No KYC Occasional Trader

- Trade and withdraw up to 1.5 BTC per day without verification.

- Good for small sums and test runs.

Limits trigger KYC. Some fiat features require verification.

1,000+ spot pairs and 500+ perps supported

Supports up to 200x leverage on derivatives, higher than most competitors

Available to U.S. users

Optional KYC for withdrawals up to 50,000 USDT per day

Proof of Reserves and an 800 BTC protection fund

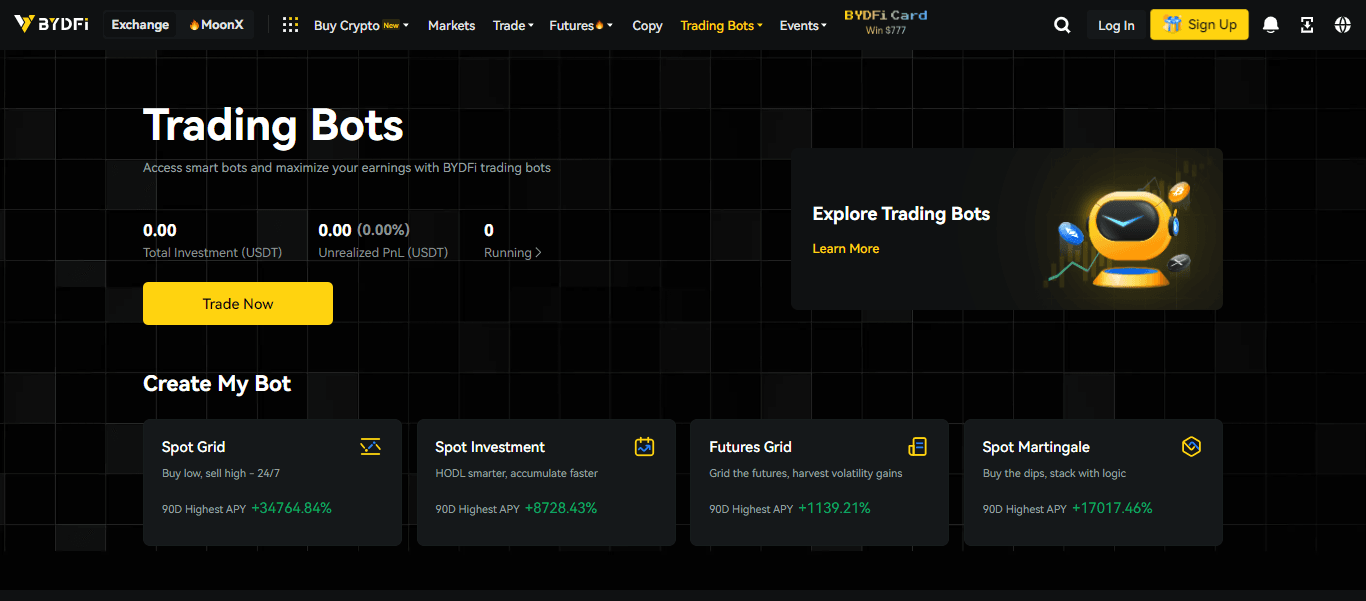

Native bots, grid, Martingale, and DCA

1,000+ spot pairs and 500+ perps supported

Supports up to 200x leverage on derivatives, higher than most competitors

Available to U.S. users

Optional KYC for withdrawals up to 50,000 USDT per day

Proof of Reserves and an 800 BTC protection fund

Native bots, grid, Martingale, and DCA

No staking or passive income options available

Perps restricted in the UK and parts of the EU

No staking or passive income options available

Perps restricted in the UK and parts of the EU

BYDFi is a high-leverage, KYC-optional exchange with clear fees, fast copy trading, and MoonX for on-chain memecoins on Solana and BNB. You get 200x perps, bots, and a growing product set, plus Proof of Reserves and an 800 BTC protection fund. It doesn’t pretend to be the biggest exchange in the room; it would rather be the most usable one. In a market where traders juggle between regulation and freedom, BYDFi strikes a middle ground: structured compliance without smothering flexibility.

| Cryptocurrencies Supported | 1,000+ spot pairs, 500+ perps pairs; MoonX routes 500,000+ on-chain pairs |

|---|---|

| Trading Fees (Maker/Taker) | Spot 0.10% / 0.10%; Perps 0.02% / 0.055%; leveraged tokens 0.20% per trade plus 0.03% daily |

| Funding Methods | Crypto deposits free, fiat via third parties where available, card and bank options vary by country |

| Typical Withdrawal Fees | BTC ~0.00025 BTC; ETH ~0.0028 ETH; USDT TRC20 ~1 USDT, network dependent |

| Products | Spot, Perps up to 200x, Copy Trading, Bots, Leveraged Tokens, MoonX on-chain access, BYDFi Card, Proof of Reserves |

| Availability | 190+ countries; US partial access; UK perps restricted; EU perps limited by local rules; regional fiat ramps vary |

| App Ratings | Apple App Store: 4.6/5; Google Play: 4.6/5 |

| Security | Cold-warm-hot custody, multi-sig withdrawals, PoR over 1:1, third-party audits, 800 BTC protection fund |

Data current as of Jan. 6, 2026.

BYDFi is a cryptocurrency exchange, offering spot and derivatives trading with high leverage, competitive fees, and user-friendly features such as strategy trading and copy trading. The exchange now serves over a million users, with a healthy security fund in place. With MoonX, BYDFi’s on-chain gateway for memecoin trading, users can discover and trade trending tokens directly on-chain with real-time data and a seamless Web3 experience.

BYDFi started operations in April 2020 under the name BitYard. In January 2023, the platform adopted its new name, which stands for "BUIDL Your Dream Finance". The rebrand aligned the platform's goals with the community's needs and objectives, focusing on making finance accessible to everyone through cryptocurrency.

The company is headquartered in Singapore and operates under BYDFi Fintech Ltd. It has grown steadily since its launch and now serves over one million users across more than 190 countries. Its blend of simplicity and pro-level tools has earned it recognition from leading outlets.

Platform launched. BYDFi entered the crypto trading market.

Expanded to 500+ spot trading pairs.

Introduced perpetual contracts. 150+ pairs with 1x to 200x leverage.

Rebranded from BitYard to BYDFi. Listed on CoinMarketCap and CoinGecko.

Ensured over 1:1 asset reserves and began periodic Proof of Reserves reports.

Upgraded perpetuals with new position rules, bi-directional hedging, and shared funds in full-margin mode to reduce liquidation risk.

Launched Copy Trading.

Formed a strategic partnership with Ledger. Released a co-branded hardware wallet.

Launched MoonX, a Web3 on-chain trading tool for Solana and BNB Chain. Began the CEX plus DEX dual-engine model.

Launched BYDFi Card.

Added an 800 BTC Protection Fund to safeguard user assets.

Expanded to 1,000+ spot trading pairs.

BYDFi Is One of The Most Efficent Crypto Trading Platform. Image via BYDFi

BYDFi Is One of The Most Efficent Crypto Trading Platform. Image via BYDFiBYDFi presents itself as a global exchange, and that’s not just a slogan. The platform operates across more than 190 countries, but it’s careful about regional compliance and feature availability. Rather than offering a blanket experience, BYDFi adapts its services to fit each jurisdiction’s rules. Which means how much users can withdraw to which products they can access varies depending on the region they are in.

The exchange has built a presence in major markets, including the United States, Canada, the European Union/EEA, the United Kingdom, Singapore, Australia, Japan, and South Korea. In most of these regions, users can access the full suite of services such as spot trading, perpetual contracts, and copy trading, though a few exceptions exist.

Some features, like MoonX (the on-chain memecoin trading engine) or fiat on/off-ramps, vary by region due to local regulations. For example, perpetual contracts might be restricted in parts of the EU or UK, while fiat integrations depend on third-party providers licensed in specific countries. BYDFi’s internal “feature flags” system ensures that users only see and use what’s legally supported where they are.

Region–Feature Parity Matrix

| Region / Feature | Spot Trading | Perpetuals (Perps) | Copy Trading | MoonX (On-chain) | Fiat On/Off-Ramps | KYC Required for Full Access |

|---|---|---|---|---|---|---|

| United States (US) | ✅ | ⚠️ Limited (subject to MSB license coverage) | ✅ | ❌ Not available | ⚠️ Third-party only | Yes |

| Canada (CA) | ✅ | ⚠️ Limited (regional rules apply) | ✅ | ❌ Not available | ⚠️ Third-party only | Yes |

| European Union / EEA | ✅ | ⚠️ Restricted under ESMA derivatives guidelines | ✅ | ✅ | ✅ | Yes |

| United Kingdom (UK) | ✅ | ❌ Not available due to FCA restrictions | ✅ | ✅ | ⚠️ Third-party only | Yes |

| Singapore (SG) | ✅ | ✅ | ✅ | ✅ | ✅ | Yes |

| Australia (AU) | ✅ | ✅ | ✅ | ✅ | ✅ | Yes |

| Japan (JP) | ✅ | ⚠️ Limited (FSA restrictions) | ✅ | ⚠️ Partial access | ⚠️ Third-party only | Yes |

| South Korea (KR) | ✅ | ✅ | ✅ | ✅ | ⚠️ Local partnerships only | Yes |

| Other Regions (Global) | ✅ | ✅ | ✅ | ✅ | ⚠️ Partner gateways vary | Optional (for limited withdrawals) |

This regional segmentation keeps the platform compliant without compromising its accessibility. It’s a practical model: users in compliant regions get a full-stack trading experience, while others still retain access to core crypto functions like spot and copy trading.

BYDFi is a non-KYC (Know Your Customer) and non-VPN cryptocurrency exchange that allows users to trade with no identity verification, though KYC is optional to increase withdrawal limits. Users of unverified accounts can withdraw up to six Bitcoin within 24 hours, but can raise this limit to 12-25 BTC daily by completing the KYC process. BYDFi requires email and phone number verification for basic security and offers welcome rewards for those who complete KYC.

Users without KYC verification can also withdraw up to 50,000 USDT per day. Completing full KYC raises the limit to 500,000 USDT daily, subject to internal risk reviews.

The exchange structures user access through flexible KYC tiers, giving traders the freedom to decide how much verification they’re comfortable with.

| Verification Level | KYC steps and requirements | Unlocked daily withdrawal limit |

|---|---|---|

| Level 0 (Unverified) | Account created with email or phone number only. | Up to 0.2 BTC (or equivalent) |

| Level 1 (Standard) | 1. Provide personal information (full name, country). 2. Upload a copy of a government-issued ID (passport, driver's license, or national ID). 3. Complete a facial recognition check via a selfie. | Up to 5 BTC (or equivalent) Unlimited monthly withdrawals. |

| Level 2 (Advanced) | 1. Complete all steps for Level 1. 2. Submit Proof of Address (POA), such as a utility bill or bank statement, issued within the last three months. 3. Provide proof of income or source of funds for higher limits. | Higher limits for fiat transactions and for VIP accounts. |

No-KYC users can trade freely but face a daily withdrawal cap of around 1.5 BTC. This setup appeals to privacy-focused traders or those operating with smaller capital.

Basic and Advanced KYC tiers unlock progressively higher withdrawal limits up to 6 BTC per day for verified users. And open the door to features like fiat gateways, advanced promotions, and regional perks.

How to complete KYC on BYDFI

Basic KYC typically requires a government ID, while advanced verification adds proof of address and facial recognition. For an exchange serving 190+ countries, this tiered system keeps compliance scalable while respecting user autonomy.

The tier structure also builds trust, as users who complete full verification gain access to higher withdrawal limits and faster fiat integrations. Meanwhile, the platform mitigates regulatory risks by segregating high-risk, unverified activity.

BYDFi Fees & Funding Rates. Image via Shutterstock

BYDFi Fees & Funding Rates. Image via ShutterstockTrading costs can quietly shape a trader’s entire experience, and BYDFi builds its reputation on transparency. The exchange keeps things simple with no hidden markups, no surprise deductions, and a fee schedule that’s easy to verify.

For spot trading (BYDFi fees), both maker and taker fees sit at a flat 0.1%, comparable to industry leaders like Binance or KuCoin. High-volume traders can unlock discounts through BYDFi’s VIP tiers, with the percentage further reduced as their 30-day turnover increases.

On the derivatives side, perpetual contracts follow a maker fee of 0.02% and a taker fee of 0.055%. It’s a clear edge for active traders, particularly those running algorithmic setups or frequent short-term strategies. Leveraged token trades carry a 0.2% transaction fee when opened or closed, with a 0.03% daily management fee based on the token’s net asset value.

While these numbers might seem small, they can add up. That’s why BYDFi provides users with real-time fee breakdowns inside the trading dashboard; each cost is visible before execution.

Read our guide before you start your crypto trading journey.

Crypto deposits are completely free. Users only pay the network gas fee charged by the blockchain itself. Withdrawals, however, vary depending on the asset and network chosen.

For example:

There’s also a minimum withdrawal amount per token, visible in real time before confirmation. Fiat on-ramps, when available, are handled through third-party providers like MoonPay or Simplex, and so each applies its own processing fee.

| Feature | BYDFi | Binance (Standard VIP 0) | KuCoin (Standard VIP 0) | OKX (Standard VIP 0) |

|---|---|---|---|---|

| Spot Fee (Maker/Taker) | 0.10% / 0.10% | 0.10% / 0.10% | 0.10% / 0.10% | 0.08% / 0.10% |

| Perps Fee (Maker/Taker) | 0.02% / 0.06% | 0.02% / 0.05% | 0.02% / 0.06% | 0.02% / 0.05% |

| Max Futures Leverage | Up to 200x | Up to 125x | Up to 100x | Up to 125x |

| ETH-USD Withdrawal Fee (ERC-20) | ~0.0028 ETH | Variable, often around 0.003–0.005 ETH | Variable, check fees page | Variable, check fees page |

BYDFi’s fee system is consistent, predictable, and fair. Every transaction’s cost is visible upfront, and that level of transparency matters more than a fraction of a percent shaved off in theory. For traders moving across markets daily, predictability becomes its own kind of edge.

BYDFi rewards efficiency. Traders can reduce costs in three ways:

Trading fee minimization

Withdrawal fee minimization

General tips

Do take a look at the list of the best crypto exchanges with the lowest fees, tested and reviewed by experts at The Coin Bureau.

BYDFi Security & Safety Meausres. Image via Shutterstock

BYDFi Security & Safety Meausres. Image via ShutterstockIn crypto trading, trust isn’t built through marketing; it’s earned through design, audits, and transparency. BYDFi’s approach to security has all three. The exchange operates with a layered custody system, verified reserves, and clear compliance frameworks that support both user safety and regulatory credibility.

BYDFi utilizes a cold–warm–hot wallet architecture to strike a balance between liquidity and protection.

Discover the best crypto wallets as per your needs and choose between custodial vs non-custodial wallets.

This tiered setup reduces the surface area for exploits while keeping funds accessible. Withdrawals require multi-signature authorization, meaning no single actor can move user assets alone.

To further minimize operational risk, BYDFi allows you to create withdrawal whitelists, device binding, and anti-phishing codes, ensuring only verified devices and addresses can initiate sensitive actions.

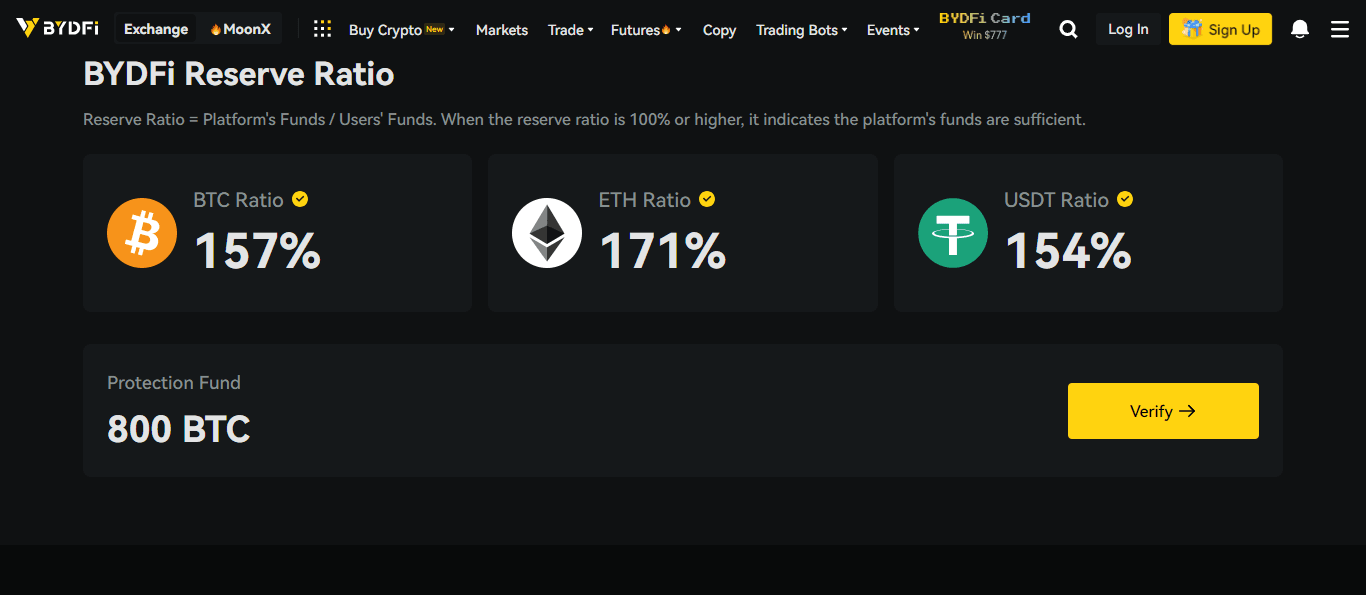

BYDFi practices Proof of Reserves (PoR) with a fully transparent approach. Users can verify that all assets held on the exchange are backed 1:1 through publicly auditable wallet data.

BYDFi BTC, ETH, USDT Reserve Ratios Remain Above 100%. Image via BYDFi PoR

BYDFi BTC, ETH, USDT Reserve Ratios Remain Above 100%. Image via BYDFi PoR The company partners with Hacken for third-party audits, which assess both solvency and cybersecurity hygiene. These reports validate reserve ratios exceeding 100%, reinforcing confidence that every deposited coin is fully accounted for.

While the exchange hasn’t faced any major breach to date, it maintains a proactive disclosure stance, publishing audit outcomes and internal security updates to reduce information asymmetry between the platform and its users.

Security extends beyond wallets and servers. BYDFi’s compliance layer operates at the same depth. BYDFi follows a range of compliance procedures designed to adhere to global anti-money laundering (AML) and know-your-customer (KYC) regulations. These protocols, along with obtaining licenses in multiple jurisdictions, aim to provide a secure and trustworthy trading environment.

The exchange has put in place KYC and AML standards that align with FinCEN, FINTRAC, and ACRA regulations. This includes ID verification, sanctions screening, and transaction monitoring.

The platform also supports the Travel Rule framework, specifically via CODE VASP integration, to transmit sender and receiver information on qualifying transactions. This aligns BYDFi with the same anti-financial crime standards that top-tier exchanges follow globally.

No exchange is immune to trade-offs, and BYDFi acknowledges its own:

Despite these constraints, BYDFi’s security track record remains clean in an industry where reputation often hinges on what hasn’t gone wrong.

Security Checklist

Wallet and funds safety

Account security

Infrastructure and app security

Compliance

Audits and transparency PoR

Risk disclosures

Security controls reduce risk, they do not remove it. Use hardware wallets for long-term storage and enable all available account protections.

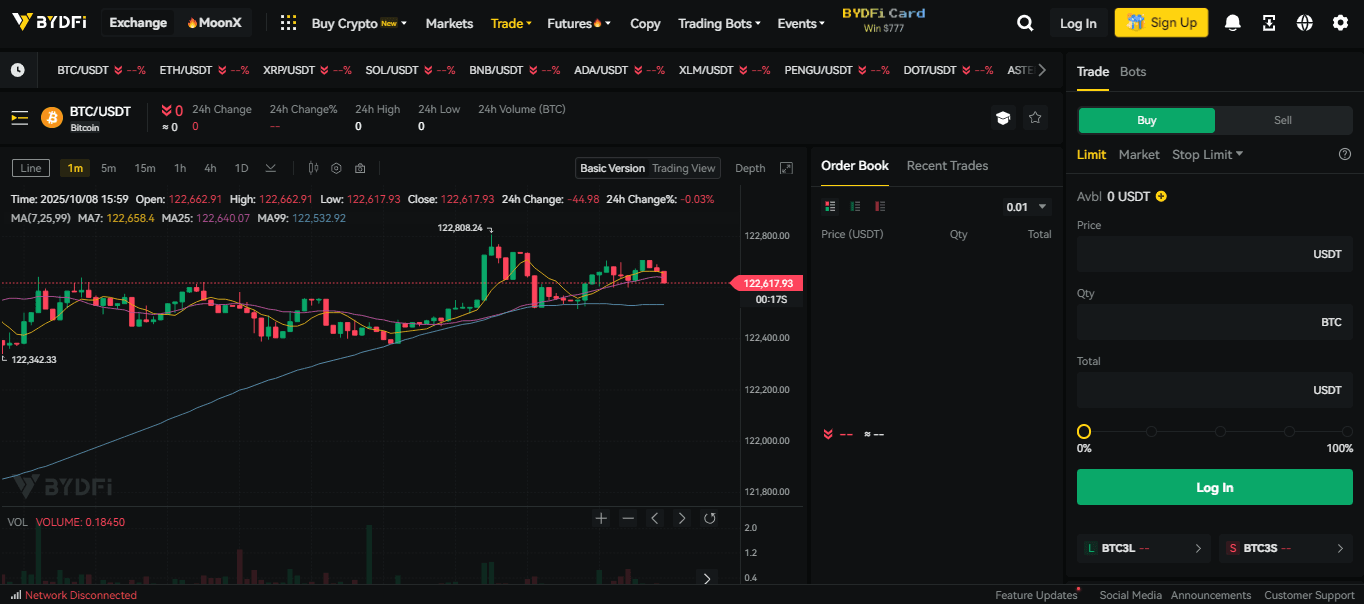

BYDFi’s trading ecosystem is built around accessibility. It’s designed so that both new and seasoned traders can operate confidently, whether they’re setting up a simple spot order or running complex perpetual strategies with leverage and bots.

Use Real-Time Price Tracking Tools on BYDFi Spot Trading. Image via BYDFi Spot

Use Real-Time Price Tracking Tools on BYDFi Spot Trading. Image via BYDFi SpotThe platform divides trading interfaces into two modes: Classic and Advanced.

Traders can switch seamlessly between the two without losing open positions or data views. BYDFi also supports a wide range of orders and margin modes.

Order types:

Margin Modes:

Perpetual contracts support up to 200x leverage with an 8-hour funding interval between long and short positions to balance contract pricing. This flexibility lets traders adapt to market volatility and manage execution risk with precision.

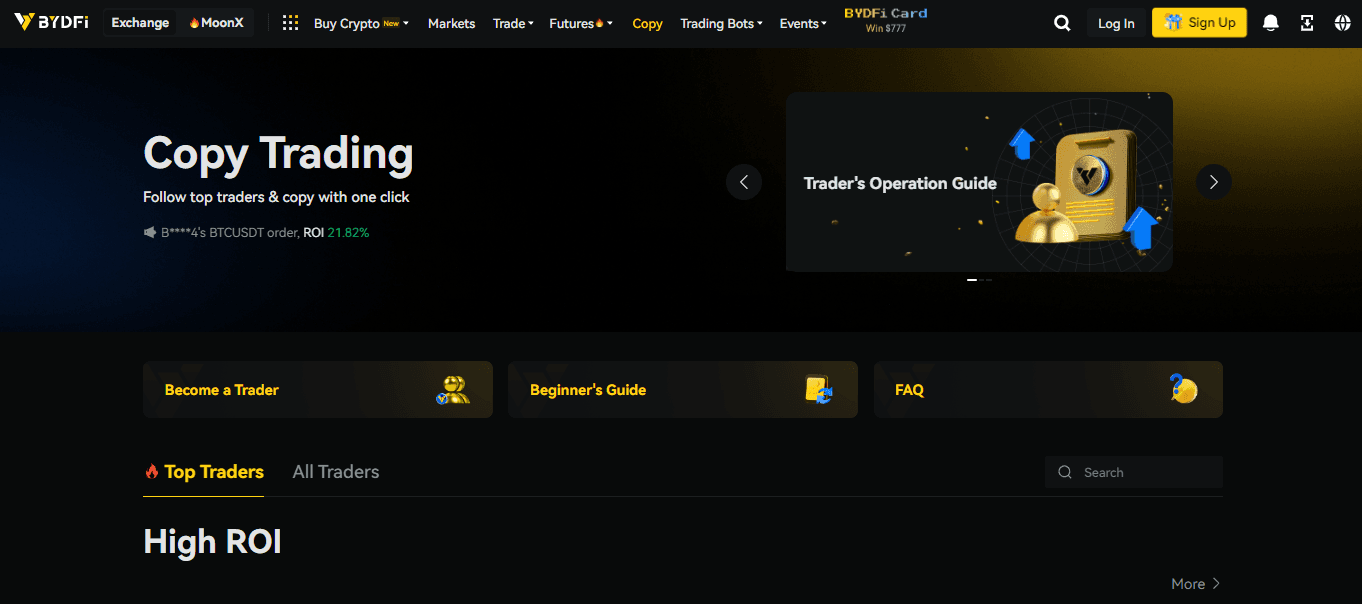

Follow Top Traders & Copy With One Click. Image via BYDFi

Follow Top Traders & Copy With One Click. Image via BYDFiBYDFi’s Copy Trading system is one of its strongest social tools. It enables users to automatically replicate trades from top-performing “leaders,” visible through a public leaderboard.

Risk Controls:

Some traders may stop trading or reduce activity, so followers should review performance regularly and diversify across multiple leaders instead of relying on one. Here is a list of the top copy trading bots and the best platforms for copy trading.

Maximize your earnings with BYDFi Smart Trading Bots. Image via BYDFi Bots

Maximize your earnings with BYDFi Smart Trading Bots. Image via BYDFi BotsAutomation plays a key role in BYDFi’s ecosystem, offering both native bots and third-party API integration.

Native Bots:

Each bot includes clear parameters for investment amount, grid range, or step size, displayed before activation, leaving no black boxes or hidden triggers.

Developers and quantitative traders can use REST and WebSocket APIs with configurable scopes (read-only, trade-only, no-withdrawal). The APIs integrate smoothly with third-party automation tools and carry published rate limits to ensure system stability.

This structure lets power users connect their external trading systems or run algorithmic strategies without breaching the platform’s internal safeguards.

In essence, BYDFi makes advanced trading feel approachable. Whether it’s a first spot order or a 200x perpetual setup, the tools scale with the user and never the other way around.

This card lets you spend crypto anywhere Visa is accepted. You can pay with Google Pay and PayPal, get Secure 3D Secure checks, and instant records after each payment.

Key benefits

How it works

Fees at a glance

Eligibility

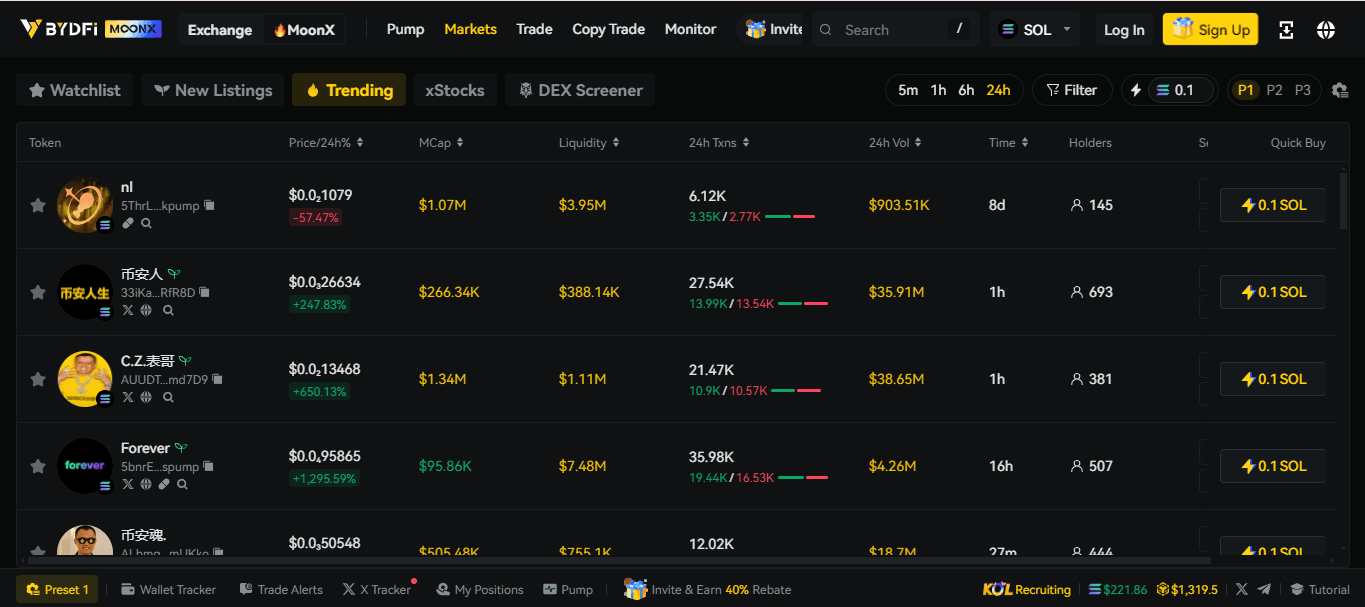

MoonX is BYDFi's Powerful New On-Chain Trading Engine. Image via BYDFi MoonX

MoonX is BYDFi's Powerful New On-Chain Trading Engine. Image via BYDFi MoonXMoonX is BYDFi’s bridge to decentralized finance, a direct link between the simplicity of a centralized exchange and the volatility-driven energy of on-chain trading. It’s built for traders who want exposure to the DeFi frontier without wrestling with wallets, contract addresses, or the risks of manual swaps.

MoonX operates as an on-chain trading engine that connects BYDFi users to DEX liquidity on Solana and BNB Chain. Through a unified interface, users can trade over 500,000 memecoin pairs drawn from top decentralized exchanges like Raydium, PancakeSwap, and Pump.fun.

Instead of juggling private keys or browser wallets, BYDFi handles routing internally, enabling one-click swaps directly from user balances. The system automatically finds the best liquidity path, minimizing price slippage while maintaining CEX-grade execution speed.

This setup merges DEX access with CEX convenience, which means no manual signing, no bridge fees, no endless tab-switching.

Trading directly on-chain introduces new risks, and MoonX addresses them through built-in defenses:

Together, these features give traders a protective layer that most on-chain platforms still lack.

MoonX isn’t for everyone; it’s a tool for traders who understand both the potential and the peril of early-stage markets.

The platform encourages a “test-buy” workflow, wherein you start small, check liquidity, confirm contract safety, and scale only after confidence builds.

BYDFi emphasizes disciplined trading inside MoonX. Users can set position-size limits and follow internal risk prompts before executing large trades. The exchange also surfaces live warnings when interacting with tokens that fail liquidity or holder checks, urging caution before confirmation.

These nudges don’t remove the risk; rather, they remind traders that DeFi reward always comes with volatility. MoonX simply removes the unnecessary friction in reaching that frontier.

In short, MoonX isn’t trying to turn everyone into a memecoin speculator. It’s giving traders a way to participate in DeFi without leaving the safety rails of a regulated exchange.

Pre-trade risk checklist for MoonX traders

Check the GoPlus Security Scan

Verify the token in MoonX with the integrated GoPlus check. Do not trade tokens flagged with high-risk vulnerabilities.

Analyze market sentiment

Review Alpha and Smart Money dashboards. Track whale wallet flows and community momentum in real time.

Control your capital

Risk no more than 1 to 2% of your total trading capital on any single meme coin position.

Set a defined strategy

Use BYDFi limit orders for precise entries and exits. Always place stop-loss and take-profit orders.

Use the Sell Half feature

When price doubles, sell half to recover your initial stake. Keep a moon bag with house funds only.

Be aware of slippage

On MoonX DEX routes, set slippage tolerance with care. Increase only if liquidity is low and fills fail.

High-risk tokens can move fast. Use small sizes, strict stops, and alerts. Never trade without a plan.

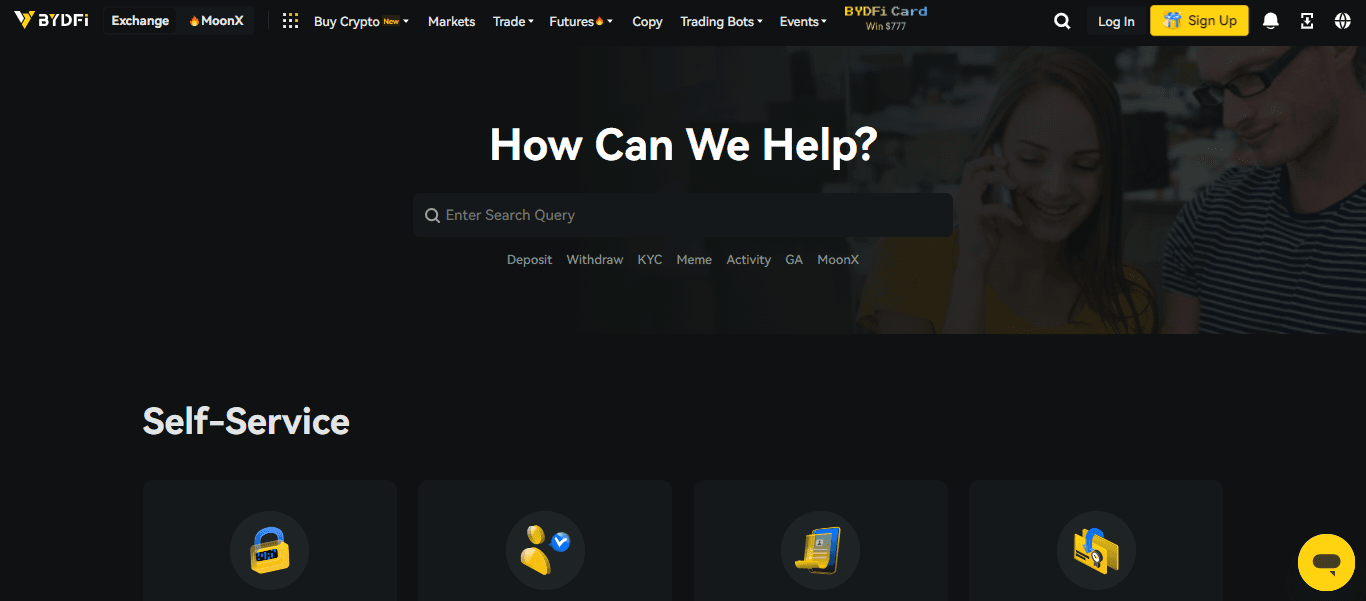

BYDFi Provides Email, Chat and Call Support. Image via BYDFi Support

BYDFi Provides Email, Chat and Call Support. Image via BYDFi SupportIn crypto, customer support often reveals more about a platform than any marketing campaign. BYDFi’s support framework balances responsiveness with structure perfectly, thus serving both casual traders who need instant answers and professionals who expect escalation paths and documentation.

BYDFi maintains a 24/7 live chat directly through its website and app. Most queries start with automated prompts for faster routing, but escalate to a human representative when complexity rises. Users can also reach the team via support email, which handles document-heavy requests like KYC reviews, withdrawal clarifications, or compliance reports.

Outside official support, the platform’s Telegram and X (Twitter) communities act as semi-open forums for updates, outage reports, and direct interaction with community managers.

Response times depend on the channel, and chat replies often arrive within minutes, while detailed cases can take several hours to a full day, depending on verification steps. There’s no hard SLA published, but the consistency of chat responses suggests a well-managed support flow.

The Help Center functions as a self-service layer. It’s organized into modules for account setup, trading operations, and technical troubleshooting, with embedded walkthroughs for common issues like funding failures, API connection errors, and margin warnings.

Like most exchanges, BYDFi encounters recurring operational bottlenecks.

This layered handling structure mirrors what top-tier exchanges use—automation for volume, human oversight for anomalies.

Based on reviews from sources like the Google Play Store, Apple App Store, and various web platforms such as Capterra and TrustPilot, BYDFi is often praised for its user-friendly interface and rich trading features, while some users criticize its withdrawal processes and customer support.

Here is a breakdown of the key user review themes for BYDFi.

Positive themes

UI and accessibility

Trading and features

Fees and costs

Security and compliance

Who Should And Shouldn’t Use BYDFi. Image via Shutterstock

Who Should And Shouldn’t Use BYDFi. Image via ShutterstockNegative themes

UI and performance

Customer service

Deposits and withdrawals

Features

Across major review platforms, BYDFi maintains a generally positive reputation. Its App Store rating stands at 4.6/5 and Google Play at 4.6/5, based on thousands of reviews, suggesting reliability in daily operations. The platform’s service quality shows through consistent functionality, transparent policies, and a human escalation system that, while not flawless, outperforms most mid-tier competitors

Mini-flow for escalating a case on BYDFi

Contact Basic Support

Start with live chat on the BYDFi website. Have your User ID and issue details ready.

For complex problems, email [email protected]. Include all relevant information and your ticket number.

Request Escalation

If the team does not resolve the issue, send a follow up email referencing the original ticket.

State that you want the case escalated to a senior representative or manager.

Use Public Channels

If internal efforts fail, post on BYDFi social media. Use X, formerly Twitter, or the official Telegram group.

Publicly describe the unresolved issue. This can prompt a faster response.

Involve External Parties

As a last resort, report the incident to regulators such as FinCEN in the United States or FINTRAC in Canada.

For significant financial losses, consult legal counsel that handles cryptocurrency disputes.

Keep records of all chats and emails. Save screenshots, dates, and names. These help in escalations and regulatory reports.

Every crypto exchange claims to be unique, but most compete on the same checklist, fees, leverage, product depth, and accessibility. BYDFi sets itself apart through flexibility: optional KYC, on-chain trading via MoonX, and higher leverage limits than most mid-tier platforms. Still, it’s worth measuring that edge against heavyweights like Binance, KuCoin, and OKX.

| Feature | BYDFi | Binance | KuCoin | OKX |

|---|---|---|---|---|

| Spot/Perps Fees | 0.10% / 0.02–0.055% | 0.10% / 0.02–0.05% | 0.10% / 0.02–0.06% | 0.08% / 0.02–0.05% |

| Max Leverage | Up to 200x | Up to 125x | Up to 100x | Up to 125x |

| Listings Depth | 700+ spot tokens, 260+ perps | 600+ spot, 350+ perps | 700+ spot, 300+ perps | 500+ spot, 250+ perps |

| MoonX / DEX Connect | Yes (Solana & BNB) | No | No | Partial (Web3 wallet bridge) |

| KYC Requirement | Optional up to 1.5 BTC/day | Mandatory | Optional (limited) | Mandatory |

| US Availability | Partial (under MSB license) | Restricted | Restricted | Restricted |

| Staking / Earn Products | Limited | Wide range | Moderate | Extensive |

| Withdrawal Window | Manual + automated batches | Instant | Instant | Instant |

| Mobile App Ratings | iOS 4.4 / Android 4.5 | iOS 4.6 / Android 4.5 | iOS 4.4 / Android 4.3 | iOS 4.5/ Android 4.4 |

Key takeaway: BYDFi beats peers on leverage, DeFi connectivity, and privacy flexibility, but trails them slightly in liquidity depth, staking diversity, and instant withdrawal execution.

You want optional KYC, privacy-preserving trading, or limited verification thresholds.

You trade high-leverage perps or memecoins and want easy access to on-chain markets via MoonX.

You value transparent fee structures and a user-friendly layout over maximum liquidity.

You prioritize deep liquidity, fastest execution, and a broad “Earn” suite with staking and yield products.

You don’t mind full KYC and slightly stricter onboarding.

You focus on altcoin depth, early listings, and flexible API trading.

You’re comfortable with partial KYC and minor withdrawal delays during high traffic.

You’re looking for copy trading, launchpad access, and derivative liquidity that rivals Binance.

You prefer a highly regulated setup with advanced portfolio tools.

BYDFi’s value is in being freer. The platform gives traders optional KYC, stronger leverage, and on-chain exposure that the giants don’t. But if your strategy depends on deep order books or passive yield, the larger exchanges still hold the advantage.

No KYC Occasional Trader

Limits trigger KYC. Some fiat features require verification.

High Leverage Perp Trader

Watch margin and liquidity. Slippage can rise on fast moves.

Copy Trading Newbie

Use as a learning tool. Diversify across leaders.

Memecoin, On chain Hunter

Start small. Volatility and scams are real risks.

Security and Compliance Focus

Unverified caps apply. Liquidity is smaller than top tier CEXs.

Every exchange has its audience, and BYDFi is no exception. It’s built for traders who want control, optional verification, and the freedom to access both centralized and decentralized markets in one place. But that same flexibility comes with conditions, and knowing where you fit makes all the difference.

No-KYC Occasional Trader

If you’re someone who values privacy and trades casually, BYDFi’s no-KYC tier is a strong draw. You can buy, sell, and withdraw up to 1.5 BTC per day without verifying your identity. The onboarding takes minutes, and withdrawals are smooth for smaller sums.

It’s ideal for users testing the market, managing side portfolios, or maintaining anonymity for personal reasons.

What to Keep in Mind:

High-Leverage Perp Trader

BYDFi shines for traders who thrive on volatility. It's 200x maximum leverage on select pairs like BTC/USDT outpaces most competitors. The platform supports Isolated and Cross Margin, plus full access to advanced order types, Market, Limit, TP/SL, and Post-Only.

Funding intervals occur every 8 hours, giving traders predictable cost structures when holding positions.

What to Keep in Mind:

Copy-Trading Newbie

Newcomers who want to learn by doing will find BYDFi’s Copy Trading feature accessible and intuitive. You can follow professional traders starting from as little as $10, reviewing each leader’s P&L, ROI, win rate, and drawdown history before committing.

Performance data is pulled directly from the platform—no screenshots or unverifiable claims.

Risk Controls Include:

What to Keep in Mind:

Copy trading works best as a learning tool, not a guarantee of profit. Results depend on consistent review and diversification across leaders to offset churn.

Memecoin / On-Chain Hunter

If you live for early access to new tokens and DeFi plays, BYDFi’s MoonX feature is built for you. It connects to DEXs like Raydium and PancakeSwap, routing trades through BYDFi’s interface, no external wallets, no bridging hassles.

You can view liquidity depth, holder data, and security scans before trading, helping avoid bad contracts and rug pulls.

What to Keep in Mind:

Users Valuing Security & Compliance

BYDFi is fully registered with FinCEN (US), FINTRAC (Canada), and ACRA (Singapore), a rare trifecta for mid-tier exchanges. Its Proof of Reserves, Hacken audits, and KYC/AML compliance make it trustworthy for users prioritizing regulation and solvency transparency.

What to Keep in Mind:

BYDFi fits traders who value freedom, high leverage, on-chain access, and optional KYC. It’s not for those chasing passive yields or institutional liquidity. Think of it as a performance-driven platform for traders who want speed, transparency, and control under one roof.

BYDFi delivers a mix that few competitors balance well. Optional KYC, high leverage, MoonX on-chain access, and copy trading that actually feels transparent. Each system it builds leans toward clarity, from fees to order execution, from risk warnings to reserve audits.

It’s also refreshing that BYDFi doesn’t chase hype cycles. Instead, it keeps improving core layers: better liquidity routing, stronger APIs, and PoR-backed solvency checks that hold up under scrutiny.

February 27th, 2026

By

February 27th, 2026

By

February 26th, 2026

By

Get exclusive access to premium content, member-only tools, and the inside track on everything crypto.