I don’t know if there has ever been more of a polarizing love/hate relationship with anything in history than there is with Ethereum.

Every time I think about Ethereum, the potential, the future, the incredible projects building on it, and how the future of global infrastructure and freedom through decentralization is being built on it, I can’t help but feel all warm and fuzzy. As my bio states, I feel that Bitcoin and projects like Ethereum are humanity’s best chance at escaping a future that is starting to look more and more Orwellian by the year. So yes, I love Ethereum.

But… Then I go to move my ERC-20 assets, withdraw them from an exchange to keep them safe in my hardware wallet, or get nightmarish flashbacks from thinking about the insanely high gas fees during the 2021 bull run, the slow confirmation times, and the oh, so dreaded, “stuck” transactions, then I hate the network and wish another protocol like Cardano, NEAR, or Avalanche were in Ethereum’s spot instead.

We all know that Ethereum has a lot of issues that need to be worked out, leaving many to believe it is only a matter of time before an “Ethereum killer” will come along with better, faster, and cheaper tech, causing Ethereum to go the way of the dinosaur. Ethereum’s troubles have led to the need for layer two scaling solutions and sidechains like Arbitrum, Polygon, and Optimism, which we will be reviewing today.

So, with Optimism providing a much-needed solution to Ethereum’s woes, can it provide any optimism about the future of Eth? Let’s find out.

Optimism Summary:

| Headquarters: | New York Website: www.optimism.io |

| Year Established: | 2019 |

| Regulation: | None |

| Token: | OP |

| Token Use: | Governance |

| Fees: | Average gas fee: $0.08 (lowers Ethereum Gas fees by 70x on average) |

| Security: | Very high- Leverages the security of the Ethereum network along with self-built security protocols. |

| KYC/AML | N/A |

What is Optimism?

Optimism (OP) is a layer-two scaling solution blockchain built on top of Ethereum. Optimism provides benefits to the Ethereum mainnet by using Optimistic Rollups, a scaling solution that relies on off-chain computation to trustlessly record transactions while still relying on the security of Ethereum. We will cover Optimistic Rollups in the next section.

A Look at the Optimism Homepage.

A Look at the Optimism Homepage.Optimism is one of the largest scaling solutions for Ethereum already with over $1 billion in On-chain value and over 70 protocols utilizing the scaling technique such as Synthetix, Aave, Uniswap, Velodrome, and more.

The Optimism chain can be added to MetaMask, or other popular wallets, and tokens can be bridged from Ethereum onto Optimism for faster and cheaper transactions. In Optimism's own words:

Image via optimism.io

Image via optimism.ioExperience Ethereum at 10x speeds and turbocharge it? Sounds good to me.

Optimism has been designed around four core tenets to make it unique:

- Simplicity

- Pragmatism

- Sustainability

- Optimism

Simplicity is self-explanatory. With just a few lines of code, developers can build on top of Optimism while largely trusting the security and infrastructure of the Ethereum Mainnet. Devs can use proven Ethereum code and the ETH infrastructure whenever possible, making the transition to Optimism incredibly simple.

The OP ecosystem emphasizes pragmatism and is encouraged by real-world use cases and needs. Optimism aims to continue to build, develop and evolve, implementing features like Ethereum Virtual Machine (EVM) compatibility eventually.

The design process is further developed around the idea of long-term sustainability and not cutting corners to scalability as we have seen with other projects we know who shall not be named. Hint, their network seems to go down every other week and the name rhymes with Scholana.

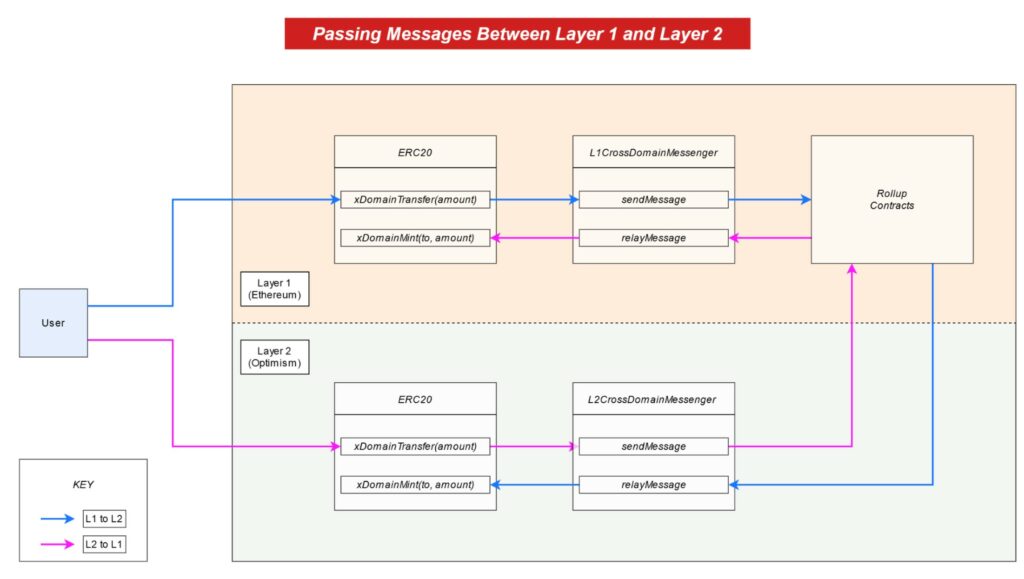

With Optimism, blocks are constructed and executed on the Layer 2 (L2) OP network, and user transactions are batched up in groups and submitted to the Layer 1 (L1) which is Ethereum. Because it is a layer two, Optimism has no mempool, and transactions are immediately accepted or rejected into the block, guaranteeing a seamless user experience.

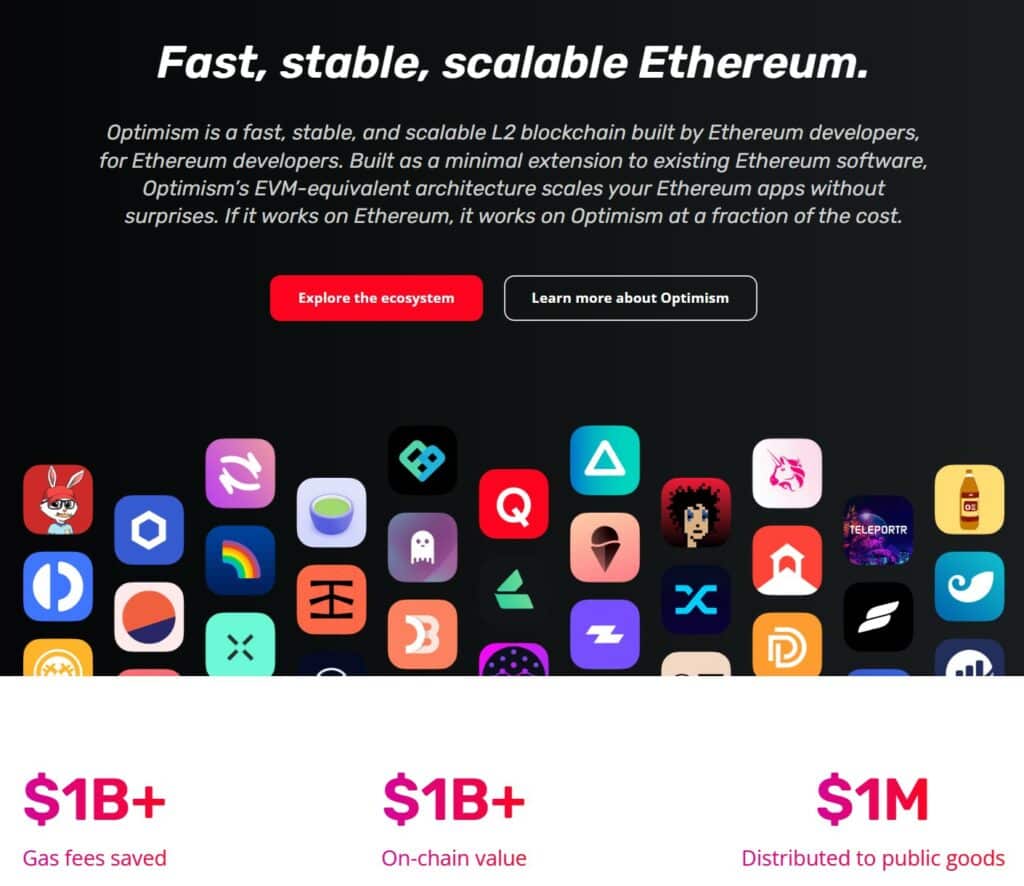

Optimism makes Ethereum Fast, Stable, and Scalable. Image via Optimism

Optimism makes Ethereum Fast, Stable, and Scalable. Image via OptimismOptimism is led by the Optimism Foundation and is governed by its OP token, which is used to vote on governance proposals for the network. Here are some of the boasting rights of what Optimism has achieved in just one short year after its mainnet launch:

- Saved users over $1.1B in gas fees

- Deployed over 6,800 contracts

- On-boarded over 300k unique addresses

- Secured over $900M of value

- Facilitated over $17.4B in transaction volume

- Generated over $24.5M in revenue

- Donated over $1M to public goods funding

OP Mainnet

As part of its "superchain" vision, the company rebranded its Optimism chain to OP Mainnet, an EVM equivalent Optimistic Rollup chain that's designed to be fast, simple, and secure. The company said this new name will help differentiate between the blockchain and the collective ethos associated with Optimism.

The superchain goal seeks to integrate otherwise siloed L2s into a single interoperable and composable system. To that effect, Optimism welcomed a new entrant to its ecosystem: Coinbase, which joined as both a core developer of the OP Stack codebase, and as a new L2 blockchain built on it, called Base.

In the near term, this collaboration strives to upgrade OP Mainnet, Base, and other L2s to an initial Superchain structure, with shared bridging and sequencing. (Source)

Optimism Funding

According to Crunchbase, Optimism has held 3 funding rounds totaling $178.5 million:

- Seed round: $3.5 million (CoLab Ventures)

- Series A: $25 million (Andressen Horowitz, Paradigm)

- Series B: $150 million (Andressen Horowitz, Paradigm)

Andressen Horowitz also invests under the name A16z, this firm along with Paradigm are two of the most highly respected VCs in the crypto space and are generally known for investing in projects with big potential. A thumbs up from these guys instantly perks my interest in a project.

Alright, now that you know some background about the project, let’s tuck into what Optimistic Rollups are and how they work from a non-technical perspective.

What are Optimistic Rollups?

Optimism implements advanced data compression techniques called Optimistic Rollups, which speed up and cut the cost of Ethereum transactions. Optimism keeps things simple, relying on the lowest number of moving parts and ensuring that there is little that can go wrong when they created their scaling solution for Ethereum.

By keeping code as simple as possible, OP improves the efficiency and speed of the Ethereum transactions and makes it more user-friendly for developers.

Periodically, the system publishes a Merkle root of the transactions that happen within the rollup in order to update the “state” of the rollup on the main underlying blockchain. Networks of external validators then check the Merkle root to ensure they are correct before the state is updated at a future time.

A Diagram Showing How Optimistic Rollups Work. Image via Paradigm Research

A Diagram Showing How Optimistic Rollups Work. Image via Paradigm ResearchIf there are any inconsistencies, a validator can publish a fraud-proof during the dispute period, which can cause the state of the system to be rolled back to the previous valid state to ensure only valid transactions are pushed to the Ethereum network.

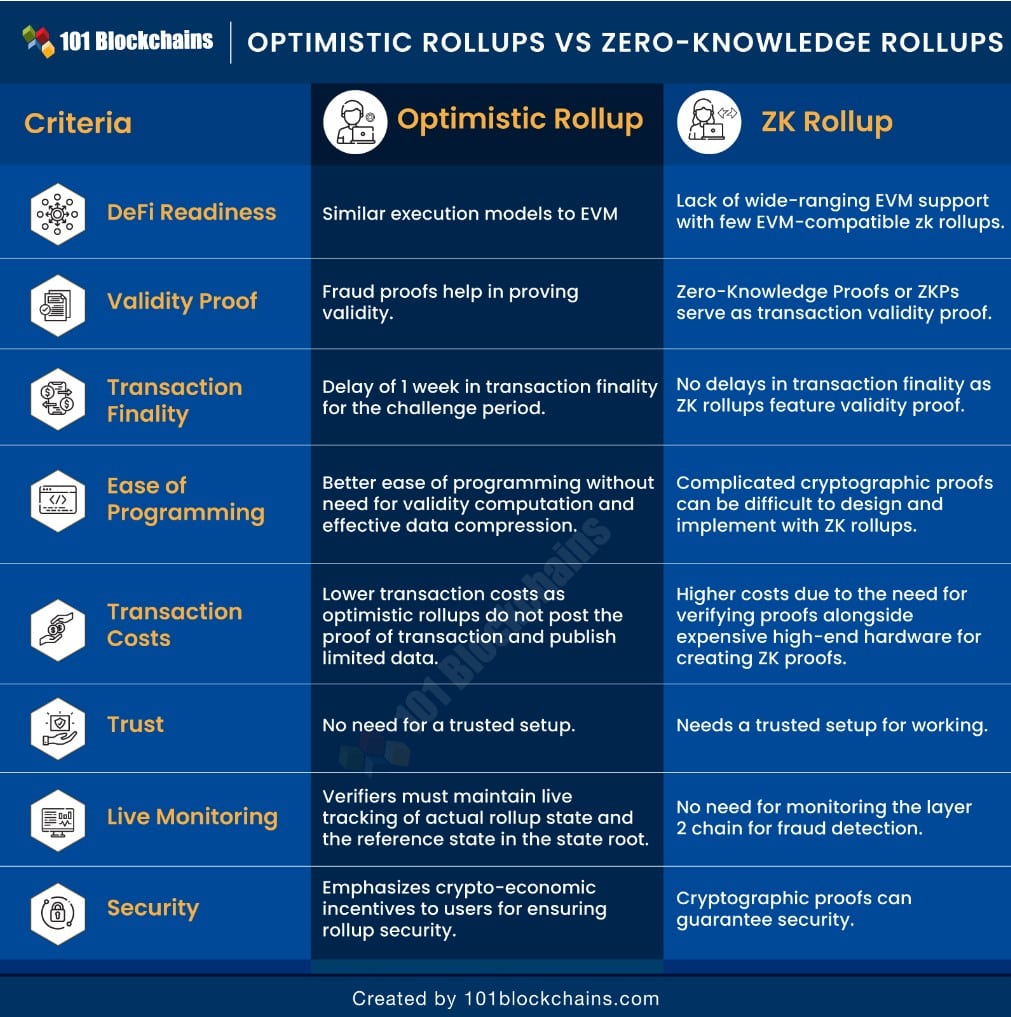

There are two main types of Ethereum scaling solutions that use rollups, the Optimistic Rollups used by Optimism, and Zero-Knowledge Rollups, or ZK rollups for short. There are also other scaling solutions such as sidechains like we see with Polygon, Plasma, and others.

Here is a great image from 101 Blockchains showing the key differences between Optimistic and ZK Rollups:

Image via 101 Blockchains

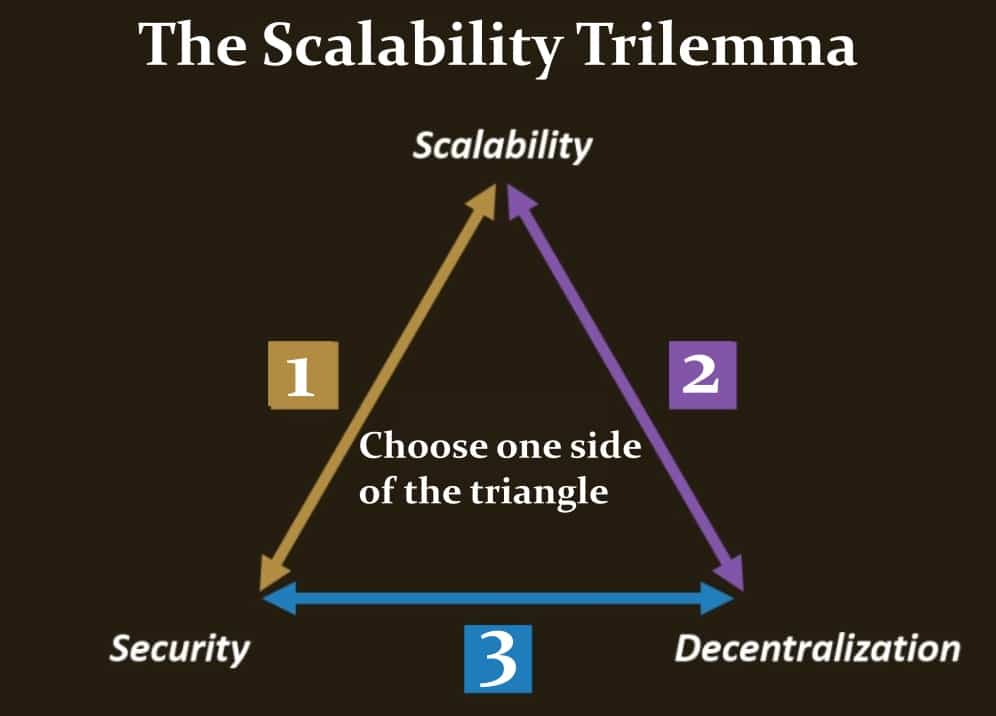

Image via 101 BlockchainsLow latency and high throughput under resource limits are the two most challenging difficulties in the Ethereum ecosystem today. The ability of the weakest node in the network to check the system’s rules determines the system's decentralization while scalable refers to how high performance a protocol can be.

These are part of the issues that make up what is known as the “scalability/blockchain trilemma” of blockchain. The scalability trilemma is an issue that plagues every layer one network, including Bitcoin. You can learn more about the trilemma and how Algorand is one of the most advanced layer one networks and the only network to claim they have solved it in our Algorand review.

The most advanced networks from a scalability perspective are the likes of Cardano and Algorand, which use complex cryptographic scaling solutions built within the core architecture, while networks like Ethereum need to rely on the layer two solutions introduced earlier in this article.

The major downside to Optimistic Rollups is the time it takes for layer 2 users to be able to withdraw funds back to the underlying blockchain. Because Optimistic Rollups have to rely on external validators to check the Merkle roots for authentic and valid transactions before the state can be updated, there needs to be a sufficient amount of time for all the activity to be checked by the validators.

The major advantage of Optimistic Rollups is that they are more generalist and can support smart contracts in a similar way to the underlying smart contract-enabled blockchain, making native support for smart contracts within the rollup easier without the need for additional development.

Here are the pros of Optimistic Rollups:

- High computational flexibility

- Turing-complete and can be used with the Ethereum Virtual Machine

- Scalable- can significantly increase Ethereum’s TPS without sacrificing centralization

- Trustless- Data is kept on chain, no need to trust off-chain data providers

- Better user experience

Here are some of the cons to Optimistic Rollups:

- Compared to other layer 2 solutions like Plasma and ZK Rollups, OP Rollups have less throughput

- Some concerns regarding security have arisen

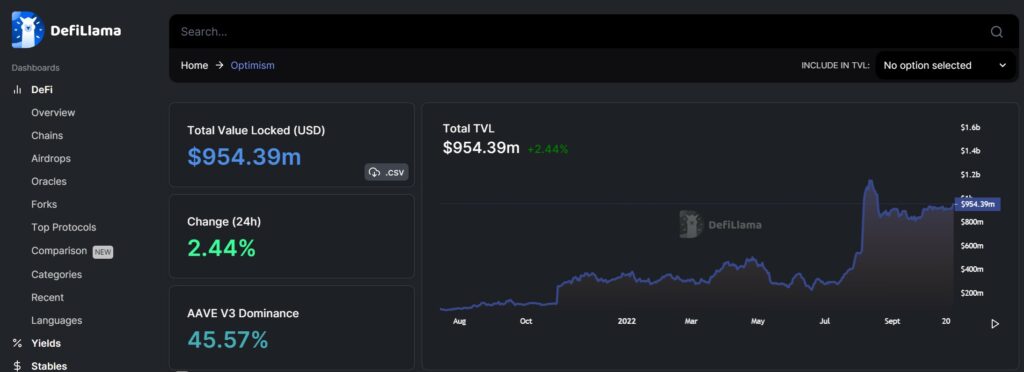

Turning our attention to DeFi Llama, we can see that the current TVL on the network is sitting at just under 1 billion dollars, with its peak at the $1.2b mark in August 2022.

Image via DeFi Llama

Image via DeFi LlamaIt’s clear to see that the network has seen impressive adoption over time and sustained growth, and perhaps, most interesting of all is that the network has not seen an extreme drop in TVL as we encroach further into the depths of the bear market as many networks have experienced.

That sums up a very brief, non-technical high overview of how Optimistic Rollups work. If you are technically inclined and want to dive deeper, here is an article from Paradigm Research that goes into technical detail.

Guy also has this fantastic video where he covers various Ethereum scaling solutions:

Optimism Review: Milestones and the Future

Optimism recently published the launch of a trust-minimized Ethereum-native conditional transaction system called Drippie. Drippie is a programmable Web2 service that can combine different triggers with actions and allows users to execute transactions under certain conditions.

According to Optimism, Drippie aims to address automation problems with on-chain activity, which will increase the performance of the Optimism blockchain.

In July 2022, Curve Finance submitted a proposal to increase the liquidity of the Optimism network, increasing the useability and adoption of the network while consequently affecting the OP token. The proposal saw one million OP tokens to be distributed over 20 weeks on the Curve pool, incentivizing liquidity providers to the protocol.

2022 was a busy year for Optimism as they also rolled out Optimism Bedrock.

Image via dev.optimism

Image via dev.optimismBuilding on the already existing and powerful roll-up technology used by Optimism, Bedrock made it cheaper, faster, and more advanced, introducing the following features:

- Calldata Submission Optimization- Going beyond simple data compression to provide users with the cheapest transactions possible.

- Consensus/Execution Client Separation- Following in the footsteps of Ethereum, Optimism can seamlessly integrate the cost-minimizing EIP-4844

- Microscopic Client Diff- Opening the door for alternative client implementations provides Optimism users with an extra layer of security.

- Fast peer-to-peer networking- Including support for Snap Sync, which makes running an Optimism node easier than before and sets the stage for decentralized sequencing.

- Faster Deposits- Deposit time decreased from 10 min to 2.5 min

- Smarter Sync, Sequencing, and State Submission- Guarantees that Optimism can remain stable in all Ethereum network conditions

Bedrock also laid the foundation for Optimism’s next-generation fault-proof system called Cannon. Collaborating with geohot, Cannon is an interactive fault-proving system designed to keep Optimism as secure as possible without removing any of the simplicity of the OP blockchain.

Thanks to Cannon, Optimism is the only rollup architecture capable of easily supporting multiple fault-proof and client implementations, which aims to remove upgrade keys from rollup fault proofs to be the first EVM-based rollup to achieve Ethereum-level security.

In October 2023, Optimism released the first version of its "fault-proof system alpha" on the OP Goerli testnet. Comprising a fault-proof program (FFP), a fault-proof virtual machine (FPVM), and a dispute game protocol, the system aims to combat malicious activity on the Optimism network.

Fault proofs are integral for preventing fraudulent transactions or errors in rollup transactions, a key security measure for optimistic rollups. The release sets the stage for the project's second stage of decentralization, allowing users to participate in a dispute game protocol. The system aims to achieve a permissionless transition of information between Layer 1 and Layer 2, facilitating secure and decentralized token movements.

The fault-proof system is open-source, and a bug bounty program is planned for increased community scrutiny.

In October 2022, Optimism introduced the OP Stack. Hold onto your boots cause this one is exciting.

Image via Optimism Blog

Image via Optimism BlogThe OP Stack is a modular, open-source blueprint for highly scalable, highly interoperable blockchains of all kinds. The OP Stack benefits the ingenuity of the entire Ethereum community, making it easier than ever for devs to build a blockchain of any kind while being able to depend and rely on Optimism and Ethereum.

This initiative from Optimism makes a bet that the future is neither multi-chain nor mono-chain, instead believing that highly integrated chains will form an emergent structure they refer to as a “Superchain.”

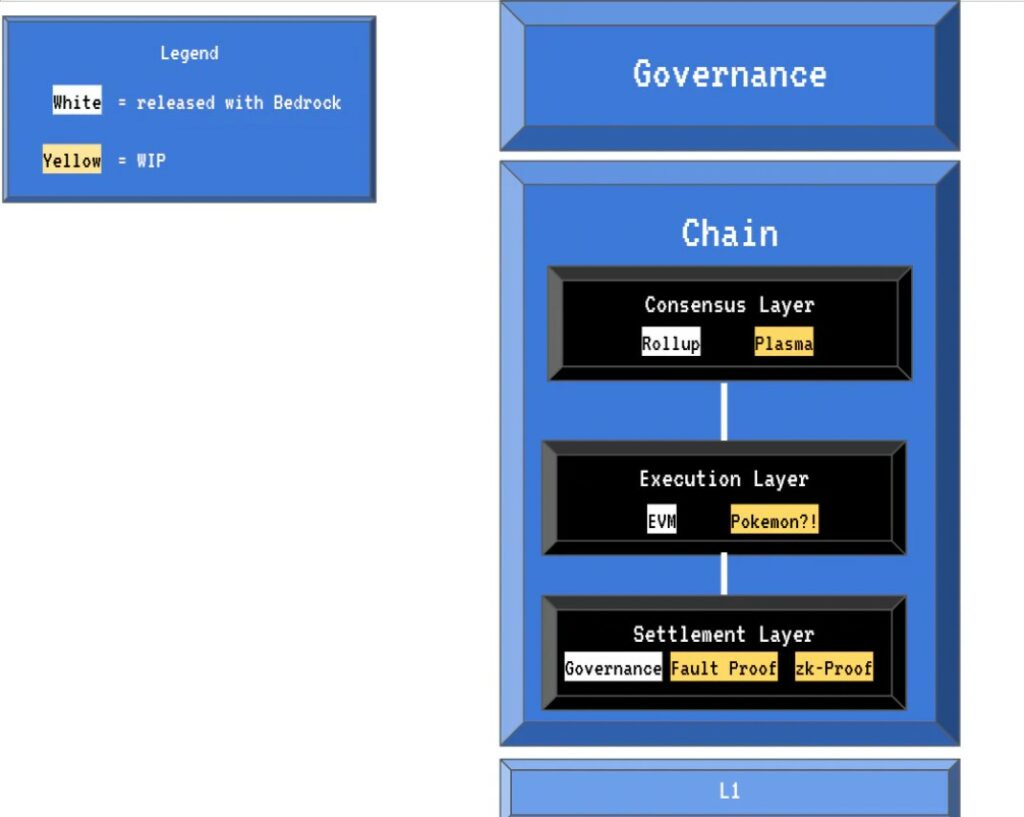

The OP Stack is a series of modules that work together to form coherent blockchains, each component implementing a specific layer of the stack. Here is an example of how it looks:

Image via Optimism Blog

Image via Optimism BlogAs I was writing this review, I had to read the section about the OP Stack a couple of times to truly grasp just how revolutionary this is. As a non-developer myself, these concepts can sometimes go straight over my head and can take a read or two to truly appreciate it, but here is why the OP Stack could be a real game changer:

The OP Stack makes creating a blockchain being similar to building with Lego, being able to mix and match different parts, functions and features. Every blockchain has its strengths and weaknesses, so why not take the strengths from each when building yours? Builders will be able to do things like swap out Ethereum for Celestia as the data availability layer, and even choose Bitcoin as the execution layer, whaaaat? That is awesome. The OP Stack is blockchain’s first realization of modular blockchain theory.

When looking into the future, to say that the Optimism team is insanely ambitious would be an understatement. They have their sights set on things like Bitcoin Rollups and furthering highly compatible L2s and L3s to build the future infrastructure for Ethereum.

Interoperability will be common and seamless as all these “op-chains,” will make up the greater “superchain” and gone will be the days of interoperability and segregated blockchains. But before you get too excited, this is many years away and as with most things in crypto, this is highly theoretical, and the entire tech space is evolving so fast that superior technology could toss all of Optimism’s ambitions out the window.

I will certainly be keeping a close eye on the project and team as this could very well be the bedrock foundation in which the future will be built.

Optimism Team

The Optimism project was started in 2019 by Founders Jinglan Wang, Karl Floersch, and Kevin Ho. The company is based in New York but is largely made up of team members from all over the world.

- Co-Founder and CEO Jinglan Wan is a successful investor and has participated in multiple Series A and B funding rounds for fintech companies, so he knows a good project when he sees it and has a good understanding of what it takes to build a successful business model.

- Co-Founder Karl Floersch is a NY-based blockchain engineer that worked with ConsenSys and as a researcher for the Ethereum Foundation. That is about as high as you can go for Blockchain devs, talk about an impressive resume.

- Co-Founder Kevin Ho was lead developer for blockchain protocol course Cryptoeconomics.study in Los Angeles before co-founding Optimism.

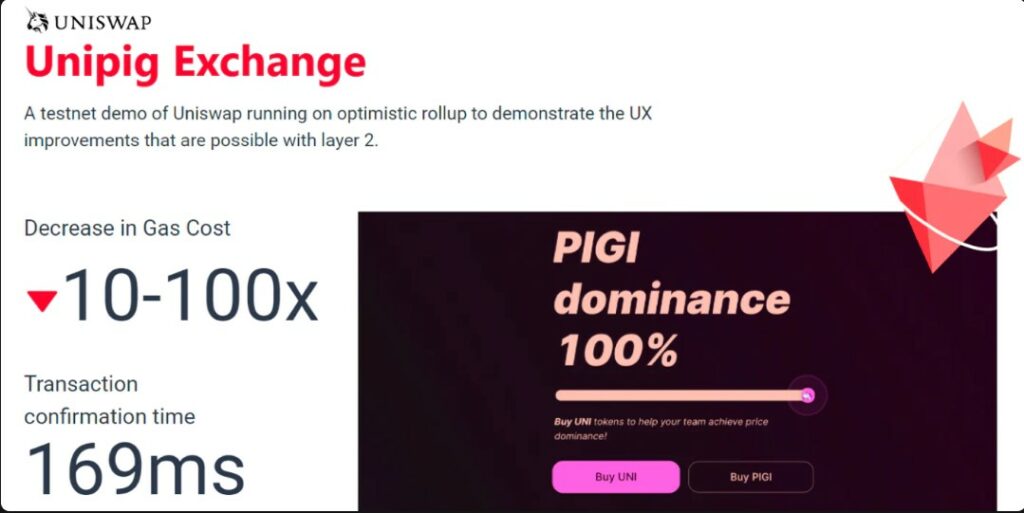

Optimism started its journey off with Unipig as a proof of concept. They essentially created a testnet demo of Uniswap, gave it a funnier name, and ran the DEX using the Optimism protocol with impressive results:

Image via Optimism Blog

Image via Optimism BlogThis essentially proved the concept of Optimistic Rollups and showed that gas costs can be decreased by up to 100x with lightning-speed transaction times.

After Unipig, the Optimism team launched another testnet in 2020, then a full mainnet launch in January of 2021. Optimism is led by the Optimism Foundation, a non-profit organization dedicated to growing the Optimism ecosystem. Optimism aims to become a fully decentralized public good that isn’t profit oriented.

Image via Optimism

Image via OptimismOptimism is largely funded by donations and grants. The foundation pledges to create an infrastructure that promotes the growth and sustainability of public goods. Dedicated to incentivizing positive impact by rewarding public good initiatives in blockchain is an altruistic endeavor by the Optimism Foundation…Good to see projects that are working for the greater good, a tip of the hat to the folks over at Optimism. 🙌

Optimism OP Token Use and Performance

The OP token is an ERC-20 token that launched in June 2022. The token allows holders to participate in the governance of the Optimism protocol and public goods funding. OP tokens are not needed to pay for gas as transactions are still paid in ETH, which gets transferred onto Optimism using a bridge.

The OP token provides value through the re-deployment of Sequencer revenue and contributes to a value ecosystem within the Optimism project. Optimism has gone through two successful security audits, which you can find the results for on the Open Zeppelin Blog. If you want to learn more about blockchain audits, what to look for, and why they are critically important, check out our article on Blockchain Security Audits.

The Optimism team states that the specific mechanisms and resource allocation are experimental at this stage and are likely to evolve over time, with holder governance currently being stewarded by the Optimism Foundation.

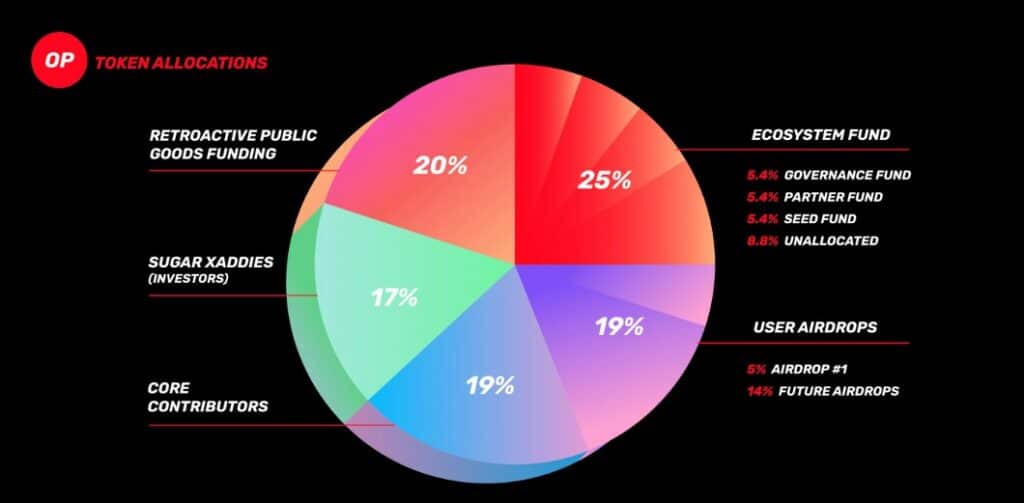

Here is a look at the distribution of the token

Image via Optimism

Image via OptimismIt is great to see that only 17% of the funds went to investors as any project where the investors are the primary token holders is a red flag as they are likely only concerned with profit and will dump on the community to pad their bank accounts first chance they get. A healthy sign is that a quarter of all tokens were allocated to the Optimism ecosystem, fuelling further growth and innovation.

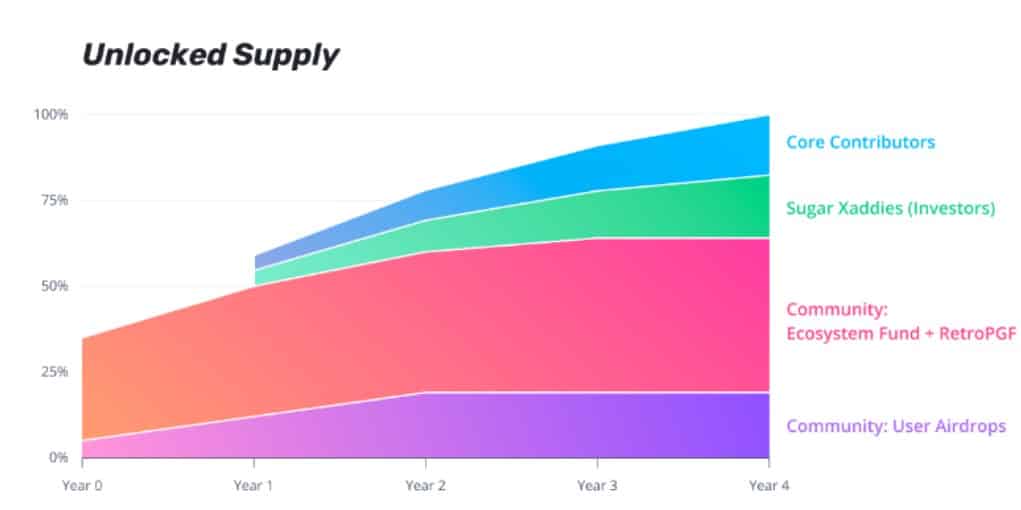

Looking at the vesting schedule, most investors and core contributors are subject to a 2-year lockup period.

The vesting schedule looks healthy, and users don’t need to worry about too much sell pressure from the team or investors.

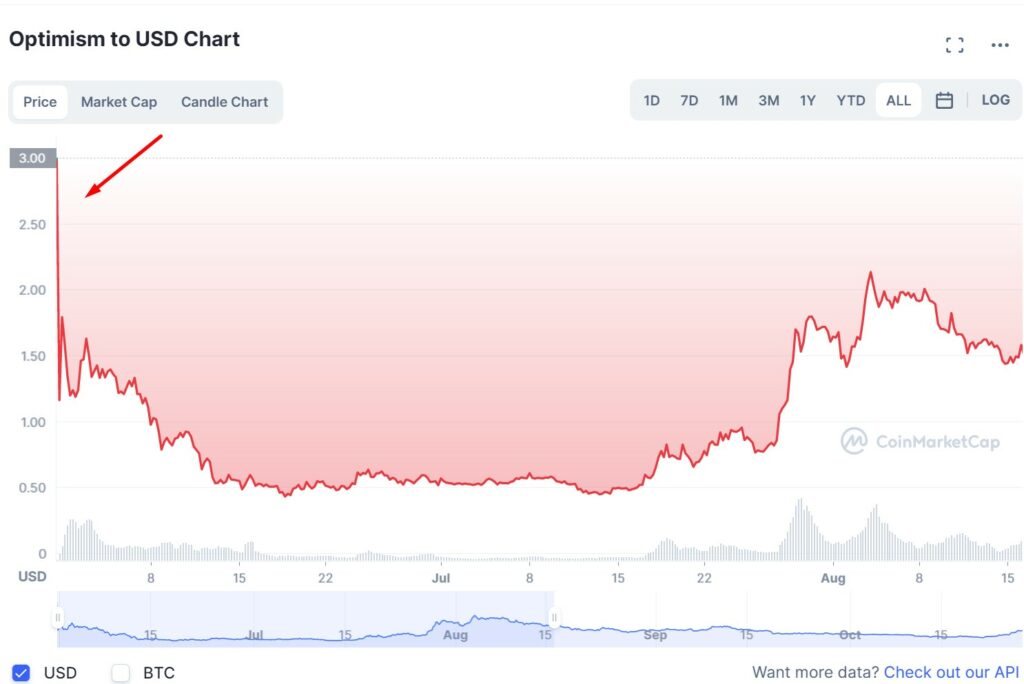

Turning our attention to price action, it is worth splitting the story of Op’s price from the launch to the peak, then from the peak to now as it has experienced some wacky price action and violent swings, it helps to explain events to make sense of it all.

The token launched at $3.00 then saw an insane instant sell-off all the way down to $1.18, then continued its dramatic fall to about the $0.50 level where it stabilized for a few weeks. A drop of 83% right off the bat... Ouch.

Image via CoinMarketCap

Image via CoinMarketCapThe reason for the dramatic collapse was the result of a botched airdrop that saw some users receive their tokens before others and had many airdrop recipients rush to sell their brand-new tokens. The event resulted in some controversial discussions around banning certain users from future airdrops and ideas around vesting schedules for airdrops to prevent price collapses in the future.

After the dust had settled and for a few weeks with price stabilizing at the $0.50 level, the OP token saw an impressive rise of 85% in 7 days after the Optimism team just kept hitting home run after home run with exciting developments and the scaling solution had proven itself to be incredibly efficient. Both price and the TVL on the network skyrocketed.

If we ignore the botched release of the token, we saw that the token hit a high of $2.13 in August 2022, before succumbing to the downward pressure that has affected the entire crypto market during this dire crypto winter.

Image via CoinMarketCap

Image via CoinMarketCapIt is interesting to analyze a token that was launched after the 2021 bull run and has only known a brutal bear market. In the image above we can see that since August, the price has fallen 70%, which sounds bad, but is actually less than the drop experienced by many altcoins that are down 90% or more.

Even more interesting is that there has somehow been some positive price action throughout October and OP is outperforming the majority of other altcoins out there. The resiliency of price and the positive price action as most other projects are bleeding out shows that this may be one token to keep a close eye on once interest returns to the crypto market for the next bull run.

Optimism Review: Closing Thoughts

Optimism has already grown to become one of the most used layer-2 scaling solutions on Ethereum, seeing huge success reaching over $1 billion in TVL and over 70 DApps adopting it in a short amount of time. The team is working on some truly impressive and next-generation technology stacks that could significantly benefit and revolutionize the entire crypto industry.

Because of the innovation and technology, the OP token use case and price stands a good chance of growing further with the increasing utility of the protocol. Optimism are one of the true visionaries and pioneers in the niche of L2 solutions, it is definitely a project that is worth keeping on your radar as they could be capable of achieving truly monumental things if their “Superchain” and Module Blockchain Theory come to fruition.

If you want to dive deeper into the Layer 2 scaling race, check out our in-depth analysis of Arbitrum vs. Optimism and ZkSync.