Quick Answer: Is Binance Safe in 2026?

The 20-second Verdict

Who Binance is Best For (and Who Should Avoid It)

Best for

- Active traders

- Frequent swappers

- Users who need deep liquidity, tight spreads, derivatives access, and broad altcoin support

Not ideal for

- Long-term holders storing large balances

- Users who want maximum regulatory certainty

- Users needing fully U.S.-regulated, U.S.-only exchange access

Key Takeaways

- SAFU emergency fund: Discretionary backstop for certain platform security incidents, not user mistakes.

- Cold storage model: Majority of funds held offline, with hot wallets used for liquidity.

- Account security controls: Strong 2FA, passkeys, withdrawal whitelisting, and API restrictions materially reduce risk.

- Proof of Reserves: User-verifiable backing for on-platform balances, but not a full financial audit.

- Biggest risks: Centralized custody and changing regulatory access by jurisdiction.

What Is Binance?

Binance is the world's largest centralized cryptocurrency exchange (CEX). It is a platform where you trade crypto through an account that Binance controls, much like an online brokerage holds shares for you. Most trading happens via an order book, where buyers and sellers post prices and the exchange matches orders in real time.

Binance is the World's Largest Centralized Cryptocurrency Exchange. Image via Binance

Binance is the World's Largest Centralized Cryptocurrency Exchange. Image via BinanceBinance announced its exchange launch date as July 14, 2017. On Binance.com, users can typically access spot markets and a wider suite of features depending on where they live. That “depending” is important: Binance’s own Licenses, Registrations and Other Legal Matters page says its site information/services are not directed at residents of certain jurisdictions, including the United States.

Binance’s regulatory and legal landscape

“Safety” isn’t only about hacking resistance. It’s also whether you can reliably use fiat rails, pass verification, and withdraw when you need to. Regulators shape all of that.

- In the UK, the FCA consumer warning banned Binance Markets Ltd from regulated business in 2021 and stopped them from approving crypto ads, leading Binance to halt new UK customers.

- In the US, the U.S. Department of Justice outlined penalties and compliance obligations tied to Binance’s 2023 case. Binance agreed to pay a financial penalty of over $4 billion, including a criminal fine. It also agreed to retain an independent compliance monitor for three years.

- In France, the AMF white list entry for Binance France SAS shows how some services can be registered locally.

Leadership and operations

Richard Teng became CEO of Binance in November 2023 and later announced Yi He as co-CEO. Binance’s Terms also make clear that “local terms” can apply, another reason your jurisdiction matters. It is best to revert to details related to your own jurisdiction for a clearer idea of how Binance operates in that region and under what terms.

Read our full Binance review for more.

How We Assessed Binance's Security

We evaluated Binance’s security using a practical, user-first framework focused on how real losses happen, not just marketing claims.

Our assessment combined:

- Custody architecture: Hot vs cold storage practices and key-management controls

- Account-level protections: 2FA options, withdrawal safeguards, API permissions, and recovery flows

- Transparency signals: Proof of Reserves disclosures and clarity around limitations

- Incident history: Documented breaches, response speed, and user outcomes

- Regulatory and operational risk: How jurisdiction, compliance actions, and Terms affect access and withdrawals

The goal wasn’t to declare Binance “risk-free,” but to judge whether its controls meaningfully reduce the most common and costly failure modes users face in practice.

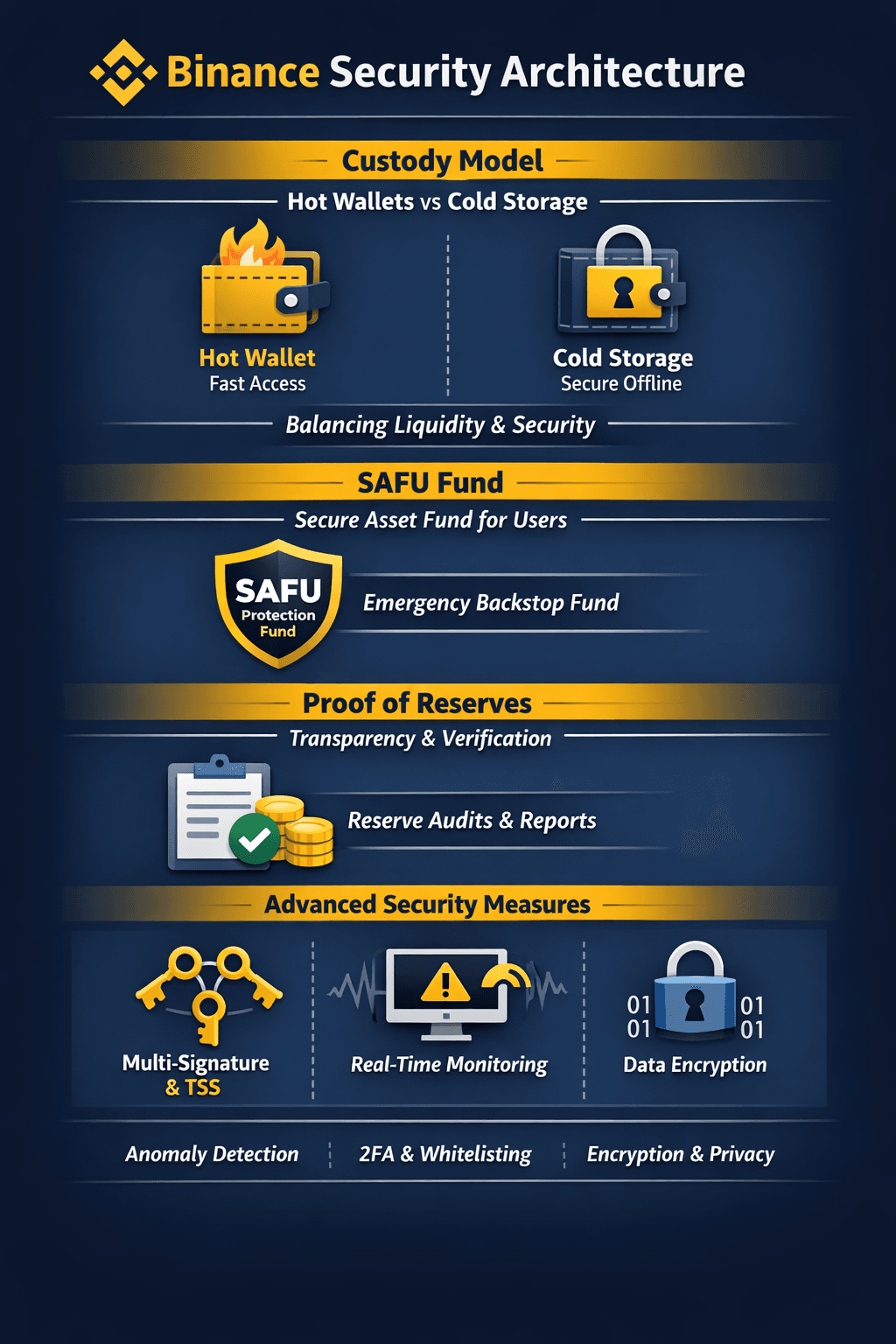

Binance Security Architecture

Binance’s security setup can be thought of as two layers working together: platform-level custody controls (how the exchange stores and moves assets) and account-level protections (the settings you enable to stop unauthorized access). The goal is to reduce both “big” risks (platform compromise) and “everyday” risks (phishing, SIM swaps, and device takeovers).

Binance Endorses Risk Control Measures and Encourages Users to Combine them with Account Security Basics

Binance Endorses Risk Control Measures and Encourages Users to Combine them with Account Security BasicsCustody model explained (hot vs cold)

Like most large exchanges, Binance needs some funds online for day-to-day withdrawals, while keeping the bulk of long-term storage offline.

On the user side, there is of course a tradeoff between hot wallets , also called software wallets, and cold storage or hardware wallets. Hot wallets give fast access but higher exposure, and cold storage keeps your keys offline which minimizes exposure to risk.

The best way is to keep the running funds in a hot wallet, and crypto that you want to stash away in a hardware wallet. For users, the key implication is that “exchange custody” prioritizes convenience and liquidity; whereas self-custody prioritizes personal control.

We highly recommend going through our primer on hot vs cold storage to understand both cases better.

Fund protection: SAFU explained

Binance says it created the Secure Asset Fund for Users (SAFU) in 2018 as an emergency backstop, funded by allocating a portion of fees. It’s important to treat SAFU as a discretionary safety net, not a government deposit guarantee: it’s intended for certain extreme events or security incidents, not for losses caused by trading, user mistakes, or scams like phishing.

Proof of Reserves (PoR) and transparency

Binance publishes a Proof of Reserves page designed to let users verify that certain on-platform balances are backed. Binance also recently announced an update to how PoR is presented, framing it as an accuracy and transparency improvement. PoR can be useful, but it’s not the same thing as a full audit of a company’s finances, governance, or risk controls.

Organizational security controls (keep your existing depth)

At the custody layer, Binance describes using approaches such as multisignature wallets and threshold signature schemes (TSS) to reduce single-key risk. Operationally, it also describes internal withdrawal/risk controls that can add friction (like holds) around higher-risk activity, alongside monitoring and anomaly detection designed to flag suspicious behavior before funds leave the platform.

Real-time monitoring and automated risk controls

Binance endorses risk control measures and encourages users to combine them with account security basics like withdrawal address whitelisting to limit where funds can be sent if credentials are compromised. Some triggers can include things like password and 2FA reset, device change, or a large withdrawal attempt, for example.

Data protection and encryption

Binance states it protects personal data by encrypting data in storage and securing data in transit via end-to-end encryption on its user protection portal that we just shared above, and its Privacy Notice (Jan 5, 2026 PDF) also describes having security measures to prevent unauthorized access or disclosure.

Binance’s Security Track Record and Incident Timeline

Binance’s security story is best understood through what has happened over time: how incidents occurred, how fast the platform responded, and what changed afterward. That history helps separate marketing from reality, and it helps users decide what risks they’re actually taking on when they leave funds on any exchange.

Why past incidents matter

Security is proven over time, not promised once. Real-world incidents stress-test an exchange’s controls, transparency, and willingness (or ability) to make users whole when things go wrong.

Timeline of major incidents and responses

| Date | What happened | Impact | Root cause category | Binance response | User outcome |

|---|---|---|---|---|---|

| May 7, 2019 | Binance Security Breach Update reported a theft of 7,000 BTC. | Exchange hot wallet hit | Platform breach (enabled via user-targeting methods like phishing) | Withdrawals paused; security review; pledged SAFU coverage | Binance said it would use SAFU to “cover this incident in full,” with “no user funds” affected. |

| Oct 2022 | BSC Token Hub exploited (extra BNB minted). | Ecosystem infrastructure hit | Ecosystem component (bridge) | Validator coordination; pause/resume; funds movement constrained | BNB Chain stated users were not affected (distinct from an exchange custody loss). |

| Ongoing | Scams increasingly target users at withdrawal time | User accounts at risk | User-targeting | Warnings, friction, and checks on risky withdrawals | Outcomes vary; prevention depends heavily on user settings |

How Binance compares to major historical exchange failures

A key distinction is “security incident + reimbursement” versus “fraud/insolvency collapse.” For example, the SEC’s complaint regarding FTX frames allegations around misuse and control failures, while Mt. Gox’s long-running creditor process is documented by the Rehabilitation Trustee under Tokyo District Court supervision. Solvency and governance can matter as much as technical security.

What we learn from the timeline

Binance has shown strong incident-response instincts in some cases, especially clear disclosure and reimbursement commitments in the 2019 breach. At the same time, no exchange is hack-proof, and the broader crypto stack adds complexity: exchange risk (custody/platform controls) is different from chain/bridge ecosystem risk (smart contract and bridge vulnerabilities).

The Biggest Risks of Using Binance

Even with strong security tooling, Binance is still a centralized exchange, so the main risks come from custody, account compromise, jurisdiction rules, and complex products.

Custody risk: “Not your keys”

The tradeoff is simple: leaving funds on an exchange is convenient, but you give up direct control of the keys. That means Binance can place holds or restrictions and change how services work under its Terms, and withdrawals can be temporarily suspended during certain security events or reviews per its withdrawal suspension FAQ.

Account-level risks (most common causes of loss)

Most losses are still “user-targeting” attacks:

Regulatory and access risks

Access can change by region, including region lockouts, and Binance requires identity verification in line with its Terms. You may also face source-of-funds checks, and fiat deposits/withdrawals can be affected if third-party rails change or experience downtime. Binance also notes that some processing involves third parties in its Terms, which is important to be aware of.

Product risk (advanced products amplify mistakes)

Leveraged products like futures and margin can magnify losses and trigger liquidation. Binance’s own margin guide stresses that leverage amplifies losses, and its futures documentation describes risk controls tied to liquidation distance.

For beginners, the bigger risk is complexity: it’s easier to misclick, misunderstand, or over-size a position.

Don't forget to check out our top picks for like futures and margin trading.

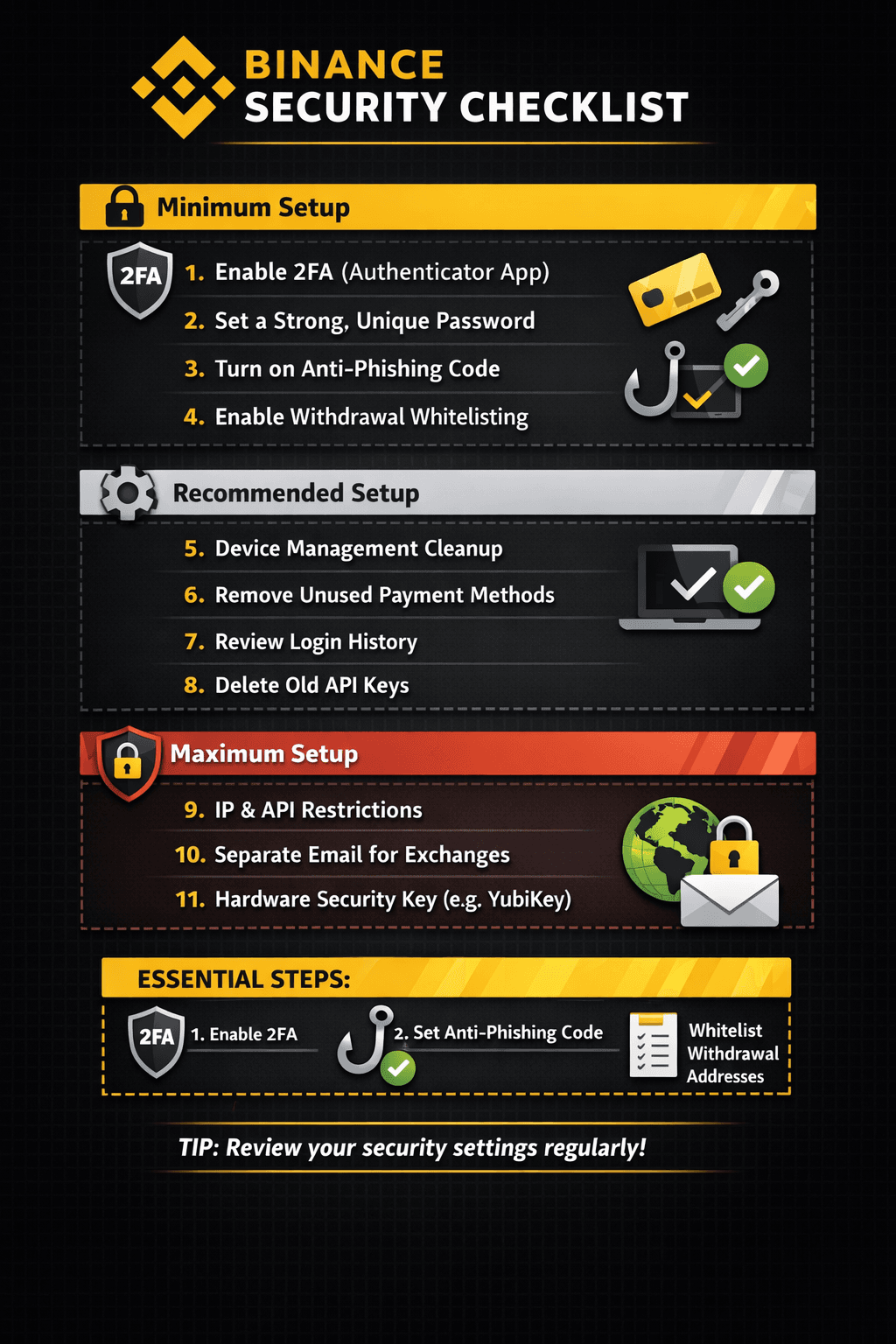

Binance Security Checklist (10 Steps You Should Do Today)

Use this as a quick “set it and forget it” hardening pass. It’s 10 core steps plus 1 advanced add-on for users who want maximum lock-down.

Treat Security Like Routine Maintenance

Treat Security Like Routine MaintenanceMinimum setup (beginners)

1. Enable authenticator-based two-factor authentication (2FA).

2. Set a strong, unique password (use a password manager).

3. Turn on an anti-phishing code.

4. Enable withdrawal address whitelisting.

Recommended setup (intermediate)

5. Do a device management cleanup (remove old devices/sessions).

6. Remove unused payment methods.

7. Review login history regularly.

8. Delete old API keys you no longer need.

Maximum setup (advanced)

9. Use IP or API restrictions (only if you understand the tradeoffs) via API key permissions.

10. Use a separate email just for exchange accounts.

11. Add a hardware security key (for example, YubiKey).

If you only do three things after reading this checklist, make them these: turn on authenticator 2FA, enable an anti-phishing code, and whitelist withdrawal addresses. These three remove a big chunk of the “easy wins” attackers look for.

Treat security like routine maintenance: revisit your device list and login history, especially after travel, a new phone, or any unexpected account alert.

How to Secure Your Binance Account

This goes beyond a basic checklist and focuses on controls that most often prevent real losses: better login security, safer withdrawals, and tighter API rules.

Authentication options and what to use

- Use an authenticator app (TOTP) like Google Authenticator on Binance rather than SMS where possible, since SMS-based MFA can be vulnerable to phishing and SIM-swap attacks.

- For high-value accounts, consider a hardware-based method: Binance supports passkeys and USB security keys, built on standards such as FIDO2.

- Finally, store your 2FA recovery material safely. Binance shows a setup key during authenticator setup that you should keep offline as a fallback.

Withdrawal protections that actually prevent losses

- Enable withdrawal address whitelisting so funds can only be sent to approved addresses.

- Expect “time locks” after sensitive changes: Binance notes withdrawals can be temporarily suspended for 24–48 hours after certain security operations.

- When adding an address, verify it carefully, as clipboard hijackers can replace copied strings without you noticing.

API security (often overlooked)

- Only create API keys when you truly need them.

- Minimize permissions (read-only vs trading), and avoid withdrawal-enabled keys unless essential. Binance’s API key permission model makes clear withdrawals require stronger constraints like IP restriction.

- Add trusted IP allowlists and rotate keys; Binance explicitly recommends whitelisting trusted IPs for API keys.

What to Do If Your Binance Account Is Compromised

If you suspect your Binance account has been breached, speed matters. The goal is to stop outflows first, then preserve evidence, then escalate through official channels.

Immediate actions (first minutes)

- Change your password (or use “forgot password” if you’re locked out). Binance provides a complete guide on what to do if your account is compromised in its security blog.

- Disable/delete any suspicious API keys and review API access via Binance’s API security overview.

- Lock down your email (change password + add strong 2FA), since Binance account resets often route through email.

- Contact Binance Support and request the account be secured/withdrawals stopped while you investigate.

Verify the damage

Check Binance’s account activity logs, including login history, withdrawal history, device list, and recent security-setting changes.

Document and escalate

Capture screenshots, note timestamps, and record TXIDs (Binance asks for transaction identifiers when reporting stolen funds in this support FAQ). Include your account email, suspicious IP/device info, and affected assets in the support ticket.

What Binance may reimburse vs won’t

Binance has previously stated it covered a platform security incident (the May 2019 breach) using SAFU “in full”. User-targeting losses (phishing/malware) are harder to guarantee, as SAFU is an emergency fund, not an insurance policy.

When to withdraw everything and move to self-custody

If suspicious activity repeats, your confidence is shaken, or you’re holding long-term funds, consider moving assets off-exchange once the account is stable. The best way to do that is to go for a hardware wallet to keep your funds offline and away from harm.

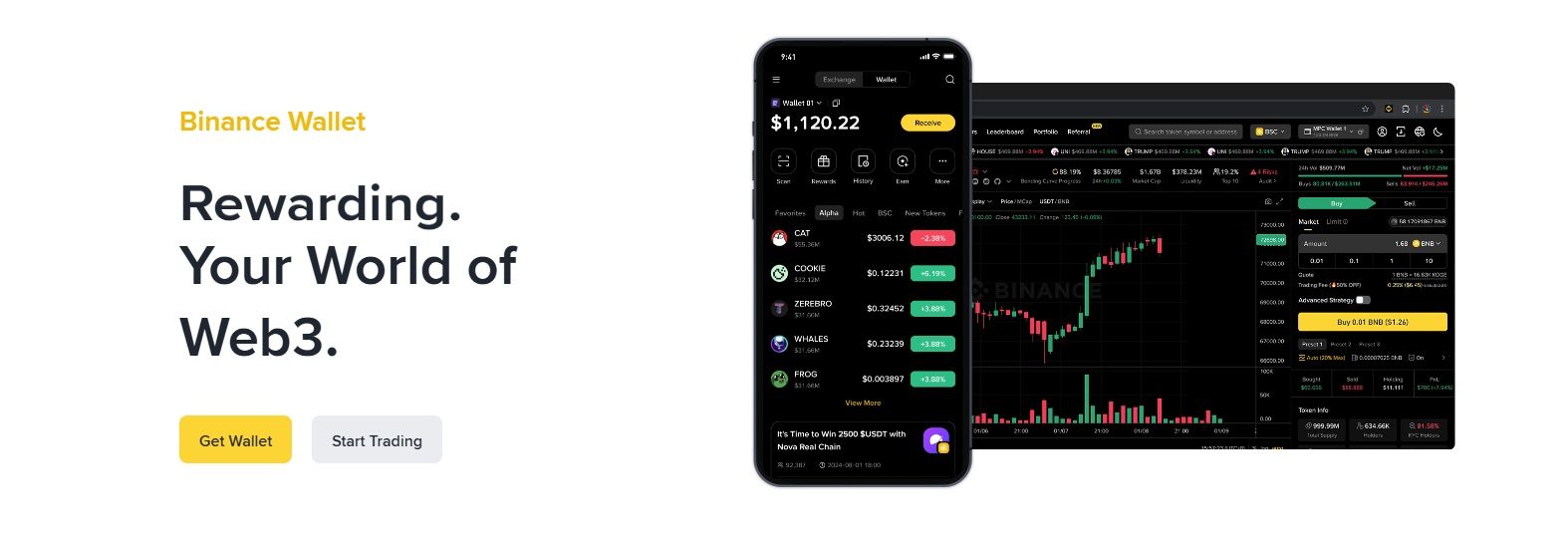

Binance Wallet Security and Self-Custody Options

Where you keep your crypto is often a bigger safety decision than which exchange you use. Binance account balances are held in a custodial wallet, meaning the platform controls the private keys, while non-custodial wallets put key control in your hands.

Where you Keep your Crypto is often a Bigger Safety Decision than which Exchange you Use. Image via Binance

Where you Keep your Crypto is often a Bigger Safety Decision than which Exchange you Use. Image via BinanceExchange custody vs self-custody

- If you trade weekly, keep only a trading float on Binance and treat it like a checking account; useful, but not where you store everything long term.

- If you hold long-term, consider moving most funds to a non-custodial wallet so you control the keys.

Wallet options in the Binance ecosystem

An exchange-linked wallet is useful for fast trading and withdrawals. For self-custody inside the Binance app, Binance launched the Binance Web3 Wallet, which Binance describes as a self-custodial wallet integrated into the app.

The core rule is seed phrase hygiene: never share your recovery phrase, and follow practical guidance like the FTC’s warning to never share your recovery phrase and CISA’s broader advice to use strong authentication and protect accounts.

You can check out our detailed review of Binance Wallet for more information.

Hardware wallet best practices

Hardware wallets are designed to keep private keys offline as cold storage, reducing remote attack risk. They’re best for larger, long-term holdings.

Common mistakes to avoid:

- storing the seed phrase digitally,

- sharing it with “support,”

- entering it anywhere except during legitimate device recovery

Binance Mobile App Security

Your phone is the “master key” to your exchange account, so mobile security is mostly about reducing exposure to risky networks, risky apps, and physical theft.

Mobile Security is mostly about Reducing Exposure to Risky Networks, Risky Apps, and Physical Theft. Image via Binance

Mobile Security is mostly about Reducing Exposure to Risky Networks, Risky Apps, and Physical Theft. Image via BinanceMobile-specific threats

- Public WiFi: Avoid sensitive actions on public Wi-Fi.

- Device theft: A weak lock screen makes takeovers easier, so use a strong iPhone passcode or Android screen lock.

- Malicious overlays: Some malware can trick taps/inputs, so keep Play Protect on and watch for clipper-style threats.

- Fake apps: Only install from official channels.

Mobile hardening steps

- Keep iOS security updates current.

- Use app/device lock + biometrics.

- Avoid sideloading; rely on Play Protect scanning.

- Use a separate device if the account value is high.

Binance vs Competitors: Safety and Trust Comparison

Let's take a quick overview of how Binance stands against some competition. We will try to focus on safety and trust in particular, as that would help us gauge security standing with competitors like Coinbase, Kraken and Gemini.

Binance vs Coinbase vs Kraken vs Gemini

| Category | Binance | Coinbase | Kraken | Gemini |

|---|---|---|---|---|

| Insurance and protections | Uses an internal emergency fund called SAFU (not government deposit insurance). | Eligible customer USD may be held with pass-through coverage via FDIC/NCUA-eligible banks (cash only); it also describes commercial crime insurance limits (crypto isn’t FDIC/SIPC). | Digital assets are not FDIC/SIPC insured. | Eligible USD may have pass-through FDIC coverage (cash only) and describes limited hot-wallet insurance (not a blanket guarantee). |

| Cold storage approach | Publishes wallet ownership checks on Proof of Reserves (includes cold + hot wallets). | Keeps majority of customer crypto in cold storage. | Cold storage and diverse security controls. | States the majority of assets are held in cold storage. |

| 2FA methods supported | Supports passkeys/security keys and authenticator apps. | Supports security keys and other 2SV options. | Supports security keys for 2FA. | Supports security keys and other 2FA options. |

| PoR availability | User-verifiable Proof of Reserves. | Provides transparency via public-company reporting such as SEC filings (not Merkle PoR). | User-verifiable Proof of Reserves. | Publishes reserve attestations related to GUSD transparency (not a universal PoR for all exchange balances). |

| Regulatory posture | Shows jurisdiction-by-jurisdiction status; major U.S. actions documented by DOJ, FinCEN, CFTC. | Explains compliance posture including FinCEN MSB and publishes SEC filings. | Provides complete list of where licensed/regulated (incl. FinCEN MSB), and a list of prohibited regions | Operates as a New York limited purpose trust company and NYDFS actions are published (e.g., consent order). |

| Track record and incident response | Publicly documented 2019 incident and response. | Cyber attack in May 2025 cost $400m. Promised reimbursement and bounty on attackers. Describes when it may reimburse under crime insurance (coverage is conditional). | No major breach. Focuses on controls and disclosure; also clearly states no FDIC/SIPC insurance. | Third party data breach in 2022. No direct major incidents so far. Clearly discloses the scope/limits of insurance coverage. |

| Fees | Spot maker/taker: 0.10% / 0.10% (Regular User) with BNB fee discounts. | Coinbase Exchange maker/taker at $0–$10k tier: 0.40% / 0.60% | Kraken Pro spot maker/taker at $0 volume: 0.25% / 0.40% (tiers reduce with 30-day volume). | ActiveTrader maker/taker at $0 tier: 0.20% / 0.40% (tiers reduce with 30-day volume). |

Which exchange is “safer” depends on your profile

- US-focused, regulation-first users often prefer platforms with clearer U.S. compliance and disclosure footprints. For example, Coinbase explains its U.S. compliance posture, including FinCEN MSB registration, and as a public company it publishes ongoing disclosures through SEC filings. Gemini, meanwhile, describes its operating structure in its User Agreement shared in the table, which is relevant for readers who prioritize a more formal U.S. regulatory framework.

- Global liquidity and product breadth can tilt users toward Binance, but the “safety” tradeoff is that your experience and protections can vary by jurisdiction. Binance summarizes its jurisdiction-by-jurisdiction status on its licenses and registrations page as mentioned earlier, and its U.S. enforcement history is documented by authorities such as the Department of Justice, FinCEN, and the CFTC.

- Beginner simplicity vs pro tooling is more about product design than “security,” because the most common losses still come from account compromise. Whichever exchange you use, prioritize stronger authentication methods like Coinbase security keys, Kraken security key (FIDO2) 2FA, or Binance passkeys and security keys.

For more information and details, don't forget to check our exclusive reviews of:

So, Is Binance Trusted and Secure in 2026?

Binance is safe enough for most active users if configured correctly, especially when you combine strong account controls (authenticator/passkeys, withdrawal safeguards) with Binance’s platform measures like Proof of Reserves and its emergency backstop, SAFU.

That said, it’s not the best place for long-term storage of large balances. Like any centralized exchange, you accept custody and policy risk under Binance’s Terms, and account-level threats (phishing, malware) remain the most common cause of loss.

A simple recommended operating model

- Keep only what you trade with on the exchange.

- Withdraw profits periodically to self-custody.

- Use the checklist and re-audit your security settings monthly.

Alternatives to Binance

Binance may still dominate in terms of volume, but it is no longer the default best choice for everyone. Regulation, product focus, and user experience now matter more than sheer scale.

Below is a clearer way to think about Binance alternatives by user type, with a focus not just on features, but on why each option can be safer depending on how you trade.

Best for regulated U.S. access

Coinbase and Kraken

If you are a U.S. user, your realistic choices narrow quickly. Coinbase and Kraken stand out because they operate under clear U.S. regulatory frameworks and offer reliable fiat on-ramps.

Why safer:

They prioritize regulatory compliance and transparency, reducing the risk of sudden service restrictions, frozen accounts, or surprise exits from the U.S. market.

Best for pro derivatives traders

Bybit

Bybit is built for traders who live in perpetuals, futures, and leverage. Deep liquidity, advanced order types, and a fast interface make it a favorite for active derivatives strategies.

Why safer:

For experienced users, safety comes from liquidity depth and execution reliability, which lowers slippage and liquidation risk during volatile market conditions.

Best for beginners

Coinbase

Coinbase remains the easiest entry point for new users who want to buy, sell, and hold without navigating complex trading dashboards or advanced risk tools.

Why safer:

Its simplicity and strong consumer protections reduce user-error risk, which is one of the biggest causes of losses for beginners, not hacks or market moves.

Best for Web3 integration

OKX

OKX goes beyond spot and derivatives trading by integrating DeFi access, NFTs, on-chain wallets, and Web3 tooling into a single ecosystem.

Why safer:

For Web3 users, safety comes from self-custody options and transparent on-chain interactions, giving you more control compared to fully custodial platforms.

Our article on the best Binance alternatives goes in-depth into each of these picks.