Cryptocurrency wallets are an essential tool for anyone venturing into the world of digital assets. Think of them as the gateway to your crypto holdings—a place to store, send, and receive your coins securely. But unlike a traditional wallet, crypto wallets come in various forms, each designed to meet different needs. Choosing the right type of wallet can significantly impact how you manage and secure your assets.

There are two types of wallets: custodial and non-custodial. Custodial wallets are managed by third parties like exchanges, offering simplicity and convenience at the cost of control. On the other hand, non-custodial wallets empower users to fully manage their private keys but come with greater responsibilities.

In this guide on custodial vs. non-custodial wallets, we will break down the differences, explore their advantages and disadvantages, and provide recommendations to help you decide which wallet type best suits your needs.

What Are Custodial Wallets?

When you step into the world of crypto, the first big question is usually about wallets. A crypto wallet isn’t your typical leather pouch for cash—it's more like your personal key to access and manage your digital assets. But did you know there are different types of wallets?

Let’s start with custodial wallets.

A Custodial Wallet is One Where a Centralized Service Manages Your Keys. Image via Shutterstock

A Custodial Wallet is One Where a Centralized Service Manages Your Keys. Image via ShutterstockDefinition

A custodial wallet is a type of cryptocurrency wallet where a third party, usually a centralized service like an exchange or wallet provider, manages your private keys. Think of it like using a bank for your money. You deposit your funds, but the bank holds the keys to your account. Similarly, custodial wallets mean you’re entrusting your crypto assets to someone else’s care.

This setup often appeals to beginners because it takes away the pressure of managing complex technical stuff like private keys or recovery phrases. But with this convenience comes a trade-off—you’re not fully in control of your assets.

Features

Why do custodial wallets remain so popular, especially with beginners? Let’s break it down:

- Convenience and Ease of Use: Custodial wallets are often integrated into exchanges or mobile apps, making it super easy to manage your crypto. Everything from sending Bitcoin to buying Ethereum is just a few clicks away. No need to fiddle with complex setups.

- Backup and Recovery Support: Lost your password? No problem! Custodial wallet providers typically have processes in place to recover your account, which is a godsend if you’re new and prone to the occasional slip-up.

- Integrated Services: Many custodial wallets come packed with additional features like staking, trading, or even earning interest on your holdings. It’s like having a one-window solution for crypto management.

While custodial wallets make life easy, remember—you’re trusting someone else with your assets. It’s a bit like leaving your valuables in a hotel safe. It’s secure, but not entirely under your control.

What Are Non-Custodial Wallets?

We repeat the famous saying again and again: “Not your keys, not your coins.” This is where non-custodial wallets come into play. For those who prefer taking the reins and being fully in control of their digital assets, non-custodial wallets are the go-to choice. They strip away the middleman, giving you complete autonomy over your crypto. Let’s dive deeper to understand what makes them so unique.

Definition

A non-custodial wallet is a type of crypto wallet where you, and only you, have access to your private keys. In simpler terms, it’s like being your own bank. Instead of handing over your keys to a third-party service, you keep them safe yourself. This means no one else—not an exchange, a platform, or a provider—can access or control your funds.

While this sounds like a dream for freedom lovers, it comes with a catch. You’re solely responsible for the security of your wallet. If you lose your private keys or seed phrase, there’s no customer support to bail you out. But for many, the sense of control and independence is worth the extra responsibility.

Examples

Non-custodial wallets are a hot favorite among crypto enthusiasts who value privacy and autonomy. Let’s look at some of the most popular options:

- MetaMask: A browser-based wallet that’s incredibly popular in the DeFi and NFT space. MetaMask makes it easy to interact with decentralized applications (DApps) while keeping control of your keys.

- Coinbase Wallet: Unlike the custodial Coinbase exchange wallet, Coinbase Wallet is a non-custodial option that allows users to manage their private keys.

- Plus Wallet: A robust multi-chain wallet that supports Bitcoin, Ethereum, Binance Coin, and Solana. It offers strong encryption and local private key storage, ensuring users have full control over their funds while maintaining cross-chain flexibility.

- Phantom Wallet: Tailored for the Solana ecosystem, Phantom Wallet is a sleek and intuitive option for managing Solana-based assets. It provides easy access to Solana’s DeFi platforms and NFT marketplaces, making it ideal for Solana users.

These wallets cater to a range of user needs, from beginners dipping their toes into crypto to seasoned investors diving deep into DeFi.

Features

What makes non-custodial wallets stand out in the crowded world of crypto management? Let’s explore the highlights:

- Complete Control and Ownership: With non-custodial wallets, you’re in charge. You hold the private keys, which means you’re the only one who can access your funds. No middlemen, no permissions—just pure autonomy.

- Enhanced Privacy: Non-custodial wallets don’t require you to share personal information or comply with KYC (Know Your Customer) regulations. This makes them ideal for those who prioritize anonymity and privacy.

- Access to DeFi Platforms: Want to explore the world of decentralized finance (DeFi)? Non-custodial wallets are your gateway. They let you interact with DApps, stake your assets, and trade on decentralized exchanges (DEXs) without any centralized barriers.

Key Differences Between Custodial and Non-Custodial Wallets

When choosing between custodial and non-custodial wallets, it all boils down to your priorities—convenience, security, control, or a mix of all three. While both wallet types serve the purpose of managing your crypto assets, they approach the task in fundamentally different ways. Here’s a breakdown of the key differences to help you make an informed decision.

Choosing Between Custodial and Non-Custodial Wallets Comes Down to Your Priorities. Image via Shutterstock

Choosing Between Custodial and Non-Custodial Wallets Comes Down to Your Priorities. Image via ShutterstockOwnership of Private Keys

The biggest distinction lies in who holds the private keys. Think of private keys as the password to your crypto fortune.

- In a custodial wallet, the private keys are held by a third party—typically a platform like an exchange or wallet service. This means you’re entrusting them with the ability to access and manage your funds. It’s a lot like storing your cash in a bank.

- With a non-custodial wallet, the private keys are entirely yours. You’re the gatekeeper of your crypto assets. There’s no intermediary, and no one can access your funds without your keys, giving you true ownership.

Security

Security is another area where custodial and non-custodial wallets differ significantly.

- Custodial Wallet Risks: When a third party holds your private keys, you’re vulnerable to their security measures. If their platform is hacked or they face an internal breach, your funds could be at risk. High-profile exchange hacks in the past, like the infamous Mt. Gox incident, are a grim reminder of this risk.

- Non-Custodial Wallet Challenges: On the flip side, non-custodial wallets are secure from external hacks tied to a centralized service because only you control your keys. However, the responsibility of keeping those keys safe rests entirely on you. If you lose your private keys or seed phrase, there’s no recovery option.

Essentially, custodial wallets trade some control for ease, while non-custodial wallets demand self-reliance for maximum security.

User Responsibility

Another major difference is how much responsibility the user has to take on.

- With custodial wallets, user responsibility is minimal. Forgot your password? No worries, the provider probably has a recovery mechanism in place. Customer support is there to help you navigate mishaps.

- Non-custodial wallets, on the other hand, require users to be highly diligent. You must securely store your seed phrase—a unique set of words that act as a backup to your wallet. Lose it, and your funds are gone forever. There’s no helpline or email recovery option.

This makes custodial wallets appealing to beginners who prefer a safety net, while non-custodial wallets are better suited to seasoned users ready to shoulder the extra accountability.

Accessibility

The ease of accessing and managing funds also differs between these wallet types.

- Custodial Wallets: Known for their user-friendly interfaces, custodial wallets are designed to be as accessible as possible. Most services come with polished apps or web platforms that simplify tasks like buying, trading, and transferring crypto.

- Non-Custodial Wallets: These require a bit more effort to set up and navigate. They often appeal to crypto enthusiasts who are comfortable with advanced tools and need features like DApp integration or DeFi access. For beginners, the steeper learning curve can be a deterrent.

Ultimately, custodial wallets prioritize simplicity, while non-custodial wallets offer more features at the cost of added complexity.

Advantages of Custodial Wallets

Custodial wallets are often the first stop for crypto newcomers, and it’s easy to see why. These wallets simplify the crypto experience by handling the more technical aspects for you. From user-friendly designs to safety nets like password recovery, custodial wallets provide plenty of perks that make managing digital assets less intimidating.

User-Friendly Interface

One of the biggest advantages of custodial wallets is their intuitive and accessible design. Most custodial wallets are built with beginners in mind, offering sleek interfaces that make tasks like buying, sending, or receiving crypto feel as simple as managing an online bank account. Whether it’s an app or a web-based wallet, everything is streamlined, removing the need to tackle the complexities of blockchain technology.

Built-In Customer Support

Let’s face it: mistakes happen, especially when you’re new to crypto. Custodial wallets have your back with robust customer support systems. Forgot your password? No problem! Many services offer recovery options, so you don’t lose access to your funds. This layer of support can be a lifesaver for users who aren’t ready to take full control of their wallets.

Integrated Trading and Staking Options

Custodial wallets often come with added functionalities that go beyond just storing your crypto. You can trade directly within the wallet, stake your assets to earn rewards, or even participate in yield farming on select platforms. This all-in-one convenience saves you from having to navigate between multiple platforms, making it a favorite choice for active traders and investors.

No Need to Manage Private Keys

Managing private keys can be daunting, especially if you’re not tech-savvy. Custodial wallets eliminate this stress by taking care of private key management for you. With the keys securely stored by the provider, you can focus on using your wallet without worrying about losing access or accidentally exposing your funds to risk.

Disadvantages of Custodial Wallets

While custodial wallets offer convenience and ease of use, they come with notable drawbacks that could be dealbreakers for some users. By handing over control of your private keys to a third party, you introduce certain risks that are worth considering. Let’s break down the main disadvantages.

Custodial Wallets Are Suited to Beginners. Image via Shutterstock

Custodial Wallets Are Suited to Beginners. Image via ShutterstockLack of Control Over Private Keys

When using a custodial wallet, you’re entrusting your private keys—and therefore your crypto assets—to a third party. This setup effectively places control of your funds in someone else’s hands. If the service experiences downtime, makes changes to its policies, or decides to restrict access, your ability to manage your assets is directly impacted. For users who value true ownership and independence, this is a significant limitation.

Higher Risk of Hacks and Platform Failures

Centralized custodians are prime targets for hackers due to the large amount of crypto they manage. Over the years, there have been numerous cases of exchange hacks leading to massive losses, such as the Mt. Gox breach or more recent attacks on other platforms. Additionally, if the wallet provider faces financial instability or operational failures, there’s a risk of losing your funds altogether. While reputable providers work hard to minimize these risks, the possibility of such events can’t be entirely eliminated.

Potential Compliance with Government Regulations

Because custodial wallet providers are centralized services, they are often required to comply with government regulations, including Know Your Customer (KYC) and Anti-Money Laundering (AML) laws. This means users need to provide personal information to use these wallets, which compromises privacy. Moreover, in some cases, governments might enforce restrictions or freeze accounts, which could limit your access to funds without warning.

Choosing Between Custodial and Non-Custodial Wallets

The decision between a custodial and non-custodial wallet depends on your individual needs, experience level, and priorities. Are you a beginner looking for simplicity, or are you a seasoned crypto enthusiast who values control and privacy? Let’s explore what works best for different users and the key factors to consider.

For Beginners: Custodial Wallets for Ease of Use

If you’re new to the world of crypto, a custodial wallet is likely your best starting point. These wallets are designed to simplify the complexities of managing digital assets. They offer user-friendly interfaces and integrated features like trading, staking, and password recovery.

With custodial wallets, there’s no need to worry about private key management or securely storing seed phrases. Services like Coinbase or Binance act as your safety net, ensuring you can recover your wallet even if you lose access. Plus, with customer support readily available, you’ll have guidance whenever you face issues.

However, keep in mind that custodial wallets come with trade-offs, such as limited control over your funds and potential privacy compromises. Still, for beginners who value ease of use and a gentle learning curve, custodial wallets are a practical choice.

For Advanced Users: Non-Custodial Wallets for Control and Privacy

If you’re comfortable navigating the crypto space and want full ownership of your assets, non-custodial wallets are the way to go. These wallets let you hold your private keys, granting you complete control over your funds without relying on any third party.

Non-custodial options like MetaMask or Trust Wallet are ideal for users who prioritize privacy and autonomy. These wallets allow you to interact directly with decentralized finance (DeFi) platforms and DApps, giving you access to the full potential of blockchain technology. However, with great power comes great responsibility—you’ll need to carefully manage your private keys and seed phrases to avoid losing access permanently.

For seasoned users, the freedom and security of non-custodial wallets often outweigh the added responsibility.

Factors to Consider

When choosing between custodial and non-custodial wallets, ask yourself the following:

- Trading Frequency: Are you an active trader who values integrated exchange features? Custodial wallets might suit you better.

- Security Preferences: Do you trust a third party to safeguard your keys, or would you rather take full control?

- DeFi Access: Are you interested in exploring DeFi and decentralized applications? Non-custodial wallets are your gateway.

By weighing these factors, you can select the wallet type that aligns with your goals and comfort level. There’s no one-size-fits-all answer—only the wallet that fits your journey best!

Best Custodial Wallets in 2025

When selecting a custodial wallet, it's essential to consider factors like security measures, fee structures, and the range of supported cryptocurrencies. Here are some of the top custodial wallet providers in 2025:

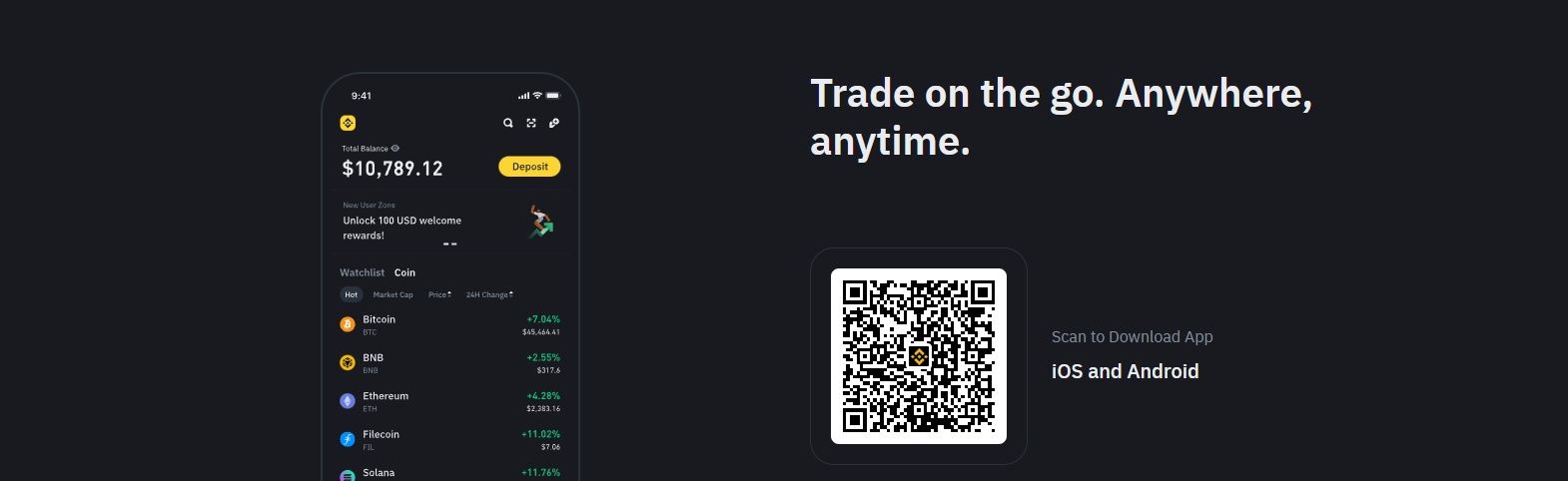

Binance

Binance Offers an Integrated Wallet that Supports a Vast Array of Cryptocurrencies. Image via Binance

Binance Offers an Integrated Wallet that Supports a Vast Array of Cryptocurrencies. Image via BinanceFeatures: Binance offers a comprehensive platform with an integrated wallet that supports a vast array of cryptocurrencies. Users can engage in spot trading, futures, staking, and lending services directly from their wallets.

Fees: Trading fees start at 0.10% per transaction. Users can receive discounts by holding Binance Coin (BNB), reducing fees to as low as 0.075% for makers and 0.024% for takers at higher VIP levels.

Security Measures: Binance employs advanced security protocols including two-factor authentication (2FA), withdrawal whitelists, and cold storage for the majority of user funds. They also maintain a Secure Asset Fund for Users (SAFU) to protect a portion of user funds in extreme cases.

Crypto.com

Crypto.com Utilizes Hardware Security Modules and Multi-Signature Technologies. Image via Crypto.com

Crypto.com Utilizes Hardware Security Modules and Multi-Signature Technologies. Image via Crypto.comFeatures: Crypto.com’s wallet supports a wide range of cryptocurrencies and offers services like crypto credit cards, staking, and a DeFi wallet for users seeking more control.

Fees: Trading fees start at 0.10%, with potential discounts for users staking the platform's native token, CRO.

Security Measures: Crypto.com utilizes hardware security modules (HSM) and multi-signature technologies, along with 2FA and insurance coverage against physical damage or third-party theft.

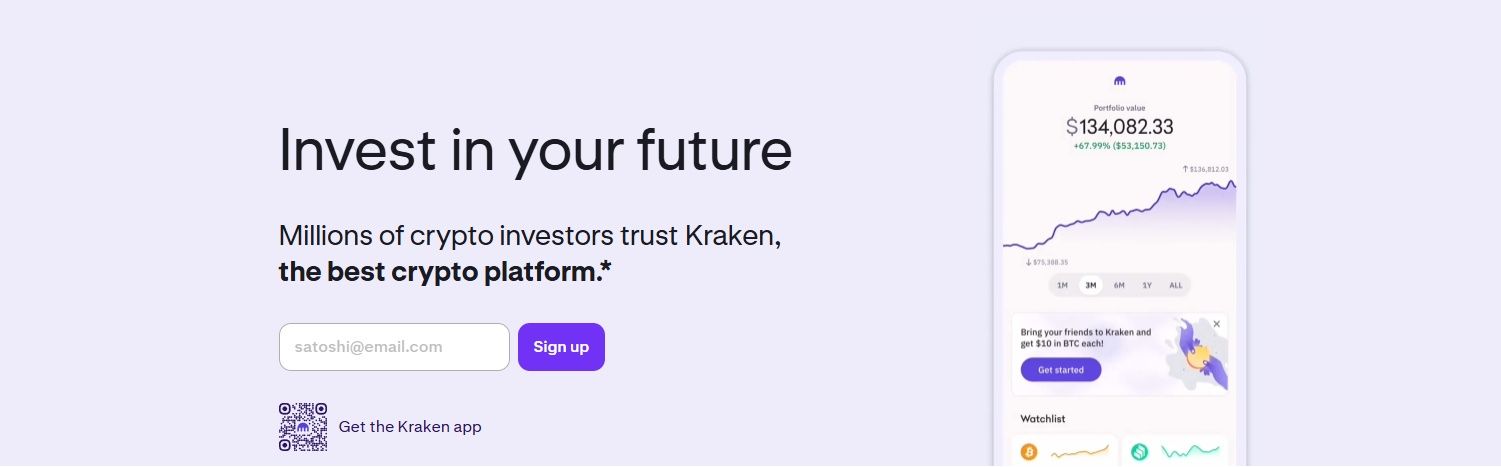

Kraken

Kraken keeps 95% of Deposits in Ooffline Cold Storage. Image via Kraken

Kraken keeps 95% of Deposits in Ooffline Cold Storage. Image via KrakenFeatures: Kraken's wallet integrates with its exchange, offering support for various cryptocurrencies along with futures trading, margin trading, and staking services.

Fees: Trading fees range from 0% to 0.26%, depending on the trading pair and 30-day trading volume.

Security Measures: Kraken keeps 95% of deposits in offline cold storage that is geographically distributed. They also offer 2FA and PGP/GPG encryption for email communication.

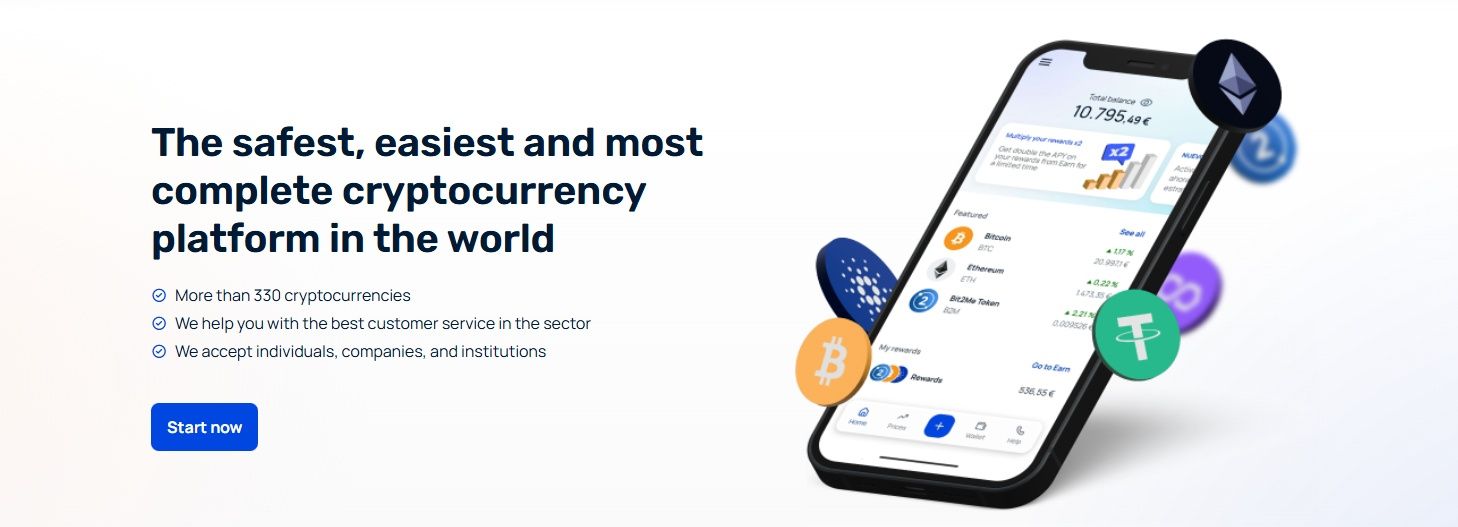

Bit2Me

Bit2Me Provides a Custodial Wallet Supporting Multiple Cryptocurrencies. Image via Bit2Me

Bit2Me Provides a Custodial Wallet Supporting Multiple Cryptocurrencies. Image via Bit2MeFeatures: Bit2Me provides a custodial wallet supporting multiple cryptocurrencies like Bitcoin, Ethereum, Cardano, Solana, and USDC. The platform features an easy-to-use interface similar to traditional banking apps.

Fees: Bit2Me's fee structure varies based on transaction type and volume; users are advised to check their official website for current fee information.

Security Measures: Bit2Me implements robust security protocols including cold storage solutions and two-factor authentication to ensure user fund safety.

Best Non-Custodial Wallets in 2025

As the cryptocurrency landscape continues to evolve, non-custodial wallets have become essential for users seeking greater control over their assets. Here are some of the top non-custodial wallet options for 2025, highlighting their features, usability, and supported blockchains:

Plus Wallet

Plus Wallet Combines Robust Security with Multi-Chain Access. Image via Plus Wallet

Plus Wallet Combines Robust Security with Multi-Chain Access. Image via Plus WalletFeatures: Plus Wallet combines robust security with multi-chain access, supporting cryptocurrencies like Bitcoin, Ethereum, Binance Coin, and Solana. It offers a seamless experience across iOS and Android devices.

Usability: The wallet features strong encryption and local private key storage, ensuring users retain full control over their funds. Its unified view allows users to manage all assets from one screen.

Supported Blockchains: Compatible with multiple networks including Ethereum, Binance Smart Chain, Solana, and more.

MetaMask

With a User-Friendly Interface, MetaMask Allows for Customizable Gas Fees and Private Key Control. Image via MetaMask

With a User-Friendly Interface, MetaMask Allows for Customizable Gas Fees and Private Key Control. Image via MetaMaskFeatures: MetaMask is a widely-used wallet primarily for Ethereum and ERC-20 tokens. It functions as both a browser extension and mobile app, facilitating easy access to decentralized applications (DApps).

Usability: Known for its user-friendly interface, it allows for customizable gas fees and private key control, making it suitable for both beginners and experienced users.

Supported Blockchains: Primarily supports Ethereum and all ERC-20 tokens.

Trezor Model T

Trezor Model T Offers Top-Tier Offline Security with a Color Touchscreen for Intuitive Navigation. Image via Trezor

Trezor Model T Offers Top-Tier Offline Security with a Color Touchscreen for Intuitive Navigation. Image via TrezorFeatures: This hardware wallet offers top-tier offline security with a color touchscreen for intuitive navigation. It supports a wide variety of cryptocurrencies.

Usability: Trezor Model T is designed for serious investors who prioritize security. Its open-source firmware ensures transparency and regular updates against emerging threats.

Supported Blockchains: Compatible with numerous cryptocurrencies including Bitcoin, Ethereum, Litecoin, and many others.

Coinbase Wallet

Coinbase Wallet Allows Users to Manage their Private Keys while Accessing DApps and NFTs. Image via Coinbase

Coinbase Wallet Allows Users to Manage their Private Keys while Accessing DApps and NFTs. Image via CoinbaseFeatures: As a non-custodial extension of the Coinbase ecosystem, Coinbase Wallet allows users to manage their private keys while accessing DApps and NFTs. This is distinct from Coinbase.com, which is a custodial service where the platform manages user funds.

Usability: It features an intuitive mobile app that caters to both new and seasoned users, providing easy integration with the Coinbase exchange while allowing full control over assets.

Supported Blockchains: Supports a wide range of cryptocurrencies including Bitcoin, Ethereum, and ERC-20 tokens.

Phantom Wallet

Phantom Wallet Provides Features for Managing Solana-based Tokens and NFTs. Image via Phantom wallet

Phantom Wallet Provides Features for Managing Solana-based Tokens and NFTs. Image via Phantom walletFeatures: Designed specifically for the Solana blockchain, Phantom wallet provides features for managing Solana-based tokens and NFTs.

Usability: Its user-friendly interface makes it easy to buy, send, receive, and store Solana assets while accessing various DApps.

Supported Blockchains: Exclusively supports the Solana blockchain.

Security Tips for Both Wallet Types

Whether you opt for a custodial or non-custodial wallet, securing your cryptocurrency should always be a top priority. While both wallet types have unique security considerations, there are best practices you can follow to safeguard your assets.

Custodial Wallets: Trust, But Verify

With custodial wallets, you’re relying on a third party to protect your funds. Here’s how to enhance security on your end:

- Choose Reputable Providers: Not all custodial wallets are created equal. Stick with well-known platforms like Binance, Coinbase, or Kraken that have a track record of strong security measures and customer trust. Research reviews, audits, and their responses to past security breaches before committing.

- Enable Two-Factor Authentication (2FA): Most custodial wallets support 2FA, which adds an extra layer of protection to your account. Even if someone steals your password, they won’t be able to access your funds without the second authentication step.

- Monitor Your Account Regularly: Keep an eye on your transactions and account activity. Enable notifications for logins and withdrawals to detect any unauthorized access immediately.

Non-Custodial Wallets: Your Keys, Your Responsibility

Non-custodial wallets give you full control of your assets, but this comes with a heavy dose of responsibility. Here’s how to keep your funds safe:

- Backup Your Seed Phrase Securely: Your seed phrase is your ultimate lifeline. Write it down on paper and store it in a safe location, away from prying eyes and environmental hazards. Avoid digital storage options like screenshots or cloud services, as they are vulnerable to hacks.

- Use Hardware Wallets for Long-Term Storage: For added security, consider hardware wallets like Ledger or Trezor. These devices keep your private keys offline, protecting them from malware and phishing attacks. They’re especially valuable for long-term holders.

- Stay Vigilant Against Scams: Be cautious of phishing attempts, malicious links, or fake wallet apps. Always double-check URLs and download wallet software directly from official websites.

By following these tips, you can significantly reduce the risks associated with both custodial and non-custodial wallets. The key is staying informed, proactive, and cautious—because in the crypto world, security is always in your hands.

Closing Thoughts

Choosing the right wallet is a critical step in your cryptocurrency journey. Custodial wallets are ideal for those who value convenience and simplicity, especially beginners who may not feel confident managing private keys. They offer integrated features, recovery options, and user-friendly interfaces but require you to trust a third party with your assets.

Non-custodial wallets, on the other hand, put the power and responsibility entirely in your hands. They are perfect for advanced users who prioritize security, privacy, and full control over their digital assets. With these wallets, you can access DeFi platforms, interact with DApps, and retain complete ownership of your funds—but only if you’re prepared to manage your private keys diligently.

Ultimately, the choice between custodial and non-custodial wallets depends on your goals, experience level, and how much control you’re comfortable taking on. By understanding the pros and cons of each type, you can confidently pick the option that aligns with your needs.