Beginners

Simplest interface, strong regulatory compliance, quick onboarding, and broad asset support — ideal for newcomers seeking safety and ease of use.

The U.S. crypto landscape has done a complete 180, shifting from a hostile regulatory environment to a more welcoming and structured one. With clearer regulations, more traders and investors are considering entering the space, but with so many exchanges available, choosing the right one can feel overwhelming. This guide is designed to simplify your decision-making by breaking down the best crypto exchanges in the U.S. based on different user needs.

TL;DR: pick based on your goal — fees, security, or simplicity — not hype.

Clean UX, fast onboarding, strong U.S. compliance for a painless start.

Flat ~0.05% maker/taker and built-in bots keep total costs down.

Security-first controls and transparent audits for cautious investors.

Here’s how leading exchanges stack up at a glance.

| Exchange | Best For | Maker/Taker | Spread Policy | Funding/Withdrawal Fees | Supported Coins | Regulation | PoR Cadence/Type | Insurance (Crime/FDIC) | Social/Copy Trading | Bots/Demo | Futures/Perps | Cards | App Rating | State Coverage |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Coinbase | Beginners/Security | 0.00%-0.40% / 0.05%-0.60% (Advanced Trade) | Added on Instant Buy | No deposit; $0–3.99% card, network on crypto | 240+ | FinCEN/SEC/NYDFS | Monthly | FDIC-USD/crime | No | No | No | Yes | 4.6/4.7 | 49 states (no HI) |

| Kraken | Day Traders | 0.00%-0.25% / 0.08%-0.40% (Kraken Pro) | Minimal, shown in UI | Low wire; network on crypto | 200+ | FinCEN/SPDI | Quarterly (public) | Crime only | No | Paper | Yes | No | 4.7/4.6 | 48 states (no NY, WA) |

| Gemini | Security-maxi | 0.00%-0.20% / 0.03%-0.40% (ActiveTrader) | Added on instant trade | Free wire/ACH; network on crypto | 130+ | NYDFS/FinCEN | Realtime (Trust Ctr) | FDIC-USD/crime | No | Demo & learn | No | Yes | 4.5/4.5 | All 50 states |

| Bitstamp | Fiat On-ramp | 0.30%/0.40% | Shown for Instant | Free SEPA/wire; network on crypto | 100+ | EU/BitLicense | Annual (public) | Crime only | No | Demo | No | Yes | 4.5/4.6 | Most states, no HI |

| Robinhood | Simplicity | Approximately 0.55% flat fee for crypto trades, though 0% on debit card deposits | Variable, no spread | Free ACH/in-app; network (crypto) | 25+ | FINRA/SEC/NYDFS | Not public | FDIC only | No | Demo | No | Yes | 4.2/4.7 | All 50 states |

| Crypto.com | Altcoin Variety | 0.25% / 0.50% (base tier) | Some pairs zero spread | Free bank; $0–2.99% card; net. for crypto | 250+ | FinCEN/NYDFS/EU | Monthly (public) | Crime & asset ins. | Social/Copy | Yes | Yes | Yes | 4.8/4.7 | 49 states (no VT) |

| Uphold | Multi-asset | A $0.99 Uphold Fee will be applied if the value of your trade is below $250. | Shown, varies by pair | Free ACH; network, 1.75% card out | 300+ | FCA/FinCEN/FCIS | Realtime (public) | Asset ins., no FDIC | No | Demo | No | Debit | 4.5/4.7 | 45 states (no NY) |

| Pionex | Low Fees/Bots | 0.05%/0.05% | None, flat fee | Free deposit; net. for crypto | 136+ | MSB (Asia, EU) | Quarterly (public) | No | No | 16 bots/Demo | Yes | No | 4.7/4.8 | Not US |

| BTCC | Futures/Pro-trader | 0.03% / 0.06% (futures base tier); 0.2% / 0.3% (spot trading) | Minimal, shown in UI | Free deposit; network for crypto | 300+ | EU, Asia, FinCEN | Monthly (public) | No | Copy trading | Demo | Yes | No | 4.5/4.6 | Not US |

Notes:

This table synthesizes the strengths, costs, and limitations of the top exchanges for fast, informed comparison. Always refer to official support/FAQ pages or regulatory filings for definitive, current details. Let’s break down how each platform performs in practice.

This section explains how this guide was built, what we verified directly, and where its limits are, so you can judge how closely it reflects real-world usage for U.S.-based readers.

We evaluated major U.S.-accessible crypto platforms using a mix of hands-on checks and primary-source verification, focusing on the factors that matter most in the U.S. market: state availability, compliance posture, total fees, and operational safety.

Testing emphasized the core retail journey and the cost-to-execute reality, not just headline maker/taker rates.

What we reviewed and verified:

Where we included comparisons like app ratings, feature grids (bots, demo, cards, futures), and PoR cadence, they reflect the most recent public information available during the update window and are subject to change.

We did not perform independent security audits, penetration tests, or attempt to verify reserves beyond what exchanges publish publicly. Proof-of-Reserves can improve transparency, but it is not a full balance-sheet audit and does not eliminate counterparty risk.

We also did not test:

Each exchange offers a different balance of security, cost, and features. The following reviews break down how the major platforms compare in real-world use.

Coinbase is the largest US-based crypto exchange, known for strong compliance, deep liquidity, and an easy interface. It offers 343+ assets with broad international availability.

Kraken is a veteran global CEX known for strong compliance, advanced trading (margin and futures), and deep liquidity across 200+ cryptocurrencies and 700+ pairs.

Gemini is a US-based, security-focused CEX offering 160+ cryptocurrencies, staking, and dual-market ActiveTrader features. It’s renowned for transparency and strong asset protection.

Bitstamp, launched in 2011, is one of Europe’s longest-running centralized exchanges (now under Robinhood ownership). It focuses on transparent, regulated, fiat-friendly crypto trading with global access.

Robinhood is a U.S.-focused brokerage offering stocks and a selection of major crypto coins, but it does not operate as a full centralized crypto exchange (CEX).

Crypto.com is a global CEX offering 400+ assets and a wide set of earning, staking, and DeFi features, backed by aggressive international expansion.

Uphold is a U.S.-regulated crypto and multi-asset platform supporting “anything-to-anything” swaps across 300+ cryptos, 27 fiat currencies, and multiple metals. Popular for transparency and real-time proof-of-reserves, it caters to retail and passive investors globally.

Pionex is an automation-first crypto exchange best known for its free in-built trading bots and ultra-low fees. It serves both algorithmic traders and beginners who want passive trading tools.

BTCC, founded in 2011, is one of the longest-running crypto exchanges. It’s now futures-dominant with high leverage, plus growing spot, copy trading, and demo features for 10M+ users worldwide.

Diffferent Crypto Apps Reflect Growing Retail Market Engagement. Image via Shutterstock

Diffferent Crypto Apps Reflect Growing Retail Market Engagement. Image via ShutterstockPicking an exchange doesn’t have to feel overwhelming. The right platform balances ease of use, trustworthiness, costs, and compliance, ensuring a smooth and safe trading experience.

When quickly evaluating exchanges, make sure to check these fundamental criteria:

Once you’ve filtered for regulation and fees, look out for hidden costs.

Beyond listed fees, beginners should understand the following subtle costs:

Beyond fees, where you live also matters.

U.S. crypto regulations vary state-by-state, impacting exchange access:

Understanding these nuances helps beginners pick exchanges that best fit their state jurisdiction and personal verification comfort.

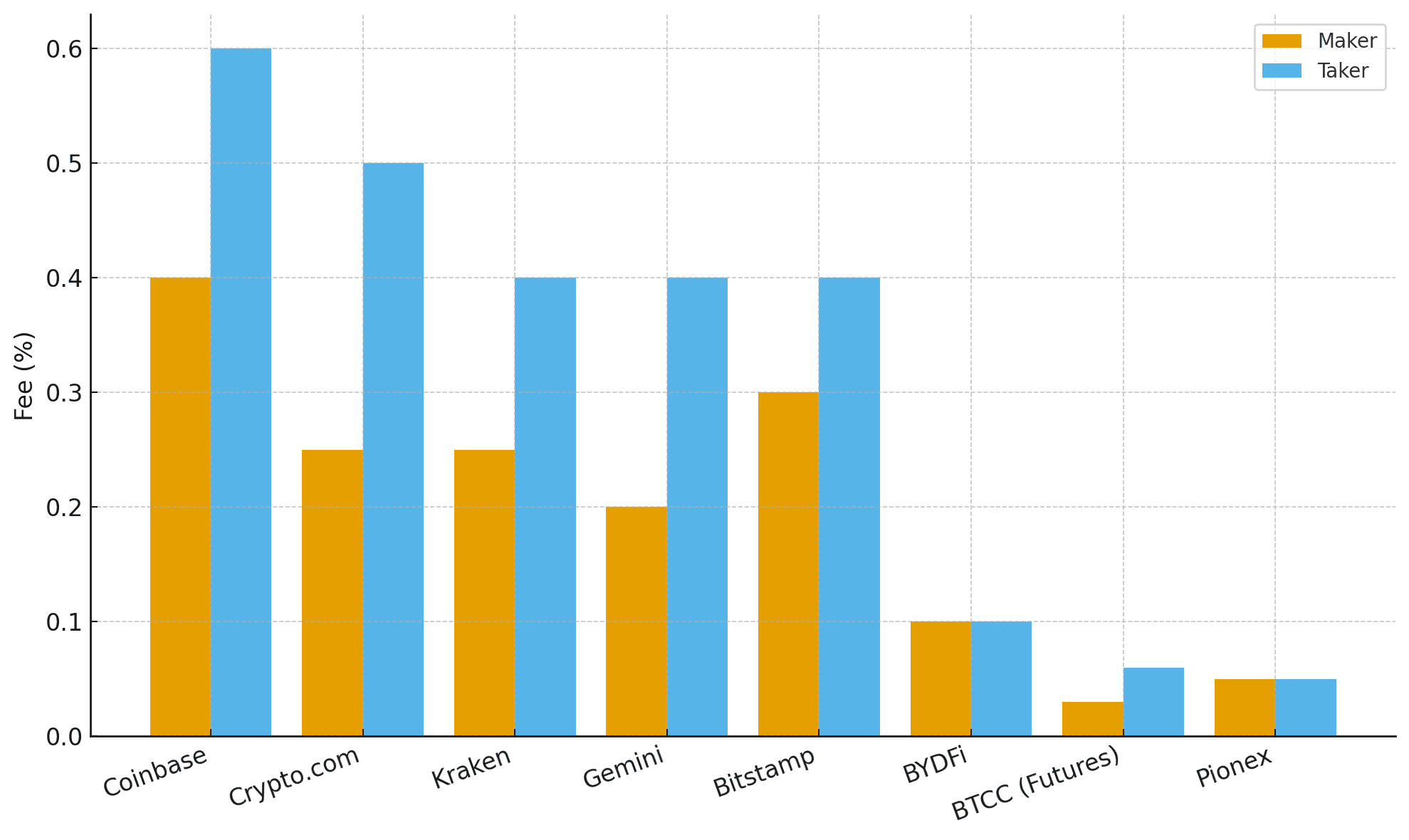

The chart below compares standardized maker and taker fees at the base retail tier for the 9 leading cryptocurrency exchanges in the U.S., providing a clear visualization of cost differences:

Base-Tier Maker vs. Taker Trading Fees Across Leading Crypto Exchanges

Base-Tier Maker vs. Taker Trading Fees Across Leading Crypto ExchangesNote: Robinhood and Uphold aren't included:

Understanding total trading costs helps you see how fees add up across different transaction types. Here are three examples that illustrate how platform fees and network charges can impact real users.

$1,000 Spot Buy/Sell (Coinbase Example):

$100,000 Taker Futures Order (BTCC Example):

Taker fee: $100 ($100,000×0.1%)($100,000×0.1%)

$500 ACH Deposit → Buy → Withdraw to Self-Custody Wallet (Coinbase Estimate):

ACH deposit fee: $0 (usually free)

Network + exchange withdrawal fees: approx. $15 + $5 blockchain fee = $20.00 total

This example shows how on- and off-ramp costs can matter just as much as trading fees, especially for smaller, cost-conscious users.

Many platforms provide fee discounts and perks via native tokens or loyalty programs, including:

Other discount mechanisms include:

Total costs depend on how often you trade, how much you move between exchanges and wallets, and whether you take advantage of fee discounts. Always factor in both trading and transfer costs before choosing a platform.

Crypto Apps Reflect Growing Retail Market Engagement. Image via Shutterstock

Crypto Apps Reflect Growing Retail Market Engagement. Image via ShutterstockBuying and trading cryptocurrencies in the U.S. requires careful attention to regulatory compliance, exchange security practices, and transparency around reserves. Understanding these aspects helps protect your assets and ensures you use trustworthy platforms.

The U.S. crypto ecosystem is regulated by multiple agencies, each with distinct roles. Here’s how the key regulators divide oversight.

With the rules clear, security practices become the real differentiator.

When evaluating exchange security, consider these features and exchange-specific performance:

An example rating scale might place Coinbase, Gemini, Kraken, and Uphold at the top due to broad coverage of these features, while newer or smaller platforms may score lower—always verify up-to-date details per exchange.

Even with regulations, crypto still carries personal responsibility, and so a few risk reminders to always keep in mind are

Understanding these risks is crucial for safe crypto participation, so be sure to read this guide by experts at Coin Bureau to help you mitigate these risks with the best strategies.

Qualities of The Best Crypto Marketplaces. Image via Shutterstock

Qualities of The Best Crypto Marketplaces. Image via Shutterstock Selecting the ideal cryptocurrency exchange depends largely on your trading goals, experience, priorities, and lifestyle. The overwhelming variety means there is no single “best” exchange for everyone. This decision guide matches top exchanges to different user personas to help you choose quickly and confidently.

Different traders need different strengths. These picks match each goal.

Simplest interface, strong regulatory compliance, quick onboarding, and broad asset support — ideal for newcomers seeking safety and ease of use.

Ultra-low 0.05% maker/taker fees and built-in bots make it a cost-conscious choice without sacrificing useful automation features.

Top-tier controls, cold storage, robust compliance, and transparent proof-of-reserves — for investors who prioritize safety over speed.

Advanced charting, deep liquidity, margin and futures access, and reliable execution for active traders who need speed and depth.

Built-in bots, paper trading, and strategy tools help beginners and pros automate trades or test ideas with minimal friction.

Hundreds of listings including new tokens, DeFi assets, and meme coins — a good fit for explorers seeking range.

Heavily vetted and licensed across major jurisdictions — suitable for users who want clear AML/KYC standards and strong oversight.

Good for smaller test purchases and multi-asset access; verification requirements vary by feature and region.

Highly rated apps with full trading and earning features designed for investing on the go.

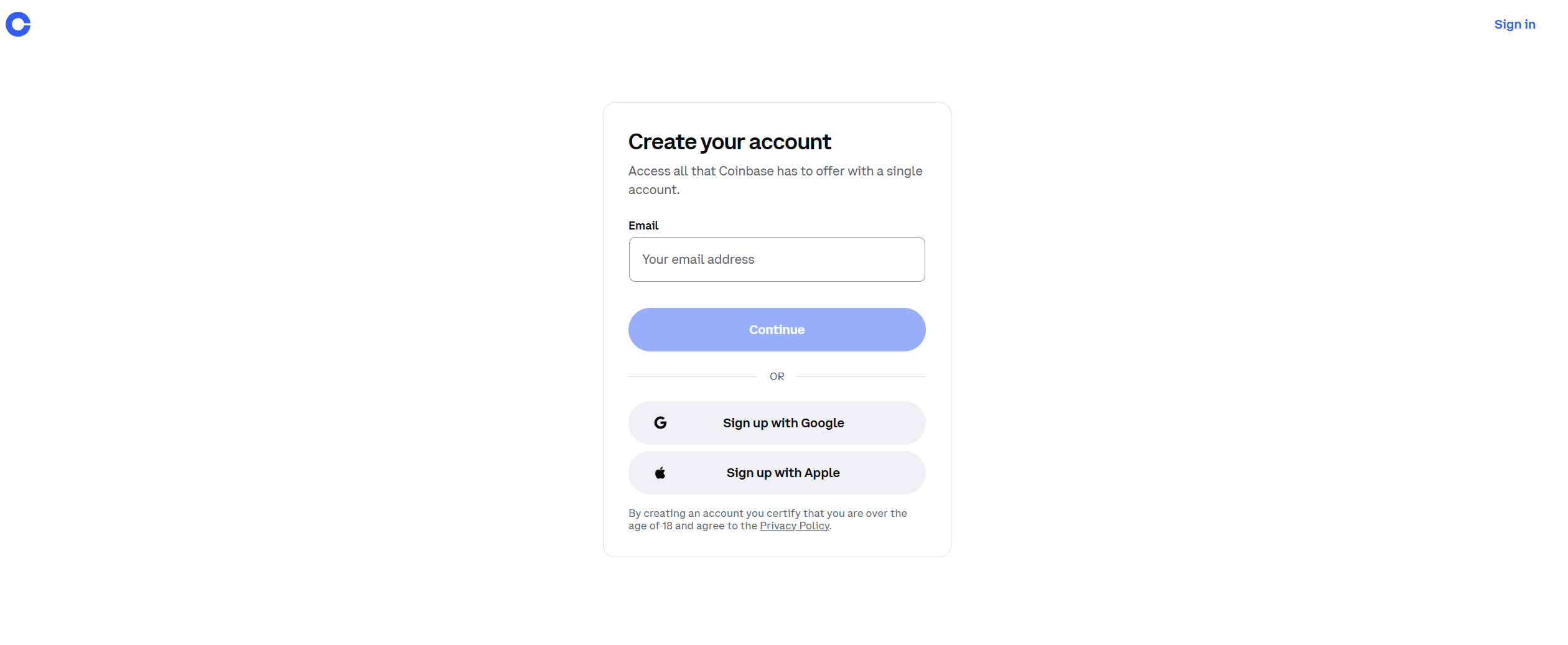

Getting started with cryptocurrency trading can be straightforward when you follow a clear process. This tutorial walks you through each essential step, from account setup to safely withdrawing coins for self-custody.

STEP 1

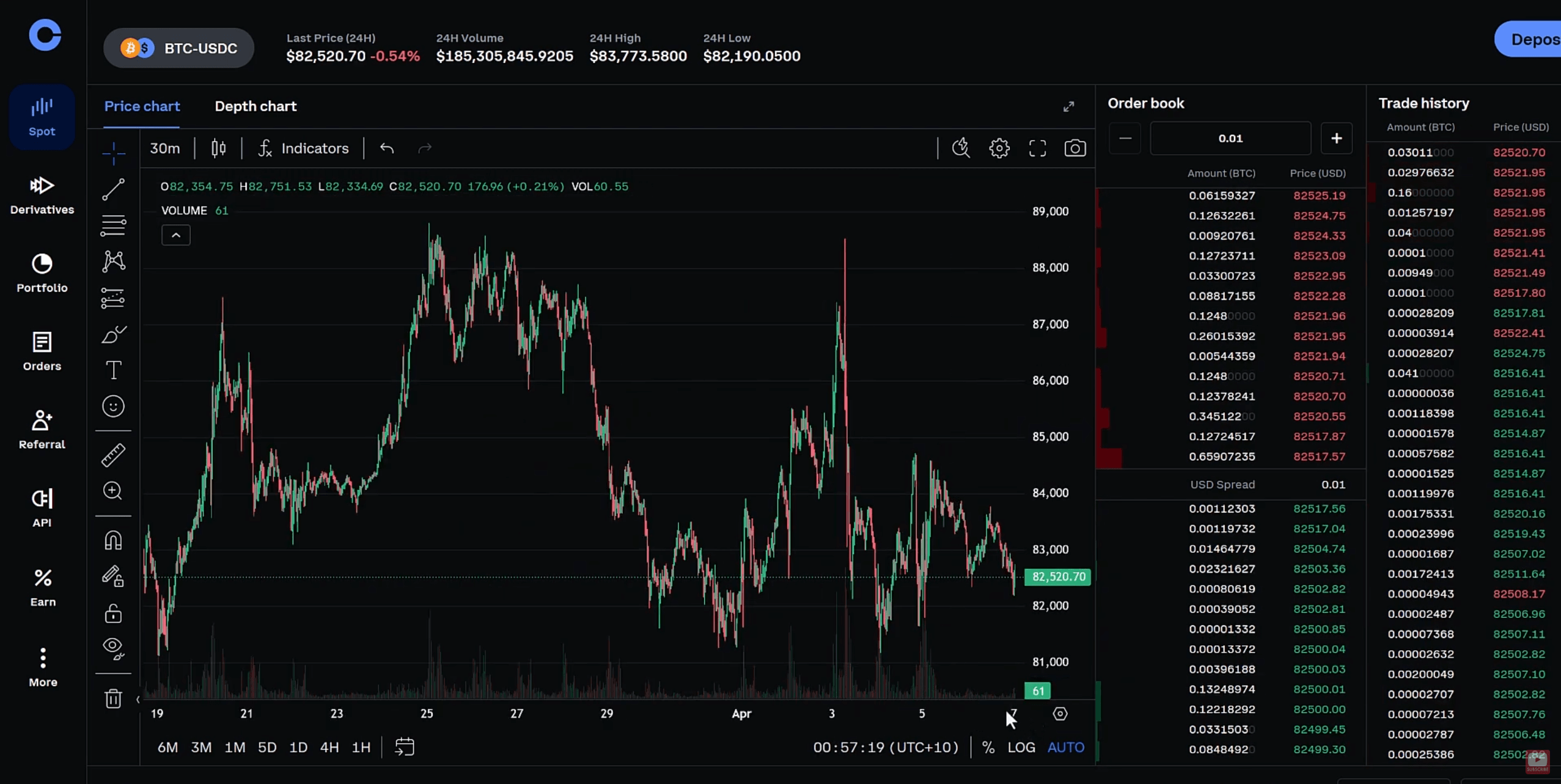

Choose trading pair: For beginners, start with common pairs like BTC/USD or ETH/USD.

Choosing Trading Pairs

Choosing Trading Pairs STEP 2

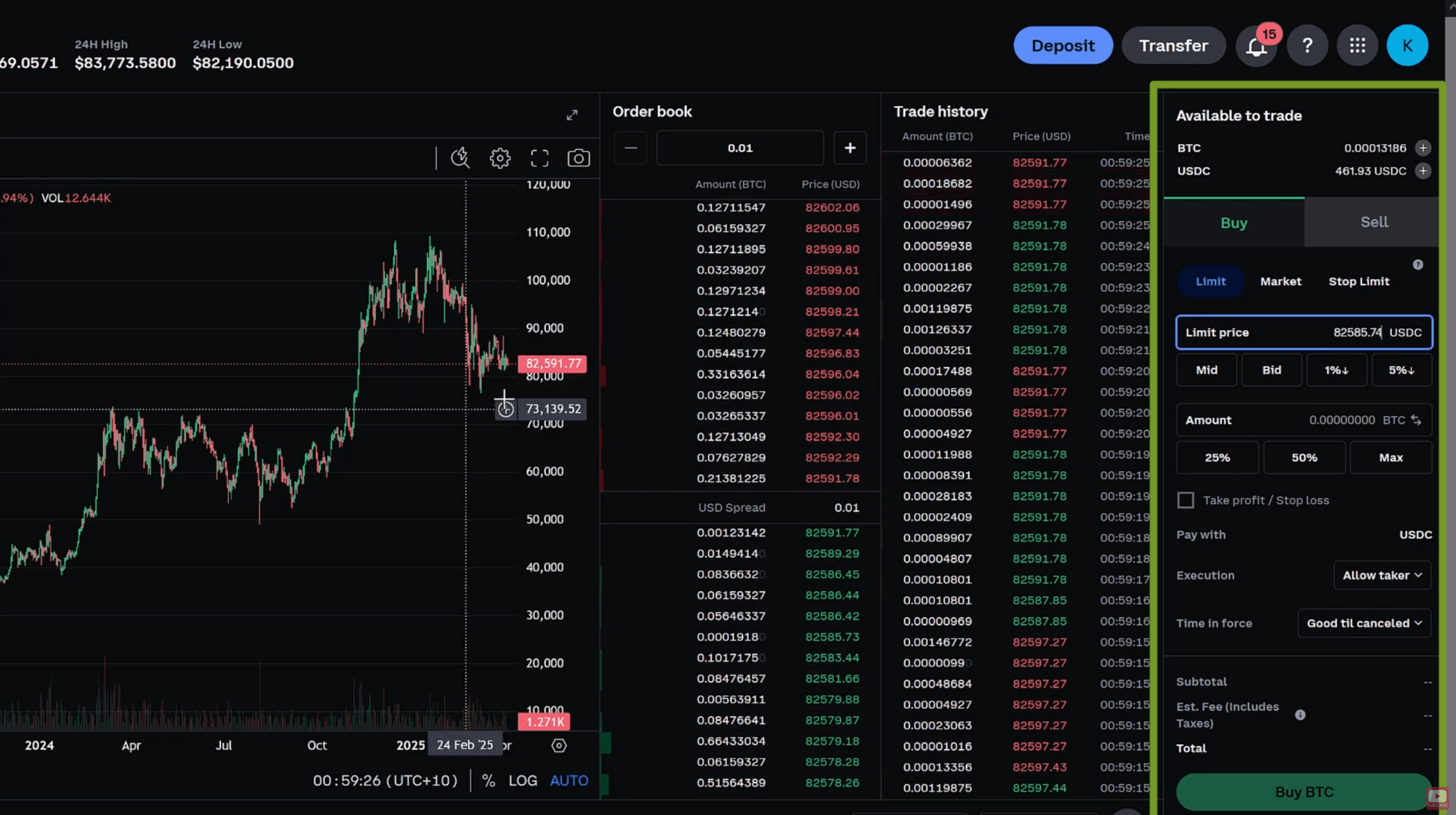

Select order type: Market order (immediate buy/sell at current best price) is simplest; limit orders let you set a price target.

Select Order Type & Set Limit

Select Order Type & Set LimitSTEP 3

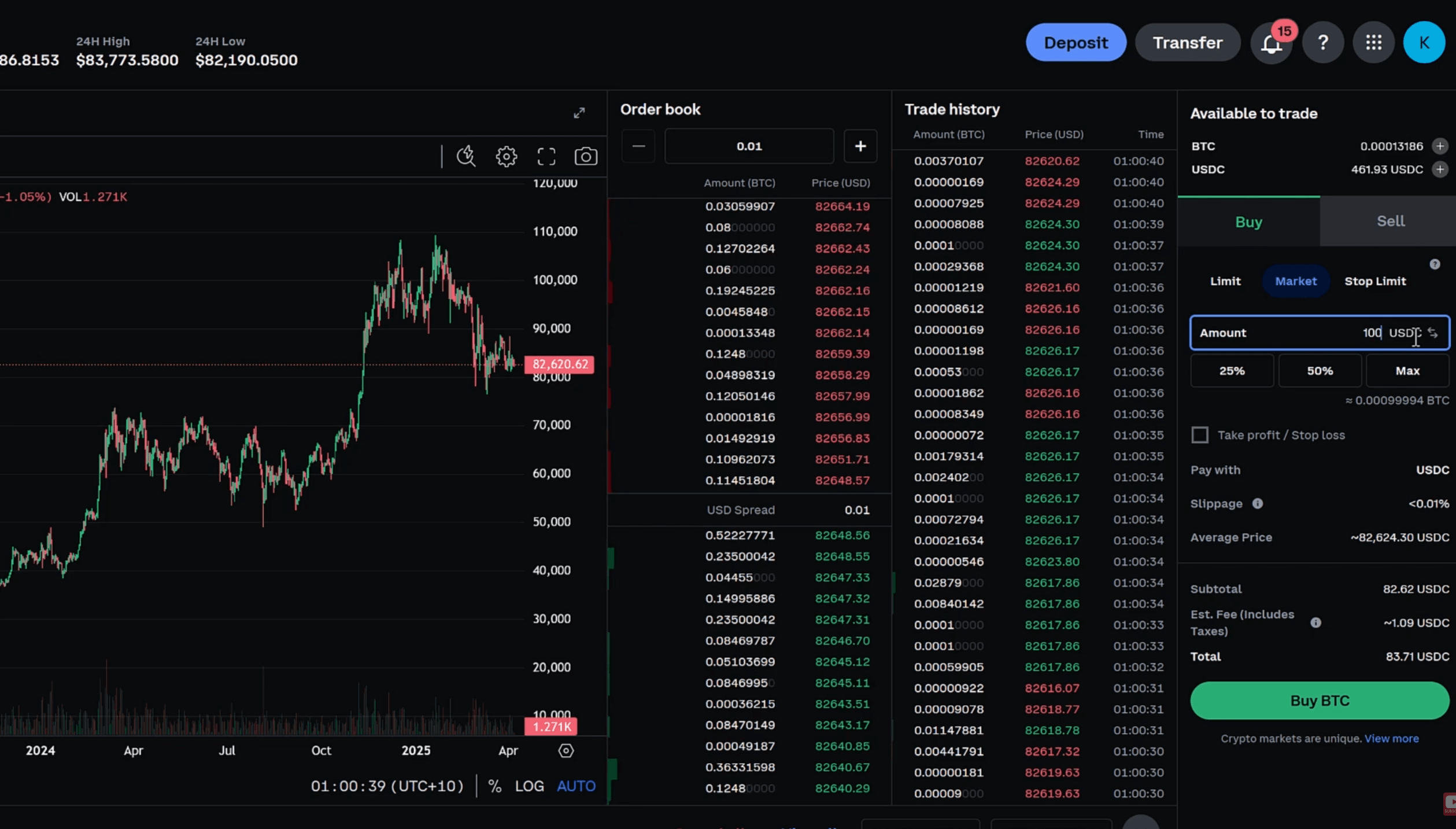

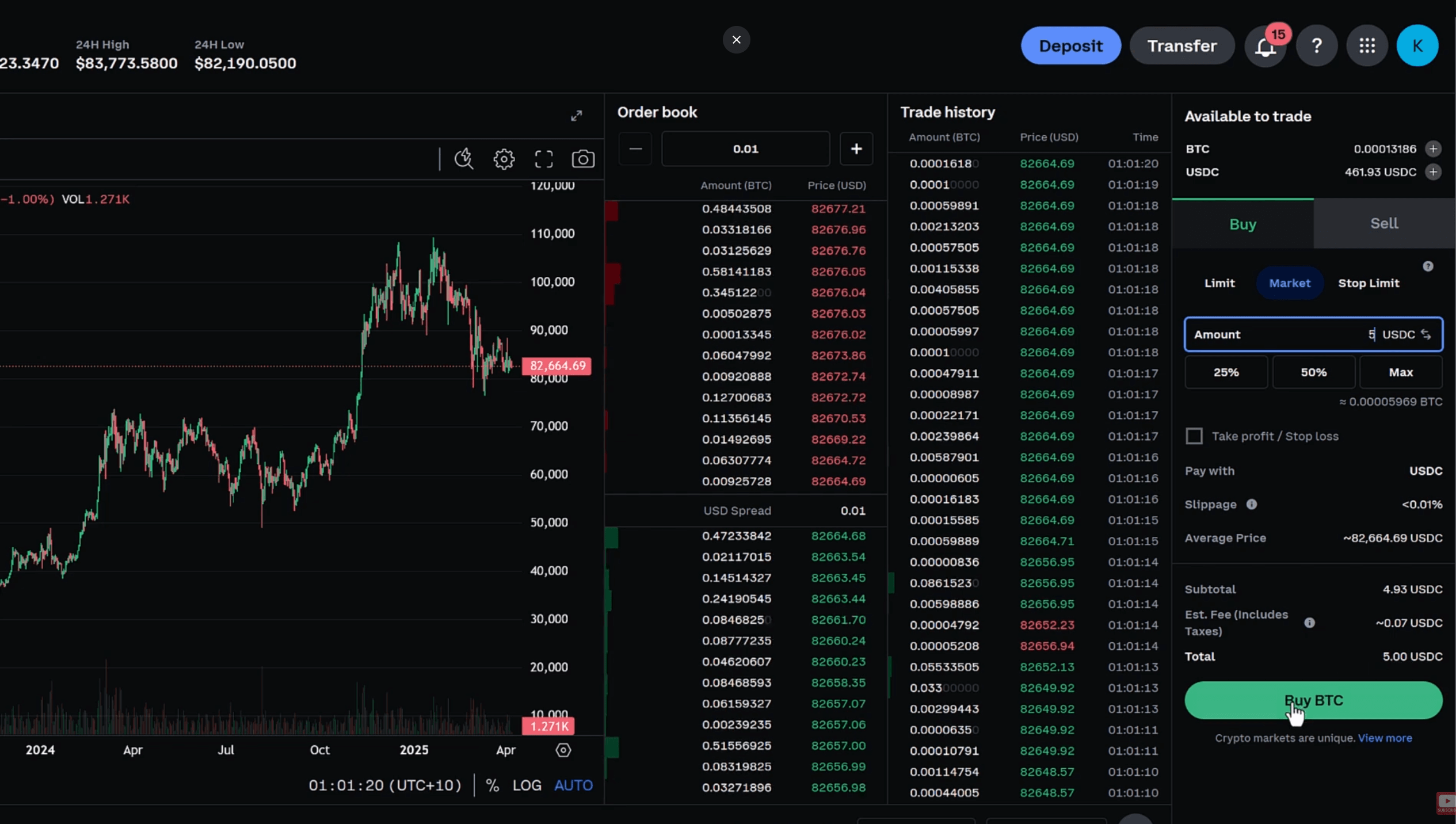

Enter trade amount: Specify how much cryptocurrency or fiat you want to trade.

Enter Final Trade Amount

Enter Final Trade AmountSTEP 4

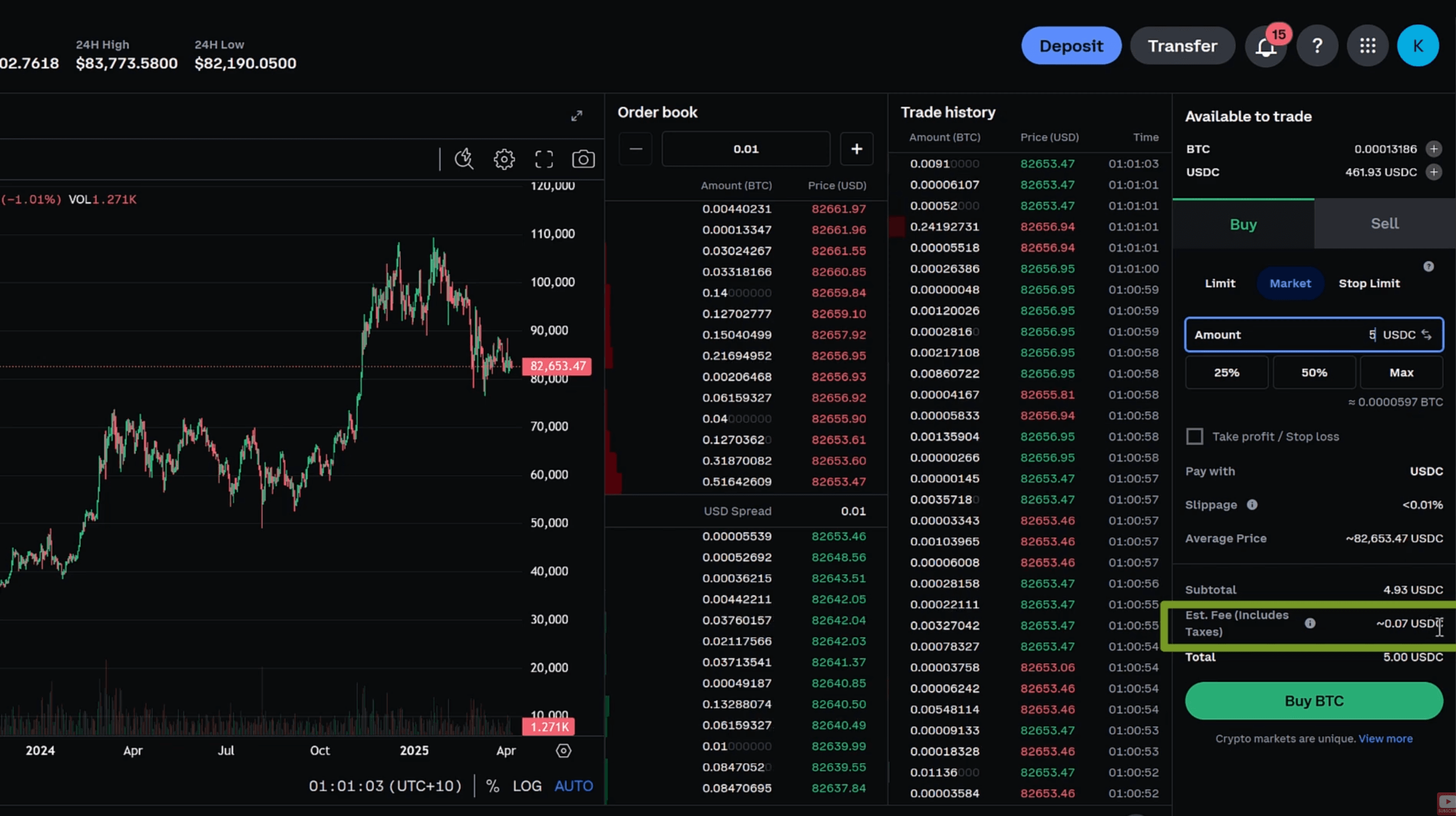

Review fees and total cost: Check maker/taker fees and total amount you’ll spend or receive.

Reviewing Market Order Fee Details Before Buying

Reviewing Market Order Fee Details Before BuyingSTEP 5

Confirm trade: Submit order and watch it execute on the order book instantly or as conditions meet.

Confirming Your Purchase Using Your Crypto

Confirming Your Purchase Using Your CryptoPost-trade, your wallet updates with your new crypto or fiat balance.

With your first trade complete and funds safely stored, you’re ready to explore more advanced tools!

Store Crypto Safely With The Best Hardware Wallet. Image via Shutterstock

Store Crypto Safely With The Best Hardware Wallet. Image via ShutterstockOwning crypto means protecting it yourself. Safeguarding your cryptocurrencies involves choosing the right storage methods and understanding self-custody principles. This guide covers the essentials of hot vs. cold wallets, seed phrases vs passkeys, hardware wallet recommendations, and critical exchange withdrawal checklists.

Each storage type fits different goals.

Hot Wallets

Cold Wallets

Seed Phrases

Passkeys / Passphrases

Check out our guide on the 5 top options for coin storage.

For secure, self-custody storage, hardware wallets are the top choice. Known for their resilience against hacking and malware:

Trezor Model T / Trezor One

Wanna know which is the best? We compared Trezor and Ledger.

Coldcard

Choosing a hardware wallet depends on your assets, usability preferences, and budget. Make sure to buy directly from manufacturers or authorized resellers to avoid tampered devices

Before transferring funds from an exchange to your self-custody wallet, ensure:

Double-check Wallet Address:

Network Compatibility & Fees:

Transaction Limits & KYC Status:

Security Precautions:

Post-transaction Verification:

Future Of Internet Driven By Web3. Image via Shutterstock

Future Of Internet Driven By Web3. Image via ShutterstockThe cryptocurrency market offers multiple ways to buy, sell, and trade digital assets. Not every trading venue works the same way, so understanding the different types of platforms helps you choose the best fit for your needs, trading style, and security preferences.

Centralized exchanges (CEXs) are platforms owned and operated by a company or organization that acts as an intermediary between buyers and sellers. Users deposit funds into accounts held by the exchange, which executes trades on their behalf by matching buy and sell orders using an order book system.

Key features of CEXs:

Pros:

Cons:

Brokers are platforms that buy and sell cryptocurrencies on behalf of users, often displaying set prices and facilitating instant trade execution. Users generally do not interact with other market participants directly. Exchanges are marketplaces where users trade crypto directly with each other via an order book or other matching engines. Prices are determined by supply and demand dynamics.

Key differences:

Use case:

Decentralized Exchanges (DEXs) run without a central authority. They use smart contracts on blockchains such as Ethereum to enable direct, peer-to-peer trading. Users connect their own wallets (non-custodial) and execute trades straight from them. Peer-to-Peer (P2P) platforms, on the other hand, link buyers and sellers directly. Trades are negotiated and settled one-to-one, often with escrow services in place to secure funds during the exchange.

Basic description:

Pros:

Cons:

Check out our top picks for the best decentralized exchanges.

Calculating Cryptocurrency Tax Using Your Transaction Records. Image via Shutterstock

Calculating Cryptocurrency Tax Using Your Transaction Records. Image via ShutterstockNavigating cryptocurrency taxes in the U.S. requires understanding the evolving IRS requirements and knowing what documents exchanges provide. Proper reporting helps prevent audits and penalties while maximizing tax accuracy.

Beyond what crypto exchanges report, tracking your own records prevents mismatches.

Many exchanges provide these forms summarizing your transaction volume or miscellaneous income if thresholds are met, mainly for income from rewards, referrals, or other sources.

The IRS plans to implement Form 1099-DA to specifically report digital asset transactions, including trades, income, disposals, and transfers, improving tax compliance and cost basis tracking for taxpayers.

Accurate record-keeping on the price paid (basis) and sale proceeds is crucial. Some exchanges offer tools or downloadable reports detailing the cost basis for gains/losses calculations.

Most major platforms enable users to export detailed transaction history in CSV or Excel formats, facilitating import into tax software such as CoinTracker, Koinly, or TurboTax.

Simplify your crypto tax reporting with the top 7 software picks for 2025.

Here are errors that trip up most filers.

Wash-Sale Rule Ambiguity:

Unlike stocks, crypto is not yet explicitly subject to wash-sale rules under current IRS guidance, but may face similar scrutiny in the future, so cautious reporting is wise.

Staking Rewards & Income Reporting:

Staking tokens earned are taxable as ordinary income at fair market value upon receipt, requiring tracking even if not sold.

Airdrops & Forks:

Tokens received via airdrop or blockchain forks count as income and require valuation at receipt time for tax purposes.

Transfers vs Disposals:

Moving crypto between your own wallets or accounts is not a taxable event, but selling, exchanging, or gifting may trigger capital gains or income taxes. Precise record-keeping is essential to avoid errors.

Incorrect or Missing Documentation:

Relying on exchange summaries alone can miss external trades or transfers, so comprehensive record aggregation is necessary.

Understanding these forms and pitfalls enables U.S. taxpayers to file correctly, claim eligible losses, and avoid common compliance mistakes in cryptocurrency tax reporting. Consult updated IRS guidance or tax professionals for personal scenarios.

Decentralized Finance Applications Include DEXs & P2Ps. Image via Shutterstock

Decentralized Finance Applications Include DEXs & P2Ps. Image via ShutterstockWhile centralized exchanges dominate crypto trading, decentralized alternatives provide unique benefits around privacy, control, and access to a broader range of assets. Understanding when to use these is key to a balanced and strategic crypto portfolio.

Decentralized exchanges (DEXs) enable non-custodial, peer-to-peer trading directly from user wallets without intermediaries. U.S. users should consider the following popular and accessible DEXs:

Uniswap:

Uniswap is one of the most widely used Ethereum-based DEXs that supports thousands of ERC-20 tokens with an automated market maker (AMM) model.

A fork of Uniswap with added features like staking, lending, and cross-chain support beyond Ethereum.

PancakeSwap:

Pancake Swap runs on Binance Smart Chain (BSC), offering low fees and high speed with a large token variety.

A DEX aggregator that routes trades through multiple DEXs to find the best prices and lowest slippage.

When to use DEXs:

Considerations:

Peer-to-peer trading platforms connect buyers and sellers directly, often with escrow systems to secure funds. They provide a flexible way to transact with local payment methods or through direct negotiations.

Platforms to consider:

When to use P2P:

Risks and tips:

For U.S. investors, DEXs and P2P platforms offer vital alternatives that complement centralized venues, especially for privacy-conscious users and those seeking niche tokens, novel DeFi features, or alternative payment access.

Choosing the right crypto exchange means balancing usability, regulation, fees, and security. This guide outlined how to assess each platform, from account setup and trading to self-custody and tax awareness. Knowing what suits your goals and risk tolerance helps you trade with confidence rather than guesswork.

Centralized exchanges remain the main entry point for most users thanks to their liquidity and simplicity, while decentralized and peer-to-peer platforms offer greater privacy and control. Whatever your choice, prioritize exchanges with strong security, transparent proof-of-reserves, and clear withdrawal policies. Remember: exchanges are for trading and wallets are for storage.

Use these insights as a framework to trade safely and efficiently. Verify platform updates, track tax changes, and stay informed about new regulations. Whether you value convenience, low fees, or autonomy, the key is staying disciplined and aware as the crypto landscape keeps evolving.

Get exclusive access to premium content, member-only tools, and the inside track on everything crypto.