Crypto exchanges can feel like aircraft cockpits, all switches and warning lights. Millionero tries to make the first takeoff less intimidating by focusing on a cleaner layout and a short list of core actions. Instead of burying basics, it puts them up front, like a dashboard with fewer knobs. You can buy and sell on spot markets or step into perpetuals, where trades run on margin and move faster than most beginners expect.

That simplicity is paired with features meant for active traders, including copy trading and tiered fees. Like any exchange that offers leverage, the experience can feel smooth on calm days and very different when volatility spikes. The goal is to understand the costs, the friction around deposits and withdrawals, and the security habits that matter before you treat it as a daily driver. Think of it as a gym: start, learn form.

Quick Verdict

Millionero keeps the feature set focused around spot trading, perpetuals, and copy trading in a simplified interface. Fees are easy to map and reduce at higher tiers, but overall trust signals require closer scrutiny. This is a platform best approached with caution, small test deposits, and conservative use of leverage until users are comfortable with execution quality, rails, and account protections.

Who It Suits

- Traders who want a simple spot and perpetuals setup in one place

- Users exploring copy trading with strict allocation limits

- Those comfortable starting small and verifying deposits and withdrawals first

Who Should Consider Other Options

- Users prioritizing maximum regulatory clarity and transparency

- Liquidity-sensitive traders needing deep order books across many pairs

- Mobile-first users who rely on fully verified app store availability

Top Alternatives to Consider

- Bybit: Deep derivatives markets, strong liquidity, and mature trading tools.

- Bitget: One of the strongest copy trading ecosystems at scale.

- Kraken: A more regulation-forward exchange with a security-first reputation.

Millionero Quick Facts

| Fact | Details |

|---|---|

| Platform Type | Centralized exchange (spot, perpetuals, copy trading) |

| Max Leverage | Up to 100x on perpetual futures |

| Spot Fees (Base Tier) | 0.12% maker / 0.15% taker |

| Perpetual Fees (Base Tier) | 0.05% maker / 0.099% taker |

| Deposit & Withdrawal Fees | 0 platform fee (on-chain network fees still apply) |

| Fiat Rails | Third-party providers such as Banxa and Transak (region-dependent) |

| Best For | Simplified spot and perpetual trading with cautious risk management |

What is Millionero?

Millionero is a crypto exchange that offers spot trading and perpetuals, with trading costs organized through a tiered fees structure. Spot markets are the simplest form of trading because you buy or sell an asset directly. Perpetuals are a type of futures contract that does not expire, which means a position can stay open as long as margin requirements are met. Because perpetuals often include leverage, small price moves can have a much bigger effect on results, similar to using a lever to lift something heavy: it amplifies both what you can accomplish and what can go wrong if control slips.

Check out our review of the best crypto exchanges and best decentralized exchanges.

Millionero is a Crypto Exchange that Focuses on Spot Trading and Perpetuals. Image via Millionero

Millionero is a Crypto Exchange that Focuses on Spot Trading and Perpetuals. Image via MillioneroMillionero began its journey in 2022, starting with a core team of 12 and led by Syed Suleman Kazim. The exchange is operated by Zanixo Corp. Alongside spot and perpetuals, the platform also includes copy trading, which is designed for users who prefer a more guided approach by mirroring other traders’ strategies within predefined settings.

Read: Top Copy Trading Platform

These are just mentions of what there is to offer. The rest of this review breaks down costs, market coverage, usability, protections, support, and the due diligence checks that matter most when derivatives and leverage are on the table.

Trading Products and Key Features

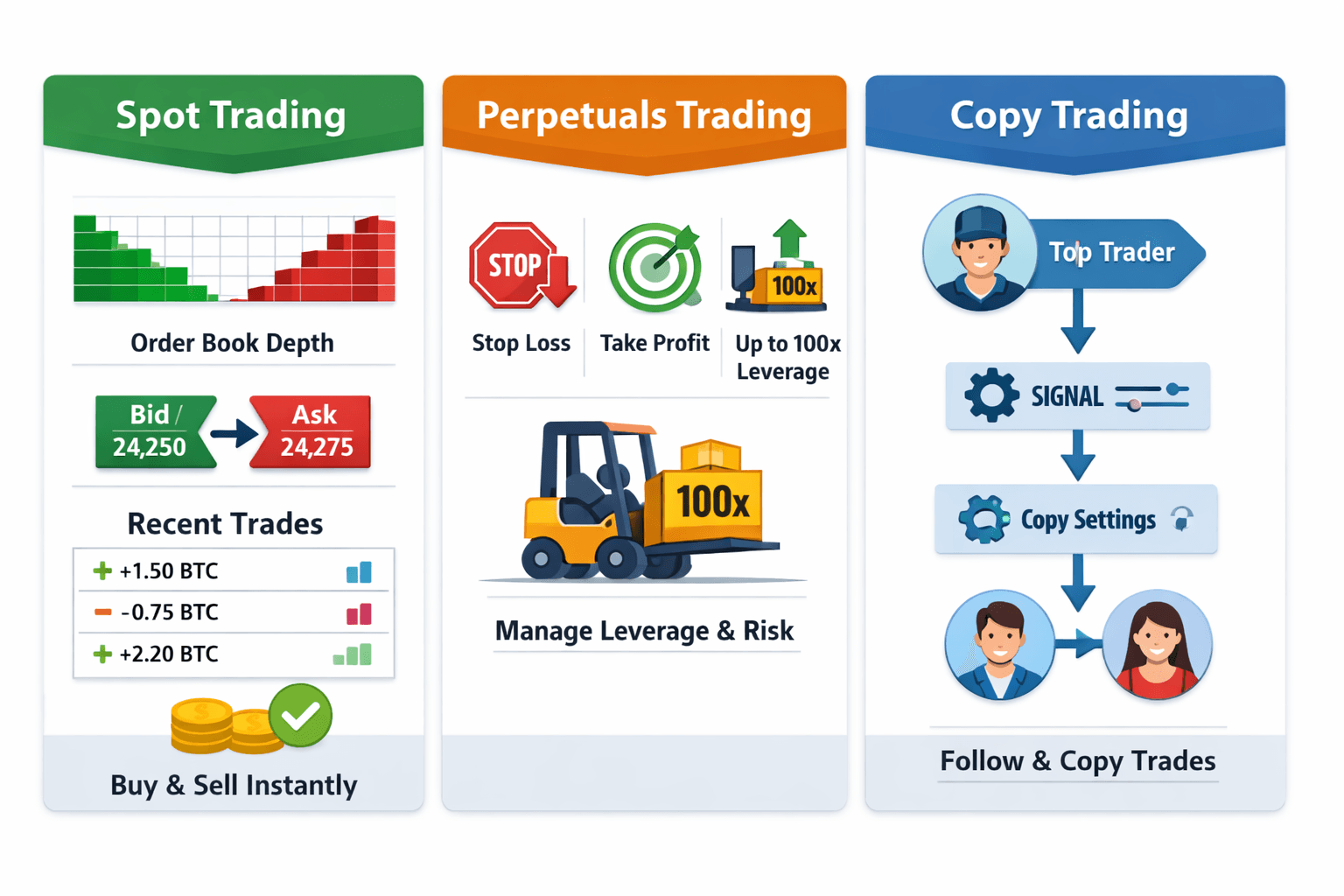

Millionero brings together three tools that tend to sit at different skill levels on most exchanges: spot trading for straightforward buying and selling, perpetuals for leveraged directional trading, and copy trading for users who prefer a more structured approach.

Millionero Brings Together Three Tools that Tend to Sit at Different Skill Levels on Most Exchanges

Millionero Brings Together Three Tools that Tend to Sit at Different Skill Levels on Most ExchangesSpot Trading

Spot trading is the simplest format because the trade settles on the asset itself, similar to paying for a product and owning it right away. That makes it a common starting point for beginners, especially when paired with a basic understanding of spot trading and how different order types behave.

A practical way to gauge whether a spot pair is tradable is to focus on execution signals rather than big headline numbers.

- Bid ask spread shows how far apart buyers and sellers are.

- Order book depth shows how much liquidity sits close to the current price.

- Recent trades show whether the market is active in real time.

When these are weak, slippage becomes more likely, which can feel like trying to buy a popular item from a small stall where the price jumps as soon as the last few units disappear. The same checks show up in common liquidity screening methods such as low liquidity indicators.

Millionero also provides an API that exposes market data like order books and trades, alongside trading functions for placing and managing orders.

Perpetuals Trading

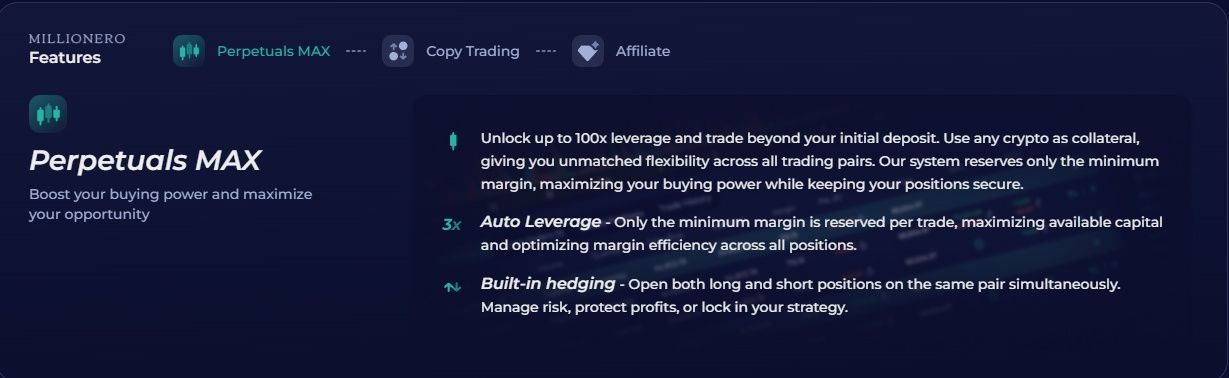

Perpetuals are futures contracts without an expiry date, so a position can stay open as long as margin requirements are met. They behave very differently from spot because leverage and liquidation become part of the trade’s mechanics, rather than rare edge cases. Millionero’s perpetual markets include leverage settings and list a maximum leverage of up to 100x on its perpetuals product page mentioned above.

Millionero’s Perpetual Markets Include Leverage up to 100x. Image via Millionero

Millionero’s Perpetual Markets Include Leverage up to 100x. Image via MillioneroIt helps to think of leverage like using a forklift instead of carrying boxes by hand. It makes heavier moves possible with less upfront effort, but mistakes become expensive faster. Perpetuals also introduce ongoing costs such as funding rates, which are part of how perpetual prices stay aligned with spot pricing.

These concepts are easier to grasp with a basic grounding in our guides on crypto futures and contract trading.

Risk controls matter more here than anywhere else. A safer perpetual setup usually includes:

- Defined exits using take profit and stop loss,

- Sensible leverage that matches volatility and account size,

- Clear margin management to reduce liquidation risk during sharp moves.

Millionero’s perpetual interface supports these position guardrails, and the same actions can also be handled through its API.

Copy Trading and Social Style Tools

Copy trading is built around following a lead trader and mirroring their trades based on allocation rules. The appeal is obvious: it can feel like using a navigation app instead of memorizing a city’s road network. Direction still matters, but structure reduces decision fatigue.

Copy Trading is Built Around Following a Lead Trader and Mirroring their Trades. Image via Millionero

Copy Trading is Built Around Following a Lead Trader and Mirroring their Trades. Image via MillioneroThe quality of a copy trading setup usually comes down to transparency and control.

- Performance visibility helps users understand what they are following.

- Allocation caps limit how much capital is exposed to copied trades.

- Stop copy controls help reduce damage when conditions shift.

The most common pitfalls often come from treating copy trading like autopilot rather than a risk tool, which is why concepts covered in our basic copy trading primer and common copy trading mistakes matter in practice.

Platform Differentiators

Millionero’s differentiator is how it packages spot, perpetuals, and copy trading into a simpler flow that emphasizes core actions over complex configuration. That can lower the learning curve, but it also makes fundamentals like execution quality, fee tiers, and risk controls more important because small differences compound quickly in leveraged or automated strategies.

These features show a platform designed to cover the full path from basic buying and selling to higher-risk derivatives and guided trading tools, with the tradeoff that risk management becomes increasingly important as soon as leverage or automated copying enters the mix.

Fees, Funding, and the Real Cost of Trading

Trading costs are not just the headline fee rate. On most exchanges, the true cost depends on whether you add liquidity or take it, how much you trade over time, and whether you are using spot or perpetuals.

Here's a quick snapshot:

| Product | Base tier (maker) | Base tier (taker) | Lowest advertised via VIP (maker) | Lowest advertised via VIP (taker) |

|---|---|---|---|---|

| Spot | 0.12% | 0.15% | 0.07% | 0.075% |

| Perpetuals | 0.05% | 0.099% | 0.008% | 0.01% |

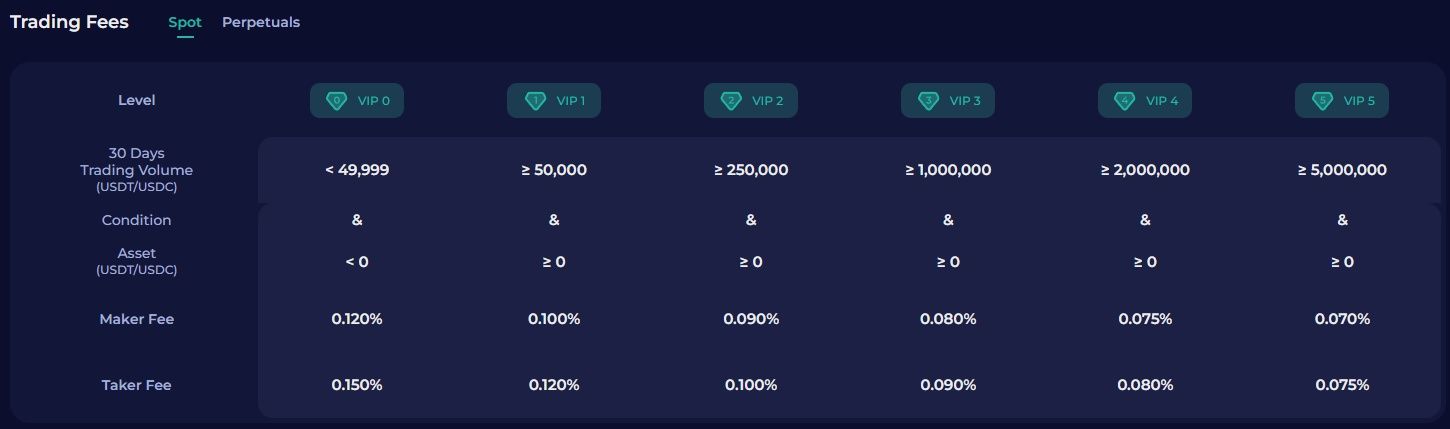

Spot Trading Fees

- Base tier spot fees: 0.12% for makers and 0.15% for takers.

- Lowest advertised via VIP tiers: 0.07% maker and 0.075% taker.

Millionero has a Maker and Taker Model, with Lower Rates Available for Higher Volumes. Image via Millionero

Millionero has a Maker and Taker Model, with Lower Rates Available for Higher Volumes. Image via MillioneroMillionero describes a maker and taker model, with lower rates available for higher volume users through VIP tiers. You can think of VIP tiers like a loyalty program: the more you use the service, the better the pricing you can qualify for over time.

If you are new to the terms, a simple way to think about it is that makers place orders that sit on the order book, while takers fill existing orders. Our crypto trading guide for beginners explains the difference using everyday examples.

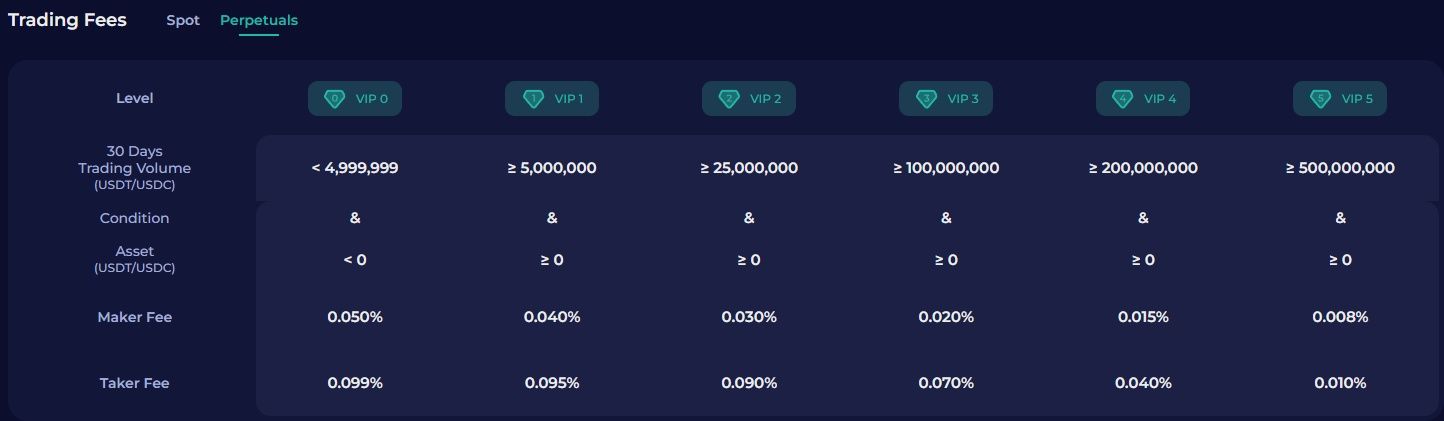

Perpetuals Fees and Ongoing Costs

- Base tier perpetual fees: 0.05% maker and 0.099% taker.

- Lowest advertised via VIP tiers: 0.008% maker and 0.01% taker.

Perpetuals can also Add Ongoing Costs that do not Exist in Spot Trading. Image via Millionero

Perpetuals can also Add Ongoing Costs that do not Exist in Spot Trading. Image via MillioneroPerpetuals can also add ongoing costs that do not exist in spot trading. The most important is the funding rate, which is a periodic payment exchanged between long and short traders to help keep perpetual prices closer to the spot market.

There can also be position related costs tied to margin rules and liquidation mechanics, which is why understanding your liquidation price matters before using leverage.

Non Trading Costs

Even if you do not place a trade, there can be account level costs to watch:

- Deposits and withdrawals: Millionero's fee page states zero withdrawal and deposit fees.

- Fiat costs: If you use third party fiat on ramps, the provider may charge fees and embed FX spreads into the conversion rate you receive.

- Other charges: It is worth checking whether the platform discloses any inactivity or account related fees in its user terms before leaving funds idle for long periods.

Millionero’s pricing is easiest to understand when you separate the headline trading fees from the costs that show up around the edges. The base tier spot and perpetual rates set your starting point, VIP tiers can reduce commissions if your trading volume grows, and the real “surprises” usually come from perpetual funding payments and payment rail spreads rather than the posted maker and taker numbers.

Deposits, Withdrawals, and Rails

Deposits and withdrawals are where small details can have outsized consequences. The practical goal is simple: match the right asset to the right network, understand where fees can appear, and set up basic account protections before funds start moving.

Deposits and Withdrawals are where Small Details can have Outsized Consequences

Deposits and Withdrawals are where Small Details can have Outsized ConsequencesCrypto Deposits and Withdrawals

| Item | What to know |

|---|---|

| Crypto deposits & withdrawals | Millionero charges zero deposit and withdrawal fees (platform-side), but users may still pay network fees on-chain depending on the asset and network used. |

| Fiat on-ramps/off-ramps | Fiat buys/sells are typically routed through third-party providers, which may charge fees and include FX spreads in quoted rates; availability and pricing depend on region and provider. |

Millionero’s deposit flow centers on choosing an asset and selecting a supported network. Networks such as Ethereum and TRON use different address formats and transfer rules, so sending the right coin on the wrong network can lead to funds becoming unrecoverable. Millionero’s limitations and user responsibility around deposits made using incompatible methods.

On the withdrawal side, Millionero states zero withdrawal fees for crypto transfers, as we mentioned earlier. Processing time is not a single fixed number because it depends on blockchain confirmations and any account verification steps tied to KYC, which can take up to 24 hours.

Fiat On Ramps and Off Ramps

Millionero’s blog and helpcenter reference card and bank transfer routes, including SEPA for eligible regions, with providers such as Banxa and Transak. Provider flows can vary by country, but Millionero lists fiat currencies such as USD, AUD, CAD, GBP, and EUR for certain purchase methods.

Key items to validate in practice include:

• Supported currencies in your region

• Fees charged by the payment provider versus any platform level fees

• Settlement times and card chargeback rules, where applicable

Practical Safety Checks for Moving Funds

A small test withdrawal is a simple way to confirm the address and network match before moving a larger balance. Account protections such as two factor authentication and withdrawal address controls like whitelisting, when available, reduce the chance that a compromised login turns into a completed withdrawal.

The safest way to use any exchange rails is to slow down for the first transfer. Matching the asset and network, understanding where third party payment fees can show up, and enabling basic security settings upfront can prevent most avoidable deposit and withdrawal issues.

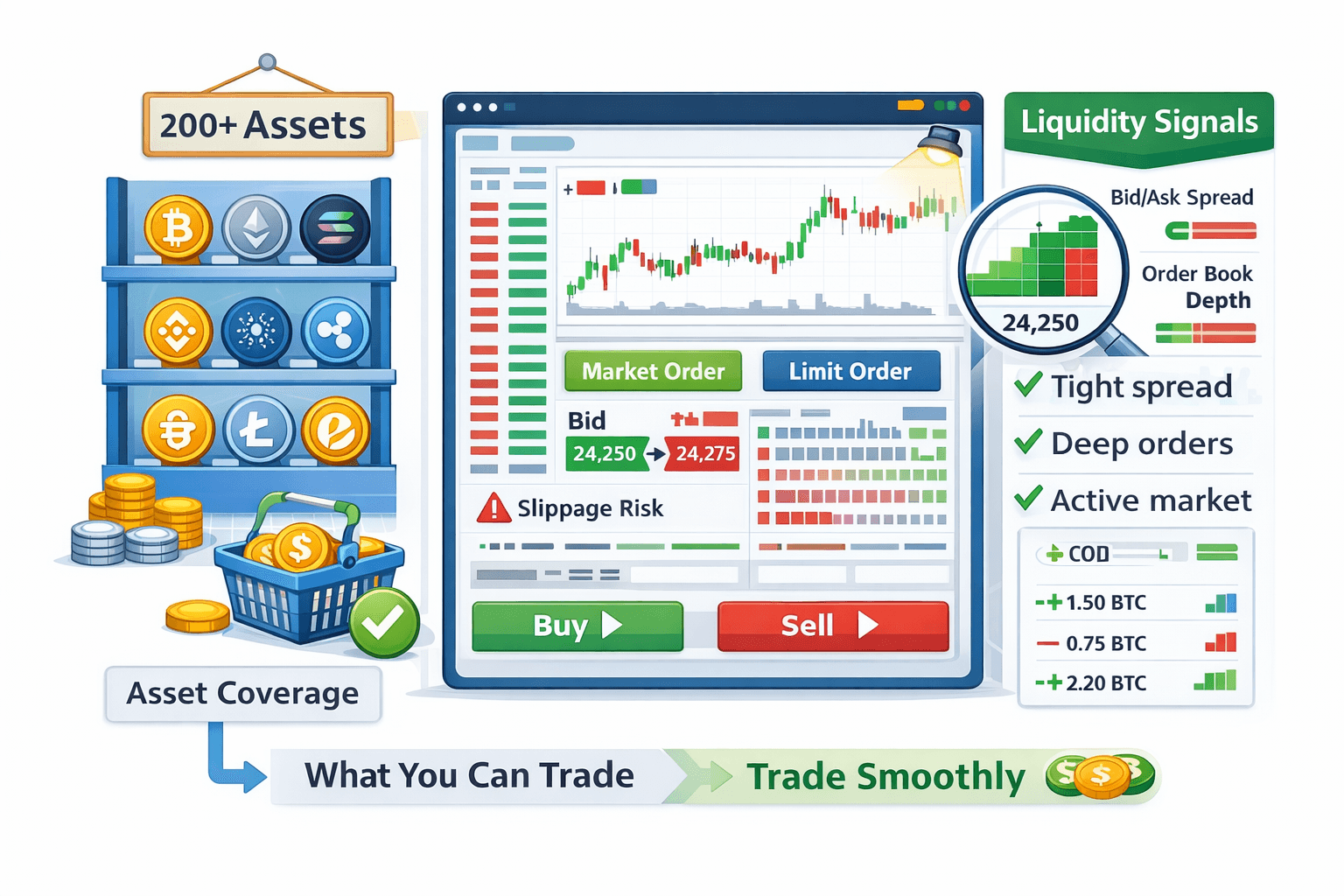

What You Can Trade and Whether It Trades Smoothly

A long list of markets can look impressive, but what matters day to day is whether those markets are actually easy to enter and exit without paying an invisible cost through poor execution.

Broad Coverage is Helpful, but Consistent Liquidity is what Makes Markets Genuinely Tradable

Broad Coverage is Helpful, but Consistent Liquidity is what Makes Markets Genuinely TradableAsset Coverage

Millionero states it supports 200+ assets. That number alone does not tell you how practical each market is to trade, because availability and activity can differ between spot trading and perpetual futures. A simple way to think about it is a store shelf: lots of products on display does not guarantee the items you want are consistently in stock at a fair price.

Liquidity and Slippage

On Millionero, liquidity signals show up directly in the trading screen, where the spot interface includes a live price chart and an order book showing the nearest buy and sell interest. That matters because the tighter the spread and the deeper the visible orders, the closer a trade usually lands to the price you had in mind.

Millionero supports both market orders and limit orders, and the choice between them often decides whether slippage becomes a meaningful cost. Market orders prioritize speed, so in thinner markets they can fill across multiple price levels and increase slippage, which is a risk Millionero also flags when discussing illiquid markets. With leverage, small execution differences can matter more because they change how close you are to a liquidation price.

Ultimately, broad coverage is helpful, but consistent liquidity is what makes those markets genuinely tradable.

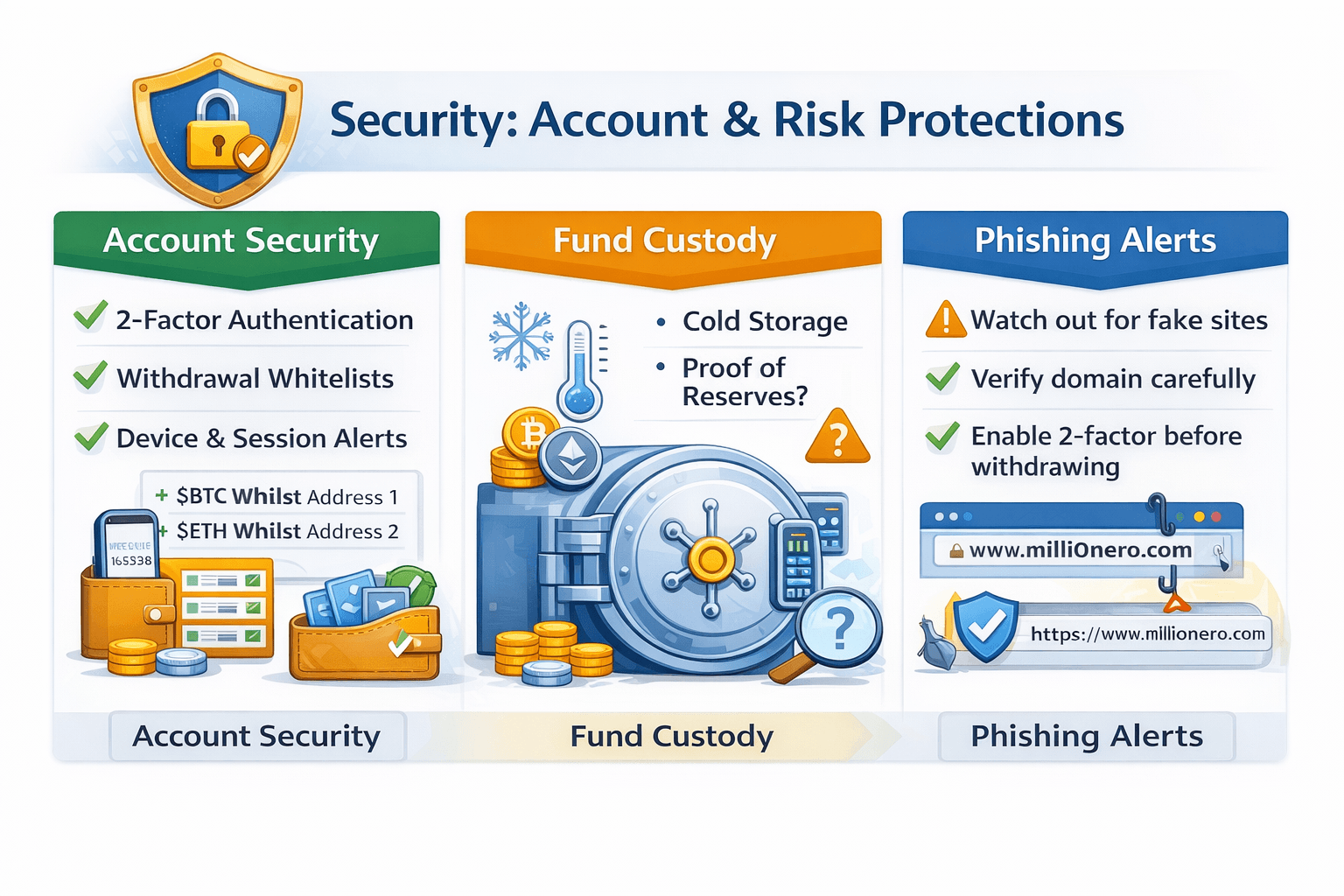

Security and Risk Reality Check

Security is easiest to judge when you look at what the platform asks you to do at the account level, what it says about how funds are stored, and how it responds to common real world threats like phishing.

Millionero Highlights 2FA, Verification Checks, and Offline Storage

Millionero Highlights 2FA, Verification Checks, and Offline StorageAccount Security Features to Look for

Millionero emphasizes setting up two factor authentication and also treats it as a core safeguard alongside identity checks and withdrawals.

Key account level controls to look for include:

- Two factor authentication for sign ins and sensitive actions such as withdrawals.

- Withdrawal protections that add friction to unauthorized cash outs, particularly when funds move off platform.

- Device and session controls that help you spot unfamiliar activity and limit access.

Verification can also affect withdrawal timing. As per its guide for beginners shared earlier, Millionero references identity checks and notes verification can take up to 24 hours. That aligns with how KYC and AML processes often work across exchanges, where additional checks can be triggered by account activity or regional requirements.

Custody and Platform Security Posture

Again, Millionero's beginners guide describes a security approach that includes keeping most user funds in cold storage, alongside other operational security measures such as audits.

The bigger question for risk focused users is how much exchange specific transparency is available beyond general security claims. Millionero has an explainer on proof of reserves, but an educational explainer is not the same thing as publishing a live, platform specific reserve report or third party attestation that can be independently checked.

Phishing and Impersonation Risks

Millionero has issued an urgent security alert about phishing websites impersonating the brand, which highlights a common reality in crypto: many losses start with a fake login page or a fake support interaction, not a direct platform breach.

Practical protections that map closely to how these attacks work include:

- Treating unexpected outreach as a potential crypto scam.

- Verifying the domain carefully before entering credentials.

- Enabling two factor authentication before initiating withdrawals.

Millionero highlights two factor authentication, verification checks, and offline storage as core protections, while the most important open ended question is whether it offers independently verifiable custody transparency beyond general descriptions. You can get more information from

Web vs Mobile: How the Experience Holds Up

On paper, the basics of using Millionero sound similar on web and mobile: create an account, complete verification if required, then switch between spot and perpetuals depending on what you want to trade. Generally, the difference is mostly about convenience, screen space, and how quickly you can find risk controls when markets move. However, in this case, we stumbled upon a concerning discrepancy during our deep dives.

The Pending Mobile App Saga Remains a Mystery. Image via Millionero

The Pending Mobile App Saga Remains a Mystery. Image via MillioneroOnboarding and Account Setup

Millionero claims to support registration on the web version and via its Android app, with the same core flow of email registration and account activation. Verification is handled through a dedicated KYC process, and Millionero notes that checks can take up to 24 hours, especially when additional review is needed.

This is what Millionero says, however, the reality seems a bit different and odd. There are a few things of concern that we spotted.

- Millionero claimed in 2024 that it's Apple Store app is on the way. It still isn't available.

- In the same February 2024 post, it's own provided link to its Google Play Store leads nowhere. Manual searches also yield no result for “Millionero”.

- Later, we found that in December 2025, Millionero announced mobile applications for iOS and Android scheduled for release in the coming weeks, which is contradictory to previous information.

Serious Concern

For us, this really hits Millionero's credibility. The fact that “published claims” do not correlate with tangible reality leaves users and readers to take its other claims with a few pinches of salt. This is why we continue to stick to our non-partisan advice to our readers on doing your own due diligence and checks before you start investing or trading on any platform.

Performance and Reliability Signals

Millionero highlights platform upgrades and trading features through its own platform update posts. In terms of third-party sentiment, Trustpilot currently lists Millionero at an “Poor” TrustScore out of 5 of 2.7 overall based on 32 reviews (as of Feb. 6, 2026). Themes in positive reviews most often highlight an easy-to-use platform and helpful support, while the negative reviews most commonly allege aggressive outreach/marketing calls and raise trust/scam concerns.

The experience comes down to whether onboarding feels smooth in your region and whether risk controls are easy to reach on the device you actually trade from. Also, if you are just beginning, a good way is to start with reputed mainstream exchanges first to understand how the crypto trading world moves before trying other platforms like Millionero.

MIL Token Overview: Use Cases and Key Considerations

Millionero’s ecosystem now includes its own token, MIL. Exchange tokens can add genuine utility inside a platform, but they also introduce an extra layer of risk because the token’s value and usefulness are closely tied to the exchange’s ongoing adoption and product delivery.

MIL is Millionero’s Token on the Solana Blockchain. Image via Millionero

MIL is Millionero’s Token on the Solana Blockchain. Image via MillioneroWhat MIL is

MIL is Millionero’s token on the Solana blockchain. The token is described with a fixed total supply of 5,000,000,000, a stated launch date of 15 January 2026, and an issue price of $0.007. The same token details list a circulating supply of 1,214,500,000 at the time of publication.

What MIL is Used for on Millionero

MIL is positioned as a utility token that connects to activity on the exchange, including:

- Paying platform costs as a means of payment for fees

- Unlocking or improving lower trading fees

- Converting activity rewards into tokens through a reward points to token model

Additional utilities are presented as planned features on the platform roadmap as per its whitepaper, including staking, a launchpool, a launchpad, and a crypto card that would offer cashback in MIL.

The vesting schedule describes a mix of immediate unlocks at the token generation event and longer release schedules, including cliffs for several categories, along with a described buyback and burn mechanism intended to reduce supply over time.

Key Risks to Know before Using MIL

The biggest consideration is that MIL’s usefulness depends on actual exchange usage and how consistently planned utilities are delivered on the stated roadmap. There is also token volatility risk, and mechanisms like buybacks depend on future platform revenue and execution under the rules described for buybacks and burns in the whitepaper.

Taken together, MIL is designed to link exchange activity to concrete perks such as fee reductions and rewards, while the main tradeoff is that the token’s value and utility remain closely tied to Millionero’s platform progress and adoption.

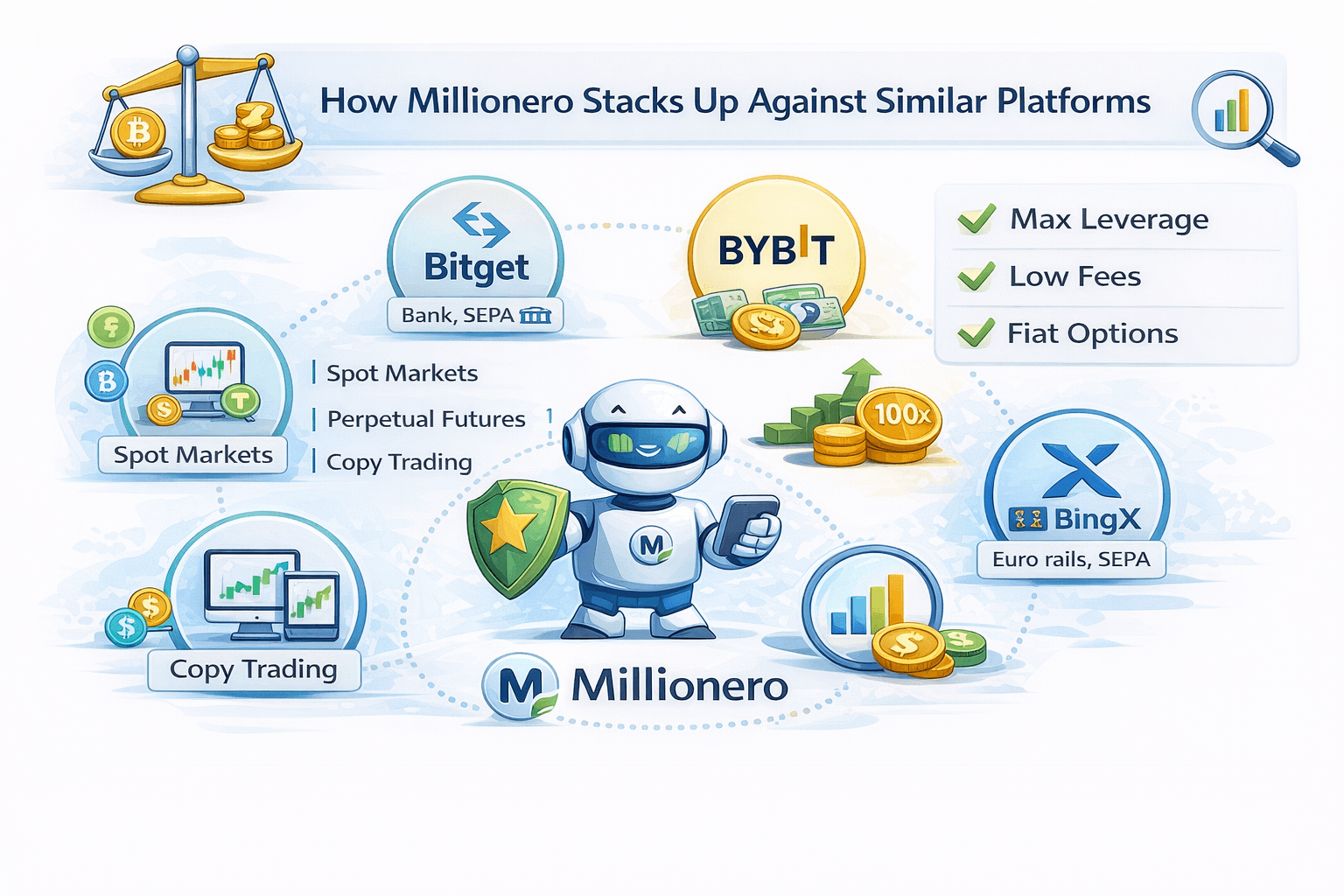

How Millionero Stacks Up Against Similar Platforms

Comparisons work best when the products are broadly similar. Millionero positions itself around spot trading and perpetuals with copy trading as a key add on, so the closest benchmarks are exchanges that combine those same features at scale.

Comparisons Work Best when the Products are Broadly Similar

Comparisons Work Best when the Products are Broadly SimilarWhy These are the Closest Comparisons

The most comparable platforms are those that offer the same core bundle:

- Spot markets

- Perpetual futures

- Copy trading with leaderboards and follower controls

That is why platforms like Bitget, Bybit , and BingX tend to sit in the same comparison set.

Comparison Table

| Platform | Core products | Max leverage where published | Fee basics | Fiat rails availability |

|---|---|---|---|---|

| Millionero | Spot, perpetuals, copy trading | Up to 100x leverage | Spot: 0.12% maker / 0.15% taker. Perpetuals: 0.05% maker / 0.08% taker with fee drops up tiers | Crypto rails plus third party options such as Banxa and Transak referenced in onboarding materials |

| Bitget | Spot, futures, copy trading | Up to 125x leverage | Spot: 0.10% maker / 0.10% taker. Futures/perpetuals: 0.02% maker / 0.06% taker. Discounts up tiers. | Bank rails including SEPA transfers in supported regions |

| Bybit | Spot, derivatives, copy trading | Up to 100x on some perpetual contracts | Spot: 0.10% maker / 0.10% taker. Perpetual & futures: 0.01% maker / 0.06% taker (non-VIP table). | Fiat deposit and withdrawal rails and fiat withdrawal FAQ including SEPA in eligible regions |

| BingX | Spot, futures, copy trading | BTC leverage increases up to 150x | Spot: 0.10% maker / 0.10% taker. Perpetual futures: 0.02% maker / 0.05% taker. | Eurozone rails including SEPA and SEPA Instant plus bank transfer for EUR deposits |

A simple way to choose between these options is to start with your primary use case. If the priority is a simplified spot and perpetuals experience with copy trading as an add on, Millionero positions itself for that audience, while the larger venues typically offer broader market coverage and more mature support documentation across regions.

For more details, we recommend that you check out our exclusive reviews of:

Support and Education

Even strong platforms feel complicated the first time you deposit, place a trade, or withdraw. What matters is how quickly you can reach support and whether the educational material answers the questions beginners actually have.

What Matters is how Quickly you can Reach Support

What Matters is how Quickly you can Reach SupportSupport Channels and Responsiveness

Millionero lists a support email at [email protected] and also references a website chatbot for assistance. Support expectations can vary by region and time zone, so response times are not always consistent for global users.

Educational Content

Millionero’s Help Center covers common actions like KYC and two factor authentication, alongside safety posts such as its phishing alert that we mentioned earlier.

Clear support routes and practical guides reduce friction, especially when you are learning the basics under real market pressure.

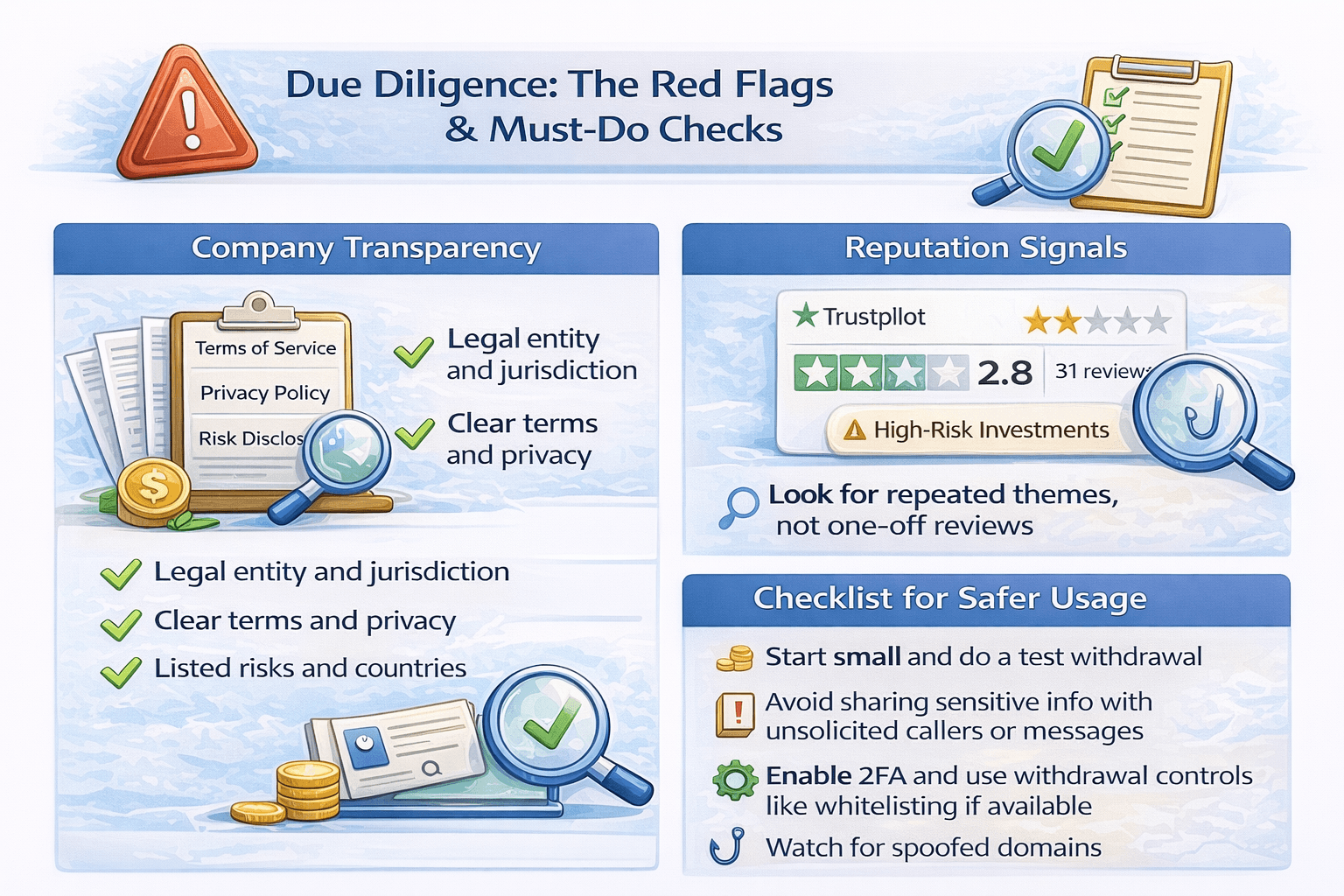

Due Diligence: The Red Flags and the Must Do Checks

Even when an exchange looks straightforward on the surface, it is worth slowing down and confirming the basics. With Millionero, the most useful due diligence comes from matching what the platform says about its rules and protections with what you can observe during onboarding and withdrawals.

Even when an Exchange Looks Straightforward on the Surface, it is worth Slowing Down and Confirming the Basics

Even when an Exchange Looks Straightforward on the Surface, it is worth Slowing Down and Confirming the BasicsVerify Company Transparency and Disclosures

The clearest baseline signals are the core documents that define how the platform works, including the Terms of Service, Privacy Policy, and Risk Disclosures.

What to look for:

- Clear legal entity details and jurisdiction

- Terms and privacy clarity around data handling and account controls

- Risk disclosures that spell out user responsibility, platform limitations, and leverage related risks

Millionero also lists restricted access by jurisdiction through its list of prohibited countries, which is especially relevant for a global audience. Make sure to check availability in your region and any specific restrictions or rules.

Weigh Third Party Reputation Signals

Reputation signals are most useful when you look for repeated themes rather than one off stories. As mentioned earlier, Millionero has a mixed profile as per Trustpilot, including a TrustScore of 2.7 with 32 reviews and a platform label that notes it may be associated with high risk investments.

A practical way to interpret feedback is to separate issues that can be verified, such as withdrawal timing or account access friction, from claims that cannot be independently confirmed.

Checklist for Safer Usage

- Start small and do a test withdrawal

- Avoid sharing sensitive information with unsolicited callers or messages

- Enable two factor authentication and use withdrawal controls such as whitelisting if available

- Watch for spoofed domains, especially in light of Millionero’s phishing alert shared earlier

Done well, due diligence does not require deep technical knowledge, it just means confirming the fundamentals and treating unclear disclosures or repeated user reported friction as a risk signal.

Final Verdict: Who It’s For, Who Should Pass

Millionero is most likely to suit traders who want a straightforward place to combine spot and perpetuals, especially if they value a simpler interface and are comfortable doing the basic setup that makes an exchange account meaningfully safer. It can also appeal to users who are curious about copy trading as a way to learn, as long as they treat it like training wheels rather than autopilot and keep position sizes small while they get familiar with how fees, funding, and execution behave in real conditions.

On the other hand, anyone who prioritizes maximum regulatory clarity, independently verifiable transparency signals, or consistently deep liquidity across a wide range of markets may be better served by larger, more established venues. Especially notable is the communication and lack of clarity on its App. The biggest decision drivers come down to whether the pricing and product mix match your style, whether the trust signals meet your comfort level, and whether the experience on your preferred device feels frictionless enough for the way you trade, with the added reminder that leverage and copy trading can magnify mistakes as quickly as they magnify gains.