Crypto arbitrage means buying low on one exchange and selling high on another—profiting from the quirks and gaps in this fast-moving market. Sounds like a cheat code, right?

Now, imagine having a digital assistant that works 24/7, scans dozens of exchanges at lightning speed, and never misses a beat. That’s what crypto arbitrage bots do. These automated tools take the hustle out of hunting for price discrepancies and execute trades.

But not all bots are built the same. Some are sleek and smart, others are clunky or limited. That’s why we’ve put together this guide. Whether you’re a hands-on trader or someone who just wants to set it and forget it, this article will help you pick the right tool to boost your profits.

Understanding Crypto Arbitrage

Crypto arbitrage is the strategy of profiting from price differences for the same cryptocurrency on different exchanges. Picture Bitcoin priced at $50,000 on Exchange A and $50,200 on Exchange B. If you can buy low and sell high quickly enough, that $200 spread is yours to pocket.

Why Do Price Differences Exist?

It all comes down to market inefficiencies. Each exchange operates in its own bubble, with different user bases, liquidity levels, and trading volumes. These factors cause price discrepancies, especially in fast-moving or lower-volume markets. The inefficiencies might only last seconds, but they’re very real and, if you're fast, very profitable.

The Role of Real-Time Price Tracking

Speed is everything in arbitrage. Since these opportunities disappear quickly, traders rely on bots that scan multiple exchanges in real time. This automation helps spot discrepancies and execute trades way faster than any human could.

Simple Arbitrage Example

Let's take another example. Say Ethereum is $2,000 on Exchange X and $2,015 on Exchange Y. You buy 1 ETH on X, send it to Y, and sell it for a $15 gain. That’s a basic form of spatial arbitrage. Of course, you’ll need to factor in trading fees, transfer times, and whether the price gap still exists by the time your ETH arrives.

Triangular Arbitrage Explained

Then there’s triangular arbitrage, which happens within a single exchange. You might trade BTC for ETH, ETH for USDT, and then USDT back to BTC—profiting from small inefficiencies in those conversion rates.

Top Crypto Arbitrage Bots of 2025

With dozens of crypto arbitrage bots out there, finding the right one can be overwhelming. Each has its own features, fees, and flair. In this section, we’ll break down what makes them tick, where they shine, and where they might fall short.

By the way, you can also check out the top AI crypto trading bots if you are keen on knowing how the bots industry is applying AI.

| Bot Name | Automation | Exchange Support | Unique Features | Pricing (Monthly) | Best for |

|---|---|---|---|---|---|

| Arbitrage Scanner | Manual | 40+ CEXs & DEXs | Custom filters, wallet analysis | $69+ | Security-focused manual traders |

| Bitsgap | Automated | Multiple Exchanges | AI Assistant, GRID & DCA bots | $29–$148 | Multi-bot strategy traders |

| Cryptohopper | Automated | Multiple Exchanges | Strategy designer, marketplace | $29–$129 | Strategy creators and signal users |

| Pionex | Automated | Pionex Only | Built-in bots, spot-futures arbitrage | Free (Trading fees apply) | Beginners wanting simplicity |

| 3Commas | Semi-Automated | Multiple Exchanges | Smart terminal, copy trading | Free–$55 | Advanced tool users |

| Binance | Manual / Third Party | Binance Only | Cross-market tools, low fees | 0.10% Spot / 0.02% Maker and 0.05% Futures | DIY traders with tech skills |

| Bitget | Manual / Semi-Auto | Multiple Exchanges | Copy trading, fast execution | 0.10% Spot / 0.02% Maker and 0.06% Futures | Traders valuing speed & copy trading |

Arbitrage Scanner

Arbitrage Scanner has carved out a niche for traders who value insight over automation. Unlike fully automated bots, this platform delivers real-time arbitrage data, leaving the actual trading in your hands—perfect for those who want more control over their eventual decisions.

A Smart Pick for Traders Who want Full Visibility without Handing Over the Reins to Automation. Image via Arbitrage Scanner

A Smart Pick for Traders Who want Full Visibility without Handing Over the Reins to Automation. Image via Arbitrage ScannerKey Features:

- Multi-Exchange Coverage: Monitors over 40 CEXs and DEXs across 20 blockchains.

- Live Arbitrage Alerts: Sends instant notifications on profitable gaps.

- Manual Execution: No need for API keys or wallet connections, boosting security.

- Custom Filters: Users can narrow down alerts by exchange, pair, or profit margin.

- Extra Tools: Includes wallet tracking and basic sentiment analysis.

Pros:

- Covers a wide range of exchanges

- Real-time data and alerts

- Manual control adds a layer of safety

- Simple, intuitive interface

Cons:

- Not fully automated—needs user action

- Requires constant monitoring, suiting highly active traders only

Pricing:

- Starts at $69/month with tiered plans available. (Annual packages may provide the lowest prices).

Ideal For:

- Security-focused traders who prefer hands-on decision-making

- Users seeking real-time arbitrage insights with added analytical tools

Bitsgap

Bitsgap has earned its stripes as a powerful all-in-one crypto trading platform, especially for users looking to automate arbitrage across multiple exchanges. It offers both beginner-friendly tools and advanced automation features under one roof.

Bitsgap is a Reliable Option for Traders Who want Efficiency and Flexibility. Image via Bitsgap

Bitsgap is a Reliable Option for Traders Who want Efficiency and Flexibility. Image via BitsgapKey Features:

- Multi-Exchange Integration: Supports 15+ top exchanges like Binance, Kraken, and KuCoin.

- Arbitrage Scanner: Highlights real-time price gaps across exchanges.

- Automated Bots: Includes GRID and DCA bots to support various trading styles.

- AI Assistant: Helps optimize bot settings and market strategies automatically.

- Secure API Usage: Uses encrypted connections without withdrawal permissions.

Pros:

- Easy to navigate

- Wide exchange support

- Versatile bot options

- Built-in portfolio tracking

Cons:

- Premium features require higher-tier plans

- No dedicated mobile app yet

Pricing:

Starts at $29/month, scaling up to $148/month based on features (Annual packages may provide lower prices).

Ideal For:

- Traders wanting a centralized platform for automation and arbitrage

- Users looking to manage multiple bots and exchanges with ease

Cryptohopper

Cryptohopper is a versatile crypto trading bot that caters to both beginners and seasoned traders. It offers automated trading strategies, including arbitrage, across multiple exchanges.

Allows you to Create Custom Trading Strategies Using a Drag-and-Drop Interface. Image via Cryptohopper

Allows you to Create Custom Trading Strategies Using a Drag-and-Drop Interface. Image via CryptohopperKey Features:

- Exchange Arbitrage: Execute trades between different exchanges without transferring funds.

- Market Arbitrage: Profit from price differences within the same exchange.

- Strategy Designer: Create custom trading strategies using a drag-and-drop interface.

- Backtesting & Paper Trading: Test strategies against historical data before going live.

- Marketplace: Access and purchase pre-built strategies and signals from other traders.

Pros:

- Supports multiple arbitrage strategies.

- User-friendly interface with extensive tutorials.

- Robust community and support resources.

Cons:

- Advanced features may have a learning curve.

- Some features require higher-tier subscriptions.

Pricing:

- Plans range from $29 to $129 per month, with a free trial available (Annual packages may provide lower prices).

Ideal For:

- Traders seeking automated arbitrage solutions.

- Users interested in customizing or purchasing trading strategies.

Pionex

Pionex stands out as one of the few crypto exchanges that comes with built-in arbitrage bots. It's tailored for users who want a simple, all-in-one platform without the hassle of third-party integrations.

Pionex is Ideal for those Who want Simplicity, Automation, and Low Costs. Image via Pionex

Pionex is Ideal for those Who want Simplicity, Automation, and Low Costs. Image via PionexKey Features:

- Built-in Arbitrage Bots: Access ready-to-go bots right on the exchange—no extra setup needed.

- Low Trading Fees: Charges a competitive 0.05% maker and taker spot fee, 0.02% maker and 0.05% taker futures fee, making small arbitrage profits more viable.

- Mobile App Support: Fully functional app for trading and bot management on the go.

- Spot-Futures Arbitrage Bot: Exploits price differences between spot and futures markets.

- GRID and DCA Bots Included: Additional automation tools to diversify your strategies.

Pros:

- No need to link external bots or exchanges

- Beginner-friendly with minimal setup

- Very low fees

Cons:

- Limited to Pionex exchange only

- Less customization than standalone bots

Pricing:

- Free to use; standard trading fees apply (0.05% maker and taker spot fee, 0.02% maker and 0.05% taker futures fee).

Ideal For:

- Beginners looking for an easy arbitrage setup

- Traders who want an all-in-one platform without extra complexity

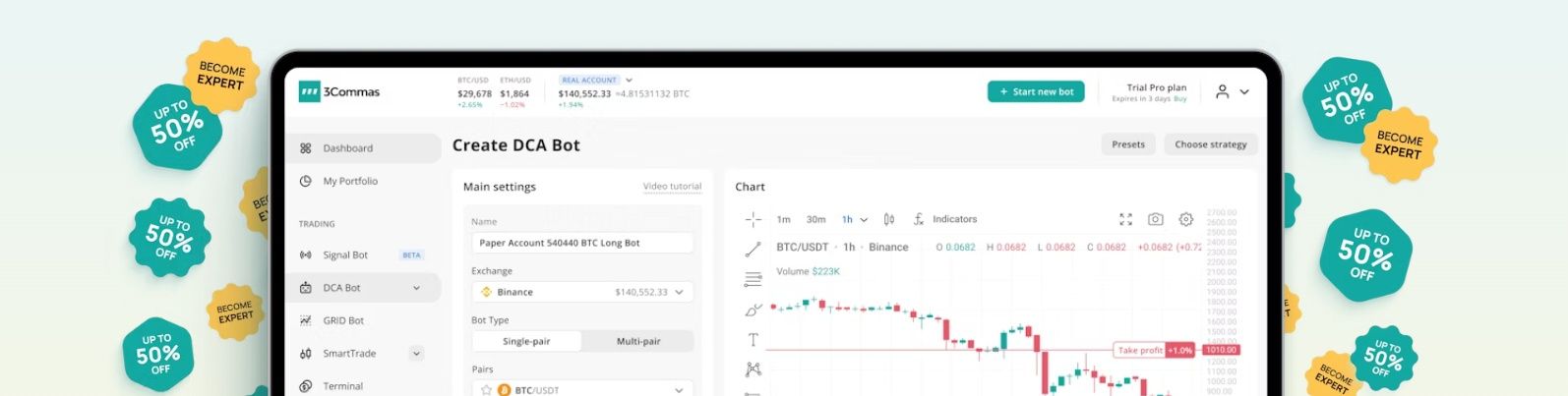

3Commas

3Commas is a powerful trading platform that combines smart tools and automation for crypto traders. Its arbitrage functionality is part of a broader suite that includes smart trading terminals, portfolio tracking, and customizable bots.

Arbitrage Functionality is Part of a Broader Suite that Includes Smart Trading Terminals and More. Image via 3Commas

Arbitrage Functionality is Part of a Broader Suite that Includes Smart Trading Terminals and More. Image via 3CommasKey Features:

- Arbitrage Tools: Supports both inter-exchange and intra-exchange arbitrage strategies using GRID and DCA bots.

- Smart Trade Terminal: Advanced order types and trade management from a single dashboard.

- Copy Trading: Follow and mimic the strategies of successful traders.

- Multi-Exchange Connectivity: Integrates with major platforms like Binance, Kraken, and Coinbase.

- Mobile App & Web Interface: Full access to tools on desktop and mobile.

Pros:

- Feature-rich platform

- Supports a wide range of exchanges

- Advanced trade customization options

Cons:

- Arbitrage tool is not beginner-focused

- Steeper learning curve for newcomers

Pricing:

- A free version is available with limited features. Plans with advanced features start at $39/month and go up to $55/month (Annual/Bi-Annual packages may provide the lowest prices).

Ideal For:

- Intermediate to advanced traders seeking flexible, customizable tools

- Users who want more than just arbitrage features in their toolkit

Binance

Binance isn’t a traditional arbitrage bot, but it deserves a spot here thanks to its vast ecosystem and built-in tools that enable arbitrage-style strategies. With deep liquidity and fast execution, Binance is a prime playground for spotting and exploiting price inefficiencies.

Binance is Ideal for DIY Arbitrage Traders Who want Powerful Tools. Image via Binance

Binance is Ideal for DIY Arbitrage Traders Who want Powerful Tools. Image via BinanceKey Features:

- High Liquidity: Binance's massive user base ensures tight spreads and quick order fulfillment.

- Wide Asset Support: Trade hundreds of crypto pairs across spot, margin, and futures markets.

- Cross-Market Opportunities: Use spot vs. futures price differences for arbitrage-like strategies.

- Advanced API Access: For users running custom bots or third-party tools.

- Built-In Trading Tools: Includes TradingView charts, advanced order types, and signals.

Pros:

- Extremely fast execution and low latency

- Built-in features that support arbitrage-style setups

- Lowest trading fees among major exchanges

Cons:

- Not a dedicated arbitrage bot

- Requires manual strategy execution or third-party integration

Pricing:

- Spot trading fees start at 0.10% maker and taker, futures fees start at 0.02% maker and 0.05% taker (can be reduced with BNB usage or higher volume)

Ideal For:

- Advanced users building custom arbitrage strategies

- Traders exploiting futures vs. spot price differences

Bitget

Bitget is emerging as a solid choice for traders seeking low-latency, fast-execution platforms suitable for manual or semi-automated arbitrage strategies. While not a pure arbitrage bot, Bitget’s infrastructure and tools make it a strong contender in our list.

Fast-Execution Platforms Suitable for Manual or Semi-Automated Arbitrage Strategies. Image via Bitget

Fast-Execution Platforms Suitable for Manual or Semi-Automated Arbitrage Strategies. Image via BitgetKey Features:

- Multi-Market Access: Offers spot, margin, and futures trading across a wide range of assets.

- Copy Trading: Follow successful traders or implement arbitrage strategies by mirroring their actions.

- High-Speed Execution: Designed for quick trades, ideal for narrow arbitrage windows.

- API Integration: Enables custom bots and third-party arbitrage tools.

- Secure Trading Environment: Advanced security measures with compliance certifications.

Pros:

- Fast trade execution

- Intuitive interface and mobile app

- Strong copy trading feature

Cons:

- No dedicated arbitrage feature

- Fewer integrations compared to bigger platforms

Pricing:

- Free to use, but trading fees apply; 0.1% for spot maker and taker, 0.02% maker and 0.06% taker for futures (discounts with BGB token).

Ideal For:

- Traders who want speed and simplicity

- Users experimenting with copy trading or manual arbitrage setups

Bitget might not offer a built-in arbitrage bot, but its performance and versatility make it a handy platform for traders with a DIY approach to arbitrage.

Benefits of Using Crypto Arbitrage Bots

Let’s be real—no human can be glued to a screen 24/7, scanning hundreds of markets across dozens of exchanges. But crypto arbitrage bots? That’s their entire personality. Here’s why these digital hustlers are such a game-changer.

Bots can Help You Stay Sharp, Minimize Risk, and Catch Profits You would Otherwise Miss. Image via Shutterstock

Bots can Help You Stay Sharp, Minimize Risk, and Catch Profits You would Otherwise Miss. Image via ShutterstockSpeed: Beating Humans Every Time

In crypto, milliseconds matter. Arbitrage opportunities don’t hang around—they pop up and vanish in a flash. Bots are built to act instantly. Once they detect a price mismatch, they can trigger a buy-sell combo across exchanges in less time than it takes you to blink. No hesitation, no “should I?”—just action.

24/7 Market Monitoring

Crypto never sleeps. Unlike traditional markets, there’s no closing bell. Bots are perfect night owls—they keep watching, analyzing, and executing even when you’re off the clock or dreaming about your next moonshot. That around-the-clock vigilance means you never miss a potential profit window just because it’s 3 AM.

Risk Management on Autopilot

The best bots aren’t just fast—they’re smart. Many come with built-in risk controls like stop-losses, profit targets, and exposure limits. You can program them to follow strict rules so they don’t get carried away in volatile markets. Basically, they’re like disciplined traders who never get emotional or tired.

Profiting from Micro-Gaps

Arbitrage isn't about scoring jackpot-level returns—it’s about stacking small, consistent wins. Bots excel at picking up on these micro-gaps that humans would either miss or ignore. And when those tiny profits stack up dozens—or hundreds—of times a day, you’re looking at some serious compounding magic.

Key Features to Consider in an Arbitrage Bot

Not all bots are created equal. If you’re serious about using crypto arbitrage to its full potential, you’ve got to know what features actually matter. Here’s what separates the game-changers from the gimmicks.

The Best Arbitrage Bot is the One that Fits Your Strategy and Keeps Your Assets Safe. Image via Shutterstock

The Best Arbitrage Bot is the One that Fits Your Strategy and Keeps Your Assets Safe. Image via ShutterstockAlgorithmic Trading Efficiency

At the heart of every solid arbitrage bot is efficient algorithmic trading software. This is what allows bots to process complex calculations, detect opportunities, and execute trades—all in milliseconds. A clunky or slow algorithm? That’s money slipping through your fingers. Look for bots that are known for speed, stability, and minimal downtime.

Exchange Connectivity and Real-Time Data

A good arbitrage bot should connect to multiple crypto exchanges, both centralized (CEXs) and decentralized (DEXs), so it has more ground to scan for price discrepancies. Just as important is real-time data access—because what’s the use in spotting a price gap if it’s already gone by the time your bot reacts?

Security Features That Actually Matter

We’re talking end-to-end encryption, API key protections, and no withdrawal permissions. If your bot connects to your exchange accounts, it needs to keep those connections locked down tight. Some platforms even allow read-only API settings just to be extra safe. This is one area where cutting corners is a big no-no.

Customization, Risk Management & Usability

Trading styles differ, so your bot should be customizable—whether that’s setting profit margins, choosing which exchanges to scan, or limiting how much capital it uses per trade. And don’t overlook the UI. A clean, intuitive interface can save hours of headaches, especially if you're tweaking strategies regularly. Here is a lot more on risk management that might interest you.

How Crypto Arbitrage Bots Operate

If you've ever wondered what goes on behind the scenes of these clever bots, you're not alone. Let’s lift the hood and break down how these digital traders actually work.

Understanding How Arbitrage Bots Operate gives You a Big Edge. Image via Shutterstock

Understanding How Arbitrage Bots Operate gives You a Big Edge. Image via ShutterstockThe Tech Under the Hood: AI and Algorithms

At the core of every crypto arbitrage bot is a set of algorithms—think of them as the bot’s brain. Some are relatively simple rule-based engines, while more advanced bots tap into machine learning and AI to adapt to shifting market patterns. The smarter the tech, the better it can predict and react, rather than just react.

Spotting the Gaps: Real-Time Price Tracking

Arbitrage bots monitor dozens—sometimes hundreds—of exchanges around the clock. They compare the prices of the same asset across platforms in real time. Once a price difference hits a predefined threshold, the bot logs it as a viable opportunity. Without this real-time scanning, you'd be stuck chasing shadows in a market that moves faster than you can refresh a tab.

From Signal to Execution

When a bot detects a profitable gap, it springs into action. First, it validates that the opportunity still exists (because crypto is fast, and stale data is useless). Then it places the buy order on the cheaper exchange and the sell order on the pricier one—either simultaneously or in rapid sequence, depending on setup. The whole process takes seconds, sometimes milliseconds.

The Volatility Factor

Crypto markets are famously volatile, and that’s both a blessing and a curse for arbitrage bots. More volatility means more opportunities, but it also means more risk. Sudden price swings, slippage, or a delay in execution can wipe out potential profits—or worse, lead to losses. That’s why top-tier bots often include built-in checks and limits to minimize exposure during wild market swings.

Setting Up and Optimizing Your Arbitrage Bot

You’ve picked your bot—great start. Now let’s get it running like a well-oiled machine. Here's how to go from zero to automated profit-seeker.

The Real Magic Happens when You Stay Engaged—Testing, Tweaking, and Optimizing. Image via Shutterstock

The Real Magic Happens when You Stay Engaged—Testing, Tweaking, and Optimizing. Image via ShutterstockStep 1: Create Accounts and Connect Exchanges

First things first, you’ll need accounts on the exchanges your bot will monitor and trade on. Choose platforms that are supported by your bot and known for good liquidity. Once registered, grab your API keys from each exchange—these are like secure handshakes between your bot and the platform. Make sure to set them with trading-only permissions (no withdrawals!) for safety.

Step 2: Fine-Tune Your Bot Settings

Now it’s time to dial things in. Most bots let you choose your trading pairs, profit thresholds, how much capital to deploy, and risk controls like stop-loss orders. Start small, and don’t just copy someone else’s settings blindly—your trading goals, tolerance, and capital are unique.

Step 3: Back-Test Before You Go Live

Think of back-testing as a test drive. Good bots allow you to simulate trades using historical data to see how your settings would’ve performed. This is your chance to iron out any kinks before putting real money on the line. Many platforms also offer paper trading for live simulations without the risk.

Step 4: Optimize and Troubleshoot

Even after you go live, your bot’s job isn’t “set and forget.” Monitor its performance, tweak settings when markets shift, and stay on top of exchange updates or API issues. If your bot isn’t trading or logs errors, check logs, reconnect your API keys, and review your filters. A small tweak can often make a big difference.

Getting your arbitrage bot set up is just the beginning. The real magic happens when you stay engaged—testing, tweaking, and optimizing along the way. Treat it like a trading partner, not a one-click solution, and you’ll get way more out of it.

You will also love our exclusive guide on how to create your crypto trading bot. Do check it out!

Risk Management Strategies with Arbitrage Bots

Arbitrage might sound low-risk on paper, but when you’re dealing with volatile markets, moving money across exchanges, and relying on tech, things can get dicey fast. Here’s how to protect your capital and keep your bot from becoming a liability.

A Good Arbitrage Bot can Do a Lot—but it’s Only as Safe as the Strategies Behind It. Image via Shutterstock

A Good Arbitrage Bot can Do a Lot—but it’s Only as Safe as the Strategies Behind It. Image via ShutterstockKnow the Risks: Execution, Slippage, and Security

The most common risk? Execution delay—that tiny lag between your bot spotting a price gap and placing the trade. By the time it’s done, the opportunity could be gone. Then there’s slippage, where you don’t get the price you expected due to sudden market moves. And let’s not forget cybersecurity risks—a poorly secured API or shady bot platform could put your funds in jeopardy.

Use Smart Strategies to Mitigate Losses

Stop-loss orders are your best friend in volatile conditions. They ensure your bot exits a trade if prices move too far in the wrong direction. Spread your trades across different assets or exchanges—diversification reduces the risk of any single point of failure. And don’t just “set and forget”—continuous monitoring helps you catch bugs, dead APIs, or underperforming strategies before they cause real damage.

Understand Your Bot’s Limits

Every bot has its quirks. Some work better in high-volatility markets, others thrive in more stable ones. Know how your bot behaves, what it was designed to do, and what situations might trip it up. This insight helps you avoid overestimating its capabilities and underestimating the risks.

Adjust as the Market Moves

Crypto markets shift fast. A strategy that worked last month could be useless tomorrow. Review your bot’s performance regularly, test tweaks in back-testing environments, and be ready to pivot. Smart traders evolve with the market—and so should their bots.

Conclusion and Final Recommendations

Crypto arbitrage bots aren’t just fancy tech—they’re powerful allies in the race to profit from price gaps across exchanges. We’ve explored how they work, what features matter most, and which bots are crushing it in 2025. From manual tools for the cautious to fully automated systems for the hands-off trader, there’s something out there for everyone.

The key? Choose a bot that fits your vibe. If you’re all about control and security, go manual. If you’re chasing efficiency and scale, automation’s your game. And no matter what you pick, don’t just flip the switch and walk away—keep an eye on performance, market changes, and tweak your strategy as needed.

Crypto is wild, fast, and full of opportunity—but it rewards the prepared. So whether you’re new to this game or looking to up your edge, remember: the right bot can make all the difference.