Crypto mining has come a long way from the early days when hobbyists could run a laptop and earn rewards in the background. As networks grew, mining shifted from CPUs to GPUs, and for Bitcoin it eventually became an ASIC-driven industry where specialized machines compete on efficiency.

Today, Bitcoin mining is less a geeky side project and more a power-and-hardware business: margins move with electricity prices, network difficulty, and Bitcoin’s price, while transaction fees can add a volatile “tip” on top of the block reward. This guide breaks down what that means in 2026 without hype and with clear examples.

Editor's note: We fully updated this guide in February 2026 to reflect the post-halving reality of Bitcoin mining. The refresh adds a clearer “quick answer” verdict with electricity-price breakpoints, updated network stats and assumptions (price, hashrate, difficulty, and the 3.125 BTC block subsidy), and a simple profitability calculator you can copy and fill in. We also rebuilt the profitability section with real, scenario-based examples, expanded the hardware comparison to focus on efficiency (J/TH) over headline hashrate, and strengthened the risk and due-diligence sections around hosting/cloud contracts and scam red flags.

Quick Answer: Can You Still Make Money Mining Bitcoin in 2026?

Yes, Bitcoin mining can still be profitable in 2026, but only if your operating costs are low and your hardware is efficient. After the 2024 halving cut the block subsidy to 3.125 BTC per block, margins tightened. The gap between cheap power + modern ASIC and everything else widened significantly.

The 20-Second Verdict

YES, but only under the right conditions. For most retail setups, this is now a margin game, not a gold rush.

- ✅ Electricity under $0.03/kWh: Strong setup, competitive edge.

- ⚖️ $0.03–$0.06/kWh: Marginal to workable, only with top-tier efficiency.

- ❌ Above $0.08–$0.10/kWh: Unlikely to be profitable long term.

- ✅ Latest-gen ASIC efficiency (low J/TH) matters more than “hashrate bragging rights.”

- ✅ Pool mining is the default. Solo mining is lottery-tier unless you control serious hashrate.

- ⏳ ROI expectation: Think 18–36 months in strong conditions, often longer. Not weeks.

Reality Check

- Mining revenue moves with BTC price and difficulty.

- Your power bill does not.

- Small efficiency differences compound over years.

- Bad months are part of the model, not an exception.

Quick Profitability Checklist (Self-Score Before You Buy)

- ⬜ My all-in electricity rate (energy + delivery + taxes) is under $0.06/kWh.

- ⬜ I am using a modern ASIC under ~15 J/TH (or close to it).

- ⬜ I have space that can handle heat and “shop-vac loud” noise.

- ⬜ I can afford the upfront hardware cost without financial strain.

- ⬜ My time horizon is measured in years, not months.

- ⬜ I’ve checked local rules, wiring capacity, and any taxes or restrictions.

If you’re missing more than two boxes, pause and reconsider before purchasing hardware.

Quick Decision Tree

- If power > $0.10/kWh → Don’t mine. Consider buying BTC directly instead.

- If power is $0.06–$0.10/kWh → Only consider mining with top efficiency gear at a deep discount.

- If power is $0.03–$0.06/kWh → Mining can work, but run the calculator and model difficulty drift.

- If power < $0.03/kWh → Competitive edge. Proceed to detailed profitability modeling.

Bitcoin Mining Explained

Bitcoin mining is the process that adds new blocks to the blockchain and helps keep the network honest. Miners do this by performing repeated computations until they find a valid block. Think of it like millions of lottery tickets per second, where the network controls how hard it is to win.

Bitcoin Mining is the Process that Adds New Blocks to the Blockchain and Helps Keep the Network Honest

Bitcoin Mining is the Process that Adds New Blocks to the Blockchain and Helps Keep the Network HonestBitcoin Mining: A Brief History

In the early days, people could mine with normal CPUs, then GPUs (better at doing many simple operations in parallel), and later more specialized hardware. Cambridge’s overview of mining hardware evolution explains how the industry moved from general-purpose gear toward Application-Specific Integrated Circuits or ASICs, which are chips built specifically for Bitcoin mining, because they’re far more efficient. Today, most mining uses ASICs, as reflected in the Bitcoin Developer Guide’s mining flow.

Mining Equipment Glossary

ASIC: Purpose-built mining machine (like a dedicated appliance).

TH/s: How many “tries” per second your miner makes.

J/TH: Efficiency, like miles-per-gallon (lower is better).

Difficulty: The network’s “hardness setting,” adjusted to keep blocks coming regularly.

Environmental Debate

Energy impact is heavily debated because estimates depend on assumptions and data sources. For context, the US EIA says crypto mining likely represented 0.6%–2.3% of US electricity use (preliminary estimate). For global tracking and methodology, Cambridge’s CBECI is a widely used reference.

2026 Bitcoin Mining Landscape

Mining in 2026 is still the same core idea: miners spend electricity to propose valid blocks and secure Bitcoin, but the economics tightened after the 2024 halving. With fewer new coins earned per block, efficiency and operating costs matter more than “raw hashrate” bragging rights.

Bitcoin Adjusts Difficulty every 2,016 Blocks to Target ~10-Minute Blocks

Bitcoin Adjusts Difficulty every 2,016 Blocks to Target ~10-Minute BlocksKey Network Stats (February 2026 Snapshot)

| Metric | Snapshot (as-of Feb 14, 2026) |

|---|---|

| BTC reference price | $68,485.42 via the CME CF Bitcoin Reference Rate (BRR) |

| Block reward (subsidy) | 3.125 BTC |

| Network hashrate | About 1,030 EH/s (from Hashrate Index) |

| Difficulty | About 125.86T via Blockchain.com |

| Fees | Miners earn block reward + transaction fees, and fees can spike when the network is busy |

| Pool distribution snapshot | Pool shares move around; treat any snapshot as directional |

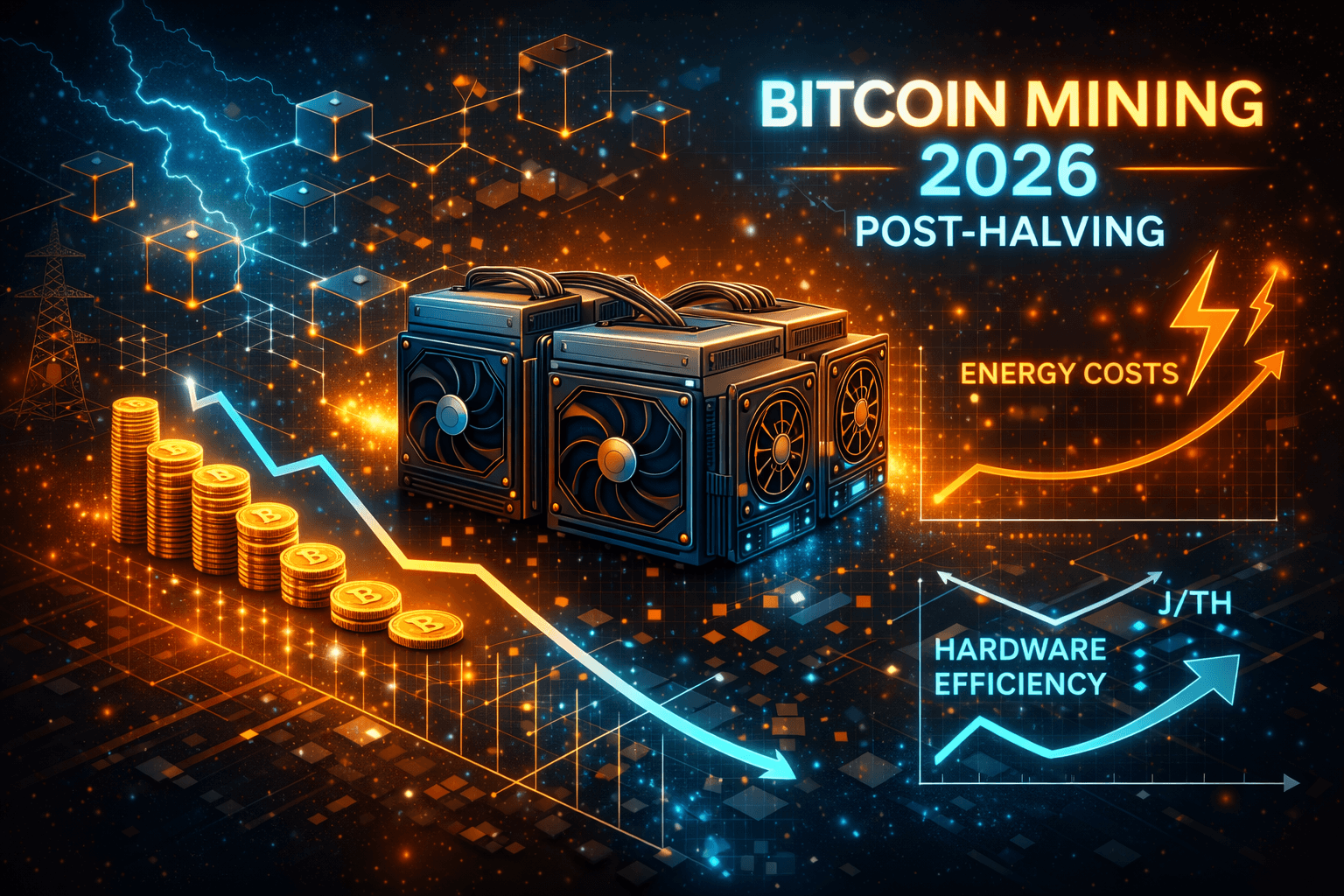

What the 2024 Halving Changed

Bitcoin’s “base pay” to miners (the block subsidy) is programmed to halve roughly every four years. In 2024, that subsidy dropped from 6.25 BTC to 3.125 BTC per block. If everything else stayed equal, that’s a big revenue hit, so higher-cost miners were the first to become unprofitable. In 2026, J/TH (joules per terahash) is like fuel economy: the “more miles per gallon” machine survives longer when energy is expensive.

The New Reality: Difficulty Drift and Hardware Obsolescence

Bitcoin adjusts difficulty every 2,016 blocks to target ~10-minute blocks. In practice, that means your earnings can trend down over time unless you upgrade efficiency or lower costs. ROI models should assume difficulty won’t stay flat, because the network adapts as competition changes.

Check out our very own detailed guides on Bitcoin Mining and Bitcoin Halving to learn more.

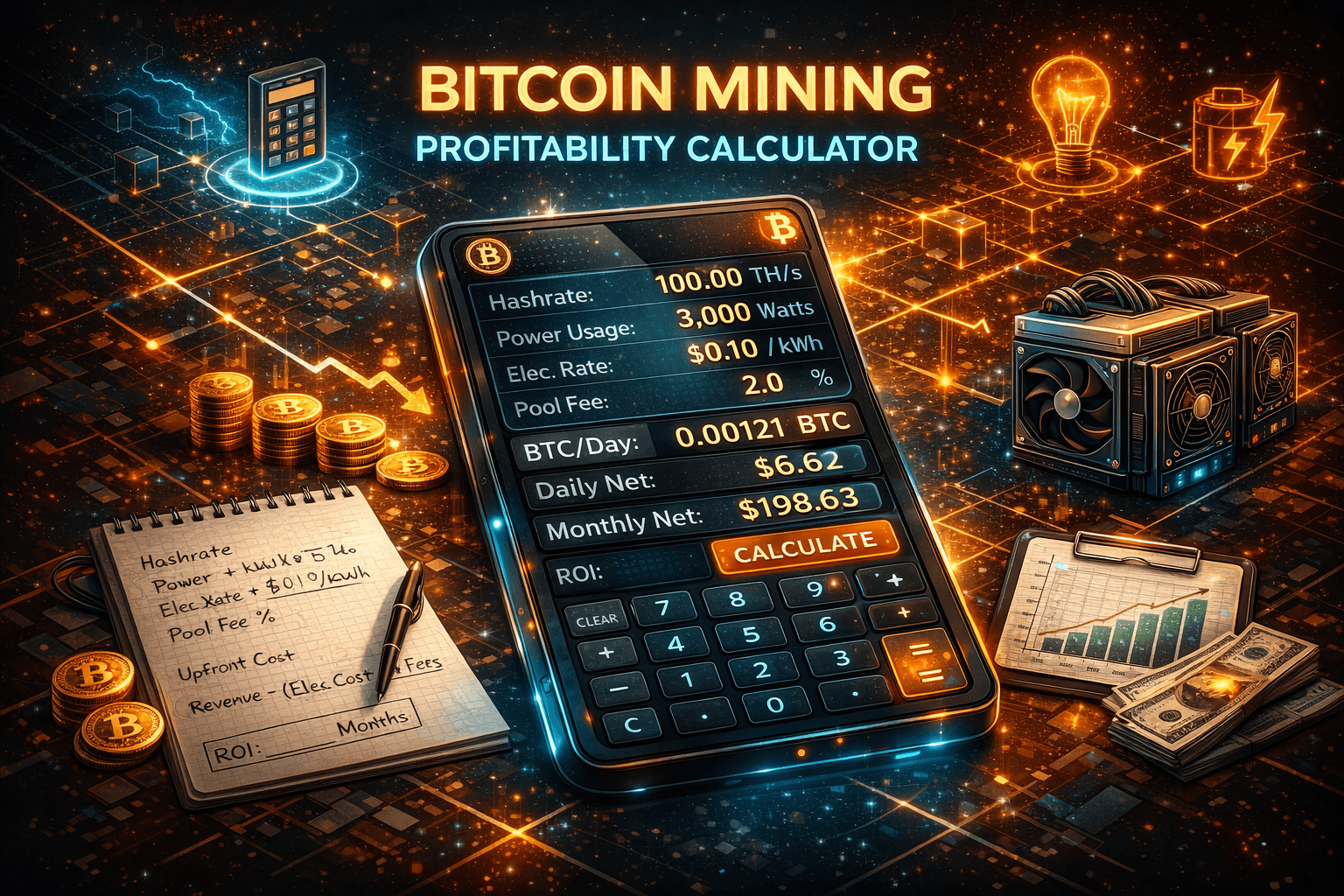

Bitcoin Mining Profitability Calculator

Before you spend money on an ASIC, run a simple profitability check. Mining income isn’t set and forget; it’s the output of a few moving parts: what you earn per day (BTC), what it costs to run (electricity and fees), and how long it takes to earn back your upfront spend. The goal here is transparency: you should be able to explain every line of your estimate to a friend.

Before You Spend anything on an ASIC, Run a Simple Profitability Check

Before You Spend anything on an ASIC, Run a Simple Profitability CheckThe Formula

A practical daily estimate looks like this:

Daily revenue: (Your expected BTC/day × BTC price). Miners earn block subsidy + transaction fees.

Electricity cost: (kW × 24 × $/kWh), where kW = watts ÷ 1000.

Pool fees: (Revenue × pool fee %). Pools typically charge a percentage for providing steadier payouts.

Optional add-ons: hosting fees, and a small maintenance reserve (fans, filters, downtime).

Inputs That Matter Most

Electricity rate: Use your true rate (energy + delivery + taxes), not just the headline number.

ASIC efficiency + power draw: Use real watts at your chosen mode (stock/underclock).

Pool fee and payout model: Fees and payout schemes affect variance and net returns.

Hardware price + shipping + tax: Don’t ignore import duties or delivery costs.

Downtime assumption: Use a conservative buffer (for example, 2–5%) for reboots, heat issues, or maintenance.

Quick Estimate

| Input | Your number |

|---|---|

| Hashrate (TH/s) | |

| Power (Watts) | |

| Electricity ($(figure)/kWh) | |

| Pool fee (%) | |

| Upfront cost ($(figure)) | |

| Estimated BTC/day | |

| Daily net ($(figure)) | |

| Monthly net ($(figure)) | |

| Estimated ROI (months) |

Note: All you need to do is copy this table, and fill it up to know where you stand.

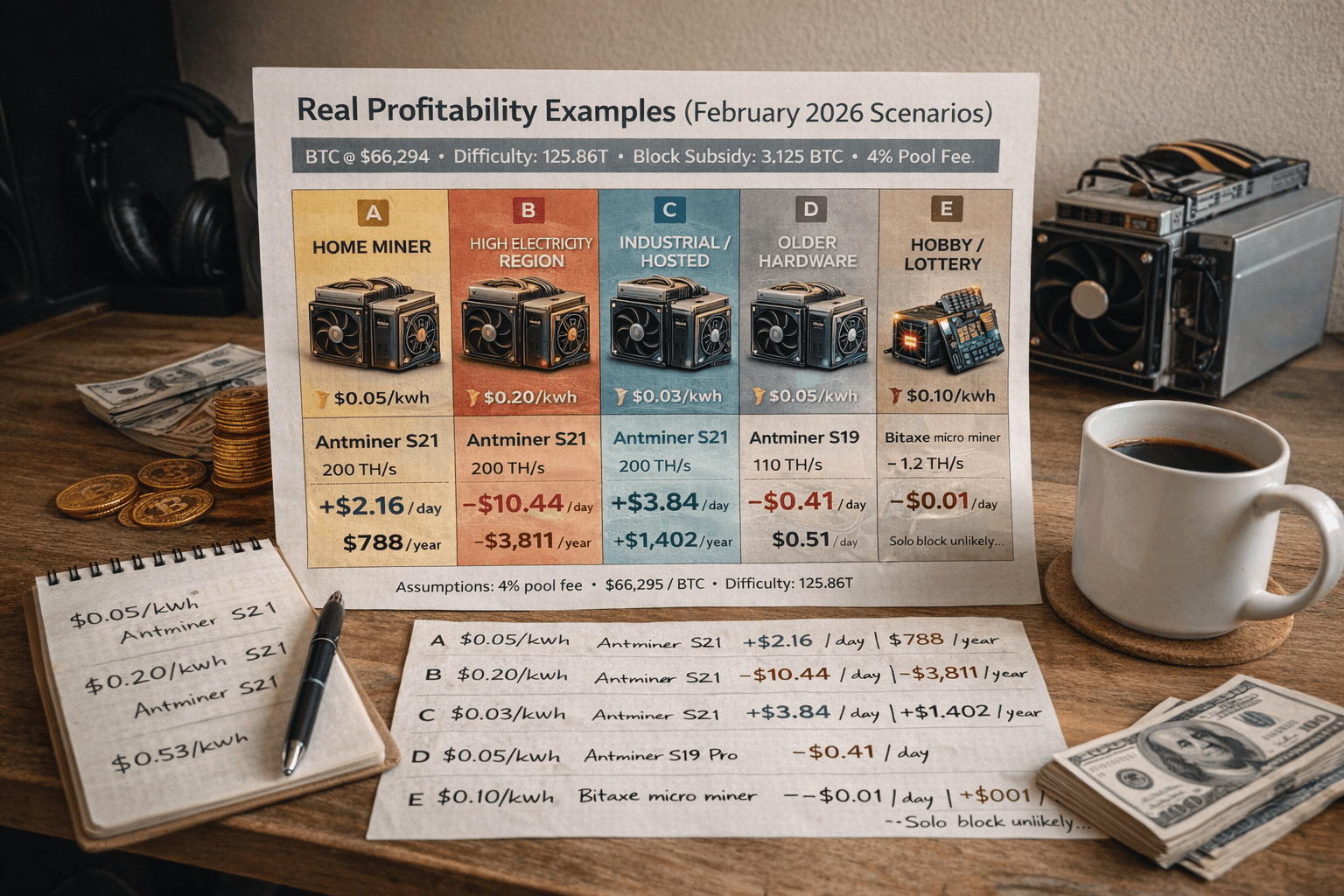

Real Profitability Examples

Mining profitability is easiest to understand with real numbers. Think of your miner like a delivery van: you’re paid for work done, but fuel (electricity) and platform fees (pool fees) come out of your pocket. These are point-in-time estimates, as difficulty and BTC price change.

Mining Profitability is Easiest to Understand with Real Numbers

Mining Profitability is Easiest to Understand with Real NumbersAssumptions: BTC price is at $66,293.74. Difficulty is 125.86T. The block subsidy is 3.125 BTC. Pool fee assumes f2pool's FPPS with a 4% commission. Revenue below excludes transaction fees.

Scenario A: Home Miner With Reasonable Power (Profitable or Marginal)

If you can access relatively cheap home electricity, a top-efficiency ASIC can net a profit, but the payback period can still be long.

| Item | Value |

|---|---|

| Example miner model | Bitmain Antminer S21 |

| Hashrate / Power | 200 TH/s / 3,500W |

| Electricity rate | $0.05/kWh |

| Pool fee assumption | FPPS, 4% |

| Estimated gross/day (subsidy-only) | $6.62 |

| Power cost/day | $4.20 |

| Pool fee/day | $0.26 |

| Net/day | $2.16 |

| Net/month (30d) / Net/year (365d) | $64.80 / $788.40 |

| Example breakeven | ~54 months if your all-in cost is $3,500 |

Scenario B: High Electricity Region (Why Most People Lose Money)

With high retail electricity, even efficient hardware typically goes negative fast.

| Item | Value |

|---|---|

| Miner model | Bitmain Antminer S21 |

| Hashrate / Power | 200 TH/s / 3,500W |

| Electricity rate | $0.20/kWh |

| Pool fee assumption | FPPS, 4% |

| Estimated gross/day (subsidy-only) | $6.62 |

| Power cost/day | $16.80 |

| Pool fee/day | $0.26 |

| Net/day | -$10.44 |

| Verdict | Don’t mine at this rate unless you can materially lower your effective power cost (hosted/industrial/renewables). |

Scenario C: Industrial or Hosted Rate (Why Big Players Survive)

Lower electricity (or a truly competitive all-in hosting rate) is where mining starts to look like a real business again.

| Item | Value |

|---|---|

| Miner model | Bitmain Antminer S21 |

| Hashrate / Power | 200 TH/s / 3,500W |

| Electricity rate (or equivalent all-in power component) | $0.03/kWh |

| Pool fee assumption | FPPS, 4% |

| Estimated gross/day (subsidy-only) | $6.62 |

| Power cost/day | $2.52 |

| Pool fee/day | $0.26 |

| Net/day | $3.84 |

| Net/month (30d) / Net/year (365d) | $115.20 / $1,401.60 |

| Example breakeven | ~30 months if your all-in cost is $3,500 |

| Hosting caveat | Contracts introduce counterparty risk (downtime terms, payout timing, and exit clauses matter). |

Scenario D: Used/Older ASIC (The Trap Case)

Older rigs can look “cheap,” but worse efficiency often means electricity eats the savings.

| Item | Value |

|---|---|

| Example older model | Bitmain Antminer S19 Pro |

| Hashrate / Power | 110 TH/s / 3,250W |

| Electricity rate | $0.05/kWh |

| Pool fee assumption | FPPS, 4% |

| Estimated gross/day (subsidy-only) | $3.64 |

| Power cost/day | $3.90 |

| Pool fee/day | $0.15 |

| Net/day | -$0.41 |

| Guidance | Used ASICs only make sense when the purchase price is extremely low and your power is very cheap, otherwise they’re usually a false economy. |

Scenario E: Hobby / Lottery Mining (Bitaxe-type micro mining)

Micro miners are mostly about learning and supporting decentralization, and not making meaningful income. Think “home lab,” not “side hustle.”

| Item | Value |

|---|---|

| Example project | bitaxeGamma (open-source miner) |

| Typical scale (varies by settings) | ~1.2 TH/s, ~20W-class power budget (device settings vary) |

| Example electricity rate | $0.10/kWh |

| Estimated gross/day (subsidy-only) | ~$0.04 |

| Power cost/day | ~$0.05 |

| Net/day | ~-$0.01 |

| Expectation | “Winning” a solo block is lottery-level unlikely; treat any revenue as a bonus. |

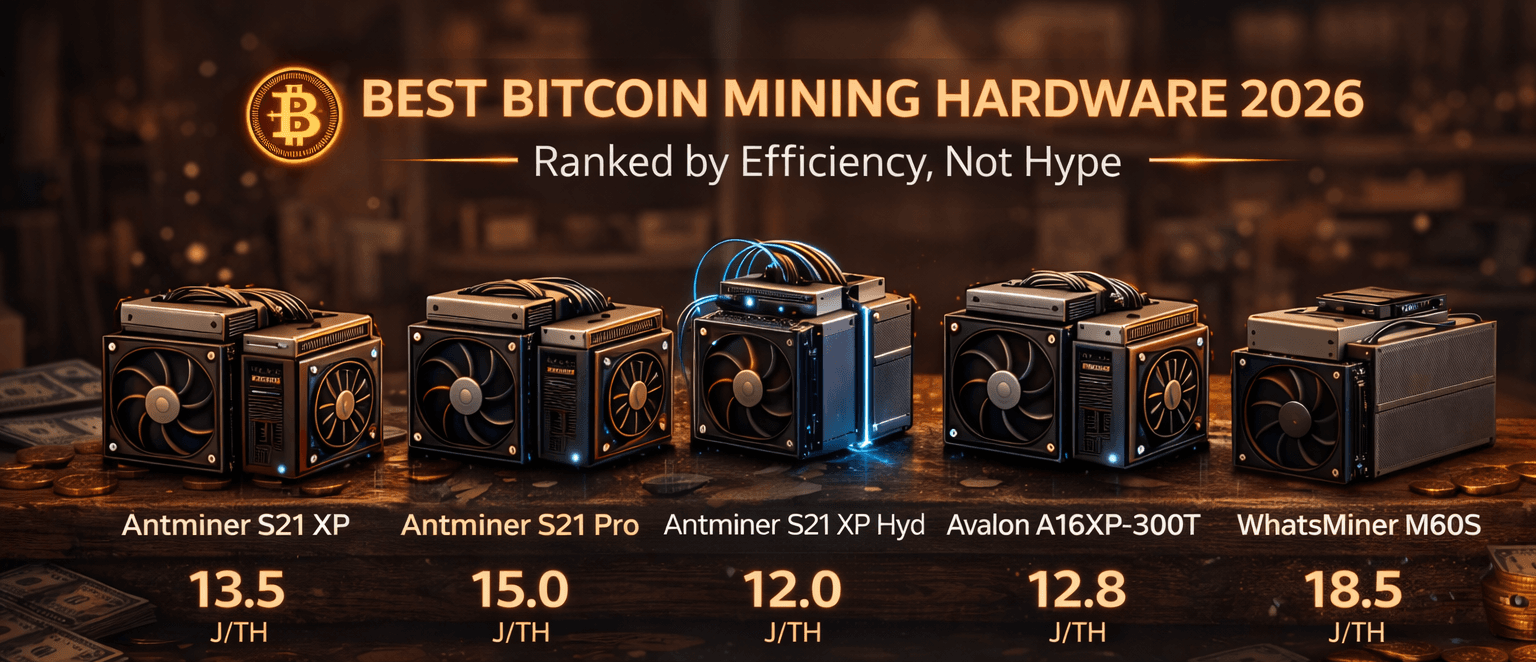

Best Bitcoin Mining Hardware in 2026

In 2026, the “best” Bitcoin miner is usually the one that turns the most electricity into hashrate, and not the one with the flashiest marketing. That’s why efficiency (J/TH) is the starting point, with price and power requirements as the reality check (taxes/VAT and shipping can also swing costs by region).

Stability and Safe Settings Matter as much as Peak Hashrate

Stability and Safe Settings Matter as much as Peak HashrateTop ASIC Miners 2026 (Comparison Table)

Specs and list pricing below are pulled from manufacturer spec sheets and official stores.

| Model | Hashrate (TH/s) | Power (W) | Efficiency (J/TH) | Typical price range | Best for (home/garage/hosted/industrial) | ROI band at $0.05/kWh |

|---|---|---|---|---|---|---|

| Antminer S21 XP | 270 | 3,645 | 13.5 | $4,590 | Hosted / garage (power + noise heavy) | ~36 months* |

| Antminer S21 Pro | 234 | 3,510 | 15.0 | $3,744 | Hosted / garage | ~39 months* |

| Antminer S21 XP Hyd | 473 | 5,676 | 12.0 | $10,170 | Industrial/hosted (hydro) | ~41 months* |

| Avalon A16XP-300T | 300 | 3,850 | 12.8 | ~$5,580.00 list (+ shipping/tax) | Hosted / industrial | ~36–40 months* |

| Avalon A16-282T | 282 | 3,900 | 13.8 | ~$4,681.20 list (+ shipping/tax) | Hosted / garage | ~35–40 months* |

| WhatsMiner M60S | 188 | 3,478 | 18.5 | ~$2,105.60 list (+ shipping/tax) | Budget entry / hosted | ~35–45 months* |

| WhatsMiner M66S | 290 | 5,365 | 18.5 | ~$3,248.00 list (+ shipping/tax) | Industrial (high-voltage setups) | ~40+ months* |

*ROI bands are rough, calculator-style snapshots (assumptions: Feb 2026 conditions, 4% pool fee, steady uptime, hardware priced at the official list where shown). Use the calculator section to plug in your power rate and purchase price.

Best for Home vs Best for Industrial vs Best Budget

Best overall value (efficiency/price balance): Avalon A16-282T often lands in a reasonable middle ground on $/TH and J/TH.

Best performance (highest hashrate class): Hydro units like the S21 XP Hyd can push far more TH/s per box, but they assume a hosted/industrial environment.

Best budget (lowest entry, still remotely sensible): A lower-priced unit like the WhatsMiner M60S can reduce upfront risk, even if efficiency is weaker.

What Specs Actually Matter (Buyer’s Filter)

Efficiency first (J/TH): Lower is better; like miles-per-gallon for mining.

Thermals/cooling method: Air vs. hydro/immersion determines where you can realistically run it.

Noise reality check: Most air-cooled ASICs are “shop-vac loud,” not living-room devices.

Warranty/support & counterfeit risk: Prefer official channels and verify serials where possible.

Firmware and reliability reputation: Stability and safe settings matter as much as peak hashrate.

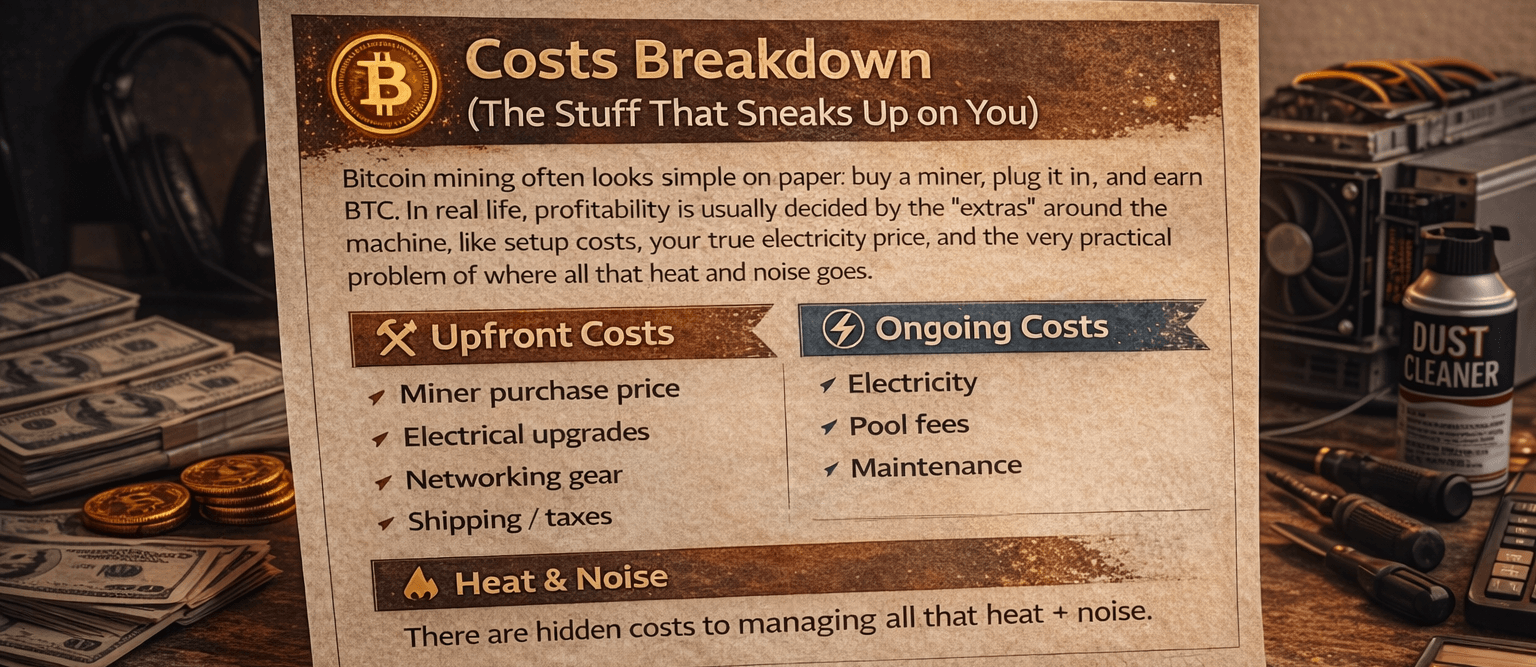

Costs Breakdown

Bitcoin mining often looks simple on paper: buy a miner, plug it in, and earn BTC. In real life, profitability is usually decided by the “extras” around the machine, like setup costs, your true electricity price, and the very practical problem of where all that heat and noise goes. (In the UK, bills commonly include unit rates + standing charges; and in the US, published “retail prices” generally reflect delivered electricity costs including taxes and fees.)

Bitcoin Mining Often Looks Simple on Paper, but there are many Variables to Understand before You Jump in

Bitcoin Mining Often Looks Simple on Paper, but there are many Variables to Understand before You Jump inUpfront Costs

Miner purchase price.

PSU (if separate).

Electrical work (panel capacity, dedicated circuits, wiring, breakers).

Basic networking (Ethernet, router/switch).

Shipping, import duties, VAT/sales tax (country-dependent).

Sound control and ventilation (optional, but common).

Ongoing Costs

Electricity (usually the dominant cost).

Pool fees.

Maintenance and parts (fans, dust management, unexpected downtime).

Cooling overhead (extra AC or ventilation power, often worse in summer).

Note: We remind you to look back at the table template we have provided above to insert your values and calculate your costs.

Heat & Noise: The “Real Life” Tax

A miner turns nearly all consumed electricity into heat in your space, which is fine in an outbuilding, but painful in a bedroom. Apartments usually struggle most (noise complaints + heat buildup), while garages and sheds are more practical. Noise suppression, ducting, and immersion/hydro can help, but they add cost and complexity.

So, the point is simple. There are a number of variables that depend on your requirements and choices, and these eventually affect not just the cost, but the overall worth of mining Bitcoin.

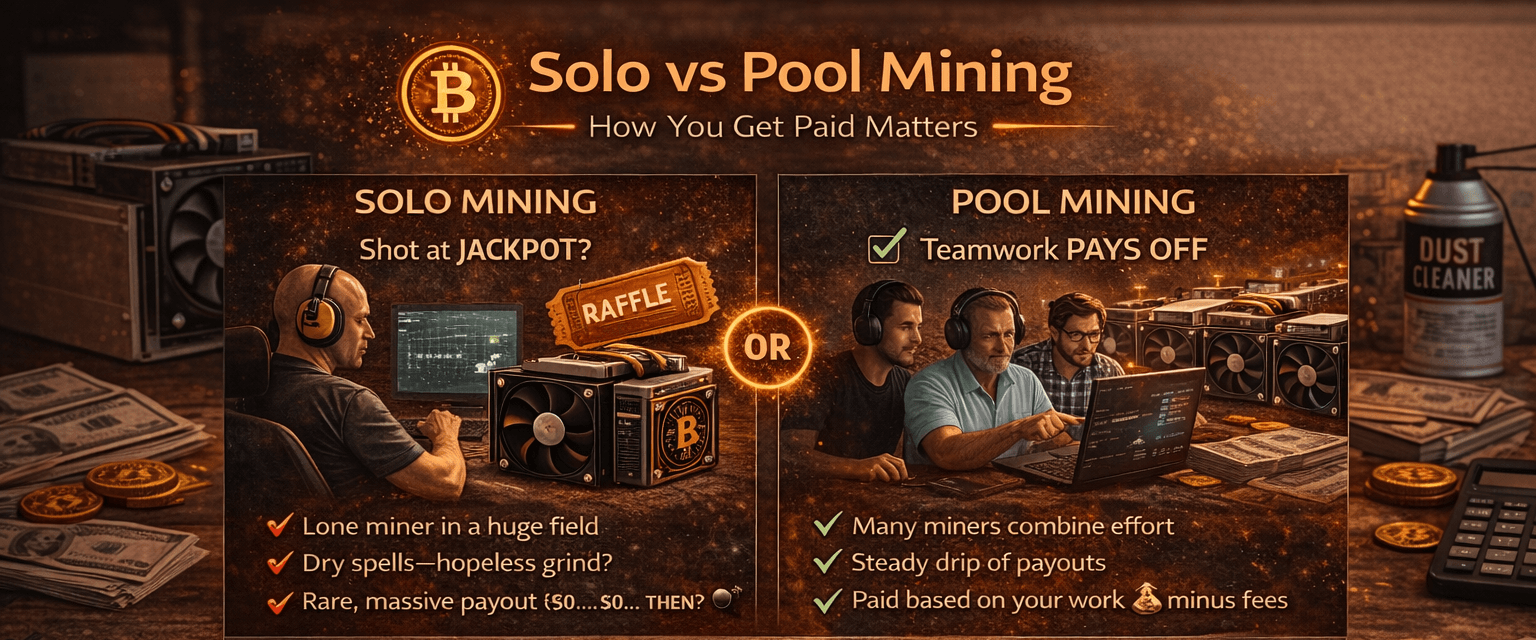

Solo vs Pool Mining

If you point your miner at solo mining, you’re basically buying a single raffle ticket in a stadium full of tickets. The Bitcoin network targets one block about every 10 minutes (on average), so unless you control a meaningful slice of total hashrate, you could run for a long time with $0 to show for it; then (rarely) hit a huge payout all at once.

Solo Mining is like Buying a Single Raffle Ticket in a Stadium Full of Tickets

Solo Mining is like Buying a Single Raffle Ticket in a Stadium Full of TicketsFor most miners, a mining pool smooths that “all-or-nothing” experience by paying you smaller, steadier rewards based on your contributed work, minus fees (for example FPPS or PPLNS, depending on the pool).

| Pool name | Hashrate share* (Estimates that can change fast) | Fee | Payout scheme (FPPS/PPS+/PPLNS) | Min payout threshold | Best for |

|---|---|---|---|---|---|

| AntPool | 16.773% | FPPS 4% / PPLNS 0% | FPPS / PPLNS | 0.005 BTC | Larger miners who want widely used pool infrastructure. |

| f2pool | 11.661% | FPPS 4% / PPLNS 2% | FPPS / PPLNS | 0.005 BTC | Miners who want clear defaults and global endpoints. |

| ViaBTC | 12.300% | PPS+ 4% / PPLNS 2% / SOLO 1% | PPS+ / PPLNS / SOLO | 0.001 BTC | Miners who want multiple payout modes and a low payout threshold. |

*Note: Hashrate Share can change fast, often yielding varying figures so these numbers are just estimates as of the time of writing.

How to Choose a Pool

Start with the Payout Model

FPPS/PPS tends to be steadier, while PPLNS can swing more, as ViaBTC summarized in its profit calculation rules that we have referenced under the fee column above.

Prioritize Reliability and Transparency

Look for clearly published fees, thresholds, and payout timing. For example, AntPool documents linked above show its default minimum payout threshold at 0.005 BTC.

Latency

Latency is usually minor, but it still helps to choose a nearby server region.

Use Good Custody Hygiene

Set payouts to a wallet you control and follow basics like the Bitcoin.org wallet security checklist.

We recommend you also check out our comparison guide on Solo vs Pool mining for better understanding of both methods.

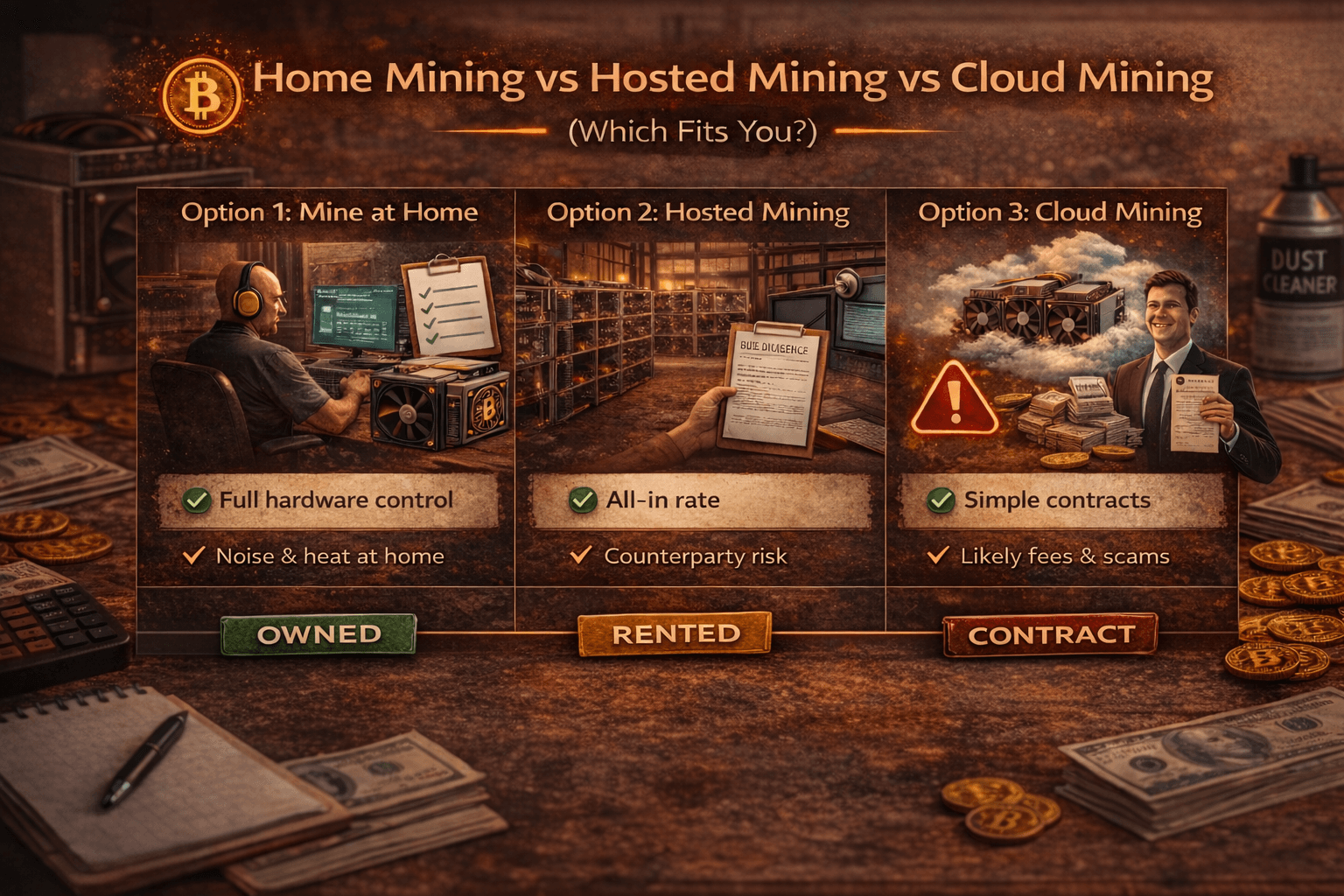

Home Mining vs Hosted Mining vs Cloud Mining

All three options aim for the same outcome, which is to earn BTC from hashrate; but they differ in what you control. A helpful mental model is renting versus owning: the less you control (especially in “cloud” setups), the more you rely on promises, contracts, and trust.

A Helpful Mental Model is Renting Versus Owning

A Helpful Mental Model is Renting Versus OwningOption 1: Mine at Home (When It Makes Sense)

Requirements checklist:

Cheap, reliable electricity.

Safe electrical capacity (dedicated circuit), plus ventilation.

A place where “shop-vac loud” noise won’t cause problems.

Pros:

You control the hardware and payouts.

No counterparty holding your machine.

Cons:

Heat/noise management becomes a lifestyle constraint.

Your real $/kWh (including delivery and taxes) decides profitability.

Option 2: Hosted Mining (Convenience With Counterparty Risk)

Hosted mining is “ASICs in someone else’s warehouse,” billed as an all-in rate (power + operations) or power plus a management fee.

Pitfalls + due diligence:

Look for clear terms on downtime, fees, payout timing, and exit clauses.

Verify facility proof and the legal entity behind the contract.

Be skeptical of “guaranteed” returns, as regulators flag that as a classic fraud warning sign also mentioned in the SEC’s guidance on crypto investment scams.

Option 3: Cloud Mining (Why You Can Get Burned)

Cloud mining is when you buy a contract from a company that runs the mining hardware in its own facility, and it mines on your behalf and sends your share of the proceeds to your wallet for the duration of that contract.

Most cloud mining underperforms because fees and margins are stacked against you, and the space is crowded with scams. The FTC warns that crypto scams often involve bogus “investment opportunities” and pressure tactics in its consumer guidance on cryptocurrency and scams.

Don't miss our detailed guide on cloud mining for more information.

Risks You Must Understand Before Buying a Miner

Mining can look like a simple “machine makes money” setup, but it behaves more like a small business with volatile revenue and mostly fixed costs. Before you buy, make sure you understand the five risks below; because any one of them can flip a profitable spreadsheet into a loss.

Before You Buy, Make Sure You Understand the Risks

Before You Buy, Make Sure You Understand the RisksPrice Risk (BTC Drops, Your ROI Explodes)

If BTC drops -30%, your mining revenue usually drops by roughly the same amount, while your electricity bill doesn’t. A back-of-the-napkin way to think about it: if costs stay flat, ROI can stretch to about 1.4× longer (because you’re earning ~70% of the revenue you expected).

Mitigation:

Don’t over-leverage

Keep cash runway for months when mining is marginal

Difficulty Risk (You Earn Less Over Time)

As competition rises, Bitcoin’s difficulty adjustment makes blocks harder to find, which can reduce how much BTC your hashrate earns. Blockchain.com notes difficulty adjusts every 2,016 blocks to keep average block times near 10 minutes on its difficulty chart methodology.

Mitigation:

Assume difficulty won’t stay flat in your model

Buy efficient gear (low J/TH)

Plan for “dilution” over time

Electricity Risk (Rates Change, Seasons Hurt)

Many regions use time-variable pricing, which US agencies describe as time-of-use rates, and the UK’s Ofgem explains off-peak tariffs like Economy 7. Summer can also sting because cooling loads rise; the US Department of Energy notes air conditioning is a major electricity user.

Mitigation:

Know your all-in $/kWh

Monitor real watt draw

Use fail-safes (temp shutoffs, surge protection)

Hardware & Scam Risk

Fake sellers and “refurbished-as-new” units are common enough that Bitmain maintains guidance on identifying real vs. fake miners. On the payment side, regulators warn that crypto-related scams often rely on urgency and “guaranteed returns,” per the SEC’s crypto investment scams alert and the FTC’s crypto scam guidance referenced earlier as well.

Mitigation:

Buy from official channels

Use escrow where appropriate

Insure shipments when possible

Regulatory & Local Constraints

Even if mining is profitable, practical rules can stop you: noise complaints, zoning limits, wiring codes, or local restrictions/taxes. Not to mention the overall crypto regs in your region. Be careful if anything related to this activity is deemed illegal under local laws.

Mitigation:

Check local requirements before you buy, especially for home setups.

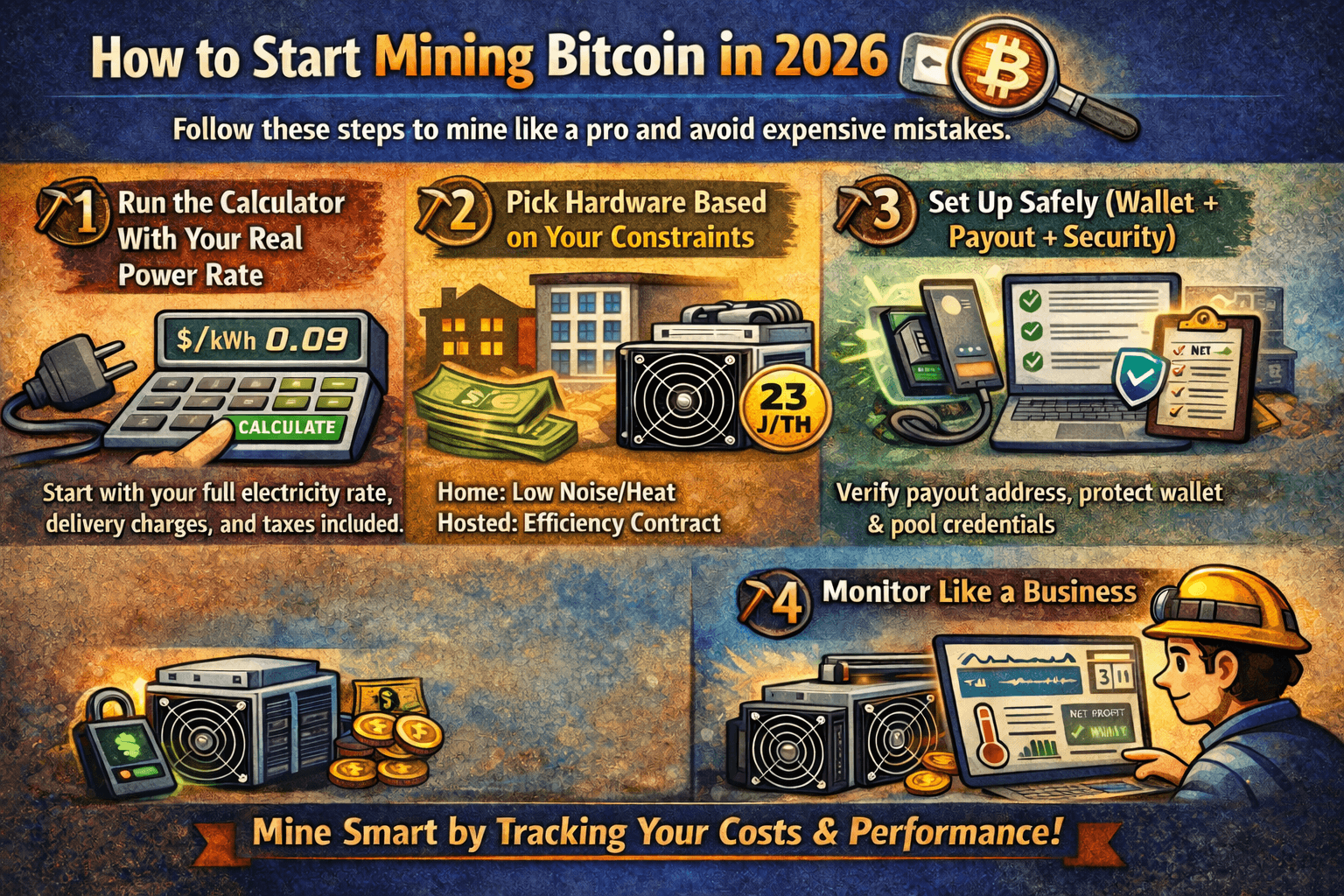

How to Start Mining Bitcoin in 2026 (Step-by-Step)

Mining is easiest when you treat it like a small operation: know your costs, pick the right equipment for your environment, and track performance regularly. The steps below are designed to help beginners avoid the most common (and expensive) mistakes.

Mining is Easiest when You Treat it like a Small Operation

Mining is Easiest when You Treat it like a Small OperationStep 1: Run the Calculator With Your Real Power Rate

Start with your all-in electricity rate, and not just the advertised “energy” price. In many places, the delivered rate includes delivery charges and taxes (the UK bill structure is explained by Ofgem, and US retail electricity prices are described by the EIA). If you can’t estimate profitability at your real $/kWh, don’t buy hardware yet.

Step 2: Pick Hardware Based on Your Constraints

Home: Put noise and heat first. A miner that technically “pencils out” can still be unusable in an apartment or shared space.

Hosted: Prioritize efficiency (J/TH) and contract terms (downtime rules, payout schedule, and exit clauses). If someone promises “guaranteed returns,” treat it as a red flag as we mentioned earlier as well.

Step 3: Set Up Safely (Wallet + Payout + Security)

Use a separate payout wallet you control. Always verify payout addresses (slow down and double-check), and use whitelists where your wallet provider supports them. Keep firmware and pool credentials protected like you would any account.

Step 4: Monitor Like a Business

Track uptime, temperatures, and watt draw daily, and watch your pool dashboard for hashrate drops. Re-check profitability monthly using current difficulty/price, and set decision rules (e.g., “if net is negative for X weeks, underclock, relocate, or shut down”).

Final Verdict: Should You Mine Bitcoin in 2026?

Mining in 2026 can still be profitable, but it’s rarely “easy money.” After the 2024 halving reduced the block subsidy to 3.125 BTC, the winners are usually the operators who can run efficient hardware with low, stable operating costs; and who treat mining like a business, not a gamble.

If You Match These Conditions, Mining Can Work

Your all-in electricity is genuinely low (including delivery/taxes), and you can keep it stable.

You can run a modern, efficient ASIC (low J/TH) in a space that can handle heat + “shop-vac” noise.

You’re comfortable with a longer timeline (often measured in years, not weeks) and you can survive bad months.

You use a reputable pool and get payouts to a wallet you control.

If You Don’t, Here’s the Better Move

If power is expensive or your living setup can’t handle heat/noise: don’t mine at home.

If you can’t verify a hosting provider or the contract terms: avoid hosted/cloud deals, as regulators warn about “guaranteed returns” style pitches.

For most people, the simpler choice is buying BTC and focusing on safe custody.