Spending crypto in everyday life still feels harder than it should. Most crypto cards today sit on top of custodial exchanges or fintech layers that require pre-loading funds, trust an intermediary to hold funds, and accept the risk of frozen accounts or sudden policy changes. Even when payments work, the user experience often breaks the most important promise of crypto: direct ownership and control.

This gap between holding crypto and actually using it is where Tangem Pay positions itself. Tangem Pay is a self-custodial crypto payment product that lets users spend on-chain stablecoins through Visa rails, starting with USDC on Polygon, without handing over private keys to an exchange or bank-like custodian.

Tangem Pay aims to merge cold-wallet-style control with the global acceptance of card payments. Funds remain on-chain and under user control until the moment a payment is made, while merchants receive fiat just as they would from any standard Visa transaction. For users, this means fewer trust assumptions and fewer conversion steps between crypto savings and real-world spending.

This article breaks down how Tangem Pay works and why it matters. It starts with Tangem’s background and its move from secure storage into payments, then explains the product’s architecture, transaction flow, and security model. From there, it looks at user experience, fees, geographic rollout, comparisons with traditional crypto cards, and the trade-offs involved. The goal is to assess whether Tangem Pay represents a meaningful step toward practical, self-custodial spending rather than another layer of crypto-branded fintech.

Quick Verdict

Tangem Pay is built for fast, everyday crypto spending without the usual card friction. You manage your payment balance in USDC (starting with USDC on Polygon), swap into it directly in the Tangem app, then pay with a simple, “two-tap” flow. Pricing is clear: 1:1 USDC-to-USD conversion with no hidden fees, and the card itself is free.

Under the hood, it still keeps the self-custody advantage intact, with assets staying in your Tangem cold wallet until you choose to move USDC into your payment account. The main trade-offs are the realities of card rails, issuer partners, and regional availability, plus the fact that your payment balance is stablecoin-based rather than a “spend anything, anywhere” banking replacement.

If you want an all-in-one setup for storing, managing, swapping into USDC, and spending in a couple of taps, Tangem Pay is a coherent, convenience-first option that still keeps security in the loop.

Who It Suits

- Anyone who wants a fast, “two-tap” way to spend crypto day to day

- Users who want simple spending while keeping long-term holdings protected in a self-custodial cold wallet

- People who like clear pricing and want straightforward 1:1 conversion from USDC to USD with no hidden fees

- Users who want one place to store, manage, swap into USDC (on Polygon), and spend without extra platforms

Who Should Consider Other Options

- Power users who need advanced “bank-like” features such as credit lines or highly developed dispute tooling

- Anyone in regions where Visa-linked crypto cards face heavy restrictions or unreliable availability

- Users who specifically want multi-currency payment balances today (beyond a USDC-managed payment account)

- Those who prefer a pure on-chain merchant payment flow rather than card rails and issuer partners

Background: Tangem and the Push for Self-Custody Payments

Before Tangem Pay makes sense as a product, Tangem itself needs some context. Tangem is best known as a hardware wallet company that took a different path from seed phrases, browser extensions, and metal backups. Its main products are physical form factors, cards, and rings, built around secure chips that hold private keys directly and interact with a mobile app through NFC.

At the center of Tangem’s approach is a strong stance on self-custody. The company has consistently pushed the idea that crypto ownership should not depend on remembering seed phrases or trusting cloud backups. Instead, the secure element inside the Tangem card or ring generates and stores keys in a way that feels closer to consumer hardware than to traditional wallet software. For many users, this lowered the barrier to self-custody without introducing custodial risk.

That philosophy naturally extends beyond long-term storage. Holding assets securely is only half the story if spending them still requires routing funds through exchanges or banks. Tangem has framed this as a structural gap in crypto adoption. Users can self-custody assets, but the moment they want to pay rent, buy groceries, or subscribe to a service, they are often pushed back into custodial rails.

Moving from storage into payments closes that loop. Tangem Pay applies the “not your keys, not your coins” principle to everyday transactions rather than just HODLing. Instead of treating spending as a separate, custodial activity, Tangem positions payments as another operation authorized by the user’s own keys, with external partners limited to narrowly defined roles.

The announcement of a Visa-backed payment product marked a clear shift in ambition. By working within the Visa ecosystem, Tangem signaled that it was not trying to build a parallel merchant network or crypto-only payment rail. The goal was mainstream acceptance from day one, using infrastructure merchants already trusted, while keeping crypto-native custody guarantees on the user side.

This framing places Tangem Pay as more than a card add-on. It is positioned as an attempt to reconcile two worlds that usually clash: regulated card networks and self-custodial on-chain assets. Understanding that tension sets the stage for a closer look at what Tangem Pay actually is and how it differs from existing crypto payment products.

Read out full Tangem Wallet review.

With that background in place, the next step is to define Tangem Pay itself and outline its characteristics.

What is Tangem Pay?

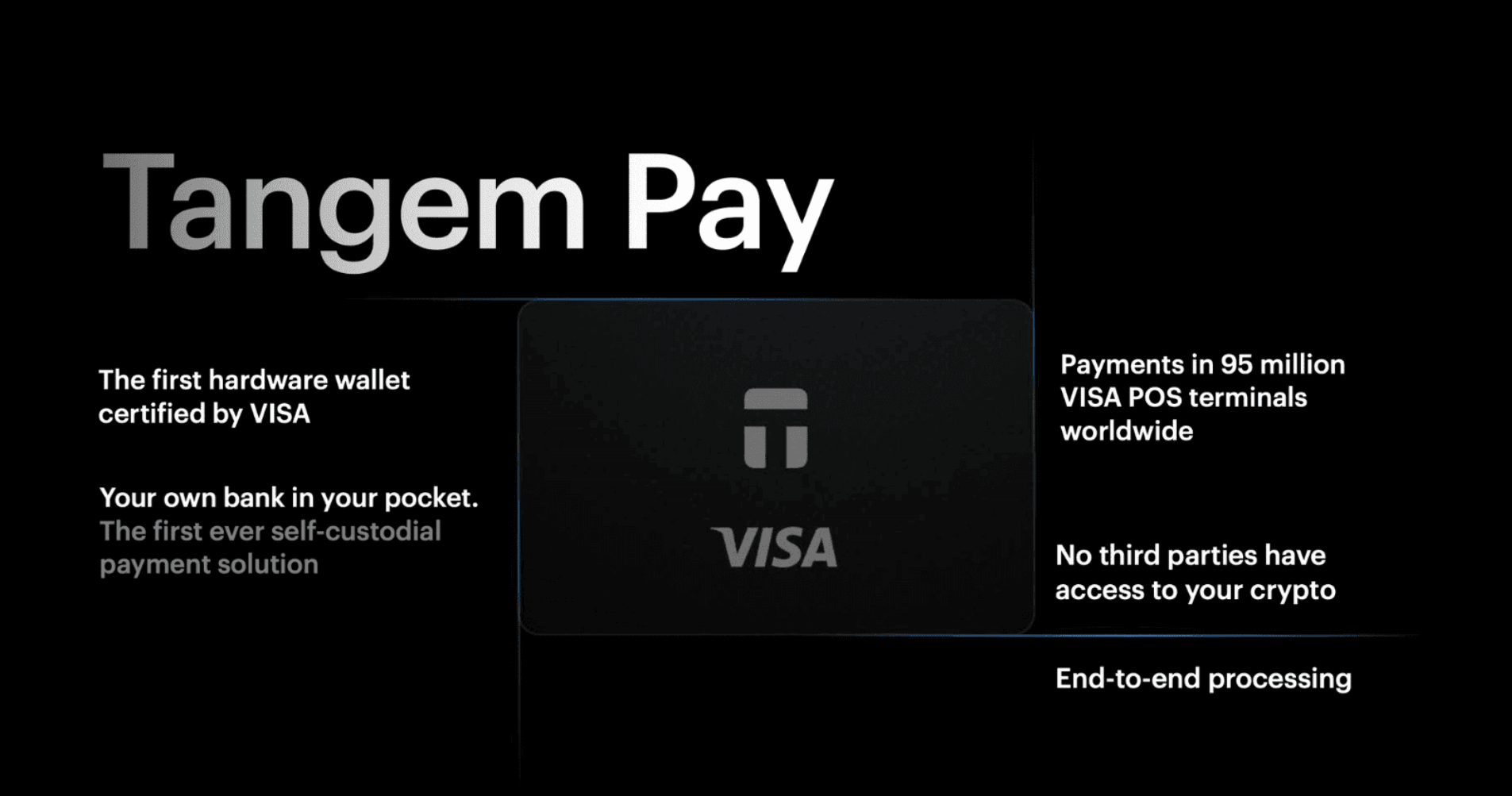

Overview Of Tangem Pay And Its USPs. Image via Tangem Pay

Overview Of Tangem Pay And Its USPs. Image via Tangem PayTangem Pay sits at the very intersection of self-custody wallets and card-based payments. It is not a separate bank account and not an exchange wallet with a card attached. Instead, it is designed as a regulated payment layer that plugs into Tangem’s existing self-custodial wallet stack while respecting the constraints of global card networks.

At a high level, Tangem Pay lets users hold stablecoins on-chain and spend them anywhere Visa is accepted, without first moving funds into an off-chain, custodial balance.

For a quick check on costs and trade-offs, see our Tangem Wallet deal overview.

Core Definition

Tangem Pay is a non-custodial payment account embedded directly inside the Tangem Wallet app. Users activate it alongside their regular Tangem Wallet, but it operates as a distinct module designed specifically for payments.

The product issues a virtual Visa card that can be added to Apple Pay and Google Pay, enabling contactless and online payments from day one. A physical card version is also planned, extending the same functionality to traditional card use cases without relying on a smartphone.

On the asset side, Tangem Pay launches with support for on-chain USDC on Polygon. This choice is deliberate. USDC provides price stability for everyday spending, while Polygon offers low fees and fast confirmation times that fit point-of-sale requirements. Tangem has stated that support for additional stablecoins and networks is planned over time.

The key distinction is that funds do not sit in a custodial ledger maintained by Tangem or an exchange. USDC remains on-chain and under user control until a payment is actually authorized.

Key Characteristics

What sets Tangem Pay apart is not the presence of a Visa card, but how that card interacts with on-chain funds.

- First, the product is explicitly self-custodial. Users retain control of their private keys, and there are no pooled balances or omnibus accounts where customer funds are rehypothecated or internally netted. This sharply contrasts with most crypto cards that are effectively wrappers around exchange accounts.

- Second, conversion happens in real time. USDC stays on-chain until the moment of purchase. When a transaction is initiated, the system verifies the on-chain balance and authorization, then converts the required amount one-to-one into fiat through Visa settlement rails. There is no need to pre-sell crypto or maintain a fiat balance ahead of time.

- Third, Tangem Pay functions as a non-custodial spending account rather than a bank account or exchange wallet. This distinction matters. There is no escrowed balance controlled by Tangem, and there is no internal ledger that can be frozen independently of the user’s keys. The payment layer has limited, purpose-built authority, while ownership remains with the user.

Taken together, these characteristics position Tangem Pay as a bridge rather than a vault. It does not try to replace banks or wallets outright. Instead, it attempts to let self-custodial crypto behave like spendable money without abandoning the guarantees that make self-custody appealing in the first place.

For quick clarity on custody differences, see our custodial vs. non-custodial wallets breakdown.

How Tangem Pay Works Under the Hood

At the surface, Tangem Pay behaves like a familiar card product. You tap a phone, pay online, and the merchant receives fiat. Underneath that flow, however, the mechanics are closer to an on-chain authorization system than a traditional card balance check. Understanding this structure is key to seeing why Tangem Pay is meaningfully different from most crypto cards.

Account Setup and Funding

- The setup process starts inside the Tangem Wallet app.

Account Setup and Funding

Account Setup and Funding- Users activate Tangem Pay as a separate payment account and complete identity verification. This KYC step applies only to the Tangem Pay card account (the Visa-linked layer), which must meet card network and issuer compliance requirements. Your Tangem cold wallet remains self-custodial and private: your keys stay on the secure chip, and the wallet itself does not require identity verification.

- Once activated, funding the account is straightforward.

- Users send USDC on Polygon from any external wallet or exchange directly into the Tangem Pay account address. There is no conversion to fiat at this stage and no internal ledger credit. If you’re holding USDT elsewhere, Tangem Wallet also lets you move into the right rail fast with a one-tap, 1:1 USDT → USDT (Polygon) swap with no commission, so you can fund Tangem Pay without extra steps.

- The funds arrive as on-chain USDC, visible on the blockchain.

An important architectural detail is the separation between the main Tangem Wallet and the Tangem Pay account.

The wallet remains a fully self-custodial, non-KYC crypto wallet.

Tangem Pay, by contrast, is a regulated payment product with identity checks and issuer oversight. These two environments are deliberately siloed. This allows Tangem to comply with payment regulations without turning the entire wallet into a regulated account.

Transaction Flow at the Point of Sale

When a user makes a payment, the experience looks identical to any other card transaction.

- A Visa authorization request is triggered when the card is tapped or used online. From the merchant’s perspective, this is a standard Visa flow.

- Behind the scenes, the difference becomes clear. Instead of checking an off-chain fiat balance, the payment processor queries the on-chain USDC balance associated with the Tangem Pay account. This check is performed through a smart-contract-based bridge that links card authorization logic to blockchain state.

- Two verifications happen in parallel.

- First, the system confirms that there is sufficient USDC on-chain to cover the transaction amount.

- Second, it verifies that the correct Tangem card or device is authorizing the spend, using cryptographic proof tied to the user’s keys. Both conditions must be met for the transaction to proceed.

- Once authorized, the required amount of USDC is converted one-to-one into fiat during settlement on Visa rails.

- The merchant receives fiat currency as usual, with no exposure to crypto volatility or blockchain mechanics.

From the user’s side, funds only leave the on-chain account at the moment of a successful purchase.

Security and Key Management

Security is where Tangem Pay leans most heavily on its hardware wallet roots.

The system uses a two-key architecture. One key is fully controlled by the user and secured by the Tangem chip. The second key is held by the issuing partner, commonly referenced as Rain, and is tightly restricted in scope.

The partner-held key cannot move funds freely or withdraw balances. Its sole purpose is to co-sign valid card transactions that meet predefined conditions. This means the issuer can help authorize payments without ever having unilateral control over user funds.

This model strikes a balance between usability and control. It allows Tangem Pay to integrate with card tokenization systems, fraud checks, and online payments while preserving a cold-wallet-grade security posture. Even if an issuer or processor were compromised, the attacker would not have direct access to drain funds outside of approved spending flows.

By combining hardware-secured keys with narrowly scoped payment authorization, Tangem Pay attempts to reduce the typical trade-off between security and convenience that plagues crypto payment products.

For basic safeguards before you trade, our crypto safety and protection guide is a helpful reference.

Features and User Experience

Once the underlying mechanics fade into the background, Tangem Pay is meant to feel familiar. The goal is not to teach users a new way to pay, but to let them spend stablecoins with the same ease as a conventional card, while keeping the custody model intact. This section looks at how that design translates into everyday usage, costs, and privacy trade-offs.

Everyday Spending

In daily use, Tangem Pay behaves like a standard Visa card. It can be used at physical point-of-sale terminals, for online shopping, and for recurring payments such as subscriptions. Because the card is virtual by default, it integrates directly with Apple Pay and Google Pay, enabling tap-to-pay without waiting for a physical card.

This makes it viable for routine expenses. Users can pay for groceries, transportation, utilities, rent, or digital services directly from on-chain stablecoin balances. There is no intermediate step of selling crypto, waiting for settlement, or moving funds into a bank account before spending.

A typical flow looks like this. A user transfers USDC from an exchange or another wallet into their Tangem Pay account. Later, at a supermarket checkout, they tap their phone. The payment is authorized, USDC is debited on-chain, and the merchant receives fiat. From the user’s perspective, the experience is no different from paying with a debit card, except that the balance is crypto-native.

Everyday Spending Fees, Limits, and Costs

Tangem Pay does not charge monthly maintenance fees or additional transaction fees at the application layer. Users primarily pay standard Polygon network gas fees when funds move on-chain, along with any foreign exchange charges applied by Visa when spending in a non-base currency.

Polygon’s role here is important. Low transaction costs and fast confirmation times make it suitable for point-of-sale use, where latency and unpredictable fees would quickly degrade the experience. This is one reason Tangem launched with Polygon rather than the Ethereum mainnet.

Like most card products, Tangem Pay operates with limits. These can include per-transaction caps, daily or monthly spending limits, and regional restrictions. The exact thresholds depend on issuer policies and local compliance requirements. While some parameters are public, others are expected to change as the product expands into new jurisdictions and Visa programs.

Privacy and KYC

Privacy is handled through compartmentalization rather than full anonymity. KYC applies only to the Tangem Pay account, not to the core Tangem Wallet. Identity verification is required to issue and operate a Visa card, but the wallet itself remains a separate, self-custodial environment without built-in identity linkage.

Personal data associated with Tangem Pay is handled by the issuing partner under card network compliance rules. KYC and identity data are processed by Rain on behalf of the card issuer. Tangem does not collect or store your personal data. Tangem’s wallet infrastructure is architected separately, reducing data leakage between custody and payment layers. This design choice aims to limit how much user identity is exposed relative to full exchange-based accounts.

There is an unavoidable trade-off. Using global card rails requires compliance, which means KYC and transaction monitoring at the payment layer. Tangem Pay accepts this constraint while preserving self-custody of funds. For users who prioritize spending flexibility over full anonymity, this balance may be acceptable. For those seeking purely permissionless, anonymous payments, it highlights the limits of integrating crypto with existing financial infrastructure.

Geographic Availability and Rollout

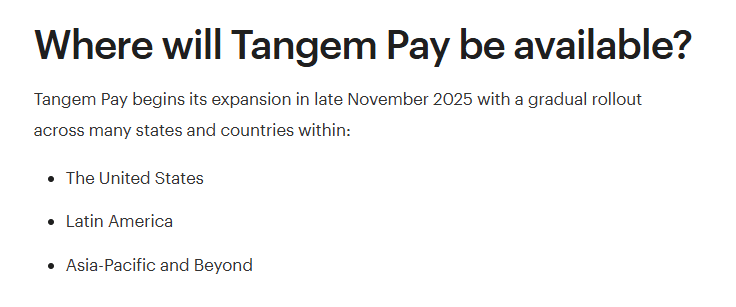

Users Can Sign up Via Waitlist In These Regions. Image via Tangem Wallet

Users Can Sign up Via Waitlist In These Regions. Image via Tangem WalletTangem Pay is not launching as a globally available product overnight. Instead, Tangem has opted for a phased rollout that reflects the regulatory complexity of issuing card-based payment products tied to on-chain assets. This gradual approach is intended to balance expansion with compliance and infrastructure readiness.

The rollout follows a waitlist-based model. Users can express interest through the Tangem Wallet app and are onboarded in stages as regions are activated. This process began in late 2024 and continues through 2025, with capacity expanding as issuer partnerships, Visa programs, and local regulatory approvals come online.

Initial target regions span multiple markets rather than a single geography. These include parts of the United States, Latin America, and Asia-Pacific and Africa, with specific mentions of markets such as Japan, Singapore, Hong Kong, Australia, South Africa, and the United Arab Emirates. Each of these regions represents a different regulatory posture toward crypto payments, which explains the staggered activation rather than a uniform global launch.

Expansion timelines are influenced by several factors. Local regulation around stablecoins and crypto payments plays a central role, as does the availability of compliant issuer partners capable of supporting Tangem Pay’s architecture. Visa program eligibility and network-level approvals also shape which countries can be added and when.

This controlled rollout suggests that Tangem is treating Tangem Pay as a long-term infrastructure product rather than a marketing-driven card launch. While this limits immediate access for some users, it reduces the risk of abrupt service suspensions that have affected crypto cards in the past due to regulatory reversals or issuer withdrawals.

Tangem Pay vs Traditional Crypto Cards

Most crypto cards promise the same outcome: spend crypto like cash. The difference lies in where funds live before you tap the card and who controls them along the way. Tangem Pay takes a structurally different approach, and that becomes clearer when set against exchange-backed cards and so-called DeFi cards.

Check out our top picks for the best crypto credit cards.

Architecture Differences

Exchange-linked crypto cards are built on custodial foundations. Funds are deposited into an exchange account, tracked on an internal ledger, and only indirectly tied to blockchain balances. The card checks that off-chain balance, not the chain itself. If the exchange freezes withdrawals, pauses services, or faces insolvency risk, spending stops regardless of what the blockchain says.

Tangem Pay flips that model. Custody remains with the user. USDC stays on-chain until the moment of purchase, and there is no requirement to pre-fund a custodial wallet or maintain a fiat balance. The card authorization checks the blockchain state and cryptographic permission rather than an exchange ledger.

This difference directly affects counterparty risk. With exchange-backed cards, users are exposed to the operational and regulatory risk of the platform holding their funds. With Tangem Pay, that exposure is narrowed. Issuer partners facilitate card settlement but do not control pooled customer balances.

Many “DeFi cards” marketed as non-custodial still rely on intermediaries in practice. They often require pre-loading assets into smart contracts that are effectively controlled by a service provider or routed through centralized processors. Tangem Pay’s architecture aims to limit that control to a narrowly scoped spending authorization rather than full custody.

User Experience Differences

From a usability perspective, Tangem Pay competes directly with the convenience of traditional cards. Payments are fast, tap-to-pay works as expected, and online checkouts do not require manual conversions or swaps ahead of time. The user does not need to decide when to sell crypto or move funds into fiat. That happens automatically at settlement.

The integration with Tangem’s hardware wallet environment is another differentiator. Spending originates from the same secure context designed for long-term self-custody, rather than from a web dashboard or exchange app. This reduces the mental split between “savings wallet” and “spending account” that many users manage today.

Regulatory friction still exists, but it is scoped. KYC is required for the payment layer to operate on Visa rails, yet it does not automatically extend to the entire wallet ecosystem. Compared to full exchange onboarding, which often includes broader surveillance and account controls, Tangem Pay limits compliance to what is strictly necessary for card functionality.

Overall, the comparison highlights a trade-off. Tangem Pay sacrifices some of the flexibility and asset variety offered by exchanges in favor of tighter custody guarantees and simpler spending flows. For users who prioritize control and reduced counterparty exposure, that trade may be compelling.

Benefits and Use Cases

Tangem Pay is not designed to replace every financial tool a user might need. Its value shows up most clearly in specific situations where self-custody, stability, and everyday spendability intersect. Looking at the benefits first, and then at concrete use cases, helps clarify where the product fits.

Key Benefits

Tangem Pay is about control without isolation. The benefits flow from that design choice.

- Full Control Over Funds: Users keep their private keys while still accessing Visa’s global card network. No bank or exchange sits between custody and spending.

- Spend Stablecoins Without Cashing Out: USDC stays on-chain until the moment of payment. That removes repeated conversions, timing risk, and extra fees.

- Reduced Platform Risk: Funds are not parked on exchanges or pooled custodial wallets. This limits exposure to freezes, withdrawal halts, or insolvency events.

Example Use Cases

One clear audience is digital nomads and remote workers paid in stablecoins. For users earning USDC through global clients, DAOs, or on-chain payroll systems, Tangem Pay provides a direct bridge to local expenses without routing income through banks or exchanges each month.

Users in high-inflation or capital-controlled economies are another group. Holding value in USDC can offer relative stability compared to local currencies. Tangem Pay allows those balances to be spent on everyday goods and services without first converting to local fiat through informal or expensive channels.

A third use case is on-chain earners more broadly. This includes users generating yield through DeFi protocols, receiving freelance payments in stablecoins, or managing treasury funds on-chain. Tangem Pay lets these funds move from smart contracts to offline spending with minimal friction, reducing the need for manual cash-out strategies.

Even so, no payment system is without trade-offs. The next section examines the risks, limitations, and open questions surrounding Tangem Pay.

Risks & Limitations of Tangem Pay

Tangem Pay improves how stablecoins are spent, but it does not remove risk entirely. The constraints fall into a few clear buckets.

- Issuer and Card Network Dependency: Even with self-custody, payments still rely on Visa programs and regulated issuer partners. If an issuer exits or policies change, card access can be disrupted.

- Regulatory Uncertainty Across Regions: Rules around stablecoins and crypto-linked cards vary by country. What works smoothly in one jurisdiction may face limits or restrictions in another.

- Limited Asset and Network Support Today: At launch, Tangem Pay supports USDC on a single network. Users holding funds elsewhere must bridge or convert before spending.

- Smart Contract And Wallet Risk: While Tangem has a strong security track record, on-chain systems always carry residual risk from bugs, exploits, or implementation flaws.

- No Protection From Market Volatility: Stablecoins reduce price swings, but users remain exposed to issuer risk and bigger stablecoin market events.

- Not Designed For Complete Banking Replacement: Tangem Pay covers spending well, but features like credit, dispute handling, and full financial services remain limited.

Before using bridges, check our explanation of how cross-chain bridges work and where risks lie.

Taken together, these risks do not negate Tangem Pay’s value. They simply define where the product fits today, and where traditional finance or custodial services may still play a role for some users.

How to Get Started With Tangem Pay

Scan Your Card, Setup Your Wallet and Begin. Image via Tangem Pay

Scan Your Card, Setup Your Wallet and Begin. Image via Tangem PayGetting up and running with Tangem Pay begins inside the Tangem Wallet app and involves a mix of self-custodial setup and required identity verification for card issuance.

Here are the official steps:

1. Prepare your Tangem Wallet and device

- Install the official Tangem Wallet app on your iOS or Android smartphone.

- Make sure you have a Tangem Wallet (card or ring) already set up — this provides the self-custodial foundation for your funds.

2. Ensure eligibility

- You need a valid ID and a residency address in a supported country to complete KYC.

- Your device must be supported and have the Tangem app installed.

3. Activate Tangem Pay inside the app

- Open the Tangem Wallet app and join the Tangem Pay waitlist if required.

- When invited, start the Tangem Pay activation flow.

- Complete the one-time identity verification (KYC) required to issue a virtual Visa card. This process is handled by the issuing partner and is siloed from your main wallet’s self-custody layers.

4. Fund your Tangem Pay account

- Once the virtual card is issued, top up your Tangem Pay account by sending USDC on Polygon from your Tangem Wallet or another external wallet.

- Funds stay on-chain in a smart contract you control until they’re spent.

5. Add your virtual card and spend

- Add the virtual Tangem Pay Visa card to Apple Pay or Google Pay.

- Use it anywhere Visa is accepted for contactless and online payments.

Optional: If a physical Tangem Pay card becomes available in your region later, you can order and activate it through the same flow.

Safety History, Security Posture and Past Issues

Tangem’s security track record is an important context for assessing Tangem Pay’s risk profile. Tangem hardware wallets use secure, EAL6+ certified chips to store private keys offline, and the company has operated since 2017 with millions of cards distributed worldwide. Independent audits and certifications support the baseline strength of this architecture.

However, no product is immune to scrutiny or bugs, and Tangem has faced specific security-related incidents:

- Mobile app vulnerability (2024): In late 2024, Tangem acknowledged a bug in the mobile wallet app where private keys were mistakenly logged in application logs when a wallet was activated using a seed phrase, and the user contacted support via the app within a short window. Tangem fixed the issue quickly, deleted the logs, and confirmed that no funds were stolen or keys compromised as a result.

- Genuine check vulnerability (2025): A third reported issue involved a flaw in the card authenticity “genuine check” on Android that could, in specific conditions, allow counterfeit cards to appear genuine in older app versions. Tangem released a patch in updated app builds to address this verification vulnerability.

Taken together, these events reflect a mix of proactive and reactive security responses:

There have been no publicly confirmed catastrophic hacks of Tangem hardware wallets that led to mass theft of funds.

Reported issues have been resolved through patches or clarified as theoretical/lab-only risks rather than real-world exploits.

The company’s layered security (offline key storage, no internet-connected firmware updates, and secure chip protections) aligns with industry practices for cold wallets, although smartphone-connected apps and card rails introduce additional surfaces that require vigilance.

Tangem Pay inherits the same base security model as Tangem Wallet for custody, but it also introduces regulated payment rails and on-chain smart-contract interactions. That hybrid approach reduces some risks (no custody on an exchange) but adds others (contract logic, bridging, KYC systems) — making scrutiny of both wallet and payment layers important.

User Reviews

Product design only tells part of the story. Adoption depends on how real users experience setup, security, and reliability over time. Although Tangem Pay is still early, feedback from Tangem Wallet users and initial Tangem Pay testers offers insight into how the product performs outside controlled demos.

Google Play Store – (4.1/5)

Tangem Wallet’s Android app, which forms the base layer for Tangem Pay, has accumulated a large volume of user feedback on the Google Play Store. Reviews focus primarily on usability, security, and everyday reliability.

Positive Reviews

Simple setup and NFC-based onboarding: Users frequently mention how easy it is to set up the wallet using the Tangem card, without seed phrases or technical friction.

Confidence in offline security: Many reviewers highlight trust in the secure chip and offline key storage, often comparing it favorably to software wallets.

Lightweight and portable design: Several users appreciate the card form factor, especially for travel and daily carry, calling it simpler than USB-style hardware wallets.

Negative Reviews

Limited advanced features: Some users note the lack of deeper DeFi integrations, staking options, or advanced portfolio tools compared to other wallets.

Concerns around app dependency: A recurring concern is reliance on the mobile app, with users expressing anxiety about phone loss or app-level issues.

Apple App Store – (4.2/5)

On iOS, Tangem Wallet receives similar feedback, with an emphasis on polish, stability, and long-term storage use cases.

Positive Reviews

High trust in the security model

iOS users frequently mention confidence in the secure element and the absence of exposed private keys or seed phrases.

Clean and stable user experience

Reviews often describe the app as smooth, well-designed, and consistent with iOS UX standards.

Suitable for long-term holding

Many users frame Tangem as a “peace-of-mind” wallet rather than an active trading tool, valuing stability over features.

Negative reviews

Feature parity expectations

Some users expect faster rollout of new features and better token or network support.

Recovery and backup anxiety

Despite the seedless design, a subset of users expresses discomfort about recovery scenarios if cards are lost or damaged.

Trustpilot – (4.1/5)

Trustpilot reviews cover Tangem as a company and ecosystem, including wallet hardware and early Tangem Pay mentions.

Positive reviews

Overall trust and reliability

Users praise Tangem’s long operating history, product quality, and clear communication around security.

Early real-world usage reports

Some reviews reference successful real-world spending experiences after gaining access to Tangem Pay.

Negative reviews

Customer support delays

A smaller set of reviews mentions slow response times or unclear communication when contacting support.

Availability and rollout frustration

Some users express impatience with phased access to Tangem Pay and regional limitations.

Across platforms, user feedback points to strong confidence in Tangem’s security model and ease of use, with criticism centered on feature depth, rollout pace, and reliance on the mobile app. These themes align closely with Tangem Pay’s positioning as a self-custodial spending bridge rather than a feature-heavy financial super app.

As Tangem Pay rolls out gradually, large-scale, long-term feedback on the payment product itself is still limited. What is available, however, is a substantial body of user feedback around the Tangem Wallet ecosystem that underpins Tangem Pay, along with early reactions from users who have begun testing real-world spending. Taken together, these reviews offer a useful signal on usability, trust, and where expectations are being met or challenged.

Final verdict

Tangem Pay sits in a narrow but important space between self-custody and real-world usability. It does not attempt to replace banks, nor does it promise permissionless payments everywhere. Instead, it makes a more practical bet: that stablecoins can become everyday money if users are allowed to keep custody while spending through rails that merchants already accept. By keeping USDC on-chain until the moment of purchase and limiting intermediary control, Tangem Pay meaningfully reduces the trust trade-offs that define most crypto cards today.

That said, the product’s strengths are inseparable from its constraints. Dependence on Visa programs, issuer partners, and regional regulation means Tangem Pay cannot offer the same guarantees as purely on-chain payments. Asset support is intentionally narrow, KYC at the payment layer is unavoidable, and availability will remain uneven as long as regulatory clarity differs by region. For power users with complex portfolios or those seeking full anonymity, these limitations will matter.

Viewed in context, Tangem Pay is best understood as a spending bridge rather than a financial replacement. For users already living in stablecoins who want to close the gap between holding value and using it, the design makes sense. If Tangem can expand asset support, maintain its security posture, and navigate regulation without drifting toward custodial shortcuts, Tangem Pay could become a credible model for how self-custodial payments scale without breaking user trust.