The crypto landscape is constantly evolving, and with it are the tools that traders use to navigate the market. Telegram trading bots have emerged as a streamlined solution, allowing users to execute trades, monitor market activity, and automate strategies—all within the Telegram messaging app.

Rather than manually connecting wallets, adjusting slippage, and navigating decentralised exchanges, Telegram trading bots simplify the entire process. With just a few commands, users can buy and sell tokens, set limit orders, track price movements, and even mirror the trades of other wallets.

As these bots continue to gain popularity, they are becoming an essential tool for traders looking to improve efficiency and execution speed. But with so many options available, finding the right one can be a challenge.

So, are Telegram trading bots a game-changer or just another tool in the ever-expanding crypto toolkit? Let’s find out. In this guide, we’ll explore what Telegram trading bots are, their benefits, and the top bots of 2026. We’ll also cover how to choose the right bot, key security considerations, and potential risks.

What Are Telegram Trading Bots?

Efficiency and automation have become key priorities for crypto traders. Telegram trading bots provide a solution by allowing users to execute trades, monitor market movements, and automate strategies—all within the Telegram app. These bots integrate with decentralised exchanges, offering a more streamlined and accessible way to interact with the crypto market.

How Do They Work?

Telegram trading bots function as automated trading assistants that execute transactions based on user-defined commands. They replace the need for navigating exchange interfaces by allowing traders to buy and sell tokens, set price alerts, and even automate trading strategies—all through a chat-based interface.

The process is relatively straightforward:

- Bot Setup – Users open a Telegram trading bot, connect their wallet, or generate a new one directly within the platform.

- Trade Execution – The bot processes buy and sell orders on decentralised exchanges, handling everything from liquidity sniping to limit orders.

- Customization & Strategy Management – Users can set stop-loss and take-profit orders, enable private transactions, or automate trading based on predefined rules.

Some bots also provide copy trading, allowing users to mirror the trades of specific wallets. Others specialize in airdrops, liquidity tracking, or arbitrage trading, offering a range of features beyond simple trade execution.

Integration with Cryptocurrency Exchanges

Most Telegram trading bots are designed to seamlessly connect with decentralised exchanges (DEXs) like Uniswap and PancakeSwap. Instead of manually interacting with these platforms, users can execute trades instantly through Telegram.

Here’s how the integration works:

- Smart contract interaction – Bots facilitate direct trading on DEXs, removing the need for third-party interfaces.

- Wallet connectivity – Users can either connect existing wallets or create new ones within the bot.

- Real-time data access – Bots provide live price feeds, liquidity updates, and token tracking sourced directly from blockchain networks.

Some bots also integrate with centralised exchanges (CEXs), offering additional trading tools such as API-based trading, portfolio management, and market analytics.

Benefits of Using Telegram Trading Bots

Crypto trading has long been associated with complexity, requiring traders to navigate multiple platforms, manually execute trades, and constantly monitor the market. Telegram trading bots simplify this process by automating trades, providing real-time market insights, and streamlining execution—all from within a messaging app.

Telegram Bots Offer Seamless Integration With DEX’s. Image via Shutterstock

Telegram Bots Offer Seamless Integration With DEX’s. Image via Shutterstock

Here’s a closer look at the benefits they bring to the table.

Automation of Trades

One of the key advantages of Telegram trading bots is the ability to automate trading strategies. Instead of manually placing orders, bots can execute trades based on predefined parameters.

- Pre-set trading strategies – Bots execute buy and sell orders automatically, following predetermined conditions.

- Reduced human error – Automation removes the possibility of manual mistakes.

- Advanced order execution – Bots support a range of functionalities, including stop-loss orders, take-profit levels, copy trading, and liquidity sniping.

Real-Time Market Analysis

Understanding market trends and identifying potential opportunities can be time-consuming. Telegram trading bots assist by delivering relevant market data directly to the user, making analysis more accessible.

- Instant notifications – Bots provide updates on price movements, liquidity shifts, and notable market activity.

- Token tracking – Some bots allow users to monitor new token launches and contract activity for early insights.

- On-chain data access – Users can retrieve market data from both decentralised and centralised exchanges without leaving Telegram.

Efficiency & Execution Speed

By integrating with decentralised exchanges, Telegram trading bots provide an efficient way to execute trades, eliminating unnecessary steps typically required in manual trading.

- Seamless trade execution – Bots handle transactions directly from Telegram, removing the need to navigate multiple platforms.

- Multi-wallet management – Advanced bots can execute trades across multiple wallets simultaneously, a feature not typically available in standard DEX interfaces.

Trading Signals & Alerts

For those who prefer a structured approach to trading, Telegram bots offer customizable alerts and signals to help inform decision-making.

- Price alerts – Notifications when selected tokens reach user-defined price levels.

- Whale monitoring – Some bots allow users to track large wallet movements, offering insights into broader market trends.

- Limit & stop-loss orders – Automated risk management ensures trades are executed at the intended levels without manual oversight.

User-Friendly Interface

Navigating decentralised exchanges can be daunting, particularly for those new to crypto trading. Telegram trading bots simplify the process, allowing users to execute trades with minimal complexity.

- Easy wallet integration – Bots connect directly to users' wallets, enabling transactions without additional setup.

- Straightforward trade execution – Buying and selling tokens is as simple as pasting a contract address into the chat.

- Minimal learning curve – The intuitive nature of Telegram bots makes them accessible to both experienced traders and newcomers alike.

Our Top Picks

Before diving into the details of each Telegram trading bot, here’s a comprehensive comparison table summarizing their key features, security measures, and unique functionalities:

| Bot Name | Sniping & Auto-Trading | Copy Trading | Security Features | Unique Features |

|---|---|---|---|---|

| Maestro | Yes – Sniper bot with liquidity tracking | Yes | Anti-rug protection, contract scanning | God Mode for pro traders |

| GMGN | Yes – Automated trading execution | Yes | Contract security checks | AI-driven analytics, automated portfolio tracking |

| Banana Gun | Yes – Auto sniping & limit orders | Yes | Anti-rug protection, scam detection | MEV-resistant swaps, auto trading adjustments |

| BullX | Yes – Cross-chain trade automation | No | Real-time security audits, encrypted API integration | Fast blockchain indexing, live trading charts, multi-wallet support |

Now let’s dive into each one in more detail.

Maestro Bot

Maestro Bot is a multi-chain Telegram trading bot designed to automate and streamline crypto trading. Supporting networks like Ethereum, BNB Smart Chain, Solana, Arbitrum, and more, it enables fast trade execution, automated strategies, and real-time market tracking without requiring users to navigate complex exchange interfaces.

Maestro Homepage. Image via Maestro

Maestro Homepage. Image via MaestroFeatures:

- Multi-Chain Support – Enables trading across multiple blockchain networks.

- Sniper Trading – Executes trades instantly when liquidity is added, ensuring fast entry into new token launches.

- Auto-Snipe – Automates participation in token launches without requiring manual input of contract addresses.

- Anti-Rug Protection – Detects suspicious contract changes and potential scams, attempting to exit positions before losses occur.

- Copy Trading – Allows users to mirror the trades of successful wallets.

- Wallet & Whale Tracking – Provides real-time alerts on large transactions and wallet movements to identify market trends.

- Trade Automation & Risk Management – Features stop-loss and take-profit orders to help manage risk.

Benefits:

- Efficiency & Speed – Automates trade execution with minimal delays, optimizing price entries and exits.

- Enhanced Security – Implements Anti-Rug Protection and encrypted private keys to safeguard user funds.

- User-Friendly Trading – Operates directly within Telegram, eliminating the need for traditional DEX interfaces.

- Comprehensive Market Insights – Tracks liquidity, price movements, and whale activity, providing valuable market data.

- Flexible Trading Strategies – Supports multi-wallet trading, copy trading, and sniper tools to cater to different trading styles.

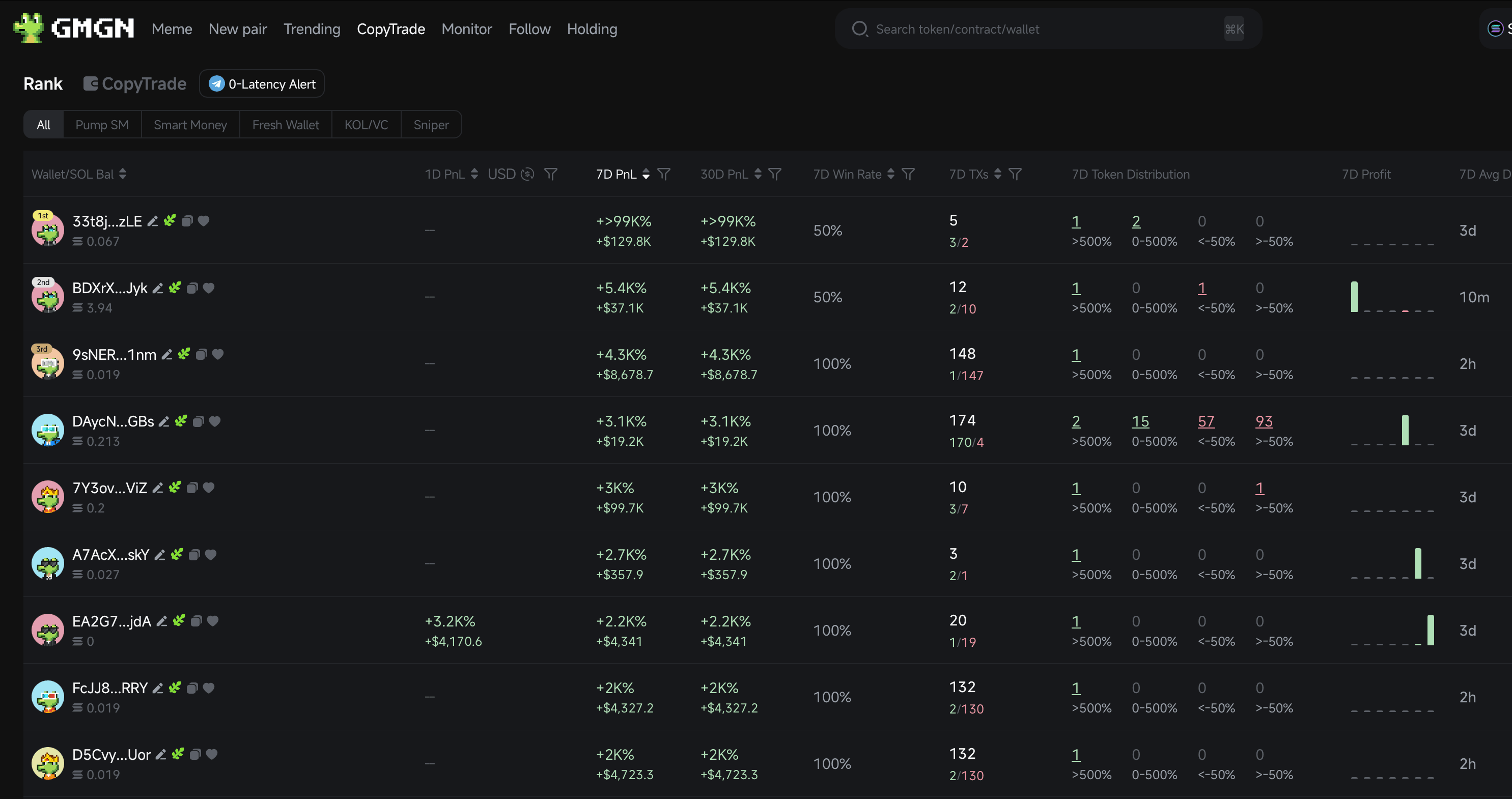

GMGN Bot

GMGN Bot is an innovative Telegram-based trading bot designed to streamline and automate cryptocurrency trading. By integrating directly with Telegram, it offers users a seamless experience to execute trades, monitor market trends, and implement advanced trading strategies without the need for traditional exchange interfaces.

GMGN Homepage. Image via GMGN

GMGN Homepage. Image via GMGNFeatures:

- Multi-Chain Support – Facilitates trading across various blockchain networks, including Ethereum and Solana.

- AI-Driven Analytics – Utilizes artificial intelligence to analyze market data, offering insights and predictions to inform trading decisions.

- Automated Trading – Enables users to set predefined trading parameters, allowing the bot to execute trades automatically based on market conditions.

- Copy Trading – Allows users to mirror the trades of successful traders.

Benefits:

- Efficiency – Automates trading processes, reducing the need for manual intervention and enabling rapid response to market fluctuations.

- Informed Decision-Making – AI-driven analytics provide valuable market insights, assisting traders in making data-backed decisions.

- Accessibility – Operates within the Telegram platform, offering a user-friendly interface that simplifies the trading experience.

- Risk Mitigation – Security features help identify and avoid potentially malicious contracts.

- Community Engagement – The copy trading feature fosters a sense of community by allowing users to follow and learn from successful traders.

Banana Gun

Banana Gun is a Telegram-based trading bot designed to facilitate rapid and secure cryptocurrency transactions, offering users a range of features aimed at optimizing trading efficiency and safety.

Banana Gun Homepage. Image via Banana Gun

Banana Gun Homepage. Image via Banana GunFeatures:

- Auto Sniping – Enables users to automatically purchase tokens upon their launch by providing the contract address and desired settings.

- Limit Orders – Allows traders to set automated buy or sell orders at specified price points, including stop-loss and trailing stop-loss orders.

- Copy Trading – Offers the ability to replicate the trades of successful traders automatically, leveraging their strategies for potential gains.

- Fast & Secure Swaps – Provides MEV-resistant swaps that protect against sandwich attacks and frontrunning.

- Scam Protection – Utilizes built-in simulations to detect and prevent transactions with malicious tokens, ensuring user safety.

Benefits:

- Efficiency – Automates complex trading processes, allowing users to execute trades swiftly and effectively without manual intervention.

- Security – Incorporates advanced protective measures to minimize risks associated with decentralised trading.

- User-Friendly Interface – Accessible via Telegram, it provides a straightforward and intuitive platform for both novice and experienced traders.

- Community Engagement – The copy trading feature fosters a collaborative environment, enabling users to learn from and emulate successful traders.

BullX Bot

BullX Bot is an advanced Telegram trading bot designed to enhance the trading experience across multiple blockchain networks. Developed by Kugelblitz, it offers a suite of features aimed at providing speed, security, and comprehensive trading tools for both novice and experienced traders.

BullX Homepage. Image via BullX

BullX Homepage. Image via BullXFeatures:

- Multi-Chain Support – BullX operates across various blockchain networks, including Solana, Ethereum, Binance Smart Chain, Arbitrum, and more, allowing users to trade on their preferred platforms seamlessly.

- Fast Indexing – The platform boasts industry-leading blockchain indexing speeds, ensuring that users have access to the most up-to-date information for timely decision-making.

- Multi-Wallet Management – Users can manage multiple wallets effortlessly through an intuitive interface, facilitating diversified trading strategies and asset management.

- Live Charts and Statistics – Offers live market data, interactive charts, and comprehensive analytics to assist traders in making informed decisions.

- Limit Orders – BullX allows users to set limit buy and sell orders across multiple blockchains, enabling strategic trading based on predefined price points.

- Telegram-Web Interface – Integrating seamlessly with Telegram, BullX enables users to manage trades, monitor updates, and receive alerts in real-time.

Benefits:

- Efficiency – With its fast indexing and real-time data, BullX ensures that traders can execute transactions swiftly.

- Security – The platform's real-time security audits and advanced protective measures offer users confidence in the safety of their assets during trading activities.

- User-Friendly Experience – The intuitive multi-wallet management system and seamless Telegram integration make BullX accessible and convenient for traders of all levels.

- Comprehensive Tools – From live charts to limit orders, BullX provides a range of tools that support strategic trading and informed decision-making.

How to Choose the Right Telegram Trading Bot?

With a growing number of Telegram trading bots available, selecting the right one requires careful evaluation. While automation can enhance efficiency, factors like security, usability, and exchange compatibility must be considered to ensure a seamless trading experience. Here’s what to look for when choosing a Telegram trading bot.

Evaluating Trading Strategies

Different bots cater to different trading styles. Some are built for sniping newly launched tokens, while others focus on copy trading or liquidity tracking. Before selecting a bot, consider:

- Trading objectives – Do you need a bot for quick scalping, long-term portfolio management, or liquidity-based strategies?

- Customization options – Look for bots that allow users to configure stop-loss, take-profit, limit orders, and automated execution.

- Multi-wallet support – Advanced bots allow users to trade across multiple wallets simultaneously.

Choosing the Right Telegram Trading Bot Depends on Multiple Factors. Image via Shutterstock

Choosing the Right Telegram Trading Bot Depends on Multiple Factors. Image via ShutterstockSecurity Considerations

Security should be a top priority when selecting a Telegram trading bot, as some require access to private keys or API integrations with centralised exchanges. To minimize risks, consider:

- Non-custodial vs. custodial bots – Non-custodial bots give users full control of their funds, while custodial bots may store private keys, increasing potential risks.

- Smart contract audits – Ensure the bot has been independently audited to prevent vulnerabilities and rug-pull risks.

- Encryption & data protection – Bots should use secure encryption for sensitive data like API keys or private keys.

- Anti-rug & scam detection – Some bots offer security features that detect suspicious liquidity locks, or abnormal contract activity.

Exchange Compatibility

Not all bots support every blockchain or exchange, so selecting one that aligns with your trading preferences is crucial. Consider:

- DEX vs. CEX integration – Some bots exclusively support decentralised exchanges (DEXs) like Uniswap, while others integrate with centralised exchanges (CEXs) like Binance and KuCoin.

- Multi-chain support – Bots that work across Ethereum, BNB Smart Chain, Solana, Arbitrum, and other blockchains provide greater flexibility.

- Liquidity access – Ensure the bot integrates with high-liquidity pools to reduce slippage and improve trade execution speeds.

How to Set Up a Telegram Trading Bot

Setting up a Telegram trading bot is a straightforward process, but ensuring it functions correctly requires careful configuration. Whether you’re automating trades, tracking market movements, or executing advanced strategies, proper setup is key to optimizing performance. Here’s a step-by-step guide to getting started.

Selecting the Right Bot

Before anything else, you need to choose a Telegram trading bot that aligns with your trading style and security preferences. Consider:

- Trading features – Does the bot support sniping, copy trading, stop-loss orders, or multi-wallet functionality?

- Blockchain compatibility – Ensure the bot integrates with your preferred decentralised or centralised exchanges.

- Security measures – Look for non-custodial options, encrypted key storage, and anti-rug protection.

- Pricing model – Some bots charge per trade or require a subscription.

Once you’ve selected a bot, head to its official Telegram channel or website to begin the setup process.

Proper Telegram Bot Setup is Key For Success. Image via Shutterstock

Proper Telegram Bot Setup is Key For Success. Image via ShutterstockConnecting to a Telegram Channel or Platform

Most bots operate within a dedicated Telegram channel or bot interface, allowing users to interact via simple text commands.

- Open Telegram and search for the official bot channel (e.g. Maestro, Banana Gun).

- Click Start to initiate the bot.

- Follow the on-screen prompts to create or connect an existing wallet.

Some bots generate new wallets automatically, while others allow you to import an existing wallet—keep in mind that importing requires sharing your private key, which may pose security risks.

Integrating API Keys with Exchanges

For bots that support centralised exchange (CEX) trading, API integration is required. This allows the bot to execute trades on your behalf without requiring full control of your funds.

To integrate an exchange API:

- Log in to your preferred crypto exchange (e.g., Binance, KuCoin, OKX).

- Navigate to API Management and create a new API key.

- Set permissions (enable trading but disable withdrawals for security).

- Copy the API key and secret and enter them into the Telegram bot.

For decentralised trading bots, API integration isn’t necessary since trades are executed directly on DEXs.

Configuring Trading Strategies

Once connected, it’s time to customize your trading strategy. Most Telegram bots allow users to:

- Set buy/sell limits – Define price points for automatic purchases and sales.

- Enable stop-loss & take-profit orders – Protect against market volatility by setting predefined exit points.

- Activate copy trading – Automatically mirror the trades of selected wallets.

- Use liquidity sniping – Enter new token launches instantly as liquidity is added.

- Adjust gas fees & slippage – Optimize transaction execution speed and cost.

These settings can typically be adjusted via simple Telegram commands or in the bot’s settings menu.

Monitoring and Optimizing Performance

Once your bot is live, regular monitoring ensures optimal execution and risk management.

- Review trade logs – Track executed trades, profits, and market conditions.

- Set up notifications – Receive alerts for price movements, liquidity changes, or failed transactions.

- Optimize strategy – Adjust trading parameters based on market conditions and performance analytics.

Common Risks & How to Mitigate Them

While Telegram trading bots offer convenience and automation, they also come with risks that traders should be aware of. From security vulnerabilities to market volatility and scams, using these bots responsibly requires an understanding of potential pitfalls and how to mitigate them.

It’s Crucial To Make Sure You Are Connecting To a Legitimate Telegram Bot. Image via Shutterstock

It’s Crucial To Make Sure You Are Connecting To a Legitimate Telegram Bot. Image via ShutterstockSecurity Concerns & Best Practices

The most significant risk with trading bots is security. Many bots require wallet access, API key integration, or even private key imports—all of which introduce potential attack vectors.

Common security risks:

- Custodial risks – Some bots hold private keys or API access, making them potential targets for hacks.

- Smart contract vulnerabilities – Poorly audited bots may contain exploitable bugs that can drain user funds.

- Data breaches – If a bot’s infrastructure is compromised, user data (including trade history and wallet info) could be leaked.

How to mitigate:

- Use non-custodial bots that do not require private key imports.

- Limit API permissions – If using a CEX bot, disable withdrawal access when setting up API keys.

- Choose well-audited bots with a track record of security.

- Use a separate wallet – Never connect your primary holdings to a trading bot.

Handling Market Volatility

The crypto market is highly volatile, and while automation can improve trade execution, it can also amplify losses if risk management isn’t properly configured. Bots that execute trades based on price fluctuations can be caught in rapid market swings, leading to unexpected losses.

Common volatility risks:

- Slippage – High volatility can cause orders to execute at unfavorable prices.

- Sudden price drops – Bots that don’t use stop-loss orders can hold onto assets during extreme downturns.

- Liquidity issues – Low liquidity tokens can cause failed transactions or significant price deviations.

How to mitigate:

- Set stop-loss and take-profit orders to automate risk management.

- Adjust slippage tolerance to prevent executing trades at extreme price levels.

- Monitor bot activity regularly to ensure trades are executing as intended.

Avoiding Scams & Fake Bots

The rise of Telegram trading bots has also led to an increase in scams and fraudulent services. Some bots are designed to steal funds, misuse API access, or manipulate users into signing malicious transactions.

Common scam risks:

- Fake trading bots – Imitation bots that look legitimate but steal user funds.

- Phishing links – Fraudulent Telegram channels sharing fake bot links.

- Ponzi schemes – Bots promising guaranteed profits or requiring token staking with unrealistic rewards.

How to mitigate:

- Only use official bot links from verified sources.

- Avoid bots that ask for direct wallet access or private key imports.

- Be cautious of “too good to be true” offers—bots cannot guarantee profits.

- Research community feedback on Telegram, Twitter, or crypto forums before using a bot.

Closing Thoughts

Telegram trading bots have streamlined crypto trading, offering automation, real-time market insights, and efficient execution—all within a messaging app. By integrating with DEXs and CEXs, these bots enable traders to buy, sell, and manage assets seamlessly, eliminating the need for manual transactions. Features like sniping, copy trading, and multi-wallet management make them valuable tools for both beginners and experienced traders.

However, security remains a key concern. Choosing reputable, well-audited bots, avoiding private key imports, and implementing risk management strategies are essential for safe usage. Not all bots are the same, so selecting one that aligns with your trading goals, exchange preferences, and security requirements is crucial.

For those looking to enhance their trading experience, Telegram bots offer a powerful alternative to traditional platforms. The key is to research, test, and optimize their use for your specific needs. With the right approach, these bots can become an indispensable asset in navigating the fast-moving crypto market.