Throughout history, finance has mainly operated within centralized systems controlled by authoritative entities, from ancient temples to modern legislative bodies. These systems, crucial for economic functions, were based on trust and authority, exemplified by Mesopotamia's granaries and the medieval church's financial power. This centralization was necessary due to technological and societal limits, with smaller communities and no concept of global interconnectedness.

The Transcendence of Finance, Imagined by AI

The Transcendence of Finance, Imagined by AIThe emergence of the internet and blockchain technology introduces a significant shift towards decentralized finance (DeFi), moving away from centralization. DeFi leverages blockchain to create a transparent, efficient, and accessible financial ecosystem free from traditional gatekeepers. This technological and societal revolution challenges the necessity of centralized financial systems. As we approach this new era, DeFi represents an exciting evolution in scalability, governance, and global economic interactions, marking a transition from ancient centralized finance to a decentralized, interconnected framework, signifying a transformative phase in the communalization of finance in the digital age.

The Pitfalls of CeFi

Centralized finance (CeFi), while foundational to the global economy, faces significant pitfalls that have led to calls for more inclusive and efficient financial systems like decentralized finance (DeFi). Here's an exploration of these challenges, supported by real-world examples and cases.

1. Limited Access and Financial Exclusion

Globally, 1.7 billion adults remain unbanked, according to the World Bank. This is not merely a reflection of poverty but also of the barriers posed by documentation and red tape in banking relationships. For instance, in regions like sub-Saharan Africa, the scarcity of formal ID documents and physical banking infrastructure limits access to financial services, perpetuating financial exclusion.

2. Inefficient Interoperability and Geographical Division

CeFi institutions operate in silos. Services from one bank are not easily transferable to another, complicating customer mobility. For example, transferring accounts or services between banks within the same country can be cumbersome, let alone across borders. Moreover, international remittances, a lifeline for millions, often take days to process and come with high fees, as seen in traditional banking systems compared to blockchain-based solutions offering near-instant and cheaper transfers.

3. Money is Permissioned

The disparity in the value of currencies exacerbates the economic divide between nations. For example, the Venezuelan Bolivar's hyperinflation has rendered the local currency nearly worthless, pushing citizens towards cryptocurrencies as a more stable store of value. Decentralized cryptocurrencies are permissionless, meaning there is nobody capable of limiting access, which is not the case for many national currencies.

4. Opacity of Financial Institutions

The 2008 financial crisis highlighted the dangers of opaque financial practices, where the lack of transparency in mortgage-backed securities contributed to a global economic meltdown. This opacity diminishes the auditability of transactions and forces a reliance on trust in institutions whose interests may not always align with those of their customers and may even be immoral.

5. Technological Maturity

The dominance of established financial institutions has stifled innovation within the CeFi space. For example, the reluctance of major banks to adopt new technologies for faster payments has kept systems like SWIFT in place, despite their inefficiencies, because they benefit the incumbents.

6. Financial Subordination

Depositors at banks effectively lose control over their assets, subject to the bank's terms of service, which may include the right to freeze accounts. This was seen in the Cyprus banking crisis in 2013 when depositors faced unprecedented levies on their savings as part of a bailout plan.

7. Too Many Intermediaries

The finance sector's reliance on intermediaries like brokers and bankers adds layers of cost and complexity and increases the potential for systemic failures. The collapse of Lehman Brothers in 2008 serves as a stark reminder of how intermediary failures can lead to widespread economic disruption.

8. Vulnerability and Lack of Composability

The lack of composability and interoperability within the traditional banking sector is by design, to keep customers within an ecosystem. However, this lack of flexibility can be detrimental, as seen in the 2008 crisis, where the interconnectedness of financial institutions led to a cascading failure. Conversely, DeFi promotes an open ecosystem where services can be seamlessly integrated and composed, offering greater resilience and innovation.

These examples underline the need for a shift towards more transparent, inclusive, and efficient financial systems, a void that DeFi seeks to fill by addressing the inherent limitations of CeFi.

A Challenger Emerges

The pitfalls of CeFi called for a self-sovereign financial system. The Bitcoin network emerged right after the 2008 financial crisis and marked the beginning of trustless, borderless, and permissionless finance.

Bitcoin is a living example of a monetary system operating without authoritarian control. It sparked a hope of building a self-sustaining financial framework that could challenge the reach and control of centralized finance. For a Decentralized Financial system to exist, certain characteristics were paramount:

- Decentralization: It must operate without a central authority. No sole body must have the authority to determine the rules of issuance, regulation, and management of money and financial services.

- Transparency and No Need for Trust: Traditional finance relies on trust in centralized entities. DeFi should represent a system where transactions are visible, verifiable by anyone, and cannot be altered, which reduces the need for trust in a central party.

- Security: The system must eliminate single points of failure and accommodate means to mitigate cascading failures.

- Programmability: The terms of agreement within the financial system must be programmable and autonomously enforceable.

- Interoperability and Composability: The different financial services and products should be easily integrated and built upon each other like Legos. This level of interoperability and composability was not feasible in traditional finance due to the siloed nature of financial institutions and services.

The invention of smart contract-powered blockchain networks was the first solution that could effectively serve these needs. Therefore, the launch of the Ethereum network marked the birth of Decentralized Finance.

What is Decentralized Finance?

Decentralized Finance (DeFi) is a transformative approach to banking and financial services, leveraging blockchain technology to remove intermediaries from financial transactions. At its core, DeFi represents a shift from traditional, centralized financial systems—controlled by institutions like banks, brokers, and governments—to a decentralized model where transactions are executed directly between participants. This is facilitated through smart contracts on blockchain platforms, primarily Ethereum, which automate and secure financial operations without human intervention.

DeFi encompasses a broad spectrum of financial services, including lending and borrowing platforms, decentralized exchanges (DEXs), stablecoins, insurance protocols, and yield farming, among others. These services aim to replicate and improve upon traditional financial offerings, providing greater accessibility, transparency, and efficiency. Users can earn interest, take out loans, exchange assets, and access a wide range of financial products without going through a centralized authority or undergoing traditional banking procedures like credit and background checks.

The appeal of DeFi lies in its potential to offer financial inclusion to the unbanked, reduce transaction costs, and increase transaction speeds. However, it also poses challenges, including regulatory uncertainty, scalability issues, and security vulnerabilities. Despite these challenges, DeFi continues to grow, driven by the promise of a more open, interoperable, and flexible financial system.

How Does DeFi Work?

Decentralized Finance comprises assets, programs, and identities built on blockchain technology. Smart contracts form the bedrock of DeFi protocols. They are a standard for creating a financial system that operates independently of traditional, centralized institutions like banks, brokers, and insurance companies.

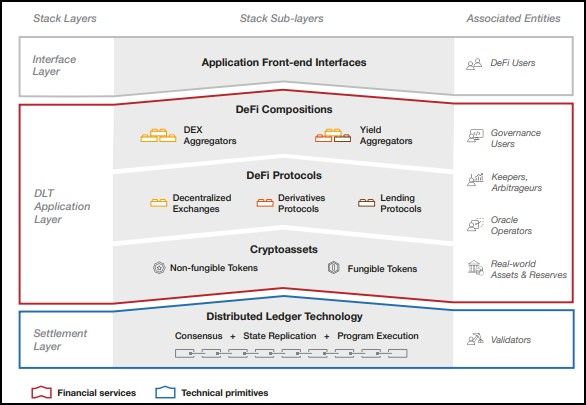

DeFi is not a single process but a multitude of on-chain interactions and value exchange facilitating capital and financial services where smart contract programs replace traditional financial institutions, cryptocurrencies replace fiat currencies and wallet addresses replace people. The DeFi Stack is a bird's eye representation of these interactions:

The DeFi Stack

The DeFi Stack | Image via BIS Working Papers

The DeFi Stack | Image via BIS Working Papers The DeFi Stack outlined in the diagram above provides a structured framework to understand the layers and components that constitute the DeFi ecosystem. This model is conceptualized to illustrate the technical primitives, financial functions, and compositions of DeFi protocols. Here's a detailed breakdown of the DeFi Stack:

Settlement Layer

- Purpose: This foundational layer stores a record of completed financial transactions and establishes consensus on the blockchain system's current state.

- Functionality: Typically provided by Distributed Ledger Technology (DLT), which implements consensus protocols and replicates the state globally across all distributed computer nodes. DLTs like Ethereum or Solana also offer an execution environment for smart contracts, which are core to DeFi protocols.

- Components: DLT platforms come with a native token (e.g., ETH for Ethereum), which facilitate transactions and interactions within the network.

Application Layer

- Purpose: In the application layer, blockchain entities interact and exchange information and resources to facilitate financial transactions.

- Functionality: It is a platform for executing smart contract operations based on the values and instructions provided by on-chain addresses. Several programs are composed on top of one another to build more complex programs and financial services.

- Components: The application layer comprises a Virtual Machine (e.g., Ethereum Virtual Machine), a decentralized virtual computer that executes these operations.

Interface Layer

- Purpose: Provides graphical front-end interfaces to DeFi users, facilitating interaction with the underlying protocols and services without needing to interact directly with the smart contracts or blockchain.

- Functionality: It acts as the interface between a user and the blockchain network, providing an intuitive platform to access the components of DeFi.

- Components: It comprises a web client that is connected to a node through which users relay their commands to the blockchain network.

This DeFi Stack Model provides a comprehensive framework for understanding the complex structure of the DeFi ecosystem, illustrating how various components interact to offer decentralized financial services. It emphasizes the layered and composable approach of DeFi, from the foundational blockchain technology to the user interfaces that allow for interaction with the ecosystem.

How DeFi is Used

Decentralized finance is rooted in the same economic principles of supply and demand, lending and borrowing. It offers products that serve the same purpose as traditional banking and financial institutions, albeit moulded to respect the fundamental principles of DeFi. Let's put these products in contrast with their CeFi counterparts to get a sense of what DeFi platforms offer:

| Financial Transaction | CeFi | DeFi |

|---|---|---|

| Banks and Savings Accounts | Traditional banks offer savings accounts, where customers can deposit their money, earn interest, and use various financial services. | Decentralized protocols offer yield farming and liquidity mining, where users can deposit cryptocurrency into a liquidity pool or lending protocol to earn interest or rewards (e.g., Compound Finance). |

| Loans and Credit | Banks and credit institutions provide loans and credit facilities, which require an application process, credit checks, and often collateral. | Decentralized lending platforms allow users to borrow and lend cryptocurrencies without a central authority, using smart contracts to automate the process. Interest rates are often determined algorithmically (e.g., Aave) |

| Exchanges and Trading Platforms | Centralized exchanges (CEXs) facilitate asset buying, selling, and trading. These platforms act as intermediaries and custodians of users' funds. | Decentralized exchanges (DEXs) enable peer-to-peer trading without an intermediary, using liquidity pools and automated market makers (AMMs) to facilitate trades directly between users' wallets. (e.g., Uniswap) |

| Asset Management and Investment Services | Financial advisors and investment firms offer asset management services, managing investments in stocks, bonds, and other assets on behalf of clients. | DeFi platforms offer decentralized asset management through protocols that enable automated investment strategies, allowing users to invest in a diversified portfolio of crypto assets (e.g., Yearn Finance). |

| Payment Systems | Traditional payment systems involve banks, credit card companies, and online payment platforms like PayPal, facilitating the transfer of money between parties. | Decentralized payment protocols allow for instant, borderless, and low-cost transfers of cryptocurrency directly between parties, without the need for traditional payment processors (e.g., Bitcoin, Curve Finance). |

| Insurance | Insurance companies provide policies to protect against various risks, using a centralized model for policy issuance, premium collection, and claim settlements. | Decentralized insurance protocols use smart contracts to pool risks and automate claims processing, offering coverage against smart contract failures, hacking incidents, and other risks (e.g., Nexus Mutual). |

| Identity and Verification | Financial institutions require identity verification (Know Your Customer, KYC) and anti-money laundering (AML) checks to comply with regulatory standards. | While DeFi has largely operated without KYC/AML procedures, there's a growing emphasis on decentralized identity solutions and privacy-preserving verification methods to enhance security without compromising user anonymity (e.g., Proof of Humanity). |

Beyond DeFi, blockchain technology itself solves numerous real-world problems and has found innovative applications. Check out Coin Bureau's analysis of Blockchain Use Cases and Applications.

Adoption and Growth of DeFi

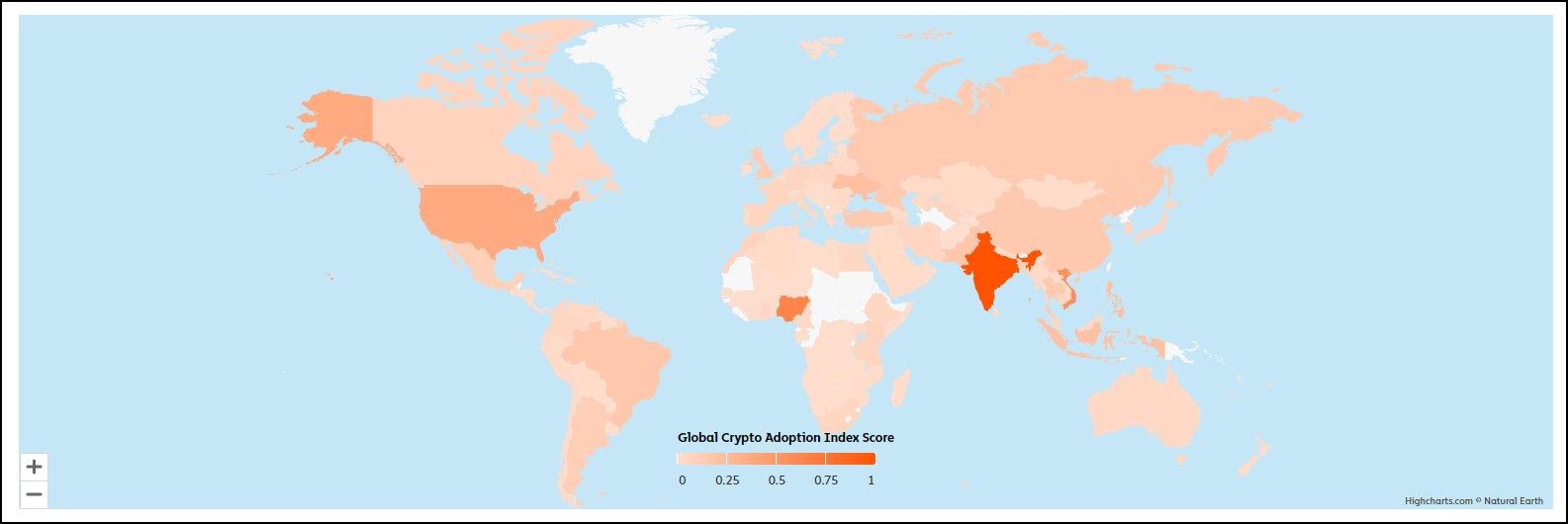

Every year, Chainanalysis conducts comprehensive research on global crypto adoption to measure the level of cryptocurrency adoption across countries. The index consists of five sub-indexes, each reflecting the usage of different cryptocurrency services. The process includes:

- Ranking Countries: Ranking countries based on their crypto usage and adjusting them based on population and purchasing power parity (PPP) per capita.

- Geometric Mean Calculation: The geometric mean of each country's rankings across all five sub-indexes is calculated to integrate the diverse aspects of crypto adoption into a single metric.

- Normalization: Normalizing the data between a scale of 0 to 1, where a score of 1 indicates high adoption rate.

- Estimating Transaction Volumes: The research uses web traffic and protocol usage patterns to estimate transaction volumes. It also acknowledges this approach’s limitations due to VPNs and privacy-protecting tools.

The key takeaway from their research report is that Central and Southern Asia and Oceania regions dominated the index. The report claims that crypto adoption peaked around Q4 of 2021 and bottomed around the FTX saga. However, adoption has been rising since the beginning of 2023, and India has led the pack around this cycle, followed by Nigeria, Vietnam, the United States, and Ukraine, constituting the top five.

Chainanalysis created a heat map to signify global crypto adoption

Chainanalysis created a heat map to signify global crypto adoptionBenefits of DeFi

Decentralized Finance offers a multitude of benefits reshaping the landscape of financial services:

- Accessibility: DeFi provides global access to financial services, removing geographical barriers and offering inclusion for the unbanked or underbanked populations.

- Reduced Costs: DeFi significantly lowers the fees associated with transactions and financial services by eliminating intermediaries like banks and brokers.

- Transparency: Transactions and contracts are recorded on a public blockchain, ensuring transparency and allowing anyone to verify transactions.

- Security: Utilizing blockchain technology, DeFi offers enhanced security features, reducing the risk of fraud and unauthorized access compared to traditional financial systems.

- Programmability: Smart contracts automate transactions and agreements, enabling complex financial instruments and services to be executed without human intervention.

- Interoperability: DeFi protocols are designed to work together seamlessly, allowing for innovative financial products and services that can be easily integrated.

- Permissionless: Anyone with an internet connection can access DeFi platforms without needing approval from a governing body or financial institution.

- Innovation: DeFi's open-source nature encourages continuous innovation, with developers freely building on existing protocols to introduce new services and improvements.

- Financial Sovereignty: Users have full control over their assets without relying on third parties, enhancing privacy and control over personal finances.

These benefits illustrate DeFi's potential to create a more inclusive, efficient, and transparent financial ecosystem, although it also comes with its own set of challenges and risks.

Challenges of DeFi

Decentralized Finance presents several challenges and risks alongside its innovative benefits:

- Smart Contract Vulnerabilities: Bugs or flaws in smart contract code can lead to significant financial losses, as seen in various exploits and hacks.

- Scalability Issues: High demand can lead to network congestion, slow transactions, and increased fees, particularly on platforms like Ethereum (the theory of Scalability Trilemma explores this characteristic).

- Regulatory Uncertainty: The lack of clear regulatory frameworks for DeFi poses challenges for compliance and could lead to legal issues for users and developers.

- Complexity and Usability: The technical nature of DeFi platforms can be daunting for newcomers, making it difficult for the average person to navigate and understand DeFi products safely.

- Market Volatility: Cryptocurrencies' high volatility can affect DeFi protocols, impacting investments' stability and collateral value.

- Liquidity Risks: Some DeFi platforms may face liquidity issues, making it difficult to enter or exit positions without significant price impact.

- Impermanent Loss: Providing liquidity to automated market makers (AMMs) can lead to impermanent loss, where the value of deposited assets decreases compared to holding them.

- Lack of Insurance: Unlike traditional banks, DeFi platforms typically do not offer deposit insurance, increasing the risk of total loss in case of a platform failure or hack.

- Interoperability Risks: While interoperability is a benefit, it also increases the complexity and potential for systemic risks across interconnected protocols.

These challenges highlight the need for ongoing development, improved regulatory clarity, and enhanced user education to mitigate risks and fully realize DeFi's potential.

DeFi in the Future

In 2024, DeFi stands at an evolutionary crossroads, propelled by innovation and regulatory shifts, notably through tokenizing real-world assets (RWAs) like stocks, bonds, and real estate and introducing DeFi-native services like RaaS (Rollups as a Service). This move towards integrating RWAs is set to significantly enhance liquidity and reduce costs, marking a departure from high, often unsustainable APYs to a focus on real, sustainable yields.

Yet, the path forward is fraught with regulatory challenges. The industry's quest for a balance between privacy and transparency is crucial, aiming to secure operations while aligning with evolving global standards. 2024 could be decisive for DeFi, as regulatory clarity will either catalyze its integration into the broader financial ecosystem or stymie its progress due to compliance hurdles.

The future of DeFi hinges on its ability to navigate these regulatory landscapes, innovate responsibly, and foster the tokenization trend. Success and sustainability in DeFi will largely depend on its adaptability and the continued convergence of traditional and decentralized finance, promising a transformative yet uncertain horizon for the sector.

Closing Thoughts

Decentralized Finance represents a paradigm shift from traditional, centralized financial systems towards an open, blockchain-based ecosystem. By leveraging smart contracts on platforms like Ethereum, DeFi offers a range of financial services — from lending and borrowing to trading and insurance — without intermediaries. Its emergence addresses issues like financial exclusion, inefficiencies, and transparency in the existing system.

However, DeFi also faces challenges, including regulatory uncertainties, scalability issues, and security vulnerabilities. The future of DeFi is poised for growth, driven by innovations like the tokenization of real-world assets and the integration of stablecoins, yet hinges on navigating regulatory landscapes and technological advancements. As DeFi evolves, it aims to redefine financial services, emphasizing accessibility, efficiency, and user sovereignty, albeit with a cautious eye on overcoming its inherent challenges.