If the crypto world had a red carpet, Shiba Inu would’ve walked it in style with its tail wagging, community cheering, and hashtags trending. Born as a fun, meme-inspired rival to Dogecoin, the self-proclaimed “Dogecoin killer” has since grown into much more than an internet joke.

With its growing ecosystem, layer-2 network (Shibarium), and NFT projects, SHIB has captured the attention of both casual traders and serious crypto enthusiasts.

Whether you’re here for the memes, the tech, or the potential profits, your Shiba Inu journey starts with one crucial step: buying your first SHIB.

This guide covers everything from the basics to step-by-step purchasing instructions, alternative buying methods, and storage tips so you can enter the SHIBArmy well-prepared.

Disclosure: Some links in this guide are affiliate links, meaning we may earn a commission if you purchase through them at no extra cost to you. This does not influence our product recommendations or the rankings in this article. We only recommend exchanges we have tested or thoroughly vetted for security, usability, and reliability.

TL;DR — Buying Shiba Inu (SHIB)

- You can buy SHIB in three simple steps: open an account on a supported exchange, fund it with fiat or USDT, and place a market or limit order. It's advisable to withdraw to a self-custody wallet.

- Top choices include Binance, Coinbase, Kraken, OKX, KuCoin, Bit2Me, and MEXC, so pick based on fees, regional availability, and payment methods.

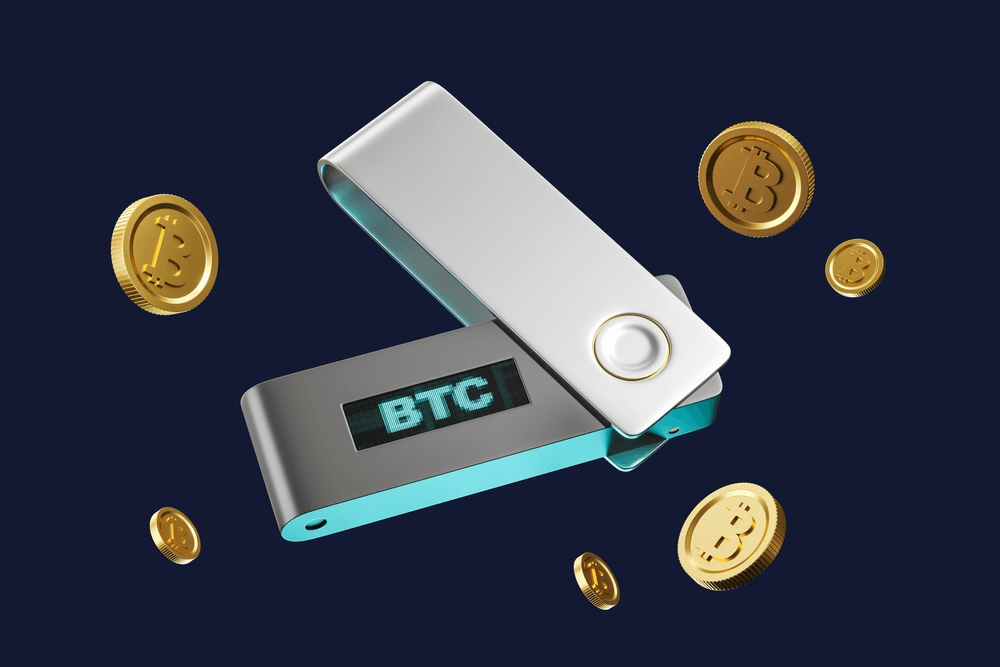

- Store long term in a hardware wallet like Ledger or Trezor or use software wallets such as Trust Wallet or MetaMask, and remember that SHIB is ERC-20 on Ethereum unless you are using Shibarium.

- Analysts forecast SHIB trading between $0.00001184 and $0.00002057 in late 2025, with 2026 projections ranging from $0.00001474 to $0.00002790 depending on market sentiment and Shibarium adoption.

👉 Quick start: sign up on a reputable exchange, verify your identity, fund with fiat or USDT, buy SHIB on a spot pair, and move it to a wallet you control for safekeeping.

Quick Answer — How to Buy SHIB

Open a reputable exchange, fund with fiat/USDT, buy SHIB on a spot pair, then move it to a self-custody wallet.

Top Pick (Overall)

Binance

- Deep SHIB liquidity

- Low spot fees (BNB discount)

- Multiple fiat on-ramps

- Earn options

Availability/features vary by region. Always enable 2FA.

Fast Path (2–3 minutes)

- Create account & finish KYC

- Deposit via bank/card (or send USDT)

- Buy SHIB/USDT (market or limit)

- Withdraw to self-custody wallet (ERC-20 or Shibarium)

No-KYC Options to Buy SHIB (Advanced Users)

These routes prioritize privacy but add complexity and risk. Double-check contract addresses and use small test swaps first.

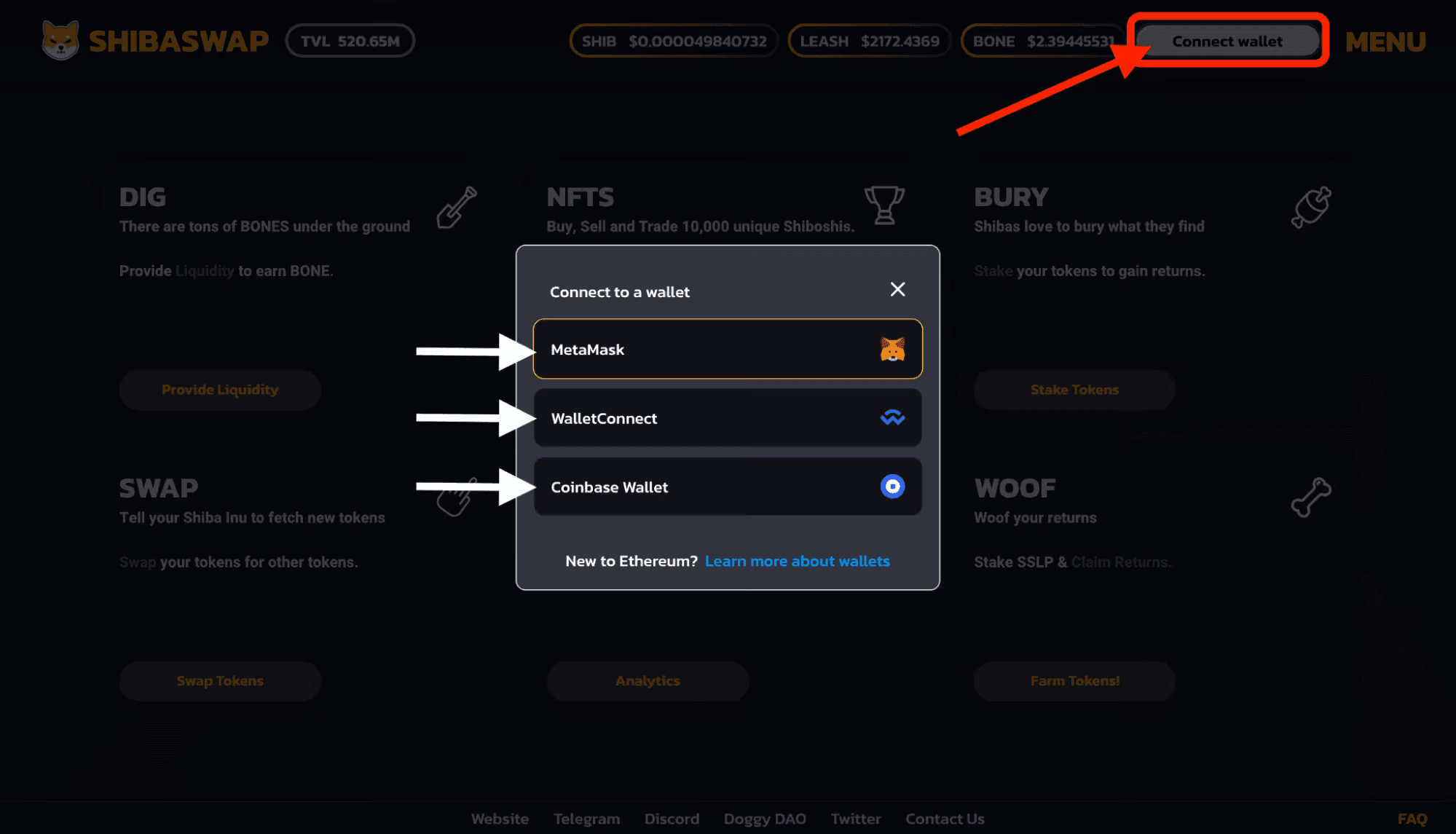

DEX Swap (Uniswap / ShibaSwap)

- Wallet: MetaMask or hardware wallet

- Fund with ETH (gas) → swap ETH/USDT → SHIB

- Network: ERC-20 (Ethereum) or Shibarium

Verify SHIB contract on Etherscan. Beware fake tokens.

P2P Market (Binance/OKX/KuCoin P2P)

- Buy USDT from vetted sellers (escrow)

- Transfer USDT to spot → buy SHIB

- Release funds only after payment confirmed

Check seller ratings and limits; record proofs of payment.

In-Wallet Aggregators (Non-custodial)

- Use built-in swap (e.g., 1inch, 0x) in wallet

- Routes across DEXs for best price

- No exchange account required

Compare quotes incl. gas; mind minimum received.

Crypto ATMs / Gift Cards

- High fees (5–15%) and limited SHIB support

- Often route via BTC/USDT then swap to SHIB

Use only reputable operators; keep receipts.

Risk Notes:

No-KYC routes can involve higher spreads/fees, phishing risk, and zero recourse on scams. Start small, verify contracts, and never share seed phrases.

What is Shiba Inu Coin (SHIB)?

- Token type: SHIB isn’t its own chain. It’s an ERC-20 token that rides on Ethereum, so it works with all the standard Ethereum wallets.

- Networks: You don’t have to stick with Ethereum fees. The project launched Shibarium, a Layer-2 that makes moving SHIB faster and less expensive.

- Supply: At launch there were a mind-boggling 1 quadrillion tokens. A huge piece of that pile was later burned or given away, cutting the supply down.

- Ecosystem: SHIB is part of a bigger family. Alongside it you’ll find BONE (used for governance), LEASH (a much scarcer token), and the project’s own DEX, ShibaSwap.

- Volatility: This coin trades on hype as much as anything else. Big swings are normal, so it’s not for the faint-hearted.

- Wallets: Long-term holders usually stash SHIB on a hardware wallet like Ledger or Trezor. Active traders lean toward apps such as Trust Wallet or MetaMask.

- Taxes: In most countries, moving in and out of SHIB counts as a taxable event. Keeping records of your trades will save you trouble later.

Shiba Inu Coin, or just SHIB, popped up in August 2020. The anonymous creator, who only went by Ryoshi, pitched it as a community experiment more than a serious tech project. At first glance, it looked like a cheeky knockoff of Dogecoin: same dog mascot, same meme vibes. But it didn’t stay a joke for long.

Ryoshi launched SHIB as an ERC-20 token on Ethereum. That choice meant it plugged right into the existing crypto world — MetaMask, hardware wallets, DeFi apps — all worked out of the box. The trade-off was obvious: you get Ethereum’s security and decentralization, but you also inherit its downsides, like gas fees that can swing from a dollar to twenty depending on network traffic.

What really pushed SHIB into the spotlight wasn’t just the tech; it was the people. The active community dubbed the “SHIBArmy” ran with the meme, trending hashtags and celebrating every exchange listing. They turned an internet joke into one of the most talked-about coins of the 2021 bull run, and the community hasn’t gone quiet since.

From its playful beginnings, SHIB’s ambitions grew. The ecosystem developed its decentralized exchange (ShibaSwap), native NFT projects, and a layer-2 scaling solution called Shibarium, aiming for faster, cheaper transactions on top of Ethereum.

Technical Basics of SHIB

- ERC-20 standard: SHIB isn’t a coin with its own chain. It rides on Ethereum, following the ERC-20 rulebook that tells tokens how to move, approve, and interact with smart contracts. The upside is obvious: it works out of the box with MetaMask, Trust Wallet, Ledger, and pretty much any Ethereum-friendly app.

- Gas fees and congestion: The catch? Every SHIB transfer needs ETH for gas. Sometimes that’s just a buck or two, other times it’s $20+ if Ethereum is slammed. Small transfers can feel pointless when fees outweigh the amount sent.

- Why Shibarium matters: To fix that pain point, the community built Shibarium, a Layer-2 that runs on top of Ethereum. Transactions there are cheap, often just cents, and settle quicker. For holders, that means SHIB can actually be moved around without worrying that the fee is bigger than the transfer.

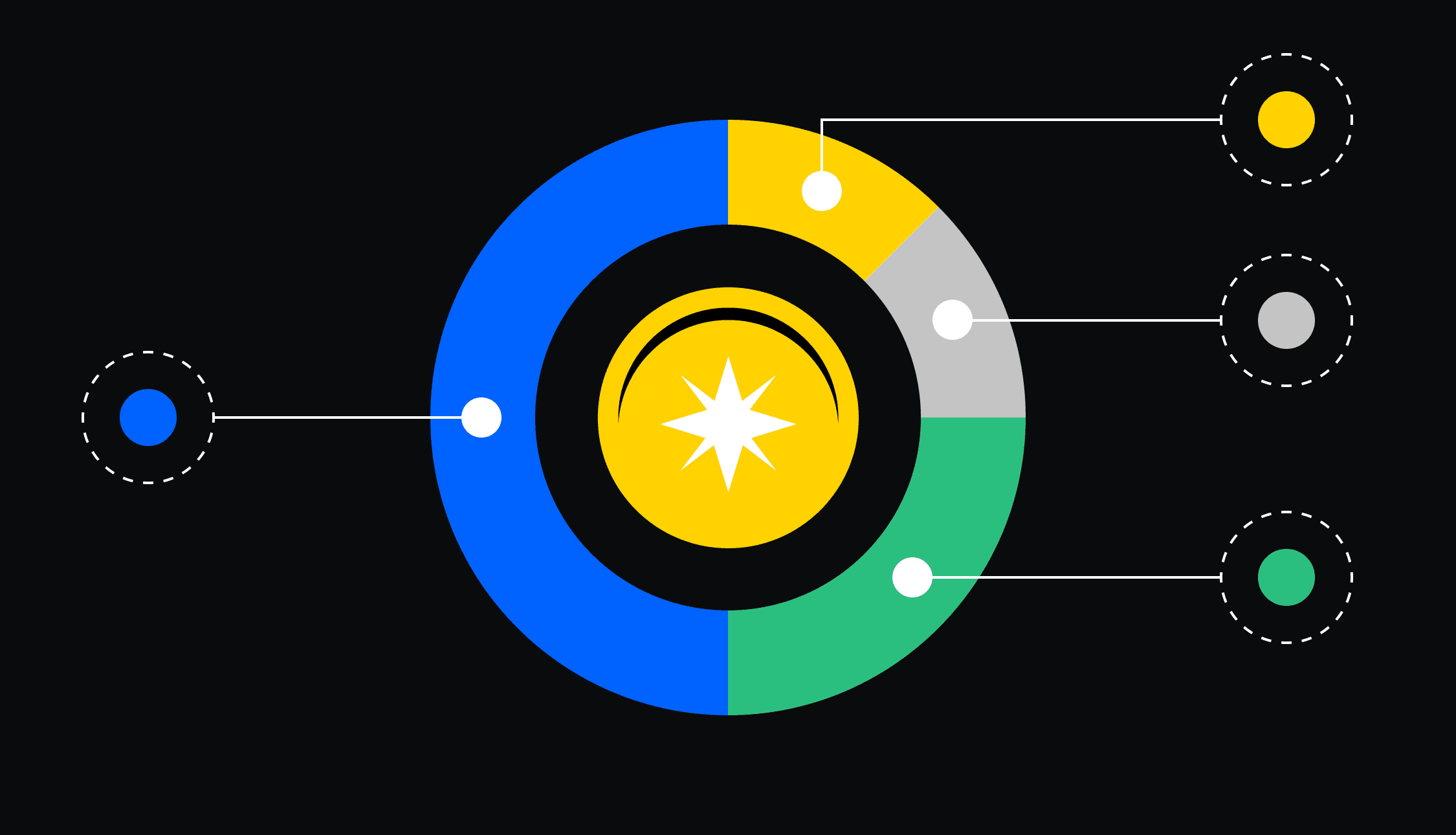

SHIB Tokenomics Overview

Tokenomics drives value, utility, and trust. Image via

CoinbaseSHIB is an ERC-20 token on the Ethereum blockchain, initially launched with a total supply of 1 quadrillion tokens. One aspect of Shiba Inu’s tokenomics that stood out was when 50% of the supply was allocated to Ethereum’s creator, Vitalik Buterin, who later burned the majority, permanently removing it from circulation, and donated the rest to charity.

The remaining tokens are used for liquidity, rewards, community incentives, and development. SHIB’s tokenomics are characterized by its vast circulating supply and emphasis on decentralized ownership, with no central team controlling the majority of tokens.

Step-by-Step Guide: How to Buy Shiba Inu Coin

Now that you understand the basics of Shiba Inu, let's take a look at the practical steps of buying a Shiba Inu coin. The first crucial step is selecting a reliable crypto exchange.

Step 1 – Choose a Crypto Exchange

Some popular options include:

Compare fees, regional availability, payment methods, and user experience. Now, for the sake of simplicity and the fact that Binance is one of the most used platforms, we will use it as an example in this article.

Step 2 – Create and Verify Your Account

Sign up with your email and a secure password. Complete your KYC (identity verification) and activate 2FA security before proceeding.

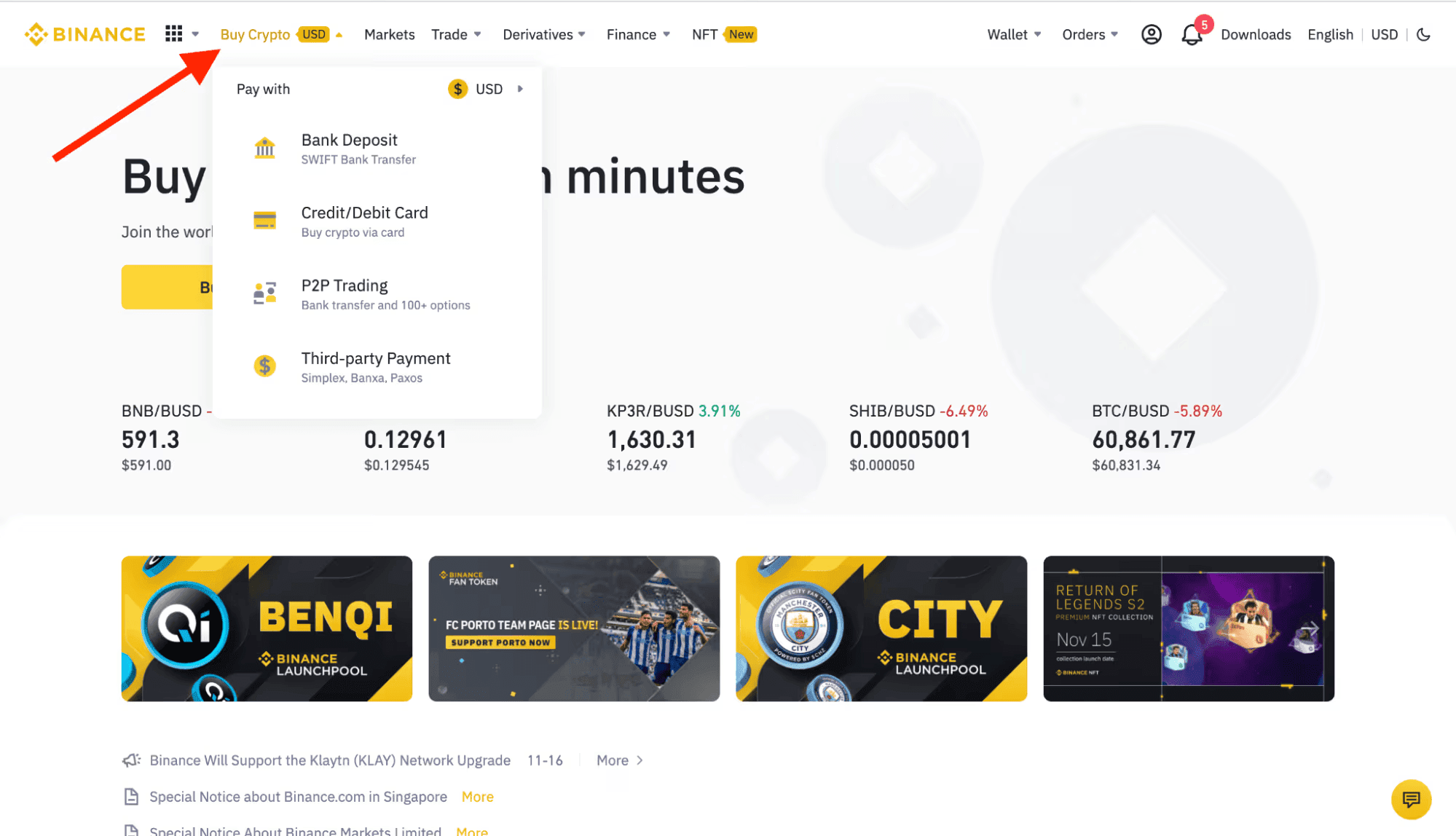

Step 3 – Deposit Funds

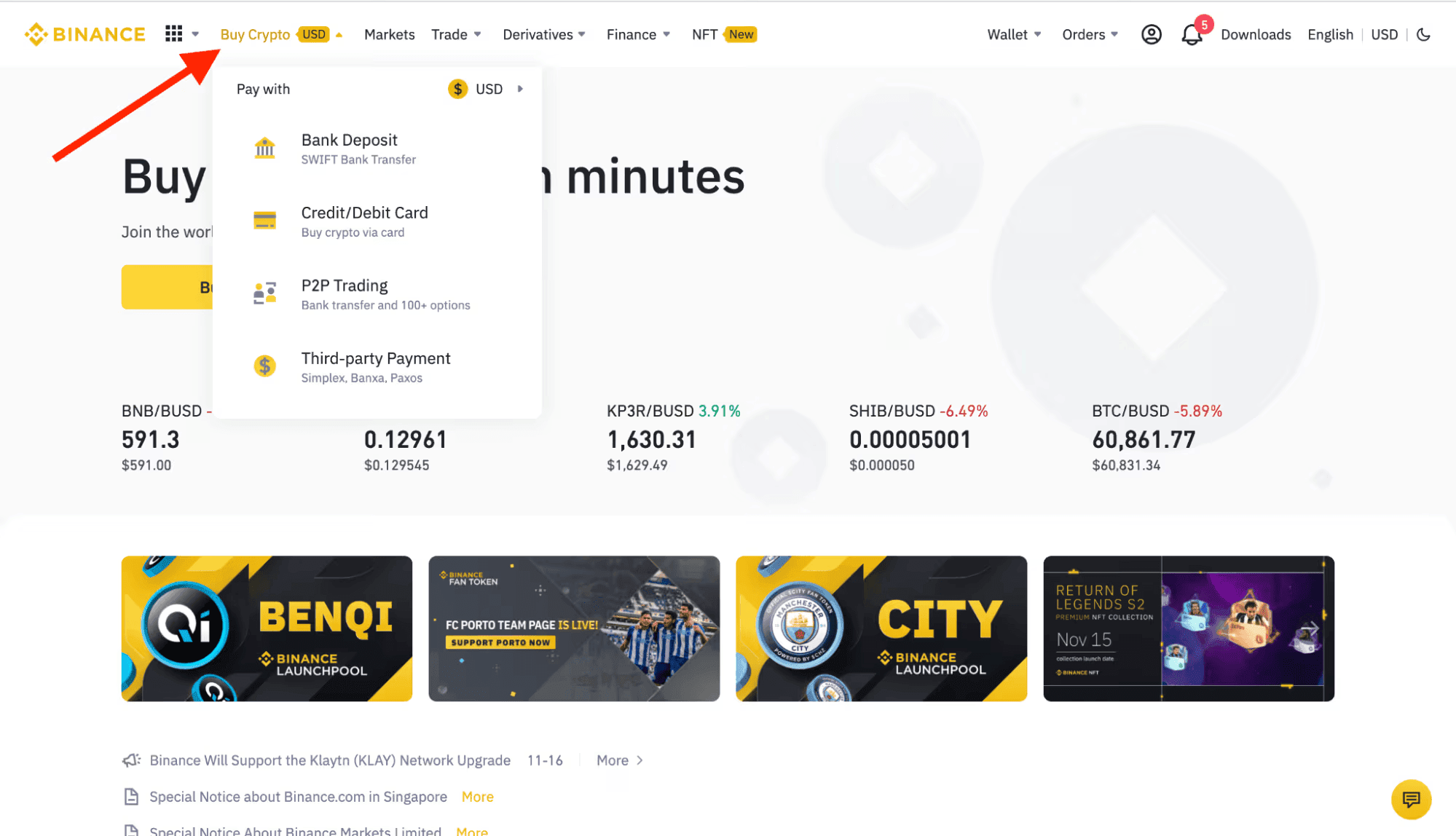

Once you go to the platform, click on Buy Crypto, and a bunch of options to deposit funds show up.

Image via

Binance- Bank transfer

- Debit/Credit card

- PayPal (on some platforms)

- Crypto deposits (e.g., ETH, USDT)

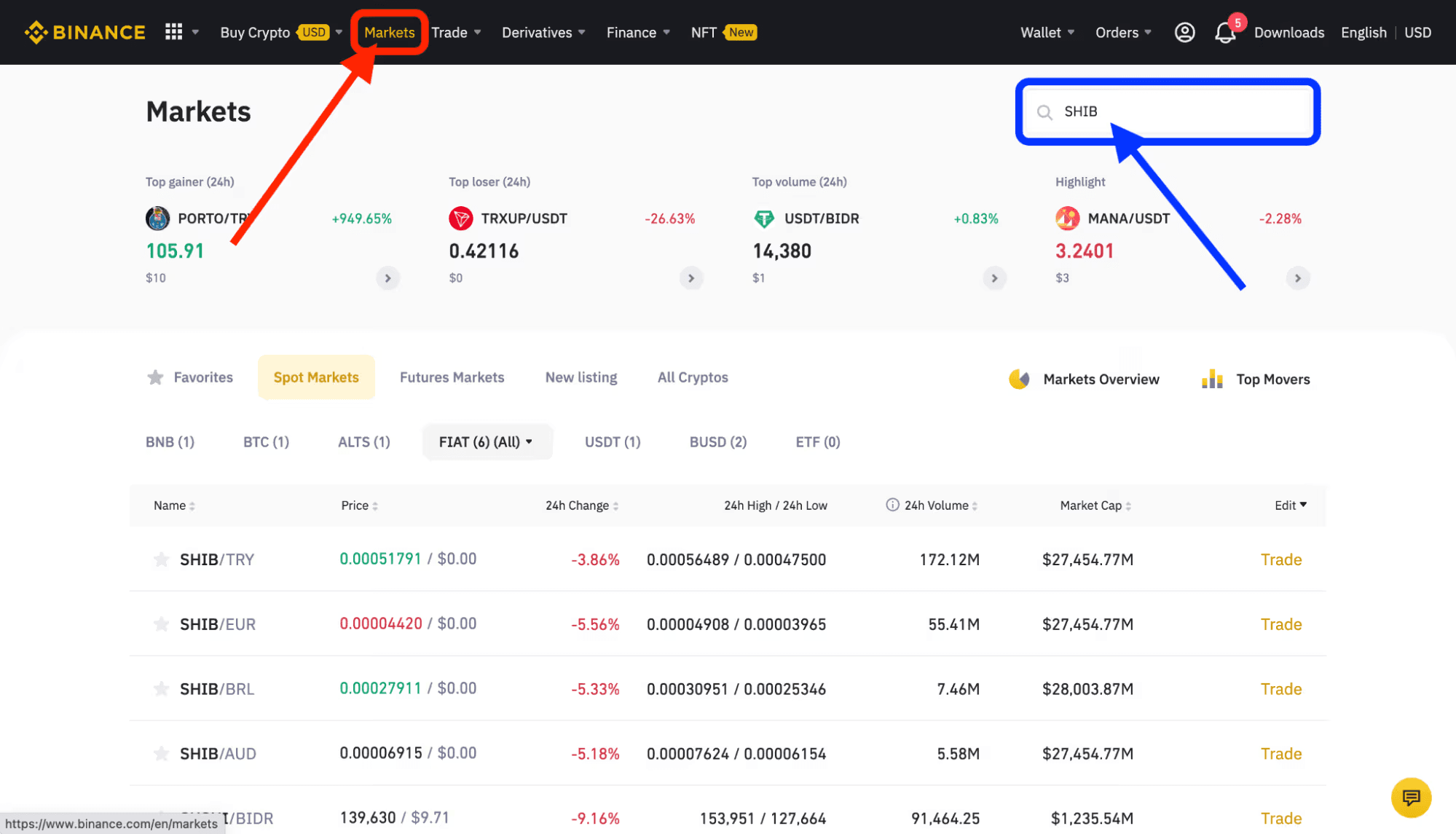

Step 4 – Purchase SHIB

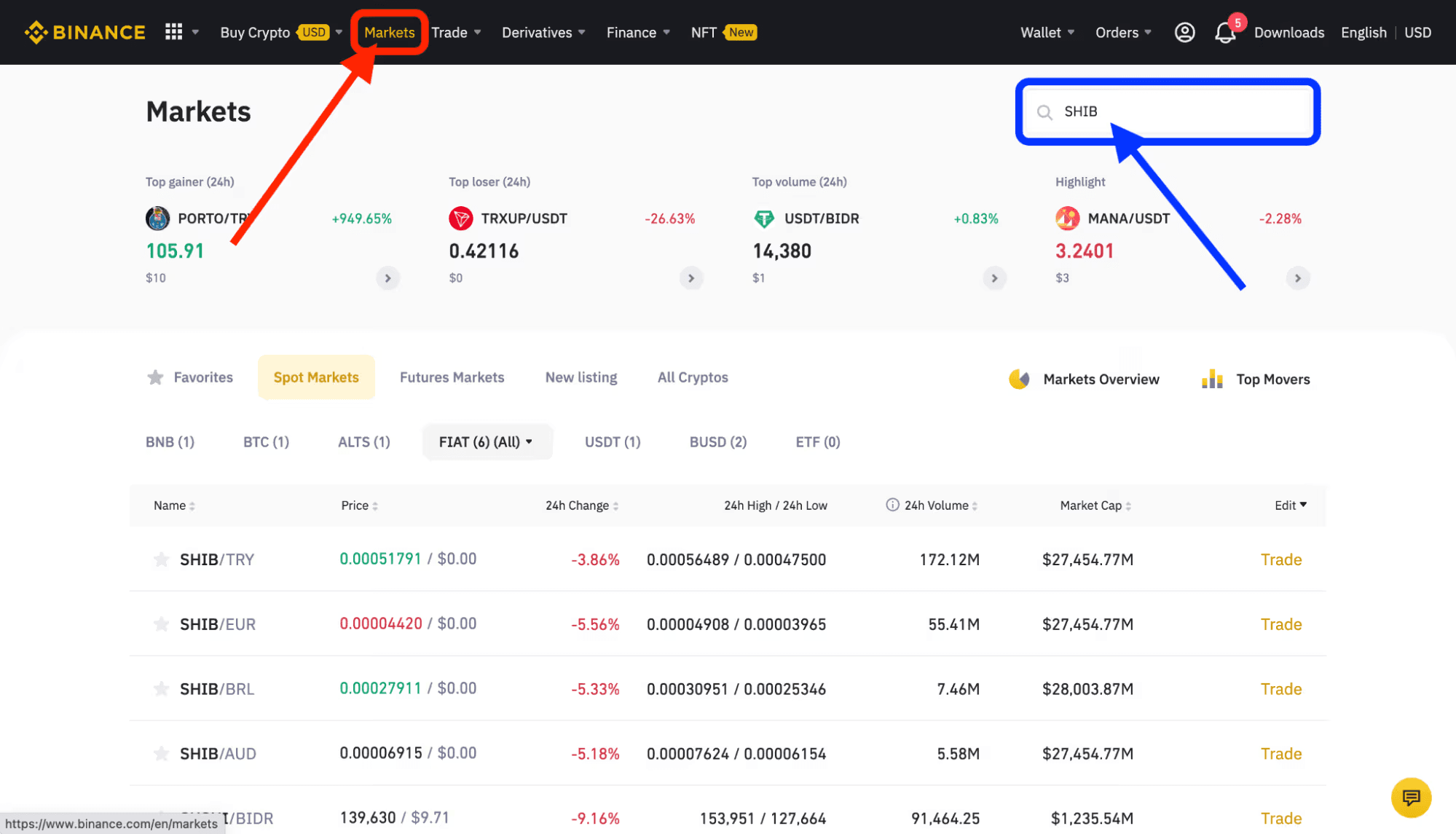

Search for SHIB in the Buy/Sell or Trade section.

Image via

BinanceChoose market order (instant) or limit order (your set price). Then review fees, confirm, and execute the trade.

Step 5 – Store SHIB Securely

You can store SHIB securely in hardware wallets like Ledger or Trezor for maximum offline protection, or software wallets such as Trust Wallet or MetaMask for easy access.

Read our comparison of Trezor and Ledger to see which hardware wallet you should choose.

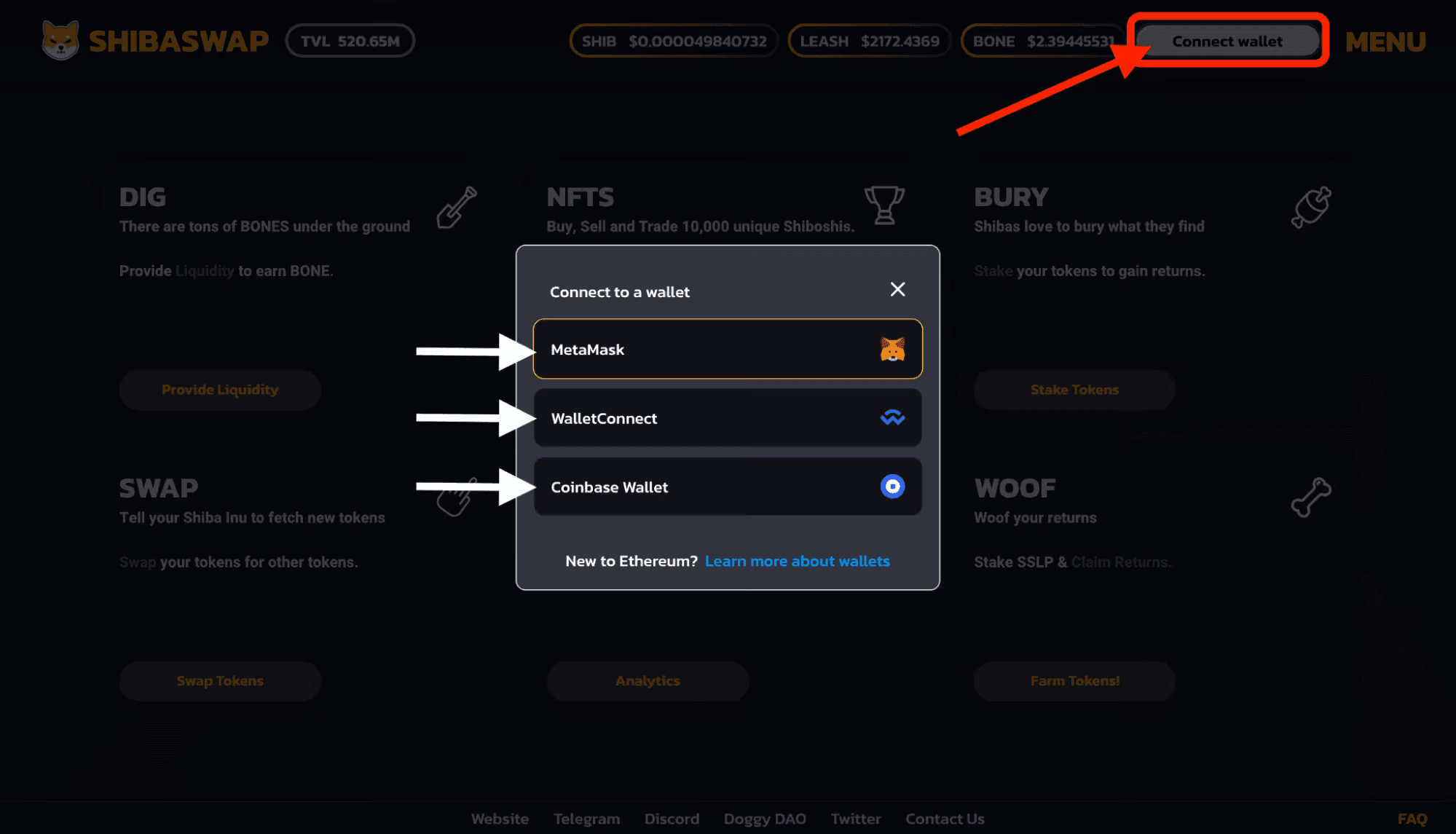

Image via

SHIBASWAPBest Platforms to Buy Shiba Inu Coin

Looking to join the SHIBArmy? Choosing the right exchange is the first step. The platforms below offer reliable access to Shiba Inu Coin, with differences in fees, payment options, features, and regional coverage. Here’s how they stack up so you can find the best fit for your needs.

| Exchange |

Best For |

Spot Fees |

Payment Options |

Pros |

Cons |

| Binance |

Best Overall Exchange |

0.1% (BNB discount) |

Card, Bank, P2P, Crypto |

Low fees, high liquidity |

Limited in some regions |

| Coinbase |

Easiest for Beginners |

0.4%/0.6% (Advanced) |

Card, Bank, PayPal |

Regulated, user-friendly |

Higher instant-buy fees |

| Kraken |

Most Secure Option |

0.16%/0.26% |

Card, Bank, Crypto |

High security, strong support |

Slower verification |

| OKX |

SHIB + Web3 Access |

0.08%/0.10% |

Card, Bank, P2P, Crypto |

Low fees, Web3 wallet |

Busy interface for beginners |

| KuCoin |

Altcoin Variety |

0.1% (KCS discount) |

P2P, Crypto |

Huge token list, low fees |

No fiat in some countries |

| Bit2Me |

Eurozone SHIB Buyers |

0.95% |

SEPA, Card, Bank |

EU-regulated, SEPA support |

Limited global reach |

| MEXC |

Low Fees + Launchpad |

0.0%/0.05% |

P2P, Card, Crypto |

Low fees, early listings |

Variable P2P/card fees |

Partner

1. Binance — Best Overall Exchange

Binance is a fast, cost-efficient way to buy SHIB, with deep SHIB/USDT liquidity, competitive fees, and multiple fiat on-ramps. It suits both first-time buyers and active traders.

Why We Like Binance for SHIB

- High SHIB liquidity for tight spreads and fast fills.

- Multiple purchase routes: card, bank transfer, P2P, or crypto swap.

- Low spot fees (typically 0.1%, with extra discounts when paying fees in BNB).

- Simple one-tap “Buy” for beginners plus full Pro charts and order types.

- Earn options and instant conversion if you want to rotate out of SHIB later.

Fees for Buying SHIB on Binance

- Spot trading fee: 0.1% (discounted if paying in BNB).

- Debit/Credit card purchases: 1.8%–2%.

- Crypto deposits: Free.

- Withdrawal fees: Vary by asset; SHIB withdrawals typically have low network costs.

Fees last checked: Aug 15, 2025. Always confirm on the Binance fee schedule before trading.

Pros & Cons

Pros

- Deep SHIB order books; minimal slippage.

- Global fiat on-ramps and flexible payment choices.

- Advanced security stack and SAFU fund.

- Fee discounts available with BNB.

Cons

- Availability and features vary by jurisdiction.

- Pro interface can feel complex at first.

Author’s Tip: “For SHIB buys, I use a limit order slightly below the current price to avoid sudden wicks. If you’re new, start with a small test trade, then scale.”

How we evaluated: fees, SHIB pair liquidity/depth, fiat on-ramps, order types, and post-purchase options (convert/earn). We tested the onboarding and a SHIB purchase flow end-to-end.

Affiliate Disclosure: If you sign up through our link, we may earn a commission at no extra cost to you.

Disclaimer: This is not financial advice. Crypto is volatile; only invest what you can afford to lose.

2. Coinbase — Best for Beginners (US/EU)

Coinbase offers one of the most beginner-friendly ways to buy SHIB, especially for users in the US, EU, and other regions where it operates under strict regulation. Its clean interface, instant purchase options, and strong compliance make it ideal for first-time SHIB buyers.

Why We Like Coinbase for SHIB

- Instant SHIB purchases via debit/credit card or bank transfer.

- Fully regulated in the US and EU — strong consumer protections.

- Simple, intuitive interface for first-time crypto users.

- Built-in custodial wallet for easy storage (optional self-custody).

- Educational rewards program that sometimes includes SHIB-related content.

Fees for Buying SHIB on Coinbase

- Instant buy (card/PayPal): Around 2.49% plus spread.

- Bank transfer (ACH/SEPA): Lower fees but slower processing.

- Coinbase Advanced Trade: 0.4% maker / 0.6% taker (lower for high-volume traders).

- Withdrawals: Network fees vary; fiat withdrawals have flat fees depending on method.

Fees last checked: Aug 15, 2025. Always confirm on the Coinbase fee page before trading.

Pros & Cons

Pros

- Extremely beginner-friendly platform.

- Highly regulated and insured for custodial funds.

- Wide fiat support for US, EU, and other regions.

- Mobile app and web interface are both easy to use.

Cons

- Higher fees than most global exchanges.

- Fewer advanced trading tools unless using Advanced Trade.

Author’s Tip: “If you’re new to SHIB, start on regular Coinbase for simplicity, then switch to Advanced Trade to save on fees once you’re comfortable.”

How we evaluated: fiat on-ramp options, SHIB liquidity, ease of onboarding, security compliance, and available trading interfaces. We tested both instant buys and Advanced Trade for SHIB.

Disclaimer: This is not financial advice. Crypto is volatile; only invest what you can afford to lose.

3. Kraken — Most Secure Option

Kraken is known for its industry-leading security and transparent operations, making it an excellent choice for cautious SHIB buyers. With a strong regulatory record and advanced trading tools, it’s a platform trusted by both retail and institutional investors.

Why We Like Kraken for SHIB

- Highly secure platform with a proven track record.

- Supports SHIB purchases via bank transfer, card payments, and crypto deposits.

- Advanced order types for strategic SHIB trading.

- Strong regulatory compliance across multiple jurisdictions.

- Responsive 24/7 customer support.

Fees for Buying SHIB on Kraken

- Instant buy (card/ACH): 0.9%–1.5% plus payment processing fees.

- Kraken Pro (spot trading): From 0.16% maker / 0.26% taker, with volume discounts.

- Crypto deposits: Free.

- Withdrawals: Network fees for SHIB are typically minimal; fiat withdrawal fees vary by method.

Fees last checked: Aug 15, 2025. Always confirm on the Kraken fee schedule before trading.

Pros & Cons

Pros

- Top-tier security and transparency.

- Good SHIB liquidity and fair pricing.

- Advanced charting and order options.

- 24/7 customer support.

Cons

- Higher instant buy fees compared to Pro trading.

- Verification process can be slower than some competitors.

Author’s Tip: “If you’re buying SHIB on Kraken, use Kraken Pro for lower fees and set limit orders to maximize value.”

How we evaluated: platform security, SHIB liquidity, fiat funding options, regulatory standing, and support quality. We tested both instant buy and Kraken Pro SHIB trades.

Disclaimer: This is not financial advice. Crypto is volatile; only invest what you can afford to lose.

Partner

4. OKX — Combining SHIB Trading with Web3 Access

OKX offers deep SHIB liquidity alongside an integrated Web3 wallet, making it easy to trade, store, and interact with the Shiba Inu ecosystem from one platform. It’s ideal for traders who want both CEX speed and DEX flexibility.

Why We Like OKX for SHIB

- High SHIB trading volume with tight spreads.

- Built-in Web3 wallet for accessing ShibaSwap and other DeFi apps.

- Low trading fees, further reduced for high-volume users.

- Variety of payment methods for global users.

- Regular promotions and earn products featuring SHIB.

Fees for Buying SHIB on OKX

- Spot trading fee: 0.08% maker / 0.10% taker (with further VIP discounts).

- Instant buy (card/P2P): Varies by payment provider.

- Crypto deposits: Free.

- Withdrawals: Network fees apply; SHIB withdrawals are typically low-cost.

Fees last checked: Aug 15, 2025. Always confirm on the OKX fee page before trading.

Pros & Cons

Pros

- Low fees and deep SHIB liquidity.

- Integrated Web3 wallet for DeFi access.

- Global reach with many fiat payment options.

- Frequent promos and earn opportunities.

Cons

- Some features may be restricted in certain regions.

- Interface can be busy for complete beginners.

Author’s Tip: “If you want to trade SHIB and explore DeFi on the same platform, link your OKX account to the OKX Web3 wallet for seamless transfers.”

How we evaluated: SHIB trading liquidity, fee structure, Web3 integration, payment methods, and promotional offers. We tested both spot and instant buy methods for SHIB.

Affiliate Disclosure: If you sign up through our link, we may earn a commission at no extra cost to you.

Disclaimer: This is not financial advice. Crypto is volatile; only invest what you can afford to lose.

Partner

5. KuCoin — Best for India Users

KuCoin is a favorite among altcoin traders for its massive token selection, including SHIB and hundreds of other assets. With optional KYC for small trades and competitive fees, it’s ideal for SHIB buyers who want privacy and access to niche tokens.

Why We Like KuCoin for SHIB

- Strong SHIB liquidity with multiple trading pairs.

- Optional KYC for smaller trades — more privacy.

- Low trading fees with further discounts for KCS token holders.

- Built-in P2P marketplace for flexible payment methods.

- Launchpad access for early-stage altcoins.

Fees for Buying SHIB on KuCoin

- Spot trading fee: 0.1% (discounted when paying with KCS).

- P2P trades: No fees, but exchange rate set by sellers.

- Crypto deposits: Free.

- Withdrawals: Network fees apply; SHIB withdrawals are low-cost.

Fees last checked: Aug 15, 2025. Always confirm on the KuCoin fee page before trading.

Pros & Cons

Pros

- Extensive altcoin list, including niche SHIB pairs.

- Low trading fees with KCS discounts.

- P2P marketplace for flexible buying.

- Privacy-friendly with optional KYC for small trades.

Cons

- No direct fiat onramp in many countries.

- Less regulatory coverage than US/EU exchanges.

Author’s Tip: “If you want to save on fees when buying SHIB, hold some KCS to get an instant trading discount.”

How we evaluated: SHIB liquidity, fee competitiveness, privacy features, altcoin availability, and payment flexibility. We tested both spot and P2P purchase flows for SHIB.

Affiliate Disclosure: If you sign up through our link, we may earn a commission at no extra cost to you.

Disclaimer: This is not financial advice. Crypto is volatile; only invest what you can afford to lose.

6. Bit2Me — Best for Eurozone Users

Bit2Me is a regulated European exchange that makes buying SHIB fast and straightforward for eurozone customers. With SEPA support, competitive euro deposit options, and a user-friendly interface, it’s well-suited to EU-based SHIB buyers.

Why We Like Bit2Me for SHIB

- Direct euro deposits via SEPA with low fees.

- Regulated in Spain and compliant with EU crypto rules.

- Beginner-friendly buying process for SHIB.

- Multiple payment methods, including card and bank transfer.

- Good educational content for new crypto investors.

Fees for Buying SHIB on Bit2Me

- Spot trading fee: Around 0.95%.

- Euro deposits via SEPA: Free.

- Card purchases: Higher fees than SEPA (varies by provider).

- Withdrawals: Network fees for SHIB are low; fiat withdrawals have fixed rates.

Fees last checked: Aug 15, 2025. Always confirm on the Bit2Me fee page before trading.

Pros & Cons

Pros

- Excellent euro deposit and withdrawal options.

- EU-regulated and transparent.

- Simple SHIB buying process.

- Educational resources for beginners.

Cons

- Limited to certain European countries.

- Smaller asset list compared to global exchanges.

Author’s Tip: “If you’re in the eurozone, use SEPA transfers to fund your account — it’s usually free and much cheaper than card payments.”

How we evaluated: SHIB availability, euro deposit costs, ease of onboarding, EU compliance, and beginner friendliness. We tested SEPA and card-based SHIB purchases.

Disclaimer: This is not financial advice. Crypto is volatile; only invest what you can afford to lose.

7. MEXC — Low-Fee + Early Listings

MEXC stands out for its extensive altcoin library, frequent token launches, and optional KYC for smaller trades. It’s a strong pick for SHIB buyers who want early access to SHIB-adjacent tokens while keeping trading fees low.

Why We Like MEXC for SHIB

- Early access to new token listings via MEXC Launchpad.

- Multiple SHIB pairs with solid liquidity.

- Very low spot fees and quick onboarding.

- Flexible funding through P2P, cards, and crypto deposits.

- Active promos that sometimes feature SHIB pairs.

Fees for Buying SHIB on MEXC

- Spot trading: 0.0% maker / 0.05% taker.

- P2P & card purchases: Vary by provider and region.

- Crypto deposits: Free.

- Withdrawals: Network fees apply; SHIB withdrawals are typically low-cost.

Fees last checked: Aug 15, 2025. Confirm on the MEXC fee page before trading.

Pros & Cons

Pros

- Launchpad access for SHIB-adjacent tokens.

- Low trading fees with good liquidity.

- Optional KYC pathway for small trades.

- Fast sign-up and broad payment methods.

Cons

- P2P/card fees can vary widely by region.

- Less regulatory coverage than US/EU exchanges.

Author’s Tip: “Track MEXC’s Launchpad calendar if you want early exposure to new tokens. For lowest fees, place limit orders instead of instant buys.”

How we evaluated: SHIB pair depth, Launchpad access, fee structure, funding flexibility, and onboarding speed. We tested spot buys and P2P/card flows for SHIB.

Disclaimer: This is not financial advice. Crypto is volatile; only invest what you can afford to lose.

Alternative Methods to Buy SHIB

Explore Alternative Ways To Secure Your SHIB. Image via Shutterstock

While centralized exchanges are the go-to for most buyers, they aren’t the only route. Some investors prefer more flexible, private, or decentralized approaches.

Here’s a breakdown:

Peer-to-Peer (P2P) Trading

Trade directly with other individuals through platforms like KuCoin P2P or Binance P2P. P2P trading platforms offer flexible payment methods and fewer KYC steps. On the other hand, they hold a higher risk of scam if there is no escrow, and not to forget that instant trades take some time.

DEXs like Uniswap or ShibaSwap let you swap ETH/USDT for SHIB directly from your wallet. Buying Shiba Inu offers benefits like no intermediaries, no KYC, and global accessibility. However, it requires crypto and wallet setup, and potentially high Ethereum gas fees.

Crypto ATMs

Some crypto ATMs now support SHIB directly. This method is simple, cash-friendly, and doesn't require an exchange account. However, it comes with high fees (5–15%) and low availability.

Gift Cards & Payment App

Buy SHIB indirectly via P2P trades using gift cards or apps like PayPal.

Why Buy Shiba Inu Coin?

The Shiba Inu Community Thrives on Decentralized Power. Image via

Shiba InuShiba Inu Coin mixes speculation, community power, and ongoing development, making it appealing to many investors. For some, SHIB represents the fast-paced world of meme-driven investing, where viral trends and internet buzz can lead to big price jumps.

Its major rallies in 2021 turned some early buyers into millionaires, and the hype often returns when prices dip. SHIB’s low cost per token also makes it an easy entry point for beginners, while its active “SHIBArmy” community helps spread awareness and support adoption.

Beyond its meme origins, SHIB has grown into a broader project. It now has ShibaSwap, its decentralized exchange; NFT integrations; and Shibarium, a layer-2 network designed for faster and cheaper transactions. Being listed on major exchanges and accepted for some payments has also added to its credibility.

Still, SHIB remains highly volatile. Its price is often influenced more by market sentiment and hype than by traditional financial factors, so buyers should be ready for rapid ups and downs.

Fees, Limits and Timing

When you buy SHIB, the sticker price isn’t the full story. What you actually end up paying depends on the exchange, how you fund the account, and even what time you place the trade.

Spot vs Instant Buy vs Card Fees

- Spot trades: On big platforms like Binance, Kraken, KuCoin, and OKX, normal spot orders usually cost somewhere between 0.08% and 0.26%. If you’re paying fees in BNB or KCS, you can shave it down closer to 0.1%.

- Instant buys: The one-tap “Buy Now” buttons are quick but pricey. Coinbase charges around 2.49%, while Binance adds its 1.8%–2% card fee plus a spread.

- Cards: Debit and credit card payments are nearly always the most expensive route. On Binance or Bit2Me, you’ll see 1.8%–3%; Coinbase can run higher than 2% once spreads are factored in.

- Bank transfers: Slower, but usually a bargain. ACH in the US and SEPA in the EU often let you deposit for free, leaving only the normal spot trading fee.

Quick tip: If keeping costs down matters, go bank transfer → spot trade. Use cards only when speed matters more than the fee hit.

Network Fees — Ethereum vs Shibarium

- Ethereum: Since SHIB is an ERC-20 token, moving it on Ethereum means paying gas in ETH. Right now, simple transfers cost $1–$5 on quiet days, but it’s not unusual to see fees spike past $20 when traffic picks up.

- Shibarium: The project’s Layer-2 is much cheaper. Transfers usually cost just fractions of a cent and confirm faster.

- Withdrawals from exchanges: Platforms like Binance and KuCoin let you pick the network when moving SHIB out. Fees differ depending on whether you choose Ethereum or Shibarium.

Quick tip: If you’re moving small amounts or making frequent transfers, Shibarium is the smarter option. Ethereum still anchors SHIB, but gas fees stack up quickly.

Best Time to Buy

- Liquidity: The deepest order books show up when US and EU hours overlap — roughly 13:00 to 17:00 UTC — so spreads are usually tightest then.

- Volatility: SHIB tends to react to hype and headlines. Buying when social feeds are buzzing often means paying more. Waiting for quieter sessions can save you a few percent.

- Funding cycles: SHIB perpetuals reset funding every 8 hours. Even if you only trade spot, these resets can nudge prices short-term.

- Weekends vs weekdays: Liquidity dries up on weekends, which can lead to odd price swings. Midweek trading is steadier.

Quick tip: There’s no perfect time, but weekday sessions when US and EU markets overlap usually mean better liquidity and less slippage.

Storing and Managing Your SHIB Safely

Store And Manage Your SHIB With Confidence. Image via Shutterstock

Once you’ve got SHIB in your account, the next question is: where should it live? Leaving coins on an exchange is fine for quick trades, but it’s risky long-term. Here’s how to think about storage and security.

Hot Wallets vs Cold Wallets

| Wallet Type | Pros | Cons |

|---|

| Hot wallets (apps like Trust Wallet or MetaMask) | Free, quick to set up, perfect if you want to trade or connect to DeFi apps | Always online → exposed to hacks; best for small balances |

| Cold wallets (hardware like Ledger or Trezor) | Keys stay offline, strong defense against hacks, ideal for long-term storage | Costs money ($70–$250), less handy if you move coins often |

Hardware Wallet Setup (Ledger vs Trezor)

Both Ledger and Trezor support SHIB since it’s an ERC-20 token. Setup is pretty similar:

- Unbox and connect: Ledger connects by USB or Bluetooth; Trezor by USB.

- Install the app: Ledger Live or Trezor Suite.

- Create a wallet: The device shows you a 24-word recovery phrase. Write it down on paper or metal, never on your phone or cloud.

- Set a PIN: A short code to unlock the device. Ledger also lets you add a passphrase.

- Add Ethereum: SHIB runs on Ethereum (and on Shibarium), so you’ll need an ETH account in the wallet.

- Transfer SHIB: Copy the ETH address from your hardware wallet, paste it into the exchange withdrawal screen, pick the right network, and send a test amount first.

Ledger’s strength is its sleek app ecosystem. Trezor leans open-source and is often seen as easier for beginners.

Best Practices for Security

A wallet only works if your habits are solid. A few ground rules:

- Enable 2FA everywhere. Use an authenticator app, not SMS.

- Treat your recovery phrase like cash. Write it down, back it up in more than one safe place, preferably on metal. Never screenshot it.

- Beware of phishing. Bookmark the official exchange/wallet sites and ignore DMs offering “support.”

- Stay updated. Install firmware and app updates promptly.

- Test recovery once. Restore a wallet with a small balance so you know your backup works.

For better insight, read our guide on Crypto Safety.

Trading and Selling SHIB

Trade SHIB Easily, Sell Instantly Anytime On CEXs and DEXs. Image via Shutterstock

Buying SHIB is one thing; deciding what to do with it afterwards is another. Some holders sit tight, others trade the swings. Whatever you choose, it helps to have a plan.

Trading Strategies for SHIB

- HODL: The simplest play. Buy, stash it in a wallet, and wait. Works best if you believe in SHIB’s long-term community power and don’t mind sharp ups and downs in the meantime.

- Swing trading: Instead of holding forever, traders try to catch medium-term moves — buying dips and selling rallies. Timing is tricky, but SHIB’s volatility gives plenty of opportunities.

- Dollar-cost averaging (DCA): A calmer approach. You buy fixed amounts on a schedule (say, weekly or monthly), no matter what the price is. Over time, this smooths out the entry price and lowers the impact of hype-driven spikes.

- Active trading: For the risk-tolerant. That means short-term trades using tools like stop-losses, limit orders, or even bots. With SHIB’s liquidity, this can work, but mistakes and fees add up quickly.

Key point: Match the strategy to your risk comfort. SHIB’s wild swings can make you money, but they can also wipe gains fast if you chase moves without a plan.

Tools for Tracking SHIB Price

- TradingView: Best for charting. You can draw trendlines, set alerts, and track SHIB against Bitcoin or Ethereum. Many swing traders rely on it.

- CoinMarketCap: Great for quick checks — market cap, trading volume, exchange listings. It also has a handy watchlist feature if you’re tracking multiple tokens.

- CoinGecko: Similar to CoinMarketCap, but with more data on liquidity pools, DeFi integrations, and community metrics. Useful if you’re watching SHIB beyond just the price.

For casual holders, CoinMarketCap or CoinGecko is plenty. If you’re trying to trade actively, TradingView’s extra tools are worth it.

Regulation and Taxes

Crypto rules aren’t the same everywhere. Before buying or selling SHIB, it helps to know the basics of where you live.

Crypto Regulations & Taxes by Region

| Region | Regulator | Tax Treatment |

|---|

| United States | SEC, CFTC, FinCEN, IRS | Crypto is property; every sale/trade is a taxable event (capital gains). |

| European Union | ESMA, local regulators (under MiCA) | Capital gains tax applies; rate depends on member state. |

| United Kingdom | Financial Conduct Authority (FCA) / HMRC | HMRC taxes crypto as capital gains; frequent trading may count as income. |

| Canada | FINTRAC | Gains may be capital gains or business income depending on activity. |

| Australia | AUSTRAC / ATO | Crypto is a capital asset; CGT applies on disposals (sell/swap/spend). |

| Singapore | Monetary Authority of Singapore (MAS) | No capital gains tax; income tax applies if trading is a business. |

| India | Reserve Bank of India (RBI), CBDT, Ministry of Finance | Flat 30% tax on gains; 1% TDS on transfers; no set-off/carry forward of losses; GST at 18% may apply if classified as goods. |

KYC/AML Snapshots — US, EU, UK, Canada, Australia, Singapore, India

- United States: Centralized exchanges must follow strict KYC (Know Your Customer) and AML (Anti-Money Laundering) rules. ID checks are standard. The IRS treats crypto as property, so every sale or trade is taxable.

- European Union: Under MiCA (Markets in Crypto-Assets Regulation), all EU exchanges require KYC. AML checks are also in place, with tax treatment similar to capital gains on investments.

- United Kingdom: Exchanges must register with the FCA and apply KYC/AML. HMRC taxes crypto as capital gains, though frequent traders can sometimes fall under income tax rules.

- Canada: Platforms are considered money service businesses under FINTRAC. KYC is required. Gains from SHIB can be taxed as capital gains or business income, depending on trading activity.

- Australia: Exchanges are regulated by AUSTRAC, with KYC/AML obligations. The ATO treats SHIB as a capital asset. Selling or swapping triggers capital gains tax (CGT).

- Singapore: Exchanges must register with MAS and comply with AML/CFT rules. There’s no capital gains tax, but income tax applies if you’re trading as a business.

- India: Exchanges follow PMLA-based KYC/AML rules. Crypto and NFT gains are taxed at a flat 30% plus surcharge/cess, with no loss set-off. A 1% TDS applies on most transfers above INR 10,000 (INR 50,000 for specified persons). If treated as goods, 18% GST may apply.

Capital Gains Basics + Record-Keeping Checklist

Most countries tax crypto the way they do stocks: sell for more than you bought = taxable gain; sell for less = deductible loss.

✅ Keep these records:

- Dates of every buy, sell, and transfer

- Amount of SHIB (in tokens and fiat value at the time)

- Fees paid (exchange + network gas fees)

- Wallet addresses involved

Pro tip: Use crypto tax software to automate this.

Tax-Loss Harvesting & Wash-Sale Considerations

- Tax-loss harvesting: If your SHIB position is down, you may sell it to lock in a capital loss, then use that loss to offset gains elsewhere. Many investors do this near year-end.

- Wash-sale rules: In the U.S., current law doesn’t yet apply wash-sale restrictions to crypto. That means you could technically sell SHIB at a loss and rebuy it right away.

- Other regions: The UK and EU apply stricter “bed-and-breakfast” rules. If you buy back the same asset within 30 days, the loss may not count. Always check your local tax guidance.

Bottom line: KYC is unavoidable on major exchanges, and taxes follow you whether you cash out to fiat or swap SHIB for another coin. Staying on top of records is the easiest way to avoid headaches later.

Market Analysis: Is SHIB a Good Investment in 2025 and Beyond?

Shiba Inu’s story in 2025 is less about hype and more about stability. Prices have narrowed into a tighter range, trading volumes remain healthy, and the token has carved out a spot as a mid-cap asset. At the same time, forecasts highlight both growth potential through Shibarium and ecosystem expansion, and the risks tied to volatility and speculative demand.

Price Performance and Market Cap

Based on the last two weeks of August 2025, SHIB has been trading in a narrow band around $0.000012–$0.0000135. Market cap stayed close to $7.2–$7.9 billion, while daily volumes swung from $110 million to over $400 million, showing how quickly activity rises and falls depending on sentiment.

A few highlights from CoinGecko:

- Aug 31, 2025: Market cap ~$7.27B, volume ~$136M, price $0.00001219.

- Aug 23, 2025: Market cap ~$7.89B, volume ~$404M, price $0.00001325.

- Aug 14, 2025: Market cap peaked above $8.2B with price near $0.00001291.

- Aug 2, 2025: Local low — cap ~$7.12B, but volume spiked over $340M as SHIB dipped to $0.00001184.

Context: Compared to the 2021 all-time high of ~$0.00009 and ~$40B+ market cap, today’s figures reflect a coin that’s matured into a steady mid-cap asset, with deep liquidity but plenty of volatility left.

For the most up-to-date price, refer to the live widget below:

Figures auto-update via CoinGecko; always verify on your chosen exchange before trading.

Risks and Opportunities Ahead

Shibarium has surpassed 1 billion transactions, which is a strong sign of growing ecosystem engagement. However, activity fell sharply (~99.8%) in late August.

Price forecasts are all over the map

According to CoinCodex, SHIB’s price outlook through 2025 suggests a wide trading band:

- September 2025: Expected range $0.00001184–$0.00001555, with an average near $0.00001312.

- October 2025: Forecast jumps to $0.00001291–$0.00003149, averaging $0.00002091.

- November 2025: Range $0.00001487–$0.00002141, average $0.00001927.

- December 2025: Predicted $0.00001426–$0.00002057, averaging $0.00001720.

For 2026, projections show SHIB trading between $0.00001474 and $0.00002790, with an average price of $0.00001973. The most bullish month is February 2026, when prices could climb as much as 130% above current levels.

| Month | Min. Price | Avg. Price | Max. Price |

|---|

| January | $0.00001822 | $0.00001979 | $0.00002172 |

| February | $0.00002059 | $0.00002245 | $0.00002790 |

| March | $0.00002145 | $0.00002260 | $0.00002676 |

| April | $0.00001887 | $0.00002061 | $0.00002300 |

| May | $0.00001774 | $0.00001895 | $0.00002025 |

| June | $0.00001699 | $0.00001992 | $0.00002256 |

| July | $0.00001550 | $0.00001650 | $0.00001715 |

| August | $0.00001513 | $0.00001599 | $0.00001699 |

| September | $0.00001474 | $0.00001633 | $0.00002064 |

| October | $0.00001996 | $0.00002186 | $0.00002567 |

| November | $0.00002042 | $0.00002256 | $0.00002370 |

| December | $0.00001807 | $0.00001925 | $0.00002010 |

Forecasts: CoinCodex, retrieved Sept. 1, 2025. Not financial advice; models can be wrong and may change.

SHIB vs DOGE: Which Fits Your Strategy?

Let’s break down how these two meme favorites really differ:

| Feature | Shiba Inu (SHIB) | Dogecoin (DOGE) |

|---|

| Meme culture | Built around the “Dogecoin killer” tagline, fueled by hashtags, SHIBArmy, and viral campaigns. Heavy community involvement in driving hype. | The original meme coin, born from the Doge meme in 2013. Gained traction via Reddit and Elon Musk’s tweets. |

| Blockchain | ERC-20 token on Ethereum, now supported by Shibarium (Layer-2) for faster and cheaper transfers. | Native blockchain with Proof-of-Work mining. Simple design, no Layer-2 or complex ecosystem. |

| Ecosystem | Expanding with ShibaSwap (DEX), Shibarium, NFT projects, and plans for metaverse integration. | Limited to basic transfers and tipping. Used mainly for small payments and community fun. |

| Supply | Initially 1 quadrillion tokens, with significant burns to reduce supply over time. | Unlimited supply — inflationary by design, with ~5 billion DOGE mined annually. |

| Use case | Speculative trading, DeFi integrations, staking, and potential metaverse/NFT adoption. | Primarily peer-to-peer payments, tipping, and a lighthearted store of value. |

Meme Culture

Both SHIB and DOGE ride on nostalgia and internet humor, but in different ways. Dogecoin was the original — born from the Doge meme and propelled forward by early Reddit users (and later Elon Musk’s tweets). Shiba Inu tapped that same breed and meme energy, but leaned even harder into community-driven hype, hashtags, and rallies to stand out.

Ecosystem and Tech Layer

Dogecoin keeps it simple; it’s its own blockchain running PoW (Proof of Work), surviving on piggyback digital mining, and often treated as digital pocket change for tips or small purchases. Shiba Inu? It’s more ambitious. Started as an ERC-20 token on Ethereum, it’s building its infrastructure — ShibaSwap (a DEX), Shibarium (Layer‑2), and plans for metaverse and NFT integration.

Final Thoughts: Is Buying SHIB Right for You?

From its playful start as an internet meme to its rise as a growing ecosystem with real-world use, Shiba Inu Coin has gone from a joke to a global talking point. Buying SHIB is about taking a step into a movement full of community, ambition, and fun.

With proper diligence, good knowledge about tight security, and a clear game plan, you can enjoy both the thrills and bumps ahead. SHIB’s future belongs to those who dare to believe and help build it.

Tokenomics drives value, utility, and trust. Image via

Tokenomics drives value, utility, and trust. Image via  Image via

Image via  Image via

Image via  Image via

Image via  Explore Alternative Ways To Secure Your SHIB. Image via Shutterstock

Explore Alternative Ways To Secure Your SHIB. Image via Shutterstock The Shiba Inu Community Thrives on Decentralized Power. Image via

The Shiba Inu Community Thrives on Decentralized Power. Image via  Store And Manage Your SHIB With Confidence. Image via Shutterstock

Store And Manage Your SHIB With Confidence. Image via Shutterstock Trade SHIB Easily, Sell Instantly Anytime On CEXs and DEXs. Image via Shutterstock

Trade SHIB Easily, Sell Instantly Anytime On CEXs and DEXs. Image via Shutterstock