$1 PEPE is mathematically impossible under its fixed 420.69 trillion token supply. Even $0.01 would imply a $4.2 trillion market cap—larger than all cryptocurrencies combined. A realistic next-cycle range sits closer to $0.000006–$0.00002, depending on meme rotation, liquidity depth, and Bitcoin’s macro trend. Treat PEPE as a short-term momentum trade, not a compounding asset.

Quick forecast:

- 2026 cycle high: $0.000015–$0.000018 (~$7 b cap).

- 2030 base case: $0.000017–$0.000028 (~$12 b cap).

- $1 math: 420.69 T × $1 = $420.69 trillion market cap — about 4× the global equities market.

- Risk label: Extreme risk, sentiment-driven, subject to whale and social flows.

What could change:

- Supply reductions: Massive, verifiable burns (>90%) or redenomination to reduce float.

- Utility creation: Gaming, NFT, or payment loops with fee-based burn mechanisms.

- Liquidity expansion: Sustained depth across Binance, OKX, and DEX pools.

- Cross-chain scaling: Migration to L2s for cheaper transactions and wider reach.

- Cultural resurgence: Major viral moment reviving memecoin flows sector-wide.

What to watch:

- Burn cadence: Monthly net burns as % of float and their verifiability on-chain.

- Liquidity depth: 1–2 % order-book depth across top venues and DEX aggregators.

- Volume sources: Share of tier-1 CEX vs on-chain flow; wash-trade adjustments.

- Holder distribution: Top-100 ownership trend toward <15 % for healthier float.

- Market sentiment: Social dominance peaks and search volume as rotation signals.

- Macro context: Bitcoin cycle momentum and risk-on/off liquidity conditions.

Snapshot date: Feb. 2, 2026. Figures based on CoinCodex and CoinGecko data. Always verify live supply and market cap before trading.

The Mathematical Reality — Why $1 Is Impossible

Pepe’s supply is fixed at 420.69 trillion tokens, a number that mathematically blocks any path to a $1 valuation. At the current price of $0.00007013, PEPE’s market capitalization stands near $2.97 billion. Raising that to $1 would require $420.69 trillion, a figure larger than the combined capitalization of every listed company worldwide. Let's break down this logic with the help of supply and market cap.

Supply vs Market Cap

The relationship between a token’s circulating supply and its market capitalization determines how its price moves. So if supply stays constant, market cap growth directly increases price.

Price × Circulating Supply = Market Cap

So, to understand why a $1 price target for Pepe is not feasible, consider the following equation:

$1×420.69 trillion=$420.69 trillion market cap

This means that at a $1 price per token, Pepe’s market capitalization would reach an astronomical $420.69 trillion. For perspective, Bitcoin’s market cap is under $1 trillion, Ethereum’s is below $500 billion, and the total global crypto market cap is still below $3 trillion. According to SIFMA, the entire world’s equities market is estimated at roughly $120 trillion, making Pepe at $1 worth more than all stocks globally combined.

Even if every dollar of global liquidity rotated into meme coins, the numbers still fail to close the gap. The token count is the limiting factor.

Realistic Ceilings

Let’s break down more plausible price targets:

- $0.0001 per PEPE: Market cap would be about $42 billion, roughly double Dogecoin’s peak and within the realm of major altcoins.

- $0.001 per PEPE: Market cap jumps to about $420 billion, comparable to Ethereum or a top Fortune 10 company.

- $0.01 per PEPE: Market cap would hit $4.2 trillion, larger than all cryptocurrencies combined and rivaling tech giants plus entire sectors globally.

Each tier above would require unprecedented levels of adoption and deep global liquidity, which is let's be honest, is well beyond anything seen in crypto. The infeasibility becomes clear when these figures are matched against current capital flows and asset allocation.

And for Pepe to sustain any of these higher valuations, massive, coordinated worldwide buying would be required, with liquidity rivaling or exceeding entire stock markets or nation-state treasuries. No meme coin has ever approached this scale, and it would demand a paradigm shift in both crypto utility and global capital allocation.

What Is Pepe Coin?

Pepe Coin Is Viral Cryptocurrency Built On Humor And Massive Online Community

Pepe Coin Is Viral Cryptocurrency Built On Humor And Massive Online CommunityPepe Coin is an ERC-20 token on the Ethereum blockchain, launched on April 17, 2023. It was designed as a tribute to the long-running “Pepe the Frog” meme culture. The project had no presale, no VC funding, and no roadmap at launch, making it a purely community-driven experiment that quickly became a major meme-asset with measurable liquidity and exchange coverage.

Origins and Background

PEPE’s viral rise began on decentralized exchanges, then spread to major centralized listings. Its narrative relied on cultural recognition rather than utility. Within weeks of launch, the token reached hundreds of millions in market cap as social sentiment and retail speculation collided.

Its structure mirrors earlier meme coins such as Dogecoin (DOGE) and Shiba Inu (SHIB), but on a tighter supply model:

- Blockchain: Ethereum

- Token Standard: ERC-20

- Launch Date: April 17, 2023

- Initial Supply: 420,690,000,000,000 PEPE

- Presale/Team Allocation: None disclosed; community launched

- Primary Theme: Internet meme legacy + speculative trading

Like DOGE and SHIB, PEPE’s identity lies in community virality, not in fundamental economic design.

Pepe Ecosystem and Utility

The ecosystem remains light. PEPE functions primarily as a tradeable meme asset, not a productive protocol token. Its limited practical use cases include:

- Liquidity provisioning on DEXs such as Uniswap.

- Exchange listings on Binance, OKX, and Bybit are driving retail access.

- Community initiatives such as NFT collections and meme contests reinforce brand recall.

- Token burns (notably the 6.9 trillion burn in October 2023) serve sentiment rather than supply impact.

Developers have hinted at future integrations such as mini-games and NFT tie-ins, but these remain speculative. It is safe to say that PEPE has a social-market experiment showing how online culture can bootstrap a asset without any formal roadmap or intrinsic utility.

Historical Price Trends of PEPE

Pepe’s price history mirrors the macro market with inflation, brief consolidations, and reflexive recoveries tied to social sentiment rather than utility growth. Since its April 2023 launch, PEPE’s chart has shown four different phases of price trends: initial mania, correction and stabilization, burn-driven rally, and 2025 consolidation.

Launch and Early Surge (April–May 2023)

PEPE debuted at roughly $0.00000006036. Within three weeks, speculative flows from retail traders and meme communities sent it soaring by over 1,000x, breaching $0.0000072 in early May 2023. The surge followed Binance’s and OKX’s listings, which pushed volume above $1 billion per day at peak.

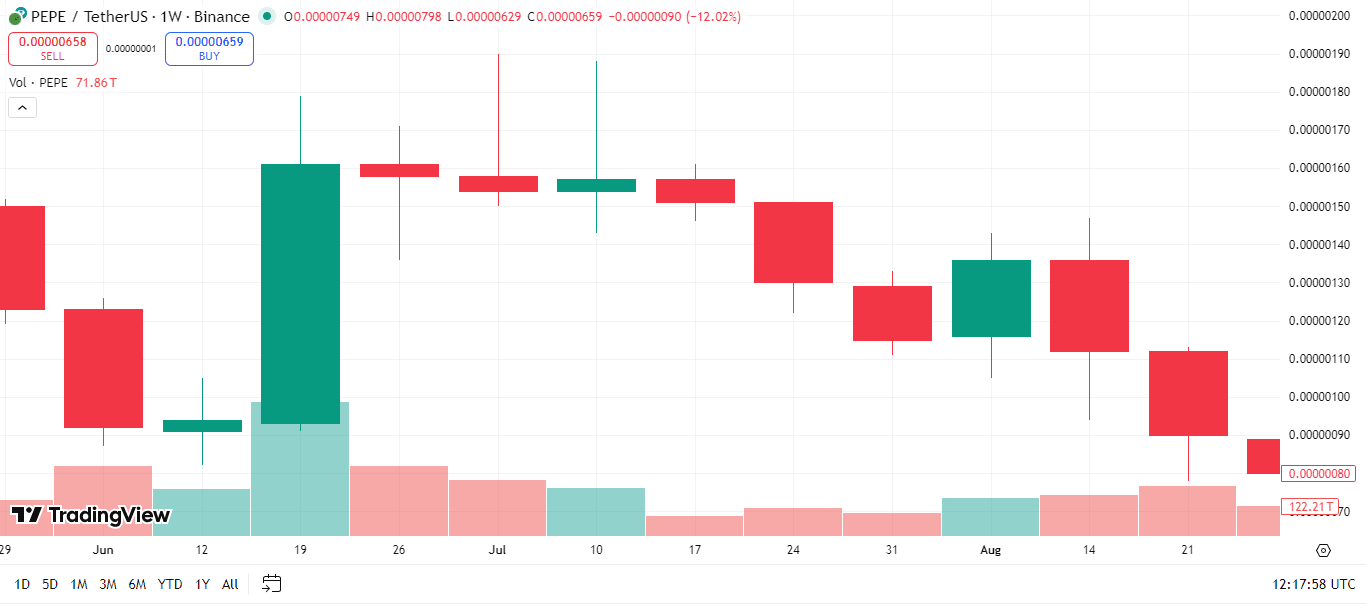

First Correction and Stabilization (June–August 2023)

Pepe Faced Its First Market Correction In 2025. Image via TradingView

Pepe Faced Its First Market Correction In 2025. Image via TradingViewAfter the hype cooled, profit-taking caused a 70% retracement. The token found support around $0.0000018–$0.0000022, where it stabilized as daily volumes dropped below $200 million. This period also saw a gradual migration of liquidity to DEXs and smaller CEX pairs.

Token Burn and Rally (October 2023–June 2024)

Pepe ATH in June 2024 At $0.00002825. Image via TradingView

Pepe ATH in June 2024 At $0.00002825. Image via TradingViewOn October 24, 2023, the project executed a 6.9 trillion PEPE burn, worth about $55 million at the time. This triggered a renewed wave of bullish sentiment, leading to a rally that peaked at an all-time high (ATH) of $0.00002825 in June 2024. The event proved that community-driven burns, though mathematically minor, could influence short-term demand and perception.

2025 Cycle and Current Phase (January–October 2025)

Current Cycle and Phase Of Pepe. Image via TradingView

Current Cycle and Phase Of Pepe. Image via TradingViewAs of October 2025, PEPE trades near $0.00007013 with a $2.97 billion market cap. Despite being 65% below its ATH, the token has retained a stable ranking among the top-50 cryptocurrencies.

Current volumes of $500 million+ per day indicate persistent speculative interest, even as meme coin liquidity overall has fragmented across Solana and Base ecosystems.

The technical indicators of Pepe (at the time of writing) show:

- Structure: Sideways accumulation since July 2025 between $0.000065–$0.000073.

- Momentum: RSI hovering near 47, reflecting neutral bias.

- Support levels: $0.000065 (local floor); Resistance: $0.000075 (immediate cap).

- Bias: Range-bound, waiting for a macro trigger from Bitcoin or retail rotation.

The historical pattern sticks to one truth, which is, PEPE’s price movements respond more to liquidity waves (and macro changes) and meme rotation cycles than to any internal utility evolution.

Market Capitalization & Supply Considerations

Total Value Of All Pepe Tokens Circulating In Market Affects Its Price. Image via Shutterstock

Total Value Of All Pepe Tokens Circulating In Market Affects Its Price. Image via ShutterstockPepe’s valuation mechanics hinge entirely on its token supply and circulating market capitalization. With all 420.69 trillion tokens already in circulation, the market has no deflationary buffer, and every price change directly multiplies across the entire supply, magnifying the implied market cap beyond sustainable thresholds.

Current Market Cap vs. $1 Target

At $0.00007013, Pepe’s market cap stands at approximately $2.97 billion. This places it around 50th rank globally, comparable to established mid-tier projects such as Aptos (APT) and Arbitrum (ARB).

If the price reached $1, its market cap would balloon to $420.69 trillion, over 140x Bitcoin’s and more than 4x the value of the global equity market.

Pepe’s market ceiling is mathematically bound by supply. Even incremental price increases demand liquidity inflows that exceed what crypto markets can absorb.

Supply and Circulation Challenges

Unlike Bitcoin or Ethereum, PEPE lacks programmed scarcity. Its total and circulating supply are identical, meaning there is no emission schedule or lockup to manage float.

The October 2023 burn event removed 6.9 trillion PEPE (link attached above for editor), less than 1.6% of total supply, creating minimal structural change. To make a significant impact or say, to reduce supply by 99.9% would require destroying over 420 trillion tokens, an operation economically and technically infeasible under Ethereum’s ERC-20 architecture.

Pepe’s supply model also locks it into a speculative valuation loop, where the price rallies depend on trading momentum, not tokenomics. The fixed supply ensures transparency but also caps future appreciation. Unless large-scale token reduction or genuine utility is introduced, Pepe’s valuation will continue to mirror market-wide liquidity cycles rather than intrinsic growth.

Realistic Price Targets: What PEPE Can Achieve

Realistic Price Targets Of Pepe. Image via Shutterstock

Realistic Price Targets Of Pepe. Image via ShutterstockWhile the $1 target is mathematically impossible, Pepe can still chart realistic growth levels during favorable market cycles. Price expansion depends on capital inflows, liquidity depth, and larger market beta rather than intrinsic fundamentals.

Short-Term Outlook (Next 6–12 Months)

Based on current Coincodex projections from October 2025 through March–April 2026, PEPE’s near-term trajectory appears corrective before a possible mid-2026 rebound phase.

Phase 1: Mild Correction and Sideways Accumulation (Oct 2025 – April 2026)

Forecasts indicate PEPE may trade between $0.0000004594–$0.0000005392 through Q1 2026, marking a gradual drawdown of roughly –20% to –27% from current levels.

This period aligns with broader market cooling after the meme sector’s summer rotation, with technicals suggesting compressed volatility and RSI near neutrality.

- Support band: $0.00000045 – $0.00000052

- Resistance: $0.00000060 – $0.00000065

- Sentiment driver: BTC consolidation near $90 K and fading retail leverage.

Phase 2: Upside Recovery and Momentum Re-Entry (Jun – Dec 2026)

- By mid-2026, projections show a clear inflection: from $0.0000005302 in June to as high as $0.000014–$0.000018 by August 2026 — a potential +150–170% rally as liquidity returns to speculative assets.

- Probable trigger: Renewed meme rotation and social-media-led flow revival.

- Projected range: $0.000010–$0.000015

- Indicative market cap: ~$4B – $6B, assuming circulating supply holds constant.

Technical & Structural Takeaways

Momentum: Neutral short-term (RSI ≈ 47), but expected to rise if volume expands in H2 2026.

EMA alignment: 50-day ≈ flat; 200-day trending upward, suggesting consolidation before a potential crossover.

Liquidity bias: Binance and OKX remain key hubs; watch for new margin listings or social catalysts on Base/Solana.

If Bitcoin maintains the $85K–$95 K accumulation band, the model favors a gradual re-accumulation into Q2 2026, followed by a speculative breakout cycle into Q3–Q4 2026, targeting the $0.000010–$0.000015 zone.

Cycle-High Scenario (2026–2027 Window)

Between mid-2026 and late-2027, PEPE’s modelled cycle suggests a full expansion-and-cool-off arc. Following six months of drawdown into early 2026, projections imply an aggressive mid-year recovery and a late-2026 speculative peak, before a moderated comedown through 2027.

Phase 1: Breakout and Parabolic Advance (June – December 2026)

After five months of corrective action near $0.00000046–$0.00000054, PEPE’s trend pivots sharply upward in June 2026, when price projections accelerate from $0.00000053 to over $0.00001674 by July, a +148% jump.

Momentum persists through August – October 2026, with average trading levels around $0.000014–$0.000015 and highs above $0.000018, implying a short-term market capitalization near $6–7 billion—a five-fold expansion from mid-2025 levels.

Cycle trigger factors

- Bitcoin pushing toward new highs and meme-sector rotation.

- Reactivation of retail leverage on Binance, OKX, and Base ecosystems.

- Viral campaigns, token burns, and influencer-led narratives amplifying flows.

This window forms the likely “cycle-high zone”, peaking in Q3–Q4 2026, roughly 12 months after consolidation began.

Phase 2: Plateau and Gradual Cooling (Jan – December 2027)

Through 2027, forecasts reflect stabilization and a slow decline from the euphoric highs. Prices moderate from $0.000011–$0.000012 in early 2027 to roughly $0.000006–$0.0000076 by December, translating to a 40–50% retracement from the mid-2026 apex.

Key dynamics shaping the slowdown

- Diminishing social hype and profit rotation into newer meme projects.

- Reduced burn cadence and cooling daily volumes.

- Broader crypto market normalization after the 2026 bull-cycle crest.

Upper-Bound Valuation Context

If speculative liquidity fully re-enters the meme segment, peak extensions toward $0.00002–$0.00005 remain mathematically possible, equating to $8–$20 billion in market value.

However, even a far-fetched $0.0005–$0.001 scenario (as once hypothesized) would imply a $210–$420 billion capitalization, demanding a global crypto market north of $6 trillion and sustained meme-asset dominance—conditions that exceed current structural capacity.

Verdict

The 2026–2027 cycle likely defines PEPE’s speculative high, with a realistic top zone near $0.000015–$0.00002, followed by consolidation in the $0.000006–$0.00001 corridor into late 2027.

Stretch Case: Why $0.001 Is Difficult

Reaching $0.001 per PEPE represents an extreme upper-bound outcome that borders on mathematical impossibility under current market mechanics.

At that level, with a circulating supply of 420.69 trillion tokens, PEPE’s market capitalization would soar to roughly $420.69 billion, requiring it to command 7%–8% of the entire global crypto market (assuming a total capitalization near $6 trillion during a strong bull phase).

Such dominance would mean a meme coin with no intrinsic yield, governance, or DeFi utility surpassing the combined value of many layer-1 ecosystems, including Solana, Avalanche, and Cardano.

For context:

- Dogecoin’s 2021 peak reached about $90 billion, fueled by Elon Musk’s influence and historic retail inflow; yet that still falls ~80% below what PEPE would need to touch $0.001.

- Shiba Inu’s 2021 top was roughly $40 billion, even with aggressive burns and widespread exchange listings.

In short, to justify a $0.001 valuation, PEPE would require:

- A paradigm shift in meme-asset perception (memes viewed as “cultural stores of value”).

- Massive global liquidity rotation from productive assets into non-yielding memes.

- Sustained speculative demand outpacing any rational valuation model.

Without these structural transformations, $0.001 remains a theoretical ceiling; an aspirational narrative rather than a credible price target.

Factors That Drive PEPE’s Price

Social Media & Market Sentiment Hype Dominates Pepe Price Trends. Image via Shutterstock

Social Media & Market Sentiment Hype Dominates Pepe Price Trends. Image via ShutterstockPepe’s price dynamics are defined less by fundamentals and more by behavioral liquidity loops, feedback cycles driven by retail sentiment, meme culture, and short-term trading flows. Each price movement ties back to the same structural variables: community engagement, the overall market liquidity, and exchange depth.

Community & Social Media Momentum

PEPE thrives on cultural energy. Mentions across X (formerly Twitter), Reddit, and Telegram correlate directly with intraday volatility.

- Social Dominance: Data from LunarCrush shows PEPE’s social mentions spiking during meme rotations, particularly during burn events or influencer tweets.

- Engagement Loops: Increased social chatter leads to retail inflows, raising price and in turn boosting online visibility. This reflexive cycle sustains short-term rallies but fades rapidly when attention shifts. The 2023 and mid-2024 rallies both began with viral Twitter trends that coincided with a surge in wallet activity and CEX volumes.

Sentiments of the community remain the single most consistent driver of PEPE’s volatility.

Broader Market Cycles

PEPE’s liquidity patterns loosely follow Bitcoin’s market cycles but with much higher volatility and short-lived trends. Analysis shows that when Bitcoin experiences significant rallies, as in early and mid-2025, PEPE can see amplified but temporary surges driven by speculative sentiment and meme hype rather than strictly macroeconomic factors. However, the statistical correlation between PEPE and Bitcoin remains weak, and PEPE’s price is far more susceptible to sharp corrections, often diverging from Bitcoin after initial rallies.

- Volatility and Momentum: PEPE often outperforms during short-lived Bitcoin bull phases but then suffers sharper and more frequent corrections, making its price trajectory highly unpredictable.

- Liquidity Compression: Bearish periods in the crypto market see huge PEPE volume declines, but available data shows instead, daily volumes fluctuate with broader market sentiment and speculative activity.

Trading Volume & Listings

Liquidity distribution dictates survivability.

- Exchange Coverage: PEPE is listed across all major centralized platforms: Binance, OKX, Bybit, Bitget, and KuCoin, and trades actively on Uniswap V3 and Curve.

- Volume Patterns: Average daily turnover exceeds $500 million, with about 70% of liquidity concentrated on Binance and OKX pairs.

- Spread Dynamics: The presence of perpetual futures markets amplifies both price discovery and volatility.

- Listing Effects: Historical spikes (e.g., Binance listing in May 2023, Coinbase tracking announcement in mid-2024) produced 30–80% short-term rallies as access expanded.

Sustained growth depends on maintaining high-quality liquidity, not just retail order flow. If tier-1 exchanges sustain deep order books, PEPE can remain structurally tradeable regardless of price stagnation.

Check out the best memecoin exchanges.

Risks & Challenges

High Volatility, Low Utility, Manipulative Whales: Memecoin Fears. Image via Freepik

High Volatility, Low Utility, Manipulative Whales: Memecoin Fears. Image via FreepikDespite its visibility and community scale, PEPE operates under structural and behavioral risks that limit its long-term stability. These risks are tied to market reflexivity, regulatory uncertainty, liquidity fragility, and lack of intrinsic value creation. Together, these factors make it a high-volatility asset class.

- Extreme price swings: The token is infamous for its volatility, with the price prone to dramatic spikes and equally sharp crashes. For instance, a recent downturn saw PEPE lose a significant portion of its value.

- Reflexive drawdowns: This risk is evident in PEPE's history, with analysts noting a recurring pattern of large-percentage drawdowns (historically averaging around 64%) after reaching new price highs. These corrections happen when momentum fades, leading to a self-reinforcing downward spiral as holders exit their positions.

- High market saturation: The meme coin market is crowded with many competitors, including established players like Dogecoin (DOGE) and Shiba Inu (SHIB). This makes it challenging for PEPE to maintain investor attention over the long term, especially without a distinct utility.

- Fading hype: For PEPE to have long-term success, its cultural relevance and community engagement must be sustained. This is a significant challenge, as internet trends and popular memes can be fleeting.

- "Whale" influence: Large holders of PEPE tokens, known as "whales," have the ability to significantly influence the market. Their buying or selling activity can cause sudden price movements that inexperienced retail investors may not anticipate, leading to losses.

- No intrinsic value: PEPE was created as an entertaining meme token with no inherent utility or intrinsic value, as its creators have openly stated. Its value is based entirely on market demand and social factors, not on technological innovation.

- Poor scalability: As an ERC-20 token built on the Ethereum L1 (Layer 1 protocol), PEPE transactions can be slower and more expensive due to network congestion, especially when compared to dedicated L2 solutions designed for scalability.

It is always more effective to prevent losses in the crypto market by proactively following risk management strategies than to react to them.

PEPE Long-Term Potential

Is Pepe Anything Beyond the Meme? Image via Shutterstock

Is Pepe Anything Beyond the Meme? Image via ShutterstockPEPE's long game depends on converting attention into repeatable on-chain activity. That requires new demand sinks, not more trading pairs.

What would need to change:

- Utility modules: payment plugins, tipping rails, loyalty points, mini-games that consume PEPE.

- Partner distribution: brand tie-ins that lock PEPE for perks or merch access.

- Creator economy hooks: revenue shares or ad credits funded in PEPE.

- Programmable burns: fee-based burns tied to usage rather than one-off events.

But even for this to be achieved few measurable signals must be watched:

- Active addresses sustained >150k weekly for 8–12 weeks.

- On-chain transfer volume is rising with a stable median transfer size. Not just whale bursts.

- DEX+CEX depth at 1% price impact above $10m combined. Reduces slippage and panic exits.

- The holder distribution is improving. Top-100 share trending down toward 12–14%.

- Recurring sinks: protocol fees burned per month and the percentage of supply affected.

- Dev traction: commits, new contracts deployed, third-party integrations per quarter.

Plausible growth paths

- Payments niche: meme-native tipping across social apps with auto-convert at checkout. Needs SDKs and low-friction wallets.

- Gaming loop: PEPE as in-game currency with craft sinks, tournament fees, and seasonal burns.

- Brand fandom: limited drops that require time-locked PEPE or staking for access.

- L2 migration for scale: cheaper transfers to support micro-use cases. Must avoid fragmenting liquidity.

What likely won’t move the needle

- One-off burns with no fee engine.

- New listings without deeper order books.

- Roadmaps without shipped contracts and usage.

Long-term potential exists only if PEPE adds real sinks and recurring demand. Without that, price will continue to track liquidity cycles and social buzz.

Pepe Price Predictions: Yearly Tables

| Year | Minimum Price | Average Price | Maximum Price | Implied Market Cap at Max |

|---|---|---|---|---|

| 2025 | $0.000000459 | $0.000000514 | $0.000000659 | $277 M |

| 2026 | $0.00000053 | $0.0000110 | $0.0000180 | $7.6 B |

| 2027 | $0.0000080 | $0.0000096 | $0.0000121 | $5.1 B |

| 2028 | $0.0000066 | $0.0000070 | $0.0000093 | $3.9 B |

| 2029 | $0.0000089 | $0.0000113 | $0.0000134 | $5.6 B |

| 2030 | $0.0000148 | $0.0000175 | $0.0000280 | $11.8 B |

Forecasts: CoinCodex, retrieved Oct. 17, 2025. Not financial advice; models can be wrong and may change.