger moves over a longer time frame. Swing trading tends to be more beginner friendly because it doesn’t feature the fast-pace and stress of day trading and other short-term trading strategies. Swing trading allows a trader to take their time and make more informed trading decisions.

Position Trading

Position trading is one step away from investing in that it is a long-term strategy in which positions are generally held for months at a time to capture a long-term price trend in an asset. Position traders may not strictly be hodlers, but they are similar to investors given their long-term horizon.

What specifically distinguishes the position trader from the swing trader is the rationale behind the trade decision. Position traders are most concerned with long term trends in the price of an asset. Swing traders might not be as concerned with the long term trend, and are willing to trade counter-trend for a week or more to capture a pullback or bounce in the price of an asset.

Because of the long time horizon favored by position traders it isn’t unusual for them to rely more heavily on fundamental analysis. That’s because their longer trade window allows them the luxury of watching fundamental events play out. That’s not to say that they don’t also rely on technical analysis. Because they are working on the assumption of a continued trend the use of technical indicators can be useful in identifying potential trend reversals.

Position traders take advantage of superior risk / reward ratios.

Position traders take advantage of superior risk / reward ratios. Position trading also tends to be a good strategy for beginning traders as the longer time horizon gives them plenty of time for analysis and trade decisions.

Scalping

The aforementioned strategies, even day trading, use a longer time frame, while scalping is confined to very short, well timed traders. Scalpers might look to make many smaller profits by getting into and out of trades in a matter of minutes, or even seconds.

They use technical analysis almost exclusively, and can also use more advanced techniques like arbitrage and exploiting bid-ask spreads. Because of the short time frame the profit on each trade is necessarily small, but scalpers might make dozens of trades a day. Automated scalping systems can be in and out of trades in seconds and place hundreds of trades daily.

Scalping is the most active of the trading styles.

Scalping is the most active of the trading styles. Scalping is in no way suitable for beginning traders. It requires an in-depth understanding of the markets, the trading platform, technical analysis, order types, order books, and more. However for more experienced traders who have all this knowledge, scalping can be an excellent strategy that yields excellent profits.

Other very Important Crypto Trading Concerns

With the information above you could get started in your crypto trading journey. However there’s much more to learn yet if you want to get into trading with a good level of preparation. Keep reading to help set yourself up for success.

Securing Your Trading Account

Hacking is a real thing for crypto traders, and if that happens to you you’ll lose everything. Recovering coins from a hacked account rarely happens, so keeping your account and wallet secured is super important. Follow the basics of using a secure password, 2-factor authentication, and other security practices.

You can never be too safe with online trading. Image via Pinterest.ca

You can never be too safe with online trading. Image via Pinterest.ca If you are using Coinbase, that includes turning on whitelisting to make it more difficult for a hacker if they try to access your account. For external wallets it means backing up and encrypting your wallet, and keeping a secure offline copy of your seed phrase to recover your wallet if necessary. Finally, make sure to secure your passwords by using a password manager.

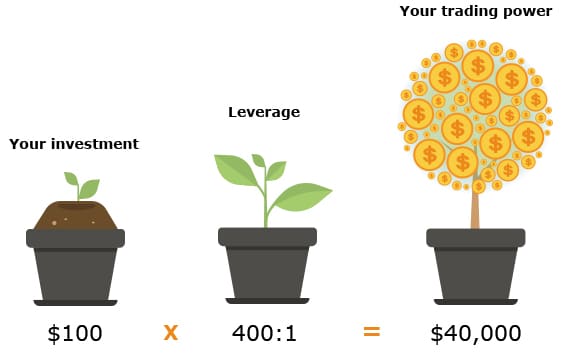

Beginners should avoid Margin and Leverage

Margin trading involves trading using funds that are borrowed from a third party. In traditional markets this is usually the broker. In cryptocurrency markets margin might be provided by the exchange, or it can come from other exchange users. The use of margin in trading amplifies the results obtained – both profits and losses. Using margin gives traders access to more capital than they might have otherwise, and is also considered an efficient means for trading since the same sized position can be opened with much less capital.

Leverage is often mentioned together with margin, and they are different but related. Margin is the amount of capital provided by the trader and is expressed in percentage terms, such as 10% margin or 2% margin. Leverage is how much the position is amplified and is expressed in terms of 2x or 10x.

So, 10x leverage amplifies a trade by 10 times and would be accomplished by putting up 10% margin.

Leverage is a two-edged sword.

Leverage is a two-edged sword. The potential profits of using margin and leverage often have greedy traders watering at the mouth, but leverage amplifies losses just as much as profits. This means that even though a $100 profit becomes $1,000 when using 10x leverage, the same is true for a loss. That can quickly wipe out an account, particularly in the volatile and fast-moving cryptocurrency markets.

Derivatives are not the same as Actual Cryptocurrenies

Now that the cryptocurrency market is growing up there are a number of different derivatives that have become available. It’s important to understand that these derivatives are not the same as the actual underlying cryptocurrencies. A Bitcoin futures contract or option is very different from owning actual Bitcoin. Options and futures come with their own specific risks that make them unsuitable for beginning traders.

Cryptocurrencies are also becoming increasingly available from CFD brokers. These CFDs, or contracts for difference, are only based on the price of the underlying crypto. When you buy a CFD you do not own the underlying cryptocurrency. They can be fine for speculating on price, but it’s important to know the difference between an actual cryptocurrency exchange, where you are buying cryptocurrencies, and a CFD broker where you are purchasing a derivative product that is only speculating on price action.

Cryptocurrencies are Taxable Assets

In most jurisdictions cryptocurrencies are now considered to be taxable assets, and there are tax implications for trading cryptocurrencies. For one thing, different coins aren’t necessarily considered to be “like-king assets”, which can lead to surprises when you file your taxes. Thankfully there are now crypto tax services that track your crypto gains and losses from trading and help you with your tax filing.

On Cryptocurrency Mining

Cryptocurrency mining or staking is a great way to get involved in cryptocurrencies. However it isn’t so much trading as it is investing.

Crypto mining can help provide funds for your trading activity.

Crypto mining can help provide funds for your trading activity. It is relevant to talk about in this crypto trading piece however because staking coins need to be acquired from an exchange, and mining profits can only be turned into fiat currency or other cryptocurrencies by using an exchange – which is trading.

Conclusion

So, that’s quite a bit to digest, and yet it’s really only scratched the surface of crypto trading. We could go into far more depth regarding both fundamental and technical analysis. An exploration of exchanges and their strengths and weaknesses wouldn’t go amiss either, and we’ve actually done that already for Binance and KuCoin so you can check those out before you start trading.

Other future topics could focus on trading strategies, risk management, trading software, and other aspects of trading in cryptocurrencies. You could also head over to our YouTube channel and subscribe. Guy does a great job in presenting the pros and cons of many different cryptocurrencies that you might be interested in trading.

After all this our best advice is just to choose an exchange and start trading. Start researching different coins and tokens, start learning more about trading strategies, and just start doing trades. Will you make a mistake because of your inexperience? Probably. But that’s all part of the learning process. By the 10th trade you’ll feel more comfortable, and by the 100th trade you’ll feel like a trading expert.

So get out there and get started crypto trading!