Quick Verdict (At-a-Glance): Choosing between Coinbase and Robinhood depends on whether your priority is depth of crypto trading or simplicity with multi-asset investing. Coinbase is built for users who want access to hundreds of digital assets, staking, advanced order types, and the option for self-custody. Robinhood is designed for retail investors who want stocks, ETFs, and crypto in one app with a streamlined interface and commission-free stock trading.

Coinbase vs Robinhood: Comparison Table

Before diving into individual features, here’s a side-by-side look at the platforms. The table covers core categories investors evaluate most often.

| Category | Coinbase | Robinhood | Why it matters |

| Supported Cryptocurrencies | 240+ assets (Coinbase Help) | 50+ assets | Wider asset range means more choice for traders |

| Stocks/ETFs | No | Yes | Robinhood is multi-asset; Coinbase is crypto-only |

| Options Trading | No | Yes | Robinhood supports options strategies |

| Fees | Maker/taker: 0.60% taker, 0.40% maker under $10k monthly, discounts with higher volume (Coinbase Fee Schedule) | No commission; routing fees apply 0.85% → 0.10% depending on monthly volume (Robinhood Fee Schedule PDF) | Costs shape net returns, especially at scale |

| Payment Methods | Bank transfer, debit card, PayPal, Apple/Google Pay | Bank transfer, debit card | Determines funding speed and convenience |

| Staking | Yes, many coins (ETH, ADA, SOL); ~35% fee on rewards (Coinbase Fees) | Yes, fewer coins; ~25% fee on rewards ([Robinhood Fee Schedule]) | Passive yield depends on reward share |

| Withdrawals / Self-Custody | Yes, external wallets supported | Limited. Europe supports deposits/withdrawals; U.S. partial (Robinhood Wallet) | External withdrawals = asset ownership |

| App Ratings | iOS 4.7 / Android 4.2 | iOS 4.3 / Android 3.8 | Ratings reflect daily reliability |

| Geographic Coverage | 100+ countries (Coinbase Coverage) | U.S. main base; EU/UK expansion | Determines if you can access features in your region |

| Support | Email, chatbot, some phone support | Email/in-app support only | More support options reduce risk during issues |

| Outages/Restrictions | Occasional high-traffic downtime | History of trade halts in volatility | Stability matters for active trading |

Fees & Pricing (What You’ll Actually Pay)

Understanding what you’ll pay in real life means looking past the headlines. Coinbase and Robinhood both say their fees are “fair,” but the differences in trading tiers, spreads, and withdrawal charges add up fast. The details below show what each platform actually charges, so you can see where costs hide.

Trading Fees & Spreads

| Platform / Mode | Fees | Spreads |

|---|---|---|

| Coinbase (Retail) | Flat fee (varies by order size) | ~0.5% (spread) |

| Coinbase (Advanced Trade) | Maker 0.40%, Taker 0.60% at entry; lower with volume; some USDC pairs $0 | Market-dependent (varies) |

| Robinhood (Crypto) | $0 commission | ~0.1%–1% (embedded spread) |

| Robinhood (Equities) | $0 commission | Bid–ask spread (varies) |

On Coinbase, fees depend on whether you use the basic retail interface or the Advanced Trade interface.

Coinbase Advanced / Exchange (maker-taker model):

- The retail flow charges a spread (typically ~0.5%) plus a flat fee that scales with order size, making small purchases relatively expensive.

- Advanced Trade replaces flat fees with a maker–taker model: 0.60% for taker orders and 0.40% for maker orders at the entry tier, with fees declining as monthly volume rises. For example, users trading more than $50,000 per month pay lower percentages, and at institutional levels, rates fall near zero.

- Coinbase also offers zero-fee trading for USDC pairs, making them the cheapest option for active traders who can route orders through stablecoins

Robinhood takes a different approach.

- It advertises commission-free crypto and stock trading, but the true cost comes from spreads embedded into the execution price.

- The spread varies by asset and market conditions but typically ranges between 0.1% and 1%. Robinhood does not disclose exact spreads upfront, so cost transparency is weaker.

- For equities, Robinhood also earns revenue through payment for order flow (PFOF) — a controversial practice, but one that allows it to keep commissions at zero

In short, Robinhood feels cheaper on small, casual buys, while Coinbase Advanced Trade is more efficient for larger or frequent orders.

Deposits, Withdrawals & Payment Methods

How you move money in and out also matters.

Coinbase supports ACH transfers, wire transfers, debit cards, and PayPal (region-dependent). ACH transfers are free but can take several business days to clear. Wire transfers settle faster but come with bank fees. Crypto withdrawals incur network fees, which vary depending on congestion. For U.S. customers, there are no fees for withdrawing USDC on supported networks.

Robinhood accepts bank transfers and debit cards, with instant availability for smaller amounts but standard settlement windows for larger deposits. Withdrawals are limited to linked bank accounts, and while there are no explicit platform fees, users still pay underlying bank or network costs. Unlike Coinbase, Robinhood does not offer PayPal or broad crypto withdrawal support beyond a few major assets (BTC, ETH, DOGE, SOL)

Coinbase:

- ACH (USD): Free for both deposit and withdrawal.

- Wire (USD): Incoming $10, outgoing $25.

- SEPA (EUR): Deposit €0.15, withdrawals free.

- SWIFT/GBP: Deposit free, withdrawal ~ £1.

- Network (miner) fees apply whenever you withdraw crypto. These are based on the blockchain’s conditions.

Robinhood:

- Standard bank transfers: No fee.

- Instant withdrawals to bank/debit card: 1.75% fee, minimum $1, max $150 per transaction.

- Crypto transfers/withdrawals: Platform charges no fee, but you pay network/miner fees.

Take a look at some of the best crypto exchanges with the lowest fees.

Supported Assets & Market Offering

Supported Currencies And Available Trading Pairs. Image via Shutterstock

Supported Currencies And Available Trading Pairs. Image via ShutterstockAsset breadth refers to the flexibility of each platform. A trader who only wants Bitcoin and Ethereum doesn’t care about depth, but if you’re chasing new listings, staking rewards, or exposure to equities alongside crypto, the platform’s coverage decides whether you can do it in one account or need multiple apps.

Cryptocurrency Selection

Coinbase crypto exchange supports over 250 cryptocurrencies and 320+ trading pairs on Coinbase Exchange. Its frequent listing cadence makes it a hub for altcoin traders who want early access to new tokens. Coinbase also supports staking for assets like ETH, SOL, and ADA (region-dependent), giving users additional yield opportunities. The categories covered are:

- Layer-1 networks: Bitcoin, Ethereum, Solana, Avalanche, etc.

- Layer-2s: Arbitrum, Optimism, Base.

- Stablecoins: USDC, DAI, Tether.

- Meme coins: DOGE, SHIB, BONK, PEPE.

- DeFi tokens: UNI, AAVE, COMP

- New listings include: Coinbase frequently adds tokens, often coinciding with airdrops or liquidity campaigns. This cadence benefits altcoin traders and anyone farming new projects.

- Staking-eligible assets: ETH, ADA, SOL, XTZ, ATOM, and others. Coinbase takes ~35% commission on rewards.

- Wallet coverage: Coinbase Wallet extends beyond the exchange — supporting all ERC-20 tokens, NFTs, and assets on EVM chains plus Solana. This makes Coinbase relevant for users who want to hold assets that aren’t yet listed for trading.

Robinhood supports a much smaller list of roughly 32 coins, focused on majors like BTC, ETH, DOGE, SOL, and a handful of others. The platform has expanded cautiously after regulatory pressure, which means meme traders and altcoin explorers will often find it too restrictive.

- Blue-chips: BTC, ETH, LTC.

- Popular meme coins: DOGE, SHIB.

- Selected DeFi tokens: COMP, UNI.

- Cadence: Robinhood adds new tokens much more slowly than Coinbase, usually focusing on mainstream demand.

- Staking: Available only for a few assets, with ~25% fee on rewards.

- Withdrawals: Crypto transfers are supported, but only in approved states and regions. Users still rely heavily on Robinhood’s custody unless they also use Robinhood Wallet.

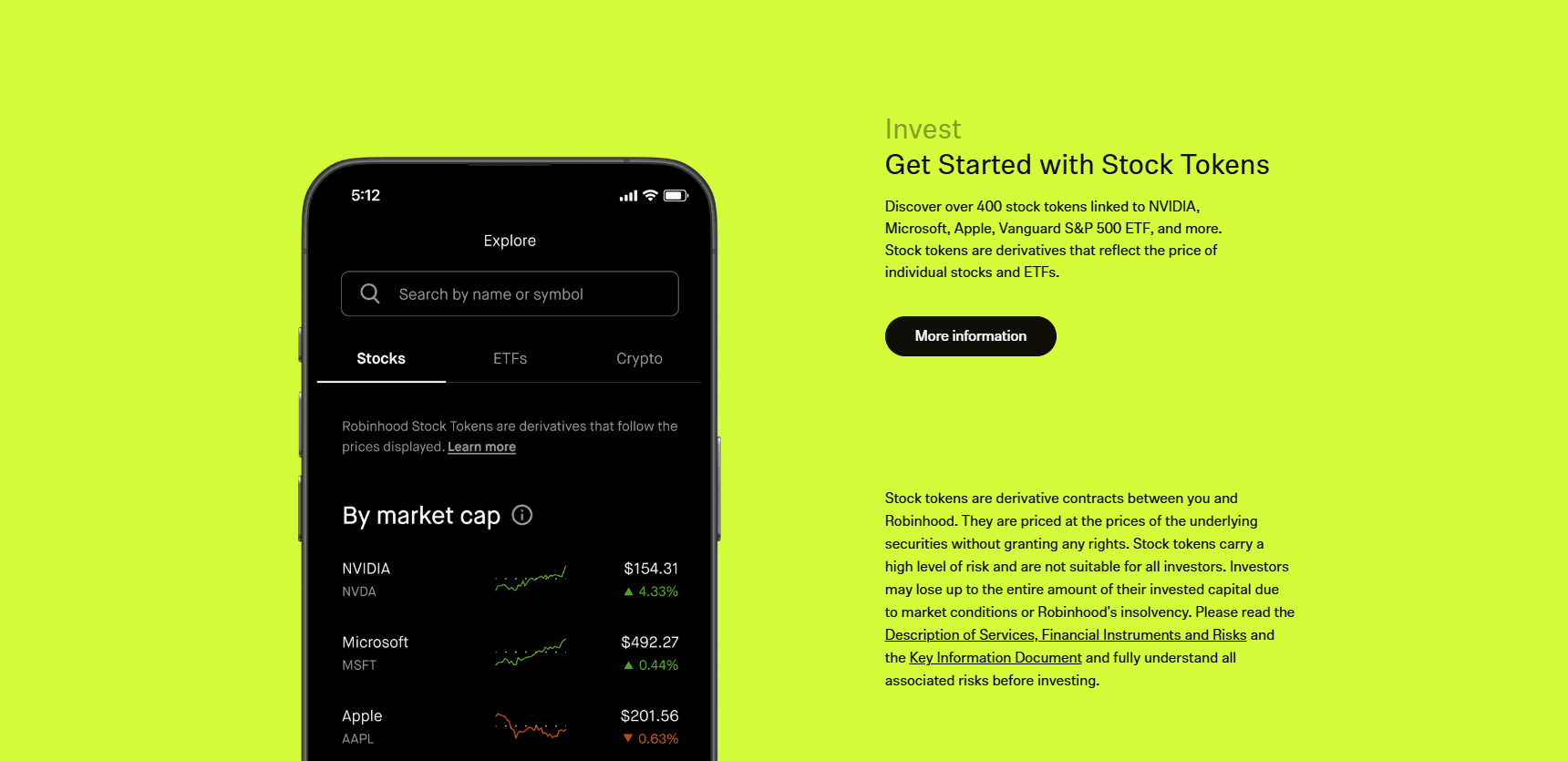

Stocks, ETFs & Options

Here’s where Robinhood flips the script. Robinhood gives you commission-free trading in stocks, ETFs, and options, something Coinbase does not offer at all. It’s a one-stop shop for equity traders who also want light crypto exposure. Options traders in particular benefit from Robinhood’s built-in tools and margin accounts.

- Stocks: Access to thousands of U.S.-listed equities, including fractional shares.

- ETFs: Full coverage of major U.S. ETFs (SPY, QQQ, sector funds).

- Options: Commission-free options trading with contracts on equities and ETFs. Users can trade calls, puts, spreads, and covered strategies.

- Europe: Tokenized U.S. stocks and ETFs introduced for Robinhood EU customers, alongside perpetual crypto futures.

Coinbase is crypto-only. If you want to trade stocks or ETFs, you’ll need a second platform. Its strength is in specialized crypto products, advanced charts, order types, staking, and wallets.

The trade-off is clear: you cannot consolidate a full portfolio (equities + crypto) inside Coinbase, but you gain more coverage of niche crypto projects.

User Experience & Learning Curve

Getting past “create account” matters more than most users admit. If onboarding drags or the interface is confusing, that friction can cost trust. Below are how Coinbase and Robinhood compare in onboarding, interfaces, and what users are saying about them.

Onboarding & KYC

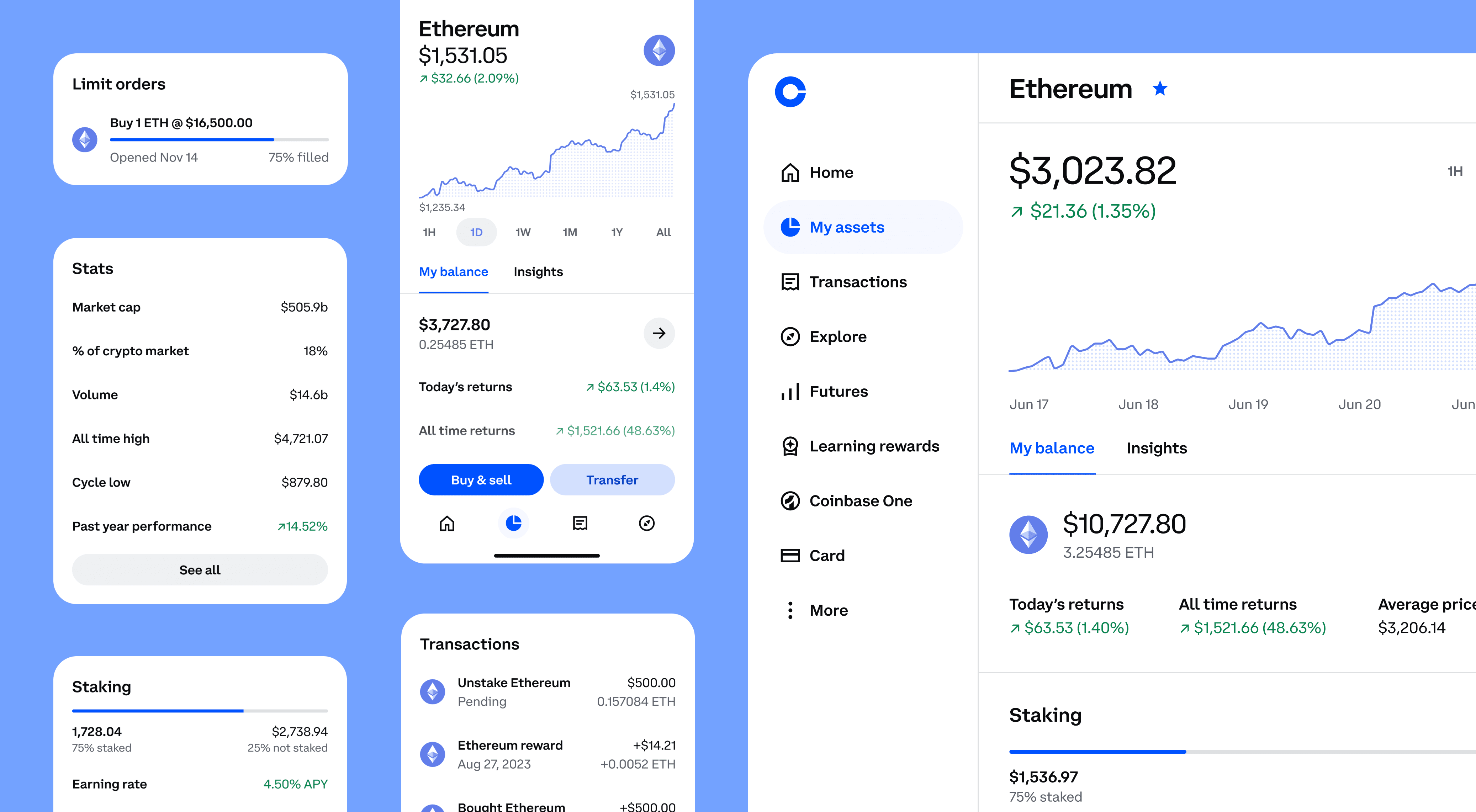

Coinbase User Experience And Platform Navigation in Simple Trade. Image via Coinbase

Coinbase User Experience And Platform Navigation in Simple Trade. Image via CoinbaseCoinbase walks new users through identity verification, linking payment methods, and basic trading tutorials. The setup process feels structured but can be lengthy due to compliance checks.

- Download and open the Coinbase mobile app. Do not use a browser on your mobile device.

- Select Create free account.

- Enter your email address and select Continue.

- Enter the verification code Coinbase sends to your email address.

- Create a password and select Continue.

- Enter your first and last name as they appear on your government-issued ID, and select Continue.

- Enter your phone number to receive an SMS verification code and select Continue.

- Enter the verification code to proceed to the next step.

Registration on the browser is the same, just that Coinbase gives you the option to select “Individual or ”Browser" on your computer. Once inside, the app offers educational modules where users can earn small amounts of crypto for completing lessons, giving beginners both knowledge and token rewards.

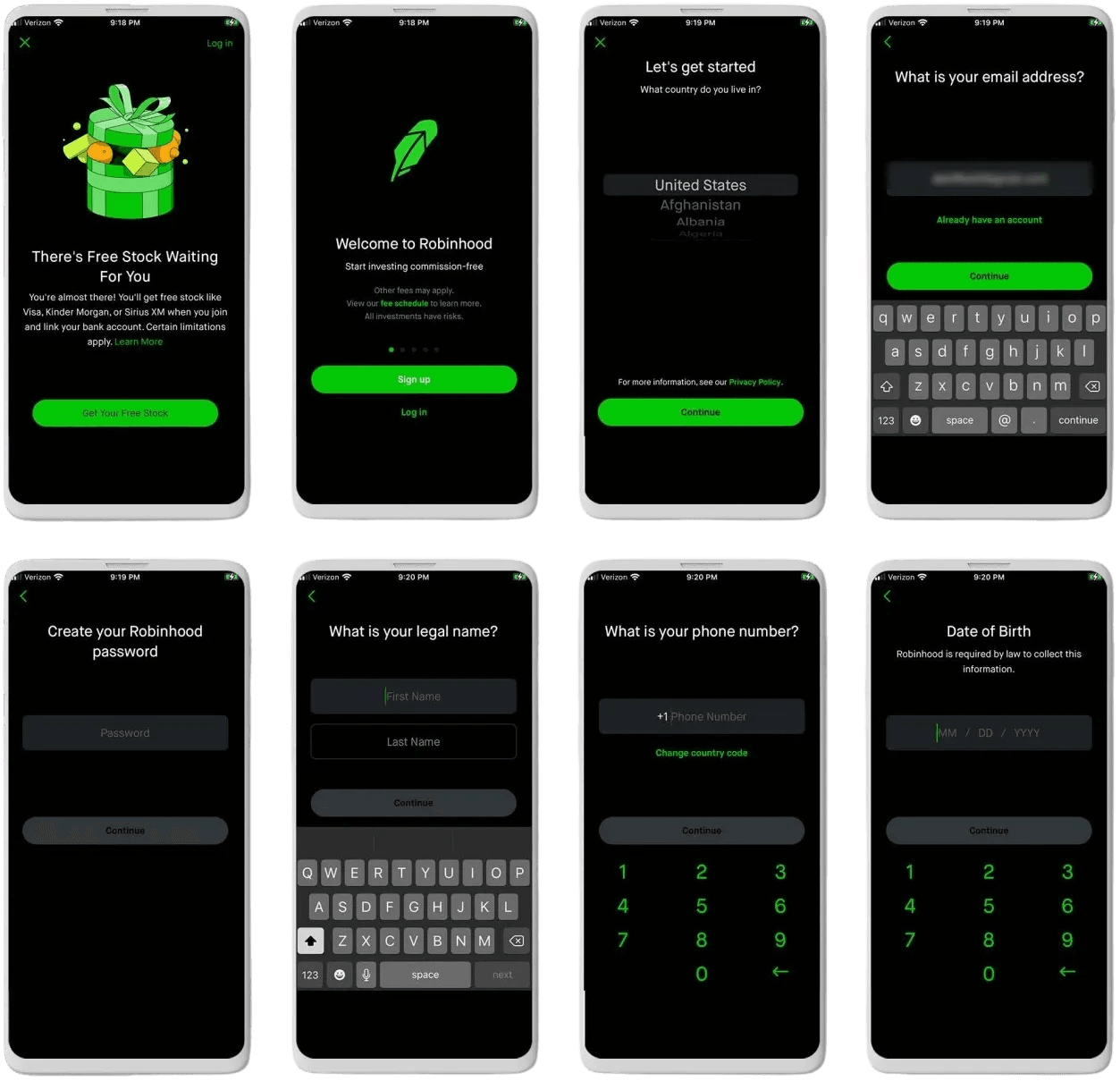

Robinhood User Experience And Platform Navigation. Image via Jorrit Medium

Robinhood User Experience And Platform Navigation. Image via Jorrit MediumRobinhood’s onboarding is more streamlined. Account creation, bank linking, and initial trades can often be completed within minutes. The process mirrors a stock brokerage signup, with less emphasis on crypto-specific education. There are learning resources built into the app, but they focus more on equities and investing basics than blockchain mechanics.

- Create Login: Start by providing your first name, last name, email address, and desired password.

- Download App: Download and install the Robinhood app from the App Store (for iPhone) or Google Play Store (for Android).

- Sign In: Open the app and sign in using the login credentials you just created.

- Provide Personal Information: You will be prompted to enter your legal name (as it appears on government ID), phone number, residential address, date of birth, and US citizenship status.

- Verify Identity: You will need to provide your Social Security number and may be asked for a photo ID and a three-point selfie to complete identity verification.

- Answer Investing Questions: Robinhood asks about your investing experience and employment information. You may also need to answer questions related to insider trading, which are standard for brokerage accounts.

- Tax Certification: Review and agree to the tax certification, confirming the accuracy of the information provided for your taxable investment account.

- Review & Accept Terms: Review and accept Robinhood's terms of service and agree to electronic delivery of documents.

- Fund Account (Optional): You can link your bank account using Plaid to transfer funds to your Robinhood account.

- Enable Options Trading (Optional): The application may include questions about options trading; you can choose to enable this feature later in your account settings.

Interfaces (Mobile & Web)

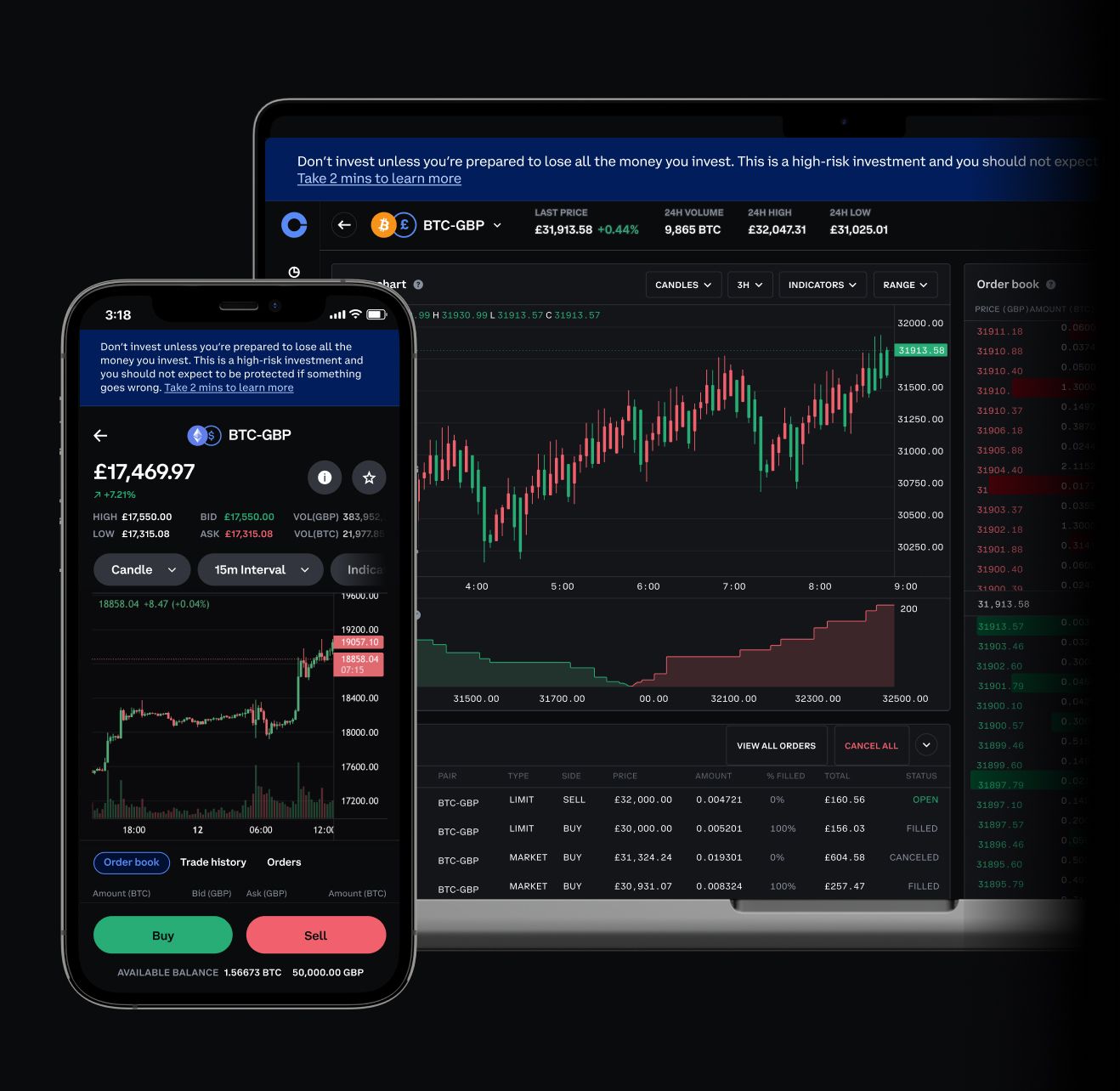

Coinbase Advanced Trade Dashboard. Image via Coinbase

Coinbase Advanced Trade Dashboard. Image via CoinbaseCoinbase

- Two modes, two mindsets: The default “Simple” flow prioritizes a clean buy/sell ticket, price cards, and a minimal portfolio view—great for first-time purchases but light on depth (no L2 ladder, limited order types). Advanced Trade unlocks a pro-style layout: multi-pane chart + order book + recent trades, with limit/stop-limit/stop-market, post-only, and fee tier visibility.

- Navigation: Simple mode funnels you into a purchase quickly (asset → amount → preview). Advanced uses a top nav for Markets/Portfolio/Orders and a left rail for pairs; keyboard shortcuts on web and swipeable tabs on mobile speed up pair switching.

- Watchlists & alerts: Watchlists sync across devices; price alerts are straightforward (price crosses X), but Advanced adds pair-specific alerts and better granularity.

- Charts & tools: Simple shows a basic line; Advanced offers candlesticks, intervals down to 1m, overlays (MA/EMA), depth chart, and a live L2 book with trade tape. Drawing tools are basic; think execution-first rather than TA-heavy.

- Order book & depth: Advanced shows aggregated L2 with adjustable zoom and a compact tape; toggles for last price/mark price and fee estimates help pre-trade planning.

- Friction points: Toggling Simple ↔ Advanced can be confusing for newcomers, and some asset pages still route to Simple by default. Mobile Advanced compresses the layout—usable, but best on web for serious charting.

Robinhood

- Equity-first design that carries over to crypto: The interface centers on a unified portfolio, fast search, and a single trade ticket metaphor for options, stocks, and crypto. It feels snappy and predictable, with fewer settings to fiddle with.

- Navigation: Global search is excellent; symbol pages are consistent across asset classes. The bottom tab bar (mobile) and left nav (web) keep things approachable—ideal for quick peeks and impulse-sized orders.

- Watchlists & alerts: Multiple lists with drag-to-reorder; price alerts and news alerts are prominent. Alert logic is simple (thresholds), but you don’t get pair-level, book-driven triggers.

- Charts & tools: Clean, responsive charts with basic indicators and event markers; crypto pages include a modest order book preview but no true L2 ladder and fewer order types (market/limit dominate).

- Depth & execution context: Depth is abstracted; you see less microstructure (no advanced post-only, no maker/margin of the book). That keeps the UI calm but hides spread/impact details power users expect.

- Friction points: Power users will miss granular controls (post-only, reduce-only, routing nuance). For multi-leg or conditional crypto orders, you’ll outgrow it fast.

Simple and Intuitive UI For Robinhood Mobile App. Image via Robinhood

Simple and Intuitive UI For Robinhood Mobile App. Image via Robinhood

Bottom line

- Casual users will feel at home on Robinhood’s unified, low-cognitive-load UI or Coinbase Simple.

- Active traders should jump straight to Coinbase Advanced for the L2 book, richer order types, and clearer fee context—especially if they care about maker fills, post-only, or routing via USDC pairs.

Security, Custody & Insurance (What’s Actually Protected)

Security is the one category users often assume is “standard,” but Coinbase and Robinhood take different routes. Some protections apply to securities, others to fiat, and only a few extend to crypto itself.

Custody Model & Cold Storage

Cold Storage And Institutional Grade Asset Protection. Image via Shutterstock

Cold Storage And Institutional Grade Asset Protection. Image via ShutterstockSecurity is often the deciding factor between exchanges and brokerages. Coinbase and Robinhood both emphasize asset safety, but their methods, scope, and insurance policies differ.

Coinbase

Coinbase Custody primarily stores cryptocurrency offline in geographically distributed, air-gapped cold storage facilities that combine physical security with advanced cryptography. For institutional clients, the system uses a combination of offline storage, multiparty computation (MPC), and secure physical vaults.

- Uses an institutional-grade custody stack.

- Historically disclosed that ~98% of customer crypto is held offline in geographically distributed cold storage vaults. The hot wallet share is kept small and only for operational liquidity.

- Custody relies on hardware security modules (HSMs), strict key-splitting, and geographic redundancy.

- Institutional clients often use Coinbase Custody Trust Company, a regulated New York trust entity.

- Segregated Accounts: Client funds are kept separate from Coinbase's operational funds and are "bankruptcy remote".

- Regular Audits: Coinbase Custody undergoes rigorous audits, including SOC 1 Type II and SOC 2 Type II examinations, to ensure robust internal controls and security practices.

- Automated Risk Analysis: Transactions undergo automated checks for anomalies and tampering to ensure integrity.

Also on The Coin Bureau: Is Coinbase Safe?

Robinhood

- States that the “overwhelming majority” of customer crypto is held in cold storage.

- Cold and hot wallet balances are segregated, with hot wallets used for day-to-day liquidity.

- In Europe, Robinhood Wallet relies on multi-party computation (MPC) so no single server ever holds a complete private key.

- Their disclosures confirm they do not rehypothecate or lend customer crypto.

- Mixed Storage: Robinhood stores the majority of user cryptocurrency in offline "cold storage" to protect it from online threats. A smaller portion is kept in "hot wallets" to support day-to-day operations and faster access.

- Robinhood offers a separate, non-custodial wallet that allows users to hold their private keys and directly manage their crypto assets across multiple networks like Ethereum, Bitcoin, Dogecoin, Arbitrum, Polygon, Optimism, and Base. This provides users with more control but also places more responsibility on them for security.

- Encryption and Cybersecurity: Robinhood employs strong encryption for sensitive data and utilizes advanced cybersecurity measures, including continuous system monitoring and multi-layered defenses on its AWS infrastructure.

Check out some of the most crypto-secure wallets before you enter the crypto market.

Account Protection

Security Features And Account Protection Measures. Image via Shutterstock

Security Features And Account Protection Measures. Image via ShutterstockCoinbase

- Mandatory two-factor authentication (2FA). Supports TOTP apps, hardware security keys (YubiKey), Coinbase Security Prompt push notifications, and passkeys on modern devices.

- Device confirmation: new devices or IPs must be verified by email or 2FA challenge.

- Withdrawal allowlisting: You can restrict withdrawals so coins only move to addresses you pre-approve. Changing the list requires 2FA and a cooldown period.

- Session monitoring shows active logins; suspicious sessions can be terminated manually.

Robinhood

- 2FA via SMS or authenticator apps, with passkeys available for phishing-resistant login.

- Device approvals are required when logging in from new hardware; a trusted-device list is maintained.

- Customers receive push/email alerts for sign-ins and withdrawals.

- Robinhood’s “Security Guarantee” page outlines fraud-monitoring tooling and scam-prevention education, but reimbursements are discretionary.

Insurance & Coverage Nuance

Coinbase carries a commercial crime insurance policy, which covers losses from hacks or theft of Coinbase’s own systems but not losses from unauthorized account access caused by phishing or weak passwords. U.S. dollar balances may have FDIC pass-through insurance up to $250,000, but only if they are stored as fiat in custodial accounts, crypto itself is never FDIC-insured.

Here, the Robinhood setup once again differs. Securities accounts (stocks, ETFs, options) are protected by SIPC up to $500,000, including $250,000 for cash balances. Crypto held through Robinhood Crypto LLC has no SIPC or FDIC protection, though Robinhood maintains its own commercial insurance for certain theft scenarios.

Self-Custody & Withdrawals

Coinbase supports withdrawals across dozens of blockchains, including free USDC withdrawals on supported networks. Users must ensure they select the correct chain to avoid loss. Advanced users can withdraw directly into DeFi protocols or hardware wallets via Coinbase Wallet.

Robinhood allows crypto withdrawals for Bitcoin, Ethereum, Solana, Dogecoin, and a limited set of ERC-20 tokens. The selection is narrower, and some assets remain “buy/sell only.” Bank withdrawals are straightforward, but users cannot export stocks or ETFs, only crypto.

Trading Tools & Advanced Features

Trading Fees And Commission Structures Compared. Image via Shutterstock

Trading Fees And Commission Structures Compared. Image via ShutterstockBeyond assets and fees, the real test of a platform is what it lets you do once you log in. Coinbase and Robinhood both offer useful trading features, but they target different user profiles.

Order Types & APIs

Coinbase caters to API-heavy and order-book traders, whilst Robinhood focuses on safety buffers and a clean UI, but Legend adds advanced charting for equity and crypto traders.

Coinbase

- Order types: Market, limit, stop-limit, bracket orders (take-profit + stop-loss), and TWAP for slicing large trades.

- Market status controls: Post-only, limit-only, and full trading modes.

- Advanced charting: 100+ TradingView indicators, Heikin-Ashi, multiple chart intervals, and drawing tools.

- APIs: REST for market data, WebSocket for real-time depth and trades. Advanced Trade API supports higher throughput for pro use.

Robinhood

- Crypto orders: Market, limit, stop, and stop-limit. Market orders are internally wrapped as limit orders with slippage buffers (1% buy / 5% sell).

- Options and futures include simple market and limit order entry.

- Legend (desktop platform) allows direct trading from charts, symbol-linked watchlists, and layout customization — up to 8 charts side by side

If you are a beginner, then here is a list of the best crypto exchanges to begin your crypto trading journey.

Staking / Yield / Rewards

Keeping the UX simple, Robinhood has comparatively fewer options for users to stake their tokens.

Coinbase

- Supports ETH, ADA, ATOM, SOL, and other assets for staking. Each asset has its own lockup and reward cadence.

- USDC Rewards (~4% historically) for holding stablecoin balances.

- APY is displayed per-asset, not a flat rate. Prime clients get validator choice and governance delegation.

Robinhood

- EU users can stake ETH, SOL, and others via Robinhood Crypto. U.S. staking is paused due to regulatory risk.

- Rewards are credited automatically, with disclaimers about variability.

- APY shown in-asset view, and unstaking flows are one-click with minimal complexity.

Take a look at the top crypto coins to stake.

Research & Education

As expected by the leading giant, Coinbase keeps education crypto-focused and folds analytics into trading. On the other hand, Robinhood pushes a multi-asset education hub, with more emphasis on equities and cross-market screeners.

Coinbase

- Asset pages show live price, market cap, depth, and volatility stats.

- Advanced alerts: Price, volume, and some order book conditions. Loss notifications appear in compliance with regional regulators.

- Education: Tutorials, guides, and “Crypto Basics.” Learning Rewards ended in 2025.

- Portfolio tracking and tax reports are included in Advanced Trade.

Robinhood

- Robinhood Legend provides analyst ratings, news feeds, and aggregated market data next to charts.

- Screeners and collections group assets by sectors, themes, or performance.

- Robinhood Learn covers equities and crypto with structured lessons.

- Futures and strategy builder tools let users simulate returns and build multi-leg option strategies.

Reliability, Outages & Support

When markets heat up, outages and support delays matter more than fees or features. Both Coinbase and Robinhood have faced pressure here, and their records are mixed.

Historical Reliability

Both Coinbase and Robinhood have histories of struggling during high-volatility events.

- Coinbase has faced repeated “partial outage” or “degraded performance” incidents during Bitcoin price surges. For example, outages were logged in March 2020, January 2021, and again in May 2021. These were often tied to traffic spikes, leading to failed logins or delayed order execution. You can refer to the Coinbase Status page for any current issues.

- Robinhood had its most infamous reliability crisis in March 2020, when a two-day outage left users unable to trade during one of the most volatile stock market periods in a decade. Lawsuits and regulatory inquiries followed. More recently, its systems have been more stable, but Reddit and Trustpilot discussions still flag “throttling” during meme-stock or altcoin rallies.

The key difference is scale: Coinbase outages are usually brief and tied to crypto volume spikes, while Robinhood’s past disruptions involved full service downtime.

Customer Support Channels

Support remains one of the most discussed pain points for both apps.

- Coinbase offers live chat, phone callbacks, and email. Wait times have improved since 2021, but Reddit threads still describe response delays of several days. The help center covers most self-service queries (account recovery, 2FA resets, withdrawal errors). Escalation for hacked accounts or fraud requires ID verification, which can prolong resolution.

- Robinhood historically relied only on email, which fueled frustration during the GameStop saga. In 2022, they added 24/7 phone support with callback functionality. Users generally report faster access than Coinbase, though complex crypto issues (like stuck withdrawals) still take multiple touches to resolve.

For routine account lockouts, Robinhood’s callback flow tends to be smoother, while Coinbase still benefits from a broader crypto-specific help library.

Reputation Signals

User ratings and watchdog records paint a mixed picture.

- Trustpilot: Coinbase averages around 4 stars, with complaints citing frozen accounts and slow support. Robinhood's Trustpilot page shows a dismal 1.3 rating, but the most frequent issues involve perceived unfair trade restrictions and sudden account freezes.

- App Stores: On iOS, Coinbase hovers near 4.2/5 with praise for its simple interface but criticism of fees. Robinhood rates slightly lower at 3.8/5, with reviews split between equity traders who love the zero-commission model and crypto users who dislike its limited coin offering. On Google Play, Coinbase sits around 4.1, Robinhood around 3.9, both dragged down by support frustrations.

- BBB (Better Business Bureau): Robinhood holds an “F” rating, largely tied to unresolved complaints during the trading curbs. Coinbase has a “D” rating, with the majority of cases revolving around slow or absent customer support. Neither is BBB-accredited.

The sentiment data shows both platforms still battling reputation scars. Coinbase is critiqued as “expensive but functional,” while Robinhood is often framed as “convenient but untrustworthy.”

Regulation & Geographic Availability

Regulation And Compliance In Crypto Trading Platforms.Image via Shutterstock

Regulation And Compliance In Crypto Trading Platforms.Image via ShutterstockHow platforms handle regulation affects both trust and long-term viability. Coinbase and Robinhood are regulated differently, reflecting their origins as a crypto exchange and a stock brokerage.

Coinbase Global Footprint

Coinbase is structured as a global operator. Coinbase is headquartered in the United States and operates under multiple federal and state licenses. It is registered with FinCEN as a money services business and holds money transmitter licenses in most states. In New York, Coinbase is regulated by the Department of Financial Services, which imposes strict compliance standards. The company is also a publicly traded entity on NASDAQ, which adds layers of disclosure and SEC oversight.

Internationally, Coinbase tailors its services based on jurisdiction. It complies with the European Union’s MiCA framework, operates under local registrations in countries like Germany and Ireland, and restricts features such as staking where regulation is uncertain. This allows Coinbase to maintain availability in more than 100 countries, though asset availability can differ by region.

Coinbase Licenses & registrations:

- U.S.: Registered as a Money Services Business with FinCEN and holds money transmitter licenses in most states.

- Europe: Holds a VASP (Virtual Asset Service Provider) registration in multiple EU countries and recently secured an e-money license in Ireland.

- Singapore: Licensed by the Monetary Authority of Singapore (MAS) as a Major Payment Institution.

- Japan: Registered with the Financial Services Agency (though Coinbase Japan scaled back operations in 2023).

- Canada: Restricted dealer registration under the Canadian Securities Administrators.

Robinhood U.S. Focus

Robinhood’s (licenses & registrations) model is far more concentrated. It primarily serves U.S. customers, with crypto trading available in most, but not all, states. The company operates under SEC and FINRA oversight for its securities business, while Robinhood Crypto LLC is a registered money services business with FinCEN.

A few states remain unsupported due to licensing gaps, and Robinhood’s crypto product scope is narrower than Coinbase's because it does not hold the same global VASP registrations. International expansion has been limited compared to Coinbase’s footprint.

What Regulation Changes in 2025 Mean

The US appears to be moving away from an enforcement-heavy approach toward a more structured regulatory framework. Key agencies like the SEC and CFTC are collaborating to clarify definitions and roles, streamlining oversight from a complex state-by-state licensing model to a more unified federal approach.

Key Legislation Changes:

- GENIUS Act: This act, signed into law on July 18, 2025, provides a comprehensive framework for payment stablecoins, defining them as payment tools rather than securities, and mandates 1:1 backing with liquid assets like USD.

- MiCA (EU): The Markets in Crypto-Assets Regulation, fully effective in Europe in 2025, creates a unified licensing framework across the EU, enhancing consumer protection and market integrity.

- Continued Enforcement: Despite the shift towards clarity, fraud monitoring and enforcement actions will persist, especially concerning custody, fraud, and disclosure practices.

- AML/KYC Requirements: Regulations, such as the FATF Travel Rule, are being increasingly implemented globally, requiring Virtual Asset Service Providers (VASPs) to collect and share identity data for crypto transfers exceeding a certain threshold (e.g., $3,000 USD in the US).

What this could mean for Coinbase and Robinhood

The clarified federal framework is expected to ease Robinhood's compliance burden, potentially allowing it to expand its crypto offerings beyond the major tokens currently listed. Robinhood has also secured MiCA licenses in the EU, showing a proactive approach to regulated markets. The SEC has reportedly closed an investigation into Robinhood's crypto arm without enforcement action.

Coinbase, a global leader in compliance, is well-positioned for regulatory clarity. The SEC has reportedly dropped its lawsuit against Coinbase, signaling a broader trend of regulatory easing. However, the EU's MiCA regulation has seen Coinbase's retail participation drop, and it faces potential compliance cost increases. Coinbase is seeking SEC approval for tokenized stock offerings in the US and has launched Smart Wallets.

Both platforms will need to maintain Know Your Customer (KYC) and Anti-Money Laundering (AML) programs, alongside other compliance measures like transaction monitoring and reporting requirements.

Trust & History Timeline (Why Users Care)

Company History And Founding Timelines. Image via WLC

Company History And Founding Timelines. Image via WLCA platform’s track record says as much as its features. Flashpoints, lawsuits, and incident handling shape whether users believe their money is safe.

Robinhood Flashpoints

- 2021 GameStop trading curbs: Robinhood restricted buying of “meme stocks” like GameStop and AMC in January 2021, citing collateral requirements from clearinghouses. This decision led to lawsuits, congressional hearings, and ongoing reputational damage.

- 2020 SEC settlement: Robinhood paid $65 million to settle charges that it misled customers about its revenue sources (payment for order flow) while claiming trading was commission-free.

- 2021 data breach: A hacker gained access to about 7 million customer accounts (email addresses, some phone numbers, and limited account data). Robinhood disclosed the breach publicly and claimed no Social Security numbers or bank details were exposed.

Robinhood has since upgraded its security architecture, expanded passkey support, and created a dedicated “Security Guarantee” hub.

Coinbase Legal/Regulatory Notes

- 2025 lawsuit dismissal: In January 2025, a federal judge dismissed a major class action alleging that Coinbase sold unregistered securities. This was a relief for Coinbase, though appeals are still possible. Coinbase blog update

- Compliance posture: Coinbase operates with licenses in dozens of jurisdictions and has pushed for clearer U.S. regulation through public lobbying and its “Stand with Crypto” initiative. Stand With Crypto

- Incident handling: Past issues include repeated traffic-related outages (2017, 2020, 2021, 2024) and smaller security incidents. Coinbase has an incident transparency blog and a real-time status page. Coinbase status page

What It Means for You

For users, these histories translate into practical risk factors:

- Halts: Robinhood has a track record of restricting trading under stress (GameStop). Coinbase outages tend to be access failures during peak traffic, not deliberate halts.

- Liquidity: Robinhood’s brokerage model means collateral and clearinghouse rules can override customer demand. Coinbase’s model risks are tied to system load and the exchange's matching engine.

- Recourse: Both firms offer account recovery flows, but have faced criticism for slow support responses after incidents.

- Communications: Both now publish status updates and security blogs, but timeliness and clarity differ; Coinbase posts structured incident updates, and Robinhood relies heavily on blog posts and Twitter.

Which Platform Fits Which User? (Decision Matrix)

Choosing between Coinbase and Robinhood comes down to which type of user each platform best serves. Here’s how the match looks when you break it down by persona.

Persona Table

| Persona | Recommended Platform | Why | Must-Enable Features | Gotchas |

|---|---|---|---|---|

| Beginner stock investor | Robinhood | Equities, ETFs, and options under one app; simple UX. | Enable 2FA and passkeys; explore “Collections.” | No crypto depth; SIPC does not cover crypto. |

| Long-term crypto allocator | Coinbase | Institutional-grade custody, staking, wide asset coverage. | Use withdrawal allowlisting; set recurring buys. | Higher fees if not using Advanced Trade; outages during peaks. |

| Altcoin explorer | Coinbase | 250+ supported assets, fast listing cadence, DeFi access via Coinbase Wallet. | Use Coinbase Wallet for breadth; monitor new listings. | Region-based restrictions on staking; some assets have high spreads. |

| Advanced crypto trader / API user | Coinbase | Advanced Trade APIs, order books, charting with TradingView, order types (TWAP, bracket). | Link API keys with IP allowlists; use WebSocket for real-time feed. | Not as fast as Binance-level depth; occasional downtime under load. |

| Options trader | Robinhood | Equity options with simple strategy builder; commission-free flow. | Enable options approval tiers; use Legend for advanced charting. | Options risk disclosures apply; not all spreads supported. |

| International user | Coinbase | Licensed globally, products available in EU, Singapore, Canada, etc. | Confirm supported region on Coinbase licenses. | Derivatives/futures limited to Coinbase International Exchange. |

| “Small buys” DCA user | Both | Robinhood for commission-free simplicity; Coinbase for crypto breadth with recurring buys. | On Coinbase, enable recurring buys; on Robinhood, set fractional stock/crypto purchases. | Fees hidden in Robinhood spread; Coinbase charges explicit fees. |

Decision Flowchart — Simple Yes/No Path to Robinhood vs Coinbase vs Both

Follow the questions top-to-bottom. Take the arrow that matches your answer.

- Robinhood Choose if you want stocks/ETFs/options, simple UI, and casual crypto.

- Coinbase Choose if you want 200+ coins, staking, order-book trading, self-custody.

- Both Choose if you want equities and deep crypto in parallel with cost control.

Run a small test, compare effective cost (price impact + fees) and feature fit. Keep the winner for your primary flow; keep the other for its strengths.

Pros & Cons

Every trader cares about the trade-off: where a platform shines and where it creates friction. Here’s a fuller breakdown without colons or fluff, just direct bullets.

Coinbase Pros and Cons

Coinbase Pros

- 250+ supported cryptocurrencies across multiple categories

- Advanced Trade tools, including APIs, order books, TWAP, bracket orders, and TradingView charting

- Seamless withdrawals with multi-chain support and Coinbase Wallet integration

- Institutional-grade security stack with cold storage, HSMs, allowlisting, and hardware key support

- Broad staking coverage with asset-specific APYs and institutional staking for Prime clients

- Global regulatory licenses across the U.S., EU, Singapore, and Canada

- Portfolio tracking, tax reports, and automated recurring buys

Coinbase Cons

- Higher retail fees unless using Advanced Trade

- Support queues and long escalation times during high-traffic periods

- Known for outages and degraded performance during bull runs

- Limited to crypto, no equities, ETFs, or options

- Staking is unavailable in certain U.S. states

Robinhood Pros and Cons

Robinhood Pros

- Commission-free stock and ETF trades with fractional share access

- Options trading with simple approval tiers and multi-leg support

- Unified app covering equities, ETFs, crypto, and options in one account

- Beginner-friendly UI with smooth onboarding and recurring investment setup

- Robinhood Legend desktop with advanced charting, layouts, and screeners

- Futures trading, including indexes, oil, and Bitcoin

- Tokenized stocks and ETFs for EU customers

Robinhood Cons

- Roughly 32 supported cryptocurrencies compared to Coinbase’s 250+

- Self-custody features are limited, with fewer networks supported than Coinbase Wallet

- The history of trading halts during the 2021 GameStop event still impacts trust

- Customer support is often cited as slow and template-driven

- Education and research tools are stronger on equities than on crypto

- SIPC protection only applies to securities, not to crypto holdings

Bottom Line

Choosing between Coinbase and Robinhood comes down to your priorities rather than a clear winner.

- If your focus is on stocks, ETFs, and basic crypto access, Robinhood provides everything in a single app, with low barriers to entry.

- If you want deep crypto coverage, advanced trading tools, and stronger custody options, Coinbase is the more natural fit.

Costs vary depending on trade size and method. Robinhood advertises commission-free trades, but spreads can add hidden costs. Coinbase charges explicit maker-taker fees, which can feel expensive, though Coinbase Advanced offers lower rates for active traders.

Security and self-custody also differ. Robinhood crypto withdrawals are more limited, while Coinbase integrates better with wallets and offers detailed insurance structures.

The real takeaway is this: don’t choose based on hype. Run the calculator + trading test linked in this guide. See your actual costs, check which features you’ll use most, and match that against your comfort with custody and regulation. That way, you’ll know if Robinhood, Coinbase, or even a mix of both best fits your needs.

Also on The Coin Bureau