Taxes are already a stressful task, but when you throw cryptocurrency into the mix, things can get even more complicated.

The decentralized and often volatile nature of crypto adds layers of complexity that can leave even the most diligent taxpayers scratching their heads. From tracking every trade and transfer to ensuring compliance with constantly changing regulations, managing crypto taxes can feel overwhelming. This is where crypto tax software comes in.

Designed to simplify the process, these tools can automatically track your transactions, calculate your gains and losses, and generate accurate tax reports, taking the burden off your shoulders. Koinly is one such tax service provider.

In this Koinly review, we'll show you how to use Koinly, and highlight its features and benefits.

Review Summary

Koinly is a comprehensive crypto tax software that simplifies the complex process of managing cryptocurrency taxes. With automated transaction tracking, integration with over 400 exchanges and wallets, and support for various tax formats and countries, Koinly ensures accurate and efficient tax reporting.

The Key Features of Koinly Are:

- Automated crypto tax reporting

- Integrations with over 400 crypto exchanges and wallets

- Real-time tracking of crypto transactions and gains/losses

- Tax reports for over 100 countries, including the US, UK, Canada, and Australia

- Supports multiple accounting methods, including FIFO, LIFO, Highest Cost, Average Cost Basis, and more

- Comprehensive reporting of taxable events, including trades, transfers, airdrops, forks, DeFi income, and mining

- Integration with popular tax software like TurboTax and TaxAct

- Ability to import data from CSV and Excel files

- Cryptocurrency portfolio tracking and analytics

- Supports tax formats such as Form 8949, and can populate figures for Schedule D

- Distinguishes income from different sources such as staking, mining, lending, etc.

- User-friendly interface

Looking for more options? Check out our top picks for the best crypto tax software.

| Headquarters: | London |

| Year Established: | 2018 |

| Regulation: | N/A |

| Countries Supported: | USA, UK, Canada, Australia, Sweden, Norway, Ireland and 20+ other countries for specialized tax report generation. General tax reports are available for 100+ countries. |

| Cryptocurrencies Supported: | 20,000+ |

| Platforms Supported: | 400+ exchanges, 100+ wallets |

| Beginner Friendly? | Yes |

| Used By: | Retail traders, crypto investors, accountants, businesses, and accountancy firms. |

The Problem With Crypto Taxes

If you are new to the world of crypto and taxes, it can be an absolute minefield. To start off, there is no "one rule" to govern all your transactions, and crypto is classified differently in different countries.

Some jurisdictions classify crypto as property, some as "miscellaneous," while others consider it a commodity or "intangible property." How it is classified changes whether the tax will be treated as capital gains tax or income, and this is just on the personal side. If your business deals with cryptocurrencies in any capacity, either as a service, to accept payments, or if you are trading as part of a business activity, now you have opened up a whole new dimension of the proverbial "can of worms."

Tired of Looking Like This While Figuring Out Taxes? Koinly can Help. Image via Shutterstock

Tired of Looking Like This While Figuring Out Taxes? Koinly can Help. Image via ShutterstockAnd if that isn't complicated enough, consider all the different ways one can earn some form of profit on crypto, many of which are taxed differently. Here are some examples of events that are taxable in many countries:

- Selling crypto for fiat at a profit or loss.

- Exchanging digital assets on a DEX or centralized exchange- Yup, even swapping an altcoin for another altcoin or Bitcoin can trigger a tax event. You need to know the fiat value of the tokens at the time of swap, which is where crypto tax software comes in handy.

- Receiving airdrops- Yes, apparently this is “income” in many countries.

- Sale of NFTs- This can trigger capital gains, or income tax depending on the nature of the income.

- Earning income from Blockchain and P2E games.

- Staking income.

- Providing liquidity or yield farming- Any APY earned may be considered income.

- Using CeFi lending platforms like Nexo, an exchange, or DeFi lending protocols like Compound Finance or Aave.

- Crypto mining.

- Using crypto debit cards.

- Earning rental/advertisement income from digital land or renting NFTs.

What I am driving at is that the problem with crypto taxes is that it's complicated and there are many factors to consider. These distinctions matter because they determine how much tax you have to pay on each transaction.

To avoid trying to figure all this out yourself and risk making a mistake which can lead to fines or even jail time, I highly recommend a crypto tax software like Koinly.

How Koinly Solves the Crypto Tax Problem

Koinly makes crypto tax reporting easy. As mentioned, crypto taxes can be incredibly complex and difficult, and without a tool like Koinly, it can take hours to put together all the transaction data needed to prepare your crypto tax report documents.

Consider the following scenario:

If you use a decentralized exchange (DEX) to swap one token for another, you may have to pay a gas fee to execute the transaction on the blockchain, a liquidity provider fee to access the pool of tokens on the DEX, and a protocol fee to support the development of the DEX. Each of these fees can affect your cost basis and capital gains or losses.

DeFi transactions can also generate income that is taxable. For example, if you provide liquidity to a DEX by depositing your tokens into a pool, you may receive a share of the fees collected by the DEX as well as governance tokens that represent your voting rights in the protocol. Both of these rewards may be taxable as income at their fair market value when you receive them.

DeFi transactions can be challenging to track and report because they may not be recorded by your exchange or wallet. It is also highly doubtful that you will receive forms or statements from the DeFi protocols themselves for tax reporting purposes. That’s why it’s important to use crypto tax software that can help you identify and calculate your DeFi transactions accurately.

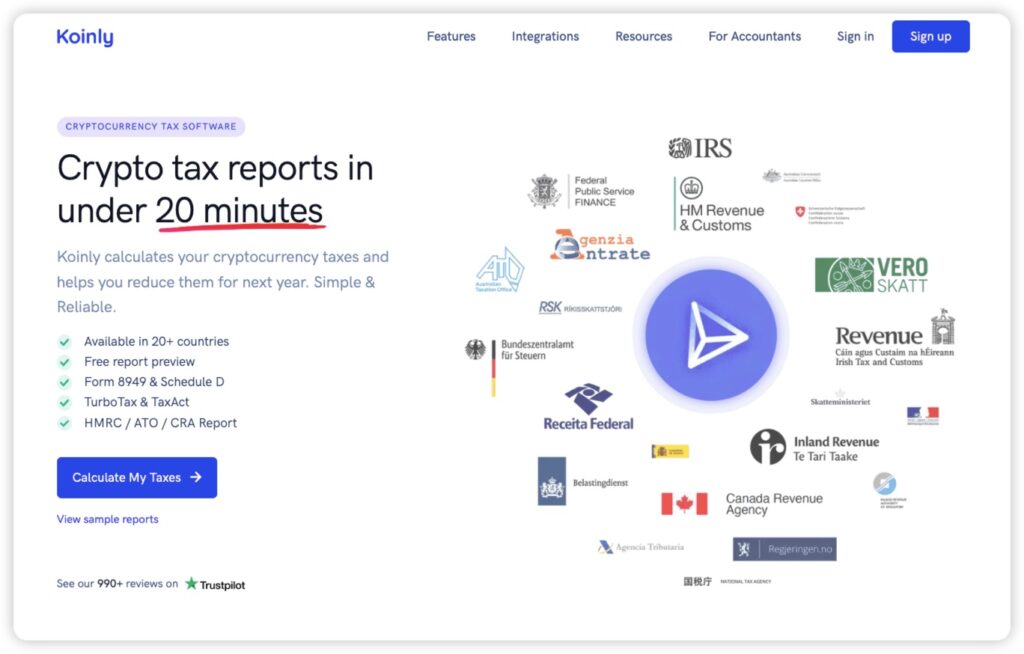

A Look at the Koinly Homepage

A Look at the Koinly HomepageDue to the inherent complexities surrounding all the different events that may or may not trigger taxable events, and the different ways they are categorized, trying to do crypto tax on your own manually also exposes the user to a significant risk of mistakes and overpaying taxes. Koinly ensures accuracy and compliance when tax time comes around.

What is Koinly and How Does it Help with Crypto Tax Solutions?

Koinly is a crypto tax software that helps you manage and automate your crypto taxes, and is also a very valuable portfolio tracking instrument. It provides a comprehensive set of tools and features to help users accurately calculate their crypto taxes, while also providing an easy-to-use interface.

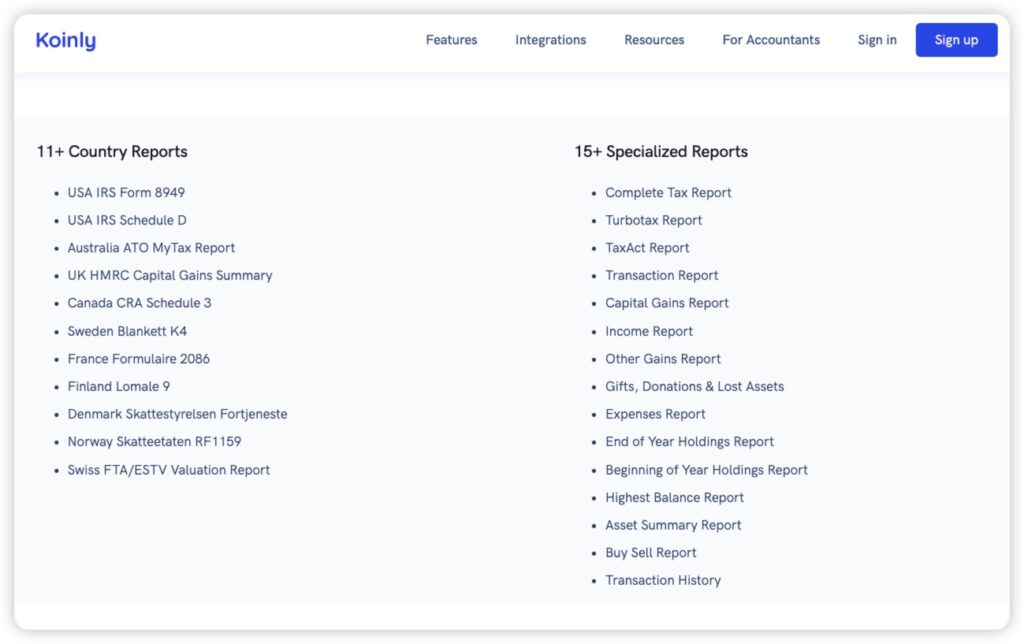

Koinly Key Features Image via Koinly

Koinly Key Features Image via KoinlyPerhaps the best thing about Koinly is that it can directly integrate with most crypto exchanges and wallets, even self-custodial and DEXes to import crypto activities automatically, saving you hours, if not days of work.

When I say days, I'm not exaggerating either. Many other crypto traders and users, myself included, would literally spend days scouring through crypto transactions like trades, staking, lending, etc, across various DEX and CEX platforms, making sure we were recording proper data. Then it got worse when I started using multiple different crypto debit cards and learned that thousands of purchases I had made over the year could also constitute taxable events, so yeah, tax season was a nightmare before knowing about tax tools like Koinly.

In fact, I've met crypto users who despise trying to figure out crypto tax so much that they even uprooted their lives to relocate to crypto-tax-friendly countries. Using Koinly is probably a more rational solution than immigrating, but if you are looking for sunnier horizons or more tax-friendly jurisdictions, you may be interested in checking out our Top Crypto Tax-Friendly Countries article.

On that note, if you are considering relocating to avoid taxes, or you are just looking for a little adventure, feel free to book a call with our friends from Offshore Citizen to plan and execute your move legally. They help with residency permits, bank accounts, company structures, etc.

Back to taxes, with Koinly, you can easily track all your cryptocurrency transactions, generate detailed reports for tax filing, and even get tax advice tailored to your individual needs. With its powerful features and user-friendly design, Koinly is the perfect choice for those looking for a reliable and efficient solution to their crypto tax problems.

How Does Crypto Tax Software Work?

Crypto tax software simplifies the computation, calculation, processing, and collection of crypto transactions and enters the data with the appropriate tags and classifications and can populate that information into the appropriate tax forms.

The programs can help individuals and businesses calculate and report on their cryptocurrency activities such as trading, mining, staking, selling, lending, and more. The process is done by connecting the software to a user's crypto wallets, exchanges, and DeFi platforms, and the information is automatically synchronized via API keys. If API keys are not available, the user can also export the data into a CSV file to upload into the tax software.

Once the data is collected in the crypto tax software, depending on the platform, the user can go ahead and file their taxes, generate a report that can be used in a tax filing tool like TurboTax, or forms can be printed and sent to an accountant.

Features & Benefits of Koinly for Crypto Investors

As Koinly automatically imports and organizes your crypto transactions, and the software is updated for compliance so it stays up to date with the constantly evolving regulatory environment, using Koinly ensures that users are not overpaying any unnecessary taxes on crypto investments or violating tax obligations.

Supported Countries. Image via Koinly

Supported Countries. Image via KoinlyThe software is also capable of automatic tax loss harvesting and using capital losses to offset capital gains for maximum tax efficiency.

Portfolio Tracking

With Koinly, users can track their crypto assets and performance across multiple platforms. It is common for crypto users to have digital assets spread all over the place, from different wallets and platforms to exchanges, making it impossible to track your portfolio's performance. Koinly provides an all-in-one dashboard view showing your total crypto asset position.

The portfolio tracking feature is useful as it can calculate your actual ROI across all holdings, growth over time, and provide an overview of any mining, staking, lending income, and more.

Data Import

Koinly wouldn't be very useful if it didn't support automation and mass data import, now would it? Instead of having to go back and forth between every platform you store crypto and enter every single data point, users can sync their data to Koinly and mass upload files for anything that cannot be automatically synced.

Supporting over 20k tokens, 170 chains, 400+ exchanges, wallets and services, here is what can be done:

- Connect accounts via API and add wallets using x/y/zpubs and ETH tokens using your public address.

- Track margin trading on centralized exchanges

- Automatically tag "income" from imported sources coming from platforms like Nexo, Compound, Aave, etc.

- Smart Transfer Matching- Koinly has an AI detection tool and can detect transfers made between your own wallets to exclude them from tax reports.

With automated data input, the software further eliminates manual effort by recording the date of the transaction, the number of tokens in the transaction and the price of the transaction.

Cryptocurrency Tax Reports

Once all the data has been collected, Koinly allows users to preview their capital gains and losses, along with some other tax reports for free, and generate the appropriate tax documents when the user is ready. Here are some of the tax reports available:

- Form 8949, Schedule D. For US users, Koinly can generate filled-in IRS tax forms on your behalf.

- International tax reports for the USA, Canada, UK, Germany, Sweden, Brazil, and 100 other countries. Localized and specific tax reports are available for 20+ countries.

- Tax reports suitable for users looking to declare taxes in any country that uses these accountancy methods: First In First Out (FIFO), Last In First Out (LIFO), Highest Cost, Average Cost Basis, Shared Pool, or PFU.

Image via Koinly

Image via KoinlyKoinly tools also make error reconciliation easy thanks to its double-entry ledger system. Every change in your asset balances is backed by an entry so any mistakes can be identified and rectified quickly and easily. The software will also highlight and flag any missing transactions or errors that arise from importing, so you have that double-check to make sure everything is good to go. The tool is also smart enough to identify and remove duplicate transactions, saving you the worry of duplications if you are importing data from multiple sources.

How to Use Koinly

You'd think that signing up and using a tool as comprehensive and robust as Koinly would be difficult and only suitable for advanced users, but you'd be more wrong than those who still believe Bitcoin transactions are anonymous and a tool only used by criminals. 🤦

Koinly is surprisingly user-friendly and easy to get set up and running. You don't even have to be an accountant or know anything about taxes to benefit from it. The web-based platform is accessible from any computer and any browser, and there is no specialized software that needs to be downloaded. They have a "how to" video and step-by-step guide on the Koinly Help Site, but I will also summarize here:

Step 1

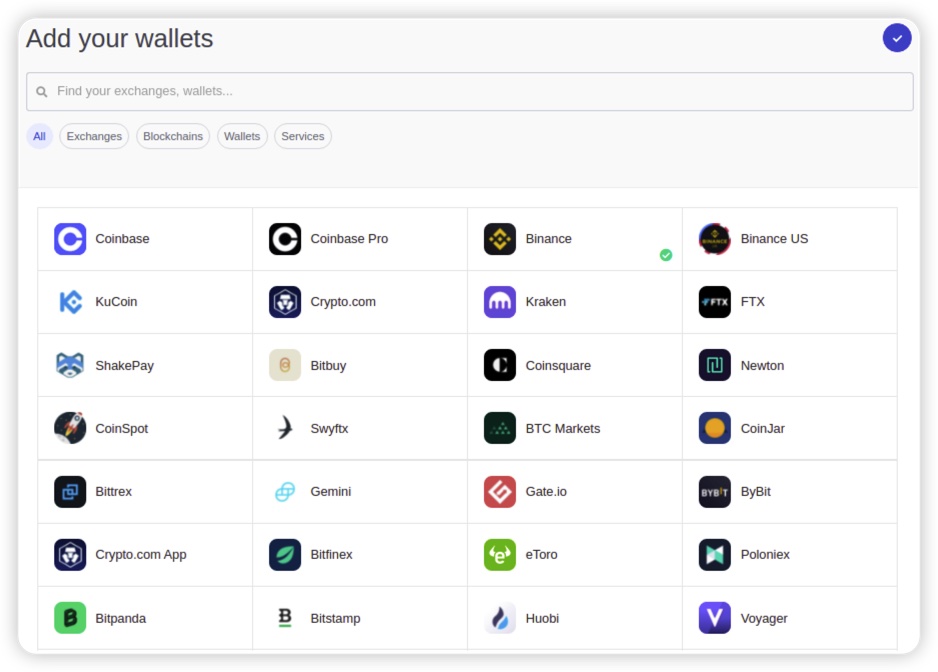

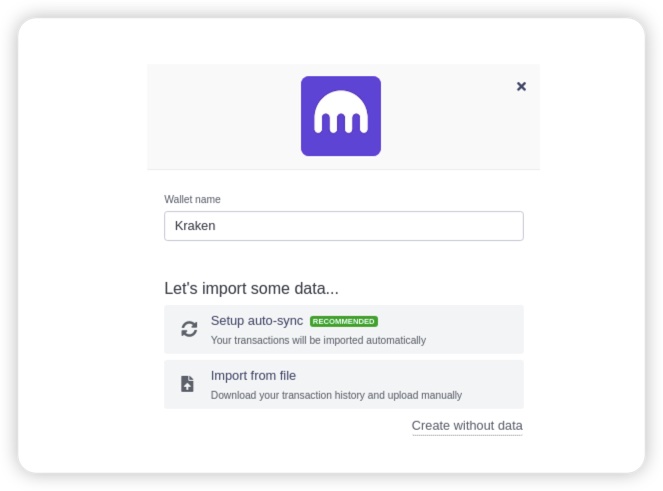

The first thing you will want to do is add all your wallets, exchange platforms, lending services, etc. This is done in the "Add Wallets" section. Note that everything in Koinly is referred to as a "wallet" when connecting platforms.

Add Your Wallet or Exchange. Image via Koinly

Add Your Wallet or Exchange. Image via KoinlyStep 2

This is the fun part, importing your data. Once you have selected the platform from step 1, you will be able to choose how you want to import your transactions. Importing data can be done simply either API keys or through x/y/zpubs and/or wallet addresses. Here we can see the option for importing data from Kraken. Check out that auto-sync option. Could it be any easier?

Auto-Sync Many of the Top Exchanges. Image via Koinly

Auto-Sync Many of the Top Exchanges. Image via KoinlyMost major exchanges have the auto-sync feature that uses API keys to seamlessly integrate the exchange with Koinly.

Step 3

Now you will need to wait for Koinly to do its thing so you will be on a loading screen for a while. What Koinly is doing is fetching market prices, matching transfers, identifying transactions, and calculating capital gains.

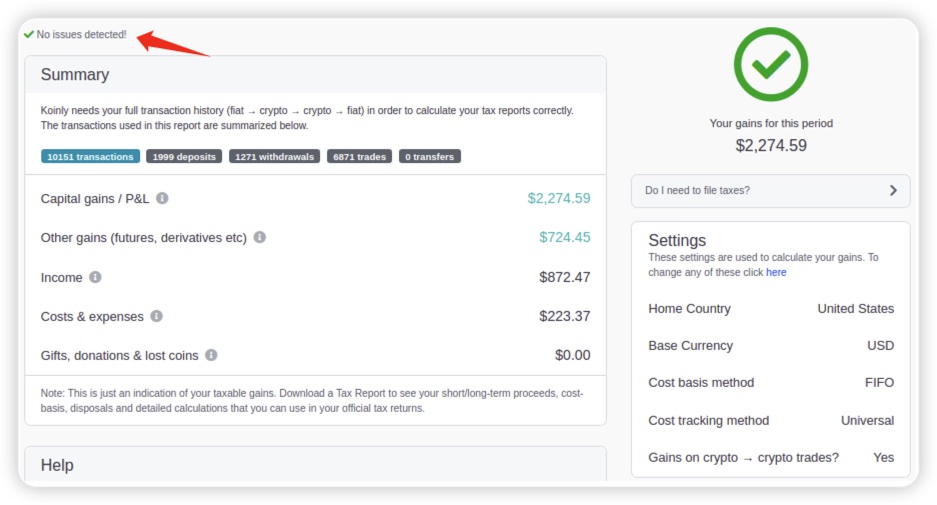

Step 4

Once the tax tool is done "thinking," you will be able to navigate to the Tax Reports page to see a summary of your gains and income for the tax year.

Image via Koinly

Image via KoinlyBe sure to keep an eye on the top where it says "No issues detected." If there are issues, you will want to make sure they are rectified. Koinly has self-help articles for common issues and their customer support team is really efficient if you get stuck.

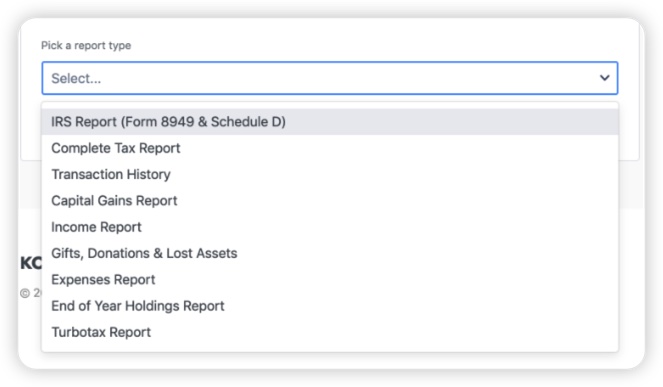

Looking at the report, you will be able to scroll to the bottom and select one of the download options available, or simply download as a CSV, Excel, or PDF file.

Select the Report You Would Like to Generate. Image via Koinly

Select the Report You Would Like to Generate. Image via KoinlyAnd that is it. From here you can either send this tax report off to your accountant or log into your tax preparation software like TurboTax and upload the document, job done. 🤓

Who is the Best Fit for Koinly?

Koinly is a tool that anyone who dabbles in cryptocurrency can use, from those who simply hodl, to advanced and professional users who frequently trade, run a business, or dive into the complexities of DeFi.

This tax software is used by retail traders, accountants, businesses, and accountancy firms alike, there isn't anyone that Koinly isn't suitable for. For anyone who finds crypto taxes overwhelming, Koinly also has a team of experts who are more than happy to walk you through the whole process to make sure you are confident with your tax responsibilities.

The Pros & Cons of Using Koinly vs Other Crypto Tax Software

There are multiple cryptocurrency tax softwares available that aim to fulfil the same need as Koinly, but there are two that I would say stand out above the rest. Those two are Koinly and CoinLedger (previously called Cryptotrader.tax).

The reason I feel these two are the best crypto tax software tools is that they have been in the industry a long time and the teams aren't just "crypto bros" designing software to try to help with crypto taxes. Both companies have worked closely with tax professionals to ensure that the platforms are as accurate and compliant as possible. Both companies also have tax professionals on the payroll, so users can be confident these platforms are updated to reflect the latest cryptocurrency regulations and requirements.

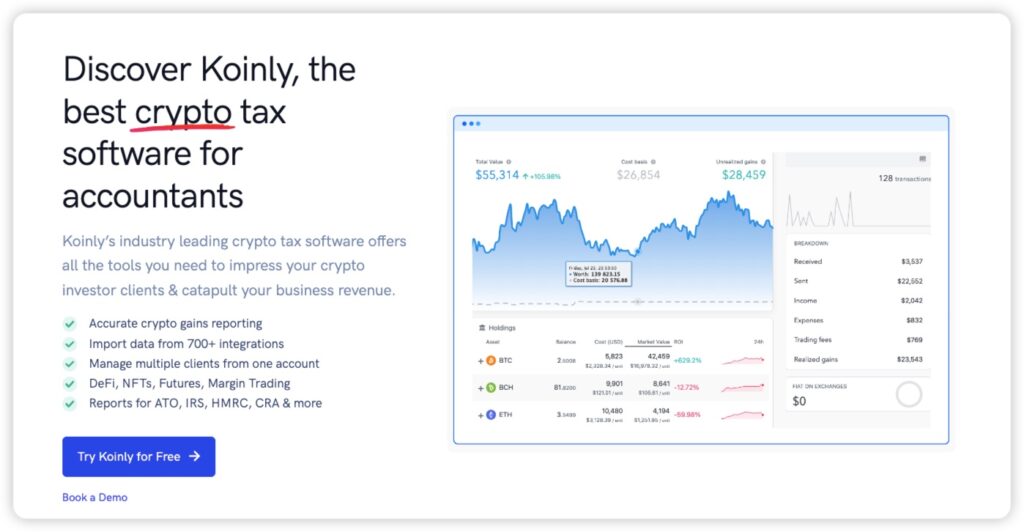

Both platforms also have certified accountants on hand to help users with any tax questions or issues they may have, which is a huge plus. Both CoinLedger and Koinly are also trusted by hundreds of thousands of users worldwide, not just retail users, but professional accountants and businesses as well.

Either of these platforms is more than suitable for any retail or business user, but I would have to give Koinly the edge for accountants as they have dedicated tools and resources available to help accountants grow their business and take on crypto clients as well.

Koinly is the Tool of Choice for Tax Professionals. Image via Koinly

Koinly is the Tool of Choice for Tax Professionals. Image via KoinlyIn all honesty, I can't really come up with any cons to using Koinly over most crypto tax software. The cost is reasonable, there is a free version, and the platform delivers very well on what it promises. If you are interested in exploring other tax software, we compare the top crypto tax tools in our Top Tax Tools article.

If you prefer video format or are interested in Guy's take, here are his favourite crypto tax tools:

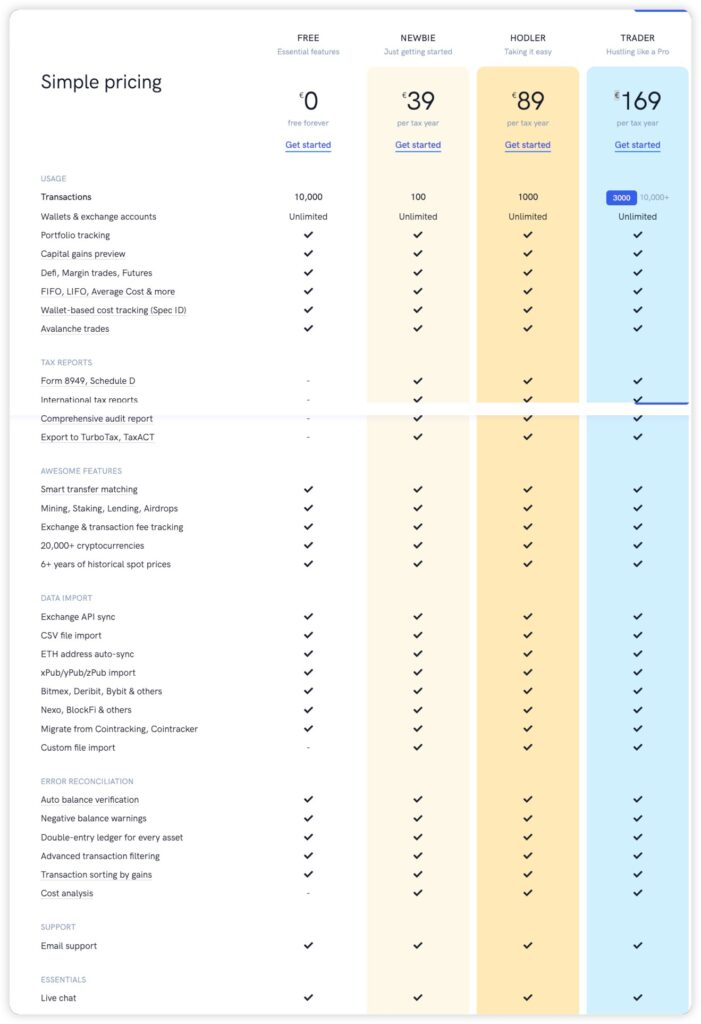

Koinly Fees

Koinly has a tiered fee structure ranging from free to €169 per year depending on usage and needs of the user. The free version is great for lite users who only need portfolio tracking and previews, then the prices increase as the user needs get more complex. Here is a look at the features that are available with each price level.

Image via Koinly

Image via KoinlyConclusion

Koinly is a fantastic tax tool that makes crypto tax management as easy as possible, providing one of the most comprehensive platforms available that can provide solutions to meet the needs of any crypto user.

The Koinly team has years of experience in the field of finance and accounting, as well as crypto, and this is evident in the platform developed that is trusted by both regular users and tax professionals around the world. I wouldn't hesitate to recommend Koinly to anyone who is looking to make tax season as painless as possible.

👉 Sign up to Koinly and get your taxes done in minutes with ease!