Definition

Solana memecoins are a type of digital currency, or token, built on the high-speed Solana blockchain. Unlike foundational cryptocurrencies with serious financial or technological purposes, memecoins are inspired by internet culture, humor, or viral trends.

They follow the Solana Program Library (SPL) standard, similar to Ethereum's ERC-20, which dictates the rules for how tokens function and interact within the ecosystem. While they use standard blockchain technology, their value is primarily speculative, driven by social media hype and community enthusiasm rather than any intrinsic utility or fundamental value.

One distinct feature of memecoins is their token supply, which often begins in the billions or trillions. This allows them to trade at a fraction of a cent per token, making them accessible to many investors.

Unlike blue-chip assets like SOL or ETH, memecoins are not tied to a product roadmap or revenue model. Their value is mostly based on momentum, memetic appeal, and social sentiment.

Quick Facts:

| Category | Typical Range |

|---|

| Supply | From 100 million (e.g., MEW, WIF) to 94 trillion (e.g., BONK) |

| Typical Fees | $0.0005 to $0.002 per transaction (paid in SOL) |

| Typical Slippage | 0.5% to 3% for high-liquidity tokens (BONK, WIF), up to 5–8% for smaller caps |

Why Solana

Solana has emerged as the leading blockchain for meme coin activity in 2025, overtaking Ethereum and BSC in certain metrics. Its key advantages include:

- High Throughput: Over 1,00,000 transactions per second (TPS) with sub-second finality.

- Low Fees: Average transaction cost is less than $0.002, making rapid trading feasible.

- Vibrant Ecosystem: A booming NFT and DeFi community makes discovery and virality easier.

- Efficient Trading: Platforms like Jupiter and Raydium enable fast, low-slippage swaps for meme tokens.

This combination of speed, cost-efficiency, and user activity makes Solana an ideal playground for meme coin speculation and trend-based trading. New coins can launch and go viral within days, thanks to the low barriers to entry and high network responsiveness.

Risks vs Blue-Chips

While memecoins offer massive upside potential, they also carry significantly higher risk compared to established assets like SOL or ETH. Let’s compare how memecoins on Solana have performed recently versus more established blue-chip cryptocurrencies like SOL, ETH, and BTC.

1. Solana Memecoins (30D and YTD Swings)

Solana memecoins are known for their sharp, often unpredictable price movements. The table below shows the 30-day and year-to-date (YTD) changes for five of the most actively traded meme tokens on the network.

| Token | 30D Change | YTD Change |

|---|

| BONK | –0.45% | –6.19% |

| WIF | –10.62% | –70.12% |

| MEW | –10.62% | –63.11% |

| POPCAT | –9.97% | –63.11% |

| SAMO | –7.63% | –77.51% |

Data as of Oct. 11, 2025.

Average Volatility for Memecoins

- 30-Day Swing: –7.9%

- YTD Swing: –56.6%

But how do memecoins compare to more stable assets?

While memecoins are heavily influenced by short-term sentiment and viral momentum, blue-chip cryptocurrencies tend to move more gradually. Their volatility is often tied to macro market cycles, regulatory news, and institutional adoption rather than memes or community hype.

Now let’s compare those same performance windows of 30-day and YTD change for top-tier assets like Solana (SOL), Ethereum (ETH), and Bitcoin (BTC).

2. Blue-Chip Tokens (SOL, ETH, BTC – October 2025)

These are the foundational assets of the crypto ecosystem, typically offering more predictable trends and less extreme price swings.

| Token | 30D Change | YTD Change |

|---|

| SOL | +2.3% | +61.8% |

| ETH | +1.5% | +42.6% |

| BTC | +0.8% | +38.2% |

Average Volatility for Blue Chips:

- 30-Day Swing: +1.5%

- YTD Swing: +47.5%

It is quite clear that understanding volatility is essential when evaluating the risks and potential rewards of trading Solana memecoins. These assets often attract traders due to their rapid price movements, but that volatility can also lead to steep drawdowns.

Top 5 Solana Meme Coins to Watch in 2025

Based on their market capitalization, liquidity, and trading volume as of early Oct. 11, 2025, here are five of the most active Solana memecoins.

| Coins | Price (USD) | Market Cap (USD) | 24h Volume (USD) | 30D Change | YTD Change | Main Pool(s) |

|---|

| BONK | $0.00001987 | $1.62 B | $470.03 M | –0.45% | –6.19% | Raydium (BONK/SOL), Orca |

| WIF | $0.73403 | $733.18 M | $194.54 M | –10.62% | –70.12% | Raydium (WIF/SOL), Jupiter |

| MEW | $0.2387 | $250.71 M | $28.27 M | –10.62% | –63.11% | Raydium (MEW/SOL) |

| POPCAT | $0.2328 | $228.14 M | $31.30 M | –9.97% | –63.11% | Raydium (POPCAT/SOL) |

| SAMO | $0.1388 | $457.05 M | $15.07 M | –7.63% | –77.51% | Raydium (SAMO/SOL) |

Notes on the data: Due to high volatility, market data can change rapidly. The figures in the table reflect a snapshot from various sources taken on Oct. 11, 2025. Market capitalization is based on CoinGecko and TradingView data. Main pools are derived from ecosystem information and common trading practices.

Token mini-cards

Figures auto-update via CoinGecko; always verify on your chosen exchange before trading.

Platform Comparison – Best Places to Buy Solana Memecoins

When it comes to buying Solana memecoins, users can choose between centralized exchanges (CEXs) and decentralized exchanges (DEXs). Each offers different levels of convenience, control, and fees. Here's how the top options compare.

Check out our top picks for the best memecoin exchanges.

Centralized Exchanges (CEXs)

Centralized exchanges are ideal for beginners. They offer fiat on-ramps, simple interfaces, and better liquidity for top memecoins like BONK and WIF. However, users must complete Know Your Customer (KYC) verification and entrust their assets to a third party.

Solana DEX Options

For users who prefer self-custody and on-chain execution, decentralized exchanges on Solana offer greater control and access to newer tokens that haven’t yet reached CEXs.

Top Solana DEXs:

| DEX | Aggregator Support | Fees | Pool Depth | Features | Mobile UX Score |

|---|

| Jupiter | Yes (multi-route) | 0.05% | Very High | Best price routing, SPL token support | 9/10 |

| Raydium | No (direct swap) | 0.25% | High | Integrated pools, analytics tools | 8/10 |

| Orca | Yes (auto-routing) | 0.25% | Moderate | Mobile-first UX, simplified interface | 9/10 |

Key DEX Considerations:

- Aggregator routing: Jupiter's main advantage is its ability to route orders across multiple DEXs to secure the best possible trade execution for users.

- Price impact: This is the percentage difference between the market price and the executed price for a trade. It is higher in low-liquidity pools.

- Pool depth: The amount of liquidity available in a trading pool. Deeper pools allow for larger trades with less price impact.

- Slippage: The expected price deviation during a swap. For volatile memecoins, increasing the slippage tolerance (e.g., from 0.5% to 5% or higher) is often necessary to ensure the transaction goes through.

Set Up Your Wallet

Securing Your Wallet Before Buying Solana Memecoins. Image via Shutterstock

Before you can buy Solana memecoins, you need a compatible wallet. A Solana wallet allows you to store SOL (the native coin used for gas fees) and interact with decentralized exchanges (DEXs) like Jupiter, Raydium, or Orca. Two of the most popular wallets in the Solana ecosystem are Phantom and Solflare.

Phantom Wallet

Phantom is one of the most popular and user-friendly wallets for the Solana ecosystem.

Steps to set up Phantom:

- Install: Download the Phantom extension for your web browser (Chrome, Firefox) or the mobile app for iOS/Android from the official website.

- Create a new wallet: Open the app and select "Create New Wallet".

- Seed security: You will be given a Secret Recovery Phrase (seed phrase) of 12 or 24 words. Write this down on paper and store it securely offline. Never share this phrase with anyone or store it digitally.

- Scam warnings: Be aware of unsolicited messages, NFTs, or links that promise rewards or airdrops. Phantom will never ask for your seed phrase. Only interact with verified dApps and sites.

- Funding: Deposit SOL into your new wallet by sending it from a CEX or by buying it directly within the Phantom app using a payment provider like MoonPay.

- Trading: To buy memecoins, use the in-wallet swap feature. Search for the token by name or paste its contract address from a trusted source like CoinGecko or the project's official site.

Solflare

Solflare is another feature-rich and secure wallet that supports the Solana ecosystem, including Ledger hardware wallet integration.

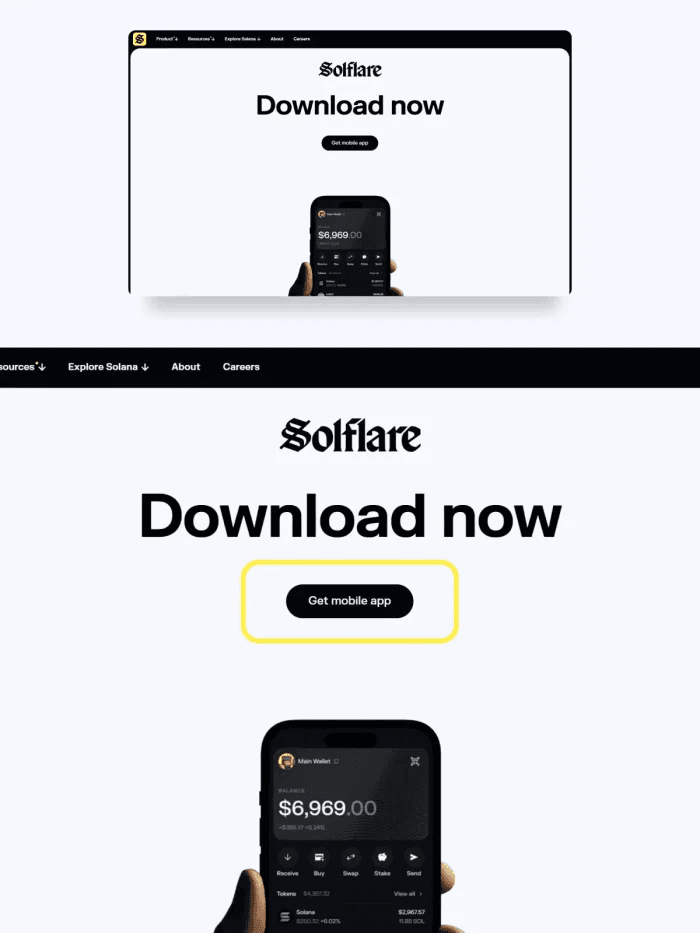

Steps to set up Solflare:

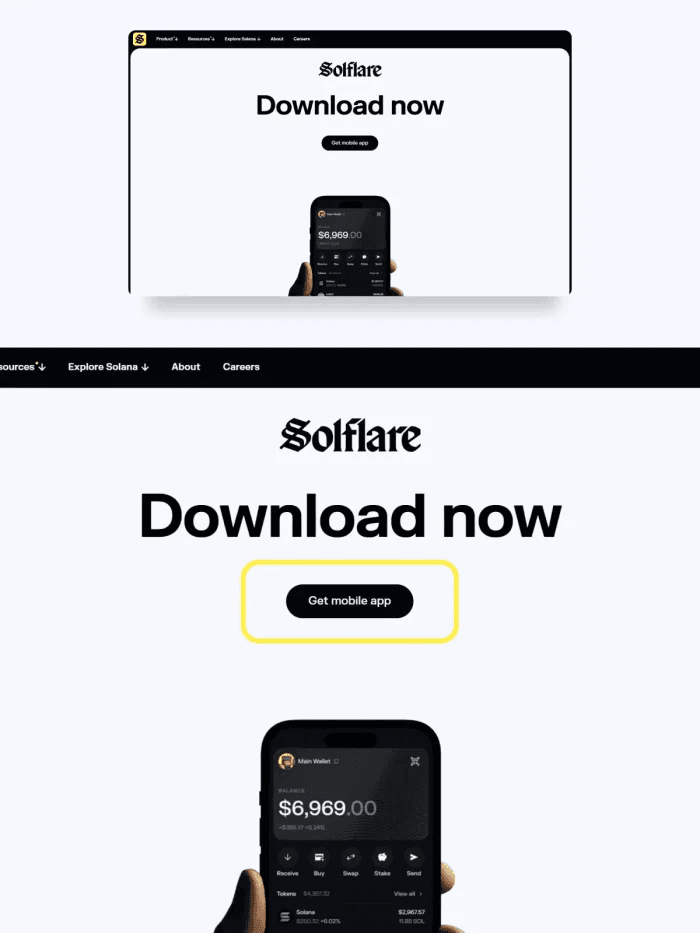

Step 1: Download Solflare

Image via

SolflareGo to solflare.com and click Download now. Choose the Get mobile app to install it from the App Store or Google Play.

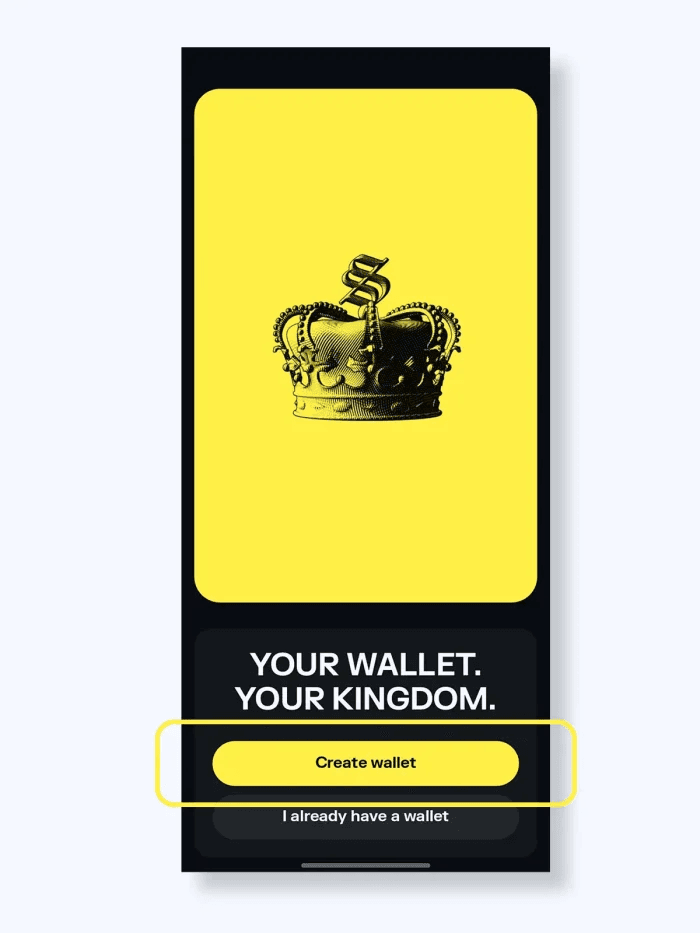

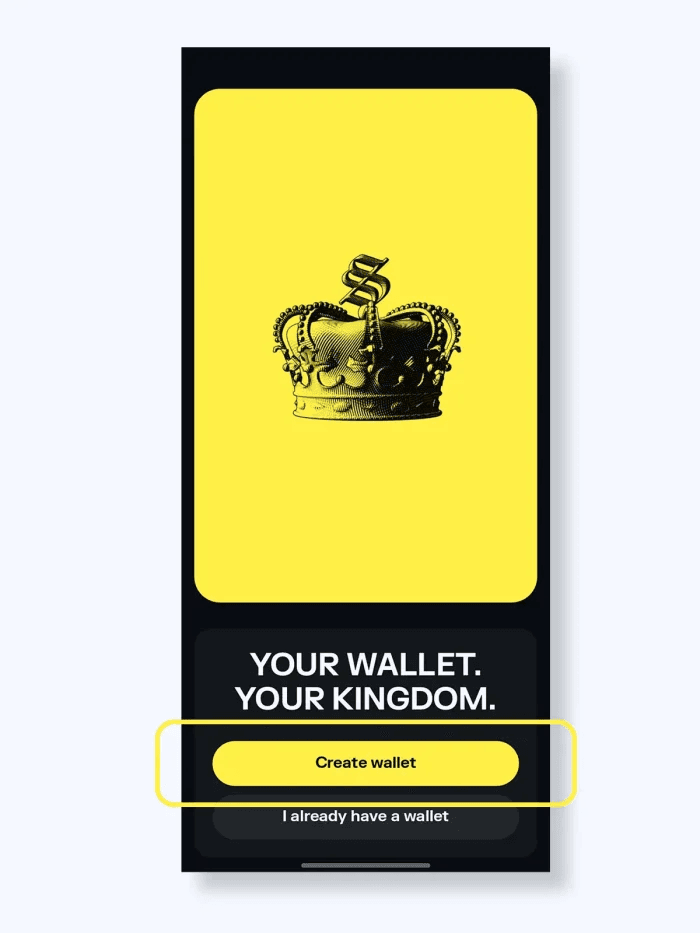

Step 2: Create Your Wallet

Image via

SolflareOpen the app and tap Create wallet. You’ll see a message — Your wallet. Your kingdom.

If you already have one, tap I already have a wallet instead.

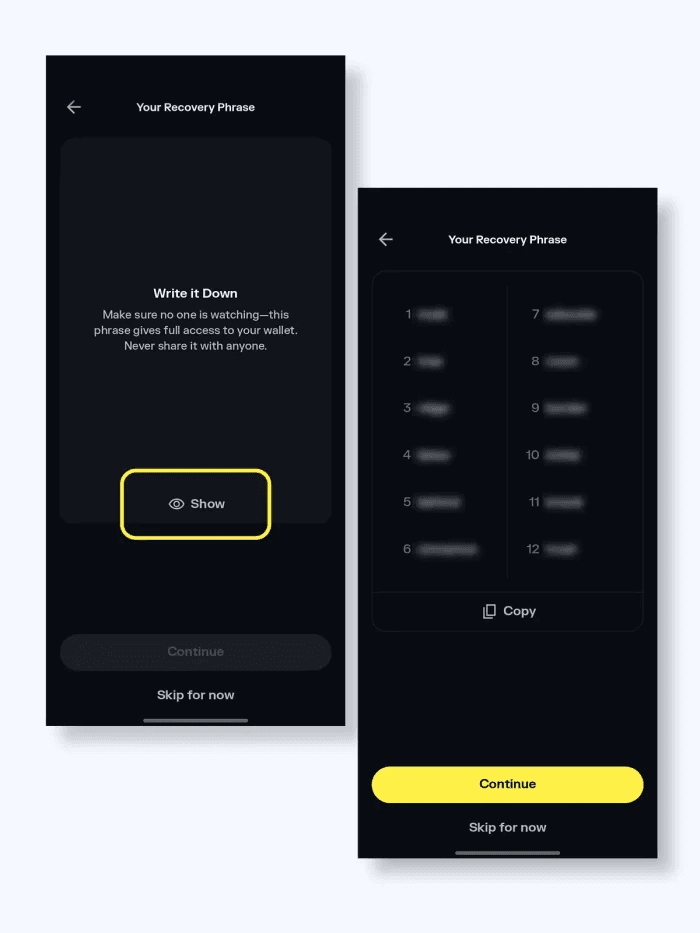

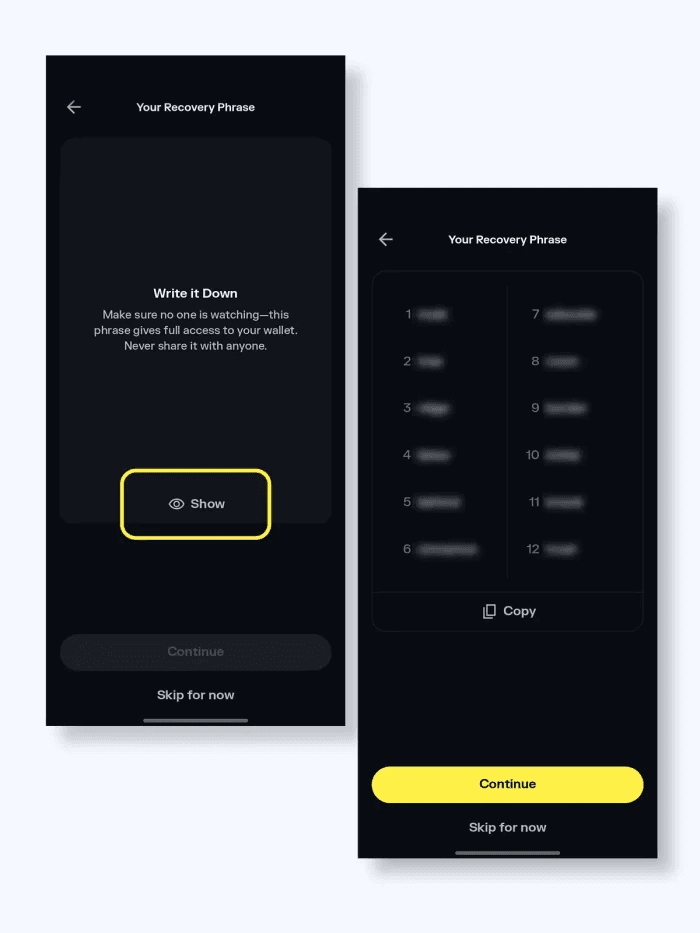

Step 3: Backup Your Recovery Phrase

Image via

SolflareYou’ll get a 12-word recovery phrase. Tap Show to reveal it. Write it down securely and never share it with anyone. Once done, tap Continue.

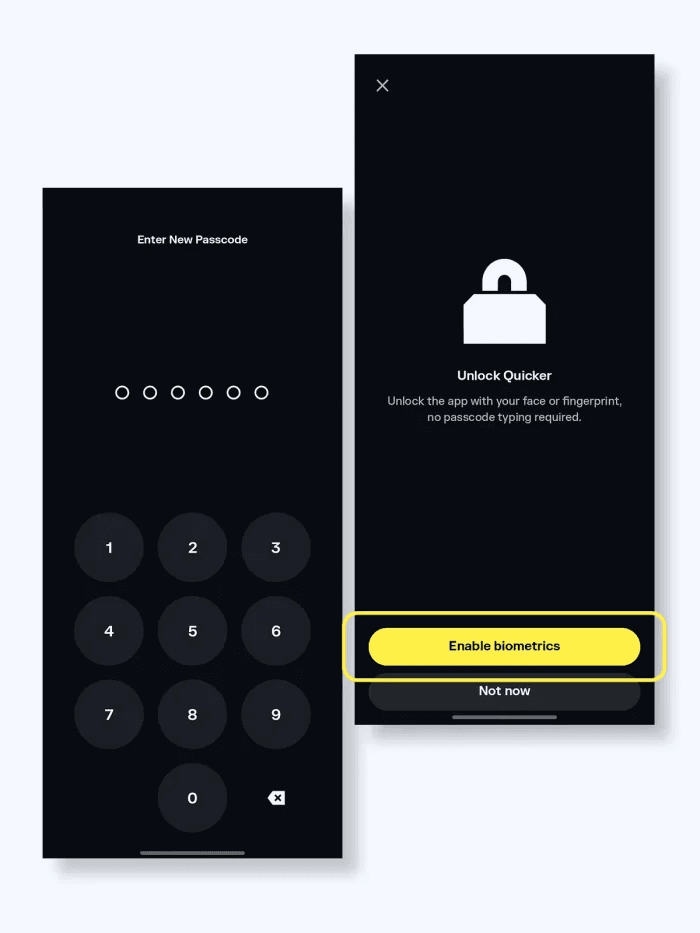

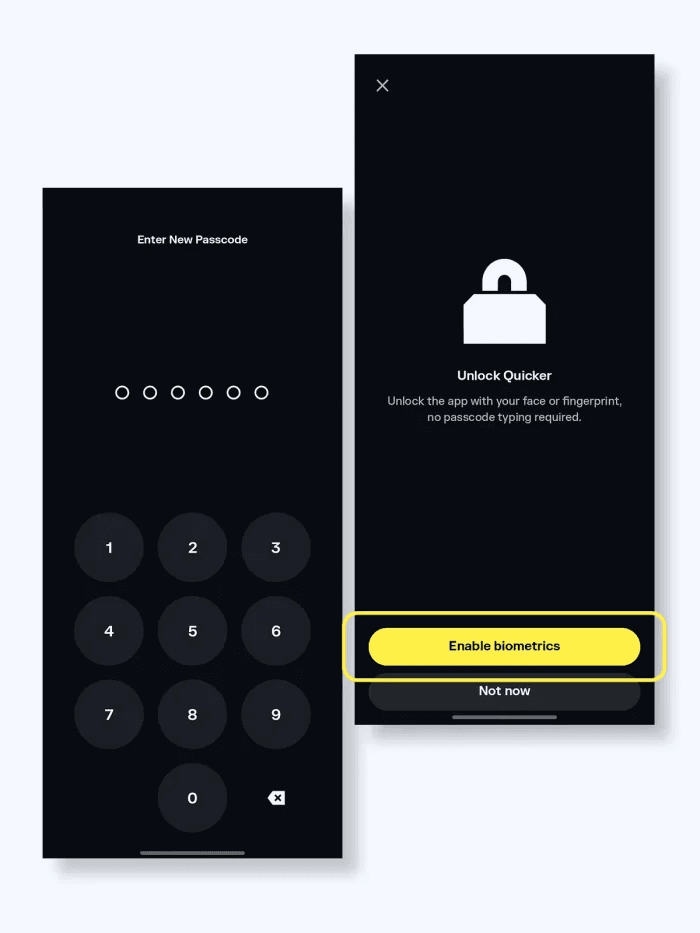

Step 4: Set a Passcode and Enable Biometrics

Image via

SolflareCreate a 6-digit passcode to protect your wallet. Then choose Enable biometrics for faster logins using Face or Touch ID.

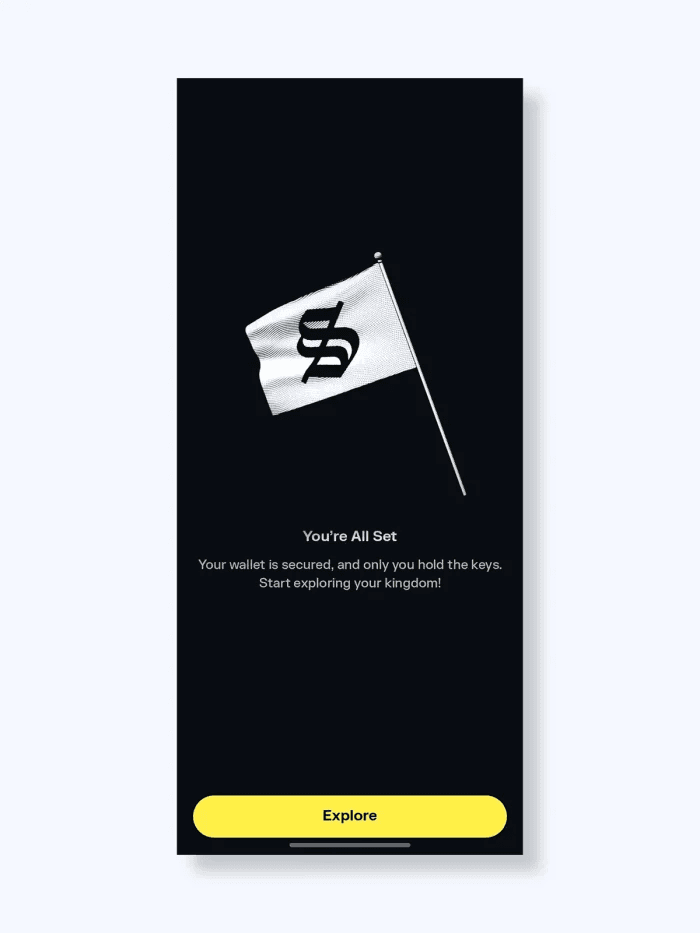

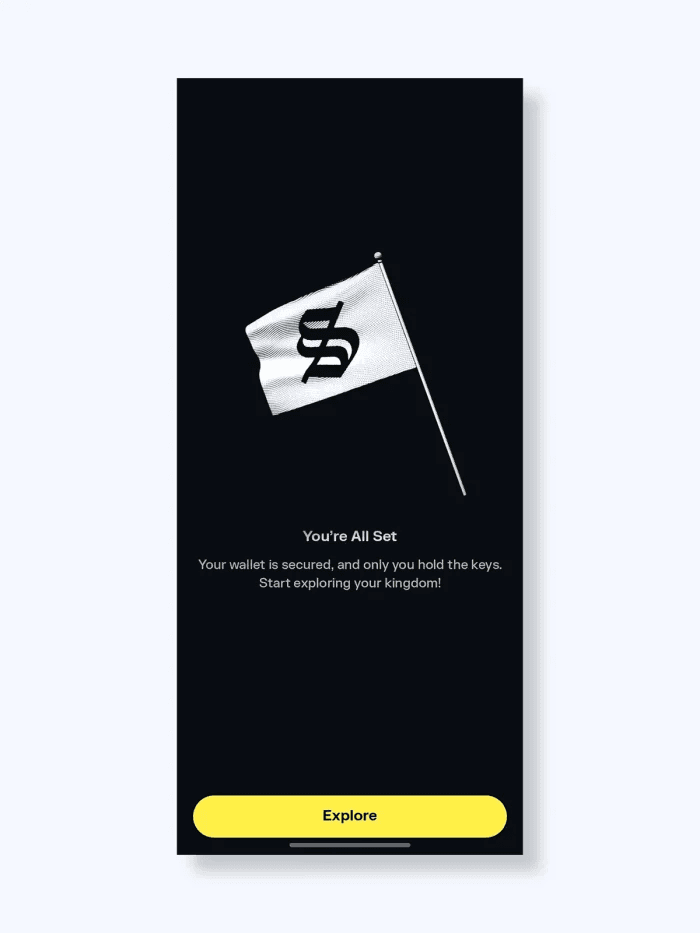

Step 5: Wallet Setup Complete

Image via

SolflareYou’ll see a confirmation screen saying “You’re All Set”. Tap Explore to enter your wallet dashboard.

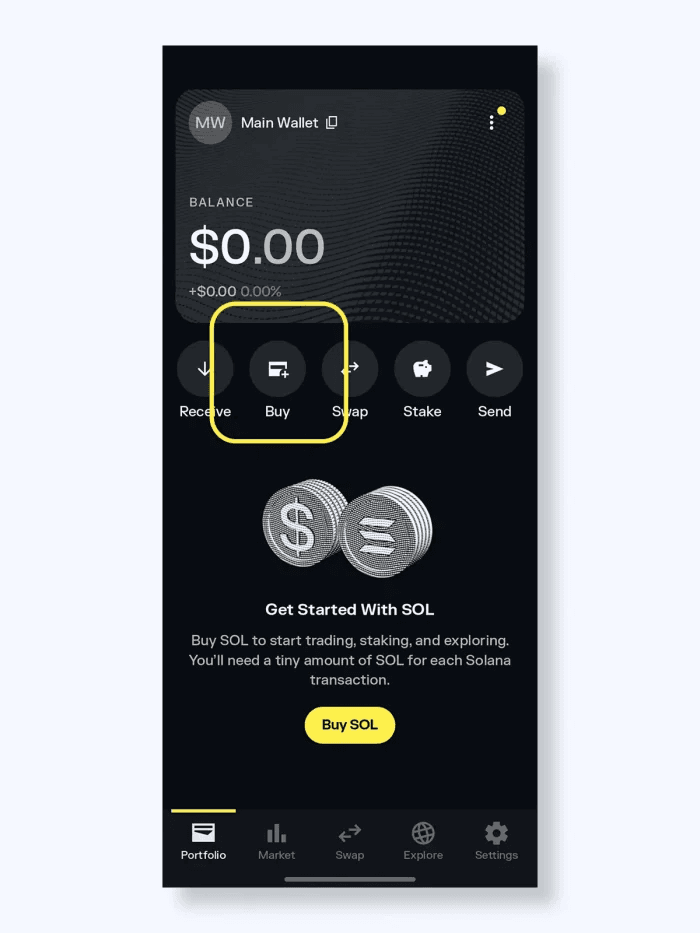

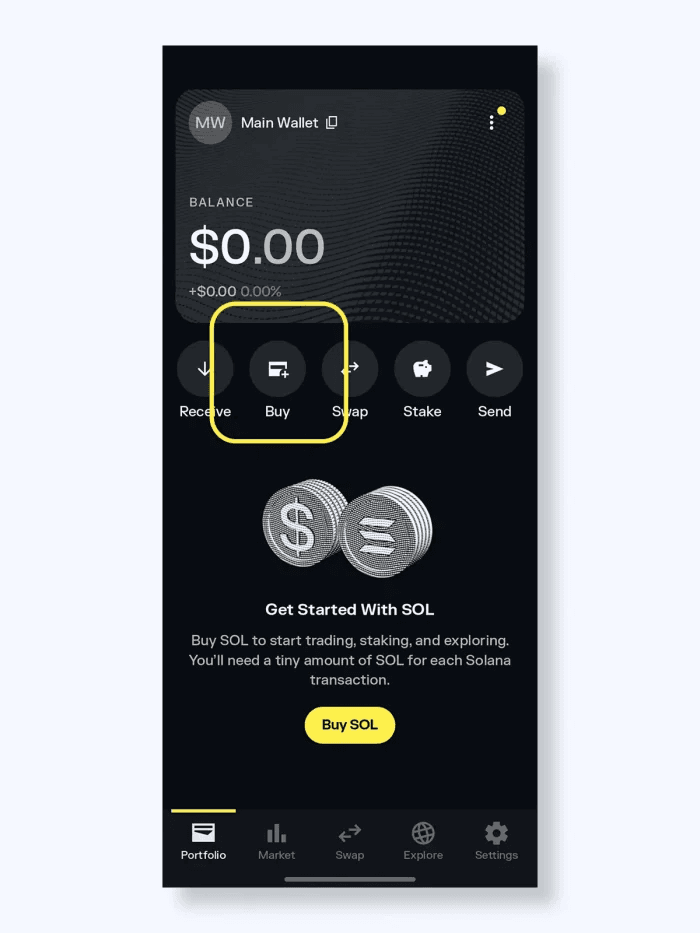

Step 6: Get Started With SOL

Image via

SolflareFrom the main screen, tap Buy or Buy SOL to purchase Solana (SOL). You’ll need a small amount of SOL to make any transaction on the Solana network.

For maximum security, connect a Ledger hardware wallet. Here is what to flow would look like:

- Prerequisites: Ensure the Solana app is installed and updated on your Ledger device, and close the Ledger Live app.

- Connect: In Solflare, navigate to "I already have a wallet," then select "Ledger."

- Authorize: Follow the prompts to connect via Bluetooth (mobile) or USB (web), and approve the connection on your Ledger device.

- Import: Select the desired accounts to import. For interacting with DEXs, you may need to enable "blind signing" in your Ledger's Solana app settings.

- Transfer: For extra security, move your assets from your hot wallet to the newly connected Ledger-controlled account.

Fund Your Wallet With SOL

Fund Your Wallet With SOL Before Buying Any Memecoin. Image via Shutterstock

Before you can purchase memecoins on a decentralized exchange (DEX), you must first acquire Solana (SOL), as it is the base currency used for transactions and fees on the Solana network.

Buy SOL

You can easily purchase SOL on a centralized exchange (CEX). This method allows you to use traditional fiat currency (like USD or EUR) to enter the crypto market.

CEXs typically support various payment methods, including credit/debit cards, bank transfers (ACH or wire), and third-party services like PayPal. These platforms charge fees for transactions, which can range from 0.5% to 5% or more, depending on the payment method and the specific exchange. Bank transfers are often the cheapest option, while credit card purchases incur higher fees due to processing costs.

Transfer SOL

Once you have purchased SOL on a CEX, you must transfer it to your personal wallet (like Phantom or Solflare) to interact with DEXs.

- Network: When withdrawing from the CEX, it is crucial to select the Solana network. Transferring SOL on the wrong network will result in a permanent loss of funds.

- Tag Not Needed: Unlike some other cryptocurrencies, the Solana network does not require a destination tag, memo, or payment ID. You only need the recipient's wallet address.

- Confirm Address: Double-check the wallet address you are sending to. Always copy and paste the address to avoid errors from manual entry.

- Small Test Send: For larger transfers, a best practice is to first send a small amount of SOL (e.g., $1) to confirm the address is correct and the transaction goes through successfully before sending the full amount.

Step-by-Step on a DEX

Setup Your DeFi Wallet, Connect And Buy Memecoin on DEXs. Image via Shutterstock

With SOL in your wallet, you are ready to trade for memecoins on a Solana decentralized exchange (DEX) like Raydium or Jupiter.

Connect Wallet

- Open the DEX: Navigate to the official website of the DEX you wish to use (e.g., https://jup.ag).

- Verify URL: Always double-check that the URL is correct to avoid phishing scams. A common scam involves creating a fake site with a similar-looking URL.

- Connect: Click the "Connect Wallet" button and select your wallet (e.g., Phantom).

- Reject unknown permissions: The wallet will prompt you to connect and approve permissions. Only approve connections from trusted sites, and ensure the request does not ask for full control of your funds.

Pick Token

To swap your SOL for a meme coin, you need to select the correct token.

- Verify Contract Address: The most reliable way to find a meme coin is by its official contract address, not its name or ticker. Find the contract address on the project's official website, social media, or a trusted crypto data aggregator like CoinGecko.

- Paste SPL Address: In the DEX's trading interface, paste the copied SPL (Solana Program Library) contract address into the token selection field. This ensures you are trading the legitimate token and not a counterfeit.

Set Slippage and Swap

Slippage is a crucial setting to manage for meme coin trades due to their volatility.

- Slippage Range: For liquid tokens, a slippage tolerance of 0.5% to 1% is typically sufficient. However, for new or low-liquidity memecoins, you may need to increase the slippage to 5% or even 10% to ensure the transaction succeeds.

- Minimum Received: Most DEXs show a "minimum received" amount, which is the smallest number of tokens you can get after slippage and fees are accounted for.

- Route Preview: An aggregator like Jupiter will often show you the transaction route, detailing which DEXs it is using to get you the best price.

- MEV Protection: Some platforms offer MEV (Maximal Extractable Value) protection, which helps prevent bots from front-running your trade.

Post-Trade Checks

After you have executed the swap, it is important to confirm that the transaction was successful.

- Track Token in Wallet: The meme coin should automatically appear in your wallet. If it doesn't, you may need to manually add it using its contract address.

- Confirm Balance on Solscan: Use a Solana block explorer like Solscan (https://solscan.io) to verify the transaction. Paste your wallet address into the search bar, and you can see all your token balances and transaction history, confirming the meme coin has been received.

Advanced Security for Solana Meme Coin Trading

Hardware Wallets Like Ledger Offer The Highest Level Of Security. Image via Shutterstock

Trading memecoins on Solana can be lucrative, but it’s also risky. The very traits that make the ecosystem exciting with fast launches, hype cycles, and viral momentum also make it a target for scams, spoofed tokens, and wallet exploits. This section covers the key practices and tools that can help protect your funds while trading.

Hardware wallet integration

Hardware wallets like Ledger offer the highest level of security by storing your private keys offline, away from internet-connected devices susceptible to malware and hacking. When trading Solana memecoins, you connect the hardware wallet to a software interface like Phantom or Solflare to initiate transactions.

Your hardware wallet's certified secure element chip stores your private keys and seed phrase. This information is never exposed to your computer or phone during a transaction. All cryptographic signing operations happen within the hardware wallet's secure chip.

How to approve swaps with Ledger and Phantom/Solflare:

- Connect your Ledger device to your computer via USB and unlock it with your PIN.

- Open the Solana app on your Ledger device. On your device's screen, enable "blind signing" in the settings, as this is required to approve complex transactions like swaps on Solana.

- Initiate the swap in your Phantom or Solflare wallet's interface on your computer.

- The wallet will send the transaction details to your Ledger for confirmation.

On your Ledger device, you must physically review and approve the transaction details using the device's buttons. This physical confirmation step ensures that even if your computer is compromised, a hacker cannot execute a transaction without your consent.

Approval and permission hygiene

To protect your wallet, regularly manage the permissions you grant to decentralized applications (dApps).

Revoke risky approvals

Many crypto exploits occur because users have granted unlimited spending permission to a malicious or compromised smart contract. For meme coin trading, which often involves new and unaudited dApps, it's crucial to revoke permissions after you have completed your trades. Use a reputable revoke tool like the one offered by Famous Fox Federation to review and remove approvals for token spending on the Solana network.

Rotate fresh wallets for airdrops and mints

Never use your primary, high-value wallet to claim airdrops, mint new coins, or interact with new projects. Many scams use these activities to lure users into signing malicious transactions. Use a dedicated, disposable "burner" wallet with only a small amount of funds to minimize potential losses.

Some advanced dApps and games on Solana use session keys for a smoother user experience, reducing the number of times you need to approve a transaction. While convenient, this creates a temporary security vulnerability. Be aware of the dApp's reputation and the expiration date of the session to prevent unauthorized activity.

Scam Recognition

Meme coin traders are frequent targets for scams due to the hype and speculation in the market.

- Fake sites: Scammers create websites that are near-perfect replicas of legitimate exchanges or launchpads to trick users into connecting their wallets. Always double-check the URL for misspellings (e.g., solanacom.xyz instead of solana.com). Bookmark legitimate sites to avoid typosquatting.

- Spoofed tickers: Scammers can create tokens with names and ticker symbols that are very similar to popular memecoins. Verify the official contract address of the token from the project's official social media or website before buying to ensure you are trading the correct asset.

- Airdrop dusting: Airdrop dusting is a scam where malicious actors send tiny amounts of crypto to your wallet. The purpose is to track your wallet's activity and potentially link your identity to it. Do not interact with or send these tokens.

- Honeypots: A honeypot is a malicious smart contract that allows you to buy a token but prevents you from selling it. Once trapped, the scammer can drain the liquidity pool. Always be wary of new, low-liquidity memecoins, and use block explorers to check for suspicious token behavior.

- Telegram bots: Scammers frequently use bots and manipulated charts in Telegram groups to create a false sense of hype and volume for a worthless meme coin. Do not rely on pump groups for trading advice.

In crypto, you’re never more than a click away from a scammer, and it’s a problem that never goes away, so always beware and watch out for crypto scams.

Centralized exchange (CEX) hygiene

While many memecoins are found on DEXs, CEXs are a common on/off-ramp for crypto. Secure your CEX accounts to prevent a single point of failure.

- Use an authenticator app like Google Authenticator or Authy for 2FA instead of SMS-based verification. SMS can be intercepted through a SIM swap attack.

- Enable a withdrawal address whitelist on your CEX. This feature restricts withdrawals to a list of pre-approved addresses, preventing a hacker from withdrawing your funds to an address they control.

- Pay attention to security alerts and device logs from your CEX. Review active sessions and remove any unfamiliar devices.

- If you are not an active algorithmic trader, disable any API keys on your exchange account. If you do use them, only grant the necessary permissions and set IP restrictions.

Position Sizing and Risk Rules

Meme coin trading is high-risk, so proper position sizing is critical for long-term survival. These assets are highly volatile, often illiquid, and subject to sudden sentiment shifts. Here’s how to approach them responsibly:

- Risk No More Than 1–2% Per Trade: Most experienced traders suggest risking 1–2% of your total portfolio per position, especially with memecoins. This limits potential losses even if the trade goes south.

- Use a Tiered Allocation Strategy: Divide your Solana meme coin portfolio into tiers: High-conviction picks (e.g., BONK, WIF) can receive up to 30–50% of your meme coin allocation.

- Mid-cap or trending tokens: 20–30%.

- Speculative microcaps or new launches: 5–15% per token.

- Cap Meme Coin Exposure: Limit meme coin exposure to 10–20% of your total crypto portfolio. These coins are speculative by nature and shouldn’t replace stable investments.

- Pre-Define Stop-Losses and Profit Targets: Before entering a trade, set a stop-loss level (e.g., 20–30% below entry) and a profit-taking target (e.g., 2–3x). This removes emotion from the trade.

- Factor in Liquidity and Slippage: Avoid putting large amounts into low-volume tokens. A sudden sell can tank the price due to thin liquidity and high slippage, especially on DEXs like Raydium.

- Start Small and Scale In: For new traders, the best approach is to start with small test positions, monitor performance, then scale in only if the trade is moving in your favor.

Troubleshooting

Despite Solana's speed and low fees, problems can and do happen—especially when trading lesser-known memecoins. Whether your wallet won’t connect, swaps are failing, or tokens don’t appear, this section provides step-by-step solutions for the most common issues.

Wallet Will Not Connect

If you're having trouble connecting your Solana wallet (like Phantom or Solflare) to a decentralized exchange (DEX), here are several solutions: This usually happens when the DEX or DApp cannot detect your wallet extension, or there's an issue with permissions.

If you're having trouble connecting your Solana wallet (like Phantom or Solflare) to a decentralized exchange (DEX), here are several solutions:

- Clear site connections: In your wallet's settings, find the "Trusted Apps" or "Manage Connected Websites" section. Remove the connection to the DEX you are trying to use. Then, refresh the DEX page and attempt to reconnect your wallet.

- Reset DApp permissions: Resetting permissions can resolve issues where your wallet is stuck in a pending connection state.

- Switch RPC: If you are using a custom RPC endpoint, try switching back to the default one provided by the wallet. Custom RPCs can sometimes be unstable or out of sync.

- Use mobile versus desktop: If you're on a desktop browser, try using the DEX's mobile app or the wallet's in-app browser instead. Connection issues can sometimes be related to browser extensions or cookies, and using a fresh environment can resolve them.

- Hard refresh: For desktop users, performing a hard refresh (Ctrl+Shift+R on PC or Cmd+Shift+R on Mac) on the DEX page can clear cached data that might be causing connection problems.

Insufficient SOL for Fees

You may encounter errors like “transaction failed” or “insufficient balance” when trying to swap or approve transactions, even if you have tokens in your wallet. This means you don’t have enough SOL to pay the network fee.

Minimum SOL buffer: To avoid transaction failures, maintain a small buffer of SOL in your wallet. Recommendations range from 0.005 SOL to 0.1 SOL, with some experts suggesting keeping at least 0.05 SOL to cover standard transactions and account rent during busy periods.

How to top up fast:

- Transfer SOL from a centralized exchange (CEX) like Binance or Coinbase to your wallet address.

- Use an in-wallet fiat on-ramp service to purchase SOL with a credit card, though this may not be the fastest method.

- If you hold other tokens, swap them for a small amount of SOL on a DEX within your wallet.

Token Not Showing in Wallet

You’ve completed the swap, but your new memecoin isn’t visible in your crypto wallet balance. This is a very common issue for newly listed or obscure tokens.

After a swap, the new meme coin may not immediately appear in your wallet's token list. You can:

- Add custom token by mint address: Phantom and Solflare wallets generally auto-detect new tokens. However, if it doesn't appear, you can manually add the token.

- Find the token's mint address on a reliable source like Solscan or the project's official website.

In your wallet, go to the "Manage token list" or "Add custom token" section.

Paste the mint address. The token's name and symbol should populate automatically. - Refresh: Simply refreshing your wallet or reconnecting it can often prompt the token to appear.

- Check on Solscan: Use a blockchain explorer like Solscan to verify the transaction. Paste your wallet address into the search bar and check your token accounts. If the token is listed there, it means you own it, and the issue is with the wallet's display.

Swaps Failing

Failed swaps on Solana DEXs typically come from three issues: slippage too low, pool depth too shallow, or network congestion.

How to Resolve:

Raise slippage tolerance:

- For small-cap memecoins, 5% is often required.

- On Jupiter: Settings > Slippage > set to 3%–5%.

- On Raydium: Settings gear > increase slippage gradually.

Split the trade:

Instead of swapping 5 SOL in one transaction, try two swaps of 2.5 SOL each.

This reduces price impact and slippage failure likelihood.

Switch routing path:

On Jupiter, you can toggle between route options.

Use USDC as an intermediate if direct swaps fail (SOL → USDC → Token).

Retry on another DEX:

If Jupiter fails, try Orca or Raydium. Some tokens are better supported on different platforms.

Check the token status:

- Tokens may become frozen, rugged, or blacklisted.

- Check Birdeye for live price activity.

- Check the token's Telegram or X (Twitter) for warnings.

- These settings can prevent unauthorized access even if your login credentials are compromised.

Cross-Chain Context

Different Blockchain Networks Power Solana Meme Coin Transactions. Image via Shutterstock

While Solana has become the dominant force in meme coin trading by 2025, it’s not the only chain where memecoins thrive. Ethereum and Binance Smart Chain (BSC) still maintain active meme coin ecosystems. But how do these chains compare, especially for meme coin investors and traders?

This section breaks down how Solana stacks up against Ethereum and BSC in key areas like fees, liquidity, speed, and overall user experience.

Solana vs Ethereum vs BSC

| Feature | Solana (SOL) | Ethereum (ETH) | BNB Chain (BSC) |

|---|

| Fees | The median transaction fee is under $0.0025. In 2024, Solana earned approx. $750.65M in fees. | Average gas fee dropped to 1.816 gwei (~$0.39 for swaps, ~$0.65 for NFTs). 2024 fee revenue: $2.48B. | Avg fee in 2024 was $0.03. After an October 2025 reduction, average fee is $0.005. 2024 fees: $194.78M. |

| Finality | Current average finality time: 12.8 seconds. The upcoming Alpenglow upgrade aims to reduce this to ~150ms. | Block finality is ~15 minutes, though most reach practical finality in 30–90 seconds (avg ~60s). | After upgrades, finality is now under 4 seconds for users (was 7.5s). “Fast Finality” upgrade completed in 2025. |

| Liquidity Depth | Liquidity is expanding rapidly, especially around memecoins and NFTs, via DEXs like Raydium. | Largest and most mature DeFi ecosystem, with deep pools across thousands of protocols. | Strong DeFi activity, especially for EVM tokens. TVL exceeded $5.5B in 2024. |

| Bot Activity | High, due to ultra-low fees and fast execution. Sniping and MEV are growing issues. | High bot activity, especially with MEV and gas wars, but high fees deter low-value attacks. | Also high; EVM tools make bot deployment easy, and lower fees make it cost-effective. |

Key Takeaways:

- Solana leads on speed and cost, making it ideal for active meme trading and micro-transactions.

- Ethereum remains the most secure and battle-tested chain, but fees price out many casual traders.

- BSC offers ease of use and quick launches, but is known for lower-quality tokens and higher scam volume.

Solana’s architecture gives it an edge in meme coin trading, especially when speed, low slippage, and affordability are top priorities. The sheer volume of meme coin launches on Solana in 2025 further reinforces its position as the default chain for early-stage meme speculation.

However, cross-chain awareness is still essential. Many investors move funds between chains, and some tokens bridge from one ecosystem to another. Tools like Wormhole Bridge and Portal enable bridging between Solana, Ethereum, and BSC, but users must remain vigilant to avoid interacting with fake bridge sites or mismatched tokens.

Taxes and Records

Understanding Tax Implications Of Solana Meme Coin Trading. Image via Shutterstock

Meme coin trading on Solana may feel casual or impulsive, but from a legal and financial standpoint, it’s no different from trading any other cryptocurrency. Whether you’re making a few swaps on Jupiter or flipping tokens daily, every transaction is potentially a taxable event in most jurisdictions.

This section explains how to track your activity and maintain compliance with local tax regulations.

Tracking

The moment you buy, sell, swap, or even receive an airdrop of memecoins, a digital paper trail is created. Keeping detailed records of these transactions is essential for both tax filing and portfolio performance tracking.

What to Record:

- Transaction Date and Time: The exact moment the transaction occurred.

- Asset Involved: The specific token, e.g., BONK, SOL, USDC.

- Action: What you did, e.g., "Swap BONK for USDC" or “Claimed Airdrop.”

- Amount: The number of tokens received and spent.

- Cost Basis: Your initial investment in a token, including any fees.

- Fair Market Value (FMV): The price of the token at the time of the transaction.

- Fees: The network fees (in SOL) paid for the transaction.

- Transaction Hash (TX hash): A unique identifier for your transaction on the blockchain. You can find this on a block explorer like Solscan.

Recommended Tools:

- CoinTracker and Koinly: Sync with Phantom or Solflare to import transaction history

- Solscan or SolanaFM: Search your wallet address to export TX history manually

- Google Sheets: For manual tracking with custom categories (ideal for smaller portfolios)

Even if you’re trading on-chain using only DEXs, every trade counts toward capital gains and must be tracked

Country Notes

Tax laws differ globally, but one thing remains true: most countries treat crypto as a taxable asset. Below is a general overview of how different regions, including India, handle Solana meme coin transactions. Always consult a licensed tax advisor in your jurisdiction for personalized advice.

| Country | General Crypto Tax Approach | Notes |

|---|

| United States - IRS | Treated as property; every trade/swap is a taxable event | Capital gains apply. Airdrops, staking rewards are treated as ordinary income. |

| United Kingdom - HMRC | Subject to Capital Gains Tax (CGT) | HMRC requires detailed records of acquisition, disposal, and fair market value. |

| Australia - ATO | CGT applies; frequent traders may be classified under income tax | Holding duration affects tax rate; ATO considers intent and frequency of trades. |

| Canada | Usually taxed as capital gains, but active trading = business income | CRA may reclassify high-frequency trading as business activity, fully taxable. |

| Germany | Tax-free after holding over 1 year | If sold within 12 months, the full gain is taxable. |

| Singapore | No capital gains tax (still current in 2025) | Income tax may apply if trading is frequent or business-like in nature. |

| India | Flat 30% tax on profits; 1% TDS on all trades | No deduction of expenses allowed; losses cannot offset other income. Applies to both CEX and DEX trades. |

Best Practices:

- Take monthly snapshots of your wallet balances

- Export transaction logs quarterly to avoid year-end overload

- Use tools that support Solana SPL token tracking specifically

Simple Template (Manual Tracking Example):

| Date | Token | Action | Amount | Price (USD) | Fee (SOL) | TX Hash |

|---|

| 2025-09-20 | BONK | Buy | 1M | 0.00002 | 0.0002 | 5k92...d93p |

| 2025-09-22 | WIF | Sell | 120 | 0.84 | 0.0003 | 6av4...a2tz |

Maintaining accurate records gives you insight into what’s actually working in your trading strategy.

Securing Your Wallet Before Buying Solana Memecoins. Image via Shutterstock

Securing Your Wallet Before Buying Solana Memecoins. Image via Shutterstock Image via

Image via  Image via

Image via  Image via

Image via  Image via

Image via  Image via

Image via  Image via

Image via  Fund Your Wallet With SOL Before Buying Any Memecoin. Image via Shutterstock

Fund Your Wallet With SOL Before Buying Any Memecoin. Image via Shutterstock Setup Your DeFi Wallet, Connect And Buy Memecoin on DEXs. Image via Shutterstock

Setup Your DeFi Wallet, Connect And Buy Memecoin on DEXs. Image via Shutterstock Hardware Wallets Like Ledger Offer The Highest Level Of Security. Image via Shutterstock

Hardware Wallets Like Ledger Offer The Highest Level Of Security. Image via Shutterstock Different Blockchain Networks Power Solana Meme Coin Transactions. Image via Shutterstock

Different Blockchain Networks Power Solana Meme Coin Transactions. Image via Shutterstock Understanding Tax Implications Of Solana Meme Coin Trading. Image via Shutterstock

Understanding Tax Implications Of Solana Meme Coin Trading. Image via Shutterstock