Curve Finance Quick Verdict (30-Second Summary)

Curve is still one of DeFi’s most important liquidity venues, but it should be treated as risk-on infrastructure, not a passive savings tool. Post-2023 hack, Curve remains operationally mature and unusually transparent about audits and incidents, yet users must accept smart-contract, depeg, and governance risk as the cost of low-slippage stablecoin liquidity. In short: Curve is still “safe enough” for informed users who know what they’re doing, and still a poor fit for anyone looking for simplicity or guarantees.

Best For

- Power users swapping stablecoins or correlated assets

- LPs who understand pool-specific risks and depeg mechanics

- Traders prioritizing low slippage over “one-click” UX

- Users comfortable monitoring positions and approvals

Avoid If

- You want a beginner-proof or reversible experience

- You can’t actively monitor pools, pegs, or governance changes

- You’re mainly swapping volatile, uncorrelated assets

- You’re uncomfortable with smart-contract and tooling risk

Curve is not a general-purpose DEX like Uniswap; it’s a specialist liquidity layer optimized for stable and closely priced assets, and it should be judged on that basis.

How We Reviewed Curve Finance

For this review, we used a reproducible “reader’s checklist” rather than claiming lab-style testing or an independent code audit. The goal is to show what a careful user can verify using Curve’s own public materials before swapping or providing liquidity.

Our Testing Methodology

- Read Curve’s Technical Docs to understand how its core designs work (especially StableSwap and the protocol’s major components).

- Reviewed Curve’s published security posture and the curated Audits index, which links to official audit PDFs and disclosures.

- Cross-checked “what’s deployed” using Curve’s Deployed contracts reference, and used the Address Provider documentation to understand how Curve surfaces key registry addresses across chains.

What We Observed

Curve’s documentation is unusually explicit about operational realities. For example, the Address Provider docs note that its "admin" is an individual (not the DAO) and that IDs/addresses can be updated. which is an important transparency point for integrators and advanced users.

Similarly, the Deployed contracts page includes a clear caveat that address lists can become outdated, which is a practical reminder to cross-check on-chain when accuracy matters.

On the security side, Curve provides a dedicated security contact and publishes bug bounty scope and payout tiers in its security documentation.

Limitations of Our Testing

We did not perform an independent smart-contract audit, stress test liquidity, or benchmark real-time execution costs at publication time. Treat this section as a transparency-first overview of what we checked in official sources, not a guarantee of safety.

Critical Security Updates

Curve is one of DeFi’s most battle-tested protocols, but it has also been a high-profile target, mainly because so much liquidity flows through its pools.

Curve Publishes an Ongoing Security Hub and a Central Audits Index

Curve Publishes an Ongoing Security Hub and a Central Audits IndexWhat Happened In 2023

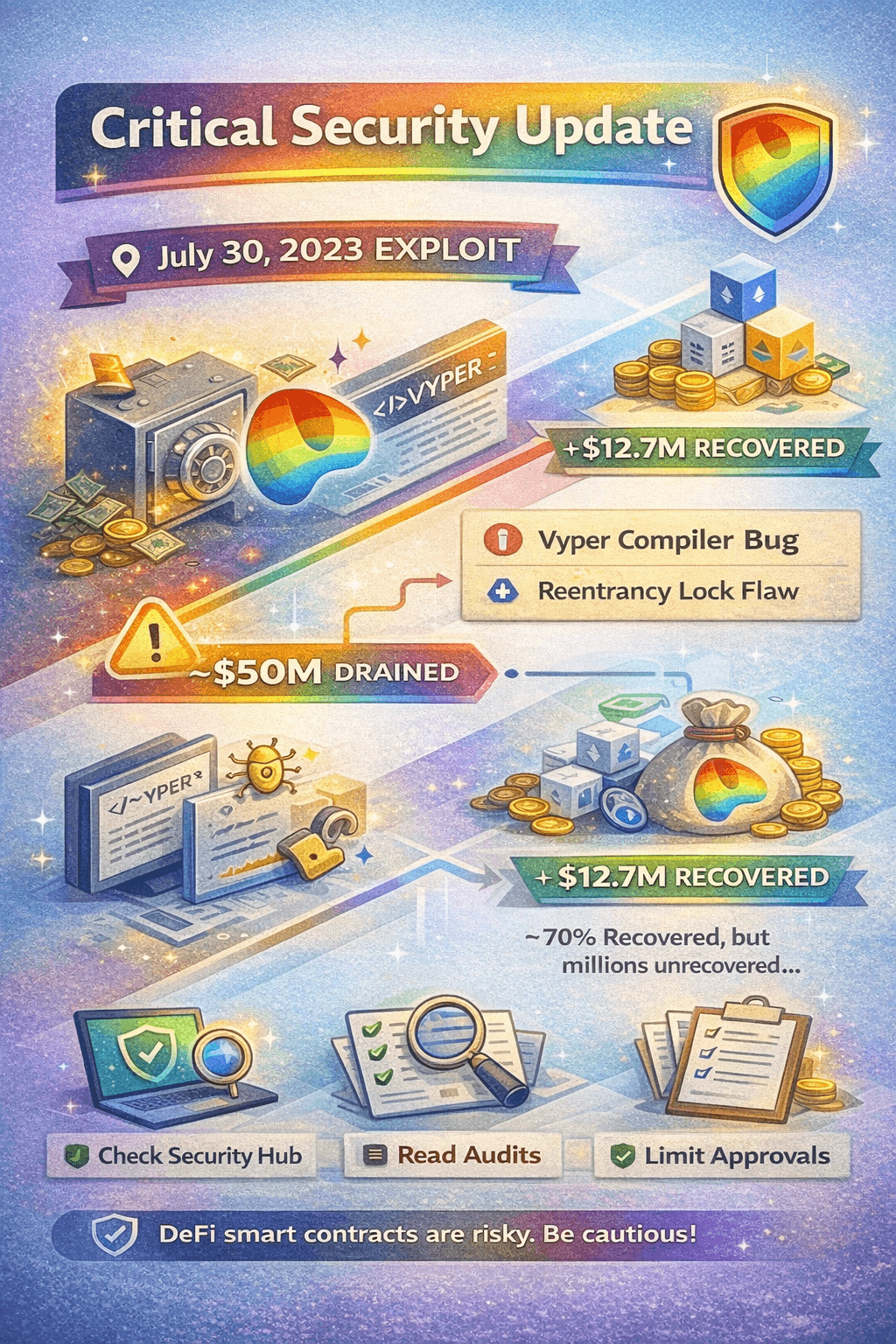

On July 30, 2023, several Curve pools were exploited in an incident widely reported as about $50 million drained ($70 million according to Chainalysis). A key detail: the root cause wasn’t “Curve math” breaking, but was a Vyper compiler issue affecting certain contracts compiled with vulnerable versions.

In plain English, it’s like installing a security lock that looks engaged, but due to a manufacturing defect, doesn’t actually stop someone from slipping back in through a second door. The flaw involved incorrectly allocated named re-entrancy locks in specific Vyper versions, enabling cross-function reentrancy. You can see this described in the NIST NVD entry for CVE-2023-39363 and the Vyper security advisory.

Vyper’s own technical post-mortem explains how the bug surfaced and why only certain designs were exploitable.

Recovery Status

Less than a week later, one exploiter returned 4,820 alETH and 2,258 ETH, valued at about $12.7 million at the time. The Chainalysis report shared above also claimed that Curve had recovered 70% of the lost funds.

What This Means For Users Today

Curve publishes an ongoing Security hub and a central audits index, so use these as your first stop before depositing. Also read Curve’s official risk disclaimer so you’re clear on smart contract, peg, and irreversibility risks.

DeFi smart contracts can fail in unexpected ways. Even “audited” code can have bugs, and transactions are generally irreversible. Only use funds you can afford to lose and start small. We advise you to read through our guide on Smart Contract Attacks to gain more knowledge and stay safe.

What Is Curve Finance

Curve Finance is a decentralized exchange (DEX) that uses an automated market maker (AMM) model, meaning trades happen through smart contracts and liquidity pools, not an order book. In practice, it’s best known for swapping stablecoins and other closely priced assets (like different “digital dollars”), where the goal is to keep slippage as low as possible.

Curve is not Your General-Purpose DEX, but is Optimized Around its Stableswap Design. Image via Curve

Curve is not Your General-Purpose DEX, but is Optimized Around its Stableswap Design. Image via CurveIt’s not a general-purpose DEX. Curve is primarily optimized around its Stableswap design, which concentrates liquidity around a target price (for example, 1 USDC ≈ 1 USDT) to help large swaps clear with smaller price impact than many general AMM designs. A simple way to picture this is a currency-exchange booth with two jars of nearly identical “digital dollars”: if one jar starts emptying, the booth slightly adjusts the rate to encourage trades that refill it.

Curve also supports pools for more volatile assets through its Cryptoswap design, but its core identity remains “stable, low-slippage liquidity” that other DeFi apps and aggregators often route through.

Check out our top picks for the best decentralized exchanges.

How Curve Finance Works

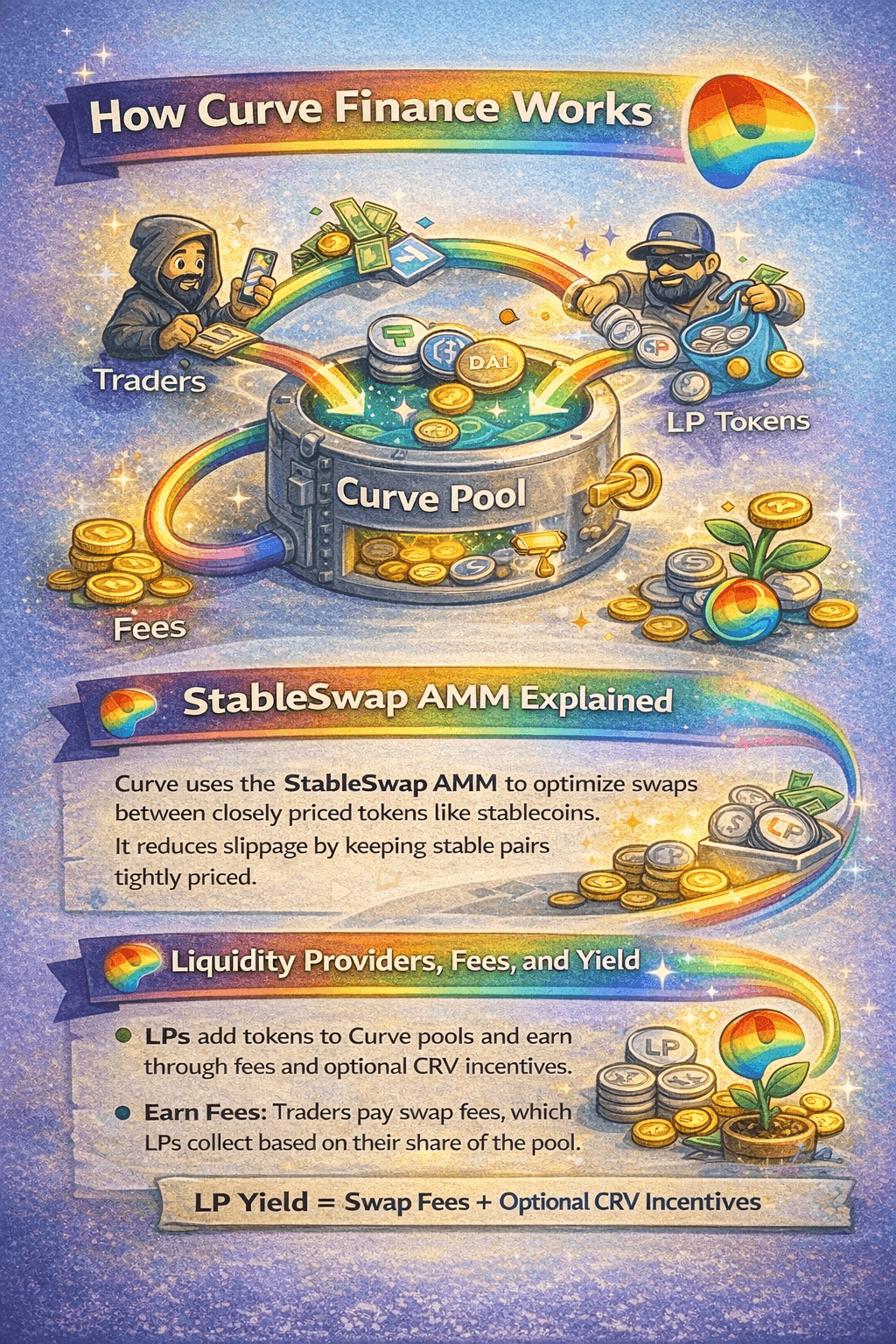

At a high level, Curve works like a set of shared “swap vaults.” Traders swap into and out of these vaults, while liquidity providers (LPs) stock the vault with tokens and earn fees for making trading possible. The key detail is that Curve is designed to work best when the tokens in a pool are closely priced; especially stablecoins.

Curve Works like a Set of Shared “Swap Vaults”

Curve Works like a Set of Shared “Swap Vaults”Curve’s StableSwap AMM Explained

Curve prices trades using its StableSwap automated market maker. The idea is simple: if two assets are supposed to be worth about the same (for example, two different USD-pegged stablecoins), the pool can keep prices “tighter” around that shared value, which usually means lower slippage for large swaps.

Liquidity Providers, Fees, and Yield

Liquidity providers (LPs) deposit tokens into a Curve pool and receive LP tokens in return. Think of LP tokens like a receipt: they represent your share of the pool and are what you use to withdraw later.

On Curve, yield for LPs typically comes from two main places:

- Swap fees: Every trade pays a fee that’s collected by the pool, so LPs earn a share of the trading activity.

- Incentives (optional): LP tokens can be staked in liquidity gauges to earn CRV emissions, which are directed to different gauges based on veCRV voting (i.e., governance decides where incentives go).

Fee-based yield (roughly) scales with activity:

LP fee earnings ≈ (swap volume × pool fee) × your share of the pool over a given period.

Separately, Curve pools can also apply an admin fee that is defined as a percentage of the pool fee; Curve’s own resources note that Stableswap admin fees are 50% of the total swap fee, and these admin fees are collected, converted into a single token, and distributed to veCRV holders through Curve’s fee system. Curve documents how fees are collected and routed through its system in its Fee Collection, Burning, and Distribution overview.

It’s important to treat any quoted APR/APY as variable: fee-based yield depends on trading volume, and incentive-based yield depends on gauge weights and reward conditions.

Impermanent Loss on Curve (Why It’s Different)

Impermanent loss is the trade-off LPs face when pool prices move versus simply holding the tokens; Uniswap’s docs provide a clear walkthrough of the concept and math.

In Curve’s stablecoin-heavy pools, impermanent loss is often lower because the assets are meant to track the same price. But it can still show up during depegs, in less-correlated pools, or in Curve’s more volatile designs like its Cryptoswap pools.

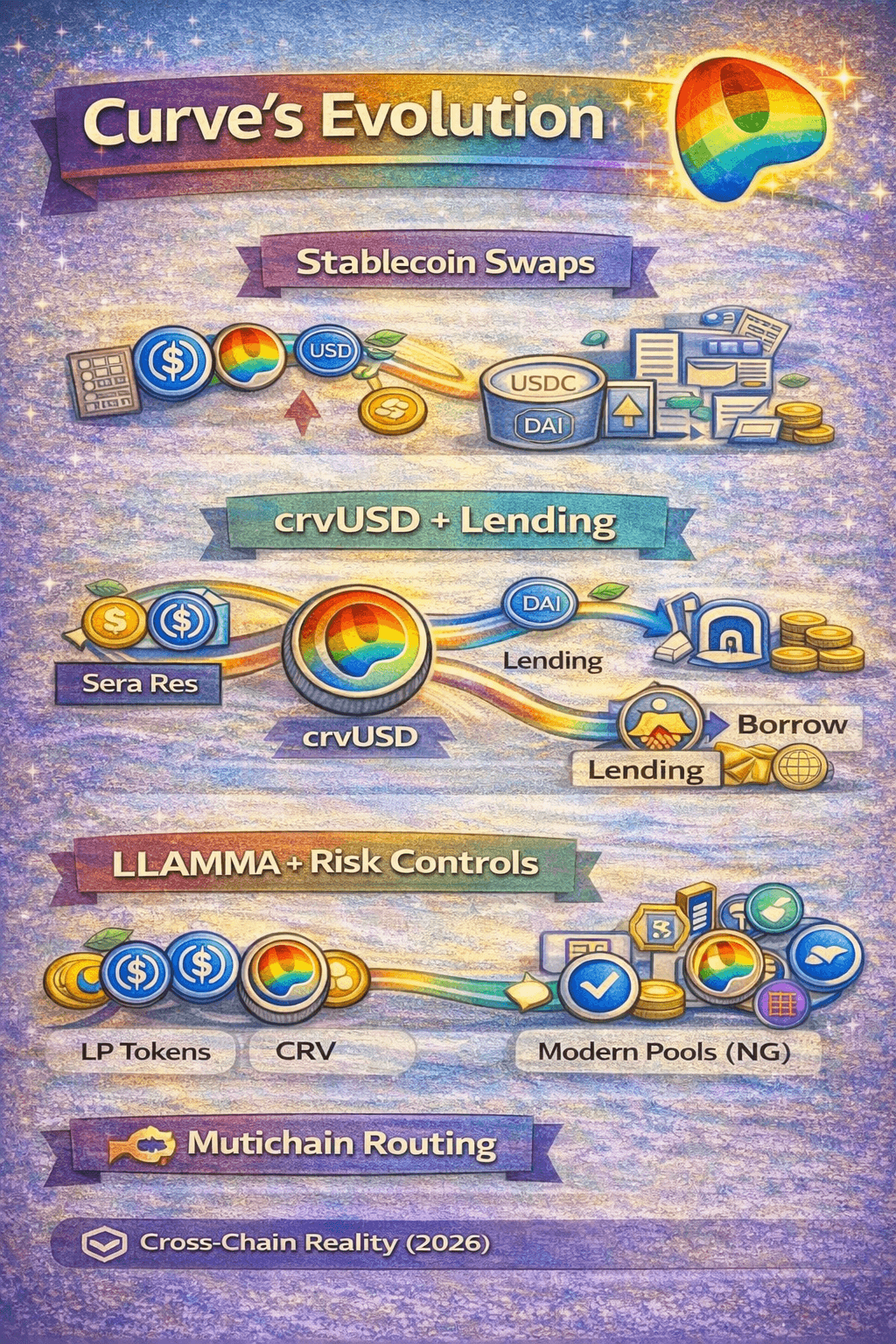

Curve’s Evolution: From Stablecoin DEX to DeFi Liquidity Infrastructure

Curve started as a specialist DEX for low-slippage swaps between stablecoins and other closely priced assets. Over time, it has expanded into a broader set of onchain “plumbing” that other apps can route through; spanning swaps, lending, and stablecoin infrastructure built around the same pool-and-incentives foundation.

Curve Moved from “a Place You Swap Stablecoins” to “a System that can also Create Credit (Loans) and a Native Stablecoin”

Curve Moved from “a Place You Swap Stablecoins” to “a System that can also Create Credit (Loans) and a Native Stablecoin”The New Core: crvUSD + Lending

- Curve’s biggest evolution is the addition of crvUSD, a stablecoin system where users can mint crvUSD using approved collateral, with new collateral additions subject to DAO approval.

- Alongside that, Curve Lending supports markets where users can borrow crvUSD against other tokens (or borrow other tokens against crvUSD) in an isolated setup, meaning markets are designed not to “intertwine” with each other.

In plain terms: Curve moved from “a place you swap stablecoins” to “a system that can also create credit (loans) and a native stablecoin,” with swaps, borrowing, and liquidity incentives feeding into one another.

Risk Engine: LLAMMA + Risk Controls

- A key part of the crvUSD/lending design is LLAMMA (Lending-Liquidating AMM Algorithm). Instead of a single “cliff” liquidation price, LLAMMA uses a liquidation range where collateral can be continuously rebalanced as prices move, which is more like a thermostat making frequent small adjustments than a breaker switch that flips once.

- On the control side, Curve’s system includes guardrails like debt ceilings, and the docs note that adding new crvUSD markets requires a successfully passed DAO vote (it’s not permissionless in the same way pool creation can be).

Modern Pools and Capital Efficiency

Curve has also upgraded its pool infrastructure. Stableswap-NG is positioned as a technically enhanced iteration of the earlier Stableswap system, supporting different pool types (like plain pools and metapools) for stable and pegged assets.

For more volatile assets, Curve has newer designs like Tricrypto-NG, described as a 3-coin, auto-rebalancing implementation. These “NG” systems aim to improve usability and flexibility, but they also add complexity, which is its own form of risk.

Multichain and Liquidity Routing Reality

Finally, Curve is no longer “just Ethereum mainnet.” Its documentation lists deployments across multiple chains, and Curve provides Deployment Addresses plus an Address Provider contract that acts as an entry point to key registries on chains where Curve is live.

The practical takeaway: prices and slippage can vary by chain because liquidity is fragmented. If you want the “best” swap, you’re often choosing between cheaper gas on an L2 and deeper liquidity elsewhere; so it’s worth checking where the pool is most mature and liquid before moving serious size.

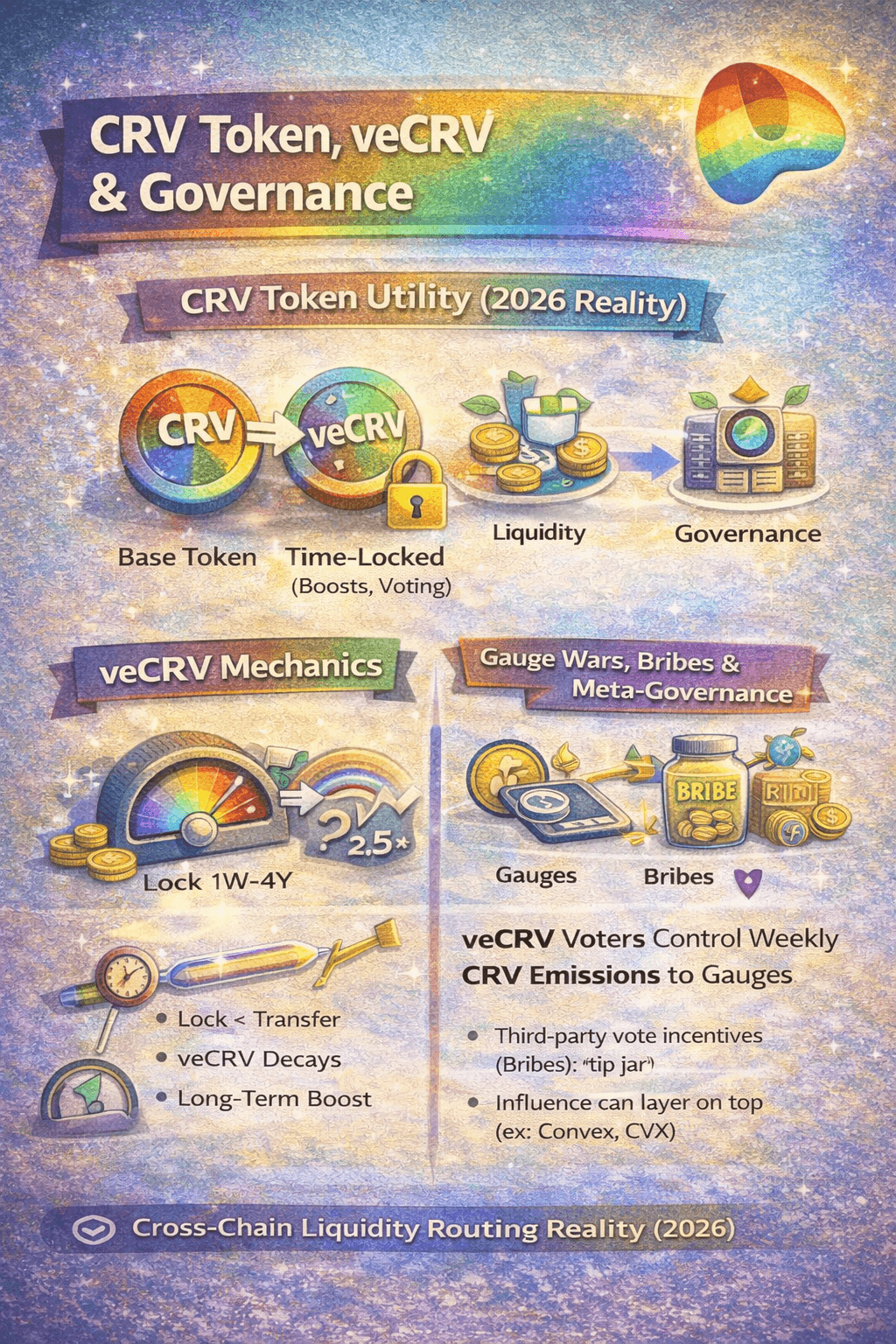

CRV Token, veCRV, and Governance Today

Curve’s governance system revolves around CRV and a time-locked version of it called veCRV (vote-escrowed CRV). A beginner-friendly way to think about this is: CRV is the base token, while veCRV is a “commitment receipt” you get for locking CRV for a period of time; and that receipt is what unlocks most governance and incentive control.

To Get veCRV, You Lock CRV in Curve’s Voting-Escrow System

To Get veCRV, You Lock CRV in Curve’s Voting-Escrow SystemCRV Token Utility

Curve’s own materials describe CRV as the token used to incentivize liquidity and participate in the protocol’s governance and emissions system. When CRV is locked into veCRV, it can also be used in mechanisms that route a share of protocol fees to long-term participants (rather than only to short-term farmers).

veCRV Mechanics

To get veCRV, you lock CRV in Curve’s voting-escrow system for between one week and four years. The same Curve FAQs note that veCRV is non-transferable and that your veCRV balance decays as your lock approaches expiry (because your “commitment” is getting shorter). Curve also states that veCRV can boost CRV rewards up to 2.5× for eligible liquidity positions, which is why long-term lockers can earn more than someone providing the same liquidity without a lock.

Gauge Wars, Bribes, and Meta-Governance

- Where governance becomes practical is emissions. Curve’s liquidity gauges distribute CRV incentives, and veCRV voters decide how those weekly emissions are split across pools. This is what people mean by “gauge wars”: different projects compete for votes because more emissions can attract more liquidity.

- Bribes (often called vote incentives) are the “extra tip jar” attached to that system: third parties can add additional rewards for a specific gauge, paid out to voters in proportion to how they vote.

- Meta-governance shows up when large voting blocs form. For example, Convex explains that it votes in Curve’s system as a veCRV holder, but routes that voting influence through its own community (vote-locked CVX holders), effectively creating a second governance layer on top of Curve.

Security & Risk Assessment (Post-Hack)

Curve is considered one of DeFi’s most battle-tested liquidity layers, but “battle-tested” is not the same as “risk-free.” The 2023 incident is a reminder that risk can come from places users don’t always notice, including the tooling used to compile smart contracts, not just the contracts themselves.

Curve may be DeFi’s Most Battle-Tested Liquidity Layers, but that's not the same as “Risk-Free”

Curve may be DeFi’s Most Battle-Tested Liquidity Layers, but that's not the same as “Risk-Free”Audits, Bug Bounties, and Monitoring

Curve states that its security approach includes regular audits, continuous monitoring, and a structured process for responsible disclosure via its Security documentation. Think of audits like a building inspection: they can catch many issues, but they can’t guarantee nothing will ever break after people start using the building.

Curve also maintains a public Audits index and publishes security incident material through its official channels.

For vulnerability reporting, Curve lists a dedicated bug bounty program and scope guidance.

Llama Risk Framework

For Curve’s lending stack, “risk management” largely means parameter management. For example, Curve’s crvUSD system includes concepts like debt ceilings (limits on how much can be minted/borrowed in a market), which are implemented and adjustable within the protocol’s contracts and governance processes.

Curve governance discussions from LlamaRisk describe a methodology for setting debt ceilings that considers factors like collateral liquidity, borrower behavior, and features unique to Curve’s LLAMMA-based markets.

Security Scorecard

- Smart contracts (6.0): Curve publishes a public list of audits across its DAO, DEX, and lending/stablecoin modules, and it runs a defined bug bounty with an explicit disclosure policy. Even so, Curve’s 2023 losses highlight that risk can also come from compiler/tooling and not just contract logic via the Vyper named re-entrancy lock issue.

- Incident response (7.5): After the July 30, 2023 exploit tied to a Vyper compiler vulnerability, Curve governance discussed a reimbursement plan on its official forum proposing 71,768,597.75 CRV from the Community Fund, vesting over one year, distributed via claim contracts, with calculation work shared publicly (via curvefi/curve-snapshot) and an explicit note that CRV price moves affect USD outcomes.

- Transparency (7.0): As mentioned earlier, the protocol centralizes audit links and notes that “audits and security disclosures” are hosted publicly, which makes verification easier for users.

- Governance risk (5.5): Parameter changes and incentive direction are governance-driven. Curve documents its governance and voting rules (including who can create votes and vote duration) and its gauge system for emissions, which means outcomes can shift as voting power concentrates or delegates.

Why 6.5/10?

Strong on documentation, audits, and structured disclosure, but still meaningfully exposed to smart-contract and tooling risk, plus the added complexity of governance-controlled incentives and parameters.

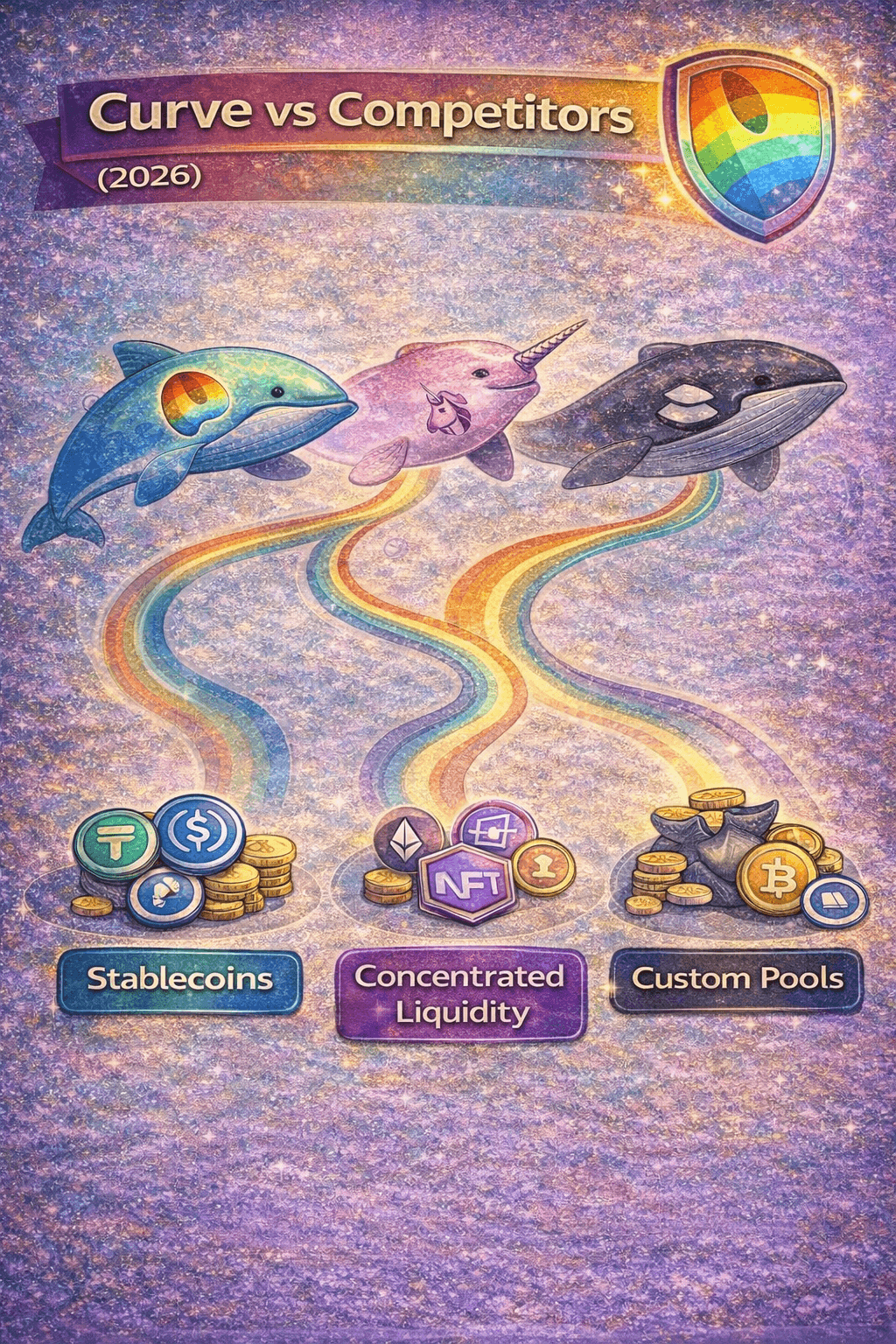

Curve vs Competitors

Curve is still easiest to understand as a specialist: it’s optimized for stablecoins and closely priced assets via its StableSwap design, while also offering a separate Cryptoswap model for uncorrelated assets.

Curve is Optimized for Stablecoins and Correlated Assets via StableSwap

Curve is Optimized for Stablecoins and Correlated Assets via StableSwap

| Feature | Curve | Uniswap V3 | Balancer |

|---|---|---|---|

| Best fit | Stablecoins, pegged/correlated assets | Broad token pairs, active LP strategies | Custom pools, multi-token exposure |

| Core design | StableSwap (plus Cryptoswap) | Concentrated liquidity + fee tiers | Weighted Pools + Stable Pools |

| LP experience | Often simpler in stable pools; pool-specific depeg risk | LP positions are NFT-based and range-managed | Many pool types/parameters; flexible but more options |

| Governance | veCRV voting steers CRV emissions | UNI-governed upgrades | veBAL governance via Snapshot |

Curve vs Uniswap V3

- Asset focus: Curve is optimized for stablecoins and correlated assets via StableSwap, while Uniswap V3 is built for broad token pairs using concentrated liquidity.

- Slippage behavior: Curve’s StableSwap is designed to keep prices tighter for near-parity assets, whereas Uniswap V3 slippage depends heavily on how much liquidity is positioned in your trade’s price range (a direct consequence of concentrated liquidity).

- LP mechanics: Curve LPing is typically pool-share based (you deposit assets into a pool and hold the pool’s LP token). Uniswap V3 LP positions are NFT-based and require choosing a price range, which makes LPing more “hands-on.”

- Fees: Uniswap V3 supports multiple fee tiers, letting LPs choose higher fees for riskier pairs. Curve fees are configured at the pool level and are generally positioned around efficiency for stable-style swaps (varies by pool).

- Main risks: Curve’s “stable” pools still carry depeg/imbalance risk; Uniswap V3 LPs face more active management risk (range selection) and can end up “out of range,” changing their exposure.

Take a look at our exclusive review of Uniswap for more details.

Curve vs Balancer

- Pool design: Curve is purpose-built around stable/correlated liquidity (StableSwap + related pool types), while Balancer is a flexible toolkit with Weighted Pools and Stable Pools.

- Use cases: Curve tends to shine when assets should trade near the same price; Balancer is often used when teams want custom index-like exposure (multi-token weights) or tailored pool parameters.

- LP complexity: Curve offers fewer pool “shapes” (more opinionated design). Balancer offers more configuration choices, which can be powerful but increases decision complexity for LPs.

- Governance/incentives: Curve uses veCRV and gauges to steer emissions. Balancer governance runs through veBAL and community voting mechanisms like Snapshot.

- Main risks: Curve’s risk is often pool-specific (depegs, parameterization, smart-contract risk). Balancer’s risk often depends on the pool type/weights and how well the pool design matches market conditions.

When Curve Is the Wrong Tool

- You’re swapping mostly volatile, uncorrelated pairs (Curve’s stable optimization isn’t the point).

- You want passive LPing without understanding pool-specific risks like depegs and imbalance.

- You’d rather use a simpler, general DEX flow without choosing among many pool types.

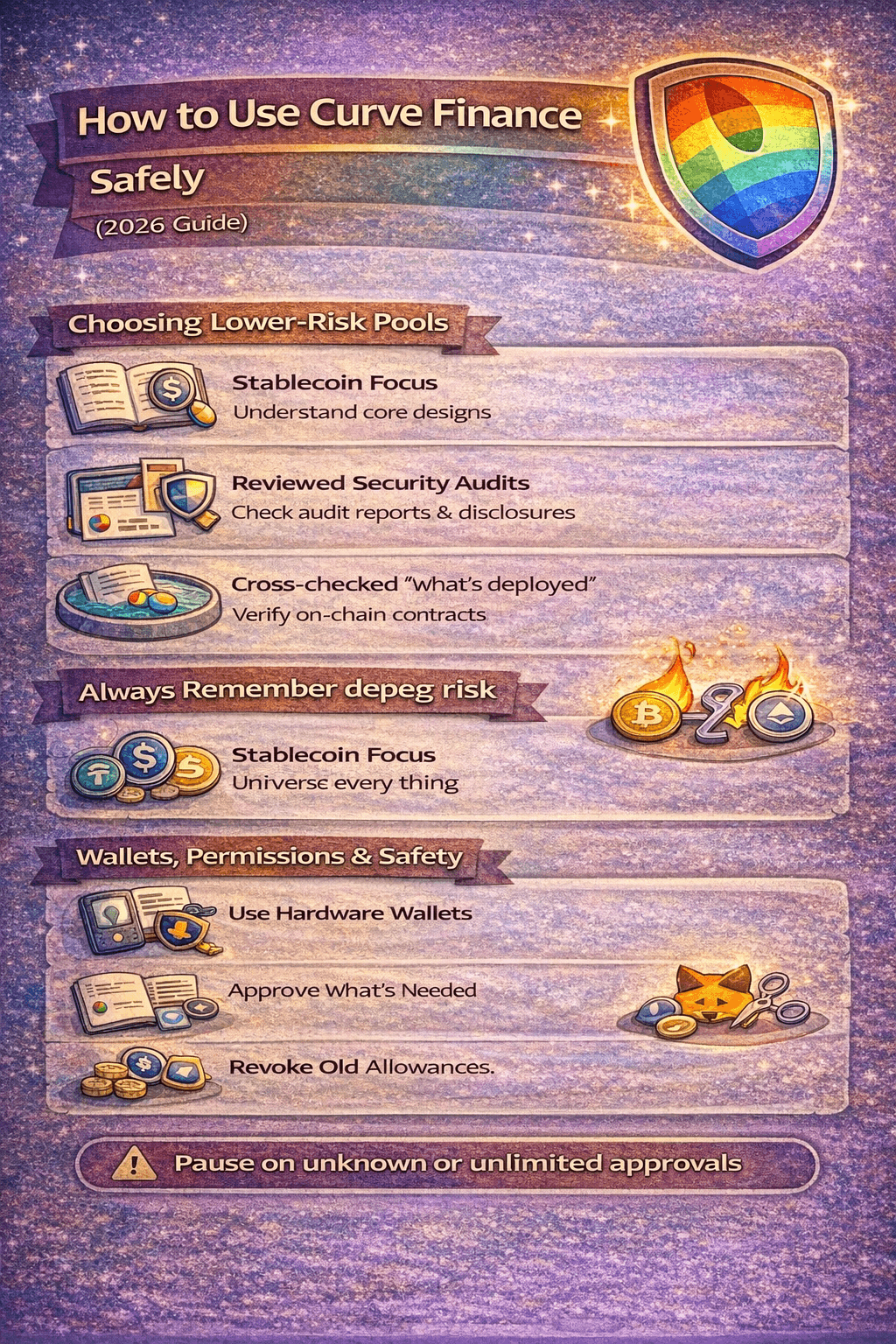

How to Use Curve Finance Safely (2026 Guide)

Curve can be a great tool for low-slippage swaps and liquidity, especially for stablecoins; but the safest way to use it is to treat every pool like its own “mini product” with its own risks. A careful setup (wallet hygiene + approval discipline) matters just as much as choosing the right pool.

Curve can be a Great Tool for Low-Slippage Swaps and Liquidity

Curve can be a Great Tool for Low-Slippage Swaps and LiquidityChoosing Lower-Risk Pools

- Prefer established StableSwap pools for closely priced assets, where the design is specifically intended to reduce slippage for stable pairs.

- Start with simpler pool structures (for example, Plain Pools) before touching more complex setups like metapools. Complexity isn’t “bad,” but it usually increases the number of things that can go wrong.

- Treat volatile-asset designs as higher risk by default. Curve’s Cryptoswap and Tricrypto-NG are built for uncorrelated assets, which can behave very differently during market stress.

- Remember the “stablecoin catch”: even stable pools can hurt LPs during depegs or imbalances (you may withdraw more of the weaker asset).

Wallets, Permissions, and Safety Tips

- Use basic Ethereum safety habits: use a hardware wallet, double-check transactions, and set smart contract spend limits where possible.

- Understand what an ERC-20 approval is: the ERC-20 standard allows you to approve a “spender” to move tokens on your behalf, so approvals should be treated like handing someone a key with a spending limit.

- Avoid leaving old “keys” lying around: MetaMask explains how to review and revoke token allowances, and Ledger’s guidance also recommends limiting or revoking unused approvals.

Note: If you don’t recognize the contract you’re approving; or it asks for an unlimited allowance when a smaller amount would do; pause and reassess.

Interested in a hardware wallet? Find out our top picks in our article on the best hardware wallets.

Final Verdict: Should You Use Curve Finance in 2026?

Curve remains one of DeFi’s most important venues for stablecoin and correlated-asset liquidity, built around its StableSwap design. If your main need is exchanging “digital dollars” with relatively low slippage, Curve can still be a strong fit; as long as you treat it as risk-on infrastructure, not a savings account. Its public security guidance and audits index help with due diligence, but they don’t erase smart-contract, depeg, or governance risk.

Our post-hack score: 6.5/10. Curve earns points for maturity and transparency, but loses points for the reality that complex DeFi systems can fail in unexpected ways.

- Best for: Power users swapping stable assets; LPs who understand pool-by-pool risks and monitor positions.

- Use caution: Anyone exploring crvUSD and lending; more moving parts means more edge-case risk.

- Avoid if: You want simplicity, can’t monitor positions, or don’t understand approvals and depeg risk.