Traders use Bitget for futures, copy trading, low fees, and strong liquidity. But with growth comes questions about safety, regulation and reliability.

This guide breaks down Bitget’s security features, licenses, user experience, risks, and how it compares with competitors.

Bitget Safety Verdict

Bitget delivers one of the strongest security stacks among major global exchanges: live, verifiable Proof of Reserves, a 6,500 BTC protection fund, offline multi-sig cold storage, ISO 27001 certification, advanced on-chain monitoring, and growing regulatory coverage across multiple countries.

Cold storage

Majority of user assets in offline multi-signature cold wallets.

Protection Fund

6,500 BTC emergency reserve for extreme incidents or insolvency risk.

Proof of Reserves

Live transparency + monthly Merkle-tree reports. BTC 307%, ETH 224%, USDT 105%, USDC 129% (Oct 2025).

Licenses / registrations

AUSTRAC, OAM Italy, Poland VASP, El Salvador BSP/DASP, FCA partner model (UK), Bulgaria, Lithuania, Czech Republic, Georgia Free Zone, Argentina.

Note: Data current as of Feb. 3, 2026.

Overview of Bitget as a Platform

Bitget has grown from a small derivatives exchange into a global trading platform used by 120 million registered users across the globe as of Q2, according to the company’s 2025 transparency report.. The company focuses on transparency, competitive fees, and product innovation.

Background and Growth

Bitget was launched in 2018 during a challenging market cycle. The founding team came from traditional finance and entered crypto with a strong focus on user protection and long-term development. Early growth was driven by derivatives trading and a clear vision for a mobile-first experience.

Over the years, Bitget has expanded across more than 60 countries and built a global workforce of over 1,800 employees. It now serves more than 120 million users and regularly processes more than 20 billion USDT in daily trading volume.

Bitget also strengthened its reputation with monthly Proof of Reserves updates showing high reserve ratios, along with a large Protection Fund that acts as a safety buffer.

Today, Bitget is a major player in the global derivatives market.

For more information, check our full Bitget review.

Services Offered by Bitget

Bitget offers a wide range of trading and investment tools designed for different levels of experience. The platform combines active trading features with simple access to high-quality research tools and automated systems. Key services include:

- Spot trading with market, limit, stop limit, and OCO orders

- Futures trading with competitive fees and deep liquidity

- Margin trading for users who want additional exposure

- Copy trading with leaderboards, one-click follow, and risk caps

- Access to more than 666 coins and 760 trading pairs, according to CoinGecko

- TradingView charts with full technical analysis tools

- A mobile app with fast execution and real-time alerts

- Bitget PRO for high-volume users who need advanced tools

- AI-powered GetAgent for strategy ideas, alerts, and risk prompts

- RWA Index Perpetuals for exposure to tokenized real-world assets

- Fiat on and off ramps for supported regions

- Bitget Wallet for self-custody and MoonPay off-ramp support

On top of this, Bitget also offers an Earn program and a launchpad.

Security Features of Bitget

Bitget takes safeguarding user assets very seriously and provides a number of features in the domain. Let’s go through Bitget’s security features in detail.

Asset Protection Measures

Bitget stores most of its customers' funds offline in cold wallets, which are safeguarded by multi-signature access. Using cold storage to hold private keys on devices not connected to the internet allows the platform to minimize remote attack risk.

Bitget also maintains a Protection Fund of 6,500 BTC.

Additionally, Bitget maintains a Proof of Reserves portal, which is updated monthly, showing asset-liability ratios per asset class. The October ledger reports that Bitget holds about 10,275 BTC, 134,096 ETH, 1,773,939,676 USDT, and 108,484,792 USDC for users. The reserve ratios are strong. BTC sits at 307%, ETH is at 224%, USDT is at 105% and USDC is at 129%.

All assets are backed above a one-to-one level, showing that reserves are sufficient.

Withdrawal and Transaction Security

Bitget places great emphasis on safety protocols. It safeguards users’ data with manifold protections.

It starts with two-factor authentication, which is mandatory for logins and withdrawals on the platform. The platform verifies every new device on the platform via email or SMS confirmation.

Additionally, it allows users to create custom anti-phishing codes in official emails and whitelist wallet addresses to prevent unauthorized transfers.

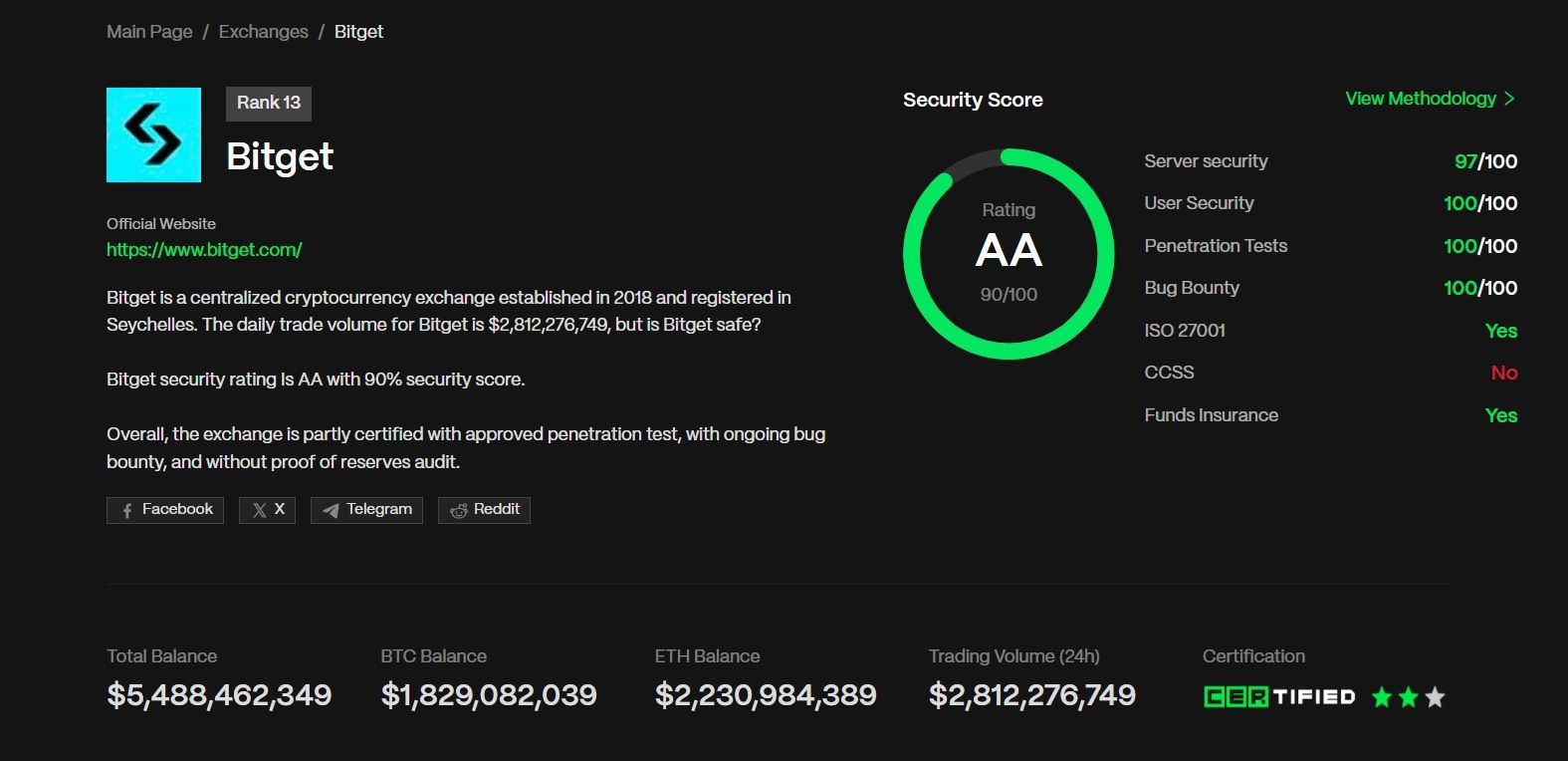

Bitget currently maintains an AA rating on CER.live, a third-party safety tracker, placing it in the top tier globally.

Bitget Is Among The Safest Crypto Exchanges. Image via CER.live

Bitget Is Among The Safest Crypto Exchanges. Image via CER.liveRisk Management Systems

Bitget uses a structured risk management framework designed to detect threats early, protect user assets, and ensure stable operations during market stress.

Monitoring

Elliptic's Blockchain Intelligence tools are integrated into Bitget’s infrastructure, enabling real-time transaction monitoring, multi-hop wallet screening and risk detection across multiple chains.

The exchange also has automated alerts for anomalous transfers and contract calls through its on-chain monitoring system

For futures and margin users, real-time risk ratio tracking and mark-price-based liquidation controls help to reduce exposure to extreme market moves.

Audits and certifications

Bitget achieved the International Organization for Standardization (ISO) 27001:2022 certification in August 2024, demonstrating its commitment to an Information Security Management System (ISMS) at an international standard.

In addition, monthly Proof of Reserves (PoR) reports, using a Merkle-tree structure, are published publicly so that users can independently verify that the exchange holds more than the liabilities.

Response protocols

As noted, Bitget maintains a large Protection Fund to cover user assets in extreme events such as security breaches or insolvency risks. It's worth noting that Bitget has never been hacked.

The platform also uses layered custody controls: private keys generated in isolated environments, multi-level transaction verification, device segregation, and pre-approved withdrawal addresses to limit unauthorized access

Incident response is structured to operate 24/7, including holidays and out-of-hours. Drills, privileged-access controls and real-time infrastructure monitoring form core parts of the response strategy.

Regulatory Compliance and Trustworthiness

Through the years, Bitget has increased its compliance by obtaining local registrations and partnerships across numerous regions.

Bitget Has Secured Licenses In a Number of Jurisdictions. Image via Bitget

Bitget Has Secured Licenses In a Number of Jurisdictions. Image via BitgetLicenses and Registrations

Bitget was incorporated in Seychelles and is registered in Georgia’s Tbilisi Free Zone. Bitget is not available in the US. In addition, UK users must visit the UK-specific website that only allows buying and selling.

As of Feb. 3, 2026, here's a list of countries Bitget isn't available in, according to its terms of service:

| Crimea | Donetsk | Luhansk | Cuba | Hong Kong |

| Iran | North Korea | Singapore | Sudan | United States |

| Puerto Rico | Guam | U.S. Virgin Islands | American Samoa | Northern Mariana Islands |

| Baker Island | Howland Island | Jarvis Island | Johnston Atoll | Kingman Reef |

| Midway Islands | Navassa Island | Palmyra Atoll | Wake Island | Iraq |

| Libya | Yemen | Afghanistan | Central African Republic | Democratic Republic of the Congo |

| Guinea Bissau | Haiti | Lebanon | Somalia | South Sudan |

In July 2025, the Financial and Consumer Affairs Authority of Saskatchewan issued a notice stating that Bitget was not registered to trade or advise in securities or derivatives in the province.

Here's a table showing the regulatory licenses/approvals Bitget has received as of Feb. 3, 2026.

| Jurisdiction | Licenses / Approvals | Regulator |

|---|---|---|

| Australia | Digital currency exchange provider registration | Australian Transaction Reports and Analysis Centre (AUSTRAC) |

| Italy | AML registration as provider of virtual currency services | Organismo degli Agenti e dei Mediatori (OAM) |

| Poland | Virtual asset service provider | Ministry of Finance, Poland |

| El Salvador | Bitcoin Service Provider (BSP) Digital Asset Service Provider (DASP) | BSP: Central Reserve Bank (Banco Central de Reserva, BCR) DASP: National Commission of Digital Assets (Comisión Nacional de Activos Digitales, CNAD) |

| United Kingdom | FCA approved platform partnering with an Authorized Person under Section 21 of the Financial Services and Markets Act 2000 | Financial Conduct Authority (FCA) |

| Bulgaria | Virtual asset service provider | National Revenue Agency, Bulgaria |

| Lithuania | Virtual asset service provider | Centre of Registers, Lithuania |

| Czech Republic | Virtual asset service provider | Czech National Bank |

| Georgia (Tbilisi Free Zone) | Digital asset exchange, wallet service, and custody service provider | National Bank of Georgia |

| Argentina | Virtual asset service provider | Comisión Nacional de Valores (CNV) |

Transparency and Audits

The platform’s transparency mainly relies on its proof-of-reserve reports and visible on-chain wallets. And as we have already established, Bitget also holds an AA rating on CER.live, demonstrating strong transparency and security standards.

On Bitget, users have the option to self-verify balances by matching their account hash within Bitget’s Merkle tree, allowing traders to verify without exposing personal data.

However, no independent audit of Bitget Holdings has been published to date.

User Experience and Customer Support

Bitget aims to provide a smooth trading experience on both web and mobile. The platform is built for fast order execution, strong liquidity, and clear navigation. This section looks at how reliable the exchange is during heavy activity and how users feel about its support team.

Reliability of the Platform

Bitget scores well on pure app experience, but user sentiment is split across review sites. On Capterra, it holds an overall rating of 4.2 out of 5, with 4.3 for ease of use, 4.1 for features, and 3.8 for customer service. Users often praise the smooth trading flow, copy trading tools, and simple interface.

Trustpilot tells a different story. Bitget has a “Poor” label with a TrustScore of 2.5 out of 5 from around 2,200 reviews, with almost half of all reviews at one star. Many recent comments highlight frustration with liquidations during outages, delayed withdrawals, frozen accounts, and disputes over promo rewards or refunds.

Uptime and speed

In normal conditions, most Capterra reviewers describe Bitget as fast, stable, and easy to use for daily trading. They like the clean interface and say the app feels smooth even with frequent use. A smaller group notes that the app can feel slow at times, especially during heavy markets or when many features load on one screen.

Observed issues

Trustpilot reviews highlight recurring pain points. Users complain about app outages during sharp market moves, auto margin or liquidation behaviour they see as unfair, and long lockouts when KYC or compliance checks are triggered. Others report slow or generic responses when they chase support for missing deposits, frozen assets, or event rewards.

Customer Support Quality

Support quality at Bitget draws both praise and serious criticism. On Capterra, Bitget’s customer service category is rated 3.8 out of 5, indicating moderate satisfaction among users. On Trustpilot, the picture is much less favourable: Bitget holds a TrustScore of 2.5 out of 5, with roughly 48% of reviews at one star, indicating deep dissatisfaction among a large subset of users.

Channels

- Live chat (in-app)

- Email support

- Help centre and knowledge base

User reports

- Positive experiences: Some users on Capterra noted prompt response times and efficient resolution for simple queries like password resets or new account support.

- Negative experiences: Many Trustpilot users report delays of days or weeks, receive templated responses, or claim they cannot reach a human agent at all. Issues frequently mentioned include locked accounts, withdrawal delays, and unclarified liquidations.

Risks of Using Bitget

Bitget offers strong tools for active traders, but like any exchange, it carries risks that users should understand before committing funds. These risks relate to markets, regulation, operations, and the platform’s most popular feature: copy trading. Below is a clear overview based on public information and user-reported experiences.

Market Risk

Bitget is heavily used for perpetual futures and high-leverage trading. High leverage magnifies both gains and losses. When volatility spikes, even small price movements can trigger liquidations within seconds, especially for users running 50x to 125x positions. Reviews on both Capterra and Trustpilot show several users reporting heavy losses during sudden market drops and outages, often tied to leverage or rapid price swings. This type of loss is not unique to Bitget but is a structural risk of derivatives trading.

Regulatory Risk

Bitget operates globally but does not have full licensing coverage in every region. Users in parts of North America, including the Government of Saskatchewan, have issued public alerts warning residents to use caution when dealing with the platform due to its registration status. Limited regulatory recourse means that users in restricted jurisdictions may have fewer protections in disputes, frozen accounts, or service failures. Bitget also restricts service in several countries, including the U.K., which can affect access if local rules change suddenly.

Operational Risk

User-reported issues on Trustpilot show a pattern of operational complaints. These range from frozen accounts and unresponsive tickets to delays with deposits, withdrawals, or KYC reviews. Some users describe outages during fast market moves that prevented them from managing positions, leading to liquidations. Others highlight problems with P2P traders, such as disputes, slow confirmations, or mismatched pricing. While many users report smooth daily trading, the negative reviews show that operational failures can have significant financial consequences.

Copy Trading Risk

Copy trading is one of Bitget’s signature features, but it carries its own risks. Followers may copy traders who look profitable on leaderboards but use high-risk strategies such as martingale sizing, high leverage, or frequent averaging down. Strategy blow-ups can wipe out follower accounts quickly and with little warning. Slippage can also be significant during fast markets, meaning followers may enter much worse prices than the original trader. Beginners who rely too heavily on copy trading without risk caps or stop settings face a high chance of amplified losses.

Is Bitget Safe Compared to Other Exchanges

Here’s a snapshot of Bitget’s comparison with other prominent exchanges. Let’s take a look.

| Exchange | CER Security Rating | PoR Coverage | Protection Fund | Top-Tier Licence | Complaints Trend |

|---|---|---|---|---|---|

| Bitget | AA | Live PoR dashboard; 254% for BTC (Jan. 2026) | 6,500 BTC fund | Limited global licences, expansion ongoing | Mixed: many complaints about withdrawals & frozen accounts |

| Binance | AA | Live PoR data; 100.06% for BTC as of Jan. 2026 | SAFU Fund (amount varies) | Broad licences globally, but regulatory issues present | High volume of complaints especially in restricted jurisdictions |

| Bybit | AA | Monthly PoR: BTC Reserve Ratio at 105% (Jan. 2026) | Insurance fund (amount varies) | Major derivatives licences; limited in US/Canada/Singapore | Reports of account freezes & withdrawal delays |

| KuCoin | AAA | Live PoR data; 108%% BTC reserve ratio (Jan. 2026) | Insurance fund exists (specific size not always public) | No full US licence; global reach but regulatory caution remains | Some complaints from past hack (2020) but improved transparency |

| Kraken | AAA | PoR snapshot Sept 30 2025: BTC 100.4% | No protection fund | Deep regulatory licences in US/EU/etc | Complaints fewer; known for strong compliance and support |

Final Verdict: Should You Trade on Bitget in 2026

Bitget is a strong choice for experienced traders who want low fees, high leverage, a polished mobile app, and powerful copy-trading tools. It is best suited for users who understand derivatives, manage risk carefully, and value transparency features like PoR and a large Protection Fund.

It is less ideal for complete beginners, users who need institutional-grade regulation and guaranteed recourse, or anyone uncomfortable with the possibility of delays or outages during extreme market conditions.

If you approach Bitget with proper risk management, understand its strengths, and stay aware of its limitations, it can be a highly competitive platform for active crypto trading.

Also Read

- Bitget Exchange Fees

- Bitget Trading Guide

- Best Bitget Alternatives

- How to Buy Bitcoin on Bitget

- How to Sign Up on Bitget