Quick Verdict

EdgeX is a perps DEX that brings CEX-grade speed to a non-custodial StarkEx rollup. With forced-withdrawal safety, Stork oracle pricing, and razor-thin taker/maker fees (~0.038% / 0.012%), it’s a serious venue for perp traders who want on-chain settlement without sacrificing execution.

Who It’s For

- Traders who want L1-settled, non-custodial perps

- Fee-sensitive takers/makers executing frequently

- Teams that value ZK verifiability and auditability

Who Should Consider Alternatives

- Users who need the deepest menus on a single L1

- Beginners who prefer pure instant-buy UX

- Traders requiring equity/stock perps on the same venue

edgeX Quick Facts

| Mainnet Launch | 2024 |

|---|---|

| Incubated By | Amber Group (global digital asset firm) |

| Architecture | StarkEx ZK-rollup on Ethereum; non-custodial with forced withdrawals |

| Collateral & Gas | USDT as trading collateral on Arbitrum; ETH for gas |

| Oracles | Stork decentralized oracle for index/mark pricing |

| Trading Pairs | 160+ perpetual markets (BTC, ETH, SOL, majors & select memecoins) |

| Order Types | Limit, Market, Conditional; FOK / IOC / GTT / Post-Only / Reduce-Only |

| Baseline Fees (Maker/Taker) | ~0.012% / ~0.038%; tiered by 30-day volume |

| Withdrawals | ETH L1 batched & verified; non-ETH via L2 pools (fee: 1 USDT + 0.05%) |

| Mobile Apps | Apple App Store / Google Play |

Helpful Links

Data current as of Oct 22, 2025.

What is edgeX Exchange?

EdgeX Exchange is an Ethereum Layer 2 decentralized platform for perpetual futures trading (Perp DEX), designed to deliver centralized exchange (CEX)-level performance while preserving the transparency, self-custody, and verifiability of decentralized finance (DeFi).

As a Layer-2 financial settlement chain, edgeX aims to address long-standing challenges in DeFi by building a trading environment that feels as seamless as a CEX but operates within a fully decentralized framework.

The project positions itself as a professional-grade DeFi trading infrastructure rather than a typical DEX. Its architecture is built on StarkEx Layer 2 technology, an on-chain engine that has processed over $1.28 trillion in cumulative trading volume since 2020. Through Zero-Knowledge (ZK) rollups, edgeX achieves high throughput and low latency while ensuring that all trades are securely validated and settled on Ethereum.

EdgeX was incubated by Amber Group, a global digital asset firm that launched the exchange’s mainnet in 2024. Founded in 2017 and headquartered in Hong Kong, Amber Group manages over $3 billion in assets, works with more than 30 banks, and serves over 2,000 institutional clients.

The edgeX team includes professionals with backgrounds at Morgan Stanley, Barclays, Goldman Sachs, and Bybit, combining traditional finance experience with years of crypto exchange engineering and derivatives trading expertise.

Check out our top picks for the best crypto exchanges and best decentralized exchanges.

You can also watch our full edgeX beginners' guide below:

How edgeX Works: Technical Architecture

Below is an overview of the key components that define how edgeX functions.

The 4-Layer System Explained

EdgeX operates through a four-layer architecture designed to balance high performance, security, and decentralized control.

- Settlement Layer: Handles transaction finality by batching validated trade data to the Ethereum mainnet via StarkEx’s zero-knowledge rollup system. This ensures all trades are verifiable, transparent, and tamper-resistant.

- Match Engine Layer: Powers the exchange’s core execution system, with capacity for 200,000 orders per second and sub-10 millisecond latency. This engine manages real-time order matching and ensures precision execution for perpetual futures traders.

- Hybrid Liquidity Layer: Enables cross-chain interoperability with more than 70 blockchains, combining liquidity across ecosystems to reduce slippage and improve price depth.

- User Interface Layer: Provides a unified, professional DeFi trading experience across web and mobile platforms, supporting advanced order types, sub-accounts, and detailed risk metrics.

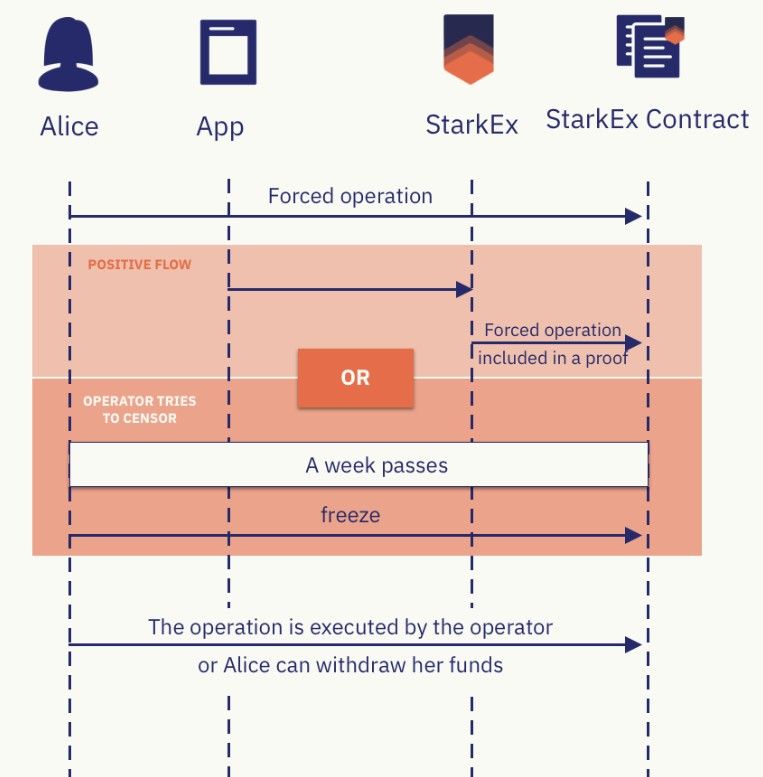

Flow of Forced Withdrawals. Image via edgeX

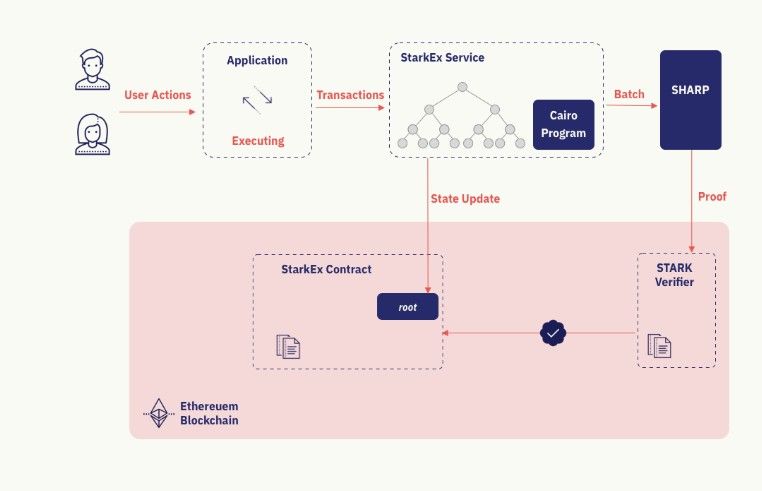

Flow of Forced Withdrawals. Image via edgeXStarkWare & Zero-Knowledge Proof Technology

EdgeX is built on StarkEx, a scalability engine developed by StarkWare that uses STARK zero-knowledge proofs to process large volumes of trades efficiently.

- What is StarkEx: A Layer-2 scalability framework that compresses and validates transactions off-chain before submitting a proof of correctness to Ethereum.

- Benefits: Enables massive scalability (up to 200,000 TPS), cost efficiency, and privacy protection while maintaining cryptographic verification of every transaction.

- How it works: ZK proofs confirm trade validity without revealing sensitive order details or user data, preserving both confidentiality and integrity.

Why this matters: Institutions and high-frequency traders gain access to a system that combines on-chain settlement assurance with CEX-grade performance.

EdgeX Operational System Flow. Image via edgeX

EdgeX Operational System Flow. Image via edgeXSelf-Custody Model

EdgeX uses a non-custodial architecture where users retain complete control over their funds through Ethereum smart contracts.

- User control: Private keys remain in user custody, ensuring withdrawals and account actions cannot be executed by any third party.

- Compared to CEXs: Unlike Binance or Coinbase, which hold customer funds, edgeX’s structure allows direct asset recovery from the blockchain even in the event of operator failure.

- Asset recovery: Funds can always be withdrawn through verified on-chain operations, maintaining trustless access.

- MPC wallet integration: Onboarding is simplified through Multi-Party Computation (MPC) wallets and social logins (Privy), giving users secure access without traditional seed-phrase complexity.

This layered system allows edgeX to deliver institutional-grade execution, decentralized security, and a seamless user experience—all verified and settled on-chain.

Decentralized Oracle Pricing

Centralized exchanges can be vulnerable to flash crashes or price anomalies caused by manipulation or technical faults, leading to unjustified liquidations. Decentralized oracles address this by collecting data from multiple independent exchanges and validating it through distributed consensus mechanisms.

EdgeX sources its Oracle Price from Stork, an independent decentralized oracle provider, to calculate margin requirements and liquidation thresholds. This decentralized approach helps maintain price accuracy and fairness while mitigating manipulation risks.

How This Prevents Manipulation

- Decentralized Data Sources: Aggregate prices from several exchanges to avoid reliance on any single data point.

- Consensus Verification: Nodes filter anomalies and agree on verified data through network consensus.

- Transparency and Auditability: Every step is publicly verifiable, ensuring full data traceability.

Stork’s Technical Architecture

Stork supports over 35 perpetual DEXs, 2,000+ assets, and has secured more than $300 billion in trading volume. Its architecture includes:

- Decentralized Publisher Network: Independent data providers sign and deliver market data.

- High-Frequency Oracle: Redundant, geo-distributed infrastructure ensures low-latency WebSocket feeds.

- Off-Chain Component: Determines relevant updates before submission on-chain.

- On-Chain Verifier: Confirms the authenticity and source of data published by approved publishers.

By integrating Stork, edgeX maintains accurate, tamper-resistant pricing and a fair trading environment, enhancing reliability for all participants.

eStrategy

EStrategy functions as the liquidity and strategy trading protocol within the edgeX ecosystem. It supports market-making and strategy-based trading to improve liquidity depth, capital efficiency, and overall trading quality.

In its first phase, eStrategy employs an Automated Market Maker (AMM) model, where depositors provide liquidity by taking the opposite side of trader positions (e.g., acting as counterparties to shorts or longs). Returns are generated from AMM profits, liquidation fees, and a share of edgeX trading fees.

A future update will introduce customizable strategy pools, enabling traders or institutions to manage funds independently. Users can choose to allocate capital to these pools based on historical performance and risk metrics.

Withdrawal Policy

Users can request withdrawals anytime, but a 48-hour lock-up period applies to allow for position settlement. After this period, funds become available to claim through the same wallet used for deposits. No returns are accrued during the lock-up.

EdgeX Trading Pairs

EdgeX currently features 163 trading pairs, according to CoinGecko. Of course, the largest pair is BTC-USD, followed by ETH-USD with SOL-USD rounding out the top three.

Outside of the blue chips, you can trade memecoins like DOGE, POPCAT, WIF, and CAKE, among others.

Order Types on edgeX

EdgeX supports three main order types for perpetual contract trading: Limit Orders, Market Orders, and Conditional Orders. Each serves a different purpose depending on trading strategy and execution preference.

1. Limit Order

A limit order allows you to set a specific price at which you want to buy or sell a contract. The trade will only execute if the market reaches that price or a better one.

Example

- You want to buy BTC-PERP at $90,000, but the current market price is $91,200.

- You place a limit buy order at $90,000.

- The order remains open until BTC’s price drops to $90,000 or lower, at which point it executes.

Advanced options:

- Fill-or-Kill (FOK): Must execute immediately in full or cancel entirely.

- Good-Till-Time (GTT): Remains open until fulfilled or up to 4 weeks.

- Immediate-or-Cancel (IOC): Executes as much as possible instantly, cancels the rest.

- Post-Only: Ensures you act as a maker, not a taker.

- Reduce-Only: Prevents the order from increasing your open position size.

2. Market Order

A market order executes immediately at the best available price on the order book. You cannot specify a price — only the amount you wish to buy or sell.

Example

- BTC-PERP is trading at $91,200, and you want to sell 1 BTC immediately.

- You submit a market sell order, which matches instantly with the best available bids on the order book.

- The final execution price may vary slightly due to market depth (slippage).

- Market orders guarantee execution but not the exact price.

3. Conditional Order

A conditional order executes only when a predefined trigger price is met. It can be a Conditional Market Order or a Conditional Limit Order.

Example (Conditional Market Order)

- BTC-PERP is trading at $91,200, and you expect it to fall further if it breaks $90,000.

- You set a trigger price at $90,000 for a conditional market sell order.

- Once BTC hits $90,000, your order executes immediately at the best available market price.

Example (Conditional Limit Order)

- You want to buy BTC-PERP if the price rises above $92,000, but only up to $92,200.

- You set a trigger price at $92,000 and a limit price at $92,200.

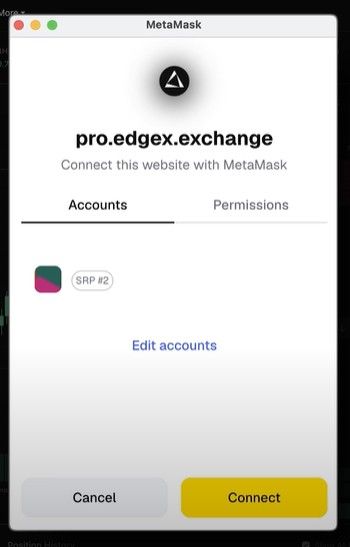

Getting Started With edgeX (Step-by-Step)

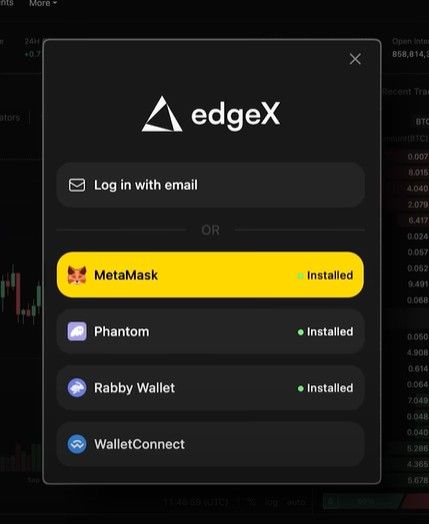

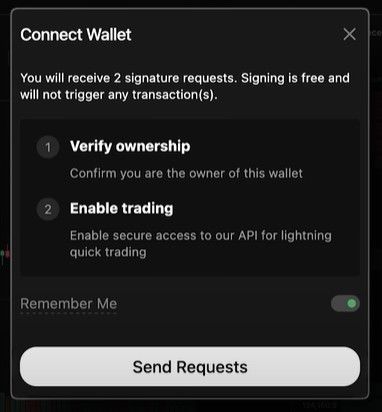

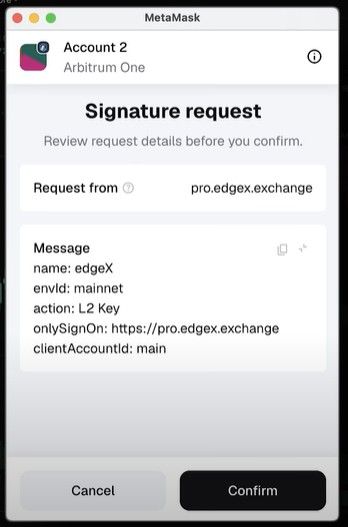

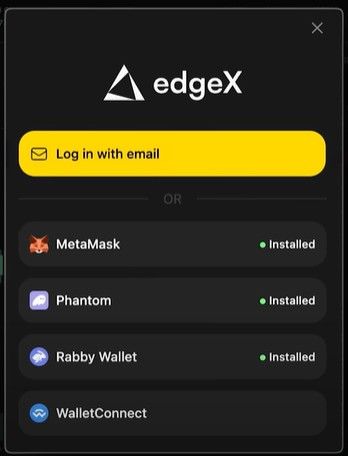

You can either connect an existing EVM-compatible wallet or create a new MPC wallet.

Connect a Wallet

1. Click “Connect Wallet.”

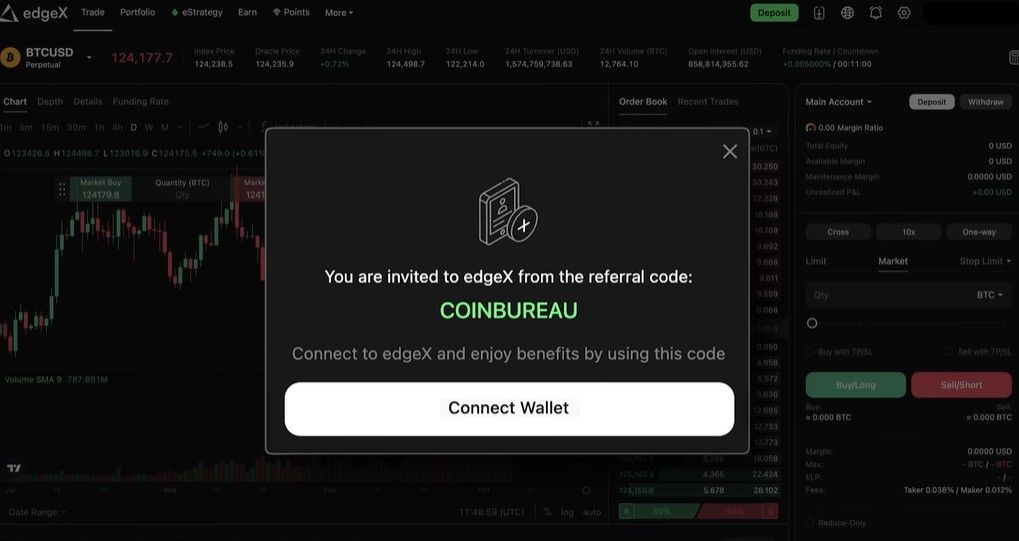

You Can Use Our Code For Some Perks

You Can Use Our Code For Some Perks2. Choose your wallet

3. Prepare funds in your wallet:

- USDT (Arbitrum): collateral for trading.

- ETH (Arbitrum): gas for deposits/transactions.

4. Log in with your wallet and pick the address you want to use.

5. Click “NEXT.”

6. Sign the message in your wallet to complete connection.

7. Deposit USDT (on Arbitrum) to your edgeX account when prompted.

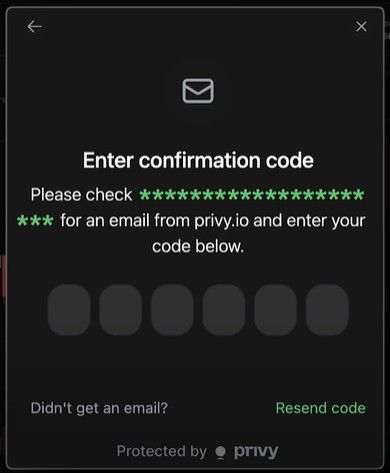

Create & Use an MPC (Email) Wallet

1. Click “Connect” → choose MPC Wallet (email).

2. Enter your email and press Submit.

3. Check your inbox and enter the 6-digit code to log in.

4. edgeX auto-generates an EVM address for your email.

5. Send USDT (Arbitrum) to this new address (from a CEX or another wallet).

6. Once the deposit lands, you’re connected and funded.

Quick Tips

- Network: Use Arbitrum for both USDT deposits and ETH gas.

- Gas: Keep a small ETH buffer for fees.

- Collateral: Only USDT counts as trading collateral (ETH is for gas).

- Security: Always verify you’re on the official edgeX site before connecting or sending funds.

Deposits and Withdrawals

The deposits and withdrawals process on edgeX is designed to be straightforward while maintaining the security and transparency expected from a decentralized trading platform.

Deposits

To start trading on edgeX, you first need to deposit funds into your account. The minimum deposit requirement is 10 USDT, which ensures that you have enough margin to open a position.

Ethereum Deposits

After connecting your wallet, you can deposit USDT directly to the Ethereum mainnet. Once your transaction is confirmed on the blockchain, it takes about 15 confirmations (roughly five minutes) for the funds to appear in your edgeX account and become available for trading.

Non-Ethereum Deposits

edgeX also supports deposits from other blockchains through dedicated asset pools. When you send USDT or another supported asset from a non-Ethereum network, an equivalent amount is credited to your Layer-2 (L2) account using the corresponding asset pool on that chain.

While Ethereum deposits are processed almost instantly, very large non-Ethereum deposits (typically over $300,000) may require up to two hours to rebalance liquidity between Layer 1 and Layer 2 before they are visible on your account.

Deposit Fees

edgeX does not charge any platform deposit fees. You only pay the standard gas fee associated with the network you are using.

Keep in mind:

- USDT acts as your trading collateral.

- ETH is used for gas fees on the Arbitrum network.

- Always double-check that you are sending funds over the correct network to avoid delays or loss of funds.

Withdrawals

edgeX supports withdrawals to both Ethereum and other EVM-compatible blockchains.

Ethereum Withdrawals

Withdrawals made to Ethereum are handled with maximum security. All transactions are batched, verified, and settled on Ethereum Layer 1 (L1) to ensure integrity. This process can take up to four hours to complete, depending on network congestion and the verification cycle.

Non-Ethereum Withdrawals

For other supported EVM-compatible chains, assets are withdrawn through edgeX’s Layer-2 (L2) asset pools. When a withdrawal request is made, the system first moves the amount from your trading account to the L2 pool, then transfers the equivalent value from edgeX’s asset reserve on the target chain directly to your wallet.

Keep in mind that your maximum withdrawal limit depends not only on your account balance but also on the available liquidity in the specific chain’s asset pool.

Withdrawal Fees

- Ethereum withdrawals: You only pay the standard Ethereum gas fee.

- Non-Ethereum withdrawals: A small fee applies, consisting of a 1 USDT base charge plus 0.05% of the withdrawal amount. This fee covers the gas cost on the corresponding blockchain.

Before confirming any withdrawal, always verify that you are using the correct network and wallet address to ensure smooth processing.

EdgeX Fees

For non-VIP users, edgeX charges taker fees of 0.038% and maker fees of 0.012%. The exchange adopts a tiered fee structure based on a trader’s rolling 30-day trading volume.

Feature Comparison: edgeX vs Aster vs Hyperliquid

| Dimension | edgeX | Hyperliquid | Aster |

|---|---|---|---|

| Core design | StarkEx L2 perps DEX evolving into a settlement chain; Amber Group–incubated | Sovereign L1 with on-chain orderbook; HyperEVM + HyperBFT | Multi-chain perps (BNB/Ethereum/Solana/Arbitrum), “Simple/1001x” + Pro with hidden orders |

| Order model | CLOB on StarkEx; self-custody withdrawals enforced on-chain | Full on-chain CLOB at base layer; sub-sec finality focus | Pro: CLOB (hidden/iceberg), Simple: ALP/AMM “1001x” |

| Baseline fees | ~0.012% maker / 0.038% taker (tiers vary) | Typically ~0.01% maker / ~0.045% taker before VIP/discounts; staked HYPE can cut further | Pro baseline ~0.01% maker / 0.035% taker; ASTER payment & VIP discounts exist |

| Max leverage | 100x | Generally up to ~40–50×; dynamic caps by asset; frequent perf upgrades (e.g., HIP-3) | Up to 1001× on Simple line; Pro uses lower, per-listing caps |

| Collateral | USDT primary; non-custodial; forced-withdrawal paths | Conventional margin; gas-free trading on L1; no native yield on margin | Supports yield-bearing collateral (e.g., asBNB, USDF) to offset funding |

| Oracles | Uses Stork decentralized oracle for index/mark pricing | Standard perp indices; expanding permissionless listings via HIP-3 | Multi-oracle setup; MEV-aware routing + hidden orders on Pro |

| Chains & access | Ethereum L2 (StarkEx); also references EVM pools for non-ETH routes/withdrawals | Runs on Hyperliquid L1 (HyperEVM) | BNB, Ethereum, Solana, Arbitrum (single UX across chains) |

| Stock perps | Not a focus | Crypto-first | Yes, AAPL/TSLA/NVDA/etc. in Pro, 24/7 |

| Notable extras | Amber-incubated; StarkEx data availability and forced withdrawals; clear withdraw fee policy | HIP-3 enables permissionless perp market creation on-chain; growing validator set over 2025 | Hidden orders + MEV-aware routing; 1001x “Simple”; ASTER airdrop/launch 09/2025 |

Strengths, Trade-offs, and Fit

EdgeX — StarkEx performance with strict self-custody

- Why pick it: StarkEx rollup assurances with non-custodial, forced-withdrawal paths; competitive baseline fees; institutional pedigree (Amber incubated).

- Mind the trade-offs: Newer ecosystem versus sovereign L1s; liquidity depth varies by market; non-ETH chain withdrawals depend on asset-pool liquidity/fees.

- Best for: Traders who value auditability + L1 settlement guarantees and want a CEX-style book.

Hyperliquid — Single, high-throughput L1 built for perps

- Why pick it: Purpose-built L1 with HyperEVM/HyperBFT for low latency; mature CLOB UX; ongoing decentralization work (e.g., HIP-3 permissionless listings). VIP structures can make heavy-taker fees extremely sharp.

- Mind the trade-offs: Validator set size and governance transparency are still works-in-progress versus older L1s.

- Best for: High-volume crypto-perp traders who want one venue/one chain with deep menus and fast fills.

Aster — Multi-chain perps with hidden orders and yield-bearing margin

- Why pick it: Hidden orders (reduced signaling), MEV-aware routing, yield-bearing collateral (asBNB/USDF), and stock perps alongside crypto. Aggressive baseline fees (~1/3.5 bps) + token discounts.

- Mind the trade-offs: 1001× headline leverage is hazardous; young ecosystem with incentive-driven growth dynamics—watch unlocks/whale concentration and liquidity sustainability.

- Best for: Pros who want privacy-preserving execution and carry on collateral, or who need equity perps 24/7 in the same terminal.

Fees

- EdgeX: ~0.012% maker / 0.038% taker baseline; tiers reduce further.

- Hyperliquid: Baseline often ~0.01% / ~0.045%; VIP + HYPE staking can materially lower taker costs.

- Aster: 0.01% / 0.035% on Pro, plus ~5% discount when paying with ASTER; VIP tiers. Simple/1001x has block-level funding that accrues straight into unrealized PnL.

Risk Notes

- Extreme leverage: Aster’s 1001× means a ~0.10% adverse move can approach liquidation depending on maintenance/funding; Hyperliquid’s caps (often 25–50×) soften but do not remove tail risk.

- Oracle/mark pricing: edgeX leans on Stork for decentralized, auditable pricing; verify feed health on high-volatility prints.

- Withdrawals/liquidity: On edgeX, non-ETH routes have 1 USDT + 0.05% style fees and are limited by per-chain pool liquidity.

Bottom Line

- Need hidden orders, MEV-aware routing, yield on margin, plus stock perps? → Aster.

- Want one ultra-fast chain, big crypto menus, and VIP economics at size? → Hyperliquid.

- Prefer StarkEx rollup guarantees with clear forced withdrawals and Amber-incubated pedigree? → edgeX.