Aave has become one of the core building blocks of decentralized finance. It is no longer just a lending app, but a multi-chain liquidity layer used by individual borrowers, institutional-sized liquidity providers, and DeFi protocols themselves. With features like flash loans, capital-efficient borrowing via eMode, and a native stablecoin in GHO, Aave offers power and flexibility that few competitors can match.

That power comes with responsibility. This review breaks down how Aave actually works in practice today, what it does better than rivals like Compound, MakerDAO, and Liquity, and where the real risks lie, especially around liquidation, gas costs, and user error.

Quick Verdict and Rating

Best For

- Intermediate-to-advanced DeFi users comfortable monitoring Health Factor

- Borrowers who want stable/variable rate switching and eMode efficiency

- Multi-chain users optimizing for lower fees on L2s

- Builders integrating a battle-tested money market (and flash loans) into apps

- Users who want native overcollateralized stablecoin exposure via GHO

Not Ideal For

- Complete beginners who won’t monitor positions or understand liquidation mechanics

- Small mainnet users where gas can erase yield or raise borrowing costs

- Anyone borrowing near max LTV without alerts, buffers, or a repayment plan

- Users who want fixed-rate simplicity and one-click “set-and-forget” lending

- People looking for human customer support instead of community-led support

Key Takeaways (TL;DR)

- Flash loans: Aave’s signature primitive, letting advanced users tap deep liquidity without collateral inside a single atomic transaction.

- V3 tools (eMode, caps, isolation/siloing): Capital efficiency plus guardrails, letting Aave list more assets while containing tail risk.

- Portal and multi-chain markets: Aave behaves like a multi-network liquidity layer, with each chain running its own reserves and risk parameters.

- Gas reality: Ethereum mainnet is the premium lane; most retail users get better net outcomes on L2s where fees are dramatically lower.

- Liquidation is the #1 risk: Smart contracts rarely fail, but users do, especially when they borrow too close to the edge or ignore volatility.

- GHO in one line: Aave’s native, overcollateralized stablecoin you mint by borrowing against collateral, best for Aave-native loops and DAO-aligned users.

- Aave vs Compound: Aave is the power toolkit (rate switching, eMode, flash loans); Compound is the simpler “just lend/borrow” experience.

- Aave vs MakerDAO: Maker is the DAI-focused vault world; Aave is the multi-asset, multi-chain money market with broader lending utility.

- Aave vs Liquity: Liquity is narrow and ETH-centric with ultra-low “set-and-hold” borrowing; Aave is broader, configurable, and more feature-dense.

How We Tested and Reviewed Aave

This review combines hands-on testing with on-chain data and primary documentation to judge how Aave performs in real conditions in 2026.

Testing Methodology

What we tested

- Supplying + withdrawals (aTokens, liquidity under utilization)

- Borrowing with variable and stable rates, plus rate switching

- Health Factor + liquidation UX (warnings, thresholds, clarity)

- Multi-chain experience (mainnet vs L2 costs and speed)

- GHO mint/repay flows and how clearly risks are communicated

- App UX + docs accuracy and usability

Testing window

- Live testing performed during our 2025 update cycle, refreshed for 2026.

Wallets used

- MetaMask (software wallet)

- Ledger (hardware wallet)

How we evaluated

- Real costs (APR/APY + gas), transaction speed, UX clarity, risk signaling, transparency of parameters, and documentation quality.

Data Sources We Used

- Aave documentation (protocol, risk parameters, GHO, governance)

- DeFiLlama (TVL, chain deployments)

- Gas trackers (network fee averages)

- Security references (audits, bug bounty, Safety Module info)

Limitations

- Didn’t test every chain; focused on major deployments users actually pick.

- Flash loans were validated mainly on testnet/simulations, not large mainnet execution.

What Is Aave?

Aave is a Liquidity Protocol Where You Can Borrow Assets. Image via Aave

Aave is a Liquidity Protocol Where You Can Borrow Assets. Image via AaveAave describes itself as a liquidity protocol designed to enable users to earn interest by supplying assets and to borrow assets using a variable interest rate model. Its scope extends beyond that of a simple lending application; it is designed to be a fundamental financial primitive.

Aave in One Paragraph

Aave is an open-source, non-custodial system that facilitates the creation of decentralized liquidity markets. Users can supply and borrow assets using dynamic interest rates. All borrowing positions are strictly overcollateralized, with risk monitored in real-time by the Health Factor and specific asset liquidation thresholds. Suppliers receive aTokens that accrue interest, and borrowers receive debt tokens representing their obligation. This entire framework is enforced by smart contracts across multiple deployed networks, making Aave an essential piece of DeFi infrastructure.

Aave History and Team

The protocol’s governing bodies are the Aave Governance and the Aave DAO, which manage all upgrades, parameter changes, and new features. The shift to Governance v3, a modular system designed specifically for an on-chain DAO, is a clear signal that control has moved from the founding team to a fully governance-based stewardship model.

Aave’s Core Value Proposition

Aave V3 is a top liquidity protocol that works across more than 14 blockchains, allowing detailed control over risk factors. It features a multi-asset money market where liquidity providers earn interest from borrowers. Key features include Flash Loans, eMode, Isolation Mode, and its own stablecoin (GHO), all managed by adjustable risk settings set by the DAO.

Multi-chain money markets

V3's architecture is explicitly multi-network, meaning each chain deployment has its own independent reserves and risk configurations. This design choice enables the same core functions (supply, borrow, etc.) to be executed on lower-cost Layer 2 networks without forcing all users onto a single, high-fee chain.

Advanced borrowing tools

Borrowing is always overcollateralized, relying on the Health Factor and liquidation thresholds per reserve. The protocol supports both variable and stable interest rates, which update according to a sophisticated two-slope utilization model. The continuous emphasis is that while the tools are powerful, their safe operation is dependent on the user’s continuous tracking of risk signals.

Aave vs Competitors

Total Value Locked (TVL) in The entire DeFi Ecosystem Has Surpassed $100 Billion in 2025. Image via Shutterstock

Total Value Locked (TVL) in The entire DeFi Ecosystem Has Surpassed $100 Billion in 2025. Image via ShutterstockBefore diving into the mechanics of Aave, the most critical question for any user is: How does it stack up against the competition? Decentralized finance is a crowded space, and the choice between top protocols like Aave, Compound, MakerDAO, and Liquity often comes down to specific features, risk tolerance, and cost. To help you make that decision, we've broken down the key differences.

Quick Comparison Table

| Metric | Aave | Compound | MakerDAO | Liquity |

|---|---|---|---|---|

| TVL (DeFiLlama) | $33.31B | $1.88B | N/A | 353.11M |

| Chains (DeFiLlama) | 19 | 9 | Ethereum and L2s | Ethereum |

| Assets | 100s | 73 | ETH-focused vaults | ETH/LSTs |

| Rate Types | Variable/Stable | Variable mainly | Stability Fee | Fixed 0.5% |

| Max LTV | 80-90% eMode | 50-82% | ~66% (150% ratio) | 90.91% ETH |

| Collateral Ratios | Dynamic LTV/threshold | Collateral factors | 150% min | Max 110% ICR |

| Liquidation Penalty | 5-10% | Varies | Flat fee | Stability pool gains |

| Native Stablecoin | GHO | None | DAI | BOLD |

| Flash Loans | Yes, 0.09% | No | No | No |

| UX Difficulty | Medium | Easy | Complex | Simple ETH-only |

| Best For | Multi-chain power | Simple lending | DAI stability | High-LTV ETH |

Note: Data is current as of Dec. 30, 2025.

Detailed Feature Comparison

| Feature | Aave | Compound | MakerDAO | Liquity |

|---|---|---|---|---|

| Decentralization | Fully | Fully | Fully | Fully |

| KYC Required | No | No | No | No |

| Fiat On-Ramp | No | No | No | No |

| Rate Switching | Stable/Variable | Variable only | Fixed stability fee | 0% fixed |

| Liquidation Penalty | 5-10% | 8% | 13% | 0.5% |

| Mobile App | Web only | Web only | Web only | Web only |

| Customer Support | Community | Community | Community | Community |

| Insurance Fund | $450M Safety Module | No | No | No |

Fee and “Real Outcome” Comparison

While features and security are crucial, the bottom line often comes down to what you actually earn or pay. The comparison below illustrates the "real outcome" of a scenario — lending $10,000 in USDC for one year, factoring in current APY rates and the often-overlooked but significant variable of network gas fees.

Scenario: Net yield after ~12mo $10k USDC lending (est. 5% APY base, gas deducted; data 2025 avgs)

| Platform/Chain | Gross APY | Est. Gas (12 deposits/withdraws) | Net Yield (~5% gross) |

|---|---|---|---|

| Aave Ethereum | 4.8% | $45 (~$3.78/tx) via Coinlaw | $445 |

| Aave Polygon/Arbitrum | 4.7% | $6 (<$0.50/tx) | $484 |

| Compound Ethereum | 4.5% | $45 | $425 |

| Maker DSR | 5.0% | $30 (fewer tx) | $470 |

Key Insight: This analysis clearly demonstrates that choosing a Layer 2 network is paramount for cost efficiency. For example, using Aave on Layer 2s (Polygon/Arbitrum/Optimism) offers 10x cheaper gas than Ethereum mainnet while maintaining the same APYs, often leading to a better net return than competing protocols.

Which One Should You Choose?

After reviewing the tables and fee comparison, you should have a clearer picture. To consolidate your decision, use this final decision framework, which categorizes the protocols based on the primary user profile and their goals.

Choose Aave if:

- Need flash loans for arbitrage/liquidation bots

- Want multi-chain flexibility (12+ networks)

- Value rate switching (stable/variable)

- Building DeFi integrations

- Need GHO stablecoin exposure

- Can navigate complex interfaces

Choose Compound if:

- Want the simplest DeFi lending experience

- Prioritize lower gas fees on Ethereum

- Don't need flash loans

- Prefer variable rates only

- Lower learning curve acceptable trade-off for fewer features

Choose MakerDAO if:

- Focused on the DAI stablecoin ecosystem

- Want to mint/borrow DAI specifically

- Need the highest stability/predictability

- Don't mind higher collateral requirements (150%)

Choose Liquity if:

- Want absolute minimum interest (0%)

- Only need to borrow LUSD stablecoin

- Don't need to earn yield on deposits

- Want the lowest liquidation penalty (0.5%)

Take a look at our top picks for the best lending and borrowing protocols.

How Does Aave Work?

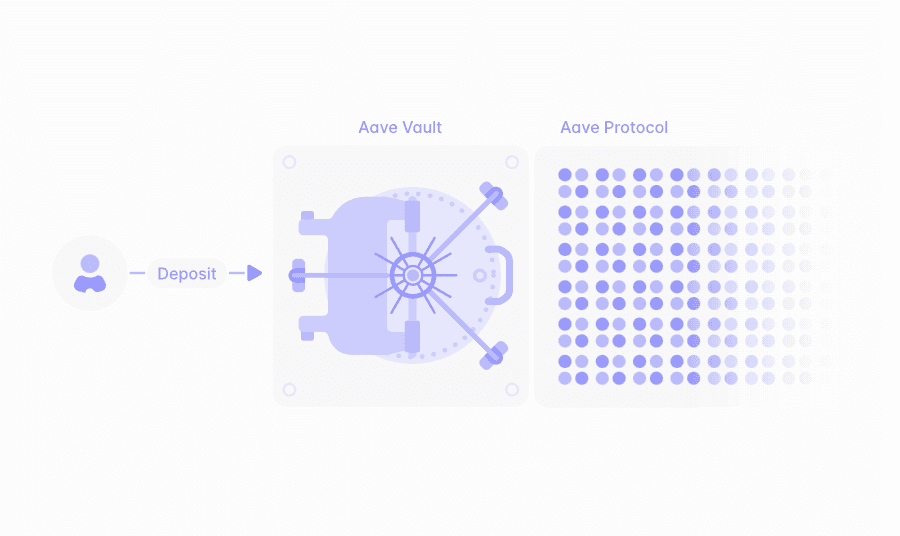

Aave Works On a Money Market Model. Image via Aave

Aave Works On a Money Market Model. Image via AaveAave is a non-custodial, decentralized finance protocol that operates as a money market, allowing users to supply crypto assets to liquidity pools to earn interest or borrow assets by posting collateral. The system's smart contracts automatically manage these funds, with utilization rates dynamically adjusting the interest rates for both stable and variable rate loans to ensure sufficient liquidity. This over-collateralized model, reinforced by a liquidation mechanism, serves individual lenders, borrowers, and DeFi builders across numerous blockchain networks.

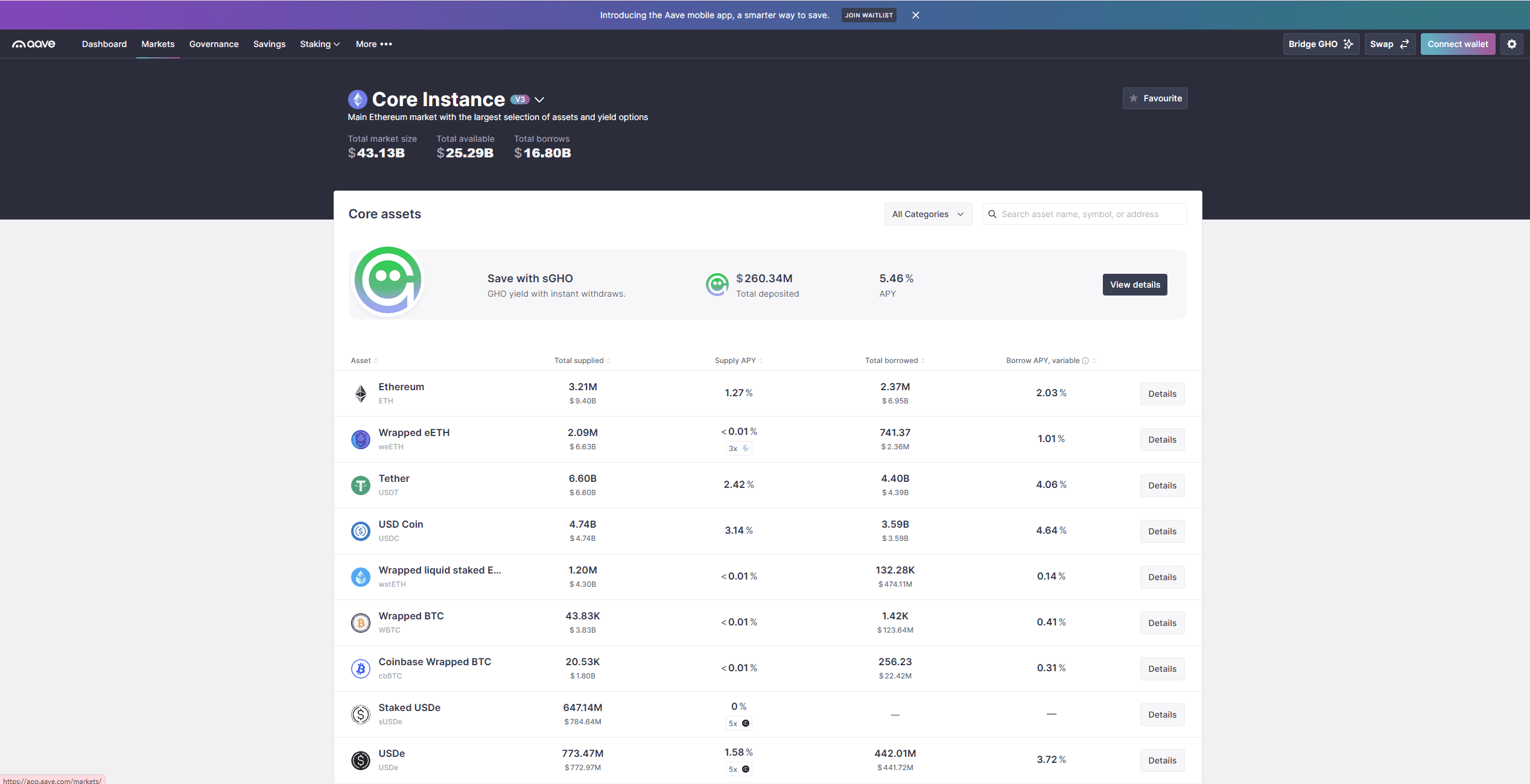

The Aave “Money Market” Model

Aave operates as a pool-based system. Users supply their assets into common reserves, and other users borrow from these reserves, subject to collateral requirements. The Utilization of each reserve (the ratio of borrowed to supplied assets) is the engine that drives interest rates. When utilization is low, borrow rates are lower. As the demand for a certain asset pushes utilization toward or past an optimal level, the borrowing rates increase sharply (a two-slope model). This mechanism is designed to discourage further borrowing and incentivize new supply. Suppliers, in turn, earn yield from the borrower interest, net of a small reserve factor fee that is directed to the protocol treasury.

In practical terms:

- Suppliers deposit assets and receive aTokens, which are ERC-20 tokens that accrue interest in real-time.

- Borrowers post collateral and take variable or stable loans, with the health of their position constantly assessed to determine the Health Factor.

This pooled model is why Aave scales so effectively; it is a shared liquidity system governed by on-chain rules, not a system that matches individual lenders to borrowers.

aTokens Explained

aTokens represent a user’s supplied liquidity and automatically accrue interest through an increasing balance model; the token balance simply grows over time. They are redeemable at any time for the underlying reserve asset, provided there is enough liquidity in the pool. Since they are ERC-20 tokens, they are highly composable and can be integrated into other DeFi protocols, which means users must manage token approvals carefully.

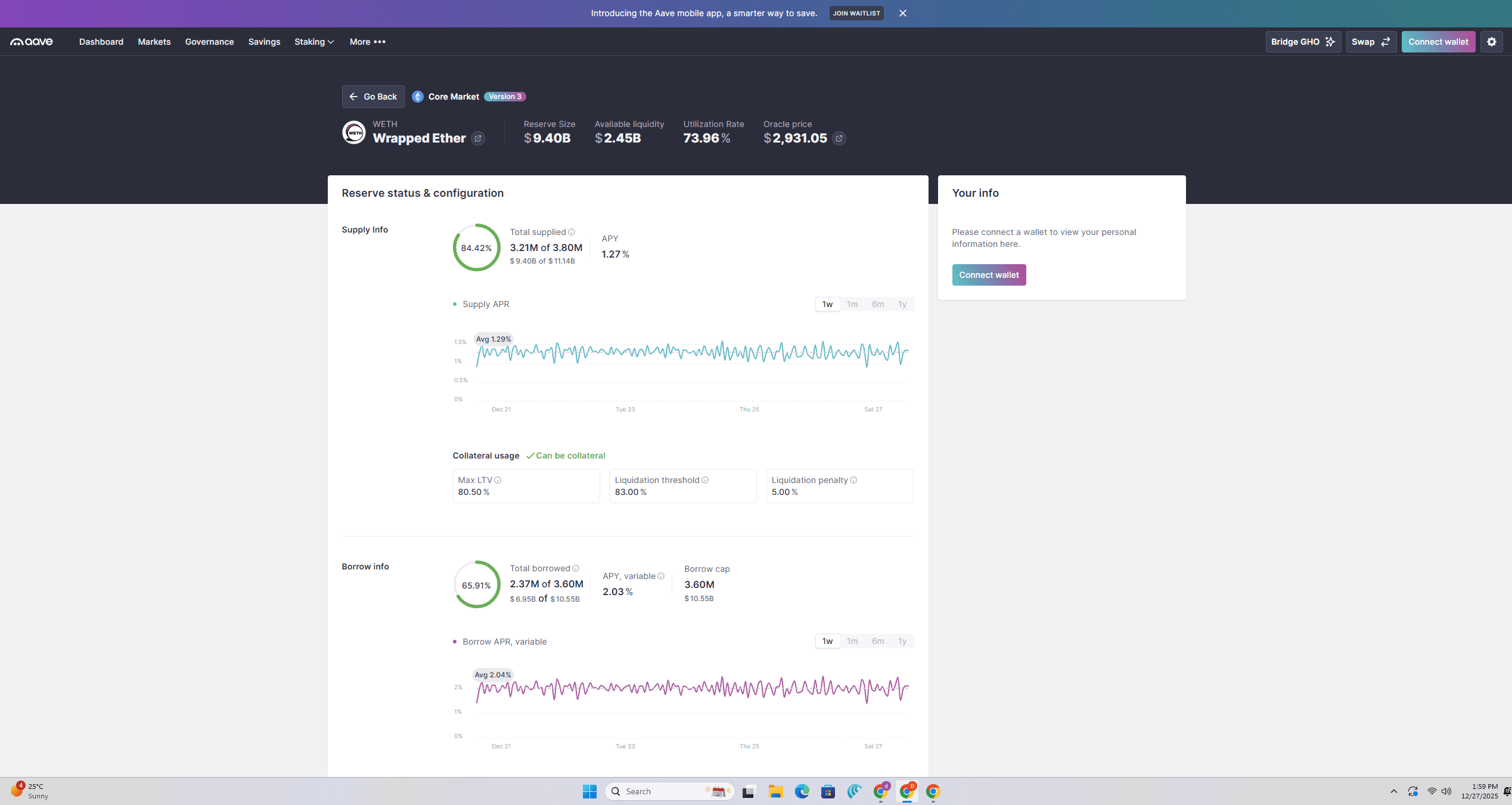

Interest Rates

Aave uses a two-slope interest rate model centered on an optimal utilization point. Below this point, the borrowing rate increases gradually as utilization rises. However, above this point, the rate increases with a much steeper slope. This design is critical for managing liquidity, ensuring rates incentivize supply when assets are scarce.

Aave supports two types of borrowing rates:

- Variable rate borrowing, where the rate adjusts constantly with changes in pool utilization.

- Stable rate borrowing, which offers predictability but can still be rebalanced by the protocol under specific, high-stress conditions.

Variable rates are typically better for short-term or low-utilization environments, while stable rates are preferred for long-term positions where cost predictability is paramount.

Risk Controls Under the Hood

Risk parameters are central to Aave’s design and are codified on-chain, constantly referencing the core concepts of liquidation safety.

- Over-collateralization: This is the foundational rule. Borrowing requires that the value of supplied collateral, multiplied by its liquidation threshold, exceeds the value of the borrowed assets, ensuring the protocol’s solvency.

- LTV and Liquidation Threshold: Loan-to-Value (LTV) controls the maximum amount that can be borrowed against an asset. The higher Liquidation Threshold defines the price point at which a position becomes eligible for liquidation. This deliberate separation creates a necessary safety buffer.

- Health Factor: The single most important safety number. A score below 1 triggers liquidation and is derived by: (Total Collateral Value × Weighted Avg Liquidation Threshold) / Total Borrow Value.

- Liquidation mechanics: When the Health Factor falls below 1, a liquidator can repay up to 50% of the borrower’s debt, seizing the equivalent value of collateral plus a liquidation fee.

How to Supply on Aave

You Can Supply and Stake on Aave Using Your Stablecoins And Earn. Image via Aave

You Can Supply and Stake on Aave Using Your Stablecoins And Earn. Image via Aave Aave’s supply process is designed as a straightforward interaction with the liquidity pools. Users deposit assets and receive aTokens that automatically accrue interest based on pool utilization.

Step-by-Step: Supplying (Beginner Flow)

- Connect a Web3 wallet and select a chain, remembering that each network has independent reserves and risk settings.

- Choose an asset that has an active supply market on the chosen network.

- Approve and deposit the asset by authorizing the pool contract to spend the tokens and executing the supply transaction.

- Receive aTokens, which are minted to the user’s address and represent their share of the reserve plus accrued interest.

- Withdrawing later involves calling the withdraw function to burn aTokens and retrieve the underlying assets, subject to available liquidity in the pool at that time.

Find out about our top picks for the best crypto wallets.

Example Scenario: Supplying on Aave

- Scenario: You decide to deposit $10,000 in USDC on the Aave Polygon market.

- Action: You connect your wallet and complete the deposit transaction.

- What You Earn: Your $10,000 is converted into aUSDC (Aave USDC). This token's balance increases over time directly in your wallet, representing your principal plus the accrued interest, which is currently 2.7% variable APY (based on data in the comparison table). Your annual earnings would be approximately $270 (before gas fees).

Supplier Risks

- Utilization Constraints: If demand for borrowing is extremely high and reserve utilization approaches 100%, withdrawing assets can become temporarily difficult due to constrained liquidity.

- Asset Risk: Suppliers inherently bear the price risk of the underlying asset they deposit; for example, stablecoins can de-peg, and volatile assets can fluctuate and reduce real returns.

- Smart Contract & Composability Risk: While Aave is highly secure, using aTokens in other DeFi protocols increases the overall risk profile and requires users to manage token approvals carefully.

How to Borrow on Aave

Deposit Collateral and Borrow Your Desired Assets on Aave. Image via Aave

Deposit Collateral and Borrow Your Desired Assets on Aave. Image via AaveBorrowing on Aave requires supplying collateral first and always remains overcollateralized. The Health Factor is the real-time safety metric that determines how close your position is to liquidation.

Step-by-Step: Borrowing Safely

- Deposit collateral and enable it for use to establish borrowing power based on the asset’s Loan-to-Value (LTV) ratio.

- Choose the borrow asset and the desired rate type (variable or stable) while reviewing the asset's APR and utilization.

- Understand the Health Factor before confirming: The application displays the maximum borrow limit and the resulting Health Factor. It is crucial to proceed only with a comfortable safety buffer.

- Monitor post-borrow: Your obligation is tracked by debt tokens. You can repay the debt at any time via the repay function to close the position.

Borrow Example With Numbers

Scenario:

You want to borrow stablecoins but use your volatile crypto as collateral.

Action:

- You deposit 10 ETH (valued at $2,500 per ETH) as collateral, totaling $25,000. The maximum Loan-to-Value (LTV) for ETH is typically 80%.

- Conservative Borrow Target: To minimize liquidation risk, you aim for a 50% LTV, meaning you borrow 50% of your collateral value.

- Max Borrow Amount (80% LTV): $25,000 * 0.80 = $20,000

- Conservative Borrow Amount (50% LTV): $25,000 * 0.50 = $12,500 USDC

Health Factor (HF) and Liquidation:

- Your initial conservative position of $12,500 borrowed against $25,000 collateral gives you a high Health Factor (HF) well above the liquidation threshold of 1.0.

- If the price of ETH were to fall, your HF would drop. If ETH's price falls enough that your collateral value approaches the liquidation threshold, your position could be partially liquidated to restore the HF to a safe level. A 50% LTV target provides a substantial buffer against price drops.

Borrower Risks

- Liquidation risk: The primary danger, where a Health Factor below 1 allows liquidators to seize collateral.

- Rate changes: The Variable Borrow APR rises sharply above optimal utilization due to the two-slope model, increasing the cost of the loan.

- Collateral volatility: Highly volatile collateral assets increase the Health Factor’s sensitivity to price swings, reducing the time available to react to market moves.

Flash Loans

Flash Loans Allow Large Withdrawals Without Collaterals. Image via Aave

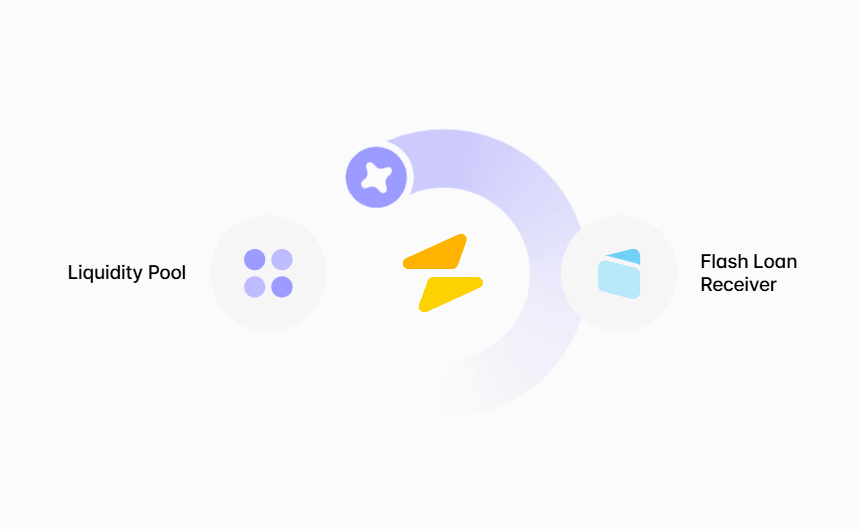

Flash Loans Allow Large Withdrawals Without Collaterals. Image via AaveAave’s Flash Loans are a core primitive that allows users to access massive protocol liquidity without providing collateral, provided the principal plus a small fee is repaid entirely within the same atomic transaction.

Flash Loans in Plain English

A contract borrows funds from available reserves, executes complex operations (such as arbitrage or refinancing) via its own logic, and must repay the principal and a governance-set premium before the transaction ends. If the repayment fails, the entire transaction automatically reverts, meaning the only loss is the gas fee incurred.

Flash Loan Use Cases That Actually Matter

- Arbitrage: Exploiting price differences across decentralized exchanges (DEXes).

- Collateral swaps: Refinancing collateral exposure in a single transaction.

- Debt refinancing: Closing high-rate debt and opening lower-rate debt more efficiently.

- Liquidations: Repaying undercollateralized positions on other protocols to claim the liquidation bonus.

- Security testing: Simulating high-impact behavior against other protocols.

Flash Loan Risks & Limitations

Flash loans carry their own risks & limitations as well. Let's take a look at them:

Risk 1: Failed Transaction = Lost Gas Fees

- If the loan cannot be repaid within a single transaction, the entire transaction reverts.

- You still have to pay the network gas fees ($4-$50, depending on the network) for the failed transaction.

- Solution: Test your smart contract logic on a testnet first and use gas price limits for mainnet deployment.

Risk 2: MEV Bots Can Front-Run

- Arbitrage opportunities are visible in the public memory pool (mempool).

- Faster bots (Maximal Extractable Value or MEV bots) can detect your transaction and execute their own transaction before yours, stealing the arbitrage profit.

- Solution: Use private transaction relays (like Flashbots/Eden Network) to prevent your transaction from being seen in the public mempool before it's confirmed.

Risk 3: Price Slippage

- Large flash loan trades can move the market price of the assets mid-transaction, causing your calculated profit to disappear.

- Solution: Set a slippage tolerance on your trades and consider using limit orders where possible.

Risk 4: Smart Contract Bugs

- The custom smart contract you write to execute the flash loan operations must be flawless. A bug in your contract will lead to a failed transaction and a loss of gas fees.

- Solution: Conduct thorough testing, especially on a testnet, and seek professional audits for complex or high-value operations.

Risk 5: Oracle Manipulation

- Flash loans can be used in complex attacks to manipulate price oracles, leading to exploits on other protocols.

- Solution: Be aware of which protocols restrict flash loan addresses and ensure you are using time-weighted average price (TWAP) oracles for reliable price feeds.

Aave V3 Overview

Aave V3 Overview. Image via Aave

Aave V3 Overview. Image via AaveAave V3 was a major protocol upgrade designed for greater capital efficiency, enhanced security, and multi-chain deployment. Key features include eMode, which allows for higher Loan-to-Value (LTV) ratios for correlated assets, and Isolation Mode and Siloed Borrowing, which limit risk exposure for less common collateral. The addition of Portal also paved the way for improved cross-chain functionality, establishing Aave as a leader in multi-chain DeFi lending.

What Changed From V2 to V3

Aave V3 is a major upgrade designed to improve the platform significantly. It focuses on better gas efficiency, improved risk management tools, and a structure that allows support for multiple networks. Unlike V2, which treated Aave as one large market, V3 works across different blockchains, each with its own reserve settings. This upgrade brings important changes and new features that enhance the efficiency, security, and ability to work across various chains, which we will now review.

eMode

Efficiency Mode (eMode) is a key V3 feature that groups correlated assets, such as USD-pegged stablecoins. By grouping these assets, eMode allows for much higher Loan-to-Value (LTV) ratios and liquidation thresholds when supplying and borrowing within the same category. This is designed to maximize capital efficiency in low-volatility scenarios where the risk profile of the collateral is better understood.

Isolation Mode, Siloed Borrowing, Caps

These features act as practical guardrails for the entire protocol.

- Isolation Mode constrains how riskier, long-tail assets can be used as collateral

- Siloed Borrowing isolates debt risk so it cannot spill over across the entire market

- Supply and Borrow Caps limit the total exposure the protocol has to a given asset

Collectively, these tools help Aave safely list new assets and expand to new networks without inheriting unlimited tail risk.

Portal and Cross-Chain Liquidity

The Portal feature introduces cross-chain functionality, enabling the movement of positions via abstracted messaging. This is presented as an evolution beyond relying on simple bridge-dependent designs. For advanced users, this means the multi-network architecture can be leveraged more deeply, while retail users can simply select a single low-cost chain for a consistent experience.

Is Aave Worth Using in 2026?

Aave V3 Creates a Sophisticated System. Image via Aave

Aave V3 Creates a Sophisticated System. Image via AaveAave V3 positions it as a mature, multi-network liquidity layer designed for long-term scalability. Its governance and risk primitives are explicitly built to adapt across its supported chains.

The combination of Flash Loans, the capital-efficient eMode, the integration of GHO, and the granular, per-reserve risk controls creates a sophisticated system. It works equally well for retail yield seekers and for developers needing deeper composability for their products. The main cost to the user is complexity, and Aave’s design implicitly places the burden of understanding this complexity on the user.

What's Improved Since 2024

- Network Expansion: V3 supports "14+ blockchain networks" with independent deployments, allowing the protocol to be truly global.

- UX and Protocol Changes: Gas optimizations from V3, along with features like eMode and Portal, represent clear improvements in efficiency and functionality over earlier versions.

- GHO Adoption Expansion: The native stablecoin, GHO, is now deeply integrated into the V3 supply and borrow flows. The interest paid by GHO borrowers accrues directly to the Aave DAO treasury, creating a feedback loop that strengthens the protocol's resources through its own usage.

What's Gotten Worse or Harder

- Competition Rising: The continuous emphasis on governance and parameter tuning reflects the ongoing pressure Aave faces to adapt and remain competitive against rising rivals.

- Regulatory Uncertainty: Asset eligibility and risk settings are subject to governance-driven changes, implying continuous scrutiny and adaptation to the evolving decentralized landscape.

- Ethereum Gas Still Expensive: Despite V3’s optimizations, the cost of interacting with the main Ethereum chain remains high. The multi-network design is the protocol's practical solution, making Layer 2 (L2) network selection the default for most cost-sensitive users.

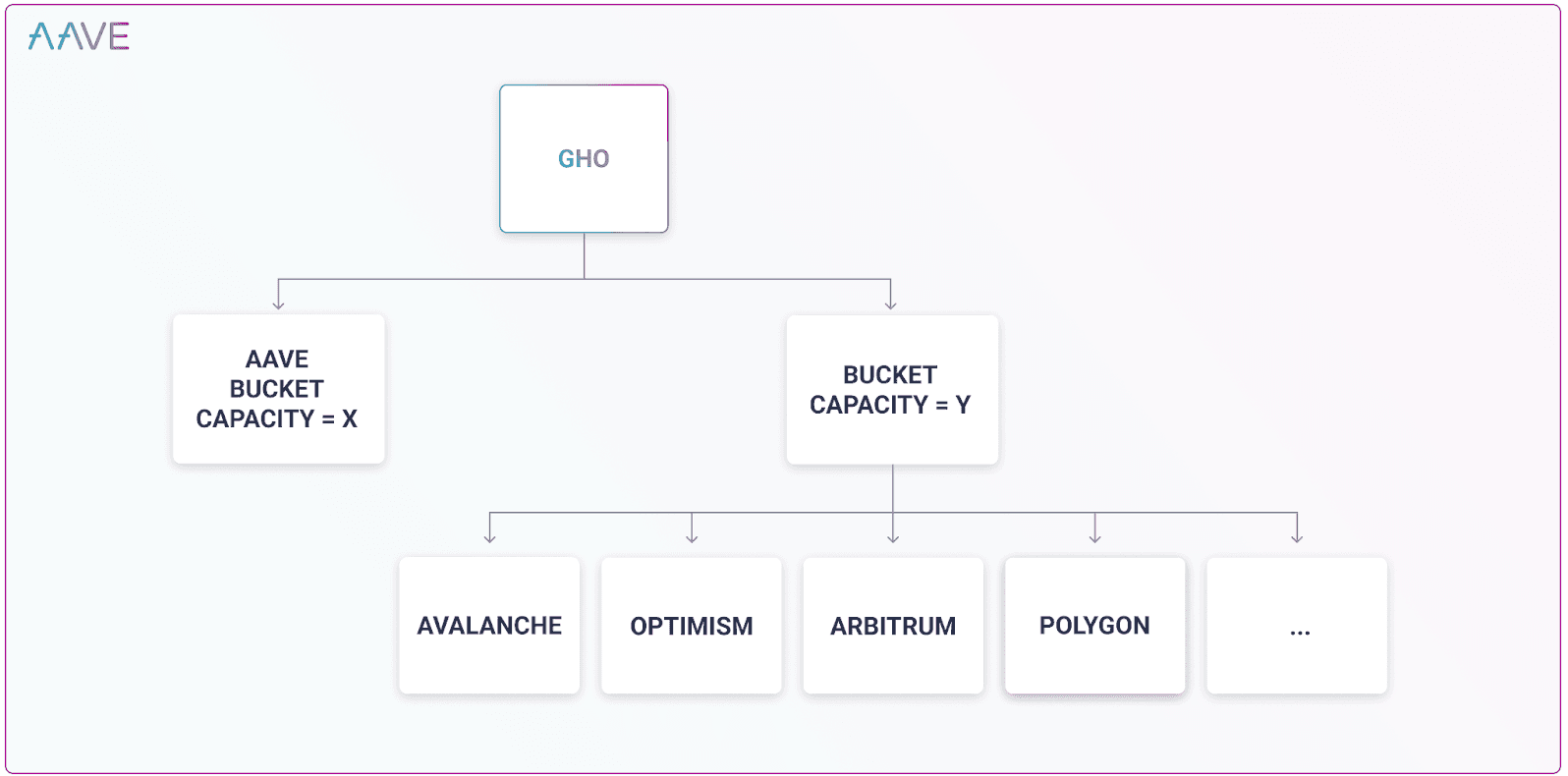

GHO Stablecoin

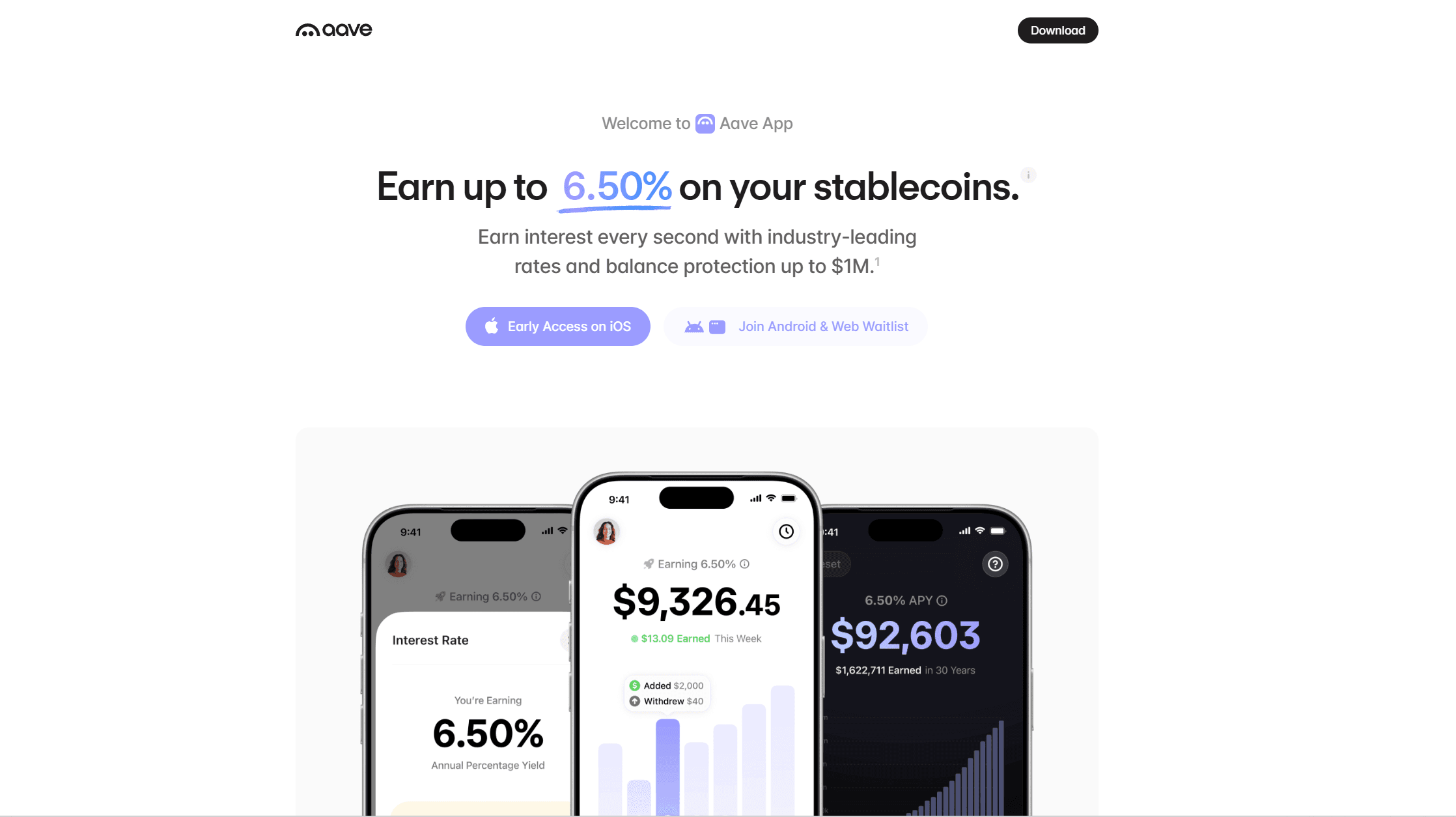

GHO is Aave's Stablecoin. Image via Consensys

GHO is Aave's Stablecoin. Image via Consensys

GHO is Aave’s native, decentralized stablecoin exposure, which is built directly on top of the same collateral and liquidation system used across all Aave borrowing markets.

What Is GHO

- Minting Model and Peg Mechanics: Users mint GHO by supplying collateral into Aave V3 markets and borrowing GHO against it, following standard Aave rules for LTV, liquidation thresholds, and Health Factor.

- How it Differs from Centralized Stablecoins: GHO is decentralized and overcollateralized, minted permissionlessly against eligible collateral. It is governed by the Aave DAO, rather than a corporate issuer, and is designed for deep composability within Aave’s markets.

How to Mint and Repay GHO

You supply eligible collateral, borrow GHO within the allowed limits, and then use GHO in DeFi. To close the debt, you repay the GHO plus accrued interest and withdraw your collateral as your Health Factor allows. GHO is particularly useful for users already integrated into Aave who want native stablecoin loops or when its borrowing costs are competitive.

GHO Risks

- Peg Stress Scenarios: The stablecoin's peg remains tied to systemic liquidation pressure and liquidity depth in its markets.

- Governance Risk: Governance can change the borrow caps, interest models, and collateral eligibility, which can impact GHO's economics.

- Collateral Risks: The underlying collateral is subject to standard Aave liquidation risk if the borrower's Health Factor falls below 1.

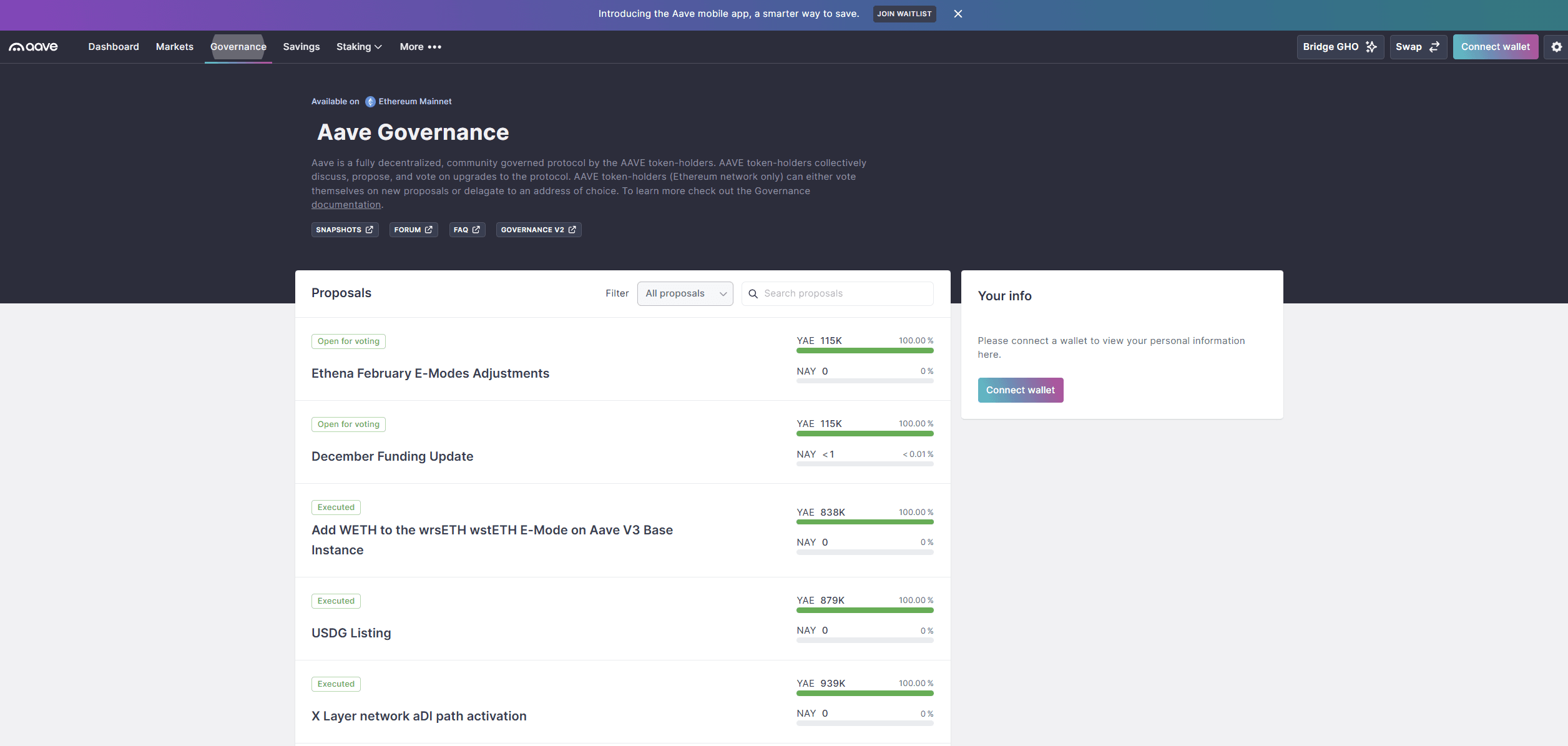

Governance and Decentralization

Aave Governance Model Ensures It Remains a Censorship Resistant Protocol. Image via Aave

Aave Governance Model Ensures It Remains a Censorship Resistant Protocol. Image via Aave True decentralization is the foundational tenet of Aave, ensuring it remains an open, non-custodial, and censorship-resistant money market. Unlike traditional finance, Aave is not controlled by a corporation but by its community of token holders.

How Aave Governance Works

Aave is governed entirely by the holders of its native token, AAVE, through the use of Aave Improvement Proposals (AIPs). The process is a multi-step, community-driven lifecycle:

- AIPs Overview: AIPs are formal proposals for changes to the protocol. They are created, debated, and voted upon by the community. They cover a wide spectrum, from adjusting core risk parameters (like Loan-to-Value ratios and liquidation thresholds) to listing new assets, setting fees, and distributing funds from the treasury.

- Who Votes: Only AAVE token holders can vote, directly or by delegating their voting power. Once a proposal passes the community vote, it is placed in a Timelock contract. This is a security measure that enforces a delay (typically 48 hours) before execution, allowing all users time to review the upcoming change and exit the protocol if they disagree. Crucially, the protocol’s core logic is entirely managed by these community-approved smart contracts, meaning no individual founder or team member has administrative control.

Aavenomics and Incentive Design

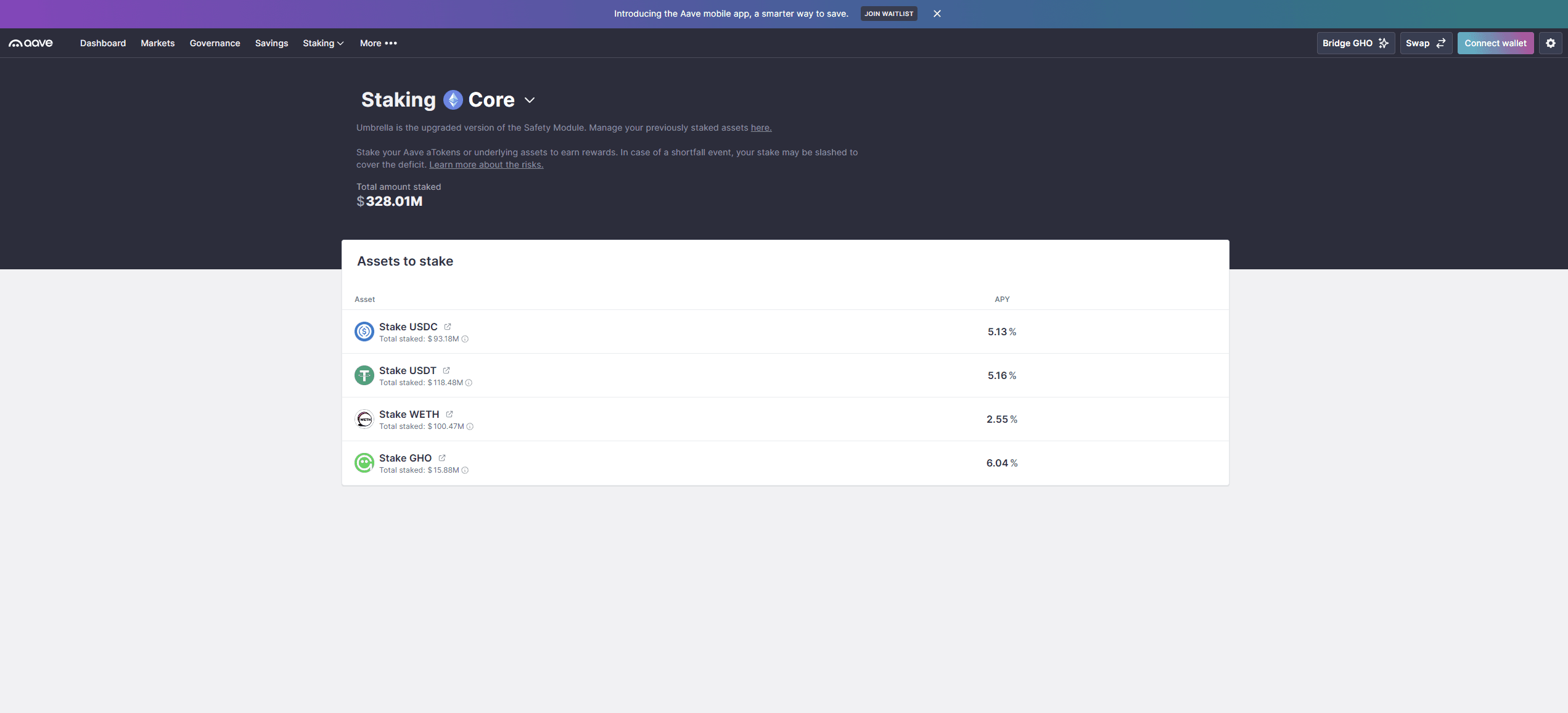

Aavenomics, the economic structure of the protocol, is built on a robust incentive system designed for both security and growth:

- Security Incentive: The Safety Module (SM): The primary security feature is the Safety Module, which is funded by AAVE tokens staked by the community. Stakers are incentivized with rewards to lock their tokens, and in return, they provide the protocol's first line of defense. In the unlikely event of a "shortfall event" (a systemic loss), a portion of the staked AAVE is liquidated to cover the deficit. This economic insurance mechanism protects the protocol and instills confidence in users.

- Growth Incentives: The DAO actively uses AAVE or other reward tokens to incentivize user adoption, often targeting new deployments on Layer 2 networks (L2s) or encouraging liquidity provision for specific assets. These rewards are key to bootstrapping new markets and maintaining Aave's competitive edge in multi-chain DeFi.

What “Decentralization” Means Here

For a user, decentralization on Aave means two primary things:

- Non-Custodial Funds: Your funds are never held by Aave Labs (the development team) or any intermediary. They are secured by the smart contracts of the protocol. If Aave Labs were to disappear, your deposited assets would still be accessible.

- Community Control over Critical Decisions: While the initial smart contracts were deployed by the founding team, all critical parameters and future changes are controlled by the decentralized, token-holding community (the DAO). The DAO controls the Reserve Factor (fees), sets the risk caps for new assets, and votes on all major upgrades. The protocol has no single administrative or "kill switch" key that can be used to unilaterally shut down or drain the markets.

AAVE Token

Aave Token is The Governance Token in the Protocol's Decentralized Security Model. Image via Aave

Aave Token is The Governance Token in the Protocol's Decentralized Security Model. Image via AaveThe AAVE token is more than a standard cryptocurrency; it is the backbone of the Aave protocol's governance and a critical component of its decentralized security model. Its utility is central to the project's long-term sustainability and stability, giving its holders a direct stake in the protocol's future.

What AAVE Does

The AAVE token serves three primary functions within the Aave ecosystem:

- Governance: AAVE holders are granted voting power over Aave Improvement Proposals (AIPs), which dictate the protocol's future. These votes determine critical parameters like interest rate models, new asset listings, fee structures, and the overall strategic direction of the decentralized autonomous organization (DAO).

- Staking / Safety Module Linkage: AAVE can be staked in the Safety Module (SM) to act as an economic safeguard for the protocol. Stakers earn rewards (AAVE) in return for committing their tokens as capital to be used in the event of a "shortfall event" (e.g., a smart contract hack or mass liquidation) to cover any resulting deficit. This mechanism aligns user incentives with protocol safety.

- Incentives: The token is also used to fund various community-driven programs and liquidity mining incentives across Aave's multiple deployments (e.g., on Layer 2 networks) to encourage users to provide liquidity and drive adoption.

Tokenomics

The tokenomics of AAVE were designed to be deflationary, secure, and governance-focused:

- Supply Cap: The total supply of AAVE is capped at 16 million tokens. This hard limit is designed to create scarcity. Of this total, 3 million were allocated to the Safety Module as an initial reserve, and the remaining 13 million were swapped 1:100 for the original ETHLend (LEND) tokens, with any unswapped tokens being burned.

- Role of Fees/Buybacks: Fees generated from flash loans and other protocol activities are directed into the DAO treasury. A portion of these funds can be used for AAVE token buybacks or to fund grants, enhancing the token's value by supporting the ecosystem or reducing circulating supply, as approved by governance.

Where to Buy and Store AAVE

AAVE is a widely available token on most major exchanges and is supported by common wallet infrastructure:

- Exchanges: AAVE is tradable on virtually all major centralized cryptocurrency exchanges (e.g., Coinbase, Binance, Kraken) as well as decentralized exchanges (DEXs) like Uniswap and SushiSwap across all supported Aave networks.

- Wallet Storage Options: AAVE can be stored in any Ethereum-compatible wallet, as it is an ERC-20 token. This includes software wallets like MetaMask, Trust Wallet, etc, and hardware wallets like Ledger, Trezor (for the highest level of security).

- Short Safety Note: Always ensure you are transferring AAVE tokens using the correct network and be mindful of high Ethereum mainnet gas fees. Never share your private keys or seed phrase.

Fees and Cost Reality

Aave Charges Protocol and Gas Fees To It's Users. Image via Shutterstock

Aave Charges Protocol and Gas Fees To It's Users. Image via ShutterstockThe total cost of using Aave is a combination of protocol-level fees and external gas costs.

What Fees You Actually Pay

- Borrow APR: 5%-10%,

- Supply APY: 4%-8%,

- Liquidation: 5%-10%,

- Flash: 0.09%

- Gas costs: The cost of the underlying blockchain transaction, which is highly variable.

Best Chains for Aave in 2026

| Chain | Avg Gas/Tx (Coinlaw) | Best For |

|---|---|---|

| Ethereum | $3.78 | Institutions/large |

| Polygon | <$0.10 | Stables/low vol |

| Arbitrum | $0.20-$0.50 | General/DeFi |

| Optimism | $0.20 | MEV/flash |

| Base | $0.10 | Retail/cheap |

Is Aave Safe?

The Protocol Is Audited By Top Firms Like Certikk and OpenZepplin. Image via Shutterstock

The Protocol Is Audited By Top Firms Like Certikk and OpenZepplin. Image via ShutterstockThe question of safety in a DeFi protocol like Aave is complex, encompassing smart contract security, economic stability, and user-level operational risk. Aave is considered one of the most battle-tested and secure protocols in the space, but like all decentralized systems, it is not risk-free.

Protocol Security

The core safety of Aave rests on multiple layers of defense and decentralized guarantees:

- Audits: The protocol has undergone numerous professional audits (6+) by top firms, including Trail of Bits, OpenZeppelin, and Certik. The code is open-source and has been battle-tested over its 7+ years of operation with zero protocol hacks (as of late 2025).

- Safety Module (SM): This is the protocol's insurance fund, holding over $450M in staked AAVE. This module is designed to be the first line of defense in the event of a catastrophic shortfall, paying out to cover the deficit and protecting user funds.

- Bug Bounty: A continuous bug bounty program incentivizes white-hat hackers to identify and report vulnerabilities, adding an ongoing layer of defense that is crucial for a protocol managing over $18B in TVL.

- Oracles: Aave relies on robust, decentralized price oracles (primarily Chainlink) to determine the value of collateral and borrowed assets. The security and reliability of these oracles are paramount, as faulty price feeds are a common vector for DeFi exploits.

The Real Risk: Liquidation

For most users, the single biggest danger is not a smart contract hack, but liquidation, the systematic, automated loss of collateral.

- Health Factor formula: The Health Factor (HF) is the primary metric for loan safety. It represents the safety margin of your collateral relative to your borrowed funds. The Health Factor is calculated as the ratio of your total collateral value (adjusted by the liquidation threshold) to your total outstanding debt (borrowed amount plus accrued interest).

Key Components Explained:

- Asset Collateral Value: The dollar value of each asset you have supplied and designated as collateral.

- Liquidation Threshold: A protocol-defined percentage (e.g., 75% or 0.75) for a specific asset. This is the maximum collateral-to-debt ratio before liquidation is triggered.

- Total Borrows in USD: The combined dollar value of all assets you have borrowed.

- Total Borrow Interest in USD: The total interest accrued on your borrowed amount.

- Safe ranges (1.5+, etc.): A Health Factor below 1.0 triggers liquidation. For a safe position, experts often recommend keeping your HF at 1.5 or higher to buffer against sudden and volatile price drops in your collateral.

- A worked example showing how price drops trigger liquidation: If your HF is 1.25 and your collateral (ETH) drops by 20% in value, your HF may drop below 1.0. A liquidator would then pay off a portion of your debt, take a portion of your collateral (plus a 5-10% penalty), and return your HF to a safe level, leaving you with less collateral.

How to Avoid Liquidation

Liquidation is entirely preventable with proactive risk management:

- Conservative borrowing: Borrow significantly less than your maximum allowed Loan-to-Value (LTV). Aiming for 50-60% LTV, even if 80% is the maximum, provides a large safety buffer.

- Alerts: Set up price and Health Factor monitoring alerts (via third-party services) to notify you immediately if your collateral value is dropping or your HF is nearing a critical level.

- Add collateral early: The simplest way to raise your Health Factor is to deposit more collateral into your position before the HF drops below 1.0.

- Partial repayment: You can instantly raise your Health Factor by repaying a portion of your outstanding loan.

- Use stable collateral when appropriate: Collateralizing your loan with a stablecoin (like USDC or DAI) removes the price volatility risk inherent in using assets like ETH or BTC.

Aave Safety Checklist

Always perform these checks when interacting with the protocol:

- Before supplying: Confirm the asset's security rating, check the utilization rate (to ensure you can withdraw later), and verify that you are connecting to the official Aave URL.

- Before borrowing: Calculate your worst-case liquidation price, understand your chosen interest rate (variable or stable), and ensure your Health Factor is well above 1.5.

- While the loan is active: Actively monitor your collateral price, check your Health Factor daily, and maintain a budget for unexpected gas fees if you need to perform an emergency collateral top-up.

Closing Thoughts

Having covered Aave's features, risks, and its position against competitors, the final verdict is clear: Aave is a powerful platform best suited for experienced users who understand its complexity. Before you make your final decision, the next section addresses the most common and crucial questions users have, ensuring you have all the details on safety, costs, and key functionality.

Who Aave Is Best For

- DeFi intermediates and advanced users who understand Health Factor, rate modes, and eMode.

- Builders and automation strategies that leverage flash loan composability and multi-network access.

- Multi-chain users prioritizing cost and execution environments.

Who Should Skip It

- Complete beginners unfamiliar with overcollateralized borrowing and liquidation.

- Anyone unable to monitor their positions routinely.

- Small mainnet users where gas costs erase returns.

Final Verdict Recap

Aave’s 4.6/5 score reflects its unmatched capability through V3’s multi-chain markets, Flash Loans, eMode, and GHO. This capability requires user responsibility: Health Factor vigilance, strategic network selection, and liquidation awareness are mandatory for safe use. The design is battle-tested, mature, and best suited for users who view risk parameters as an integral part of the product.